Health insurance sector in India: an analysis of its performance

Vilakshan - XIMB Journal of Management

ISSN : 0973-1954

Article publication date: 30 November 2020

Issue publication date: 16 December 2020

Health insurance is one of the major contributors of growth of general insurance industry in India. It alone accounts for around 29% of total general insurance premium income earned in India. The growth of this sector is important from the perspective of overall growth of general insurance Industry. At the same time, problems in this sector are also many which are affecting its performance.

Design/methodology/approach

The paper provides an understanding on performance of health insurance sector in India. This study attempts to find out how much claims and commission and management expenses it has to incur to earn certain amount of premium. Methodology used for the study is regression analysis to establish relationship between dependent variable (Profit/Loss) and independent variable (Health Insurance Premium earned).

Findings of the study indicate that there is significant relationship between earned premium and underwriting loss. There has been increase of premium earnings which instead of increasing profit for the sector in fact has increased underwriting loss over the years. The earnings of the sector is growing at compounded annual growth rate of 27% still it is unable to earn underwriting profit.

Originality/value

This study is self-driven based on secondary data obtained from insurance regulatory and development authority site.

- Health insurance premium

- Management expenses

- Insurance regulatory and development authority

- Underwriting loss

- Compound annual growth rate

Dutta, M.M. (2020), "Health insurance sector in India: an analysis of its performance", Vilakshan - XIMB Journal of Management , Vol. 17 No. 1/2, pp. 97-109. https://doi.org/10.1108/XJM-07-2020-0021

Emerald Publishing Limited

Copyright © 2020, Madan Mohan Dutta.

Published in Vilakshan - XIMB Journal of Management . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence maybe seen at http://creativecommons.org/licences/by/4.0/legalcode

1. Introduction

1.1 meaning of insurance.

Insurance is a contract between two parties where by one party agrees to undertake the risk of the other in exchange for consideration known as premium and promises to indemnify the party on happening of an uncertain event. The great advantage of insurance is that it spreads the risk of a few people over a large group of people exposed to risk of similar type.

Insurance has been identified as a sunrise sector by the financial planners of India. The insurance industry has lot of potential to grow, penetrate and service the masses of India. Insurance is all about protection. An insured needs two types of protection life and non-life. General insurance industry deals with non-life protection of the insured of which health insurance is a part.

1.2 Meaning of health insurance

Health insurance is a part of general insurance which contributes about 29% of premium amongst all other sectors of general insurance. But problems in this sector are many which is the driving force behind this study. This study will help the insurance companies to understand their performance and the quantum of losses that this sector is making over the years.

A plan that covers or shares the expenses associated with health care can be described as health insurance. These plans fall into commercial health insurance, which is provided by government, private and stand-alone health insurance companies.

Health insurance in India typically pays for only inpatient hospitalization and for treatment at hospitals in India. Outpatient services are not payable under health policies in India. The first health policy in India was Mediclaim Policy. In 2000, the Government of India liberalized insurance and allowed private players into the insurance sector. The advent of private insurers in India saw the introduction of many innovative products like family floater plans, critical illness plans, hospital cash and top-up policies.

Health insurance in India is an emerging insurance sector after life and automobile insurance sector. Rise in middle class, higher hospitalization cost, expensive health care, digitization and increase in awareness level are some important drivers for the growth of health insurance market in India.

Lifestyle diseases are on the rise. A sedentary lifestyle has pervaded our being. There is lower physical labour today than earlier and there is no reason why this would not be the trend going forward. The implication is the advent of lifestyle chronic diseases such as cardiac problems and diabetes.

In the context of the Indian health insurance industry, one could look at it both ways. Mired by low penetration and negative consumer perception about its utility are affecting the prospect of this industry. The flipside though is that we have hardly scratched the surface of the opportunity that lies in the future. It is as if the glass is half full. Much remains to be conquered and even more remains to be accomplished.

Health insurance companies needs to be optimistic and have courage to bring in innovation in the areas of product, services and distribution system. Bring it to the fold as the safety net that smartly covers and craft a health insurance plan befitting the need of the customers.

1.3 Background of health insurance sector in India

India’s tryst with health insurance programme goes back to the late 1940s and early 1950s when the civil servants (Central Government Health Scheme) and formal sector workers (Employees’ State Insurance Scheme) were enrolled into a contributory but heavily subsidized health insurance programmes. As a consequence of liberalization of the economy since the early 1990s, the government opened up private sector (including health insurance) in 1999. This development threw open the possibility for higher income groups to access quality care from private tertiary care facilities. However, India in the past five years (since 2007) has witnessed a plethora of new initiatives, both by the central government and a host of state governments also entering the bandwagon of health insurance. One of the reasons for initiating such programs may be traced to the commitment of the governments in India to scale up public spending in health care.

1.4 The need for health insurance in India

1.4.1 lifestyles have changed..

Indians today suffer from high levels of stress. Long hours at work, little exercise, disregard for a healthy balanced diet and a consequent dependence on junk food have weakened our immune systems and put us at an increased risk of contracting illnesses.

1.4.2 Rare non-communicable diseases are now common.

Obesity, high blood pressure, strokes and heart attacks, which were earlier considered rare, now affect an increasing number of urban Indians.

1.4.3 Medical care is unbelievably expensive.

Medical breakthroughs have resulted in cures for dreaded diseases. These cures however are available only to a select few. This is because of high operating and treatment expenses.

1.4.4 Indirect costs add to the financial burden.

Indirect sources of expense like travel, boarding and lodging, and even temporary loss of income account for as much as 35% of the overall cost of treatment. These facts are overlooked when planning for medical expenses.

1.4.5 Incomplete financial planning.

Most of us have insured our home, vehicle, child’s education and even our retirement years. Ironically however we have not insured our health. We ignore the fact that illnesses strike without warning and seriously impact our finances and eat into our savings in the absence of a good health insurance or medical insurance plan.

1.5 Classification of health insurance plans in India

Health insurance plans in India today can be broadly classified into the following categories:

1.5.1 Hospitalization.

Hospitalization plans are indemnity plans that pay cost of hospitalization and medical costs of the insured subject to the sum insured. There is another type of hospitalization policy called a top-up policy . Top-up policies have a high deductible typically set a level of existing cover.

1.5.2 Family floater health insurance.

Family health insurance plan covers entire family in one health insurance plan. It works under assumption that not all member of a family will suffer from illness in one time.

1.5.3 Pre-existing disease cover plans.

It offers covers against disease that policyholder had before buying health policy. Pre-existing disease cover plans offers cover against pre-existing disease, e.g. diabetes, kidney failure and many more. After waiting for two to four years, it gives covers to the insured.

1.5.4 Senior citizen health insurance.

This type of health insurance plan is for older people in the family. It provides covers and protection from health issues during old age.

1.5.5 Maternity Health insurance.

Maternity health insurance ensures coverage for maternity and other additional expenses.

1.5.6 Hospital daily cash benefit plans.

Daily cash benefits are a defined benefit policy that pays a defined sum of money for every day of hospitalization.

1.5.7 Critical illness plans.

These are benefit-based policies which pay a lump sum amount on certain critical illnesses, e.g. heart attack, cancer and stroke.

1.5.8 Disease-specific special plans.

Some companies offer specially designed disease-specific plans such as Dengue Care and Corona Kavach policy.

1.6 Strength, weakness, opportunity and threat analysis of health insurance sector (SWOT analysis)

The strengths, weaknesses, opportunities and threats (SWOT) is a study undertaken to identify internal strengths and weaknesses as well as external opportunities and threats of the health insurance sector.

1.6.1 Strengths.

The growth trend of the health insurance sector is likely to be high due to rise in per capita income and emerging middle-income group in India. New products are being launched in this sector by different insurance companies which will help to satisfy customers need. Customers will be hugely benefited when cash less facility will be provided to all across the country by all the insurance companies.

1.6.2 Weaknesses.

The financial condition of this sector is weak due to low investment in this sector. The public sector insurance companies are still dominating this industry due to their greater infrastructure facilities. This sector is prone to high claim ratio and many false claims are also made.

1.6.3 Opportunities.

The possibility of future growth of this sector is high, as penetration in the rural sector is low. The improvement of technology and the use of internet facility are helping this sector to grow in magnitude and move towards environment-friendly paperless regime.

1.6.4 Threats.

The biggest threat of this sector lies in the change in the government regulations. The profitability of this sector is affected due to increasing expenses and claims. The economic slowdown and recession in the economy can affect growth of this sector adversely. The increasing losses and need for insurance might reach a point of no return where insurance companies may be compelled to decline an insurance policy.

1.7 Political economic socio cultural and technological analysis of health insurance sector (PEST analysis)

This analysis describes a framework of macro-environmental factors used as strategic tool for understanding business position, growth potential and direction for operations.

1.7.1 Political factors.

Service tax on premium on insurance policies is being increased by the government for past few years during budget. Government monopoly in this sector came to an end after insurance companies were opened up for private participation in the year 2000. Foreign players were allowed to enter into joint venture with their Indian counterpart with 26% holding and which was further increased to 49% in the year 2015.

1.7.2 Economic factors.

The gross savings of people in India have increased significantly thereby encouraging people to buy insurance policy to cover their risks. Insurance companies are fast becoming prominent players in the security market. As these companies have huge disposable income which they are investing in the security market.

1.7.3 Socio-cultural factors.

Increase in insurance knowledge is helping people to increase their awareness about the risk to be covered through insurance. Change in lifestyle is leading to increase in risk thereby giving an opportunity to insurance companies to innovate newer products. Societal benefit is derived by transfer of risk through insurance due to improved socio-cultural environment.

1.7.4 Technological factors.

Insurance companies deals in large database and maintaining it by the application of latest technology is huge gain for this sector. Technological advancement has helped insurance companies to sale their products through their electronic portals. This has made their task of providing service to the customers easier and faster.

2. Review of literature

After opening up of the insurance industry health insurance sector has become significant both from economic and social point of view and researchers have explored and probed these aspects.

Ellis et al. (2000) reviewed a variety of health insurance systems in India. It was revealed that there is a need for a competitive environment which can only happen with the opening up of the insurance sector. Aubu (2014) conducted a comparative study on public and private companies towards marketing of health insurance policies. Study revealed that private sector services evoked better response than that of public sector because of new strategies and technologies adopted by them. Nair (2019) has made a comparative study of the satisfaction level of health insurance claimants of public and private sector general insurance companies. It was revealed that majority of the respondents had claim of reimbursement nature through third party administrator. Satisfaction with respect to settlement of claim was found relatively higher for public sector than private sector. Devadasan et al. (2004) studied community health insurance to be an important intermediate step in the evolution of an equitable health financing mechanism in Europe and Japan. It was concluded that community health insurance programmes in India offer valuable lessons for its policy makers. Kumar (2009) examined the role of insurance in financing health care in India. It was found that insurance can be an important means of mobilizing resources, providing risk protection and health insurance facilities. But for this to happen, it will require systemic reforms of this sector from the end of the Government of India. Dror et al. (2006) studied about willingness among rural and poor persons in India to pay for their health insurance. Study revealed that insured persons were more willing to pay for their insurance than the uninsured persons. Jayaprakash (2007) examined to understand the hurdles preventing the people to purchase health insurance policies in the country and methods to reduce claims ratio in this sector. Yadav and Sudhakar (2017) studied personal factors influencing purchase decision of health insurance policies in India. It was found that factors such as awareness, tax benefit, financial security and risk coverage has significant influence on purchase decision of health insurance policy holders. Thomas (2017) examined health insurance in India from the perspective of consumer insights. It was found that consumers consider various aspects before choosing a health insurer like presence of a good hospital network, policy coverage and firm with wide product choice and responsive employees. Savita (2014) studied the reason for the decline of membership of micro health insurance in Karnataka. Major reason for this decline was lack of money, lack of clarity on the scheme and intra house-hold factors. However designing the scheme according to the need of the customer is the main challenge of the micro insurance sector. Shah (2017) analysed health insurance sector post liberalization in India. It was found that significant relationship exists between premiums collected and claims paid and demographic variables impacted policy holding status of the respondents. Binny and Gupta (2017) examined opportunities and challenges of health insurance in India. These opportunities are facilitating market players to expand their business and competitiveness in the market. But there are some structural problems faced by the companies such as high claim ratio and changing need of the customers which entails companies to innovate products for the satisfaction of the customers. Chatterjee et al. (2018) have studied health insurance sector in India. The premise of this paper was to study the current situation of the health-care insurance industry in India. It was observed that India is focusing more on short-term care of its citizens and must move from short-term to long-term care. Gambhir et al. (2019) studied out-patient coverage of private sector insurance in India. It was revealed that the share of the private health insurance companies has increased considerably, despite of the fact that health insurance is not a good deal. Chauhan (2019) examined medical underwriting and rating modalities in health insurance sector. It was revealed that while underwriting a health policy one has to keep in mind the various aspects of insured including lifestyle, occupation, health condition and habits. There have been substantial studies on health insurance done in India and abroad. But there has not been any work on performance of health insurance sector based on underwriting profit or loss.

3. Research gap

After extensive review of literature it is understood that there has not been substantial study on the performance of health insurance sector taking underwriting profit or loss into consideration. In spite of high rate of growth of earned premium, this sector is unable to make underwriting profit. This is mainly because growth of premium is more than compensated by claims incurred and commission and other expenses paid. Thereby leading to growth of underwriting loss over the years across the different insurance companies covered under both public and private sector. This unique feature of negative performance of this sector has not been studied so far in India.

4. Objectives

review health insurance scenario in India; and

study the performance of health insurance sector in India with respect to underwriting profit or loss by the application of regression analysis.

5. Research methodology

The study is based on secondary data sourced from the annual reports of Insurance Regulatory Development Authority (IRDA), various journals, research articles and websites. An attempt has been made to evaluate the performance of the health insurance sector in India. Appropriate research tools have been used as per the need and type of the study. The information so collected has been classified, tabulated and analysed as per the objectives of the study.

The data is based on a time period of 12 years ranging from 2006–2007 to 2018–2019.

Secondary data analysis has been done using regression of the form: Y = a + b X

The research has used SPSS statistics software package for carrying out regression and for the various graphs Microsoft Excel software has been used.

5.1 The problem statement

It is taken to be a general assumption that whenever the premium increases the profit also increases. This determines that profits are actually dependent on the premium income. Hence, whenever the premium tends to increase, the profit made also supposed to increase.

The aim of the study is to find out whether the underwriting profit of the health insurance sector is increasing or there is an underwriting loss.

The problem statement is resolved by applying regression analysis between the premium earned and underwriting profit or loss incurred. It is assumed that if the underwriting profit increases along with the premium received, then the pattern forms a normal distribution and alternate hypothesis can be accepted and if this pattern of dependability is not found then the null hypothesis will be accepted stating that there is no relation between the premium and the underwriting loss or the underwriting profit by the sector. But what is happening in this sector is the increase in premium is leading to increase in underwriting loss. So premium is negatively impacting underwriting profit which is astonishing thing to happen and is the crux of the problem of this sector.

5.1.1 Underwriting profit/loss = net premium earned – (claim settled + commission and management expenses incurred).

Underwriting profit is a term used in the insurance industry to indicate earned premium remaining after claims have been settled and commission and administrative expenses have been paid. It excludes income from investment earned on premium held by the company. It is the profit generated by the insurance company in the normal course of its business.

5.2 Data analysis

Table 1 shows that health insurance premium increased from Rs.1910 crores in 2006–2007 to Rs. 33011 crores in 2018–2019. But claims incurred together with commission and management expenses have grown from Rs. 3349 crores to Rs. 40076 crores during the same period. So the claims and management expenses incurred together is more than the health insurance premium earned in all the years of our study thereby leading to underwriting loss.

Claim incurred shown above is the outcome of the risk covered against which premium is received and commission and management expenses are incurred to obtain contract of insurance. Both these expenses are important for insurance companies to generate new business as stiff competition exists in this sector since it was opened up in the year 2000.

Figure 1 depicts the relationship between health insurance premium earned and claims and management expenses incurred by the insurance companies of the health insurance sector for the period 2006–2007 to 2018–2019.

Bar chart between premiums earned and claims and management expenses incurred show that claims and management expenses together is higher than premium earned in all the years of the study thereby leading to losses. Claims, commission and management expenses are important factors leading to the sale of insurance policies thereby earning revenue for the insurance companies in the form of premium. But proper management of claims and commission and management expenses will help this sector to improve its performance.

Table 2 provides insight into the performance of health insurance sector in India. The growth of health insurance in India has been from Rs.1909 crores for the financial year 2006–2007 to Rs. 33011crores for the financial year 2018–2019. The growth percentage is 1629% i.e. growing at an average rate of 135% per annum. Compounded Annual Growth Rate (CAGR) is working out to be 27%.

From the same table, it can be inferred that health insurance sector is making underwriting loss in all the financial years. There is no specific trend can be seen, it has increased in some years and decreased in some other years. Here underwriting loss is calculated by deducting claims and commission and management expenses incurred from health insurance premium earned during these periods.

With every unit of increase in premium income the claims incurred together with commission and management expenses paid increased more than a unit. Thereby up setting the bottom line. So instead of earning profit due to better business through higher premium income, it has incurred losses.

Underwriting principles needs to be streamlined so that proper scrutiny of each policy is carried out so that performance of this sector improves.

It is seen from Figure 2 that there is stiff rise in premium earned over the years but claims and commission and management expenses incurred have also grown equally and together surpassed earned premium. So the net impact resulted in loss to this sector which can also be seen in the figure. It is also seen that loss is increasing over the years. So, increase in earnings of revenue in the form of premium is leading to increase in losses in this sector which is normally not seen in any other sectors.

But a time will come when commission and management expenses will stabilize through market forces to minimize underwriting losses. On the other hand, it will also require proper management of claims so that health insurance sector can come of this unprofitable period.

5.3 Interpretation of regression analysis

5.3.1 regression model..

Where Y = Dependent variable

X = Independent variablea = Intercept of the lineb = Slope of the line

5.3.2 Regression fit.

Here, Y is dependent variable (Underwriting Profit or Loss) which is to be predicted, X is the known independent variable (Health Insurance Premium earned) on which predictions are to be based and a and b are parameters, the value of which are to be determined ( Table 3 ). Y = − 1028.737 − 0.226 X

5.3.3 Predictive ability of the model.

The value of R 2 = 0.866 which explains 86.6% relationship between health insurance premium earned and loss made by this sector ( Table 4 ). In other words, 13.4% of the total variation of the relationship has remained unexplained.

4.1 Regression coefficients ( Table 5 ).

H1.1 : β = 0 (No influence of Health Insurance Premium earned on Underwriting Profit or Loss made)

5.4.1.2 Alternative hypothesis.

H1.2 : β ≠ 0 (Health Insurance Premium earned influences underwriting Profit or Loss made by this sector)

The computed p -value at 95% confidence level is 0.000 which is less than 0.05. This is the confidence with which the alternative hypothesis is accepted and the null hypothesis is rejected. Thus regression equation shows that there is influence of health insurance premium earned on loss incurred by this sector.

The outcome obtained in this analysis is not what happens normally in the industry. With the increase of revenue income in the form of premium, it may lead to either profit or loss. But what is happening surprisingly here is that increase of revenue income is leading to increase of losses. So growth of premium income instead of influencing profit is actually influencing growth of losses.

6.1 Findings

The finding from the analysis is listed below:

The average growth of net premium for the health insurance has been around 135% per annum even then this sector is unable to earn underwriting profit.

The CAGR works out to around 27%. CAGR of 27% for insurance sector is considered to be very good rate of growth by any standard.

Along with high growth of premium, claims and commission and management expenses incurred in this sector have also grown substantially and together it surpassed in all the years of the study.

Thus, growth of claims and commission and management expenses incurred has more than compensated high rate of growth of health insurance premium earned. This resulted into underwriting loss that this sector is consistently making.

Astonishing findings has been higher rate of increase of premium earnings leading to higher rate of underwriting loss incurred over the years. Even though the sector is showing promise in terms of its revenue collection, but it is not enough to earn underwriting profit.

6.2 Recommendations

COVID 19 outbreak in India has led to a spike in health-care costs in the country. So, upward revision of premium charges must be considered to see bottom line improvement in this sector.

Immediate investigation of the claim is required. This will enable the insurers to curb unfair practice and dishonest means of making a claim which is rampant in this sector.

Health insurance market is not able to attract younger generation of the society. So entry age-based pricing might attract this group of customers. An individual insured at the age 30 and after 10 years of continuous coverage the premium will be less than the other individual buying a policy at the age of 40 for the first time.

6.3 Limitations and scope of future studies

The analysis of performance of health insurance sector in India taking underwriting profit into consideration is the only study of its kind in this sector. As a result, adequate literature on the subject was not available.

Health insurance and health care are part of medical care industry and are inter dependent with each other. So performance of health insurance sector can be better understood by taking health-care industry into consideration which is beyond the scope of the study.

This sector is consistently incurring losses. So, new ideas need to be incorporated to reduce losses if not making profits.

Opportunity of the insurance companies in this sector lies in establishing innovative product, services and distribution channels. So, continuous modification by the application of research is required to be undertaken.

Health insurance sector will take a massive hit, as tax benefit is going to be optional from this financial year. This can be a subject of study for the future.

6.4 Conclusion

This sector is prone to claims and its bottom line is always under tremendous pressure. In recent times, IRDA has taken bold step by increasing the premium rate of health insurance products. This will help in the growth of this sector.

With better technological expertise coming in from the foreign partners and involvement by the IRDA the health insurance sector in India must turn around and start to earn profit.

The COVID-19 pandemic is a challenge for the health insurance industry on various fronts at the same time it provides an opportunity to the insurers to fetch in new customers.

The main reason for high commission and management expense being cut-throat competition brought in after opening up of the insurance sector in the year 2000. So, new companies are offering higher incentives to the agents and brokers to penetrate into the market. This trend needs to be arrested as indirectly it is affecting profitability of this sector.

The study will richly contribute to the existing literature and help insurance companies to know about their performance and take necessary measures to rectify the situation.

Chart on health insurance premium earned and claims and management expenses paid

Chart on performance of health insurance sector in India

Data showing health insurance premium earned and claims and management expenses paid

. Dependent variable: Underwriting profit or loss;

. Predictors: (Constant), Health insurance premium earned

Aubu , R. ( 2014 ), “ Marketing of health insurance policies: a comparative study on public and private insurance companies in Chennai city ”, UGC Thesis, Shodgganga.inflibnet.ac.in .

Chatterjee , S. , Giri , A. and Bandyopadhyay , S.N. ( 2018 ), “ Health insurance sector in India: a study ”, Tech Vistas , Vol. 1 , pp. 105 - 115 .

Chauhan , V. ( 2019 ), “ Medical underwriting and rating modalities in health insurance ”, The Journal of Inssurance Institute of India , Vol. VI , pp. 14 - 18 .

Devadasan , N. , Ranson , K. , Damme , W.V. and Criel , B. ( 2004 ), “ Community health insurance in India: an overview ”, Health Policy , Vol. 29 No. 2 , pp. 133 - 172 .

Dror , D.M. , Radermacher , R. and Koren , R. ( 2006 ), “ Willingness to pay for health insurance among rural and poor persons: Field evidence form seven micro health insurance units in India ”, Health Policy , pp. 1 - 16 .

Ellis , R.P. , Alam , M. and Gupta , I. ( 2000 ), “ Health insurance in India: Prognosis and prospectus ”, Economic and Political Weekly , Vol. 35 No. 4 , pp. 207 - 217 .

Gambhir , R.S. , Malhi , R. , Khosla , S. , Singh , R. , Bhardwaj , A. and Kumar , M. ( 2019 ), “ Out-patient coverage: Private sector insurance in India ”, Journal of Family Medicine and Primary Care , Vol. 8 No. 3 , pp. 788 - 792 .

Gupta , D. and Gupta , M.B. ( 2017 ), “ Health insurance in India-Opportunities and challenges ”, International Journal of Latest Technology in Engineering, Management and Applied Science , Vol. 6 , pp. 36 - 43 .

Hand book on India Insurance Statistics revisited ( 2020 ), “ Insurance regulatory and development authority website ”, available at: www.irda.gov.in ( accessed 2 July 2020 ).

Jayaprakash , S. ( 2007 ), “ An explorative study on health insurance industry in India ”, UGC Thesis, Shodgganga.inflibnet.ac.in .

Kumar , A. ( 2009 ), “ Health insurance in India: is it the way forward? ”, World Health Statistics (WHO) , pp. 1 - 25 .

Nair , S. ( 2019 ), “ A comparative study of the satisfaction level of health insurance claimants of public and private sector general insurance companies ”, The Journal of Insurance Institute of India) , Vol. VI , pp. 33 - 42 .

Savita ( 2014 ), “ A qualitative analysis of declining membership in micro health insurance in Karmataka ”, SIES Journal of Management , Vol. 10 , pp. 12 - 21 .

Shah , A.Y.C. ( 2017 ), “ Analysis of health insurance sector post liberalisation in India ”, UGC Thesis, Shodgganga.inflibnet.ac.in .

Thomas , K.T. ( 2017 ), “ Health insurance in India: a study on consumer insight ”, IRDAI Journal , Vol. XV , pp. 25 - 31 .

Yadav , S.C. and Sudhakar , A. ( 2017 ), “ Personal factors influencing purchase decision making: a study of health insurance sector in India ”, BIMAQUEST , Vol. 17 , pp. 48 - 59 .

Further reading

Beri , G.C. ( 2010 ), Marketing Research , TATA McGraw Hill Education Private , New Delhi, ND .

Dutta , M.M. and Mitra , G. ( 2017 ), “ Performance of Indian automobile insurance sector ”, KINDLER , Vol. 17 , pp. 160 - 168 .

Majumdar , P.I. and Diwan , M.G. ( 2001 ), Principals of Insurance , Insurance Institute of India , Mumbai, MM .

Pai , V.A. and Diwan , M.G. ( 2001 ), “ Practice of general insurance ”, Insurance Institute of India , Mumbai, MM .

Shahi , A.K. and Gill , H.S. ( 2013 ), “ Origin, growth, pattern and trends: a study of Indian health insurance sector ”, IOSR Journal of Humanities and Social Science , Vol. 12 , pp. 1 - 9 .

Corresponding author

Related articles, we’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Evolution and Regulatory Framework of Life Insurance Companies in India: A Conceptual Review

- First Online: 21 July 2022

Cite this chapter

- Shib Pada Patra 4 ,

- Siddhartha Sankar Saha 5 &

- Mitrendu Narayan Roy 6

41 Accesses

The main objective of this chapter is to conceptually review (a) the evolution of the life insurance industry in different parts of the world and India especially in the pre- and post-independence era; (b) current structure of life insurance industry operating in India; and (c) regulatory framework governing life insurance business in the pre- and post-independence era with special emphasis on regulatory framework governing portfolio investments of life insurance companies. Before independence, Indian life insurance industry was dominated by mainly British life insurance companies and the applicable regulations were made keeping in view their interest. After India’s independence, nationalisation of the LICI by bringing together numerous small insurance companies was a significant event in India’s life insurance history. After financial sector reforms, private participation, technology up-gradation, numerous products and after sale service have enhanced the efficiency of the life insurance sector. The entire life insurance sector was brought under the ambit of the IRDAI. The IRDAI has also regulated the total fund of the life insurance companies into three segments, like life fund, pension and annuity fund, and ULIP fund. In the pre-reform era, investments were made in Government and approved securities, while it has been extended to infrastructure and social sectors in the post-reform era.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Aegon Religare Life insurance Company. History of company. Retrieved from AEGON RELIGARE Website: http://www.aegonreligare.com

Aviva Life Insurance Company. History of company. Retrieved from AVIVA INDIA Website: http://www.avivaindia.com

Bajaj Allianz Life Insurance Company. History of company. Retrieved from BAJAJ ALLIANZ Website: http://www.bajajallianz.com

Bharti AXA Life Insurance Company. History of company. Retrieved from BHIRTI AXALIFE Website: https://www.bharti-axalife.com

Bhasin, N. (2007). Banking and financial market in India 1947 to 2007 . Century Publication.

Google Scholar

Bhattacharyya, R. K. (2004). Money and financial system. Kolkata: Bhattacharjee Brothers

Bhole, L. M. (2004). Financial institutions and market. New Delhi: Tata McGraw Hill.

Birla Life Insurance Company. History of company. Retrieved from Insurance BIRLA SUNLIFE INSURANCE Website: http://insurance.birlasunlife.com

Cummins, D., & Venard, B. (2007). Handbook of international insurance between global dynamics and local contingencies . Springer.

Book Google Scholar

DHFL Pramerica Life Insurance Company. History of company. Retrieved from DHFL PRAMERICA Website: https://www.dhflpramerica.com

Edelweiss Tokio Life insurance Company. History of company. Retrieved from EDELWEISS TOKIO Website: http://www.edelweisstokio.in

Exide Life Insurance Company. History of company. Retrieved from EXIDE LIFE Website: http://www.exidelife.in

Future Generali India Life Insurance Company. History of company. Retrieved from FUTURE GENERALI Website: http://www.futuregenerali.in

Gopalakrishana, D. (2010). The philosophy of life insurance. The Journal of Insurance Institute of India, XXXVI , 75–81.

HDFC Standard Life Insurance Company. History of company. Retrieved from HDFC LIFE Website: http://www.hdfclife.com

ICICI Prudential Life Insurance. History of company. Retrieved from ICICI PRULIFE Website: http://www.iciciprulife.com

IDBI Federal Life Issuance Company. History of company. Retrieved from IDBI FEDERAL Website: http://www.idbifederal.com

India First Life Insurance Company. History of company. Retrieved From INDIAFIRST LIFE Website: http://www.indiafirstlife.com

Insurance Law Bill. Amendment Bill, 2008. Retrieved from INDIAN BAR ASSOCIATION Website: https://www.indianbarassociation.org

Insurance Laws. Amendment Bill, 2015. Retrieved from INDIAN BAR ASSOCIATION Website: https://www.indianbarassociation.org

Insurer Regulations. About IRDA. Retrieved from SHODHGANGA Website: http://shodhganga.inflibnet.ac.in

IRDA, (Investment) (Amendment), Regulations, 2013.

IRDA, (Investment) Regulations, 2000.

IRDA, Annual Report, 2013–2014.

Khan, M. Y. (2006). Indian financial system . Tata McGraw Hill.

Kotak Mahindra Old Mutual Life Insurance Company. History of company. Retrieved from INSURANCE KOTAK Website: http://insurance.kotak.com

Kumar, D. (1991). Tryst with trust: The LIC story . Mumbai: LIC of India.

Life Insurance Company. Overview of life insurance company. Retrieved from SHODHGANGA Website: http://shodhganga.inflibnet.ac.in

Life Insurance Corporation Bill. Amendment Bill, 2009. Retrieved from BILLTEXTS Website: http://164.100.47.4/billstexts/lsbilltexts/PassedBothHouses/LIC .

Max Life Insurance Company. History of company. Retrieved from MAXLIFEINSURANCE Website: http://www.maxlifeinsurance.com

Obligation of Insurer. IRDA Regulations, 2000. Retrieved from IRDA Website: https://www.irdai.gov.in

Overview of life Insurance company. Brief Study. Retrieved from SHODHGANGA Website: http://shodhganga.inflibnet.ac.in

Palande, P. S., Shah, R. S., & Lunawat, M. L. (2003). Insurance India changing policies and emerging opportunities . Response Books.

Pathak, B. V. (2006). The Indian financial system. New Delhi: Pearson Education

PNB MetLife India Insurance Company. History of company. Retrieved from PNB METLIFE Website: http://www.pnbmetlife.com

Reliance Life Insurance Company. History of company. Retrieved from RELIANCE LIFE Website: http://www.reliancelife.com

Saha, S. S. (2021). Indian financial system: Financial markets, institutions and services (2nd ed.). Tata McGraw Hill.

Sahara India Life Insurance Company. History of company. Retrieved from SHODHGANGA Website: http://shodhganga.inflibnet.ac.in

SBI Life Insurance Company. History of company. Retrieved from SBI LIFE Website: http://www.sbilife.co.in

Sharma, R. (2010). Insurance . Agra: Lakshmi Narain Agarwal.

Shriram Life Insurance Company. History of company. Retrieved from SHRIM LIFE Website: http://www.shriramlife.com

Sinha, A., & Gandhi, S. K. (2014). Financial performance analysis of life insurers in India . Scholar’s Press.

Star Union Dai-Ichi Life Insurance Company. History of company . Retrieved from SUD LIFE Website: https://www.sudlife.in

Tata AIA Life Insurance Company. History of company. Retrieved from TATA AIA Website: http://www.tataaia.co

Trivedi, P., R. (2008). Encyclopaedia of insurance business and management . Nagaland: Janada, Prakashan.

www.irdai.gov.in

Download references

Author information

Authors and affiliations.

Department of Commerce, Chittaranjan College, Kolkata, West Bengal, India

Shib Pada Patra

Department of Commerce, Faculty Council for Post Graduate Studies in Commerce, Social Welfare and Business Management, University of Calcutta, Kolkata, West Bengal, India

Siddhartha Sankar Saha

Department of Commerce, Goenka College of Commerce and Business Administration, Kolkata, West Bengal, India

Mitrendu Narayan Roy

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Shib Pada Patra .

Rights and permissions

Reprints and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Patra, S.P., Saha, S.S., Roy, M.N. (2022). Evolution and Regulatory Framework of Life Insurance Companies in India: A Conceptual Review. In: Investment Pattern of LICI and Select Private LICs in the Post-reforms Era in India. Palgrave Macmillan, Singapore. https://doi.org/10.1007/978-981-19-2799-7_2

Download citation

DOI : https://doi.org/10.1007/978-981-19-2799-7_2

Published : 21 July 2022

Publisher Name : Palgrave Macmillan, Singapore

Print ISBN : 978-981-19-2798-0

Online ISBN : 978-981-19-2799-7

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

THE INSURANCE INDUSTRY IN INDIA: A COMPARATIVE ANALYSIS OF THE PRIVATE AND PUBLIC PLAYERS

Related Papers

IOSR Journals

IJAR Indexing

Life insurance is very important for protecting human lives against accidents, causalities and other types of risks. Life insurance has been dominated by public sector (LIC) in India; however, with the liberalization of Indian economy, private sector entry in life insurance has got momentum. The public sector Insurance Company, i.e. LIC of India has emphasized on exploiting the potential of rural India as rural life insurance provides immense scope.But still its penetration is very low as compared to that in developed nations. This paper highlights emerging trends, patterns, and opportunities in Indian rural life insurance business. It also focuses on the role of private companies in life insurance in India.

eko prasetyo

Editorial QyDado

Abraham Gonzalez Lara

Los ideales, ritos y costumbres inspirados por el delirante espíritu épico han hecho de los europeos unos buscadores constantes, tenaces, de la libertad como único ámbito de acción. Esta intrépida identidad que toma la levedad en serio, la proyecta hacia la construcción de la sociedad, la utiliza para asentar la voluntad de poder sobre las ansias humanas. Muy pocos han evaluado la eficacia transformadora que poseen los arquetipos liberadores del sabio errante, el ideal de caballero y dama de “almas bellas”, trascendiendo la trampa de la eternidad circular. Experimenta la oscuridad laberíntica, la duda que forja cada existencia en esencia, incluso el valor del extrañamiento personal como la mejor manera de aventurarse al misterio de la verdadera vida.

Sergey Abashin

Carlos Alberto Rojas Cruz

Journal of Clinical Microbiology

Thomas Davis

High-risk human papillomavirus (hrHPV) testing is now being introduced as a potential primary screening test for improved detection of cervical precancer and cancer. Current U.S. Food and Drug Administration-approved tests are batch tests that take several hours to complete. A rapid, non-batch test might permit point-of-care (POC) testing, which can facilitate same-day screen and management strategies. For a non-batch, random-access platform (GeneXpert; Cepheid, Sunnyvale, CA), a prototype hrHPV assay (Xpert) has been developed where testing for 14 hrHPV types can be completed in 1 h. In the first clinical evaluation, Xpert was compared to two validated hrHPV tests, the cobas HPV test (cobas, Roche Molecular Systems) and Hybrid Capture 2 (hc2, Qiagen), and to histologic outcomes using specimens from colposcopy referral populations at 7 clinical sites in the United States ( n = 697). The sensitivity of Xpert for cervical intraepithelial neoplasia grade 2 or more severe diagnoses (CIN...

China Particuology

Vasileios Protonotarios

2006 IEEE International Conference on Systems, Man and Cybernetics

Ming-Hsuan Yang

Neuroscience Letters

Gregory Hanna

RELATED PAPERS

ASSET: Jurnal Manajemen dan Bisnis

niar azriya

European Archives of Oto-Rhino-Laryngology

Lucia Staníková

Food Bioscience

Manuela Pintado

Physical Review B - PHYS REV B

hector aguilera

Discursos y narrativas sobre violencia, miedo e inseguridad en México: el caso Ciudad Juárez

José Octavio Islas Carmona

Florencia Maggi

Alexandra Krenn-Leeb

ACM SIGSOFT Software Engineering Notes

Ted Biggerstaff

Third Workshop on …

Pradip Bose

Journal of Computer Science

Yogesh Singh

Sergey Sukhankin

International Journal of Orthopaedics Sciences

saumitra dwivedi

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- School of Hospitality and Tourism Management

- School of Culinary Excellence

- School of Design and Creative Arts

- School of Management & Entrepreneurship

- Undergraduate Admission

- Postgraduate Admission

- Financial Aid

- Hospitality Management

- Culinary Arts

- Design & Creative Art

- Business Studies

- Campus Highlights

- Student Life

- Faculty Publications

- Journal of Services Research

- Conferences

- FDP/Workshops

- Vedatya at a Glance

- Partnerships

- News & Media

Home » Research » Blog » INSURANCE SECTOR IN INDIA

INSURANCE SECTOR IN INDIA

Impact of liberalization on the insurance sector in india.

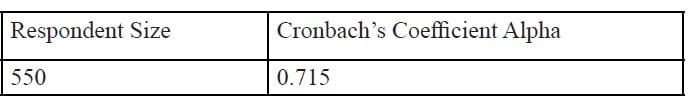

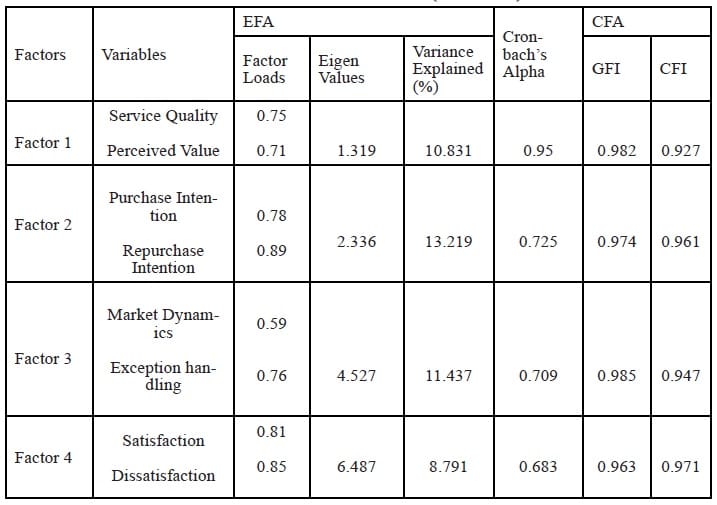

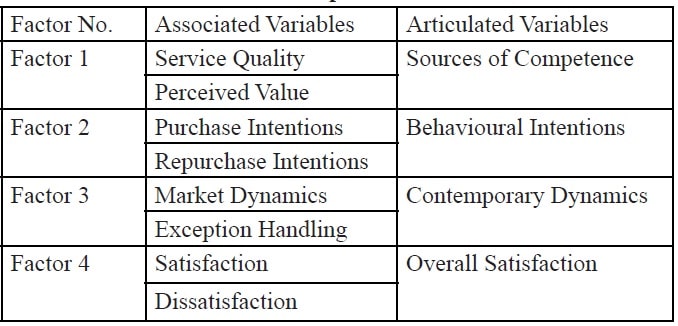

This study identifies the impact of liberalization on the insurance industry in India and particularly on LIC. Efforts have been invested, starting from problem formulation to overall impact measurement. After assessing the conceptual foundations and conducting an empirical testing of the present state of the insurance sector in India, conclusions point towards eighth dimensions of impact measurement. These eight dimensions are: service quality, perceived values, purchase intentions, repurchase intentions, market dynamics, exception handling, satisfaction and dissatisfaction on which the impact of liberalization can be measured. Finally, these eight dimensions taken for impact measurement are summed up into four measurements. The four measurements are sources of competence, behavioural intentions, contemporary dynamics and overall satisfaction. All the dimensions are statistically proved and having values on or above the acceptable limit. In other words it can be said that, the impact of liberalization has come in terms of these four variables.

INTRODUCTION

The history of insurance is rooted within the story of mankind. The same instinct that stimulate modern businessmen and gives them a sense of security against loss and disaster also existed in primitive men . Primitive men also sought to avert the evil consequences of fire, flood and loss of life and were willing to make some sort of sacrifice in order to achieve security. The concept of insurance has moved through various situations and phases in its journey. With the passage of time many elements have been preserved or discarded, largely being a conceptualization from the recent past. Insurance is the most effective way of strengthening and hedging the risk. Since its appearance, insurance has become an inevitable asset to every aspect related to human life. Whether it is health disorders or constructing properties, household requirements or multimillion dollar projects; insurance is being recognized as a strong safety device to meet unexpected losses. It is clear that generally, an insurance firm tolerates the liability of offering world-class services to their clients, which requires efforts in each aspect. The insurance business in India started without any obligations in the nineteenth century. At that time, it was a typical story of a colonial era. Only few British insurance companies were controlling the whole market and were serving the larger cities of India. The Life Insurance Company was domestically floated in 1956 after independence, and then the firms were formed in 1972 in the general insurance business. Till the entry of private firms, the Life Insurance sector in underdeveloped markets was only tapped by LIC of India (the only public sector life insurer). The dispersion of life insurance products and services extended to 19% of the total 400 million of the insurable population. The insurance products sold by the state owned LIC were mostly tax saving tools. Insured customers had almost no flexibility in availing the products. With the entry of private firms the rules of the scenario have changed. The Government of India liberalized the insurance sector in March 2000 through the Insurance Regulatory and Development Authority (IRDA) Bill, lifting all entry decisions for private firms and allowing foreign firms to enter the market with some restrictions on direct ownership. The bill was passed to guard the interest of the customers in their dealing with global and private firms. Under the present guidelines, there is a 49% equity cap for global investments in an insurance company. Taking all facts into consideration, it is true that the LIC of India is still dominating the industry and is the consistent market leader in the insurance sector of India.

THE LITERATURE REVIEW

A literature review is conducted to generate a theoretical and scientific analysis of a particular phenomenon and uncover what is known and the gaps related to that topic. The primary purpose of a literature review is to gain a broad background related to problems in conducting research on a particular topic, selecting a problem and purpose, developing a framework and formulating a lesson plan. In order to attempt reach this goal, an attempt has been made to review and discuss literature related to the field of insurance.

Available Literature Before 1990

Dodds J.C. and Croom H. (1979) have critically analyzed the investment behavior of life insurance companies; with an objective to providing guidelines to show the future investment pattern in the insurance business. Hubner S.S. and Kenneth B. Jr. (1982) have worked on life insurance & health insurance and the different types of products and plans that are offered by insurers. The fundamentals of pricing of a variety of products, the organizational and marketing aspects of insurance firms are also discussed at length by the authors. Marks,S. D. (1982) explained the fundamentals of insurance and discussed the various types of insurance such as life, fire, marine, life etc are discussed in detail. Rajan Sexena (1986) in his article titled “Marketing of Life Insurance Services”, discussed different issues related to the marketing strategies of insurance firms. The author focused on the importance of applicability of marketing concepts to the selling of life insurance products, and the need for interactive strategies in the marketing of life insurance products.

Available Literature between 1990- 2000 Hofsted G. (1995) identified the major function of life insurance was to guard against financial loss. Any event affecting an individual’s earning ability has an impact on the individual’s human life. This event may be early death, incapacity, retirement or unemployment. Besides covering the risk of death, it covers the risks of disability, serious illness and superannuation. Pedro P. B. (1996) in his article “Competition Effects of Price Liberalization in Insurance” outlines the insurer’s decision making process, and their exercise of monopoly power. The author concluded with presenting a case study of the Portuguese auto-insurance market. Two distinct time spans were taken and a panel of data was used. 1982-1988 was characterized by price regulation, and 1989-1990, was characterized by pricing freedom. A clear change in the company’s market conduct was observed after the price liberalization event. The results suggested that firms behaved in a more competitive way than the post liberalization period, where a significant degree of conspiracy was identified.

Gidhagen (1998) attempted to develop a conceptual framework from a relationship perspective for the study of insurance services marketing. Deregulation and internationalization have created a new, increasingly competitive business climate. The focus of this research work is on the relationship between insurance companies and their corporate customers. Mishra and Simita M. (2000) compared the position of the Indian insurance sector to European countries, in which life insurance accounted for 58% of the global direct premium and non-life comprised 42%. The study states that the need for insurance arises when economic activity increases, families become nuclear, kins gets geographically dispersed and individuals become more dependent on employment. The author analyzed the top ten largest insurance markets and how they are ranked by revenue in the year 1998.

Available Literature 2001 Onwards Agarwal (2001) examined the role of information technology in the insurance sector in his study, and focused upon the requirements of providing effective services due to the entry of private firms. An insurance firm can utilize its services in many ways such as: customer service, investment management, claim management, relationship management etc. This article emphasizes that to gain overall boost in the size and revenue of the insurance market, it is understood that information technology must take on a vital role, to enable extensive penetration.

Michael (2001) analyzed the demographic facets in this article and appraised the insurance business with a case. Additional features added to conventional products are referred to as help products. In this study, the author has conducted a customer survey to identify the demographic aspects and their roles. The author has also invested efforts to analyze the consumer’s decision towards a new class of insurance products. Finally the study concludes that, there is a weak relationship between the consumer’s decision making process and the class of products offered, as demographic factors do not always perform as expected. Therefore, it seems sensible to focus on alternate factors alongside to ensure effective marketing. Nikhil G. (2001) in his article has identified, that the strategies that Indian insurance firms adopt, is hinged upon the product’s essential usefulness in providing safety features. The author highlights the growing proportional aspects, penetration levels and other macro factors affecting the global insurance market during the year 1999. Each private player’s viewpoint is to sell the product for customers at their own risk.

Vasanthi S., Prakash, and Sithramu (2001) explored the (agents in the liberalized economy and the changes taking place in their management. This article aimed upon identifying the competencies needed and methodology adopted for selecting effective agents. A sample of 15 agents of the age range between 28 to 47 years, and customers of such agents were taken for qualitative assessment. The findings of the research conducted indicated that, professional competency plays a vital role for successful insurance agents. The study also highlighted how to manage agents to develop competencies and area experts in the selection of effective agents. Ajay K. R. and Mukesh D. (2002) focused upon the social implications in opening up of the insurance sector to private firms to identify reasons as to why there was private entry after nationalization, what the social aspects are so far and how the reforms have taken place in the Indian insurance industry. The issues faced by private firms due to competition are to enhance resource optimization, reduce premium cost, mobilize funds domestically, offer better pay packages and attract inflow of foreign capital. This study has also revealed that, most of the private firms concentrate on business only in the urban areas, due to a lucrative market response.

Pradeep G. and Sanjay B. (2002) analyzed and discussed the challenges with possible solution strategies, applicable to the insurance sector in India. Authors have made an attempt to identify how different brands can be positioned in the market and how business practice codes are given by IRDA to maintain standards. The research piece revealed that after liberalization, awareness of brands is 100% for LIC, 70% for ICICI Prudential awareness and 52% for HDFC. Hendel and Lizzeri (2003) studied the long -term contract properties and found empirical support, for forecasting the model by using data from the life insurance market. In particular, they presented that all types of life insurance contracts especially the more front-loaded contracts, are associated with lower lapses and lower present discounted value of premiums over their coverage period. They argued that asymmetric information among others is not a reasonable option or explanation of their findings. Pramod P. and Saumya S. (2003) in their research article tried to find out the competitiveness between LIC and the new players and carried out as SWOT analysis to advise effective strategies. The objective of this article was to assist the public sector insurance giant to boost the market share, to help LIC to retain old customers, and to attract new customers. The study also highlighted the level of customer satisfaction and quality of services disbursed. The methodology applied in this article has been derived through open-ended interview with customers, to identify their perceptions and expectations. 100 customers in Dhanabad and its surrounding areas were selected to collect information on the sum assured, annual premium paid etc. The findings of the study noted, that majority of customers were graduates, who felt that the main work of LIC is to insure human life. Most respondents however preferred only money back polices and Bima Nivesh covering a single premium. Hitt and Croson (2004) pointed out, that there were three principal issues i.e. transparency, dis-intermediation and differential pricing that help in determining the transformation of retails financial services, including life insurance firms. The authors have explored, that financial services industries are gradually transformed by these three trends. Vaidyanathan R. (2007) discussed regulation and financial convergence in the insurance sector. In his article he mentioned, that there is no legislative framework for considering the compound nature of the working of the financial corporation. A new structure needs to be developed to monitor activities of insurance providers in a structured system.

Santosh D. and Upinder D. (2007) tried to focus on global state of affairs, as they opine that India cannot remain inaccessible. It is apparent that the existing firms need to gear up to face the competition. These new firms will have to consider new requirements of customers. The existing firms will also have to take care of customer specific aspects and needs. As a matter of information, custom-based products will have to be developed to suit specific customer needs. New products have to be developed for large corporate groups. The Insurance industry is going to undergo a vast change in its marketing practices, as well as its marketing strategies. The existing and new firms will have to work out different strategies to keep and improve their market share. Devasenathipathi, Saleendran and Shanmugasundaram (2007) in their study, “A Study on Consumer Preference and Comparative Analysis of All Life Insurance Companies” analyzed and rated all life insurance firms by analyzing certain factors. They examined the effect of privatization, measured customer perception, purchase behavior and consumer awareness regarding life insurance products. The study concluded that the deciding factor of the purchase process depended on quality, convenience and promptness of services that may lead a company to acquire the top rank with a huge market share.

Pillai (2007) in his article titled the “Life Insurance Business” defined life insurance as, the business of offering contracts of insurance upon human life, including any contract whereby the payment money is assured on death (except death by accident only) or the happening of any contingency affecting human life. This also includes any contract which is subject to the payment of premium for ensuring a team’s human life. Narayanan (2008) in his article attempted to decode the secrecy of pension plans and assist people to zeroing down on an apt pension plan. Originally, it dealt with the basics of Unit Linked Pension Plans (ULPP) and how it works. The article explained how it is different from the traditional insurance plan and discussed, the basis for selecting an appropriate ULPP will would prove to be beneficial at the time of retirement. Mahesh Chand G. and Deepti (2008) in their article, “Efficiency of the General Insurance Industry in India in the Post-Liberalization Era: A Data Envelopment Approach”, attempted to examine the technical competence and the scale efficiency of 12 general firms in India , in the financial year 2002-03 and 2005-06. Their study presented that, private firms are lagging behind public firms but they are fast catching up and the competence scores of public and private firms seem to converge. James P.C. (2008) understood that by calculating the probabilities of the occurrence of risks leading to loss; it is possible to convert risk conditions into catalysts for driving the economic momentum in society. In fact insurance public good; regulation, self-regulations and standards usually requires that rates and terms are fair, reasonable and not excessive’ Ramin Cooper M. and Chris Sakellariou (2008) in their paper, “Financial Liberalization, Deposit Insurance and Bank Stability” investigated the impact of implementing an explicit deposit insurance scheme, on the likelihood of banking crisis in countries with well-liberalized financial systems. They concluded that deposit insurance will be successful in alleviating moral hazard and will increase the constancy of the financial system, only if an adequate degree of financial liberalization exists.

Sonia S.(2008) observed the potential for insurance companies in housing areas, with the objective to find out the profiles of consumers in insurance, and the attributes of insurance that become functional while taking decisions. The author concluded with findings from 500 respondents, that there is an immense prospect for insurance in housing areas as most of these areas are untouched. For insurance firms to be successful in their areas, must design their products and services in such a way so as to attract customers, and provide them with the best products and services. Kirti D. (2009) focused on consumer beliefs and attitudes towards advertising media. He concluded that it is very important for marketers to generate advertisements that are believable and offer relevant information about the product. The message in the advertisements should focus on benefits and attributes, with required amount of creativity in it to get maximum results. Rajendran R. and Natarajan B. (2009) highlighted that the business in India, the business outside India as well as the total business of LIC has always had an increasing trend. The collected and analyzed data proved that liberalization, privatization and globalization are exerting a positive influence on LIC and its performance. Murthy T.N., Raja Babuand Riswana Ansari (2009) in the paper titled , “Performance Evaluation of LIC: Ways of Winning Confidence” highlighted the development and expansion of the company, a performance review before and after liberalization, their innovative product lines, improved customer services and enhanced distribution channels of Life Insurance Corporation of India (LIC). Their objectives was to know about the growth and development of the LIC business before and after liberalization, privatization and globalization; and to study the ways to improve customer services in LIC for winning confidence, and making appropriate suggestions for the improvement of the LIC business. The study concluded that to achieve greater insurance penetration, public as well as private insurance units have to improve in terms of quality of services offered and greater efficiency. M.C. Garg and Anju Verma (2010) in their paper titled “An Empirical Analysis of Marketing Mix in the Life Insurance Industry in India”, analyzed the marketing mix in life insurance in India. The population for this research comprised of all employees of public and private life insurance companies in India. A sample of 95 employees was drawn on the basis of convenient sampling. Their prime objective was to study the nature, pattern and process of the marketing mix in life insurance companies in India. They concluded that various dimensions of the marketing mix where measured and analysed. For instance age-wise, sex-wise, qualification-wise, hierarchy-wise and organization-wise analyses depicted that a majority of respondents are of the opinion, that the concept of marketing mix is understood and implemented regularly, that the suppleness of various mix ingredients aren’t always studied by the marketing departments of life insurance firms, that the marketing departments of life insurance firms always review the mix, that regular careful analysis is carried out to develop an optimal and most economic mix, and that other departments are always invited to take part in developing this optimal mix . However, they were also of the opinion that the marketing departments sometimes an attempt at quantifying the level of expenditure, that life insurance companies sometimes attempt at analyzing their competitors’ mix, and that life insurance companies sometimes do briefing about the mix plan to outside contractors. Life insurance companies rarely adjust their marketing mix in relation to specific segments.

Manjit Singh and Rohit K. (2011 in their paper “Efficiency Analysis of the Public Sector General Insurance Companies: A Comparative Study of Pre- and Post-Reform Period”, compared the competence of the Indian public sector general insurance firms during the pre- and post-reform periods. The pre-reform time span includes 1993-94 to 1999-00, and the postreform time span includes 2000-01 and 2007-08. The results concluded that the competence of the public sector general insurance firms is higher in the post-reform period, than the pre-reform period. Debabrata Das and Jasojit Debnath (2012) in their paper, “Performance of Insurance Companies in India: A Comparison of Public and Private Insurers”, highlighted the performance of life insurance sector in terms of variety of parameters, and also threw light on the different marketing channels. Their study also suggested that life insurers have improved over the years, and insurance is now not limited only to a particular class or society. Rather with innovative products and better customer services, the insurance firms are trying to cultivate a insurance habit among all segments of the population. Pamecha and Chhajer (2013) in their article discussed the paradigm changes that took place in the Life Insurance industry in India. These authors have elaborated the rationale behind the leadership position enjoyed by LIC in the market. The recent regulatory changes in the Life Insurance industry in India have also been highlighted in the article. Authors found that the global integration of financial markets resulted from de-regulating measures, explosion of technological information and financial innovation. Also the study emphasized, that liberalization and globalization have allowed the entry of foreign players in the insurance sector, providing a better array of services for the customers at competitive prices. V. Ushakiran, Maschendar and Sreenivasa (2013) discussed that growth in the life insurance sector touched new statures, and the entry of the private companies has given a tough challenge to the Life Insurance Corporation of India. The entire risk business has started to show significant changes. Right from increasing insurance penetration to changing the customer’s mind-set about life insurance to the state of reducing risk as an investment alternative. Insurance firms have started focusing upon innovative policies and creative practices in the Indian market. This orientation has changed the entire shape of the life insurance sector in India. Mandeep K. and Dalwinder K. (2014), in their paper, “Customer Satisfaction towards Life Insurance in Punjab” identified the association between customer satisfaction and demographics of customers. Their study brought out seven factors through factor analysis, namely; services and company reputation, quick and timely services, customer convenience, additional facilities, loyalty of employees, efficient departments with disdisciplined employees, and service material and understanding of requirements. Ramamoorthi and Kumar (2014), reviewed the theoretical analysis of product liability insurance between buyers and sellers. A model consisting of three groups of buyers, a producer-seller, and an insurance institution has been developed under varying assumptions in their study. Authors have found that the liberalization of the economy has resulted in the availability of large number of lucrative alternative products and financial services. Sinha (2015) has used a dynamic slacks based data development analysis model (DEA). The DEA model was proposed by Tone and Tsutsui (2010) to be used for performance evaluation. The same has been used in this study using 15 life insurance companies in a seven-year period (2005–2006 to 2011–2012). The author has identified that, the unique selling point of the present approach is unlike the conventional static DEA models. He has also presented a framework, by using a link variable, connecting the observed years and thereby creating a common benchmark.

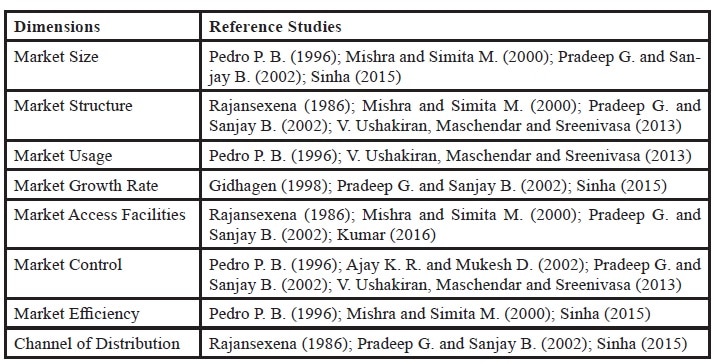

Joy and Pratim (2016) explored that in the pre-reform era, the Life Insurance Corporation of India dominated the Indian life insurance market with a market share close to 100 %. But the situation drastically changed since the enactment of the IRDA Act in 1999. At the end of the FY 2012-13 the market share of LIC stood at around 73%, with the number of players in India’s life insurance sector. The authors deliberated that; the reason for the decreased market share over this period could be attributed to the increasing competition prevailing in the country’s life insurance sector. At the same time, the liberalization of the life insurance sector for private participation has eventually raised issues, about ensuring sound financial performance and solvency of the life insurance companies; besides safeguarding the interests of the policyholders. Kumar (2016) explored, that there has been an observable change in the market dynamics since liberalization and introduction of economic reforms. A considerable amount needs to be done for future growth and development of the market in an orderly and sustained manner. Even post liberalization insurance companies in India have been ignoring rural markets. Insurance companies in India will have to show long term commitment to the rural sector as well, and will have to design products which are suitable for rural people. Insurance companies need to think about their distribution mechanism to work effectively in rural markets. Table 1: Identifications of Dimension from the Previous Literature

Observations from Conducting the Literature Review: Observation 1. Previous authors have focused more on the operational efficiency andanalysis of the industry regarding insurance companies in India. The intention is more tilted towards policy formation and business analysis.

Observation 2: Previous studies in this field are looking at the impact of liberalization on specific aspects. For example, policy holders, number of customers, number of companies, and total business of the insurance sector in India etc. In general, the overall impact of liberalization on the insurance sector and LIC, is seeking the attention of researchers and so it will be rational to explore the same. The present study will act as bridge to address multiple dimensions under one umbrella, such as industry aspects, LIC related aspects and customer related aspects.

Articulation of Impact Measurement Variables The Life Insurance market in India is an emerging market because the ratio of GDP to life insurance premium is only about 4 % and the dispersion level is about 26%. Though the market has grown exponentially following liberalization with the entry of private firms on 1 April 2000, it is still an emerging market. Therefore, resourceful marketing strategies are needed by the insurance service providers for both these reasons. Firstly, to attract new customers; and secondly to retain existing customers and increase market share. Research by Fornell (1992) , Lenskold (2003) and Lombardi (2005) has shown that, self-protective approaches directed at retaining existing customers and increased sales to them, can be more profitable than attracting new customers The objective of this empirical section is to identify the relationship between different aspects and factors related to the insurance sector, insurance business firms and insurance customers. Service Quality In the previous researches conducted on life insurance services, the service quality has been analyzed through consumer ratings of performance and observations of an agent, by using an adapted SERVQUAL or SERVPERF scale. This includes items from the original five factors but adapted, both in wording and context as opined by Tsoukatos and Rand, (2006). Durvasula et al. (2004) measured consumer service quality observations by calculating the compound score for each respondent from their ratings on a six-item scale; consisting of attributes related to sales agent quality of reliability, helpfulness, responsiveness, empathy, trustworthiness and product information. Studies have been performed taking financial products in India as a sample. Chaudhary (2013), Srivastava and Singh (2015) have identified and examined the importance of service quality in selling financial products in India.

Perceived Value

Perceived customer value is defined as the difference between total benefits and total sacrifices perceived by consumers in purchasing a product or service. Total benefits include the functional, social and psychological benefits as perceived by Sweeney and Soutar (2001), and total costs include the monetary costs emphasises by Monroe,(1990) and non-monetary costs state Anderson and Sullivan, (1993), namely energy, time and effort propounded by Cronin et al. (1997). The way customers perceive financial products, help financial and insurance firms to ensure customer satisfaction and competitive advantage state Zameer et al. (2015) and Mende et al. (2015).

Purchase intentions