Have an account?

Business Plan Math - Reading Quiz

11th - 12th grade.

10 questions

Introducing new Paper mode

No student devices needed. Know more

What is the term used for a 3-5 year forecast of your income and expenses?

Financial model

Profits and losses

Spreadsheet

What is an example of a monthly, recurring expense?

Lease down payment

What is the type of pricing determined largely by what other companies in your industry are charging?

Competitors' pricing

Value-based pricing

Simple pricing

Cost-plus pricing

What is the rate at which the business grows or increases revenue from sales?

Profit margin

Monthly profit

Growth percentage

Examples of direct costs are:

Utilities and rent

Labor and material costs

Pricing your product based how a customer perceives the product is called:

Sales revenue is calculated by:

Number of sales multiplied by average customer sale dollar amount

Sales price multiplied by cost of goods sold

Number of sales multiplied by cost of goods sold

True or False: Net profit is greater than gross profit.

Starting a company in which you only spend money that is absolutely necessary at each point in time is called a:

Lean startup

Sole proprietor

Growth startup

What is the description of each axis on a breakeven chart?

Profit and volume

Sales and expenses

Direct costs and indirect costs

Explore all questions with a free account

Continue with email

Continue with phone

Total Instructional Time

The instructional time for ACCOUNTING ranges from 11 hours (simulation exercises only) to 22 hours (simulation exercises, reading assignments , reading quizzes, and math quizzes) . You can configure your course to include or exclude reading assignments (3.7 hours) , reading quizzes (1.8 hours) and math quizzes (5.5 hours) . For instructions on how to configure your course, click here to access a series of videos to help you get your classroom up and running with Virtual Business.

Prior to beginning work with ACCOUNTING , students should sign in to their account at vb.KnowledgeMatters.com and go through the Tutorial.

Lesson: T-Accounts, Debits & Credits

Description.

In this lesson, students explore the application of debits and credits to accounts in their business. They use T-accounts to learn about normal balances in asset, liability, and owner’s equity accounts. Students start by examining source documents such as customer invoices. Then they match transactions to appropriate accounts and decide whether to debit or credit the accounts. Students also review copies of paid checks and decide how to enter those transactions. Finally, students run their business forward in time, generating new source documents. They enter those transactions in T-accounts and receive dynamic feedback as cells turn red or green depending on the correctness of entries.

LEARNING OBJECTIVES

- Understand the accounting equation

- Understand the concept and use of T-accounts

- Identify asset, liability, and owner’s equity accounts

- Identify normal balances in a variety of accounts

- Analyze source documents

- Assign transactions to accounts

- Correctly debit or credit accounts for normal business transactions

Lesson: Using a General Journal

In this lesson, students learn that a journal is a sequential recording of all transactions in a business. They next explore the format of a journal with its corresponding debit and credit entries. Students learn how journal entries are tied back to source documents through entries in the journal. Students then move on to reviewing source documents, such as invoices for sales on account and purchases of parts that will be placed in inventory. They learn how to properly enter journal transactions for these somewhat more complex transactions. Students then run the simulation forward for a week and can turn on the Animate Transaction option, which shows transactions flying out of the business in the journal. The final day of transactions is not journaled, and students finish by making correct entries for that day. As in the previous lesson, they receive visual (red/green) feedback as they make their entries.

- Understand the role of the journal versus T accounts

- Understand the business meaning of different transactions in the journal

- Tie journal transactions to source documents

- Enter correct transactions for sales on account

- Enter correct transactions for purchases of inventory parts

- Correctly enter a day’s worth of transactions

Lesson: The General Ledger

In this lesson, students learn the role of the general ledger in grouping transactions by account and maintaining a running balance of each account. They begin by examining the chart of accounts for their business. They select their sales account and learn the difference between temporary accounts and permanent accounts. Students identify both ending balances and balances at specific points in time. Students then learn how account numbers tie postings from the general journal to the general ledger. Next, students review a bank statement and their cash account balance to prove cash. Finally, students notice that while their cash balance oscillates up and down, there is a steady decline in cash over time. Instructions point them to the business cause of the decline, and they take action to reverse the decline and return their cash balance to a specific goal amount.

- Understand what a chart of accounts is

- Understand how a general ledger differs from a journal and why it is valuable

- Use a general ledger to maintain running balances in accounts

- Identify how journal postings are tied to the general ledger

- Prove cash by comparing a bank statement to a cash account in the general ledger

- Identify a business issue through analysis of general ledger accounts

- Solve a business problem and see the results of action through general ledger accounts

Lesson: Worksheet & the Accounting Cycle

In this lesson, students learn how a worksheet organizes account balances from the general ledger into meaningful business data. They begin by looking at how balance sheet accounts and income statement accounts are grouped into a trial balance column and how debits and credits must add to a balance at the bottom of the worksheet. They then explore the role of adjusting entries in recognizing expenses such as insurance costs and part used during the accounting period. Next, they bring account balances from income statement accounts together with adjusting entries to get an adjusted trial balance and compute net income. The net income is applied correctly to balance sheet accounts to give a final, equal balance of assets and liabilities plus owner's equity. Finally, students run forward in time for one month and then complete the worksheet for the next month. As in previous lessons, they get visual feedback as correct entries turn green and incorrect entries turn red.

- Understand the role of the worksheet in organizing account balances for business decisions

- Explain the concepts of trial balance, adjusting entries, and adjusted trial balance

- Compute net income from a worksheet

- Apply net income (or loss) correctly to keep the balance sheet in balance

- Complete a partially completed monthly worksheet

Lesson: Analyzing Financial Statements

After working through the complexities of the worksheet, students learn how financial statements simplify balance sheet and income statement information for managers and the public. They also look at how financial statements typically show figures over multiple time periods to help in the identification of trends. Students identify important line items on the balance sheet and income statement to expose a trend. Students learn that financial statements can often be compared across companies and look at the financial statements of another company in the same industry. Based on this, they find an expense that is too high for their company. Finally, students are challenged to reduce this expense to achieve a profitability goal, without reducing it so far that they negatively impact revenue.

- Understand how financial statements are different from worksheets

- Understand the role of financial statements in communicating with the public

- Be able to identify trends from financial statements

- Distinguish between items found on a balance sheet and an income statement

- Compare financial statements across businesses in the same industry

- Make decisions, based on financial statement information, to improve the performance of a business

Lesson: Managerial Accounting I

In this lesson, students take on the role of a financial consultant brought in to help a struggling business. They dig deep into the business by learning how the details in source documents can be combined with summary information in accounting documents to make more-informed decisions. They begin by reviewing a worksheet for the last month and discovering a net loss. Transaction data shows that the business is making a lot of sales. By analyzing time sheets and pay records, they discover that the business owners have mispriced a number of services and are losing money on them. Finally, students are charged to set more appropriate prices and restore the business to profitability.

- Read a worksheet for actionable information

- Analyze time sheets

- Read and extract information from pay records

- Use math to combine source information and estimate service-level profitability

- Make decisions about pricing based on overall accounting information and source document details

Lesson: Managerial Accounting II

In this lesson, students again take on the role of an accounting advisor to a company. They are brought in by a company in a very busy city that has tremendous potential but is underperforming. They review the income statement and discover lower-than-expected revenue. By exploring individual expenses on the income statement, they find that wage expenses are well below estimates of similar companies in the area. They then look at source documents to assess the output of employees and conclude that low wages may be leading to less-skilled employees who take longer to complete jobs. They raise wages to attract more-skilled employees, and output increases substantially. Finally, students are challenged to meet a profit goal by adjusting all wages at the business.

- Read an income statement to assess business performance

- Understand individual income statement line items and their meanings

- Use source documents to assess productivity

- Create hypotheses of why performance is suboptimal and how it could be fixed

- Test hypotheses

- Use test results to improve a business

Lesson: Ratio Analysis

In this lesson, students are introduced to the concept of ratio analysis. They learn that the relationship between two numbers can often tell you more than either of the numbers by themselves. They begin by taking a look at several liquidity ratios. They classify their assets and liabilities as current versus long-term and compute their current ratio. They also compute the more stringent quick ratio. Students then turn to the balance sheet and look at return on sales. They discover that their return on sales is low because of an expense ratio that is unusually high. Finally, students are challenged to reduce the high expense to meet a return on sales goal.

- Explain what ratio analysis is

- Give examples of liquidity ratios and explain how to compute them

- Explain and compute return on sales

- Evaluate what a good ratio is for the above examples

- Use information from ratio analysis to improve business performance

Lesson: Forensic Accounting Challenge I

Note: The description of the three Forensic Accounting lessons is the same and is a general description. Exact details (answers) are not given, because these descriptions are publicly available and students could use them as a cheat.

In the three forensic accounting lessons, students are introduced to the concepts of errors and fraud in a business. In each lesson, they are challenged to find two instances of gross error or fraud at an operating business. They can run time forward and observe the business operating. Students can adjust the speed down to watch details or up to produce more time periods of accounting information. Types of problems that students may encounter include employee theft, improper withdrawals, inappropriate accounting entries, unauthorized payments, and so on. Students use visual observation, review of accounting documents, and review of source documents to discover the problems. Each of the three lessons includes different improprieties for students to find.

- Understand the role of forensic accounting

- Identify the types of fraud and errors that a business may encounter

- Use visual observation to uncover fraud

- Review accounting documents for errors or inappropriate entries

- Review source documents for conflicts

- Find specific instances of fraud or accounting errors in a business

Lesson: Forensic Accounting Challenge II

Note: The description of the three Forensic Accounting lessons is the same and is a general description. Exact details (answers) are not given, because these descriptions are publicly availability, and students could use them as a cheat.

Lesson: Forensic Accounting Challenge III

Lesson: run your own business - unique city per class.

In this lesson, students have full control of their computer repair business. They can change prices, wages, layout, and advertising levels. They have access to T-account information, a general journal, general ledger, worksheets, income statements, and balance sheets. In addition, they have access to time sheets, pay records, bank statements, customer invoices, and paid checks. They can also see comments from customers. Students are challenged to reach a specific profit goal. By default, this project is set up as a competition so students in the class can see the scores of other students. This can be turned off by the instructor. When students reach the goal, they can elect to continue for competitive purposes.

- Use accounting information to identify business issues and correct them

- Use source documents to dig deep, allowing further optimization of the business

- Measure results and react based on accounting documents

- Make decisions about pricing, wages, spending, and physical plant based on financial information

- Understand the competitive nature of business and the profit motive

Lesson: Multiplayer Competition

In this project, students go head-to-head in competition. Students each run a computer repair business that they get to name. Students’ business choices affect whether customers choose to go to their business or to a competitor. A weekly graph of market share gives students quick feedback on how they are doing competitively. All competing students’ profits are displayed on a scoreboard within the simulation. The scoreboard updates in real time with new players appearing as they join the session.

- Understand the fluid, competitive nature of business

- Respond dynamically to challenges brought on by other competitors

- Effectively compete in a realistic business setting and achieve a profit

- React to surprises and have contingency plans in place

- High School

- News & Events

- Support Home

- Privacy Policy

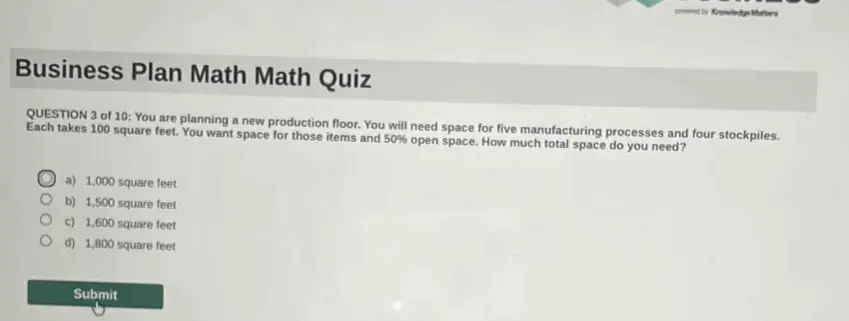

= Knowledge Matters Business Plan Math Math Quiz QUESTION 3 of 10: You are planning a new production floor. You will need space for five manufacturing processes and four stockpiles. Each takes 100 square feet. You want space for those items and 50% open space. How much total space do you need? a) 1,000 square feet b) 1,500 square feet c) 1,600 square feet d) 1,800 square feet Submit

Gauth ai solution.

IMAGES

VIDEO

COMMENTS

Knowledge Matters Simulation - Place - Math Quiz. The terms of a percentage lease state that rent is 4% of sales up to $100,000 and 2.5% of sales over $100,000. Your business plan projects monthly sales to average $270,000 per month. There is a $250 per month maintenance fee.

Business Plan Math - Math Quiz. 1. Multiple Choice. Production space in a building costs $22 per sq ft per year. You are looking at leasing a space that is 345 ft x 123 ft.

1) Define objective. 2) Determine strategy to gain and keep customer. 3) Implement through tactics (sp actions) Marketing Plan Example: Objective: to be perceived as the restaurant of choice. Strategy: to give customers a better value. Tactics (flow from strategy) -Have table ready for reservations.

Financial statements are the road map to your business and can spell the difference between failure and success. The two most important statements are your income statement (P&L) and your balance sheet. Statement showing your revenue (sales) and expenses for a given period of time. It is often useful to look at expenses and margins on your P&L ...

Knowledge Matters is a leading publisher of software-based simulations for education. Our business, marketing, and financial literacy simulation software has been used by over a million students in over 5000 schools. ... Lesson: Financing & Business Planning. DESCRIPTION. ... Math Quiz: 0 minutes (optional) Simulation Exercise: 240 minutes ...

virtual business business math plan. Flashcards; Learn; Test; Match; Q-Chat; Flashcards; Learn; Test; Match; ... Business quiz 1. 7 terms. mary7_m. Preview. Terms in this set (15) ... Budget. A document outlining your monthly expenses. Direct costs. Costs that include labor and materials. Financial model. A 3-5 year forecast of your income and ...

Knowledge Matters' Virtual Business simulations support Common Core and state standards, and can be used to teach STEM concepts. ... All Virtual Business sims include over 50 pages of written content as well as reading and math quizzes.Math concepts include numbers and quantity, algebra, geometry, functions, probability and statistics, and ...

savings: Money that is not spent. surplus: The amount of money remaining after all expenses have been met. take-home pay: Money received after all adjustments and deductions are made. unexpected expense: An unforeseen cost. Key terms Learn with flashcards, games, and more — for free.

Finance and Business Mathematics Quiz 1. Compounding. Click the card to flip 👆. keeping an increase (return) on your initial principal "invested" rather than taking it out and using it. A way to more quickly increase your investment over time. Click the card to flip 👆.

Immersive simulation experiences to teach high school business, marketing, and personal finance. Nine different simulaton curriculum packages can be seamlessly integrated into your existing curriculum and lesson plans (available individually or together via Virtual Business All-Access licensing). Collaboration Simulations will help you teach ...

Business Plan Math - Reading Quiz quiz for 11th grade students. Find other quizzes for Business and more on Quizizz for free! ... Financial model . Profits and losses. Spreadsheet. 2. Multiple Choice. Edit. 2 minutes. 1 pt. What is an example of a monthly, recurring expense? Signage. Utilities .

The instructional time for MANAGEMENT ranges from 24 hours (simulation exercises only) to 34 hours (simulation exercises, reading assignments , reading quizzes, and math quizzes) . You can configure your course to include or exclude reading assignments (3.3 hours), reading quizzes (1.7 hours) and math quizzes (5 hours) .

This simulation requires a browser that supports the HTML5 <canvas> feature. Zoom in. Zoom. Zoom out. Overlay menu. Current Business:

credit card. a plastic card used to make purchases now and pay for them later. creditor. any bank or business that extends credit to others; a lender. debit card. a plastic card that can be used to instantly deduct funds from your checking account. debtor. anyone who owes money; a borrower. finance charge.

MANAGEMENT. Virtual Business - Management gives your students the chance to be the boss of their own company. With this online simulation, students begin by managing a small facility and controlling limited factors. As they develop their business knowledge, they can lease as much space as they want and grow into manufacturing giants.

Finance Test Questions. 1. The concept of present value relates to the idea that *. The discount rate is always higher when you invest now than in the future. The discount rate is always higher when you invest in the future than now. The money you have now is worth less today than an identical amount you would receive in the future.

Knowledge Matters is a leading publisher of software-based simulations for education. Our business, marketing, and financial literacy simulation software has been used by over a million students in over 5000 schools. ... reading assignments , reading quizzes, and math quizzes). You can configure your course to include or exclude reading ...

Total Instructional Time. The instructional time for PERSONAL FINANCE ranges from 13 hours (simulation exercises only) to 31 hours (simulation exercises, reading assignments , reading quizzes, and math quizzes) . You can configure your course to include or exclude reading assignments (6 hours), reading quizzes (3 hours) and math quizzes (9 hours) .

Virtual Business - Retailing is our bestselling sim of all-time. Teenagers love to shop, and this online simulation teaches students the business basics and exposes the secrets of retailing. Students learn the tough business decisions that impact their common shopping experiences - why stores are located where they are, how stores decide to ...

Knowledge Matters is a leading publisher of software-based simulations for education. Our business, marketing, and financial literacy simulation software has been used by over a million students in over 5000 schools. ... (simulation exercises, reading assignments , reading quizzes, and math quizzes). You can configure your course to include or ...

Maureen Ginley, General Manager of Knowledge Matters & The Knowledge Matters Team Shark project—Students sharpen their presentation skills as they pitch their business to classmates and seek investments. Business plan project—Teachers award students a loan based on their written business plan. + Spotting the Opportunity + Market Research

= Knowledge Matters Business Plan Math Math Quiz QUESTION 3 of 10: You are planning a new production floor. You will need space for five manufacturing processes and four stockpiles. Each takes 100 square feet. You want space for those items and 50% open space. How much total space do you need?

Business plan project—Teachers award students a loan based on their written business plan. Mega-mogul project—Grow your business empire (including starting/owning more than one business). Random setups—Every project has unique parameters, so students cannot copy solutions from a classmate. Dynamic cities—Students can watch as cities grow