Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

What is the purpose of a business plan?

A business plan is like a map for small business owners, showing them where to go and how to get there. Its main purposes are to help you avoid risks, keep everyone on the same page, plan finances, check if your business idea is good, make operations smoother, and adapt to changes. It's a way for small business owners to plan, communicate, and stay on track toward their goals.

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

Send invoices, estimates, and other docs:

- via links or PDFs

- automatically, via Wave

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada . See Wave’s Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Business plan FAQs

How does having a business plan help small business owners make better decisions.

Having a business plan supports small business owners in making smarter decisions by providing a structured framework to assess all parts of their businesses. It helps you foresee potential challenges, identify opportunities, and set clear objectives. Business plans help you make decisions across the board, including market strategies, financial management, resource allocation, and growth planning.

What industry-specific issues can business plans help tackle?

Business plans can address industry-specific challenges like regulatory compliance, technological advancements, market trends, and competitive landscape. For instance, in highly regulated industries like healthcare or finance, a comprehensive business plan can outline compliance measures and risk management strategies.

How can small business owners use their business plans to pitch investors or apply for loans?

In addition to attracting investors and securing financing, small business owners can leverage their business plans during pitches or loan applications by focusing on key elements that resonate with potential stakeholders. This includes highlighting market analysis, competitive advantages, revenue projections, and scalability plans. Presenting a well-researched and data-driven business plan demonstrates credibility and makes investors or lenders feel confident about your business’s potential health and growth.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

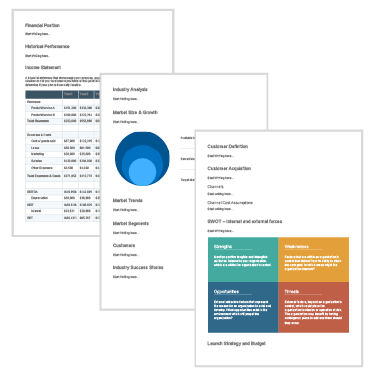

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

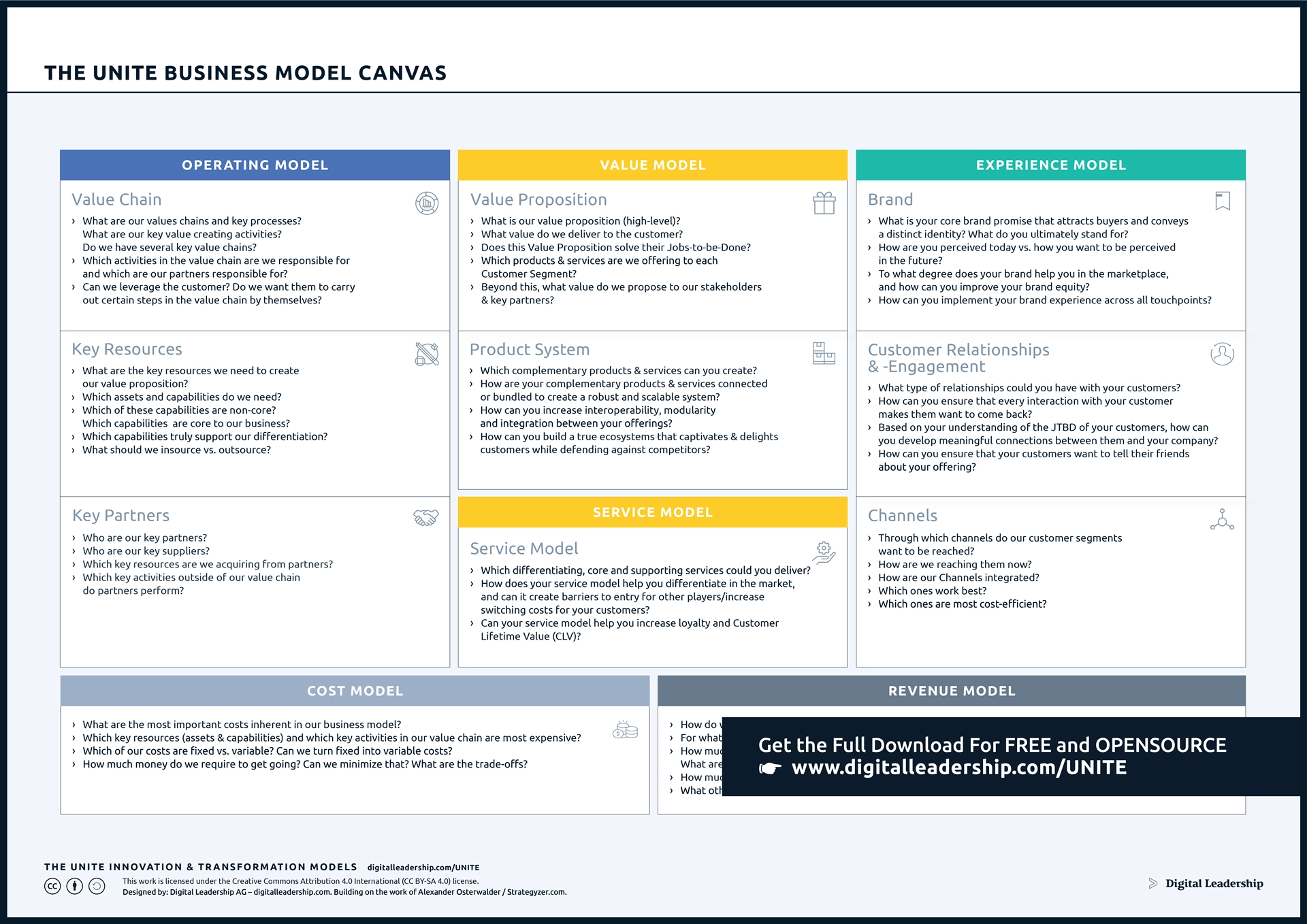

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

7 Min. Read

How to Write a Bakery Business Plan + Sample

3 Min. Read

What to Include in Your Business Plan Appendix

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

1 Min. Read

How to Calculate Return on Investment (ROI)

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Original text

Many of you put a lot of time and effort into creating a business plan for your new business and now it sits on a shelf or in a drawer collecting dust. Maybe you had an executive business plan that you used to entice potential investors, or a managerial business plan to pitch your business to investors, or the full operational business plan that is your true business blueprint and map to show you the way to achieve your business goals.

No matter which type of business plan you created, you should ALWAYS review it on an annual basis at a minimum. Publications such as Entrepreneur, Forbes, Inc. and many more recommend that you conduct a thorough update on your business plan at least once annually.

Apple has their business plans out to the mid-2020, but they update their plans every 90 days. This way they can be adaptable to the market trends, technology, consumer behavior, regulations, and much more.

Updating your business plan regularly can help ensure that you and your partners or co-owners are on the same page if there are multiple owners of your company.

When major changes occur at your company or in your industry, this is also a good time to update your business plan. Your plan needs to reflect the current situation and it needs to be relevant within the current business landscape that you are operating in. If something major has changed, it is essential that you make an update to your business plan to accommodate that shift.

Keeping your business plan updated is vital because no company can succeed unless it stays current with the times and unless it evolves.

Goals change

The goals that you have for your organization will be different when you first get started than the goals you have once your organization is already underway. You want your plan to reflect the latest goals that you hope your company will accomplish so you have clear and measurable objectives to work towards.

Keeping your plans updated also...

- allows you to adjust to any changes in the law or market conditions that could affect profitability

- helps you to identify new competitors and new potential sources of business

- allows you to see how your company is progressing with enhancing profitability over time.

Business plans are living documents and need to be revisited every so often to ensure they are still relevant. In this way you can continue to use and benefit from the strategies and tactics.

You probably prepared the original business plan yourself, since you were likely the only employee. If you have now grown and added staff, try to involve them so there is buy-in. That way, when it is time to implement the plan, your staff will be on-board, and the activities will go smoother.

To recap on why you should review and update your business plan at least one time every year:

- External and events can trigger the need to update your business plan (consumer trends, competition, regulations, suppliers, market, etc.).

- Internal events have changed (employee growth, new products, systems/processes, etc.). You are not the same company that you were a year ago.

- Updating your business plan is more focused and fun than the writing the original one.

- Involve staff in the updating process-watch how this helps your business.

- It is never too late to create a business plan-start now if you haven’t already.

A SCORE Mentor can help you review your business plan for free! Click here to schedule a meeting at a Phoenix Valley location near you!

Greater Phoenix SCORE also has several workshops that will help you with strategic and management planning. Click here for the full calendar.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

- Search Search Please fill out this field.

Your IdeaIs

Differentiation, market analysis, market share, cost analysis, the bottom line.

- Small Business

- How to Start a Business

5 Essential Steps To Evaluating Your Business Idea

Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

:max_bytes(150000):strip_icc():format(webp)/CSP_ER9-ErikaR.-dce5c7e19ef04426804e6b611fb1b1b4.jpg)

There's no doubt that America and other industrialized countries are small-business-friendly right now. In a year where elections around the world will play a key role in how economies continue to recover, there is at least one subject that most people agree on and that's small businesses. Politicians believe that small business is the key to economic growth and countries like the United States are passing legislation to make it easier for small businesses to thrive.

Robert Litan, economist from the Kauffman Foundation, the largest foundation in the world dedicated to the growth of small businesses, estimates that in order to add one percentage point to the United States' gross domestic product, or GDP, it would take 30 to 60 "home run" $1 billion companies.

Your business idea a home run idea? Being a successful small business owner doesn't require your company to be a $1 billion company, but entrepreneurs like to think big. National Federation of Independent Business Education Foundation (NFIB) estimates that only 40% of all small businesses are profitable and another 30% merely break even. These statistics prove that even with all of the incentives, it's difficult to turn your business in to one of those home run companies. Experts agree that you can improve your odds of success with careful preparation.

Identify the Need

What is the mission of your business? What is the need in the marketplace that you're filling and is it something that will appeal to a large portion of the population? Have you ever received a survey from a company asking you what you think of a product and if you would be likely to purchase the product and for how much?

This is the first step in market analysis . Don't just conduct an Internet survey. Go to a mall or other place where there are a lot of people and ask them to evaluate your idea.

How is your business different than others in the marketplace ? If you have competitors, what will make somebody come to your business instead of your competitor? Successful businesses have a USP or unique selling point that is used as the cornerstone of the business. The more you blend in the more you directly compete with others.

Avoiding the head to head competition, especially for a brand new business, is well advised.

Specifically, how big is your market? Does it include both males and females and people of all races and religions? How fast is the market growing or contracting?

If you design a product or service that only appeals to a small niche market, it will be difficult to gain enough market share to sustain a profitable business. It will also take a significant amount of advertising funds to find the people that comprise the niche market.

Based on your market analysis, how much of a market share do your competitors currently hold? What is left over for you or what is your strategy for taking share from them? Your business may have broad market appeal, but if the market is already saturated, the battle to gain customers may be too expensive.

Startups trying to manufacture new automobiles have found it exceedingly difficult to take market share from existing car companies. Evaluate whether that's a battle worth fighting and if you have the funds to fight it.

How much will it take to open your business? If you have family obligations, you'll probably have to pay yourself, adding additional costs to your budget. How will you get the money? Recently, Washington passed the JOBS Act, a law that made crowdfunding legal . This may provide a way for small businesses to gain funding without the use of banks or venture capital, but even with all of the recent legislation, businesses are finding it difficult to secure funding.

As an entrepreneur, your dream is likely centered around being one of those $1 billion or more businesses, but remember that many businesses fail and that's largely due to poor planning. Before investing a large amount of money in your business idea, create a plan and make sure that your idea is something that customers would be excited about purchasing. There are plenty of great opportunities waiting for a small business owner who follows a business startup system.

Top 6 Reasons New Businesses Fail

:max_bytes(150000):strip_icc():format(webp)/ENTREPRENEUR-final-b58bd9e9d38542dc9b96ee5e8b0b18a7.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- What Is TAB

- Advisory Boards

- Business Coaching

- StratPro Leadership Transformation Program

- Strategic Leadership Tools

- Our Members

- Case Studies

- White Papers

- Business Diagnostic

The Alternative Board Blog

What is a business assessment, and when do you need one.

We’ve already explained the 5 steps in TAB’s strategic business leadership process:

- Vision - Personal and business

- SWOT analysis - Strengths, weaknesses, opportunities, threats

- Plan - Personal and business

- Make it happen - Communication, review, accountability, planning team

- Turn the wheel - continuous review and revision as needed

And we’ve already discussed the importance of having a strategic plan for your business , the kind of plan that will make you remember the big picture: why you started your business in the first place.

But while having a vision for your business and having a strategic business plan to grow it are both keys to success, how do you get from A to B? How do you even know you need a strategic plan?

That’s when a business assessment comes in handy. Business assessments are a crucial aspect of understanding what your business plan should look like, what’s working the way it should, and what isn’t.

Think of your business as a car, and a business assessment as the blueprint for its design. While you might know your vehicle’s exact make, model, and mileage, you probably can’t remember all the details about its construction, such as the exact diameter of each of its hoses. The same goes for small businesses. If you install a hose that’s not the exact fit, the car will come screeching to a halt - and in this particular analogy, there are hundreds of hoses in varying sizes.

So much happens and so many decisions are made on a monthly basis -- without a business assessment it can be incredibly difficult for business owners to remember all of the details that can make huge differences in their operations and bottom line.

We recently interviewed hundreds of small business owners about what they wish they could do differently, if they could build their companies all over again. Out of all the aspects of running a business, the entrepreneurs wish they would’ve spent more time on strategic planning. Only 2% of respondents thought that a better product would have helped their business more than a better strategy.

Want additional insight? Read 4 Step Guide to Strategic Planning now to learn more

That’s why a business assessment is so important. If you have a vision for your business but don’t know where to start when it comes to figuring out a strategic plan for growth, it’s probably time for a business assessment. From there, you can build out your strategic plan and outline specific goals, as well as outline how you’re going to achieve them.

What does “SWOT” stand for?

Different firms offer different business assessments, each with their distinct advantages, but all business assessments are fundamentally lead to a balanced SWOT analysis of the organization.

A SWOT analysis looks at internal and external factors that are helpful or harmful to your business and the way it’s run. This type of assessment is particularly interested in identifying factors in the following 4 categories:

- The strongest parts of your business model and your best selling points. The core competencies of your team and your investments.

W eaknesses

- The weakest parts of your business model and weak spots in the sales funnel. What’s lacking in your team and missing from your investments.

O pportunities

- Potential leads, investors, events, and even new target markets.

- Potential competitors, reasons investors would cut funding, or negative market developments.

At a glance, it’s easy to see where most small business owners (and most business owners in general) like to spend their time - among the tropical shade and white sands of their company’s Strengths and Opportunities.

Rare is the business owner who takes the time to sit down and honestly assess weaknesses in his business model as well as potential threats (which can be difficult to see without another pair of eyes). This is why many small businesses fail -- entrepreneurs often have a vision, but no strategic plan for growth. And they have no strategic plan because they never conducted an honest business assessment.

They thought they were doing just fine when, in reality, weaknesses were eating away at their business model and threats were looming large in their market.

When’s the right time to get a business assessment?

That’s why we offer TAB Business Diagnostic. Our tool that we developed over years of research working with thousands of business owners that lets you comprehensively identify your competitive strengths but also key gaps in your business. Think of it as an MRI for your business that compares your business to others in the same industry. Not only does it identify the gaps but it also helps you prioritize, so you’ll know what challenges and opportunities you need to focus on first.

A business assessment does not take a lot of time but the results are invaluable. The output of the assessment is fed into the SWOT process. This helps identify the key areas of the strategic plan. Taking the first step in this process will put you on a path to running your business more strategically.

No matter of the economic conditions thrown at you and your business, there are steps to help safeguard your business so that you not only survive, but thrive. Download the whitepaper to learn more here

Read our 19 Reasons You Need a Business Owner Advisory Board

Written by The Alternative Board

Subscribe to our blog.

- Sales and marketing (140)

- Strategic Planning (135)

- Business operations (128)

- People management (69)

- Time Management (52)

- tabboards (39)

- Technology (38)

- Customer Service (37)

- Entrepreneurship (35)

- company culture (27)

- Business Coaching and Peer Boards (24)

- Money management (24)

- businessleadership (23)

- employee retention (23)

- Work life balance (22)

- Family business (17)

- leadership (15)

- business strategy (14)

- communication (12)

- human resources (12)

- employee engagement (11)

- employment (11)

- strategy (8)

- innovation (7)

- productivity (7)

- remote teams (7)

- adaptability (6)

- businesscoaching (6)

- cybersecurity (6)

- professional development (6)

- salesstrategy (6)

- strategic planning (6)

- businessethics (5)

- leadership styles (5)

- marketing (5)

- peeradvisoryboards (5)

- branding (4)

- employeedevelopment (4)

- hiring practices (4)

- socialmedia (4)

- supplychain (4)

- Mentorship (3)

- business vision (3)

- collaboration (3)

- culture (3)

- environment (3)

- future proof (3)

- networking (3)

- newnormal (3)

- remote work (3)

- sustainability (3)

- work from home (3)

- worklifebalance (3)

- workplacewellness (3)

- Planning (2)

- ecofriendly (2)

- globalization (2)

- recession management (2)

- salescycle (2)

- salesprocess (2)

- #contentisking (1)

- #customerloyalty (1)

- accountability partners (1)

- artificial intelligence (1)

- blindspots (1)

- building trust (1)

- business owner (1)

- businesstrends (1)

- customer appreciation (1)

- customerengagement (1)

- data analysis (1)

- digitalpersona (1)

- financials (1)

- globaleconomy (1)

- greenmarketing (1)

- greenwashing (1)

- onlinepresence (1)

- post-covid (1)

- risk management (1)

- riskassessment (1)

- social media (1)

- talent optimization (1)

- team building (1)

- transparency (1)

Do you want additional insight?

Download our 19 Reasons Why You Need a Business Advisory Board Now!

TAB helps forward-thinking business owners grow their businesses, increase profitability and improve their lives by leveraging local business advisory boards, private business coaching and proprietary strategic services.

Quick Links

- Find a Local Board

- My TAB Login

keep in touch

- Privacy Policy

- Terms & Conditions

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

When Should Entrepreneurs Write Their Business Plans?

- Francis J. Greene

- Christian Hopp

Don’t write a plan before you understand your customer.

It pays to plan. Entrepreneurs who write business plans are more likely to succeed, according to research. But while this might tempt some entrepreneurs to make writing a plan their very first task, a subsequent study shows that writing a plan first is a really bad idea. It is much better to wait, not to devote too much time to writing the plan, and, crucially, to synchronize the plan with other key startup activities.

It pays to plan. Entrepreneurs who write business plans are more likely to succeed, according to our research, described in an earlier piece for Harvard Business Review . But while this might tempt some entrepreneurs to make writing a plan their very first task, our subsequent study shows that writing a plan first is a really bad idea. It is much better to wait, not to devote too much time to writing the plan, and, crucially, to synchronize the plan with other key startup activities.

- FG Francis J. Greene is Chair in Entrepreneurship in the University of Edinburgh Business School.

- CH Christian Hopp is Chair in Technology Entrepreneurship in the TIME Research Area, the Faculty of Business and Economics, RWTH Aachen University.

Partner Center

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Measure Your Business Performance

- 14 Nov 2023

Measuring your business’s performance is essential to its long-term success. By assessing its operations, you can make informed decisions, find ways to improve, and establish accountability in the workplace .

Despite these benefits, many businesses struggle to use the vast amounts of data they have access to. According to a report by data storage company Seagate , businesses act on just 32 percent of the data available to them—with the remaining 68 percent going unleveraged.

If you want to help your organization achieve its strategic objectives, here’s why it’s vital to measure business performance and how to do it.

Access your free e-book today.

Why Measure Your Business Performance?

Measuring business performance is critical to ensuring effective strategy formulation and implementation . It can also help identify obstacles and setbacks that impact your company’s success—similar to risk management .

According to the online course Strategy Execution , performance measurement comprises the formal, information-based routines and procedures managers use to maintain or alter patterns in organizational activities.

Engaging in performance measurement helps you and organizational leaders , investors, and employees understand how your roles and responsibilities relate to your business’s strategy—creating a culture of accountability and commitment to achieving its goals and objectives .

How to Measure Business Performance

Long-term business success doesn’t just result from effective strategy execution; it also relies on a holistic approach to monitoring, measuring, and evaluating performance. This involves creating objective and subjective measures—often called key performance indicators (KPIs) .

While objective measures—like revenue and profit margin—are crucial to assessing performance, subjective measures are often overlooked.

“If a measure is objective, you can independently verify it,” says Harvard Business School Professor Robert Simons, who teaches Strategy Execution . “You and I could look at the same set of data and draw the same conclusion. A subjective measure, by contrast, requires judgment.”

For example, measuring employee engagement can help gauge the amount of internal support for your business strategy. High employee engagement can also greatly impact your company’s bottom line—increasing profitability by up to 23 percent .

“These measures work well only when there's a high degree of trust between employees and managers,” Simons says in Strategy Execution . “Employees must feel confident that subjective measures are applied fairly.”

Using diagnostic control systems —information systems managers use to monitor organizational outcomes and correct negative performance—you can ensure consistency and standardization when measuring success.

Examples of diagnostic control systems include:

- Performance scorecards

- Project monitoring systems

- Human resources systems

- Standard cost-accounting systems

Before implementing such systems and measuring your business performance, here are three factors to consider.

3 Considerations When Measuring Business Performance

1. financial goals.

Measuring business performance starts with financial goals. This is largely because your company’s financial value is its first indicator of success or failure. Financial goals also help ensure your diagnostic control systems effectively monitor profitability and provide insight into how to fix problems.

To set financial goals, you can use a profit plan —a summary of a specific accounting period’s anticipated revenue inflows and expense outflows—presented in the form of an income statement . Profit plans serve several purposes; their most important is creating control systems that place responsibility on management.

“Individual managers can be held accountable for achieving specific revenue and expense targets and the overall profitability of the business,” Simons says in Strategy Execution .

To confirm that your profit plan holds you and others accountable for your organization’s financial health , Simons suggests asking the following:

- Does the business create enough profit to cover costs and reinvest in future endeavors?

- Does the business generate enough cash to remain solvent through the year?

- Does the business create sufficient financial returns for investors?

“Once managers have completed the profit planning process,” Simons says, “people throughout the organization will be in agreement about the direction of the business and the assumptions that underpin the forecasts.”

Related: 7 Financial Forecasting Methods to Predict Business Performance

2. Non-Financial Goals

While financial metrics are critical to assessing short-term profitability, non-financial goals can impact your business’s long-term success.

Objectives like improving customer satisfaction, boosting employee engagement, and enhancing ethical practices can all drive business performance—even financially.

“An organization that's focused just on financial goals will rarely achieve those goals for a long period of time,” says Tom Polen, CEO and president of medical technology company Becton Dickinson, in Strategy Execution . “It's all the other goals that are going to feed into the financial goals.”

In the course, Polen says he consistently communicates his organization’s strategic objectives to employees and uses an incentivization system to reward those working to support non-financial goals.

“As a health care provider, the most important thing—bar none—is quality,” Polen says. “While we’re focused on financial goals, our quality goals—which cut across manufacturing, regulatory, marketing, and medical—contribute to making sure that we have quality products at the end of the day. And we’ll never sacrifice a quality goal for a financial goal.”

3. Intangible Assets

Your goals aren’t the only thing you can use to measure your company’s performance. Intangible assets—non-physical assets your business significantly values—can also help.

Examples of intangible assets include:

- Research capabilities

- Brand loyalty

- Customer relationships

“These are among the most valuable assets in many of today's businesses,” Simons says in Strategy Execution . “But you won't find them anywhere on an income statement or balance sheet .”

Since you can’t monitor these assets using traditional accounting systems, you can instead use a balanced scorecard —a tool designed to help track and measure non-financial variables.

“The balanced scorecard combines the traditional financial perspective with additional perspectives that focus on customers, internal business processes, and learning and development,” Simons says in Strategy Execution . “These additional perspectives help businesses measure all the activities essential to creating value.”

For example, if your business strategy focuses on improving an intangible asset, like brand loyalty, you can use a balanced scorecard to track customer satisfaction through surveys and reviews.

In this way, the balanced scorecard offers a comprehensive view of business performance, helping you make informed decisions to protect and enhance intangible assets’ value.

Start Measuring Your Business Performance

Measuring business performance doesn’t have to be difficult. By implementing the appropriate metrics and control systems, you can seamlessly track strategic initiatives’ progress.

By enrolling in an online course, such as Strategy Execution , you can be immersed in a dynamic learning experience featuring real-world examples of businesses that have employed performance measurement strategies to secure long-term success.

Do you need help measuring your business performance? Explore Strategy Execution —one of our online strategy courses —and download our e-book to discover how to think like a top strategist.

About the Author

- Scroll to top

- / Sign Up

- HOW WE HELP CLIENTS

- schedule your conversation

Business Plan Roadmap: Building Your Path to Business Success

Published: 31 December, 2023

Social Share:

Table of Contents

In today’s fast-paced entrepreneurial landscape, a meticulously crafted business plan functions as the guiding star for your venture’s journey toward success. Whether you’re an experienced entrepreneur or a budding startup creator, possessing a comprehensive business plan is indispensable, serving as the key to securing funding, making well-informed decisions, and effectively navigating the ever-evolving business environment.

Within the confines of this article, we will embark on a comprehensive exploration of the art of crafting an engaging and impactful business plan . We shall dissect critical components, including in-depth market research, meticulous financial projections, savvy marketing strategies, and effective operational blueprints. Additionally, we will unveil a plethora of tips and best practices designed to elevate your business plan above the competition, rendering it a value proposition for those seeking to invest in or collaborate with your enterprise.

What is a Business Plan

A business plan definition is a written document that outlines the goals, strategies, and detailed operational and financial plans of a business. It serves as a roadmap for the business, providing a clear direction for its growth and development. A typical business plan includes information about the company’s mission and vision, its products or services, market analysis, competition, target audience, marketing and sales strategies, organizational structure, financial projections, and funding requirements. Business plans are commonly used to secure funding from investors or lenders, guide the company’s operations, and communicate its vision and strategy to stakeholders.

A conventional business plan typically divides into two primary segments:

- The Explanatory Segment: This portion encompasses written content that serves the business purpose of providing a detailed description of the business idea and/or the company. It covers elements such as the executive summary, company overview, market analysis, product or service particulars, marketing and sales strategies, organizational structure, operational blueprints, and funding needs.

- The Financial Segment: Within this section, you’ll discover financial data and projections, encompassing income statements, balance sheets, cash flow forecasts, and detailed information regarding financing prerequisites and potential sources. This segment offers a quantitative view of the business’s financial situation and future expectations.

Components of a Business Plan: What is Included in a Business Plan

Crafting a thorough and compelling business plan is a fundamental step for entrepreneurs and business leaders seeking to chart a successful course for their ventures. A well-structured business plan not only serves as a roadmap for your business’s growth but also communicates your vision, strategy, and potential to investors, partners, and stakeholders. The key components of a business plan make up a robust business plan, offering valuable insights and practical tips to help you create a document that inspires confidence and aligns your team with a shared vision. Each key element plays a critical role in constructing a business plan that not only secures financial support but also guides your organization toward sustainable success. Let’s delve deeper into these components, adding depth and clarity to your business plan ‘s narrative.

- Executive Summary: This should succinctly encapsulate the essence of your business plan . It should briefly touch on the market opportunity, your unique value proposition, revenue projections, funding requirements, and the overarching goals of the business.

- Company Description: Elaborate on your company’s history, including significant milestones and achievements. Clearly define your mission, vision, and values, providing insight into what drives the company’s culture and decisions.

- Market Analysis: Delve into the market’s nuances by discussing not only its size but also its growth rate, trends, and dynamics. Highlight specific target market segments, customer personas, and pain points that your business aims to address. Include a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to showcase your understanding of the competitive landscape.

- Products or Services: Offer a detailed explanation of your offerings, emphasizing their key features and benefits. Describe how these offerings fulfill specific customer needs or solve problems, and explain any proprietary technology or intellectual property.

- Marketing and Sales Strategy: Provide a comprehensive overview of your marketing and sales plans. Discuss your pricing strategy in depth, outlining how it aligns with market dynamics. Explain your distribution channels and marketing tactics, including digital and traditional methods.

- Organizational Structure: Present bios of key team members, underscoring their relevant experience, expertise, and roles within the organization. Include an organizational chart to illustrate reporting relationships and the structure’s scalability.

- Operational Plan: Go into detail about your daily operations, covering everything from production processes and supply chain management to facility requirements and technology utilization. Discuss quality control measures and scalability strategies.