Sample Personal Statement Accounting and Finance

by Talha Omer, MBA, M.Eng., Harvard & Cornell Grad

In personal statement samples by field.

The following personal statement is written by an applicant who got accepted to several top accounting and finance programs. Variations of this PS got accepted at the University of Michigan, Vanderbilt, and Indiana University. Read this personal statement to understand what a top essay in Accounting and Finance should look like.

Example Personal Statement Accounting and Finance

I have never made popular choices, whether academic or professional. Where high academic achievement irrefutably means pursuing a career in Medicine or STEM, I opted for a career in management. I was free to choose a path for myself, owing to my performance during an extensive pre-induction professional training program. Fortunately, I picked a path that everyone believed was insignificant.

My decision to move to a new city to pursue my path did not receive encouragement. Making my own decisions has given me the freedom to dream and make it a reality. It has strengthened my belief that I am the only one who can bring a difference for myself and those around me. Brazil’s institutions may seem frozen, yet, at the grassroots, Brazil is in perpetual motion with ceaseless creativity. To accelerate this motion, we need to bring better and more affordable solutions; I plan to do that.

Growing up in Brazil, I have constantly questioned why we are still not growing economically despite having abundant resources. I frequently discussed the economic factors affecting us with my father, leading me to work at local NGOs and attend voluntary programs. My interest intensified when I discovered during these experiences that the unequal distribution of resources was a major cause of our economic constriction.

Moreover, our medical, engineering and academic professionals would not work in rural areas due to a lack of facilities, further debilitating the imbalance. It made me realize that we could only reap the benefits of our efforts if there were a proportionate distribution of resources. Realizing how effective mobilization of resources can aid in eradicating social ills, I developed an interest in management. This equipped me with technical knowledge and provided room for opinion building.

Pursuing this path, I joined the leading undergraduate institution in the country. The zeal with which I made this decision led me to graduate summa cum laude. While studying, I taught communication skills to undergraduate business students from rural areas. Meeting these students compelled me to get involved even though I lacked formal teaching training. Through empathy and friendly get-togethers, I was able to help these students conveniently traverse in English. With this experience, I understood that my time and energy had been well spent and that as an agent of change, one does not necessarily need to be exceptional; instead, one requires creativity, patience, and emotional intelligence.

After graduation, I followed through with my goal of facilitating change by joining the banking sector as an accounting and finance trainee. By working in Brazil’s most vital financial sector, I was exposed to diversified experiences, from being as simple as issuing customer chequebooks to designing accounting and credit proposals to the tune of USD 1.2 billion. Furthermore, while working on individual projects, I developed an in-depth understanding of international accounting rules that regulated trade transactions; the learning opportunities were immense.

Two and a half years of experience in the finance sector brought me to work for the country’s central bank. The anxiety that accompanied moving away from home for the first time was overwhelmed by my professional and personal growth. Nine months of extensive training and on-the-job assignments exposed me to interminable learning opportunities. However, my real gain has been in the form of self-improvement and growth that accompanied my first experience living independently. Leaving the protective living that I enjoyed with my family is challenging, but it has developed and strengthened my capabilities of taking and owning my decisions. Above all, knowing that my family is not always around to guide me has instilled in me a greater sense of responsibility.

During the two a half years of experience in accounting and finance, I observed the financial exclusion experienced by some important yet financially constrained sectors of the economy. This exposure motivated me to join the Development Finance Department upon my appointment to the country’s central bank. Moreover, most of the firms operating in any country of the world are either small or medium enterprises. Thus, providing an enabling environment to such enterprises is significant for economic growth and employment generation.

In Brazil also, 90 percent of the enterprises are small and medium-sized, and lack of access to formal sources of finance is a significant impediment to these enterprises’ growth. Therefore, a huge room for improvement is available concerning the development of policy framework and market infrastructure for the financial inclusion of this sector. As a part of the central bank, I have been allowed to intervene in a system that is not effectively performing its role of financial intermediation. Innovation in financial products, development of accounting and risk mitigation strategies are requirements to alleviate this segment’s financial exclusion.

By broadening my exposure and enhancing my knowledge, I aim to equip myself better to address the shortcomings of one of the critical segments of the economy.

WANT MORE AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Outstanding Examples of Personal Statements

- The Ultimate Guide to Writing a Winning Personal Statement

- Common Pitfalls to Avoid in Your Personal Statement

- Writing a Killer Opening Paragraph for Your Personal Statement

- Ideal Length for a Graduate School Personal Statement

- 100 Inspiring Quotes to Jumpstart Your Personal Statement

Sample Personal Statement for Masters in International Business

Sample Personal Statement for Masters in International Business My journey began amidst the kaleidoscope of Qatar's landscapes, setting the stage for a life attuned to cultural nuances. Transitioning to Riyadh in my teens, I absorbed a mosaic of traditions, sparking a...

Sample Personal Statement for Family Medicine Residency

Personal Statement Prompt: A personal letter is required. We are looking for mature, enthusiastic physicians who bring with them a broad range of life experiences, are committed to providing excellent patient care, and can embrace the depth and breadth of experiences...

[2024] 4 Law School Personal Statement Examples from Top Programs

In this article, I will discuss 4 law school personal statement samples. These statements have been written by successful applicants who gained admission to prestigious US Law schools like Yale, Harvard, and Stanford. The purpose of these examples is to demonstrate...

Sample Personal Statement Cybersecurity

In this article, I will be providing a sample grad school personal statement in the field of cybersecurity. This sample was written by an applicant who got admitted into George Mason, Northeastern and Arizona State University. This example aims to show how prospective...

100+ Grad School Personal Statement Examples

Introduction Importance of a Strong Personal Statement A personal statement is essential in the graduate school application process, as it plays a significant role in shaping the admissions committee's perception of you. In fact, a survey conducted by the Council of...

WANT AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Personal Statement Templates

Call us : +88 (0) 1712969390, +44 (0) 7495942849, +44 (0) 7459725824

Sign in | Sign up

Personal Statement of Purpose Finance and Accounting MSc

- Sample personal statement

28 July, 2022

Personal statement of purpose finance and accounting msc share.

- 12 May, 2013

With my deep interest, I want to pursue the course Finance and Accounting MSc at the University of Brighton because this course has access to modern computing facilities and specialist computing packages. And this course will provide me with the skills to make these investment decisions across various business areas. This degree will give me develop an in-depth knowledge of financial theory and practice, research methods, financial markets, financial accounting and management accounting. Moreover, I found this Finance and Accounting MSc will help me to specialise and meet the growing demand for finance professionals with strong research skills. I can also progress with or continue by studying for a Ph.D. I want to develop my career in this sector and the accounting and financial services sectors require a high level of understanding of theory and practice. And this MSc course can make me professional. I believe that this course will help me become professional and proficient in my future career.

Following my Intermediate and Secondary education from the Business Studies group, I completed my Bachelor’s degree major in Accounting in February 2022 from National University, Gazipur, Bangladesh. In my home country, there are many open places to develop a career in accountancy but they require a professional applicant. From this MSc course, I can meet the growing demand for finance professionals with strong research skills. So, I decided to complete my further higher studies by choosing this Finance and Accounting MSc at the University of Brighton. While studying, I was involved in various co- curricular activities to enrich my knowledge and skills. Attended and organized different types of seminars and workshops, participated in different voluntary services and activities, and actively participated. From my last education qualification, I have realized that I need to gain knowledge about business accounting and finance part as well as I want to grow my career in this area. I also have my English language concern and I attend a UKVI IELTS test where my overall band score is 6.0. I think I should gain more knowledge in the field so I decided to continue my further studies with this course. I am confident that my professional goal makes me a suitable candidate for the course.

By reviewing the university website, I have seen the course Finance and Accounting MSc at the University of Brighton is ideal preparation for continuing my studies at MPhil or Ph.D. level, also I will be able to work as a professional researcher in finance. The course will prepare me for a specific level of accounting and financial roles, accountancy firms, consultancies and finance departments in the private and public sectors. Studying in a simulated business environment will teach me to explore business practices from regulatory and risk management issues to how financial markets operate and what makes them crash. This course has been designed to help me develop the necessary skills to solve the financial accounting standards, complex business problems in recent facing situations. Modules on the course involve both taught sessions and guided independent study. The core module units include Economics of Financial Markets, Financial Theory and Practice, Research Methods for Finance and Economics, Dissertation or Work Placement Project. Mandatory specialism modules are- Contemporary Issues in Accounting, International Investment and Trading, Economics of Money, Interest Rates, Banking and Financial Institutions. Completion of my dissertation will teach me the undertake research leading to practicable recommendations based on sound analysis and judgment. All of these modules will help me to broaden my knowledge of accountancy understanding in an international context which will prepare me for my employment in an increasingly internationalized business world. Hopefully, I have been able to clear the purpose of my admission to the university. Moreover, during times of crisis, accountancy is seen as a stable profession. By completing this course, I will be able to work with reputed organisations in my home country ranging from accountancy, banking, financial management, and management consultancy. So, I believe this course will be the right choice for my career plans and objectives.

UK’s academic reputation is globally renowned and it is known that having a graduate degree from a UK university will definitely propel one’s career to a significant level. However, the study environment in my country follows the theoretical system of education which is quite different and no soft skills are acquired. The UK maintains a quality management system with high standards in all fields. In recent years, all companies in Bangladesh are emphasizing hiring of Bangladeshi graduates with degrees from abroad, as they see the transferrable skills carried forward from the international education will play a key role in transforming their approach to the business and believe these graduates are capable of doing so. The transferable skills from the UK are key to advancing graduates through organizational growth and gaining a competitive advantage. This reason attracted me to pursue a degree in the UK. A recent survey of International Graduation Results in 2019 produced by iGraduate by Universities UK International shows that 82% of international graduates say their UK degree is valuable for financial investment and a similar number of graduates say they are satisfied or very satisfied with their careers. About 83% think a UK degree has helped them get a job. These aspects have driven my ambition to get a degree from a UK institution.

University of Brighton is one of the re-known top universities in the UK. As my study destination is the UK and I wish to study at the University of Brighton, because it offers an experience that goes way beyond the classroom. Their core values are part of a dynamic, diverse and creative community that embraces partnership working and that makes a positive difference to society. From there, I will be able to gain real-world knowledge and transferable skills that employers look for in graduate recruits. And by the time I graduate, I’ll feel confident and fully prepared to start my career anywhere in the world. The university won a Silver Award in Teaching Excellence Framework, which means that the learning environment and the teaching I will receive are consistently better than the national requirements for UK Higher Education. The university has around 18,000 students and 2,400 staff studying and working at four campuses in Brighton and Eastbourne. Also, according to Destination Leavers from Higher Education 2017-2018, 94% of University of Brighton graduates get engaged in work or further study within the first 6 months. I will also be able to make connections with local, national and international companies, as the university has links with over 1800 businesses, including Fujitsu, BT, Sky, Boots, IBM, and the NHS, while the university educates professionals from 90% of FTSE 100 companies. The university puts students on a fast track that is designed to get a postgraduate degree into faster employment with excellent career opportunities. Moreover, the University brings the workplace into classrooms so it will be beneficial for me to attain my personal career objectives by practicing in this type of learning environment. I am looking forward to studying and wish to experience all the opportunities the University of Brighton has to offer.

Find more resources

- Invitation letter for standard visit visa application

- MSc Management with Finance

- MSc Management and International Business

- Personal Statement of Purpose BSc Pharmacology

- Personal Statement - MSc Healthcare Leadership

Read similar resources

BA (Hons) Business Management (Final Year)

Business success requires a breadth of knowledge and abilities of efficient management to survive in fierce global co...

BA (Hons) Business and Marketing

Modern business is a dynamic environment in which customer wants and needs constantly change at an ever-faster pace. ...

Association of Chartered Certified Accountants

Following my MSc in Financial Management qualification in 2012, I have been in constant search for a real career for ...

Are you looking to study abroad?

Touch your dream with University Admission Expert

- Offering 15,000+ courses at 100+ study locations

- Maintaining 99% visa success rate

- Serving with 14+ years accumulative admission experience

- Providing end-to-end services, almost 24/7

Newsletter Subscription

Keep up to date with the latest news on UK student visa, courses, universities, scholarships, start dates, study guides etc.

Post Comment

404 Not found

Financial Management Personal Statement Examples

- 1 Personal Statement Example Links

- 2 Career Opportunities

- 3 UK Admission Requirements

- 4 UK Earnings Potential For Financial Managers

- 5 Similar Courses in UK

- 6 UK Curriculum

- 7 Alumni Network

Personal Statement Example Links

- Personal Statement Example 1

- Personal Statement Example 2

- Personal Statement Example 3

- Personal Statement Example 4

- Personal Statement Example 5

- Personal Statement Example 6

Ever been captivated by the idea of managing funds, optimising investments, and maximising financial growth? Intrigued by the prospect of shaping financial strategies and decision-making processes for businesses?

If so, a degree in Financial Management could be your ideal journey. This dynamic field equips you with the knowledge and skills to navigate the complexities of financial markets, ensuring the financial health and sustainability of an organisation.

Financial Management is a field of study that focuses on the management of money and other financial resources. It is a broad field that encompasses a variety of topics, including investments, banking, insurance, taxation, and more. Financial management is a critical component of any business, and those who pursue a degree in this field will be prepared to take on a variety of roles in the financial industry.

When writing a personal statement for a Financial Management degree, it is important to emphasize your interest in the field and your aptitude for the subject. You should also highlight your relevant skills and experiences, such as any internships or volunteer work in the financial sector. Additionally, you should explain why you are passionate about the field and why you think you would make a great addition to the program.

Career Opportunities

A degree in Financial Management can open up a wide range of career opportunities. Graduates can pursue a variety of roles in the finance industry, such as financial analyst, financial planner, investment banker, and portfolio manager. Other roles in the finance industry include risk management, compliance, and auditing.

Graduates can also pursue a career in banking, such as a loan officer, credit analyst, or bank manager. They may also pursue a career in insurance, such as an insurance underwriter, claims adjuster, or risk analyst.

Those with a degree in Financial Management can also pursue a career in accounting, such as a certified public accountant (CPA), tax accountant, or financial controller.

Graduates can also pursue a career in the public sector, such as a budget analyst, financial analyst, or financial manager. They may also pursue a career in government, such as a financial regulator or financial policy analyst.

Graduates can also pursue a career in the corporate sector, such as a corporate finance manager, financial analyst, or financial controller. They may also pursue a career in the nonprofit sector, such as a financial analyst or grant writer.

Finally, graduates can pursue a career in the financial services sector, such as a financial advisor or investment banker. They may also pursue a career in venture capital, private equity, or hedge funds.

UK Admission Requirements

In order to be accepted into the University Course Financial Management, applicants must have achieved a minimum of a 2:1 (or equivalent) in a relevant degree such as finance, accounting, economics, mathematics, or business.

Applicants must also have achieved a minimum of a grade C in GCSE English and Maths.

In addition, applicants must have achieved a minimum of a grade B in A Level Maths or equivalent.

These entry criteria are similar to those of other courses in the field of finance, accounting, and economics. However, the University Course Financial Management requires a higher level of achievement in A Level Maths than many other courses. This is to ensure that applicants have the necessary skills and knowledge to succeed in the course.

UK Earnings Potential For Financial Managers

The average earnings for someone with a degree in financial management vary depending on the type of job they pursue. Generally, graduates with a degree in financial management can expect to make an average salary of £36,000 to £45,000 per year. However, this can vary significantly depending on the sector and the level of experience.

Recent trends in the job market for financial management graduates show that there is an increasing demand for skilled professionals in the field. This is due to the growing complexity of financial markets and the need for professionals who are able to navigate these markets and provide sound financial advice.

As a result, salaries for financial management professionals have been steadily increasing over the past few years. Additionally, there is an increasing demand for financial management professionals in the banking and investment sectors, which can lead to higher salaries for those with the right skills and experience.

Similar Courses in UK

Other related university courses in the UK include Accounting and Finance, Economics, Business Management, and Business Administration.

The key differences between Financial Management and these other courses are that Financial Management is more focused on the management of money and financial resources, while Accounting and Finance is more focused on the recording and reporting of financial transactions.

Economics focuses on the study of economic systems and the factors that influence them. Business Management is focused on the management of people and organizations, while Business Administration is more focused on the management of processes and operations.

UK Curriculum

The key topics and modules covered in a university course on Financial Management typically include:

- Introduction to Financial Management: This module provides an overview of the fundamentals of financial management and introduces students to the main concepts and tools used in financial decision-making. Topics may include financial statement analysis, budgeting, capital budgeting, working capital management, and risk management.

- Financial Markets and Institutions: This module explores the workings of financial markets and institutions, including the stock market, bond market, and banking system. It also covers topics such as the role of financial intermediaries, the regulation of financial markets, and the role of central banks.

- Investment Management: This module examines the principles of investment management, including portfolio theory, asset pricing, and the evaluation of investment opportunities. It also covers topics such as portfolio diversification, asset allocation, and portfolio construction.

- Corporate Finance: This module examines the principles of corporate finance, including capital structure, dividend policy, and mergers and acquisitions. It also covers topics such as capital budgeting, project financing, and working capital management.

- International Finance: This module explores the principles of international finance, including exchange rate determination, international capital flows, and the management of international financial risks. It also covers topics such as the international monetary system, foreign exchange markets, and international capital budgeting.

Hands-on experience or practical work may involve case studies, simulations, internships with partnering financial institutions, and team projects that mirror real-world financial scenarios. This approach allows students to apply theoretical knowledge to practical situations, enhancing their problem-solving skills and preparing them for a career in financial management.

Alumni Network

Notable alumni from the Financial Management course include Warren Buffett , the CEO and Chairman of Berkshire Hathaway, and Jamie Dimon, the CEO and Chairman of JPMorgan Chase.

Warren Buffett is widely regarded as one of the most successful investors in the world, having grown his company’s value from $19 billion to over $600 billion. He is a philanthropist, donating billions of dollars to charitable causes, and has been a vocal advocate for responsible investing.

Jamie Dimon has been at the helm of JPMorgan Chase since 2004, and during his tenure, the company has grown to become the largest bank in the United States. He is a leader in the financial industry and has been a vocal advocate for responsible banking practices.

Alumni events and networking opportunities are available through the Financial Management course’s alumni network. The network hosts events such as alumni panels, networking sessions, and career fairs for alumni to connect and share their experiences. Additionally, the network offers resources such as job postings and career advice for alumni looking to further their careers in the financial industry.

Reach out to us for career and sponsorship opportunities

© 2024 Acrosophy Excellence in Application

A Medical MBA Company The Medical MBA Ltd Company number: 13561401 86-90 Paul Street, London, England, United Kingdom, EC2A 4NE

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

4.22: Introduction to Financial Statements

- Last updated

- Save as PDF

- Page ID 45809

- Lumen Learning

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

What you will learn to do: Examine the elements of common financial statements

There are many ways that we can describe a business—by product, by target market or even by geographic location. However, simply describing a business gives us little information about the internal workings of the business and how efficiently it is managing its resources. This internal examination is accomplished by looking at a company’s financial statements. These statements are like a company report card. They tell external (and internal) stakeholders how well the company is managing its financial resources. In order to understand this financial report card it is necessary to first have a basic understanding of how companies account for all of the financial transactions of the business using the double entry accounting system.

Once you see how financial transactions effect the various accounts you can move on to reading and understanding the key financial statements of the business. Ultimately these financial statements will be used to create annual financial reports that investors can use to evaluate the overall financial health of the business. As you can imagine, creating these financial statements is an essential part of managing a business.

- Numeracy Skills

- Money Management and Financial Skills

Accounting Skills Every Person Should Know

Search SkillsYouNeed:

Rhubarb The blog at SkillsYouNeed

- Rhubarb Front Page -guidelines for contributors-

- Financial Management Skills

- Hidden Costs of DIY After a Personal Injury in Florida

- 15 Personal Finance Lessons They Didn't Teach at School

- Navigating the Digital Marketplace: Essential Skills for Online Trading Success

- Soft Skills to Lower Taxes With AGI

- Navigating the Digital Waves of Trading: A Beginner's Journey to Mastering Online Markets

- Essential Skills and Tools Needed for Gutter Cleaning

- Life Skills for Budgeting, Tracking, and Record-Keeping

- Navigating the Forex Market: The Unseen Power of Soft Skills

- Skills Needed to Buy Investment Property in Dubai

- The Essential Skills You Need to Book Hotels in Texarkana

- Savoring Wellness on a Budget: A Guide to Nutritious Meals Without Breaking the Bank

- The Importance and Applications of Percentage Increase

- Can I Get a Refund for My Health Insurance Premiums After 10+ Years of Payment?

- Debt Defense: How to Win the Fight Against Creditors

- Mastering the Art of Car Auctions: Essential Skills for Savvy Buyers and Sellers

- The Role of Annuities in Retirement Income Planning

- Forex Trading and Behavioral Economics - Exploring the Influence of Behavioral Biases on Currency Markets

- Where to Find the Best Scholarships for College This Year?

- The Essential Car Buying Skills: A Comprehensive Guide

- Upgrade Your Soft Skills with EMI Licensing

- Can Bad Credit Hurt You Getting a New Job?

- Top 10 Tips to Save Money as a Student

Subscribe to our FREE newsletter and start improving your life in just 5 minutes a day.

You'll get our 5 free 'One Minute Life Skills' and our weekly newsletter.

We'll never share your email address and you can unsubscribe at any time.

Managing personal finances is a crucial practice that we should master. It’s necessary for handling daily transactions and securing better financial stability through planning and decision-making.

To effectively manage your finances , you must possess numerous accounting skills that will enable you to navigate through your payments and investments wisely. If you don’t know what they are, read this guide below. We will enumerate all the skills you must master to handle your finances better.

Basic Bookkeeping

Bookkeeping is a standard accounting practice that systematically records and organizes all individual, household, or business transactions.

It’s a fundamental accounting skill that provides a clear picture of your financial activity, allowing you to monitor income, track expenses, and manage cash flow effectively. It’s also a crucial practice to help you simplify your tax filing process. Doing so will help you claim deductions seamlessly and avoid penalties for inaccuracies.

One of the most important ways to be effective at bookkeeping is to record all financial transactions daily. It could be as simple as keeping receipts and logging them into a spreadsheet or a financial tracking app.

You must also always be organized. Keep all your financial documents in one file or app, like bills, receipts, and bank statements. Additionally, it would help to be consistent with how you record your transactions. Decide on a specific method for logging different types of transactions and stick with it.

Finally, always ensure your data is secure, whether you keep digital records or physical logbooks. Use robust passwords or lock your drawers. These security measures will help protect such sensitive information from theft or loss.

Proper Budgeting

Creating a realistic budget can be challenging, but it’s a necessary skill to manage your finances effectively. A budget acts as a financial roadmap that will guide you on how much you can spend, save, and allocate without overspending.

Before setting your budget, you must track your income and expenses first. List all your sources, like salaries, bonuses, and any passive income. Then, you must categorize your expenses into recurring and miscellaneous. This step will help you determine which costs you must prioritize so you can adjust your budget accordingly.

Once you have a clear picture of your income and expenses, you can set a budget using the 50/30/20 rule . The budgeting practice is where 50 percent of your income goes to your necessities, 30 percent to your miscellaneous expenses, and 20 percent to your savings or debt repayment. This technique will help keep you organized and stay within your goal.

Meanwhile, using a budgeting app is an excellent alternative or support to the 50/30/20 rule. Many reliable options are available today that you can download on your mobile devices, offering numerous services that significantly boost your finance management. Often, they provide budget creation, expense tracking, bill payment reminders, goal setting, and financial reports.

When setting a budget, it’s vital that you also consider various financial opportunities to optimize your plan further. These opportunities will be helpful to extend your budget and enhance your ability to save or invest. These include discounts and coupons, savings or checking account promotions , and cash back or rewards programs.

Financial Forecasting

Forecasting is where you analyze various patterns to predict future needs and challenges. This is a valuable skill that can help you effectively identify investment opportunities and prepare for savings like retirement and emergency funds. It can also enhance your risk management skills by knowing potential issues before they happen.

This skill involves studying and understanding numerous factors for an accurate forecast, including historical data, income sources, spending habits, and investment returns. Mastering it will help you gain insights from such factors and use it to boost your financial planning.

The key to effective forecasting is compiling and understanding your financial data from the past few years.

Look for consistent trends and patterns, from income increases to seasonal expenses, and determine what they mean for your future financial health. Identify how they will impact your finances in the coming years. You must also consider external influences like economic changes and inflation rates.

Navigating Financial Statements

Understanding your financial statements is essential to better take charge of your finances. These documents provide a formal copy of your financial activities and current standing. Gathering information from these records can help you make more informed decisions, plan for the future, and accurately communicate your financial health to potential lenders or investors.

There are three types of financial statements you must constantly monitor: balance sheet, income statement, and cash flow statement. Knowing how to read them will help you create better budgets and forecasts.

Debt Management

Debt is often perceived negatively. However, it’s essential to know that not all debt can harm your financial health. There are “good debts” and “bad debts;” understanding the difference between the two will help you make smarter borrowing decisions.

Good debt is characterized by its ability to generate value over time. Getting one can enhance your net worth or credit score to make you more qualified for financial opportunities with better terms. Some of the best examples of this are mortgages, investment loans, and business loans.

Meanwhile, bad debts are those that can’t be collected. It involves borrowing money to invest in depreciating assets or consumption with no significant return. Some of the common examples of this are credit card debt, expensive car loans, and payday loans.

Often, these debts have high interest rates that increase the total amount owed and are used to purchase non-essential items. When left unaddressed, they can lead to debt traps.

Understanding the difference between the two will help you determine which debts to take on or prioritize for repayment. It can also help you decide which ones to avoid and use.

Personal Audits

Finally, conducting regular audits is crucial to ensure optimal financial health. Auditing is a necessary skill you must master to help you identify any inefficiencies or areas of improvement, particularly with how you handle your finances.

Schedule recurring audits and review all your financial records and activities. Doing so will help you learn about consistent patterns or changes impacting your financial health. Taking advantage of the insights you gain from these reviews can help you further optimize your management strategies and secure your financial health.

Regular audits are also vital to help you detect any inconsistencies that could affect your tax filings. Because of that, you can address any issues early and avoid penalties when tax season comes.

Secure Your Financial Health with the Right Skills

Managing your finances takes a lot of effort to ensure that you’re making the right decisions. The skills above will help you optimize your financial plans significantly, allowing you to allocate budgets effectively while saving for the future.

About the Author

Ivan Serrano: I have been a technology and business writer since 2015 working with companies like SmallBizClub, StartupNation, Namecheap and Time Doctor. I have loved writing my whole life and being in business development has given me a unique perspective. I'm obsessed with our constantly evolving fast-paced society and finding new ways to integrate that into amazing content that teaches the readers something new.

Continue to: Developing Commercial Awareness Careers in Administration and Management

See also: 10 Accounting Skills You Need to Succeed on the Job Basic Accounting Skills Every Entrepreneur Should Know 11 Key Skills Every Accountant Needs to Succeed

From Hong Kong to Singapore: Incorporation Services with Spring Discounts! Explore Today!

Hong Kong Business Account

International and local payments

Payment Cards

Foreign Exchange

Get rewarded

Business Guides

Business Account Reviews

Comparisons

Company Secretary Reviews

Whitepapers & E-Books

Industry Newsletters

PayPal Fee Calculator

Stripe Fee Calculator

Invoice Generator

About Statrys

Customer reviews

Partner Programs

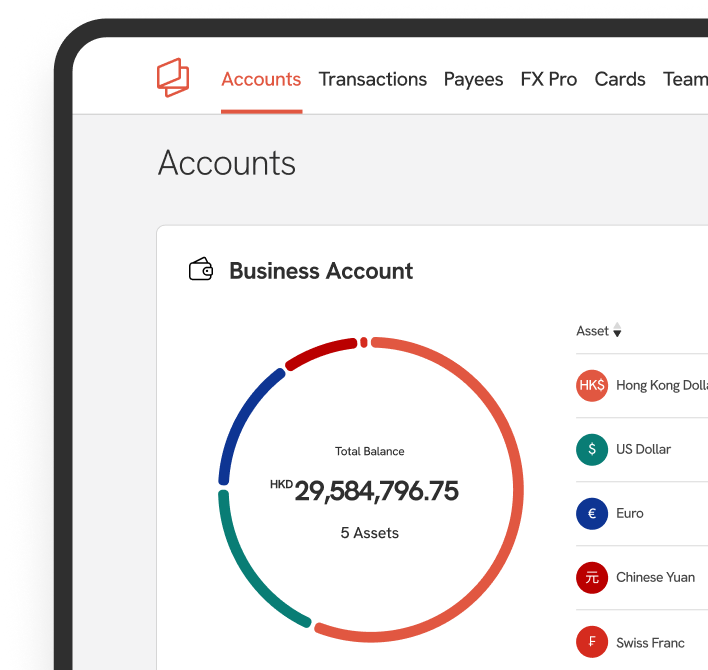

What Is a Financial Statement: 4 Types With Examples

6 minute read

Key Takeaways

Financial statements summarise a company's financial activities, presenting comprehensive details about its financial position, performance, and cash flows at a specific time.

There are 4 primary types of financial statements, including the balance sheet, the income statement, the cash flow statement, and the statement of retained earnings.

Whether you're just starting a business or have been operating for a while, having transparent financial reports is crucial. Eventually, you will need to clarify your financial situation, whether for a loan application, investor pitches, or strategic decisions like pricing and revenue projections. In these situations, you will likely need "financial statements."

This article will cover the basics of financial statements, why they're necessary, the various types and examples, and the differences between audited and unaudited statements.

What Is a Financial Statement?

Financial statements are a compilation of written records that display a company's financial activities and performance at a specific time, usually annually, quarterly, or monthly. The purpose is to provide the company's financial position information to internal and external stakeholders.

Financial statements are typically prepared by bookkeepers and accountants who adhere to Generally Accepted Accounting Principles (GAAP) or industry-specific best practices.

Why You Need Financial Statements

Financial statements are crucial for monitoring a company's financial health, obtaining funding, and reducing tax complexities.

Companies often prepare these statements quarterly to assess business profitability, financial stability, and resource allocation. This aids in making informed key decisions, such as pricing strategies, cost reduction, and growth planning.

When seeking outside investment or loans, these statements offer shareholders and creditors crucial details to assess the company's creditworthiness, risks, and potential returns on investment or loans. Properly prepared financial statements could make securing necessary funding more attainable.

Lastly, annual financial statements are crucial for tax reporting and tax return filing. Documenting income, expenses, assets, and liabilities in the statements simplifies completing the paperwork required by tax authorities each year.

Get A Multi-currency Business Account

100% online, with applicable payment cards and support from an account manager.

4 Types of Financial Statements

The primary types of financial statements are the balance sheet, income statement, cash flow statement, and statement of retained earnings.

Each offers a different perspective on a company's financial status. Combined, they provide a complete picture for owners, stakeholders, and investors.

Let's look into each of these statements to understand their significance and components.

Balance Sheet

A balance sheet is a summary of a company's assets (what the company owns), liabilities (what the company owes), and shareholders' equity (the net worth of shareholders) at the end of a specific period in time, most commonly a year.

This statement is alternatively known as a statement of financial position or a statement of financial condition.

Components of a Balance Sheet

The 3 main components of a balance sheet consist of assets, liabilities, and shareholders' equity. The table below breaks down the key details.

This statement is called a balance sheet because the total assets must equal the total liabilities and shareholders' equity, ensuring the balance between what a company owns and what it owes. Therefore, the balance sheet follows the equation:

Total Assets = Total Liabilities + Total Shareholders' Equity.

Income Statement

An income statement is a financial record that presents a company's revenue and expenses over a specific period, most commonly a year, indicating whether the company is making a profit or loss. This statement helps business owners determine profit-generating strategies, such as increasing revenues or reducing costs.

An income statement is also referred to as a profit and loss (P&L) statement or an earnings statement.

Components of an Income Statement

The main components of the income statement include revenue, expenses, and net profit or loss.

These may be broken down into

- Revenue: The total income earned by a business within a specific period.

- Costs of goods sold (COGS): The total expense of making the products, covering the cost of materials and labor.

- Gross profit: The total revenue deducts COGS.

- Total expenses: The total amount of money spent to make, sell, or promote the products.

- Operating income: The total profits minus operating expenses, such as equipment and labor costs.

- Depreciation: The reduction in value of a company's assets over time.

- Pretax income or income before taxes: Income minus costs but before taxes are subtracted.

- Net income: The total income after deducting all costs.

The income statement formula can be written as:

Net income = Revenues – Expenses

Cash Flow Statement

A cash flow statement, also known as a statement of cash flows, aggregates data regarding all cash and cash equivalents, inflows, and outflows that a company experiences in a given period.

This statement shows where cash is being generated and used and whether the business has enough liquid cash to meet its obligations and invest in assets.

Tip: Explore our articles to find everything you need to know about cash flow management and cash flow analysis.

Components of a Cash Flow Statement

A cash flow statement includes operating activities, investing activities, and financing activities.

- Operating activities: the cash flow generated or used in regular business operations, including revenue and expenses from goods and services provided.

- Investing activities: The cash flow from buying or selling assets, such as real estate and vehicles, or intangible assets like patents and licenses.

- Financing activities: The cash flow resulting from the acquisition of debt or equity.

Example of Cash Flow Statement

Statement of Retained Earnings

The retained earnings statement is a financial report that shows the net income a company has retained after distributing dividends to shareholders. It also outlines the changes in this balance during a particular accounting period.

These earnings are usually used to pay off debts or reinvest. When retained earnings gather over time, they can be referred to as accumulated profits.

Some company's financial statements may not feature a separate statement of retained earnings. Instead, this information is included or provided as an addendum to either the income statement or balance sheet.

A statement of retained earnings is also called a statement of change in equity.

Components of a Statement of Retained Earnings

The retained earnings consist of three main elements: the initial retained earnings at the beginning of the period, the net profit incurred during the accounting period, and the dividends distributed in both cash and stock during the accounting period.

- Beginning Retained Earnings: This is the equity balance from the end of the previous period, which carries forward to the start of the current period.

- Net Income: The profits generated from operations, automatically adding to the company's equity and transferring to retained earnings at the end of the year.

- Dividends: This represents the portion of profits distributed to shareholders rather than being retained by the company.

Retained earnings are calculated by combining the beginning retained earnings with the net income for the current period and then subtracting any dividends paid out to shareholders.

In other words, the formula is:

Retained Earnings = Beginning Retained Earnings + Net Income − Dividends

Example of Statement of Retained Earnings

How Different Types of Financial Statements Interact

Essentially, a company’s operations, investments, and financing activities are interrelated, resulting in the connection between various types of financial statements.

For instance, the net income detailed in the company's income statement initiates the cash flow statement and contributes to retained earnings on the balance sheet, retained earnings on the statement of retained earnings will be stated on the balance sheet, and depreciation recorded in the income statement affects asset values on the balance sheet.

Changes in working capital, asset purchases, borrowing, debt repayment, dividends, or stock repurchases affect both the cash and equity balances on the balance sheet and the cash flow statement.

Do Financial Statements Need to Be Audited?

Unaudited financial statements are reports prepared by accountants but have not undergone examination and verification by an external independent auditor.

In contrast, audited financial statements are reviewed by a certified public accountant (CPA) to ensure compliance with standard accounting rules. Naturally, audited financial statements are more credible, but they require additional time and cost to prepare.

Whether financial statements require auditing depends on the entity and jurisdictions. For instance, in the US, publicly traded companies must file audited financial statements . Similarly, in New Zealand, financial statements submitted to the Companies Office must be audited . In Hong Kong, the Hong Kong Companies Registry mandates auditing for all companies.

When securing a loan or funding, most potential funders and creditors prefer audited financial statements over unaudited ones.

Get a Good Business Account

Keeping good financial records is essential for a successful business. However, bookkeeping can easily get complicated if you combine personal and business finances in a single account. Hence, having a dedicated business account is the vital first step.

A business account that can be integrated with accounting software and allows you to connect and download transactions directly from your linked business bank account will be a significant plus. This will simplify not only your financial statement preparation but also your overall financial management.

If your business is registered in Hong Kong, Singapore, or the BVI, Statrys offers a multi-currency business account integrated with Xero accounting software and a comprehensive reporting dashboard.

Here is a quick look at our key services:

What is a simple explanation for financial statements?

Financial statements are summaries that outline a company's financial activities, including its income, expenses, assets, liabilities, equity, and cash flow at a particular point in time.

What are the types of financial statements?

The four basic financial statements include: 1. Balance Sheet: Shows the company's assets, liabilities, and shareholders' equity at a specific period. 2. Income Statement: Outlines the company's revenues and expenses over a period, resulting in net profit or loss. 3. Cash Flow Statement: Details the inflows and outflows of cash and cash equivalents, indicating the company's liquidity. 4. Statement of Retained Earnings: Displays changes in retained earnings over a period, including profits retained in the business after dividends.

What is the objective of financial statements?

The objective of financial statements is to provide stakeholders with a clear and accurate overview of the company's financial status and performance. This information helps in making strategic decisions, securing funding, and complying with regulatory requirements.

When do you need financial statements?

You often need financial statements for annual tax reporting, quarterly company finance assessments, and when asking for loans. In cases of significant corporate events like changes in ownership, sales, or mergers, up-to-date financial statements are also necessary. They provide a transparent financial snapshot of the company.

Can I prepare financial statements myself?

Depending on the size and needs of your business, you may be able to prepare the unaudited financial statements yourself. However, it's not generally recommended, as errors can lead to fines and more complications. It's often better to work with a professional who is familiar with accounting principles to ensure accuracy and compliance with relevant standards. Additionally, if an audited financial statement is required, it must be prepared by a Certified Public Accountant (CPA) or an equivalent professional.

In this article

Related articles

Bookkeeping vs Accounting: What They Do & Key Differences

Accounting Tips

What is Accounts Receivable (AR)? How Businesses Use Them

What is Bookkeeping? How It Works & Why You Need Them

Browse Accounting Tips

Looking for a business account.

100% online application

No account opening fee, no initial deposit

Physical and virtual cards

Clearing Universities & Courses

Clearing advice.

Recommended Clearing Universities

Popular Course Categories

Course Search & Discover

Start the search for your uni. Filter from hundreds of universities based on your preferences.

Search by Type

Search by region.

Recommended Universities

Northeastern University - London

London (Greater) · 100% Recommended

.jpg)

The University of Law

London (Greater) · 92% Recommended

University of East London

London (Greater) · 94% Recommended

Search Open Days

What's new at Uni Compare

Bangor University

Find the perfect Criminology degree which allows you to specialise in your interests

Heriot-Watt University

Your Edinburgh adventure awaits. Study career-led courses for graduate prospects.

Ranking Categories

Regional rankings.

More Rankings

Top 100 Universities

Taken from 65,000+ data points from students attending university to help future generations

About our Rankings

Discover university rankings devised from data collected from current students.

Guide Categories

Advice categories, recommended articles, popular statement examples, not sure what to search for, take our quick degree quiz.

Find the ideal uni course for you with our Course Degree Quiz. Get answers in minutes!

Take our full degree quiz

Get more tailored course suggestions with our full Course Degree Quiz and apply with confidence.

PERSONAL STATEMENT EXAMPLE Accounting and Finance (with a Placement Year) Personal Statement*

Submitted by Sharlyn

Get the skills needed for an engaging and successful career

Pick Roehampton's Accounting degree for hands-on learning, networking opportunities, and paid placements setting your future up for success.

Become a tech specialist at Bangor University.

Become highly employable with a Computer Science degree that allows you to specialise in areas such as game design, data science & artificial intelligence.

Accounting and Finance (with a Placement Year) Personal Statement*

Since speaking with a Careers Advisor and my mentor from PricewaterhouseCoopers, I have developed a strong interest in the world of Finance . To broaden my knowledge of Accountancy and Finance, I attended a conference held by the Institute of Chartered Accountants in England and Wales. From attending this conference I had learnt that in summary, Accounting and Finance is like a puzzle. It involves solving problems to real-life situations - this, in my opinion, is what makes Accounting and Finance exciting. In addition to the numerical and analytical aspects of Accounting and Finance, it is the broadness and flexibility of Accounting and Finance that has further sparked my interest in wanting to study this course. Given my passion for travelling and experiencing new things, I aspire to acquire a role within Finance which will allow me to work in different fields across the globe.

Studying A Levels has enabled me to develop analytical, qualitative, quantitative and essay writing skills. Philosophy enables me to think critically when assessing the theories of historic philosophers. Economics involves drawing and analysing graphs, making calculations such as the price elasticity of demand and drawing conclusions from the results. Politics has furthered my ability to analyse and evaluate political institutions, processes and ideologies.

Moreover, as Economics and Politics are broad, current subjects, this requires me to keep up to date with current world affairs; I regularly read the BBC news and The Economist magazine. This not only enhances my commercial awareness but also puts me at the advantage of being able to apply and incorporate recent issues into my essays and thus enhance the quality of my written work. For example, in one of my economics essays, I discussed how Brexit has impacted the economy in terms of exchange rates, business uncertainty and trade. Each of these subjects has enabled me to develop a valuable and transferable skill set in preparation for university.

By attending insight days at Architas and Nomura investment banks, and a business conference at Barclay's headquarters where I participated in networking activities to get to know other employers and learn about the company itself, my networking skills have improved. Furthermore, during my work experience at PricewaterhouseCoopers where I worked in the Tax Department, I was able to shadow professionals and visit other departments. I also had the opportunity to help a colleague conduct research for her project and create an accounts rota on excel spreadsheet; thereby advancing my research and IT skills.

During the summer holidays, I undertook a week's internship with APAX Partners working under the Consumer Department. I was required to work in a team of four to conduct research for a project based on the relationship between retail and e-commerce industry. Part of the research involved analysing reports, conducting international telephone interviews and creating questionnaires. Consequently, my research and teamwork skills have improved. Overall, these experiences have given me an insight into the world of Finance and has thus reinforced my desire to study Accounting and Finance.

Volunteering as a Shop assistant at Royal Trinity Hospice charity requires me to interact with customers, maintain the appearance of the shop, process cash and card transactions. This experience has heightened my time management and organisational skills as I have managed to maintain a balance of college work, volunteering, Japanese club, Netball club and my social life.

As demonstrated by my academics, work experiences and extra-curricular activities, I believe I have the determination and commitment to succeed at university. I feel that studying Accounting and Finance will provide me with a steady career path into the financial world. Experiencing the independent lifestyle university has to offer is also something I very much look forward to.

Recommended Course

Recommended Statements

Submitted by Goutham

Accounting and Finance Personal Statement

New dynamic markets are offering boundless opportunities with firms gravitating towards these markets, whe...

Submitted by Hardeka

Economics with Accounting Personal Statement

I am part of an economy that influences society in ways I am yet to discover. I see economics as a ubiquit...

Submitted by Shay

Flying Start Accountancy Personal Statement | Examples | Uni Compare

Since earning my first hourly wage at fifteen, I became aware of the real value of money and am conscious ...

Submitted by Ravina

My interest in business mainly stems from my experience of selling various items independently in order to...

undergraduate Universities

Undergraduate uni's.

Northeastern Uni

.jpg)

114 courses

Uni of East London

575 courses

Uni for Creative Arts

672 courses

Leeds Beckett Uni

454 courses

Swansea Uni

1319 courses

Uni of Sunderland

340 courses

467 courses

Uni of Kent

580 courses

886 courses

Uni of Chester

645 courses

Heriot-Watt Uni

334 courses

Uni of Westminster

503 courses

Cardiff Met Uni

501 courses

Uni of Leicester

432 courses

Uni of Roehampton

468 courses

Uni of Winchester

259 courses

Middlesex Uni

634 courses

548 courses

Uni of Bradford

390 courses

Staffordshire Uni

472 courses

Uni of Portsmouth

761 courses

Uni of Hertfordshire

584 courses

Kingston Uni

617 courses

Ravensbourne

103 courses

Wrexham Uni

289 courses

Goldsmiths, UOL

344 courses

Uni of Brighton

407 courses

West London IoT

Escape Studios

Uni of Reading

685 courses

Bath Spa Uni

520 courses

Uni of Surrey

750 courses

Uni of Suffolk

186 courses

Coventry Uni

480 courses

Uni of Bedfordshire

656 courses

Queen's Uni

635 courses

,-Bristol.jpg)

UWE, Bristol

497 courses

Uni of Huddersfield

668 courses

Leeds Arts University

ARU Writtle

104 courses

Uni of Essex

1400 courses

Uni of C.Lancashire

798 courses

709 courses

Anglia Ruskin Uni

808 courses

Edge Hill Uni

383 courses

Uni of Hull

498 courses

Nottingham Trent

912 courses

FIND THE IDEAL COURSE FOR YOU

Degree Course Quiz

Find the ideal university course for you in minutes by taking our degree matchmaker quiz today.

Find the latest from Uni Compare

Northeastern Uni London

Want to earn two globally recognised degrees simultaneously? Look no further!

Cardiff Metropolitan Uni

Ranked as the most sustainable university in Wales (P&P Uni League 2023/24)

- Skip to Content

- Skip to Main Navigation

- Skip to Search

IUPUI IUPUI IUPUI

- My area of study is in accounting

- My area of study is not in accounting

- Discover downtown Indianapolis

MS in Accounting

- Graduate Certificate in Accounting

- Graduate Certificate in Internal Audit

- MS in Taxation

- Graduate Certificate in Taxation

- How to Apply

- Cost and Funding

- International Students

Kelley School of Business

- Centers & Institutes

- News & Resources

- Kelley Store

- Graduate Accounting

- Degree Options

- Accounting Options

Master of science in accounting

Pursue our Master of Science in Accounting (MSA) degree full time or part time, depending on the demands of your work and personal life. Our courses are offered in the evening in downtown Indianapolis to accommodate your busy schedule. Students can complete this 30 credit hour program part time, including summers, in as little as 18 months.

Preparing for the CPA exam

Earing the MSA degree is a great way to help you meet the minimum 120 credit hours you need in order to sit for the CPA exam. And our program’s 100% career placement rate means MSA graduates leave Kelley as top candidates for the jobs they want. Learn more about how our curriculum successfully prepares you to become a CPA.

Learn about the CPA

Fast-track your master's with the +1 MSA

By adding just one year to your Kelley bachelor’s degree, you can earn the MSA degree that is proven to provide career security and financial stability. Jump-start your path into da master’s in accounting degree and begin earning MSA courses at an undergraduate rate through our MSA+1 degree path for Kelley students.

Hear how Fernando Borges-Chavez, BS’22, MSA’22, added a year to his undergraduate studies to earn an MSA.

Read Nando's story

Ready to advance your accounting education?

Apply now to enroll in the next semester of the MSA Program.

Admission requirements

Applicants must have an overall undergraduate GPA of 3.2 or higher when applying to the MSA program. Students with GPAs between 2.8 and 3.2 may be admitted with permission from the Graduate Accounting Programs faculty chair.

To ensure your success, we ask you to complete the following courses — or their equivalents — before you begin the MSA Program:

- A201 Intro to Financial Accounting (3 cr.)

- A311 Intermediate Accounting I (3 cr.)

- A325 Cost Accounting (3 cr.)

- E201 Intro to Microeconomics (3 cr.)

- E270 Intro to Stat Theory Econ and Business (3 cr.)

- F300 Intro to Financial Management (3 cr.)

- K201 The Computer in Business

- L203 Commercial Law I (3 cr.)

- P300 Intro to Operations Management (3 cr.)

MSA required courses

If you've previously completed one of the accounting courses below and used it toward another degree, you may replace it with an approved elective.

A511 Financial Accounting Theory and Practice II (3 cr.)

Prerequisite: A311/A510 (Intermediate Accounting I) or equivalent

Application of intermediate accounting theory to problems involving long-term liabilities, corporations, earnings per share, tax allocation, pensions, leases, and cash flows.

A514 Auditing Theory and Practice (3 cr.)

Prerequisites: A511 and A523

This course addresses the concepts and procedures of external and internal audits for businesses, including issuance of the audit report, reviews of internal control, statistical sampling, EDP systems, the company's business cycles, forensic accounting, auditing for fraud, and other assurance services. Many topics covered are included on the CPA exam.

A515 Introduction to Taxation (3 cr.)

Co-requisite: A551

This course focuses on the income taxation and tax planning for individuals, introducing students to U.S. federal income tax law. The basic treatment of other entities also is considered, including the taxation of corporations, partnerships, limited liability companies, trusts, and estates. In addition, a portion of the course is devoted to tax research, enabling students to appreciate the sources of tax law such as the Internal Revenue Code, regulations, administrative pronouncements, and case law.

A551 Tax Research (1.5 cr.)

Prerequisite: A515 or concurrent

This course covers how to access the primary and secondary sources of tax law, including the Internal Revenue Code, regulations, and other administrative pronouncements and judicial decisions, with an emphasis on how to read and interpret those source materials.

A523 Business Information Systems (3 cr.)

An overview of accounting systems and their existence within businesses. The course includes discussions of system controls, transaction processing, business cycles and issues related to development and installation of automated accounting systems.

A539 Advanced Tax: Entity Issues (3 cr.)

Prerequisite: A515 or equivalent

Introduction to the taxation of regular corporations, partnerships, limited liability companies, and S corporations.

A500 Professional and Ethical Responsibilities in Accounting (1.5 cr.)

Focus on the role that ethics plays in the accounting profession. The ultimate goal of this course is for students to develop a passion for acting ethically in their profession and possess the tools to live out this passion.

L503 Advanced Business Law (3 cr.)

Prerequisite: L203 or equivalent

This course examines concepts of law as applied to the accounting profession, including contracts, agency, forms of organization, property, wills and trusts, securities regulation, consumer protection, antitrust, secured transactions, negotiable instruments, commercial paper, payment systems, bankruptcy, and related subject areas.

Learning in a Professional Environment (LIPE)

We understand real-life work experience is essential to success outside of the classroom. Learning in a Professional Environment (LIPE) allows you to earn up to three hours of graduate credit for work experience you obtain while earning your MS in Accounting. Learning in a Professional Environment is a required course for international students who secure an internship, and we highly recommend it for those students who come to the MSA Program without previous work experience in accounting. LIPE provides a way to put accounting skills into practice while developing professional acumen.

MSA elective courses

Accounting electives, a517 financial statement analysis (3 cr.).

Financial statement analysis is a problem-solving case course designed to teach and understand the techniques used to evaluate the financial dynamics of businesses.

A560 Information Technology Auditing (3 cr.)

This course examines the security and control of information systems (IS) from the perspective of management, including the IS assurance process. The emphasis is on technical, professional, and regulatory best practices in information systems security and assurance. The course is designed to meet the IS security information needs of both managers and IS security assurance professionals. As such, the course is structured to cover most topics in the common body of knowledge (CBK) for professional examinations with an information security component, including the CPA, CISA (Certified Information Systems Auditor) and CIA (Certified Internal Auditor) exams.

A566 Advanced Auditing (3 cr.)

This course examines advanced issues in auditing, including in-depth review of forensic accounting and fraud examination, litigation support and expert witness services, the use of statistical sampling in auditing, internal auditing, assurance services, and extending the attestation function.

A575 Auditing and Corporate Governance (3 cr.)

This course introduces basic concepts of internal auditing, emphasizing business process controls as well as entity-level controls. The course is taught from a corporate governance perspective, which stresses the role played by internal audit in assisting management and the board in evaluating and improving the effectiveness of risk management, internal controls, and the governance process. The course also includes an introduction to audit software.

Business electives

R502 real estate finance, investment and analysis (3 cr.).

This course focuses on the application of financial concepts and techniques to the analysis of real estate financing and investment alternatives.

Taxation electives

A526 pass-through entities ii (3cr.).

This course builds on and expands on the materials and concepts introduced in A525 Pass-through Entities I.

A537 Corporate Taxation I (3 cr.)

This course builds upon the introductory material included in BUPA-A539 Advanced Taxation I: Entity Issues pertaining to the U.S. federal income taxation of corporations taxable under Subchapter C of the Internal Revenue Code.

A539 Advanced Taxation I: Entity Issues (3 cr.)

The course introduces students to the taxation of regular corporations, partnerships, limited liability companies, and S corporations.

A558 Taxation of Tax Exempt Organizations I (1.5 cr.)

This course provides a brief overview of the basic concepts of the laws and regulations governing NFP organizations. Specific topics include: the formation and dissolution of a NFP entity, the operation and governance of the NFP entity, tax exemption issues, unrelated business income tax, and charitable contributions.

A567 Taxation of Tax Exempt Organizations II (1.5 cr.)

This course provides a very detailed focus of several concepts of the tax laws and regulations governing NFP organizations. Specific topics include: operation of NFP entities, regulation of charitable solicitation, and the unrelated business income tax. This course has a web site that was created with Canvas, a set of tools that assists professors and students to use the web to provide content, communication, and evaluation.

The MSA gave me the opportunity to choose my path through tax and accounting while gaining a well-rounded education. Madelyn Heron, MSA’22, Tax Senior at EY

Contact us to discuss how to create a customized accounting degree path to meet your career goals.

- Search Search Please fill out this field.

What Is a Cash Flow Statement (CFS)?

- Using the Cash Flow Statement

How to Prepare a Cash Flow Statement

How cash flow is calculated.

- Limitations

- Income Statement & Balance Sheet

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Cash Flow Statement: What It Is and How to Read One

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

A cash flow statement tracks the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency.

The CFS measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. As one of the three main financial statements, the CFS complements the balance sheet and the income statement. In this article, we’ll show you how the CFS is structured and how you can use it when analyzing a company.

Key Takeaways

- A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

- The CFS highlights a company's cash management, including how well it generates cash.

- This financial statement complements the balance sheet and the income statement.

- The main components of the CFS are cash from three areas: Operating activities, investing activities, and financing activities.

- The two methods of calculating cash flow are the direct method and the indirect method.

How the Cash Flow Statement Is Used

The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. Also known as the statement of cash flows, the CFS helps its creditors determine how much cash is available (referred to as liquidity ) for the company to fund its operating expenses and pay down its debts. The CFS is equally important to investors because it tells them whether a company is on solid financial ground. As such, they can use the statement to make better, more informed decisions about their investments.

Structure of the Cash Flow Statement

The main components of the cash flow statement are:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

- Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP) .

Cash From Operating Activities

The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services.

These operating activities might include:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers of goods and services used in production

- Salary and wage payments to employees

- Rent payments

- Any other type of operating expenses

In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations.

Cash From Investing Activities

Investing activities include any sources and uses of cash from a company’s investments. Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category. In short, changes in equipment, assets, or investments relate to cash from investing.

Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing.

Cash From Financing Activities

Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases , and repayment of debt principal (loans) that are made by the company.

Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders , the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity.

1 . Gather Financial Statements

Before you begin, collect the necessary financial statements:

- Income statement: Provides information on revenues, expenses, and net income.

- Balance sheet: Shows the company’s assets, liabilities, and equity at the beginning and end of the period.

2. Determine the Reporting Period

Identify the period for which you are preparing the cash flow statement. This could be monthly, quarterly, or annually.

3. Choose the Method

Decide whether you will use the direct method or the indirect method to prepare the CFS.