- Find a Branch

- Call 1-800-769-2511

RBC Online Banking for Business

Manage your finances and cash flow anytime, anywhere.

Running a business is hard work, especially for business owners who manage their company’s finances. That’s why we made it easy to bank according to your schedule. Review your accounts, pay bills, transfer funds and file government remittances all in one place.

Enjoy these features with RBC Online Banking 1 for Business:

- You can view and track expenses and payments

- Enjoy the convenience of setting up recurring payments to employees or vendors, or make a one-time Interac e-Transfer

- Instantly access and view current and past business transaction information, including up to 7 years of transaction history

- Make international wire payments in more than 30 currencies

- Review and submit your business taxes online through Online Tax Filing

- View Canadian and U.S. business banking accounts on one page

Looking for a solution with more features?

Ready to get started, call our 24/7 business helpline, ready to enrol.

View Legal Disclaimers Hide Legal Disclaimers

Compare Your Options

| Services | Online Banking for Business | Premium Online Banking for Business with RBC Express |

|---|---|---|

| 24/7 Account Access | ||

| Mobile App (bank on the GO) | ||

| Pay Bills, Transfer Funds, File and Pay Taxes | ||

| Pay Employees & Vendors through direct deposit | ||

| Mobile Cheque Deposit | – | |

| Manage banking for more than 1 entity | – | |

| Multiple Cheque Deposit | – | |

| High Volume Paper Cheque Management Service | – | |

| Cheque Fraud Prevention Tools | – | |

| Unique Users | 1 | Unlimited |

| Banking on the Go Using a Mobile Device | ||

| Email/SMS Money Transfers | ||

| View and Manage Accounts in Canadian and U.S. Currencies | ||

| Access Information on Operating Accounts Located Outside of Canada, in Local or International Currencies | – | |

| Making and Receive Payments in Local and International Currencies | – | |

| Manage Foreign Exchange | – | |

| Send Domestic and International Wires Up to $10,000 Per Day | – | |

| Send Domestic and International Wires With Preferred Foreign Exchange Rates & No Daily Limit | – | |

| Collect Membership Fees or Recurring Payments | – | |

| Cost Per Month | Free | Starts at $0 |

- Find a Branch

- Call 1-800-769-2511

- Canada - EN

- Canada - FR

- Our Company

- Investor Relations

- News & Stories

- Thought Leadership

- RBC Thought Leadership Menu

- Economics Overview

- Featured Insights

- Canadian Housing

- Economy and Markets

- Provincial Outlook and Fiscal Analysis

- Ten Minute Take

- The RBC Conversation

- The Growth Project

- Climate Action Institute

- Email Subscription

- View By Topic

Five Ways to Help Small Business

RBC Economics has followed the small business sector closely since the publication of our June report.

Government programs helped many small business owners keep their lights on—even as their doors closed—during the first lockdown. But ongoing support will be vital as local economies across Canada have shut down for a second time.

Below, is a set of updated data that help paint a picture of this vital sector, and the opportunities and challenges they face heading into a new year and very different world.

Small businesses were hit hard in the early stages of the pandemic

- Small business employment fell 30% year-over-year in April, while overall private sector employment was down 22%

- Statistics Canada analysis shows hours worked at small firms fell by 9.4% in Q1/20, significantly more than the 5.6% decline for the business sector as a whole

- Real output of the small business sector fell by 2.1% in Q1/20, compared with a 1.7% decline across all firm sizes

- Nearly 1/3 of CFIB survey respondents were fully closed in early-April, and only 20% were fully open

- According to a Statistics Canada survey, 61% of large businesses remained fully operational throughout the pandemic, compared with just 40% of smaller firms

Easing restrictions allowed for a partial recovery over the summer

- Small business employment rebounded to 4% below year-ago levels by November—roughly in line with the shortfall in overall private sector employment

- According to a CFIB survey, 2/3 of small businesses were fully open as of late-October and 43% had returned to full staffing

- Business insolvencies were down 24% year-over-year in Q3

Some industries are still struggling

- The latest CFIB survey showed re-opening rates remained low in the most heavily-impacted industries, including hospitality (31% fully open as of late-October) and arts and recreation (37%)

- The same survey indicates 18% of businesses are still operating with less than half their usual staff and 1/4 are making less than half their usual revenue

- Less than 1/5 of businesses in the most impacted industries have returned to full staffing and only 10% have returned to normal revenue

- Nearly 40% of businesses said they were losing money every day they were open, and 14% were actively considering bankruptcy or winding down operations—the latter is closer to 1/4 in the most impacted industries

The second wave will hurt small businesses

- As of late-October, half of businesses surveyed by CFIB—and as many as 3/4 in the most impacted industries—reported a drop in sales due to the second wave

- 3/4 of businesses said “uncertainty around a second wave” was one of their top concerns

- A Statistics Canada survey from mid-September to late-October showed that, relative to larger firms, small businesses are less likely to be prepared financially for a second wave of COVID-19

Ongoing government support will remain crucial

- That Statistics Canada survey also showed small businesses were more likely to report financial constraints, or challenges maintaining sufficient cash flow or managing debt, compared with larger firms

- Fewer small businesses had the cash or liquid assets they need to operate, and more small businesses said they couldn’t take on more debt

- Among reasons for not accessing funding, small businesses were more likely to report application requirements or complexity or lack of awareness

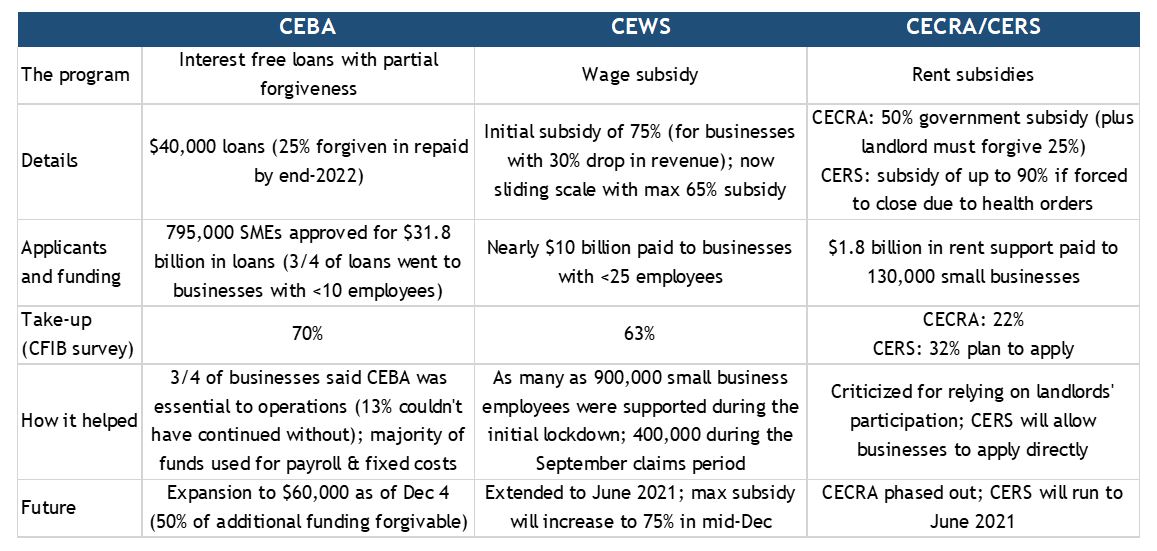

- In the CFIB’s survey, 64% of businesses strongly agreed or somewhat agreed that the updated suite of federal relief programs (CEWS, CERS and CEBA) offer their business “the lifeline it needs to survive”

- The federal government says it will launch a new Highly Affected Sectors Credit Availability Program (HASCAP) offering 100% government-guaranteed, low-interest loans of up to $1 million with maturities of up to 10 years for businesses in sectors like tourism, hospitality, hotels, arts and entertainment

Some small businesses are adapting to the pandemic and new normal

- Relative to larger firms, small businesses were less likely to have some e-commerce sales pre-pandemic

- According to a CFIB survey, 20% of small businesses were selling online pre-pandemic, 8% started selling online since and another 5% are in the process of setting up e-commerce

- Businesses in hardest-hit industries are among the top e-commerce adopters

- The same survey showed 22% of small businesses—as many as 1/3 in retail and 1/4 in hospitality and arts and recreation—will increasingly rely on online sales to survive COVID-19

But others face challenges pivoting to e-commerce

- Of the 17% of small businesses that had no web presence in 2019, 30% cited barriers like lack of technical expertise or said setup and maintenance costs were too high

- According to a Statistics Canada survey, relative to larger firms, fewer small businesses reported plans to increase sales through e-commerce channels and fewer planned to permanently increase online sales capacity post-pandemic

- A CFIB survey showed the top reasons businesses aren’t adopting e-commerce are lack of knowledge of how to apply e-commerce to business model, lack of technical expertise or resources, and additional costs

- Sectors including hospitality and health and personal services reported limited ability to quickly pivot to online or phone sales

- 1/4 of businesses surveyed said selling online has been a struggle, generating little or no revenue

- According to a BDC survey, 30% of entrepreneurs have not yet found a way to make online sales profitable, and 33% of those relying on online sales said they need to gain expertise and knowledge in the field

References:

BDC, How Entrepreneurs Are Adapting to the Pandemic

Canadian Federation of Independent Business (CFIB), COVID-19: State of Small Business (various survey dates)

Canadian Federation of Independent Business (CFIB), Small Businesses’ Experience with eCommerce during the Pandemic

Gu, Wulong (Statistics Canada), Economic Impact of the COVID-19 Pandemic on Canadian Businesses across Firm Size Classes

Office of the Superintendent of Bankruptcy Canada, Insolvency Statistics

Statistics Canada, Canadian Survey on Business Conditions

Statistics Canada, Labour Force Survey (microdata)

Statistics Canada, Survey of Digital Technology and Internet Use

Originally published on June 11, 2020

“Too big to fail” was the guiding principle for policymakers as they shored up systemically important banks, insurers and supply chains during the 2008-2009 global financial crisis. As Canada navigates an urgent route through the current COVID 19 pandemic, the emerging policy motto must be “too small to fail.”

The small enterprises that are crucial to the Canadian economy – representing 42% of GDP and 48% of new jobs – are also those at greatest danger in this unique recession. Tending to be “digital novices” –a significant number are without a website, or the ability to facilitate online payments – small firms were ill-prepared for the rapid economic shift that has emerged in the pandemic’s wake, an abrupt lurch to a virtual marketplace that has caught many off guard.

This crisis may be the moment for these companies to reboot and reposition themselves for a new economy that will be more digital, more virtual and more mobile than anything we’ve seen.

The ability of our nation of small businesses – the local barber shops, health food stores, software startups and greenhouse operations – to pivot to this new reality will be critical to Canada’s overall recovery.

In short, Canada’s rebuild depends on small business’s rebound.

In a new report from RBC Thought Leadership, Small Business, Big Pivot , we lay out a five-part plan to help Canadian small businesses thrive in a post-pandemic economy.

Read the full report and recommendations

What we found:.

- Small firms have recorded almost double the rate of job losses as mid-sized and large firms.

- Small firms in five sectors—accommodation and food services; arts and entertainment; non-essential retail; mining and oil & gas services; commercial real estate leasing—are most vulnerable; potentially affecting 1.2 million workers.

- Small firms in sectors like technology, wholesale trade and administrative services face a relatively lower risk; their fixed-cost burden is lighter and they can deliver products and services with little to no physical contact.

- Women and youth face the greater job risk from small-business woes; they’ve suffered outsized employment declines already.

- We expect GDP in some of our hardest-hit sectors to remain around 25-50% below February levels at the end of the year, even as the recovery takes hold.

- The pandemic is creating new economic trends and accelerating others, offering roadmap for an altered economy: more digital delivery; more domestic procurement; less market concentration; more consumer caution.

Charting a course out of the pandemic won’t be as easy as flicking a digital switch, nor can it mean a reversion to practices that worked in the past.

Fiscal support and a rebound in consumer spending will ensure an overall recovery. But its scale and speed will depend on how small firms reimagine themselves to confront the challenges and opportunities of the post-pandemic business landscape.

Here’s how the country can help:

1. Streamline relief programs. As we shift to a recovery, the government has an opportunity to refresh and streamline its business relief programs. Most immediately, those options could include:

- a topped up Canada Emergency Business Account (CEBA) and modified Business Credit Availability Program (BCAP) with greater forgiveness to cover a protracted recovery and help owners retrofit facilities for social distancing

- changing the Canada Emergency Response Benefit (CERB) to allow for a sliding scale to be paid to those going back on payroll;

- offering a brief tax holiday for small businesses to spur the recovery of local shopping and tourism.

2. Invest in capacity for safe reopening. Provincial governments should consider investing in broad-based programs to help employers restart their businesses. These could include:

- a nationally-coordinated program to certify public-facing facilities as COVID-safe;

- provincially-led and funded coalitions of business groups and chambers to provide personal protective equipment to small companies;

- an initiative to remotely connect students with small businesses to help them gain work skills and mentorship opportunities.

3. Build digital networks . Small firms will not only need tools for a post-pandemic economy, they’ll need to form alliances to compete in the global platform economy. A recovery plan needs to incorporate a digital strategy that could include:

- tax credits for small firms to invest in Canadian designed software and hardware to enable digital growth;

- a national program to create virtual farmers’ markets and virtual Main Streets;

- an acceleration of the Budget 2019 commitment to provide high-speed Internet to every Canadian and business by 2030.

4. Set new economic strategies to help scale . Governments and large enterprises have an opportunity to invest in sectors that leverage Canadian supply chains and fuel small business growth including:

- coordinated procurement efforts to designate preferred small business suppliers with a special focus on PPE, testing and tracking technologies and health care;

- Canada 2020-21 tourism campaign to spur domestic travel;

- a renewed provincial commitment to lower interprovincial trade barriers for small firms in 2021.

5. Create a more strategic approach to globalization . In a world that is likely to be more fragmented, Canada will need a more focused approach to trade. We may need:

- a “Go Global” program using trade accelerators to boost exports to countries more open to Canadian goods;

- a coalition of governments, banks and other institutions to form a “Brand Canada” platform for small firms;

- expanded expat networks to connect knowledge-based industries with global Canadians.

To learn more about how small businesses are transforming for the virtual economy, listen to our podcast episode.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

RBC Thought Leadership December 8, 2020

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share on Pinterest

- Share by Email

Get the latest forecasts and analysis from RBC Economics

- Entrepreneurship

Read This Next

Genai: is canada ready.

June 20, 2024

Proof Point: The Canadian tourism sector is struggling to stage a rebound

June 18, 2024

Homebuyers play the waiting game

June 17, 2024

WxT Language switcher

Dropdown language (interface text).

- Português, Brasil

- Canada.ca |

- Services |

- Departments

Sample business plans and templates

Sample business plans and templates can help you develop a professional document that will serve as an in-depth marketing tool to convince others of your venture's potential for success. However, creating your own plan can be a complex process, and you may need the assistance of a professional (like an accountant) depending on the type of business you have (or want to run), and what you are seeking in terms of investment.

Business development organizations and Canadian banks have free templates, writing guides, sample plans, and even interactive tools available online. These resources allow you to walk through a plan line by line. You will get a sense of the information you might be asked to provide when you are looking for financing, for example.

While many of these online tools are free, you may choose to purchase software that will help you prepare your plans and forecasts.

Business development organizations

These organizations may provide tools to help their clients prepare professional business plans through their regional offices or via the Web.

- SBC Ontario - What is a Business Plan? Take a free online small business course about various types of business plans and how these might fit your business and intended audience.

- CBDC - Business Plan You can use this fillable business planning tool to prepare your business plan.

- BDC - Business plan template You can create your own professional business plan with the help of the BDC sample plan and business plan template.

- Futurpreneur Canada - Business Plan Writer Are you ready to start your business? You can use this online tool to develop, write, and download your business plan.

- Planning for success: your guide to preparing a business and marketing plan Learn about 9 essential sections of a business plan and what to include in each one.

Canadian banks and lenders

If you approach a bank for help with financing, the bankers will want your business plan to include the specific information they need to make their decision. These requirements may vary from one bank to another, and from one type of business to another. Therefore, if you know which institution(s) you would like to speak with, it's a good idea to see what key sections they would like included.

- Bank of Montreal - Tools and tips for small business owners Find planning resources that can help you start, grow and improve your business.

- RBC Royal Bank - Starting a Business Learn about key sections of a business plan.

- Scotiabank - Business Plan Writer Access an interactive tool to help you create an effective business plan.

- National Bank - My Business Model If you are starting or growing a business, use this business model tool to help with your planning process.

- Farm Credit Canada - Business Plan Tools for Producers Get business plan information specific to farm operations and agriculture businesses.

1-888-576-4444

Contact us by email

Related Topics

- Business plan guide

- Business planning success

Business succession planning

Transition your business with confidence and a clear path to meeting your personal and business goals. Let us show you how.

You’ve worked hard to drive your business to where it is today. With that in mind, it’s never too early to start thinking about and creating a well-rounded transition plan for down the road.

Whether you’re retiring or exiting your business next year or several years from now, we can guide you through your options and opportunities. At RBC Wealth Management, we can help you develop a comprehensive succession plan that positions you, your family and your business for the best possible outcome.

What should your business plan include?

No two situations or businesses are the same, and we understand how planning for a business transition can be complicated, challenging and emotional.

We’re here to help encourage a smooth transition for your business, whether it’s selling or transferring to a family member, a management buyout, a partner or shareholder buyout, or selling to a third party.

Together, we can create your business succession plan, which may include:

- Potential strategies to transition from your business in a tax-effective way.

- Strategies or options to fill any gaps in your existing plans.

- Possible retirement savings solutions for you or your key employees.

- Overall financial and contingency planning to help protect you and your business.

Feel confident about your next chapter

Discover how RBC Wealth Management can set you—and your business—up for success.

Related solutions

Business owner planning.

Move confidently through each stage of your business life cycle with personalized planning—backed by expert insights—to meet your evolving needs.

Estate planning

From yesterday to today to tomorrow, your wealth tells a personal story. We’ll help you align your plans with your wishes and the legacy you envision.

Financial planning

A personalized plan can help make it easier for you to manage your wealth, so you can focus on what’s important to you and your family.

Our insights

The value of having a strategic charitable giving plan in place, federal budget 2024: key measures that may have a direct impact on you, women and wealth: the future is female.

- Life & Money

- Innovation & Perspective

- Inspired Investor

What Business Owners Need to Know: Important Updates in Relief and Support Programs

Rbc small business poll reveals canadians are turning to entrepreneurship for financial security and career autonomy.

- Celebrating Small Business Month: The Stories Behind Today's Successful Entrepreneurs

October is Cyber Awareness Month: Time to Check in On Your Cyber Security

Ask the experts: how to protect your business from fraud and cyber threats in 2023.

- Experts Share What you Need to Know Before you Open a Franchise

- How Business Bankruptcy Can Affect Your Employees

- Fae Pictures Creates Cinematic Content for, By and About Queer, Trans and BIPOC People

- Ask Bryan and Sarah Baeumler Anything: [Exclusive Virtual Event]

- Learn How the Canada Small Business Financing Program Can Help Grow Your Business

Diane Amato November 1, 2021

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share by Email

Throughout the pandemic, government relief programs enabled many businesses to access the cash needed to operate, recover and grow as local economies opened up. As some programs come to an end and others evolve, it’s important to know what’s available as well as the deadlines for application and action.

Government Relief Programs Updates: Q&A with RBC Experts

RBC Business Advisors share valuable tips for business owners to maximize cash flow, manage debt and identify funding opportunities for financial growth.

Canada Emergency Business Account (CEBA)

| CLOSED

The Government of Canada provided the Canada Emergency Business Account (CEBA) to support Canadian businesses adversely affected by COVID-19 through loans up to $60,000. Until January 20, 2022, your RBC loan is funded as a revolving line of credit, after which date the outstanding balance is converted to a term loan. Organizations may qualify for loan forgiveness if stated repayments are made by December 31, 2021. | Revolving line of credit converts to a term loan

– If you repay $40,000 of the $60,000 by this date, loan forgiveness of $20,000 will apply. – If 75% of the maximum balance is paid by this date, loan forgiveness of 25% will apply. Interest begins to apply to any outstanding loan amount The entire loan and all accrued and unpaid interest becomes due and payable |

Q: I’ve received a CEBA loan and I’m ready to repay it. How and when do I pay it back to take advantage of the debt forgiveness part of the program?

A: “Repaying the outstanding balance of your loan (other than the amount available to be forgiven) by December 31, 2022, will result in loan forgiveness,” explains Joanne Ironside, RBC Business Account Manager. Loan forgiveness applies provided that no default under the CEBA loan has occurred. Here are the terms of loan forgiveness explained further:

If you borrowed $40,000 or less , you may be eligible for loan forgiveness of 25 percent of the maximum amount that you borrowed on your loan. For example:

- If you borrowed $40,000 and repay $30,000 by December 31, 2022, $10,000 of the loan will be forgiven and you will not need to repay it.

If you borrowed $60,000, you may be eligible for $20,000 in loan forgiveness. For example:

- If you borrowed $60,000 and repay $40,000 by December 31, 2022, $20,000 of the loan will be forgiven.

Visit RBC’s CEBA page for more details on this program.

The full terms of loan forgiveness can be found on the Government of Canada website .

Q: I’ve received a CEBA loan, and I won’t be paying it back early (I still need access to the full amount). What are my payment terms?

A: “You can access funds from your CEBA loan until January 20, 2022,” says Ironside. “After this date, it converts to a term loan – there is 0% interest charged until December 31, 2022 and no principal payments are required during this time.”

As of January 1, 2023, you will be charged interest on your loan at a rate of 5% per annum which is payable monthly. No principal repayments are required until December 31, 2025 when the entire loan and all accrued and unpaid interest becomes due and payable.

Q: I’ve received a CEBA loan and I’m not ready to repay it, but I don’t need to use it all right now. How can I get the money working hard for me until I need it?

A: “Every business has unique cash flow needs. I recommend speaking with your Account Manager or speak with an RBC Business Advisor ( book appointment online or call 1-800-769-2520) to discuss the options that are best for you and your business,” advises Ironside.

Highly Affected Sectors Credit Availability Program (HASCAP)

| The Highly Affected Sectors Credit Availability Program (HASCAP) was introduced to support Canadian businesses that were negatively impacted by COVID-19. Eligible applicants can access up to $1 million (maximum loan amounts depend on business size) to cover operational cash flow needs. To qualify, your business must have been financially viable prior to March 1, 2020, and be able to show you have sustained at least a 50% year-over-year revenue decline over a three-month period (not necessarily consecutive) within the eight-months before your HASCAP application. Your business will have had to apply for – and have received payments from – either the or the . For businesses that do not qualify for CEWS or CERS, financial statements must reflect at least three months of 50% or more year-over-year revenue decline. For full eligibility criteria, visit the . | HACSAP is available until December 31, 2021, however business owners are encouraged to apply by November 30, 2021 so applications may be processed before this deadline. |

Q: I haven’t applied for HASCAP yet. What should I consider as I apply?

A: “It’s important to keep in mind that the HASCAP loan is a fixed rate loan product, which comes with a penalty should it be repaid early. Careful consideration should be made as to the amount your business requires to effectively operate until regular volumes can be resumed,” explains Ironside.

“It’s also important to note that eligibility is dependent on a 50% year-over-year revenue decrease in any three of the last eight months trailing your application date,” adds Jeffrey Heard, RBC Commercial Account Manager.

If your application is completed in December, for instance, you will be comparing revenue as follows:

April 2021 – November 2021 vs. April 2020 – November 2020

“When figuring out if you are indeed still eligible, you’ll want to consider that you are now dealing with year-over-year monthly comparisons that are no longer in the heart of the shutdown on either end of the comparison,” Heard further explains.

Heard and Ironside also emphasize that HACSAP is formal term debt and should be allocated into a company’s fixed expense projections for the term of the loan. For example, it should be treated how rent, insurance or other fixed expenses would be planned and accounted for.

Q: I received a HASCAP loan earlier this year. How much longer can I defer principal payments?

A: “When your HASCAP loan is approved by your lender, your repayment terms will be determined at that time,” says Ironside. “You can choose to make interest-only payments over the first twelve months and select a repayment term and schedule that meets your needs after that. Loans can be amortized for up to ten years – interest rates are fixed at 4%.”

Status of Other Programs

| The Canada Recovery Hiring Program provides a subsidy on eligible salaries or wages to help hard-hit businesses hire the workers they need to recover and grow. There are two streams under this program: provides wage and rent support to hotels, tour operators, travel agencies and restaurants of up to 75%* supports other businesses that have incurred deep losses with a subsidy rate of up to 50%* | OPEN | The government is proposing to extend the Canada Recovery Hiring Program until May 7, 2022. |

| The Canada Emergency Rent Subsidy (CERS) provided a rent and mortgage subsidy for eligible expenses to qualifying businesses, charities and non-profits. The first phase of CERS ended October 23, 2021, however hard-hit sectors such as hotels and restaurants are eligible to claim up to $300,000 in total eligible expenses as of October 24, 2021. | Phase 1: CLOSED (as of October 23) Phase 2: (for hard-hit sectors): OPEN | The government is proposing targeted support for eligible hard-hit employers until March 13, 2022. |

| The Government of Canada’s Canada Emergency Wage Subsidy (CEWS) provided eligible employers with a subsidy of 75% of employee wages for up to 24 weeks, retroactive from March 15, 2020, to August 29, 2020. | CLOSED (as of October 23, 2021) Phase 2: (for hard-hit sectors): OPEN | The government is proposing targeted support for eligible hard-hit employers until March 13, 2022. From March 13 – May 7, 2022, the subsidy rates will decrease by half. |

| The BDC Co-Lending program is designed to support Canadian businesses of all sizes that have been negatively impacted by COVID-19. Eligible applicants can access funding up to $6.25 million CAD (maximum loan amounts dependent on business size) to cover operating expenses (such as rent, payroll and other operating expenses) and working capital needs. | OPEN | This support is available until December 31, 2021. |

| The BDC Mid-Market Financing Program is designed to help medium-sized Canadian businesses (revenues in the range of $100 million to $500 million) impacted by COVID-19. Eligible applicants can access $12.5 million to $60 million CAD (or USD equivalent) in short-term liquidity to maintain their staff, preserve supply chains and manage cash-flow. | OPEN | This support is available until December 31, 2021. |

| The Export Development Canada (EDC) BCAP Guarantee is designed to help Canadian businesses impacted by COVID-19. Eligible applicants can access up to $6.25 million CAD in short-term liquidity to cover expenses that are critical to business continuity such as rent, payroll and other operational costs. Eligible companies with revenues between $50 million and $300 million can access from $16.75 million to a maximum of $80 million to sustain operations. | OPEN | This support is available until December 31, 2021. |

| The Large Employer Emergency Financing Facility (LEEFF) provides bridge financing to Canada’s largest employers, providing businesses, their workers and suppliers to remain active and positioned for recovery. | OPEN | LEEFF will be open until further notice |

Q: There are several different financing programs available. How do I determine which one I should apply to?

A: “As there are many programs, each with different purposes and eligibility requirements, it’s a good idea to speak with your Account Manager or designated RBC representative. Alternatively, you can book an online appointment to speak with an RBC Business Advisor. They can help you navigate the options and provide guidance on making a decision that’s best for the present and future needs of your business,” says Josh Morawetz, RBC Business Advisor.

Q: What should I do to prepare for a loan application?

A: “Applying for loans in the current environment is slightly different than pre-COVID. Loan approvals are not as black and white as they used to be.” explains Heard. “It’s a good idea to engage in a conversation with your Account Manager early on so they can help you from a strategic planning perspective. Getting as detailed as possible about your prospects and having plans and projections prepared will help with the process,” he explains.

Alternative Funding Options

There are more ways to fund your business beyond government programs, many of which come with additional benefits such as networking and mentorship opportunities. Here are programs that can help you run your business, whether you’re currently recovering, growing or holding steady.

Non-repayable government grants can allow companies to expand, create jobs, advance innovation and launch environmental initiatives. While grants can be game-changers for businesses, the grant landscape is both complex and dynamic.

GrantMatch is an industry leader in securing government funding for organizations. They cut through the confusion and complexity and uncover the financial resources and incentives that best match the needs of your business.

Learn More >

Provincial Programs

In addition to federal government programs, provincial governments have implemented a wide range of initiatives to support local businesses. Visit the Government of Canada website to locate provincial and territorial support.

Futurpreneur

Futurpreneur is the only national, non-profit organization that provides resources, financing and mentoring to aspiring and new entrepreneurs so they can build a successful future.

Supporting young entrepreneurs with an expert business mentor for up to two years and resources to help plan, launch, manage and grow a business, they help turn great ideas into thriving businesses.

RBC Black Entrepreneur Loan Fund

The RBC Black Entrepreneur Loan Fund is available to eligible Black entrepreneurs in Canada who are looking to start, manage or grow their business with access to loans up to $250,000.

In addition, the Black Entrepreneur Program brings together business, marketing and digital experts with community leaders to share ideas and best practices in a concrete effort to advance growth for Black entrepreneurs. Not only does the program provide access to capital, it offers access to experts and support for Black communities across Canada.

Learn more >

Magnet Student Work Placement Program

For businesses looking to grow and take advantage of government subsidies, the Magnet Student Work Placement Program (SWPP) , in partnership with RBC Future Launch, provides businesses up to $7,500 to hire students in a cost-effective way, while supporting youth and diversity employment.

Bringing together “employers, students, and post-secondary school stakeholders to create quality work-integrated learning (WIL) opportunities, the program provides employers with wage subsidies to hire post-secondary students for paid work experiences. Students in turn benefit with quality work experience so they can secure employment in their chosen fields of study.”

1. While some of these options may be available to you and your business, they may increase your interest costs or your outstanding principal balance over the life of your loan or increase the outstanding balance on your credit card during the relief period, if applicable. You should carefully evaluate your financial situation and priorities before exercising any of these options to the extent they are available to you.

2. while information presented here is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. if you have further questions about any of these programs please consult the applicable government websites or, if you are an rbc business client, speak to an rbc advisor by booking an online appointment ..

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Most Recent

Read This Next

September 26, 2023

Celebrating Small Business Month: The Stories Behind Today’s Successful Entrepreneurs

September 21, 2023

September 14, 2023

- Find a Financial Planner

- Call 1-800-463-3863

RBC Financial Planning

How to stay the course with your investment plan.

Follow these proven investing principles to help you stay on track.

Update on Canadian government’s economic response to COVID-19

A summary of the proposed measures that will provide support to Canadian workers and businesses.

A Good Financial Plan Begins With Your Goals and Priorities

Answer two simple questions and we’ll suggest some resources that may interest you.

Attention: 2024 Federal Budget

A summary of key measures that may have a direct impact on you. Click here for pdf

See all the ways a Financial Planner can help

Learn more about Financial Planning

Life Events

Prepare for the big (and little) things in life.

Financial Windfall

Early retirement, turning 65 or 71, loss or hardship, live for today and plan for tomorrow.

Have a plan that balances your competing priorities.

Keep your investment plan on track.

Make a plan for your time and money.

Define your legacy and make your wishes clear.

Financial Planner Locator

We can come to you — home, office or café.

Based on your location, is a Financial Planner near you.

I can speak to you by phone, video or the at nearest RBC Royal Bank Branch. Contact Me

Enter your Details and will be in touch soon!

I understand I am under no obligation and RBC Royal Bank and/or Royal Mutual Funds Inc. (RMFI) will contact me using the information provided only in relation to financial planning. RBC Royal Bank and its affiliates are committed to keeping your personal information confidential. All RBC Royal Bank and RMFI employees are required to maintain the confidentiality of client information at all times.

Thanks for sharing! will be in touch with you soon.

People Like Me

Hear from others about their experiences.

Randy Changed His Lifestyle at 50

Tia Discovered What Matters in Retirement

Libby Saved, Invested and Retired in Style

View Legal Disclaimers Hide Legal Disclaimers

What's on your mind today?

When do you expect to retire?

Saving and planning for Retirement

Your retirement can last 30 years or longer. An RBC Financial Planner can help you design a plan that will be relevant and sustainable for the Next 30 ™ years of your life.

Recommended Topics:

Tools & Calculators:

Retirement can last 30 years or more. Think about how, where and who you want to spend this time with— before you look at the numbers.

Studies show that Canadians working with advisors have more retirement savings than those saving without the advice of an advisor. 1

Early retirement can bring many questions that aren’t always easy to answer. For example, when is the best time to take CPP/QPP? An RBC Financial Planner can help fill in the blanks.

You know that being retired doesn’t mean that retirement planning stops. You still have big decisions to make— such as, should you downsize your home. An RBC Financial Planner can help.

How young are you?

My Retirement Paycheque

These days retirement can last 30 years or more. A well-designed financial plan can help make sure your money lasts for your Next 30 ™ years. Let us show you how.

These days retirement can last 30 years or more. A well-designed financial plan can help make sure your money lasts throughout your retirement. Let us show you how.

Although you are over 71 and can no longer save in an RRSP, you can continue to save with a Tax-Free Savings Account and non-registered investments.

What's your top investing concern right now?

My Investment Portfolio

Investors working with advisors are more likely to invest regularly, save enough for their needs, diversify, and have a financial plan. 2 Discover how an RBC Financial Planner can help you .

Whether the market is up or down, focusing on your long-term investing goals and having a diversified portfolio will help you avoid emotional investing.

Research shows that investors working with advisors are more likely to invest regularly, save enough for their needs, diversify, and have a financial plan. 2

What is your top priority right now?

My Marriage and Finances

Now is the time to ensure you and your spouse are on the same page regarding finances as you’re also tying the financial knot. An RBC Financial Planner can help.

My Marriage, Family and Finances

One of the best ways you can protect your family financially is to make sure you have an estate plan and a valid will in place. An RBC Financial Planner can help you get started.

People who have an advisor are more likely to invest regularly, save enough for their needs, diversify, and have a financial plan. 2 Discover how an RBC Financial Planner can help you and your spouse.

Going through a divorce or losing a spouse can be a challenging time. In addition to seeking professional advice, there are few things you can do to give yourself some peace of mind.

How old are your kids?

Helping My Kids with Post-Secondary Education

Getting a head start on saving for your new baby’s education is a huge gift to your child. Take the time now to make sure your financial plan is in place.

With children to put through school, mortgage payments and saving for retirement, you may have a lot of competing financial priorities. See how an RBC Financial Planner can help.

You may be wrestling with helping your grown kids with their education and saving more for your retirement. An RBC Financial Planner can help you figure it all out.

Do you have a valid Will?

Passing on My Wealth and/or Business

Estate planning is one of the most complex—and overlooked—topics in financial planning. You’ve completed an important first step by having a valid Will in place.

Estate planning is one of the most complex—and overlooked—topics in financial planning. Getting your Will created is one of the first things you will want to take care of.

Estate planning is one of the most complex—and overlooked—topics in financial planning. Whether it’s deciding what to do with your business or the cottage, it’s important to have a plan in place.

Sign-in to:

Use our online services to help you manage your day-to-day activities.

Choose from these sign-in options:

Business Insurance

Business insurance helps protect you, your employees and your business.

Take care of your investment and your future with insurance solutions that can keep your business running.

- E-mail Us to learn how we can help protect your business.

What Are You Interested In?

Business overhead expense.

I want to make sure my business can always pay the bills.

I want to help my business survive the loss of a key employee.

I want to protect my business and family against the loss of an owner.

Have Employees?

Group benefits.

We can help you provide affordable and tailored group benefits to your employees.

Car and Home Insurance for Employees

Help employees save money on insurance.

Protect What You've Put Into Your Business

The Business Loan Insurance Plan can help you keep up with the financial obligations of your business in the event of the unexpected.

Business Travel Insurance

Whether you travel a little or a lot for business, find the coverage that makes sense for you and your company.

Reasons To love RBC Insurance

Reasons to love rbc insurance.

Protect yourself, your family, your employees and your business with a range of business insurance solutions.

We can help protect more than your business, with personal insurance solutions that can cover your home, car, life, health, travel and retirement.

Discover & Learn

View Legal Disclaimers Hide Legal Disclaimers

- Small Business

- English Selected

TD Every Day Business Plans

A cost-effective way to conduct your business banking

Service plan options

| Open account | Open account | Open account | |

Here's what you get

- All Every Day Service Plans include 2 free monthly e-Transfers to send or request money using Interac e-Transfer®

- Capability to send Additional Remittance Details (subject to a fee of $0.50)

- $10 monthly fee rebate 1 on Business Overdraft Protection

- All debit and credit card deposits credited to your account through POS terminals, are non-chargeable transactions and are not subjected to transaction and deposit item limits

Not sure which service plan is right for you?

Try our selector tool

Discover which Service Plan best matches your business needs.

You might also be interested in:

- Business Credit Cards

Choose a TD Business Credit Card with benefits and features that can help you grow and manage your business.

- TD Merchant Solutions

Use TD Merchant Solutions for straightforward advice and payment solutions you can count on to keep pace with your growing practice.

Deposit cheques from your office

TD Remote Deposit Capture and TD Mobile Deposit are fast, easy and convenient ways to deposit cheques 5 .

Open my account

Contact an account manager.

Talk to an Account Manager Small Business (AMSB) to discuss your business needs.

Talk to a Small Business Specialist at our Small Business Advice Centre.

Deposit Insurance

Your deposits may be insurable by the Canada Deposit Insurance Corporation.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan Miles

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Saving and Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- Foreign Currency Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking?

- TD Bank Small Business Banking?

- TD Bank Commercial Banking?

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

1 Included Business Overdraft Protection is available only on Canadian dollar accounts. Subject to complying with TD Canada Trust lending policies and criteria.

2 Your monthly plan fee will be rebated when your daily balance is greater than or equal to the required amount throughout the month.

3 Deposit items are cheques (including cheque image through TD Remote Deposit Capture and TD Mobile Deposit), money orders, drafts and all other clearing items.

4 Cash deposits are paper currency and coins, rounded to the nearest dollar.

5 Subject to eligibility requirements, applicable fees and technology and device capabilities.

Interac is a registered trade-mark of Interac Corp. Used under licence.

IMAGES

VIDEO

COMMENTS

Does the business plan template work for small businesses? Yes! The business plan template in the RBC Business Plan Builder is useful for businesses of any size. ... products or services is expressly given or implied by Royal Bank of Canada or its affiliates. Ownr is an RBC Ventures company. * For sole proprietorship registration "$49 back ...

Create an executive summary. Describe the current business environment. Outline your marketing and pricing strategies. Describe how your business will operate. Detail your financing and cash flow needs. Describe your team (even if it's just you) Identify risks and how you'll protect your business. Write a conclusion.

A well-thought-out business plan explains to others your vision for the business, the gap in the market your business will fill and the steps you will take to succeed. ... Canada Small Business Financing Loan. ... ("BDA") within 60 days ("Application Criteria"). Royal Bank of Canada (not Ownr or RBC Ventures Inc.) will in its discretion make ...

When business is anything but usual, we're here to help. The RBC Small Business Navigator provides practical resources, money saving offers, stories from small businesses and financial advice, so you feel confident choosing the path that's right for your business. Offers, resources and advice are always being updated.

RBC Avion Visa Infinite Business. Get started today with 35,000 welcome points upon approval. Make the most of your business spending with the RBC Avion Visa Infinite Business card - a card designed to reward passionate business owners like you.

Product Solutions. A business plan will map out the vision for your business, help you execute on your goals and set you up for success - today and tomorrow. Learn how to write a business plan that clearly defines your objectives and goals and then how you will realize them.

Accounts for Small Businesses and Corporations. Find the business chequing, savings, foreign currency, cross-border and other accounts you need to reach your goals and run your business.

Enjoy these features with RBC Online Banking 1 for Business: You can view and track expenses and payments. Enjoy the convenience of setting up recurring payments to employees or vendors, or make a one-time Interac e-Transfer. Instantly access and view current and past business transaction information, including up to 7 years of transaction history.

4. Draw a Line in the Sand. Once you're a business owner, you'll find that mixing business finances with personal ones may complicate things. By separating your business and personal finances from the get-go, you may be in a better position to track your P&Ls, manage your taxes, and keep an eye on your cash flow and spending.

Tell us a bit about your business needs and we'll provide you with advice and insights that will help your business succeed.

One key element to a successful business is a solid business plan, says Allison Marshall, vice president of high-net-worth planning services and financial advisory support at RBC Wealth Management in Toronto. "Many entrepreneurs have big ideas about how to approach their business, but don't write it down," Marshall says.

1. Streamline relief programs. As we shift to a recovery, the government has an opportunity to refresh and streamline its business relief programs. Most immediately, those options could include: offering a brief tax holiday for small businesses to spur the recovery of local shopping and tourism. 2.

Business owners and entrepreneurs. Who we help. Your business started with a purpose—let us help you focus on it. We understand the complexities of business ownership and can support you through every stage. We'll work together to define your goals and help your business thrive.

Business development organizations and Canadian banks have free templates, writing guides, sample plans, and even interactive tools available online. These resources allow you to walk through a plan line by line. You will get a sense of the information you might be asked to provide when you are looking for financing, for example.

Business Checking Minimum deposit to open account $1,000.00 Monthly maintenance fee: Business Checking (includes Remote Deposit Business*) Business Checking (includes Remote Deposit Business and U.S. Business ACH Origination) $150.00 $175.00 Account setup fee (per service): Remote Deposit Business (includes 2 tokens)

Together, we can create your business succession plan, which may include: Potential strategies to transition from your business in a tax-effective way. Strategies or options to fill any gaps in your existing plans. Possible retirement savings solutions for you or your key employees. Overall financial and contingency planning to help protect you ...

Unfortunately, they don't have a chequing account - which would've been nice since all their chequing accounts are no fee. The Tangerine Business Savings Account can get you up to 2.95% interest on your deposits, with the following tiers: $0 - $99,999.99: 2.35%. $100,000.00 - $499,999.99: 2.45%.

The Government of Canada provided the Canada Emergency Business Account (CEBA) to support Canadian businesses adversely affected by COVID-19 through loans up to $60,000. Until January 20, 2022, your RBC loan is funded as a revolving line of credit, after which date the outstanding balance is converted to a term loan.

RBC Financial Planning is a business name used by Royal Mutual Funds Inc. (RMFI). Financial planning services and investment advice are provided by RMFI. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated.

Small businesses with sufficient cash flow to fund the IPP . Individual Pension Plans (IPPs) ... If so, you may want to consider an Individual Pension Plan (or IPP). An IPP is a defined benefit pension plan your company can set up for you. ... a business segment of Royal Bank of Canada. *Member - Canadian Investor Protection Fund.

Reasons to love RBC Insurance. Call 1-877-917-6925 or request details today on the business insurance solutions offered by RBC Insurance.

All Every Day Service Plans include 2 free monthly e-Transfers to send or request money using Interac e-Transfer®. Capability to send Additional Remittance Details (subject to a fee of $0.50) $10 monthly fee rebate 1 on Business Overdraft Protection. All debit and credit card deposits credited to your account through POS terminals, are non ...

2. Show More. Emery Evans. #28 in Global Rating. 44 Customer reviews. Learn How to Order. 4248. Royal Bank Of Canada Small Business Plan -.