- Employer Tech

- Employee Tech

- Client Login

- Transferee Login

Temporary (Short Term) Domestic Assignments

Domestic Relocation , Employee Relocation , U.S. Relocation

With more and more companies looking for creative ways to save money, many have turned to their relocation policies for areas in which to cut costs. One trend that has gained in popularity recently is the temporary domestic assignment (TDA).

The IRS defines a short-term assignment as one that lasts for less than one year. This is a very important distinction because the benefits change from non-taxable or deductible to taxable at the one-year mark. Companies that provide relocation tax assistance can save a considerable amount of money by not having to pay taxes on the benefits.

According to Worldwide ERC (Employee Relocation Council), home sale assistance costs average nearly $45,000 per transferee. On the surface, it might appear that opting for short-term assignments rather than relocation would save companies a bundle, but it’s not so simple.

As a rudimentary example, National Corporate Housing states that the average daily rate for a corporate apartment in the U.S. is approximately $145. Multiply this by 365 days and you get a cost of $52,925. And that doesn’t even account for other short-term assignment costs, like T&E. Of course, there are significant savings equated with a short-term assignment: no homefinding trip, little or no household goods to ship and no home purchase benefit.

As a practical matter, a stay of this length would usually qualify for a larger daily discount, which could essentially make the cost of a short-term assignment and a permanent move similar.

Technological advances and more liberal policies toward remote work arrangements are other factors that have facilitated the rise in TDAs. The face to face working dynamic that is initially created through the TDA can then be carried back to the home office or remote working location and fostered through technology. This allows companies to meet their needs for a specific skill set, build teams and transfer knowledge without having to bear the cost of a permanent relocation, and employees to avoid the some of the stress that comes with relocating their families.

Of course, the family issue is complex and while a TDA does reduce some of the stress, it cannot eliminate it. Most short-term assignments are unaccompanied and some employees and their families struggle when apart for extended periods. This can also be a significant challenge for single parents who might find that they have to turn down an offered assignment.

It is important for companies to keep in mind that TDAs require separate, formal policies, letters of assignment, and defined processes. By having these in place, companies can reduce the risk of tax exposure and increase the odds of a successful, productive assignment for the company and the employee.

Need Help Improving your Employee Relocation Benefits?

Download this complimentary Whitepaper: Domestic Relocation Packages: Best Practices

Keep Exploring This Topic.

Get more expert insight on what matters most for your business -- keep checking out the TRC blog.

Continued Concern for Employer Duty of Care

Corporate Relocation , Domestic Relocation , Employee Relocation , International Relocation , Talent Mobility

Duty of care refers to employers’ legal and ethical responsibility to ensure their employees’ and their families’ health, safety, and well-being while on a relocation assignment or traveling outside traditional workplace boundaries. In the global mobility industry,...

Remote Work Compliance Complexities

Employee Relocation , Relocation Policy , Talent Mobility

With technological advancements and changing attitudes towards remote work, more companies are embracing a decentralized workforce, allowing employees to work from anywhere. While remote work offers numerous benefits, it also presents unique challenges related to...

Employee Mobility Program Trend: Increased Focus on the Employee Experience

Corporate Relocation , Domestic Relocation , Employee Relocation , International Relocation , Relocation Policy , Talent Mobility

Traditionally, an employee mobility program focused primarily on logistical aspects such as the household goods move, departure home disposition, and tax compliance. However, there has been a growing recognition that a positive employee experience is crucial for the...

Key Relocation Trends for 2024: The Continued Rise of Managed Cap Relocation Programs

Corporate Relocation , Domestic Relocation , Employee Relocation , Relocation Policy , Talent Mobility

Managed Cap relocation programs, also known as Capped Allowance programs, have gained popularity due to their cost-effectiveness, flexibility, and ability to streamline the relocation process. These programs allow employers to manage and contain costs more effectively...

Ready to make your relocation program even better? Let’s move.

You’ve got a destination. We’ve got the plan to get you there. Let’s get started.

Talk to a relocation specialist today

- Our Company

- Our Beliefs

- Our Advantages

- Our CSR Journey

- Our Leadership

- Relocation Services

- Advisory Services

- Our Technology

- Small/Emerging Programs

- Compliance Solutions

- Government Services

- Industry Insights

- Upcoming Events

- Israel-Gaza Update

Debunking the Myths of Domestic Temporary Assignments 10.8.2014 | Jennifer Connell

- Domestic Assignments

- Short Term Assignment

- Workforce Mobility

As companies strive for greater flexibility to respond to the increasing speed of business and broader range of opportunities, temporary domestic assignments have grown in popularity.

In fact, according to the results of our 2014 Workforce Mobility Survey , more than half of companies now offer such assignments.

As their usage becomes more widespread, so have some myths concerning temporary domestic assignments. In this article, I’ll address and debunk them.

Myth: Temporary assignments only help us complete project work.

While the majority of organizations use domestic temporary assignments for project work-based needs, our survey revealed that a growing number of companies in the U.S. and Canada use them to develop future leaders and high potentials. In fact, high growth companies (companies with revenue growth of more than 5% over the past year) tend to use fewer short term assignments for “project work” and instead rely on these programs for career development purposes.

Myth: It’s less expensive to send my employee on a temporary assignment than a permanent move.

This is a common misconception. For short-term assignments, the vast majority of costs are typically covered by the company, including housing. While there is a favorable tax impact, companies are experiencing an increase among assignments that extend beyond one year. Not only does this increase the costs, it may affect the taxability of the provisions.

Prolonged family separation and other personal issues that arise over time could lead to more return trips home, dependent visits or time away from the project or assignment to tend to family issues. The costs involved in a permanent move may be comparable to the costs of a long-term assignment (greater than 12 months) when tax consequences are taken into account.

Myth: Temporary assignments are easier to administer than permanent moves because we only have to worry about the employee on the assignment.

Separation from family was cited as one of the top obstacles in using temporary assignments and can have a negative impact on productivity as the employee attempts to manage their home from the assignment location and connect with family. This can ultimately lead to higher turnover and retention issues and subsequently increasing recruiting and staffing costs.

Many companies structure temporary assignments based on the duration of the assignment and the family status (accompanied or unaccompanied). These aspects are closely aligned because not many families are willing to be separated for long-term assignments (more than 12 months). In addition, the longer the anticipated assignment length, it’s more common to develop a long-term policy that addresses accompanying family costs or the costs of property management.

Myth: Assignments that extend beyond a year are still not taxable.

Our survey indicates that more companies are extending the length of temporary assignments or transitioning them into permanent moves. This is not without tax consequences.

Therefore, when planning a temporary move, certain things need to be considered:

- Time limit. In the United States, under federal tax law, certain reimbursed expenses incurred while on a short-term assignment (or “temporary assignment” in tax parlance) of up to 12 months could potentially be considered non-taxable to the employee.

- Types of expenses. Expenses that may be considered non-taxable include travel between the home and the assignment location, accommodations at the assignment location, and meals or per diems while at the assignment location.

- Intended length of the assignment. Consider the timeframe anticipated for the assignment and when the decision was made to extend the assignment past 12 months, if applicable.

For example, if your company has an employee nine months into a 12 month assignment and a decision is made to extend that assignment beyond the 12 month limit, any reimbursements made after that nine month point are considered taxable income to the employee. Likewise, if an assignment has not surpassed the one-year limitation, yet the assignment was expected to last one year or more, the IRS considers this a taxable event. At the point that an assignment is believed to be greater than one year, the taxability of the reimbursed expenses begins.

Myth: A lump sum should cover all of the living costs incurred on the temporary assignment.

Lump sums can be difficult for employees to manage for a temporary assignment, particularly if their attention is divided among their family/home residence and the demands of their position in the new location. If the funds are not managed closely, this can negatively impact the employee’s productivity and can lead to subsequent requests for additional funds. If using a lump sum, the simple (but costly) solution is to consider all lump sum allowances as income and tax protect those payments.

Continue Reading

Infographic: internships and workforce mobility 04.06.2016 | jennifer connell, cookie statement.

In order to deliver an optimized user experience, this site uses cookies. To learn more, please see our cookie policy .

Subscribe to our Newsletter

Subscribe to our newsletter. It's an easy way to stay connected to the latest workforce mobility trends and best practices.

<b>Internet Explorer is no longer a supported browser on imercer.com.</b> For an optimal experience on imercer.com, please use Chrome, Edge, Firefox, or Safari.

North America Domestic Temporary Assignment Policies & Practices Survey

Finding solutions for your temporary assignments.

Product Highlights

The North America Domestic Temporary Assignment Policies & Practices survey is a new survey dedicated to domestic assignments that are temporary in nature. Covering multiple industries, data collected will be focused on policies and practices surrounding your temporary assignment programs. If you transfer employees within the US or Canada temporarily, this survey is designed for you.

MULTILEVELMULTISELECTION

Please complete your other currency purchase before adding a product of a different currency to your shopping cart.

If you need assistance, please contact customer service.

Added To cart

Your Cart Contains items

Order Subtotal

Individuals or companies using Mercer data for consulting services or commercial purposes are subject to different rates.

Please contact us if you have any questions.

- IsOrderingSet Yes

- Ordering Type MultiLevelMultiSelection

- Enable Participation Yes

- Participation Start Date 06/05/2024

- Participation End Date 06/17/2024

- Sub Title Finding solutions for your temporary assignments

- Region Global

- Short Description Policy data for your temporary assignments.

- isCOLQOL NO

- Enable Widgets No

- Enable Home Page Display Do Not Show

Find out how you can save by becoming a participant in this survey. Learn More

Product Details

Delivered via imercer.com.

When thinking about domestic relocation, temporary assignments can look different than long-term permanent moves. What are challenges you face with temporary assignments in your organization? How do your policies for these moves differ from those of permanent moves? Get the solutions you need when approaching assignments for a temporary relocation.

The North America Domestic Temporary Assignment Policies & Practices survey is a new survey dedicated to domestic assignments that are temporary in nature. Covering multiple industries, data collected will be focused on policies and practices surrounding your temporary assignment programs. If you transfer employees within the US or Canada temporarily, this survey is designed for you.

Results from this survey will provide you with an opportunity to gain better insight into your workforce, the ability to compare your policies and practices data with peers and competitors across markets, and allows you to secure a significant savings on your purchase of the survey results.

Survey results are delivered in a published PDF format to your imercer.com account under My Downloads.

What Happens After Purchase?

Once you submit an online order, our team will get to work right away to validate your purchase and grant access to the dataset. For new users, this may take us longer to verify your information.

Customers with an account

It may take up to 48 hours before the data is accessible. You will be notified via email when the data is available.

New customers without an account

It may take up to 72 hours to gain access to this dataset. Once your account is created, your access link will be sent to your email.

Have a Question?

Contact our customer service team for assistance.

Ready to Purchase?

Select Your Product

Additional buying options are available

Learn how you can qualify for additional discounts..

You tell us what’s happening in your organization – from what you pay to how you pay – for your positions and we’ll give you a discount on the results. Survey participation is open to all organizations with matching jobs.

Participate online

Participation Window

Opens: 06/05/2024

Closes: 06/17/2024

Frequently Asked Questions Product Management > Products FAQs" src="https://www.imercer.com/uploads/common/HTML/Rebranding2023/Tooltip.svg" data-original-title="Participation at Mercer means your organization submitted data for inclusion in the published results.">

You may also be interested in, mobility: alternative international assignment (aia) survey, worldwide survey of international assignment policies and practices, related articles.

- English (United States)

- English (United Kingdom)

- français (Suisse)

- norsk bokmål (Norge)

- português (Brasil)

- Deutsch (Deutschland)

- SIRVA

- Learning Center

Temporary Domestic Assignments in the US: Part 1

- Are looking to fill a position for temporary project work

- Need a specialized skill at a particular location for a certain period of time

- Want to train an employee at a certain location

- Are reluctant to offer a full relocation package in order to control costs

Temporary Domestic Assignments

Pulse Survey

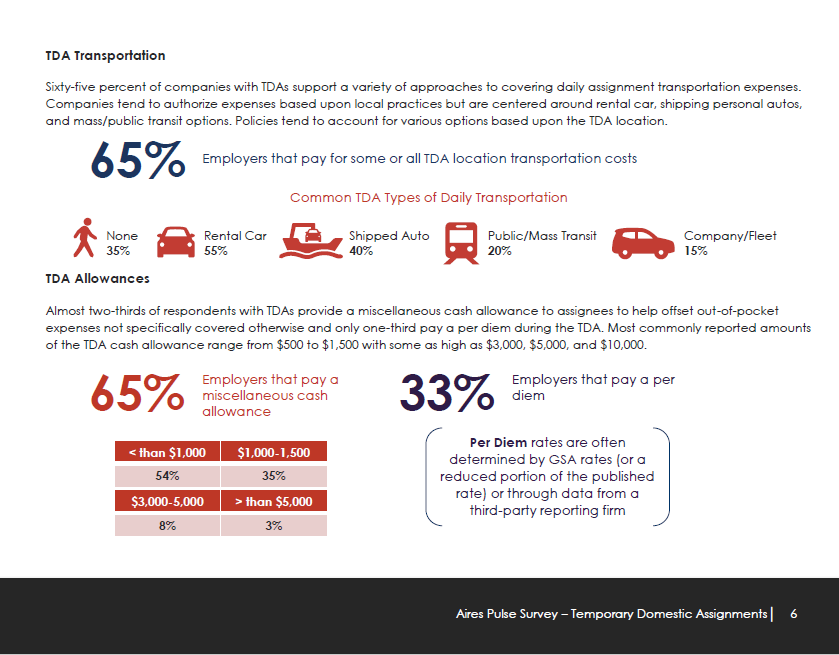

The most recent Aires Pulse Survey takes a closer look at temporary domestic assignments. This report includes benchmark data for the types of support provided by employers and identifies the common reasons why employees are sent on short term domestic assignments. Domestic mobility is constantly evolving and growing to meet businesses’ and transferees’ needs. This is evident through notable trends such an increase in both policy tiers and types of relocations. Traditionally, domestic relocation implied a permanent move and often involved selling and purchasing real estate. The recession brought about change, reflection, and efficiencies. Hence, the temporary domestic assignment (which potentially eliminates or reduces costly permanent relocation expenses) caught the attention of several companies.

When first researched and surveyed in 2012, Aires found only 48% of companies offering temporary domestic assignments. Today, three-quarters of survey participants confirm that temporary domestic assignments are part of their domestic mobility program, yet more than a quarter of them are sending employees on temporary domestic assignments with no formal policy.

Below is a sneak peek of the Temporary Domestic Assignments survey.

Request Temporary Domestic Assignments

- Global Services

- Our Technology

Domestic Short Term Assignments: What You Should Know

By: Sam Hoey | CRP, GMS

November 13, 2019

Many companies are using domestic short term assignments to strategically respond to corporate growth initiatives. Some business opportunities may only require a limited focus for a specific length of time. Often companies have current employees with knowledge and experience who can effectively contribute in various capacities. The IRS defines a temporary assignment or job as lasting for one year or less .

For example, the healthcare industry increasingly uses domestic short term assignments. These roles help the industry meet the challenge of hiring and keeping talent with high levels of skills. Many of these employees enjoy going to new locations on a regular basis and thrive in the excitement and adventure of domestic short term assignments.

By leveraging its current pool of talent, a company can quickly respond to changing priorities. Also, it can place a greater focus on growth initiatives rather than recruiting for new hires.

What are the Benefits?

Company benefits of domestic short term assignments.

There are many benefits for companies that can leverage domestic short term assignments. Issues relating to skills, training, and costs can be effectively addressed, often without having to incur significant costs:

- Easier to Attract Talent Interested in Challenging Assignments

- Gap in Skills is Effectively Closed as Employee Fills Role and Provides Training

- Productivity Increases

- Talent Acquisition Costs are Reduced or Eliminated

Employee Benefits of Domestic Short Term Assignments

An employee who fills a short term assignment also benefits in several ways. Often, the employee gains problem-solving skills and they will increase their ability to communicate across the organization. From a teamwork standpoint, the employee may inspire others to participate in finding solutions:

- Experience Increases

- Leadership Potential Rises

- Morale Increases with Recognition for Assignment and Achievement

- Network of Mentors and Peers Expands

What Does This Mean?

Companies that offer domestic short term assignments often gain a significant number of benefits. They can respond quickly and effectively to changing business priorities. Additionally, they can save talent acquisition costs and close skills gaps with placement and training.

Employees also gain many benefits by taking these positions. Their skill levels increase, and they can expand their network of mentors and peers in the organization. As a result, their leadership potential rises and their productivity increases.

What Should Employers do About Domestic Short Term Assignments?

Employers with transferees that fill domestic short term assignments should work with a qualified and experienced Relocation Management Company (RMC) . Often the company’s relocation policy focuses on benefits and programs for employees and family members moving to a new location.

However, employees that fill domestic short term assignments will need a different range of benefits and support, since they will return to their home after the assignment is complete. They may need assistance with travel , temporary housing options, or transportation solutions while at the new location.

Companies should review their relocation policy to ensure it follows industry best practices for relocation benefits provided to employees who take domestic short term assignments . GMS tailors each client’s program based on specific budgets, needs, and compliance. As a result, clients can offer an industry-leading relocation program designed to fully meet the needs of these employees. This helps ensure successful assignments and increases employee satisfaction.

Industry Benchmarking Studies Help Employers Compare Their Relocation Program

GMS has recently published several Industry Benchmarking Studies to help employers learn whether their company’s relocation program is designed following industry-specific best practices. There are many benefits to a corporate relocation policy benchmarking. For example, employers can learn how benefits provided for domestic short term assignments in their relocation program compare to those offered by competitors in their specific industry.

Industry best practice is to schedule a relocation program and policy review every 12 to 18 months to ensure your company maintains its competitive position . This review will also help your company learn about how the relocation industry is evolving to meet increased employee demands, especially with regard to domestic short term assignments.

GMS’ team of corporate relocation experts has helped thousands of our clients understand how to leverage domestic short term assignments to meet corporate objectives. Our team can help your company design a relocation policy that provides the best experience for employees during their temporary assignments.

GMS was the first relocation company to register as a .com, created the first online interactive tools and calculators, and revolutionized the entire relocation industry. GMS continues to set the industry pace as the pioneer in innovation and technology solutions with its proprietary MyRelocation™ technology platform .

Global Mobility Solutions is proud to be named and ranked #1 Overall, and #1 in Quality of Service by HRO Today’s 2019 Baker’s Dozen Customer Satisfaction Survey.

Contact our experts online to discuss how your company can leverage domestic short term assignments to meet corporate objectives, or give us a call at 800.617.1904 or 480.922.0700 today.

Sam Hoey | CRP, GMS

Senior Vice President, Global Account Management Sam joined Global Mobility Solutions in 1996 and has a unique perspective with her 25 years of industry experience. Samantha offers her clients relocation expertise and a commitment to excellence in her. Her proficiency in orchestrating the BVO and GPO Programs, as well as relocation policy design and implementation, are invaluable assets to the accounts she manages. Her experience in administering Pre-Decision Relocation services to enhance the recruiting process further demonstrates her unique abilities to service her clients. Samantha’s diverse experience, leadership, and outstanding communication skills enable her to manage the relocation process for her clients with finesse and polished professionalism.

Related Posts

How Spousal Support and Family Services Affect Relocation Decision-Making

Things to Consider When Planning a Group Move

What Is Corporate Housing?

How to Negotiate a Relocation Package

Other Services

Our Technology

Global Relocation

Group Moves

U.S. & Canadian Relocation

GMS Client Login

Privacy Policy

Global Mobility Solutions 15333 N. Pima Road Scottsdale AZ, 85260

1.800.617.1904

Available 24/7/365

1.800.617.1904 Available 24/7/365

Looking for something?

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

Temporary Assignments Policy

[Company Name] may periodically re-assign employees to other work locations for temporary duty based on business need. The purpose of this policy is to complement [Company Name]'s relocation policy and its business travel policy. Under this policy, temporary assignments are not less than 60 days and not more than 180 days.

Temporary assignments are subject to a written agreement detailing the terms of the assignment and the approximate duration. The distance of the new work location must be greater than 50 miles from the employee's regular work location. If the distance is less than 50 miles, the assignment is handled under the business travel policy.

Allowances during Temporary Assignment

Travel costs to and from the temporary work location by public transportation, personal vehicle or rental car will be reimbursed by [Company Name]. For public transportation, travel arrangements must be made through [Company Name]'s contracted travel service and costs will be paid directly by [Company Name]. For personal vehicle use, reimbursement will be made based on the standard mileage rate of [current IRS rate] per mile. All rental vehicles should be reserved through our contracted travel service.

Costs for return visits to the employee's home location every two weeks during the temporary assignment will be covered.

Per Diem and Lodging

The employee will receive per diem and lodging allowances during the temporary assignment. If known in advance that the duration of the assignment will be for more than three months, arrangements with a corporate apartment provider will be handled through our travel service. If the duration is unknown, the employee will be required to stay at a hotel scheduled through our travel service.

Payment of Expenses

Any expense that is authorized by [Company Name] will be paid through accounts payable. Expenses for lodging, meals and incidental expenses paid by the employee should be submitted weekly to the accounting department for reimbursement.

Tax Considerations

Reasonable expenses incurred due to temporary assignments are considered proper business expenses that can be deducted by the company and are not considered taxable income to the employee. Thus, actual expenses reimbursed to an employee are not subject to federal or state withholding.

Related Content

Why AI+HI Is Essential to Compliance

HR must always include human intelligence and oversight of AI in decision-making in hiring and firing, a legal expert said at SHRM24. She added that HR can ensure compliance by meeting the strictest AI standards, which will be in Colorado’s upcoming AI law.

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

Conduent Support Center

- Submit Request

- /app/account/overview, Support History > /app/account/questions/list, Account Settings > /app/account/profile, Notifications > /app/account/notif/list"/>

- Your Account

RTX TE Temporary Domestic Off-Site Assignment (TDOA)

What is a Temporary domestic off-site assignment (TDOA) and the policy?

Click the link below for Short-and-Long Term Assignments for Domestic and International.

While on TDOA all reimbursable charges are based on what is written in the MOU.

FCP-HR-TR-04 Short-and-Long Term International Assignments

FCP-HR-TR-08 Short-Term & Long-Term Temporary Domestic Off-Site Assignment

Was this answer helpful?

Published answers.

- RTX TE Pet Sitting, Boarding, Dog Animal (Internal to Help Desk Only)

- RTX AP - Performance Based Purchase Order (PBP) - Guidelines and Policies

- RTX TE Rstars Spot Awards / Giveaway Recognition

- RTX TE Corporate Card Citibank

- RTX TE FCPA, BCAR, Foreign Corrupt (Internal to Help Desk Only)

Accounts Payable and Travel & Expense

- 8:00 a.m. - 5:00 p.m. ET from Monday - Friday

- Wednesday - Closed from 12:00 p.m. – 1:00 p.m. ET

Helpful Links

Short-Term Assignments: Key Considerations and Essential Information

By Tracy Langlois, CRP, GMS

Short-term work assignments have been steadily increasing over the years and certain factors like the pandemic have shined a light on vulnerabilities within numerous industries. For instance, the demand for travel nurses has never been higher, as certain staffing agencies need to fill voids and provide additional support at hospitals all over the US. Other companies are asking employees to train new hires at different locations or attend workshop programs and conferences out of state. Those working in media may need to spend days, weeks, or months in different locations covering news stories. HR representatives are focusing on talent mobility, which may require employees to take on short-term work assignments for specialized training and upward growth within a company.

No matter the industry or reason, employers are recognizing the value of short-term assignments, as well as the logistical steps required to smoothly transition their employees from point A to B. With that in mind, CapRelo put together an overview of short-term assignments, so your company knows what is needed to assist your employee during the hectic transition of a short-term assignment.

What is a Short-Term Assignment?

A temporary assignment is defined as a work stint lasting for one year or less. A short-term assignment can be a series of shorter rotational assignments or an assignment that requires an employee to stay in one place for the entire duration. Similar to temporary duty assignments in the military, short-term assignments are not permanent and are meant to carry out a specific purpose. Companies may send one employee or a whole team out on temporary assignments, depending on the industry and work goal.

What is the Purpose of a Short-Term Assignment?

There are plenty of different reasons why companies would send their staff out on short-term assignments. For instance, an employee may need to assist a branch that’s struggling to perform and help them to increase their sales numbers. It’s also not uncommon for staff to oversee different departments during a company merger, requiring temporary assignments to ensure company policies are being carried out consistently across the board. Perhaps limited resources have prevented staff at different locations from being properly cross-trained, necessitating the need for temporary work trips.

Whether three weeks or three months long, short-term assignments typically require companies to cover lodging, food, transportation, and other travel-related expenses with stipends.

Benefits and Challenges of Short-Term Assignments

While short-term assignments sound like a breeze, they can pose some serious challenges for both the employee and the company itself. International short-term assignments can pose tax and immigration issues if companies don’t comply with the laws and regulations in each country. Secondly, some countries have turbulent landscapes, which could potentially put staff at risk. Employees may also get stranded in the assignment country due to canceled flights or COVID-related concerns, further implicating the company when temporary assignments do not go according to plan.

On the flip side, a company can create a robust talent mobility strategy with initiatives that reward current and new hires willing to take on short-term assignments. For instance, paying employees during travel time can lead to higher retention rates. Companies can also train staff across locations to improve their skills, eliminating any consistency errors. A change of scenery might help employees to improve productivity as well, especially in locations that offer plenty of sunshine and warm weather for post-work relaxation.

Short-Term Assignment FAQs

- Are Short-Term Assignments International? Short-term assignments can be either domestic (within a country) or international (across country borders). Certain companies like Amazon, FedEx, and Apple are known for leading the way with the most corporate travel, requiring employees to rack up airline miles to fulfill their job duties.

- How Does the IRS Define Short-Term Assignments? The IRS defines short-term assignments as work in one location that can be reasonably completed in one year or less (and is). Employees typically file taxes with their home state. If a work assignment lasts for longer than a year then it is considered an indefinite assignment, prompting an employee’s tax home to change.

- What is Relocation Tax Assistance? Before 2018, any moving-related payments or reimbursements to employees were not included in their annual reportable wages. These expenses did not require withholding taxes and would have been paid by the employee and later deducted. The Tax Cuts and Job Act of 2017 changed the way payroll handled relocation expenses. Nowadays, employers can offer relocation tax assistance or tax gross-ups . A tax gross-up simply means that a company provides a larger payment sum to the employee to compensate for the taxes that will be withheld from their payment if that employee is relocating somewhere new.

- Do Family Members Join Employees on Short-Term Assignments? When it comes to temporary assignments, most companies do not assist families to join the employee in the new location if the assignment is expected to have a duration of six months or less. Assignments greater than six months may include company support for family accompaniment. Some companies will offer to pay for visits home after a certain amount of time has passed for employees who are not accompanied. This could be anywhere from 8 to 12 weeks after the start of the assignment but depends on the company’s unique policies.

How Can Companies Assist Employees?

Companies should have well-defined relocation policies in place before sending employees out on temporary assignments. The policy should include details on the relocation services and benefits which will be provided to employees and who will be assisting them with these services. It is important to note for international cases that proper immigration documentation is required before the start of the assignment. Letters of assignment (LOA)s should also be created for employee and company signature and should include specifics on the location and duration of the assignment and specific benefits. Companies should have a dedicated budget in place to assist with short-term assignment relocation expenditures; a comprehensive cost estimate including tax costs can be prepared in advance to ensure appropriate approvals can be obtained. A survey of HR professionals conducted in partnership with CapRelo found that 33% of participants stated their relocation policies have been updated to accommodate employees’ mental health and well-being, which is another factor that should be taken into consideration to help employees cope better with their new surroundings.

Do You Need a Relocation Program?

So, you’re ready to send your employees out on short-term assignments, but don’t know where to start? Whether you need help transferring one employee intra-country, or flying a whole team across the globe for specialized training, we can help.

At CapRelo , we provide relocation solutions for companies that need them, covering a host of services including cost estimate preparation, corporate housing, auto shipment, property management, travel services, immigration coordination, and much more.

Our team specializes in seamless transfer operations and sorts out all of the logistical steps before your employee’s short-term assignment so you can have peace of mind knowing that they are in the best of hands. Allow us to take one more thing off your plate and contact our highly qualified team at CapRelo today to get started.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share with Email

Insights + Resources

Caprelo insider june 2024, caprelo insider may 2024, unpacking corporate policies: understanding the impact of household goods shipment weight caps, navigating the skyrocketing rent crisis: insights from major cities worldwide.

- Social Science

temporary domestic assignments - Midwest Relocation

Related documents.

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

CoCounsel: The GenAI assistant for tax and accounting professionals

Save time and effort by reducing long research sessions into simple tasks with AI-assisted research on Checkpoint Edge.

Build a career without boundaries

Learn more about how Thomson Reuters informs the way forward in The Power of Purpose

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Legal expert urges businesses to follow paid military leave case law

What are APIs and how can they streamline tax provision calculations?

401(k) tax FAQ: Tax considerations for contributions and withdrawals

- Mobile Equity Services

- Mobile Workforce Management

- Mobility Tax Compliance and Consulting

- Private Client Services

- In the News

- Resource Center

- My GTN Portal

Changes to Assignments – Hidden Tax Costs

COVID-19, current travel restrictions, and government and business shutdowns have certainly made it difficult for many mobile employees to carry out “business as usual.” This can be particularly true for employees that were on a short-term or long-term assignment prior to COVID-19. Because of safety considerations or travel restrictions, two common scenarios that have emerged from the COVID-19 pandemic include:

- Scenario 1: Individuals that were on a short-term assignment (i.e., 1 year or less) are having their assignments extended.

- Scenario 2: Individuals that were on a long-term assignment (i.e., more than 1 year) are temporarily returning to their Home location or going to a different location.

In both scenarios, many companies are providing assistance to employees to help with either the additional costs of staying on assignment, such as in Scenario 1, or assistance with the costs of temporarily going back home or to a new location, as in Scenario 2. The additional costs of such assistance may be substantial, but there could be even more hidden costs for the company due to the following:

- Additional tax implications could result due to a change in where the employee was originally expected to be located. For example, an employee who remains in a location longer than anticipated could become subject to tax in that location because an income tax treaty no longer applies and/or because they have become a resident for Host location tax purposes. You can read more on this topic in one of our other recent blog articles .

- Payments made by the company to assist mobile employees that have an unexpected change in location may be considered taxable income if the individual is working in or is a tax resident of the location.

From a US federal income tax perspective, the Internal Revenue Code (IRC) defines taxable wages as all remuneration for services performed by an employee for their employer (both cash payments and non-cash benefits paid in any way other than cash), UNLESS specifically exempted by another IRC section. Here, one of the most well-known IRC sections that exempts payments from taxable compensation is IRC Section 162(a)(2), which is often referred to as the “business traveler exemption.” However, as shown in the following example, it is important to not assume this exemption will always apply, especially if facts change due to COVID-related issues .

Business Traveler Exemption

Under IRC Section 162(a)(2), an employee with a tax home in location A who is on a “temporary” assignment or business trip to location B can receive tax-free reimbursement of certain travel costs (e.g., reasonable housing, per diems) from their employer. Here, a temporary assignment would be defined as one that is expected to last and, in actual terms does last, for one year or less. If the assignment later is expected to go over the one-year mark, it will no longer be considered temporary, such that the travel costs no longer qualify for exemption under IRC Section 162(a)(2).

The following scenario illustrates this concept considering a possible COVID-related assignment extension.

Scenario 1 – Extended US Domestic Assignment

Assume an employee went on a temporary assignment from Florida to Tennessee on May 1, 2019 and was expected to complete their assignment on April 15, 2020. However, due to COVID-19, the employee decided to remain in Tennessee because perhaps their home in Florida was a COVID-19 hotspot or there were travel restrictions limiting their ability to travel back to Florida.

In this scenario, once the intent of the assignment was expected to exceed one year, the “business traveler exemption” would no longer apply (from that point onward), with all payments for housing, meals, and travel in Tennessee now subject to US federal taxation. Due to this factor, the change in taxability for the assignment costs could result in a very unpleasant surprise for the individual or company (if the company policy would cover the incremental tax costs for their employee).

In this example, as Florida state and Tennessee state do not have state income tax, a state income tax event would not be incurred. Although outside the scope of this blog, a review of state tax requirements should always be undertaken to determine the state income tax impacts.

In addition to domestic US scenarios, it is also critical to consider the ongoing applicability of IRC Section 162(a)(2) for employees who temporarily relocate due to COVID-related reasons. The following example illustrates this need for an employee and family who are temporarily returning to the US for safety considerations.

Scenario 2 – Temporary repatriation to the US

Assume an employee was on a 3-year assignment from the US to another country and started the assignment on January 1, 2019. During this assignment the employee’s family joined them and they rented out their house in their Home location for the duration of the assignment. Due to the COVID-19 pandemic, the employee returned to the US in March of 2020, and the company provided temporary housing for the employee and his family.

In this scenario, the travel back to the US could be deemed a “temporary assignment” if the individual’s tax home remained in the other country. Accordingly, the “business traveler exemption” could apply to have the housing, meals, and travel costs be exempt from taxable income, but only for the costs related to the employee. Any payments related to the family do not meet the requirements of IRC Section 162(a)(2) to be considered exempt from compensation. Accordingly, any of the following payments for the family would be considered taxable income:

- Housing costs in the US (i.e., the incremental cost of housing for the family beyond a one-bedroom place or similar housing that would normally be provided to an employee on a short-term assignment)

- Travel costs for the family to travel from the assignment location to the US

- Any meals/food for the benefit of the employee’s family

In addition to any US federal tax costs, it would also be necessary to consider whether the additional housing, travel, and meal costs would be subject to state tax or to tax in the non-US country. Once again, the taxability on these payments by the company could result in very unpleasant surprises for the employee and employer.

Section 139 to the Rescue?

While the “business traveler exemption” may not provide much relief to companies that are supporting changes in assignment locations for their mobile employees, there is another IRC section that could assist in limiting any unexpected tax bills.

Soon after the events of September 11, 2001, IRC Section 139 was added to the IRC as an instrument for private entities to provide disaster relief payments to individuals on a tax-free basis. The current pandemic is a “qualified disaster” for purposes of IRC Section 139 and will remain qualified until the President declares that the federally declared disaster condition has ended.

Qualified disaster relief payments are exempt from federal and most states’ personal income tax for the recipient and are exempt from federal tax withholding, FICA, FUTA, Medicare, and self-employment taxes for all parties if structured properly. Further, qualifying payments are still deductible business expenses for the employer, even though they are not taxable to the recipients. Some potential expense reimbursements that could qualify for relief under IRC Section 139 include:

- Housing: Expenses incurred for a hotel room due to quarantine

- Transportation: Expenses incurred as a result of COVID-19 including rental cars and parking expenses

- Meal: Expenses from delivery services as a result of restricted travel

- Remote work: Expenses associated with remote work arrangement as a result of the pandemic

- Medical: Expenses related to COVID-19

There is no specified dollar limitation on the amount of payments that may be excluded from income by operation of IRC Section 139; however, the expenses must be “reasonable and necessary” and your organization should document that the actual payments comply with their own policy (e.g., the amount of payment should be commensurate with the expenses for which the payment is being made.) Also, it is important to note that payments for income replacement purposes, such as payments to individuals for lost wages or unemployment compensation, are not eligible for tax relief.

As mentioned above, the ultimate taxation of traveling costs can vary depending on the locations involved (e.g., states and/or countries) and the specific facts and circumstances. If you have any employees that fit the fact patterns described above, and you would like to explore if IRC Sections 162(a)(2) or 139 could reduce your employee or company’s overall tax cost, please contact us and we would be happy to provide assistance.

Author: Brett Sipes

6900 Wedgwood Rd N, Ste 400

Maple Grove, MN 55311

+1.888.486.2695 | [email protected]

- Our Services

- Mobile Equity

- Mobile Workforce

- Mobility Tax

- Private Clients

- Your Resources

- Global Coverage

- Transition Process

- Philanthropy

© 2024 Global Tax Network TERMS OF USE AGREEMENT PRIVACY POLICIES PRIVACY AND SECURITY

Support for you during the COVID-19 pandemic

The Mercer Mobility Exchange website and its divisional websites may be translated for your convenience using translation software powered by Google Translate, a free online language translation service that can translate text and web pages into different languages. Reasonable efforts have been made to verify the reliability of the translation service, however, no automated translation is perfect nor is it intended to replace human translators. Mercer does not guarantee the accuracy of the translated text. Some pages may not be accurately translated due to the limitations of the translation software. Text in images, PDF files, Word documents or other document types cannot be translated. The official text is the English version of the website. Any discrepancies or differences created in the translation are not binding and have no legal effect for compliance or enforcement purposes. If any questions arise related to the accuracy of the information contained in the translated website, please refer to the English version of the website which is the official version

Effective Short-term Assignment Per Diem Calculations

Short-term assignments is a growing – and growingly complicated – category within international mobility, with the number of short-term assignees increasing at over half of multinational companies over the last two years, according to Mercer’s 2012 and 2010 Worldwide Surveys of International Assignment Policies and Practices. An increasing number of assignments means higher costs, and it is more important than ever to ensure that the short-term allowances you provide to your employees are calculated accurately and consistently. Most multinational employers choose to use short-term per diem allowances rather than an expense-report-based reimbursement system for short-term assignees for consistency and budget control. But how should you approach per diem calculations to ensure your allowances are cost-effective, fair and consistent?

What is a short-term assignment?

First of all, it is important to be clear with what constitutes a short-term assignment. Employers may be differentiate based on family status, nationality, salary levels or other factors when determining the daily living allowance for these assignees. However, typically, a short-term assignee at a multinational company

- is on an assignment of 3 to 12 months,

- is unaccompanied by family members,

- is housed in a company-provided furnished apartment, with a self-catering facility (i.e. kitchen),

- receives transportation assistance from the company, and

- remains on home-country payroll and benefits.

What matters in determining short-term per diems?

What should you watch for when determining daily allowance recommendations for this type of assignees?

The key to effectively managing per diems is to ensure that you are getting data based on correct assumptions. The data should be flexible, accurate, and tailored toward short-term assignees at companies like yours.

The accuracy of the data that goes into the calculations is, of course, primary. That does not only mean that the various costs that make up the per diem should reflect current spending levels of assignees in a particular location. But the data should also be based on the spending of other business employees on short-term assignments. That means the calculations are made with appropriate assumptions, such as that the employees are staying in lodgings with self-catering facilities rather than in hotel dwellings where they would spend significantly more on eating out.

It is also important that the recommendations are transparent and flexible. Being able to pinpoint the costs of various elements of the per diem will not only help you manage budget and expectations, but will also let you adjust the allowance based on specific circumstances. You may want to adjust the market basket and/or compensate short-term assignees differently depending on their salary level, the purpose of their assignment or other factors. Mercer’s short-term per diem calculator presents our clients with three price levels and allows to customize per diem elements, so that they can apply the recommendation that fits their company’s budget and spending assumptions.

Isn’t free public data the easiest and cheapest source of recommendations?

When searching for per diem recommendations, you may find free public data available online, often published by government agencies. But this data may not meet the objectives of your short-term assignment policy or budget for a number of reasons. Here are some differences between the governmental approach, this one of the United States Department of State, and that of Mercer, which is experienced in providing data specifically for short-term assignees from multinational companies:

- Assumes employees are living in apartments/hotels with kitchen facilities for meal preparation

- Prices are updated twice a year and exchange rates are updated weekly

- Prices reflect outlets used frequently by expatriates in each location

- The number of meals out varies by the three levels offered by Mercer and can be customized to include as many or as few as a company deems essential. It is based on typical costs at dining facilities frequented by expatriates.

- Data includes expenses based on statistical research of consumption on short-term assignments and includes items in categories of personal care, recreation, public transportation and over-the-counter medicine.

- Assumes employees are living in hotels without kitchen facilities and eat all meals out

- Prices for hotels and meals are updated every two years (unless major changes require an interim update)

- Prices reflect the hotels and meals most frequently used by typical government travelers

- The meal portion is based on the average costs of three daily meals at dining establishments typically used by federal employees in that location.

- The “incidentals” portion is calculated as the cost of meals plus 10% of the combined lodging and meal costs, to cover incidental travel expenses

What do these differences in data sources and per diem calculations mean in terms of daily allowances? Let’s look at some of the most common short-term assignment locations worldwide and compare Mercer’s recommended per diems with those of the US Department of State:

Per diem allowances: Mercer vs. US Department of State (DoS) – Data other than % in USD; all data as of 15 October 2012

Unaccompanied assignee, price levels (all in USD)

| Unaccompanied assignee, price levels (all in USD) | |||||

| Location | Mercer Low | Mercer Medium | Mercer High | US Dept. of State (DoS) | Difference between DoS and Mercer High |

|---|---|---|---|---|---|

| 64 | 80 | 99 | 180 | + 82% | |

| 102 | 121 | 145 | 245 | + 69% | |

| 64 | 80 | 96 | 143 | + 49% | |

| 57 | 68 | 80 | 119 | + 49% | |

| 71 | 88 | 108 | 145 | + 34% | |

| 70 | 86 | 104 | 139 | + 34% | |

| 73 | 93 | 117 | 155 | + 32% | |

| 73 | 88 | 106 | 120 | + 13% | |

| 59 | 70 | 83 | 93 | + 12% | |

As you can see, the differences in assumptions and approach yield significantly higher daily per diem recommendations from the US Department of State data. Using these recommendations would cause an employer with short-term assignees to waste hundreds to thousands of dollars per assignee per month, even if you compare to the “High” price level in Mercer’s range. So much for cost-effectiveness!

As multinationals increase their reliance on short-term assignees to reach their business goals, they should also increase their vigilance in ensuring that those assignees are provided living expenses based on realistic assumptions. Use of accurate and flexible per diem assumptions will not only be fair to assignees but will benefit employers’ bottom lines.

Related Articles

- Mercer and Crown partner for enhanced relocation data solutions and support

- Host-based compensation approaches revisited

- Why align employee remuneration and global mobility data

- Compensating mobile employees in a new era

- Addressing the impact of exchange rate fluctuations on cost of living allowances

- Managing hardship issues in a pandemic

- Managing cost-of-living issues in a pandemic

- COVID-19 update: foreign exchange volatility and COLA

- Delivering flexibility

- Talent mobility: compensation dilemmas

- Long-term assignments: tips to manage expatriate allowances

- Global Mobility and Changing Reward Priorities

- Local Approaches for Internationally Mobile Employees

- Two Minutes to Understand Local Plus Compensation Approaches

- Four Steps in Revisiting Mobile Talent Compensation

- Practical Mobility Management: Compensation Tips for Long-Term Assignments

- Exploring Alternatives: Local Plus and Permanent Moves

- New Trends Reshaping Expatriate Compensation and Mobility Policies

- Paying Expatriates: Understanding Split Pay

- International Pay Structures: Why Are Companies Considering Them?

- Managing International Assignments: Compensation Approaches

- Changes to Cost of Living Allowances: A Closer Look

- What Is the Relationship Between Family Size and Mercer Spendable Income Amounts?

- Cost of Living Housing Exceptions - Policy Flaw or Necessity?

- Home-Host Housing Options: What Makes Sense and Why

- How Do “Expat Lite” Programs Manage to Cut Costs?

- Localization and Local Plus Packages: An Alternative Deal for Foreign Talent

- Local Plus: Focusing on the Practicalities of an Increasingly Popular Concept

Events and training Throughout the year, Mercer conducts a variety of free webinars and paid training sessions, online and in person, to help you keep pace with the evolution of international talent mobility and global workforce management.

Policy benchmarking Gain insights into your peers' international assignment programs and global mobility policies and practices. Participate in Mercer surveys to access unique benchmarking solutions.

Need help? Whether your organization is looking to create a global mobility program, enhance the one you currently have, or get answers to any issues or concern you're facing, we can help.

Get the latest global mobility news, event invitations, and articles from Mercer. sign up now

IMAGES

VIDEO

COMMENTS

Chevron U.S. Domestic Temporary Assignment program - Repatriation to Point of Origin January 1, 2013 (Updated January 2014) Page 7 of 13 Summary of U.S. Temporary Domestic Assignment (TDA) - Repatriation to Point of Origin (Greater than 12 Months)* *Requires business unit HR manager and HR Shared Services pre-approval.

Temporary Domestic An assignment of planned limited duration from which it is anticipated that you Assignment (TDA) will return to your same primary work location.The up -to 12 months TDA covers an assignment period that lasts between 91 days and one year (365 days). Brookfield Global Brookfield GRS is a relocation management company that administers

Chevron U.S. Domestic Temporary Assignment Policy -Greater than 12 Months January 1, 2013 (Updated; January 2014) Page 3 of 24 Introduction Congratulations on your new temporary domestic assignment (TDA). Chevron has designed the U.S. TDA program to provide financial assistance, professional services and ongoing administrative support

If you're sending employees on temporary domestic assignments, it's a good idea to have a policy for those moves. Unfortunately, our Annual Mobility Survey revealed that only 37% of companies have a formal policy in place to manage short-term assignments. The danger here is that managing domestic temporary relocations on an ad-hoc basis ...

One trend that has gained in popularity recently is the temporary domestic assignment (TDA). The IRS defines a short-term assignment as one that lasts for less than one year. This is a very important distinction because the benefits change from non-taxable or deductible to taxable at the one-year mark. Companies that provide relocation tax ...

While the majority of organizations use domestic temporary assignments for project work-based needs, our survey revealed that a growing number of companies in the U.S. and Canada use them to develop future leaders and high potentials. ... In addition, the longer the anticipated assignment length, it's more common to develop a long-term policy ...

Domestic Assignments. The Overseas Briefing Center provides resources for a return from a U.S. embassy or consulate overseas, including information on some 33 Department of State locations within the United States. Foreign affairs personnel can contact the OBC for more complete information and assistance.

The North America Domestic Temporary Assignment Policies & Practices survey is a new survey dedicated to domestic assignments that are temporary in nature. Covering multiple industries, data collected will be focused on policies and practices surrounding your temporary assignment programs. If you transfer employees within the US or Canada ...

Of course there are other reasons a company may provide a TDA, but these are some of the most prevalent. If you are considering temporary domestic assignments, this Issue of Policy Matters (Part 1) will cover: what is considered a short/long term-assignment by the IRS, how a base home and regular place of work are defined, and tax ramifications ...

This is evident through notable trends such an increase in both policy tiers and types of relocations. Traditionally, domestic relocation implied a permanent move and often involved selling and purchasing real estate. The recession brought about change, reflection, and efficiencies. Hence, the temporary domestic assignment (which potentially ...

Global Mobility Solutions is proud to be named and ranked #1 Overall, and #1 in Quality of Service by HRO Today's 2019 Baker's Dozen Customer Satisfaction Survey. Contact our experts online to discuss how your company can leverage domestic short term assignments to meet corporate objectives, or give us a call at 800.617.1904 or 480.922.0700 ...

5. If I take a permanent position where SPEEA does not already represent employees and I want a union in my workplace, how do I make that happen? Contact SPEEA from a personal email account or personal phone number and ask for a SPEEA organizer. Email: [email protected] Phone: 800-325-0811 (Tukwila) or 877-355-2883 (Everett). 6.

Temporary Assignments Policy. . [Company Name] may periodically re-assign employees to other work locations for temporary duty based on business need. The purpose of this policy is to ...

Click the link below for Short-and-Long Term Assignments for Domestic and International. While on TDOA all reimbursable charges are based on what is written in the MOU. FCP-HR-TR-04 Short-and-Long Term International Assignments. FCP-HR-TR-08 Short-Term & Long-Term Temporary Domestic Off-Site Assignment.

A temporary assignment is defined as a work stint lasting for one year or less. A short-term assignment can be a series of shorter rotational assignments or an assignment that requires an employee to stay in one place for the entire duration. Similar to temporary duty assignments in the military, short-term assignments are not permanent and are ...

EXPAND YOUR HORIZONS Make the Right Connections Everything You Wanted to Know About Short-Term Domestic Assignments Today's Presenters: • Craig Anderson, C.E. Anderson & Company • Kevin Shimkus, Deloitte • Dawn Higgins, Nestle Purina PetCare Product Technology Center TEMPORARY DOMESTIC ASSIGNMENTS Short Term Assignments Long Term Assignments • Generally - assignments of less ...

The IRS has released an information letter explaining the statutory one-year rule that determines when a work assignment ceases to be temporary for purposes of travel deductions and the income exclusion for travel expense reimbursements. Generally, travel reimbursements are excludable if they would be deductible as ordinary and necessary ...

Chevron U.S. Domestic Temporary Assignment Program - Repatriation Not to Point of Origin January 1, 2013 (Updated: January 2014) Page 7 of 21 Summary of U.S. Temporary Domestic Assignment (TDA) - Repatriation Not to Point of Origin (Greater than 12 Months)* *Requires business unit HR manager and general manager HR Shared Services pre-approval.

The Marathon Petroleum Temporary Assignment Guide is designed to assist you with the steps necessary for temporarily relocating to a new work location. If you have questions about issues or circumstances not addressed in the Guide, contact the Employee Relocation Ofice in Findlay at [email protected].

Long-Term Temporary Duty (LTT) Assignments What You Need to Know • Internal Revenue Code is the statutory authority for tax implications on LTT • A LTT is either temporary or indefinite based on the expected length of the TDY assignment o LTT assignments expected to be at one location for more than 1 year.

The following scenario illustrates this concept considering a possible COVID-related assignment extension. Scenario 1 - Extended US Domestic Assignment. Assume an employee went on a temporary assignment from Florida to Tennessee on May 1, 2019 and was expected to complete their assignment on April 15, 2020.

Insights. Effective Short-term Assignment Per Diem Calculations. Short-term assignments is a growing - and growingly complicated - category within international mobility, with the number of short-term assignees increasing at over half of multinational companies over the last two years, according to Mercer's 2012 and 2010 Worldwide Surveys ...