Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

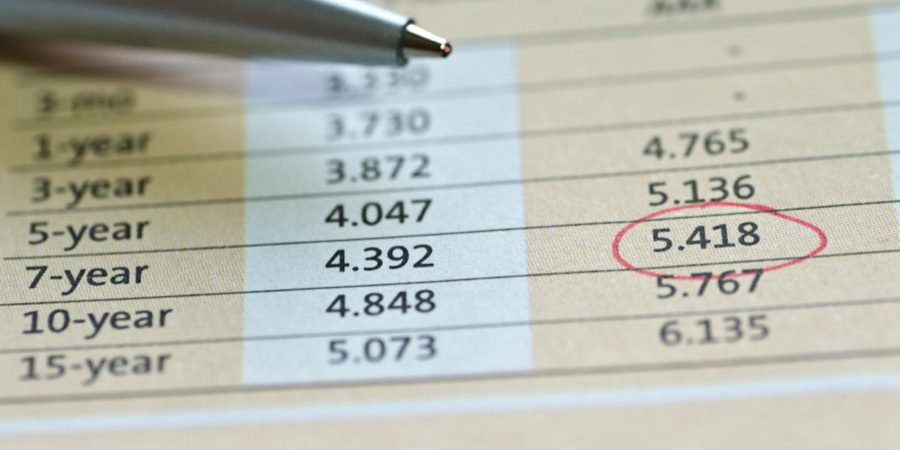

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

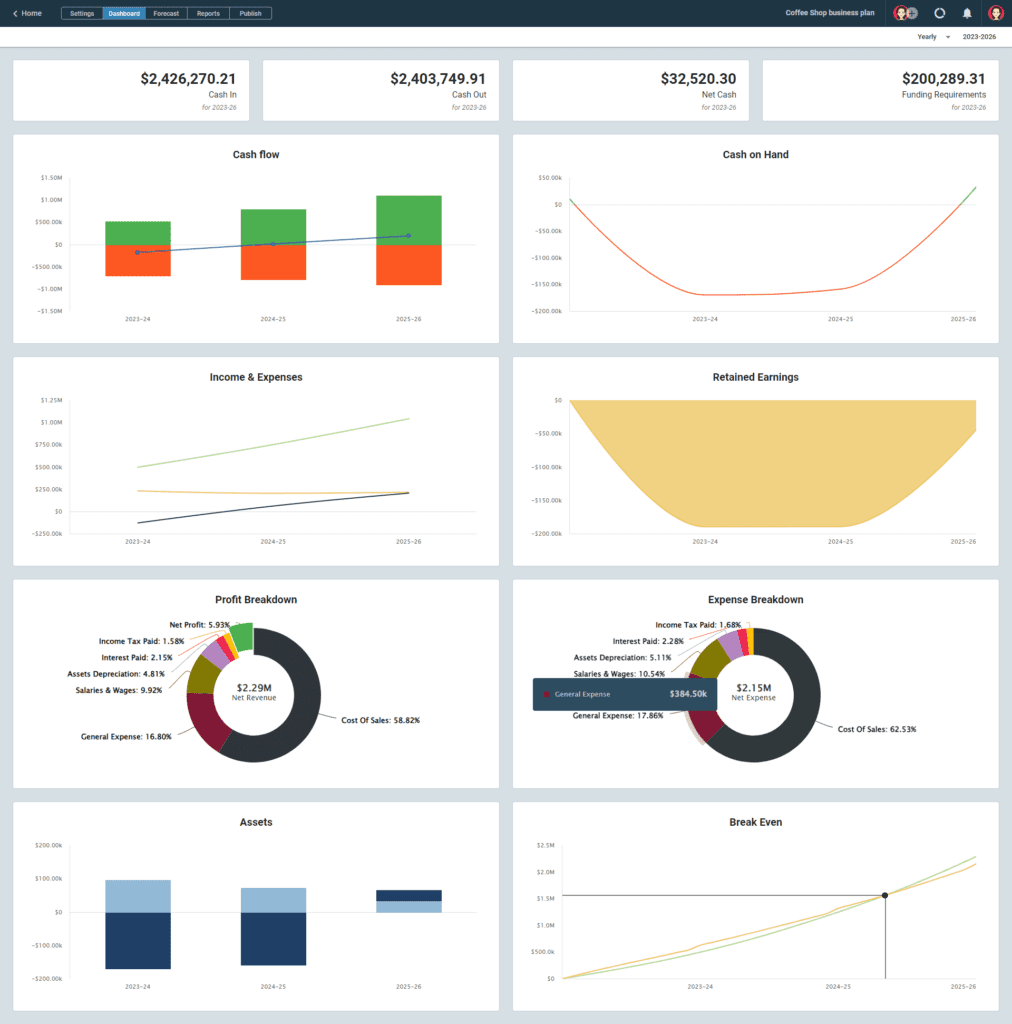

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

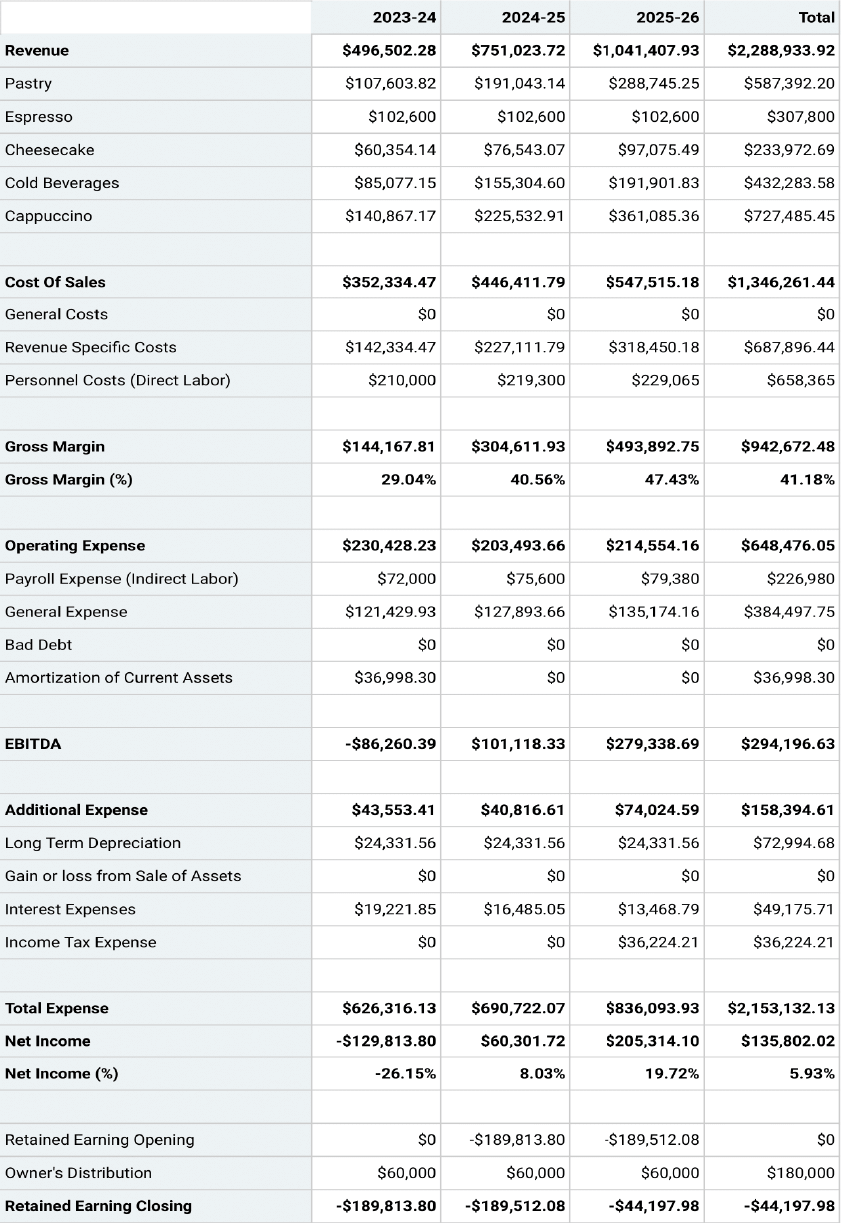

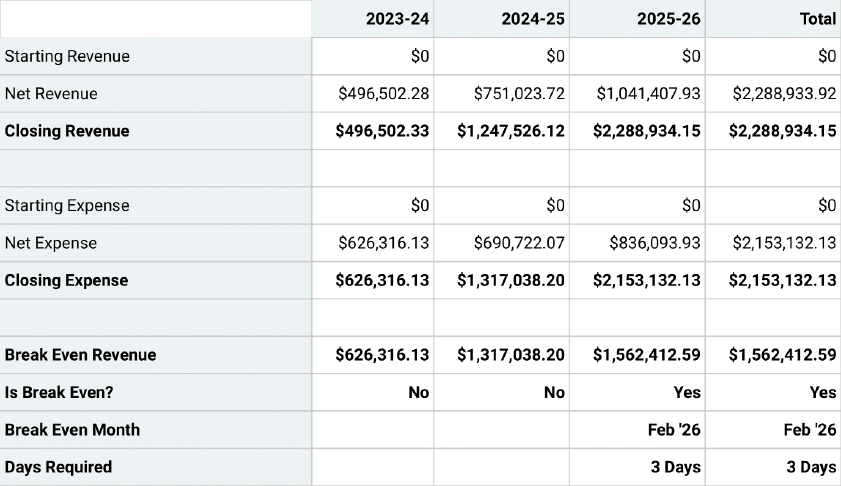

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

Simple Business Plan Template for Startups, Small Businesses & Entrepreneurs

Financial plan, what is a financial plan.

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays.

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since it indicates whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Financial Plan Template: 4 Components to Include in Your Financial Plan

The financial section of a business plan should have the following four sub-sections:

Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

Financial Overview & Highlights

In developing your financial plan, you need to create full financial forecasts including the following financial statements.

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. The statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a company’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much of the funding you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

Exit Strategy

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market who have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Business Plan Financial Plan FAQs

What is a financial plan template.

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. The financial plan template includes formulas that will automatically calculate your revenue, expenses, and cash flow projections.

How Can I Download a Financial Plan Template?

Download Growthink’s Ultimate Business Plan Template which includes a complete financial plan template and more to help you write a solid business plan in hours.

How Do You Make Realistic Assumptions in Your Business Plan?

When forecasting your company’s future, you need to make realistic assumptions. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates.

You should also use historical data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Learn more about how to make the appropriate financial assumptions for your business plan.

How Do You Make the Proper Financial Projections for Your Business Plan?

Your business plan’s financial projections should be based on your business model and your market research. The goal is to make as realistic and achievable projections as possible.

To create a good financial projection, you need to understand your revenue model and your target market. Once you have this information, you can develop assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Once you have your assumptions set, you can plug them into a financial model to generate your projections.

Learn more about how to make the proper financial projections for your business plan.

What Financials Should Be Included in a Business Plan?

There are a few key financials that should be included in a traditional business plan format. These include the Income Statement, Balance Sheet, and Cash Flow Statement.

Income Statements, also called Profit and Loss Statements, will show your company’s expected income and expense projections over a specific period of time (usually 1 year, 3 years, or 5 years). Balance Sheets will show your company’s assets, liabilities, and equity at a specific point in time. Cash Flow Statements will show how much cash your company has generated and used over a specific period of time.

Growthink's Ultimate Business Plan Template includes a complete financial plan template to easily create these financial statements and more so you can write a great business plan in hours.

BUSINESS PLAN TEMPLATE OUTLINE

- Business Plan Template Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Business Plan Summary

Other Helpful Business Planning Articles & Templates

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement