How to Write a Five-Year Business Plan

Noah Parsons

15 min. read

Updated October 27, 2023

Learn why the traditional way of writing a five-year business plan is often a waste of time and how to use a one-page plan instead for smarter, easier strategic planning to establish your long-term vision.

In business, it can sometimes seem hard enough to predict what’s going to happen next month, let alone three or even five years from now. But, that doesn’t mean that you shouldn’t plan for the long term. After all, your vision for the future is what gets you out of bed in the morning and motivates your team. It’s those aspirations that drive you to keep innovating and figuring out how to grow.

- What is a long-term plan?

A long-term or long-range business plan looks beyond the traditional 3-year planning window, focusing on what a business might look like 5 or even 10 years from now. A traditional 5-year business plan includes financial projections, business strategy, and roadmaps that stretch far into the future.

I’ll be honest with you, though—for most businesses, long-range business plans that stretch 5 and 10 years into the future are a waste of time. Anyone who’s seriously asking you for one doesn’t know what they’re doing and is wasting your time. Sorry if that offends some people, but it’s true.

However, there is still real value in looking at the long term. Just don’t invest the time in creating a lengthy version of your business plan with overly detailed metrics and milestones for the next five-plus years. No one knows the future and, more than likely, anything you write down now could be obsolete in the next year, next month, or even next week.

That’s where long-term strategic planning comes in. A long-term business plan like this is different from a traditional business plan in that it’s lighter on the details and more focused on your strategic direction. It has less focus on financial forecasting and a greater focus on the big picture.

Think of your long-term strategic plan as your aspirational vision for your business. It defines the ideal direction you’re aiming for but it’s not influencing your day-to-day or, potentially, even your monthly decision making.

- Are long-term business plans a waste of time?

No one knows the future. We’re all just taking the information that we have available today and making our best guesses about the future. Sometimes trends in a market are pretty clear and your guesses will be well-founded. Other times, you’re trying to look around a corner and hoping that your intuition about what comes next is correct.

Now, I’m not saying that thinking about the future is a waste of time. Entrepreneurs are always thinking about the future. They have to have some degree of faith and certainty about what customers are going to want in the future. Successful entrepreneurs do actually predict the future — they know what customers are going to want and when they’re going to want it.

Entrepreneurship is unpredictable

Successful entrepreneurs are also often wrong. They make mistakes just like the rest of us. The difference between successful entrepreneurs and everyone else is that they don’t let mistakes slow them down. They learn from mistakes, adjust and try again. And again. And again. It’s not about being right all the time; it’s about having the perseverance to keep trying until you get it right. For example, James Dyson, inventor of the iconic vacuum cleaner, tried out 5,126 prototypes of his invention before he found a design that worked.

So, if thinking about the future isn’t a waste of time, why are 5-year business plans a waste of time? They’re a waste of time because they typically follow the same format as a traditional business plan, where you are asked to project sales, expenses, and cash flow 5 and 10 years into the future.

Let’s be real. Sales and expense projections that far into the future are just wild guesses, especially for startups and new businesses. They’re guaranteed to be wrong and can’t be used for anything. You can’t (and shouldn’t) make decisions based on these guesses. They’re just fantasy. You hope you achieve massive year-over-year growth in sales, but there’s no guarantee that’s going to happen. And, you shouldn’t make significant spending decisions today based on the hope of massive sales 10 years from now.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Why write a long-term business plan?

So, what is the purpose of outlining a long-term plan? Here are a few key reasons why it’s still valuable to consider the future of your business without getting bogged down by the details.

Showcase your vision for investors

First, and especially important if you are raising money from investors, is your vision. Investors will want to know not only where you plan on being in a year, but where the business will be in five years. Do you anticipate launching new products or services? Will you expand internationally? Or will you find new markets to grow into?

Set long-term goals for your business

Second, you’ll want to establish goals for yourself and your team. What kinds of high-level sales targets do you hope to achieve? How big is your company going to get overtime? These goals can be used to motivate your team and even help in the hiring process as you get up and running.

That said, you don’t want to overinvest in fleshing out all the details of a long-range plan. You don’t need to figure out exactly how your expansion will work years from now or exactly how much you’ll spend on office supplies five years from now. That’s really just a waste of time.

Instead, for long-range planning, think in broad terms. A good planning process means that you’re constantly revising and refining your business plan. You’ll add more specifics as you go, creating a detailed plan for the next 6-12 months and a broader, vague plan for the long term.

You have a long development time

Businesses with extremely long research and development timelines do make spending decisions now based on the hope of results years from now. For example, the pharmaceutical industry and medical device industry have to make these bets all the time. The R&D required to take a concept from idea to proven product with regulatory approval can take years for these industries, so long-range planning in these cases is a must. A handful of other industries also have similar development timelines, but these are the exceptions, not the rule.

Your business is well-established and predictable

Long-term, detailed planning can make more sense for businesses that are extremely well established and have long histories of consistent sales and expenses with predictable growth. But, even for those businesses, predictability means quite the opposite of stability. The chances that you’ll be disrupted in the marketplace by a new company, or the changing needs and desires of your customers, is extremely high. So, most likely, those long-range predictions of sales and profits are pretty useless.

- What a 5-year plan should look like

With the exception of R&D-heavy businesses, most 5-year business plans should be more like vision statements than traditional business plans. They should explain your vision for the future, but skip the details of detailed sales projections and expense budgets.

Your vision for your business should explain the types of products and services that you hope to offer in the future and the types of customers that you hope to serve. Your plan should outline who you plan to serve now and how you plan to expand if you are successful.

This kind of future vision creates a strategic roadmap. It’s not a fully detailed plan with sales forecasts and expense budgets, but a plan for getting started and then growing over time to reach your final destination.

For example, here’s a short-form version of what a long-term plan for Nike might have looked like if one had been written in the 1960s:

Nike will start by developing high-end track shoes for elite athletes. We’ll start with a focus on the North West of the US, but expand nationally as we develop brand recognition among track and field athletes. We will use sponsored athletes to spread the word about the quality and performance of our shoes. Once we have success in the track & field market segment, we believe that we will be able to successfully expand both beyond the US market and also branch out into other sports, with an initial focus on basketball.

Leadership and brand awareness in a sport such as basketball will enable us to cross over from the athlete market into the consumer market. This will lead to significant business growth in the consumer segment and allow for expansion into additional sports, fashion, and casual markets in addition to building a strong apparel brand.

Interestingly enough, Nike (to my knowledge) never wrote out a long-range business plan. They developed their plans as they grew, building the proverbial airplane as it took off.

But, if you have this kind of vision for your business, it’s useful to articulate it. Your employees will want to know what your vision is and your investors will want to know as well. They want to know that you, as an entrepreneur, are looking beyond tomorrow and into the future months and years ahead.

- How to write a five-year business plan

Writing out your long-term vision for your business is a useful exercise. It can bring a sense of stability and solidify key performance indicators and broad milestones that drive your business.

Developing a long-range business plan is really just an extension of your regular business planning process. A typical business plan covers the next one to three years, documenting your target market, marketing strategy, and product or service offerings for that time period.

A five-year plan expands off of that initial strategy and discusses what your business might do in the years to come. However, as I’ve mentioned before, creating a fully detailed five-year business plan will be a waste of time.

Here’s a quick guide to writing a business plan that looks further into the future without wasting your time:

1. Develop your one-page plan

As with all business planning, we recommend that you start with a one-page business plan. It provides a snapshot of what you’re hoping to achieve in the immediate term by outlining your core business strategy, target market, and business model.

A one-page plan is the foundation of all other planning because it’s the document that you’ll keep the most current. It’s also the easiest to update and share with business partners. You will typically highlight up to three years of revenue and profit goals as well as milestones that you hope to achieve in the near term.

Check out our guide to building your one-page plan and download a free template to get started.

2. Determine if you need a traditional business plan

Unlike a one-page business plan, a traditional business plan is more detailed and is typically written in long-form prose. A traditional business plan is usually 10-20 pages long and contains details about your product or service, summaries of the market research that you’ve conducted, and details about your competition. Read our complete guide to writing a business plan .

Companies that write traditional business plans typically have a “business plan event” where a complete business plan is required. Business plan events are usually part of the fundraising process. During fundraising, lenders and investors may ask to see a detailed plan and it’s important to be ready if that request comes up.

But there are other good reasons to write a detailed business plan. A detailed plan forces you to think through the details of your business and how, exactly, you’re going to build your business. Detailed plans encourage you to think through your business strategy, your target market, and your competition carefully. A good business plan ensures that your strategy is complete and fleshed out, not just a collection of vague ideas.

A traditional business plan is also a good foundation for a long-term business plan and I recommend that you expand your lean business plan into a complete business plan if you intend to create plans for more than three years into the future.

3. Develop long-term goals and growth targets

As you work on your business plan, you’ll need to think about where you want to be in 5+ years. A good exercise is to envision what your business will look like. How many employees will you have? How many locations will you serve? Will you introduce new products and services?

When you’ve envisioned where you want your business to be, it’s time to turn that vision into a set of goals that you’ll document in your business plan. Each section of your business plan will be expanded to highlight where you want to be in the future. For example, in your target market section, you will start by describing your initial target market. Then you’ll proceed to describe the markets that you hope to reach in 3-5 years.

To accompany your long-term goals, you’ll also need to establish revenue targets that you think you’ll need to meet to achieve your goals. It’s important to also think about the expenses you’re going to incur in order to grow your business.

For long-range planning, I recommend thinking about your expenses in broad buckets such as “marketing” and “product development” without getting bogged down in too much detail. Think about what percentage of your sales you’ll spend on each of these broad buckets. For example, marketing spending might be 20% of sales.

4. Develop a 3-5 year strategic plan

Your goals and growth targets are “what” you want to achieve. Your strategy is “how” you’re going to achieve it.

Use your business plan to document your strategy for growth. You might be expanding your product offering, expanding your market, or some combination of the two. You’ll need to think about exactly how this process will happen over the next 3-5 years.

A good way to document your strategy is to use milestones. These are interim goals that you’ll set to mark your progress along the way to your larger goal. For example, you may have a goal to expand your business nationally from your initial regional presence. You probably won’t expand across the country all at once, though. Most likely, you’ll expand into certain regions one at a time and grow to have a national presence over time. Your strategy will be the order of the regions that you plan on expanding into and why you pick certain regions over others.

Your 3-5 year strategy may also include what’s called an “exit strategy”. This part of a business plan is often required if you’re raising money from investors. They’ll want to know how they’ll eventually get their money back. An “exit” can be the sale of your business or potentially going public. A typical exit strategy will identify potential acquirers for your business and will show that you’ve thought about how your business might be an attractive purchase.

5. Tie your long-term plan to your one-page plan

As your business grows, you can use your long-term business plan as your north star. Your guide for where you want to end up. Use those goals to steer your business in the right direction, making small course corrections as you need to.

You’ll reflect those smaller course corrections in your one-page plan. Because it is a simple document and looks at the shorter term, it’s easier to update. The best way to do this is to set aside a small amount of time to review your plan once a month. You’ll review your financial forecast, your milestones, and your overall strategy. If things need to change, you can make those adjustments. Nothing ever goes exactly to plan, so it’s OK to make corrections as you go.

You may find that your long-term plan may also need corrections as you grow your business. You may learn things about your market that change your initial assumptions and impacts your long-range plan. This is perfectly normal. Once a quarter or so, zoom out and review your long-range plan. If you need to make corrections to your strategy and goals, that’s fine. Just keep your plan alive so that it gives you the guidance that you need over time.

- Vision setting is the purpose of long-term planning

Part of what makes entrepreneurs special is that they have a vision. They have dreams for where they want their business to go. A 5-year business plan should be about documenting that vision for the future and how your business will capitalize on that vision.

So, if someone asks you for your 5-year business plan. Don’t scramble to put together a sales forecast and budget for 5 years from now. Your best guess today will be obsolete tomorrow. Instead, focus on your vision and communicate that.

Explain where you think your business is going and what you think the market is going to be like 5 years from now. Explain what you think customers are going to want and where trends are headed and how you’re going to be there to sell the solution to the problems that exist in 5 and 10 years. Just skip the invented forecasts and fantasy budgets.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

Related Articles

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

13 Min. Read

How to Write a Nonprofit Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

[Updated 2023] How to Write a Five Year Business Plan [Best Templates Included]

![business plan 5 year projections [Updated 2023] How to Write a Five Year Business Plan [Best Templates Included]](https://www.slideteam.net/wp/wp-content/uploads/2021/10/Five-Year-Business-Plan-PowerPoint-Presentation-Templates-1-1013x441.jpg)

Smriti Srivastava

Achieving a set of goals is challenging.

Maintaining the motivation and productivity to achieve business goals is even harder.

In the words of Yogi Berra, a big-league baseball player-turned-manager, “Without a plan, even the most brilliant business can get lost. You need to have goals, create milestones, and have a strategy in place to set yourself up for success.”

This is why everyone in the industry — from an interviewer looking to hire top talent to an entrepreneur who accomplishes goals systematically — splits their business plan into five years. A five-year business plan not only extends a generous period to attain the set targets but at the same time keeps everyone on their toes, removing procrastination.

But writing a five-year business plan can get tedious, messy, and, sometimes, take forever to hit the right spot.

Therefore, this blog will cover the essential steps to help you write a tremendous five-year business plan.

Chronology of writing a spectacular five-year business plan

It is quite simple. You cannot achieve something great when you don’t know your priorities, objectives, ways, and timeframe to achieve those targets. It is essential to build a five-year plan for your business as well as the outcomes and expectations related to it.

But where do you start?

Here are the five sections you must include in your plan:

#1 A clear company introduction

A brief yet effective overview of your business, its market, team structure, roles and responsibilities, company offerings, and value proposition builds the foundation for your future endeavors. You use a company overview to set the right tone at the beginning of your business plan, as it serves as the base and a direction for your audience.

Related read: How to Create an Attention-Grabbing Company Introduction Slide in 10 Minutes

#2 vision and mission statement.

You have to ensure your employees, stakeholders, investors, and potential clients understand what your company is all about and what you stand for. Your vision and mission statement helps you with it. It enlightens the audience about your future plans - where you see your company in five years and the results you will work to achieve.

Related read: Top 10 Mission and Vision Statement Templates to Guide Your Organizational Culture

#3 target market and branding.

State who your company is looking to serve and why. Provide clarity on your target market based on psychographics and demographics. And do not forget to mention the size of your target market. You have to create a framework for making your brand visible exponentially and simultaneously create a lead generation and conversion strategy.

Related read: Top 30 PowerPoint Templates to Analyze Dominant Market Drivers

#4 product overview.

Set clear priorities based on the distinction between your primary and secondary products. You need to connect your branding around the product or service core to your company. This categorization will help you establish the revenue your products generate and the impacts they create. Further, it will help modify your plans accordingly.

Related read: Top 10 One-Page Product Overview PowerPoint Templates to Drive Sales

#5 swot analysis.

Measuring your strengths, weaknesses, opportunities, and threats in the industry can help you successfully dominate the market. Therefore, your five-year business plan must include regular and timely analysis of all your business operations. There is no better way to meet targets than keeping a check on one’s activities. It will help you focus on the proprietary system of your company.

Related read: Top 50 SWOT Analysis PowerPoint Templates Used by Professionals Worldwide

Templates to nail your business plan.

Often we have countless ideas to plan our way to a successful business. But as the day-to-day grind starts, it is easy to get distracted from the end goal and stray from the path leading to our intent. We look for a north star to point us directly to our mission. So we decided to make your life a bit easier by providing our readymade and editable five-year business plan templates. You can access them below. Dive in!

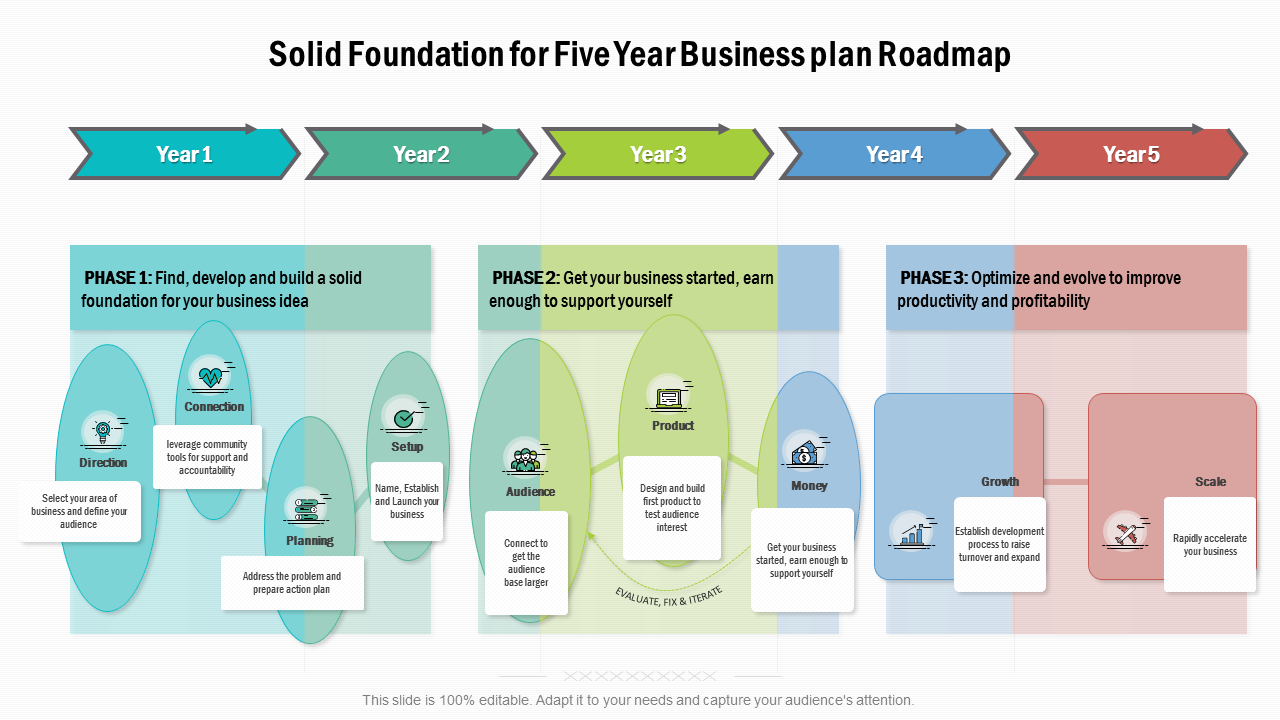

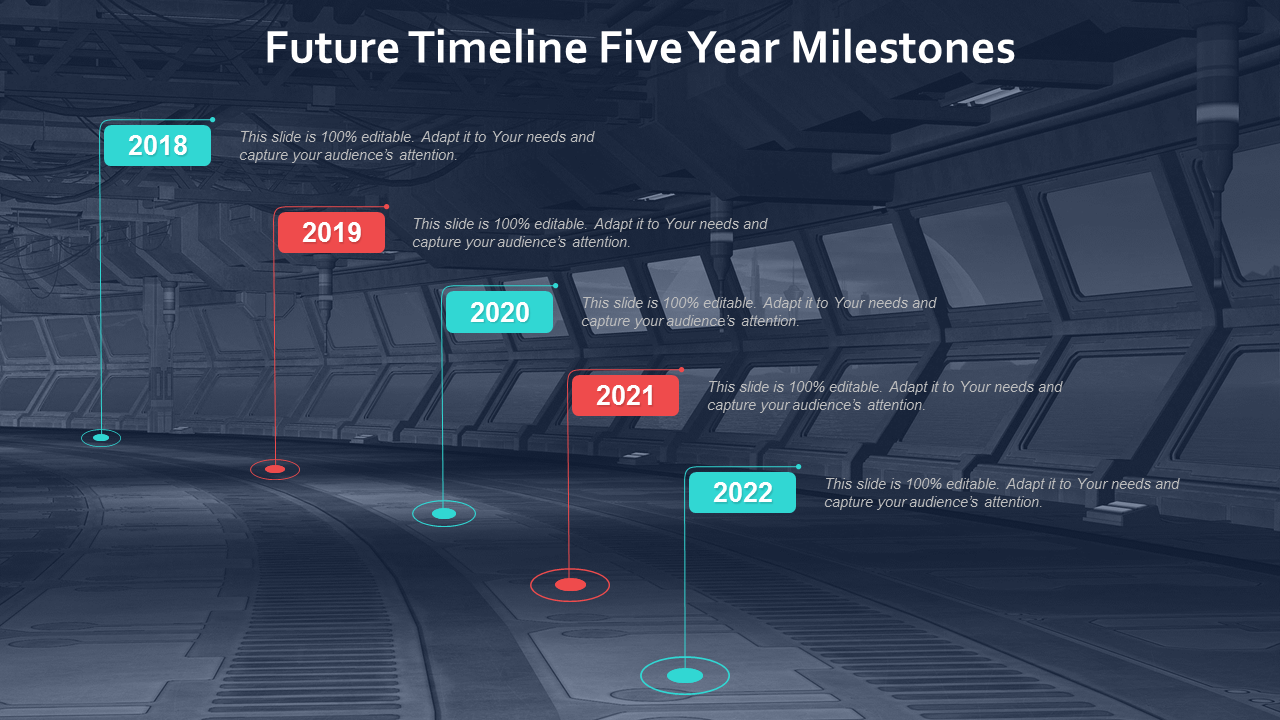

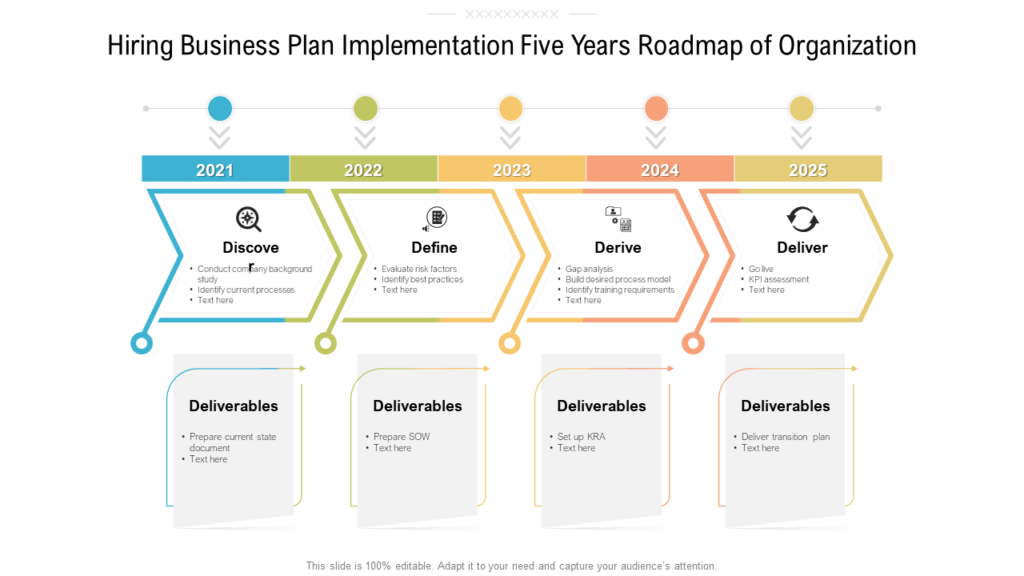

Template 1: Five Year Business Plan Roadmap Template

Help your team stay on track with your future business ambitions by taking the assistance of our invigorating PowerPoint template. This content-ready template helps you visualize your work plan and present your vision impactfully. You just need to click the download link to start customizing it.

Download this template

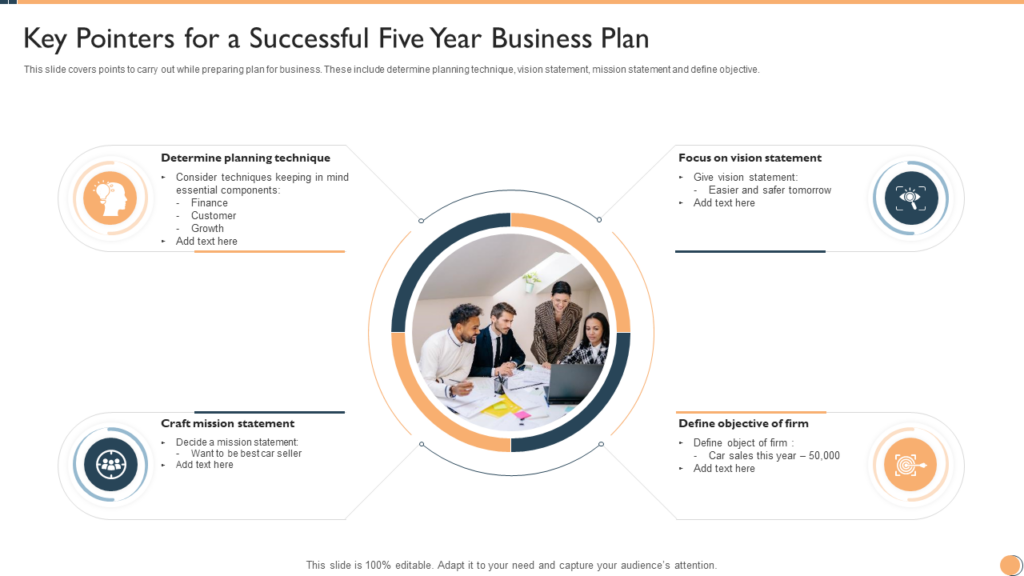

Template 2: Key Poniters for Five Year Business Plan

Use this business plan template that includes vital pointers such as setting clear goals and objectives, conducting market research and competitor analysis, developing a comprehensive marketing strategy, creating financial projections, and establishing a system for measuring progress and adjusting your plan accordingly. By following a structured template and considering these essential elements, you can create a plan that sets your organization up for long-term success.

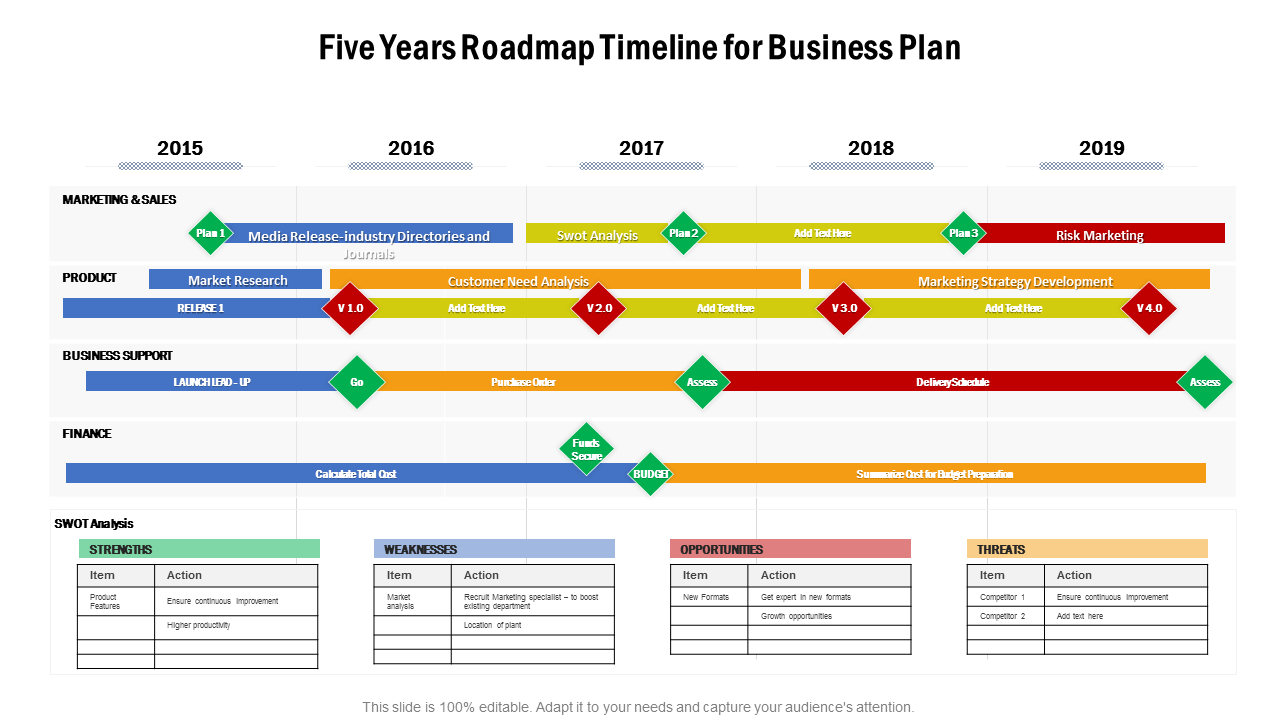

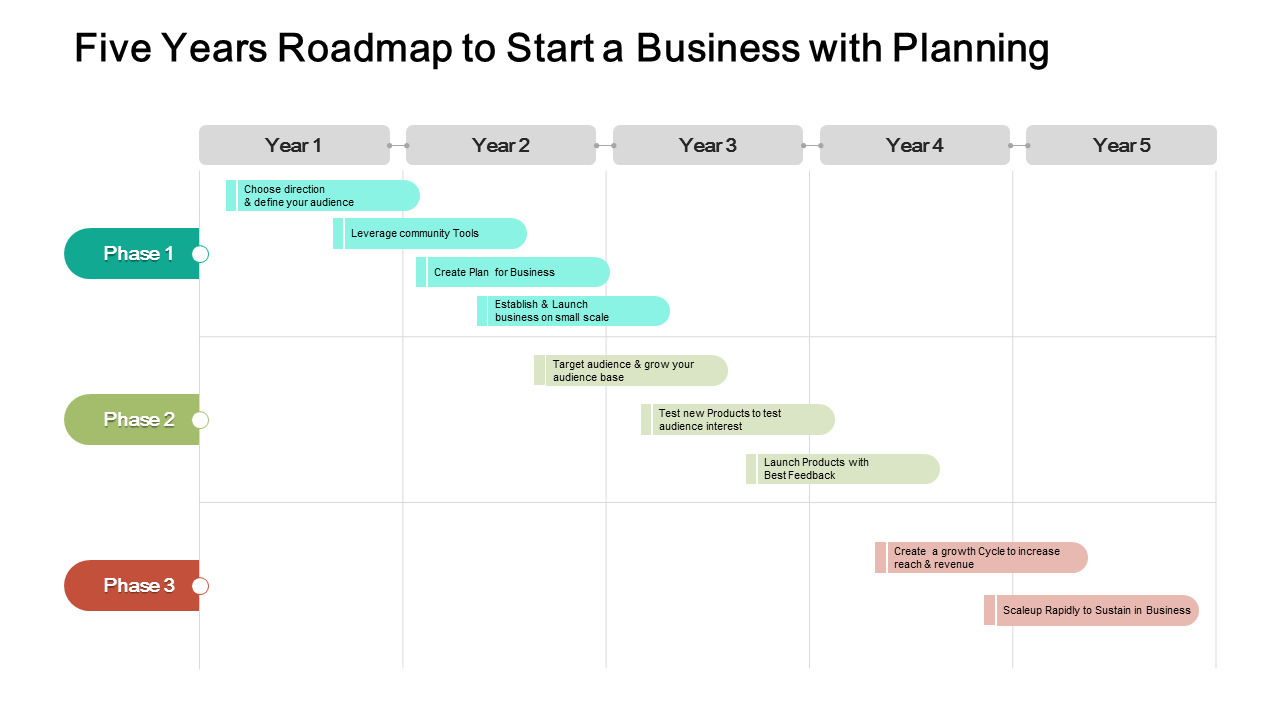

Template 3: Five Year Roadmap Timeline for Business Plan

Employ this professionally curated template to improve the success rate of your business. This template helps you track the progress of all your operational activities without any hassle. Also, our color-coded template makes it easy to comprehend and follow. So download this adaptable template to start adding your data effortlessly.

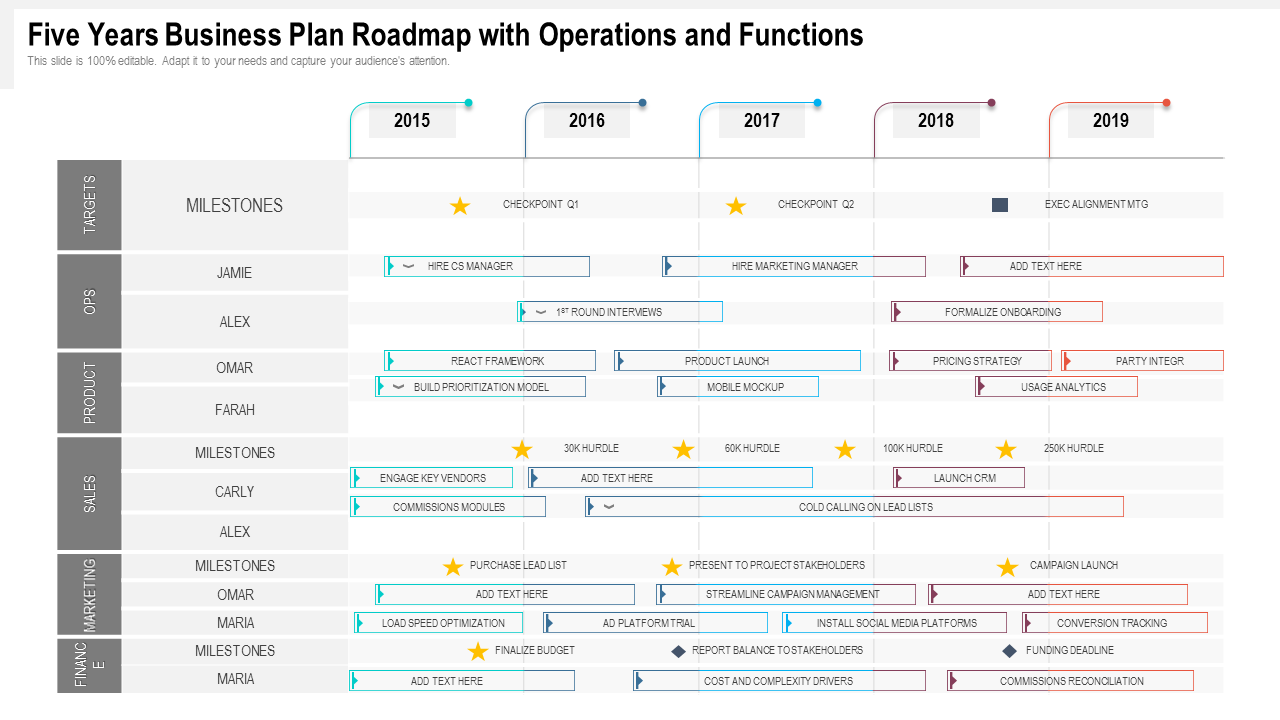

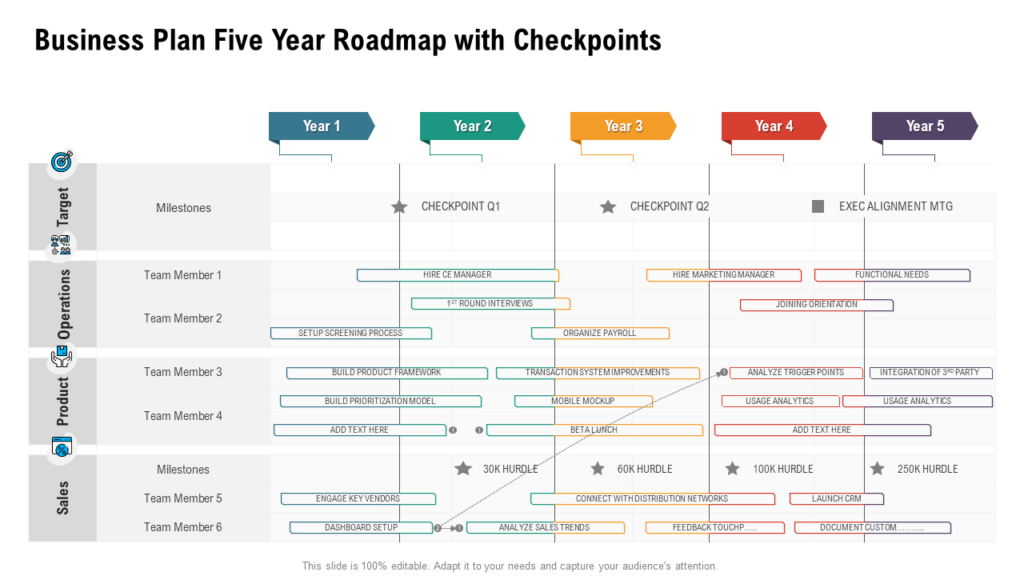

Template 4: Five-Year Business Plan Roadmap with Operations and Functions

You can utilize this template to articulate the workflow of your organization smoothly. This template allows you to write an attractive executive summary of your business operations and functions. Download the template and start assembling your key milestones immediately. Click the link below!

Template 5: Five Year Milestones Template

Outline the timeline for achieving future goals with the help of this template. Our experts have designed this PowerPoint template to help you summarize your vision, mission, targets, and timeframe in an easily accessible format. Grasp the attention of your employees and stakeholders right away by downloading this template.

Template 6: Five-Year Roadmap for Business Planning

A comprehensive plan of action displays confidence and foresightedness. Therefore, we have curated this content-specific template to help you create a strategic roadmap for your business goals. This template distributes the target phases based on yearly milestones, thereby making it easily understandable. Grab it now!

Template 7: Five Year Business Plan with Roadmap

Take your business to the next level with this five-year business roadmap with checkpoints. It includes sections for sales, product, operations, and targets set for different team members. It also includes timelines and checkpoints for processes and activities. Download this editable PowerPoint Slide now to streamline your business alignment.

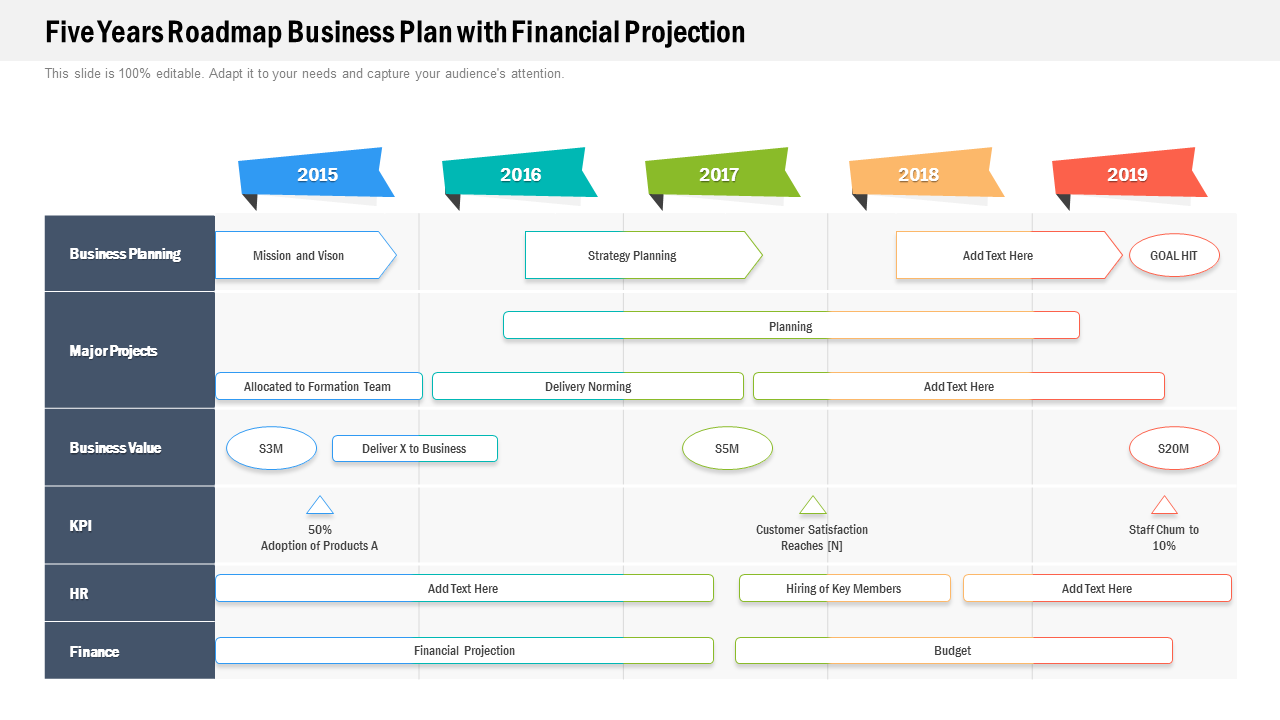

Template 8: Five Year Business Plan With Financial Projection

Make your future financial outcomes expectations loud and clear by using this PowerPoint template. Represent your business planning elements creatively by employing this template. You can even highlight your company’s ongoing functions and practices in a structured way with the assistance of our entirely adaptable PPT template.

Template 9: Five Year Business Plan Implementation Roadmap

The success rate of business plans hugely depends on the plan of action, and this editable five years roadmap of the organization rightly serves the purpose. Encapsulate all the information related to the project in a well-structured manner to obtain maximum efficiency by incorporating this stunning PowerPoint slide. State the critical deliverable, steps involved, time frame, workforce allocation, and lots more in an easy-to-understand manner by utilizing this pre-designed roadmap layout. Download now!

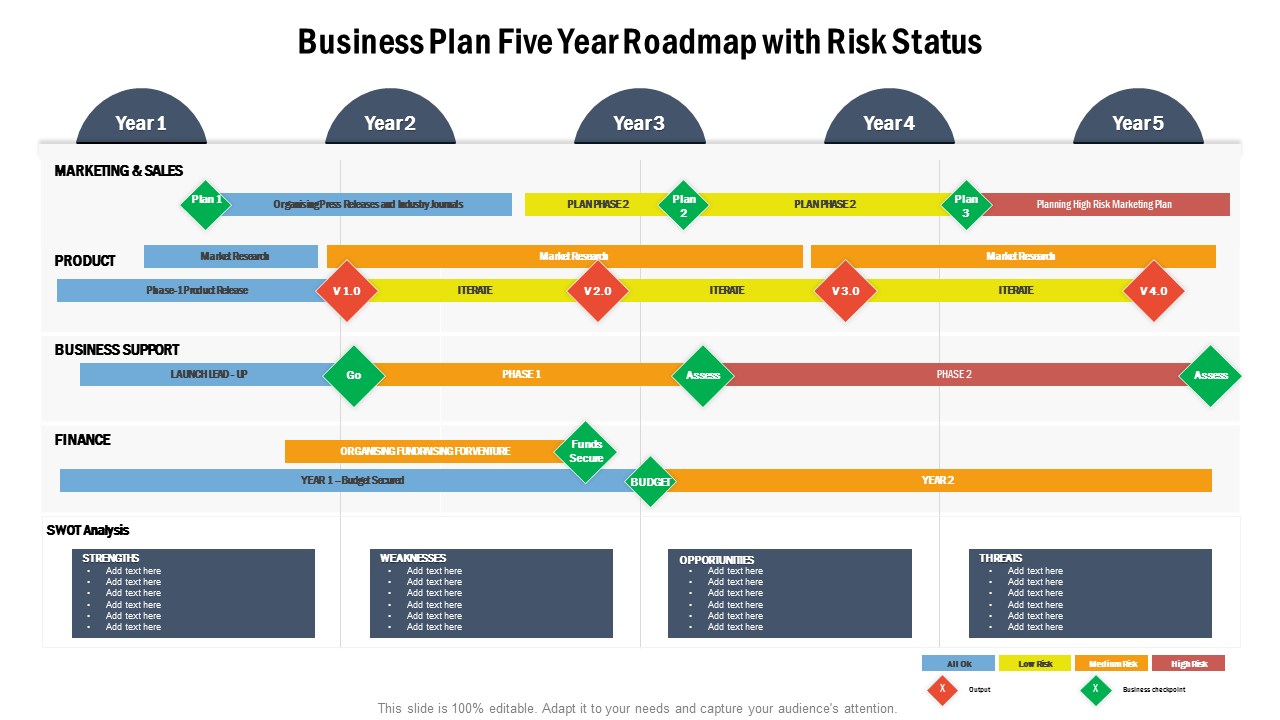

Template 10: Five Year Business Plan with Risk Status

Select this PowerPoint template to predict your future growth. Using this PPT template, you can assess potential risks that can stunt your business development in the coming years. Revamp your venture by utilizing this template as a guiding star. Download it and start with your strategic planning right away!

Having a strategic roadmap for handling your business operations and objectives is the only way to go. You cannot expect high profit and returns on investment without having a clear outline for the next five years of your business. With our stunning business plan ppt templates, you will definitely look confident, assertive, reliable, and foresighted.

FAQs on Five-Year Business Plan

How to write a five year business plan.

Here are some key steps to consider when writing your plan:

Define your mission and vision: Start by articulating your organization's purpose and long-term goals.

Conduct market research : Analyze your industry, identify trends, and understand your target audience.

Evaluate your competition: Analyze your competitors' strengths and weaknesses, and determine how you can differentiate yourself in the marketplace.

Develop a marketing and sales strategy: Outline how you will reach and engage with your target audience and define your pricing strategy.

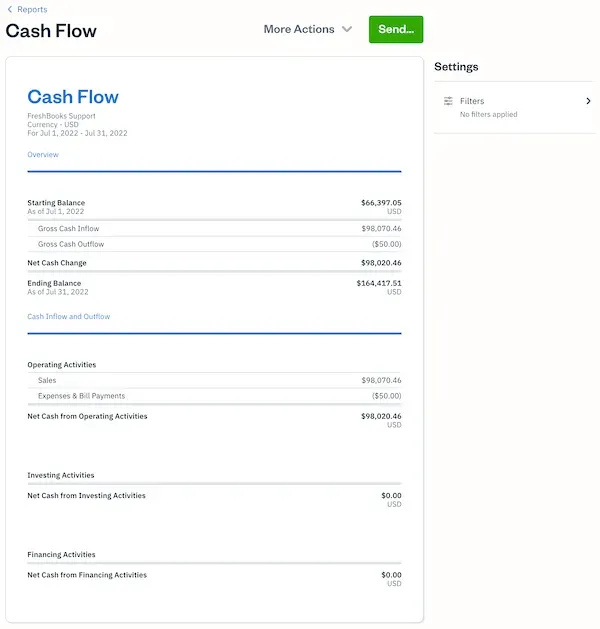

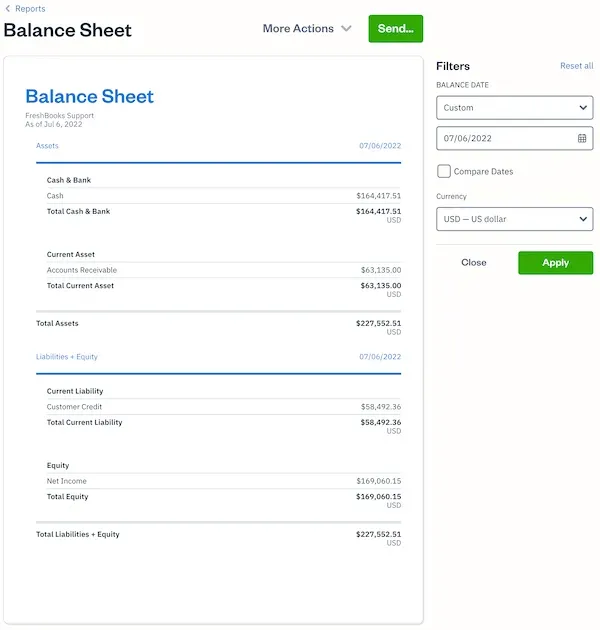

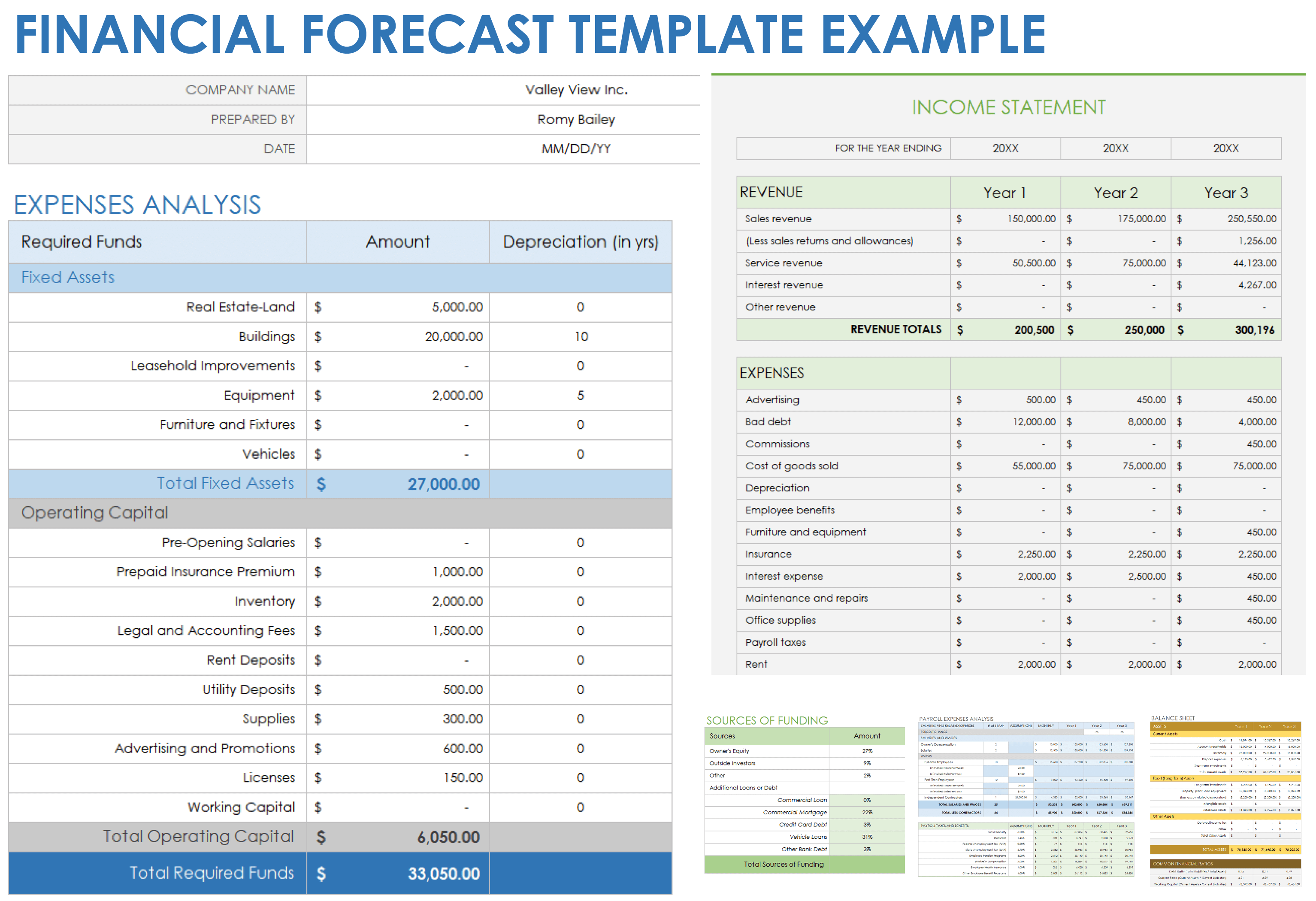

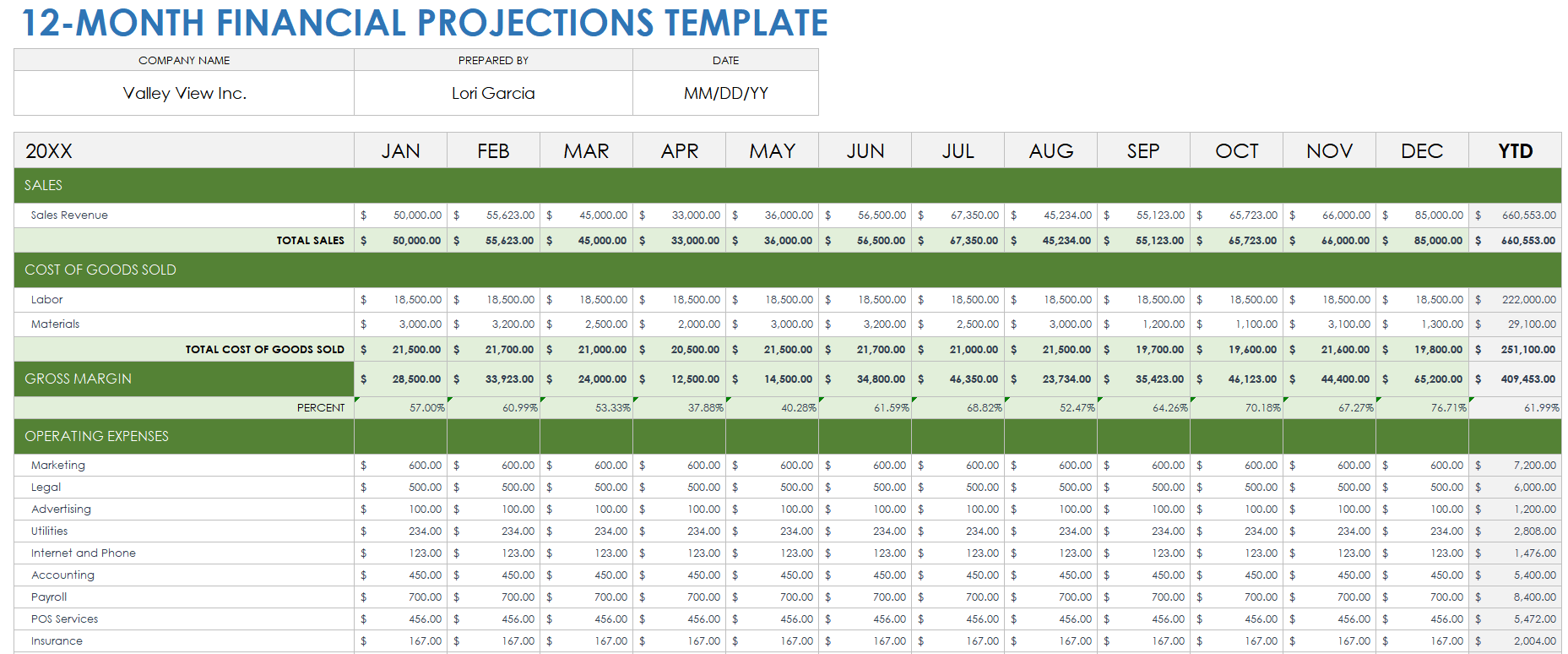

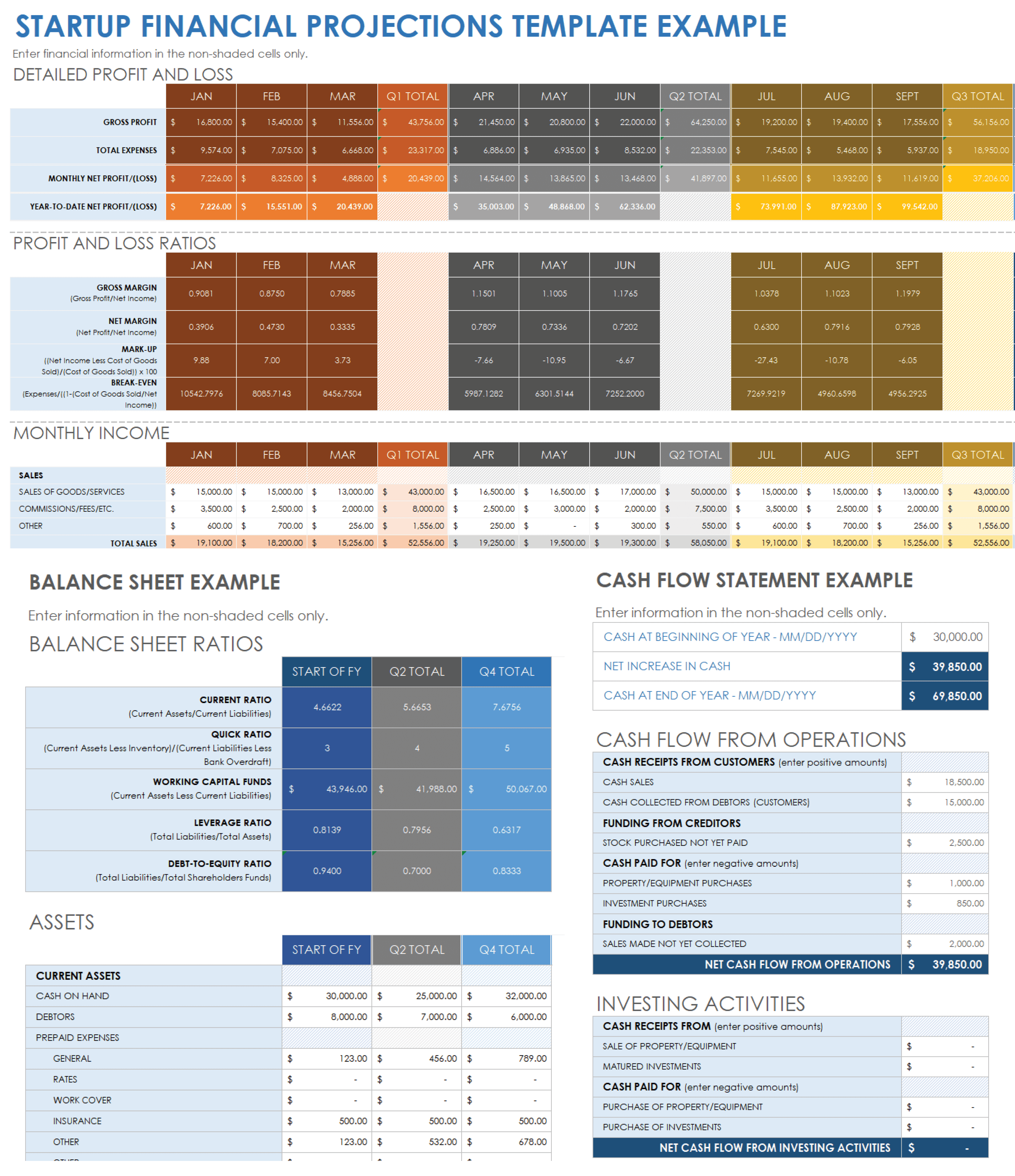

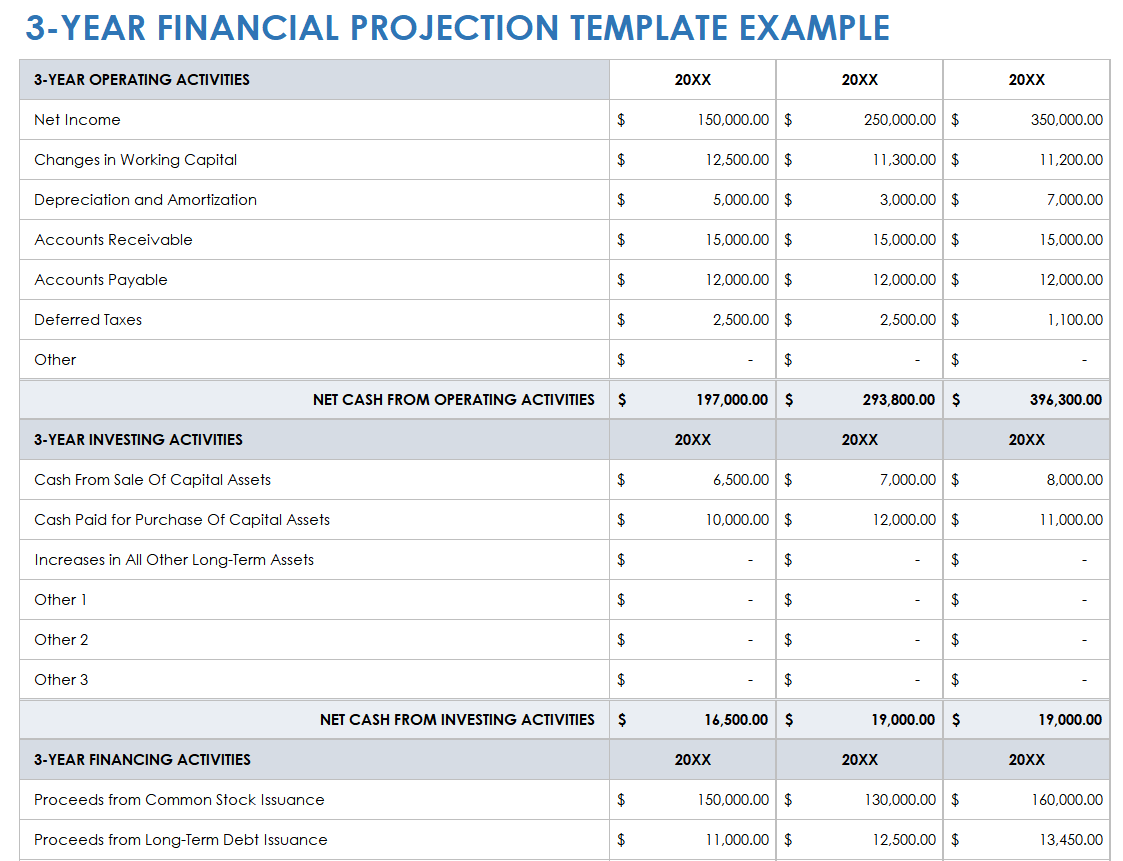

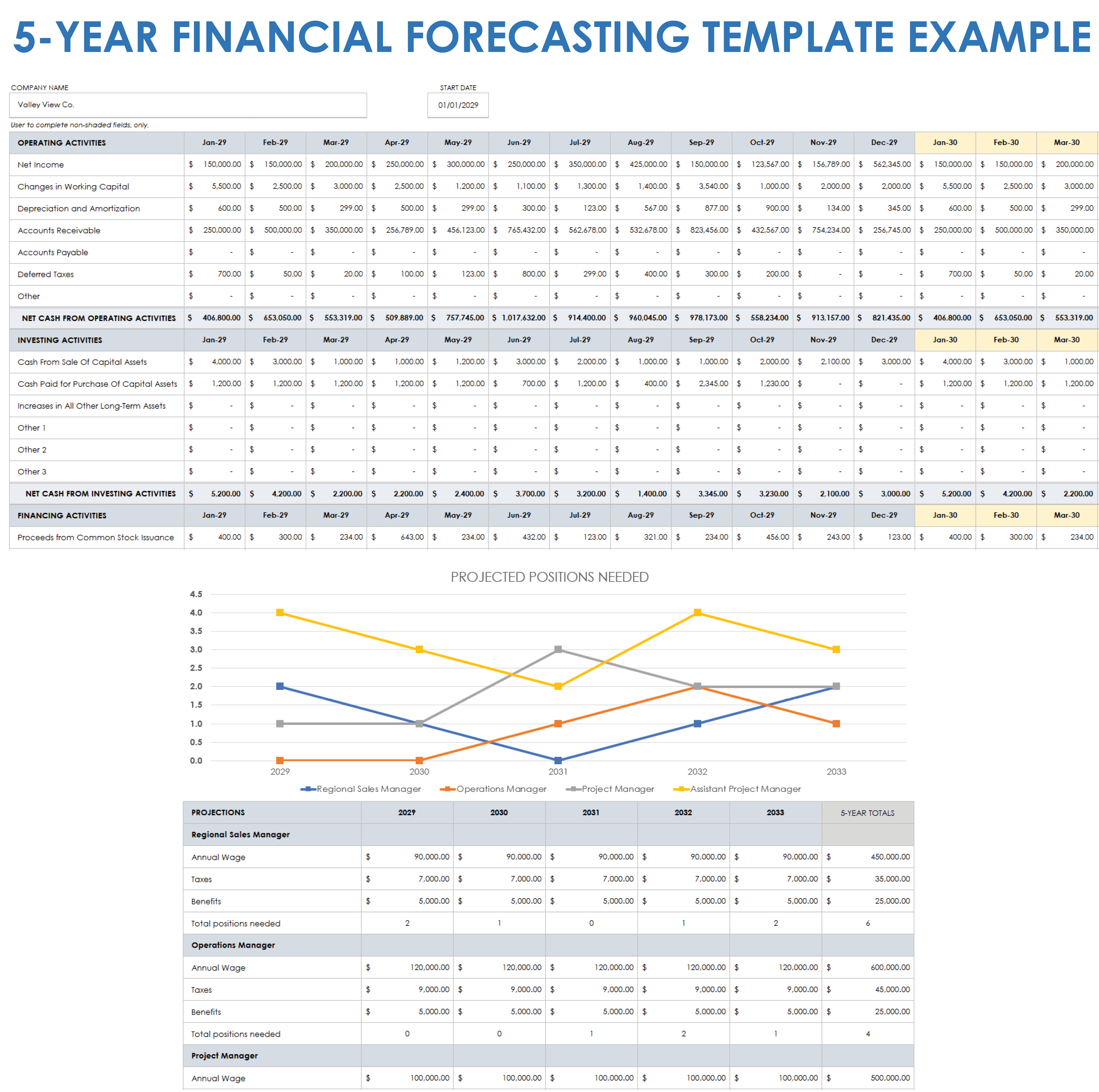

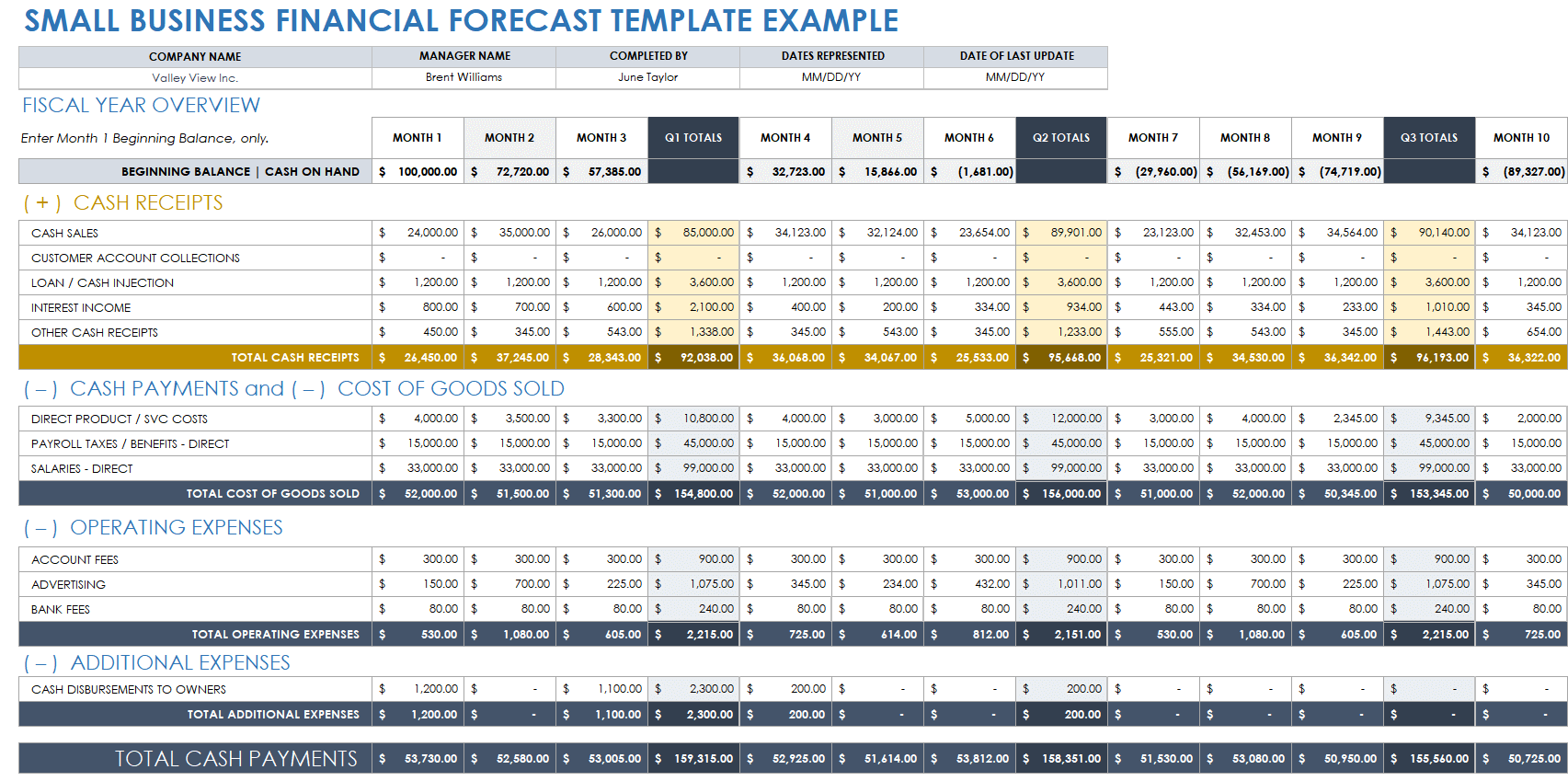

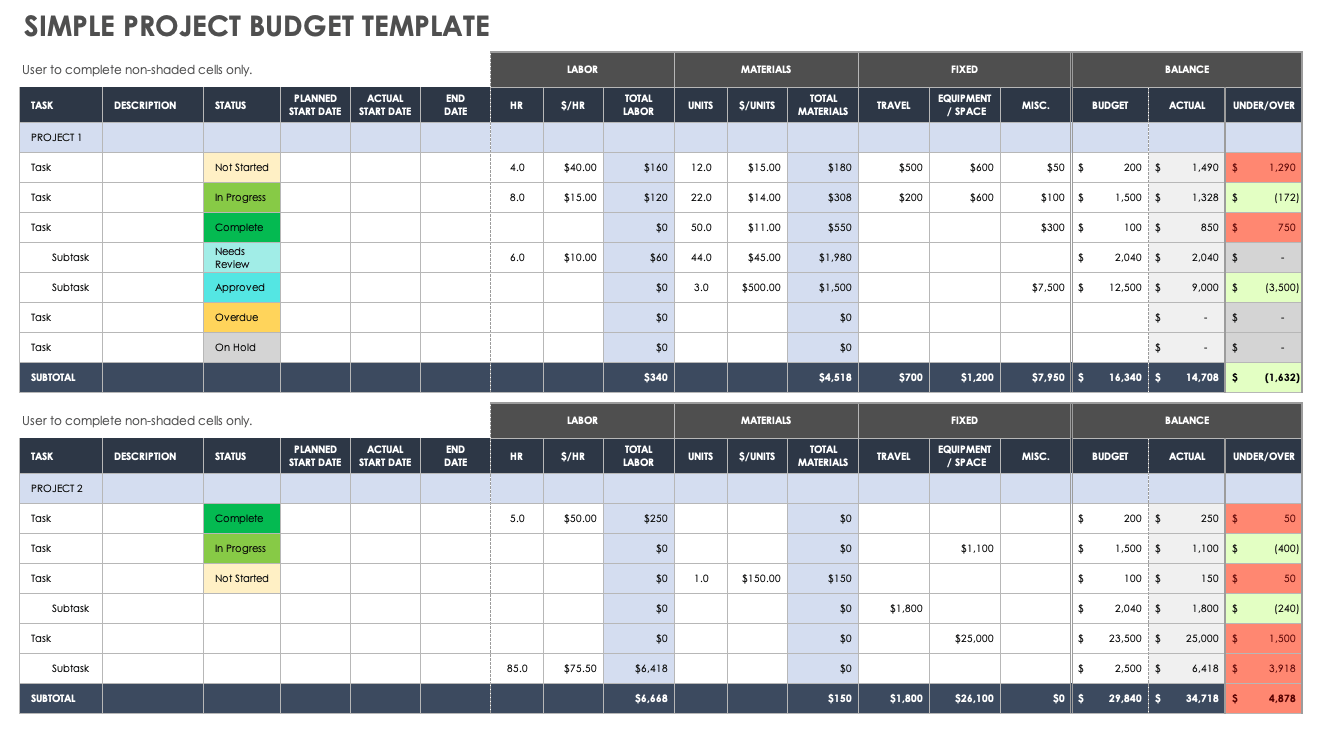

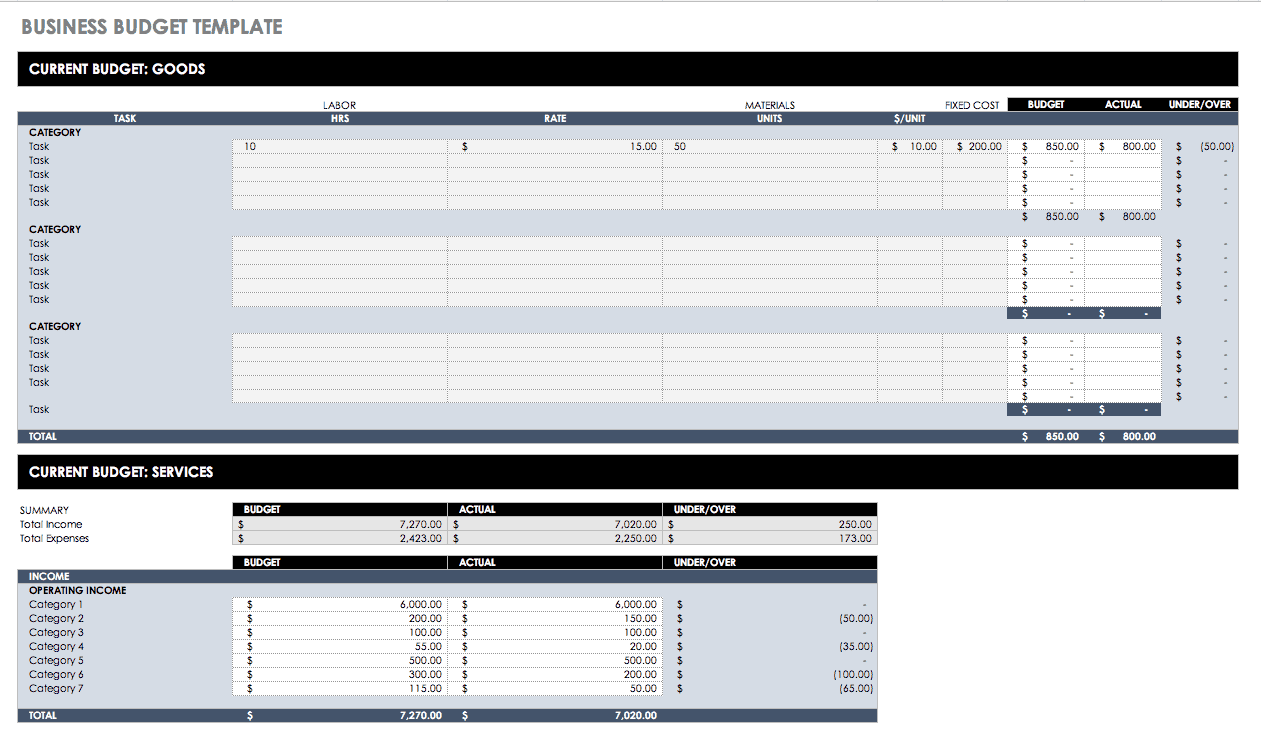

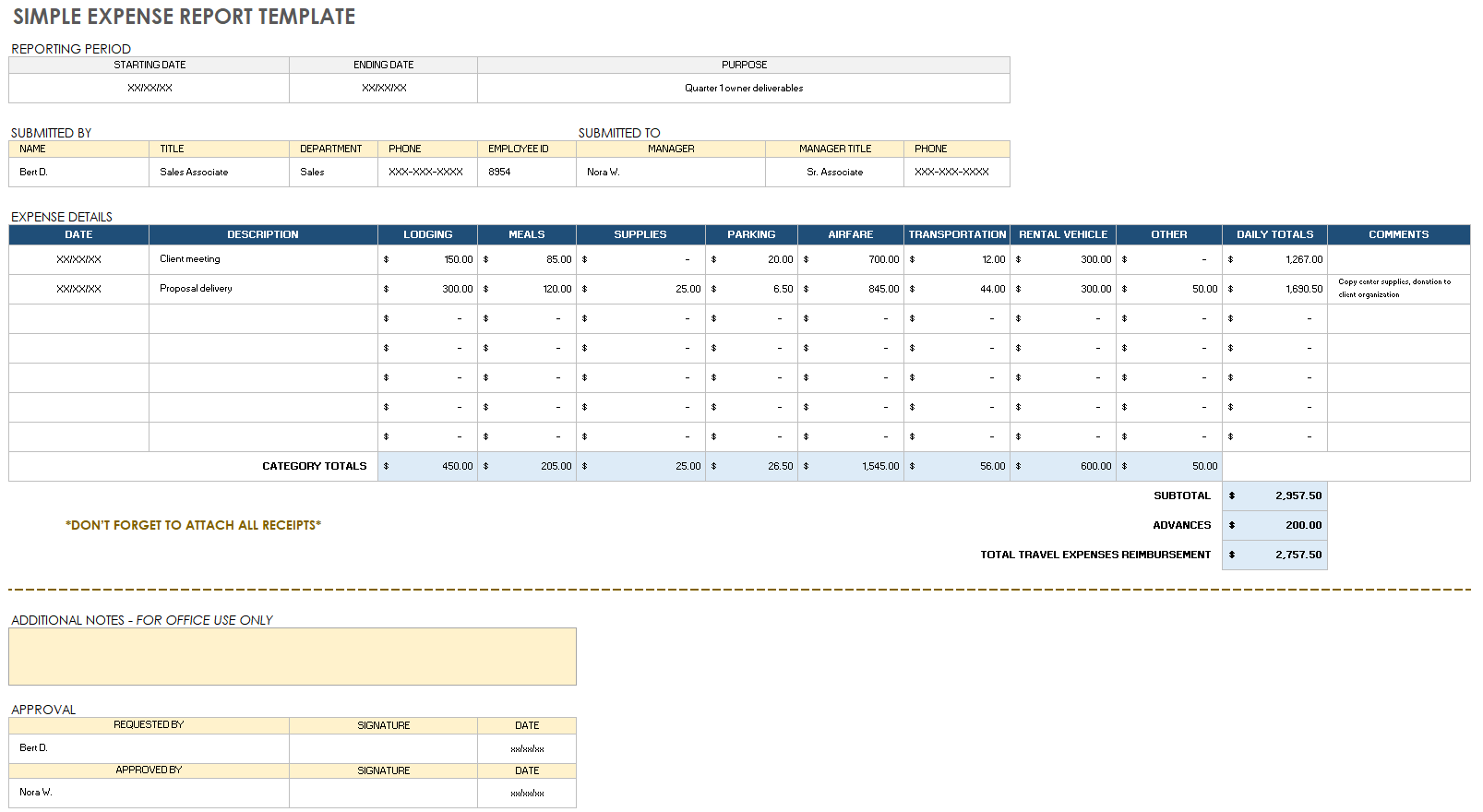

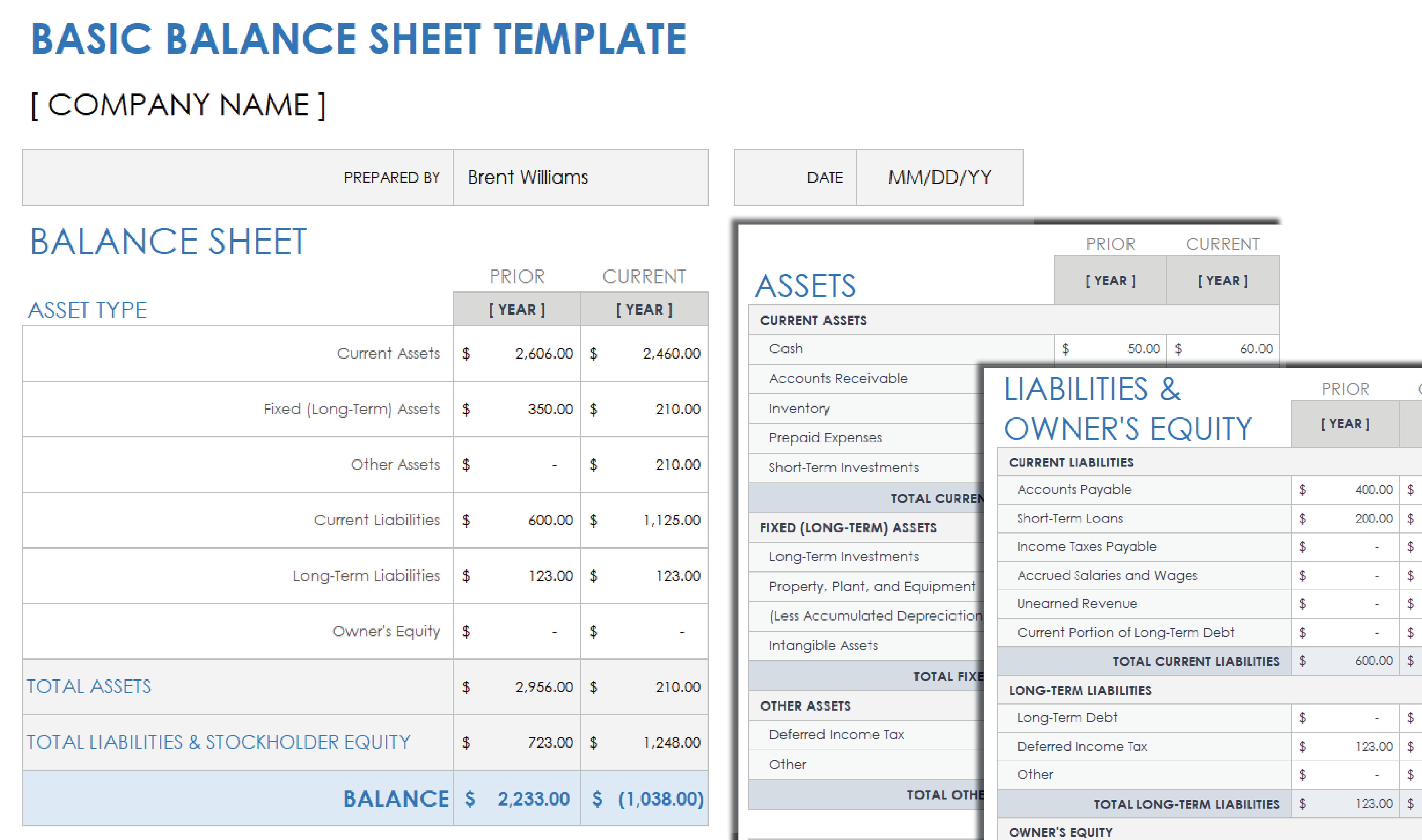

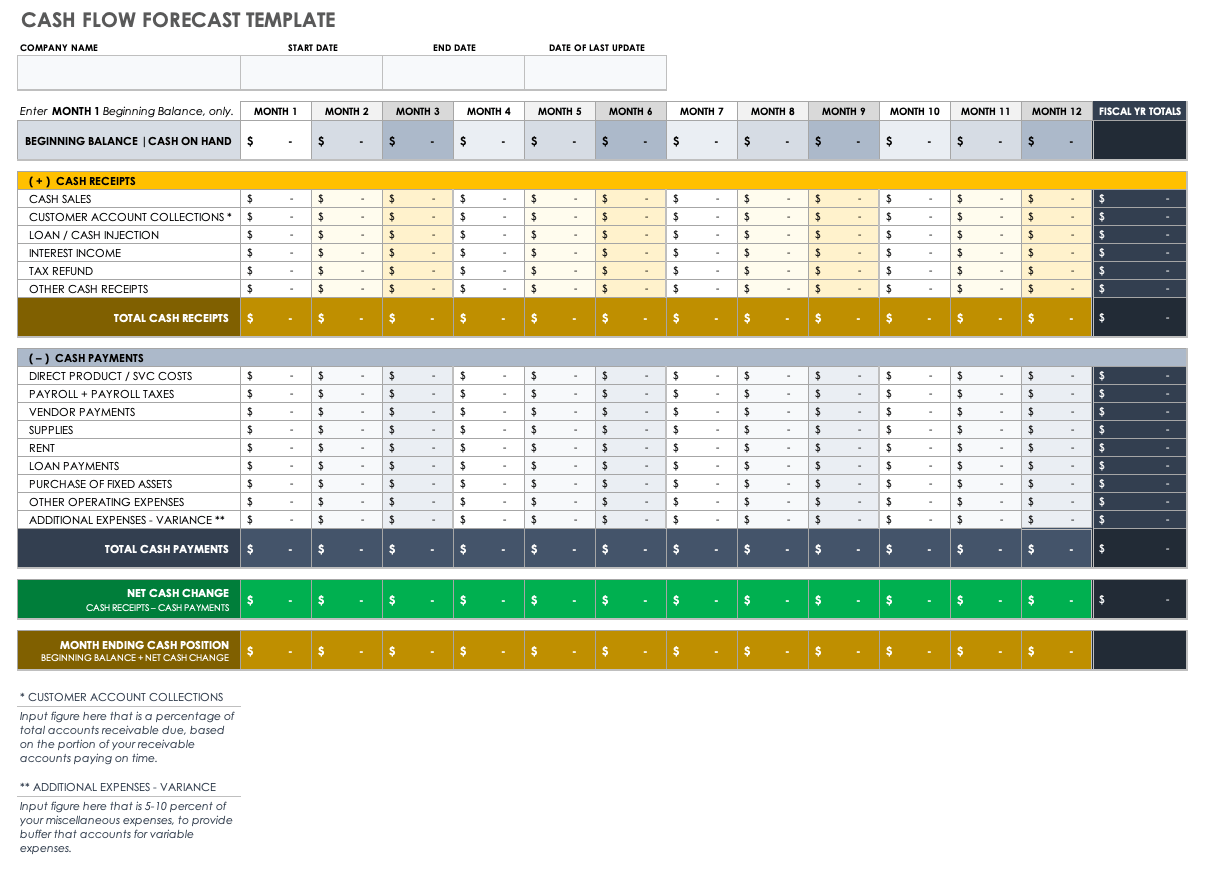

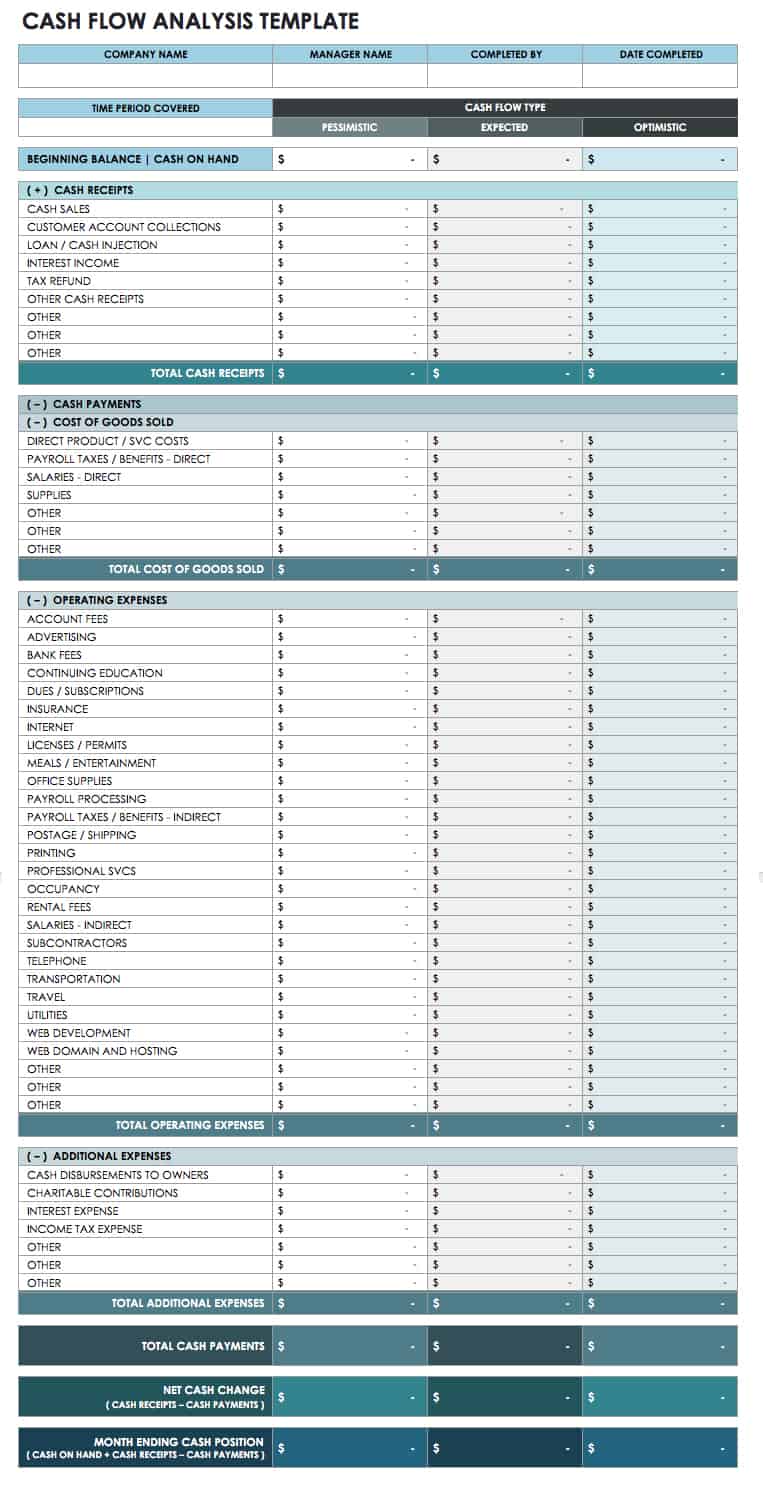

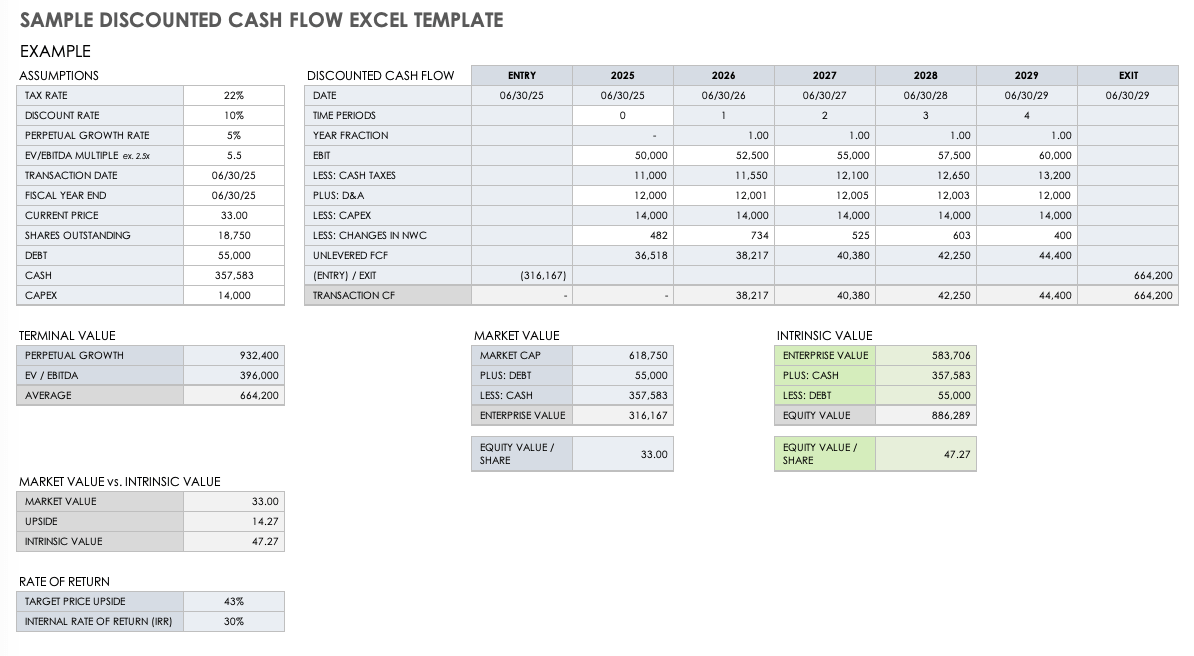

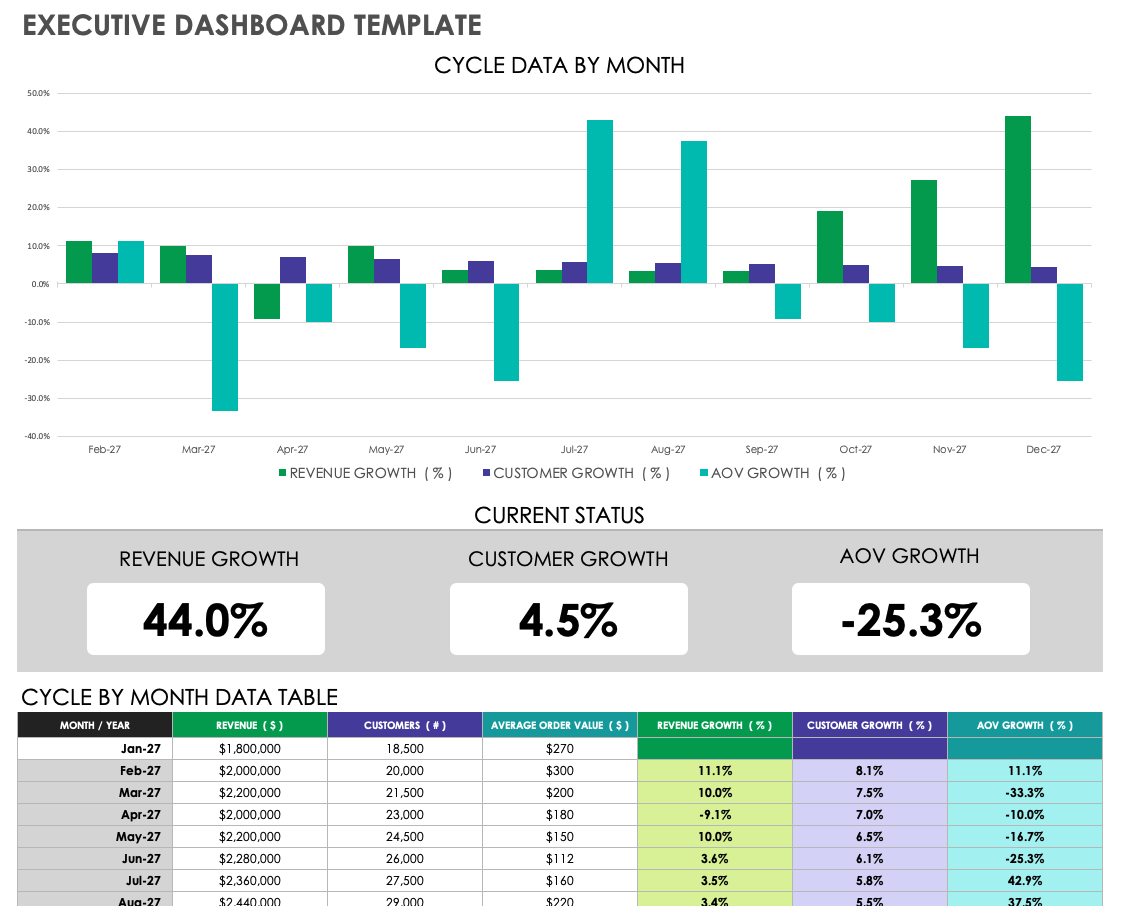

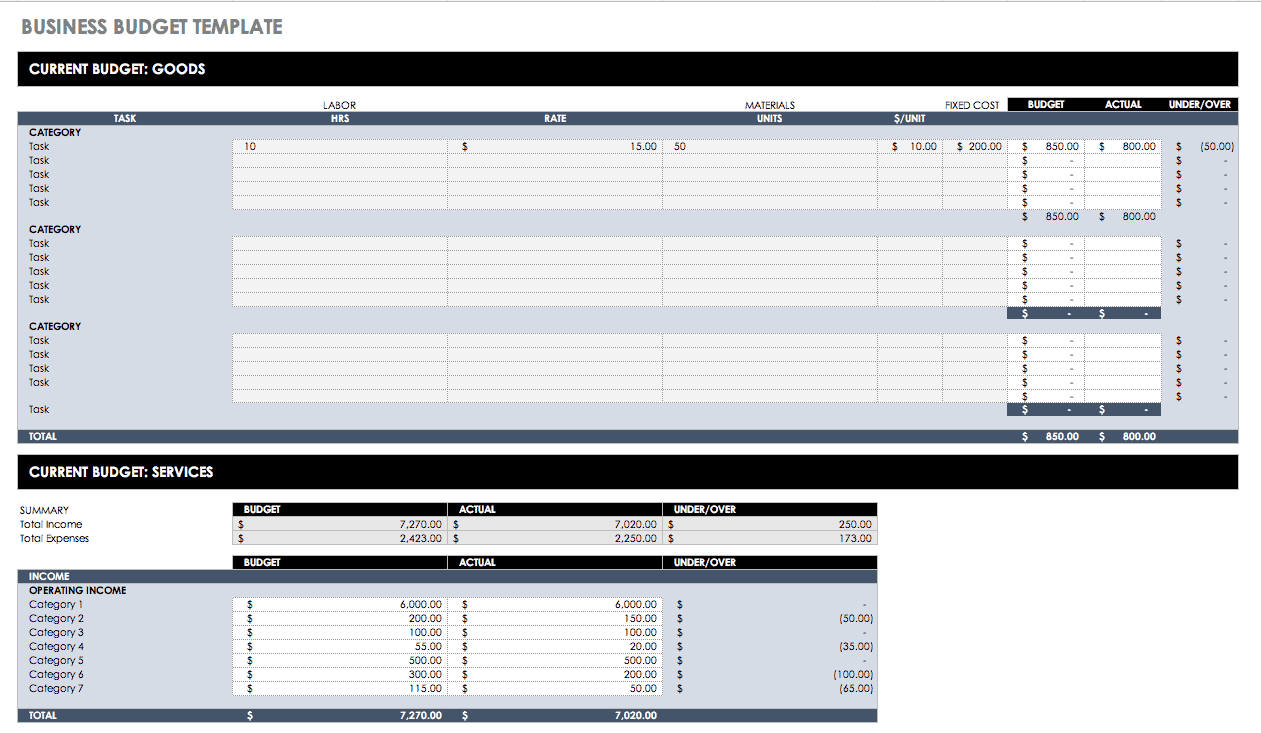

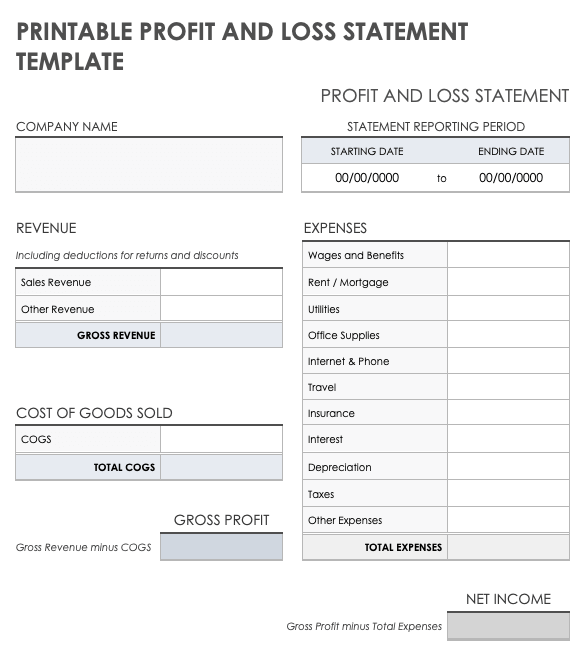

Create financial projections: Develop a comprehensive financial model that includes revenue and expense projections, as well as cash flow analysis.

Establish a system for measuring progress: Determine key performance indicators (KPIs) that will help you track progress towards your goals, and create a plan for reviewing and updating your plan on a regular basis.

What is a good 5-year business plan?

A good 5-year business plan is a comprehensive document that outlines an organization's strategy for achieving its long-term goals. Here are some key elements to include in a good 5-year business plan:

Executive summary: Provide an overview of your organization's mission, vision, and goals, as well as a summary of the key elements of your plan.

Market analysis: Conduct thorough research to understand your industry, target audience, and competition.

Marketing and sales strategy: Outline how you will reach and engage with your target audience, and define your pricing strategy.

Financial projections: Develop a comprehensive financial model that includes revenue and expense projections, as well as cash flow analysis.

Organizational structure: Outline the roles and responsibilities of key personnel, and describe how your organization will be structured to achieve its goals.

Risk management: Identify potential risks and develop strategies to mitigate them.

Performance metrics: Determine key performance indicators (KPIs) that will help you track progress towards your goals, and create a plan for reviewing and updating your plan on a regular basis.

Related posts:

5 essential tips to develop a solid 5-year business plan.

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

Liked this blog? Please recommend us

Looking to Start a Small Business? These Top 15 Printable Business Plan Templates Will Save You Time and Money

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

How to Create a 5-Year Business Plan in 8 Easy Steps

- March 11, 2024

12 Min Read

As an entrepreneur or a business owner, you know it can be challenging enough to predict business growth for the long term. And the business decisions you make today will shape your company’s future.

Well, having a strategic plan for the next three or even five years will guide you toward long-term business goals and increase the potential for success.

So, why take a chance? Keep a solid five-year business plan with you!

Need help writing a business plan from scratch? Don’t worry; we’re here to support you with our 5-year business plan template .

This will help you learn more about the business plan for 5 years and what components you should include in it. Also, it allows you to organize ideas, set realistic growth targets, and refine your business strategy that will attract investors.

Sounds good, right? Let’s get started.

What is a 5 Year Business Plan?

A 5-year business plan is a professional document that serves as a strategic roadmap for your company’s future. It outlines business goals, strategies, financial projections, and growth plans for the next five years.

It helps you set clear objectives, define target customers, allocate resources effectively, mitigate risks, adapt to changing market conditions, and make informed decisions.

Ultimately, a well-developed 5-year plan keeps you on track and drives sustainable growth and profitability over the specified timeframe.

Why do you need a 5 year business plan?

Writing a solid business plan is one of the most important aspects of your entrepreneurial journey.

A 5-year business plan gives you a structural framework to think strategically about your company’s plans over the next few years. It helps you organize your business idea and guide your strategic decision-making.

The following are a few key reasons why it’s valuable to have a 5-year business plan:

Highlight your long-term vision

A 5-year plan helps you articulate your long-term vision and define a set of strategic goals for your business over the next five years. This will allow you to stay focused on your objectives and make smart decisions to navigate the complexities of your business environment.

Build investor confidence

If you’re looking for investors or stakeholders to fund your business expansion, a well-written 5-year plan is necessary. It demonstrates your commitment to long-term growth and assures investors that your business will make profits. So, this will increase their confidence and belief in your long-term strategy.

Mitigate potential risks

Analyzing and identifying potential risks is the key aspect of any business. So, an actionable plan helps you develop strategies to mitigate those risks and ensure your business continuity. If there is economic volatility, regulatory transitions, or technical disruptions, a 5-year business plan helps you anticipate and prepare for business challenges.

Promote strategic planning

A good 5-year business plan enables you to think about the business and how to attain sustainable growth and success over the next few years. It also helps you make strategic hiring decisions and anticipate future staffing needs. By identifying market trends, competitors, and internal capabilities, you can enhance strategies to capitalize on opportunities and reduce potential risks.

Now that you know why a business plan is necessary, it’s time to understand what to include in a detailed 5-year plan.

What to include in your detailed five-year business plan

1. executive summary.

An executive summary is a brief introduction to your 5-year business plan and summarizes each component you mentioned in the document.

Though it is the first section, it is written in the last, since it provides a high-level overview of the complete business plan.

The executive summary is the introductory section of the plan, so its primary goal is to quickly attract readers and convince them to delve further into the rest of the plan.

Here are a few details you may consider including in your executive summary:

- A quick overview of your business idea and objectives

- Your company’s mission and vision statements

- Industry analysis and market research

- Sales and marketing plan

- Key performance indicators

- Introduction of your management team

- Financial forecasts for the next five years

Remember that you keep your summary simple, concise, and compelling enough to build investors or readers trust.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

As its name indicates, the business overview section provides a detailed description of your company. It covers all the essential information, from a business idea to its long-term goals.

Since you’ll give a brief company description in the executive summary, this chapter would be an expansion on it, providing an in-depth understanding of your business.

So, this section makes it easier for readers or potential business partners to quickly understand and confirm the nature of your business, such as what your company does, who the potential customers are, and how you plan to reach your objectives.

You may include all the following crucial elements in this section:

- The type of small business you operate

- A brief history or background details of your business

- Achievements or milestones you’ve achieved

- Business legal structure(s-corp, LLC, sole proprietorship, etc.)

- Mission statement

- Short-term goals and long-term objectives

3. Market Analysis

Industry analysis and market research is a detailed breakdown of the external business environment. It provides a thorough understanding of the specific industry or sector in which your business will operate.

This section helps your readers or potential investors to easily understand the broader industry, target customers, emerging trends, and market demands.

Apart from that, it helps you and your team to analyze and identify the untapped key areas in the market and develop strategies to stand out from the competitors.

Here are some specific details you may include:

- Market size and growth potential

- Target market

- Ideal customers, along with their preferences and buying habits

- Competitors’ research and SWOT analysis

- Industry trends

- Regulatory environment

4. Product and Services

In the product and services section, you may provide details of your product or service range, main features, pricing, and more. It helps you demonstrate the current capabilities of your business and highlight the USPs.

So, you may consider adding the below points in this section:

- Product/service description

- Pricing details

- Quality standards

- Future product development plan

While you’re planning how to start your own business, you have to explore the market and determine how your offerings will encounter customer problems and satisfy their needs better than competitors.

5. Sales and Marketing Strategies

Your sales and marketing plan outlines the strategies you’ll use to reach the target audience and how you’ll bring more customers by promoting your products/services to them.

A well-written marketing plan will encourage you to create effective campaigns and simplify your marketing efforts while maintaining the marketing budget and maximizing return on investment.

Thus, you may describe a list of sales strategies and promotional tactics to attract new customers and retain existing ones.

Here’s a list of key components you may include in this section:

- Target audience

- Marketing strategy

- Sales approach

- Sales and marketing goals

- Customer retention program

6. Operations Plan

As you’ve mentioned your business goals in the previous sections, now it’s time to define how you’ll meet those goals.

In your operations plan, you’ll need to outline all the details of everyday business operations and activities. This will help you and your team to define responsibilities, daily tasks, and short-term goals you plan to achieve, keeping track of your future goals.

Well, here is some distinct information you should include in the operations plan:

- Staffing and training

- Operational process

- Supply chain & Inventory management

- Facilities and equipment

Note that your operations plan is a living document, you may adjust and update it as needed.

7. Management Team

A well-trained and experienced management team is crucial for driving your business ahead.

So, highlight your business owners and key executives in this section, along with their roles & responsibilities, educational qualifications, industry experience, and how you plan to compensate them.

It allows readers to easily understand your management team’s background, skills, and expertise that help you grow your company and make informed business decisions.

The following information you may consider including in the management team section:

- Company owner profile

- Resume-styled summary of key members

- Organizational structure

- Compensation plan

- Advisory board members

8. 5-year Financial Projections

A financial plan is the most crucial aspect of your five-year business plan, as potential investors or lenders want to know more about your business profit margins.

It provides a detailed blueprint of your business’s 5-year financial reports broken out both monthly or quarterly for the first year of operation and then annually.

While creating an in-depth financial plan for the next 5-years, you’ll need to highlight all the below factors:

- Revenue forecast

- Cost estimates

- Profitability analysis

- Cash flow projections

- Break-even analysis

- Business ratios

In addition to that, if you’re seeking funding or investors, you will need to summarize exactly how much money you need, how you plan to use these funds, and how you pay it back.

Well, having realistic financial forecasts at your hand can help you evaluate your business’s financial health and growth potential in the long run.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Tips for creating a five-year business plan

Now that you understand what to include in a business plan, it’s time to consider how you’ll actually create the document. Here are some tips for drafting a comprehensive five-year business plan.

This will help you prepare a business plan that serves its purpose and can be an easy reference for the years ahead.

Conduct thorough analysis

Conduct a thorough analysis of the market, competition, internal capabilities, and the current financial situation of your business before you finalize your five-year plan. Also, identify your strengths and address weaknesses. This helps you pinpoint potential risks and opportunities that impact your business and strategic decisions for the next few years.

Set realistic financial goals

While setting your business objectives, it’s important to define specific, measurable, and achievable goals that you can accomplish in the years ahead. Try to consider a few factors, such as marker conditions, emerging trends, and your business capabilities when setting revenue targets, profit margins, and other financial milestones. This will help you stay focused and motivated.

Demonstrate the potential for ROI

A 5-year plan should effectively show the investors and stakeholders that your business has the potential for return on investment(ROI). It will help you outline how your strategic initiatives will generate revenue and profitability over the next five years. So you can provide a clear opportunity for investment and support.

Develop contingency plans

Developing a contingency plan is crucial for the potential challenges that may arise over the next few years. You can consider several factors like economic downturns, supply chain disruptions, regulatory changes, or other unforeseen events. This will mitigate the impact of these risks and ensure that your business runs smoothly even in challenging circumstances.

Ensure clear communicate

A detailed five-year plan allows entrepreneurs and business owners to clearly communicate their business goals, milestones, and strategies. So this will be easy to understand for all the stakeholders, including potential partners, investors, and employees. You can also use charts, graphs, and visuals to share intricate details and make your plan more compelling.

Review and update regularly

Once you have crafted your entire business plan, you should regularly schedule reviews to assess progress, update assumptions, and update strategies as needed. Since the business plan is a living document, it evolves over time based on new facts or varying business environments. By revising and updating your plan, you make sure that it will remain relevant and effective.

So, try to keep in mind these few factors while creating a 5-year plan. Now, let’s move forward and explore several types of business plan templates.

Examples of 5-year business plan templates

As there are several types of 5-year business plan templates available, no two business owners build the same 5-year plans.

This is so because the business plan template that works best for your company depends on the age of your business, objectives, and the purpose behind using the plan.

Here are a few examples that are tailored to different aspects of business planning:

Traditional 5-year business plan template

This kind of business plan template follows the standard format as you establish a new business or startup, define the target audience, and market your products/services. It includes lengthy sections about company overview, market analysis, marketing and sales strategies, or financial forecasting. So, this will provide a detailed plan for your business over the next 5 years.

Strategic plan for growth and expansion

When you’ve been running the business for a few years and thinking about expansion or growth, a strategic growth plan might be your choice. It will help you approach your growth strategically and provide the best opportunities to identify risks and techniques to mitigate them. So, this type of template helps align your business activities with long-term objectives.

Simple one-page plan

As the name suggests, it is a single-page business plan that helps you provide a high-level overview of your business to the partners, investors, or suppliers. Since it is shorter in length, it highlights the most crucial points, and even writing a one-page business plan can be much simpler and quicker compared to the traditional business plan.

Start preparing your business plan

Finally, with the help of details and resources provided in this guide, you’re well-equipped to start an exciting journey of preparing a successful 5-year business plan.

Whether you’re an experienced entrepreneur or a new business owner, you can consider using a business plan app like Upmetrics to streamline your business planning approach.

Upmetrics is a user-friendly platform that provides easy-to-follow guides, 400+ business plan examples, and AI support to create an actionable plan in manageable steps. It also helps you develop realistic financial projections if needed or when you feel stuck with a financial plan.

So, start writing your plan today and bring your vision to life!

Make your plan in half the time & twice the impact with Upmetrics

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.

Frequently Asked Questions

Is it good to make a 5 year plan.

Creating a 5-year or long-term plan is highly beneficial for your businesses. It helps you set clear goals, anticipate potential risks & challenges, develop realistic financial outlook, demonstrate growth potential to investors, and build their confidence. So, it guides you in the right direction to attain sustainable growth and success over the long term.

How much detail should I include in the financial projections?

The following are a few key elements that you need to include in your financial projections:

- Sales forecast

- Expenses budget

- Cash flow statement

- Profit and loss statement (Income statement)

- Balance sheet

How long should my 5-year business plan be?

The length of a 5-year business plan typically ranges from 15-35 pages and beyond as it depends on your purpose, business concept, objectives, resources you plan to use, and the strategies you will need to achieve your business goals.

Can I write a business plan myself?

Of course, you can write your business plan by yourself. If you are new to the planning process, you may get help from various resources available. You may consider including business plan software, online guides, templates, strategic planning sessions, and professional writers.

What's the best way to format my 5-year plan?

The best way to format your 5-year plan depends on your specific needs, target market, and business strategy. You may follow the below guidelines to create a professional-looking business plan:

- Write a compelling executive summary

- Provide a detailed company overview

- Conduct thorough market and industry analysis

- Describe the products and services

- Outline sales and marketing strategy

- Summarize operations plan

- Introduce your management team

- Present 5-year financial forecast

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Ready to Kickstart Your Business Planning?

– Don’t Miss It

Startups made easy. Sorted.

- Essential Startup Contracts

- Founder Agreements

- Register a company

- Team Agreements

- Apply for SEIS & EIS

- Staff Handbook

- Company Policies

- Pitch to Investors

- Raise Before a Round

- Do a Funding Round

- Legal Advice for a Round

- Instant Investment

- Raise with Crypto

- SEIS/EIS Compliance

- Share Option Schemes

- EMI Option Schemes

- EMI Valuation

- Unapproved Option Schemes

- R&D Tax Credits

- Legal Advisory Service

- Share Transfers

- Manage your board

- USA Expansion

- Sell your company

Create a syndicate

Run your deal, seis/eis relief, manage your portfolio, mission & values.

Already have an account? Log in

💰 The ebook your investors want you to read – Get the 2024 guide to startup funding

- FR ( French )

Five-year business plan: why you need one and how to write it

What is a five-year business plan, do you actually need a five-year business plan, who is a five-year business plan for, how to write a five-year business plan, five business plan tips from anthony rose, final thoughts, kaylin sullivan.

Many founders roll their eyes at the idea of forecasting the growth of their business for the next five years. However, having a clear plan that sets out your ambitious yet realistic growth targets can help get investors on board.

In this article, we’ll reveal why you need to write a five-year business plan with tips from Anthony Rose, SeedLegals’ CEO and serial entrepreneur.

A five-year business plan gives an overview of what a business does, what it intends to do and how it plans to do it.

It includes everything from vision statements to market research, strategic planning and financial forecasts. The five-year plan helps prospective investors get an idea of whether they feel a business has long term potential.

Founders and investors both know that a five-year business plan includes some artistic licence. You don’t know exactly how things are going to go. Things can take longer than you expect and the economic landscape can shift overnight.

However, there’s still plenty of value in a five-year business plan. If you get your numbers right, you can use the business plan to show investors why they should invest in you and how they could see a return on their time and money.

Your five-year plan is also necessary if you’re applying for SEIS/EIS Advance Assurance . HMRC needs to see a three or five-year business plan in your pitch deck so they can be confident that you actually plan to grow the business.

In the startup space, a five-year business plan is especially useful for founders and investors.

It helps founders strategise how their business is going to work and shows investors how they might get a return on their investment.

Founders can use the business plan to align on the direction of travel with other senior members of the team.

Investors see the five-year business plan as a measure of the market opportunity for the business. If the opportunity looks good, investors are more likely to want to get involved.

It’s a good idea to create two versions of your business plan: a detailed version and a compact general overview.

A detailed plan that covers all aspects of your business can help you gain clarity and refine your goals.

Once you’re clear on what you want to do, the general overview shows investors what your plans are in a digestible way.

What to include in your detailed five-year business plan

The purpose of your five-year plan is to explain the who, what, why and, most importantly, the how behind your company’s plans. The detailed version of your plan should include:

- A description of your business

- Long-term goals

- Short-term goals

- A SWOT analysis (strengths, weaknesses, opportunities and threats)

- A competitor analysis

- Details on who your customers are

- What your products and services are and their pricing

- Details on the management team you have and need

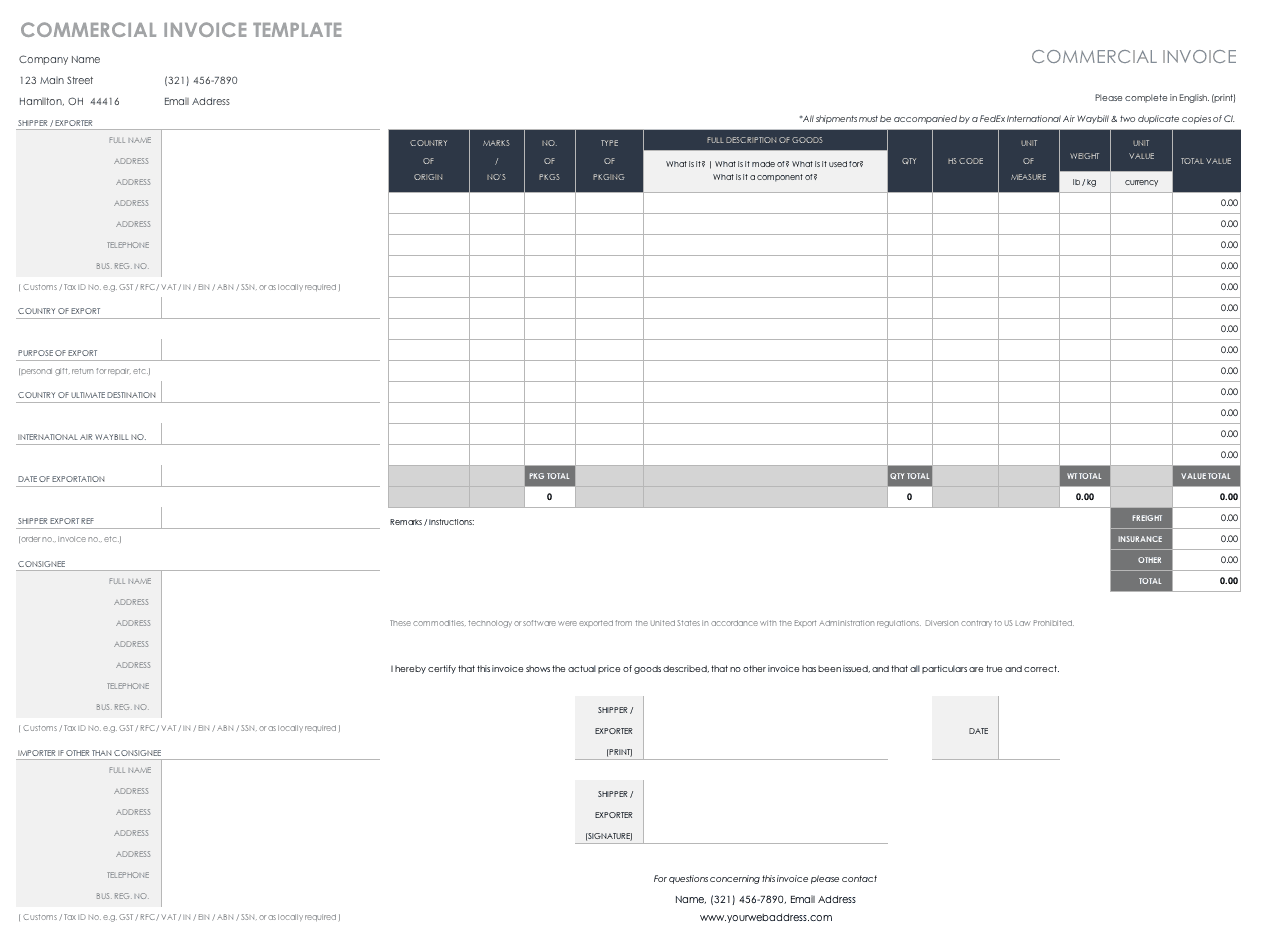

- A spreadsheet that details all your company’s financials

- A financial forecast including a line graph depicting growth in revenue

- Investment you require

Once you have that, you can condense it into a general overview.

What to include in your general overview

Creating a general overview helps you to convey the most important information about your business in a concise manner.

When dealing with investors, your time is limited. No investor wants to go through a 20-page business plan. They want to cut to the chase, and founders need to be prepared to accommodate them.

Based on feedback from founders who’ve been through funding rounds themselves, we recommend that you condense your detailed five-year plan into the following:

- A one-page executive summary

- A SWOT analysis

- A line graph showing your revenue growth forecast over 5 years

- A spreadsheet that breaks down all the financials behind that line graph including profit and loss, expenditure and revenue

Your pitch deck for investors should include the line graph, SWOT analysis and executive summary. HMRC will also want to see this info when you apply for SEIS/EIS.

In your pitch, you’ll need to describe your business and point out your business goals, but you don’t need to include all of the finer details from your in-depth business plan at this stage. The financials spreadsheet doesn’t need to be in your pitch deck. It’s only for later on when you meet with investors.

It’s worth having a look at some pitch deck examples for inspiration.

What to include in your line graph

The purpose of the graph is to depict your projected growth in revenue at a glance.

The number of years you show depends on your business’ initial growth rate. If it’s going to take a few years before you generate revenue because you have complex product development to do, you’ll want to forecast far enough into the future to show when the exponential growth happens.

The graph should include:

- Profit forecast over X number of years

- Loss forecast over X number of years

What to include in your financials spreadsheet

This is your opportunity to break down every financial detail behind what’s depicted in the line graph. Your spreadsheet should include:

- All your business costs

- Your revenue projections

- Market size

- Cost of acquiring customers

The more information the better. This is what you’re going to present to investors once they’ve expressed interest in your pitch.

What you present will be a significant factor in whether they invest in you or not. Here’s an idea of what your spreadsheet might look like.

Image source: Brixx

SeedLegals CEO Anthony Rose has been through a fair amount of funding rounds and seen hundreds of pitch decks himself. In the video below, he offers his insights on “The art of the five-year business plan”.

We’ve put Anthony’s thoughts from the video into a written breakdown below to help you digest the information.

1. Show the potential for ROI

Showing your ambition goes beyond an inspiring vision statement. It’s about creating hype through numbers – the real, grounded kind of hype that makes investors feel excited and confident that the goals can be achieved.

A five-year business plan that’s going to close investments needs to show the founder’s ambitions to grow the business exponentially. The investor is going to want to see that making this investment is worth their while.

Many founders are satisfied with a modest approach. The fact that they can create a good, profitable business that will add value to its market and pay the salaries and bills that need to be paid is what makes them happy.

But an investor might see it as a “hobby business” if you’re not ambitious enough. Your five-year business plan needs to include financial projections that show a steady, exponential increase in your revenue (which means the same for their ROI).

An investor is going to want to see a massive return on investment. In five years they’re going to want to see a 10x or a 50x return on the investment to make it worthwhile, given the risks involved. Anthony Rose Co-founder & CEO, SeedLegals

2. Don’t overpromise

The key here is to get your five-year number just right. Your graph should show a steady increase in revenue, but not at an unachievable rate.

If you’re not delivering on the numbers you projected at the get-go, you’ll have unhappy investors and a lot of changes to make. You will most likely have trouble getting investors on board in the first place if you’re projecting growth at a statistically unlikely rate.

Seeing that founders can run the numbers is an important measure for investors. If the numbers aren’t connecting from one year to the next, or you appear to be losing money altogether, investors aren’t going to have a whole lot of faith in you running your business well.

3. Use the unicorn formula

Before we dive into the formula, it will help to know that a company is classified as a unicorn if it is valued at US$1 billion or more (around £800 million).

The unicorn formula is the growth pathway to becoming a unicorn company, and it goes like this: triple, triple, triple, double, double.

So what does that mean for your five-year business plan? It means that if you can create a graph projecting financial growth at a rate of tripling year-on-year revenue for three years and doubling it for two, you’re on a good, steady growth path towards becoming a unicorn.

At a rate of 10x revenue for your valuation, reaching that (roughly) £100 million in revenue after five years would classify your company as a unicorn.

Not every company intends to become a unicorn, however, so how does this apply if that’s you? Well, the golden nugget in this formula is the rate of growth it suggests. It’s ambitious and steady, which will appeal to investors. So even if you’re not aiming for a unicorn valuation, applying the formula to your financial forecasting will still be beneficial.

The line graph below depicts a hypothetical business’s revenue according to the unicorn formula rate. It’s the shape of the line that’s important here – this is the shape of a healthy growth rate.

4. Spreadsheet the numbers

We covered this in the section on how to write a five-year business plan, so make sure you read and re-read that section. In case you missed it, though, we’ll reiterate the point here.

The most important part of your meetings with investors is presenting a robust breakdown of your company’s financials. Make sure you keep an up-to-date spreadsheet that details current and future income and expenditure.

5. Be honest about where you are now

Be fully transparent about where your business’s revenue is now. Don’t allow for disparity between what is displayed in the graph on your pitch deck and the revenue your business is making today.

Make sure your financial forecasting is up-to-date and begins with where you stand currently. Make sure you update it regularly so you remain confident and transparent whenever you meet with investors.

The five-year business plan still has value. It will help with procuring investment and getting your SEIS/EIS Advance Assurance from HMRC.

The key takeaway is to get your financials just right. Show ambition, grow steadily and be transparent. First-hand advice from people who have been there and done that is extremely valuable, so turn to expert input for help.

At SeedLegals, we have a team of experts who can help you with all the nuances involved in starting and growing your business, so hit the chat button to get in touch. We’ll be happy to guide you and answer any questions.

Win investors with the perfect pitch

Create your free pitch page in minutes.

Related posts

How to find startup investors.

How to find startup investors… one of the most common questions we get asked at SeedLegals. So, here’s the c...

Jonny Seaman

How to create a pitch deck: top tips from an expert pitch coach.

A good pitch deck gets you out of the inbox and into investor meetings. Find out the slides you need and learn how to te...

Kirsty MacSween

More ways to personalise your pitch.

Since we launched SeedLegals Pitch in November 2021, thousands of founders have created a Pitch page. Here are the updat...

Suzanne Worthington

Start your journey with us.

How to Write a 5-Year Business Plan: A Guide to Creating a Good Business Future

Learning how to write an effective five-year business plan helps you manage, and optimize your business operations for the better.

Jenna Bunnell

Jenna Bunnell is the Senior Manager for Content Marketing at Dialpad, an AI-incorporated cloud-hosted multi line phone system for small business that provides valuable call details for business owners and sales representatives.

To run and grow a successful business, planning is crucial.

A typical business plan covers the next one to three years and details your target audience, marketing strategy, and products or services for that time period. A five-year business plan expands on this premise, and predicts what your business might do in the next five years.

Learning how to write an effective five-year business plan helps you manage, and optimize your business operations for the better. Without a firm business plan, you risk straying from your intended course.

Establishing a long-term plan determines your business’s priorities and aspirations, including several important milestones. A long-term business ensures you are improving business time management skills.

To get cracking with developing your ideal five-year business plan, follow this simple guide to success.

Why Create a 5-Year Business Plan?

Suppose you implement a robust five-year business plan at some point in your business’s lifetime. In that case, it will provide valuable insight into how your business is likely to fare over the coming years.

In addition to long-term business insights, your business plan helps with:

An important part of your business plan is thorough market research, and measuring what your competitors are doing. Conducting this analysis allows you to make strategic decisions about moving your business forward.

Strategic Planning

The creation of your five-year business plan solidifies the ideas you have for your business, and what you need in place to see those ideas come to fruition.

Partnerships

If you can envision future collaboration opportunities, your five-year business plan is a great resource for other companies to learn about your business, and decide if they want to go into partnership with you.

A strategic five-year business plan helps you encourage data-driven business growth in the long-term, and assists with decisions about the company’s future. Businesses that create long-term business plans are good at strategic thinking and prepared for potential obstacles their companies may face.

What Should a 5-Year Business Plan Include?

A traditional five-year business plan should include business strategies, financial projections, competitive analysis, SWOT analysis, and future roadmaps. In essence, your five-year business plan should detail your business's direction, what you think your industry will look like in five years, trend predictions, and how your business will solve your target audience’s problems.

Your five-year business plan will probably include the following aspects; however, it may vary slightly from this outline:

- Executive Summary. A brief description of your business, and its goals.

- Business Description. Where does your business operate, and what does it do?

- Management Team. The people who run your business.

- Products and Services. A description of your business’s offerings.

- SWOT Analysis. Analysis of strengths, weaknesses, opportunities, and threats concerning your business.

- Target Audience. Who buys from your business, and are there potential new audiences you want to reach?

- Competitive Analysis. Who are your competitors, and how does your business compare to them?

- Market Analysis. How does your business meet the needs of its customers?

- Marketing and Sales Plan. Plans for brand awareness, and increasing sales.

- Financials. Profit and loss statements, and future financial projections.

- Conclusion. An overall summary of your five-year business plan.

How to Write a 5-Year Business Plan

Let’s look at the outline above in detail, to uncover what to include in each section.

Executive Summary

Write your executive summary with your business’s overview, and mission statement. Concise mission statements that reflect your business’s goals and objectives are ideal, such as these from famous brands:

“To connect the world’s professionals to make them more productive, and successful.” LinkedIn “To help people worldwide plan and have the perfect trip.” Trip Advisor

Consider writing your business’s executive summary after completing the other sections, as this element of your plan should be a complete rundown of your business.

Business Description

This section contains all the essential information about your business, including your goals, target customers, business structure, and future restructuring plans to align with objectives. Consider why your business exists, your hopes for your business’s future, and its values to fill out this section.

Management Team

Include a brief description of your management team’s job responsibilities, skills, and how they fit into your business. Your team can act as your business’s USP, especially if they bring unique talents to the table.

Products and Services

A detailed description of your business’s products and services, including benefits, features, and supplier information if relevant. List potential new services or products in the early planning stages, how much revenue you plan to make from them, and how they will serve your target audience.

SWOT Analysis

Focus on your business’s strengths, weaknesses, opportunities, and potential threats. For example, strengths may include your business’s exemplary customer service. A weakness might be that you need to optimize resource scheduling . Opportunities are areas your business can explore to scale up, and threats can include opposition problems or changes in your industry.

Target Audience

Describe your current target audience, and any potential new audiences your business plans to expand to reach. Segment your customers into demographics, behavior patterns, values, and level of education if appropriate to your business. Doing this helps readers of your five-year business plan further understand how your business plans to grow.

Competitive Analysis

Your business plan should include information about who your competitors are, and, where your business sits compared to them. For example, SaaS businesses would conduct cloud call center software comparison research to understand the competitive landscape. Finish off with details about your competitors’ strengths, and weaknesses in this section. Competitive analysis helps you understand areas your business can win over your competitors. If their social media platforms show that their overall customer service is underperforming, you can make strides to elevate your customer service efforts, and overtake them in this area.

Market Analysis

Research your market and write your findings, incorporating statistics, and relevant data. This area of your business plan should focus on where your business is positioned currently in the market, and your predictions for future market changes regarding your business’s strategies. Think about how big the current market is for your products or services, and this should create ideas for future product developments.

Marketing and Sales Plan

You need an overall plan for marketing your business’s offerings to your target audience. Include information about digital marketing plans, and opportunities to increase your brand’s reach. If you plan to explore the benefits of local phone numbers to level up your sales team’s capabilities, add this information as part of your marketing plan.

Include details about your sales strategy, involving future staff required to meet your business’s goals. Information about sales targets is helpful in this section of your business plan.

Financials

Prepare a financial report demonstrating your business’s financial projections over the next five years. Your report must include anticipated revenue based on market, and competitor research.

Conclusion

Illustrate the key points within your five-year business plan in a neat summary. This section should reassure potential investors that your business is viable, and has solid plans for growth.

Develop Long-term Growth Targets

While creating your five-year business plan, always have in mind where you envision your business in five years.

When writing your long-term business plan, the following questions are helpful:

- How many customers do you predict to gain in the next five years?

- What do you need to put in place to achieve that customer number?

- Do you need to consider shopify alternatives ?

- How much does your business need to earn in year three to be on track?

- Do you need to hire new staff members? If so, how many?

- Will you change your business location?

- Will you need to open up different locations for your business operations?

- Will you introduce new products or services?

Consider setting milestones for the course of your five-year business plan, as this approach is often easier to manage.

Say your business plans to dabble in the affiliate marketing world. Investigate drop shipping vs affiliate marketing approaches to ascertain which marketing method is most beneficial for your business. Then set a milestone to join a set number of affiliate marketing programs by a specific date, review your results, and move upwards from there.

Making a Good Business Future

Your five-year business plan will require amendments over time. And that’s perfectly normal. As your business grows and changes, you’ll learn new things about your business’s industry, and need to alter your roadmap accordingly.

An effective five-year business plan serves to convince investors that your business is worth investing in. It also ensures that your business moves in the right, and planned direction.

By creating a five-year business plan now, your business stands the best chance of success for the next five years, and the future.

About the author

Jenna Bunnell is the Senior Manager for Content Marketing at Dialpad, an AI-incorporated cloud-hosted multi line phone system for small business that provides valuable call details for business owners and sales representatives. She is driven and passionate about communicating a brand’s design sensibility and visualizing how content can be presented in creative and comprehensive ways. Jenna Bunnell also published articles for domains such as Attention Insight and Traffit . Check out her LinkedIn profile.

Related articles

How to Write a 5-Year Business Plan

- Small Business

- Business Planning & Strategy

- Help in Writing a Business Plan

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Rotate a Slide in PowerPoint

6 types of business plans, effective communication skills used in public relations & marketing.

- How to Create Effective Business Plans

- How to Write a 3-Year Business Forecast

A 5-year business plan will help you manage your company and seek loans or investment money. This term is familiar to most commercial loan officers and small business investors. Learning how to write an effective five year business plan helps you manage better and improves your chances of receiving the loans or investment dollars you need to succeed.

You should thoroughly understand business plan components and your company to complete a winning blueprint for success. Below are several points to consider when writing an effective 5-year business plan.

Design Your Strategic Plan

Design your strategic plan. Combine your goals with your vision for your company. Decide on the best strategies – e-commerce, retail locations, business-to-business, business-to-consumers or combinations thereof – to reach your business objectives. These will be the benchmarks for your five-year business plan

Prepare an Executive Summary

Prepare an executive summary. This section outlines your goals, objectives, strategies and your expertise in achieving the results you project. When seeking loans or investment, this is the most critical section of your business plan. You have limited time to impress a loan officer or investor, both of whom read many business plans daily. Make it brief, "hard hitting" and highly focused on achievement.

Introduce Your Management Team

Display the talent of your management team. Like a resume – only more interesting – management team biographies increase the credibility of your executive summary and all projections that follow. If you are a one-person management team, be sure to emphasize all your skills.

For example, if you are strong in technology and accounting, be sure to mention your marketing, customer relations and operations skills. If you're going to "outsource" these functions, explain how you plan to use other experts and whom you're considering.

Describe Products or Services

Describe the products or services you offer, in detail. In a five-year business plan, you should convince the reader that your products/services are marketable now and will continue to be popular in the coming years. Clearly state sound reasons that your products are currently viable and how you will react to future challenges in the market.

Create Financial Projections

Create financial projections for the next five years. Include income statements, balance sheets, and cash flow estimates. For years one and two, show Income and cash flow Statements on a monthly basis. You can use quarterly projections for years three through five. If your starting a small business, you can estimate your balance sheet on a semi-annual basis because you probably expect few major changes.

Things You Will Need

Valid business idea

Popular product or service

Calculator or PC

Accounting statement knowledge

Write a detailed "narrative" to explain and support your financial projections. Keep your plan thorough, but clear. Exotic, colorful graphs or other additions are unnecessary in most cases. Anticipate and prepare answers for questions that may come from readers. Spend more time researching and studying your market than writing the plan.

Don't fill your plan with unnecessary or subjective text or numbers. Readers want you to stay "on point" and focused. Never exaggerate or dramatically overestimate financial results. Your plan quickly loses credibility.

- Planware.org: Characteristics of Business Plans

- Forbes: trategic Plan Template: What To Include In Yours

- Stirling.gov.uk: Stirling Council Five-year Business Plan

- Business Plan Checklist

- Write a detailed "narrative" to explain and support your financial projections.

- Keep your plan thorough, but clear. Exotic, colorful graphs or other additions are unnecessary in most cases.

- Anticipate and prepare answers for questions that may come from readers.

- Spend more time researching and studying your market than writing the plan.

- Don't fill your plan with unnecessary or subjective text or numbers. Readers want you to stay "on point" and focused.