- 1800 102 2355

- Download the APP

- 1800 102 2355 [9:30AM-6:30PM]

- Branch Locator

- Customer Portal Login

- Advisor Portal Login

What is Assignment and Nomination in Life Insurance?

‘Assignment’ and ‘Nomination’ are two most common terms used in a life insurance policy document. Let us understand the importance of these two terms in-detail.

By Future Generali. Updated On Oct 06, 2022

Your life insurance policy is a contract between you (insured) and the insurance company (insurer). The contract is filled with jargon. To the extent possible, we must understand all the terms mentioned in the policy bond (certificate). ‘Assignment’ and ‘Nomination’ are two most common terms used in the insurance world.

For instance, in the event that you plan to apply for a home loan, your home loan provider will surely use these terms. Hence, it is best to be sure and understand exactly what the terms mean before you make a decision to buy the policy.

What is assignment in life insurance?

A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment.

An “assignor” (policyholder) is the person who assigns the insurance policy. An “assignee” is the person to whom the policy rights have been transferred, i.e. the person to whom the policy has been assigned.

In the event rights are transferred from an Assignor to an Assignee, the rights of the policyholder are canceled, and the Assignee becomes the owner of the insurance policy.

People often assign their life insurance policies to banks. A bank becomes the policy owner in this case, while the original policyholder continues to be the life assured whose death may be claimed by either the bank or the policy owner.

Types of Assignment

There are two ways to assign an insurance policy. They are as follows:

1. Absolute Assignment

During this process, the rights of the assignor (policyholder) will be completely transferred to the assignee (person to whom the policy rights have been transferred). It is not subject to any conditions.

As an example, Mr. Rajiv Tripathi owns a Rs 1 Crore life insurance policy. Mr. Tripathi wants to gift his wife this policy. Specifically, he wants to make “absolute assignment” of the policy in his wife's name, so that the death benefit (or maturity proceeds) can be paid directly to her. After the absolute assignment has been made, Mrs. Tripathi will own this policy, and she will be able to transfer it to someone else again.

2. Conditional Assignment

As part of this type of assignment, certain conditions must be met before the transfer of rights occurs from the Assignor to the Assignee. The Policy will only be transferred to the Assignee if all conditions are met.

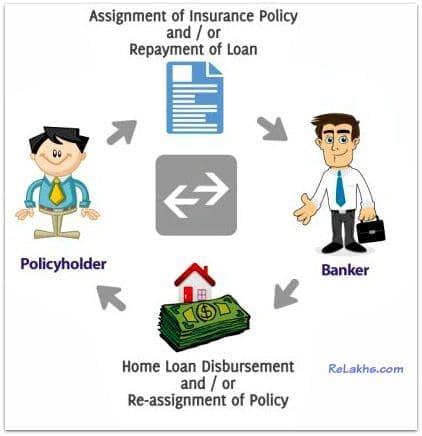

For instance, a term insurance policy of Rs 50 Lakh is owned by Mr. Dinesh Pujari. Mr. Pujari is applying for a home loan of Rs 50 Lakh. For the loan, the banker asked him to assign the term policy in their name. To acquire a home loan, Mr. Pujari can assign the insurance policy to the home loan company. In the event of Mr. Pujari’s death (during the loan tenure), the bank can collect the death benefit and get their money back from the insurance company.

Mr. Pujari can get back his term insurance policy if he repays the entire amount of his home loan. As soon as the loan is repaid, the policy will be transferred to Mr. Pujari.

In the event that the insurer receives a death benefit that exceeds the outstanding loan balance, the bank will be paid from the difference between the death benefit and the loan and the balance will be paid directly to the nominee. In the above example, the remaining amount (if any) will be paid to Mr. Pujari’s beneficiaries (legal heirs/nominee).

Key Points to know Note About Assignment

In regards to the assignment, the following points should be noted:

- A policy assignment transfers/changes only the ownership, not the risk associated with it. The person assured thus becomes the insured.

- The assignment may lead to cancellation of the nomination in the policy only when it is done in favour of the insurance company due to a policy loan.

- Assignment for all insurance plans except for the pension plan and the Married Women's Property Act (MWP), can be done.

- A policy contract endorsement is required to effect the assignment.

What is nomination in life insurance?

Upon the death of the life assured, the nominee/ beneficiary (generally a close relative) receives the benefits. Policyholders appoint nominees to receive benefits. Under the Insurance Act, 1938, Section 39 governs the nomination process.

Types of Nominees

In a life insurance policy, the policyholder names someone who will receive the benefits in the event of the life assured's death. Here are a few types of nominees:

1. Beneficial Nominees

In accordance with the law, the beneficiary of the claimed benefits will be any immediate family member nominated by the policyholder (like a spouse, children, or parents). Beneficiary nominees are limited to immediate family members of the beneficiary.

2. Minor Nominees

It is common for individuals to name their children as beneficiaries of their life insurance policies. Minor nominees (under the age of 18) are not allowed to handle claim amounts. Hence, the policyholder needs to designate a custodian or appointee. Payments are made to the appointee until the minor reaches the age of 18.

3. Non-family Nominees

Nominees can include distant relatives or even friends as beneficiaries of a life insurance policy.

4. Changing Nominees

It is okay for policyholders to change their nominees as often as they wish, but the latest nominee should take priority over all previous ones.

Key Points to Note About Nomination

In regards to the nomination, the following points should be noted:

- In order to nominate, the policyholder and life assured must be the same.

- In the case of a different policyholder and life assured, the claim benefits will be paid to the policyholder.

- Nominations cannot be changed or modified.

- The policy can have more than one nominee.

- As part of successive nominations, if the life assured appoints person “A” as the first person to receive benefits. Now, in the event of the life assured’s death after person “A” dies, the claim benefits will be given to person “B”. The benefits will be available to Nominee “C” if Nominee “A” and Nominee “B” have passed away.

What is the difference between nomination and assignment?

Let's talk about the differences between assignment and nomination.

Nomination and Assignment serve different purposes. The nomination protects the interests of the insured as well as an insurer in offering claim benefits under the life insurance policy. On the other hand, assignment protects the interests of an assignee in availing the monetary benefits under the policy. The policyholder should be aware of both of them before buying life insurance.

Connect with our trusted financial advisors right away!

Fill in below details to get a call back

One of our associate will connect with you soon.

Latest Articles

Life Insurance 4 min What is Investment? A Complete guide to start your investment journey.

By Future Generali. Dec 06, 2023

Life Insurance 5 min Endowment Policy: Returns, Benefits & Requirement

By Future Generali. Sep 06, 2023

Life Insurance 4 min Understanding Sum Assured: Significance & Calculation

By Future Generali. Jul 28, 2023

Couldn't find what you are looking for? TRY SEARCH

ARN No.: Comp-April-2022_534.

Assignment of Life Insurance Policy

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee.

Assignment of a Life Insurance Policy simply means transfer of rights from one person to another. The policyholder can transfer the rights of his insurance policy to another for various reasons and this process is called Assignment.

The person who assigns the policy, i.e. transfers the rights, is called the Assignor and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee. Once the rights have been transferred to the Assignee, the rights of the Assignor stands cancelled and the Assignee becomes the owner of the policy.

here are 2 types of Assignment:

- Absolute Assignment – This means complete Transfer of Rights from the Assignor to the Assignee, without any further conditions applicable.

- Conditional Assignment – This means that the Transfer of Rights will happen from the Assignor to the Assignee subject to certain conditions. If the conditions are fulfilled then only the Policy will get transferred from the Assignor to the Assignee.

Let’s take an example:

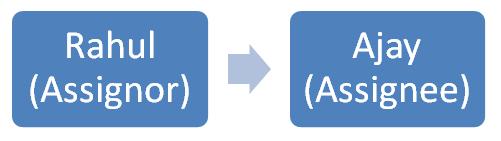

Rahul owns 2 Life Insurance policies of value Rs 2 lakhs and Rs 5 lakhs respectively. He would like to gift one policy of Rs 2 lakhs to his best friend Ajay. In that case, he would like to absolutely assign the policy in his name such that the death or maturity proceeds are directly paid to him. Thus, after the assignment, Ajay becomes the absolute owner of the policy. If he wishes, he may again transfer it to someone else for any other reason. This type of Assignment is called Absolute Assignment.

Now, Rahul needed to take a loan for Rs 5 lakhs. So, he thought of doing so against the other policy that he owned for Rs 5 lakhs. To take a loan from ABC bank, he needed to conditionally assign the policy to that Bank and then the bank would be able to pay out the loan money to him. If Rahul failed to repay the loan, then the bank would surrender the policy and get their money back.

Once Rahul’s loan is completely repaid, then the policy would again come back to him. In case, Rahul died before completely repaying the loan, then also the bank can surrender the policy to get their money back. This type of Assignment is called Conditional Assignment.

Sachin Telawane is a Content Manager and writes on various aspects of the Insurance industry. His enlightening insights on the insurance industry has guided the readers to make informed decisions in the course of purchasing insurance plans.

- Submission Guidelines

Assignability of Life Insurance Policies

Normal 0 false false false EN-US JA X-NONE

About the author

Umakanth Varottil

Umakanth Varottil is an Associate Professor at the Faculty of Law, National University of Singapore. He specializes in corporate law and governance, mergers and acquisitions and cross-border investments. Prior to his foray into academia, Umakanth was a partner at a pre-eminent law firm in India.

Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Attention may be drawn to the posted comments @ http://www.moneylife.in/article/red-tape-vs-red-carpet-ndashpart3/40798.html

As viewed: The stand initially taken by the 'Insurer' (as set out in the write-up) is quite sound and valid, both legally and legitimately; and accords/in tune with the basic concept of 'INSURANCE'. On that premise, in one's conviction, the idea of directly or indirectly 'trading on (IN?)'any kind of 'insurance product' is anathema, hence deserves to be eschewed. If so, the whole matter, to be precise the wisdom or absence of it in the amendments of the law, ought not but be revisited and be frightfully reviewed from all its inter-connected (-woven) angles.

- Invoking India’s Money Laundering Regime for Environmental Crimes: Impact on Businesses

Data-Protection in the International Arbitration Regime

‘beneficial owner’ is not a ‘related party’ under the ibc, the unavailability of writ jurisdiction for interference with one-time settlements.

Email Address*

Top Posts & Pages

- Supreme Court on the Regularization of Temporary Employees

- A Stamp Paper – What Good is it Beyond Six Months?

- Section 14, SARFAESI Act: Settling A Jurisdictional Conundrum

- Foreign Jurisdiction Clauses in Commercial Contracts: An Indian Perspective

- Validity of Employment Bonds in India

- Employee’s Right to Sue after Obtaining Full and Final Settlement from Employer

- Litigation against Credit Rating Agencies: Delhi High Court Delineates the Scope

Recent Comments

- TANISTHA MANGARAJ on CCI’s Decision on Abuse of Dominant Position by Google

- Umakanth Varottil on Supreme Court Invokes Article 142 to Permit Withdrawal of CIRP

- Araz Mirbavandi on Supreme Court Invokes Article 142 to Permit Withdrawal of CIRP

- Hari Prakash on Guest Post: Reduction of Provident Fund Contributions to Statutory Limits

- Adv Ragav on Secondment Taxation and the Northern Operating Systems Case

Social Media

- View @IndiaCorpLaw’s profile on Twitter

The Insurance Laws (Amendment) Act, 2015 and life insurance policyholders

- Published: 15 October 2015

- Volume 6 , pages 231–253, ( 2015 )

Cite this article

- Mangesh Patwardhan 1 &

227 Accesses

Explore all metrics

The insurance sector in India has long been an area that required a comprehensive legislative overhaul. This paper examines the recent amendments brought in this area through legislation. It is well known that insurance reform in India has followed a long and convoluted process spanning more than a decade, including a report by the Law Commission of India, a series of parliamentary standing and select committees and the use of ordinance powers. The paper explains the impact that the amendments have on nomination and assignment with respect to life insurance policies, the legal issues that arise in case of subsequent assignment, the nature of insurable interest under the new regime and the applicability of this framework to assignment of non-life personal insurance policies. This paper proposes a framework that would do away with current notions of nomination and assignment, instead adopting the twin concepts of beneficiary and transferee. In this manner, problems that arise from the dual nature of life insurance, as protection and property, would partly disappear once the legal regime is more closely aligned with the underlying economic rationale behind such instruments.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Social health insurance in the Philippines: do the poor really benefit?

Ai, big data, and the future of consent.

Analysing credit risk in persons with disabilities as an instrument of financial inclusion

Law Commission of India, 190th Report on the Revision of the Insurance Act, 1938 and the Insurance Regulatory and Development Authority Act, 1999 (2004), available at http://lawcommissionofindia.nic.in/reports/InsuranceReport-2nddraft1.pdf [hereinafter LCI Report].

Report of the Select Committee on the Insurance Laws (Amendment) Bill, 2008 (2014), available at http://www.prsindia.org/uploads/media/Insurance/Select%20committee%20on%20Insurance%20Laws.pdf . (The Report was presented to the Rajya Sabha on Dec. 10, 2014) [hereinafter Select Committee Report].

For the sake of convenience, we refer to the Act as it was in force immediately prior to the promulgation of the Ordinance as the earlier Act and the Act as amended by the Ordinance as the amended Act. The amending provisions in the Ordinance and those in the 2015 Act are identical.

OXFORD ADVANCED LEARNER’S DICTIONARY (9th ed., 2009).

A.I.R. 1984 S.C. 346.

We retain the masculine gender only so that the discussion aligns smoothly with the references in the Act provisions.

LCI Report, supra note 1, at 80, 82.

IRDA has been renamed as the Insurance Regulatory and Development Authority of India by § 105 of the 2015 Act.

Select Committee Report, supra note 2, at 34.

Insurance Development Regulatory Authority Act, 1999, § 39(6).

The Insurance Laws (Amendment) Act, No. 5 of 2015, § 39(8).

This corresponds to § 38(8) of the amended Act.

The proviso to § 39(4) of the earlier Act.

The Insurance Laws (Amendment) Act, No. 5 of 2015, §45.

LCI Report, supra note 1, at 71.

The Insurance Laws (Amendment) Act, No. 5 of 2015, proviso to § 38(10).

LCI Report , supra note 1, at 71.

Kenneth Black Jr. ET AL ., Life Insurance 660 (14th ed. 2013).

Id. , at 455.

Id. , at 455–56.

Insurance Institute of India, Principles of Insurance IC-01 112 (1st ed. 2011).

222 U.S. 149 (1911).

Id. , at 155.

Id. , at 156.

A.I.R. 1962 S.C. 814.

See Black et al, supra note 19, at 604–5.

[2007] 79 S.C.L. 583 (Bom.).

A.I.R. 1959 S.C. 78.

LIC has moved the Supreme Court vide a Special Leave Petition. See Falaknaaz Syed, LIC to Move SC over Policy Trading Issue , Bus. Stand. (April 27, 2007) available at http://www.business-standard.com/article/finance/lic-to-move-sc-over-policy-trading-issue-107042701041_1.html .

LCI Report , supra note 1, at 73.

The Insurance Laws (Amendment) Act, No. 5 of 2015, § 38(2).

The Insurance Laws (Amendment) Act, No. 5 of 2015, § 38(3) and (4).

See Black ET AL, supra note 19, at 23.

The issue as to the legal status of the nominee in these contexts is a complex one. See Mangesh Patwardhan, The Nomination Riddle: Will the Real Nominee Please Stand Up? , 41 Chart. Secry. 170 (2011).

Amir & Orly Lobel, Stumble, Predict, Nudge: How Behavioral Economics Informs Law and Policy, 108 Colum. L. Rev. 2098, 2121 (2008).

See Debosmita Nandy & Avisha Gupta, Insure Policy Plus Services (P) Ltd. v. Life Insurance Corporation of India: Can Life Insurance Policies Be Traded? , 1 Nujs L. Rev. 653, 667 (2008).

Id. , at 664.

See Black ET AL, supra note 19, at 605.

Id. , at 101.

See Mithoolal Nayak v. LIC of India AIR, 1962 S.C. 814.

See Colin Camerer et al., Regulation for Conservatives: Behavioral Economics and the Case for Asymmetric Paternalism , 151 U. Pa. L. Rev. 1211, 1212 (2003) (arguing that [a] regulation is asymmetrically paternalistic if it creates large benefits for those who make errors, while imposing little or no harm on those who are fully rational).

MINISTRY OF FINANCE, REPORT OF THE FINANCIAL SECTOR LEGISLATIVE REFORMS COMMISSION (2013), available at http://finmin.nic.in/fslrc/fslrc_index.asp [hereinafter FSLRC Report].

Id. , at 152.

Id. , at 177. (Unless specified, insurable interest will not be required to constitute a valid insurance contract. The Regulator may specify the types of contracts of insurance that may require insurable interest).

FSLRC Report, supra note 43, at 152.

INSURANCE INSTITUTE OF INDIA, supra note 22, at 51.

George E. Rejda, Principles of Risk Management and Insurance 178 (10th ed. 2011).

It is not clear whether the Regulator can specify this requirement only at inception or as a general rule. This ambiguity only makes the problem worse.

Aradhya Sethia, Excessive Delegation in the Judicial Appointments Bill?, Law and Other Things (August 30, 2014), available at http://lawandotherthings.blogspot.in/2014/08/excessive-delegation-in-judicial.html .

Ajoy Kumar Banerjee v. Union of India, (1984) 3 S.C.C. 127.

Author information

Authors and affiliations.

National Insurance Academy, Pune, India

Mangesh Patwardhan & S. Uma

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Mangesh Patwardhan .

Rights and permissions

Reprints and permissions

About this article

Patwardhan, M., Uma, S. The Insurance Laws (Amendment) Act, 2015 and life insurance policyholders. Jindal Global Law Review 6 , 231–253 (2015). https://doi.org/10.1007/s41020-015-0014-3

Download citation

Published : 15 October 2015

Issue Date : October 2015

DOI : https://doi.org/10.1007/s41020-015-0014-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Life insurance

- Nominations

- Assignments

- Non-life personal insurance

- Find a journal

- Publish with us

- Track your research

Assignment in Insurance Policy | Meaning | Explanation | Types

Table of Contents

- 1 What is Assignment in an Insurance Policy?

- 2 Who can make an assignment?

- 3 What happens to the ownership of the policy upon Assignment?

- 4 Can assignment be changed or cancelled?

- 5 What happens if the assignment dies?

- 6 What is the procedure to make an assignment?

- 7 Is it necessary to Inform the insurer about assignment?

- 8 Can a policy be assigned to a minor person?

- 9 Who pays premium when a policy is assigned?

- 10.1 1. Conditional Assignment

- 10.2 2. Absolute Assignment

What is Assignment in an Insurance Policy?

Assignment means a complete transfer of the ownership of the policy to some other person. Usually assignment is done for the purpose of raising a loan from a bank or a financial institution .

Assignment is governed by Section 38 of the Insurance Act 1938 in India. Assignment can also be done in favour of a close relative when the policyholder wishes to give a gift to that relative. Such an assignment is done for “natural love and affection”. An example, a policyholder may assign his policy to his sister who is handicapped.

Who can make an assignment?

A policyholder who has policy on his own life can assign the policy to another person. However, a person to whom a policy has been assigned can reassign the policy to the policyholder or assign it to any other person. A nominee cannot make an assignment of the policy. Similarly, an assignee cannot make a nomination on the policy which is assigned to him.

What happens to the ownership of the policy upon Assignment?

When a policyholder assign a policy, he loses all control on the policy. It is no longer his property. It is now the assignee’s property whether the policyholder is alive or dead, the assignee alone will get the policy money from the insurance company.

If the assignee dies, then his (assignee’s) legal heirs will be entitled to the policy money.

Can assignment be changed or cancelled?

An assignment cannot be changed or cancelled. The assignee can of course, reassign the policy to the policyholder who assigned it to him. He can also assign the policy to any other person because it is now his property. We can think of a bank reassigning the policy to the policyholder when their loan is repaid.

What happens if the assignment dies?

If the assignee dies, the assignment does not get cancelled. The legal heirs of the assignee become entitled to the policy money. Assignment is a legal transfer of all the interests the policyholder has in the policy to the assignee.

What is the procedure to make an assignment?

Assignment can be made only after issue of the policy bond. The policyholder can either write out the wording on the policy bond (endorsement) or write it on a separate paper and get it stamped. (Stamp value is the same, as the stamp required for the policy — Twenty paise per one thousand sum assured). When assignment is made by an endorsement on the policy bond, there is no need for stamp because the policy is already stamped.

Is it necessary to Inform the insurer about assignment?

Yes, it is necessary to give information about assignment to the insurance company. The insurer will register the assignment in its records and from then on recognize the assignee as the owner of the policy. If someone has made more than one assignment, then the date of the notice will decide which assignment has priority. In the case of reassignment also, notice is necessary.

Can a policy be assigned to a minor person?

Assignment can be made in favour of a minor person. But it would be advisable to appoint a guardian to receive the policy money if it becomes due during the minority of the assignee.

Who pays premium when a policy is assigned?

When a policy is assigned normally, the assignee should pay the premium, because the policy is now his property. In practice, however, premium is paid by the assignor (policyholder) himself. When a bank gives a loan and takes the assignment of a policy a security, it will ask the assignor himself to pay the premium and keep it in force. In the case of an assignment as a gift, the assignor would like to pay the premium because he has gifted the policy.

Types of assignment

Assignment may take two forms:

- Conditional Assignment.

- Absolute Assignment.

1. Conditional Assignment

It would be useful where the policyholder desires the benefit of the policy to go to a near relative in the event of his earlier death. It is usually effected for consideration of natural love and affection. It generally provides for the right to revert the policyholder in the event of the assignee predeceasing the policyholder or the policyholder surviving to the date of maturity.

2. Absolute Assignment

This assignment is generally made for valuable consideration. It has the effect of passing the title in the policy absolutely to the assignee and the policyholder in no way retains any interest in the policy. The absolute assignee can deal with the policy in any manner he likes and may assign or transfer his interest to another person.

Related Posts

- Privacy Policy

How to assign a life insurance policy

What is meant by assigning?

Interest in a life insurance policy can be transferred from the policyholder to a lender or relative by assignment of policy. Here the policyholder is known as the assignor and the person in whose favour the policy has been assigned is called assignee.

Types of assignment

There are two types of assignment: Conditional assignment: This is done when the insured wishes to pass benefits of the policy to a relative in case of early death or certain conditions. The rights of the policyholder are restored once the conditions are fulfilled. Absolute assignment: This is done as a part of consideration for a loan in favour of the lender/bank/lending institution. In such an assignment, the insured loses his rights in the policy and the absolute assignee can deal with it independently.

Notice of assignment

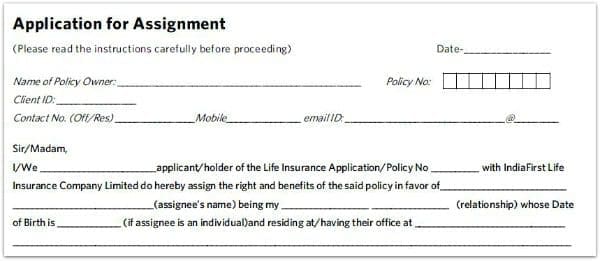

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer. A form prescribed by the insurers must be filled and signed. In case of conditional assignment, your reason needs to be mentioned as well.

Documents required

Proof of income. Self attested copy of photo ID and address proof. Self attested copy of PAN card.

Fees and stamp duty

If the assignment is made by endorsement on the policy document, it is exempt from stamp duty. However, in case of a separate deed, stamp duty is payable.

Acceptance and the right to reject

If the insurance company decides to register the assignment, it will record it and inform the assignor. On paying a fee, the assignee can obtain an acknowledgement. The insurer also has a right to reject if it believes that the assignment is not bona fide or against the interest of the policyholder or public interest or for the purpose of trading the insurance policy. (Content on this page is courtesy Centre for Investment Education and Learning (CIEL). Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta.)

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Assignment under Insurance Policies

By J Mandakini, NUALS

Editor’s Note: This paper attempts to explore the concept of assignment under Indian law especially Contract Act, Insurance Act and Transfer of Property Act. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. Also, it explains how ICICI Bank faces certain problems in executing the same.

INTRODUCTION

For any facility sanctioned by a lender, collateral is always deposited to secure the same. Such mere deposition will not suffice, the borrower has to explicitly permit the lender to recover from the borrower, such securities in case of his default.

This is done by the concept of assignment, dealt with adequately in Indian law. Assignment of obligations is always a tricky matter and needs to be dealt with carefully. The Bank should not fall short of any legally permitted lengths to ensure the same. This is why ambiguity in its security documents have to be rectified.

This paper attempts to explore the concept of assignment in contract law. It seeks to appreciate why the assignment is made use of for securities of a facility sanctioned by ICICI Bank. The next section will deal with how ICICI Bank faces certain problems in executing the same. The following sections will talk about possible risks involved, as well as defenses and solutions to the same.

WHAT IS ASSIGNMENT?

Assignment refers to the transfer of certain or all (depending on the agreement) rights to another party. The party which transfers its rights is called an assignor, and the party to whom such rights are transferred is called an assignee. Assignment only takes place after the original contract has been made. As a general rule, assignment of rights and benefits under a contract may be done freely, but the assignment of liabilities and obligations may not be done without the consent of the original contracting party.

The liability on a contract cannot be transferred so as to discharge the person or estate of the original contractor unless the creditor agrees to accept the liability of another person instead of the first. [i]

Illustration

P agrees to sell his car to Q for Rs. 100. P assigns the right to receive the Rs. 100 to S. This may be done without the consent of Q. This is because Q is receiving his car, and it does not particularly matter to him, to whom the Rs. 100 is being handed as long as he is being absolved of his liability under the contract. However, notice may still be required to be given. Without such notice, Q would pay P, in spite of the fact that such right has been assigned to S. S would be a sufferer in such case.

In this case, that condition is being fulfilled since P has assigned his right to S. However, P may not assign S to be the seller. P cannot just transfer his duties under the contract to another. This is because Q has no guarantee as to the condition of S’s car. P entered into the contract with Q on the basis of the merits of P’s car, or any other personal qualifications of P. Such assignment may be done with the consent of all three parties – P, Q, S, and by doing this, P is absolved of his liabilities under the contract.

1.1. Effect of Assignment

Immediately on the execution of an assignment of an insurance policy, the assignor forgoes all his rights, title and interest in the policy to the assignee. The premium or loan interest notices etc. in such cases will be sent to the assignee. [ii] However, the existence of obligations must not be assumed, when it comes to the assignment. It must be accompanied by evidence of the same. The party asserting such a personal obligation must prove the existence of an express assumption by clear and unequivocal proof. [iii]

Assignment of a contract to a third party destroys the privity of contract between the initial contracting parties. New privity is created between the assignee and the original contracting party. In the illustration mentioned above, the original contracting parties were P and Q. After the assignment, the new contracting parties are Q and S.

1.2. Revocation of Assignment

Assignment, once validly executed, can neither be revoked nor canceled at the option of the assignor. To do so, the insurance policy will have to be reassigned to the original assignor (the insured).

1.3. Exceptions to Assignment

There are some instances where the contract cannot be assigned to another.

- Express provisions in the contract as to its non-assignability – Some contracts may include a specific clause prohibiting assignment. If that is so, then such a contract cannot be assigned. Assignability is the rule and the contrary is an exception. [iv]

Pensions, PFs, military benefits etc. Illustration

1.4. enforcing a contract of assignment.

From the day on which notice is given to the insurer, the assignee becomes the beneficiary of the policy even though the assignment is not registered immediately. It does not wait until the giving of notice of the transfer to the insurer. [vi] However, no claims may lie against the insurer until and unless notice of such assignment is delivered to the insurer.

If notice of assignment is not provided to the obligor, he is discharged if he pays to the assignor. Assignee would have to recover from the assignor. However, if the obligor pays the assignor in spite of the notice provided to him, he would still be liable to the assignee.

The following two illustrations make the point amply clear:

Illustrations

1. Seller A assigns its right to payment from buyer X to bank B. Neither A nor B gives notice to X. When payment is due, X pays A. This payment is fully valid and X is discharged. It will be up to B to recover it from A

2. Seller A assigns to bank B its right to payment from buyer X. B immediately gives notice of the assignment to X. When payment is due, X still pays A. X is not discharged and B is entitled to oblige X to pay a second time.

An assignee doesn’t stand in better shoes than those of his assignor. Thus, if there is any breach of contract by the obligor to the assignee, the latter can recover from the former only the same amount as restricted by counter claims, set offs or liens of the assignor to the obligor.

The acknowledgment of notice of assignment is conclusive proof of, and evidence enough to entertain a suit against an assignor and the insurer respectively who haven’t honoured the contract of assignment.

1.5. Assignment under various laws in India

There is no separate law in India which deals with the concept of assignment. Instead, several laws have codified it under different laws. Some of them have been discussed as follows:

1.5.1. Under the Indian Contract Act

There is no express provision for the assignment of contracts under the Indian Contract Act. Section 37 of the Act provides for the duty of parties of a contract to honour such contract (unless the need for the same has been done away with). This is how the Act attempts to introduce the concept of assignment into Indian commercial law. It lays down a general responsibility on the “representatives” of any parties to a contract that may have expired before the completion of the contract. (Illustrations to Section 37 in the Act).

An exception to this may be found from the contract, e.g. contracts of a personal nature. Representatives of a deceased party to a contract cannot claim privity to that contract while refusing to honour such contract. Under this Section, “representatives” would also include within its ambit, transferees and assignees. [vii]

Section 41 of the Indian Contract Act applies to cases where a contract is performed by a third party and not the original parties to the contract. It applies to cases of assignment. [viii] A promisee accepting performance of the promise from a third person cannot afterwards enforce it against the promisor. [ix] He cannot attain double satisfaction of its claim, i.e., from the promisor as well as the third party which performed the contract. An essential condition for the invocation of this Section is that there must be actual performance of the contract and not of a substituted promise.

1.5.2. Under the Insurance Act

The creation of assignment of life insurance policies is provided for, under Section 38 of the Insurance Act, 1938.

- When the insurer receives the endorsement or notice, the fact of assignment shall be recorded with all details (date of receipt of notice – also used to prioritise simultaneous claims, the name of assignee etc). Upon request, and for a fee of an amount not exceeding Re. 1, the insurer shall grant a written acknowledgment of the receipt of such assignment, thereby conclusively proving the fact of his receipt of the notice or endorsement. Now, the insurer shall recognize only the assignee as the legally valid party entitled to the insurance policy.

1.5.3. Under the Transfer of Property Act

Indian law as to assignment of life policies before the Insurance Act, 1938 was governed by Sections 130, 131, 132 and 135 of the Transfer of Property Act 1882 under Chapter VIII of the Act – Of Transfers of Actionable Claims. Section 130 of the Transfer of Property Act states that nothing contained in that Section is to affect Section 38 of the Insurance Act.

I) Section 130 of the Transfer of Property Act

An actionable claim may be transferred only by fulfilling the following steps:

- Signed by a transferor (or his authorized agent)

The transfer will be complete and effectual as soon as such an instrument is executed. No particular form or language has been prescribed for the transfer. It does not depend on giving notice to the debtor.

The proviso in the section protects a debtor (or other person), who, without knowledge of the transfer pays his creditor instead of the assignee. As long as such payment was without knowledge of the transfer, such payment will be a valid discharge against the transferee. When the transfer of any actionable claim is validly complete, all rights and remedies of transferor would vest now in the transferee. Existence of an instrument in writing is a sine qua non of a valid transfer of an actionable claim. [x]

II) Section 131 of the Transfer Of Property Act

This Section requires the notice of transfer of actionable claim, as sent to the debtor, to be signed by the transferor (or by his authorized agent), and if he refuses to sign it, a signature by the transferee (or by his authorized agent). Such notice must state both the name and address of the transferee. This Section is intended to protect the transferee, to receive from the debtor. The transfer does not bind a debtor unless the transferor (or transferee, if transferor refuses) sends him an express notice, in accordance with the provisions of this Section.

III) Section 132 of the Transfer Of Property Act

This Section addresses the issue as to who should undertake the obligations under the transfer, i.e., who will discharge the liabilities of the transferor when the transfer has been made complete – would it be the transferor himself or the transferee, to whom the rest of the surviving contract, so to speak, has been transferred.

This Section stipulates, that the transferee himself would fulfill such obligations. However, where an actionable claim is transferred with the stipulation in the contract that transferor himself should discharge the liability, then such a provision in the contract will supersede Ss 130 and 132 of this Act. Where the insured hypothecates his life insurance policies and stipulates that he himself would pay the premiums, the transferee is not bound to pay the premiums. [xi]

FACILITIES SECURED BY INSURANCE POLICIES – HOW ASSIGNMENT COMES INTO THE PICTURE

Many banks require the borrower to take out or deposit an insurance policy as security when they request a personal loan or a business loan from that institution. The policy is used as a way of securing the loan, ensuring that the bank will have the facility repaid in the event of either the borrower’s death or his deviations from the terms of the facility agreement.

Along with the deposit of the insurance policy, the policyholder will also have to assign the benefits of the policy to the financial institution from which he proposes to avail a facility. The mere deposit, without writing, or passing of any document of title to such a claim, does not create any equitable charge. [xii]

ETHICS OF ASSIGNING LIFE INSURANCE POLICY TO LENDERS

The purpose of taking out a life insurance policy on oneself, is that in the event of an untimely death, near and dear ones of the deceased are not left high and dry, and that they would have something to fall back on during such traumatic times. Depositing and assigning the rights under such policy document to another, would mean that there is a high chance that benefits of life insurance would vest in such other, in the event of unfortunate death and the family members are prioritized only second. These are not desirable circumstances where the family would be forced to cope with the death of their loved one coupled with the financial crisis.

Thus, there is a need to examine the ethics of:

- The bank accepting such assignment

The customer should be cautious before assigning his rights under life insurance policies. By “cautious”, it is only meant that he and his dependents and/or legal heirs should be aware of the repercussions of the act of assigning his life insurance policy. It is conceded that no law prohibits the assignment of life insurance policies.

In fact, Section 38 of the Insurance Act, 1938 , provides for such assignments. Judicial cases have held life insurance policies as property more than a social welfare measure. [xiii] Further, the bank has no personal relationship with any customer and thus has no moral obligation to not accept such assignments of life insurance.

However, the writer is of the opinion that, in dealing with the assignment of life insurance policies, utmost care and caution must be taken by the insured when assigning his life insurance policy to anyone else.

CURRENT STAND OF ICICI REGARDING FACILITIES SECURED BY INSURANCE POLICY, WITH SPECIFIC REFERENCE TO ASSIGNMENT OF OBLIGATIONS

This Section seeks to address and highlight the manner in which ICICI Bank drafts its security documents with regard to the assignment of obligations. The texts placed in quotes in the subsequent paragraphs are verbatim extracts from the security document as mentioned.

Composite Document for Corporate and Realty Funding

“ 8 . CHARGING CLAUSE

The Mortgagor doth hereby:

iii) Assign and transfer unto the Mortgagee all the Bank Accounts and all rights, title, interest, benefits, claims and demands whatsoever of the Mortgagor in, to, under and in respect of the Bank Accounts and all monies including all cash flows and receivables and all proceeds arising from Projects and Other Projects_______________, insurance proceeds, which have been deposited / credited / lying in the Bank Accounts, all records, investments, assets, instruments and securities which represent all amounts in the Bank Accounts, both present and future (the “Account Assets”, which expression shall, as the context may permit or require, mean any or each of such Account Assets) to have and hold the same unto and to the use of the Mortgagee absolutely and subject to the powers and provisions herein contained and subject also to the proviso for redemption hereinafter mentioned;

(v) Assign and transfer unto the Mortgagee all right, title, interest, benefit, claims and demands whatsoever of the Mortgagors, in, to, under and/or in respect of the Project Documents (including insurance policies) including, without limitation, the right to compel performance thereunder, and to substitute, or to be substituted for, the Mortgagor thereunder, and to commence and conduct either in the name of the Mortgagor or in their own names or otherwise any proceedings against any persons in respect of any breach of, the Project Documents and, including without limitation, rights and benefits to all amounts owing to, or received by, the Mortgagor and all claims thereunder and all other claims of the Mortgagor under or in any proceedings against all or any such persons and together with the right to further assign any of the Project Documents, both present and future, to have and to hold all and singular the aforesaid assets, rights, properties, etc. unto and to the use of the Mortgagee absolutely and subject to the powers and provisions contained herein and subject also to the proviso for redemption hereinafter mentioned.”

ICICI Bank’s Standard Terms and Conditions Governing Consumer Durable Loans

“ insurance.

The Borrower further agrees that upon any monies becoming due under the policy, the same shall be paid by the Insurance Company to ICICI Bank without any reference / notice to the Borrower, but not exceeding the principal amount outstanding under the Insurance Policy. The Borrower specifically acknowledges that in all cases of claim, the Insurance Company will be solely liable for settlement of the claim, and he/she will not hold ICICI Bank responsible in any manner whether for compensation, recovery of compensation, processing of claims or for any reason whatsoever.

Reference has been made only to assignment of assets, rights, benefits, interests, properties etc. No specific reference has been made to the assignment of obligations of the assignor under such insurance contract.

THE ISSUE FACED BY ICICI BANK

Where ICICI Bank accepts insurance policy documents of customers as security for a loan, in the light of the fact that the documents are silent about the question of assignment of obligations, are they assigned to ICICI Bank? Where there is hypothecation of a life insurance policy, with a stipulation that the mortgagor (assignor) should pay the premiums, and that the mortgagee (assignee) is not bound to pay the same, Sections 130 and 132 do not apply to such cases. [xiv] With rectification of this issue, ICICI Bank can concretize its hold over the securities with no reservations about its legality.

RISKS INVOLVED

This section of the paper attempts to explore the many risks that ICICI Bank is exposed to, or other factors which worsen the situation, due to the omission of a clause detailing the assignment of obligations by ICICI Bank.

Practices of Other Companies

The practices of other companies could be a risk factor for ICICI Bank in the light of the fact that some of them expressly exclude assignment of obligations in their security documents.

There are some companies whose notice of assignment forms contain an exclusive clause dealing with the assignment of obligations. It states that while rights and benefits accruing out of the insurance policy are to be assigned to the bank, obligations which arise out of such policy documents will not be liable to be performed by the bank. Thus, they explicitly provide for the only assignment of rights and benefits and never the assignment of obligations.

Possible Obligation to Insurance Companies

By not clearing up this issue, ICICI Bank could be held to be obligated to the insurance company from whom the assignor took the policy, for example, with respect to insurance premiums which were required to be paid by the assignor. This is not a desirable scenario for ICICI Bank. In case of default by the assignor in the terms of the contract, the right of ICICI Bank over the security deposited (insurance policy in question) could be fraught in the legal dispute.

Possible litigation

Numerous suits may be instituted against ICICI Bank alleging a violation of the Indian Contract Act. Some examples include allegations of concealment of fact, fraud etc. These could be enough to render the existing contract of assignment voidable or even void.

Contra Proferentem

This doctrine applies in a situation when a provision in the contract can be interpreted in more than one way, thereby creating ambiguities. It attempts to provide a solution to interpreting vague terms by laying down, that a party which drafts and imposes an ambiguous term should not benefit from that ambiguity. Where there is any doubt or ambiguity in the words of an exclusion clause, the words are construed more forcibly against the party putting forth the document, and in favour of the other party. [xv]

The doctrine of contra proferentem attempts to protect the layman from the legally knowledgeable companies which draft standard forms of contracts, in which the former stands on a much weaker footing with regard to bargaining power with the latter. This doctrine has been used in interpreting insurance contracts in India. [xvi]

If litigation ensues as a result of this uncertainty, there are high chances that the Courts will tend to favour the assignor and not the drafter of the documents.

POSSIBLE DEFENSES AGAINST DISPUTES FOR THE SECURITY DOCUMENTS AS THEY ARE NOW

This section of the paper attempts to give defences which the Bank may raise in case of any disputes arising out of silence on the matter of assignability of obligations.

Interpretation of the Security Documents

UNIDROIT principles expressly provide a method for interpretation of contracts. [xvii] The method consists of utilizing the following factors:

This defence relates to the concept of estoppel embodied in Section 115 of the Indian Evidence Act, 1872. According to the Section, when one person has, by his declaration, act or omission, intentionally caused or permitted another person to believe a thing to be true and to act upon such belief, neither he nor his representative shall be allowed, in any suit or proceeding between himself and such person or his representatives, to deny the truth of that thing.

If a man either by words or by conduct has intimated that he consents to an act which has been done and that he will not offer any opposition to it, and he thereby induces others to do that which they otherwise might have abstained from, he cannot question legality of the act he had sanctioned to the prejudice of those who have so given faith to his words or to the fair inference to be drawn from his conduct. [xviii] Subsequent conduct may be relevant to show that the contract exists, or to show variation in the terms of the contract, or waiver, or estoppel. [xix]

Where the meaning of the instrument is ambiguous, a statement subsequently interpreting such instrument is admissible. [xx] In the present case, where the borrower has never raised any claims with regard to non assignability of obligations on him, and has consented to the present conditions and relations with ICICI Bank, he cannot he cannot be allowed to raise any claims with respect to the same.

Internationally, the doctrine of post contractual conduct is invoked for such disputes. It refers to the acts of parties to a contract after the commencement of the contract. It stipulates that where a party has behaved in a particular manner, so as to induce the other party to discharge its obligations, even if there has been a variation from the terms of the contract, the first party cannot cite such variation as a reason for its breach of the contract.

Where the parties to a contract are both under a common mistake as to the meaning or effect of it, and therefore embark on a course of dealing on the footing of that mistake, thereby replacing the original terms of the contract by a conventional basis on which they both conduct their affairs, then the original contract is replaced by the conventional basis. The parties are bound by the conventional basis. Either party can sue or be sued upon it just as if it had been expressly agreed between them. [xxi]

The importance of consensus ad idem has been concretized by various case laws in India. Further, if the stipulations and terms are uncertain and the parties are not ad idem there can be no specific performance, for there was no contract at all. [xxii]

In the present case, the minds of the assignor and assignee can be said to have not met while entering into the assignment. The assignee never had any intention of undertaking any obligations of the assignor. In Hartog v Colin & Shields, [xxiii] the defendants made an offer to the plaintiffs to sell hare skins, offering to a pay a price per pound instead of per piece.

AVOIDING THESE RISKS

To concretize ICICI Bank’s stand on the assignment of obligations in the matter of loans secured by insurance policies, the relevant security documents could be amended to include such a clause.

For instances where loans are secured by life insurance policies, a standard set by the American Banker’s Association (ABA) has been followed by many Indian commercial institutions as well. [xxvi] The ABA is a trade association in the USA representing banks ranging from the smallest community bank to the largest bank holding companies. ABA’s principal activities include lobbying, professional development for member institutions, maintenance of best practices and industry standards, consumer education, and distribution of products and services. [xxvii]

There are several ICICI security documents which have included clauses denying any assignment of obligations to it. An extract of the deed of hypothecation for vehicle loan has been reproduced below:

“ 3. In further pursuance of the Loan Terms and for the consideration aforesaid, the Hypothecator hereby further agrees, confirms, declares and undertakes with the Bank as follows:

(i)(a) The Hypothecator shall at its expenses keep the Assets in good and marketable condition and, if stipulated by the Bank under the Loan Terms, insure such of the Assets which are of insurable nature, in the joint names of the Hypothecator and the Bank against any loss or damage by theft, fire, lightning, earthquake, explosion, riot, strike, civil commotion, storm, tempest, flood, erection risk, war risk and such other risks as may be determined by the Bank and including wherever applicable, all marine, transit and other hazards incidental to the acquisition, transportation and delivery of the relevant Assets to the place of use or installation. The Hypothecator shall deliver to the Bank the relevant policies of insurance and maintain such insurance throughout the continuance of the security of these presents and deliver to the Bank the renewal receipts / endorsements / renewed policies therefore and till such insurance policies / renewal policies / endorsements are delivered to the Bank, the same shall be held by the Hypothecator in trust for the Bank. The Hypothecator shall duly and punctually pay all premia and shall not do or suffer to be done or omit to do or be done any act, which may invalidate or avoid such insurance. In default, the Bank may (but shall not be bound to) keep in good condition and render marketable the relevant Assets and take out / renew such insurance. Any premium paid by the Bank and any costs, charges and expenses incurred by the Bank shall forthwith on receipt of a notice of demand from the Bank be reimbursed by the Hypothecator and/or Borrower to the Bank together with interest thereon at the rate for further interest as specified under the Loan Terms, from the date of payment till reimbursement thereof and until such reimbursement, the same shall be a charge on the Assets…”

The inclusion of such a clause in all security documents of the Bank can avoid the problem of assignability of obligations in insurance policies used as security for any facility sanctioned by it.

An assignment of securities is of utmost importance to any lender to secure the facility, without which the lender will not be entitled to any interest in the securities so deposited.

In this paper, one has seen the need for assignment of securities of a facility. Risks involved in not having a separate clause dealing with non assignability of obligations have been discussed. Certain defences which ICICI Bank may raise in case of the dispute have also been enumerated along with solutions to the same.

Formatted by March 2nd, 2019.

BIBLIOGRAPHY

[i] J.H. Tod v. Lakhmidas , 16 Bom 441, 449

[ii] http://www.licindia.in/policy_conditions.htm#12, last visited 30 th June, 2014

[iii] Headwaters Construction Co. Ltd. v National City Mortgage Co. Ltd., 720 F. Supp. 2d 1182 (D. Idaho 2010)

[iv] Indian Contract Act and Specific Relief Act, Mulla, Vol. I, 13 th Edn., Reprint 2010, p 968

[v] Khardah Co. Ltd. v. Raymond & Co ., AIR 1962 SC 1810: (1963) 3 SCR 183

[vi] Principles of Insurance Law, M.N. Srinivasan, 8 th Edn., 2006, p. 857

[vii] Ram Baran v Ram Mohit , AIR 1967 SC 744: (1967) 1 SCR 293

[viii] Sri Sarada Mills Ltd. v Union of India, AIR 1973 SC 281

[ix] Lala Kapurchand Godha v Mir Nawah Himayatali Khan, [1963] 2 SCR 168

[x] Velayudhan v Pillaiyar, 9 Mad LT 102 (Mad)

[xi] Hindustan Ideal Insurance Co. Ltd. v Satteya, AIR 1961 AP 183

[xii] Mulraj Khatau v Vishwanath, 40 IA 24 – Respondent based his claim on a mere deposit of the policy and not under a written transfer and claimed that a charge had thus been created on the policy.

[xiii] Insure Policy Plus Services (India) Pvt. Ltd. v The Life Insurance Corporation of India, 2007(109)BOMLR559

[xiv] Transfer of Property Act, Sanjiva Row, 7 th Edn., 2011, Vol II, Universal Law Publishing Company, New Delhi

[xv] Ghaziabad Development Authority v Union of India, AIR 2000 SC 2003

[xvi] United India Insurance Co. Ltd. v M/s. Pushpalaya Printers, [2004] 3 SCR 631, General Assurance Society Ltd. v Chandumull Jain & Anr., [1966 (3) SCR 500]

[xvii] UNIDROIT Principles, Art 4.3

[xviii] B.L.Sreedhar & Ors. v K.M. Munireddy & Ors., 2002 (9) SCALE 183

[xix] James Miller & Partners Ltd. v Whitworth Street Estates (Manchester) Ltd., [1970] 1 All ER 796 (HL)

[xx] Godhra Electricity Co. Ltd. v State of Gujarat, AIR 1975 SC 32

[xxi] Amalgamated Investment & Property Co. Ltd. v Texas Commerce International Bank Ltd., [1981] 1 All ER 923

[xxii] Smt. Mayawanti v Smt. Kaushalya Devi, 1990 SCR (2) 350

[xxiii] [1939] 3 All ER 566

[xxiv] Terrell v Alexandria Auto Co., 12 La.App. 625

[xxv] http://www.uncitral.org/pdf/english/CISG25/Pamboukis.pdf, last visited on 30 th June, 2014

[xxvi] https://www.phoenixwm.phl.com/shared/eforms/getdoc.jsp?DocId=525.pdf, last visited on 30 th June, 2014

[xxvii] http://www.aba.com/About/Pages/default.aspx, last visited on 30 th June, 2014

Related Posts:

Leave a Comment Cancel reply

Give it a try, you can unsubscribe anytime :)

Thanks, I’m not interested

- Life Insurance

- Assignment Vs Nomination In Life Insurance Know The Difference

- Understanding Nomination and its Types

- Understanding Assignment and its Types

- Key Differences Between Nomination and Assignment

Buy Policy in just 2 mins

2 lakh + Happy Customers

Free Comparison

Customized Term Insurance Plan for you.

Get upto 10% Online Discount*

Select Your City

Popular Cities

Delhi Gurgaon Noida Bengaluru Chennai Ahmedabad Hyderabad Kolkata Mumbai

Select Your Annual Income Your life insurance cover limit will be calculated based on your income. You may be asked to provide income proof at the time of purchase.

15 Lacs+ P.A. 10-15 Lacs P.A. 7-10 Lacs P.A. 5-7 Lacs P.A. 3-5 Lacs P.A. Upto 3 Lacs P.A.

Enter Your Name

Mobile Number

By proceeding you are accepting our T&C and privacy policy

Confused? No Worries, We Are Here To Help!

Health offer, invest offer.

Assignment vs Nomination in Life Insurance

In life insurance plans, Nomination and Assignment are the two important terms that are frequently used. Acknowledging these terms helps the policyholder to extract the benefits available under the life insurance policy without making a hole in his/her pocket.

Policyholders should know the exact difference between the two before making any decision to purchase the policy. It is required that individuals should read terms and conditions carefully so that one doesn't make any mistake and use the policy in the right way.

What is the Nomination?

The nomination is a right given to the policyholder that authorizes him/her to appoint a person (usually a close family member) to receive the benefits in the event of the death of the life assured. The person who is appointed by the policyholder to receive the benefit is called a Nominee. The nomination is governed under Section 39 of the Insurance Act, 1938.

Types of Nominees

Under the life insurance policy , the policyholder nominates a person who is entitled to receive the benefits in case something happens to the life assured. Some of the different types of nominees given below:

Beneficial Nominees

As per the law, any immediate family member (like spouse, children or parents) nominated by the policyholder is entitled to receive the monetary benefits and will be the beneficial owner of the claim benefits. It is important to note that only immediate family members can be termed as Beneficial Nominees.

Minor Nominees

Many individuals appoint their children as beneficiaries of their life insurance policies. Minor nominees (who are less than 18 years of age) are not considered eligible to handle claim amounts. For this, the policyholder needs to assign an appointee or custodian. The claim amount is paid to the appointee until the minor turns 18.

Non-family Nominees

These types of nominees can be distant relatives or even friends as the beneficiary of the life insurance policy.

Changing Nominees

Policyholders can change their nominees as many times as they want, but the latest nominee should supersede all previous ones.

Life Insurance Companies

Compare and buy the most suitable Life Insurance Plan from the below-mentioned IRDAI-approved Life Insurance companies.

- Term Insurance

LIC Of India

Hdfc life insurance, icici prudential life insurance, sbi life insurance, max life insurance, tata aia life insurance, pnb metlife india insurance, bajaj allianz life insurance, bandhan life insurance, kotak mahindra life insurance, canara hsbc life insurance, bharti axa life insurance, aviva life insurance, indiafirst life insurance, exide life insurance, edelweiss tokio life insurance, ageas federal life insurance, future generali life insurance, birla sun life insurance, reliance life insurance, pramerica life insurance limited, shri ram life insurance, sahara india life insurance.

Know More About Life Insurance Companies

LIC Term Insurance

Hdfc term insurance, icici term insurance, sbi life term insurance, max life term insurance, tata aia term insurance, pnb metlife term insurance, bajaj allianz term insurance, bandhan life term insurance, kotak life term insurance, canara hsbc obc term insurance, bharti axa term insurance, aviva term insurance, indiafirst term insurance, exide life term insurance, edelweiss tokio term life insurance, ageas federal term insurance, future generali term insurance, birla sun life term insurance, reliance term insurance, pramerica term insurance.

Know More About Term Insurance Companies

Key Points to Know Regarding Nomination

- The nomination is possible only when the policyholder and life assured are the same. In case, the policyholder and life assured are different, the claim benefits will be availed by the policyholder only.

- The nominee cannot ask for changes/modifications to the policy.

- There can be more than one nominee in the policy.

- In the successive nomination, if the life assured appoints person A to be the first person to receive the claim benefits in case of assured's death and person A is no more, then the claim benefits will be passed to person B. However, if Nominee A and Nominee B have passed away, later Nominee C will be appointed to avail the benefits and so on.

What is Assignment?

Assignment of the policy refers to the transfer of rights, title, and policy ownership from the policyholder to another person or entity. The person involved in assigning/transferring the policy is called assignor, and the person/institution to which it is assigned is called the assignee. The assignment is regulated under Section 38 of the Insurance Act, 1938.

The assignment is categorized under two different types, i.e. Absolute Assignment and Conditional Assignment.

Absolute Assignment

Under the absolute assignment, all rights, title and interest are transferred by the assignor to an assignee without reversion to the assignor (in case of any event). It shifts the ownership of the insurance policy to other parties without any terms and conditions. This assignment is usually done for money consideration such as raising a loan, out of love or affection towards family members.

Conditional Assignment

It means that the transfer of rights will happen from the Assignor to the Assignee subject to certain terms and conditions. If the conditions are fulfilled, only then the policy will be transferred.

Key Points to know Regarding Assignment

- Under the assignment, only the ownership is transferred/changed, not the risk of the policy. This means the life assured is/will be considered as the person insured.

- The assignment may lead to cancellation of the nomination in the policy only when it is done in favour of the insurance company due to a policy loan.

- The assignment applies to all the insurance plans except Pensions Plan and Married Women's Property Act (MWP).

- The assignment is effected through an endorsement on the policy contract.

Difference Between Assignment and Nomination

Let's discuss how assignment differs from nomination.

Nomination and Assignment serve different purposes. The nomination protects the interests of the insured as well as an insurer in offering claim benefits under the life insurance policy. On the other hand, assignment protects the interests of an assignee in availing the monetary benefits under the policy. The policyholder should be aware of both of them before buying life insurance.

Life Insurance Articles

Top 5 Benefits of Life Insurance Jan, 2024

GST On Life Insurance Aug, 2023

Importance of Life Insurance Aug, 2023

Factors That Affect Life Insurance Premiums July, 2023

Life Insurance For Cancer Patients July, 2023

Difference Between ULIP and Traditional Plans July, 2023

Grace Period In Life Insurance Policy July, 2023

Life Insurance With Maturity Benefits July, 2023

Difference Between Life Insurance and Health July, 2023

Benefits of Life Insurance July, 2023

Advantages and Disadvantages Of Life July, 2023

Life Insurance Premium June, 2023

Cash Value Of Life Insurance June, 2023

Free Look Period in Life Insurance June, 2023

Ladli Laxmi Yojana Policy May, 2023

Group Term Life Insurance March, 2023

Bima Sugam Life Insurance December, 2022

Whole Life Insurance Policy September, 2022

Sabse Pehle Life Insurance April, 2022

Life Insurance FAQs September, 2021

Pandemic Challenges in Life Insurance May, 2021

Term Life vs. Traditional Life Insurance- Which Is Better? January, 2021

How to Get Duplicate LIC Policy Bond? October, 2020

How To Check ICICI Prudential Life Insurance Policy Status? May, 2020

What Are Late Payment Charges For LIC Premiums? September, 2020

How To Check SBI Life Insurance Policy Status? April, 2020

Life Insurance Claim Process & Requirements July, 2020

SBI Life Insurance Premium Payment April, 2020

Guaranteed Income Plan June, 2020

ICICI Prudential Life Insurance Login and Registration April, 2020

ICICI Prudential Premium Payment May, 2020

Revival of Lapsed LIC Policy - Steps to Revive It Online December, 2019

See More Life Insurance Articles

Top 10 Indian Life Insurance Companies Jan, 2024

How To Download LIC Premium Receipt Online? December, 2019

Top 10 Pension Plans in India December, 2019

How To Check HDFC Life Policy Status? November, 2019

Sukanya Samriddhi Yojana Vs LIC Kanyadan Policy September, 2019

Best Single Premium Insurance Plans in India December, 2019

How To Update HDFC Life Insurance Policy Online? November, 2019

Max Life Premium Payment November, 2019

What our customers have to say.

SUD Life term plan truly stands out my expectations as I got SUD Life term plan along with additional riders at very affordable premiums.

I am impresses with the hassle free and quick claim settlement process of SUD Life. Thanks to PolicyX who guided me to get my claim settled.

Bought SUD Life Family Income Benefit Rider plan to secure the future of my plan financially even in my absence.

I was looking for a term plan to secure the future of my family. So I contacted PolicyX and one of their representatives Mr. Vaibhav helped me choose SUD Life term plan.

Armaan khan

May 17, 2024

I recently purchased a Pramerica term insurance policy from Policyx.com. The customer service team was very helpful in answering all my queries and guiding me through the application process. I...

Rahul Yadav

PolicyX’s dedicated support made renewing my Bandhan Life Insurance policy easy. I’m absolutely delighted with the service offered by PolicyX Insurance Advisor.

Priyanshu Sharma

I bought a Bandhan Life Insurance through PolicyX, and I must say the level of communication and assistance I have received has been truly impressive.

After getting advice from the PolicyX experts, I chose a Bandhan Life Insurance term plan. Thank you, PolicyX, for helping me buy a term plan at such a low premium.

Reviewed By: Naval Goel

Naval Goel is the CEO & founder of PolicyX.com. Naval has an expertise in the insurance sector and has professional experience of more than a decade in the Industry and has worked in companies like AIG, New York doing valuation of insurance subsidiaries. He is also an Associate Member of the Indian Institute of Insurance, Pune. He has been authorized by IRDAI to act as a Principal Officer of PolicyX.com Insurance Web Aggregator.

Talk to our Trusted Insurance Advisors for Best Plans

Search Anything

Most Searched:

- Tax Planning

What is ‘Assignment’ of Life Insurance Policy?

Insurance is a contract between the insurance company (insurer) and you (policyholder) . It is a contract with full of jargon. As much as possible, we must try to understand all the insurance terms mentioned in the policy bond (certificate) . One such insurance jargon which is mostly used is Assignment .

If you are planning to apply for a home loan, your home loan provider may surely use this term. So, what is Assignment? Why assignment of a life insurance policy is required? What are different types of assignment? What are the differences between Assignment & Nomination?

What is Assignment?

Assignment of a life insurance policy means transfer of rights from one person to another. You can transfer the rights on your insurance policy to another person / entity for various reasons. This process is referred to as ‘ Assignment ’.

The person who assigns the insurance policy is called the Assignor (policyholder) and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee .

Once the rights have been transferred from the Assignor to the Assignee, the rights of the policyholder stands cancelled and the assignee becomes the owner of the insurance policy.

Assigning one’s life insurance policy to a bank is fairly common. In this case, the bank becomes the policy owner whereas the original policyholder continues to be the life assured on whose death the bank or the policy owner is entitled to receive the insurance money.

Types of Assignment

The assignment of an insurance policy can be made in two ways;

- Example : Mr. PK Khan owns a life insurance policy of Rs 1 Crore. He would like to gift this policy to his wife. He wants to make ‘absolute assignment’ of this policy in his wife’s name, so that the death benefit (or) maturity proceeds can be directly paid to her. Once the absolute assignment is made, Mrs. Khan will be the owner of the policy and she may again transfer this policy to someone else.

- Example : Mr. Mallya owns a term insurance policy of Rs 50 Lakh. He wants to apply for a home loan of Rs 50 Lakh. His banker has asked him to assign the term policy in their name to get the loan. Mallya can conditionally assign the policy to the home loan provider to acquire a home loan. If Mallya meets an untimely death ( during the loan tenure) , the banker can receive the death benefit under this policy and get their money back from the insurance company.

- In case if the death benefit received by the banker is more than the outstanding loan amount, the insurer will pay the bank the outstanding dues and pay the balance to the nominee directly. The balance amount (if any) will be paid to Mallya’s beneficiaries ( legal heirs / nominee) .

How to assign a life insurance policy?

The Assignment must be in writing and a notice to that effect must be given to the insurer. Assignment of a life insurance policy may be made by making an endorsement to that effect in the policy document (or) by executing a separate ‘ Assignment Deed ’. In case of assignment deed, stamp duty has to be paid. An Assignment should be signed by the assignor and attested by at least one witness.

Download absolute assignment deed sample format / conditional assignment deed format.

Nomination Vs Assignment

Nomination is a right given to the policyholder to appoint a person(s) to receive the death benefit (death claim) . The person in whose favor the nomination is effected is termed as ‘nominee’. The nominee comes into picture only after the death of the life assured (policy holder) . The nominee will not have the absolute right over the money (claim proceeds) . The other legal heirs of the policy holder can also recover money from the nominee.

(However, as per Insurance Laws (Amendment) Act, 2015 – If an immediate family member such as spouse / parent / child is made as the nominee, then the death benefit will be paid to that person and other legal heirs will not have a claim on the money)

Under nomination, the rights of the policyholder are not transferred. But, assignment is transfer of rights, interest and title of the policy to some other person (or) entity. To make assignment, consent of the insurer is also required.

Important Points

- Assignment of policies can be done even when a loan is not required or for some special purposes.

- If you assign the policy for other purpose other than taking a loan, the nomination stands cancelled.

- If the policy is assigned, then the assignee will receive the policy benefit. Death benefit will be paid to the Nominee, in case the policy is not assigned.

- The policy would be reassigned to you on the repayment of the loan (under conditional assignment) .

- Types of insurance policies used for assignment purpose to get business loans, generally include an endowment plan, money back policy or a ULIP. Home loan providers generally ask for the assignment of Term insurance plans on their names. (The term plan tenure should be more than the home loan tenure)

- An assignment of a life insurance policy once validly executed, cannot be cancelled or rendered in effectual by the assignor. The only way to cancel such assignment would be to get it re-assigned by the assignee in favor of the assignor.

- You can also raise a loan against your policy from your insurance company itself. In this case, your policy would have to be assigned to insurance company.

- An insurer may accept the assignment or decline. (The insurer shall, before refusing to act upon the endorsement, record in writing the reasons for such refusal and communicate the same to the policy-holder not later than thirty days from the date of the policy-holder giving notice of such transfer or assignment)

- In case of death of the absolute Assignee (to whom the policy rights have been transferred under absolute assignment) , the rights under the policy will be transferred to the legal heirs of the assignee.

- You can also assign a life insurance policy under Married Women’s Property Act . (At the time of making the application (buying a policy), a separate MWPA form has to be filled by the proposer for it to be covered under MWP Act. Do note that the existing life insurance policies cannot be assigned under MWP Act)

- Partial assignment or transfer of a policy can also be made. But banks will accept any of your life insurance policies as long as the sum assured is equal to or greater than the loan amount.

Hope you find this post informative and do share your comments.

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

About The Author

Sreekanth Reddy

Can a LIC policy be assigned to someone not related by blood??

Dear Chowdhury, Yes, it is possible. However, Assignment is not permitted on all life insurance policies issued under How to buy Term Life Insurance under Married Women’s Property Act?

Very useful and gathered more knowledge

Hi, I got a question in CFP EXAM 5( case study paper) with regard to assignment of money back policy to a minor. I would like to know can a conditional assignment be made to a minor and if yes what about the premium that is yet to be paid? and would a guardian need to be appointed till the minor attains majority? and is it possible that an absolute assignment can be made?

Dear Dhaarini,

Where an assignment is made in favour of minor, the policy can not be dealt with during the minority of the assignee, even with consent of natural guardian or appointed guardian. This means minor assignee cannot raise loan, surrender or further assign the policy during his/her minority.