- Call to +1 844 889-9952

Accounting: Financial Statement Analysis

| 📄 Words: | 1577 |

|---|---|

| 📝 Subject: | |

| 📑 Pages: | 7 |

| ✍️ Type: | Essay |

Introduction

According to a definition, “Financial statements are significant for a business. They should provide information about the financial position, which is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions.” (Kam, 2000) Meanwhile, they are important to decision makers who use the financial information they provide to evaluate the performances of the firm and themselves.

Thus, inaccurate financial statements may distort the portrayal of financial position and operating results of a business. For this reason, cash basis of accounting, as one of the accounting methods, is argued whether it is accurate and can be used in preparing financial statements or it is imperfect and may mislead the understanding of the financial statements by decision makers. Cash basis of accounting is defective and financial statements prepared on a cash basis of accounting may distort the portrayal of financial position and operating results of a business.

Every organisation aims to maintain its market dominant position as well as to maximise its profitability through a series of activities, so as to remain competitive within framework of the market mechanism and to advance functions. It is necessary for managers to be familiar with the overall performance of the enterprise, in an effort to develop an effective strategic plan for companies’ prosperity and progress. Thus it is essential to identify the capabilities of a company in economic terms, so as to enable first line management to determine the business’s objectives and targets, concerning its operations.

In an effort to examine an organisation in financial terms, so as to provide managers with sufficient information, referring to its economic evolution, certain financial statements have evolved, such as Balance Sheet, Trial Balance, Profit and Loss Account, Ratios and so on. Nowadays, there are two forms of accounting used by business, cash basis of accounting and accrual basis of accounting. The cash basis method of accounting is based on real-time cash flow.

In such method, you report an expense when it is paid and record income when it is received. So, expenses do not appear on the financial statements until they have been paid. With accrual accounting, you record income when it is earned, not when it is paid.

For one business, financial information, especially income and expense, are extremely important. The net income of the business, which can be considered as the differences between income and expense, directly relates to that company’s profit and loss. Therefore, different methods of accounting choosing in preparing financial statements will cause different results on that business’s profit and loss reporting. Moreover, it will cause different further operations based on those different financial information by decision makers. In fact, comparing with the accrual basis method of accounting, the cash basis method of accounting will mislead the financial position of a business.

One example, as J.H.White described in “Excerpt from Shirt-Sleeves Bookkeeping: The Problem with Cash Basis Accounting” (White, J, H, 1996) is that: for some businesses, cash basis accounting systems create a situation that leads to bankruptcy while, at the same time, reports the company is making a profit. Imagine one company has a project that uses several years. Its income is received prior to completion of the job, but its major costs are paid after the job is completed. In other words, the company receives money in a year prior to paying its expenses. Profit is the difference between the money received and the money spent.

The company who uses Cash Basis Accounting System may provide a financial statement that shows profit in the end of the year. To reduce its tax liability, the best effort is to reducing its profit by spending the money.

In fact, this money is the prepayment of the major cost, which has not accrued until the next year. But it is spent on other things and, because there is so much money available, its spending is out of control. When the major bill does arrive in the next year or so, there is little or no money left from the project to pay for it. The only way is to use the money received from new projects to pay the costs of the old ones. If there are many jobs and huge amounts of money flowing through the business, profits appear on the financial statement to be high. And it looks the company have made a great profit. In such situation, the business may slow down and new jobs stop coming.

Therefore, the money stop coming and only thing left is lots of unpaid bills. Under the cash basis method of accounting, the unpaid expenses are not recorded in financial statement. Thus, the financial statement will report that the company has made a profit rather than its bankruptcy.

Financial statements prepared on a cash basis of accounting may not only cause bad effects on operating a business by managers who could be internal users, but also effect on external users, such as investors and creditors. Profitability refers to the ability of the business to earn income. Net income is the most significant measure of profitability. “Investors and creditors have a great interest in evaluating the current and prospective profitability of a business”. (Woelfel, 1994)

So they can get information about the amount of expected returns and the risk of their investments and loans. In a sense, the cash basis method of accounting is failed to present the significant financial information about the level of profitability of a business, even if to present whether the business is profit or loss. All the financial information is recorded while income and expenses does not actually generate.

Indeed, the efficient operation on a business is related to the actual financial position, which is based on that the business actually earns its income. Income is generated as a result of a business’s performance in an economic exchange. That means a business enters into a contractual agreement to exchange a performance for a consideration, which can be considered as cash. When it completes that performance, it is entitled to receive that cash; it has earned it as income. At that time income only can be recognized.

Moreover, there are four types of timing differences in recognizing income and expenses, which may not be distinguished by Cash Basis Accounting. They are:

- Income is recognized before cash is received

- Expense is recognized before cash is paid

- Income is recognized after cash is received

- Expense is recognized after cash is paid (Kam, 2000)

The importance of control programs and effective internal control techniques are made clear in the business conduct guide for Target and in Wal-Mart’s proxy statement. Wal-Mart gives specific guidelines of an eligible person who can be part of the auditing committee according the New York Stock Exchange Definitions. The duties of the auditing committee are also outlined. Wal-Mart has implemented the strategy of segregation of duties which separates the responsibilities of account keeping amongst different departments in different phases (Albrecht et al, 2005).

Target also uses an auditing committee and a segregation of duties (Albrecht et al, 2005). Target describes the importance of maintaining accurate books, records and accounts in order to ensure accounting objectives are met and the financial integrity of the company is upheld. Target discusses in the business conduct guide their commitment to comply with all laws and regulations. Target promises to give accurate reports to the Securities and Exchange Commission and to the New York Stock Exchange.

Sarbanes-Oxley Act The 2002 Sarbanes-Oxley Act requires, among other things, that every company’s annual report contain an “internal control report,” which must state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting and contain an assessment of the effectiveness of the internal control structure. In the wake of illegal political campaign contributions, business frauds, and numerous illegal payments to foreign officials in exchange for business favors. These acts were needed because of companies falsifying records and were not accurate financial records. (Gaffikin, 2002)

The main point of the income statement according to Weygandt & Kieso, (2005) is to report the profitability or loss of the business during a specific period of time. On the income statements the revenues are listed first. After the revenues the expenses are listed. The income statement is useful to managers because this tool allows the managers to see whether the business was profitable or not. The income statement is also useful to investors. Through the income statement, the investors can observe if the investment is a profitable one.

The financial statements are useful to both internal users and external users. The internal users according to Weygandt & Kieso (2005) are the managers who not only plan a business but also organize and run the business. In order to have a successful business, a manager needs to have answers to questions. In order to have the answers, the managers must resort to the financial statements. The financial statements will provide the necessary information, which could be used for future financial projections. The external users as Weygandt & Kieso (2005) state are investors or owners and creditors.

The investors use the financial statements in order to decide whether to buy, hold or sell the stock. The creditors which include the suppliers and lenders use the financial information found in the financial statements to evaluate all the risks involved in lending the company money or granting the company credit.

Gaffikin, M, 2002, Principles of Accounting 2002 Edition, Pearson Education Australia, Australia.

Kam, 2000, Accounting Theory, Second Edition, John Wiley $ Sons, New York.

White, J, H, 1996, Mind & Money, Seattle, WA.

Woelfel, C, J, 1994, Financial Statement Analysis: The Investor Self-Study Guide to Interpreting & Analyzing Financial Statements, Revised Edition, Probus Publishing Company, Canada.

Albrecht, W. S., Stice, J. D., & Swain, M. R. (2005). Accounting: Concepts and Applications. In Chapter 6: Ensuring the Integrity of Financial Information. South-Western.

Weygandt, J., Kieso, D., and Kimmel, P. (2005). Financial Accounting (5th ed.). Hoboken. NJ: John Wiley & Sons, Inc. 22-25, 110-14.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, December 16). Accounting: Financial Statement Analysis. https://business-essay.com/accounting-financial-statement-analysis/

"Accounting: Financial Statement Analysis." BusinessEssay , 16 Dec. 2022, business-essay.com/accounting-financial-statement-analysis/.

BusinessEssay . (2022) 'Accounting: Financial Statement Analysis'. 16 December.

BusinessEssay . 2022. "Accounting: Financial Statement Analysis." December 16, 2022. https://business-essay.com/accounting-financial-statement-analysis/.

1. BusinessEssay . "Accounting: Financial Statement Analysis." December 16, 2022. https://business-essay.com/accounting-financial-statement-analysis/.

Bibliography

BusinessEssay . "Accounting: Financial Statement Analysis." December 16, 2022. https://business-essay.com/accounting-financial-statement-analysis/.

- The Peer Review Process and Standards

- Management Accounting: Standard Costing System

- Accounting and Control in Business

- Audit Standards Comparison

- The Nature of Management Accounting

- Activity Based Costing and Activity Based Budgeting

- Lowe’s Companies Inc.’s Consolidated Balance Sheets

- Islamic Financial Institutions: Accounting Concepts

- The Balanced Scorecard Concept

- International Financial Reporting Standards Convergence

Guide to Financial Statement Analysis

1. income statement analysis, 2. balance sheet and leverage ratios, 3. cash flow statement analysis, 4. rates of return and profitability analysis, more financial statement analysis, analysis of financial statements.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Start Free

One of the main tasks of an analyst is to perform an extensive analysis of financial statements . In this free guide, we will break down the most important types and techniques of financial statement analysis.

This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return.

Most analysts start their financial statement analysis with the income statement . Intuitively, this is usually the first thing we think about with a business… we often ask questions such as, “How much revenue does it have?” “Is it profitable?” and “What are the margins like?”

In order to answer these questions, and much more, we will dive into the income statement to get started.

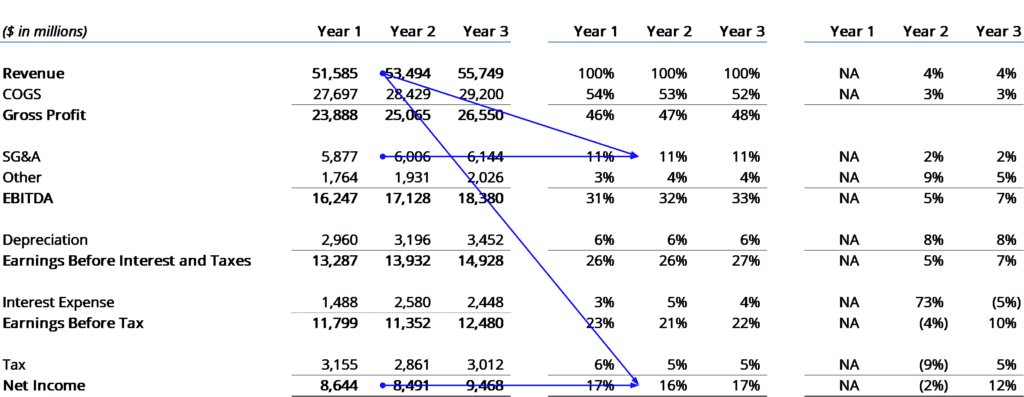

There are two main types of analysis we will perform: vertical analysis and horizontal analysis.

- Vertical Analysis

With this method of analysis, we will look up and down the income statement (hence, “vertical” analysis) to see how every line item compares to revenue, as a percentage.

For example, in the income statement shown below, we have the total dollar amounts and the percentages, which make up the vertical analysis.

As you see in the above example, we do a thorough analysis of the income statement by seeing each line item as a proportion of revenue .

The key metrics we look at are:

- Cost of Goods Sold (COGS) as a percent of revenue

- Gross profit as a percent of revenue

- Depreciation as a percent of revenue

- Selling General & Administrative ( SG&A ) as a percent of revenue

- Interest as a percent of revenue

- Earnings Before Tax (EBT) as a percent of revenue

- Tax as a percent of revenue

- Net earnings as a percent of revenue

To learn how to perform this analysis step-by-step, please check out our Financial Analysis Fundamentals Course .

Key Highlights

- One of the main tasks of a financial analyst is to perform an extensive analysis of a company’s financial statements. This usually begins with the income statement but also includes the balance sheet and cash flow statement.

- The main goal of financial analysis is to measure a company’s financial performance over time and against its peers.

- This analysis can then be used to forecast a company’s financial statements into the future.

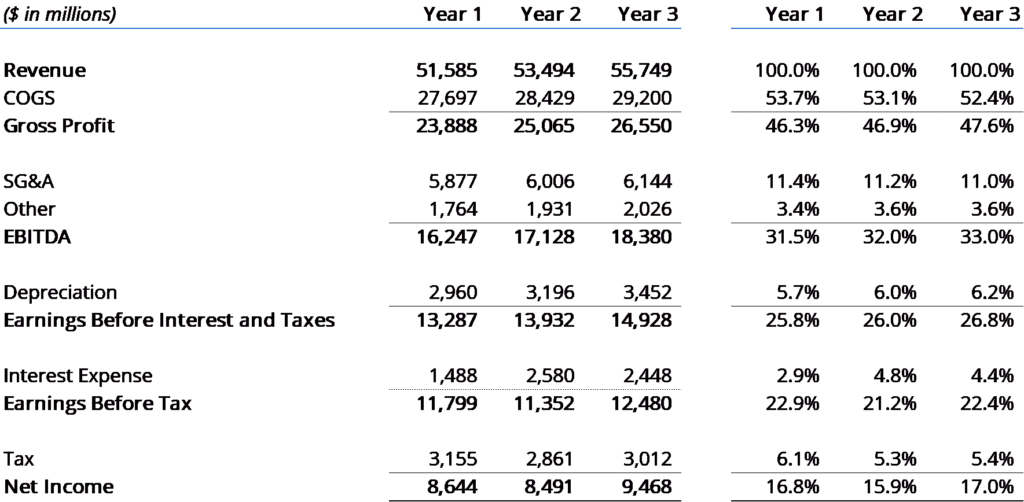

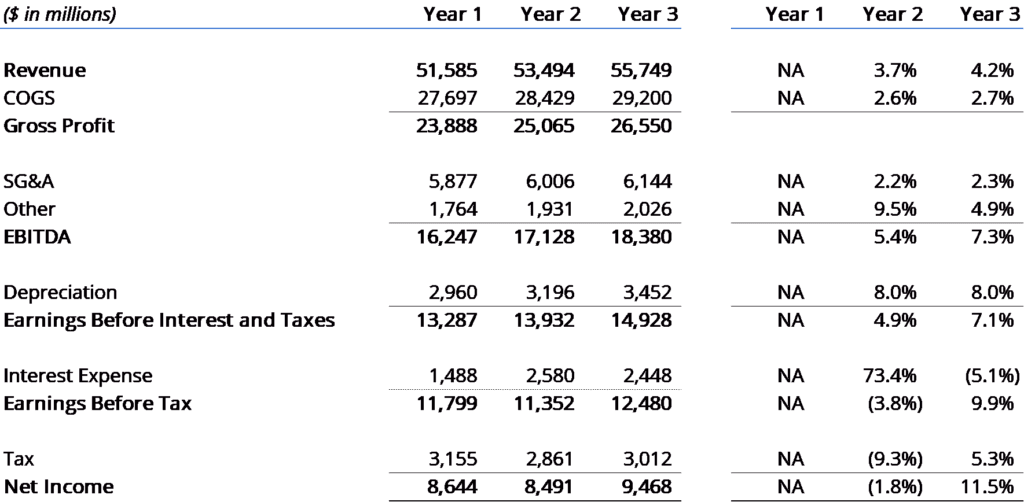

Horizontal Analysis

Now it’s time to look at a different way to evaluate the income statement. With horizontal analysis, we look at the year-over-year (YoY) change in each line item.

In order to perform this exercise, you need to take the value in Period N and divide it by the value in Period N-1 and then subtract 1 from that number to get the percent change.

For the below example, revenue in Year 3 was $55,749, and in Year 2, it was $53,494. The YoY change in revenue is equal to $55,749 / $53,494 minus one, which equals 4.2%.

To see exactly how to perform this horizontal analysis of financial statements, please enroll in our Financial Analysis Fundamentals Course now!

Let’s move on to the balance sheet . In this section of financial statement analysis, we will evaluate the operational efficiency of the business. We will take several items on the income statement and compare them to accounts on the balance sheet.

The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency.

The main liquidity ratios for a business are:

- Quick ratio

- Current ratio

- Net working capital

The main leverage ratios are:

- Debt to equity

- Debt to capital

- Debt to EBITDA

- Interest coverage

- Fixed charge coverage ratio

The main operating efficiency ratios are:

- Inventory turnover

- Accounts receivable days

- Accounts payable days

- Total asset turnover

- Net asset turnover

Using the above financial ratios, we can determine how efficiently a company is generating revenue and how quickly it’s selling inventory.

Using the financial ratios derived from the balance sheet and comparing them historically versus industry averages or competitors will help you assess the solvency and leverage of a business.

In our course on Analysis of Financial Statements , we explore all the above metrics and ratios in great detail.

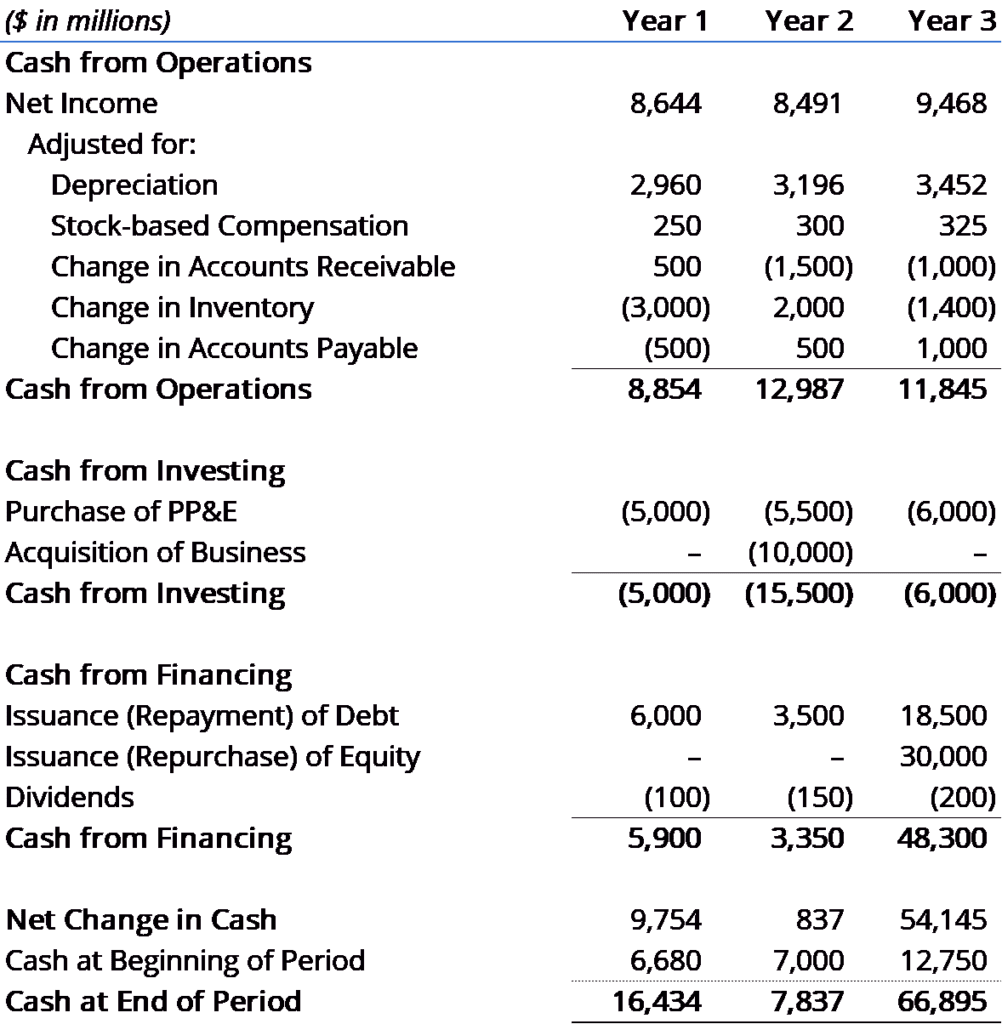

With the income statement and balance sheet under our belt, let’s look at the cash flow statement and all the insights it tells us about the business.

The cash flow statement will help us understand the inflows and outflows of cash over the time period we’re looking at.

Cash flow statement overview

The cash flow statement, or statement of cash flow, consists of three components:

- Cash from operations

- Cash used in investing

- Cash from financing

Each of these three sections tells us a unique and important part of the company’s sources and uses of cash over a specific time period.

Many investors consider the cash flow statement the most important indicator of a company’s performance.

Today, investors quickly flip to this section to see if the company is actually making money or not and what its funding requirements are.

It’s important to understand how different ratios can be used to properly assess the operation of an organization from a cash management standpoint.

Below is an example of the cash flow statement and its three main components. Linking the 3 statements together in Excel is the building block of financial modeling. To learn more, please see our online courses to learn the process step by step.

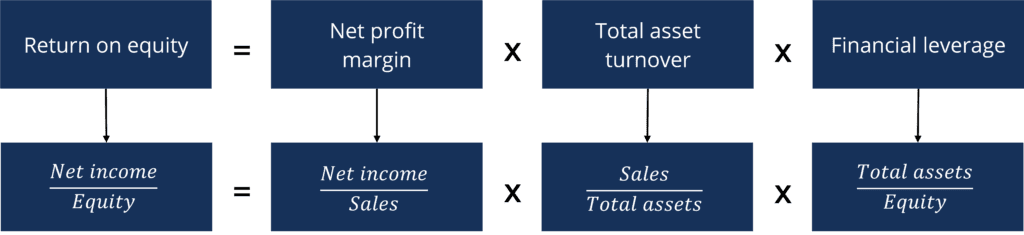

In this part of our analysis of financial statements, we unlock the drivers of financial performance. By using a “pyramid” of ratios, we are able to demonstrate how you can determine the profitability, efficiency, and leverage drivers for any business.

This is the most advanced section of our financial analysis course, and we recommend that you watch a demonstration of how professionals perform this analysis.

The course includes a hands-on case study and Excel templates that can be used to calculate individual ratios and a pyramid of ratios from any set of financial statements.

The key insights to be derived from the pyramid of ratios include:

- Return on equity ratio (ROE)

- Profitability, efficiency and leverage ratios

- Primary, secondary and tertiary ratios

- Dupont analysis

By constructing the pyramid of ratios, you will gain an extremely solid understanding of the business and its financial statements.

Enroll in our financial analysis course to get started now!

We hope this guide on the analysis of financial statements has been a valuable resource for you. If you’d like to keep learning with free CFI resources, we highly recommend these additional guides to improve your financial statement analysis:

- How to Link the 3 Financial Statements

- Aggregation

- Interactive Career Map

- See all accounting resources

Free Accounting Courses

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes . These courses will give the confidence you need to perform world-class financial analyst work. Start now!

Building confidence in your accounting skills is easy with CFI courses! Enroll now for FREE to start advancing your career!

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

EssayEmpire

Financial statement analysis essay.

Financial statement analysis is a methodology that enables stockholders, potential investors, creditors, and managers to evaluate past, current, and future performance of a company by examining relationships among financial statement elements. It involves examining trends, making industry comparisons, and analyzing the financial health and growth prospects of a company. Financial statement analysis can be performed independently by interested parties, by companies themselves, or by financial analysts who study certain industries and provide information so that investors can make informed decisions with respect to the purchase and sale of stocks, bonds, and other financial instruments. Financial statement analysis is comprised of three types of analyses: ratio analysis, horizontal analysis, and vertical analysis.

Ratio analysis is the most popular form of financial statement analysis. It is used to express relationships among selected items on financial statements and is useful for intracompany, intercompany, and industry average comparisons. Intracompany analysis compares a company’s prior year with the current year, intercompany analysis compares a company with its competition, and industry averages compare a company with industry benchmarks or norms (e.g., those provided by organizations such as Moody’s, Standard and Poor’s, or Dun and Bradstreet).

Ratio analysis can be expressed as a percentage, rate, or proportion and is generally classified into four categories. Liquidity ratios (e.g., current ratio, acid test ratio, inventory turnover ratio, working capital) measure a company’s ability to meet it current obligations, i.e., those due within a year. These ratios are of interest to short-term creditors (e.g., bankers, suppliers). Solvency ratios (e.g., debt-to-equity ratio, times interest earned ratio) gauge a company’s ability to meet long-term obligations and survive over the long term. These ratios are of interest to stockholders and long-term creditors. Profitability ratios (e.g., return on assets, asset turnover ratio, return on equity, gross profit ratio) provide an indication of a company’s operating success. These ratios are of interest to creditors and investors. Finally, market indicator ratios (e.g., price earnings ratio, dividend yield ratio) relate the market price of a share of stock to what investors would be willing to pay.

Horizontal or trend analysis involves analyzing financial statement data by comparing both dollar and percentage changes for a given company over time to determine the increase or decrease that has taken place. Although this type of analysis can be used for comparison between two years, it is more informative when several years can be compared and a trend can be depicted. Horizontal analysis can be detailed (e.g., comparison of each line item on the financial statements). Alternatively, selected items may be extracted (e.g., sales, net income) to analyze trends for specific financial statement items.

Horizontal analysis requires restating financial statement items as a percentage of some selected base year. For example, if a 10-year period (e.g., 1997–2006) is being considered, each item in the analysis could be restated as a percentage of the corresponding item in 1997. Information is presented with the most recent year appearing first (e.g., 2006, 2005, … 1997). Horizontal analysis is primarily used for intracompany comparisons.

Vertical analysis evaluates financial statement data at a given point in time by expressing each financial statement item as a percent of some base amount. This approach produces what is referred to as common-size financial statements. Balance sheet items are commonly expressed as a percentage of total assets (e.g., Cash Percentage = Cash/Total Current Assets) while income statement items are commonly expressed as a percentage of sales (e.g., Net Income Percentage = Net Profit/Sales).

Vertical analysis is particularly useful for comparisons between companies of different sizes. Comparisons that ignore size can be quite misleading. For example, if Company A has a higher net income than Company B, this is not an indication that Company A is performing better than Company B, unless both companies have the same sales revenue. To realistically assess the performance of each company, the net income of each entity would need to be expressed as a percentage of the sales revenue of each entity. This conversion to common-size financial statements reduces bias when comparisons are made between companies of differing sizes. Vertical analysis is used for both intracompany and intercompany comparisons.

Financial statement analysis that is used carefully can provide valuable information about a company’s financial health and future growth prospects. However, the following caveats should be noted: (1) Financial statements are based on historical costs. Thus, they do not reflect replacement costs or inflation; (2) Companies use different accounting policies (e.g., depreciation valuation and inventory valuation). Footnotes to financial statements should therefore be carefully reviewed to ascertain the accounting policies used. When policies differ, it will be necessarily to restate the data for the companies being analyzed using a common policy in order to make a meaningful comparison; (3) Ratios can be calculated using different variations. The composition of items that are used in the calculations should therefore be investigated in order to make a valid comparison; (4) Financial statements contain many estimates (e.g., uncollectible receivables, contingent losses). Users should therefore be wary that inaccurate estimates will provide inaccurate ratios and percentages.

Bibliography:

- Ray H. Garrison, Eric W. Noreen, and Peter C. Brewer, Managerial Accounting, 12th ed. (McGraw-Hill, 2008);

- Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Financial Accounting: Tools for Business Decision Making, 5th ed. (Wiley, 2009);

- Jane L. Reimers, Financial Accounting: A Business Approach, 2nd ed. (Pearson Educational Ltd., 2008).

This example Financial Statement Analysis Essay is published for educational and informational purposes only. If you need a custom essay or research paper on this topic please use our writing services. EssayEmpire.com offers reliable custom essay writing services that can help you to receive high grades and impress your professors with the quality of each essay or research paper you hand in.

- How to Write an Essay

- Business Essay Topics

- Business Essay Examples

ORDER HIGH QUALITY CUSTOM PAPER

Special offer!

GET 10% OFF WITH 24START DISCOUNT CODE

Related posts.

Checked : Mark A. , Curtis H.

Latest Update 21 Jan, 2024

Table of content

The components of the financial statement

1. the balance sheet, 2. the income statement, 3. the cash flow table.

- Understanding a company's financial statements in 5 points

Financial statement objectives

Evaluate performance and plan for the future, assess the financial strength of a business, analyze the solvency of the organization.

To analyze the performance and manage the growth of a company, financial statements are a handy tool.

A financial statement is a summary document drawn up periodically. Information on performance, financial and accounting situation, and the development of a company from one accounting year to the next appears.

It is presented in an organized and standardized manner and is based on the following concepts and obligations:

- Faithful image and compliant with IFRS (International Financial Reporting Standards, which have been the accounting standard applicable to companies listed on the European market since 2005). The financial statements must be structured and presented in a clear manner and in accordance with the transactions and the facts.

- Going concern: financial statements must be prepared on the assumption that the company will continue its activities for an indefinite period

- Commitment accounting: Expenses and income must be allocated to the period during which they were incurred and attach these funds at the close

- Consistency of presentation: The presentation and classification of items in the financial statements must remain unchanged from one financial year to the next unless there are changes imposed by IFRS standards

- Relative importance and grouping: each significant category of similar elements must be presented separately in the financial statements unless they are not significant

- Non-offsetting of assets, liabilities, charges, and income: Assets, liabilities, charges, and income should not be offset against each other unless required by an IFRS standard

- Comparative information with the previous period: the financial statements must give corresponding information from previous years to allow users to compare the financial situation and the performance of a company over time

is a basic summary table which gives an image of the company's financial situation during a period and presents three main elements:

- The asset: economic resources controlled by the company from which it expects future economic benefits, or simply what the company has

- Liabilities: obligation to do or pay, which represents a negative value for the company, or what the company has to pay

- Equity: net worth of the company resulting from the difference between assets and liabilities.

commonly called the statement of comprehensive income or PP (loss and profit), is an accounting document that gives an image of the company's economic performance over a given period in terms of gains or losses.

It provides information on what the business has gained and spent and then indicates whether it has made a profit or a loss during the accounting period.

It is the difference between the products, which are the operations that increase the wealth of the company and the charges, which are the consumption of resources that impoverishes the company. The income statement provides useful information on the company's dynamics and its ability to generate profit as well as its positioning in relation to its competitors.

details and explains the change in cash during the entire accounting year. These are the company's bottom-line inflows and outflows for paying off debts and purchasing the products it needs.

The flows are classified into three categories:

- The flows linked to the company's operational activity: They define the variation of the company's liquidities held by the company linked to its main activity.

- Flows linked to investment activities: They represent all the expenses and income associated with acquisitions and disposals of fixed assets.

- Cash flows linked to financing activities: They mainly relate to capital increases and reductions, the payment of dividends to shareholders, and the obtaining or repayment of financial loans.

- The statement of changes in equity indicates all the transactions that affect an enterprise's total equity during an accounting year. It identifies the wealth created and/or potentially available to shareholders.

- The appendices are mandatory or significant documents intended to clarify the reading of the balance sheet and the income statement. It also provides useful qualitative information, but absent from the financial statements. For instance, the accounting practices and standards on which the financial statements are established, provisions, pension funds, discontinued operations, dispute resolution, disposal of tangible capital assets, the number of dividends proposed or decided, etc. as well as any other relevant information that could impact the company.

No single financial statement gives a complete picture of the business. They are all linked. The change in assets and liabilities arising from the balance sheet corresponds to the charges and income appearing in the income statement, which determines the company's gains or losses. The cash flows provide additional information on the liquid assets listed in the balance sheet. Financial statements are a valuable source of information for investors and donors for economic decision-making.

Understanding a company's financial statements in 5 points

The financial statements of a company show its economic situation in different aspects. A management tool, these summary documents allow members of the board of directors and managers to make informed decisions in the light of complete and reliable information and to provide third parties with a true picture of the company's situation. Here's how to understand a company's financial statements in 5 points. Three main documents

There are three main types of financial statements:

- the balance sheet which presents a photograph of the assets (assets), debts (liabilities), and assets of shareholders or associates (equity) of the company at the end of the past financial year

- the income statement which lists the revenues (products) and expenses (expenses) over a year

- the statement of changes in a financial position which provides information on the company's operating, financing and investing activities

Quebec law imposes an obligation on companies to present financial statements for the year ended during the annual general meeting. The board of directors has a photograph of the company's economic situation and a report on the past year of activity. The financial statements provide:

- business assets and liabilities

- The charges.

But financial statements also have other uses:

- they help the manager make informed decisions

- they serve as the basis for establishing the price during a transfer

- they allow investors and lenders to analyze the company's situation before deciding to inject funds or finance the development of the activity

- they support an insurance compensation claim in the event of a business interruption linked to a disaster

The income statement lists the company's revenues and expenses over a year. It allows you to see whether the financial year is profitable or loss-making and, in particular, to compare each item of expenditure and each category of product with the forecast budget and previous years. Thus, the organization can determine whether the strategic plans are being followed or whether they require a reassessment or even a modification.

The income statement also serves as the basis for establishing the budgets for the coming years by integrating changes linked to the economic situation (increase in the prices of raw materials, the cost of labor, etc.) and managerial decisions (such as an example of hiring or, on the contrary, job cuts, changes of premises, the opening or closing of a department).

We Will Write an Essay for You Quickly

In addition to revealing the assets and liabilities of a company, the balance sheet also provides information on the equity of the organization and makes it possible to analyze its financial solidity as well as its capacity to absorb any operating losses.

The statement of changes in financial position is an indicator of a company's cash flows from operating, investing, and financing activities. It allows:

- collect information on accounts receivable and payable

- monitor purchases and sales of fixed assets

- to examine the methods of financing purchases and the repayment of debts

These elements help to assess the liquidity and the solvency of the company and to determine its capacity to self-finance and to repay its debts.

The annual production of financial statements does not only satisfy a legal obligation. It provides economic data relating to the company's state and development, which helps the manager make informed decisions. It gives a true and complete picture of the organization's situation to third parties.

Looking for a Skilled Essay Writer?

- University of California, Los Angeles (UCLA) Bachelor of Arts

No reviews yet, be the first to write your comment

Write your review

Thanks for review.

It will be published after moderation

Latest News

What happens in the brain when learning?

10 min read

20 Jan, 2024

How Relativism Promotes Pluralism and Tolerance

Everything you need to know about short-term memory

- Undergraduate

- High School

- Architecture

- American History

- Asian History

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- Linguistics

- Criminal Justice

- Legal Issues

- Anthropology

- Archaeology

- Political Science

- World Affairs

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Pharmacology

- Earth science

- Agriculture

- Agricultural Studies

- Computer Science

- IT Management

- Mathematics

- Investments

- Engineering and Technology

- Engineering

- Aeronautics

- Medicine and Health

- Alternative Medicine

- Communications and Media

- Advertising

- Communication Strategies

- Public Relations

- Educational Theories

- Teacher's Career

- Chicago/Turabian

- Company Analysis

- Education Theories

- Shakespeare

- Canadian Studies

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

- Movie Review

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Marketing Plan

- Multiple Choice Quiz

- Personal Statement

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Reaction Paper

Research Paper

- Research Proposal

- SWOT analysis

- Thesis Paper

- Online Quiz

- Literature Review

- Movie Analysis

- Statistics problem

- Math Problem

- All papers examples

- How It Works

- Money Back Policy

- Terms of Use

- Privacy Policy

- We Are Hiring

Analysis of Financial Statements, Essay Example

Pages: 3

Words: 706

Hire a Writer for Custom Essay

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

Financial statements are the summary of an organization’s affairs as well as their transactions represented in a manner that is discernible as well as logical. The financial affairs of an organization presented in a simple manner form the financial statements (BPP 2009). A proper research and analysis of an entity’s financial statements gives insight into the actual status of the organization. Management therefore ought to analysis and closely scrutinise such information that is presented in the financial statements of an entity to determine whether an entity is performing well or it is not. There are various benefits to be gained from analysis of these financial statements.

First by analysing such financial statements management can perform ration analysis that will assist them determine various comparable performance rations of the organization. Among them the management is able to determine the financial performance indicators which can be compared with the organization’s performance in the prior year as well as with the performance of comparable entities that are in direct competition with the entity. First the management is able to compare profits in the current period against budget as well as against prior periods. This way they can verify whether they were able to meet the budget as well as whether they have made significant progress. The analysis of the financial statements also enables the management to determine whether they have cost effective practices (BPP 2009)

The analysis of financial statements gives a clear guide on the ongoing affairs of an entity. This enables the management (as investors) to make informed decisions on the organizations financial health (Harper 2010). The investors can therefore through clear research establish the current status of various vital rations such as gearing which helps establish the organization’s debt ratio. They can also establish whether the organization has a good return on capital employed (ROCE) as well as good earnings per share. Finally a good research as well enables the company to establish whether they have a healthy liquidity ratio and accounts payable period.

The research and analysis of the various ratios mentioned above helps the company to arrive at a decision whether the company is doing well financially or not and whether it is headed in the right direction or not. The management is therefore able to overcome the risks involved when decisions are made based on the profit figure only. For example, a company might have a good profit but be highly geared. Analysis of such an entity would enable the management to determine that it is not safe to enter into a credit agreement to fund expansion. Similarly a company with low earnings per share would be indicative for the management to reduce the share capital.

The management should make decisions based on their analysis of financial statements. All analysts insist on users of financial information doing their homework (Harper 2010). This is because there are creating accounting techniques that if not well investigated can leave the management believing that a company is doing well while in reality it is tottering on the brink of collapse. The management also needs to look comparatively at the cost of sales and compare net profit margin to gross profit margin and therefore determine whether they need to institute cost cutting measures to improve their performance.

Present value and future value analysis seeks to establish the expected value of a present day asset in a specified period in the future. This also seeks to measure the expected cash inflows from a current day asset or otherwise known as capitalization. The management also seeks to factor in the predicted impact of inflationary trends on the financial wellbeing of the company. The future value of present assets therefore will enable the management predict the organization’s financial strength in the future as well as predict future cash flows. The management is therefore able to discern the financing as well as the investment options that are workable as well as determine how to deal with the current problems. If for example the company expects to receive a lot of money in future as dividends this is a future value of present day investment which can affect their decision.

BPP Learning Media (2009). Performance Management . London: BPP publishers.

Harper D (2010). Financial statements . Retrieved 2 May 2010. Available. http://www.investopedia.com/university/financialstatements/default.asp

Stuck with your Essay?

Get in touch with one of our experts for instant help!

Nathaniel Hawthorne’s 'Young Goodman Brown', Essay Example

MacBook Pro Target Market, Research Paper Example

Time is precious

don’t waste it!

Plagiarism-free guarantee

Privacy guarantee

Secure checkout

Money back guarantee

Related Essay Samples & Examples

Voting as a civic responsibility, essay example.

Pages: 1

Words: 287

Utilitarianism and Its Applications, Essay Example

Words: 356

The Age-Related Changes of the Older Person, Essay Example

Pages: 2

Words: 448

The Problems ESOL Teachers Face, Essay Example

Pages: 8

Words: 2293

Should English Be the Primary Language? Essay Example

Pages: 4

Words: 999

The Term “Social Construction of Reality”, Essay Example

Words: 371

Table of Contents

Framework and applications of financial statement analysis, financial statement analysis - framework and application.

Financial Statement Analysis refers to the process of analyzing and assessing a company’s financial statements to gain an understanding of its business model, financial performance , risk and profitability of the business.

The role of financial statement analysis is to utilize the information available in a company's financial statements (Balance Sheet, Income Statement, Cash flow Statement etc) along with other relevant information, to make economic decisions. Key objective of financial statement analysis include assessing decisions such as whether to invest in the company's securities or recommend them to investors, and whether to extend trade or bank credit to the company. Analysts use financial statement data to evaluate past performance and current financial position of a company in order to form opinions about the company's ability to earn profits and generate cash flow in the future. The framework for financial statement analysis may be broadly categorized into following six steps:

- State the objective and context : Determine what questions the analysis seeks to answer, the form in which this information needs to be presented, and what resources and how much time is available to perform the analysis.

- Gather data : Acquire the company's financial statements and other relevant data on its industry and the economy. Ask questions of the company's management, suppliers, and customers and visit company sites.

- Process the data : Make any appropriate adjustments to the financial statements. Calculate ratios. Prepare exhibits such as graphs and common-size balance sheets.

- Analyze and interpret the data : Use the data to answer the questions stated in the first step. Decide what conclusions or recommendations the information supports.

- Report the conclusions or recommendations : Prepare a report and communicate it to its intended audience. Be sure the report and its dissemination comply with the Code and Standards that relate to investment analysis and recommendations.

- Update the analysis: Repeat these steps periodically and change the conclusions or recommendations when necessary.

Common Size Analysis:

- Common-size financial statements allow an analyst to compare performance across firms, evaluate a single firm across time, and quickly view certain financial ratios.

- Vertical common-size ratios are stated in terms of sales (for income statements) or total assets (for balance sheets). Horizontal common-size financial sheet data index each item to its value in a base year.

- Stacked column graphs and line graphs can illustrate the changes in financial statement values over time.

Financial Ratio Analysis:

- Financial ratios can be classified as activity, liquidity, solvency, profitability, and valuation ratios. An analyst should use an appropriate combination of different ratios to evaluate a company over time and relative to comparable companies.

- Financial ratios can be classified as activity, liquidity, solvency, profitability, and valuation ratios.

- Activity ratios include receivables turnover, days of sales outstanding, inventory turnover, days of inventory on hand, payables turnover, payables payment period, and turnover ratios for total assets, fixed assets, and working capital.

- Liquidity ratios include the current, quick, and cash ratios, the defensive interval, and the cash conversion cycle.

- Solvency ratios include the debt-to-equity, debt-to-capital, debt-to-assets, financial leverage, interest coverage, and fixed charge coverage ratios.

- Profitability ratios include net, gross, and operating profit margins, pretax margin, return on assets, and operating return on assets, return on total capital, return on total equity, and return on common equity.

- Ratios used in equity analysis include price-to-earnings, price-to-cash flow, price-to-sales, and price-to-book value ratios, basic and diluted earnings per share. Other ratios are relevant to specific industries such as retail and financial services.

- Credit analysis emphasizes interest coverage ratios, return on capital, debt-to-assets ratios and ratios of cash flow to total debt.

Limitations of ratio analysis:

- Ratios are not useful when viewed in isolation.

- Different companies use different accounting treatments.

- Comparable ratios can be hard to find for companies that operate in multiple industries.

- Ratios must be analyzed relative to one another.

- Determining the range of acceptable values for a ratio can be difficult.

Business segments and geographic segments can be analyzed separately to provide more detail about a company's financial performance. Common-size financial statements and ratio analysis can be used to construct pro forma financial statements based on a forecast of sales growth and assumptions about the behavior of a firm's financial ratios. Happy learning! We wish you good luck in your "Finance for Non-Financial Professionals Certification Training" journey!

Learn from Industry Experts with free Masterclasses

Finance management.

Financial Modeling statistical functions in Excel

Recommended Reads

Free eBook: Guide To The PMP Exam Changes

Considering the Benefits and Limitations of Income Statements

What is AWS Load Balancer [Algorithms & Demos Included]

Free eBook: 2015 Top 8 IT Certifications

Fixed Income

What Is Data Science: Lifecycle, Applications, Prerequisites and Tools

Get Affiliated Certifications with Live Class programs

Finance for non-financial professionals.

- 24x7 learner assistance and support

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

- Search Search Please fill out this field.

What Is Ratio Analysis?

- What Does It Tell You?

- Application

The Bottom Line

- Corporate Finance

- Financial Ratios

Financial Ratio Analysis: Definition, Types, Examples, and How to Use

:max_bytes(150000):strip_icc():format(webp)/andrew_bloomenthal_bio_photo-5bfc262ec9e77c005199a327.png)

- Valuing a Company: Business Valuation Defined With 6 Methods

- Valuation Analysis

- Financial Statements

- Balance Sheet

- Cash Flow Statement

- 6 Basic Financial Ratios

- 5 Must-Have Metrics for Value Investors

- Earnings Per Share (EPS)

- Price-to-Earnings Ratio (P/E Ratio)

- Price-To-Book Ratio (P/B Ratio)

- Price/Earnings-to-Growth (PEG Ratio)

- Fundamental Analysis

- Absolute Value

- Relative Valuation

- Intrinsic Value of a Stock

- Intrinsic Value vs. Current Market Value

- Equity Valuation: The Comparables Approach

- 4 Basic Elements of Stock Value

- How to Become Your Own Stock Analyst

- Due Diligence in 10 Easy Steps

- Determining the Value of a Preferred Stock

- Qualitative Analysis

- Stock Valuation Methods

- Bottom-Up Investing

- Ratio Analysis CURRENT ARTICLE

- What Book Value Means to Investors

- Liquidation Value

- Market Capitalization

- Discounted Cash Flow (DCF)

- Enterprise Value (EV)

- How to Use Enterprise Value to Compare Companies

- How to Analyze Corporate Profit Margins

- Return on Equity (ROE)

- Decoding DuPont Analysis

- How to Value Private Companies

- Valuing Startup Ventures

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as the balance sheet and income statement. Ratio analysis is a cornerstone of fundamental equity analysis .

Key Takeaways

- Ratio analysis compares line-item data from a company's financial statements to reveal insights regarding profitability, liquidity, operational efficiency, and solvency.

- Ratio analysis can mark how a company is performing over time, while comparing a company to another within the same industry or sector.

- Ratio analysis may also be required by external parties that set benchmarks often tied to risk.

- While ratios offer useful insight into a company, they should be paired with other metrics, to obtain a broader picture of a company's financial health.

- Examples of ratio analysis include current ratio, gross profit margin ratio, inventory turnover ratio.

Investopedia / Theresa Chiechi

What Does Ratio Analysis Tell You?

Investors and analysts employ ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. Comparative data can demonstrate how a company is performing over time and can be used to estimate likely future performance. This data can also compare a company's financial standing with industry averages while measuring how a company stacks up against others within the same sector.

Investors can use ratio analysis easily, and every figure needed to calculate the ratios is found on a company's financial statements.

Ratios are comparison points for companies. They evaluate stocks within an industry. Likewise, they measure a company today against its historical numbers. In most cases, it is also important to understand the variables driving ratios as management has the flexibility to, at times, alter its strategy to make it's stock and company ratios more attractive. Generally, ratios are typically not used in isolation but rather in combination with other ratios. Having a good idea of the ratios in each of the four previously mentioned categories will give you a comprehensive view of the company from different angles and help you spot potential red flags.

A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other.

Types of Ratio Analysis

The various kinds of financial ratios available may be broadly grouped into the following six silos, based on the sets of data they provide:

1. Liquidity Ratios

Liquidity ratios measure a company's ability to pay off its short-term debts as they become due, using the company's current or quick assets. Liquidity ratios include the current ratio, quick ratio, and working capital ratio.

2. Solvency Ratios

Also called financial leverage ratios, solvency ratios compare a company's debt levels with its assets, equity, and earnings, to evaluate the likelihood of a company staying afloat over the long haul, by paying off its long-term debt as well as the interest on its debt. Examples of solvency ratios include: debt-equity ratios, debt-assets ratios, and interest coverage ratios.

3. Profitability Ratios

These ratios convey how well a company can generate profits from its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratios are all examples of profitability ratios .

4. Efficiency Ratios

Also called activity ratios, efficiency ratios evaluate how efficiently a company uses its assets and liabilities to generate sales and maximize profits. Key efficiency ratios include: turnover ratio, inventory turnover, and days' sales in inventory.

5. Coverage Ratios

Coverage ratios measure a company's ability to make the interest payments and other obligations associated with its debts. Examples include the times interest earned ratio and the debt-service coverage ratio .

6. Market Prospect Ratios

These are the most commonly used ratios in fundamental analysis. They include dividend yield , P/E ratio , earnings per share (EPS), and dividend payout ratio . Investors use these metrics to predict earnings and future performance.

For example, if the average P/E ratio of all companies in the S&P 500 index is 20, and the majority of companies have P/Es between 15 and 25, a stock with a P/E ratio of seven would be considered undervalued. In contrast, one with a P/E ratio of 50 would be considered overvalued. The former may trend upwards in the future, while the latter may trend downwards until each aligns with its intrinsic value.

Most ratio analysis is only used for internal decision making. Though some benchmarks are set externally (discussed below), ratio analysis is often not a required aspect of budgeting or planning.

Application of Ratio Analysis

The fundamental basis of ratio analysis is to compare multiple figures and derive a calculated value. By itself, that value may hold little to no value. Instead, ratio analysis must often be applied to a comparable to determine whether or a company's financial health is strong, weak, improving, or deteriorating.

Ratio Analysis Over Time

A company can perform ratio analysis over time to get a better understanding of the trajectory of its company. Instead of being focused on where it is today, the company is more interested n how the company has performed over time, what changes have worked, and what risks still exist looking to the future. Performing ratio analysis is a central part in forming long-term decisions and strategic planning .

To perform ratio analysis over time, a company selects a single financial ratio, then calculates that ratio on a fixed cadence (i.e. calculating its quick ratio every month). Be mindful of seasonality and how temporarily fluctuations in account balances may impact month-over-month ratio calculations. Then, a company analyzes how the ratio has changed over time (whether it is improving, the rate at which it is changing, and whether the company wanted the ratio to change over time).

Ratio Analysis Across Companies

Imagine a company with a 10% gross profit margin. A company may be thrilled with this financial ratio until it learns that every competitor is achieving a gross profit margin of 25%. Ratio analysis is incredibly useful for a company to better stand how its performance compares to similar companies.

To correctly implement ratio analysis to compare different companies, consider only analyzing similar companies within the same industry . In addition, be mindful how different capital structures and company sizes may impact a company's ability to be efficient. In addition, consider how companies with varying product lines (i.e. some technology companies may offer products as well as services, two different product lines with varying impacts to ratio analysis).

Different industries simply have different ratio expectations. A debt-equity ratio that might be normal for a utility company that can obtain low-cost debt might be deemed unsustainably high for a technology company that relies more heavily on private investor funding.

Ratio Analysis Against Benchmarks

Companies may set internal targets for their financial ratios. These calculations may hold current levels steady or strive for operational growth. For example, a company's existing current ratio may be 1.1; if the company wants to become more liquid, it may set the internal target of having a current ratio of 1.2 by the end of the fiscal year.

Benchmarks are also frequently implemented by external parties such lenders. Lending institutions often set requirements for financial health as part of covenants in loan documents. Covenants form part of the loan's terms and conditions and companies must maintain certain metrics or the loan may be recalled.

If these benchmarks are not met, an entire loan may be callable or a company may be faced with an adjusted higher rate of interest to compensation for this risk. An example of a benchmark set by a lender is often the debt service coverage ratio which measures a company's cash flow against it's debt balances.

Examples of Ratio Analysis in Use

Ratio analysis can predict a company's future performance — for better or worse. Successful companies generally boast solid ratios in all areas, where any sudden hint of weakness in one area may spark a significant stock sell-off. Let's look at a few simple examples

Net profit margin , often referred to simply as profit margin or the bottom line, is a ratio that investors use to compare the profitability of companies within the same sector. It's calculated by dividing a company's net income by its revenues. Instead of dissecting financial statements to compare how profitable companies are, an investor can use this ratio instead. For example, suppose company ABC and company DEF are in the same sector with profit margins of 50% and 10%, respectively. An investor can easily compare the two companies and conclude that ABC converted 50% of its revenues into profits, while DEF only converted 10%.

Using the companies from the above example, suppose ABC has a P/E ratio of 100, while DEF has a P/E ratio of 10. An average investor concludes that investors are willing to pay $100 per $1 of earnings ABC generates and only $10 per $1 of earnings DEF generates.

What Are the Types of Ratio Analysis?

Financial ratio analysis is often broken into six different types: profitability, solvency, liquidity, turnover, coverage, and market prospects ratios. Other non-financial metrics may be scattered across various departments and industries. For example, a marketing department may use a conversion click ratio to analyze customer capture.

What Are the Uses of Ratio Analysis?

Ratio analysis serves three main uses. First, ratio analysis can be performed to track changes to a company over time to better understand the trajectory of operations. Second, ratio analysis can be performed to compare results with other similar companies to see how the company is doing compared to competitors. Third, ratio analysis can be performed to strive for specific internally-set or externally-set benchmarks.

Why Is Ratio Analysis Important?

Ratio analysis is important because it may portray a more accurate representation of the state of operations for a company. Consider a company that made $1 billion of revenue last quarter. Though this seems ideal, the company might have had a negative gross profit margin, a decrease in liquidity ratio metrics, and lower earnings compared to equity than in prior periods. Static numbers on their own may not fully explain how a company is performing.

What Is an Example of Ratio Analysis?

Consider the inventory turnover ratio that measures how quickly a company converts inventory to a sale. A company can track its inventory turnover over a full calendar year to see how quickly it converted goods to cash each month. Then, a company can explore the reasons certain months lagged or why certain months exceeded expectations.

There is often an overwhelming amount of data and information useful for a company to make decisions. To make better use of their information, a company may compare several numbers together. This process called ratio analysis allows a company to gain better insights to how it is performing over time, against competition, and against internal goals. Ratio analysis is usually rooted heavily with financial metrics, though ratio analysis can be performed with non-financial data.

:max_bytes(150000):strip_icc():format(webp)/terms_l_liquidityratios_FINAL-d2c8aea76ba845b4a050eacd22566cae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Financial Reporting Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Objectives of financial reporting, qualitative characteristics of financial statements, principles of presentation, fundamental accounting assumptions, other measures, reference list.

The following essay examines the fair presentation of financial statements. The essay also examines the objectives of financial reporting, components of financial statements, Principles of Presentation, qualitative characteristics of financial statements and Fundamental Accounting Assumptions.

It is important to first determine the meaning of financial statements before examining the fair presentation of financial statements. Financial statements entail the end products which are prepared from the adjusted trial balance. Financial statements play an important role of communicating key accounting information concerning a business organization to those people who are interested in the business.

The financial statements act as a model of a business enterprise by showing the business organization in financial terms (Berger, 2007, 47). The major financial statements includes income statements or profit and loss account, the balance sheet or statement of financial position, the cash flow statement and changes in owner’s equity.

The income statement or the profit and loss account summarizes the expenses and revenues that a business incurs in a particular accounting period. Income statement is an important financial statement as it enables people to determine as to whether the business has attained its profitability objectives or not. The balance sheet main purpose is to explain the position of a firm at a particular date i.e. either at the end of year or month. Cash flow statement usually focuses on the liquidity of a business .

Thus cash flows refers to the inflows as well as outflows of money. Changes in owner’s equity or the statement of retained earnings explain the changes that occur in the retained earnings in a particular accounting period. The main propose of financial statements according to IAS 1 is to provide the users with information concerning the financial performance of a business entity. In addition, the financial statements help to show the management’s results (Nikolai et.al. 2009, 79).

The main purpose of financial reporting it to provide the users of information so as to enable them makes well-versed decisions. Various users require information so as to come up with sound decisions regarding a business entity. The users includes the

stockholders,bankers,bondholders,suplliesr,employees,lenders,cerditoirs,government,customers among others (Porter, & Norton,2010,58).

The investors provide risk capital and therefore they are concerned with the firm’s risk inherent as well as the returns for their investments. They thus need the financial information so as to enable them to know as to whether or not they should sell, buy or hold shares. The investors also require the information so as to determine the capability of the firm to pay dividends. The employees together with their representative unions require the information so as to determine their profitability and stability of their company.

The employees also require knowing the firm’s ability to remunerate them well, to provide them with employment opportunities and also to provide them with the retirement benefits.

The lenders provide the firm with the required funding and therefore, they are interested in financial information so as to enable them to know as top whether or not the firm is able to pay their loans plus interests when due. The suppliers requires the information so as to enable them to know as to whether or not the firm is capable of paying them the amounts unsettled.

Customers are mainly interested with the continuity of a firm and so, they requires information so as to enable them to know as to whether or not the firm will continue meeting their needs. The government regulates the business entities and therefore, they require the financial information in order to know which activities require to be regulated and also to determine the taxation policies (Needles, Powers & Crosson, 2010, 210).

These users have to make such decisions as whether or not to invest in a particular firm e.t.c.The external users usually relies on the financial statements i.e. balance sheet, profit and loss account and the cash flow statement so as to obtain information. The statement of financial position enables the users to know the obligations that are due soon and also the kind of assets that are available in the firm. The profit and loss account enables the users to determine the expenses and revenues of a business entity in a given time period.

The cash flow statement provides the users with information concerning the sources of cash and also how the cash was utilized in a certain period. Another important tool that is used for providing the external users is the notes. Notes plays an important role of providing key details concerning a firm’s accounting practices as well as other important factors that can affect the firm’s financial performance.

The users have to clearly understand the accounting policies that a firm adopts in preparation of the financial statements and therefore, the accountants considers the following ;the purpose of financial reporting, the salient features that make the information useful, the most ideal manner of displaying the information obtained in the cash flow statements, balance sheet and profit and loss account.

Apart form providing the users with financial information, financial reporting serves other purposes i.e. financial reporting helps to reflect the potential cash receipts to creditors and investors, financial reporting reflects the cash flows that a company is likely to obtain in near future and also, financial reporting reflects s the resources of a firm (Needles, & Powers,2007,226).

Qualitative characteristics of financial statements refer to the aspects that enhance the usefulness of financial information. Qualitative characteristics of financial statements include reliability, relevance, comparability and understandability.

Information is deemed to be relevance if it is capable of influencing the users’ decisions. According to the International Accounting Standards, information should be predictive, timely and also have feedback value for it to be regarded as relevance. Predictive value entails the ability of information to predict past, present and future outcomes. Feedback value entails the capacity of information to enable the users to confirm with the prior expectations.

The relevance of financial information is mainly determined by its materiality. Materiality basically involves the importance and relative size of a financial transaction to business entity. An item thus is considered as material if it is capable of influencing the decisions of the users of financial statements (International Accounting Standards Committee Foundation & International Accounting Standards Board, 2008, 22).

With regards to reliability, information is considered to be reliable if it is free from any bias or error and also represents faithfully what it purports to present or what it is expected to present. According to the International Accounting Standards, information must be able to meet the following three conditions for it to be considered as reliable i.e. information should be verifiable, the information should have faithful representation and also, the information should be neutral.

Faithful representation entails that the information should not have any error or bias. In order for the information to be deemed as reliable, information is required to faithfully represent the transactions it purports to represent. This implies that the balance sheet is required to faithfully represent the transactions in assets and liabilities of a business entity at the reporting time.

Verifiability entails that the information should be easy to confirm. Neutrality implies that the information should not intend to obtain predetermined outcomes. Another aspect that helps to ensure that the information is true and fair is the substance over form. In order for the information to faithfully represent what it purports to stand for, it is important that it is presented and accounted for with regards to their economic and substance reality rather than its legal form (Stolowy, H, & Lebas, 2006, 160).

With regards to comparability, the information should be easy to compare with other firms in the industry.Also; the financial statement should be easily comparable form one accounting period to another (International Accounting Standards Committee Foundation & International Accounting Standards Board, 2008, 22).

Understandability is an essential characteristic of the financial information and it basically implies that the information in the financial statements should be easy to understand in order to enable the users to make good decisions. With this regard, the users are thus assumed to know the various economic and business activities as well as accounting. The users are also required to have a willingness to learn the financial information in a diligent manner. Understandability and usefulness of information goes together.

The usefulness of the financial statements with regards to decision makers is dependent on the reports being complete and detailed enough.However; the understandability depends mainly on the background of the user in that, those who have higher accounting education understands more as compared to those with little or no accounting background (International Accounting Standards Committee Foundation & International Accounting Standards Board, 2008, 22).

The International Accounting Standards (IAS) 1 identifies the following characteristics for the presentation of financial statements i.e. fair presentation and compliance with IFRS, going concern, accrual basis of accounting, materiality and aggregation, offsetting, frequency of reporting and consistency of presentation.

With regards to the fair presentation and compliance with International Financial Reporting Standards, financial statements are supposed to fairly present the financial performance, the cash flow and the financial position of a business entity.

Fair presentation entails the act of faithful representation with regards to the effects of business transactions as stated in the IAS framework. The International Accounting Standards (IAS) 1, states that the IFRS application coupled with disclosure when required should enhance the fair presentation of financial statements.

The International Accounting Standards 1 also recognizes that the mere compliance with International Financial Reporting Standards may be unsuitable or inadequate in certain circumstances. According to International Accounting Standards 1, an entity is supposed to use the IFRS virtually in all the circumstances so as to ensure that there is a fair presentation.However; the IAS 1 allows an entity to depart form this requirement in extremely unusual circumstances.

When an entity departs from this requirement of IFRS in a previous accounting period and the amounts that is recognized in the present period is affected as a result, the entity is thus required to disclose the title of the International Financial Reporting Standard that has been departed by an entity, the kind of the IFRS departure e.t.c.

The International Accounting Standard states that an entity is not supposed to deliberately depart from IFRS.In case where an entity deliberately depart form IFRS.In is required to act in accordance with the particular standard and also disclose in notes the effect (IASB,2009,903).

The other principle of presentation of financial statements is the going concern. The IAS provides that the financial statements should be prepared with regards to a going concern basis except in a case where the senior leadership team intends to cease the business entity or plans top liquidate it.

The management usually uses all the available information concerning the future of a business entity in determining whether the business will continue in its operations in the unforeseeable future. Thus an entity that has past profitable operations may be deemed to be a going concern entity (Kolitz, Quinn & McAllister, 2009, 152).

The International Accounting Standards 1 provides that a business should use an accrual basis of accounting during the preparation of financial statements. Paragraph 7 of IAS 1 explain that this basis of accounting is important as it allows items to be recognized as income,expenses,assets ,liability and equity when they meets the recognition criteria in the Accounting Framework.

Materiality and aggregation requires that the management evaluate the size and nature of the items in order to determine as to whether or not the information is material. Information is material if it has the ability of influencing the decisions of users and thus the IAS requires each and every material item to be presented individually in the financial statements. For immaterial amounts, they require not to be presented individually (Everingham, Kleynhans& Posthumus, 2008, 20).