Research & Insights

Sharper vision for your decisions. Driven by our scale, people and innovation.

Global Research

Through the breadth of our coverage, the depth of our expertise and commitment to client service, we are a trusted advisor for clients across the world.

Leveraging cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Our award-winning analysts set the industry standard for delivering the most comprehensive and impactful research to clients by employing big data analysis, machine learning and other techniques—combined with their macro, asset class, sector and company expertise.

Key Benefits

Capabilities.

- J.P. Morgan Markets platform

- Research data tools

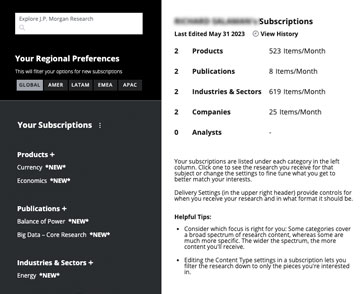

- My research subscriptions

- Mobile first

J.P. Morgan Markets Platform

Access our research across asset classes and utilize our data products and tools.

Additionally, discover our interactive forecasts and calendars, updated in real time, to view forward-looking and historical data.

Research Data Tools

Explore our data tools including DataQuery, InvestableAI, Banks Analyzer and ESG Discovery.

My Research Subscriptions

Manage the transparency and control over the research you receive. Access the research through a personalized subscription dashboard displaying your subscribed research content.

Mobile-First

Mobile first.

Consume research where you are, through the newly designed J.P. Morgan Markets app found on the App Store, or through J.P. Morgan’s Research Podcast Channels, Global Data Pod , At Any Rate and All into Account available on Apple and Spotify.

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USE

Global research disclaimer.

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Copyright 2023 JPMorgan Chase & Co. All rights reserved.

© 2023 JPMorgan Chase & Co. All rights reserved.

Request Access

Please select from the options below to request access.

- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore Blockchain

Client Service

Process Payments

Manage Funds

Safeguard Information

Banking-as-a-service

Send Payments

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

Explore a variety of insights.

- Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

J.P. Morgan Global Index Research

- Select Section

- Why J.P. Morgan Indices?

Product Suite

Index perspectives.

- Index Methodology

- • Why J.P. Morgan Indices?

- • Product Suite

- • Index Perspectives

- • Solutions

- • Index Methodology

- • Regulation

- • Contact Us

J.P. Morgan’s Global Index Research is a market leader in fixed income indices with over 30 years of experience as thought leaders developing indices in emerging and developed markets. The team creates index solutions through our markets-aligned approach by integrating J.P. Morgan’s top-rated research franchise to provide first-class client service. Our objectives are to provide knowledgeable insights, bespoke products and informed index management decisions that clients can rely on.

Since the launch of our first fixed income index in 1989, our business has evolved to meet the diverse needs of our clients in an increasingly complex and data-driven market environment. Our product suite now incorporates multiple asset classes including ESG, CLOs, Rates, Sovereign, Credit and more amongst Emerging and Developed Markets.

Broad coverage across fixed-income markets

Part of Award-Winning Fixed Income Global Research

Global Client Reach

The J.P. Morgan Index Advantage

As part of J.P. Morgan’s top rated Global Fixed-Income Research franchise , the J.P. Morgan Index Research group:

partners closely with Research analysts to provide the best-in-class benchmark methodology and insights

offers rules-based market representative indices that investors can select as part of their active or passive fund management processes

provides custom benchmark services working alongside our dedicated index research specialist(s) to tailor your own index strategy

For the J.P. Morgan Index Research Group, investor engagement is key to shaping the fixed-income index landscape :

Leveraging the knowledge and experience of the wider J.P. Morgan franchise

Providing transparent discourse and partnership for clients to effectively manage their exposure to our indices

Soliciting feedback via annual governance consultation meetings

To assist our clients in their journey to adopt ESG practices in their investment decision making , since the initial launch of our JESG index family in 2018, we have focused on developing a full suite of ESG Index products which:

Uses a balanced application of ESG factors

Provides clients the flexibility to have bespoke index solutions using our ESG framework

Offers unique insight and consultations with our dedicated ESG index specialists

As Development Finance Structuring Agent (DFSA), we assist corporate and sovereign clients in preparing disclosures of the anticipated development impact of their intended projects or activities in emerging markets. We provide a development impact assessment, a report that applies our methodology to the transaction, produces an intensity score, and provides a framework for reporting on the impact of the transaction over its time.

The JPM DFI assists investors to identify investment opportunities in transactions with anticipated contributions to the UN SDGs.

The JPM DFI collaborates with ODIs (such as national and multilateral development banks) on transactions with sustainable development impact. For example, J.P. Morgan may serve as a bond underwriter for the ODIs and may work with DFIs that act as an anchor investor in a transaction.

JESG Green Bond Index

Jamie Dimon: Today the world is facing a number of significant environmental, social, and governance challenges. As a global financial institution, JPMorgan Chase recognizes, that our business decisions have the potential to impact the environment, and surrounding communities. Climate change is one of the priorities we are addressing. We are growing our capabilities, to help clients raise the capital they need, to invest in projects and initiatives, intended to achieve positive environmental and social outcomes. And we are calling for coordinated policy solutions that can help all of us effectively confront this threat. In 2020, we are aiming to facilitate $200 billion dollars in financing, to drive action on climate change, and advance the objectives of the United Nations Sustainable Development Goals. There are numerous ESG initiatives the firm is undertaking and we'll continue to expand our commitment to sustainable business practices to better serve our clients, customers, employees, and our local communities. Thank you.

Marilyn Cece: J.P. Morgan is proud to be one of the original co-authors of the Green Bond Principles. And to continue to serve on its executive committee, we are pleased our involvement has given rise to the further development and expansion of the sustainable debt capital markets, including the social bond principles, sustainability bond guidelines, and the most recently the sustainability linked bond principles, providing the market best practice guidance. Our firm's approach to ESG has facilitated partnerships across various lines of business at J.P. Morgan enabling us to better serve our issuer and investor clients.

Gloria Kim: Responsible investing is increasingly being integrated into our index business and in J.P. Morgan's research overall. We recognize there's an opportunity, but also a responsibility, to better serve and support our clients, as they advance in their own ESG capabilities. With this in mind, our index team launched the J.P. Morgan ESG Suite of Indices. It's designed to provide investors with a foundational framework to incorporate ESG discipline within their investment process, regardless of where they are in their ESG journey. Since the launch in 2018, the assets managed against the J.P. Morgan ESG indices have grown exponentially. Our latest edition to the ESG index lineup will be a green bond index, with the support of Climate Bonds Initiative. It will explicitly contain green bonds as determined by CBI. This index is unique in that it rewards certified green bonds that are aligned with the Paris Agreement of two degrees warming verses just general green bond issuances. And we believe this will help promote the transparency and vigor the green bond market needs to achieve scale. Thank you for your continued partnership and support for J.P. Morgan's global index research offerings and we will continue to service you with more innovative products. Thank you.

Environmental, Social, and Governance (ESG)

The J.P. Morgan ESG (JESG) Index Suite builds upon our flagship fixed-income indices implementing an ESG risk mitigation methodology while still adhering to the core risk-reward profile of the underlying asset class The JESG Index Suite offers coverage across multiple asset classes, including:

- Credit bonds universe tracked by the JESG Global Corporate Index (JESG GCI) , JESG Corporate Emerging Markets Bond Index (JESG CEMBI) , JESG Asia Credit Index (JESG JACI)

- Sovereign bonds tracked by JESG Emerging Markets Bond Index (JESG EMBI) and JESG Government Bond Index – Emerging Markets Index (JESG GBI-EM)

- The JESG Green, Social, and Sustainability Bond Index (JESG GESSIE) and JESG Green Bond Index (JESG GENIE) track global issuance of labeled debt instruments.

- JESG GBI-EM

- JESG GESSIE

The J.P. Morgan sovereign indices offer extensive coverage across developed and emerging markets local currency bonds:

- Developed market local currency bonds are tracked by the J.P. Morgan Government Bond Index (GBI) , complimented by the J.P. Morgan US TIPS Index (JUSTINE) , the J.P. Morgan Euro Linker Securities Index (ELSI) , and the J.P. Morgan Gilt Inflation Linked Local Index (GILLI)

- The J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) covers emerging market domestic sovereign bonds

- The GBI Aggregate Index (GBI-AGG) tracks sovereign local currency bonds across developed and emerging markets, while GBI-Cross Markets Index (GBI-CM) primarily tracks fixed-rate developed market local government bonds with exposure to advanced emerging markets

- Region-specific indices include European Monetary Union Index (EMU), China Aggregate Index , and the J.P. Morgan Asia Diversified Index (JADE) family exclusively covers local currency bonds within the Asia region

- GBI Aggregate / Diversified

- GBI Cross-Markets

- JADE Global Diversified

- JADE Broad Diversified

Developed Markets

Inflation linkers, emerging markets.

- GBI-EM Global Diversified

- GBI-EM Broad Diversified

- GBI-EM Narrow Diversified

- China Aggregate

Within the credit space, we offer a broad suite of indices covering both developed and emerging markets universe:

- Our flagship J.P. Morgan Emerging Markets Bond Index (EMBI®) family covers hard-currency denominated sovereign bonds, while Next Generation Market Index (NEXGEM) focuses on the frontier economies

- Emerging markets corporate bonds are tracked by the Corporate Emerging Market Bond Index (CEMBI) , the J.P. Morgan Asia (JACI) suite, the Central America and Caribbean (CACI) , and the Middle East Composite (MECI) indices

- The J.P. Morgan Global Corporate Index (GCI) suite of indices tracks corporate bonds across developed and emerging markets

Global Corporates

- EMBI® Global / Diversified

- EURO EMBIG / Diversified

- CEMBI Broad / Diversified

- CEMBI Narrow / Diversified

- CEMBI+ IG / HY

- JACI / Diversified

Securitized

The J.P. Morgan Securitized suite of indices provides a wide range of coverage within the securitized space:

- The J.P. Morgan Collateralized Loan Obligation Index (CLOIE) is the first rule-based total return benchmark designed to track the USD-denominated, broadly syndicated, arbitrage US CLO market

- The J.P. Morgan Asset Backed Securities Index (ABS) represents US dollar denominated tradeable ABS instruments.

- The J.P. Morgan MBS Agency Index (MAX) is an in-depth measure of the US Mortgage-Backed Securities fixed-rate agency market

Products within the rates & FX space:

- The Emerging Local Markets Index Plus (ELMI+) tracks total returns for local currency denominated money market instruments in emerging market countries

- The J.P. Morgan Cash Index serves as a reliable performance benchmark for a fund’s cash component and are offered in multiple tenors

- Cash Index - Euro / Global

Cross-Asset

Within the Cross-Asset space:

- The J.P. Morgan Global Aggregate Bond Index (GABI) unifies all core J.P. Morgan bond indices under a single platform, leveraging flagship indices such as the EMBI ® , GBI, and CLOIE which are industry standards in their respective asset classes

- Complementing the global benchmark is the US-only GABI - the GABI US is a holistic gauge for the entire US fixed income market capturing all USD denominated debt within the GABI

- The J.P. Morgan Emerging Markets Blended (JEMB) suite of indices is an aggregate EM fixed income benchmark that blends US dollar and local currency denominated sovereign, quasi-sovereign, and corporate bonds

Bespoke Solutions

The J.P. Morgan Index Research team offers a custom benchmark experience where clients work alongside a dedicated index research specialist to tailor their index strategies across various asset classes.

- Custom indices and ETF benchmarks – tailored solutions for portfolio management and risk assessment for asset owners, asset managers, sovereign wealth funds, ETF issuers, and more

- The J.P. Morgan Index Research Replication Strategy (IRR) offers durable cash-based passive indexing strategies for investors looking to efficiently replicate the performance of the J.P. Morgan EM fixed income suite of indices. The IRR platform aims to optimize both execution and coverage

- Custom Indices

- Replication

Introducing the J.P. Morgan EM Credit Core Index

Introducing GBI-EM Net-of-Tax Index Return Series

Are European CLOs ready for a benchmark?

Investing for the Future J.P. Morgan ESG Fixed Income Suite of Indices

Introducing the J.P. Morgan ESG Global Corporate Index

Partner with our Global Index Research team to design your bespoke index solution

Access to JPM Indices

A global franchise with teams located across Asia, Europe and the United States offering convenient Index access via:

J.P. Morgan Markets

Index Manager

Direct Distributions Web-based application or API All major third-party vendors

For platform access, contact Index Licensing at [email protected]

Get in touch

For more information, speak to a member of our team:

Related insights

Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

Electronic trading solutions available on J.P. Morgan Markets.

A New Credit Market Horizon

Solutions for the Innovative Investor.

Modal title

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

Please update your browser .

- History of Our Firm

- Art Collection

- Our Leadership

- CEO Letters

- Overview Opens Supplier Overview page

- Diversity Opens Supplier Diversity page

- Gold Suppliers Opens Gold Suppliers page

- Contingent Workers Opens Contingent Workers page

- Guidelines & Documents Opens Guidelines & Documents page

- FAQs Opens Faqs page

Our Business

- Morgan Health

- Business Principles

- Media Contacts

- Historical Prime Rate

- Human Rights

Our Culture

- Employee Programs

- Diversity, Equity & Inclusion

- Awards & Recognition

- Governance Principles

- Board of Directors and Board Committees

- Code of Conduct & Ethics

- Policy Engagement & Political Participation

- ESG Information

- COVID-19 Response

- Racial Equity

Our Approach

- Jobs and Skills

- Small Business Expansion

- Neighborhood Development

- Financial Health

- PolicyCenter

- Impact Finance

Communities

- Advancing Cities

- Our Markets

- Advancing Black Pathways : Advancing Black Pathways

- Advancing Hispanics & Latinos :Advancing Hispanics & Latinos

- Asian & Pacific Islander :Asian & Pacific Islander

- Disability Inclusion : Disability Inclusion

- LGBTQ+ : LGBT+

- Military and Veterans :Military and Veterans

- Skilled Volunteerism

- Spotlight Stories

- Women on the Move : Women on the Move

- Be[Series] Be Series

Sustainability

- Our Initiatives

- Stakeholder & Policy Engagement

The changing demographics of retail investors

Household Income & Spending

Small Business

Household Debt

- Cities & Local Communities

Financial Markets

Labor Markets

- COVID-19 :opens link

- Data Privacy Protocols

News & Events

- Expert Insights for the Public Good Accessible Text

- Research Accessible Text

Latest Research

2024-05-23T00:00:00.000-05:00

2024-04-25T00:00:00.000-05:00

Household Pulse: Balances through February 2024

2024-04-16T00:00:00.000-05:00

Hidden costs of homeownership: Race, income, and lender differences in loan closing costs

2024-04-03T00:00:00.000-05:00

Scaling to $1 Million: How Small Businesses Fare by Owner Race and Gender

2024-04-02T00:00:00.000-05:00

The rise in retail investing: Roles of the economic cycle and income growth

2024-03-27T00:00:00.000-05:00

How did advance Child Tax Credit payments affect households’ 2021 tax year outcomes and spending response?

2024-03-25T00:00:00.000-05:00

Checking in on Real Incomes after February Labor Market Data

2024-02-23T00:00:00.000-05:00

Balancing restarted student loan payments and a mortgage: How will household budgets adapt?

2024-01-25T00:00:00.000-05:00

Household Pulse: Balances through October 2023

2023-11-20T00:00:00.000-05:00

The Purchasing Power of Household Incomes: Worker outcomes through August 2023 by income and race

2023-07-12T00:00:00.000-05:00

Household Pulse: Balances through March 2023

Household Cash Buffer Management from the Great Recession through COVID-19

2023-06-21T00:00:00.000-05:00

Measuring the gap: Refinancing trends and disparities during the COVID-19 pandemic

2023-06-15T00:00:00.000-05:00

Household Pulse & Cash Buffer Management throughout the pandemic

2023-05-26T00:00:00.000-05:00

The potential borrower impact of proposed IDR reforms

JPMorgan Chase Institute Take

2023-05-24T00:00:00.000-05:00

Cash or credit: Small business use of credit cards for cash flow management

Cities and Local Communities

2023-01-31T00:00:00.000-05:00

Downtown Downturn: The Covid Shock to Brick-and-Mortar Retail

2022-12-12T00:00:00.000-05:00

The Dynamics and Demographics of U.S. Household Crypto-Asset Use

2022-11-15T00:00:00.000-05:00

How families used the advanced Child Tax Credit

2022-10-27T00:00:00.000-05:00

The Purchasing Power of Household Incomes from 2019 to 2022

2022-09-13T00:00:00.000-05:00

Household Pulse through June 2022: Gains for most, but not all

Last Updated with June 2022 data

2022-08-31T00:00:00.000-05:00

Who benefits from the 2022 student debt cancellation?

JPMorgan Chase Institute

2022-08-15T00:00:00.000-05:00

Expanding Access to Unemployment Insurance

Spending and Job-Finding Impacts of Expanded Unemployment Benefits

2022-07-26T00:00:00.000-05:00

Credit and the Family: The Economic Consequences of Closing the Credit Gap of US Couples

2022-06-28T00:00:00.000-05:00

Income Driven Repayment: Who needs student loan payment relief?

2022-06-21T00:00:00.000-05:00

Household Pulse: The State of Cash Balances through March 2022

Last Updated with March 2022 data

2022-05-26T00:00:00.000-05:00

Healthcare spending through the Pandemic: the impact of high-cost medical events on household finances

2022-05-19T00:00:00.000-05:00

Racial Income Inequality Dynamics

Big Data Insights from 2013 through COVID-19

2022-05-03T00:00:00.000-05:00

Small business owner liquid wealth at firm startup and exit

2022-04-20T00:00:00.000-05:00

Rising prices for fuel, rent, and food eat into families’ financial gains

2022-04-18T00:00:00.000-05:00

Lessons learned from the Pandemic Unemployment Assistance Program during COVID-19

2022-04-11T00:00:00.000-05:00

Post-COVID Consumer Spending in New York City

2022-03-29T00:00:00.000-05:00

Reading Inflation Expectations from the Treasury Market

Insights from Institutional Investor Trading Activity

2022-03-02T00:00:00.000-05:00

What do Fed rate hikes mean for U.S. households’ financial health?

2022-02-23T00:00:00.000-05:00

Household Pulse: The State of Cash Balances at Year End

Last Updated with December 2021 data

2022-02-17T00:00:00.000-05:00

Will this tax season be a boost or bust?

2021-12-15T00:00:00.000-05:00

Year in Review: 10 Key charts that summarize 2021

2021-12-09T00:00:00.000-05:00

Did the Paycheck Protection Program Support Small Business Activity?

2021-11-30T00:00:00.000-05:00

The COVID Shock to Online Retail: The persistence of new online shopping habits and implications for the future of cities

2021-11-15T00:00:00.000-05:00

Household Cash Balance Pulse: Family Edition

Last updated with September 2021 data

2021-10-21T00:00:00.000-05:00

How did landlords fare during COVID?

2021-10-18T00:00:00.000-05:00

The Online Platform Economy through the Pandemic

2021-09-21T00:00:00.000-05:00

How did the distribution of income growth change alongside the hot pre-pandemic labor market and recent fiscal stimulus?

2021-09-15T00:00:00.000-05:00

Household Finances Pulse: Cash Balances during COVID-19

Last updated with July 2021 data

2021-08-31T00:00:00.000-05:00

The Governor’s choice: Continue or end expanded unemployment benefits?

2021-08-17T00:00:00.000-05:00

Spending after Job Loss from the Great Recession through COVID-19

The Roles of Financial Health, Race, and Policy

2021-07-29T00:00:00.000-05:00

When unemployment insurance benefits are rolled back

Impacts on job finding and the recipients of the Pandemic Unemployment Assistance Program

2021-06-30T00:00:00.000-05:00

Financial outcomes by race during COVID-19

2021-06-23T00:00:00.000-05:00

Small Business Finances in Illinois during the COVID-19 Pandemic

2021-06-15T00:00:00.000-05:00

The Local Commerce Data Series

2021-05-04T00:00:00.000-05:00

Family cash balances, income, and expenditures trends through 2021

A distributional perspective

2021-04-19T00:00:00.000-05:00

Retail Spending Response to Local Conditions during COVID-19

2021-04-06T00:00:00.000-05:00

Local Commerce Data Series: Pandemic Spending

2021-04-01T00:00:00.000-05:00

Balancing accessibility and fraud prevention in housing assistance

2021-03-17T00:00:00.000-05:00

Who Benefits from Student Debt Cancellation?

2021-03-11T00:00:00.000-05:00

Renters vs. Homeowners

Income and Liquid Asset Trends during COVID-19

2021-03-04T00:00:00.000-05:00

Small business ownership and liquid wealth

2021-02-24T00:00:00.000-05:00

The First 100 Days and Beyond

Data-Driven Policies to Support Inclusive Economic Recovery and Equitable Long-Term Growth

2021-02-10T00:00:00.000-05:00

Unemployment insurance, job search, and spending during the pandemic

2021-01-27T00:00:00.000-05:00

The Paycheck Protection Program

Small Business Balances, Revenues, and Expenses in the Weeks after Loan Disbursement

2021-01-21T00:00:00.000+05:30

The Stock Market and Household Financial Behavior

2020-12-16T00:00:00.000-05:00

Household Cash Balances during COVID-19: A Distributional Perspective

2020-12-15T00:00:00.000-05:00

The New Year’s Cliff: How the Expiration of Unemployment Benefits Will Affect Families

2020-12-02T00:00:00.000-05:00

Tapping Home Equity

Income and Spending Trends Around Cash-Out Refinances and HELOCs

Did Mortgage Forbearance Reach the Right Homeowners?

Income and Liquid Assets Trends for Homeowners during the COVID-19 Pandemic

2020-11-19T00:00:00.000-05:00

Small Business Expenses during COVID-19

Home Advantage? Resident Retail Distances and Small Business Financial Outcomes

2020-10-15T00:00:00.000-05:00

The unemployment benefit boost: Initial trends in spending and saving when the $600 supplement ended

2020-10-01T00:00:00.000-05:00

Student Loan Debt: Who is Paying it Down?

Evidence from administrative banking data, credit bureau student loan data, and public records on race

2020-08-10T00:00:00.000+05:30

Expanded Unemployment Benefits and the Impact of Inaction

2020-07-31T00:00:00.000-05:00

Data Dialogue: The Initial Impact of COVID-19 on Consumer Spending and Local Economies

2020-07-22T00:00:00.000+05:30

Small Business Owner Race, Liquidity, and Survival

Racial Gaps in Small Business Outcomes

2020-07-20T00:00:00.000-04:00

Small Business Financial Outcomes during the COVID-19 Pandemic

2020-07-16T00:00:00.000-05:00

Report Consumption Effects of Unemployment Insurance during the COVID-19 Pandemic

2020-07-15T00:00:00.000-05:00

Consumption Effects of Unemployment Insurance during the COVID-19 Pandemic

2020-07-01T00:00:00.000-05:00

The Early Impact of COVID-19 on Local Commerce Report

Changes in Spend Across Neighborhoods and Online

2020-07-01T00:00:00.000+05:30

Fed watchers now turn their attention to September

2020-06-26T00:00:00.000+05:30

The Housing Wealth Effect in the Post-Great Recession Period

Evidence from Big Data

2020-06-25T00:00:00.000+05:30

Initial Impacts of the Pandemic Reflect that Families Changed their Saving and Spending Behavior

2020-06-24T00:00:00.000+05:30

Small Business Financial Outcomes during the Onset of COVID-19

2020-06-03T00:00:00.000+05:30

Data Dialogue: National Urban League, PolicyLink, and the Joint Center for Political and Economic Studies Discuss Racial, Economic, and Social Equity

The Early Impact of COVID-19 on Local Commerce

2020-05-29T00:00:00.000+05:30

Data Dialogue: The Economic Impacts of COVID-19 on Small Business

2020-05-27T00:00:00.000-04:00

The Initial Household Spending Response to COVID-19 Part 2

Evidence from Credit Card Transactions - Part 2

2020-05-20T00:00:00.000-04:00

Tracking Spillovers During the Taper Tantrum

Evidence from Institutional Investor Transactions in Emerging Markets

2020-05-14T00:00:00.000-04:00

The Initial Household Spending Response to COVID-19

Evidence from Credit Card Transactions

2020-05-04T00:00:00.000-04:00

How COVID-19 is impacting local economies and small businesses

A Cash Flow Perspective on the Small Business Sector

2020-04-20T00:00:00.000+05:30

Racial Gaps in Financial Outcomes

Big Data Evidence

2020-04-16T00:00:00.000-04:00

How COVID-19 could widen racial gaps in financial outcomes

2020-04-09T00:00:00.000-04:00

Forbearance for mortgages a short-term solution; savings programs for the long term

2020-04-01T00:00:00.000-04:00

Small Business Cash Liquidity in 25 Metro Areas

2020-03-31T00:00:00.000-05:00

Expanded unemployment insurance may lessen impact of layoffs

JPMorgan Chase Institute take

2020-03-31T00:00:00.000-04:00

Who benefits from a tax-payment deadline extension?

2020-03-24T00:00:00.000-04:00

Coronavirus may impact workers' income volatility

2020-03-20T00:00:00.000-04:00

Quick liquidity to small businesses could mitigate impacts from coronavirus

2020-03-06T00:00:00.000-05:00

Tax Refunds and Household Spending

2020-03-01T00:00:00.000-05:00

The potential economic impacts of COVID-19 on families, small businesses, and communities

Insights from five years of big data research

2019-12-04T00:00:00.000-05:00

Small Business Financial Outcomes in Miami Communities

2019-11-21T00:00:00.000-05:00

The Gender Gap: Exploring Consumer and Small Business Financial Health

2019-11-05T00:00:00.000-05:00

Financial and Physical Health in a Changing Healthcare Market

2019-10-31T00:00:00.000-04:00

Bridging the Gap

How Families Use the Online Platform Economy to Manage their Cash Flow

2019-10-23T00:00:00.000-04:00

Weathering Volatility 2.0

A Monthly Stress Test to Guide Savings

2019-09-30T00:00:00.000-04:00

Place Matters

Small Business Financial Health in Urban Communities

2019-09-26T00:00:00.000-04:00

In Conversation: Experts on Student Loan Payments and JPMC Institute Research

2019-08-12T00:00:00.000-04:00

Facing Uncertainty

Small Business Cash Flow Patterns in 25 U.S. Cities

2019-07-31T00:00:00.000+05:30

Data and Collaboration for Good

The JPMorgan Chase Institute 2nd Annual Conference on Economic Research

2019-07-01T00:00:00.000-04:00

Student Loan Payments

Evidence from 4 Million Families

2019-06-01T00:00:00.000-04:00

Trading Equity for Liquidity

Bank Data on the Relationship Between Liquidity and Mortgage Default

The San Francisco Economy

Household and Small Business Financial Outcomes

2019-05-09T00:00:00.000-04:00

How Data Can Improve the Financial Health of U.S. Small Businesses

2019-05-01T00:00:00.000-04:00

The Small Business Sector in Urban America

Growth and Vitality in 25 Cities

2019-04-01T00:00:00.000-05:00

The Online Platform Economy in 27 Metro Areas

The Experience of Drivers and Lessors

2019-03-22T00:00:00.000-05:00

Technology and the Future of Work

2019-03-01T00:00:00.000-05:00

How Families Manage Tax Refunds and Payments

2019-02-01T00:00:00.000-05:00

Gender, Age, and Small Business Financial Outcomes

2019-01-15T00:00:00.000-05:00

Does the Timing of Central Bank Announcements Matter?

Trade-Level Data on Hedge Fund Behavior Before Swiss National Bank Meetings

2018-12-04T00:00:00.000-05:00

Local Commerce Index

The Local Commerce Index (LCI) is a measure of the monthly year-over-year growth rate of everyday debit and credit card spending by over 64 million de-identified Chase customers across 14 metro areas in the US. The LCI is an alternative view of the health and vibrancy of the US consumer.

Estimating Family Income from Administrative Banking Data

A Machine Learning Approach

2018-12-01T00:00:00.000-05:00

Deferred Care

How Tax Refunds Enable Healthcare Spending

Shopping Near and Far: Local Commerce in the Digital Age

Insights from 4 Billion Transactions across the United States

2018-10-23T00:00:00.000-05:00

Measuring the Online Platform Economy

How Banking and Survey Data Compare

2018-10-01T00:00:00.000-04:00

Falling Behind

Bank Data on the Role of Income and Savings in Mortgage Default

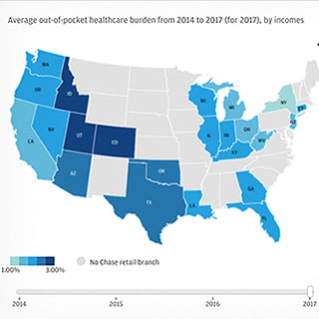

On the Rise

Out-of-Pocket Healthcare Spending in 2017

2018-09-01T00:00:00.000-05:00

The Online Platform Economy in 2018

Drivers, Workers, Sellers, and Lessors

2018-08-29T00:00:00.000-04:00

JPMorgan Chase Institute 2018 Inaugural Conference on Economic Research

2018-07-01T00:00:00.000-04:00

Growth, Vitality, and Cash Flows

High-Frequency Evidence from 1 Million Small Businesses

2018-06-20T00:00:00.000-05:00

Where are all the Contingent Workers?

2018-06-12T00:00:00.000-04:00

FX Markets Move on Surprise News

Institutional Investor Trading Behavior around Brexit, the U.S. Election, and the Swiss Franc Floor

2018-04-01T00:00:00.000-04:00

Filing Taxes Early, Getting Healthcare Late

Insights from 1.2 Million Households

2018-03-15T00:00:00.000-04:00

Healthcare When It’s Needed

How to Mitigate High Costs and Deferred Care

2018-03-01T00:00:00.000-05:00

The Commercial Vibrancy of Chicago Neighborhoods, 2016

2018-02-01T00:00:00.000-05:00

Bend, Don’t Break

Small Business Financial Resilience After Hurricanes Harvey and Irma

Weathering the Storm

The Financial Impacts of Hurricanes Harvey and Irma on One Million Households

Local Consumer Commerce in the Wake of a Hurricane

2017-12-14T00:00:00.000-05:00

Institute Insights for Open Enrollment

2017-12-01T00:00:00.000-05:00

Mortgage Modifications after the Great Recession

New Evidence and Implications for Policy

2017-11-01T00:00:00.000-04:00

Paying a Premium

Dynamics of the Small Business Owner Health Insurance Market

2017-10-10T00:00:00.000-04:00

Younger and Lower Income Consumers Drive Small Business Spending

2017-09-06T00:00:00.000-04:00

Coping with Medical Costs through Life

2017-09-01T00:00:00.000-04:00

Paying Out-of-Pocket

The Healthcare Spending of 2 Million U.S. Families

Mapping Segments in the Small Business Sector

2017-05-01T00:00:00.000-04:00

The Gender Gap in Financial Outcomes

The Impact of Medical Payments

2017-04-20T00:00:00.000-04:00

The Consumer Spending Response to Mortgage Resets

2017-04-01T00:00:00.000-04:00

The Consumer Spending Response to Mortgage Resets Report

Microdata on Monetary Policy

2017-03-17T00:00:00.000-04:00

The Monthly Stress-Test on Family Finances

2017-03-01T00:00:00.000-05:00

Consumption Inequality

What’s in Your Shopping Basket?

Going the Distance

Big Data on Resident Access to Everyday Goods

Seniors Lead the Slowdown in Local Consumer Commerce

2017-02-09T00:00:00.000-05:00

Why Managing Expenses Is Not an Easy Task

2017-02-01T00:00:00.000-05:00

Coping with Costs

Big Data on Expense Volatility and Medical Payments

2017-01-18T00:00:00.000-05:00

The Ups and Downs of Small Business Employment

2017-01-01T00:00:00.000-05:00

The Ups and Downs of Small Business Employment Report

Big Data on Payroll Growth and Volatility

2016-11-15T00:00:00.000-05:00

Is the Online Platform Economy the Future of Work?

2016-11-01T00:00:00.000-05:00

The Online Platform Economy

Has Growth Peaked?

2016-11-01T00:00:00.000-04:00

Shedding Light on Daylight Saving Time

2016-09-21T00:00:00.000-04:00

For Small Businesses: Cash is King

2016-09-09T00:00:00.000-04:00

Big Spend on the Weekend:

The Local Consumer Commerce Index declined in May

2016-09-01T00:00:00.000-04:00

Cash is King: Flows, Balances, and Buffer Days

Evidence from 600,000 Small Businesses

2016-08-18T00:00:00.000-05:00

Past 65 and Still Working

Big Data Insights on Senior Citizens’ Financial Lives

2016-07-14T00:00:00.000-04:00

A Year of Low Gas Prices: The Consumer Response in 15 Metro Areas

2016-07-11T00:00:00.000-04:00

The Consumer Response to Lower Gas Prices

2016-07-01T00:00:00.000-04:00

The Consumer Response to a Year of Low Gas Prices

Evidence From 1 Million People

2016-06-29T00:00:00.000-04:00

Good Things Come in Small (Business) Packages

2016-05-05T00:00:00.000-05:00

The Online Platform Economy: Who earns the most?

2016-04-13T00:00:00.000-04:00

Taking the Financial Stress Out of Tax Time

2016-03-29T00:00:00.000-04:00

The Local Consumer Commerce Index

How did everyday spending fare in December 2015?

2016-02-18T00:00:00.000-05:00

Understanding Income Volatility and the Role of the Online Platform Economy

2016-02-09T00:00:00.000-05:00

Dining Out or Eating In: Where does your city rank?

Spending Growth at Restaurants

2016-02-08T00:00:00.000-05:00

Consumption Inequality: Where does your city rank?

Spending by the Top Income Quintile

2016-02-04T00:00:00.000-05:00

Travel for Business or Pleasure: Where does your city rank?

Share of Spending by Visitors to the Metro Area

2016-02-01T00:00:00.000-05:00

Paychecks, Paydays, and the Online Platform Economy

Big Data on Income Volatility

The Online Platform Economy Trajectory

What is the growth trajectory?

2016-01-31T00:00:00.000-05:00

Recovering from Job Loss

The Role of Unemployment Insurance

2016-01-18T00:00:00.000-05:00

Economic Contributions by Seniors

Spending by Consumers 65 years and Older

2016-01-07T00:00:00.000-05:00

Big Data to Build Sharper Profiles of Consumer Commerce at the City Level

2016-01-01T00:00:00.000-05:00

Boutiques or Big Box Stores: Where does your city rank?

Share of Spending at Small and Medium Enterprises

2015-12-01T00:00:00.000-05:00

Profiles of Local Consumer Commerce

Insights from 12 Billion Transactions in 15 U.S. Metro Areas

2015-10-01T00:00:00.000-04:00

How Falling Gas Prices Fuel the Consumer

Evidence From 25 Million People

2015-05-01T00:00:00.000-04:00

Weathering Volatility

Big Data on the Financial Ups and Downs of U.S. Individuals

Small Business Data Resources

Diverse Ownership

Business Dynamism

Regional Employment

Economic Activity

Where did recent gas price declines affect consumers the most?

JPMCI HOSP Geographic Data Visualization Tool

Major Market Events Data Visualization Tool

Infographic: How Falling Gas Prices Fuel the Consumer

Infographic: Weathering Volatility

Small Business Data Dashboard

Small businesses are an economically important component of the US economy and a key driver of production, employment, and growth.

How Much Cash Buffer Do You Need?

Data Visualization

You are now leaving JPMorgan Chase & Co.

JPMorgan Chase & Co.'s website terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its website terms, privacy and security policies to see how they apply to you. JPMorgan Chase & Co. isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the JPMorgan Chase & Co.

JP Morgan Research

- What is J.P. Morgan Research?

Support Center Articles

Product access & information.

- Additional Language Resources

- ProQuest Support Center

- Platform Status Page

- Upcoming Webinars

J.P. Morgan Research includes a ccess to quality market research is essential for business school students as it teaches real-world business research skills and helps students develop analytical capabilities. J.P. Morgan Research allows business students to perform in-depth company and industry research through the most highly regarded analysis available. Through this collection, students can access all of J.P. Morgan’s analyst and economics reports from 2011 forward, covering over 3,000 global companies across all industries with just a seven-day embargo.

For more information about J.P. Morgan Research , navigate to the Content Page.

J.P. Morgan Research database is also part of the Business Premium Collection and ProQuest One Business. J.P. Morgan Research resides on the ProQuest Platform. For more information, see the ProQuest Platform LibGuide .

- ProQuest Business Databases Content Updates

- Next: Content >>

- Last Updated: Jul 28, 2023 1:27 PM

- URL: https://proquest.libguides.com/jpmorgan

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Before accessing the site, please choose from the following options.

If you are an Individual Investor and you have queries in respect of your investment in Morgan Stanley Investment Management products, you should contact your Financial Adviser. If you are unable to contact your Financial Advisor and require assistance, please send an email to [email protected]

Stock Market Concentration: How Much Is Too Much?

- Stock market concentration has increased sharply over the past decade, creating a challenging environment for active managers and also raising unease about the loss of diversification, the valuations of the largest stocks, and the effect of flows into index funds.

- In this report, we look at concentration over the past 75 years to see where we stand today and to reflect on what it means for active equity managers.

- We examine which companies have had the largest stock market capitalizations and how that population has changed.

- We ask whether there is a correct level of concentration, both by comparing the U.S. to other global markets and by presenting the possibility that concentration was too low in the past.

- We then seek to determine whether fundamental corporate performance supports the current increase in concentration.

Subscribe to Counterpoint Global Insights - Consilient Observer

Please enter the code sent to your email address.

Valid for 10 minutes only

Invalid Otp

Resend Code

Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.</p> "> Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.

DEFINITIONS Market Capitalization is the total dollar market value of all of a company's outstanding shares.

IMPORTANT INFORMATION The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

This material is for the benefit of persons whom the Firm reasonably believes it is permitted to communicate to and should not be forwarded to any other person without the consent of the Firm. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It is the responsibility of every person reading this material to fully observe the laws of any relevant country, including obtaining any governmental or other consent which may be required or observing any other formality which needs to be observed in that country.

This material is a general communication, which is not impartial, is for informational and educational purposes only, not a recommendation to purchase or sell specific securities, or to adopt any particular investment strategy. Information does not address financial objectives, situation or specific needs of individual investors.

Any charts and graphs provided are for illustrative purposes only. Any performance quoted represents past performance. Past performance does not guarantee future results. All investments involve risks, including the possible loss of principal.

For the complete content and important disclosures, refer to the article pdf .

COMMENTS

From driverless cars to chatbot doctors, rapidly improving artificial intelligence (AI) technology is transforming industries at scale. Here, J.P. Morgan Research explores how AI is disrupting healthcare, the electric vehicle (EV) and driverless car market, and the future of power consumption in China and beyond. Learn more.

J.P. Morgan's Research team leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice. ... where public companies are required to report implemented policies and where regulations are constantly evolving to reflect broader sustainability goals. Take the EU Green Deal, a set of ...

A subset of survey results are shown for Global Equity Investors Quarterly participants taken in April 2024. These responses are taken from a quarterly survey representing 41 CIOs and portfolio managers across Global Equities. Build stronger equity portfolios with J.P. Morgan.

We forecast 10-year yields at 4.25% by mid-year and 3.75% by the end of 2024," said Jay Barry, Co-Head of U.S. Rates Strategy at J.P. Morgan. Commodity markets outlook. After falling in 2023, J.P. Morgan Research expects Brent oil prices to remain largely flat in 2024 and edge down a further 10% in 2025.

J.P. Morgan's center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future. ... 250 analysts focused on equity research in 24 countries #1 All-America Equity Research Team (2019) *Source: Coalition FY18 Country Franchise Analytics. Related insights.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 24 28 32 36 40 $

After two years of uncertainty and lockdowns that resulted in the largest drop in global GDP history, the 2022 outlook is looking brighter. As pandemic volatility continues to fade, J.P. Morgan Global Research forecasts are upbeat, with expectations of further equity market upside and above-potential growth.

a rebound in the equity market. Despite this improving optimism, the details of the recovery are less convincing as continued weakness in domestic demand necessitates a reliance on strong export growth. Challenges in the real estate sector remain unresolved, creating some doubts about the sustainability of the Chinese rally.

Market outlook: Stocks, inflation and commodities in focus at mid-year. June 27, 2022. Key economic and market forecasts for the second half of 2022 from J.P. Morgan Global Research. If there is no recession - which is our view - then risky asset prices are too cheap. Many equity market segments are down 60-80%.

Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this ...

J.P. Morgan Asset Management's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. ... Equity research in-depth: How the disruptive power of technology can remake the economy. 11/05/2020. Joe Wilson. ... Sources: Gartner, J.P. Morgan Asset Management, company reports. The security ...

Common stockholders' equity 259,289 249,291 234,337 Total stockholders' equity 294,127 279,354 261,330 Market data Closing share price $ 158.35 $ 127.07 $ 139.40 Market capitalization 466,206 387,492 429,913 Common shares at period-end 2,944.1 3,049.4 3,084.0 Headcount 271,025 255,351 256,981

Source: FactSet, CME Group, J.P. Morgan Asset Management. Post-Nov. FOMC reflects market data for November 3, 2022, which serves as the peak federal funds terminal rate in futures markets. Data are as of December 5, 2022. Credit outlook . With investment-grade (IG) and high-yield (HY) corporate bonds yielding close to 6% and 9%, respectively ...

Equity securities are subject to "stock market risk" meaning that stock prices in general (or in particular, the prices of the types of securities in which a portfolio invests) may decline over short or extended periods of time. When the value of a portfolio's securities goes down, an investment in a fund decreases in value.

racial equity $30B 2020 ANNUAL REPORT . Financial Highlights As of or for the year ended December 31, (in millions, except per share, ratio data and headcount) 2020 2019 2018 ... Information about J.P. Morgan's capabilities can be found at jpmorgan.com and about

In this report, the JPMorgan Chase Institute introduces a newly augmented small business data asset to empirically address questions of small business growth, vitality, and economic contribution. We built a sample of 1.3 million de-identified small businesses with Chase . Business Banking accounts active between October 2012 and February 2018.

The research reports contain estimates used widely by investment bankers to help drive the assumptions underpinning 3-statement models and other models commonly built on the sell side. On the buy side, equity research is also widely used. Like investment bankers, buy-side analysts find the insights in sell-side equity research reports helpful.

J.P. Morgan's Global Index Research is a market leader in fixed income indices with over 30 years of experience as thought leaders developing indices in emerging and developed markets. The team creates index solutions through our markets-aligned approach by integrating J.P. Morgan's top-rated research franchise to provide first-class client ...

This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan. Summary of JPM Cross Asset, Equity & Strategy Research as well as Industry Developments in 2H20

In October 2020, JPMorgan Chase & Co. (together with its subsidiaries, "JPMorgan Chase" or the "firm") announced its $30 billion Racial Equity Commitment ("REC") to help close the racial wealth gap among Black, Hispanic and Latino communities. The firm has brought together its business, policy, data and philanthropic expertise to ...

J.P. Morgan Research from ProQuest provides the most highly-regarded financial research available. It contains in-depth reports for 3,400 companies analyzed by 800 expert research analysts worldwide, covering all industries and all regions with just a 7 day embargo. The collection is derived from Morgan Markets, J.P. Morgan's exclusive ...

The JPMorgan Chase Institute is focused on conducting original research, developing expert insights, framing critical economic problems, and convening policymakers, business leaders, and other decision makers to consider the most pressing global economic issues.

J.P. Morgan Research allows business students to perform in-depth company and industry research through the most highly regarded analysis available. Through this collection, students can access all of J.P. Morgan's analyst and economics reports from 2011 forward, covering over 3,000 global companies across all industries with just a seven-day ...

Table of Contents: 1:43: Part 1: Stock Pitches vs. Equity Research Reports 6:00: Part 2: The 4 Main Differences in Research Reports 12:46: Part 3: Sample Reports and the Typical Sections 20:53: Recap and Summary You can get the reports and documents referenced in the video here: Equity Research Report - Jazz Pharmaceuticals [JAZZ] - OUTPERFORM [BUY] Recommendation [PDF]

Our Research Frameworks come entirely from the opposite, bottom up perspective. Across global equity we have a 40 question ESG Checklist which ask the same questions of every company under global coverage to establish a baseline of their ESG credentials. In Emerging Markets and Asia Pacific we also have a Materiality Framework.

June 04, 2024. Stock market concentration has increased sharply over the past decade, creating a challenging environment for active managers and also raising unease about the loss of diversification, the valuations of the largest stocks, and the effect of flows into index funds. In this report, we look at concentration over the past 75 years to ...