BIWS Platinum, Venture Capital, and Project Finance Course Prices Increasing on July 1st, 2024

View Details

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The DCF Model: The Complete Guide… to a Historical Relic?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

It may be an understatement to say that we live in “interesting times.”

Cryptocurrencies based on dog memes suddenly spike up or down by 500%, people think that meme stocks are better investments than high-dividend stocks, and growth-oriented tech stocks seem to rise forever, all based on promises of “profits in the future – the distant future.”

In this environment, it’s fair to ask if the discounted cash flow (DCF) analysis and DCF models are still relevant at all.

I’ll address this question at the end of this article, but the short answer is that the DCF model still matters – but perhaps less so for a tiny percentage of overhyped companies and less so in crazed market environments.

But let’s start by describing each step of the analysis and giving you a few simple examples:

DCF Model: Video Tutorial and Excel Templates

If you’d prefer to watch rather than read, you can get this [very long] tutorial below:

Table of Contents:

- 2:29: The Big Idea Behind a DCF Model

- 5:21: Company/Industry Research

- 8:36: DCF Model, Step 1: Unlevered Free Cash Flow

- 21:46: DCF Model, Step 2: The Discount Rate

- 28:46: DCF Model, Step 3: The Terminal Value

- 34:15: Common Criticisms of the DCF – and Responses

And here are the relevant files and links:

- Walmart DCF – Corresponds to this tutorial and everything below.

- Walmart 10-K Excerpts .

- Slide presentation for this tutorial .

- Uber Valuation and DCF – Different DCF model for a high-growth company (sort of).

- Snap Valuation and DCF – Different DCF model for a different high-growth company.

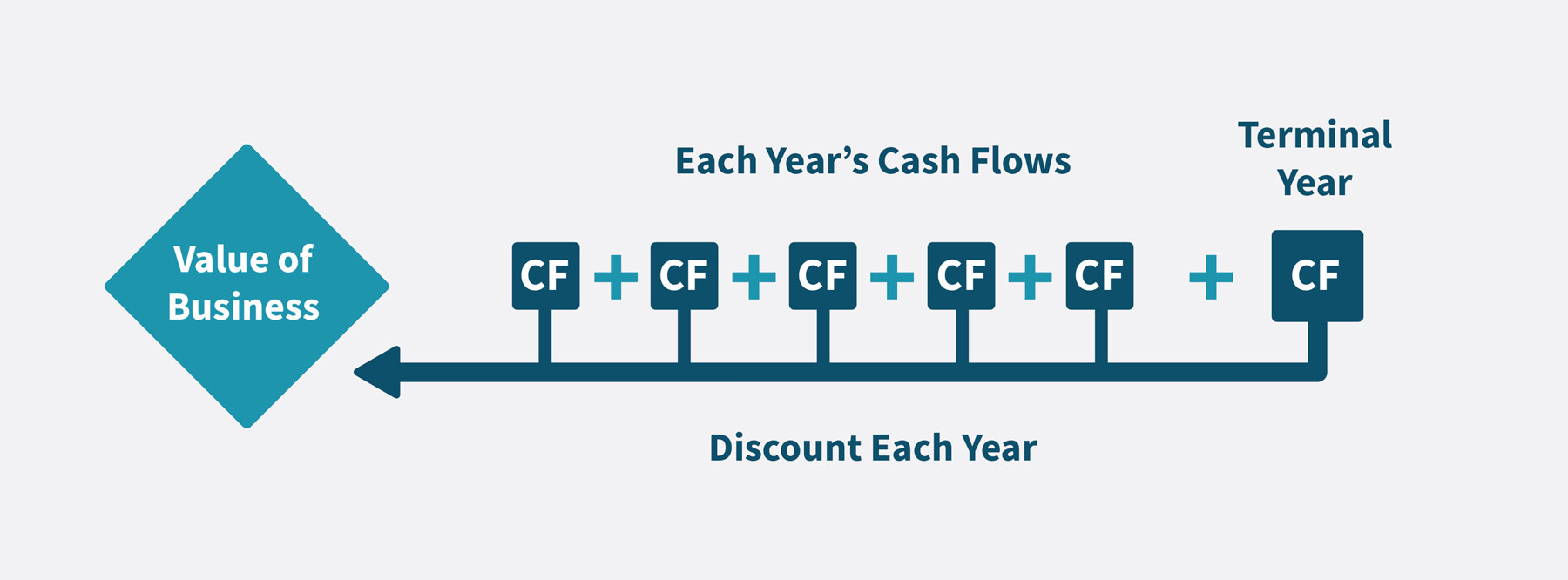

The Big Idea Behind a DCF Model

The big idea is that you can use the following formula to value any asset or company that generates cash flow (whether now or “eventually”):

The “Discount Rate” represents risk and potential returns – a higher rate means more risk, but also higher potential returns.

A company is worth more when its cash flows and cash flow growth rate are higher, and it’s worth less when those are lower.

The company is also worth less when it is riskier or when expectations for it are higher, i.e., when the Discount Rate is higher.

If a company’s Discount Rate and Cash Flow Growth Rate stayed the same forever, then investment analysis would be simple: just plug the numbers into this formula.

But that never happens!

Companies grow and change over time, and often they are riskier with higher growth potential in earlier years, and then they mature and become less risky later on.

Valuation is more than this simple formula because companies’ Discount Rates and Cash Flow Growth Rates change over time.

To represent that change, you divide companies’ lifecycles into two periods:

- Period #1 (Explicit Forecast Period): The company’s Cash Flow, Cash Flow Growth Rate, and potentially even the Discount Rate change over 5, 10, 15, or 20+ years, but the company reaches maturity or “stabilization” by the end.

- Period #2 (Terminal Period): The Discount Rate and Cash Flow Growth Rate stop changing because the company is mature. Its Cash Flow will still change, but the valuation formula above works because it requires only the first year of Cash Flow in this period.

You value the company in both these periods and then add the results to get its total value from today into “infinity” (AKA until the Present Value of its cash flows falls to near-0).

Company/Industry Research

Before you jump into Excel and start entering numbers, you should do a bit of company and industry research to establish the following:

- What are the top 5-10 most important drivers for the company?

- How can you project its revenue beyond a simple percentage growth rate? What about its expenses?

- What do its historical trends look like, ideally going back 5-10 years?

The company’s annual report and investor presentations are the best starting points.

You could also search for industry data from companies like IDC , Gartner , and Forrester , but it’s not necessary for a quick analysis of a mature company.

And if you are dealing with a rapidly changing company or a tech startup (e.g., Uber or Snap), it’s often more useful to get KPIs and financial stats from similar companies that were once growing quickly but have since matured.

In theory, you could spend days, weeks, or months on industry and company research, but that much effort is not necessary.

We recommend reading through the annual report and investor presentation to the extent that you can come up with those 5-10 key drivers .

For Walmart, we came up with the following:

Its annual filing repeatedly cited its total square feet, so we made the total retail square feet the top-line driver and based other numbers on $ per square foot figures.

DCF Model, Step 1: Unlevered Free Cash Flow

While there are many types of “Free Cash Flow,” in a standard DCF model, you almost always use Unlevered Free Cash Flow (UFCF) , also known as Free Cash Flow to Firm (FCFF) , because it produces the most consistent results and does not depend on the company’s capital structure.

Unlevered Free Cash Flow should include:

- COGS and Operating Expenses

- Depreciation & Amortization and sometimes other non-cash adjustments*

- The Change in Working Capital

- Capital Expenditures

*Depreciation & Amortization gets a bit more complicated, especially if you’re analyzing a company that follows IFRS (see the next section).

This list means that you ignore almost everything else: Net Interest Expense, Other Income / (Expense), most non-cash adjustments, most of the Cash Flow from Investing section, and the Cash Flow from Financing section.

For Walmart, many of the items in UFCF are simple $ per square foot figures:

To calculate UFCF, start with Revenue and subtract COGS , OpEx, and Taxes (which are now different since they’re based on Operating Income ).

Then, add back D&A, factor in Deferred Taxes, any other recurring operating activities, and the Change in Working Capital, and subtract CapEx:

In some cases, we recalculate items such as Deferred Taxes because we’re modifying the company’s historical Taxes to make them comparable to future Taxes.

Most of these items should be fairly low as percentages of revenue or the change in revenue.

For example, it would be highly unusual if the Change in Working Capital represented 50% of a company’s UFCF.

For most companies, Working Capital is not a major value driver because it represents simple timing differences.

We also made sure that CapEx as a percentage of revenue stays ahead of D&A as a percentage of revenue in each year because Walmart’s cash flows are growing .

Even if the growth is modest, the company will need to increase its Net PP&E over time to support that growth.

If you don’t know what some of these items mean, please see our coverage of the Change in Working Capital and Unlevered Free Cash Flow for more details.

It would also help to know a bit about the company’s operating leverage to forecast some of the expenses, but it’s not essential for a quick analysis.

But Wait! What About Operating Leases in DCF Models?

Accounting for operating leases has become more complicated with the introduction of IFRS 16 in 2019, which required companies to put Operating Lease Assets and Liabilities directly on their Balance Sheets (see: our full tutorial to lease accounting ).

The equivalent rules under U.S. GAAP aren’t too bad because U.S. companies still record Rent as a simple operating expense on their Income Statements.

Under IFRS, however, Rent is split into an Amortization or Depreciation element and an Interest element, similar to the treatment for Finance Leases.

Over a large portfolio of leases with different start and end dates, the Lease Amortization + Lease Interest is about the same as the Rental Expense under U.S. GAAP.

The goal in a DCF is to reflect the company’s cash revenue , cash expenses , and cash taxes , so we believe the best approach is to deduct the entire Operating Lease Expense in UFCF.

For IFRS-based companies, that means you’ll have to deduct the Interest element in the EBIT and NOPAT calculations:

Also, you should not add back the Operating Lease Depreciation or Amortization because in this case, it represents part of an actual cash expense .

If you follow this treatment, the UFCF number will reflect the deduction for the full Lease Expense.

Some argue that you should add back the entire Lease Expense and count Operating Leases as an item in the Equity Value to Enterprise Value bridge.

We don’t favor that approach because UFCF does not reflect the company’s cash expenses if you do that, and it’s more difficult to compare companies that way.

DCF Model, Step 2: The Discount Rate

Once you’ve projected the company’s Unlevered Free Cash Flows, you need to discount them to their Present Value : what they’re worth today.

That value today depends on how much you could earn with your money in other, similar companies in this market, i.e., your expected, average annualized returns.

The Discount Rate expresses these expected, average annualized returns, and in an Unlevered DCF, it’s equal to WACC, or the “ Weighted Average Cost of Capital .”

The name means what it sounds like: you estimate the “cost” of each form of capital the company has, weigh them by their percentages, and then add them up.

“Capital” means “a source of funds.” So, if a company borrows money in the form of Debt to fund its operations, that Debt is a form of capital.

And if it goes public in an IPO, the shares it issues, called “Equity,” are also a form of capital.

The exact formula is:

WACC = Cost of Equity * % Equity + Cost of Debt * (1 – Tax Rate) * % Debt + Cost of Preferred Stock * % Preferred Stock

The Cost of Equity represents potential returns from the company’s stock price and dividends, or how much it “costs” the company to issue shares.

For example, if the company’s dividends are 3% of its current share price (i.e., the dividend yield is 3%), and its stock price has increased by 6-8% each year historically, its Cost of Equity might be between 9% and 11%.

The Cost of Debt represents returns on the company’s Debt, mostly from interest, but also from the market value of the Debt changing.

For example, if the company is paying a 6% interest rate on its Debt, and the market value of its Debt is close to its face value, then the Cost of Debt might be around 6%.

You also multiply that by (1 – Tax Rate) because Interest paid on Debt is tax-deductible. So, if the Tax Rate is 25%, the After-Tax Cost of Debt would be 6% * (1 – 25%) = 4.5%.

The Cost of Preferred Stock is similar because Preferred Stock works similarly to Debt, but Preferred Stock Dividends are not tax-deductible, and overall rates tend to be higher, making it more expensive.

The Discount Rate in Real Life vs. Simple Approximations

The calculations for the Cost of Debt and Preferred Stock are straightforward, but the Cost of Equity is more challenging because it’s subjective and depends on how other, similar companies have performed relative to the market.

In many DCF models, you’ll see a sheet dedicated to this calculation, where the modeler “un-levers Beta” for each peer company to estimate its risk/volatility independent of its capital structure and then re-levers it for the subject company:

The problem with this approach is that you need quick access to data for comparable companies, which may be tricky without Capital IQ, FactSet, or similar services.

Luckily, there is a “shortcut method” as well, which involves using the same formula but simplifying the last input:

Cost of Equity = Risk-Free Rate + Equity Risk Premium * Levered Beta

The Risk-Free Rate (RFR) is what you might earn on “safe” government bonds in the same currency as the company’s cash flows (so, U.S. Treasuries here).

The Equity Risk Premium (ERP) is the percentage the stock market is expected to return each year, on average, above the yield on these “safe” government bonds.

And Levered Beta tells you how volatile this stock is relative to the market as a whole, factoring in both business risk and risk from leverage (Debt).

If it’s 1.0, then the stock follows the market perfectly and goes up by 10% when the market goes up by 10%; if it’s 2.0, the stock goes up by 20% when the market goes up by 10%.

Rather than finding comparable companies and un-levering and re-levering Beta, you could just look it up for the company on Yahoo Finance:

You can then combine it with easy-to-find data on 10-year U.S. Treasury yields and the Equity Risk Premium from Damodaran’s collection (or other sources – there are plenty of estimates for the current ERP in different markets):

The Discount Rate is around 4.0% with this approach (assuming ~90% Equity and ~10% Debt for Walmart), close to the 4.37% in the full model.

Sure, you could make it more complicated, but I would argue it’s a waste of time in a case study or modeling test unless they specifically ask for it.

The important part is that the company’s Discount Rate is closer to 5% than 10% or 15%, so we can use a range of values with 5% in the middle.

Also, you can now use this Discount Rate to take the Present Value of each UFCF (PV = UFCF / ((1 + Discount Rate) ^ Year #):

DCF Model, Step 3: The Terminal Value

The Terminal Value goes back to the “big idea” behind a DCF model.

Put simply, the “Company Value” in this formula:

IS the Terminal Value – assuming that each input represents the Terminal Period in the DCF model.

To calculate it, you need to get the company’s first Cash Flow in the Terminal Period and its Cash Flow Growth Rate and Discount Rate in that Terminal Period.

In an Unlevered DCF, this formula becomes:

Terminal Value = Unlevered FCF in Year 1 of Terminal Period / (WACC – Terminal UFCF Growth Rate)

And you can estimate the UFCF in Year 1 of the Terminal Period like this:

Terminal Value = UFCF in Final Year of Explicit Forecast Period * (1 + Terminal UFCF Growth Rate) / (WACC – Terminal UFCF Growth Rate)

This “Terminal Growth Rate” should be low : below the long-term GDP growth rate, especially in developed countries.

You could also estimate the Terminal Value with an EBITDA multiple based on median multiples from the comparable companies, but we don’t recommend that as the primary method.

It’s too easy to pick multiples that imply ridiculous Terminal FCF Growth Rates, so it’s safer to start with the growth rates and then check their implied multiples .

Once you have the Terminal Value, you can discount it back to Present Value and add it to the Sum of the Present Values of the Free Cash Flows:

And then, you can back into the Implied Equity Value and Implied Share Price from there:

You can also set up a sensitivity analysis in Excel to assess what the company’s valuation looks like with different assumptions for the Terminal Growth Rate, Terminal Multiple, Discount Rate, and so on:

One Final Note: This Terminal FCF Growth Rate should be fairly close to the UFCF growth rate in the final year of the explicit forecast period.

You don’t want UFCF to grow at 10% or 20% and suddenly drop to 2% in the Terminal Period.

If it does, you need to re-think your assumptions or extend the analysis.

Because of this problem, we extended the explicit forecast period to 20 years in the Uber valuation .

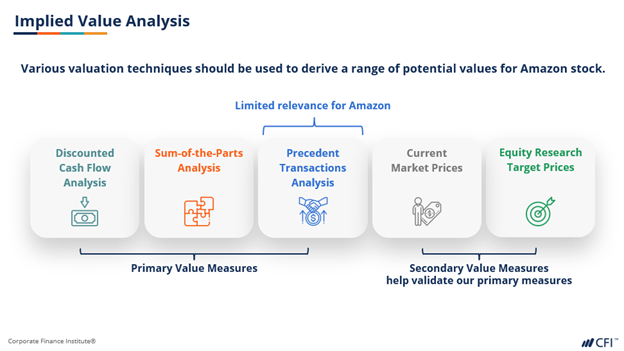

Conclusions from This DCF Model

Overall, Walmart seems modestly undervalued because its implied share price in most of the sensitivity tables is above its current share price of ~$140.

There is one problem with this analysis, though: we’re assuming that Walmart keeps growing its retail square feet, even though that number has been declining in recent years.

Therefore, if we had more time and resources, we might create a few operating scenarios, similar to the Uber and Snap models, to assess the results in “growth” vs. “stagnant” vs. “decline” cases.

Common Criticisms of the DCF Model – and Responses

People often criticize the DCF model for the following reasons:

- “But how can you possibly predict a company 5, 10, or 15 years into the future? No one can!”

- “The DCF is too sensitive to small changes in assumptions, such as growth rates and margins.”

- “A DCF ignores market conditions and comparable companies, so it might not give you the accurate market value.”

- “The DCF is no longer applicable because stocks are valued based on memes / crypto / Reddit! No one cares about cash flow.”

My response to the first three objections is similar: it’s not about the exact numbers but ranges, scenarios, and sensitivities .

No, you don’t know whether the Year 10 growth rate will be 10% or 8% or 12%, but you should have an idea of whether it will be closer to 10% or 20%.

And if you don’t, it’s fine to build a DCF with a wide valuation range that reflects high uncertainty.

The complaint about a DCF being “too sensitive” raises other questions: for example, is the FCF growth rate in the final year of the explicit forecast period close to the Terminal FCF Growth Rate?

If not, you need to re-think your assumptions or extend the projections.

And the critique about ignoring market conditions conveniently ignores that the Discount Rate is always based on current market conditions, no matter how you calculate it.

The DCF is indeed less reflective of the current market than comparable company analysis (for example), but it still reflects some market conditions.

And finally, for the crypto/meme/Reddit objection: yes, I agree that certain stocks seem to defy all logic and cash flow-based analysis.

That said, these stocks represent a tiny fraction of all the public companies worldwide.

The media gives them excessive attention, but they ignore the hundreds of thousands (millions?) of other companies that follow some semblance of logic.

And as for crypto, I agree that you cannot use a DCF to value Bitcoin, Ethereum, or Dogecoin.

But this is nothing new: a DCF only works for assets that generate cash flow , whether now or in the future.

No one has ever suggested valuing gold or silver with a DCF, and I’m not sure how crypto is any different in this regard.

DCF Models: Further Learning

If you want to learn more about DCF models and get a step-by-step walkthrough in more detail, sign up for our free financial modeling tutorials .

These tutorials provide a 3-part series on the valuation of Michael Hill, a retailer in Australia and New Zealand, and they go into each step in more depth than we did above.

And if you want in-depth case studies backed by real-world data and research, the Core Financial Modeling course delves into valuation/DCF analysis in even greater detail:

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

A few modules are dedicated to valuation and DCF analysis, and there are example company valuations in other industries.

If you want even more complex examples, the Advanced Financial Modeling course might be more appropriate since it deals with topics like the mid-year convention, stub periods, a normalized terminal year, and net operating losses in a DCF:

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Investment Strategy

Discounted Cash Flow Analysis: Complete Tutorial With Examples

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

This guide show you how to use discounted cash flow analysis to determine the fair value of most types of investments, along with several example applications.

You can either start here from the beginning, or jump to the specific section you want:

- Discounted cash flows 101: how it works

- Business example using discounted cash flows

- Project example using discounted cash flows

- Bond pricing example using discounted cash flows

- A streamlined stock valuation method

- Limitations of discounted cash flow analysis

How to do Discounted Cash Flow (DCF) Analysis

The discounted cash flow method is used by professional investors and analysts at investment banks to determine how much to pay for a business, whether it’s for shares of stock or for buying a whole company.

And it’s also used by financial analysts and project managers in major companies to determine whether a given project will be a good investment, like for a new product launch or a new manufacturing facility.

It’s applicable to any scenario where you are considering paying money now in expectation of receiving more money in the future.

I’ve personally used it both for engineering projects and stock analysis.

Put simply, discounted cash flow analysis rests on the principle that an investment now is worth an amount equal to the sum of all the future cash flows it will produce, with each of those cash flows being discounted to their present value.

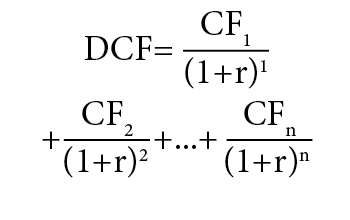

Here is the equation:

Let’s break that down.

- DCF is the sum of all future discounted cash flows that the investment is expected to produce. This is the fair value that we’re solving for.

- CF is the total cash flow for a given year. CF1 is for the first year, CF2 is for the second year, and so on.

- r is the discount rate in decimal form. The discount rate is basically the target rate of return that you want on the investment.

And we’ll start with an example. If a trustworthy person offered you $1,500 in three years, and asked how much you’re willing to pay for that eventual reward today, how much would you offer?

To answer that question, you need to translate that $1,500 into its value to you today.

For example, if you had $1,000 today, and compounded it at 14.5% per year, it would equal about $1,500 in three years:

Alternatively, if you had $1,200 today, and compounded it at just 7.7% per year, it would equal about $1,500 in three years:

So, the amount that $1,500 three years from now is worth to you today depends on what rate of return you can compound your money at during that period. If you have a target rate of return in mind, you can determine the exact maximum that you should be willing to pay today for the expected return in 3 years.

That’s what the DCF equation does; it translates future cash flows that you will likely receive from an investment into their present value to you today, based on the compounded rate of return you could reasonably achieve with your money today.

When you’re buying shares of stock, or a whole business, or real estate, or trying to figure out which project to invest in out of several options, analyzing the expected discounted cash flows can help you decide which investments are worthwhile and which ones are not.

If you find that you can buy an investment for a price that is below the sum of discounted cash flows, you may be looking at an undervalued (and therefore potentially very rewarding!) investment. On the other hand, if the price is higher than the sum of discounted cash flows that its expected to produce, that’s a strong sign that it may be overvalued.

Now let’s go over a bunch of example applications.

How to Determine the Fair Value of a Business

Suppose you were offered a private deal to buy a 20% stake in a local business that has been around for decades, and you know the owner well.

The business has been passed down through three generations and is still going strong with a growth rate of about 3% per year. It currently produces $500,000 per year in free cash flows, so this investment into a 20% stake will likely give you $100,000 per year in cash, and will likely grow at a 3% rate per year.

How much should you pay for that stake?

This year, the business will give you $100,000. Next year, it’ll give you $103,000. The year after that, it’ll give you $106,090. And so on, assuming your growth estimates are accurate.

The stake in the business is worth an amount of money equal to the sum of all future cash flows it’ll produce for you, with each of those cash flows being discounted to their present value.

Since this is a private business deal with low liquidity, let’s say that your target compounded rate of return is 15% per year. If that’s a rate of return you know you can achieve on other investments, you would only want to buy this business stake if you can get it for a low enough price that it’ll give you at least that rate of return. Therefore, 15% becomes the compounded discount rate that you apply to all future cash flows.

So, let’s do the equation:

“DCF” in that equation is the variable we are solving for. That’s the sum of all future discounted cash flows, and is the maximum amount you should pay for the business today if you want to get a 15% annualized return or higher for a long time.

The numerators represent the expected annual cash flows, which in this case start at $100,000 for the first year and then grow by 3% per year forever after.

The denominators convert those annual cash flows into their present value, since we divided them by a compounded 15% annually.

Here’s a table for the first five years, showing that even as the actual expected cash flows will keep growing, the discounted versions of those cash flows will shrink over time, because the discount rate is higher than the growth rate:

You can use Excel or any other spreadsheet program to carry that pattern out indefinitely. Here’s the chart of the first 25 years:

The dark blue lines represent the actual cash flows that you’ll get each year for the next 25 years, assuming the business grows as expected at 3% per year. As you go onto infinity, the sum of all the cash flows will also be infinite.

The light blue lines represent the discounted versions of those cash flows.

For example, on year 5 you’re expected to receive $112,551 in actual cash flows, but that would only be worth $55,958 to you today. (Because if you had $55,958 today, and you could grow it by 15% per year for 5 years in a row, you will have turned it into $112,551 after those five years.)

Because the discount rate (15%) that we’re applying is much higher than the growth rate of the cash flows (3%), the discounted versions of those future cash flows will shrink and shrink each year, and asymptotically approach zero.

Therefore, although the sum of all future cash flows (dark blue lines) is potentially infinite, the sum of all discounted cash flows (light blue lines) is just $837,286, even if the business lasts forever.

That’s the key answer to the original question; $837,286 is the maximum you should pay for the stake in the business, assuming you want to achieve 15% annual returns, and assuming your estimates for growth are accurate.

And the sum of just the first 25 years of discounted cash flows for this example is $784,286. In other words, even if the company went out of business a few decades from now, you’d still get most of the rate of return that you expected. The company doesn’t have to last forever for you to get your money’s worth.

How to Value a Project

A lot of businesses use discounted cash flow analysis to determine which projects to invest in. They have a finite amount of money to spend each year, so they want to put it into the projects that are expected to result in the highest rate of return. They don’t just want to throw darts at a dartboard and see what sticks.

Companies usually use their weighted-average cost of capital (WACC) as their discount rate, which takes into account the average rate of return that their stock and bond holders expect.

Suppose you’re a financial analyst at a company, and you are recommending whether the company should invest in Project A or Project B.

Each of the two projects has been proposed by a lead engineer, but the company can only invest in creating one of them this year, and so your manager wants you to give her advice on which one to invest in. Your company’s WACC is 9%, so you’ll use 9% as your discount rate.

Here are the two projects:

Project A starts with an initial investment to make a tech product, followed by a growing income stream, until the product becomes obsolete and is terminated.

Project B starts with an initial investment to make a different product, and makes no sales, but the whole product is expected to be sold in five years to some other company for a large payoff of $14 million.

Which project, assuming both carry the same risk, should the financial analyst recommend to her manager?

First, let’s analyze the discounted cash flows for Project A:

The sum of the discounted cash flows (far right column) is $9,707,166.

Therefore, the net present value (NPV) of this project is $6,707,166 after we subtract the $3 million initial investment.

Now, let’s analyze Project B:

The sum of the discounted cash flows is $9,099,039.

Therefore, the net present value (NPV) of this project is $6,099,039 after we subtract the $3 million initial investment.

We can conclude that from a financial standpoint, Project A is better, since it has a higher net present value.

Even though Project B will bring in $14 million in cash over its lifetime and Project A will only bring in $12 million, Project A is more valuable because of the earlier timing of those expected cash flows.

Thus, you should advise your manager to pick Project A to invest in for this year, if she can only invest in one.

Of course, in the real world, there could still be circumstances that might lead to the manager picking project B instead. There could be non-financial reasons to invest in that project, such as assisting with long-term strategic positioning, or trying to enter a new market, or something of that nature.

But in terms of which project is inherently more profitable assuming the cash flow expectations are accurate, the answer is Project A.

How to Price Bonds with DCF

Bonds have a large secondary market, and their prices change based on the prevailing interest rates.

The prices of those bonds on the secondary market are determined by discounted cash flow analysis:

- Bond Price refers to what investors are currently willing to pay for a bond.

- The Coupon refers to the payments made as part of the bond agreement to the bondholder for each year.

- i is the interest rate in decimal form. This is the yield to maturity that the bond buyer is targeting.

- Value at Maturity is the final payment the bondholder gets back at the end, or the “par value” of the bond.

Depending on the frequency of the coupon payments, there are several variants of this formula that can re-organize it into an easier form for the specific type of bond that is being priced.

The point is, at its core, bond pricing follows the same DCF formula as everything else that provides cash flows.

The higher the interest rate “i” for the bonds, the lower the bond price will be, assuming the coupon and value at maturity are unchanged. This is why when the Federal Reserve raises interest rates, the prices of existing bonds on the secondary market may decrease. Similarly, when the Federal Reserve reduces interest rates, existing bonds may increase in price.

How to Calculate the Fair Value of a Stock

One of the most common applications of discounted cash flows is for stock analysis. Wall Street analysts delve deep into the books of companies, trying to determine what the future cash flows will be and thus what the stock is worth today.

You can apply the same method that we used for the whole business example. You just have to add an extra step of dividing the answer by the number of existing shares to determine the fair value per share.

Here’s a streamlined input model I use for stock analysis, called StockDelver :

Source: StockDelver

It breaks down the growth estimate from top to bottom, starting with volume and pricing, and moving down towards analyzing the growth of earnings per share (EPS). You can easily substitute free cash flow (FCF) for EPS if you want.

A common principle in engineering is that you solve a hard problem by breaking it into little pieces and solving those little pieces individually, which makes the whole thing a lot easier. That’s how this works.

Rather than throwing a wild guess out there at how fast the business might grow, you examine the history of its revenue growth, changes in profit margin, and changes in share count, to build a model for how it is likely to grow in the future. You also should examine investor presentations and annual reports by the company, to see what management expects going forward in terms of growth in those various areas.

Keep in mind that these are forward-looking estimates. Don’t get too caught up in details or get too specific, since you can’t precisely predict the future anyway. It’s a back-of-the-envelope calculation for fair value based on conservative estimates of what is likely to occur.

Ask yourself:

- How has sales volume changed in the past? How will it probably change in the future? Is this a cyclical industry with ups and downs or a defensive and smooth-growing one?

- Is there any reason to expect pricing to differ from inflation going forward? Has company management offered an estimate of top line (revenue) growth going forward?

- How has the margin changed? Is there any reason to expect it to change going forward? Does the company have fixed costs, or do their costs change with volume? Does management have a specific plan for margin improvement?

- Is the company buying back shares, or issuing shares? Will this trend likely continue? What did company management say about this?

- Is the dividend payout ratio low or high? Has it been growing faster than EPS? Does it have room to safely grow more?

Once you have all those inputs, you can use that to determine the fair price to pay for a stock. Here’s the output for this example:

This stock is worth about $69.32, assuming the growth estimates are accurate.

If you can buy shares of the stock for lower than that amount, it should result in a good rate of return over the long term.

Limitations of the Discounted Cash Flow Method

Once you have a system for evaluating whole businesses or individual stocks or projects or whatever your application may be, the math is easy. The hard part is predicting the future.

Estimating all the future cash flows that an investment should produce, discounting them to their present value, and summing them all together into the fair value of the investment, is both an art and a science.

If your investment achieves the future cash flows that you expect, then this equation will mathematically solve the variable you are looking for, whether it’s the fair price or the expected rate of return. If you know the future cash flows and your target rate of return, this will scientifically tell you the maximum you should pay for the investment.

The problem is that your estimate of future cash flows needs to be accurate, which is why this is also an art. If you are wrong about the future cash flows that you’ll receive, then the equation won’t be useful for you. Sometimes projects fail, and sometimes businesses encounter obstacles that nobody expected, and these things can disrupt cash flow. Alternatively, a product might sell 10x more than anyone thought, and the future cash flows could be far higher than anyone dared to hope.

Since none of us can see the future, the future cash flows that we place into the equation are only estimates. The best we can do is break the problem into small pieces, and ensure that our estimates for those pieces are reasonable.

To compensate for this, experienced investors do two things.

First, they apply a margin of safety. If they calculate that a stock is worth $50, they only buy it if it’s under $45. If they calculate a business is worth $1 million, they’ll walk away from the offer unless they can get it for $900,000. That way, even if the company doesn’t perform quite as well as they expected, they have a margin for error to still get the rate of return they’re hoping for.

Second, they diversify into numerous investments. No matter how much work you do, an investment could turn out badly. By splitting their wealth up into multiple projects, businesses, stocks, or properties, they reduce their risk as a whole.

When these two methods are combined, it means that you systematically evaluate the fair value of investments, only buy them at prices that are well below their fair value, and diversify enough so that even when you’re wrong occasionally, you still come out ahead.

Final Words

Discounted cash flow analysis is a powerful framework for determining the fair value of any investment that is expected to produce cash flow. Just about any other valuation method is an offshoot of this method in one way or another.

It works for private businesses, publicly traded stocks, projects, real estate, and any other investment that is expected to produce cash flow later in exchange for cash flow today.

If you want to apply it to stocks, check out StockDelver , which is my digital book and streamlined set of Excel calculators for valuing stocks.

In addition, if you want to get information on undervalued sectors or attractively-priced stocks, join my free investment newsletter and get a detailed update on market conditions and investment opportunities. It publishes approximately every 6 weeks.

Further Reading:

- How to Determine if a Market is Overvalued

- How to Value Gold and Silver

- Contrarian/Value Investing: Why it Outperforms

Join the Free Investing Newsletter

Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

No spam, no nonsense. Ever.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

FREE DCF MODELING CRASH COURSE

Introducing...

25+ Lessons, 1.5 hours of video lessons

To Help You Thrive in the Most Prestigious Jobs on Wall Street....

HERE’S JUST SOME OF WHAT YOU’LL GET IN THIS COURSE

Dcf - the big picture (15 video lessons).

In this module, we use 15 video lessons to explain the theory and logic behind valuation before we put this knowledge into practice with a Nike case . Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more.

DCF Introduction (9 video lessons)

In this module, we use 9 video lessons to fully break down a DCF analysis. This module will also go into key terminology , how to locate information and drivers of Free Cash Flow Projections.

WSO DCF Modeling Crash Course - Video Preview

Course summary - table of contents.

Below you will find a list of the modules and lessons included in this course.

Module 1: Introduction

- About Your Instructors (2Min)

- DCF Valuation Modeling Course Objectives (3Min)

- What You Will Learn From the Course (4Min)

- Additional Resources (2Min)

Module 2: DCF - The Big Picture

- Valuation Roadmap (4Min)

- Conceptual Framework for Company Value (4Min)

- Intrinsic vs. Relative Valuation (7Min)

- Simple Example of Valuation Thought Process (4Min)

- Introduction to Discounted Cash Flows (4Min)

- Example - Simple DCF Valuation Calculation (3Min)

- Example - Simple DCF Valuation in Perpetuity (3Min)

- Use of DCF in Practice (4Min)

- Introduction to Equity Value (3Min)

- Example - Simple Equity Value Calculation (2Min)

- Introduction to Enterprise Value (2Min)

- Example - Moving from Equity Value to Enterprise Value (2Min)

- Example - Nike's Market-Implied Enterprise Value (3Min)

- Nike's Balance Sheet Implications on Enterprise Value (2Min)

- Module Summary, Reflections, and Calculations (3Min)

Module 3: DCF Introduction

- 4.1 Conceptual DCF Process Overview (2Min)

- Core Competencies for Building a DCF Valuation Model (1Min)

- P&L Terminology Used in DCF Valuation (5Min)

- How They are Applied in DCF Valuation (6Min)

- Other Financial Statement Terminology for DCF Valuation (4Min)

- Introduction to Preparing LTM Financial Metrics (6Min)

- Locating Relevant Information to Project Free Cash Flow (2Min)

- Sample FCF Projection Drivers for a DCF Analysis (3Min)

- DCF Valuation Benefits and Considerations (5Min)

Our students have landed and thrived at positions across all top Wall Street firms, including:

Don’t Take Our Word For It

Hear from a few of our 57,000+ students ....

"I find it very useful in that instead of going into the DCF immediately the instructors talk through EV and give you an extensive background on it. I’ve done other financial modeling courses and they do not go in-depth as much as this course has . [The] EV practice modules are great. The topics covered helped me grasp the EV concepts much better than I had previously."

"I must say the course is pretty exhaustive and is nicely put together. Kudos to the WSO team and special thanks to Tim, Josh and Levi for putting this together."

"Overall, I was very impressed with the DCF course! The slides were well-designed, the difficulty level was appropriate, and the speakers included many examples of how these concepts can be applied in the industry . I enjoyed the course very much. I look forward to any future projects the WSO team has to offer!"

" Overall, fairly detailed and well structured and was a good review for me. Covered some nuances of each of the step involved. Didn't handhold much and the examples were topical."

"I feel the course helped with understanding the DCF from a conceptual level to the individual steps needed, and the reasoning behind each step. Overall I would highly recommend this course to someone who needs help understanding the DCF step by step."

"I think that the course was very helpful in terms of being a refresher. For some context, I am a rising junior in college, who finished up the recruiting cycle around 5 months ago. Since then, I haven't really looked at any finance content at all, and after taking this course, it made my conceptual understanding of the material stronger as it was now reinforced. I can more confidently remember some of the material and that has been a huge help...For people who have corporate finance backgrounds and are interested in learning about the DCF model, the course probably will serve its purpose."

Before completing Wall Street Oasis’ DCF course, I had little experience in DCF modeling. This course was very well taught, clear, and easy to follow. It breaks down key concepts and guides you through introductory exercises followed by a step-by-step DCF-based valuation in a case study format. Applying the information that you learn throughout the course makes it very comprehensive and ensures your understanding! Learning from this course will be very beneficial in the future because it sharpens your Excel skills, and it prepares you for calculating DCF-based valuations. Again, another great course by WSO, and I certainly recommend this cours e!

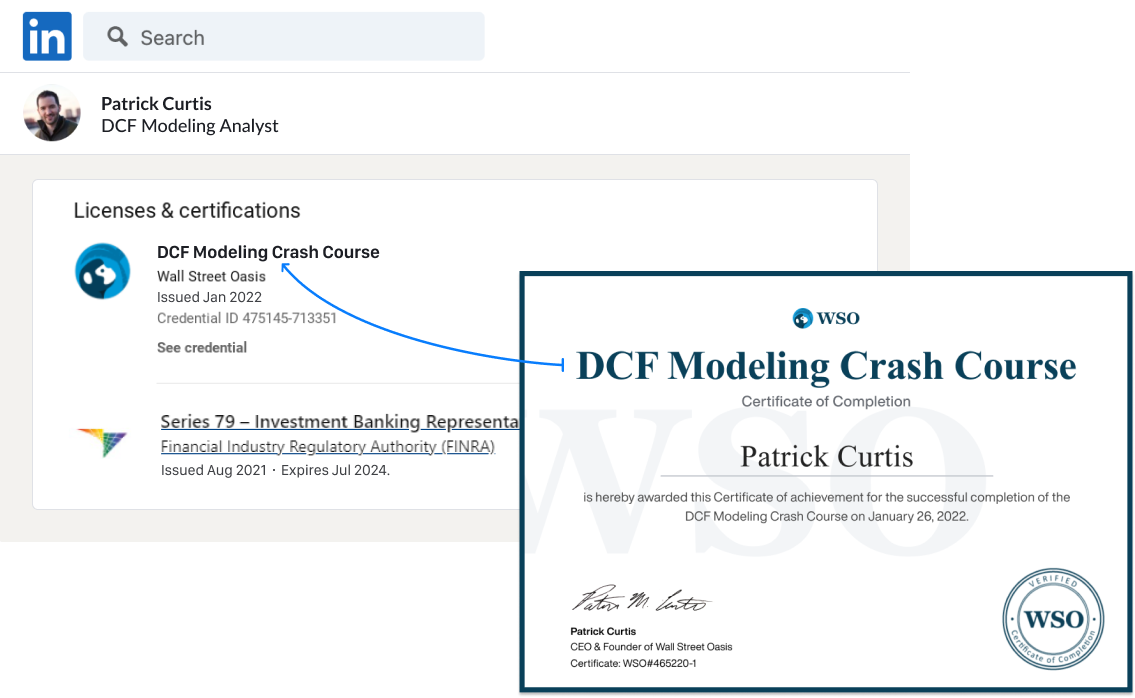

Get the DCF Modeling Crash Course Certification

After completing the course, all students will be granted the WSO DCF Modeling Crash Course Certification. Use this certificate as a signal to employers that you have the technical DCF modeling skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to become a master in discounted cash flow modeling. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your Finance Career Worth?

What You Get | Value |

|---|---|

WSO DCF Modeling Course 25+ video lessons across 3 Modules taught by a top-bucket bulge bracket investment banker... | $200 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $500 |

Get Unlimited Lifetime Access To The WSO DCF Modeling Course For 100% Off

Pay in full or make 3 monthly payments of... Just kidding. It's FREE

Secure checkout

Discounted Cash Flow Analysis—Your Complete Guide with Examples

This complete guide to the discounted cash flow (DCF) method is broken down into small and simple steps to help you understand the main ideas.

We’ll walk you through what a discounted cash flow analysis is, what it is used for, as well as what all the distinct terms mean, and provide step-by-step instructions on how to calculate company value, and share price, using the DCF method.

If you want to read to a step-by-step example of a DCF, skip to the end of the article here.

If you want to understand the pro’s and con’s, skip down to here.

If you want to understand the basic logic first, keep reading.

What is the Discounted Cash Flow Method?

What is the discounted cash flow method? The discounted cash flow (DCF) method is one of the three main methods for calculating a company’s value. It’s also used for calculating a company’s share price, the value of investments, projects, and for budgeting. The DCF method takes the value of the company to be equal to all future cash flows of that business, discounted to a present value by using an appropriate discount rate. This is because of the time value of money principle, whereby future money is worth less than money today. That’s why it’s called a ‘discounted’ cash flow.

Context of DCF: There are three main approaches to calculating a company’s value. The first is 1. the intrinsic or income-based approach, also known as an entity approach, then there is also 2. the asset-based approach also known as the cost-based approach, and finally 3. the multiple based or ‘ comps ’ (comparable company analysis) approach. A DCF analysis is the main income-based approach—an approach based on the company’s own cash flows.

The DCF Formula

We’ll explain what all these terms mean, as well as the logic behind the method, below.

DCF = discounted cash flow

CF_i = cash flow period i

r = interest rate (or discount rate)

{n} = time in years before the future cash flow occurs

In essence, this equation simply adds up all future business cash flows, but discounts each one.

A discount rate, or discount ‘factor’, is calculated and applied to each year’s cash flow, in order to arrive at the present value.

Understanding the Logic Behind a DCF

Why is it Called ‘Discounted’ Cash Flow?

Let’s imagine you’re valuing a company that’s going to operate for 3 years and then stop operating.

How much is it worth?

You could say it’s worth whatever cash flows it produces, each year, for these 3 years.

| Year | 1 | 2 | 3 |

| Cash Flow (CF) | $10 million | $10 million | $10 million |

$10 million + $10 million + $10 million.

No points for working out that this company is worth $30 million. But here’s the big problem with this basic approach:

Is that predicted $10 million of cash flow in the future, really equal to $10 million in your pocket today?

The answer is no, it’s not.

What’s worth more to you out of $10 today or $10 in three years’ time?

Your answer is probably the money right now , and so you can see money today is worth more than money in the future. This actually has a name—it’s called the Time Value of Money (TVM) principle, and there are several reasons for this to be the case:

Uncertainty —future money is not guaranteed.

Inflation —you will be able to buy less with that $10 in 3 years.

Investing —you can invest that $10 today, earn, say, 10% interest per year, and in 3 years it will be worth $13.31.

So, to be more accurate in using cash flows to value a business, you’re going to need to discount the money to be received in the future. In particular, reduce this figure of future cash flow, to bring it in line with what that amount of future money could be said to be worth today. Only at this point do you add up all the ‘discounted’ cash flows, to get your company value. It should now–we hope–be obvious why it’s called a discounted cash flow analysis.

Following the Fundamental Steps in a DCF

As just explained, in a DCF analysis, you discount the future cash flows in order to value a company more accurately.

So, by how much do you discount them? Well, by a certain discount factor. You then apply this discount factor to each year’s cash flow.

This discount factor is the main method underlying a DCF. Once you apply these discount factors, in essence, you then simply add all the years together–with the factors applied–to give you the value of the business.

The discount factor for each year is calculated as follows:

1 / (1 + r) ^ n

r = discount rate

n = number of discount years

Looking at it differently, this calculation provides you with a discount factor that tells you how much you’d have to invest today, in order to get to that figure of $10 million in year 1, $10 million in year 2, in year 3, and so on.

Remember, present money can earn interest and be worth more in the future. That is the fundamental principle underlying this method.

Adding A Row for the Discount Factor

Here we will add on a row in our table to illustrate.

You don’t need to worry exactly how the formula itself works too much to perform the method.

The important figure there is r, which we’re using as the discount rate in this whole equation. In the full DCF, it will often be the WACC, which we’ll come to later. But here, we use what interest we could get from an alternative investment in the market, called the Market Rate. This is the rate of return you’d get if you invested your money today instead.

In our example, it’s 10%.

With that r figure plugged into the above formula, you find the discount rate appropriate for each year, as so.

| Year | 1 | 2 | 3 |

| Cash Flow (CF) | $10 million | $10 million | $10 million |

| Discount Factor (using r=10%) | 0.9 | 0.83 | 0.75 |

Every year you discount it by a different factor. The further in the future, the more you discount it and thus the lower the discount factor.

Then you simply multiply the cash flow each year by this discount factor.

This provides you with your discounted cash flow figure.

| Year | 1 | 2 | 3 |

| Cash Flow (CF) | 10M | 10M | 10M |

| Discount Factor (using Market Rate: r=10%) | 0.9 | 0.83 | 0.75 |

| Discounted Cash Flow | $9 million | $8.3 million | $7.5 million |

Then if you add them all together, instead of getting $30 million… you get:

$9 million + $8.3 million + $7.5 million =

$24.8 million

This is quite a bit less than the original $30 million figure, so you can see the real impact of the TVM principle and its impact on the DCF approach right there. This value is widely referred to as the “Net Present Value” (NPV).

Congratulations, you have now seen, quite simply, the logic behind a discounted cash flow method. Does this make sense? We hope the underlying logic is fairly clear…

But, you may have spot something that’s not particularly realistic. Businesses often don’t stop operating after year 3. In fact, we don’t actually know how many years they’ll operate for. So, how do we account for the value of the cash flows across all these possible years in the future (which may be forever)?

Well, the short answer is after that forecast period where we estimate each year’s cash flows then discount them, we add a single number at the end to account for all the theoretical years in the future, called the Terminal Value (TV). We’ll explain how this works next.

But first, a quick aside, which you can feel free to skip if you want to jump ahead:

Why Do We Use the Market Rate to Calculate the Discount Factor?

The market rate of return on investing money today, tells us how much more that money will be worth in the future because it earns a return. We add that return on, and get a larger cash value in future years.

Working backwards from this larger value using the market rate can, conversely, tell us how much less money we would have losing, say, 10%, each year.

So, given an annual return of 10% on your invested money, to get $10 million by year 3, right now, in your hand today you’d need $7.5 million. This is because if you invested that today with 10% return every year, by year 3 you would have $10 million.

So, using this method, we can say that $10 million in year 3 is actually only worth $7.5 million today. That’s how much we’d need now to equal $10 million in year 3 (given that 10% market return rate on investing that money today).

This a major way that the ‘discount’ part in the discounted cash flow, gets done.

(Let’s pause here to acknowledge the big assumption that ‘interest rates will be 10% every year’. Obviously, this is an important assumption to try to predict accurately, as it has a sizeable impact on the valuation).

Explaining The Terminal Value

What happens after year 3 of our projected forecast?

How many years does the company last and what is the total and, more importantly, the Present Value, of these cash flows across these future years?

We need to know this sum total number so we can add it to the other three years of cash flows, to get the full value of the company’s entire life.

Well, the DCF method uses a number called the Terminal Value to represent this assumed sum total. This Terminal Value is the number the DCF method uses to represent what the business is worth beyond your initial 3, 5, 10-year (etc.) forecast. It’s a very important number in a DCF analysis because it represents a large chunk of the total valuation amount.

“How do I calculate the Terminal Value?” you may ask. Well, once more you can rely on a widely used formula.

FCF n x (1 + g) / (d – g)

And you need three numbers to do this.

- FCF n is the free cash flow in year n, being the last forecast period

- g is the terminal growth rate.

- d is the discount rate (which is usually the weighted average cost of capital (WACC), r in our previous example)

This formula is known as the Gordon Growth formula.

What Happens When We Add the Terminal Value?

Let’s do a quick example to illustrate the portion of the final valuation that is represented by the Terminal Value.

Let’s say the discount rate, using the WACC, is 12% (so, this is a risky business – the higher the WACC, the riskier the business as investors expect to be compensated for taking on additional risk).

The terminal growth rate is 1.7%.

(The growth rate always has to be lower than the growth rate of the economy, otherwise given enough time the company will grow larger than the economy, which doesn’t quite make sense).

If we plug these values into the above formula, this Terminal Value calculation gives $98.7 million. But remember—you still have to apply the discount factor at the end of the forecast period. Using the WACC of 12% in year 3 provides a discount factor of 0.75 which produces a Net Present Value of the Terminal Value of:

$74 million.

Can you remember how much our 3-year business was worth before this step? It was worth $24.8 million. So the Terminal Value here is three times as large!

Incidentally, adding them together gives the total value, which would then be $98.8 million. You can see why the Terminal Value is so important to the valuation as a whole!

Two Methods to Calculate the Terminal Value

As mentioned, the Terminal Value is highly important to a DCF valuation because it takes up a large chunk of the whole valuation.

There are two main methods to calculate what the business is worth after the years of your forecast cash flow. That is–of course–two ways to calculate the Terminal Value.

As it turns out, one major way is to assume the company will exist forever.

This is the perpetual growth method , also known as the Gordon Growth Method, which is the one used in the example immediately above and is particularly favored by academics.

The second approach is by assuming the business is sold at that point.

This approach then becomes technically a multiple-based approach, because of the way it works. Practitioners assume the business is sold as a multiple of some financial metric like EBITDA, based on what they can see today for other businesses that were sold, and what these comparable trading multiples are.

Some practitioners will use an average of both methods.

How to Determine the Correct Discount Rate to use?

In this article, we have referred to the discount rate to be used to discount the future cash flows as the Market Rate (r) or generally as the discount rate (d).

The principle behind determining the correct discount rate to use is that the discount rate needs to adequately reflect the riskiness of the business being valued .

In most DCF analysis, practitioners make use of the Capital Asset Pricing Model (CAPM) to calculate a discount rate that reflects the riskiness of the business being valued. The details of how the CAPM works is beyond the scope of this article but in short, the formula is as follows:

Ce = Rf + B x (Rm – Rf) + Cp

Ce = Cost of Equity

Rf = Risk-free Rate

(Rm – Rf) = Equity Market Risk Premium

Cp = Cost of Equity Premium

If the WACC is used to discount the cash flows (more on this below), then it is calculated as follows:

WACC = Ce x [E/(D+E)] + Cd x (1-t) x [D/(D+E)]

E = Equity

Cd = Cost of Debt

t = Tax Rate

How to Value Stocks Using DCF?

Valuing stocks using DCF is pretty much the same method when valuing a company but you just take one extra step.

Once you have added all your future discounted cash flows together, you get the value of the business today. Then you simply divide this figure by the number of shares. So if we take our example from before and we know they’ve issued 10,000,000 shares. We divide the value of the company by 10,000,000, so we get $9.88 per share. This gives us our own unique determination of what the share price should be.

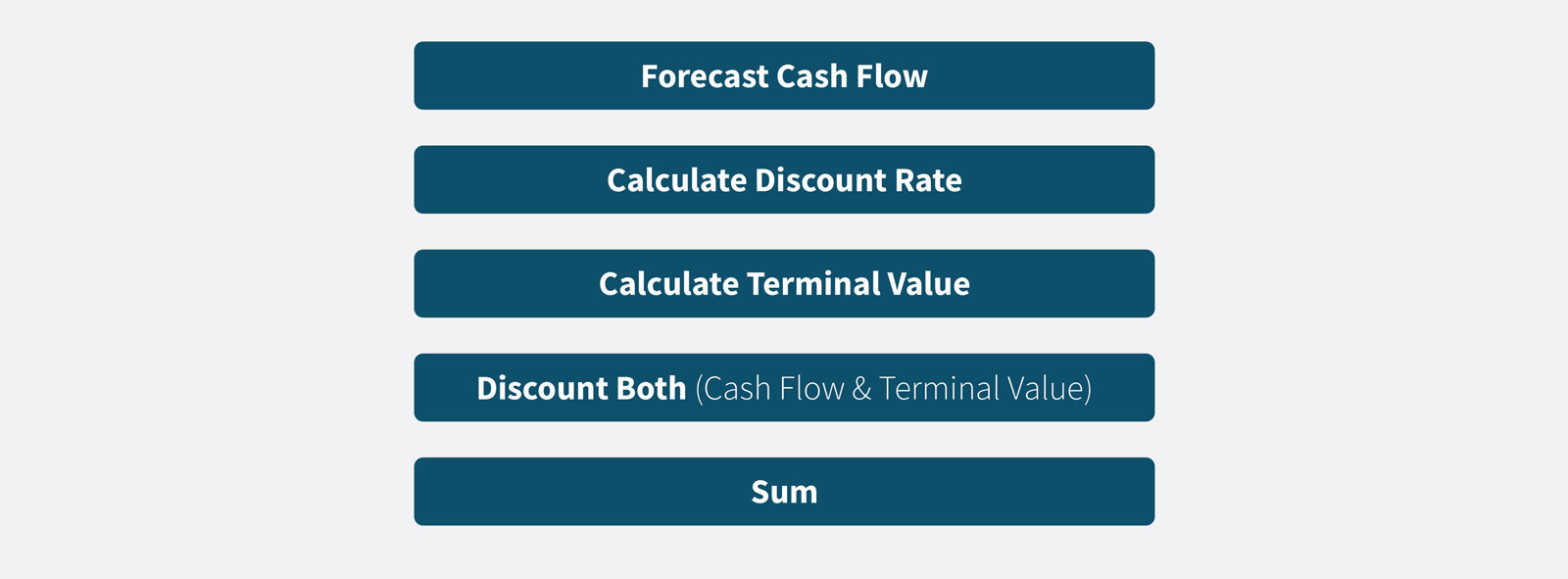

The 5 Major Steps to Calculate a DCF

Really, conducting a DCF is just like following a recipe.

There are some simple steps to take, and these are often done in MS Excel. Or, if you have a tool like Valutico, then you just need to enter some key figures and the software does all the work.

But if you want to be able to go through the steps yourself, let’s do that now.

Here is a recommended order of steps to follow:

Step 1 . Forecast cash flow. (‘free cash flow’)

Step 2 . Calculate the discount rate. Often, the Weighted Average Cost of Capital (WACC) is used*.

Step 3 . Calculate the Terminal Value.

Step 4 . Discount the cash flow. Discount the Terminal Value.

Step 5 . Add up all the figures you have to arrive at the Net Present Value. Depending on the exact methodology and discount rate used, this could be the Enterprise Value or Equity Value.

*the WACC is one popular discounted cash flow method (DCF WACC). However there are other methods.

Why Would You Use a DCF Model?

DCF is widely used in valuing companies, and it is used widely in valuing stocks as well. But it can be used in several ways, including to:

- Value a business you want to sell, or for a business you want to purchase.

- Value a company’s stock price to compare it to the actual stock price, as one piece of information to help you decide whether to invest.

- Value a project.

- Assess the impact of an initiative, like a cost-saving programme or entering a new market.

- Use for internal financial planning and accounting (FP&A) purposes, such as budgeting, and forecasting.

- Allow a company to raise money.

Problems with a Discounted Cash Flow Analysis

No approach to valuing a company or stocks is completely perfect.

Just remember, when valuing you are making educated guesses about the future.

If you get these educated guesses wildly incorrect, then your valuation will likely also be off.

But let’s take a closer look at some of the drawbacks specific to the DCF approach.

Garbage in. Garbage out.

Cash flow: A lot hinges on getting these cash flow projections correct. It might be quite straightforward to project cash flow for year 1, but when you get to year 2, and especially years 3, 4, 5 and beyond, in many industries this becomes almost impossible to predict with a high degree of certainty. Some industries like oil and gas might lend themselves to you having a longer forecast period of say 10 years, but even these industries are subject to the unknown future. When you’re trying to predict cash flow for many businesses in 5 years’ time it can be particularly difficult, and becomes closer to complete guess-work.

Moreover, year 4 cash flows are determined by year 3 cash flows, as that is the way the business works. Year 5 by the year before, and so on. If you make a mistake in the early years, this deviation can be magnified in the future. Small variations early on are magnified later.

Strengths of a Discounted Cash Flow Analysis

The DCF approach is widely used and considered a strong approach for valuing a company or stocks. Many would call it the leading approach. Here are some of the main reasons:

- It is a so-called ‘intrinsic’ approach based on data that directly reflects the company’s actual financial performance.

- It allows the practitioner to consider multiple distinct financial performance scenarios, whereby they can compare different possible futures based on making different assumptions.

- Relying on cash flow data, it incorporates a wide range of important financial metrics, such as net income, working capital, and capital expenditure.

What are the Different DCF Methods?

This article has outlined the simple form of a DCF analysis. However, there are multiple versions that differ in how they are calculated and when they should be applied:

- DCF WACC (simplified)—largely what this article has been describing, your basic DCF which calculates Free Cash Flow to the Firm and discounts these cash flows using the WACC as the discount whilst keeping a constant capital structure (D/E ratio) throughout the forecast period.

- DCF WACC—similar to the above except that it calculates a different WACC in each forecast period based on a changing capital structure (D/E) and thus a changing beta in each period.

- Flow to Equity – this calculates the Free Cash Flow to Equity and discounts these cash flows using the Cost of Equity.

Note that in theory the above three approaches should deliver an identical valuation result thus the choice of what method to use is simply down to the level of information at hand and personal preference.

A DCF Example – Each Step in a DCF Calculation in Order

In practice, you can calculate a DCF using MS Excel. However, if you do multiple valuations throughout the year, or valuations you want to update regularly, then a tool like Valutico makes things significantly easier.

To understand the steps, let’s go through each in turn with our DCF example.

Step 1. Cash Flow

You need the ‘unlevered’ cash flow*. To calculate this free cash flow (FCF), you need to add up the following figures (you do not add the tax rate, that is shown below as it’s used to calculate the tax amount).

| EBIT | 5,000 |

| Tax (from tax rate and EBIT) | -1250 |

| Depreciation | 100 |

| Amortization | 225 |

| CapEx | -1,550 |

| Non-cash working capital | -180 |

The CapEx, tax, and in this case non-cash working capital, are negative.

Add these to get the free cash flow for that single year (or particular period, like 6 months). Step 1 done.

*You can also do a different ‘levered’ cash flow method (Free Cash Flow to Equity), which ‘in theory’ at least should provide the same outcome, but unlevered is the more commonly used. Unlevered is the operating cash flows (Free Cash Flow To Firm), whereas levered is the cash flows available to shareholders once other claims (i.e. debt) has been paid.

Step 2. Discount Rate

Now, we need to calculate the discount rate. We will use the CoE and WACC formulas described above. Therefore, we can put in the following values:

| Equity | 17,500 |

| Debt | 15,000 |

| Cost of Debt | 5% |

| Tax rate | 25% |

| Risk free rate (can use 10y Treasury) | 1.5% |

| Beta | 1.3 |

| Market Return | 10% |

| Cost of Equity | 12.55% |

We had to calculate the Cost of Equity using the CAPM method as previously described. Now, we’ve got that, we can move onto two core components of the WACC equation, to finally give the WACC.

| Debt / Debt + Equity | 46.15% |

| Equity / Debt + Equity | 53.85% |

Finally, we have our discount rate.

Step 3. Terminal Value.

Now, we need the Terminal Value.

There are two methods, and one option is to combine them both and use the average.

First, the perpetuity growth method (or Gordon Growth model).

And then, the exit multiple.

The perpetuity growth formula is:

Free Cash Flow on last year + 1 / (discount rate – growth rate)

So we need:

| WACC | 8.49% |

| Growth Rate | 1.70% |

| EV/EBITDA Multiple | 7 |

The WACC we need because it’s our discount rate in this equation.

But we also need the free cash flow from the last year.

So here is the EBITDA and FCF year on year for our entire 5-year forecast period:

| Period | 1 | 2 | 3 | 4 | 5 |

| EBITDA | 5,325 | 5,530 | 5,730 | 5,820 | 5,820 |

| FCF | 2,345 | 2,510 | 2,720 | 2,795 | 2,800 |

Then taking these we get the following:

| EBITDA | 5,820 |

| Exit Multiple (EV/EBITDA) | 40,740 |

| Perpetuity Growth | 41,948 |

Step 4. Putting it all together.

Now that we have the WACC and the Terminal Value, we can do the discounting.

Both the free cash flows, and the Terminal Value need to be discounted.

Then we sum these, and get the Enterprise value (EV).

Remember, the discount factor equation is:

Discount factor = 1 / (1 + r)^n

In this case, we have chosen to use WACC for r.

So we get the following:

| 1 | 2 | 3 | 4 | 5 | ||

| 2,345 | 2,510 | 2,720 | 2,795 | 2,800 | ||

| 41,344 | ||||||

| 0.92 | 0.85 | 0.78 | 0.72 | 0.67 | ||

| 2,162 | 2,133 | 2,130 | 2,018 | 1,863 | ||

| 27,510 | ||||||

| 37,815 |

And this enterprise value is the value of the business.

Congratulations, if you worked along, you have now valued a business using the DCF method.

If you perform multiple valuations per year, and valuations are a significant part of the work you do, then using a tool that automates most of the process can make your life much easier. Try booking a demo , if this applies to you. Otherwise, we hope the explanation above has helped you wrap your head around what a DCF analysis is, and how to use one.

About the Author:

Chris botha, find out how valutico will make a difference to your valuations..

Request a Demo

Grab Your Free Guidebook

Discounted Cash Flow (DCF) Analysis: The Purpose, Formula, and How it Works

A Discounted Cash Flow (DCF) analysis is a powerful tool for investors to assess the value of a company or investment by projecting future cash flows and discounting them to their present value. This approach allows venture capitalists to identify promising startups, considering their growth potential and market conditions. In this guide, you'll discover the essentials of DCF analysis, how it differs from other valuation methods, and a detailed, step-by-step approach to conducting one. By mastering DCF, you'll gain valuable insights into determining an investment's intrinsic worth and making smarter investment decisions.

What is the Purpose of DCF Analysis?

DCF analysis serves as a cornerstone of financial valuation, especially in the venture capital arena. It enables investors to estimate the present value of an investment based on its expected future cash flows, adjusted for risk and the time value of money. DCF analysis is crucial for venture capitalists because it provides a detailed, quantitative assessment of a startup's financial health and growth prospects. By using DCF, investors can determine whether the potential returns of a startup justify the inherent risks of investing in early-stage companies.

DCF vs. NPV

While both DCF and Net Present Value (NPV) are methods used to assess the value of future cash flows, they serve slightly different purposes and are related yet distinct concepts . DCF is the process of forecasting what an investment's cash flows would be worth in today's money, giving a holistic view of future profitability adjusted for the time value of money. NPV, on the other hand, is a direct outcome of the DCF analysis, representing the difference between the present value of cash inflows and outflows. NPV tells you whether an investment will yield a profit or loss by comparing the initial investment to the DCF. It is particularly valuable in decision-making processes, helping investors weigh the profitability of different investment opportunities.

What Is the DCF Formula?

The DCF formula is used to estimate the value of an investment by predicting its future cash flows and discounting them to their present value. Here's the formula:

- CF (Cash Flows): These are the projected cash flows that the investment is expected to generate over each period (1,2,3,n). Cash flows can include revenue minus operating expenses, taxes, and changes in working capital.

- r (Discount Rate): This represents the rate of return required to make the investment worthwhile , often calculated as the Weighted Average Cost of Capital (WACC). The discount rate accounts for the risk and time value of money, reflecting the riskiness of the projected cash flows.

What Does the DCF Formula Tell You?

The DCF formula provides a method for valuing an investment based on its intrinsic value. By discounting future cash flows to their present value, the DCF formula helps investors determine whether the current price of an investment reflects its true value. This approach allows investors to:

- Assess Profitability: Determine if an investment is likely to yield a return that meets or exceeds the required rate of return.

- Compare Investments: Evaluate multiple investment opportunities to see which one offers the best value relative to its price and risk.

- Make Informed Decisions: Use quantitative data to support investment choices, helping to minimize risks and maximize returns.

How to Conduct a DCF Analysis

Conducting a DCF analysis involves several key steps that help investors estimate the intrinsic value of an investment. This process requires careful planning, detailed financial data, and precise calculations to ensure accuracy. Below is a step-by-step guide on how to perform a DCF analysis, from gathering information to interpreting the results.

1. Gather Information

The first step in conducting a DCF analysis is to collect all necessary financial data and relevant information about the company. This includes:

- Financial Statements: Obtain the company’s income statements, balance sheets, and cash flow statements. These documents provide historical financial data that is crucial for making accurate projections.

- Market Research: Conduct research on the market and industry in which the company operates. This includes understanding the competitive landscape, regulatory environment, and macroeconomic factors.

- Company-Specific Information: Gather detailed information about the company’s operations, business model, growth strategy, and management team. This helps in making realistic assumptions about future performance.

2. Forecast Future Cash Flows (FCF)

Projecting future cash flows is a critical step in the DCF analysis. This involves:

- Analyzing Historical Data: Use historical financial data to identify trends and patterns in the company’s performance.

- Making Assumptions: Develop assumptions about future revenue growth, operating expenses, capital expenditures, and working capital needs. These assumptions should be based on historical trends, industry benchmarks, and market conditions.

- Projecting Cash Flows: Forecast the company’s free cash flows (FCF) for a specific period, typically 5 to 10 years. Free cash flow is calculated as operating cash flow minus capital expenditures.

3. Determine the Discount Rate (WACC)

The discount rate used in a DCF analysis is typically the Weighted Average Cost of Capital (WACC). Calculating WACC involves:

- Cost of Equity: Estimate the cost of equity using models like the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, beta (a measure of stock volatility), and market risk premium.

- Cost of Debt: Determine the cost of debt by assessing the interest rates on the company’s outstanding debt, adjusted for tax savings.

- Weighting: Calculate the weighted average of the cost of equity and cost of debt based on their proportions in the company’s capital structure.

4. Estimate the Terminal Value (TV)

Terminal value accounts for the value of cash flows beyond the forecast period. There are two common methods to calculate TV, the Perpetuity Growth Model and Exit Multiple Method.

Industry professionals often favor the exit multiple approach because it allows them to compare the business's value to observable market data. In contrast, academics tend to prefer the perpetual growth model due to its strong theoretical basis. Some practitioners opt for a hybrid method, combining both approaches to arrive at a more balanced valuation.

- Perpetuity Growth Model: The perpetual growth method is widely favored by academics for calculating terminal value due to its solid mathematical foundation. This approach assumes that a business will continue to generate Free Cash Flow (FCF) indefinitely at a stable, normalized rate. This model captures the ongoing value of a company's cash flows beyond the forecast period, reflecting a perpetuity scenario.

TV is calculated as:

TV = (FCFn x (1 + g)) / (WACC – g)

- TV = terminal value

- FCF = free cash flow

- n = year 1 of terminal period or final year

- g = perpetual growth rate of FCF

- WACC = weighted average cost of capital

- Exit Multiple Method: The exit multiple approach estimates the terminal value by assuming the business can be sold at a multiple of a certain financial metric, such as EBITDA. This multiple is determined based on the trading multiples observed for similar businesses in the market.

The formula for calculating the exit multiple terminal value is:

TV = Financial Metric (e.g., EBITDA) x Trading Multiple (e.g., 10x)

5. Calculate the Present Value (PV)

Discounting the forecasted cash flows and terminal value to their present value is a critical step in the DCF analysis. This process involves applying a discount rate to each projected cash flow and the terminal value to reflect their value in today's terms. Here’s how you can do it both mathematically and conceptually:

- Present Value of Cash Flows: Calculate the present value of each projected cash flow using the formula

PV= CFt / (1+r)ₜ

- PV = Present Value

- CFt = Cash Flow in period t

- r = Discount rate (often the Weighted Average Cost of Capital, WACC)

- t = Time period (year)

- Present Value of Terminal Value: Discount the terminal value back to its present value using TV / (1+r) ₙ

- Total DCF Value: Sum the present values of the projected cash flows and the terminal value to obtain the total DCF value.

6. Interpret the Results

Analyzing the results of the DCF analysis involves: