What is Desk Research? A Guide + Examples

Desk research can help you make data-driven decisions, define or adapt strategies, and uncover untapped market potential to drive growth – when it’s done right!

Nowadays, we have all the information we need at our fingertips; but knowing where to find the right data quickly is key.

So, what is desk research? What does it involve, and how can Similarweb Research Intelligence help?

Let’s find out.

What is desk research?

Desk research is a type of market research that uses existing data to support or validate outcomes and conclusions. Also known as secondary research , it’s a cost-effective way to obtain relevant data from a broad range of channels.

How is desk research used?

From small start-ups to established businesses, doing desk research provides you with crucial insights into trends, competitors, and market size . Whatever you do, desk research can help with product positioning and guide data-driven business decisions that help you become the ultimate competitor and find new ways to grow.

According to the latest data on the Internet of Things , around 130 new devices connect to the web every second. Stats on the state of data show we create and consume data at an exponential rate–data interactions will only continue to rise.

Primary vs. secondary research – what’s the difference?

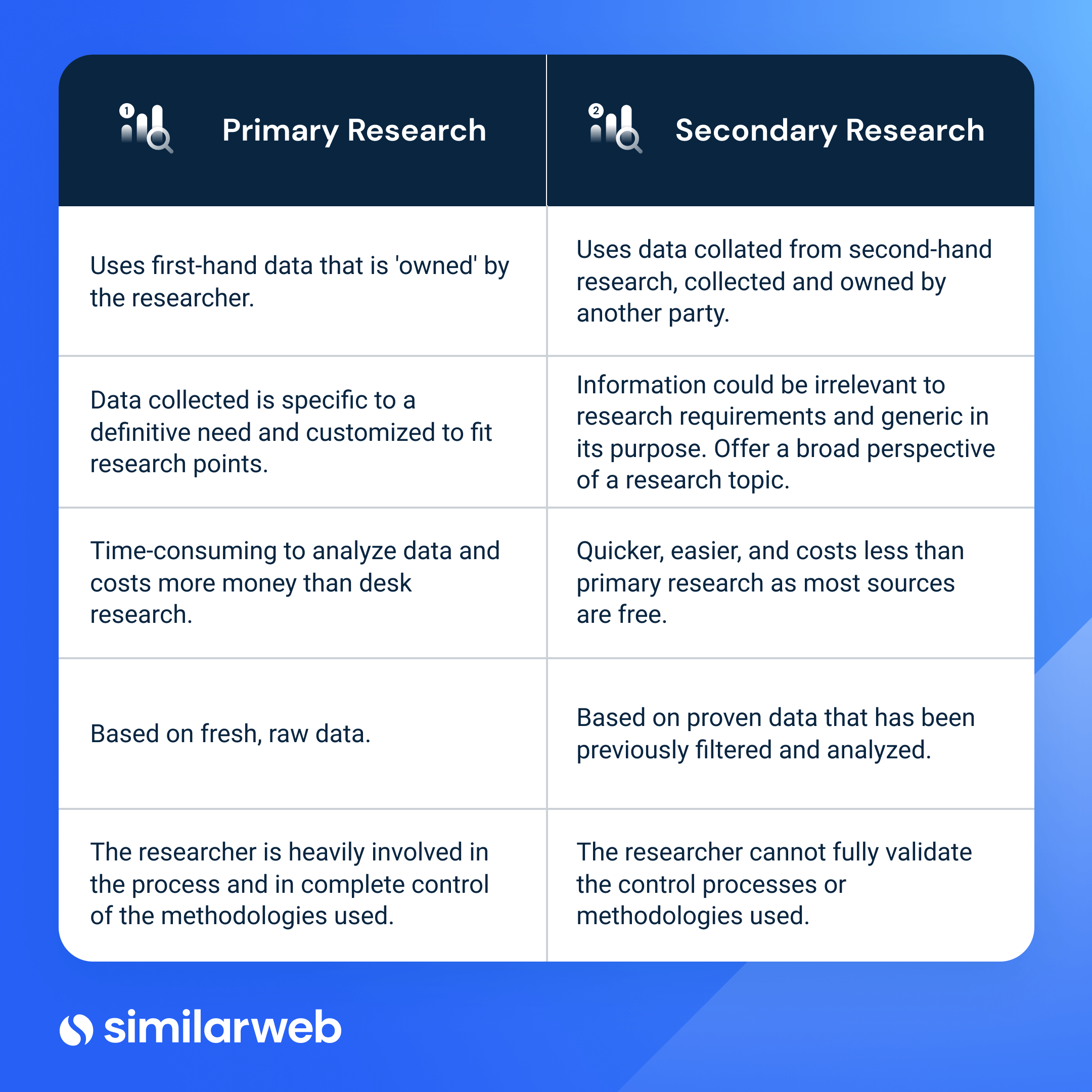

Most market research methods fall into either primary or secondary research. When we talk about desk research, we tend to focus only on secondary methods. However, most primary research can also be done remotely, from a desk.

Primary research is self-conducted research that gathers data to answer questions. It usually involves going directly to a source, such as a customer or a prospect. Compared to secondary research, it takes longer, costs more, and demands more resources. Primary research methods include interviews, market research surveys , questionnaires, competitor reviews, market mapping , focus groups, etc.

Secondary research is the synthesis or summary of existing research using previously gained information from various sources. Most market research starts with secondary research: It aims to provide a researcher or analyst with a basis of knowledge formed from existing data. Secondary research methods include collecting data from the internet, government databases, reports, and academic journals, to name just a few.

Pros and cons of desk research

As with any type of market research, you need to choose the right method to deliver the best outcome for your research goal. Desk research is advantageous for several reasons, but it won’t always suit every market research project. Market research best practice tells us that we should use desk-based research before primary research – as this helps to reduce or refine the scope of the work before the second, more costly phase.

Here’s a summary of the pros and cons of desk research.

Advantages of desk-based research

Doing secondary market research is highly beneficial; here’s why.

- Low cost – most secondary research sources are low-to-no cost.

- Speed – as the data already exists, data collection is quick.

- Clarity – desk research drives & add-value to primary research actions.

- Scalability – due to the large datasets used in secondary research.

- Availability – pre-collected data is readily available to analyze.

- Insightful – get valuable insights and help resolve some initial research questions.

Disadvantages of desk-based research

As any good researcher will attest, it’s always good to look at a topic from every angle. Here are a few things to consider before starting any secondary research process.

- Out of-date data – consider if the coverage dates of the research are relevant. In a fast-moving market, having access to up-to-date information could be critical.

- Lack of perceived control over the data – secondary research is undertaken by a third party; as such, methodology controls need to be reviewed with caution.

- No exclusivity – desk research data is widely available and can be used by other researchers.

- Verification & interpretation – particularly when working with large data sets, it can take time to analyze and review to ensure the information is suitable for your research.

Types of desk-based research

Nowadays, you can do most market research from a desk. Here, I’ll focus solely on secondary research methods: Where finding and using the right resources is key. The data you use needs to be up-to-date and should always come from a trusted source.

Desk research methods – internal data resources

Before stepping into external research, look for any relevant internal sources. This data can often prove invaluable, and it’s a great place to start gathering insights that only you can see. The information is already yours, so aside from the fact it won’t cost a dime, it’s data your rivals won’t have access to.

Sources of internal information that can help you do desk research include:

- Historical campaign and sales analysis: Everything from website traffic and conversions through to sales. Accessible through your own analytics platform(s).

- Website and mobile application data: Your own platforms can also tell you where users are – such as the device split between mobile and desktop.

- Existing customer information: audience demographics , product use, and efficiency of service.

- Previous research conducted by other analysts: Even if the research seems unrelated, there could be indicative information within.

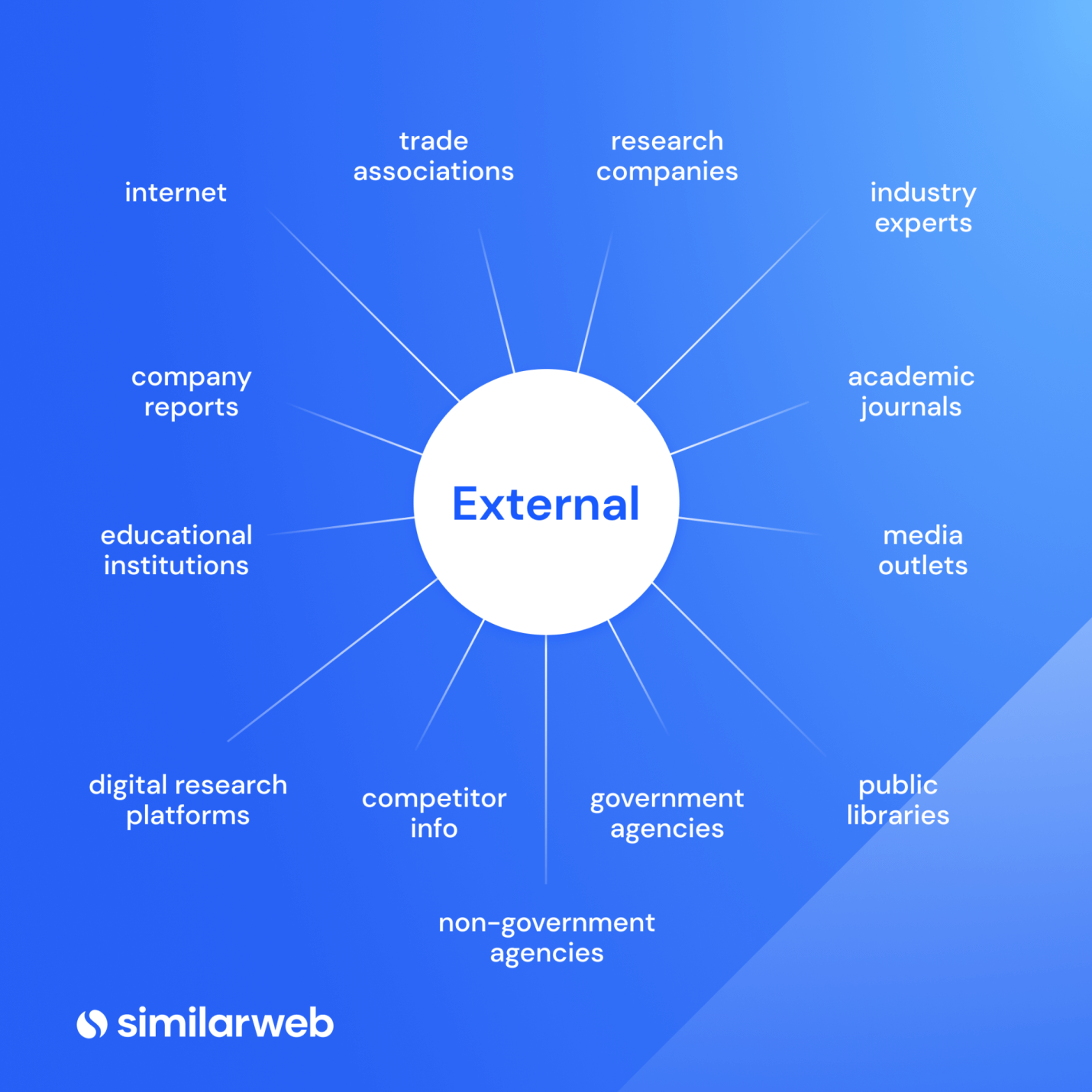

Desk research methods – external data resources

Using external data sources for desk research is an ideal way to get information about market trends, and explore a new topic.

- The internet: A virtual aggregator of all secondary research sources – always validate findings with credible sources.

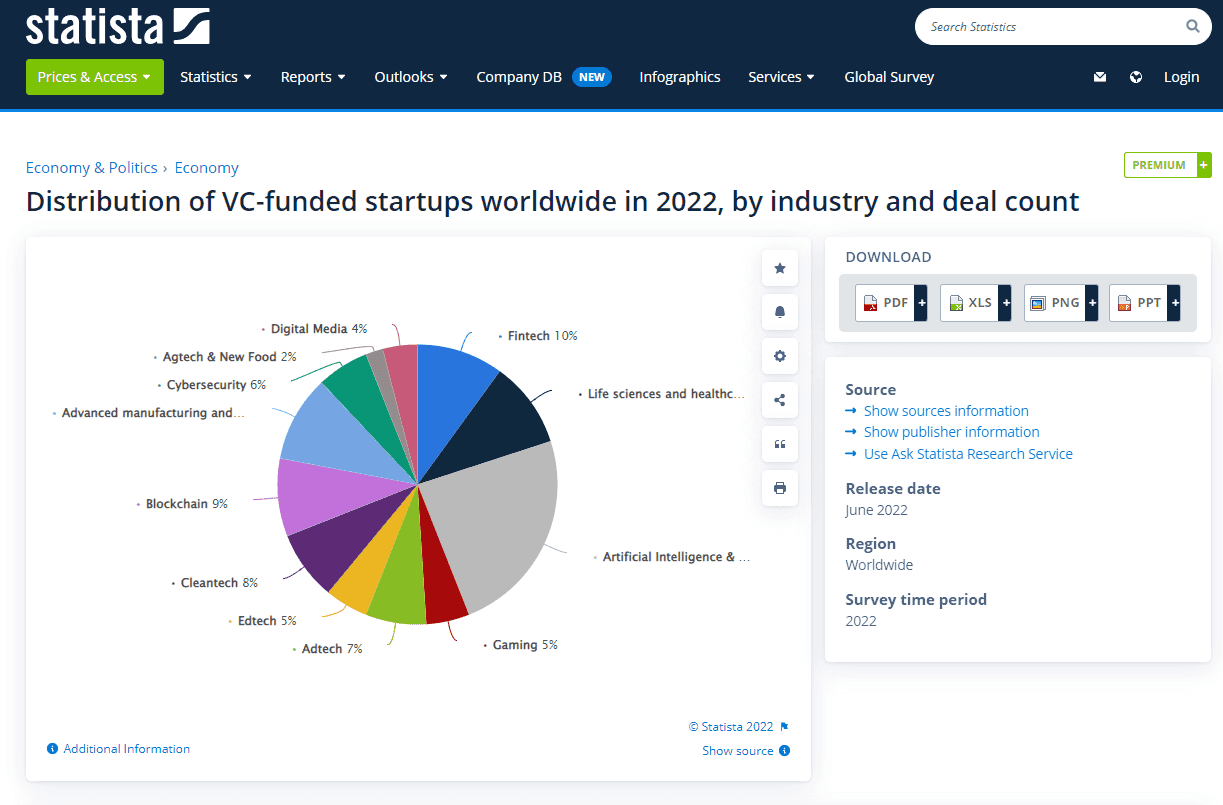

- Commercial resources: Research associations and company reports usually cost money but give you data that’s specific to your industry/aim.

- Trade association reports: To see if there’s a trade association of interest, do a quick search online or use the Encyclopedia of Associations , the Directory of Associations , or the National Trade and Professional Associations Directory

- Industry Experts: Expert consultancy is an efficient way of getting information from someone who has ‘been there, done that.’ Also, consider ‘influencers.’

- Research associations & journals: Most research associations are independent and offer bespoke, specialized reports.

- Media coverage: TV, radio, newspapers, and magazines can often help uncover facts and relevant media stories related to your topic.

- Market research intelligence software: Platforms like Similarweb give you actionable insights into industry and competitors’ trends. With access to mobile app intelligence, you get a complete picture of the digital landscape.

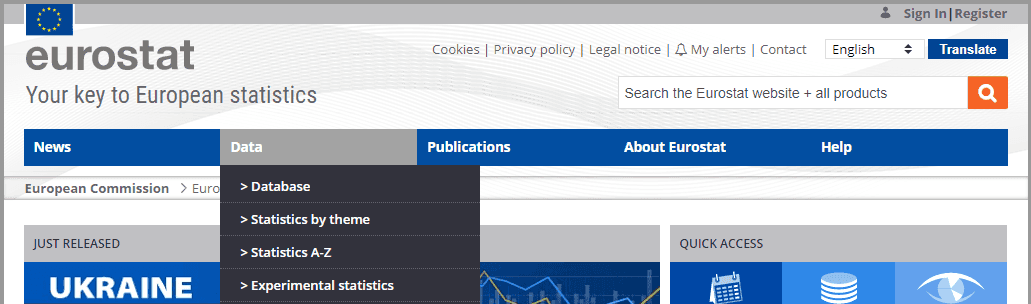

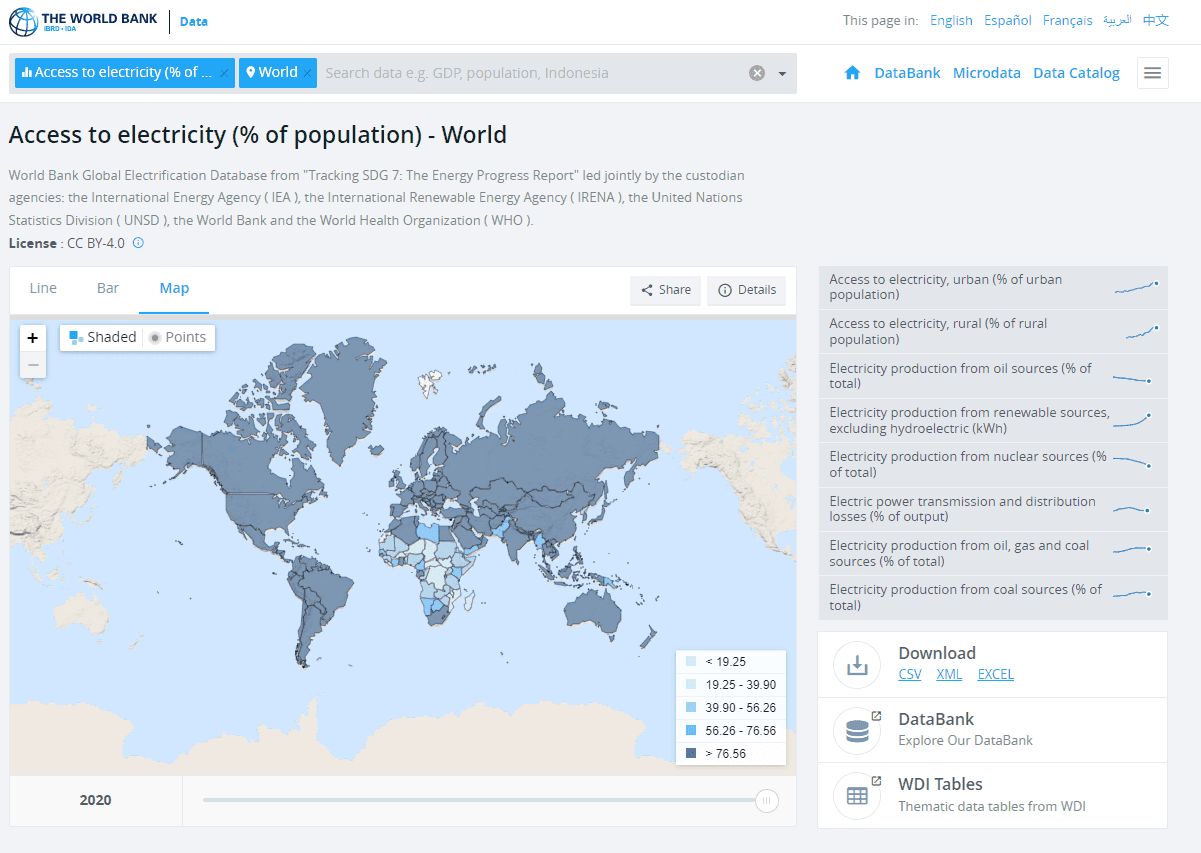

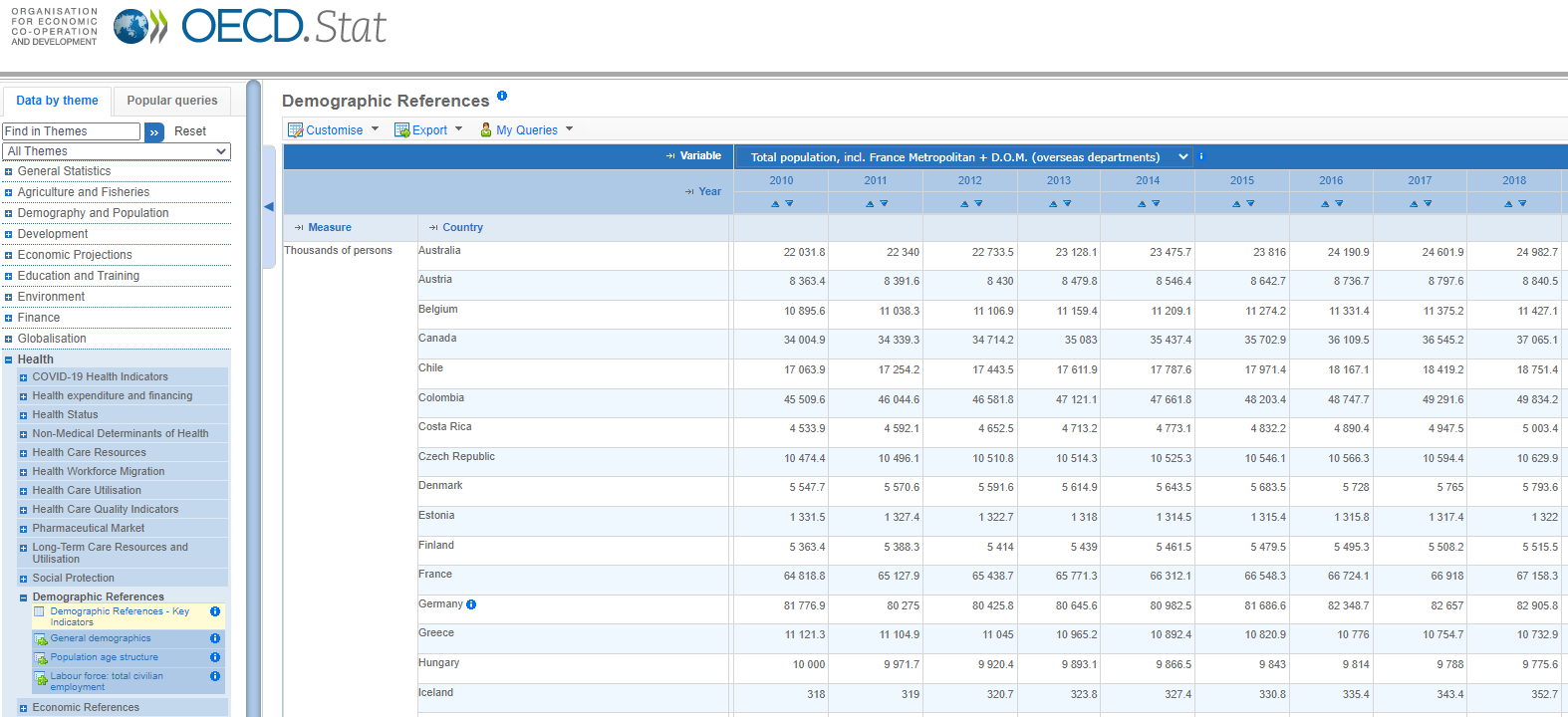

- Government & non-government agencies: In the US, the biggest generator of data is the federal government. US Census Bureau , Congressional Research Service , US Government Publishing Office , US Small Business Administration , and the Department of Education . Most information from these sources is free.

- Local government sites: A reliable source to find data on population density or employment trends.

- Public library records: Access data via the Digital Public Library of America in the US or the National Archives in the UK.

- Competitor information: Sign-up for mailing lists, view comparison reports, and read online reviews.

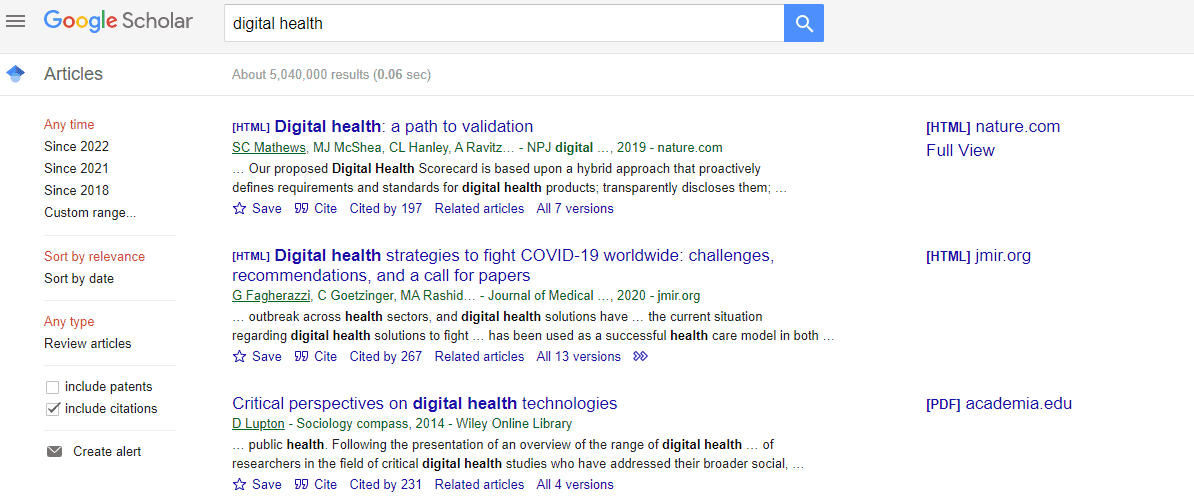

- Educational institutions: Academic research papers and journals are well-researched. If you can find a relevant one, you’ll likely get solid data from credible sources.

How to choose the best type of desk research

With so many freely-available sources online for desk-based research; it’s easy to feel overwhelmed. The best guidance I can offer is to keep a list of key questions you are trying to answer with this research, and consider:

- What are you hoping to learn from your research?

- Why is this data relevant?

- Is there an action you can take from this information?

- How up-to-date is the data you are using?

Always keep the questions you’re trying to answer front of mind. It’ll help you stay focused and keep your desk research on the right track. Time and money will usually determine the right type of desk research to use, but, even then, it’s important to stay focussed on where you spend your time vs. the return on that investment.

Inspiration: This article outlines some of the best market research questions to ask.

How to do desk research in five steps

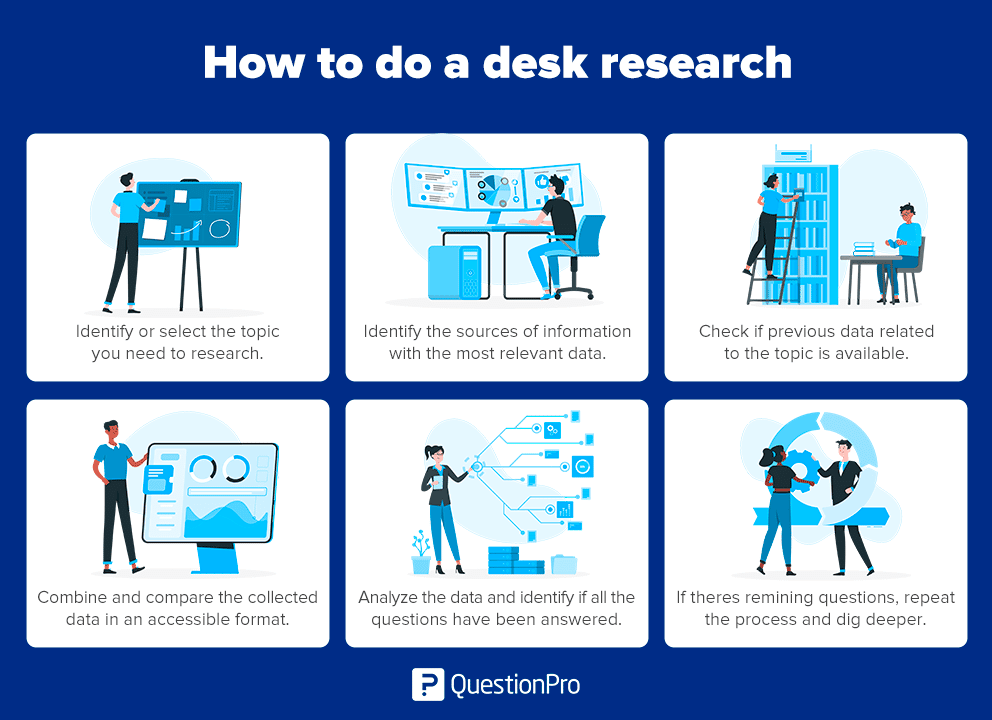

Follow these steps to guide you through doing desktop research:

1. Clearly define your research topic Identify your topic and its purpose, then list any relevant research attributes.

2. Select appropriate resources Make a list of sources that’ll provide relevant information for your research topic.

3. Look for existing data Once you’ve collated your research sources, look for internal and external data relevant to your research topic. Remember to only use data from authentic sources.

4. Collate, compare & assemble Next, you’ll need to collate all the data you’ve obtained, remove any duplication, and bring it together into a usable format.

5. Data analysis The final step of doing desk research is to analyze the data. At this point, you should be able to see if your research questions have been answered. If any questions remain unanswered, go back to step 2, and look for alternative resources that will help you get clearer insights.

Desk-based research tools

Online resources are by far your most valuable asset for doing secondary research. However, software like Similarweb Digital Intelligence , Google Analytics (GA), and Google Search Console (GSC) can save you time and give you a more visually-appealing view of relevant data.

My list of go-to tools for desk research includes:

- Google Analytics & Search Console – your own site’s performance and visitor stats.

- Similarweb Digital Research Intelligence – uncover market, industry & competitor trends across web, mobile, and apps.

- Tableau – data visualization for presenting your findings.

- Competitor data – on rival’s websites, newsletters, and social media accounts.

Read: The best market research tools of 2023

Note that GA and GSC are free to use but limited in terms of what you can see outside your own site. With Similarweb, you can access virtually limitless industry-wide data.

Stop Guessing, Start Analyzing

Get actionable insights for desk research here

How Similarweb helps with desk research

Here are just a few examples of how Similarweb Digital Research Intelligence can help you with secondary research.

- Benchmarking yourself against your industry – Benchmarking suite

- Understand how competitor websites and apps perform – Company research module

- Get a full picture of your industry – Market research & industry analysis tools

- Understand how apps are impacting your market – App Intelligence

- Analyze consumer behavior – Audience analysis tool

- Understand the complete customer journey – Consumer journey tracker

Using research intelligence tools will save you time and money while removing bias from the data – ultimately giving you clarity and a complete view of the digital world relevant to your research topic.

Success Story: See how Airbnb uses Similarweb to reveal growth opportunities in new markets .

Desk research examples with Similarweb

A good example of desk research in action is looking into an industry to uncover market leaders, trends, relevant search trends, and an overview of a complete industry. Using the market analysis module in Similarweb, you can find out exactly what’s happening in your market, and make data-driven decisions that’ll help you increase market share , and drive faster, more sustainable business growth.

For this particular desk research example, I chose the airline industry.

Let’s dive in.

Industry Overview

See a snapshot of industry traffic and engagement metrics . This data is typically based on Similarweb’s index of the top 100 websites in a chosen vertical. You can easily create a custom industry , allowing you to do competitive benchmarking against specific companies in your market.

Industry Leaders

Quickly see who is winning in an industry using the Market quadrant analysis graph and industry leaders table. Analyze top-performing websites in your vertical, and dive into their traffic and engagement performance to view bounce rates, visit duration, monthly visits, month-on-month changes, unique visitors, pages/visits, and traffic share .

Industry Trends

Analyze trends in near real-time so you can take action when it matters most–not a quarter later. Create a personalized view of your industry for in-depth analysis and make informed decisions that will help you grow your market share.

Marketing Channels

Access valuable traffic metrics and insights for each marketing channel. See data for direct, social, display ads, paid search, referrals, emails, and organic traffic channels and evaluate performance for each. Uncover opportunities to grow your own traffic share, evaluate engagement and quality of traffic, and identify trends over time.

Search Trends (within an industry)

Discover trending topics and emerging search terms in any industry. View what’s trending, search volume, % change, volume trend, and traffic leaders for both branded and non-branded search in your sector. Use these insights to get an understanding of market demand, search intent, and audience interests within a specific category, brand, or product.

Demographics

Gain crucial insights into the audiences visiting your website, your competitors’ websites, and your industry as a whole. See gender and age distribution across web, mobile, or combined traffic channels, and compare your demographics with that of your rivals.

The market analysis element of Similarweb will help you answer some of your most important research questions, such as:

- How a specific industry grew over time

- Who the top and emerging players are in your industry

- Which products or services are trending and/or what are consumers searching for

- What demographics are relevant to you, and your competitors

The app intelligence module completes the picture and gives you a broad view of the digital landscape across your market. You can quickly see how apps are impacting your industry, and look at download, engagement, installs, ranking, and more.

Here, I’m sticking with the airline industry to establish whether or not android or iOS is the best fit for a new app. Immediately, I can see there are between 1-1.5M monthly active users on iOS vs. an equivalent of around 350,000k on Android.

Like what you see? Take a tour of Similarweb for yourself.

Discover industry insights for desk research here

Wrapping up

Good desk research helps you quickly uncover key information that can shape and steer successful market research projects. When done right, you’ll be able to answer questions and discover crucial data about your industry, competitors, and key trends to consider while building a strategy for growth.

Asking the right research questions from the onset and keeping these at the forefront of your mind throughout will save time and help direct your market analysis in the right direction.

Is desk-based research free?

Depending on the method used, desktop research can be done for free. If you require industry or government agency reports, these often carry a charge but are more likely to be free from bias when compared to commercially produced reports that (sometimes) receive sponsorship.

Which businesses can utilize secondary desk research?

Desk-based research can uncover crucial insights into market trends, market sizing, and competitors. The information can be used by any size business to help guide strategic decision-making and help refine a product’s positioning.

Should you do secondary research before primary research?

Absolutely, yes. Secondary research should always come before primary or field research. The formative research phase helps pinpoint where more in-depth primary research is required. Desk research can also verify and support findings from field research but should not replace primary research–as they are each utilized under different circumstances.

Who does desk-based research?

Desk research can ‘technically’ be done by anyone, but it’s typically performed by a researcher, an analyst, or a marketing professional. Good market research has solid foundational data to drive critical business decisions. Experienced researchers and analysts are best-placed to spot opportunities, trends, and patterns when the stakes are this high.

So, while anybody can access secondary data free of charge, investing the necessary resources to do things right to get the most out of the process is essential.

Related Posts

Demand Forecasting 101: How to Predict Future Demand For Your Products

US Financial Outlook: Top Trends to Watch in 2024

Top Economic Trends in Australia to Watch in 2024

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Desk Research: What it is, Tips & Examples

What is desk research?

Desk research is a type of research that is based on the material published in reports and similar documents that are available in public libraries, websites, data obtained from surveys already carried out, etc. Some organizations also store data that can be used for research purposes.

It is a research method that involves the use of existing data. These are collected and summarized to increase the overall effectiveness of the investigation.

Secondary research is much more cost-effective than primary research , as it uses existing data, unlike primary research, in which data is collected first-hand by organizations, companies, or may employ a third party to obtain the data in your name.

LEARN ABOUT: Data Management Framework

Desk research examples

Being a cost-effective method, desk research is a popular choice for businesses and organizations as not everyone can pay large sums of money to conduct research and collect data. That is why it’s also called “ documentary research “.

Here are some more common secondary research methods and examples:

1. Data available on the Internet: One of the most popular ways to collect data for desk research is through the Internet. The information is available and can be downloaded with just one click.

This data is practically free or you may have to pay a negligible amount for it. Websites have a lot of information that companies or organizations can use to meet their research needs. However, you need to consider a reliable website to collect information.

2. Government and non-government agencies: Data for secondary research can also be collected from some government and non-government agencies. There will always be valuable and relevant data that companies or organizations can use.

3. Public libraries: Public libraries are another good source to search for data by doing desk research. They have copies of important research that has been done before. They are a store of documents from which relevant information can be extracted.

The services offered at these public libraries vary. Most often, they have a huge collection of government publications with market statistics, a large collection of business directories, and newsletters.

4. Educational Institutions: The importance of collecting data from educational institutions for secondary research is often overlooked. However, more research is done in colleges and universities than in any other business sector.

The data collected by universities is mainly used for primary research. However, companies or organizations can go to educational institutions and request data.

5. Sources of business information: Newspapers, magazines, radio and television stations are a great source of data for desk research. These sources have first-hand information on economic developments, the political agenda, the market, demographic segmentation and similar topics.

Companies or organizations can request to obtain the most relevant data for their study. Not only do they have the opportunity to identify your potential customers, but they can also learn the ways to promote their products or services through these sources, as they have a broader scope.

Differences between primary research and Desk Research

How to do a desk research.

These are the steps to follow to conduct a desk investigation:

- Identify the research topic: Before you begin, identify the topic you need to research. Once done, make a list of the attributes of the research and its purpose.

- Identify research sources: Subsequently, explain the sources of information that will provide you with the most relevant data applicable to your research.

- Collect existing data: Once the sources of information collection have been narrowed, check to see if previous data is available that is closely related to the topic. They can be obtained from various sources, such as newspapers, public libraries, government and non-government agencies, etc.

- Combine and compare: Once the data is collected, combine and compare it so that the information is not duplicated and put it together in an accessible format. Make sure to collect data from authentic sources so you don’t get in the way of your investigation.

- Analyze data: Analyze the data that is collected and identify if all the questions have been answered. If not, repeat the process to dig deeper into practical ideas.

- Most of the information is secondary research and readily available. There are many sources from which the data you need can be collected and used, as opposed to primary research, where data must be collected from scratch.

- It is a less expensive and time-consuming process, as the required data is readily available and does not cost much if it is extracted from authentic sources.

- The data that is collected through secondary or desktop research gives organizations or companies an idea about the effectiveness of primary research. Thus, a hypothesis can be formed and the cost of conducting the primary research can be evaluated.

- Doing desk research is faster due to the availability of data. It can be completed in a few weeks, depending on the objective of the companies or the scale of the data required.

Disadvantages

- Although the data is readily available, the credibility and authenticity of the available information must be assessed.

- Not all secondary data resources offer the latest reports and statistics. Even when they are accurate, they may not be up to date.

Desk research is a very popular research method, because it uses existing and reliable data that can be easily obtained. This is a great benefit for businesses and organizations as it increases the effectiveness of the investigation.

QuestionPro provides the best market research platform to uncover complex insights that can propel your business to the forefront of your industry.

START A FREE TRIAL

MORE LIKE THIS

Trend Report: Guide for Market Dynamics & Strategic Analysis

May 29, 2024

Cannabis Industry Business Intelligence: Impact on Research

May 28, 2024

Top 10 Dynata Alternatives & Competitors

May 27, 2024

What Are My Employees Really Thinking? The Power of Open-ended Survey Analysis

May 24, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

What Is Desk Research? Meaning, Methodology, Examples

Apr 4, 2024

10 min. read

Research in the digital age takes many shapes and forms. There are traditional methods that collect first-hand data via testing, focus groups, interviews, and proprietary data. And then there are ways to tap into the time and effort others have put into research, playing “armchair detective” by conducting desk research .

Desk research gives you a shortcut to insights by pulling data from other resources, which is crucial for understanding the customer journey . It takes less time and is more cost-effective compared to conducting primary market research . Most importantly, it can give you the consumer insights you need to make important business decisions.

Let’s explore the official desk research definition along with types of desk research, methodologies, examples, and how to do desk research effectively.

Desk Research Meaning: What is Desk Research?

Advantages and limitations of desk research, desk research methodology and methods, how to conduct desk research effectively, best practices for desk research, applications of desk research, how to conduct desk research with meltwater.

Desk Research definition: Desk research, also known as secondary research or complementary research , involves gathering information and data from existing sources, such as books, journals, articles, websites, reports, and other published materials. Users analyze and synthesize information from already available information.

Companies use desk research at the onset of a project to gain a better understanding of a topic, identify knowledge gaps, and inform the next stages of research. It can also supplement original findings and provide context and background information.

Desk research gives marketers attractive advantages over traditional primary research, but it’s not without its shortcomings. Let’s explore these in more detail.

Desk research advantages

- Quick insights. Conducting interviews, focus groups, panels, and tests can take weeks or even months, along with additional time to analyze your findings. With desk research, you can pull from existing information to gain similar results in less time.

- Cost-effectiveness. Desk market research is usually less expensive than primary research because it requires less time and fewer resources. You don’t have to recruit participants or administer surveys, for example.

- Accessibility. There’s a world of data out there ready for you to leverage, including online databases, research studies, libraries, and archives.

- Diverse sources. Desk market research doesn’t limit you to one information source. You can use a combination of sources to gain a comprehensive overview of a topic.

Want to see how Meltwater can supercharge your market research efforts? Simply fill out the form at the bottom of this post and we'll be in touch.

Desk research limitations

- Data quality. Marketers don’t know how reliable or valid the data is, which is why it’s important to choose your sources carefully. Only use data from credible sources, ideally ones that do not have a financial interest in the data’s findings.

- Less control. Users are at the mercy of the data that’s available and cannot tailor it to their needs. There’s no opportunity to ask follow-up questions or address specific research needs.

- Potential bias. Some sources may include biased findings and/or outdated information, which can lead to inaccurate conclusions. Users can mitigate the risk of bias by relying only on credible sources or corroborating evidence with multiple sources.

Desk research typically involves multiple sources and processes to gain a comprehensive understanding of an idea. There are two main desk methodologies: qualitative research and quantitative research .

- Qualitative research refers to analyzing existing data (e.g., interviews, surveys, observations) to gain insights into people's behaviors, motivations, and opinions. This method delves deeper into the context and meaning behind the data.

- Quantitative research refers to analyzing and interpreting numerical data to draw conclusions and make predictions. This involves quantifying patterns and trends to find relationships between variables.

Both desk research methodologies use a variety of methods to find and analyze data and make decisions.

Examples of desk research methods include but are not limited to:

- Literature review. Analyze findings from various types of literature, including medical journals, studies, academic papers, books, articles, online publications, and government agencies.

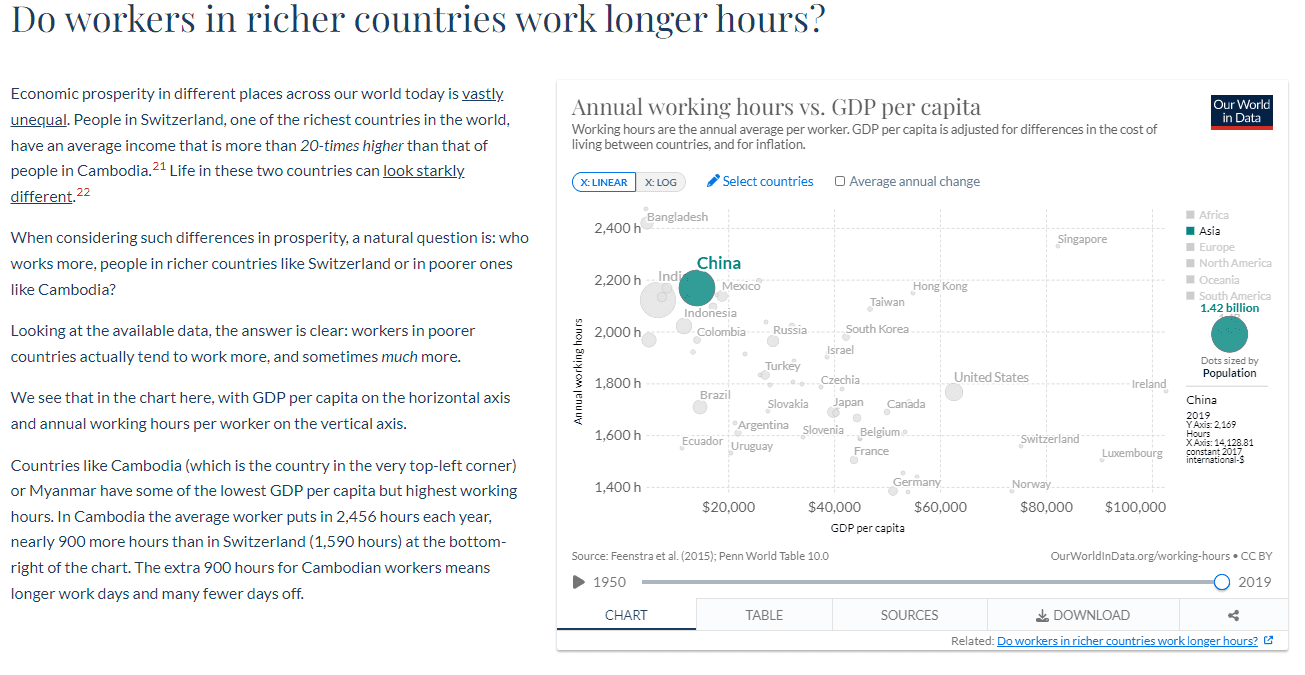

- Competitor analysis . Learn more about the products, services, and strategies of your competitors, including identifying their strengths and weaknesses, market gaps, and overall sentiment.

- Social listening . Discover trending topics and sentiments on social media channels to learn more about your target audience and brand health.

- Consumer intelligence . Understand your audience based on digital behaviors, triggers, web usage patterns, and interests.

- Market research . Analyze market reports, industry trends, demographics, and consumer buying patterns to identify market opportunities and strengthen your positioning.

Now let’s look at how to use these methods to their full potential.

While desk research techniques can vary, they all follow a similar formula. Here’s how you can conduct desk research effectively, even if it’s your first time.

1. Define your objective

Desk research starts with a specific question you want to answer.

In marketing , your objective might be to:

- Learn about Gen Z buying behaviors for home goods

- Gauge the effectiveness of influencer marketing for food brands

- Understand the pain points of your competitor’s customers

These questions can help you find credible sources that can provide answers.

2. Choose reliable data sources

Based on your objectives, start collecting secondary data sources that have done the heavy lifting for you. Examples include:

- Market reports (often available as gated assets from research companies)

- Trade publications

- Academic journals

- Company websites

- Government publications and data

- Online databases and resources, such as Google Scholar

- Secondary research companies or market research tools like Meltwater and Linkfluence

- Online blogs, articles, case studies, and white papers from credible sources

In many cases, you’ll use a combination of these source types to gain a thorough answer to your question.

3. Start gathering evidence

Go through your source materials to start answering your question. This is usually the most time-intensive part of desk research; you’ll need to extract insights and do some fact-checking to trust those insights.

One of your top priorities in this step is to use reliable sources. Here are some ways you can evaluate sources to use in your desk research:

- Consider the authority and reputation of the source (e.g., do they have expertise in your subject)

- Check whether the content is sponsored, which could indicate bias

- Assess whether the data is current

- Evaluate the publisher’s peer review processes , if applicable

- Review the content’s citations and references

- Seek consensus among multiple sources

- Use sources with built-in credibility, such as .gov or .edu sites or well-known medical and academic journals

If your source materials have supporting elements, such as infographics, charts, or graphs, include those with your desk research.

4. Cross-reference your findings with other sources

For desk research to be effective, you need to be able to trust the data you find. One way to build trust is to cross-reference your findings with other sources.

For instance, you might see who else is citing the same sources you are in their research. If there are reputable companies using those same sources, you might feel they’re more credible compared to a random internet fact that lacks supporting evidence.

5. Draw your conclusions & document the results

Organize and synthesize your findings in a way that makes sense for your objectives. Consider your stakeholders and why the information is important.

For example, the way you share your research with an internal team might have a different structure and tone compared to a client-facing document.

Bonus tip: Include a list of sources with your documentation to build credibility in your findings.

When conducting desk research, follow these best practices to ensure a reliable and helpful outcome.

Organize and manage your research data

It’s helpful to have a system to organize your research data. This way, you can easily go back to review sources or share information with others. Spreadsheets, databases, and platforms like Meltwater for market research are great options to keep your desk research in one place.

Create actionable recommendations

It’s not enough to state your findings; make sure others know why the data matters. Share the data along with your conclusions and recommendations for what to do next.

Remember, desk research is about decision-making, not the data itself.

Document your sources

Whether you choose to share your sources or not, it’s best practice to document your sources for your own records. This makes it easier to provide evidence if someone asks for it or to look back at your research if you have additional questions.

Now for the big question: How can marketers apply desk research to their day-to-day tasks?

Try these desk research examples to power your marketing efforts.

Use desk research for market intelligence

Markets, preferences, and buying habits change over time, and marketers need to stay up to date on their industries. Desk research can provide market intelligence insights, including new competitors, trends, and audience segments that may impact your business.

Apply desk research in competitive analysis

Desk research can help you identify your true competitors and provide more context about their strengths and weaknesses. Marketers can use this intel to improve their positioning and messaging. For instance, a competitor’s weak spot might be something your company does well, and you can emphasize this area in your messaging.

Include desk research in content strategy and audience analysis

Desk research can support consumer intelligence by helping you define various audience segments and how to market to them. These insights can help you develop content and creative assets on the right topics and in the right formats, as well as share them in the best channels to reach your audience.

Emerging technologies like Meltwater's integrated suite of solutions have a strong impact on desk research, helping you streamline how you find and vet data to support your desired topics.

Using a combination of data science, AI, and market research expertise, Meltwater offers the largest media database of its kind to help marketers learn more about their audience and how to connect with them. Millions of real-time data points cover all niches, topics, and industries, giving you the on-demand insights you need.

Our clients use Meltwater for desk research to measure audience sentiment and identify audience segments as well as to conduct competitor analysis , social listening , and brand monitoring , all of which benefit from real-time data.

Learn more about how you can leverage Meltwater as a research solution when you request a demo by filling out the form below:

Continue Reading

How To Do Market Research: Definition, Types, Methods

How to Gain a Sustainable Competitive Advantage with Porter's 3 Strategies

What Are Consumer Insights? Meaning, Examples, Strategy

Consumer Intelligence: Definition & Examples

The 13 Best Market Research Tools

- Desk Research: Definition, Types, Application, Pros & Cons

If you are looking for a way to conduct a research study while optimizing your resources, desk research is a great option. Desk research uses existing data from various sources, such as books, articles, websites, and databases, to answer your research questions.

Let’s explore desk research methods and tips to help you select the one for your research.

What Is Desk Research?

Desk research, also known as secondary research or documentary research, is a type of research that relies on data that has already been collected and published by others. Its data sources include public libraries, websites, reports, surveys, journals, newspapers, magazines, books, podcasts, videos, and other sources.

When performing desk research, you are not gathering new information from primary sources such as interviews, observations, experiments, or surveys. The information gathered will then be used to make informed decisions.

The most common use cases for desk research are market research , consumer behavior , industry trends , and competitor analysis .

How Is Desk Research Used?

Here are the most common use cases for desk research:

- Exploring a new topic or problem

- Identifying existing knowledge gaps

- Reviewing the literature on a specific subject

- Finding relevant data and statistics

- Analyzing trends and patterns

- Evaluating competitors and market trends

- Supporting or challenging hypotheses

- Validating or complementing primary research

Types of Desk Research Methods

There are two main types of desk research methods: qualitative and quantitative.

- Qualitative Desk Research

Analyzing non-numerical data, such as texts, images, audio, or video. Here are some examples of qualitative desk research methods:

Content analysis – Examining the content and meaning of texts, such as articles, books, reports, or social media posts. It uses data to help you identify themes, patterns, opinions, attitudes, emotions, or biases.

Discourse analysis – Studying the use of language and communication in texts, such as speeches, interviews, conversations, or documents. It helps you understand how language shapes reality, influences behavior, constructs identities, creates power relations, and more.

Narrative analysis – Analyzing the stories and narratives that people tell in texts, such as biographies, autobiographies, memoirs, or testimonials. This allows you to explore how people make sense of their experiences, express their emotions, construct their identities, or cope with challenges.

- Quantitative Desk Research

Analyzing numerical data, such as statistics, graphs, charts, or tables.

Here are common examples of quantitative desk research methods:

Statistical analysis : This method involves applying mathematical techniques and tools to numerical data, such as percentages ratios, averages, correlations, or regressions.

You can use statistical analysis to measure, describe, compare, or test relationships in the data.

Meta-analysis : Combining and synthesizing the results of multiple studies on a similar topic or question. Meta-analysis can help you increase the sample size, reduce the margin of error, or identify common findings or discrepancies in data.

Trend analysis : This method involves examining the changes and developments in numerical data over time, such as sales, profits, prices, or market share. It helps you identify patterns, cycles, fluctuations, or anomalies.

Examples of Desk Research

Here are some real-life examples of desk research questions:

- What are the current trends and challenges in the fintech industry?

- How do Gen Z consumers perceive money and financial services?

- What are the best practices for conducting concept testing for a new fintech product?

- Documentary on World War II and its effect on Austria as a country

You can use the secondary data sources listed below to answer these questions:

Industry reports and publications

- Market research surveys and studies

- Academic journals and papers

- News articles and blogs

- Podcasts and videos

- Social media posts and reviews

- Government and non-government agencies

How to Choose the Best Type of Desk Research

The main factors for selecting a desk research method are:

- Research objective and question

- Budget and deadlines

- Data sources availability and accessibility.

- Quality and reliability of data sources

- Your data analysis skills

Let’s say your research question requires an in-depth analysis of a particular topic, a literature review may be the best method. But if the research question requires analysis of large data sets, you can use trend analysis.

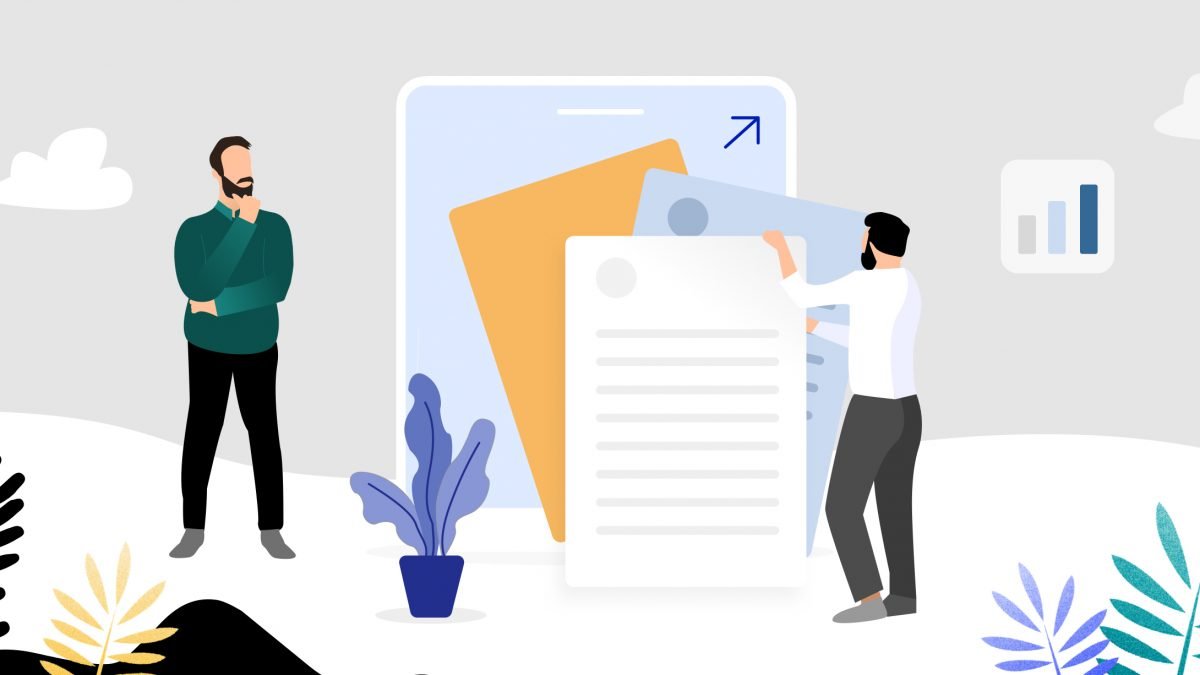

Differences Between Primary Research and Desk Research

The main difference between primary research and desk research is the source of data. Primary research uses data that is collected directly from the respondents or participants of the study. Desk research uses data that is collected by someone else for a different purpose.

Another key difference is the cost and time involved. Primary research is usually more expensive, time-consuming, and resource-intensive than desk research. However, it can also provide you with more specific, accurate, and actionable data that is tailored to your research goal and question.

The best practice is to use desk-based research before primary research; it refines the scope of the work and helps you optimize resources.

Read Also – Primary vs Secondary Research Methods: 15 Key Differences

How to Conduct a Desk Research

Here are the four main steps to conduct desk research:

- Define Research Goal and Question

What do you want to achieve with your desk research? What problem do you want to solve or what opportunity do you want to explore? What specific question do you want to answer with your desk research?

- Identify and Evaluate Data Sources

Where can you find relevant data for your desk research? How relevant and current are the data sources for your research? How consistent and comparable are they with each other?

You can evaluate your data sources based on factors such as-

– Authority: Who is the author or publisher of the data source? What are their credentials and reputation? Are they experts or credible sources on the topic?

– Accuracy: How accurate and precise is the data source? Does it contain any errors or mistakes? Is it supported by evidence or references?

– Objectivity: How objective and unbiased is the data source? Does it present facts or opinions? Does it have any hidden agenda or motive?

– Coverage: How comprehensive and complete is the data source? Does it cover all aspects of your topic? Does it provide enough depth and detail?

– Currency: How current and up-to-date is the data source? When was it published or updated? Is it still relevant to your topic?

- Collect and Analyze Your Data

How can you collect your data efficiently and effectively? What tools or techniques can you use to organize and analyze your data? How can you interpret your data with your research goal and question?

- Present and Report Your Findings

How can you communicate your findings clearly and convincingly? What format or medium can you use to accurately record your findings?

You can use spreadsheets, presentation slides, charts, infographics, and more.

Advantages of Desk Research

- Cost Effective

It is cheaper and faster than primary research, you don’t have to collect new data or report them. You can simply analyze and leverage your findings to make deductions.

- Prevents Effort Duplication

Desk research provides you with a broad and thorough overview of the research topic and related issues. This helps to avoid duplication of efforts and resources by using existing data.

- Improves Data Validity

Using desk research, you can compare and contrast various perspectives and opinions on the same topic. This enhances the credibility and validity of your research by referencing authoritative sources.

- Identify Data Trends and Patterns

It helps you to identify new trends and patterns in the data that may not be obvious from primary research. This can help you see knowledge and research gaps to offer more effective solutions.

Disadvantages of Desk Research

- Outdated Information

One of the main challenges of desk research is that the data may not be relevant, accurate, or up-to-date for the specific research question or purpose. Desk research relies on data that was collected for a different reason or context, which may not match the current needs or goals of the researcher.

- Limited Scope

Another limitation of desk research is that it may not provide enough depth or insight into qualitative aspects of the market, such as consumer behavior, preferences, motivations, or opinions.

Data obtained from existing sources may be biased or incomplete due to the agenda or perspective of the source.

Read More – Research Bias: Definition, Types + Examples

- Data Inconsistencies

It may also be inconsistent or incompatible with other data sources due to different definitions or methodologies.

- Legal and Technical Issues

Desk research data may also be difficult to access or analyze due to legal, ethical, or technical issues.

How to Use Desk Research Effectively

Here are some tips on how to use desk research effectively:

- Define the research problem and objectives clearly and precisely.

- Identify and evaluate the sources of secondary data carefully and critically.

- Compare and contrast different sources of data to check for consistency and reliability.

- Use multiple sources of data to triangulate and validate the findings.

- Supplement desk research with primary research when exploring deeper issues.

- Cite and reference the sources of data properly and ethically.

Desk research should not be used as a substitute for primary research, but rather as a complement or supplement. Combine it with primary research methods, such as surveys, interviews, observations, experiments, and others to obtain a more complete and accurate picture of your research topic.

Desk research is a cost-effective tool for gaining insights into your research topic. Although it has limitations, if you choose the right method and carry out your desk research effectively, you will save a lot of time, money, and effort that primary research would require.

Connect to Formplus, Get Started Now - It's Free!

- desk research

- market research

- primary vs secondary research

- research bias

- secondary research

- Moradeke Owa

You may also like:

25 Research Questions for Subscription Pricing

After strategically positioning your product in the market to generate awareness and interest in your target audience, the next step is...

Judgmental Sampling: Definition, Examples and Advantages

Introduction Judgment sampling is a type of non-random sampling method used in survey research and data collection. It is a method in...

Projective Techniques In Surveys: Definition, Types & Pros & Cons

Introduction When you’re conducting a survey, you need to find out what people think about things. But how do you get an accurate and...

What is Thematic Analysis & How to Do It

Introduction Thematic Analysis is a qualitative research method that plays a crucial role in understanding and interpreting data. It...

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

Get a free consultation

🎙 Product leaders speak. Don't miss the Cieden Podcast — listen now!

- Product design

- UX/UI consulting

- 2-week Design sprint

- Dedicated design team

- Product designers

- Design leads

- Design strategists

- Product management/ownership

- Hire product managers

- Development

- Video production

- Artificial Intelligence

- Enterprise-level

- Real estate

- Case studies

- Testimonials

- AI UX concepts

- UX/UI skills matrix template

- Price calculator

How to Do Desk Research in 5 Simple Steps

Before you launch a product, you should get answers to several questions. The first and, we believe, most important one is to define the overall market situation and take a closer look at the potential customer. Mastering how to do desk research is a suitable, cost-effective way to get information for making data-driven decisions.

In this article, we’re going to highlight some essential tools for conducting desk research and defining user groups.

What is desk research?

Desk research (also called secondary research) is a research method that involves using existing data. This technique will allow you to get the first idea of your market and users “from your desk.”

Secondary research includes already published materials in reports, articles, or similar documents. We also recommend using software tools that can help you become more familiar with your users (you can find some of them below).

This method is much more cost-efficient than primary research and requests less time for conducting it. Still, a lot of analysis work should be done, and the result is really helpful. The best way is to mix qualitative user research and desk research. It’ll help you fit into your timelines and budgets.

Primary vs. secondary research

Since we’ve just mentioned primary research, let’s see what it is and how it differs from secondary desk research.

Primary research refers to the process of gathering firsthand data directly from the source, be it customers or prospects. This approach takes more time and effort than desk research, but you get the latest and most detailed information.

The most common primary research methods include the following:

- interviews;

- questionnaires;

- competitor reviews;

- focus groups;

- market mapping.

Secondary research , or desk research, involves analyzing existing data and information collected by someone else or for another project or research purpose. It’s often the starting point for market research, providing foundational knowledge from pre-existing data. This method is quicker and easier than primary research, but the information you get might be older or less specific.

The desk research methods include gathering data from the following sources:

- government databases;

- academic journals;

- social media.

While both research methodologies are helpful, you may be wondering when to use each.

Go for primary research when you:

- need up-to-date information not readily available;

- study specific questions or problems not addressed in existing research;

- require in-depth info directly from your target audience;

- aim to test new ideas.

Desk research often paves the way for primary research. Chose this approach when you:

- need a basic overview of a topic or industry;

- want to get a background knowledge and context;

- aim to study existing trends and statistics;

- want to compare different perspectives on the same topic;

- seek to save time and resources.

Need help with desk research ?

Pros and cons of desk research

Desk research is a valuable tool for any researcher. But, like any tool, it has its strengths and weaknesses.

Pros of desk research

Using desk research methods is highly beneficial. Here are just several reasons for that:

- Budget-friendly. Compared to primary research, desk research is more cost-efficient. You’re using existing information at low to no cost instead of generating it yourself.

- Fast. Desk research lets you access data and reports instantly, offering quick insights without lengthy data collection.

- Scalable. Desk research allows you to cover vast amounts of data.

- Readily available data. Data for desk research is readily available online, and you can access it anytime.

- Insightful. With careful searching, you can find helpful reports, studies, and expert opinions that provide valuable perspectives on your topic.

Cons of desk research

Despite the advantages, desk research comes with its cons. Here’s what to prepare for:

- Outdated data. Data for desk research can quickly become outdated, so verifying its relevance is a must.

- Limited control. You’re relying on someone else’s data, meaning you can’t control its methodology or accuracy.

- Minimal exclusivity. Desk research findings are readily available to others, therefore they’re not exclusive to your unique project.

- Verification complexities. Verifying data sources and interpreting information can be time-consuming.

Types of internal and external data sources

Desk research is a way to gather insights literally without leaving your desk. But where do you find the necessary info? Let’s look at the secondary data sources available to you:

Internal data sources

Your company is already a goldmine of information. So before jumping into other types of desk research, consider digging into internal resources:

- Historical campaigns and sales. Review past campaigns, website traffic insights, sales conversions, and other relevant data.

- Product analytics. Dive into product analytics to learn more about different customer segments , user behavior, engagement patterns, performance metrics, and user flows.

- Internal research. Use existing internal research reports and studies (if any) and get insights from them.

External data sources

Besides studying your company information, there are plenty of external resources to explore. Look into the following examples of secondary data:

- Internet. Access any type of resources through the web.

- Commercial resources. Industry reports or market research studies by third-party firms can offer data specific to your topic.

- Trade associations. Use reports and resources from trade associations, for example, the Directory of Associations , the National Trade and Professional Associations Directory , or the Encyclopedia of Associations .

- Industry experts. Connect with industry thought leaders and analysts.

- Research associations. Access independent research papers and industry publications.

- Media. Monitor news, press releases, magazine articles, and TV and radio content to get information on your topic.

- Market research software. Leverage specialized software platforms that offer advanced analytics, reports, or access to industry data.

- Government data. Use statistics and reports from government agencies like the US Census Bureau , US Government Publishing Office , US Small Business Administration , and so on.

- Local government data. Get market data, demographic info, and employment trends through local gov websites.

- Public libraries. Access library databases through the Digital Public Library of America or the National Archives in the UK.

- Competitors. Study competitor websites, press releases, mailing lists, online reviews, and social media activity.

- Educational resources. Analyze academic research papers and journals relevant to your topic.

Examples of desk research

Let’s now explore some examples of design projects leveraging desk research:

Analyzing dreams with Sleepify

The creator of the Sleepify project sought a user-centric design for an app tracking dreams and well-being. They leveraged external desk research and competitor analysis to:

- study sleep’s impact on a person’s well-being through UCE Research and ePsychologi.pl platforms;

- discover the strengths and weaknesses of competitor apps.

The secondary research findings, along with quantitative research, were used for creating a high-fidelity prototype, ready for user testing and validation.

Keeping users fit with MYFIT

MYFIT project suggests creating a fitness app packed with workout routines, aimed to boost user engagement and retention. It is expected to be a clean, stylish, and modern fitness app designed to keep users active and motivated. The designer proposes to tackle this challenge by:

- researching user behavior and frustrations with existing apps using various methods;

- exploring why users abandon fitness apps;

- creating optimal user journeys.

Reaching personalized sales with AI

Designers aimed to explore the potential of using AI for personalized sales in the gaming industry. Their desk research targeted:

- The global market size of generative AI in business, its usage in gaming, and sales marketing.

- Industry gap. While personalization thrives in eCommerce, the gaming industry lags behind.

The insight the designers derived is that a personalized AI tool based on in-game actions, purchase history, demographics, and player data could revolutionize game sales.

Five steps to conduct desk research

As already mentioned, the reason to conduct research is to become more familiar with your users and potential customers. Your focus should be on collecting notable data and analyzing it. Here’s how to do this in five steps:

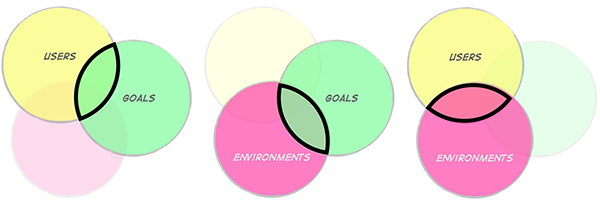

1. Determine your research topic and goal

Before even starting your research, ask yourself what you want to study and why. Outline the questions you aim to answer or the information you’re looking for. Is it to understand industry trends or handle customer journey mapping ? The more specific your question, the easier it will be to steer your research in the right direction.

2. Choose relevant secondary data sources

Go through internal and external resources relevant to your topic, making sure they are credible and objective. Make a list of resources suitable for your research topic and goals.

3. Explore existing data

Go down your resource list and find relevant data. Here’s what you can study:

Most likely, you should start with the existing text available in the public domain. What to look for? Everything! You can go through government or private companies’ reports, the original material on which these reports are based, conference proceedings, primary periodicals, official publications, and articles in newspapers and journals.

This method of data collection is the most inexpensive and nontime-consuming way.

Document analysis is an important part of business analysis . This process includes the examination of existing documents and recordings. In some way, you are using the research that has already been completed.

The objective of this process is to track changes over the whole period. You can analyze logs, email logs, databases, web analytics, minutes of meetings, staff reports, and information logs. These are only a few examples of the sources for this type of research.

For instance, before redesigning the existing product, you have to understand the reason for the low level of purchases or numerous complaints in support. Documents and records help track the interaction between employees and customers or between your current website and customers. This is the way to make correct conclusions.

Knowing your competitors helps analyze the existing solutions and define the current problems they cover. Obviously, to share the entire experience and provide an ultimate guide for conducting competitive research, we have to write a whole new article. Here are some points to pay attention to:

- determine the products your competitors offer;

- pay attention to their sales tactics and results;

- analyze how they market their products;

- take note of their content strategies;

- look at competitors’ social media presence, strategies, and go-to platforms;

- make a SWOT analysis to learn their strengths, weaknesses, opportunities, and threats.

There are a lot of tools that may help. We’d like to share some of those that we use while conducting desk research:

- Crunchbase is a live company database, which updates constantly. This tool helps you identify upcoming marketing tendencies. For example, you can find how many companies in a specific industry are raising.

- Capterra is an intermediary between buyers and technology vendors within the software industry. Here, you can find the most comprehensive lists of products per industry, reviews, ratings, and infographics, and easily compare needed competitors.

- Serpstat is one of the top-rated SEO tools and definitely will help you outline competitor analysis just by entering your domain.

- Semrush analyzes the data for you and gives you instant recommendations on SEO, content marketing, and advertising that help you improve your online visibility in days.

4. Organize and compare your data

Gathering data is just the beginning. Now, you should organize and make sense of it. Consider using mind maps or spreadsheets to structure your data. Remove any duplications as well.

5. Analyze your data

Now that you have your data in a digestible format, analyze it for helpful insights. Check if the gathered data answers the questions you aimed to study. If not, go back to step two and find other sources of information.

Useful resources for defining your user groups

As soon as you finalize your desk research, you will most likely be able to group your users. So now it’s time to take a deeper look at them. Here are some free tools you can use to identify your user personas.

Google Analytics

If you already have launched your website, don’t forget to insert the Google Analytics tracking code. It will help you get more information about your clients. Now we’ll share which reports we suggest using:

This report shows the key age group and gender of your website visitors. To kick off the demographic report, follow the flow: Audience tab at the left menu > Demographics > Overview.

Learn more about the preferred interests of your users. As you have already opened an Age or Gender report, you can add a secondary dimension. Select ‘Affinity Category’ at the dropdown. You will see all the segments your visitors are interested in. It is helpful to identify your ideal online customers at scale.

One more good analytics tool to identify the users who are actively researching and comparing items across the Google Display Network (YouTube, paid search results via AdWords, display ads via AdSense, etc.)

This report will provide you with an overview of all the languages your users have set in their browsers and the locations where they may live. It will be useful in understanding cultural differences and will decrease effort for your marketing campaigns.

If you’re going to create a mobile app, think about which devices your guests are most likely to use to access your website. Go to Audience > Benchmarking > Devices. After that, dive deeper into Mobile Devices’ info. You will see exactly which brand of mobile devices they are using. Go to Audience > Mobile > Devices.

So, we’ve just outlined some useful data to understand your users better. Now, let’s move forward to other sources.

Facebook Insights

As almost everyone over the Internet is a social media user, it is good to use the data it represents. It will help you create more target posts and campaigns that cover your customer needs.

If you already have a customer list or just a list of users with phones or email addresses, you can use it to gain extra information about these people.

You need a list in the .csv file. In the Facebook Ads Manager, you can create a custom audience. Then Facebook Audience Insights will finish uploading the list, and you will receive a ‘Ready’ notification. At this point, you can analyze your audience.

Initially, you need to open an Audience Insights tool. You can choose an Audience you want to analyze. This tool can give you access to such data:

- age, gender, and relationship status;

- lifestyle preferences, demographics, and interests;

- education level and job title;

- Facebook pages that are likely relevant to your audience;

- top cities, countries, and languages;

- frequency of certain activities;

- device usage;

- household size and estimated household income;

- homeownership status and house market value;

- spending methods, purchase behavior, and estimated retail and online retail spending habits.

Even if you don’t have a customer list yet, you can use generic insights connected to your Business Page. You can also use software tools that provide you with potential customer emails. Take a look at these tools:

- Snov.io helps find more convertible leads, verify contacts, track your lead’s progress, and automate cold outreach.

- Hunter is a cloud-based email search solution that helps businesses find emails on company websites, verify domains, compose follow-ups, and more.

Try to pull out the most useful insights about your potential users, finalize all the gathered information, and be sure your team is aware of the user groups you are trying to reach.

LinkedIn is one more powerful resource for collecting data. A good LinkedIn profile is a pretty ready proto persona. You can discover the user’s location, career path and goals, achievements, and daily work responsibilities. It is especially useful for B2B marketing. By the way, if you are in this segment, you can also use tools like Leadfeeder to understand which companies are visiting your website.

Now, we will break out four components that could be revealed from LinkedIn: business attributes, pain points, hangouts, and values.

They give you a deeper view of the demographics of your business page followers and visitors. What can you gather here? You can see location, job function, seniority, industry, company size. There is also data about similar companies and the comparison in analytics. It’s a great specific tool to reinforce Google Analytics.

Pay attention to the sections ‘Summary,’ ‘Skills & Endorsements,’ ‘Activity,’ and ‘Interests.’

In ‘Summary,’ we can get an overview of the person’s work trajectory, education, and main skills. From the ‘Skills & Endorsements’ section, we can receive data about a person’s strengths and people who endorsed their skills (who can also be useful in the research). The ‘Activity’ section is a great way to observe what the person is talking about, what they like, and comment. ‘Interests’ shows a list of the following companies and people, so it is possible to examine what engages the person.

Company Page includes information about the history, size, and career opportunities. Such pages also may have stories about employees and their quotes. The company’s job descriptions show the professional attributes required of a candidate.

After gathering all this data, you can create a direct message to increase the chances that relevant people will view it. How to do it? Open your Company Page > Click on ‘Create Post’ > Manage Post Audience: from Anyone to Targeted audience. Add some specific details about your audience.

Use LinkedIn Advanced Search to earn data about market size and the number of required companies or people. By working on the filters, you can find more insights about locations, education, seniority levels, etc.

Last thoughts

Taking market temperature and understanding your audience are the key ingredients in a way to creating a successful product. Pay attention to detail, document the whole process, and share it with your team and all the stakeholders. Help them to keep an empathic approach to your product and audience.

Have a great time conducting research. If you will need professional help with it, feel free to contact us .

Did you like the article?

Help us share it:

prev .

The Value of User Research Phase and What You Lose if You Skip it

next .

How to Use Value Proposition Canvas for Better Product-Market Fit

What is the desk research method?

Secondary desk research is a research method that involves collecting and analyzing information from existing sources like reports, articles, and websites. This approach is particularly valuable in the early stages of prototyping , as it helps to gather essential insights with a streamlined resource investment.

How to do UX desk research?

To do UX desk research, follow these steps:

1.Define your goals and research questions,

2.Choose secondary data sources like usability studies or industry reports,

3.Go through the data relevant to your research,

4.Structure and compare the gathered data,

5.Analyze the data to make necessary UX improvements.

What are examples of desk research?

What are the two types of desk research techniques?

start your project with us .

New NPM integration: design with fully interactive components from top libraries!

What is Desk Research? Definition & Useful Tools

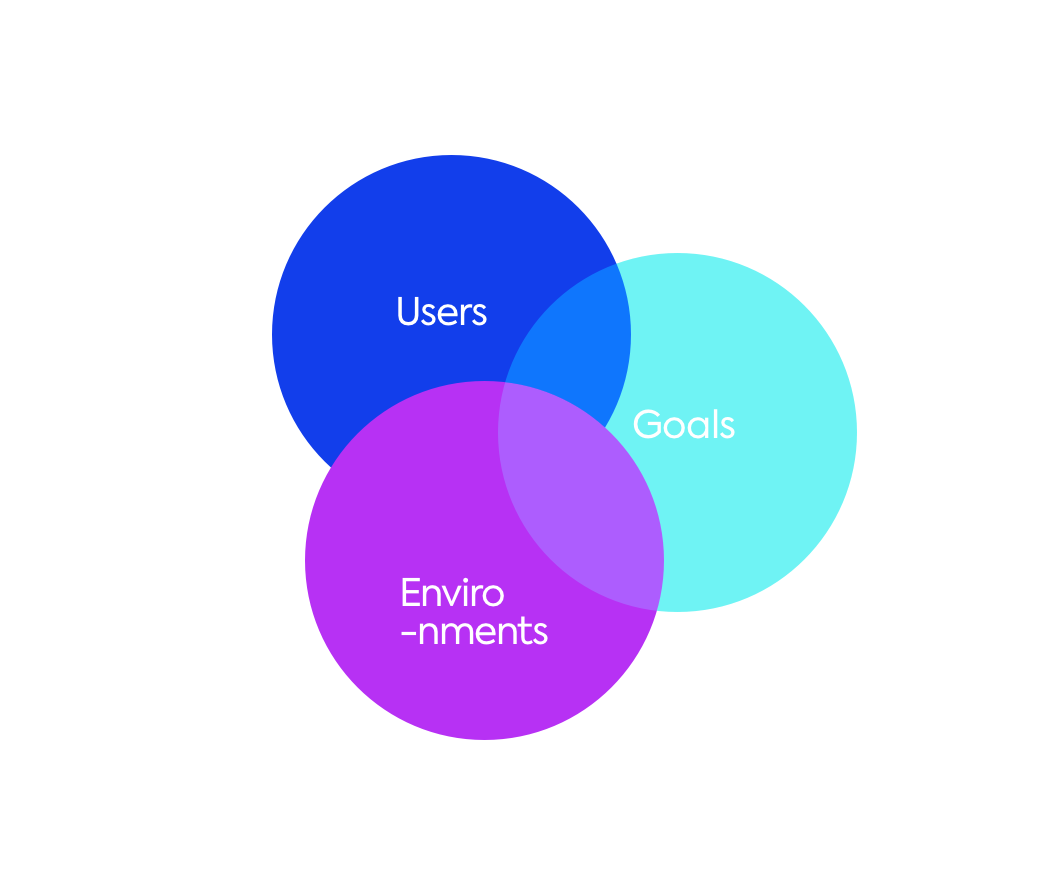

Desk research typically serves as a starting point for design projects, providing designers with the knowledge to guide their approach and help them make informed design choices.

Make better design decisions with high-quality interactive UXPin prototypes. Sign up for a free trial to explore UXPin’s advanced prototyping features.

Build advanced prototypes

Design better products with States, Variables, Auto Layout and more.

What is Desk Research?

Desk research (secondary research or literature review) refers to gathering and analyzing existing data from various sources to inform design decisions for UX projects. It’s usually the first step in a design project as it’s cost-effective and informs where teams may need to dig deeper.

This data can come from published materials, academic papers, industry reports, online resources, and other third-party data sources. UX designers or researchers use this information to supplement data, learn about certain markets/user groups, explore industry trends, understand specific topics, or navigate design challenges.

The importance of desk research in the design process

Desk research gives designers a comprehensive understanding of the context, users, and existing solutions. It allows designers to gather valuable insights without conducting primary research which can be time-consuming and resource-intensive.

Desk research helps designers better understand the problem space, explore best practices and industry trends , and identify potential design opportunities without reinventing the wheel while learning from others’ mistakes.

Primary Research vs. Secondary Research

- Primary research: new and original data from first-hand sources collected by the team, such as questionnaires, interviews, field research, or experiments, specifically for a particular research project.

- Secondary research: utilizing existing data sets and information that others have collected, including books, articles, reports, and databases.

Primary and secondary research complement each other in comprehensively understanding a topic or problem. While primary research provides new first-party data specifically for a project’s goals , secondary data leverages existing knowledge and resources to gain insights.

What is the Purpose of Desk Research?

Understanding the problem or design challenge

Desk research helps designers comprehensively understand the problem or design challenge. By reviewing existing knowledge and information, designers can grasp the context, identify pain points, and define the scope of their design project.

For example, when tasked with designing a new mobile banking app, desk research can provide insights into user preferences, common challenges in the banking industry, and emerging trends in mobile banking.

Gathering background information

Desk research allows designers to gather background information related to their design project. It helps them explore the domain, industry, target audience, and relevant factors that may influence their design decisions.

For example, when designing a fitness-tracking app, desk research may involve collecting information about fitness activities, wearable technologies, and health guidelines.

Exploring existing solutions and best practices

Desk research enables designers to explore existing solutions and best practices. By studying successful designs, case studies, and industry standards, designers can learn from previous approaches and incorporate proven techniques.

For example, when creating a website’s navigation menu , desk research can involve analyzing navigation patterns used by popular websites to ensure an intuitive user experience.

Identifying trends and patterns

Desk research helps designers identify trends and patterns within the industry or user behavior. Designers examine market reports, user surveys, and industry publications to identify trends, emerging technologies, and user preferences.

For example, when designing a smart home app, desk research can involve analyzing market trends in connected devices and user expectations for seamless integration.

Informing decision-making and design choices

Desk research provides designers valuable insights that inform their decision-making and design choices. It helps designers make informed design decisions based on existing knowledge, data, and research findings.

For example, when selecting a color palette for a brand’s website, desk research can involve studying color psychology, cultural associations, and industry trends to ensure the chosen colors align with the brand’s values and resonate with the target audience.

Secondary Research Methods and Techniques

Researchers use these methods individually or in combination, depending on the specific design project and research objectives. They select and adapt these based on the nature of the problem, available resources, and desired outcomes.

- Literature review : gathers and analyzes relevant data from academic and research publications, government agencies, educational institutions, books, articles, and online resources (i.e., Google Scholar, social media, etc.). It helps designers gain a deeper understanding of existing knowledge, theories, and perspectives on the subject matter.

- Market research : studying and analyzing market reports, industry trends, consumer behavior, and demographic data. It provides valuable insights into the target market, user preferences, emerging trends, and potential opportunities for design solutions.

- Competitor analysis : examines and evaluates the products, services, and strategies of competitors in the market. By studying competitors’ strengths, weaknesses, and unique selling points, designers can identify gaps, potential areas for improvement, and opportunities to differentiate their designs.

- User research analysis : User research analysis involves reviewing and analyzing data collected from various user research methods, such as surveys, interviews, and usability testing. It helps designers gain insights into user needs, preferences, pain points, and behaviors, which inform the design decisions and enhance the user-centeredness of the final product.

- Data analysis : processing and interpreting quantitative and qualitative data from various sources, such as surveys, analytics, and user feedback. It helps designers identify patterns, trends, and correlations in the data, which can guide decision-making and inform design choices.

How to Conduct Desk Research

Defining research objectives and questions

Start by defining the research objectives and formulating specific research questions. A clear goal will inform the type and method of secondary research.

For example, if you’re designing a mobile app for fitness tracking, your research objective might be to understand user preferences for workout-tracking features. Your research question could be: “What are the most commonly used workout tracking features in popular fitness apps?”

Identifying and selecting reliable sources

Identify relevant and reliable sources of information that align with your research objectives. These sources include academic journals, industry reports, reputable websites, and case studies.

For example, you might refer to academic journals and industry reports on fitness technology trends and user behavior to gather reliable insights for your research.

Collecting and analyzing relevant information

Collect information from the selected sources and carefully analyze it to extract key insights.