- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Best Business Plan Software in 2022

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When you’re starting a business, developing a strong business plan will be one of the first steps you take. Your business plan will cover everything from a detailed explanation of your products or services and pricing model to at least three years of financial projections—plus much more. Therefore, whether you’re not sure how to get started or you’re just looking to make the process easier, you may want to turn to business plan software for help.

In this guide, we'll break down five of the best business plan software options—discussing their pros, cons, features, pricing, and more—so you have all the information you need to decide which solution is right for your small business.

Looking for tools to help grow your business?

Tell us where you're at in your business journey, and we'll direct you to the experience that fits.

on NerdWallet's secure site

The 5 best business plan software options

The right business plan software will make the process of writing your business plan much simpler. Like many business software solutions, however, there are a number of different business plan software options out there—each of which has a unique set of features, user experience, and price.

This being said, if you're looking for a place to start your search for the best business plan software, you can explore the five top options below:

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

1. LivePlan

Best overall business plan software.

If you want template-rich, modern-feeling business plan software, then LivePlan may be the right pick for you. LivePlan excels with their user interface, which feels updated and slick, and also offers intuitive, easy-to-use features and options.

Their step-by-step instruction will help you kick things off from the beginning, and you can take advantage of their online learning center to continue to gain business skills.

Affordable plans, including pay-as-you-go option

No long-term contracts or cancellation fee; 60-day money-back guarantee

Modern, intuitive interface; cloud-based, can be used on Mac, PC, as well as tablets

Ability to create unlimited plans in one account; over 500 customizable templates

Variety of business resources including video tutorials, step-by-step instruction, and general customer support

Limited integration options

Challenging to enter your own financial modeling projections

Can be difficult to learn

Ability to create an unlimited number of business plans on one account

More than 500 business plan templates spanning various industries

Integration with Xero and QuickBooks Online

Real-time tracking of financial data with accounting integrations

Ability to export your business plan to Word or PDF

Expert advice and step-by-step instruction included

Performance dashboards for tracking against budgets and sales goals

Ability to create and export a one-page pitch executive summary

Annual plan: $15 per month, billed every 12 months

Six-month plan: $18 per month, billed every six months

Pay-as-you-go plan: $20 per month, billed once every month

2. GoSmallBiz

Best for multiple business management tools in one platform.

Next on our list of the best business plan software options is GoSmallBiz, which is much more than just a business plan software. With GoSmallBiz, you have access to business continuity planning software with features that cover creating a roadmap, working through business and legal forms, building a website, and more.

In this way, GoSmallBiz is great for startups or newer businesses looking to access multiple business management tools through one platform.

Unlimited business consultation and extensive library of online resources

Multiple business tools in one software

Website consultation analysis and business assessment

Industry-specific business plan templates with emphasis on financial projections and statements

Expensive monthly cost compared to alternatives

Limited business plan features

Entire business plan can only be exported to Microsoft Word

Outdated interface

Industry-specific business plan templates with step-by-step building wizard

Ability to create financial statements and projections

Free website hosting and website builder

Customer relationship manager with integration with MailChimp

Digital marketing dashboard with social media and Google Analytics integrations

HR document builder

Corporate minutes writer

Business documents library

Business courses library

Unlimited business consultation

$39 per month, no contracts, free cancellation

Best for simple, fast business plan creation.

If you're looking for free business plan software, Enloop will be one of your closest options—they offer an all-inclusive seven-day free trial, no credit card required. Additionally, unlike some of the other options on our list, Enloop is strictly dedicated to business plan creation, including automated text writing, financial forecast comparisons, and a real-time performance score that tracks your progress.

This being said, if you'd prefer the most straightforward, fast, and simple way to write your business plan, Enloop will be a platform worth considering.

Simple and straightforward software, solely dedicated to business plan creation

Seven-day free trial

Automatic text generation available to streamline the writing process

Affordable plans with annual discount option

Limited additional educational resources

Only one template option

No integration options

Ability to create three business plans with customizable text, images, tables, charts, and over 100 currency symbols and formats

Includes automatic text generation for each plan section that you can then customize

Automatically generated financial statements

Includes financial performance comparison analysis (using three ratios with Detailed plan and 16 with Performance plan)

Real-time performance score to track your progress

Ability to invite users to edit (two with Detailed plan, five with Performance plan)

Pass/fail report and certificate to help you identify issues with your plan

Free plan: Seven-day free trial with no credit card required

Detailed plan: $19.95 per month or $11 per month, paid annually

Performance plan: $39.95 per month, or $24 per month, paid annually

Best for startups looking to acquire funding or find investors.

Part of the Startups.com suite, Bizplan gets top marks for their user interface—it’s intuitive, easy to use, and modern. You’ll work with a step-by-step business plan builder to get exactly what you’d like from your business plan. It may remind you of a modern website builder, since it has drag-and-drop tools to build templates.

Moreover, for one subscription fee, you have access to all of the tools in the Startups.com network, including self-guided courses, how-to guides, masterclass videos, and more. All in all, with a direct connection to Fundable, Bizplan is a top business plan software option for startups looking to acquire funding and find investors.

Subscription gives you access to all Startups.com tools

Lifetime access subscription option

User-friendly drag-and-drop business plan builder

Excellent educational resources

Connection to Fundable great for businesses looking for capital

No free trial

No templates based on industry

No mobile access

Drag-and-drop templates for business plan building

Financial command center to track all business financials in one place

Unlimited account collaborators

Ability to share business plan online with investors

Online resources including self-guided courses, masterclass videos, how-to guides, mentorship access

Unlimited software use for Fundable, Launchrock, and Startups.com

Monthly plan: $29 per month

Annual plan: $20.75 per month, billed at $249 per year

Lifetime access: $349 one-time fee

5. PlanGuru

Best for financial planning and budgeting.

Finally, for some of the strongest financial features among business plan software options, including budgeting and forecasting, you might check out PlanGuru. Whereas the other solutions we've reviewed were first and foremost focused on writing a business plan, PlanGuru is dedicated to business financial planning —providing the tools you need to create budgets, financial forecasts, reports, and more.

Therefore, if you need a software solution that can streamline the financial piece of your business planning processes, PlanGuru will certainly have the most to offer.

Extensive financial tools and detailed forecasting, budgeting, and reporting capabilities

Substantial library of resources

Cloud-based and desktop options

14-day free trial and 30-day money-back guarantee

Expensive, especially for additional users

Only focuses on the financial aspect of business planning; no templates or tools for basic business plan writing

Difficult to use without prior financial knowledge

Cloud-based version of software, as well as locally installed Windows version (desktop version has a few more features)

Works with QuickBooks Online, Xero, and Excel

Budgeting and forecasting for up to 10 years

Over 20 standard forecasting methods

Formula builder to create custom methods

Ratios and KPIs

Dashboard and reporting tools

Help guides, video tutorials, knowledgebase, and live U.S.-based customer support

14-day free trial

$99 per month (additional users $29 per month)

$899 per year (additional users $299 per year)

What to look for in business plan software

Ultimately, it's up to you to decide, which, if any, of the best business plan software solutions on our list is right for your business.

So, if you're trying to figure out how to choose between the various options out there, it might be helpful to compare your top choices based on the following criteria:

Features: As we've seen different business plan software solutions offer different features. You'll want to look carefully at the feature list of any software and determine what features are most important for your business needs. Do you need an extensive library of templates with detailed customization? Would you prefer software that includes an online learning center for business skills? Are you looking for a solution that combines business plan writing with other tasks? It may be useful to list out your ideal feature set, so you can compare individual software plans to that list.

Price: Although you might be able to find some free business plan software options (or at the very least, free trials), in most cases, you'll need to pay a subscription fee to access the platform you choose. Therefore, you'll want to think about what your budget is for this business tool and what type of software is most cost-effective for your needs.

User experience: User experience can vary widely among different business plan software options. You’ll find some programs that are newer or have been recently updated. Others might have the kind of interfaces that felt new years ago but are now pretty out of date—and, subsequently, make them a little harder to use. The right user experience for your needs is genuinely a matter of opinion and comfort—nevertheless, it's worth testing thoroughly testing out a platform to ensure that it can truly work for you before investing in a monthly or annual subscription.

The bottom line

There's no doubt that properly crafting your business plan is important for the future growth and success of your small business. Luckily, the right business plan software should make the process much simpler.

This being said, whether you opt for one of the best business plan software options listed here, or another platform entirely, you'll want to take the time to compare multiple solutions and ensure you choose the one that's right for your business.

As we mentioned, it can be helpful to think about the features you're looking for, your budget, and your user-experience preferences ahead of time—that way, you'll have a set of criteria in mind as you explore different solutions.

Ultimately, perhaps the best thing you can do to find the right software is to actually test out the platforms themselves—either by using a free trial or a money-back guarantee.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

What stage is your business at?

Tell us and we’ll match you with a special LivePlan discount:

New Business Idea

Startup Phase

Established Business

Enter your email address to unlock it.

Please enter a valid email address

We care about your privacy. See our Privacy Policy .

Customer Support

The World's Leading Cloud-Based Business Plan Software

- Fill-in-the-blanks simplicity

- Real sample business plans to inspire you

- Works in all web browsers

See how it works

Start planning for $20 per month

Rated 4.8 out of 5

Trusted by 1 million+

entrepreneurs like you

Rated 4.9 out of 5

“LivePlan earns the top spot on our list of best business plan software—and for good reason. LivePlan's slick and interactive service provides a step-by-step business plan approach, a rich collection of cloud-based features, and online learning tools.”

Brooke Hayes Software Reviewer, Business.org

Here's How LivePlan Makes it Surprisingly Simple to Write a Convincing Business Plan

You get a step-by-step process to follow

- Ways to write a pitch that grabs investors' attention

- What to include in your marketing plan

- Every other essential piece of your business plan

“LivePlan saved me a lot of time because the software does so much of the work for you. All you have to do is answer questions and plug in numbers.”

Brian Sung, Eugene, OR Owner of Tailored Coffee

All the financials are calculated for you

LivePlan tells you exactly what kind of financial information you need to enter and then it does all the calculations automatically using built-in formulas. So you end up with razor-accurate financial statements that include all the tables that a lender or investor expects to see.

“Most people are intimidated by the financials, but LivePlan made planning simple, saved me so much time and just knowing that the calculations are correct makes this tool worth every penny!”

Brandie Slaton, Merced, CA Noelle Notals LLC

If you ever get stuck, we'll help you out

Most LivePlan users are able to breeze through their first business plan. But if you ever have a question, there are 3 ways to get advice:

- Call a LivePlan expert at 1-888-498-6136

- Start a chat with our advocacy team. Click here to try it .

- Or refer to more than 550 sample plans and tutorial videos built into LivePlan

See how we support our customers

Get Started Risk Free

“LivePlan was user friendly, supportive and provided meaningful guidance all while remaining very flexible.”

Freja Nelson, Oregon Freja Foods

Get a Polished Business Plan That Will Impress Lenders

Once your plan is done, you can:

- Customize the look of your plan using 10 beautiful document themes

- Download your plan as a PDF or Word doc so you share it easily

- Print out your plan to get a clean, professional document

See inside a completed plan »

Join over 1 million entrepreneurs who found success with LivePlan

35-day money back guarantee. Start planning for $20 per month.

“LivePlan is incredibly simple and easy to use. The financial sales forecasting tool is very intuitive and makes writing a business plan more fun.”

Helga Douglas Owner, Svala

LivePlan Also Gives You Tools to Help Your New Business Succeed

Access Essential Business & Legal Form Templates

Search our library of hundreds of legal forms that cover credit applications, contractor agreements, employee contracts and more.

Get Insights That Will Help Your Company Grow

Are you charging enough? Will you meet your revenue goals? LivePlan's forecasting tool can answer these type of questions at a glance.

See How You Stack Up Against Competitors

Plug in your industry and where you're located, and LivePlan will tell you how you're doing compared to businesses just like yours.

You Might Be Surprised By What New Business Owners Have Achieved with LivePlan

E'a williams, be fit tri wellness, chicago, il.

“Once the investor saw the plan, he believed in it. The interface was fresh and lively. The program gave wonderful examples of what should be in the different sections. I was able to take bits and pieces of those examples, but when I finished each section it sounded like I had written it. “I could just plug in information without having to do any of the math. That saved a lot of work. It made it very easy to get the business plan done. Once the investor saw my business plan on LivePlan, he immediately got back to me and said, ‘I'm in.’”

Mandie O'Neill

Lucky dog daycare, eugene or.

“LivePlan made an overwhelming task easy. LivePlan is incredibly easy to use. LivePlan's web-based nature allows me to log in anywhere (for me it was with my Mac Book Pro or iPad). At times writing a business plan can be a overwhelming task, especially when it comes to formatting and layout. LivePlan has made it easy to focus on putting your business ideas and goals on paper instead of fussing with all the other pesky stuff. I really liked how each section is defined and gives examples of what a quality business plan should look like.”

Rachid Tajiouti

Olive oil usa, llc, new york, ny.

“I've raised $3M so far with LivePlan! I needed to write a business plan for my investors. I was going nuts trying to create charts and properly format them. Then a friend recommended LivePlan! The financials were so easy to use and I liked knowing the calculations were all correct. It helped me create a precise plan to confidently share with investors, and I've raised $3M so far!”

Our customers give LivePlan 5 out of 5 stars

Software is professional and user-friendly. Highly recommend to any Entrepreneur. Would not be where I am today without LivePlan.

Mar. 15, 2024

I've been using LivePlan to help me write top-tier business plans over the last 2 years. A prominent business plan writing company referred me to this site to help me produce the best business plans, to collaboratively support their clients. I've consistently had the best customer service, whether by email or live chat. Rapid responses that are helpful and this is one of the "hand-down" best platforms if you're looking for high-quality products and services - and AMAZING customer service. The price of the plan subscription is a tiny drop in the ocean compared to the results I've had with business plans created through LivePlan. Thank you for the products and services here that help me present well

Feb. 29, 2024

I've used Liveplan for two projects and I have been happy with both experiences. I've needed support twice and both experiences were quickly resolved using the chat function. I'd highly recommend Liveplan to anyone wanting to get serious about new projects. They have great customer support, and it can be a vital tool to anyone wanting to build something from the ground up.

Feb. 20, 2024

I needed a business plan for a government grant and the platform helped me tremendously. It was super organized with all the touchpoints I had to fill and the AI for improving the texts was also amazing. I did a finance plan a well and I had no clue beforehand in how to do it and that was excellent and everything I needed to submit a full case! I finished my plan and submitted it. I will definitely use it again for when i need another business plan. Thank you

Feb. 3, 2024

Extremely user friendly. I appreciated how intuitive it was and useful when I got stuck or when wanting to rephrase sections - AI was a true support for me then

Sep. 26, 2023

LivePlan helps put your ideas and beliefs on paper in a professional & organized manner. It guides you through planning, organizing, and monitoring your plan.

Sep. 2, 2023

I didn't only get value for the money paid but also got the best customer service experience as well. And of course, I'm sticking to LivePlan forever.

IsefConsult

Aug. 14, 2023

Using LivePlan since March 2015, I've created precise financial plans and business strategies for ventures of all sizes. It's the perfect tool for rapid evaluation, eliminating the risk of spreadsheet errors.

Jul. 7, 2023

It's a great Financial planning software. It can also sync with Xero and Quickbooks.

Jun. 17, 2023

If you are looking to create a Business Plan then don't waste any time, buy LivePlan as it will make your life so much easier and save you days of work!

Jun. 28, 2022

A great tool for entrepreneurs with non-finance backgrounds. We all have business ideas but long-term planning is a challenge. LivePlan makes it simple and easy.

Jun. 24, 2022

I had put off writing a plan because I dreaded the research and didn't really know what I was doing. Because of you, I now have a comprehensive, professional-looking business plan.

May 24, 2022

Overall experience with LivePlan is awesome. Very informative and easy to read. Plans come with templates and other examples you can use to build your plan.

Deonta from Texas

May 11, 2022

The best part for me is the feeling of confidence it gave me. It really made me feel like my goals and even dreams were actually possible to reach.

Mar. 29, 2022

LivePlan was a lifesaver when starting our business! It helped us make a business plan and financial projections to show others, and everyone was blown away.

The Silver Fern Shop

Jan. 27, 2022

University Cycle Works

Home > Business > Business Startup

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

Data as of 3 /13/23 . Offers and availability may vary by location and are subject to change.

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

A business plan can do a lot for your business. It can help you secure investors or other funding. It can give your company direction. It can keep your finances healthy. But, if we’re being honest, it can also be a pain to write.

Luckily, you don’t have to start from scratch or go it alone. Business plan software and services can help you craft a professional business plan, like our top choice LivePlan , which provides templates, guidance, and more.

You’ve got quite a few choices for business plan help, so we’re here to help you narrow things down. Let’s talk about the best business plan tools out there.

- LivePlan : Best overall

- BizPlanBuilder : Most user-friendly

- Wise Business Plans : Best professional service

- Business Sorter : Best for internal plans

- GoSmallBiz.com : Most extra features

- Honorable mentions

Business plan software 101

The takeaway, business plan software faq, compare the best business plan software.

By signing up I agree to the Terms of Use and Privacy Policy .

LivePlan: Best overall business plan software

Data as of 3 /13/23 . Offers and availability may vary by location and are subject to change. *With annual billing

LivePlan has been our favorite business plan software for a while now, despite the stiff competition.

There’s a lot to like about LivePlan. It has pretty much all the features you could want from your business plan software. LivePlan gives you step-by-step instructions for writing your plan, helps you create financial reports, lets you compare your business’s actual financials to your plan’s goals, and much more. And if you ever need inspiration, it includes hundreds of sample business plans that can guide your writing.

LivePlan software pricing

But the best part? You get all that (and more) at a very competitive price. (You can choose from annual, six-month, or monthly billing.) While LivePlan isn’t quite the cheapest business plan builder out there, it’s not too far off either. And if comes with a 60-day money back guarantee. So there’s no risk in trying LivePlan out for yourself.

With a great balance of features and cost, LivePlan offers the best business plan solution for most businesses.

BizPlanBuilder: Most user-friendly

Need something easy to use? BizPlanBuilder fits the bill.

BizPlanBuilder doesn’t have a flashy, modern user interface―but it does have a very clear, intuitive one. You’ll be able to see your plan’s overall structure at a glance, so you can quickly navigate from your title page to your market trend section to that paragraph on your core values. And as you write, you’ll use a text editor that looks a whole lot like the word processing programs you’re already familiar with.

BizPlanBuilder software pricing

Data effective 3/13/23. At publishing time, amounts, rates, and requirements are current but are subject to change. Offers may not be available in all areas.

BizPlanBuilder also offers lots of helpful guidance for actually writing your plan. It gives you pre-written text, in which you just have to fill in relevant details. It offers explanations for what information you need to include in each section of your plan and way. It even gives you helpful tips from experts, so you’ll have all the information you need to plan like a pro.

So if you want planning software with almost no learning curve, you’ll like BizPlanBuilder.

Wise Business Plans: Best professional service

- Custom quote

Unlike all the other companies on this list, Wise Business Plans doesn’t offer software. Instead, it offers professional business plan writing services―meaning someone does all the hard work for you.

Now, you might think that sounds expensive―and you’re probably right (you have to request a custom quote for your plan). But there’s a lot to be said for expertise, and Wise Business Plans has plenty of that. Your business plan will get written by an experienced writer (with an MBA, no less). They’ll get information from you, do their own research, and then write your plan. You get one free revision, and you can always pay for more.

Wise Business Plans service pricing

Your end result will be a polished, entirely original business plan. (You can even get printed copies.) And best of all, you won’t have to spend your precious time working on the plan yourself. Wise Business Plans takes care of all the hard parts, and makes your business look good while doing it. Sounds like a service worth paying for, right?

Put simply, if you want the most professional business plan possible, we recommend using Wise Business Plans’s writing service.

Business Sorter: Best for internal plans

Many businesses need plans to show to people outside the company (to get financing, for example). But what if you just need a plan for internal use? In that case, we suggest Business Sorter.

Business Sorter uses a unique card-based method to help you craft the perfect business plan. (You can watch a demo video to see how it works.) You’ll plan some of the usual things, like finances and marketing. But Business Sorter also lets you make plans for specific teams and team members. It also emphasizes more internal matters, like operations, that might get overlooked in a business plan for outsiders.

Business Sorter software pricing

After you’ve made your business plan, Business Sorter also helps you stay accountable to it. You can create tasks, give them deadlines, and assign them to team members―giving you basic project management tools to make sure your business plans become business actions. (Oh, and did we mention that Business Sorter has the lowest starting prices of any software on this list?)

It all adds up to a business plan software that works great for internal planning.

GoSmallBiz: Most extra features

Want to get way more than just business planning software? Then you probably want GoSmallBiz.

See, GoSmallBiz offers business plan software as part of its service―but it’s just one part of a much bigger whole. You also get everything from discounts on legal services to a website builder to a CRM (customer relationship manager) to business document templates. And more. In other words, you get just about everything you need to get your startup off the ground.

GoSmallBiz software pricing

Don’t worry though―you still get all the business planning help you need. GoSmallBiz gives you business plan templates, step-by-step instructions, and the ability to create financial projections. And if you get stuck, GoSmallBiz will put you in touch with experts who can offer advice.

If you want business planning and much, much more, give GoSmallBiz a try.

- PlanGuru : Best financial forecasting

- EnLoop : Cheapest tool for startups

We recommend the software above for most business planning needs. Some businesses, though, might be interested in these more specialized planning software.

Honorable mention software pricing

Planguru: best financial forecasting features.

PlanGuru is pretty pricey compared to our other picks, but you might find its forecasting features worth paying for. It has more forecasting methods than other software (over 20) plus it lets you forecast up to 10 years.

EnLoop: Cheapest tool for startups

EnLoop doesn’t have our favorite features or interface, but it does have really, really low pricing plus a seven-day free trial. It's the most affordable software for startup business planning and still provides all the essential features like financial analysis, team collaboration, charting, and more.

Data as of 3 /13/23 . Offers and availability may vary by location and are subject to change. * With annual billing

Several of our previous favorite planning software, including BusinessPlanPro and StratPad, seem to have gone out of business.

A business plan is a written, living document that tells the story of your business and what you plan to do with it. It serves as the source of truth for you—the business owner—as well as potential partners, employees, and investors, but it also serves as a roadmap of what you want your business to be.

Why you need a business plan

While some small-business owners don’t see the point of creating a formal business plan, it can have some concrete benefits for your business. For example, one 2016 study found that business owners with written plans are more successful than those that don’t. 1

Still too vague? Then let’s get specific.

If you ever seek business funding (from, say, banks, angel investors , or venture capitalists ), you’ll have to prove that your business deserves the money you want. A formal business plan―complete with financial data and projections―gives you a professional document you can use to make your case. (In fact, most potential investors will expect you to have a business plan ready.)

Even if you’re not seeking funding right now, a business plan can help your business. A formal plan can guide your business’s direction and decision making. It can keep your business accountable (by, for example, seeing if your business meets the financial projections you included). And a formal plan offers a great way to make sure your team stays on the same page.

What to include in your business plan

Not all business plans are created equal. To make a really useful business plan, you’ll want to include a number of elements:

- Basic information about your business

- Your products/services

- Market and industry analysis

- What makes your business competitive

- Strategies and upcoming plans

- Your team (and your team’s background)

- Current financial status

- Financial and market projections

- Executive summary

Of course, you can include more or fewer elements―whatever makes sense for your business. Just make sure your business plan is comprehensive (but not overwhelming).

How business plan software can help

With so many elements to include, business plan creation can take a while. Business plan software tries to speed things up.

Most business plan software will include prompts for each section. In some cases, you can just fill in your business’s specific information, and the software will write the text for you. In other cases, the software will give you specific guidance and examples, helping you write the text yourself.

Plus, business plan software can help you stay organized. You’ll usually get intuitive menus that let you quickly flip through sections. So rather than endlessly scrolling through a long document in a word processor, you can quickly find your way around your plan. Some software even lets you drag and drop sections to reorganize your plan.

Sounds way easier than just staring at a blank page and trying to start from scratch, right?

Choosing business plan software

To find the right business plan builder for your business, you’ll want to compare features. For example, would you rather write your own text, getting prompts and advice from your software? Or would you rather go with a fill-in-the-blank method?

Likewise, think about the elements you need. If your plan will have a heavy focus on finances, you’ll want to choose business plan software with robust financial projection features. If you care more about market and competitor analysis, look for software that can help with that research.

You may also want to find business plan software that integrates with your business accounting software . Some plan builders will import data from Xero, QuickBooks, etc. to quickly generate your financial data and projections.

And of course, you’ll want to compare prices. After all, you always want to end up with software that fits your business budget.

The right business plan software can make your life easier. With LivePlan ’s wide breadth of features and online learning tools, you can’t go wrong. Plus, BizPlanBuilder 's one-time pricing makes it easy to invest while Business Sorter has a low starting cost. And if you're business is looking to grow, GoSmallBiz and Wise Business Plans will scale with you.

But of course, different companies have different needs. So shop around until you find the software that’s best for you and your business.

Now that you've got a business plan, take a look at our checklist for starting a small business. It can help you make sure you have everything else you need to get your startup off to a good start!

Related content

- 7 Steps to Build a Successful Project Management Sales Plan

- Best Project Management Software and Tools in 2023

- 4 Cost Management Techniques for Small Businesses

Creating a business plan can take anywhere from a couple hours to several weeks. Your timeline will depend on things like the elements you choose to include, whether you use software or hire a writing service, and how much research goes into your plan.

That said, much of the business plan software out there brags that it can help you create a fairly detailed plan in a few hours. So if you’re going the software route, that can help you set your expectations.

If you want to get the most out of your business plan, you should update it on a regular basis―at least annually. That way, you can continually refer to it to inform your company’s strategies and direction.

At the very least, you should update your business plan before you start looking for a new round of funding (whether that’s with investors or lenders).

Thanks to business plan software, you can easily write your own business plan rather than pay someone to do it for you. And in most cases, software will cost you less than a professional business plan service.

There are some times you might want to go with a service though. If time is tight, you might find that it’s worth the cost of a service. Or if you’ve got big investor meetings on the horizon, you might want the expertise and polish that a professional service can offer.

Ultimately, you’ll have to decide for yourself whether business plan software or a business plan service will work better for your company.

Methodology

We ranked business plan software and tools based on features, pricing and plans, and connections to project management and other services. The value of each plan and service, along with what it offers, was a big consideration in our rankings, and we looked to see if what was offered was useful to small businesses or just extra. The final thing we looked at was the ease of use of the software to see if it's too complex for small businesses.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources 1. Harvard Business Review, “ Research: Writing a Business Plan Makes Your Startup More Likely to Succeed .” Accessed March 13, 2023.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Best business plan software of 2024

For planning your business finance

Best overall

Best budget, best established, best for speed.

- How we test

The best business plan software makes it simple and easy to plan your business finances in order to present them to a bank or investors.

1. Best overall 2. Best budget 3. Best basic 4. Best established 5. Best for speed 6. FAQs 7. How we test

The whole point of a business plan is that it allows you to evaluate your strengths and weaknesses, not least via your Unique Selling Point (USP) ,and make product or service comparisons with competitors.

Of course, even the best business plan relies on estimates and guesstimates, as it's impossible to predict market changes, developments, and future performance under such conditions.

Ultimately, though, a business plan will demonstratively prove why your business is a solid enough investment to risk putting money into, and shows that you have properly and thoroughly researched your market, and details the real potential of a new business opportunities.

Here then are the best business plan software providers currently available.

You may also be interested in our featured business guides on best business laptops , best business computers and best business smartphones .

The best business plan software of 2024 in fill:

Why you can trust TechRadar We spend hours testing every product or service we review, so you can be sure you’re buying the best. Find out more about how we test.

Reasons to buy

Reasons to avoid.

Bizplan is the online business planning tool that claims usage of 30,000 startup founders from the Startups.co platform. They use a guided creator that can break the big project down into the component pieces that get tracked with a Progress Tracker, and expert guidance each step of the way including templates that can be dropped in, and completed, along with simple integration of visuals along the way.

Additional resources are also provided via the Bizplan Academy, with lessons on relevant topics, for example, “Building a Brand: How to Tell a Powerful Brand Story,” and “Critical Path Your Way to Higher Revenues,” among the many offerings. Those that need even more assistance also can take advantage of an expert consultation from a financial expert.

- ^ Back to the top

2. PlanGuru

PlanGuru is a comprehensive, and powerful software package in the business planning space. Education is provided via a series of case studies at their PlanGuru University and a whole slew of video tutorials.

The feature set includes flexible budgeting that can handle a simple small business, or a larger multi-department operating budget, and financial forecasting that uses multiple methods, including intelligent and turn-key methods - twenty methods in total. Historical results can also be imported with the general ledger import utility which can then applied to produce a rolling forecast. They also offer PlanGuru Launch, a service to bring in expertise and is charged per hour of assistance.

A significant downside is Planguru charges a higher cost than other software options. The cheapest option is around $75 per month for one business entity when billed annually. While there is no free trial, PlanGuru does offer a 30 day money back guarantee.

Our expert review:

Enloop is a great choice for business planning software for the cash strapped business as it is the rare offering that has a free tier. Step up up to the next tier, and this is no barebones product, as it has over 100 currency symbols, can automatically generate bank-ready financial reports, and even has automated text writing that can sync with financial data to turn it into text. There is also a real time performance score assigned, that dynamically changes as the business plan is strengthened.

The plans start with the Free tier, which is limited to a single business plan with simple text, no images, and does not offer any advanced features. The next plan up is the Detailed plan, that supports three business plans, and offers a significant 55% discount when paid annually, making it even better value. This plan costs around $20 per month. For a more comprehensive package you can buy the Performance plan costing around $40 per month.

Read our full Enloop business plan software review .

4. LivePlan

LivePlan is business planning software that offers a simple pricing scheme as there is only a single plan to choose from. As they have a 15+ year track record, they offer a clean and simple interface, that can create business plans that look like they were done by an expert consultant, and the software includes a live dashboard that can track day-to-day performance. Those with writer’s block will benefit from the over 500 included sample plans that can be turned to for inspiration.

Rather than complicate things with too many tiers to choose from, LivePlan only has a single plan which can be paid for monthly or annually.

5. Business Sorter

Business Sorter promises to simplify and speed up business planning and claims to be able to flesh out a plan in an hour or two, via a novel 273 card sort system that covers many common situations.

The ability to reword cards is included, or also to add cards to the already expansive deck, so no worries if there is not a pre-made card for your situation. Unlike some sites that have videos, the educational resources here are provided as PDFs and Word files, which can be quicker to access, but harder to follow for some learners.

The lowest tier plan, Basic is fully featured, and includes up to three team leaders.

Read our full Business Sorter review .

Other business plan software to consider

We've only covered some of the most popular business plan software platforms out there, but there are a number of other notables worth mentioning, plus a wide variety of providers of business plan templates. Below we'll briefly cover a range of some of the additional options out there that are worth considering to get your business plan right.

Go Business Plans is more of a consultancy than a software solution, but is worth mentioning for the simple fact that it's one of America's biggest business plan companies. While software might be able to do the job for you, if you're looking for significant funding, it's probably useful to get some professional advice, not least in terms of strategic planning, feasibility studies, and financial projections to ensure you have a solid base for your business plan.

Wise Business Plans provides a very wide range of templates to work from in constructing a business plan. These are particularly designed with funding in mind, no matter what kind of business you run. What is especially helpful is that Wise doesn’t simply deal with business plan templates for a diverse range of business types, the company also provides plan templates for franchises and non-profits.

Plan Writers is another bespoke service that essentially listens to what you want and then puts the plan together for you. Again, this technically falls outside of business plan "software", but the chances are you'll use a software package as a platform to build from, and Plan Writers can then help you build up from that base.

Bplans is another provider of business plan templates, but goes beyond that with additional pitch and SWOT analysis templates. There are also business plan guides, industry reports, and a free course on writing a business plan. Bplans also publishes a lot of free-to-use articles on business planning, financials, and tax reporting, to help ensure you can keep your figures and projections accurate and compliant.

We've also listed the best free software for small business .

A business plan is essentially your roadmap to profitability from an initial investment. Whether it's your own money, or a loan from a bank, it's still a good idea to set up a business plan for yourself.

Main things to look to are a SWOT analysis to provide an idea of your business idea's strengths and weaknesses, as well as identify a unique selling point (USP) that will give your business an edge.

While business plans inevitably demand the use of figures, and while these can be impossible to be accurate with, at least by making intelligent guesses you can set yourself targets to work towards.

That's another common feature of a plan, so that specific periods you can review your business progress and make adjustments to your plan as required. This allows you to use real figures for your projections, allowing you to better plan ahead.

Which business plan software is best for you?

When deciding which business plan software to use, first consider what your actual needs are, as sometimes free platforms may only provide basic options, so if you need to use advanced tools you may find a paid platform is much more worthwhile. Additionally, free and budget software options can sometimes prove limited when it comes to the variety of tools available, while higher-end software can really cater for every need, so do ensure you have a good idea of which features you think you may require.

How we tested the best business plan software

To test for the best business plan software we first set up an account with the relevant software platform, whether as a download or as an online service. We then tested the service to see how the software could be used for different purposes and in different situations. The aim was to push each business plan software platform to see how useful its basic tools were and also how easy it was to get to grips with any more advanced tools.

Read how we test, rate, and review products on TechRadar .

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.

Adobe Fill & Sign (2024) review

Adobe Fonts (2024) review

Netflix to add more live content, including two NFL games on Christmas Day 2024

Most Popular

- 2 Microsoft launches generative AI model designed exclusively for US intelligence services — air-gapped system for spies aims to avoid potential security leaks

- 3 Memorial Day preview: save up to $1,000 on stunning OLED TVs at Best Buy

- 4 Forget projectors – TCL’s 115-inch mini-LED TV has 6.2.2-channel Dolby Atmos speakers and 5,000 nits brightness

- 5 Peacemaker season 2's new cast reveal means it's going to be harder to follow James Gunn's DC Cinematic Universe

- 2 Forget projectors – TCL’s 115-inch mini-LED TV has 6.2.2-channel Dolby Atmos speakers and 5,000 nits brightness

- 3 Capture amazing images every single day

- 4 Sennheiser has slashed prices on some of its best headphones for Click Frenzy

- 5 You can now play PS1 games in iOS on your iPhone – here’s how

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Write your business plan

Business plans help you run your business.

A good business plan guides you through each stage of starting and managing your business. You’ll use your business plan as a roadmap for how to structure, run, and grow your new business. It’s a way to think through the key elements of your business.

Business plans can help you get funding or bring on new business partners. Investors want to feel confident they’ll see a return on their investment. Your business plan is the tool you’ll use to convince people that working with you — or investing in your company — is a smart choice.

Pick a business plan format that works for you

There’s no right or wrong way to write a business plan. What’s important is that your plan meets your needs.

Most business plans fall into one of two common categories: traditional or lean startup.

Traditional business plans are more common, use a standard structure, and encourage you to go into detail in each section. They tend to require more work upfront and can be dozens of pages long.

Lean startup business plans are less common but still use a standard structure. They focus on summarizing only the most important points of the key elements of your plan. They can take as little as one hour to make and are typically only one page.

Traditional business plan

Lean startup plan

Traditional business plan format

You might prefer a traditional business plan format if you’re very detail-oriented, want a comprehensive plan, or plan to request financing from traditional sources.

When you write your business plan, you don’t have to stick to the exact business plan outline. Instead, use the sections that make the most sense for your business and your needs. Traditional business plans use some combination of these nine sections.

Executive summary

Briefly tell your reader what your company is and why it will be successful. Include your mission statement, your product or service, and basic information about your company’s leadership team, employees, and location. You should also include financial information and high-level growth plans if you plan to ask for financing.

Company description

Use your company description to provide detailed information about your company. Go into detail about the problems your business solves. Be specific, and list out the consumers, organization, or businesses your company plans to serve.

Explain the competitive advantages that will make your business a success. Are there experts on your team? Have you found the perfect location for your store? Your company description is the place to boast about your strengths.

Market analysis

You'll need a good understanding of your industry outlook and target market. Competitive research will show you what other businesses are doing and what their strengths are. In your market research, look for trends and themes. What do successful competitors do? Why does it work? Can you do it better? Now's the time to answer these questions.

Organization and management

Tell your reader how your company will be structured and who will run it.

Describe the legal structure of your business. State whether you have or intend to incorporate your business as a C or an S corporation, form a general or limited partnership, or if you're a sole proprietor or limited liability company (LLC).

Use an organizational chart to lay out who's in charge of what in your company. Show how each person's unique experience will contribute to the success of your venture. Consider including resumes and CVs of key members of your team.

Service or product line

Describe what you sell or what service you offer. Explain how it benefits your customers and what the product lifecycle looks like. Share your plans for intellectual property, like copyright or patent filings. If you're doing research and development for your service or product, explain it in detail.

Marketing and sales

There's no single way to approach a marketing strategy. Your strategy should evolve and change to fit your unique needs.

Your goal in this section is to describe how you'll attract and retain customers. You'll also describe how a sale will actually happen. You'll refer to this section later when you make financial projections, so make sure to thoroughly describe your complete marketing and sales strategies.

Funding request

If you're asking for funding, this is where you'll outline your funding requirements. Your goal is to clearly explain how much funding you’ll need over the next five years and what you'll use it for.

Specify whether you want debt or equity, the terms you'd like applied, and the length of time your request will cover. Give a detailed description of how you'll use your funds. Specify if you need funds to buy equipment or materials, pay salaries, or cover specific bills until revenue increases. Always include a description of your future strategic financial plans, like paying off debt or selling your business.

Financial projections

Supplement your funding request with financial projections. Your goal is to convince the reader that your business is stable and will be a financial success.

If your business is already established, include income statements, balance sheets, and cash flow statements for the last three to five years. If you have other collateral you could put against a loan, make sure to list it now.

Provide a prospective financial outlook for the next five years. Include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets. For the first year, be even more specific and use quarterly — or even monthly — projections. Make sure to clearly explain your projections, and match them to your funding requests.

This is a great place to use graphs and charts to tell the financial story of your business.

Use your appendix to provide supporting documents or other materials were specially requested. Common items to include are credit histories, resumes, product pictures, letters of reference, licenses, permits, patents, legal documents, and other contracts.

Example traditional business plans

Before you write your business plan, read the following example business plans written by fictional business owners. Rebecca owns a consulting firm, and Andrew owns a toy company.

Lean startup format

You might prefer a lean startup format if you want to explain or start your business quickly, your business is relatively simple, or you plan to regularly change and refine your business plan.

Lean startup formats are charts that use only a handful of elements to describe your company’s value proposition, infrastructure, customers, and finances. They’re useful for visualizing tradeoffs and fundamental facts about your company.

There are different ways to develop a lean startup template. You can search the web to find free templates to build your business plan. We discuss nine components of a model business plan here:

Key partnerships

Note the other businesses or services you’ll work with to run your business. Think about suppliers, manufacturers, subcontractors, and similar strategic partners.

Key activities

List the ways your business will gain a competitive advantage. Highlight things like selling direct to consumers, or using technology to tap into the sharing economy.

Key resources

List any resource you’ll leverage to create value for your customer. Your most important assets could include staff, capital, or intellectual property. Don’t forget to leverage business resources that might be available to women , veterans , Native Americans , and HUBZone businesses .

Value proposition

Make a clear and compelling statement about the unique value your company brings to the market.

Customer relationships

Describe how customers will interact with your business. Is it automated or personal? In person or online? Think through the customer experience from start to finish.

Customer segments

Be specific when you name your target market. Your business won’t be for everybody, so it’s important to have a clear sense of whom your business will serve.

List the most important ways you’ll talk to your customers. Most businesses use a mix of channels and optimize them over time.

Cost structure

Will your company focus on reducing cost or maximizing value? Define your strategy, then list the most significant costs you’ll face pursuing it.

Revenue streams

Explain how your company will actually make money. Some examples are direct sales, memberships fees, and selling advertising space. If your company has multiple revenue streams, list them all.

Example lean business plan

Before you write your business plan, read this example business plan written by a fictional business owner, Andrew, who owns a toy company.

Need help? Get free business counseling

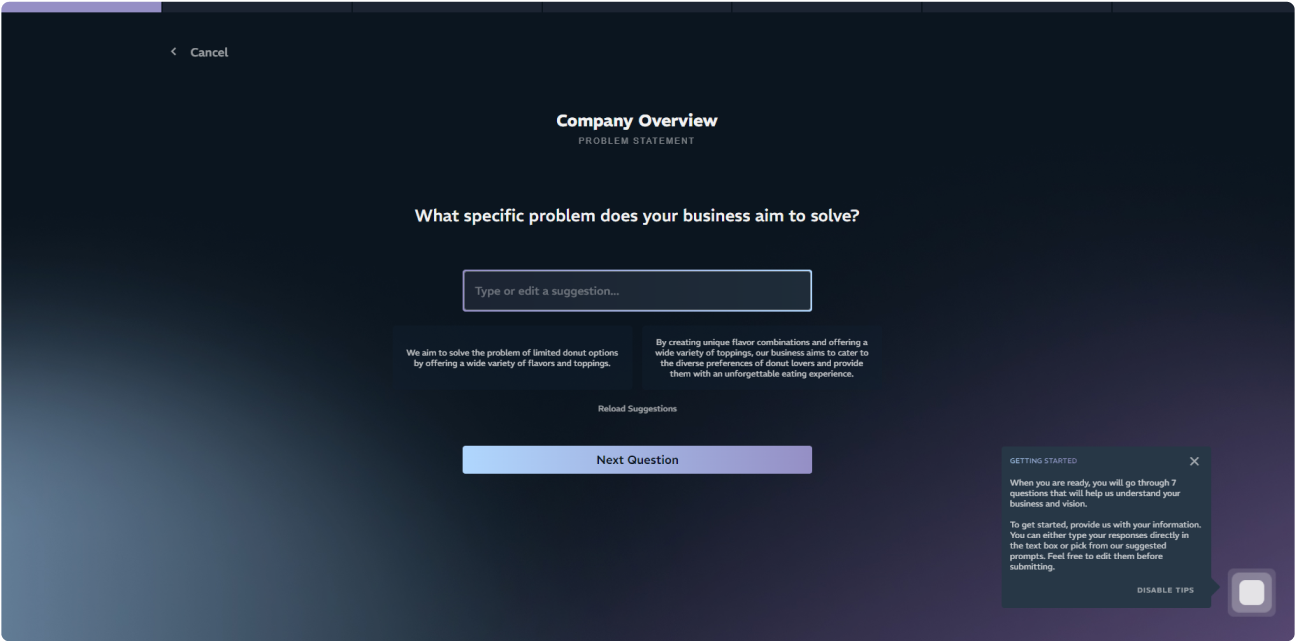

Create Your Business Plan in Minutes

Type your business idea below.

What Our Users Say

Zakariya A.

How it Works

Questionnaire

Respond to a series of targeted questions about your business goals and objectives.

AI Business Plan Generator

The engine analyzes your responses and generates a business plan tailored to your vision.

SBA Approved Business Plan

Receive a detailed, tailored business plan that aligns with your requirements. Ready for funding.

WHO BENEFITS FROM Plannit?

Aspiring Entrepreneurs

Analyze your ventures through extensive business plans aligned with your vision and goals.

Business Owners

Back your business with a solid plan that aligns with your vision and goals. Perfect for startups and small businesses.

Educational Institutions

Develop your business understanding and vocabulary by analyzing your business idea and creating a plan.

Startups Accelerators

Work alongside your founders as they build their plan to ensure they have a solid roadmap for growth and scalability.

Try Plannit AI For Free

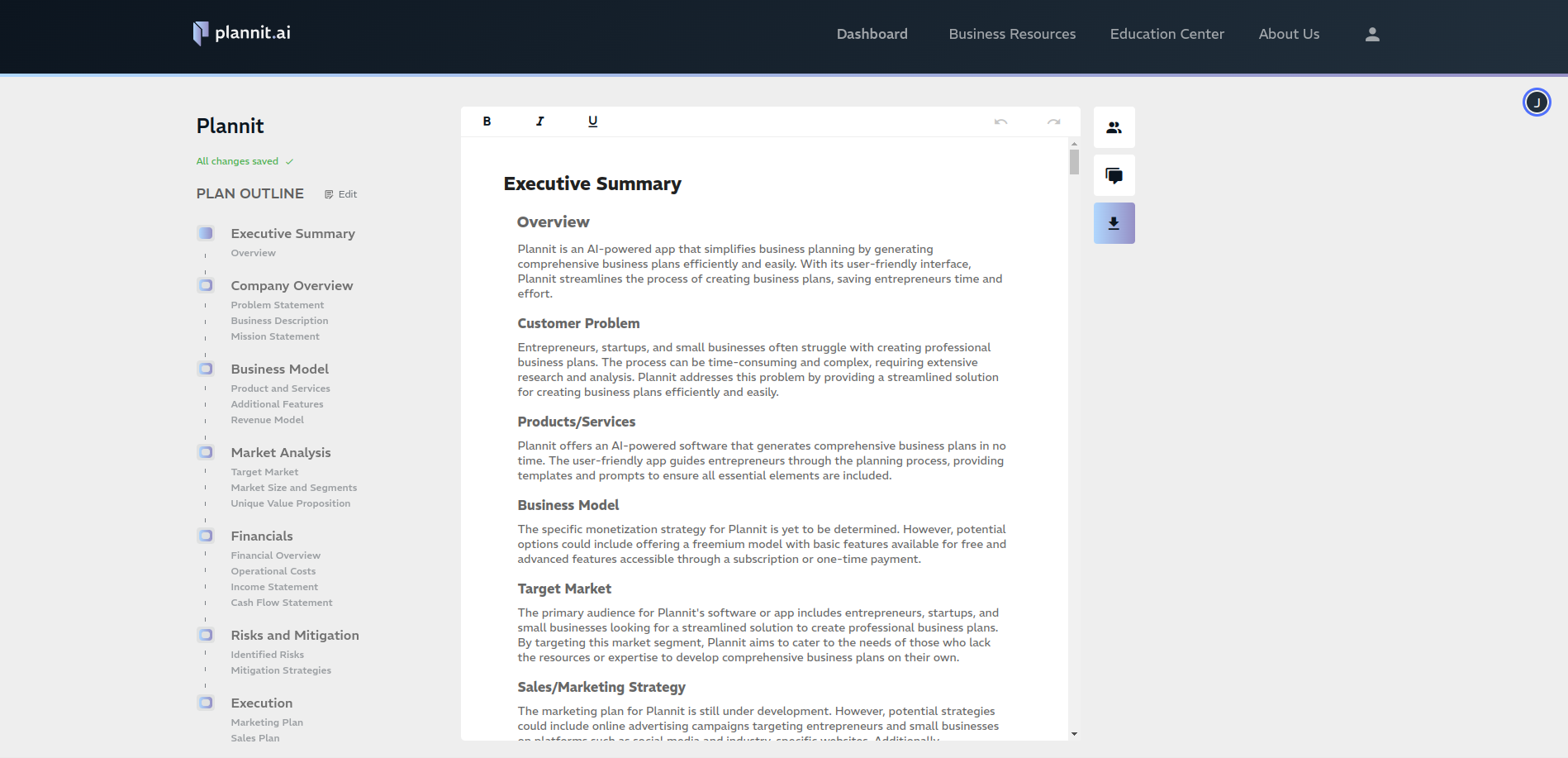

Funding ready business plan, executive summary, company overview.

Problem Statement

Business Description

Mission Statement

Business Model

Products and Services

Additional Features

Revenue Model

Market Analysis

Target Market

Market Size and Segments

Unique Value Proposition

Risks and Mitigations

Identified Risks

Mitigation Strategies

Financial Overview

Income Statement

Marketing and Sales Plan

Focus On Your Vision

Key features & benefits, ai editing companion.

Modify and regenerate sections of your business plan using premade or custom prompts. Our AI will help you refine your plan to perfection.

Multi-User Collaboration

Invite team members with easy sharing to collaborate on your business plan in real-time. Communicate and make changes together. Collaborate with your partners in real-time as you perfect your plan.

Education Center

Immerse yourself in a rich library of articles, tools, templates, webinars and resources for continuous business and professional growth. Learn all about the key aspects of starting, running and growing a business.

Powered by Chat GPT

Our algorithms are powered the latest in AI technology to ensure the most accurate and relevant output. We use OpenAI's GPT 4 and 3.5 engines for the perfect blend of accuracy and speed.

Business Resources

We recommend a variety of useful tools and resurces that help sustain your growth. We only recommend the best in the business. Filter your needs and equip yourself with the best tools.

Plan Samples

Explore a library of sample business plans we generated to get the idea of what to expect. Currently able to generate viable plans for 50+ industries.

Financial Projections

Take an additional questionnaire about your financial trajectory and get a detailed financial projection + 3 year income statement for your business.

Tools and Templates

Plannit's comprehensive suite that accompany business planning. From pitch decks to financial models, we have you covered.

Plan Export

Download your business plan in an editable .docx format. Fully edit & share your plan with investors, partners, and stakeholders.

Privacy & Security

Rest assured, your privacy is our top priority, and we're committed to keeping your information safe and confidential.

PLANNIT BUSINESS ECOSYSTEM

Frequently Asked Questions (FAQ)

- Initiate with Your Business Concept: Lay the Groundwork: Start by introducing your business idea into Plannit AI's Business Plan Generator. This first step is crucial, as it sets the tone for a tailored, insightful business plan that truly resonates with your vision. Capture the Essence: Our platform is designed to grasp the nuances of your concept, ensuring that the generated plan accurately reflects the core and potential of your business.

- Navigate Through the AI-Guided Questionnaire: Tailored Interactive Experience: Plannit AI’s AI-guided questionnaire is your interactive guide through the planning process. It meticulously gathers information about your business's objectives, strategies, and market positioning, ensuring a comprehensive and reflective plan. Intelligent Feedback and Suggestions: As you progress through the questionnaire, benefit from smart prompts and suggestions, ensuring that your plan is not just detailed but also strategically sound and aligned with industry standards.

- Generate Your Plan with Advanced AI: Intuitive Plan Creation: With the questionnaire complete, Plannit AI's advanced algorithms intelligently analyze your responses. They then craft a detailed, customizable, and strategically aligned business plan, providing you with a structured, coherent, and actionable format. Benefit from AI-Powered Insights: Plannit AI offers AI-driven insights and suggestions, ensuring your plan is not just a document but a strategic tool equipped with tailored AI prompts and an in-app plan editor. Get inspired by browsing through our sample business plans, a collection of successful strategies across various industries.

- Finalize Your Plan with Confidence: Dynamic Adaptation and Refinement: Plannit AI recognizes that a business plan is a living document. Our platform allows for continuous adaptation and refinement, ensuring your strategy remains agile, relevant, and aligned with your evolving business goals. Professional Presentation and Sharing: Once your plan meets your standards, utilize Plannit AI's export features to present your plan professionally. Choose between various formats for exporting your business plan, ready to impress stakeholders, attract investors, or guide your team. Review and Adapt: Ensure your business plan is a living document, ready to evolve with your growing business. Plannit AI's dynamic platform allows you to adapt your strategy as new opportunities or challenges arise.

- Roadmap for Success: At its core, a business plan acts as a strategic guide, providing detailed steps on how your business will achieve its objectives. It helps you navigate the startup phase, manage growth effectively, and tackle unforeseen challenges with a well-thought-out strategy.

- Securing Funding: For startups and businesses looking to expand, a business plan is crucial for securing loans or attracting investors. It demonstrates to potential financial backers that your business has a clear vision, a solid strategy for profitability, and a plan for delivering returns on their investment.

- Informed Decision-Making: A well-prepared business plan offers valuable insights into your market, competition, and potential challenges. This information is vital for making informed decisions, from day-to-day operations to long-term strategic shifts.

- Market Analysis and Strategy: It allows you to conduct an in-depth analysis of your target market, understand customer needs, and position your product or service effectively. The marketing strategy outlined in your business plan helps in identifying the best channels and tactics to reach your audience and achieve market penetration.

- Financial Planning: One of the most critical components of a business plan is the financial forecast. It outlines your funding requirements, expected revenue, profit margins, and cash flow projections. This section is essential for budgeting, financial management, and ensuring the financial viability of your business.

- Goal Setting and Performance Measurement: A business plan sets clear, measurable goals and objectives. It provides a framework for monitoring performance, measuring success, and making necessary adjustments to stay on track.

- Aspiring Entrepreneurs: If you're at the idea stage, looking to transform your vision into a viable business, Plannit AI offers the tools and guidance to bring your concept to life. Our platform helps you articulate your business idea, define your target market, and develop a solid plan to turn your dream into reality.

- Students and Educators: For students delving into the intricacies of business planning and educators teaching the fundamentals of entrepreneurship, Plannit AI serves as an invaluable resource. It provides a practical, hands-on tool for learning and teaching how to create detailed business plans, analyze markets, and understand financials in a real-world context.

- Startup Founders: In the dynamic startup environment, Plannit AI is the ideal partner for founders looking to pivot quickly, secure funding, or understand their competitive landscape. With our AI-driven insights and market analysis tools, startups can make informed decisions and adapt their strategies to thrive in competitive markets.

- Small Business Owners: For small business owners seeking to optimize their operations, expand their customer base, or explore new markets, Plannit AI offers targeted solutions. Our platform simplifies the planning process, enabling owners to focus on growth while managing the day-to-day challenges of running their business.

- Consultants and Freelancers: Consultants and freelancers specializing in business development, strategic planning, or financial advising will find Plannit AI a powerful addition to their toolkit. It allows them to provide clients with comprehensive, data-driven business plans and strategies, enhancing the value of their services.

- Non-Profit Organizations: Leaders of non-profit organizations can leverage Plannit AI to plan initiatives, secure funding, and manage resources more efficiently. Our platform helps non-profits articulate their mission, set achievable goals, and measure their impact, ensuring they can make a difference in their communities.

- Innovators and Inventors: Individuals looking to commercialize innovative products or technologies can use Plannit AI to navigate the complexities of bringing new ideas to market. From patent strategies to go-to-market plans, our platform covers all bases, ensuring innovators can focus on what they do best.

- Small Business Development Centers (SBDCs) and Government Agencies: Government and SBA backed entities can greatly benefit from integrating Plannit AI into their services, enhancing their ability to support a larger number of clients more efficiently. By facilitating quicker, more in-depth business plan development, these organizations can spend more time assisting with plan execution and less time on creation, ultimately serving their communities more effectively.

- Anyone with a Business Idea: Ultimately, Plannit AI is for anyone with a business idea, regardless of industry, experience, or stage of business development. Our mission is to democratize business planning, making it accessible, understandable, and actionable for everyone.

- Interactive Questionnaire and ChatGPT Integration: Plannit AI transforms the business planning process into an engaging conversation. Through our advanced ChatGPT integration, we offer a questionnaire that dynamically adapts to your responses, ensuring your plan is personalized, comprehensive, and aligned with your business goals.

- Dynamic Planning Environment: Unlike static templates provided by many, Plannit AI introduces a living platform that grows with your business. It features real-time updates, strategic insights, and a feedback mechanism that keeps your business plan current and actionable.

- Extensive Educational Resources: Our Education Center is packed with articles, guides, and sample plans to bolster your planning process. It's designed to arm you with the knowledge to navigate the complexities of your industry confidently.

- Enhanced Collaboration and Customization: Recognizing the collaborative essence of business planning, Plannit AI supports team efforts with multi-user editing, annotations, and feedback features, ensuring a comprehensive approach to your strategy.

- Customer Success Stories: Our users' achievements are a testament to Plannit AI's effectiveness. These success stories illustrate how diverse businesses have utilized our platform for strategic planning and growth.

- Tailored Business Plan Creation: Our platform stands out with its tailored approach, featuring customizable templates that directly cater to your business type and industry, making plan creation straightforward and relevant.

- Content Generation:: ChatGPT helps draft various sections of a business plan, from executive summaries to marketing strategies, by providing structured and coherent text based on the prompts given.

- Strategic Insights: It can offer suggestions on business strategies by analyzing trends and providing examples from a wide range of industries.

- Financial Planning: While it can't replace professional financial advice, ChatGPT can guide the structure of financial projections and statements, helping you consider important financial aspects of your plan.

Take The First Step Towards Success With our AI-Generated Business Plans

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their accounting firms.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write an accounting business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is an Accounting Business Plan?

A business plan provides a snapshot of your accounting business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Accounting Firm

If you’re looking to start an accounting firm or grow your existing accounting business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your accounting business to improve your chances of success. Your accounting business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Accounting Firms

With regards to funding, the main sources of funding for an accounting firm are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for accounting firms.

Finish Your Business Plan Today!

How to write a business plan for an accounting firm.

If you want to start an accounting business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your accounting business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of accounting business you are running and the status. For example, are you a startup, do you have an accounting business that you would like to grow, or are you operating an established accounting business you would like to sell?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the accounting industry.

- Discuss the type of accounting business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of accounting business you are operating.

For example, you might specialize in one of the following types of accounting firms:

- Full Service Accounting Firm: Offers a wide range of accounting services.

- Bookkeeping Firm: Typically serves small business clients by maintaining their company finances.

- Tax Firm: Offers tax accounting services for businesses and individuals.

- Audit Firm: Offers auditing services for companies, organizations, and individuals.

In addition to explaining the type of accounting business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?