Tesco Case Study: How an Online Grocery Goliath Was Born

Tesco boasts an impressive history in the UK and abroad. Over the years, the grocery goliath has achieved continued success by remaining at the forefront of retail trends, including everything from self-service shopping to international expansion. More recently, Tesco has made its mark with a sophisticated online grocery strategy that enables seamless digital shopping. There’s a lot that can be gleaned from Tesco’s eCommerce efforts. In this Tesco case study, we highlight the retailer’s long-term emphasis on customer service, which can be seen not only in its physical locations but also in its eCommerce strategy.

Table of Contents – Summary

A Brief History of Tesco

Tesco’s and world’s first virtual store, tesco and scandals, how tesco became a retail case study favorite, tesco’s ecommerce website, interesting technologies that tesco’s uk site uses, impressive tesco stats you may not know, faq on tesco.

- The Tesco Success

To understand current growth and successes and why they warrant a Tesco case study, it helps to understand the retailer’s history. Founded in 1919, the company initially consisted of a group of high-performing market stalls. Founder Jack Cohen conceived the idea shortly after leaving the Royal Flying Corps as World War I drew to a close. He used demobilization funds known as “demob money” to purchase surpluses of fish paste and golden syrup.

Tesco’s initial success could largely be attributed to Cohen’s understanding of mass-market sales. In a time of strict austerity, he employed a rigid business model of “stack ’em high, sell ’em low.” The brand also set itself apart by embracing a self-service approach, which, at the time, was rare in the UK. Following the introduction of its first supermarket in 1956, the retailer entered an era of rapid growth.

After emerging as the UK’s preeminent grocery chain, Tesco released the revolutionary Clubcard. During the 1990s, the chain expanded to include thousands of international locations. This was quickly followed by investments in internet retailing, which led to the chain’s current status as a top eCommerce grocer, netting £1.3 billion in pre-tax profits for the year ending in February 2018.

In 2011 Tesco was the first-ever retailer building the world’s 1st virtual grocery store in South Korea. The experiment took place in a subway station and the results were tremendous: the number of new registered members rose by +76%, online sales increased by +130% and Tesco became South Korea’s no1 online grocery retailer, outranking its rivals e-mart, so this experiment was one of the first key steps towards Tesco’s digital transformation.. After this phenomenal success, Tesco opened its first European virtual grocery shop in Gatwick Airport, UK. See how they did it in this brilliant video:

Tesco has occasionally suffered controversy in the last several decades, with 2 shocking moments that everyone remembers:

- The Horse Meat Scandal: Back in February 2013, several products believed to consist entirely of beef were found to contain horse meat. The Food Safety Authority of Ireland tested a range of cheap frozen beefburgers and it found that Tesco’s sample contained 29% horse instead of beef . The retailer made every effort to appease concerned customers. One of which included a notable promise to tighten up its supply chain and purchase a more significant share of its meat from the UK. Such efforts have likely played into the grocery chain’s recent logistics successes.

- The Accounting scandal: It was 2014 when the news dropped like a bomb: an FTSE 100 firm could get away with “cooking the books”. The company admitted submitting overstated profits by £250 million . The results? £2 billion off the supermarket’s share price in one day.

How Tesco thrived in the COVID-19 area

During Q1 2021, Tesco reported that the sales from its online store were “remarkably higher” than before the Covid-19 crisis. As Internet Retailing mentions , Tesco’s sales increased by +22% in 2020, even though the physical stores and hospitality re-opened at some point. It is believed that this success was a result of Tesco’s recent delivery enhancements and doers mentality, implemented during the first lockdown.

It’s revenue analysis shows that 1.3m online orders were conducted only in spring 2021. This means that the total number of transactions was 81.6% higher than the same period in 2019 (a before Covid-19 year), proving that Tesco actually turned COVID-19 into an opportunity for its business, achieving memorable results by quickly adjusting its business model to the pandemic’s needs.

Despite the horsemeat scandal, Tesco remains a customer favorite throughout the United Kingdom. The Tesco case study has become a common phenomenon, as the chain boasts several unique strengths worth emulating on a broad scale.

Over the years, the retailer has shifted its original “stack ’em high, sell ’em low” approach. While affordability remains a priority, Tesco did not pursue it to the detriment of quality. Instead, it combines reasonable prices with exceptional convenience and customer service. This can be seen in physical stores and eCommerce alike.

Excellent Customer Service

Strong customer service lies at the heart of Tesco’s sustained success. The retailer employs a variety of initiatives to keep consumers happy. Customer-oriented product development, for example, ensures that all stores are stocked with the items visitors actually want. This development process includes rigorous consumer testing to ensure that new products and services are well-received. Customized stores lend further appeal; each is designed based on carefully analyzed demographics.

Quality customer service means making accommodations for all consumers—including those with special needs. Tesco accomplishes this through the use of sunflower lanyards, which allow customers with hidden disabilities to secure additional assistance discreetly. The chain also provides induction loops for hard-of-hearing customers, as well as helpful visual guides for consumers with autism.

Ultimately, Tesco’s impressive customer service derives from its top-down approach, in which a commitment to customer satisfaction permeates every element of the company’s culture. Insight Traction’s Jeremy Garlick tells The Grocer that the key to large-scale retail success lies in “ understanding your customers, anticipating their needs, and giving them what they will value.” Tesco checks off all these boxes. This is true both in stores and with its website, which uses an intuitive layout to ensure that customers can quickly access the products and services they desire.

Product Diversification

Tesco may be best known as a grocery chain, but the retailer provides a surprising array of products and services. It aims to serve as the ultimate one-stop-shop for those who prioritize convenience and quality above all else. Customers can expect to find a collection of produce, dry goods, frozen products, and more. Toiletries, household products, pet food, and even apparel can also be located within Tesco stores and on the retailer’s eCommerce website.

Beyond its many product offerings, Tesco also provides a few key services to enhance customer convenience. Tesco Bank, for example, offers everything from credit cards to pet insurance. These digital offerings play largely into Tesco’s eCommerce strategy, with banking customers capable of accessing their account information online.

Fine-Tuned Logistics

Quality customer service is not possible without an effective logistics and supply chain strategy. Strong relationships with suppliers are essential, especially as Tesco seeks to diversify its already vast product collection further. Efficient routes ensure that produce and other time-sensitive products arrive promptly in stores—and are quickly distributed to customers taking advantage of the chain’s affordable home delivery program.

Ongoing investments in telematics promise to further improve Tesco’s already fine-tuned supply chain. New monitoring tools offer greater insight into the trip status and real-time decision-making—and how these elements play into both profit margins and long-term customer satisfaction.

Digital customers, in particular, appreciate Tesco’s tight supply chain. When they order items online, they can rest assured, knowing that their favorite products will consistently be in stock. What’s more, online customers feel confident that delivered items will be fresh and of exceptional quality.

Insane International Expansion

Tesco may currently dominate the UK grocery market, but it’s also an international force. While the retailer pulled out of the United States in 2014, it has enjoyed sustained growth in Eastern Europe and Thailand.

Just as Tesco targets its international in-store efforts to reflect local populations, it designs its global eCommerce strategy around a diverse consumer base. Different websites are offered in each target country, with text provided in both English and the respective region’s primary language.

Customer Loyalty

Brands such as Costco and Amazon prove that customer loyalty can pay dividends for a company’s bottom line. Tesco demonstrated this long ago with the Clubcard, which encourages customers to prioritize the chain over competitors.

Today, the Clubcard continues to play a crucial role in Tesco’s success. Further transformation is in store, as Tesco recently unveiled a £7.99 per month subscription service called Clubcard Plus . Subscribers will receive significant discounts above and beyond those offered through the traditional Clubcard, including a permanent 10 percent off many of the store’s most beloved brands. Given the current popularity of subscription services, this could prove an excellent opportunity to get existing customers even more enmeshed in the Tesco ecosystem and more responsive to eCommerce marketing automation efforts.

Tesco’s eCommerce strategy reflects the brand’s commitment to value and convenience. These priorities are evident in everything from the logo to the images and even the general layout. Website visits are just as efficient and orderly as in-person purchases at Tesco’s physical locations. Tesco’s website, like its stores, may not be fancy—but it gets the job done. In this Tesco case study, we’ve analyzed several of the key eCommerce strategies that help Tesco’s page stand out in a competitive digital marketplace, as well as a few areas that warrant improvement.

Analyzing Tesco’s Homepage

What We Liked

- Easy to navigate . Today’s impatient customers demand easy-to-navigate websites that almost instantly get them from point A to point B. Tesco’s homepage appeals greatly to convenience-oriented online shoppers, who can quickly find desired products via a simple search tool. Headings highlight main categories, including groceries, clothing, banking, and even recipes.

- Visually-appealing fullscreen displays . Rather than distract website visitors with several separate visuals, Tesco’s website maintains a single, but decidedly bold display. This impactful background stretches across the entire screen and is layered behind text and customer prompts. The homepage, featuring fresh produce, has eye-catching graphics that reflect the commitment to quality that emerges in every Tesco case study

- Minimalist, but not dull . Minimalist displays dominate modern web design. Sometimes, however, white space feels excessive. Tesco strikes an ideal balance by keeping clutter to a minimum without relying on a bare-bones approach.

- Easy logo identification . Customers can always spot the Tesco logo in the upper left-hand corner, surrounded by just enough white space to ensure that it stands out.

What We Didn’t Like

- Customer testimonials . Reviews from happy customers may prove desirable in some contexts, but there is a time and a place. These particular testimonials take up the page’s most prominent space, which could be better served by showcasing exciting deals or products.

- Tabs that open into new pages . Ideally, when clicking on a link that appears to be a tab (such as the Delivery Saver tab), the new content should open in the same page, instead of loading an entirely new page.

Analyzing Tesco’s Category Page

- Sticky cart functionality . As shoppers browse the website and add items to their carts, they can keep track of these intended purchases on the right side of the screen. This intuitive design allows for a seamless Tesco checkout process , thereby increasing the likelihood of conversion.

- Variety of filters . A wide array of filters are provided to allow customers to browse through products based on brands and categories. Furthermore, customers can customize their browsing according to specific dietary filters such as vegan or Halal. This plays into Tesco’s overarching emphasis on personalized shopping.

- Usually bought next . Situated at the bottom of each category page, this helpful section makes it easy to pair similar grocery items. This increases customer convenience while also helping to improve sales and final revenue on Tesco’s end.

What We Didn’t

- Difficult filter navigation . There’s a lot to be said for the variety of filters at customers’ disposal, but the actual process of navigating them can prove complicated, particularly compared to competitor websites.

- Navigating to different items within categories . Navigation can prove surprisingly difficult for those browsing various items within categories. The constant need to return to the homepage could quickly grate on otherwise amenable customers.

- Lack of search functionality within categories . Items cannot be sought via keywords within specific category pages. All searches must be completed using the main search bar on the top of each page. For many users, this may represent the website’s greatest weakness, as keyword category searches are an expected feature among competitors.

Analyzing Tesco’s Product Page

- Time-limited delivery notice . Produce delivery is inherently time-sensitive, as are several other services that Tesco provides via its website. The retailer harnesses the power of time-limited delivery notices to ensure that consumers use products when they’re freshest and most appealing.

- A wealth of product information . Product pages contain a wealth of relevant information, including everything consumers could possibly want to know about each item’s nutritional content, country of origin, and even preparation instructions.

- Customer reviews . Shoppers on the fence about a particular product can read customer reviews to get a better idea of whether they actually want to invest in said item. With a wealth of alternatives available, they can take solace in knowing that other options are always on hand.

- Nondescript Add to Cart button . Tesco’s approach for adding options to its carts may get the job done, but this could be an excellent opportunity for adding a bit of visual flair without detracting from the website’s minimalist approach.

- Too much text combined with too small product images . Many shoppers regularly purchase items without actually knowing their names. Rather, they focus on packaging. Tesco’s small pictures make it difficult for these shoppers to identify the elusive products they want. Some may end up with unexpected and unwelcome surprises upon delivery.

- Too much information . While it’s useful to know the origin of each item, including the exact address may seem like overkill to some users. This detailed information detracts from Tesco’s otherwise streamlined product pages.

Analyzing Tesco’s Checkout Process

- Numerous delivery slots are available . A variety of helpful slots for receiving grocery deliveries are provided on an hourly basis throughout the day. This dramatically improves customer convenience, particularly for those who work long hours and might not be available for the limited delivery times provided by some of Tesco’s key competitors.

- Automatic Click+Collect locations . Those who opt to collect deliveries at Tesco stores can look to this feature to automatically display a variety of nearby locations. This makes in-person delivery collection nearly as convenient as Tesco’s impressive delivery setup.

- Several Delivery plans are available . Shoppers who aren’t in a big hurry can elect to have their orders delivered mid-week for a reduced charge. Meanwhile, demanding customers are asked to pay extra for same-day delivery. Customers love options, particularly when they believe those options prompt significant savings.

- Oddly unavailable Click+Collect hours . Shoppers who plan their grocery pickup several days out will be surprised to find that some collection times up to a week out are unavailable. Hence, while Click+Collect provides exceptional functionality for last-minute pickups, it’s not always ideal for those who prefer to schedule in advance.

Eager to learn more about Tesco’s strategy and the technologic functionalities that make Tesco’s website so easy to use, we harnessed the power of BuiltWith to scan the website. A few of the notable technologies we spotted include:

- Omniture SiteCatalyst . Tesco’s web analytics are provided by Adobe’s Omniture SiteCatalyst — an expensive, complex system when compared to its main competition (Google Analytics). If set up correctly, however, Omniture SiteCatalyst provides excellent customer support.

- Hotjar . One of the world’s most famous screen recording and heatmaps tools, Hotjar offers a range of behavior analytic services ideal for businesses such as Tesco, which aim for a targeted approach based on actual customer behavior.

- Optimizely . This top experimentation platform plays significantly into modern web innovation. Despite its name, however, Optimizely may increase page load times throughout the Tesco site.

- OpinionLab . OpinionLab does an admirable job of collecting customer feedback on every aspect of Tesco’s webpage. This allows Tesco to customize better its web offerings based on actual customer opinions

- SendinBlue . User experience is a huge point of contention for SaaS provider Sendinblue. Clients regularly struggle with forms, automation, and APIs. ContactPigeon may prove a more customer-oriented alternative.

Some of these eCommerce tools are also used by John Lewis, UK’s homeware giant , so we do realize that these technologies play also an important part in a retailer’s business model and online success.

- As of 2019, Tesco boasted over 6,800 shops worldwide.

- Tesco currently employs over 450,000 employees around the world.

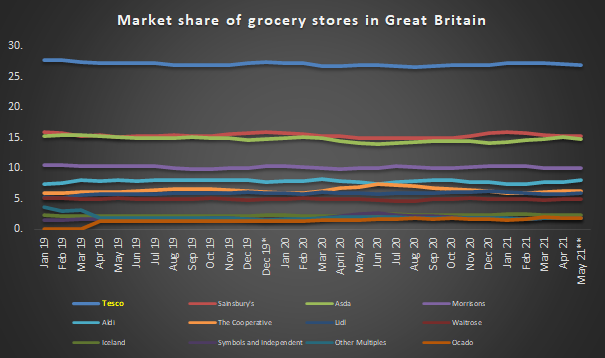

- Tesco had a 26.9 percent market share in the UK in 2019.

- Of the UK shoppers who primarily visit Aldi, 45 percent highlight Tesco as their main secondary store.

Breaking Tesco News:

- Tesco changes bonus rules after Ocado success hits pay – Read more here

- Coronavirus: The weekly shop is back in fashion, says Tesco boss – Read more here

- Tesco launches half price clothing sale – but some slam the company as ‘irresponsible’ – Read more here

- Tesco, Sainsbury’s, Asda and Aldi put restrictions on items amid stockpiling – Read more here

- Tesco sells its Thai and Malaysian operations to CP Group. Learn more here

- In September 2021 Tesco launched a zero-waste shopping service, providing customers with containers. – Learn more here.

When did Tesco begin?

Tesco technically began in 1919 but did not receive its current name until 1924. The company originally consisted of market stalls, with the first shop that might be recognizable to modern consumers not opening until 1931.

What made Tesco successful?

Tesco is popular in the UK and abroad due to its combined emphasis on quality, convenience, and affordability. The Clubcard plays a huge role in the retail chain’s continued popularity, as it keeps customers coming back for deals. So why is Tesco so successful? It is because of its customer-centric approach, that it gradually helped Tesco to develop a very loyal customer base and equity and a very powerful multinational brand.

Who is Tesco’s owner?

Tesco is currently experiencing a shakeup in leadership. After serving as CEO for several years, Dave Lewis announced his resignation in 2019. He will be replaced by Ken Murphy in 2020. John Allan currently serves as the chain’s non-executive chairman.

What is Tesco industry sector?

Tesco PLC is a retail company. Its core business is grocery retail but they also are in retail banking and assurance industries as well, as part of their product diversification strategy.

How many stores Tesco has?

Tesco has 6993 stores in 12 countries

How profitable is Tesco?

Tesco’s revenue grew by +12% YoY in 2019 hitting £63.91 billion.

Is Tesco in the public or private sector?

While Tesco was initially a privately-held company, it became a public limited company (PLC) in 1947 and has continued to operate under this approach. However, despite Tesco’s status as a PLC, it remains firmly part of the private sector.

Discover more resources about FMCG retailers

- Sainsbury’s Marketing Strategy: Becoming the Second-Largest Supermarket Chain in the UK

- ASDA’s marketing strategy: How the British supermarket chain reached the top

- The Marks and Spencer eCommerce Case Study: 3 Growth Lessons for Retailers

- The Ocado marketing strategy: How it reached the UK TOP50 retailers list

- ALDI’s marketing strategy: The key growth ingredients of the FMCG titan

- Walmart Marketing Strategy: Decoding the Success of the US Multinational Retailer

- Analyzing Lidl’s Marketing Strategy: How the Discount Supermarket Leader Scaled

- FMCG Marketing Strategies to Increase YOY Revenue

The Tesco Case Study: An overnight Success?

As our analysis showed, a variety of factors play into Tesco’s success. The retailer has a long history of using cutting-edge practices (like the virtual store mentioned above) to set itself apart from the competition. Much of its current success, however, relies on its perception as a convenient and affordable chain.

Tesco’s success is not a matter of luck. On its website and in its stores, the retailer emphasizes customer-oriented practices designed to make every shopping experience as seamless and as enjoyable as possible. This simple yet effective approach promises to keep the retailer at the forefront of the grocery industry in years to come.

If you’re looking to emulate the qualities evident in this Tesco case study, don’t hesitate to get in touch. Contact us today to book a free marketing automation consultation.

Let’s Help You Scale Up

Spending time on Linkedin? Follow us and get notified of our thought-leadership content:

Loved this article? We also suggest:

Sofia Spanou

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Sign up for a Demo

This site uses cookies..

We use cookies to optimize our communication and to enhance your customer experience. By clicking on the Agree button, you agree to the collection of cookies. You can also adjust your preferences by clicking on Customize.

Essential (Always Active)

Performance.

TESCO – British Retailer that redefined Grocery Shopping

The first time I visited a ‘Tesco Extra’ store was at midnight, making an emergency run for next morning’s breakfast. The store seemed to occupy the area of an entire football field in Ashby-De-La-Zouch, UK. Even at an ungodly hour, Tesco was well-lit with visiting customers.

Inside, there were never-ending aisles lined up with groceries, food items, clothing, electronics, and whatnot. It was easy to lose way and lose track of time in the colossal supermarket.

I thought to myself that this would be the only store of its kind in the county, but I was wrong.

Tesco has 4008 stores across the UK and Republic of Ireland , with 7005+ stores and franchises across the world. In Europe, Tesco has established itself in Hungary, Slovakia, Czech Republic, Poland and Turkey. In Asia it has stores in Thailand, South Korea, Malaysia, Japan and China.

TESCO is much more than a chain of supermarkets selling a million products. It’s a giant conglomerate, spanning across so many verticals. It’s the equivalent of one of the FAANG companies but in the Grocery & Retail sector. It becomes imperative for business enthusiasts like you and me to understand the business model of this retail giant called Tesco.

It’s considered a part of the ‘Big Four’ supermarkets alongside ASDA, Sainsbury’s, and Morrison’s in Europe.

The Birth of Supermarkets in Britain

Founded in 1919 by a war veteran – Jack Cohen , Tesco began as a grocery stall in the East End of London, making a profit of £1 on sales of £4 on day one. Tesco’s first store was launched in 1929, selling dry goods & its own brand of Tesco Tea. A hundred more Tesco stores were opened in the next 10 years.

With 100+ mom-and-pop stores in Britain, Jack wanted to expand his product range. He traveled to the US in 1946 and noticed the self-service system, where customers would select different products on the shop floor and finally checkout at a counter. Jack brought this concept back to Britain, giving birth to Tesco Supermarkets and changing the face of British Shopping. His motto was to “stack ‘em high, and sell ‘em low (cheap).”

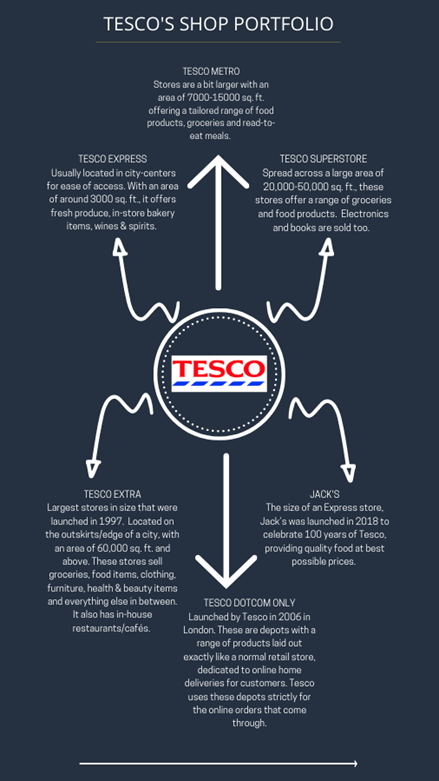

Tesco has a wide range of supermarkets depending upon their size, range of products, and location. This also helps regulate their Supply Chain to reduce wastage.

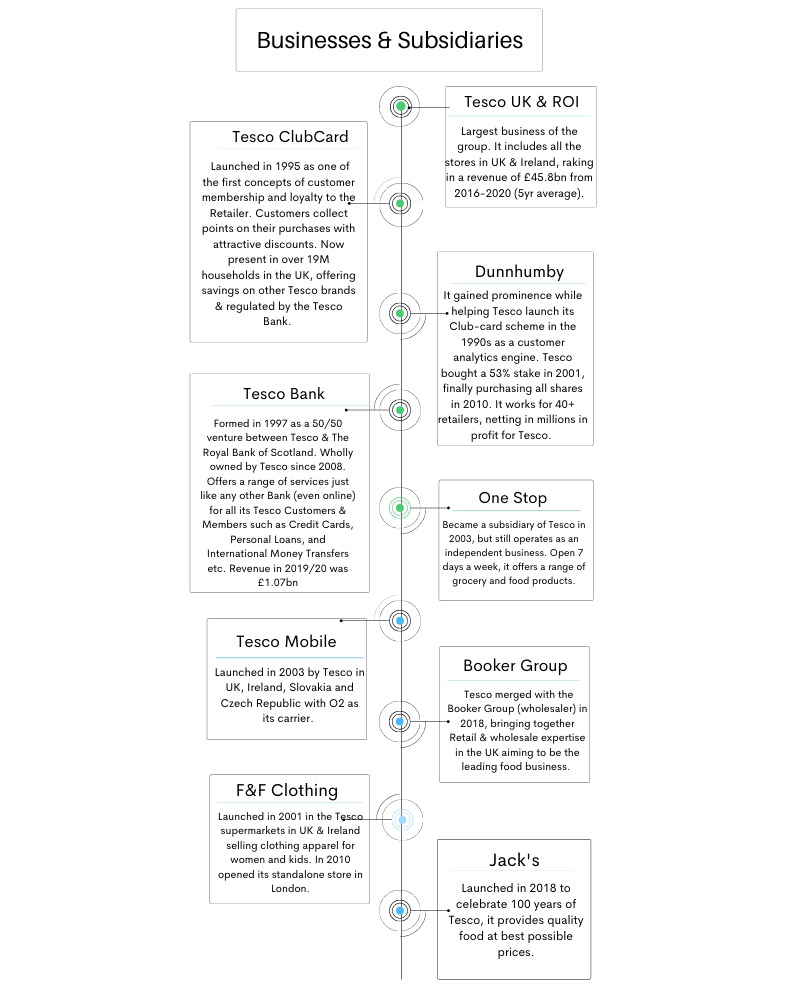

Tesco Business Model is based on various verticals

Tesco has deep-rooted its businesses in the European market so well, it’s difficult to miss out on the Tesco hoarding anywhere. Its Businesses and subsidiaries are:

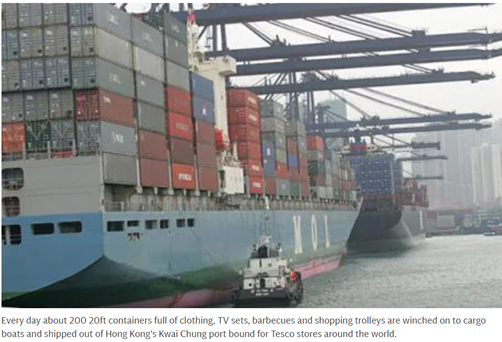

A glimpse into the Complex Supply Chain

A supply chain is one of the critical aspects of the business model of a giant retailer like Tesco. Tesco has its priorities set when it comes to procuring products from different parts of the world:

- Use expertise to offer a better range of products at reasonable prices

- Use economies of scale to buy more for less

- Leverage and maintain relations with global branded suppliers

- Grow the brand

It procures goods from over 44 countries, majorly China. A stock of up to 90,000 different products (30% are food & beverages) is transferred via the global sourcing office located in Hong Kong. Keeping wholesalers out of the loop, Tesco procures directly from suppliers. The conglomerate has developed and maintained long-lasting relations with suppliers’ world over—the main ones being General Mills, Kellogg, Mars, and Princes.

Tesco has set up a separate division to regulate its supply chain, “the machine behind the machine” – Tesco International Sourcing (TIS). It can be compared to the East India Company of the 18 th -19 th Century, catering to only one customer – Tesco.

TIS is connected to over 1000+ suppliers across 1200+ factories . It’s responsible for over 50,000 Tesco product lines in terms of quality control, sourcing, production, designing, timely delivery, and sorting trading/customs documentation.

All activities are coordinated centrally at TIS, with just 533 staff members. These staff members undergo rigorous training to detect & analyze Supplier-violations and conduct Auditing.

Tesco coordinates with TIS on a daily basis to procure products in the following ways:

- The local team uses customer insights to create a Product Brief (new or modified) specified for each region.

- TIS analyzes the product brief and develops a Product Sourcing Plan depending upon – stores that need this product and figuring out minimum transport time and cost, as per the region.

- The Plan is executed, and specific demands are handed out to Suppliers all over the world. Expert TIS Buyers make sure the best deal is made.

- Inbound logistics are consolidated at specific Tesco Depot to receive the product efficiently from Suppliers.

- Local teams then make sure the product is distributed to different Tesco stores from the Depots.

Tesco adding eCommerce to the mainstream business model

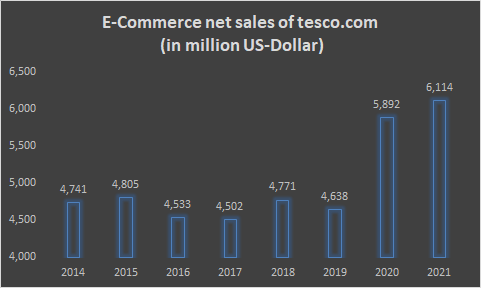

Being in the Top 50 retailers globally as of 2021 , Tesco’s annual revenue worldwide in 2020 was £58.09B , a 9.1% decline from 2019 (due to the Pandemic & disposing of its Asia operations , to focus on the core business in Europe).

It shifted from Brick & Mortar to Brick & Click stores. The Click+Collect functionality on its website accounts for 43% of E-grocery sales in the UK. The Click+Collect concept enables customers to place their orders online and collect their orders a few hours later at the nearest Tesco Depot. Tesco created these specialized Depots for online orders only.

Despite shutting down most its mall operations, Tesco survived 2020 through its online retail store Tesco.com , with double the orders. Its E-commerce net sales had shot up by 31% from 2019-2021.

A Global Operations & Technology Center in Bengaluru was also set up in 2004. This center serves as the backbone of distribution operations for Tesco worldwide. Its business functions are- Finance, Property, Distribution Operations, Customers & Product. The employees at this Center are Engineers, Analysts, Designers, and Architects.

Tesco’s Marketing Strategy

Tesco has always believed in acquiring loyal customers and regaining stakeholders’ trust. It aims to reach customers from all financial backgrounds. So it launched 2 of its own sub-brands – Tesco finest for the affluent customers and Tesco Everyday Value for the rest of the crowd.

Tesco also launched the Club Card in 1995 as a Membership card, to maintain customer loyalty and keep them coming back. The Card operates on a point-based system with discounts on products, & other subsidiaries like double data on Tesco Mobile. With 5 Million subscribers in the first year , Tesco finally overtook its competitor – Sainsbury’s to become No.1 in the UK.

The Club-card strategy was used to obtain customer data and observe buying habits. This data was analyzed, allowing Tesco to put the right products on shelves while eliminating unpopular ones. Tesco realized that the Club Card isn’t just a quick fix & temporary promotional tool; it’s a promotion in itself. This made the Tesco Club Card unique and long-lasting.

Tesco also realized that spending Billions on traditional marketing efforts and maintaining a ‘one-size-fits-all’ brand image wouldn’t work. It decided to hyper-target specific customers and to earn their trust. For starters, thousands of head-office staff and senior executives were sent to work in stores – to demonstrate how Tesco values its customer. Customization became key for its new marketing strategy; sending out discounts on birthdays via Emails and campaigning from door-to-door.

Tesco also made a partial shift to Digital Marketing which costs much lesser and has a wider outreach. It created well-tailored profiles on all social media platforms. On Twitter, it has more than 15 accounts, separate for each of its business units. The online customer care account on Twitter is active 24-7.

All supermarkets commonly advertised themselves to have quality products at a reasonable cost; Tesco wanted to differentiate itself as a unique brand. It introduced step-by-step Recipes prepared from ingredients available at any Tesco store, with Chef Jamie Oliver as its Health Ambassador . Tesco Food and its variety of recipes were a massive hit. Later on, the monthly Tesco Magazine as a food & lifestyle magazine was also launched, with 4.65Million readers worldwide.

The beginning of the pandemic in March 2020 left people apprehensive about visiting a physical store to buy groceries. To deal with customers’ concerns, Tesco came up with an instructional advertisement in April ‘20. With crisp instructions similar to that of an in-flight safety video, this ad showed customers how to physically shop and behave at Tesco stores. It was considered to be the most effective advertising and communications campaign of 2020 as per YouGov BrandIndex .

Competition

Tesco’s earliest competitor has been Sainsbury’s since the 70s. The Tesco Club Card strategy in 1995 helped it overtake Sainsbury’s to become the No.1 Retailer in the UK, but not for long. The ‘Big Four’ supermarkets in Europe have been in close competition throughout the years. Tesco has acquired a 28% majority stake in the UK market.

The horse meat and accounting scandals were a real setback for Tesco, letting competitors take over the European market. The newest German entrants – Aldi and Lidl had caught customers’ attention and market share in a short span of time.

With a combined market share of 12%, these German retailers posed a threat to Tesco. So much so that Tesco began the ‘ Aldi Price Match ’ campaign to curb the growth of the German discounter and win back customers. Tesco started price-matching thousands of its products with that of Aldi, offering better quality and branded products at Aldi’s prices.

Tesco has a majority market share in Britain, with Sainsbury’s and ASDA in tow:

Tesco Adding Sustainability to its business model – The Little Helps Plan

It’s a well-known fact that giant conglomerate retailers are one of the major causes of rapid climate change and increasing carbon footprints. Tesco realized its impact on the planet and launched the Little Helps Plan as a core part of business in 2017. This plan serves as a framework to attain long-term sustainability. Its four Pillars – People, Products, Planet, and Places are aligned with the UN’s Sustainable Development Goals.

Until now, the Plan has enabled Tesco to:

- Permanently remove 1 Billion pieces of plastic from its packaging

- Redistribute 82% of unsold food, safe for human consumption

- Remove 52Billion unnecessary calories from foods sold

Apart from this, it also aims to increase sales of Plant-Based Meat alternatives by 300% by 2025. At present, it has 350 plant-based meat alternatives on the shelf.

Apart from partnering with various other organizations, Tesco entered a 4-year partnership with World Wide Fund for Nature (WWF) to address one of the biggest causes of wildlife loss – the global food system. It aims to eliminate deforestation from products, promote recyclable/compostable packaging and minimize food waste.

Tesco is one of the few successful retailers in the world, with a compelling history. Tesco has overcome numerous issues across its supply chain, faced global criticism, and still stands undeterred in the European market with its rock-solid business model. It has always adapted to its unpredictable consumers and continues to do so while caring for the planet.

The business is healthy. We said we would rebuild the relationship with the brand and consumers; you will see that in every measure of customer satisfaction we do that. The business is healthy, vibrant and there is a lot of optimism of what we can do going forward. CEO Dave Lewis, who took over Tesco in 2014 (during the struggle years) & stepped down in September 2020

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

An Engineering grad, currently working in the fields of Big Data & Business Intelligence. Apart from being immersed in Tech, I love writing and exploring the business world with a focus on Strategy Consulting. An ardent reader of Sci-Fi, Mystery, and thriller novels. On my days off, I would spend time swimming, sketching, or planning my next trip to an unexplored location!

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Tesco Change Management Case Study

Change is a necessary part of any business’s growth and success. However, managing change can be a challenging task, especially for a company as large as Tesco.

The UK-based retail giant faced numerous challenges during its journey of growth, including increasing competition, changing consumer preferences, and economic uncertainties.

To overcome these challenges, Tesco embarked on a change management journey that transformed the company and enabled it to become one of the world’s largest retailers.

In this blog post, we will delve into Tesco’s change management case study, discussing the strategies the company employed to manage change, the challenges it faced, and the results and achievements of the change management program.

We will also examine the lessons learned from Tesco’s success story and provide insights into best practices for effective change management

Background of Tesco

Tesco is a British multinational retailer that was founded in 1919 by Jack Cohen. Initially, the company started as a market stall in London’s East End, selling surplus groceries from a stall.

In the 1920s, the company expanded its business by opening its first store in Burnt Oak, North London.

The company went public in 1947 and continued to expand its business throughout the UK in the following years.

By the 1990s, Tesco had become the largest supermarket chain in the UK.

However, despite its success, Tesco faced several challenges in the early 2000s. Increasing competition from discount retailers such as Aldi and Lidl, changing consumer preferences, and economic uncertainties had a significant impact on the company’s growth.

Tesco’s sales started to decline, and the company’s market share was shrinking. To address these challenges, Tesco’s management team realized the need for a change management program that would transform the company and enable it to regain its position as a market leader.

History and growth of Tesco

Tesco’s success story began in the early 20th century when Jack Cohen, the founder of Tesco, started selling groceries from a stall in London’s East End. By the 1920s, Cohen had established his first store in Burnt Oak, North London, under the name Tesco.

The name “Tesco” was derived from the initials of TE Stockwell, a supplier of tea to Cohen, and the first two letters of Cohen’s surname.

In the following years, Tesco continued to expand its business by acquiring other retailers and opening new stores throughout the UK.

By the 1970s, the company had become one of the largest supermarket chains in the UK. In the 1980s, Tesco introduced new products and services, including Tesco Metro stores, Tesco Express, and Tesco Clubcard, which enabled the company to enhance customer loyalty and increase sales.

In the 1990s, Tesco’s growth continued, and the company expanded its business beyond the UK by entering new international markets such as Poland, Hungary, and the Czech Republic. By the early 2000s, Tesco had become the largest supermarket chain in the UK, with over 2,500 stores worldwide.

However, the company faced several challenges in the early 2000s, including increasing competition, changing consumer preferences, and economic uncertainties, which had a significant impact on the company’s growth. Tesco’s management realized the need for a change management program that would transform the company and enable it to regain its position as a market leader.

Key Reasons of making changes at Tesco

There were several key reasons for the changes at Tesco, including:

- Increasing competition : The rise of discount retailers such as Aldi and Lidl had a significant impact on Tesco’s market share and profitability. These retailers offered lower-priced alternatives, which attracted customers away from Tesco’s stores.

- Changing consumer preferences: Consumer preferences were shifting towards healthier and more sustainable products, which Tesco was slow to respond to. This led to a decline in sales and customer loyalty.

- Economic uncertainties: The global economic recession of the late 2000s had a significant impact on Tesco’s financial performance. Consumers were more price-sensitive, and there was increased pressure on retailers to reduce prices.

- Internal issues: Tesco’s rapid expansion had resulted in organizational complexity, which made decision-making slow and inefficient. There were also issues with employee morale and engagement, which impacted the company’s ability to deliver high-quality customer service.

Steps taken by Tesco to implement change management

To address the external and internal challenges, Tesco’s management team realized the need for a change management program that would transform the company and enable it to regain its position as a market leader. The changes that were implemented included a focus on cost reduction, improving customer service, and enhancing employee engagement.

To implement the change management strategy, Tesco took several steps, including:

- Leadership commitment: The company’s senior leadership team was fully committed to the change management program and provided clear direction and support throughout the process.

- Communication : Tesco developed a comprehensive communication plan to ensure that all employees understood the rationale for the changes and their role in implementing them. The plan included regular updates, town hall meetings, and training sessions.

- Cost reduction: Tesco implemented a cost reduction program to improve efficiency and profitability. The company reduced its product lines, renegotiated supplier contracts, and streamlined its supply chain.

- Customer focus: Tesco implemented a new customer service strategy, which included improving the quality of its products, enhancing the in-store experience, and increasing customer engagement through loyalty programs and personalized marketing.

- Employee engagement: Tesco recognized the importance of employee engagement in delivering high-quality customer service. The company implemented initiatives to improve employee morale, including training programs, recognition schemes, and improved working conditions.

- Technology: Tesco invested in new technologies to improve its operations and enhance the customer experience. This included the introduction of self-checkout machines, mobile payment options, and online shopping platforms.

- Measurement and feedback: Tesco established metrics to measure the success of the change management program and solicited feedback from employees and customers to identify areas for improvement.

Positive outcomes and results of change management by Tesco

The change management program implemented by Tesco resulted in several positive outcomes and results, including:

- Increased profitability: Tesco’s cost reduction program resulted in improved profitability, with the company’s profits increasing by 28% in the first half of 2017.

- Enhanced customer experience: Tesco’s focus on improving the customer experience led to increased customer satisfaction and loyalty. The company’s customer satisfaction ratings improved significantly, and it was named the UK’s top supermarket for customer service by consumer watchdog Which? in 2018.

- Improved employee engagement: Tesco’s initiatives to improve employee engagement resulted in increased employee morale and motivation. The company’s employee engagement scores improved significantly, and it was recognized as one of the UK’s top employers in 2019.

- Streamlined operations: Tesco’s focus on improving efficiency and reducing complexity resulted in streamlined operations and faster decision-making. The company was able to reduce its product lines and negotiate more favorable supplier contracts, resulting in improved margins.

- Strong financial performance: Tesco’s change management program helped the company recover from a period of declining sales and market share. The company’s financial performance improved significantly, with revenue increasing by 11.5% and profits increasing by 34.2% in 2018.

Final Words

Tesco’s change management program is an excellent example of how a company can successfully transform itself in response to external challenges and changing market conditions. The program was comprehensive and multi-faceted, addressing the company’s challenges from multiple angles. Tesco’s leadership commitment, communication strategy, and focus on cost reduction, customer service, and employee engagement were all critical factors in the program’s success.

The positive outcomes and results of the program demonstrate the importance of change management in driving organizational success. Tesco was able to recover from a period of declining sales and market share, and become a more efficient, customer-focused, and profitable organization. The lessons learned from Tesco’s change management program are applicable to businesses of all sizes and industries, highlighting the need for organizations to remain agile and responsive to changing market conditions.

About The Author

Tahir Abbas

Related posts.

What are the Characteristics of an Agile Organization?

Non-Profit Social Media Strategy with Example

Change Management Toolkit for Leaders

How Tesco Became The Biggest Retailer In The UK

Table of contents.

There are certain brands that always seem to attract global attention and one of those is Tesco. It’s one of the largest grocery store chains in the world and over its 100-year history, it has gone through a rollercoaster of ups and downs that have brought it to where it is today.

- Stores: 4,673

- UK Employees: 336,392

- The top retailer in the UK

- Ranks 17th in NRF Top Global Retailers for 2021

- Q1 2021 Growth in Online Sales: 22.2%

- FY21 Sales: £53.4 bn

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

The Origin Story

The giant corporation that we know today had some very humble beginnings. The idea found its roots back in 1919 when Jack Cohen, the son of Polish immigrants, decided that he was going to sell groceries from a stall in East London [1] . For the first few years, that is all it was – a market stall run by a man with a big dream. But over time, as he gained confidence in what he was doing, he began to think that maybe he was destined for something bigger.

To dip his toe in the water, he opened up the very first Tesco store in 1929 in a small town in Middlesex. The brand took off almost immediately, much to the surprise of Cohen, and he realized that there was room for growth. He had stumbled onto a rather simple premise, in terms of providing food and drink in a very affordable and approachable way, and quickly started to work on expanding the concept as far and wide as he could.

Cohen’s unique personality and selling style was something that he engrained in those early sales teams, pushing them further than they ever thought they could go. He was someone who valued hard work above all else and believed that if you were out there working to make things happen, things would conspire for your benefit. This ethos is something that still lives in the company today.

In the years that followed, Tesco grew from strength to strength until it got to a stage in 1947 where it was large enough to list on the London Stock Exchange. In the two decades that followed the listing, the company continued to grow organically but it also made some aggressive acquisitions that rapidly increased the organization’s footprint. At the end of the 1960s, there were around 800 stores in operation, all maintaining healthy profitability and a growing customer base.

The strong brand was then leveraged to venture out of food and beverages specifically, and into a range of other areas including clothing, electronics, financial services, telecoms, media, internet services, and software. They also expanded geographically into the rest of the UK, Europe, and a brief but ultimately unsuccessful time in the USA.

The Tesco of today is a corporation much bigger than Cohen could have ever imagined, and that’s a testament to the company that he was able to build and the business philosophy that still undergirds their success to this day.

Creating Their Own Brands

We’ll start this strategy study properly by diving into what is widely considered the most important part of the Tesco strategy – which is the creation and scaling of their own in-house brands. When the company started they acted simply as a retailer, buying products from suppliers and then controlling the end-user buyer experience and distribution thereof. However, as they began to grow they came to the same realization that is so common for these massive product curators.

They realized that they could compete and win against these other brands because they had access to invaluable sales data, a loyal customer base who was tied into their stores, and the distribution required to bring their own brands to a mass market almost overnight. All of this while regaining a significant portion of the margin as they did so.

This is a key trend that we’ve seen across major retail conglomerates, but it’s received even more attention in the online era as Amazon has taken it to the next level. Especially in the case of common household goods where it is quite difficult to differentiate the product itself, brand and price become all that matters.

Tesco’s clothing line and their food brands provide high-quality items at prices that undercut the other 3 rd party brands that are trying to win shelf space in the stores. This makes it abundantly clear that by owning the customer relationship and the distribution, you have an immense amount of control in the value chain. Manufacturers are dependent on retailers like Tesco because they need to access the consumer market, and this places all the power in the hands of the retailer.

This business model has been incredibly successful over the past 50 years. Tesco has grown a substantial business that customers trust and whenever they want to win back margin, they can create their own white-label brand and use their pricing power to whittle away at the market share built up by other brands. The big question here though is how long will this last? [2]

In modern times we’ve seen a drastic shift away from brick-and-mortar retail and into online shopping. This was obviously accelerated by the COVID-19 pandemic, but it was something that was coming inevitably anyway. As we move to a future of online shopping, Tesco’s early advantage in terms of distribution becomes less relevant. Manufacturers and suppliers can start to build online presences that give them direct access to the consumer market and thus they can eliminate the Tesco leg entirely, provided they have the brand strength to do so.

This is where the world is moving towards, where the middlemen are eliminated over time and we see a rise of direct-to-consumer brands. This is not to say that Tesco is going to disappear. In fact, their online shopping sales have been incredibly impressive. But they have to think differently about the company they are going to be as we shift into this new paradigm.

It’s definitely something on their roadmap and they are making a lot of investments in this vein, but it’s going to be challenging to transform such a large company with so much tied up in the brick-and-mortar of retail stores. Their ability to adapt and adjust will determine whether they remain a force to be reckoned with in the years to come.

Key Takeaway

- If you control the direct relationship with the customer, you have tremendous power in the value chain that allows you to win market share and margins much more efficiently.

Horses for Courses

The next piece of the Tesco strategy that has proven so valuable for them has been their ability to adapt their value proposition for different contexts. When it comes to retail, you have to have a very good understanding of what your customers in that location are looking for, so that you can tailor your offering accordingly.

It’s tempting to think that you can copy-paste a winning formula wherever you want and scale quickly and easily – but that couldn’t be further from the truth. Even with a simple concept like a grocery store, there is a range of different nuances that determine how the store should be set up, what should be stocked, and how they should craft the buying experience.

Tesco operates 5 different types of stores:

- Tesco Extra

- Tesco Superstores

- Tesco Metros

- Tesco Express

- One Stop Shop

Each of these stores has a different use case, and it targets a unique subset of their customer base. The company has worked very hard to identify the specific items, and setup that is best suited for each one. For example, the Tesco Extra stores and the Tesco Superstores are the biggest ones in terms of size and aim to carry as much as possible so that customers can do all their shopping in one place. This is in sharp contrast to the Tesco Metros and the Tesco Express stores which are focused on convenience and speed, rather than a variety of choices.

Every part of the experience for each category is intentional and fit for purpose. Even the training that the staff will go on differs depending on the type of store that they’re going to be working in. What remains consistent is the brand, the product quality, and the prices. Everything else varies according to what that particular customer is looking for.

It’s also interesting to note that these store categories have different trajectories and trends. If you look at the last couple of years (ignoring the pandemic), the big retail outlets have been struggling for growth, while the convenience stores are growing rapidly. This shows a clear trend in terms of consumer behavior and because the stores are all set up differently, the company can respond to these changes.

Essentially, each category of store can be thought about as a different company entirely – allowing lots of flexibility to adapt and adjust accordingly. If they didn’t have this clear separation, it would be difficult to understand the data they were receiving, and they would have less chance of successfully diagnosing the nature of changes in customer behavior.

Taking this one step further, it’s clear that their online shopping vertical is a new type of store and will have unique aspects that set it apart from the rest. As Tesco follows the growth of online shopping they’ll be able to shift their efforts to these new channels because they have the data that they need to be able to do this with confidence.

- Context is everything in business. By separating your operations into subsets that cater to different contexts, you’ll have the data you need to adjust and adapt to changing trends as they arrive.

Sustainability

A key component of Tesco’s forward-looking strategy is to become as sustainable and environmentally friendly as possible. This is not too out of the ordinary in the modern context as companies around the world work towards mitigating climate change, but Tesco has really gone above and beyond to make this a part of their company DNA.

The biggest offenders in their value chain are the delivery vans which are constantly transporting goods from suppliers to warehouses and then eventually to the stores themselves. These vans number in the thousands and they are running almost 24/7 ensuring that stock levels are where they need to be at all times.

Tesco announced recently that they have begun to transition all those vans to electric vehicles in an attempt to minimize the carbon footprint and work towards a more sustainable goal. Their plan is to have their entire delivery fleet transitioned to electric by 2028 which is a very ambitious plan indeed [3] .

This is but one of their sustainability initiatives that are at the forefront of the company they want to become in the future. They are working tirelessly to integrate this into their corporate ethos for a few reasons:

- Sustainability matters. We all have to be more thoughtful about what we’re building because the impact we’re having on our planet is significant. So, from pure self-interest, a company needs to embrace this value if they are to be robust and to last over the next hundred years. Without this focus, we might find ourselves in a very dangerous position in a generation or two’s time.

- Customers demand it. Building on the point above, there is tremendous social pressure for corporations to become more sustainable because of the heightened awareness we now have of the problems that face as a species. Customers are placing sustainability and environmental concerns as key factors in their purchasing decisions and Tesco knows that. So, they are leaning into this as a key value for the future so that they can continue to build the strong brand trust that they have with their existing consumer base.

- Prices are trending downward. As we shift away from fossil fuels and towards renewable energy, the relative prices will come down and that can have a significant impact on Tesco’s profitability. It might require a lot of investment in the short term, but that will pay off by orders of magnitude as the world shifts and economic incentives work their magic.

- Competitive Advantage. Getting in on this early and working to build this into the future of the company could prove to be a significant competitive advantage for competing against their competitors. This is a clear trend that everyone can see, so those companies that get ahead of the curve will be able to leverage the early momentum to capture more and more of the market going forward.

- Opens up opportunities for innovation. Whenever there is a radical shift in thinking, it creates an opportunity to go back to the first principles. For large companies, these moments are few and far between so it’s important to use these natural breakpoints to re-examine your strategy and plot the best path forward. Tesco is definitely trying to do that so that they can remain relevant as we move beyond pure retail and into a hybrid model where you need to serve customers in-person as well as online.

Those are just some of the reasons why Tesco is giving so much credence to how sustainable their operations are. It’s also important to note that they are thinking beyond their direct circle of influence. Another significant contributor to carbon emissions is their customers who drive to the stores themselves. To mitigate this, they’ve begun to roll out thousands of charging points to their larger retail stores to support customers with electric vehicles and encourage more people to move in this direction.

This is something we’ll see a lot more of going forward, and Tesco remains one of those leading the charge, at least in the European context.

- Sustainability is a key value and operational principle that must be at the forefront of any company looking to remain relevant going forward.

The Clubcard Loyalty Program

It seems that every company these days has some form of loyalty program where they try to reward repeat purchasers in exchange for valuable sales data – but Tesco was one of the first to go this route. Their Clubcard program allows regular shoppers to benefit from automatic discounts that are applied at check-out and it makes the already-low prices even more beneficial. This obviously creates loyalty for their key customers who will use the card to get better prices for their groceries, but the more interesting aspect is what it allows Tesco to do with the data.

Before loyalty programs, large retailers like Tesco were unable to tie specific purchases to specific customers. They would be able to access aggregated sales figures about the sorts of items that were being purchased, and they could use that information to adjust their offering accordingly, but you were limited in terms of how useful it could be. Any granular demographic data had to be assumed based on the store itself and this didn’t allow for much nuance.

The modern loyalty programs, like the one that Tesco runs, offer a much more sophisticated set of data that is incredibly valuable for product development, planning, and demand forecasting. By tying each purchase to a specific customer’s card, Tesco gains a range of new insights into purchasing behavior and they can arrive at a much more granular understanding of what is actually happening in their stores.

Here are some of the ways that they can use this data:

- Demographic Analysis. Tesco can identify specific segments of their customer base and analyze purchasing habits in these unique categories. For example, they can compare their male base to their female base. They can look at how age affects the sorts of items that are purchased. They can look at ethnicity and how that impacts the brands that are most in-demand. All of these slices help to break a massive consumer base into smaller segments that can be more effectively sold into. This affects the marketing messaging, the placement of goods in the store, the outbound sales efforts, and much more.

- Lifetime Value Analysis. When you’re able to track specific customers over time, you gain a lot of insight as to how they engage with your brand and how that plays out over time. Through a more nuanced calculation of a customer’s lifetime value, it informs how they invest time and resources going forward – to maximize this value and build a strong core of loyal shoppers. This is also vital in the other direction when looking for red flags that might point to something that is going wrong along the way. When you can track this effectively, you’re in a much better position to make long-term strategic decisions that are data-driven and attached to the real-time data on the ground.

- Shopping Cart Make-Up . If we move up one level of abstraction, we can analyze the make-up of a customer’s shopping cart to understand the relative associations of different items in the store. When Tesco tracks this over time and matches it to key demographic information, they can start to understand the different use cases and common groups of items that are purchased – allowing them to adjust their offering and store placement accordingly.

- Track the performance of marketing campaigns . When Tesco undertakes various marketing initiatives, it can be difficult to track how well they perform in terms of driving sales in various target markets. The Clubcard loyalty program gives them the data that they need to do this effectively, allowing the company to track whether the marketing message is working with their target audience or if things need to be changed. Once they’ve found a winning formula, they can quickly scale that out across the rest of their stores with a lot more confidence that their investment is going to pay dividends.

Those are just some of the ways that Tesco uses this data to inform their business decisions but hopefully, it gives you a sense of why it’s such an important part of their strategy. The data alone is much more valuable than the discounts that they offer in exchange, making it one of the most impactful revenue generation mechanisms that the company has at its disposal.

- Granular customer data is worth its weight in gold and anything you can do to gather and process it effectively, should be a priority for your organization.

The Price Match Guarantee

The world of grocery stores is incredibly competitive and unless you have a specific niche focus, there is going to be a lot of competition around price. In 2014, Tesco was going through a difficult period and found itself losing ground to some up-and-coming chains that were doing anything they could to undercut Tesco’s prices and win customers away from the incumbent. Tesco realized that they couldn’t afford this to happen for very long and so they came up with what they call the ‘Brand Guarantee Scheme’ to try and mitigate against this trend.

The idea was that if a customer got to the check-out and their basket of ten or more branded items was more expensive than what could be found at a rival store, customers would receive the difference as a discount when they paid. These prices were independently verified on a daily basis and gave customers the confidence that there were no better deals out there.

This simple psychology was enough to retain the vast majority of their regular customers and removed the one major objection that might convince someone to switch to another brand. It didn’t matter whether the amount was large or small, it provided peace of mind that when you bought at Tesco, you were getting the best deal that there was.

What makes this more interesting though is that this wasn’t the first time they had tried to implement a price match system to enable this sort of deal. Previously, they would go through the same process of matching prices but instead of giving the discount right away, they would offer a gift voucher to the value of the difference between the Tesco price and what it cost at another store.

It wasn’t until they listened to customer feedback and heard that many shoppers never got to use those benefits because they forgot about the vouchers, did they realize that they needed to remove the friction entirely [4] . Creating vouchers just added another step into the process that actually was a point of potential error. And even though it was completely within the customers’ control, the impression was that they were losing out.

When the company took that away and chose to implement the discount immediately as they paid, this completely disappeared and customers found the process quite magical. They didn’t have to do anything, yet they knew that if there were savings to be had, Tesco would make sure that they got them.

Achieving this took a lot of technological investment and considerable expense to do the requisite daily market research, but it made the purchasing experience a delight and that’s what keeps customers coming back time and time again. It sends a signal to customers that you’re looking out for them and will do whatever it takes to make their grocery shopping a breeze. To this day, the Tesco Brand Guarantee is one of those components that is severely underrated in terms of the company’s success up to this point.

- The more friction you can remove from the customer journey, the more magical the experience becomes, and the more likely customers are to return.

Aggressive Acquisitions

Another key strategy that typifies who Tesco has been as a company has been its track record of large international acquisitions which looked somewhat impulsive in retrospect. They bought a wide range of different brands in countries like Poland, Japan, India, Malaysia, the Czech Republic, Hungary, Slovakia, and more [5] . In each case, they were hoping to grab a piece of the local market and then apply their technology, data, and operational know-how to rapidly scale the operations.

In most cases, they left the brand as is rather than applying the Tesco name to it, giving them diversification but also underplaying the role that they would play in those specific regions. If you look at their growth over the past few decades, a lot of it can be attributed to these deals – though it’s difficult to know exactly how much value was added in the process. Once each acquisition was absorbed under the umbrella, there are just too many variables to make an educated statement on the overall success rate.

What cannot be denied is that this was a very intentional strategy on their part. By taking the financial power that they had built up in the UK, they were able to go into new markets and take risks on brands, knowing that any losses would be subsidized by the market-leading position back home. This might not be the most efficient way to grow, but it does give you scale and speed when certain acquisitions do provide the value you were expecting.

There is lots of debate about the pros and cons of a strategy like this, but Tesco have stuck with it for their entire history and this land-grab mentality rings true today. It’s only possible when you have a significant war chest and an existing set of operations that can sustain the shocks that come with potential market failures, especially when you are moving as fast as they do.

In the next section, we’ll look at an example of where things went wrong and see what we can learn from it.

Aggressive acquisitions should only be considered when you have a large war chest and you can manage the downside risks as they present themselves.

The Failed US Expansion

Tesco hasn’t always got it right and we can often learn as much from the failures as we can from the success stories. Back in 2006, the company decided that they wanted to enter the United States and try to replicate some of the success they had found in the UK. The strategy was to open a chain of small-format grocery stores in a few states in the West of the USA, specifically Arizona, California, and Nevada. These stores wouldn’t carry the Tesco name but instead were branded as ‘Fresh and Easy’.

In the first five months they opened 60 stores, they had 150 by the end of the first year, and over the next 6 years, they expanded to have over 200 at their peak. However, they found it much more difficult to get a foothold in the market than they had originally anticipated.

It’s not entirely clear as to why the stores failed but it’s likely due to a combination of these factors [6] :

- Unfamiliar Shopping Experience. The Fresh and Easy concept was to mimic the small convenience stores from the UK – offering people a shop where you should shop daily for the food and drinks that you needed. This was a stark contrast to the typical American shopping experience which was to purchase groceries in bulk and shop much more infrequently as a result. This difference in culture meant that they could never really get the traction they wanted, and it didn’t seem to fit the buying patterns of American consumers.

- Economic Recession. The timing of this expansion was really unfortunate because it happened in the middle of the worst economic crisis that the USA (and the world) had seen for a long time. As the sub-prime mortgage crisis took hold, unemployment soared, and the purchasing power of the middle class was significantly harmed. This effect was further concentrated in these Western states and so there was a disproportionate impact on the overall demand. This was not something Tesco could have predicted or planned for, but it’s a good reminder that you don’t operate in a silo. You’re reliant on economic conditions around you to sustain whatever operations you’re involved in.

- Misaligned Product Offerings. The one common criticism that the roll-out faced was that the store focused too much on ready-to-go, microwaveable meals – something that was very popular in the UK but had less buy-in across the USA. When it came to convenience food, the US market was much more comfortable with fast-food outlets and that meant that the demand for the Fresh and Easy offering wasn’t as strong as it could have been.

As always, these reasons are purely anecdotal and it’s not entirely clear what role they played, but the key learnings were that you need to deeply understand the psychology and the buying behavior of a new target market before you enter it. If you don’t, you place the entire project at risk and this can have drastic consequences financially as well as from a reputational perspective.

Tesco had reportedly lost around $2bn when they decided to pull out of the country in 2013 and they’ve never gone back. They continue to focus on the UK market which they know very well and select other European and Asian customer bases which provide some diversification.

- When you’re entering a new market, it’s critical that you understand the nuances and psychology of the customers in that new segment. Without this, you might miss the mark and suffer significant financial damages.

Tesco remains one of the most well-known grocery store brands worldwide and their ability to combine retail dominance, strong logistics capabilities, and sophisticated use of customer data is what will be the foundation that they build their future on.

They face many challenges in the year to come as more and more customers shop directly from brands, but the company is well aware of that and is doing all that they can to pivot the company effectively for this modern paradigm shift. In this strategy study, we’ve aimed to highlight some of the key areas that they’re focusing on with the hope that you can learn from them and apply them to your own context.

As a quick refresh, here are those main takeaways from the Tesco story:

- Aggressive acquisitions should only be considered when you have a large war chest, and you can manage the downside risks as they present themselves.

Remember to take the necessary time to understand the customer context, leverage the power of data, and invest in sustainability so that you can remain relevant for decades to come.

Technology and Operations Management

Mba student perspectives.

- Assignments

- Assignment: Digitization Challenge

Tesco: A digital transformation

Tesco is the leading grocer in the UK, accounting for 25% of all grocery sales offline and 43% of all grocery sales online [1]. In the last 15 years, Tesco has digitally transformed their customer experience, business model and operating model through investments in a state-of-the-art website with click-and-collect functionality, a digitalized in-store experience and a data-driven customer loyalty platform.

How is Tesco using technology to differentiate their Business and Operating Model?

Tesco has continually been investing in technology to develop an omnichannel customer experience and to maintain a competitive edge in an increasingly digitized UK grocery landscape. Three technological advancements that have created opportunities, as well as some challenges, for Tesco have been:

- Moving from ‘bricks and mortar’ to ‘bricks and clicks’ with the emergence of Tesco Direct, an online grocery platform with ‘click-and-collect’ functionality