[Beginners Guide] How To Start A Successful Poultry Farm In Nigeria

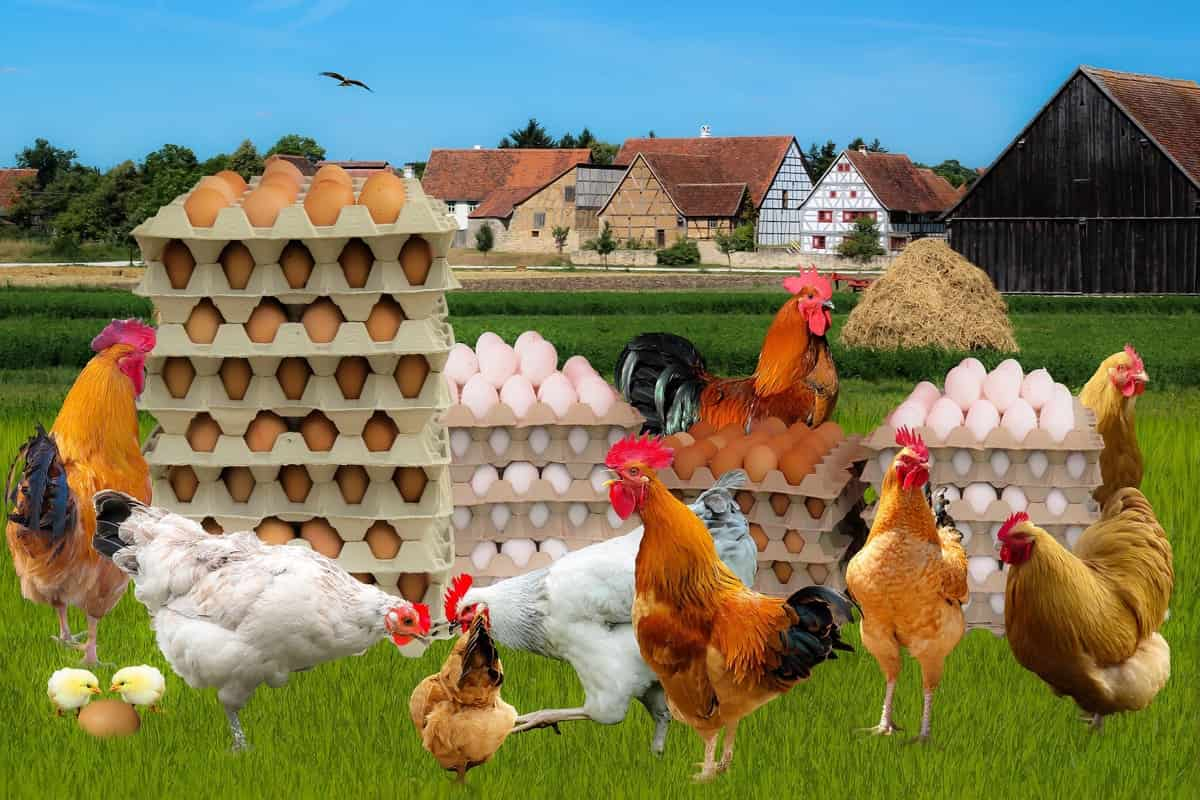

Starting a poultry farming business in Nigeria can be a rewarding venture, both financially and professionally. With a growing demand for poultry products in the country, there is a significant opportunity for entrepreneurs to establish successful poultry farms.

This comprehensive guide will walk you through the essential steps and considerations to start a poultry farming business in Nigeria, from understanding the industry to scaling and expanding your operations.

How To Start Poultry Farming In Nigeria

Table of Contents

Read Also: How To Start Bee Farming In Nigeria [Beginners Guide]

Step 1: Identifying Your Niche and Target Market

Step 2: conducting market research.

Conducting thorough market research is crucial for understanding customer preferences, demand, and pricing in the poultry industry. Identify potential buyers, such as local markets, supermarkets, restaurants, and wholesalers. Gather insights on the prevailing market prices, product quality expectations, and consumer trends.

Step 3: Developing a Business Plan

Step 4: acquiring necessary skills and knowledge.

To succeed in poultry farming , it is vital to acquire the necessary skills and knowledge. Attend training programs, workshops, or courses on poultry production, management, and health. Networking with experienced farmers and industry experts can also provide valuable insights.

Step 5: Selecting a Suitable Location

Read Also: Top 10 Biggest Fish Farm Projects in Nigeria

Step 6: Constructing Poultry Houses and Facilities

Step 7: procuring necessary equipment and supplies.

Procure the essential equipment and supplies required for poultry farming. This includes feeders, drinkers, brooders, egg incubators, and cleaning equipment. Ensure that the equipment is of good quality and appropriate for your production scale.

Step 8: Ensuring Biosecurity Measures

Understanding the poultry farming industry in nigeria.

The poultry farming industry in Nigeria is diverse and encompasses various types of poultry production, including broiler farming, layer farming, and hatchery operations. Broilers are raised for meat production, while layers are specifically bred for egg production. Hatcheries play a crucial role in providing day-old chicks to farmers.

Potential Market and Profitability

Key challenges and considerations.

While poultry farming offers promising prospects, there are several challenges that aspiring poultry farmers need to be aware of. Some of the key considerations include:

Disease outbreaks and biosecurity:

Feed costs and availability:.

The cost and availability of poultry feed can impact profitability. Developing strategies to ensure a steady supply of affordable and nutritious feed is essential.

Market volatility and competition:

Key factors to choosing the right poultry breeds to start your farm, evaluating different breeds and their characteristics.

Read Also: 20 Common Diseases In Poultry Farm

Considering the Demand and Market Preference

Selecting breeds suitable for local conditions.

Read Also: 12 Poultry Farming Tips For Beginners [Success Guide]

Managing Poultry Health and Nutrition

Implementing vaccination and disease prevention protocols, providing balanced nutrition and feed management, monitoring and maintaining flock health.

Regularly monitor the health of your flock through visual inspections, weight checks, and behavior observation. Identify and address any signs of illness or distress promptly. Establish a relationship with a veterinarian who can provide guidance and support for flock health management.

Poultry Farming Operations and Management

Day-to-day care and feeding routines, egg production and management, broiler production and management.

If you are raising broilers, develop a production plan that includes selecting quality chicks, managing brooder temperature and lighting, and implementing a feeding and growth strategy. Monitor the growth rate, adjust feed rations accordingly, and ensure proper ventilation in broiler houses.

Proper Waste Management and Disposal

Marketing and selling poultry products, identifying potential buyers and markets, developing marketing strategies.

Develop effective marketing strategies to promote your poultry products. Utilize both online and offline channels, such as social media, websites, local advertisements, and product demonstrations. Differentiate your products by highlighting quality, health benefits, or unique selling points.

Building Partnerships and Distribution Channels

Financial planning and record-keeping, estimating startup and operational costs, tracking expenses and income.

Maintain accurate and detailed records of your expenses and income. Implement a robust record-keeping system to track feed costs, veterinary expenses, labor costs, sales revenue, and other financial transactions. Regularly review your financial statements to assess the profitability of your business.

Evaluating Profitability and Making Informed Decisions

Regulations and compliance, understanding legal requirements and permits, complying with animal welfare and food safety standards.

Maintain high standards of animal welfare and hygiene in your poultry farm . Provide adequate space, ventilation, and access to clean water and feed. Follow recommended practices for disease prevention, vaccination, and medication administration. Implement proper food safety measures during egg collection, processing, and packaging.

Scaling and Expanding Your Poultry Farming Business

Evaluating growth opportunities, increasing production capacity, diversifying product offerings.

Explore opportunities to diversify your product offerings to cater to different market segments. This can include value-added products such as processed poultry meat, specialty eggs, or organic poultry products. Conduct market research and assess the feasibility and profitability of new product lines.

Can I start a poultry farming business with limited capital?

How long does it take to start making a profit in poultry farming, what are some common challenges in the poultry farming industry.

Common challenges in the poultry farming industry include disease outbreaks, feed costs, market volatility, and competition. It is important to stay updated with industry trends, invest in disease prevention measures, and develop effective marketing strategies to overcome these challenges.

How do I ensure the health and well-being of my poultry flock?

What are the future prospects for the poultry farming industry in nigeria, how much does it cost to start up a poultry farm in nigeria.

To start up a poultry farm in Nigeria, you will have at least 500,000 to 1 million nairas.

How can I start a small poultry farm?

How much do poultry farmers make in nigeria, how many bags of feed can 500 layers consume.

For the first month, 500 layer chicks will require 750 kilograms of feed if each one consumes 1.5 kilograms of feed every month. Your chicks’ food intake will increase by about 1.75 kilograms a month over the next month.

How much does it cost to raise 100 chickens?

How can i become a successful poultry farmer, can a chicken lay 3 eggs in one day.

No, it is not possible, excerpt by chance.

How long do layers lay eggs?

How long does a baby chicken take to grow.

Breed-specific differences in how rapidly or slowly an individual chicken develops may also play a role in the timing of this stage of development.

How many eggs do layers produce per day?

What is the most common poultry disease, share this:, author: adewebs, you may also like:, goat farming in the usa: how to start goat farming in the usa, can chickens eat grapes [poultry feeding tips], [beginners guide] how to start ostrich farming in nigeria, 18 toxic plants your chickens must avoid (must read), 6 replies to “ [beginners guide] how to start a successful poultry farm in nigeria ”, leave a reply cancel reply.

Poultry Farming Guide in Nigeria: Business Plan, Breeds, Cost, Profit

Looking for a Poultry Farming Guide in Nigeria plus a business plan to go with alongside. Read this article as a poultry enthusiast or an academic to know more.

Nigerian poultry farmers raise chickens, ducks, turkeys, and other fowl for their meat and eggs. The most popular fowl grown in Nigeria is the chicken, which may be raised for both meat and eggs. The least often reared poultry in Nigeria is geese.

Chicken, turkey, duck, geese, quail, pigeons, and guinea fowl are among the main poultry species bred by poultry producers. The most popularly eaten bird in Nigeria is the chicken, making it an ideal choice for farmers who wish to profit from the country’s rising demand for poultry meat and eggs. Turkey is a close second.

You can raise ducks, quails, or pigeons if you want a market with less competition. The Nigerian climate must be taken into account while deciding what kind of bird to raise. It’s critical to select a bird that can survive the temperature in Nigeria since some species of poultry birds can not thrive in hot regions.

Selecting a suitable location for your chicken house in Nigeria

- In Nigeria, a location for a chicken farm is chosen after taking into account a number of considerations. Climate is the first component. Nigeria’s typical temperature is hot and humid, which is perfect for raising chickens. However, drought conditions can have a severe effect on poultry production in some regions of the nation.

- The second element to take into account is closeness to marketplaces. Poultry farms must be situated close to marketplaces so they may readily sell their goods. If the farm is too distant from the markets, transportation expenses will eat into the revenues.

- Land quality and availability are the third element to take into account. For housing and grazing spaces for chickens, poultry farms need a lot of land. In order to properly sustain chicken farming, the land must also be of high quality. In Nigeria, it’s crucial to carefully take these three elements into account while choosing a location for a chicken farm. By doing this, you may maximize the likelihood of your chicken farm’s success.

Housing for poultry farming in Nigeria

The A-frame chicken coop is one common design for poultry farms in Nigeria. These coops are easy to build and may be outfitted using materials found nearby. They give your birds a safe and secure home, and they are simple to extend as your flock size increases. Use an existing structure on your property, such a shed or outhouse, as a place to house your poultry in Nigeria. If you choose this route, it’s crucial to make sure the structure is well-ventilated and well-lit. Additionally, you must cover all windows and doors with wire mesh to shield your birds from predators. Poultry Farming Guide in Nigeria Whichever kind of accommodation you decide on for your poultry farm in Nigeria, it’s crucial to keep it tidy and maintained. Maintaining your birds’ health and productivity will assist avoid the spread of sickness.

Commercial feeds are typically more expensive than meals that are made nearby, but they are also more nutrient-rich and benefit your birds’ health. Follow the manufacturer’s guidelines for feeding your birds if you choose to utilize commercial foods. Locally produced foods may be less nutrient-rich yet are frequently less expensive than commercial feeds. To locate a feed that is effective for your birds, you will need to experiment with several locally made foods. It’s crucial to provide your birds access to clean water, regardless of the type of feed you use. Water assists with digestion and keeps them hydrated. you stop the spread of disease, be sure you frequently clean and replenish water containers.

Small-scale chicken rearing in Nigeria

Poultry farming offers several chances for small-scale farmers to become engaged, from growing birds for eggs to producing meat. The decision of the sort of chicken you wish to produce is the first stage in beginning a small-scale poultry farm. The most popular breed is chicken, but you may also have turkeys, ducks, or geese. You’ll need to buy some baby chickens or other young birds once you’ve chosen the breed of poultry you wish to keep. These may be purchased online or from a nearby hatchery.

You must construct a brooding chamber for your newborn chicks after you’ve acquired them so they may stay warm and secure as they develop. A cardboard box and a heat bulb may be used to create a straightforward brooding setup. Your young chicks can be transferred to a bigger coop or enclosure after they have outgrown the brooding space. You’ll need to provide your birds food and water as they grow. Grain, vegetables, and chicken feed make up a healthy chicken diet. You may feed them by either growing it yourself or buying it from a nearby feed store. Water must always be accessible, and it should be replaced frequently.

In Nigeria, the average cost to set up a chicken farm is around N150,000. This price covers the cost of the necessary equipment, starter ingredients, and day-old baby chickens. In Nigeria, the startup expenditures for a commercial poultry farm might reach N1 million. In Nigeria, a chicken farm typically makes around N50,000 per month in profit. Selling eggs and meat at greater prices or lowering the cost of production via improved management methods are two ways to enhance profit.

Organic Poultry Farming in Nigeria

In Nigeria, there is a style of farming called organic poultry farming where hens are reared without the use of antibiotics or other growth-promoting substances. The chickens are given an organic feed and lots of room to wander and forage. Nigerian government regulations must be met in order for organic poultry growers to receive certification. These requirements include giving hens access to clean, pleasant surroundings, sunlight and fresh air, as well as a healthy feed.

Additionally, synthetic pesticides and herbicides must not be used on farms. Nigerian organic poultry farming is still in its infancy, but as more people learn about its advantages, it is becoming more and more well-liked. Because they are aware that organic chicken meat is healthier for their health and the environment, consumers are prepared to pay more attention to it. Farmers of poultry who transition to organic farming should anticipate increased income as the demand for their product rises.

Now that you have read this Poultry Farming Guide in Nigeria, are you ready to get a business plan alongside?

How To Download The Complete Chicken Farming Business Plan for Broilers and Layers In Nigeria PDF and Doc

Above is a part of the chicken farming business plan in Nigeria. In case you a complete business plan, follow the procedures to download it.

Pay the sum of N8000 (Eight thousand naira only) to the account detail below: Bank: GTBank Name: Oyewole Abidemi (I am putting my name and not our company account so you know I am real and you can trust me, and trace me) Ac/No: 0238933625 Type: Saving

P.S: We can also tailor the business plan to your name, business size, capital requirements, and more to fit your direct needs. Call or message +234 701 754 2853 for enquiries

Thereafter, send us your email address through text message to +234 701 754 2853 . The text must contain the title of the business plan you want and also your email address. Immediately after the confirmation of your payment, we will send the chicken farming business plan for broilers and layers in Nigeria to your email address where you can easily download it.

Thanks for reading this Poultry Farming Guide in Nigeria

Opeoluwa Falodun

Goats farming guide in nigeria, onion farming guide in nigeria – planting, care, and harvesting, you may also like, marketing automation platforms for small businesses: a budget-friendly..., headless cms showdown: contentful vs. prismic , neuromarketing: unveiling the secrets of the consumer brain, celebrating omotoni ‘teknovate’ ayobami, feasibility study sample for private school, private school business plan sample, feasibility study template for zobo production, business plan sample for zobo production, ict feasibility study sample, download ict business plan sample, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Sun. Jun 9th, 2024

NG Business

NGBusiness Gives You Access To Over 100 Business Plan Samples As Well As Other Important Business Related Information...

Poultry Farm Business Plan in Nigeria (2024 DOC)

Poultry Farm Business Plan in Nigeria 2024 Sample

The Poultry or Chicken Farming Business Plan comes as a Feasibility Study In Nigeria or birds arming, the business plan undergoes a regular up from time to time, this is done to correspond with the prevailing economic condition of the country.

CHAT WITH US ON WHATSAPP FOR YOUR

Business plans and feasibility studies to get a discount.

The Poultry Farm Business Plan In Nigeria Feasibility study comes in form of an e-book, could be converted to word document based on demand and it offers the following content;

Poultry Farm Business Plan In Nigeria Table Of Content

Chapter One – Executive summary of the business plan on poultry farming pdf

- The business Opportunity

- The market Target

- The competition

- The competitive Strategies

- The management Team

- The financial Plan, It comes in an excel spreadsheet

PURPOSE OF THE BUSINESS PLAN

A typical proposal for raising a poultry farm in Nigeria should at least come with the purpose of starting the business and then followed by other important information.

Poultry Farm Business Plan In Nigeria Market Analysis

- Poultry farm market analysis

Poultry Farm Business Plan SWOT Analysis

- Opportunities

STRATEGIC INTENT

VALUES AND PRINCIPLES

- Project Strategies

- Financial Strategies

- Marketing Strategies

- Operational Strategies

- Human Resources Strategies

IMPLEMENTATION PLAN

- Organization Structure

- Manpower Requirements

- Manpower Plan

- Man Power Budget

- Roles And Responsibilities

Poultry Farm Business Plan In Nigeria Technical And Operational Plan

- Raw Material Requirements

- Machinery And Equipment Requirements

- Layout Of The Business Premises

- Growth Management And Quality Assurance

- Disease Control And Prevention

- Egg Production Process

MARKETING PLAN

- Location Of The Project

KEY FINANCIAL MANAGEMENT CONTROLS

- Bookkeeping And Financial Administration Requirements

- Importance Of Bookkeeping And Financial Administration

- Computerized Bookkeeping And Finance System

Poultry Farm Business Plan In Nigeria Projected financial Statement

- Assumptions

- Application Of Funds

- Operating And Maintenance Costs

- Daily EEG and Feed, Drugs Computation Analysis From Point Of Lay (POL) For 12 Months period

- Income Statement Projections

- Projected Profit And Loss For 4,000 Birds In 52 Weeks

- Market Information

- Mortality Losses

- Profit projection For 4,000 Laying Birds

- Profit Projection for 10,000 Broilers

Additional Content

- Poultry farming egg Production Management

- Broiler Management Guide

- Broiler Starter formula

- Broiler Grower formula

- Pullet grower formula

- Laying Bird feed formula

- Layout Concentration Formula

- Broiler Concentration formula

To get the full business plan on Poultry Farming Business Plan in Nigeria + Feasibility Studies PDF, pay N10,000 to GTBank (Guaranty Trust Bank)

Account Name – Okite Joseph ikenna

Account No – 0044083736

Once payment is made for the Poultry Farming Business Plan in Nigeria + Feasibility Studies PDF, send the following (i) a valid email address and (ii) your payment details to any of these numbers – 07039768549.

What You Can Use Your Poultry Farm Business Plan in Nigeria ;

Obviously, the Poultry Farming Business Plan in Nigeria was written not only or the execution of a business, but it also has other purposes for which it was written, the poultry farming business plan in Nigeria comes as a well researched feasibility study with well detailed information on how to start up a poultry farming business and how to successfully run the business. This is a business plan for poultry production & marketing in Nigeria and it comes in a PDF format, every entrepreneur deserves to have this document for various purpose apart from just starting up a business, especially when it concerns sourcing of fund in order to either commence or to increase investment portfolio, below are the things you can use your poultry/chicken farming business plan or sample poultry business plan PDF;

BANK LOANS – Accessing a bank assistance in form of loan can be achieved using a well written business plan or feasibility study by a professional, most of these financial institutions , especially banks can be convinced that their money will be safe with you, the will have to trust you if you provide a template on how you intend making use of the loan facility issued to you. Banks are most times interested in the fact that the loan being issued will be recovered; your business plan for poultry farm will help out big time.

GRANTS – Your chicken farm business plan pdf file gives you an edge while applying for grants from different organization, especially government agencies. The possibilities of having these agencies listening to your apply application lies with the quality of your application, and this comes from the sample of the poultry business plan pdf file you will be submitting. This makes it a lot more easier and accessible, especially if done with a doc that will convince those issuing the grants.

PROPOSAL – Quality proposal goes a long way in your business proposal application. One of the factors that will make your proposal to be considered in any way is the information contained in the document. After getting our poultry farming business plan manual, applying for a proposal will become as good as complete, just as applying for loans and grant has become easy given the well detailed information contained in the business plan document.

Seminar presentation – You deserve a document that offers the best information required, so that in your presentation, you will not be caught reeling out un-found data and information. The things is that this business plan to forms the basis of your seminar presentation as well as research, however, you can as well get more information in order to compare information contained in your research work.

COMPETITIONS – Going for competition with this business plan can earn you your competition rewards, sometimes these rewards comes inform o cash prize or scholarship, or the entrepreneurs this competition where your journey in business begins. The essence is to win an trust me, the information contained in this business plan can earn you that..

POULTRY FARM BUSINESS IN NIGERIA

Today’s Nigeria accommodates some of the biggest poultry farms in Africa, despite this fact, Nigeria is still one of the largest importers of chicken. Understandably, this is a country of over 180 million people hence the need for edible birds will always be on the high.

The high demands for poultry birds is not restricted to just the festive periods or seasons like Easter, Christmas, Sallah etc. In fact a visit to Chicken market in a town as small as Abakaliki will tell you that the demand or this birds are high, virtually every market in Enugu has a potion where live chicken are sold, and the number of people trooping in too buy will amaze you. The story is not different from other small and large cities, and these are families buying for their consumption. When you factor in the fast food restaurants , the Supermarkets the request for these for these live stock products, you will understand why the country still import these products despite the level o production.

In essence, demand has always been high than supply, and that is where the business opportunities comes in from. As an individual poultry farmer, your business stands a chance of supplying birds to families, eateries, Malls as well as big supermarkets. The truth is that the industry has become a money spinning machine and it is estimated to worth a multi billion Naira industry.

Set Backs In The Poultry farming Business

As live stocks, the poultry industry suffered huge set back, these set back resulted in the loss of some birds, the setbacks came inform o avian influenza, salmonellosis, although it was contained, it caused huge losses to some farms as demand for birds reduced, that’s is not the case anymore even though there is still the challenges of incessant power outage which also affect other businesses not just the poultry business.

Factors Responsible for The Growth O Poultry Business In Nigeria

Despite the setback and other challenges, the industry has continued to progress, meanwhile, there are factors that have contributed to the remarkable development of the poultry industry in Nigeria, these factor has continued to control how the business is done, these factors includes the following;

- The demands for eggs, poultry meat which is the primary reason or raising a poultry farm.

- The relatively profitability of the Poultry enterprise if brought into comparison with other agriculture enterprises.

- The roles as well as the contribution of the Poultry association of Nigerian, this is the umbrella body that cover all the poultry farmers in Nigerian.

To get the full business plan on Poultry Farming Business Plan in Nigeria + Feasibility Studies PDF, pay N10,000 Into GTBank (Guaranty Trust Bank)

Once payment is made for the Poultry Farm Business Plan in Nigeria + Feasibility Studies PDF, send the following (i) a valid email address and (ii) your payment details to any of these numbers – 07039768549.

Hindrances To The Growth Of Poultry farm Business In Nigeria

Without a doubt, in as much as the industry is experiencing growth and profitability, there are factors that has caused hindrances to the Poultry Business; see below;

- High cost of inputs

- Power outages

- Seasonal diseases (periodic)

- Low purchasing power etc.

Factor To Consider Before Setting Up A Poultry Farming Business

Ensure you have the following in place before setting up your poultry farming business in Nigeria;

Overview – Write a comprehensive overview of the business you want to start up, outlining every other required information needed. You should also chose a business for your Poultry Farm, other things to include are the services as well as the production of quality, then you should highlight the affordable of your poultry meat and egg. Also you should have a set of customers you get to targeting, demand for poultry farm products and services is almost the same everywhere in Nigeria.

The Company – The business should at least be structured. Who are the owners, how are you going to finance the start up, what is the name of the Poultry Farm business, will it be established as a limited liability company, who will be the owner, manager as well as investors. And then describe your products and services, this is a known secret, the likely Poultry Farm products, they poultry egg, chickens and poultry litter waste etc, now what are the services, you could chose to provide the services known as KCW and F, in plan terms Kill–‐Cut–‐Wrap–‐Freeze, most poultry farms offer these services these days. Place emphasis on the quality of your products and how hygienic your eggs and how they are of high quality. You business motto could be something like “We produce, process and package to meet Your standard”.

Capital And Start Up fund – You can’t successfully set up and run any business without at least having you capital in place, this is applicable to all kinds of business, some business minded individuals even resort to taking loans and advances, while other s hunt or grant, business proposal etc. The essence is to have fund to start up the business.

Location – When sitting a poultry farm, the location to be selected should at least be conducive to the birds, exposing the birds to extreme climatic conditions can affect their growth and development.

Equipment – You need to have the best equipment in order to survive the delicate nature of handing your chicks. Ensure that your live stock supply are healthy, and also ensure that the Hatcheries in charge o delivering a day old chicks to your farm are well scrutinized. Also engage a qualified doctor to always check and apply vaccinations or medication when needed.

Sourcing Of Heat – What the Poultry Farm Business Plan In Nigeria feasibility study teaches you is that there are sources of supplemental heat that can benefit your poultry farm, items such as the following will do the trick;

- Cooking stoves

- Lesser extent paraffin stoves

- Brooder stoves

You can place the stove on the roof or somewhere above ground level.

Feeding – With the Poultry Farm Business Plan/Feasibility Study In Nigeria, you can learn the feed technique known as forced feeding, chicks find it difficult to feed to feed themselves, hence the need to do that yourself, at least for the first four weeks.

Types Of feed for your Poultry Farm Business Plan In Nigeria

Broiler growth and efficiency are dependent on the type of feed you give to them, there are stipulated feeds you must offer to these birds, they as follows;

- Starter feed crumbs

- The Grower feeds

- Finisher feeds

While the Grower Feeds is given to the between 14 to 16 days after the completing the Starter, you can then start administering the Broiler Finisher feeds, this is the feed that the broiler consumes most.

Other factors To Consider Includes The following;

- Brooder Guards/Rings

- Preparing For Arrival Of Chicks

- Brooder Stove Arrangement And Temperature

- Keys to Successful Brooding And Rearing

To get the full Poultry Farming Business Plan in Nigeria + Feasibility Studies PDF, pay N10,000 to

GTBank (Guaranty Trust Bank)

Once payment is made for the Poultry Farm Business Plan in Nigeria + Feasibility Studies PDF, send the following (i) a valid email address and (ii) your payment details to any of these numbers – 07039768549 .

Other Business Plan

Fish Farming Business Plan In Nigeria

Solar Energy Installation Business Plan

Haulage & Trucking/Logistics Business Plan

Cooking Gas (LPG) Plant Business In Nigeria

Bread Bakery Business Plan in Nigeria

Cosmetics Business Plan in Nigeria

Fashion Design Business Plan In Nigeria

Pig Farming Business Plan In Nigeria

Note – Free Poultry Farming Business Plan In Nigeria PDF is not available on this platform!

Related Post

Cashew nuts production business plan (2024 doc), coconut chips processing business (2024 doc), hotel business plan in nigeria (2024 doc), 2 thoughts on “poultry farm business plan in nigeria (2024 doc)”.

I’m interested in the poultry farming business Plan,that cover breeding, brooder, rearing, and processing, also the market. But I’m calling the number is not going, let’s talk. 09074477666.

Send Us a message from the website using the whatsapp link – https://api.whatsapp.com/send?phone=2347062842119

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

NIRSAL MFB Loan Application Portal Login

Cbn naira intervention | currency intervention, cbn low interest intervention loans 2024/2025, artificial intelligence and small business in nigeria.

Manage Money

Small business ideas to start up

Poultry farming in Nigeria: Overview, requirements and cost

Introduction.

In the rich tapestry of Nigeria’s agricultural landscape, one industry stands as a beacon of opportunity and prosperity — poultry farming. This comprehensive guide is your key to unlocking the potential of a poultry farming business in Nigeria. Brace yourself for a journey into the dynamic world where innovation, sustainability, and profitability converge to redefine the poultry farming narrative.

Step by step overview of poultry farming in Nigeria

1. The Poultry Farming Revolution: A Prosperous Pathway

Poultry farming in Nigeria is not merely a business; it’s a revolution. From providing a steady supply of eggs and meat to fostering economic growth, the potential for success in poultry farming transcends traditional boundaries.

2. Market Dynamics: Navigating Opportunities and Challenges

Embarking on a poultry farming venture necessitates a deep understanding of market dynamics. Explore the ever-growing demand for poultry products, identify potential challenges, and position your poultry business strategically in the market.

3. Setting Up Your Poultry Farm: Essential Steps for Triumph

- Selecting the Right Poultry Species: Choosing the appropriate poultry species is a pivotal decision. Delve into the characteristics of chickens, ducks, or turkeys and align your choice with market preferences and your business goals.

- Designing an Optimal Farm Layout: Create an efficient and hygienic layout for your poultry farm. Consider factors such as spacing, ventilation, and waste management to ensure the well-being of your birds.

- Implementing Robust Biosecurity Measures: Prioritize biosecurity to safeguard your flock from diseases. Develop strict protocols for hygiene, quarantine, and vaccinations to maintain a healthy poultry population.

4. Nutrition and Feeding: Sustaining Healthy Flocks

Devise a well-balanced feeding program for your poultry. Explore nutritional requirements for different stages of growth and invest in high-quality poultry feed to ensure optimal health and productivity.

5. Disease Management: Preserving Poultry Health

Proactive disease management is a cornerstone of successful poultry farming. Understand common poultry diseases in Nigeria, implement vaccination programs, and establish a partnership with a veterinarian to secure the well-being of your flock.

6. Breeding Strategies: Maximizing Productivity

Efficient breeding practices are vital for a thriving poultry farm. Explore strategies for optimal breeding, understand incubation techniques, and implement practices to enhance the reproductive efficiency of your flock.

7. Marketing Your Poultry Business: Crafting a Brand Identity

Establishing a strong brand presence is essential in the competitive poultry farming landscape. Leverage digital marketing strategies, create a professional website, and explore local partnerships to ensure your poultry business shines in the market.

8. Financial Management: Navigating the Numbers for Profitability

A flourishing poultry farm requires sound financial management. From budgeting for feed to calculating return on investment, understanding the financial aspects of poultry farming is key to long-term success.

9. Scaling Your Poultry Business: Exploring Growth Horizons

As your poultry business gains momentum, explore avenues for scaling your operations. This could include diversifying your product offerings, expanding your flock, or establishing partnerships with local businesses.

10. Challenges in Poultry Farming: Confronting Hurdles with Tenacity

Acknowledge and address challenges head-on. From disease outbreaks to market fluctuations, understanding and proactively managing challenges is crucial for sustained success in the poultry farming industry.

Starting a poultry farming business in Nigeria is an exciting venture that holds significant potential for success. However, it requires careful planning, adherence to regulations, and a clear understanding of the financial investments involved. Here’s a detailed insight into the requirements and costs associated with launching a successful poultry farming business in Nigeria, explained in a clear human tone.

Requirements and cost of starting a poultry farming business in Nigeria

1. Land and Infrastructure:

- Requirement: Secure a piece of land with adequate space for poultry pens, feed storage, and waste disposal. Plan the layout for efficient operations, proper ventilation, and hygiene.

- Cost: Land prices vary based on location, but budgeting between ₦500,000 to ₦1,500,000 for land acquisition and initial infrastructure development is a reasonable estimate.

2. Poultry Species and Stock:

- Requirement: Choose the poultry species you want to raise, whether it’s broilers, layers, or a combination. Acquire healthy chicks or pullets from reputable hatcheries.

- Cost: The cost of chicks or pullets varies by breed and age. Budgeting ₦100,000 to ₦300,000 for initial stock is a practical estimate.

3. Housing and Equipment:

- Requirement: Build secure and well-ventilated poultry pens. Invest in essential equipment such as feeders, drinkers, nesting boxes, and heating lamps for chicks.

- Cost: Construction costs depend on the scale of your poultry farm. Budgeting ₦100,000 to ₦500,000 for initial housing and equipment is a reasonable estimate.

4. Feed and Nutrition:

- Requirement: Develop a balanced feeding program for different stages of poultry growth. Invest in quality poultry feed to ensure optimal health and productivity.

- Cost: Feeding costs depend on the number of birds and the chosen feed. Budgeting ₦50,000 to ₦100,000 for initial feed is a practical starting point.

5. Health Management:

- Requirement: Implement a health management program, including vaccinations and regular check-ups. Establish a relationship with a veterinarian for professional advice.

- Cost: Veterinary services and vaccinations costs vary. Budgeting ₦50,000 to ₦100,000 annually for health management is a practical estimate.

- Requirement: Hire reliable labor for daily farm operations, including feeding, cleaning, and health monitoring.

- Cost: Labor costs depend on the size of your farm and the number of employees. Budgeting ₦50,000 to ₦150,000 monthly for labor expenses is a practical estimate.

7. Marketing and Branding:

- Requirement: Create a brand identity for your poultry farm. Develop a professional website, business cards, and marketing materials. Establish relationships with local markets and potential buyers.

- Cost: Marketing costs vary, but budgeting ₦30,000 to ₦100,000 for initial branding and promotional activities is a practical starting point.

8. Insurance:

- Requirement: Consider insurance coverage for your poultry farm to protect against unforeseen events such as disease outbreaks or natural disasters.

- Cost: Insurance costs vary, but budgeting ₦20,000 to ₦50,000 annually for insurance is a practical estimate.

9. Record Keeping and Management:

- Requirement: Implement a record-keeping system to track expenses, income, and farm performance. Consider using digital tools for efficient management.

- Cost: Digital tools and software costs vary. Budgeting ₦10,000 to ₦30,000 for record-keeping systems is a reasonable estimate.

Starting a poultry farming business in Nigeria requires careful financial planning and a commitment to best practices. While the costs outlined provide a general overview, it’s essential to conduct thorough research and tailor your budget to your specific circumstances and location. Success in poultry farming not only requires financial investment but also dedication to the well-being of your birds and continuous improvement of your farming practices.

Embarking on a poultry farming venture in Nigeria is not merely a business endeavor; it’s a commitment to contributing to the nation’s food security and economic growth. By combining innovative practices with traditional wisdom, your poultry farm has the potential to be a transformative force in the dynamic and flourishing landscape of Nigerian agriculture. Prepare to flock to success and reap the rewards of a thriving poultry farming business in Nigeria.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Hire Bizvestor for business research & planning, content writing, digital advertising, or to create a similar website for you → Contact Us

Poultry Farm Business Plan Sample (With Financial Template)

Share this Post:

- Share on Facebook

- Share on Telegram

- Share on LinkedIn

- Share on WhatsApp

This is a sample business plan for a poultry farm based in Nigeria. The sample business name used is Nutrichic Farms.

The business operates a poultry farm that breeds broiler and layer chickens, and is located in Nasarawa state.

The business plan outline used is a simple business plan that follows a standard business summary template used by most business schools and is usable for applying for loans, grants, and equity funding.

You can use this business plan as a guide to develop a business plan for your poultry business.

Introduction

Nutrichic Farms is a poultry farm located in Nasarawa state, Nigeria. We rear broiler and layer chickens for eggs and meat production and sales.

Through our farm, we produce healthy chickens and eggs, which are distributed at local markets in Nasarawa and other neighboring states.

Business Analysis

Nutrichic Farms operates a lean model poultry farm that houses a chicken shelter and a feed production chamber.

We produce our chicken feeds in-house to reduce cost of breeding and to ensure healthy nutrition for our chickens.

This ensures that our layer chickens lay more eggs, and our broilers are ready for sale as quickly as possible.

To ensure a fast and efficient sales process for our eggs and chickens, we have a distributor network that consists of 20 egg distributors and 15 chicken distributors within Nasarawa.

This makes our sales process faster and remittance of payments more accountable.

We are looking to make our production and distribution even more efficient by procuring more feed production machines and distribution vans for transporting our products to the market.

Product Pricing

Our fresh eggs are sold at a wholesale price of 720 Naira per crate. Our mature broilers are sold at a wholesale price of 1,500 Naira, while our old layers are sold at a wholesale price of 1,300 Naira.

On the average, we sell 65 crates of eggs, and 80 chickens per week.

Business Model & Profitability

Business model.

Our business model focuses on producing healthy chickens and eggs, reducing production costs, utilizing competitive price points, and being fast to market by leveraging our distributor network.

Expected annual customers

Since we already operate a direct B2B sales model using our distributor network, our customer base is already set.

We have 20 egg distributors and 15 chicken distributors already. Once we increase our production capacity, we’ll be able to triple this number and grow our sales.

Estimated Annual Revenue

Currently, we are able to distribute 65 crates of eggs and 80 chickens per week, which brings us an annual revenue of 2.4 million Naira and 5.8 million Naira.

We estimate that our total annual revenue of 8.2 million can be tripled once we scale our production and make our distribution more efficient.

Production & Distribution Cost

Our production costs include procuring day-old chickens for 100 Naira each, raw materials for feed production, vaccination, and fuel to power the production plant, pump water, and power the chicken shelter.

Our distribution costs include weekly transportation, logistics and other miscellaneous expenses.

Profit Margin

Currently, our profit margin stands at 65% but we are looking to scale that up to 80% once we begin the next phase of our expansion plans.

Nutrichic Farms was launched by Solomon, who is currently the CEO of the business.

Solomon has a background in agric economics and farming, and has been managing his family farm since the past 20 years.

The current business has remained a family holding, with staff consisting mainly of family members.

Other team members include Mr. Hassan, the feed plant technician; Mr. Kehinde, the truck driver and distribution head, and Ms. Victoria, our quality control and business development manager.

Each person on this team brings a unique skill set that is required to drive the business forward and fulfill the needs of our customers.

Business Journey

Nutrichic Farms was launched in 2015 by Solomon due to his passion for poultry and farming.

The business was launched with a capital of 300,000 Naira, which purchased 50 birds, built a makeshift chicken shelter, and purchased some chicken feeds.

Over the past 5 years, Nutrichic Farms has grown so much that we have been able to build a larger and more standard chicken shelter, drilled a borehole, and started our own feed production.

Since then, we have sold over 30,000 chickens and 10,000 crates of eggs, making sales of over 10 million Naira.

In that time, we have also implemented our strategy for business development and grown our distributor network. We are hoping to grow this network further in the next phase of our business.

Market Analysis

Market size/target audience.

According to Sahelcp, the poultry market in Nigeria is worth 80 billion Naira.

We estimate that the poultry market in Nasarawa and its environs is worth 0.5% of the total poultry market in Nigeria.

Hence, our market size is estimated to be worth 400 million Naira.

With the population in Nasarawa growing impressively year-on-year, we estimate that our target customers comprise over 4,000 retailers of chickens and eggs, and over 1.5 million consumers of chicken and egg.

Marketing Plan

Our marketing plan involves incentivizing and leveraging our distributor network.

We want to help these distributors of chicken and egg get the right products promptly at the right prices and to make more profit.

We plan to grow our distributor network to at least 2,000 distributors in the next 2 years.

This would help us boost sales and collect better feedback on the needs of retailers and final consumers.

SWOT Analysis

Strengths: Our Strengths lie in our strategic distributor network, strong business efficiency, and growing brand.

Weaknesses: Our identified weak areas are limited markets due to physical nature of business, and Poor transport infrastructure which relies too much on external logistics partners.

Opportunity: Our identified opportunities include the growing population and demand for chicken and eggs, strong local brand identity, and the room for growth in our production and distribution.

Threats: We see threats to our business in different areas such as individual sellers in the market competing on price, logistics partners failing on deliveries, and wholesalers buying from outside the state.

Business Needs

Nutrichic Farms is in need of funds to purchase more machinery for our feed plant, purchase trucks for our distribution, and marketing to grow our distributor network.

We plan to grow our distributor network to at least 2,000 distributors in order to capture more market share and consolidate our brand positioning.

If these requirements are met, it would help us meet our business & financial goals.

Future Plans

Over the next two years, we plan to grow our distributor network from less than 50 to 2,000.

This would help us capture a wider segment of the market, triple our sales, and enjoy a strong market advantage.

Cash Flow Projection

To create a cash flow Projection for your poultry farm business plan, click here to use our Simple Financial Template .

- Flour Mill Business Plan Sample (With Financial Template)

- Real Estate Services Business Plan (Sample + Template)

- Fashion Boutique Store Business Plan (Sample + Template)

- How to Create Financial Projection for Business Plan (With Free Template)

- Business Plan Template for Creating your Business Roadmap

Chijioke Solomon

Share This Post:

- Email this Page

- Share on Reddit

- Agriculture Farming

- Livestock Farming

Project Reports

- Hydroponics

- Best Fertilizers

- Vertical Farming

- Sheep Farming

- Goat Farming

- Poultry Farming

- Fish Farming

- Pig Farming

- Dairy Farming

- Rabbit Farming

- Success Stories of Farmers

- Boost Fruit Yield

- District Wise Crop Production

- Schemes & Subsidies

- Agriculture Colleges

- Farm Insurance

- Disease Control And Management

Agriculture

Aquaculture

Horticulture

Agri Business

How to Start a Poultry Farming in Nigeria: Business Plan, Breeds, Cost, Profit, Loan, Subsidy, and Management

Table of contents, what is poultry farming in nigeria, choosing the type of poultry bird to rear in nigeria, steps to start a poultry business plan in nigeria, selecting a suitable location for poultry farming in nigeria, providing good housing for poultry farming in nigeria, feeding and caring for the poultry birds in nigeria, small-scale poultry farming in nigeria, poultry breeds available in nigeria, poultry farming areas in nigeria, poultry production methods in nigeria, is poultry farming profitable in nigeria, good husbandry practices for nigeria poultry farmers, poultry farming loans and subsidies in nigeria, poultry farm problems in nigeria, poultry farming challenges in nigeria, set-up cost to start a poultry farming business in nigeria, profit for poultry farming business in nigeria, organic poultry farming in nigeria .

Poultry farming is a major agricultural activity in Nigeria. The country has a large population and a growing demand for poultry products. Nigeria is Africa’s largest producer of eggs and the second-largest producer of chicken meat. The industry employs millions of people and contributes significantly to the country’s economy.

How to start a poultry farming in Nigeria

Poultry farming in Nigeria is raising chickens, ducks, turkeys, and other poultry for meat or eggs. Chickens are the most common poultry raised in Nigeria and can be raised for meat or eggs. Geese are the least common poultry raised in Nigeria.

The common poultry birds raised by poultry farmers include chicken, turkey, duck, geese, quail, pigeon, and guinea fowl. Chicken is the widely consumed bird in Nigeria, making it an appropriate choice for farmers who want to take benefit of the growing poultry meat and egg demand in Nigeria; Turkey is a close second.

If you prefer a market with less competition, you can rearing quails, pigeons, or ducks. You will also need to consider the climate in Nigeria when choosing the type of bird to rear. Some types of poultry birds do not do well in hot climates, so it is important to choose a bird that can withstand the climate conditions in Nigeria.

- Choose your poultry niche : You can start many poultry businesses in Nigeria, so it’s important to choose the right one. Do the research and decide which poultry farming would be the most profitable for you.

- Get started with a business plan : A good poultry business plan is essential for any successful business, especially for a poultry business. Outline your goals, objectives, and strategies for your poultry farm and ensure you have a solid financial foundation.

- Choose the right location : The success of your poultry farm will largely depend on its location. Make sure you choose a location convenient for transport and have access to good-quality water and land.

- Build or buy your farm: Once you’ve chosen your location, it’s time to start building or buying your farm. If you’re building your farm, follow all the necessary construction regulations. If you’re buying an existing farm, ensure it meets all the requirements for a successful poultry operation.

- Stock your farm : Now it’s time to start stocking your farm with birds. This is where much of the cost associated with starting a poultry business comes in, so make sure you purchase healthy birds

In case you missed it: Poultry Farming in the Philippines: How to Start, Breeds, Subsidy, Loans, and Profits

- Several factors are considered for selecting a location for a poultry farm in Nigeria. The first factor is climate. The climate in Nigeria is generally hot and humid, which is ideal for chicken production. However, certain areas of the country experience periods of drought, which can impact poultry production negatively.

- The second factor to consider is proximity to markets. Poultry farms need to be located near markets where they can sell their products easily. Transport costs will eat into profits if the farm is too far from the markets.

- The third factor to consider is land availability and quality. Poultry farms require a lot of land for chicken housing and grazing areas. The land should also be of good quality to support chicken production effectively.

- When selecting a site for a poultry farm in Nigeria, it is important to consider these three factors carefully. Doing so can ensure that your poultry farm has the best chance of success.

- One popular type of housing for poultry farms in Nigeria is the A-frame chicken coop. These coops are simple to construct and can be made from locally sourced materials. They provide a safe and secure environment for your birds and can be easily expanded as your flock grows.

- Another option for housing your poultry in Nigeria is to use an existing building on your property, such as a shed or outhouse. If you select this option, it is important to ensure that the building is well-ventilated and has plenty of light. You will also need to protect your birds from predators by installing wire mesh over all windows and doors.

- Regardless of which type of housing you choose for your poultry farm in Nigeria, keeping it clean and well-maintained is important. Regular cleaning and disinfection will help prevent disease spread and keep your birds healthy and productive.

Commercial feeds are generally more expensive than locally produced feeds, but they are also more nutrient-rich and improve the health of your birds. If you decide to use commercial feeds, follow the manufacturer’s recommendations on how much to feed your birds. Locally produced feeds are often cheaper than commercial feeds but may not be as nutrient-rich.

In case you missed it: Raising Kadaknath Chickens (Black Chicken) in India: Check How this Guide Helps Profitable Kadaknath Poultry Farming from Scratch

You will need to experiment with different types of locally produced feeds to find one that works well for your birds. No matter what feed you use, it is important to provide fresh water for your birds. Water helps them stay hydrated and aids in digestion. Be sure to clean and refill water containers regularly to prevent the spread of disease.

Small-scale farmers have many opportunities to get involved in poultry farming, from raising chickens for eggs to meat production. The first step in starting a small-scale poultry farm is to choose the type of poultry you want to raise. Chickens are the most common choice, but you can raise turkeys, ducks, or geese. Once you’ve decided on the type of poultry you want to raise, you’ll need to purchase some baby chickens or other young birds. You can buy these from a local hatchery or online.

After you’ve obtained your baby chickens, you’ll need to set up a brooding area where they can stay warm and safe while they grow. A simple brooding set-up can be made using a cardboard box and a heat lamp. Once your baby chickens have outgrown the brooding area, they can be moved into a larger coop or pen. As your birds grow, you’ll need to provide them with food and water. A good diet for chickens includes grain, greens, and chicken feed. You can either grow your food for them or purchase it from a local feed store. Water must be available at all times and should be changed regularly.

- The Kadaknath chicken is a native breed known for its black plumage. These birds are typically used for meat production.

- The White Leghorn is a popular egg-laying breed that originates from Italy. These birds are white and are known for their high egg production.

- The Rhode Island Red is another popular egg-laying breed in many commercial operations. These birds are red and are known for their high egg production.

- The Sussex chicken is a dual-purpose bird that can be used for both meat and egg production. These birds are typically brown or red and originate from the United Kingdom.

There are many poultry farming areas and locations in Nigeria. The main poultry farming areas are in Kaduna, Oyo, Osun, and Lagos. There are also smaller poultry farms in other regions of the country. Nigeria has many poultry farming areas, but the three main regions are the Northern, Central, and Southern parts.

In case you missed it: How to Start Poultry Farming from Scratch: A Detailed Guide for Beginners

- The Northern region is home to the majority of Nigeria’s chicken farms. This area has a more temperate climate, which is better for chicken production.

- The Central region is also a key area for poultry farming, as it contains the country’s capital, Abuja. This region has a hot climate, which can be tough on chickens, but many large-scale operations have overcome this challenge.

- The Southern region has a tropical climate and is home to some of Nigeria’s biggest commercial broiler farms. This area presents challenges for chicken farmers, but there is still good potential for success.

There are approximately 1,500 poultry farms in Nigeria, with the majority being small-scale operations. Over two million Nigerians are employed in the poultry sector. Poultry farms vary in size from small family-run operations to large commercial farms. The Nigerian government offers incentives for investors interested in starting or expanding a poultry farm. These incentives include tax breaks and access to low-interest loans. The government also provides training and extension services to farmers.

- Intensive poultry production is the common method, requiring less land and capital investment. Birds are typically housed in overcrowded conditions and given little outdoor access. They are also fed a high-protein diet to promote rapid growth. While this method of production can be profitable, it often results in lower-quality meat and eggs due to the stressful living conditions of the birds.

- Extensive poultry production is less common but is seen as more humane. Birds are given more space to move around and typically have access to the outdoors. They are also fed a more natural diet, which results in higher-quality meat and eggs. However, this method of production is less profitable due to the higher costs associated with it.

Poultry farming is a lucrative business that supplies the demand for chicken and eggs in Nigeria. One of the best ways to ensure profitability in poultry farming is to keep your chickens healthy. This means vaccinating them against common diseases and providing them with regular veterinary care.

One of the most important things a poultry farmer in Nigeria can do to ensure the health and productivity of their flock is to practice good husbandry.

1. Keep your birds clean and healthy – Regularly clean and disinfect your bird pens, coops, and equipment. This will help prevent the spread of disease among your flock.

2. Provide fresh, clean water at all times – Make sure your birds have access to clean water. This is essential for their health and well-being.

3. Keep your birds well-fed – A healthy diet is essential for your birds’ growth and development. Be sure to provide them with a balanced diet with all the necessary nutrients.

4. Give your birds plenty of space – Birds need plenty of space to move around and exercise. If possible, allow them access to an outdoor area where they can stretch their wings and explore.

5. Monitor your birds closely – Keep a close eye on your birds’ health and behavior. If you notice anything unusual, contact a veterinarian immediately.

6. Vaccinations and other medical supplies – Keeping your birds healthy is crucial to the success of your poultry farm. Vaccinations and other medical supplies can add significant costs to your budget, but they are essential for preventing disease and ensuring high productivity levels.

7. Biosecurity on your poultry farm – Last but not least, you need to be careful about biosecurity on your poultry farm. This means taking measures to prevent the spread of diseases between your chickens and other animals or humans. Some simple steps include maintaining cleanliness, disinfecting equipment, and restricting visitors to your farm to prevent the spreading of diseases.

In case you missed it: Poultry Farming in Nepal: How to Start, A Step-By-Step Guide for Beginners

The poultry farming industry in Nigeria is the most lucrative business. Poultry farming loans and subsidies are available from various financial institutions in Nigeria. The interest rate on these loans is relatively low, making them affordable for small-scale farmers. The Nigerian government also provides subsidies for poultry farmers who meet certain criteria. These subsidies can cover up to 50% of the cost of poultry production, making poultry farming a viable option for small-scale farmers in Nigeria.

Poultry farming in Nigeria can be lucrative, but farmers face common problems. One of the most common problems is finding reliable staff to help run the farm. Another common problem is disease outbreaks. These can occur when birds are not appropriately vaccinated or come into contact with wild birds.

Infectious diseases such as Newcastle Disease and Avian Influenza can quickly spread through a flock and decimate a farm’s population. Finally, another challenge that poultry farmers face is theft. This is particularly common in rural areas where farms are often left unattended for long periods.

One key challenge facing poultry farmers in Nigeria is disease control. Outbreaks of avian influenza have caused significant losses for the industry in recent years. However, with proper biosecurity measures in place, such outbreaks can be prevented.

- The high cost of day-old baby chickens : Day-old baby chickens can be expensive if you buy from a reputable breeder. This makes it difficult for small-scale farmers to get started in the business.

- The risk of disease : Poultry farms are susceptible to diseases such as Newcastle Disease and Avian Influenza, which can kill entire flocks. Strict biosecurity measures must be implemented to minimize the risk of disease outbreaks.

- The need for specialist knowledge : Poultry farming requires specialist knowledge and skills, which can be difficult to acquire. There is also a lack of extension services and technical support available to poultry farmers in Nigeria.

Despite these challenges, poultry farming in Nigeria can be profitable if done correctly. With a growing population and increasing demand for chicken meat and eggs, there is great potential for growth in the Nigerian poultry industry.

You can start a small-scale poultry farming business in Nigeria with less than N150,000. Medium to large-scale farms need a lot more money, but starting a small poultry business is advisable even if you have more than enough funds to spare.

To calculate the profitability of poultry farming in Nigeria, you will need to consider the following factors:

- The cost of feed per bird

- The number of birds you plan to raise

- The price you plan to sell your chicken at

- The cost of any other necessary supplies (such as housing and water)

In case you missed it: Poultry Farming in New Zealand: Breeds, How to Start

The average poultry farm set-up cost in Nigeria is about N150,000. This cost includes the purchase of day-old baby chickens, equipment, and other materials needed to get started. Commercial poultry farm set-up costs in Nigeria can be as high as N1 million. The average profit from a poultry farm in Nigeria is about N50,000 per month. This profit can be increased by selling eggs and meat at higher prices or by reducing the cost of production through better management practices.

Organic poultry farming in Nigeria is a type of farming where chickens are raised without antibiotics or other growth-promoting drugs. Chickens are fed an organic diet and are provided with ample space to roam and forage. Organic poultry farmers in Nigeria must meet the standards the Nigerian government sets to be certified. These standards include providing chickens with a clean and comfortable environment, access to fresh air and sunlight, and a nutritious diet.

Farmers must also avoid using any synthetic pesticides or herbicides on their farms. Organic poultry farming in Nigeria is still relatively new, but it is growing in popularity as more people become aware of the benefits. Consumers are willing to pay more attention to organic chicken meat because they know it is better for their health and the environment. Poultry farmers who switch to organic production can expect higher profits as demand for their product increases.

Poultry farming provides employment for many people and contributes to the economy. Poultry farming generally requires less land and capital than other livestock farming ventures, making it a more accessible option for small-scale farmers. Poultry farming is an important agricultural activity in Nigeria. It provides a source of income for small-scale farmers and contributes to the country’s food security.

Ultimate Guide to Natural Vegetable Farming

Natural farming for sustainable livestock management, dairy farm technology in india: the future of dairy husbandry, comprehensive guide to organic farming in villages, modern sheep farming technology: the future of sheep husbandry, goat farming technology: the future of goat husbandry.

- How to Build a Low-budget Goat Shed: Cheap Ideas and Tips

Goat Farming Training Programs in India: A Beginner’s Guide

Types of pesticides used in agriculture: a beginner’s guide, economical aquaculture: a guide to low-budget fish farming, 15 common planting errors that can doom your fruit trees, how to make houseplants bushy: effective tips and ideas, innovative strategies for boosting coconut pollination and yield, pollination strategies for maximum pumpkin yield, the complete guide to chicken fattening: strategies for maximum growth.

- Natural Solutions for Tulip Problems: 100% Effective Remedies for Leaf and Bulb-Related Issues

Revolutionizing Citrus Preservation: Towards a Healthier, Greener Future

- Natural Solutions for Peony Leaf and Flower Problems: 100% Effective Remedies

- Maximizing Profits with Avocado Contract Farming in India: A Comprehensive Guide

- Natural Solutions for Hydrangea Problems: 100% Effective Remedies for Leaf and Flowers

- The Ultimate Guide to Choosing the Perfect Foliage Friend: Bringing Life Indoors

- From Sunlight to Sustainability: 15 Ways to Use Solar Technology in Agriculture

- The Ultimate Guide to Dong Tao Chicken: Exploring from History to Raising

- The Eco-Friendly Makeover: How to Convert Your Unused Swimming Pool into a Fish Pond

- Mastering the Art of Delaware Chicken Farming: Essentials for Healthy Backyard Flocks

- 20 Best Homemade Fertilizers for Money Plant: DIY Recipes and Application Methods

- How to Craft a Comprehensive Free-Range Chicken Farming Business Plan

- Brighten Your Flock: Raising Easter Egger Chickens for Beauty and Bounty

- How to Optimize Your Poultry Egg Farm Business Plan with These Strategies

- Subsidy for Spirulina Cultivation: How Indian Government Schemes Encouraging Spirulina Farmers

- Ultimate Guide to Raising Dominique Chickens: Breeding, Feeding, Egg-Production, and Care

- Mastering the Art of Raising Jersey Giant Chickens: Care, Feeding, and More

- Ultimate Guide to Raising Legbar Chickens: Breeding, Farming Practices, Diet, Egg-Production

- How to Raise Welsummer Chickens: A Comprehensive Guide for Beginners

- How to Protect Indoor Plants in Winter: A Comprehensive Guide

- Ultimate Guide to Grow Bag Gardening: Tips, Tricks, and Planting Ideas for Urban Gardeners

I would like to say a big THANK YOU for this wonderful, clear and meaningful explanations.

LEAVE A REPLY Cancel reply

Save my name and email in this browser for the next time I comment.

How to Build a Low-budget Goat Shed: Cheap Ideas and...

Natural solutions for tulip problems: 100% effective remedies for leaf..., natural solutions for peony leaf and flower problems: 100% effective..., maximizing profits with avocado contract farming in india: a comprehensive..., natural solutions for hydrangea problems: 100% effective remedies for leaf..., borewell drilling cost, pump price, and pipe cost, polyhouse subsidy, cost, profit, project report, tractor subsidy, bank loan, eligibility, schemes, process, malabar neem project report details guide, cold storage project report, cost and subsidy, mushroom farming project report, cost and profit analysis.

Nigerian Price

Poultry farming business in nigeria & cost of starting (2024).

Poultry farming is one of the most lucrative forms of farming in Nigeria today. There is a very huge market for poultry products such as meat, eggs, and dung. The cost of starting a poultry farming business in Nigeria depends on the aspect of poultry farming that you want to engage in.

In this post, we will discuss the cost to start the different types of poultry farming. However, we will focus more on chickens (broilers and layers). We will also tell you how to start a profitable poultry farming business in Nigeria. Let’s dive straight in without further ado.

Cost of Starting a Poultry Business in Nigeria

According to research, many Nigerians are becoming millionaires simply by becoming poultry farmers. The first step to starting a profitable poultry business is first finding out how much capital you need. How much does it cost to start a profitable poultry farm? Several ingredients go into running a poultry farm. It doesn’t matter whether you deal in broilers or layers, there are certain costs that you cannot do without. Here is a list below:

Land is one of the primary needs you must meet when starting a poultry farm. You can either purchase land or lease one for the business. The cost of land is relative as it depends on the scale at which you want to run the farm and your location. In some parts of Nigeria, you can get farmlands for between N300,000 and N3 million per plot.

Housing construction

After getting the land, the next thing that you must invest in is the housing for the birds. There are different types of housing depending on the rearing system that you will employ. The cheapest method is the free-range system where there isn’t an exact building. You just allow the birds to roam around in the compound.

For best results, it is best to employ floor or cage systems. The floor system just requires you to build a poultry house and allow the birds to roam around in the building. Alternatively, you can make use of bird cages. This method is regarded as the best for layers. The cost depends on the size of the farm, but cages could cost from N300,000 – N500,000 for 500 birds.

Poultry equipment

There is a whole array of poultry equipment that you need to run a profitable poultry farming business. Your choice will depend on the system that you choose. The common pieces of poultry equipment that you will need include:

- Heaters or brooders

- Laying nests

- Ventilation fan

If you are running a commercial poultry farm, you should budget between N600,000 and N800,000 for poultry equipment. Smaller farms can budget between N60,000 and N210,000.

Vaccination and other medication costs

Vaccination is very important to ensure that your birds remain healthy. It also ensures that you reduce the mortality rate on your farm to the barest minimum. Just so you know, birds are highly prone to diseases and a single disease outbreak can wipe out the whole farm.

If you have a farm of 500 chicks, you should budget between N200,000 and N260,000 for vaccination and medication. The price may be negotiable depending on the veterinarian that you consult.

This is one of the most important and non-negotiable costs to deal with in poultry farming. You can either formulate your feed or purchase ready made feed from established vendors. The former option is more affordable, however, many of the feed ingredients on the market are adulterated. As such, we suggest that you stick to purchasing from established companies.

The feeding cost for 500 birds is between N150,000 and N300,000 for a month. If you are raising layers, you need to feed them for about 18 months. This means that you could spend between N2.7 million and N5.4 million on feeding alone.

Purchase of chicks

The main raw material for poultry farming is chicks. Without them, everything else is a waste of investment. Currently, day-old chicks cost between N500 and N1000. If you want to purchase point-of-lay birds, they cost between N2,500 and N3,000.

PRICES LAST UPDATED: NOVEMBER 18, 2022.

How to Start the Poultry Farming Business in Nigeria

Wondering how to start the poultry business in Nigeria? Check out the tips below:

Study the market

The first thing that you should do is to study your market. A detailed feasibility study helps you to know what the market holds, how much capital you need, and who your prospective customers are. It also helps you to know who your competitors are and how to surpass them.

Write a business plan

After you have carried out a detailed study of the market, the next step is to write a business plan. A business plan gives a clear indication of what your business sets out to achieve. It acts as the map of your business and also helps you to attract investment when the need arises. If you cannot write a detailed business plan, you can draw up a Business Module Canvas (BMC) instead.

Seek out reputable suppliers

Two very important aspects of this business are getting healthy stock and purchasing healthy feed. You need reputable suppliers for both. Ensure that you find suppliers that have a healthy stock of birds. Doing this saves you from having excess mortality on your farm. It also assures you of high productivity. You should also seek out suppliers that have the best quality feed on the market. Don’t settle for cheap prices as they could mean substandard products.

Raise capital

Capital here means the funds you need for the business as well as the land and the equipment that you need. You can either raise capital from your savings or taking a loan. Other ways of raising capital include grants and funding from friends and family members.

Gather knowledge

In rounding up this post, we suggest that you gather as much knowledge about this business as possible. Poultry farming requires a hands-on approach, so you must be knowledgeable about raising birds. You can reach out to existing farmers to find out their failures and successes. This knowledge will help run your business.

Related Posts

Rottweiler Prices in Nigeria (May 2024)

Top Feeds Price List (May 2024)

Prices of Rabbits in Nigeria (May 2024)

Chicken Feeds Price List in Nigeria (May 2024)

Cost of Feeding 1,000 Catfish in Nigeria (May 2024)

Cost of Starting a Poultry in Nigeria (May 2024)

Leave a reply cancel reply.

You must be logged in to post a comment.

- Domain Names

- cPanel Web Hosting

- WordPress Hosting

- Windows Hosting

- SSL Certificates in Nigeria

- Online Store Builder

- Business Email Hosting

- Website Builder

- VPS Hosting

- Support Portal

- Affiliate Programme in Nigeria

- Web Hosting Select the perfect package for your business

- Reseller Hosting

- Windows Hosting Reliable Windows Web Hosting

- Bulk Email Servers Select a Perfect VPS for your Business

- Server Addons Additional software for your servers

- Cloud Servers Fastest Cloud Servers - LiteSpeed Servers

- Dedicated Servers The best dedicated servers for your business applications

- Business Email Professional Email Service & Team Collaboration

- Europe Windows Servers

- Single Domain SSL Secures 1 domain only.

- Wildcard SSL Best and Cheap Wildcard SSL Certificates

- Multi Domain SSL Cover Multiple Domains with 1 SSL

- Online Shop Online Shop

- Website builder Beautiful templates for your website

- Domain Addons Addons for Domains

- Domain Search Find the perfect domain name.

- Bulk Domain Search How many are you look for?

- Domain Transfer Want to transfer domain to us?

- Whois Lookup Check who owns a a domain name.

- Register Login

Visiting from Russia?

Poultry business plan in nigeria: how to write one.

Thinking about starting a poultry business in Nigeria?

You’re on the right track! Let’s talk about the great opportunities and the money-making potential that poultry farming holds for you in our country.

Page Contents

Poultry Farming Opportunities in Nigeria

Nigeria is buzzing with opportunities for poultry farming. This means you have a chance to turn your love for chickens into a successful business. People in Nigeria really like chicken, and that’s good news for your potential poultry venture.

Profitability Potential