2024 Best Online PhD in Risk Management [Doctorate Guide]

Analytical individuals with a passion for research might consider pursuing a PhD in Risk Management.

Risk management professionals can shape the way a company handles risk assessment and manages threats to their operation. A doctoral degree can set you apart from the crowd, signaling that you have research skills and expert knowledge of the industry.

Editorial Listing ShortCode:

Many people who obtain their Ph.D. in Risk Management choose to work in a variety of business or finance roles.

Universities Offering Online Doctorate in Risk Management Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Capella University

At Capella University, the online Doctor of Information Technology program is designed to help students acquire the knowledge and skills needed to excel as leaders in the IT industry. The program’s 13 courses and 2 virtual residencies can be completed at a student’s own pace. The curriculum covers topics like complex adaptive systems, system security, and project and risk management.

Capella University is accredited by the Higher Learning Commission.

Capitol Technology University

The courses for the Doctor of Philosophy in Occupational Risk Management at Capitol Technology University are taught by industry leaders and academic experts. The curriculum is built on key concepts in the growing safety and occupational construction field and the direct application of these concepts. The program consists of 60 credits and can be completed fully online.

Capitol Technology University is accredited by the Commission on Higher Education of the Middle States Association of Universities and Schools.

Liberty University

Liberty University offers a PhD in Organization and Management with an emphasis in Entrepreneurship. The curriculum is designed to teach strategic business concepts focused on organizational growth and advanced entrepreneurship. The program aims to help students step into dynamic leadership roles after graduation. Students can typically complete the 60 credit, online program in about 3 academic years.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

St. Thomas University

St. Thomas University offers a Doctor of Business Administration in Cyber Security Management. Graduates of the program often secure positions as chief information security officers, directors of financial systems, and high-level IT managers. This online, 60 credit program culminates in a final project. Students can choose between a traditional dissertation, an article dissertation, or action-based research.

St. Thomas University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of the Cumberlands

The University of the Cumberlands offers a Doctor of Philosophy in Information Technology. Students in the program can specialize in one of four specialties: Information Systems Security, Information Technology, Digital Forensics, or Blockchain. The program requires the completion of 60 credits. The curriculum covers topics like robotics, programming, machine learning, network technology, and information security.

The University of the Cumberlands is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Online PhD in Risk Management Programs

All organizations face risks to their operations, such as security breaches, theft, or a fluctuating market. Risk management plays a key part in protecting business by recognizing, addressing, and controlling potential threats.

Doctoral programs in risk management cover subjects in a range of fields, including finance, law, and economics. It’s also beneficial to have a strong understanding of advanced econometrics concepts, as these are used to create and analyze risk models.

A risk management doctoral program will likely include courses topics similar to those listed below:

- Regulatory and legal risk

- Organizational risk

- Econometrics

- Probability theory

- Applied regression methods

- Limited dependent variables

- Doctoral research

You can also choose to specialize in a particular area of risk management. This can be the topic that you choose to focus your research on as well. Risk management specialties can include:

- Financial intermediaries

- Risk and crisis management

A doctorate in risk management can help prepare you for leadership or research roles in the field. Risk management positions include:

- Risk management director

- Market research analyst

- Quantitative risk analyst

- Business analyst

- Claims adjuster

There are many benefits to a career in risk management, including the opportunity to work for a variety of companies. Some professionals also travel for work.

While pursuing your PhD in Risk Management, you can learn how to quantify risks and can enhance your financial knowledge and analytical skills. With experience, these abilities may help you qualify you for career advancements in the risk management industry.

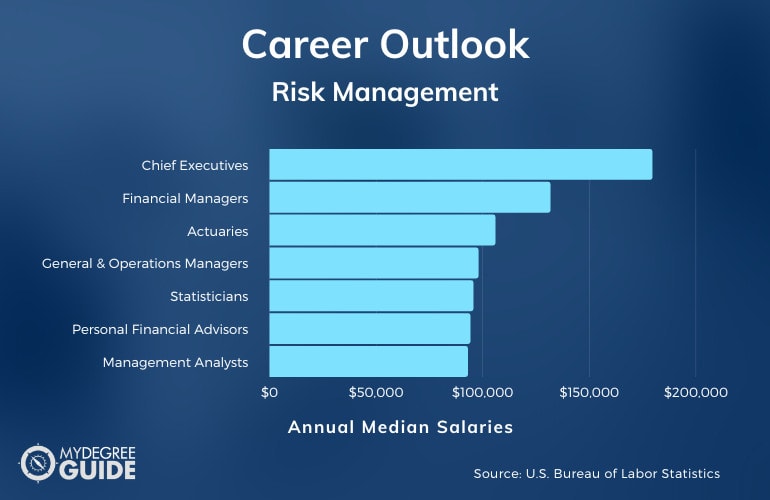

Risk Management Careers & Salaries

Much like with a masters in risk management , earning a PhD in Risk Management can open up professional opportunities in finance, economics, and education.

A typical curriculum in a risk management program consists of courses in finance theory, econometrics, and research. Having a firm foundation in these areas can help you qualify for positions at a variety of companies. According to the Bureau of Labor Statistics , experts in risk management may pursue the following career paths.

| Chief Executives | $179,520 |

| Financial Managers | $131,710 |

| Actuaries | $105,900 |

| General and Operations Managers | $97,970 |

| Statisticians | $95,570 |

| Personal Financial Advisors | $94,170 |

| Management Analysts | $93,000 |

| Financial and Investment Analysts | $91,580 |

| Operations Research Analysts | $82,360 |

| Postsecondary Teachers | $79,640 |

Many of the careers connected to risk management and insurance offer higher than average median salaries. Earning a doctorate may also increase your earning potential, though a certain pay range is not guaranteed to graduates.

When it comes to finding a job, there are a number of determining factors, such as your prior work experience, your specialized skill sets, and your geographic location.

Risk Management PhD Curriculum & Courses

The curriculum for a risk management doctoral program can change based on several factors, such as specialization or school, but you’ll likely take some courses similar to the following:

- Regulatory and Legal Risk : This course focuses on managing risk in a business setting, covering topics like managing operational and legal risks.

- Operational Risk : In this class, you’ll develop an understanding of the concepts included in a risk framework, exploring subjects such as fraud and security breaches.

- Econometrics : Designed to ready students for empiric economic work, this course explores a range of topics, including data analysis, testing, and forecasting.

- Probability Theory : This course is concerned with modeling events with uncertain results, spanning topics from conditional probability to distribution theory.

- Applied Regression Methods : This course is a study of regression models, and your lessons will include analysis of variance and covariance, along with case studies and examples.

- Limited Dependent Variables : This course focuses on specific regression models that involve dependent variables.

- Doctoral Research : You’ll have the opportunity to develop and strengthen your research skills as well as begin the process of putting together your dissertation.

- Corporate Finance Theory : In this course, you’ll study key topics in corporate finance theory, including asset pricing models and capital budgeting.

- Market Microstructure : This course explores the ways in which the interactions of traders impact pricing, and it focuses on areas such as strategic trading, market fragmentation, and liquidity.

- Risk Management Fundamentals : You’ll learn the fundamentals of risk management, including risk maturity and action, monitoring, and identification techniques.

As you apply to doctoral programs, you can read through each curriculum to ensure that it provides learning opportunities that match your interests and career goals.

Admissions Requirements

As you begin applying to doctoral risk management programs, you’ll likely notice some similarities in the application materials between schools.

Many colleges and universities will ask for the following:

- GRE or GMAT test scores (only some schools require them)

- Personal statement

- Letters of recommendation

- Official college transcripts

Because a doctorate is the highest-level degree, it is beneficial for your transcripts to reflect a strong academic performance during your undergraduate and graduate school years.

Accreditation

Have you ever wondered how employers and the general public know whether a college program is up to standard? The answer lies in the accreditation process .

Regional accreditation is a process that schools can elect to undergo in order to prove that they offer high-quality educational programs and student services. Accrediting agencies ensure that a school’s faculty is experienced and that its curriculum covers the necessary information for each subject area. Colleges and universities are also motivated to continuously improve their programs in order to maintain their accreditation status.

Financial Aid and Scholarships

Financial aid generally operates on an as-needed basis, providing monetary support for the families and individuals that need it most. There are a number of scholarships opportunities, though, that are based on other criteria, such as academic merit, field of study, and more.

To see how much financial aid you can receive from the government, you can fill out the Free Application for Federal Student Aid (FAFSA) . In addition to federal aid, you can apply for grants, loans, tuition reimbursement programs, or scholarships. These options will all look different depending on your location, personal financial history, and employer.

There are also financial aid options that are specific to certain family situations, such as aid for military families or international students.

What Can You Do with a Doctorate Degree in Risk Management?

A doctorate in risk management can lead to a number of lucrative and growing careers. Many risk management graduates go on to accept roles as financial managers, actuaries, or market research analysts.

Professionals in this sector combine their financial and regulation knowledge with their management and communication skills to help companies identify and manage potential risks. A doctoral program can also help you become well-versed in current research methods and tools. Professionals with a PhD often work in academia, typically as postsecondary teachers or researchers.

How Long Does It Take to Get a PhD in Risk Management Online?

A PhD is considered the highest degree one can earn, and a doctorate generally takes 3 to 5 years to complete with full-time enrollment.

How long it takes you to complete your online management degree can depend on the number of credit hours required by your program and the time it takes you to finish your dissertation. If there is no dissertation requirement in a doctoral program, it can generally be completed in 3 years with full-time study.

What’s the Difference Between a DBA vs. PhD in Risk Management?

A Doctor of Business Administration (DBA) and a Doctor of Philosophy (PhD) in Risk Management are both advanced degrees. A DBA is a professional doctorate, though, while a PhD is a research-based degree.

The doctoral path that’s right for you will likely depend on your professional goals.

Is a PhD in Risk Management Degree Worth It?

Yes, a PhD in Risk Management is worth it for many students. Many risk management careers are experiencing employment growth at a rate higher than the national average. For instance, postsecondary teachers, financial managers, and actuaries are expected to see 12%, 17%, and 24% job growth, respectively, over the next ten years (Bureau of Labor Statistics).

Additionally, risk management professionals have an impact on the security of the companies they work for, making them an essential part of an organization’s team. Not only do they identify potential risks, but they can work to eliminate future risks as well.

Getting Your PhD in Risk Management Online

Strong communication, financial acumen, and analytical skills are all essential for success in the field of risk management.

Earning your doctoral degree in risk management can help you improve and hone these skills while you study industry-specific knowledge and conduct original research. A doctoral degree can also help you advance your professional qualifications.

Just as they do with online masters in negotiation , a growing number of regionally accredited universities now offer risk management PhD programs both on campus and online. If you’re ready to enhance your expertise in this lucrative field, you can start exploring risk management doctoral programs today!

How to Get a PhD or DBA in Insurance & Risk Management

Risk is at the core of business profitability. The ability to evaluate risk and create strategies to mitigate its effects has broad applications–in insurance, business, manufacturing, and public policy. Factors such as the mortgage and credit crisis, environmental regulation, mass torts, health care reform, and natural disaster are creating an urgent need for advanced scholarship and visionary leadership. The International Risk Management Institute (IRMI) estimates that about half of the insurance and risk management (IRM) workforce will retire within fifteen years, fueling demand for actuarial science and risk management experts at all levels.

A doctorate in insurance and risk management qualifies you to reinvent the field for the twenty-first century, either by advancing scholarship and training the next generation of IRM workers, or by working as a senior-level financial professional. A PhD in business in Insurance and Risk Management can open doors to a career as a university professor, researcher, business school instructor, or as a senior risk analyst, actuary, financial analyst, or expert consultant.

Earning an online or campus-based PhD in Insurance and Risk Management requires discipline and planning. The degree is the highest qualification in the field and involves four to six years of graduate-level work. This guide to a PhD in Insurance and Risk Management takes you through the process of researching and applying to doctorate programs.

A Guide to the PhD in Insurance and Risk Management

The field of insurance and risk management (sometimes referred to as IRM or RMI) originated in the latter half of the twentieth century as a subset of business and finance disciplines. The field assumed a higher profile in the 1980s, reflecting a rise in the importance of business risk management. Academic insurance and risk management researchers point to executive liability, medical malpractice, product liability, and natural catastrophes to explain the rise of IRM in the past twenty years.

Today’s IRM programs incorporate elements of economics, finance, psychology, human resources, law, and even engineering and chaos theory to shed light on effective risk management. Most recently, the field has embraced high-level mathematical modeling (econometrics) to assess and manage risk

PhD or DBA?

As the discipline evolves, advanced education options are steadily expanding. In 1995, there were an estimated 80 doctoral students specializing in insurance and risk management at 11 universities nationwide. Five years later, an additional 22 schools added graduate-level IRM courses and degrees. At the doctorate level, you find two options: the Doctor of Philosophy (PhD) and the Doctor of Business Administration (DBA). These terminal doctoral degrees are considered equal in rigor, but divergent in purpose.

- The PhD in Insurance and Risk Management follows in the tradition of social science doctorates, which prepare students for advanced scholarship and college-level teaching careers. The degree culminates in a dissertation, which presents an original contribution to IRM scholarship. The research-oriented academic doctorate emphasizes quantitative methods and financial theory in risk management.

- The DBA in insurance and risk management is a professional practice doctorate, designed to prepare graduates for leadership positions in industry. The doctoral project applies existing scholarship to a particular real-world problem.

In practice, the distinction between the two doctorates has become blurred–in particular, many PhD graduates go on to high-level professional careers in the private sector. Find more information about the distinctions among doctorates at WorldWideLearn.com’s Online PhD Degrees and Doctoral Programs page.

Career Track

The two doctorates suggest the division in doctoral-level career paths–graduates can choose to pursue either an academic or a professional track.

Academic careers focus on original scholarship and teaching roles. Academics serve as university professors and researchers. Some lend their expertise as consultants to public and private sector clients or as expert legal witnesses.

Professional careers include senior-level positions as a:

- Risk management advisor

- Quantitative specialist or econometrician

- Public policy analyst

- Insurance executive

- Bank manager

Specializations

Both the PhD and DBA in Insurance and Risk Management offer a vast range of specialization options. In many cases, IRM is already a concentration within the business department. In any case, the opportunity to create your own independent project enables you to focus on a particular application or area of interest.

Some examples of academic and theoretical risk management specializations are:

- Econometrics

- Financial Intermediaries

- Risk and Crisis Management

Insurance-specific academic and applied specializations include:

- Empirical Modeling for Risk and Insurance

- Insurance Distribution and Compensation

- Insurance Capital Structure

- Insurance Market Structure

- Asset/Liability Management for Insurers

Applied insurance and risk management specializations include:

- Health/Retirement Analysis and Policy

- Public Finance

- Social Insurance Programs

- Corporate or Enterprise Risk Management

- Liability Insurance

- Corporate Hedging and Securitization

Each program emphasizes a particular set of specializations. Determining which area suits your interests helps you determine which PhD or DBA program in insurance and risk management is right for you.

How to Apply for the Doctoral Degree in Insurance and Risk Management

Once you’ve gained insight into your own academic interests and career ambitions, you’re in a good position to identify the PhD or DBA program that matches your needs.

Find the Right PhD or DBA Program

Given the highly specialized nature of doctoral education, it’s crucial to find the perfect fit. Each program offers a unique mix of resources and opportunities. The following four steps take you through the process of researching doctoral programs. You can find links to useful online resources for each step.

Step One: Develop a List of Accredited Programs

Goal: Create a comprehensive list of accredited programs that offer a PhD or DBA program in insurance and risk management.

Begin your research by compiling a list of accredited PhD or DBA programs. Accreditation is the baseline criterion of any higher education institution. Regular evaluation by an independent nationally recognized accrediting agency ensures the quality of your education and the value of your degree–not to mention your eligibility for some federal financial aid programs. The Association to Advance Collegiate Schools of Business (AACSB) is the major national accrediting agency of business graduate schools. The U.S. Department of Education maintains a comprehensive database of approved national and regional accreditation agencies.

Online PhD directories and accrediting agency member lists can point you to accredited doctoral programs in insurance and risk management. Check out the following sites:

- AACSB maintains an online database of 600 or so member institutions worldwide. Search this list by factors such as online delivery format, campus location, program of study, and degree level.

- IRMI (The International Risk Management Institute) publishes the IRMI Directory of Risk Management and Insurance Programs at U.S. Colleges and Universities . Last updated in February 2009, the guide profiles and links to thirty dedicated university risk management and insurance (RMI) programs. The list doesn’t include business degrees with RMI specializations and emphasizes undergraduate programs, but it offers a useful starting point.

- The American Risk and Insurance Association (ARIA) maintains a more extensive list of university insurance and risk management programs.

- WorldWideLearn.com features a searchable database of accredited online PhD programs in insurance and risk management. Search Degrees by Subject to find an online or campus doctorate in IRM. The site maintains a high quality standard for all its education partners, taking into account accreditation and other factors. Learn more about the accreditation process or browse a list of university partners.

Step Two: Online or Campus PhD in Insurance and Risk Management?

Goal: Focus your list by deciding which program delivery format best suits your lifestyle and learning style.

Advances in distance learning technology have made online education a viable option for higher education, particularly professional practice doctorates such as the DBA. The PhD is also available online, but aspiring academics typically choose a campus or hybrid online/campus PhD in order to access on-site resources.

- Online PhD degrees in insurance and risk management offer scheduling flexibility, making them a popular choice for working professionals balancing education alongside work and family. Aside from convenience, online degrees offer the potential for a productive synergy between work and academic research. The online format is especially suitable for professional practice doctorates such as the online DBA in Insurance and Risk Management, which rely on the application of theory in a real-world business setting.

- Campus programs remain the preferred choice for the academic PhD in Insurance and Risk Management, which rely on access to campus resources. Aspiring professors and scholars depend on relationships with faculty mentors and peers, teaching and research assistantships, and access to library collections and computer labs.

Explore program format options at WorldWideLearn.com. The Online Degree Programs and Campus Education sections help you find PhD programs with the delivery format that best meets your circumstances and career goals.

Step Three: Explore Academic Programs

Goal: Research academic programs, prospecting for potential faculty mentors who share your academic interests.

In this stage, you match your academic interests and career ambitions with a suitable academic program. Because faculty mentorship is such an important feature of a doctoral program in insurance and risk management, it’s critical to find a professor whose research and theoretical approach match your own. Take into account the following factors:

- Faculty research

- Areas of concentration

- Curriculum and course requirements

- Special programs

WorldWideLearn.com facilitates your program research by automating the matching process. Fill out an online form indicating your academic program criteria and the system identifies schools that meet your specifications. An academic counselor will contact you to discuss the program and answer your questions.

School Web sites offer useful information about professor research interests, special programs and school publications, student research projects, and more.

Academic Journals can help you focus your research interests and identify leaders in your field. Major journals in insurance and risk management include: The Journal of Risk and Insurance , Risk Management and Insurance Review , and Risk Management magazine.

Step Four: Evaluate Program Quality

Goal: Create a final list of schools to which you want to apply, balancing factors such as program quality, selectivity, and cost.

In the final analysis, the right school for you depends on a range of practical considerations, including:

- Selectivity

- Graduation Rate

- Job Placement Statistics

- Career Support Resources

- Student Body Profile

- Cost and Financial Aid

Aim to create a list of about six doctoral programs, taking into account both program quality and your own competitiveness as an applicant. It’s a good idea to apply to both a ‘dream’ school and a ‘safety’ school.

Rankings can give you a sense of a doctoral program’s reputation and selectivity. Some to consider:

- U.S. News and World Report offers a general ranking of the best business schools. This ranking focuses on the MBA, but also offers a sense of a school’s general reputation.

- The National Research Council releases its Assessment of Research Doctorate Programs less frequently, but offers a more comprehensive evaluation of doctoral program quality. The Assessment covers economics PhDs, with specialized assessments of econometrics and economic theory.

- The Center for Measuring University Performance also offers a ranking of top American research universities.

School Data offers a picture of the typical doctoral candidate, including selectivity information, demographic data, and job placement statistics.

Campus Visits allow you to meet one-on-one with faculty and graduate students to develop a more holistic sense of the doctoral program experience.

Preparing for a PhD in Insurance and Risk Management

Once you’ve developed your final list of campus or online PhD programs in insurance and risk management, the application process becomes a matter of connecting the dots. Steps to take include:

- Satisfying prerequisites

- Collecting and submitting application materials

- Lining up financial aid

The following resources can help you navigate the logistics of applying to a campus or online PhD in Insurance and Risk Management.

- WorldWideLearn.com’s Education Resources Guide can help you with the application logistics, with information on standardized test preparation, prerequisite courses, financial aid, and more

- The Insider’s College Guide for Working Adults offers an overview of resources and strategies for returning students

- Financial aid information is available on WorldWideLearn.com’s graduate education funding resource page

Joining the Academic Community

Your application to a doctoral program in insurance and risk management signifies your entrance into an elite academic community. Start building relationships now by attending conferences, subscribing to IRM publications, and joining professional organizations. Academic and industry associations include the University Risk Management and Insurance Association (URMIA) and the American Risk and Insurance Association (ARIA).

An online PhD or DBA in Insurance and Risk Management offers a stepping stone into the upper echelons of academic scholarship and professional risk assessment. Reaching this lofty goal requires planning and discipline. Develop a vision of your academic path now, and you can set yourself up to take full advantage of the opportunities that come your way through the IRM doctoral program.

- American Risk and Insurance Association (ARIA)

- The Association to Advance Collegiate Schools of Business (AACSB), AACSB Accredited Business Schools Database

- The Center for Measuring University Performance

- Columbia SIPA, Career Opportunities in Insurance and Risk Management

- International Risk Management Institute, IRMI Directory of Risk Management and Insurance Programs

- IRMI Insights, The Insurance Industry Talent Crisis: Investing in Risk Management and Insurance Graduates , by Brenda Wells

- Journal of Risk and Insurance, Collegiate Risk Management and Insurance Education , by Lisa A. Gardner and Joan T. Schmit

- National Research Council, Assessment of Research Doctorate Programs

- Risk Management and Insurance Review, Vol. 8, No. 1, Risk Management and Insurance-Related Journals: A Survey of Risk and Insurance Academics , by Tamela D. Ferguson et al.

- University of Georgia, Terry College of Business, Risk Management and Insurance Program

- University of Pennsylvania, The Wharton School, PhD in Applied Economics

- University of Wisconsin-Madison School of Business, Actuarial Science, Risk Management and Insurance

- U.S. Department of Education, Database of Accredited Postsecondary Institutions and Programs

- U.S. News and World Report, Best Business Schools

- Privacy Policy

- Terms of Use

- Disclosure: “What Determines Top/Best?”

- Do Not Sell My Personal Information (CA and NV)

Copyright © 2024 Worldwidelearn.com. All Rights Reserved.

The sources for school statistics and data is the U.S. Department of Education's National Center for Education Statistics and the Integrated Postsecondary Education Data System unless otherwise noted.

Disclosure: EducationDynamics receives compensation for many of the featured schools on our websites (see “Sponsored School(s)” or “Sponsored Listings” or “Sponsored Results” or “Featured Graduate School(s)”. So what does this mean for you? Compensation may impact where the Sponsored Schools appear on our websites, including whether they appear as a match through our education matching services tool, the order in which they appear in a listing, and/or their ranking. Our websites do not provide, nor are they intended to provide, a comprehensive list of all schools (a) in the United States (b) located in a specific geographic area or (c) that offer a particular program of study. By providing information or agreeing to be contacted by a Sponsored School, you are in no way obligated to apply to or enroll with the school.

This site does not provide a comprehensive list of all schools that offer a particular program of study.

This is an offer for educational opportunities that may lead to employment and not an offer for nor a guarantee of employment. Students should consult with a representative from the school they select to learn more about career opportunities in that field. Program outcomes vary according to each institution’s specific program curriculum. Financial aid may be available to those who qualify. The information on this page is for informational and research purposes only and is not an assurance of financial aid.

- Resources

- Prospective Students

- Current Students

- Faculty & Staff

- Alumni & Friends

- News & Media

Safety Sciences, PhD

Become a Leader in the Field of Safety Sciences

You’re a professional working in the sciences, and you’re looking to advance your skills without interrupting your career. The Safety Sciences PhD program at IUP will prepare you to become a leader in the field, developing safer workplaces and protecting employees, property, and the environment.

Through hybrid learning that combines part-time distance education with a summer workshop program, you can earn this applied research science degree without taking a break from work.

The 54-credit program, including the dissertation, can be completed in three to eight years, with 24 credits through distance education courses, 18 credits of summer workshop courses, and 12 credit hours of dissertation. See more about the Classes and Requirements .

A Degree That Leads to a Future of Options

IUP’s Safety Sciences PhD program prepares you for a higher level of professional performance. You’ll learn how to anticipate, recognize, evaluate, control, and prevent safety, health, and environmental hazards in work environments. You’ll also be ready to teach safety sciences at academic institutions and conduct independent research.

You’ll be learning alongside a diverse group of fellow students—our PhD student population is composed of 20 percent minorities and 50 percent women. Some students enter the program to advance their careers. Some want to gain qualifications for academic instruction. Others pursue the degree to change the direction of their career or to plan for a second career after retirement.

How You’ll Learn

A new student group is admitted into the program every odd-numbered year and remains together as a cohort to complete the program. In the fall and spring, you’ll attend evening classes online, and in the summer, you'll gather on campus with your cohort for a two-week workshop.

Imagine Your Future

When you envision the pinnacle of your career, what do you see? Depending on where you are in your safety and environmental health career path, an IUP Safety Sciences PhD can open doors to managerial and director positions, and even C-suite roles in the public or private sector.

If your goal is to educate the next generation of safety science professionals, this degree will prepare you to enter academia as a full-time, tenure-track or part-time adjunct professor.

Graduates of the PhD in Safety Sciences program have gone on to excel in their careers in positions such as:

- Assistant professors

- Corporate managers

- Superintendents

A Credential for Problem-Solvers

To function and compete in today’s business dynamic, organizations are looking for professionals with a higher level of safety science knowledge, skills, and abilities. Most private sector companies are required to adhere to OSHA regulations that protect workers across the United States. Many companies have unique safety programs in place to reduce their company-specific hazards and risks to acceptable levels.

Additionally, workplaces are being developed with increasingly sophisticated and complex designs and functions, and the coronavirus pandemic has underscored the importance of workplace safety professionals who can control exposures in these environments.

A PhD credential in the field demonstrates that you have the expertise to rise to the challenge.

Career Opportunities in Safety Sciences

The safety sciences field employs approximately 132,400 individuals, with opportunities projected to increase through 2031, according to the US Bureau of Labor Statistics . The job outlook as a whole is positive, with an average annual occupational growth rate of 5 percent.

In a field with a wide variety of positions and skill sets, safety science professionals have the freedom to work almost anywhere in the world. You’ll use new technologies to make a difference in the health and welfare of workers.

New Challenges for More Advanced Professionals

New technologies, techniques, and materials are creating new health and safety challenges in the workplace. Organizations are under greater pressure to identify hazardous conditions and prevent workplace injury or harm. Additionally, reputation management and a desire to uphold good corporate citizenship are driving employment growth in safety sciences.

It’s your time: seasoned professionals like you will have room to advance as more than half of occupational safety and health professionals are approaching retirement age.

Safety sciences professionals who earn a doctoral degree are poised for a fulfilling and rewarding career.

Median Annual Salary

Safety professionals holding a PhD

Classes and Requirements

Upon graduation, you’ll be able to:

- Anticipate, recognize, evaluate, control, and prevent safety, health, and environmental hazards in the work environment.

- Conduct independent research.

- Teach safety sciences at academic institutions.

The program can be completed in three to eight years. A minimum of 54 semester hours of credits is required, including:

- 24 credits (eight courses) earned through distance education courses online (six credits each fall and spring term for two consecutive years).

- 18 credits (six courses) in six one-week summer workshop courses on the IUP campus (six credits over a two-week period in the summer semester for three consecutive years).

- 12 hours of dissertation supervision.

To earn your degree, you must satisfactorily complete a comprehensive written examination, an oral defense of your dissertation proposal, a dissertation , and an oral defense of your dissertation.

The total minimum time to complete the degree is approximately three years; the average time to complete the degree is approximately five years.

Full Academic Catalog Listing

The course catalog is the official reference for all our degree and course offerings. Check it out for a full listing of the classes available and requirements for this degree.

Student Demographics

The field of safety sciences is predominantly male at present; approximately 80 percent of jobs in the field are held by men. However, the demographic of the student population in IUP’s Safety Sciences PhD program reflects a changing picture.

More than 75 percent of the current program cohort includes women, minorities, and international students ranging in age from 26 to 60.

Almost all our students currently work in the safety, health, and environmental field, and approximately half work for employers that are paying for their education. Most students reported that they see themselves eventually moving into academia to teach full- or part-time. A very limited number of our students are currently working in academia.

Program Outcomes

In this program, you’ll develop sophisticated research, analytical, and problem-solving skills that will position you for safety science leadership careers in industry, government, and academia. As a graduate, you will be prepared to:

- Apply appropriate quantitative and qualitative research methods to solve safety, health, and environmental problems.

- Conduct independent research in the safety, health, and environmental field.

- Demonstrate advanced knowledge of safety, health, and environmental management techniques.

- Effectively develop, implement, and evaluate a safety education curriculum.

Strengths of the PhD in Safety Sciences Program

As a doctoral student in the safety sciences at IUP, you’ll enter a program that can take you to the top of your field, without interrupting your career. This is the only hybrid safety science program in the nation, allowing you to pursue your degree on a part-time basis.

Our PhD program is also one of few in the general field that is not affiliated with an engineering school, public health school, or business school. While our program includes courses in these disciplines, the curriculum is intentionally balanced to appeal to a broad student base and reflect the reality of safety science as a generalized field that spans almost every industry and workplace type.

A Practical Education with Purpose

IUP’s program attracts working professionals because it’s structured as an applied research science degree. Unlike programs that focus on theory, our PhD in Safety Sciences equips you with knowledge that is immediately applicable in the workplace.

Some students leverage their dissertations to resolve specific workplace problems, increasing their visibility and potential for career advancement and creating value for employers who may be funding their education.

During the on-campus, two-week summer experience, you’ll build lifelong friendships and professional bonds with professors and fellow students in your cohort. Many students bring years of field knowledge to campus, further enhancing the quality of the program.

Recent PhD Graduate Awards

We take great pride in our graduates who continue to distinguish themselves in the field of safety science. Recent graduates have gained outstanding field recognition with awards that include:

- American Society of Safety Professionals Professional Safety Article of the Year

- Industrial Hygiene Officer of the Year

- Rising Star of Safety, awarded by the National Safety Council

- Safety Professional of the Year, awarded by ASSP Region VI

- Uniformed Services University’s F. Edward Hebert School of Medicine Dean’s Impact Award

Program Graduate Survey Results

The Department of Safety Sciences at IUP is committed to continuous improvement of our education programs, with the goal of providing a learning experience that meets the expectations of students and aligns with current industry demands.

As part of that effort, our faculty solicit input to gain insight into students’ experience in the Safety Sciences PhD program. In the survey results, students noted the quality of program professors. They describe professors as:

- Accessible to students

- Adaptable to different learning styles

- Attentive to students’ concerns

- Committed to providing valuable feedback

- Dedicated to helping students learn and grow

- Motivated to help students succeed

- Passionate about teaching

- Supportive with dissertation assistance

- Top notch in their field, with private sector experience

Comments about the program and curriculum design include praise for:

- A beneficial combination of distance and live classroom learning

- Coursework that introduces complex issues and safety, health, and environmental (SHE) problem-solving methods

- Dissertations that use specific safety and environmental health examples

- Exposure to critical thinking, reasoning, and detailed analysis of problems and solutions

- Intensive academic writing requirements that are indispensable for scholarly research and writing

- Preparing students to become future educators, with an emphasis on pedagogy and teaching

- Program flexibility and professors who accommodate the schedules of working professionals

- Statistics and research courses that are appropriate for the safety sciences field

- A transformational dissertation process that motivates further interest in research

- A well-rounded and field-relevant curriculum that enhances and builds on students’ technical abilities

Selection and Type of PhD Dissertations

Choosing a topic for your dissertation must be a carefully considered process. This is a crucial component of your doctoral studies that takes months to complete, and it requires deep immersion into the subject matter.

Based on feedback from program graduates and current students, the selection of dissertation topics is founded on five primary considerations:

- A newly discovered topic of interest drawn from a PhD class or lesson

- Corporate interest, particularly if the student’s employer is funding tuition

- Faculty interest

- Personal interest

- Urgency, based on the availability to certain data or information to the student and limited time or resources to complete a dissertation

Most dissertations in the field of safety science are mixed method studies, a combination of quantitative and qualitative research. These dissertations are founded on survey results, physical experiments, and epidemiological studies. To date, graduates of IUP’s PhD in Safety Sciences program have most frequently conducted surveys for their dissertation, followed by physical experiments, and then epidemiological studies.

PhD Dissertation Titles

- Rodriguez-Franco, Oscar. 2021. “Contributing Factors to Serious Injuries and Fatalities in Electrical Occupations Due to Contact with Electricity.”

- Mullins-Jaime, Charmane. 2021. “Assessing the Effects of a Communication Intervention on Climate Change Action Motivation Using a Health and Safety Risk Management Framework.”

- Schoolcraft, Steven G. 2021. “Factors Influencing the Perceived Social Theories Associated with Motivating Safety Performance in a Global Organization.”

- Reed, Patricia A. 2021. “Evaluating the Effectiveness of Chemical Exposure Training in Improving Employee Risk Perception with a Case Study in a Bleach Processing Plant Filling Department.”

- Pugh, Cynthia T. 2020. “Characterization of Occupational Exposures to Engineered Nanomaterials in an Electronic Recycling Facility.”

- Hunter, Pamela A. 2020. “An Evaluation of the Efficacy of Workplace Violence Prevention Programs in Reducing Workplace Violence Injuries to Registered Nurses in Connecticut.”

- Diehl, Francene S. 2020. “An Evaluation of Social Marketing Delivery Modes Aimed at Teen Smartphone Use While Driving: An Application of the Theory of Planned Behavior.”

- Mulroy, John M. 2020. “An Investigation of Occupational Safety and Health Management Attributes on High-Hazard Small Enterprise Safety Outcomes for Use in Modifying OSHA Consultation's Safety and Health Assessment Worksheet (Revised Form 33).”

- Armstrong, George. 2020. “Assessing Manufacturing Employee Perceptions of Supervisor Occupational Health and Safety Competencies and Potential for Occupational Health and Safety Training Facilitation.”

Steps to Complete Your Dissertation in Safety Sciences

Completing your dissertation: standard process.

- Complete your program coursework.

- Formulate an idea for your dissertation topic or experimental approach.

- Form a dissertation committee with approval from the program coordinator.

- Discuss your topic with your dissertation committee members.

- Take the comprehensive/candidacy exam (similar to writing the first three chapters of your dissertation).

- Present an oral defense of your dissertation proposal.

- Complete and submit your research topic approval form (RTAF), generate institutional review board (IRB) documentation, and receive approval from the graduate school.

- After you receive a written receipt of research topic approval from the School of Graduate Studies and Research, begin writing your dissertation. You may not begin dissertation research activity—other than preliminary steps such as background research, an IRB or IACUC (research animal care and use) approved pilot study, or a three-chapter writing/review)—until you have received notice of approval from the School of Graduate Studies and Research.

- Conduct formal research.

- Write your dissertation.

- Present an oral defense of your dissertation.

Completing Your Dissertation: Alternate, Expedited Process

- Complete program courses any time before graduation.

Safety Leadership Hub

IUP’s Safety Leadership Hub is founded on five pillars: Research, Education, Training, Consultation, and Partnerships. Hosted by the Department of Safety Sciences, it represents the university’s holistic approach to being a regional leader in safety, health, and environmental sciences.

Through our vision to be the premier institution for education and research and the program of choice for industry partnerships in the global safety, health, and environmental profession, the IUP Safety Leadership Hub will serve as a portal to explore our education programs, current research, collaboration opportunities, consultation services, and training.

How Many Safety Professionals Hold Doctoral Degrees?

Each year, the Board of Certified Safety Professionals conducts a safety field salary survey in collaboration with the National Safety Council to learn what type of academic degrees safety professionals earn and the median compensation by degree.

The yearly report generated from data gathered in this survey includes an expansive variety of demographic information. Review the most recent full report (pdf).

Percent of Safety Professionals Who Hold Various Educational Degrees

- Associate’s degree: 6%

- Bachelor’s degree: 45%

- Doctoral degree: 2%

- High school diploma/GED: 3%

- Master’s degree: 32%

- Some college but not a degree: 9%

- Vocational/trade school diploma or certificate: 2%

Annual Median Safety Professional Compensation by Educational Degree

- Doctoral degree: $118.5K

- Master’s degree: $105K

- Bachelor’s degree: $93K

About Our Faculty

The Safety Sciences faculty members bring to the classroom their professional experience in industries such as insurance, consulting, manufacturing, healthcare, construction, government, and others. All faculty are certified safety professionals and/or certified industrial hygienists, and many hold multiple certifications.

- Our professors are active in safety sciences research, publishing, and service to the profession.

- Their focus is on the student. All graduate students have an advisor who mentors them throughout their graduate program.

- Safety Sciences hosts an annual departmental career fair. An average of 75 companies attend the career fair, and it's here that you can find co-ops, internships and full-time employment.

Student Opportunities

Iup chapter of american society of safety professionals.

The Department of Safety Sciences has had a student section of the American Society of Safety Professionals for more than 20 years and has won the Outstanding ASSP Student Section five times. All students are encouraged to participate, and about 100 students currently are involved.

Rho Sigma Kappa

The Alpha Chapter of Rho Sigma Kappa was inaugurated at IUP in 1993. This honor society recognizes exemplary performance in the safety sciences. Graduate student membership is based on nomination by program faculty and requires completion of at least 15 credits in the major and meeting minimum grade point averages, as well as other evidence of superior performance. Typically, only 5 to 10 percent of Safety Sciences students qualify for membership in Rho Sigma Kappa.

Safety Sciences Career Fair

Our career fair is widely recognized as one of the crown jewels of the Safety Sciences Department. With our outstanding national reputation, we attract some of the largest employers in many industries who are seeking to hire personnel with safety expertise. We host the Safety Sciences Career Fair in October each year at the Kovalchick Convention and Athletic Complex. All students are invited.

Print Options

Bulletin 2023-2024, business administration/risk management and insurance phd.

FOX SCHOOL OF BUSINESS AND MANAGEMENT

Learn more about the Doctor of Philosophy in Business Administration .

About the Program

The PhD in Business Administration program, with a concentration in Risk Management and Insurance, prepares individuals for advanced research and scholarship. The primary emphasis of the program is to prepare future faculty members for successful academic careers.

Time Limit for Degree Completion: 7 years

Campus Location: Main

Full-Time/Part-Time Status: Full-time study is required.

Accreditation: The PhD in Business Administration program, with a concentration in Risk Management and Insurance, is accredited by the Association to Advance Collegiate Schools of Business (AACSB International).

Job Prospects: The program is primarily dedicated to producing well-trained researchers who will work in academic positions.

Non-Matriculated Student Policy: Non-matriculated students are not permitted to take doctoral courses.

Financing Opportunities: Typically, all PhD students receive financial assistantship in the form of full tuition remission and a stipend in return for offering services as a Research Assistant (RA) or Teaching Assistant (TA). The level of support is based on the concentration, the applicant’s qualifications, and other competitive considerations. Students may also receive remuneration for conference travel, publications and academic achievement.

Admission Requirements and Deadlines

Application Deadline:

Applications must be submitted AND complete (i.e., all required materials must be received and verified by Fox Staff) by Dec. 5 to be considered. Applications received after this deadline are reviewed on a case-by-case basis and dependent on availability.

APPLY ONLINE to this Fox graduate program .

Letters of Reference: Number Required: 2

From Whom: Letters of recommendation should be obtained from evaluators, typically college/university faculty or an immediate work supervisor, who can provide insight into your abilities and talents, as well as comment on your aptitude for graduate study.

Master's Degree in Discipline/Related Discipline: A master's degree is not required, but preferred.

Bachelor's Degree in Discipline/Related Discipline: The equivalent of a four-year U.S. baccalaureate degree from an accredited university or college is required. For three-year degrees, mark sheets must be evaluated by WES or another NACES organization.

Statement of Goals: In 500 to 1,000 words, describe your specific interest in Temple's program, research goals, career goals, and academic and research achievements.

Standardized Test Scores: GMAT/GRE: Required. GMAT scores are preferred. Test results cannot be more than five years old. Although the applicant’s test score is an important factor in the admissions process, other factors, such as the ability to conduct research as demonstrated by academic research publications and whether your indicated research interests match with those of our faculty, are also taken into consideration.

Applicants who earned their baccalaureate degree from an institution where the language of instruction was other than English, with the exception of those who subsequently earned a master’s degree in a country where the language of instruction is English, must report scores for a standardized test of English that meet these minimums:

- TOEFL iBT: 90

- IELTS Academic: 7.0

- Duolingo: 110

- PTE Academic: 68

Resume: Current resume or CV required.

Program Requirements

General Program Requirements: Number of Credits Required to Earn the Degree: 48

Required Courses: 1

| Code | Title | Credit Hours |

|---|---|---|

| Core Risk Management Seminars | ||

| Math Preparation (August) non-credit | 0 | |

| Corporate Risk Management | 3 | |

| Household Finance and Risk Management | 3 | |

| Theory of Risk and Uncertainty | 3 | |

| Theory and Research Methods Courses | ||

| Econ Theory of Choice | 3 | |

| Business Econometrics I | 3 | |

| Business Econometrics II | 3 | |

| Financial Economics | 3 | |

| Information Economics | 3 | |

| Business Econometrics III | 3 | |

| Corp Finance Theory | 3 | |

| Statistical Methods for Business Research I | 3 | |

| Electives | ||

| Select three from the following: | 9 | |

| Game Theory | ||

| Capital Markets Research | ||

| Microeconomic Theory II | ||

| Empirical Research in Corporate Finance | ||

| Empirical Asset Pricing | ||

| Statistical Methods for Business Research II | ||

| Research Courses | 6 | |

| Preliminary Examination Preparation | ||

| Pre-Dissertation Research | ||

| Dissertation Research | ||

| Total Credit Hours | 48 | |

Students require approval from their mentor and the Concentration Director for all course selections, including those dropped and/or added.

The program of study may be individualized to a significant degree for the student's best professional and scholarly development. With approval from the Concentration Director, students may take other electives to match their research interests. Suggested focus areas and courses may be chosen with approval from the Concentration Director.

This is a theory-focused course.

This is a finance-focused course.

This is an economics-focused course.

Of the 6 required research credits, a minimum of 2 credits of BA 9999 must be taken. The other 4 credits may be taken in any combination of BA 9994 , BA 9998 , and BA 9999 . Given that 6 credits constitute the minimum requirement, additional credits may be needed to fulfill the degree program's culminating experiences. Doctoral students must maintain continuous enrollment from matriculation to graduation.

Culminating Events: Preliminary Examination: The purpose of the preliminary examination is to demonstrate critical and interpretive knowledge of current research. The subject areas are determined, in advance, by the faculty of the department. The preliminary exam should be completed no more than one term after the student completes the coursework component of the program. Students who are preparing to write their preliminary examinations should confirm a time and date with their departmental advisor.

The members of the student's department write the questions for the preliminary exam. The student must answer every question on the examination in order to be evaluated by the Department Committee. The evaluators look for a breadth and depth of understanding of specific research areas, a critical application of that knowledge to specific phenomena, and an ability to write technical prose. Each member votes to pass or fail the student. In order to pass, a majority of the committee members must agree that the exam has been satisfactorily completed.

Proposal: The dissertation proposal demonstrates the student's knowledge of and ability to conduct the proposed research. The proposal should consist of the following:

- the context and background surrounding a particular research problem;

- an exhaustive survey and review of literature related to the problem; and

- a detailed methodological plan for investigating the problem.

The proposal should be completed and approved no more than one year after completing coursework. Upon approval, a timeline for completing the investigation and writing process is established.

Dissertation: The doctoral dissertation is an original empirical study that makes a significant contribution to the field. It should expand the existing knowledge and demonstrate the student's knowledge of both research methods and a mastery of their primary area of interest. Dissertations should be rigorously investigated; uphold the ethics and standard of the field; demonstrate an understanding of the relationship between the primary area of interest and the broader field of business; and be prepared for publication in an academic journal.

The Doctoral Advisory Committee is formed to oversee the student's doctoral research and is comprised of at least three Graduate Faculty members. Two members, including the Chair, must be from the student's department. The Chair is responsible for overseeing and guiding the student's progress, coordinating the responses of the committee members, and informing the student of her/his academic progress.

The Dissertation Examining Committee evaluates the student's dissertation and oral defense, including the student's ability to express verbally their research question, methodological approach, primary findings and implications. The Dissertation Examining Committee votes to pass or fail the dissertation and the defense at the conclusion of the public presentation. This committee is comprised of the Doctoral Advisory Committee and at least one additional faculty member from outside the department.

If any member decides to withdraw from the committee, the student shall notify the Chair of the Dissertation Examining Committee and the PhD Managing Director. The student is responsible for finding a replacement, in consultation with the Chair. Inability to find a replacement shall constitute evidence that the student is unable to complete the dissertation. In such a case, the student may petition the PhD Managing Director for a review. Once review of the facts and circumstances is completed, the Director will rule on the student's progress. If the Director rules that the student is not capable of completing the dissertation, the student will be dismissed from the program. This decision may be appealed to the Senior Associate Dean. If dismissed, the student may appeal to the Graduate School.

Students who are preparing to defend their dissertation should confirm a time and date with their Dissertation Examining Committee and register with the Graduate Secretary at least 15 days before the defense is to be scheduled. The Graduate Secretary arranges the time, date and room within two working days, and forwards to the student the appropriate forms. After the Graduate Secretary has scheduled the defense, the student must send to the Graduate School a completed "Announcement of Dissertation Defense" form, found in TUportal under the Tools tab within "University Forms," at least 10 days before the defense. The department posts flyers announcing the defense, and the Graduate School announces the defense on its website.

Program Web Address:

https://www.temple.edu/academics/degree-programs/business-administration-phd-bu-ba-phd

Department Information:

Fox School of Business and Management

1801 Liacouras Walk

701 Alter Hall (006-22)

Philadelphia, PA 19122

215-204-5890

215-204-7678

Fax: 215-204-1632

Submission Address for Application Materials:

https://apply.temple.edu/FOX/Account/Login

Department Contacts:

Admissions:

Fox PhD Admissions

Concentration Director:

Benjamin Collier

215-204-8155

PhD Managing Director:

Vinod Venkatraman, PhD

Associate Professor, Marketing

215-204-1409

Send Page to Printer

Print this page.

Download Page (PDF)

The PDF will include all information unique to this page.

Download PDF of entire Undergraduate Bulletin

All pages in Undergraduate Bulletin

Download PDF of entire Graduate and Professional Bulletin

All pages in Graduate and Professional Bulletin

- Interesting for you

- My settings

Everything you need to know about studying a PhD in Risk Management

Part of business & management.

Risk Management is the business discipline that deals with anticipating, evaluating and addressing possible consequences of strategic actions within an organisation. Risk Management prepares financial experts who have the necessary knowledge, skills and experience to identify and evaluate risk factors, and to implement strategy plans to prevent or minimise losses. You will learn how to protect an organisation's assets, income, employees, reputation and shareholders.

Risk Management reduces uncertainty for businesses by leveraging the potential pain points of companies. By presenting an in-depth analysis and formulating appropriate planning that meets risks and offers clarity, Risk Management experts help boost employee and manager confidence and motivation and ensure company success.

Risk Management studies cover topics mixing with diverse disciplines resulting in classes on administrative studies, business continuity, security and risk management, organisational continuity, investment and financial risk, risk management for banking, and many more.

Students acquire fundamental knowledge of predictive models and risk management systems, learn how the decision making process works, and train their quantitative skills and critical thinking, among others.

Typically, graduates in Risk Management are already young professionals working in small or large national companies, corporations, banks, audit firms, insurance companies, financial consultancy agencies or governmental agencies. Career prospects include titles such as financial business risk analyst, risk manager, director of corporate risk management, market risk quantitative analyst, etc.

View all PhDs in Risk Management . Keep in mind you can also study an online PhDs in Risk Management .

Interesting programmes for you

Specialisations within the field of business & management.

- Project Management

- Business Administration

- Entrepreneurship

- Management Studies

- Public Administration

- Human Resource Management

- Supply Chain Management & Logistics

- Agribusiness

- Business Intelligence

- Corporate Communication

- Corporate Social Responsibility

- Executive MBA

- Forensic Accounting

- Innovation Management

- International Business

- Master in Business Administration (MBA)

- Master in Management (MIM)

- Retail Management

- Risk Management

- Strategic Management

- Engineering Management

- Transport Management

- Digital Media

- Digital Marketing

- Actuarial Science

- Construction Management

- Management of Creative Industries

- IT Management

- Operations and Quality Management

- Marketing Management

- Financial Technology

- Fashion Management

- Financial Management

- Advertising

Go to your profile page to get personalised recommendations!

- Aviation and Astronautical Sciences

- Computer Science, Artificial Intelligence and Data Science

- Construction and Facilities

- Critical Infrastructure

- Cyber & Information Security

- Cyberpsychology

- Engineering

- Engineering Technologies

- Intelligence and Global Security Studies

- Management of Technology

- Occupational Safety and Health

- Uncrewed Systems

- Doctoral Degrees

- Master's Degrees

- Bachelor's Degrees

- Online Programs

- Associate Degrees

- Certificates

- Minor Degrees

- STEM Events

- Webinars and Podcasts

- Master's

- Undergraduate

- Transfer Students

- Military and Veterans

- International Students

- Admissions Counselor

- Capitol Connections

- Accepted Students

- Project Lead the Way

- Builder Culture

- Campus Life

- Clubs and Organizations

- Centers and Labs

- Online Classes

- The Capitol Commitment

- Top Employers

- Co-ops and Internships

- Professional Education

- Find a Mentor

- Career Services

- Capitol Online Job Board

- Recruiters and Employers

- Why Capitol Tech

- At a Glance

- Mission, Vision and Goals

- Diversity, Equity and Inclusion

- Washington, D.C.

- Capitol History

- Capitol Partners

- News and Events

- Visitors/Campus

- Accreditation

- Recognitions & Awards

- Current Students

- Faculty & Staff

- Alumni & Giving

- News & Events

- Capitology Blog

- Maps / Directions

- Degrees and Programs

Doctor of Philosophy (PhD) in Occupational Risk Management

- Request Information

The PhD in Occupational Risk Management degree is for current professionals in the safety and occupational construction field. The degree provides a path for Occupational Risk Management personnel to explore new ground in the rapidly evolving world of the commercial and governmental safety and industrial construction, also hygiene. Students pursue a deep proficiency in this area using an interdisciplinary methodology, cutting-edge research, and dynamic faculty. Graduates will contribute significantly to the Occupational Risk Management field through the creation of new knowledge, ideas, and technology. The Ph.D. in Occupational Risk Management program is designed as a doctorate by research where students will quickly become able to engage in leadership, research, and publishing.

Why Capitol?

Expert guidance in doctoral research

Capitol’s doctoral programs are supervised by faculty with extensive experience in chairing doctoral dissertations and mentoring students as they launch their academic careers. You’ll receive the guidance you need to successfully complete your doctoral research project and build credentials in the field.

Proven academic excellence

Study at a university that specializes in industry-focused education in technology fields, with a faculty that includes many industrial and academic experts.

Program is 100% Online

Our Ph.D. in Occupational Risk Management is offered 100% online. Once you are accepted, all you need is an internet connection and you can attend class.

Key Faculty

Degree Details

This program may be completed with a minimum of 60 credit hours, but may require additional credit hours, depending on the time required to complete the dissertation/publication research. Students who are not prepared to defend after completion of the 60 credits will be required to enroll in RSC-899, a one-credit, eight-week continuation course. Students are required to be continuously enrolled/registered in the RSC-899 course until they successfully complete their dissertation defense/exegesis.

The student will produce, present, and defend a doctoral dissertation after receiving the required approvals from the student’s Committee and the PhD Review Boards.

Prior Achieved Credits May Be Accepted

PhD in Occupational Risk Management- 60 credits

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

|

| 6 |

Program Objectives:

- Students will evaluate the need for Occupational Risk Management applications and solutions.

- Students will demonstrate advanced knowledge and competencies needed for the future in Occupational Risk Management.

- Students will analyze and synthesize theories, tools, and frameworks used in Occupational Risk Management.

- Students will execute a plan to complete a significant piece of scholarly work in Occupational Risk Management.

- Students will develop the skills to implement Occupational Risk Management plans and strategies.

Learning Outcomes:

Upon graduation:

- Graduates will incorporate the theoretical basis and practical applications of Occupational Risk Management into their professional work.

- Graduates will demonstrate the highest mastery of the needs of Occupational Risk Management.

- Graduates will evaluate complex problems, synthesize divergent/alternative/contradictory perspectives and ideas fully, and develop advanced solutions to Occupational Risk Management challenges.

- Graduates will contribute to the body of knowledge in the study of Occupational Risk Management.

- Graduates will be leaders in solving Occupational Risk Management problems.

Tuition & Fees

Tuition rates are subject to change.

The following rates are in effect for the 2024-2025 academic year, beginning in Fall 2024 and continuing through Summer 2025:

- The application fee is $100

- The per-credit charge for doctorate courses is $950. This is the same for in-state and out-of-state students.

- Retired military receive a $50 per credit hour tuition discount

- Active duty military receive a $100 per credit hour tuition discount for doctorate level coursework.

- Information technology fee $40 per credit hour.

- High School and Community College full-time faculty and full-time staff receive a 20% discount on tuition for doctoral programs.

Find additional information for 2024-2025 doctorate tuition and fees.

Need more info, or ready to apply?

- Graduate Programs

- Prospective Students

- Current Students

- Faculty & Staff

- Degree Programs >

PHD, Business Administration: Risk Management & Insurance

The Risk Management and Insurance PhD program is designed to give students an understanding of both theoretical and applied aspects of insurance and risk management.

Degree Type: Doctoral

Degree Program Summary:

The Ph.D. program in risk management and insurance is designed to prepare students for teaching and research at universities and colleges and for positions in government and business. The program is individualized to allow for specializing in various areas within the field of risk management and insurance. By supplementing courses with other programs in the Terry College of Business Administration, the student has choices in the direction and concentration of his or her desired specialty. For example, graduate students can combine their insurance program with law, economics, quantitative methods, finance, management, marketing, or accounting. This flexibility gives the student a wide degree of latitude in choosing a program that corresponds with a specific career path.

Student enrolling in the PhD Program in Business Administration select a major field of study from one of the following business areas: Accounting, Finance, Management, Management Information Systems, Marketing, Real Estate, and Risk Management & Insurance. Students are also required to select a minor field and obtain a competency in research methodology. The minor field and research methodology courses may be chosen from inside or outside the Terry College of Business. The research apprenticeship, composed of 3 hours of coursework, is also taken under the guidance of a major professor and involves research-oriented activities that help the student develop skills needed to undertake a dissertation.

Following the completion of the coursework, comprehensive preliminary examinations, both written and oral, are required. These examinations are administered by the graduate faculty in each area of the student’s program of study. The written exam tends to focus on the student’s knowledge of the major field and research methods. The oral examination assesses the integration of the technical competencies in the foundation, the major and minor fields, and the research methodology. A dissertation completes the program. The PhD Dissertation Advisory committee works with the student on all aspects of the dissertation study.

Please use the links provided above if you would like to learn more about the PhD program structure and plan of study for a particular area. These links also serve as a portal to information provided by the individual areas.

Locations Offered:

Athens (Main Campus)

College / School:

Terry College of Business

600 S. Lumpkin Street Athens, GA 30605

Department:

Risk Management & Insurance

Graduate Coordinator(s):

David Eckles

Phone Number:

706-542-3578

Search for another degree

Find your graduate program.

Offering 200+ degrees, certificates and programs of study, we’ll help you get started on your graduate journey.

or

Search by keyword, program of study, department or area of interest

Interested in earning both a bachelor’s & master’s degree in five years or less?

Learn more about Double Dawgs .

Unlocking potential. Building futures.

Apply Today

The Graduate School Brooks Hall 310 Herty Drive Athens, GA 30602 706.542.1739

- Administration

- Graduate Bulletin

- Strategic Plan

- Virtual Tour

- Submit a Complaint

- Request Information

- Requirements

- Application Fee

- Check Status

- UGA Main Campus

- UGA Gwinnett

- UGA Griffin

- UGA Atlanta-Buckhead

Majors & Careers

Online programs, certificates, hire our students, which program is right for me, certificates & capstones, for companies.

- Executive Education

Faculty & Research

- Knowledge Centers

Discover renowned faculty who guide innovation.

News & publications, get involved, recruit & hire.

- Alumni Spotlights

Initiatives & Values

Trusted to lead, popular searches.

- Undergraduate Business Majors

- Life in Madison

- Entrepreneurship programs

- Compare MBA programs

- Faculty Expertise

- MS in Business Analytics

- Specialized Master’s Programs

- Search for: Search

- Undergraduate (BBA) Overview

- Majors Overview

- Accounting Major

- Actuarial Science Major

- Finance, Investment, and Banking Major

- Information Systems Major

- Management and Human Resources Major

- Marketing Major

- Operations and Technology Management Major

- Real Estate Major

- Risk Management and Insurance Major

- Supply Chain Management Major

- Admissions Overview

- High-School Student Admissions

- Current UW-Madison Student Admissions

- Transfer Student Admissions

- Tuition & Aid

- Class Profile

- Admissions FAQs

- Leadership Opportunities

- Business Badger Badges

- Student Organizations

- Diversity, Equity & Inclusion

- Academic Advising

- Success Coaching

- Scholarships

- Learning Communities

- Mental Health & Wellness

- Study Abroad Programs

- Applying to Study Abroad

- Study Abroad Advising

- Resources for UW–Madison Students Studying Abroad

- Study Abroad FAQs

- Student Experiences

- Study Abroad Events

- Incoming Students

- Events & Visits

- Student Ambassadors

- Precollege Programs

- Business Emerging Leaders (BEL) Scholarship Program

- Human Resources

- Certificates Overview

- Certificate in Business

- Summer Certificate in Business Fundamentals

- Entrepreneurship Certificate

- Certificate in Accounting

- International Business Certificate

- Consulting Certificate

- Recruit & Hire

- Compare Graduate Programs

- Compare MBA Programs

- Full-Time MBA Overview

- Specializations Overview