- HDFC BANK LTD.

- SECTOR : BANKING AND FINANCE

- INDUSTRY : BANKS

HDFC Bank Ltd.

NSE: HDFCBANK | BSE: 500180

Await Turnaround

1447.50 -35.15 ( -2.37 %)

52W Low on Feb 14, 2024

23.3M NSE+BSE Volume

NSE 09 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

10 active buys

Broker 1Year sells

0 active sells

Broker 1Year neutral

1 active holds

Broker 1M Reco upgrade

1 Broker 1M Reco upgrade

HDFC Bank Ltd. share price target

Hdfc bank ltd. has an average target of 1870.18. the consensus estimate represents an upside of 29.20% from the last price of 1447.50. view 48 reports from 14 analysts offering long-term price targets for hdfc bank ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Equity Research

- Investing-Ideas

- HDFC Bank Ltd

HDFC Bank Ltd Banks | NSE : HDFCBANK

- Target : 1,650.0 (20.97%)

- Target Period : 12-18 Month

21 Jul 2022

Hdfc bank q1fy23 result update.

HDFC Bank is a leading private sector bank with consistent growth and operational performance over various cycles. The bank has maintained superior return ratios compared to its peers resulting in premium valuations.

- Largest private sector bank with loan book of ₹ 13.9 lakh crore

- Consistent performance with +4% NIM and +15% RoE in past many years

Treasury loss impact PAT, slippages elevated; mixed operations.

- Loans were up 21.6% YoY at ₹ 13.9 lakh crore; deposits up 19.2% YoY

- NII up 14.5% YoY, NIM stable QoQ at 4.0%, C/I at 40.6% vs 38.3% QoQ

- Credit cost at 0.91%, PAT up 19% YoY at ₹ 9196 crore

- GNPA up 11 bps QoQ to 1.28%, restructured book at 89 bps

HDFC Bank’s share price has grown over 60% in the past five years. Building of digital & physical capabilities to support continued healthy business growth, though clarity related to merger remain near term overhang.

- We remain positive and retain our BUY rating on the stock

We value HDFC Bank at ~3x FY24E ABV & ₹ 50 for subsidiaries; thus, we maintain our TP at ₹ 1650 per share

- Transmission of rate hike and improving mix towards CRB & retail segment to aid margin trajector

- Building up of physical/digital infra, branch addition to keep opex elevated followed by benefit of higher business traction

- Recent RBI approval is an NOC on merger. Clarity on regulatory forbearance to remain in focus and keep the stock price volatile

Apart from HDFC Bank, we also like Axis Bank.

- Strong liabilities franchise, adequate capitalisation and healthy provision buffer to aid business growth as well as earnings trajectory

- BUY with a target price of ₹ 970

Particulars

Shareholding pattern, price chart, research analyst.

Kajal Gandhi [email protected]

Key financial summary

Financial summary, profit and loss statement ₹ crore, key ratios ₹ crore, balance sheet ₹ crore, cash flow statement ₹ crore, previous reports pdf:.

ANALYST CERTIFICATION

I/We, Kajal Gandhi, CA, Vishal Narnolia, MBA, Sameer Sawant, MBA and Pravin Mule, MBA, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI) as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stocks price movement, outstanding positions, trading volume etc as opposed to focusing on a companys fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report.

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its stocks according -to their notional target price vs. current market price and then categorizes them as Buy, Hold, Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts valuation for a stock

Buy: >15%

Hold: -5%to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Copyright© 2022. All rights Reserved. ICICI Securities Ltd. ®trademark registration in respect of the concerned mark has been applied for by ICICI Bank Limited

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Hdfc bank ltd's dividend analysis, exploring the upcoming dividend and historical performance of hdfc bank ltd ( nyse:hdb ).

HDFC Bank Ltd ( NYSE:HDB ) recently announced a dividend of $0.7 per share, with the payment date yet to be announced and the ex-dividend date set for May 8, 2024. As investors anticipate this forthcoming dividend, it is crucial to delve into the bank's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this article examines HDFC Bank Ltd's dividend performance and evaluates its sustainability.

Overview of HDFC Bank Ltd

Warning! GuruFocus has detected 2 Warning Signs with HDB.

High Yield Dividend Stocks in Gurus' Portfolio

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

HDFC Bank Ltd is a prominent Indian bank trading publicly with significant operations across retail banking, wholesale banking, and treasury services. The bank caters to individual customers through a vast network of branches and ATMs, provides tailored services to large Indian corporations, and offers risk management solutions including foreign exchange trading.

HDFC Bank Ltd's Dividend Track Record

Since 2021, HDFC Bank Ltd has consistently disbursed dividends on an annual basis, showcasing a stable dividend payment history. Below is a visual representation of the bank's Dividends Per Share over the years, highlighting historical trends.

Examining HDFC Bank Ltd's Dividend Yield and Growth

Currently, HDFC Bank Ltd boasts a trailing dividend yield of 1.19% and a forward dividend yield of 2.38%, indicating expected increases in dividend payments over the next year. The bank's dividend yield is near a 10-year peak and surpasses 7.88 of its global peers in the banking sector. This performance positions HDFC Bank Ltd as an attractive option for income-focused investors. Over the past three years, the bank's annual dividend growth rate stood at 27.40%, further underscoring its robust dividend profile.

The Sustainability of HDFC Bank Ltd's Dividends

To determine the sustainability of its dividends, it is essential to consider HDFC Bank Ltd's dividend payout ratio, which currently stands at 0.00. This low ratio indicates that the bank retains most of its earnings, which supports future growth and financial stability. The bank's profitability rank of 7 out of 10, coupled with consistent positive net income over the past decade, reinforces its strong earnings capability.

Future Growth Prospects of HDFC Bank Ltd

HDFC Bank Ltd's growth rank of 7 suggests favorable growth prospects compared to its competitors. The bank's revenue per share and 3-year revenue growth rate of 14.50% annually outperform 75.73% of global competitors, demonstrating a strong revenue model. Additionally, the bank's 3-year EPS growth rate of 23.30% annually and a 5-year EBITDA growth rate of 20.70% further highlight its ability to sustain earnings and dividends over the long term.

Concluding Thoughts on HDFC Bank Ltd's Dividend Sustainability

Considering HDFC Bank Ltd's consistent dividend payments, robust growth metrics, and prudent financial management, the bank's dividend appears sustainable. These factors make HDFC Bank Ltd an appealing choice for investors seeking stable dividend income. For more insights and to discover other high-dividend yield opportunities, GuruFocus Premium users can utilize the High Dividend Yield Screener .

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus .

Developing ash-free high-strength spherical carbon catalyst supports

- Domestic Catalysts

- Published: 28 June 2013

- Volume 5 , pages 156–163, ( 2013 )

Cite this article

- V. V. Gur’yanov 1 ,

- V. M. Mukhin 1 &

- A. A. Kurilkin 1

49 Accesses

Explore all metrics

The possibility of using furfurol for the production of ash-free high-strength active carbons with spheroidal particles as adsorbents and catalyst supports is substantiated. A single-stage process that incorporates the resinification of furfurol, the molding of a spherical product, and its hardening while allowing the process cycle time and the cost of equipment to be reduced is developed. Derivatographic, X-ray diffraction, mercury porometric, and adsorption studies of the carbonization of the molded spherical product are performed to characterize the development of the primary and porous structures of carbon residues. Ash-free active carbons with spheroidal particles, a full volume of sorbing micro- and mesopores (up to 1.50 cm 3 /g), and a uniquely high mechanical strength (its abrasion rate is three orders of magnitude lower than that of industrial active carbons) are obtained via the vapor-gas activation of a carbonized product. The obtained active carbons are superior to all known foreign and domestic analogues and are promising for the production of catalysts that operate under severe regimes, i.e., in moving and fluidized beds.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Methods for preparation and activation of activated carbon: a review

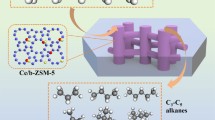

High-efficiency Ce-modified ZSM-5 nanosheets for waste plastic upgrading

A review on application of activated carbons for carbon dioxide capture: present performance, preparation, and surface modification for further improvement

Burushkina, T.N., Zh. Ross. Khim. O-va im. D.I. Mendeleeva , 1995, vol. 39, no. 6, p. 122.

CAS Google Scholar

Kryazhev, Yu. G., Abstract of Papers, Materialy XII vserossiiskogo simpoziuma s uchastiem inostrannykh uchenykh “Aktual’nye problemy teorii adsorptsii, poristosti i adsorptsionnoi selektivnosti” (Proc. of XII th All-Russia Symposium with the Participation of Foreign Scientists “Urgent Problems of the Theory of Adsorption, Porosity, and Adsorption Selectivity”), Moscow, 2008, p. 69.

Google Scholar

Kartel’, N.T., in Adsorbtsiya, adsorbenty i adsorbtsionnye protsessy v nanoporistykh materialakh (Adsorption, Adsorbents, and Adsorption Processes in Nanoporous Materials), Tsivadze, A.Yu., Ed., Moscow: Granitsa, 2011, p. 381.

RF Patent 2026813, 1993.

RF Patent 2257343, 2003.

RF Patent 2301701, 2006.

Dubinin, M.M., Zaverina, E.D., Ivanova, L.S., Kaverov, A.T., and Kasatochkin, V.I., Rus. Chem. Bull. , 1961, vol. 10, no. 1, p. 14.

Article Google Scholar

Usenbaev, K. and Zhumalieva, K., Rentgenograficheskoe issledovanie struktury i termicheskikh preobrazovanii amorfnykh uglerodov (X-ray Study of the Structure and Thermal Transformations of Amorphous Carbons), Frunze: Mektep, 1976.

Gur’yanova, L.N. and Gur’yanov, V.V., Zh. Fiz. Khim. , 1984, vol. 58, no. 6, p. 1459; 1989, vol. 63, no. 1, p. 161; 1989, vol. 63, no. 2, p. 426; 1989, vol. 63, no. 3, p. 683.

Guryanov, V.V., Petukhova, G.A., and Dubinina, L.A., Prot. Metal. Phys. Chem. Surf. , 2010, vol. 46, no. 2, p. 191.

Article CAS Google Scholar

Guryanov, V.V., Dubinin, M.M., and Misin, M.S., Zh. Fiz. Khim. , 1975, vol. 49, no. 9, p. 2374.

Gur’yanov, V.V., Petukhova, G.A., and Polyakov, N.S., Rus. Chem. Bull. , 2001, vol. 50, no. 6, p. 974.

Dubinin, M.M., Carbon , 1989, vol. 27, no. 3, p. 457.

Belyaev, N.M., Soprotivlenie materialov (Strength of Materials), Moscow: Nauka, 1976.

Temkin, I.V., Proizvodstvo elektrougol’nykh izdelii (Production of Electrocarbon Articles), Moscow: Vysshaya shkola, 1980.

Download references

Author information

Authors and affiliations.

OAO Elektrostal’ Research and Production Association Neorganika, Elektrostal’, Moscow oblast, 144001, Russia

V. V. Gur’yanov, V. M. Mukhin & A. A. Kurilkin

You can also search for this author in PubMed Google Scholar

Additional information

Original Russian Text © V.V. Gur’yanov, V.M. Mukhin, A.A. Kurilkin, 2013, published in Kataliz v Promyshlennosti.

Rights and permissions

Reprints and permissions

About this article

Gur’yanov, V.V., Mukhin, V.M. & Kurilkin, A.A. Developing ash-free high-strength spherical carbon catalyst supports. Catal. Ind. 5 , 156–163 (2013). https://doi.org/10.1134/S2070050413020062

Download citation

Received : 08 December 2011

Published : 28 June 2013

Issue Date : April 2013

DOI : https://doi.org/10.1134/S2070050413020062

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- carbon adsorbent

- porous structure

- polymerization

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

With HDFC Bank's Investment Advisory Group, get hands on to periodic report of incisive analysis & insights backed up by expert advice and in-depth research to make the best investment decisions.

HDFC Bank Ltd. share price target. HDFC Bank Ltd. has an average target of 1870.18. The consensus estimate represents an upside of 22.82% from the last price of 1522.65. View 48 reports from 14 analysts offering long-term price targets for HDFC Bank Ltd.. Reco - This broker has downgraded this stock from it's previous report.

opportunity. At HDFC Bank, we continue to focus on executing our ten-pillar strategy across various products and segments to create, catalyse and capture the next wave of growth. The focus on our straregic pillars drives our consistent performance. We continue to enhance our compliance culture and exhibit highest compliance standards.

HDFC Bank is a leading private sector bank with consistent growth and operational performance over various cycles. The bank has maintained superior return ratios compared to its peers resulting in premium valuations. Largest private sector bank with loan book of ₹ 13.9 lakh crore. Consistent performance with +4% NIM and +15% RoE in past many ...

Research. Mutual funds are funds that pool the money of several investors to invest in equity or debt markets. Mutual Funds could be Equity funds , Debt funds or balanced funds. Funds are selected on quantitative parameters like volatality, FAMA Model, risk adjusted returns, rolling return coupled with a qualitative analysis of fund performance ...

Get HDFC Bank Ltd. share price today, stock analysis, stock rating, price valuation, performance, fundamentals, market cap, shareholding, and financial report. ... Value Research Ratings. Our rating system has guided millions of investors in the past 20 years. Top Rated Stocks. All stocks with 5-star Value Research Ratings.

This study has been carried out to evaluate the financial performance of HDFCBank HDFC was. amongst the first to receive an 'in principle' approval from the Reserve Bank of India (RBI) to. set ...

HDFC Bank Ltd. India Equity Institutional Research II Result Update -Q3FY24 II 18th January 2024 KRChoksey Research is also available on Bloomberg KRCS<GO> Thomson Reuters, Factset and Capital IQ Phone: +91-22-6696 5555, Fax: +91-22-6691 9576 www.krchoksey.com ANALYST Unnati Jadhav, [email protected], +91-22-6696 5420 Result Update 18th ...

International Journal of Research Publication and Reviews Vol (2) Issue (8) (2021) Page 508-513 International Journal of Research Publication and Reviews Journal homepage: www.ijrpr.com ISSN 2582-7421 A Research on HDFC Bank Analysis and Performance in India Five Years 2016 To 2020 Annual Report Mr. J. Janarthanan1, N. Hariharan2

HDFC Bank Ltd recently announced a dividend of $0.7 per share, with the payment date yet to be announced and the ex-dividend date set for May 8, 2024. As investors anticipate this forthcoming ...

HDFC Securities has a proprietary trading desk. This desk maintains an arm's length distance with the Research team and all its activities are segregated from Research activities. The proprietary desk operates independently, potentially leading to investment decisions that may deviate from research views.

HDFC securities provides unique, consistently performing, varied kind of research products for different needs of investors investing in Equity, Mutual fund and Debt area. Apart from wide sector coverage, investors will find enough periodicity of research calls and reports, which gives customers chance to be well updated

HDFC Bank Ltd. 500180 shares dropped 2.29% to 1,448.30 Indian rupees Thursday, on what proved to be an all-around grim trading session for the stock market, with the S&P BSE Sensex Index 1 falling ...

This paper extends the earlier research of the Golden Rule in the static case [2] to the dynamic one. The main idea is to use the Germeier convolution of the payoff functions of players within the framework of antagonistic positional differential games in quasi motions and guiding control.

Victor MUKHIN, Principal Scientific Researcher | Cited by 475 | of Russian Academy of Sciences, Moscow (RAS) | Read 117 publications | Contact Victor MUKHIN

The possibility of using furfurol for the production of ash-free high-strength active carbons with spheroidal particles as adsorbents and catalyst supports is substantiated. A single-stage process that incorporates the resinification of furfurol, the molding of a spherical product, and its hardening while allowing the process cycle time and the ...

Positional calls are based on technical analysis of the stock by our research experts. The stock ideas here are based on the market movements by examining historical data, like price and volume. Our research experts analyze data & charts for trading signals and price patterns for to identify investment opportunities. Positional (7 days - 3 mths ...

Thane, Maharashtra, May 3, 2024: HDFC Bank, India's leading private sector bank, today inaugurated a three day long 'Used Car Loan Carnival' in Thane, Maharashtra. The 'Used Car Loan Carnival' will be held from May 3-5, 2024 at the Raymond Grounds, Thane, Maharashtra. The Bank has partnered with over 10 leading auto dealers who will display 150+ range of quality used cars at the event.