How To Write a Winning Accountant Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for accountant businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every accountant business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Accountant Business Plan?

An accountant business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Accountant Business Plan?

An accountant business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Accountant Business Plan

The following are the key components of a successful accountant business plan:

Executive Summary

The executive summary of an accountant business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your accountant company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your accountant business , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your accountant firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an accountant business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the accountant industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an accountant business may include small business owners, individuals with complex financial situations, or other businesses that need accounting assistance.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or accountant services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your accountant business via word-of-mouth or referrals from satisfied customers.

Operations Plan

This part of your accountant business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an accountant business include reaching $X in sales. Other examples include adding new products or services, expanding to new markets, or opening new locations.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific accountant industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Accountant Business

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Accountant Business

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup accountant business.

Sample Cash Flow Statement for a Startup Accountant Business

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your accountant company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

The goal of any business plan is to provide a roadmap for the future. A winning accountant business plan does this by providing a detailed overview of your company, its operations, and its financials. If you are seeking funding, your business plan should also include an appendix with your full financial projections and supporting documentation.

Finish Your Accounting Firm Business Plan in 1 Day!

Business development

- Billing management software

- Court management software

- Legal calendaring solutions

Practice management & growth

- Project & knowledge management

- Workflow automation software

Corporate & business organization

- Business practice & procedure

Legal forms

- Legal form-building software

Legal data & document management

- Data management

- Data-driven insights

- Document management

- Document storage & retrieval

Drafting software, service & guidance

- Contract services

- Drafting software

- Electronic evidence

Financial management

- Outside counsel spend

Law firm marketing

- Attracting & retaining clients

- Custom legal marketing services

Legal research & guidance

- Anywhere access to reference books

- Due diligence

- Legal research technology

Trial readiness, process & case guidance

- Case management software

- Matter management

Recommended Products

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

Fast track case onboarding and practice with confidence. Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

A business management tool for legal professionals that automates workflow. Simplify project management, increase profits, and improve client satisfaction.

- All products

Tax & Accounting

Audit & accounting.

- Accounting & financial management

- Audit workflow

- Engagement compilation & review

- Guidance & standards

- Internal audit & controls

- Quality control

Data & document management

- Certificate management

- Data management & mining

- Document storage & organization

Estate planning

- Estate planning & taxation

- Wealth management

Financial planning & analysis

- Financial reporting

Payroll, compensation, pension & benefits

- Payroll & workforce management services

- Healthcare plans

- Billing management

- Client management

- Cost management

- Practice management

- Workflow management

Professional development & education

- Product training & education

- Professional development

Tax planning & preparation

- Financial close

- Income tax compliance

- Tax automation

- Tax compliance

- Tax planning

- Tax preparation

- Sales & use tax

- Transfer pricing

- Fixed asset depreciation

Tax research & guidance

- Federal tax

- State & local tax

- International tax

- Tax laws & regulations

- Partnership taxation

- Research powered by AI

- Specialized industry taxation

- Credits & incentives

- Uncertain tax positions

A powerful tax and accounting research tool. Get more accurate and efficient results with the power of AI, cognitive computing, and machine learning.

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

Automate workpaper preparation and eliminate data entry

Trade & Supply

Customs & duties management.

- Customs law compliance & administration

Global trade compliance & management

- Global export compliance & management

- Global trade analysis

- Denied party screening

Product & service classification

- Harmonized Tariff System classification

Supply chain & procurement technology

- Foreign-trade zone (FTZ) management

- Supply chain compliance

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Risk & compliance management.

- Regulatory compliance management

Fraud prevention, detection & investigations

- Fraud prevention technology

Risk management & investigations

- Investigation technology

- Document retrieval & due diligence services

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Who we serve.

- Broadcasters

- Governments

- Marketers & Advertisers

- Professionals

- Sports Media

- Corporate Communications

- Health & Pharma

- Machine Learning & AI

Content Types

- All Content Types

- Human Interest

- Business & Finance

- Entertainment & Lifestyle

- Reuters Community

- Reuters Plus - Content Studio

- Advertising Solutions

- Sponsorship

- Verification Services

- Action Images

- Reuters Connect

- World News Express

- Reuters Pictures Platform

- API & Feeds

- Reuters.com Platform

Media Solutions

- User Generated Content

- Reuters Ready

- Ready-to-Publish

- Case studies

- Reuters Partners

- Standards & values

- Leadership team

- Reuters Best

- Webinars & online events

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

- Reuters Media Center

- Jurisdiction

- Practice area

- View all legal

- Organization

- View all tax

Featured Products

- Blacks Law Dictionary

- Thomson Reuters ProView

- Recently updated products

- New products

Shop our latest titles

ProView Quickfinder favorite libraries

- Visit legal store

- Visit tax store

APIs by industry

- Risk & Fraud APIs

- Tax & Accounting APIs

- Trade & Supply APIs

Use case library

- Legal API use cases

- Risk & Fraud API use cases

- Tax & Accounting API use cases

- Trade & Supply API use cases

Related sites

United states support.

- Account help & support

- Communities

- Product help & support

- Product training

International support

- Legal UK, Ireland & Europe support

New releases

- Westlaw Precision

- 1040 Quickfinder Handbook

Join a TR community

- ONESOURCE community login

- Checkpoint community login

- CS community login

- TR Community

Free trials & demos

- Westlaw Edge

- Practical Law

- Checkpoint Edge

- Onvio Firm Management

- Proview eReader

How to start an accounting firm: Your checklist for successfully starting a firm

So, you're thinking of starting an accounting firm.

That's great. No doubt you have plenty of questions about how to set up a new firm and get off to a great start.

Thomson Reuters spoke with some of our industry experts to get answers to the big questions you may have.

Here's what they told us.

Useful links

- Tax preparation software

- Accounting software

- Tax and accounting research

- Practice management software

- See all solutions

Starting your own accounting business sounds like a lot of work. Why would I want to start an accounting firm?

Starting an accounting firm is like starting any small business – it requires a lot of work. However, industry and consulting firms list accounting firms as one of the single most profitable small businesses a person can start right now.

Here are a few questions to consider when starting a firm:

- Do you want to be a cog in the machine or own a firm? Frankly, there isn’t a wrong answer to this question, but rather a preference. However, going out on your own comes with one significant benefit: you’re getting the profit from the firm, not just your wages. You go from employee to owner.

- What’s my business purpose? While perhaps a bit esoteric, defining your business’s purpose is crucial. Why am I doing this? What’s my goal behind this? It’s not just a philosophical exercise. Knowing why you’re starting a firm can help you define your target market, whether it’s helping small businesses, real estate, or another service area.

- Do you want to be nimble and cutting edge? Small firms tend to be much more agile and have a greater ability to do new things. From adopting new technology to discovering and implementing new software or other efficiency creating tools, running your own firm lets you make the decisions about what makes your business unique—and profitable.

- Should you start a legal entity? For some, a sole proprietorship won’t require incorporation – especially if the work is centered around less complex tasks such as basic tax preparation. However, there are certain liability protections by becoming an LLC, including limiting risk for your business. Assets become owned by your business and are distinguished from personal assets. When a business is not incorporated, it becomes harder to draw that line and the entire enterprise becomes at risk.

What are the requirements to open an accounting firm? What do I need?

Starting an accounting firm is no different from starting any other small business. And while there are accounting-specific requirements, it’s important to remember that you’re starting a business first.

Start by figuring out your purpose, goal, and market. This will influence many other decisions, including the function of the services you provide, whether you want a physical or virtual location, your target demographic, and the location of your business.

Once you’ve selected a location and determined your goals, it’s time to consider the nuts and bolts of owning a business.

You’ll need to:

- Obtain Employer Identification Number (EIN) and Tax ID number

- Investigate employment laws

- Determine startup costs

- Develop a pricing structure for services

- Decide on the legal structure of your business (S-Corp, L-Corp, LLC, Partnership, LLP )

- Look at business insurance

- Create a business bank account

- Develop internal policies and rules

- Hire employees

Additionally, you’ll have to think about the day-to-day needs of running a business, including managing risk, basic administrative tasks, and general questions of how and where you will meet clients.

Will I need to get a new EIN from the federal government ?

In most cases, owning and running an accounting firm necessitates an Employer Identification Number (EIN). However, the IRS website provides an in-depth explanation of who is required to have an EIN and when. A good rule of thumb is: if you plan on hiring employees – or plan to in the future – you’ll probably need an EIN.

That said, even if you don’t think you need one – or the website says it isn’t a requirement– most businesses are probably better off acquiring an EIN.

Luckily, the online process is fast, easy, and free.

If I’m not a Certified Public Accountant, do I need a CPA to open an accounting firm ?

It depends.

While all CPAs are accountants, not all accountants are CPAs. There are differences between the two, including education, experience, and certain opportunities. However, the answer goes back to the question, “What services do you want to offer?”

An accounting firm can do almost everything a CPA firm can do with one exception – audits and assurance services. So, if that is a part of your goals or your target market, then it’s probably wise to think about the steps needed to become a CPA.

However, if you are looking to focus on the multitude of other services accounting firms provide, it’s likely not a necessary credential to start. And while there are certain state-by-state exceptions about what can and cannot be undertaken by a CPA, they are not a requirement for starting an accounting firm.

However, if you want to call yourself a “CPA firm” – you will need a CPA.

Can accountants work from home ?

One of the benefits of starting an accounting firm is flexibility. So, the simple answer to the question is, yes—many accountants can and do work from a home office.

All the regulations that apply to a physical location also apply to virtual or home offices. So not having a physical office does not put an accounting firm at a disadvantage.

In fact, working from home is even easier with modern technology and software solutions that help bring vital aspects of your daily workflow into one dedicated (and usually online) space. For instance, Thomson Reuters makes its CS Professional Suite of tax and accounting software available as hosted online solutions and designed its Onvio products to run entirely in the cloud.

It’s important to note: an accounting firm must have a dedicated EFIN (Electronic Filing Identification Number) for every separate location where they perform work. So, if you have a physical location and do work in a home office, you’ll need to investigate whether you’ll need a separate EFIN for home office.

The answer largely depends on how much – and the extent of the work – you do from home. Check with the IRS for further guidance.

If I’d prefer a home-based accounting business, what should I know about starting an accounting firm from home ?

Luckily, accounting firms don’t need a physical space to operate successfully. And like the traditional brick and mortar approach, having a home-based or virtual business brings both opportunities and challenges that are unique to that approach. When considering a home-based business, it’s important to think about the unique challenges and opportunities involved.

These include:

- Shared work locations. There are many co-working locations across the country, many of which include both space for professionals to perform their tasks, as well as providing a professional, on-demand space to meet with clients. While there is usually a monthly fee to use these spaces, the benefits they provide are often worth the cost (and are significantly cheaper than leasing or purchasing office space).

- Low costs. New businesses often struggle with overhead. As you build your client list, keeping costs low is a priority. Not only does it allow you to see a profit early, but it also allows you to adjust your service menu to attract clients with lower-than-normal prices.

- Liability issues. If you choose to meet clients in your home, liability and zoning can be an issue. If a client gets hurt inside your home office, or falls outside of it, it’s important to know the laws surrounding liability.

- Zoning laws. Most cities and counties have zoning regulations. Make sure you investigate and comply with any laws to ensure your home-based business isn’t operating illegally.

- Turn limitations into unique opportunities. While not having a physical space can be challenging at times, it can also be an advantage. Consider visiting clients onsite. Not only does it solve space concerns, it communicates a message to the client—you offer a higher level of service.

What are the key services offered by accounting firm s?

In many ways, this question can be answered by once again looking at your goals and target market. What are the key services needed by that population? How can you serve them better? Still, while many services will be dictated by the specifics of your clients and their business, there are a few standards most accounting firms offer, including:

- Assurance services

- Bookkeeping

While these are typically the core offerings – and the ones that will provide consistent business in most accounting firms – it’s also important to investigate emerging and buzz-worthy services that are attracting bigger and more progressive accounting businesses.

From consulting and advising to outsourced CFO services (serving as the embedded strategic financial decision-maker for a client), taking a cue from the bigger firms – and anticipating what trends might trickle down to smaller and independent businesses – can increase the clients you serve and put you steps ahead of your competition.

What should I know about running an accounting firm ?

Starting a business is filled with new and challenging decisions. However, once the business is up and running, it’s common to be unprepared for typical day-to-day operations. Anticipating (and planning for) these concerns helps make sure you’re working as efficiently as possible.

Common questions and concerns include:

- Talent acquisition and development. Frankly, finding and keeping staff is a significant challenge, which is why hiring always leads industry surveys about common needs and concerns. Even if you aren’t ready to hire a team, it’s wise to start developing a strategy early.

- Going beyond the seasonal business . Every year it gets harder and harder to operate a seasonal accounting business, especially if you’re looking to offer a variety of services. Unless you’re doing just cookie-cutter tax prep – and you avoid complex returns – you won’t be able to operate on a seasonal basis. That said, prioritizing the season and maximizing your efficiency (and your profits) during the heavy times is critical to finding success.

- Keep on top of regulatory changes. Keeping up with major regulatory changes can be a challenge – especially if you add staff. Finding a solution that helps minimize the burden and risk that otherwise exists will help stave off the constant onslaught of new information.

- Rethink the traditional role of the accounting firm. Traditional accounting firms used to meet with clients just once a year to do their tax return. More progressive firms are moving to a year-round schedule, which not only allows them to expand services for current and future clients but implies a partnership relationship that goes beyond the “one touchpoint” per year model.

How much should an accountant charge per hour? Or should accountants charge a fixed fee ?

This, in many ways, is an unanswerable question because the only reliable advice that can be given is, “It depends.” Every context is different and is swayed by factors such as competition, location, service offerings, and level of expertise.

However, even though there isn’t a standard fee, most accounting firms are moving away from an hourly fee structure and choosing to institute to a fixed fee model that allows for better value for clients, a more manageable business plan, and eventually an increase in earnings.

Again, every context is unique, and there are certain situations when an hourly fee structure is best. These include:

- When you’re gathering information to develop a fee structure

- Gauging profitability in a newer firm and trying to determine the hours you need to work and remain profitable

- Early in your career when you need more time to complete basic tasks

Outside of those circumstances, a fixed fee is recommended and preferred. As your skill and expertise grow, so will your abilities to complete tasks quickly. With an hourly fee, this means having to take on more clients to maintain (and hopefully increase) your profits.

A fixed fee structure is about value. The expertise and skill you bring to service are of more importance than just an hour of work for clients. Pricing your abilities based on knowledge is not only good for your business but is ultimately valuable for your clients as well.

How should I price accounting and bookkeeping services ?

While there is still a debate surrounding hourly versus fixed fees in some aspects of the business, accounting and bookkeeping is not one of them.

Accounting and bookkeeping services (as well as other service lines, such as simple tax preparations) are almost universally charged as a fixed fee, and there is a market expectation for that pricing structure.

When determining a fee structure, many accountants call other firms and ask for quotes. They use the average of those quotes to determine a fair and competitive price for their services.

Another resource is local and national affiliations and associations. Many of the larger ones (such as the National Association of Tax Preparers) will distribute recommended price structures and other useful information.

How much should a CPA charge for taxes?

While you do not have to be a CPA to prepare or file taxes, the training and expertise it requires to gain that credential matters. Simply put, you’re a CPA, and you deserve a premium for your services.

When trying to structure fees, it’s important to set a minimum job value. By setting a minimum job value at, say, $500, you won’t get mired in lower-level work that you likely don’t want to take on. Plus, that work can take up time and pull you away from more valuable work that you’d rather be doing.

Knowing what you want to charge and identifying the value you bring to your clients is critical. You are providing a service to your clients, but you’re also giving them a value based on your credentials and experience. So, it’s up to you to set the standards and have them choose between lower costs (them doing it their self) versus the value of having a CPA prepare your taxes.

That said, there’s a balance.

Many CPAs make a practice of “writing down” certain services because they know their hourly rate for larger projects can quickly become untenable for a client. Not only is this seen as a discount by the client, but it also allows you to create a fixed-fee structure for your services and show the clients the savings and value they receive.

If they need more staff, what do accounting firms look for when hiring?

When hiring, accounting firms are like many businesses and are looking for a combination of credentials, experience, and the ability to perform the necessary tasks. However, in an increasingly competitive hiring market, many firms are beginning to look at soft skills as valuable for new hires.

For decades, accounting firms have focused primarily on credentials. However, more and more, it’s less and less about certification and more about aptitude. For the most part, it’s easier to train accounting knowledge than it is to build customer service skills. When hiring, it’s important to look at the qualities a candidate can bring into a firm – not necessarily just credentials.

Of course, experience and credentials do matter. Especially when the experience sets for an accountant is specific and narrow. What types of tax returns have you prepared? What specializations do you carry? And credentials such as CPA, EA, attorneys, and state certifications (when required) are all still attractive to firms looking to hire.

How much does it cost to start an accounting firm?

Start-up costs can range from $2,500 to $25,000. Your location and your goals will determine cost in several ways, including whether you want to start a traditional brick and mortar firm or are looking to create a virtual office environment.

It’s important to remember that, besides physical (or virtual) space, accounting firms need to find and install the necessary equipment and technology to help their practice run more efficiently. That, in many ways, is the first step for a new entrepreneur. Once they’ve found a tax solution that can help them achieve their goals, they’ll be able to begin tackling the other day-to-day tasks and questions of running a business.

What’s the best business structure for accounting firms?

Finding the best business structure for your accounting firm is a critical part of not only ensuring success but helping to minimize both your tax burden and your risk.

While the circumstances of what your incorporation looks like will depend on your approach, it is considered a best practice to become incorporated right off the bat due to the legal protections it provides.

Popular options include:

- Partnership

If you’re running a solo firm, you’re likely going to be looking at an S-Corp, which allows you to pay yourself as an employee. However, if you are working with other partners, a partnership might be more preferential, as it provides a little more flexibility with payment. You are permitted to take draws or distributions, and it doesn’t necessarily require a payroll department because it’s not considered “wages” per se.

Whichever structure you choose at the beginning, know that it will likely evolve throughout the maturity of your firm. For instance, a firm might accept the risk and start as unincorporated to avoid the incorporation fees. Then they might transition to S-Corp. Over time, as additional owners move into the entity structure, the firm can add additional shareholders or can reorganize as a partnership.

It’s better to have a separate legal entity than to not and better to have separate federal filing than to not.

How do I get accounting clients?

The consensus is word of mouth. However, while a strong work ethic, exceptional service, and competitive pricing will undoubtedly attract clients, a successful business always requires more than just good luck.

Here are a few tips on how to increase your client base:

- Be a business owner, not just an accountant. This means focusing on solid business practices and looking for ways to ensure both stability and growth.

- Market yourself . This goes beyond starting a business and hoping people show up. Look for ways to partner with other companies and firms, as well as networking opportunities in the community. The local chamber of commerce is an excellent resource.

- Don’t forget about friends and family. While they won’t be able to maintain your business over the long haul, friends and family are a great starting place not only for initial clients but also for referrals.

- Take advantage of easy and cheap technology . Google Ads can be capped at $20 and make for productive investments to help drive local searches for accounting firm.

- Be in the community. Look for professional speaking engagements that you can offer to local groups for free. Create thought leadership presentations, teach community education classes and provide a venue to show your skills and knowledge.

You’ll find other ideas in our blog post on finding new clients .

How about social media and online presence for accountants – is it worth the effort?

Websites, social media, and various other online presences are a great way to establish credibility in the market.

For the most part, a simple online presence is relatively easy to start with minimal start-up costs. And while an online presence won’t guarantee an increase in exposure, not having one can have a negative impact and can discredit you to a potential client. In many cases, website and social media become an augmentation to your word of mouth referrals. Most people won’t simply call a number without the opportunity to do some basic online research.

However, there is a difference between a website presence and social media. In most cases, a website is static and allows businesses to transmit basic, evergreen information such as phone number, services provided, and credentials. Social media, on the other hand, can drive business in a longer and more indirect fashion.

Auto-posting any relevant story or information can help create a brand on social media – one where you’re seen as an authority on tax and accounting subjects. Posting constant content can help with visibility and, ultimately, increasing your customer base.

If you think you may need help with this, take a look at our social media and other digital marketing solutions for accounting firms .

Some firms focus on a specific accounting specialization. Should I consider a niche accounting service?

Put simply, the more specialized you are, the more profitable you are. However, it’s not as much a question of “should you” but “can you.”

Many – if not most – firms will start as generalists and then slowly make their way a more niche practice. Sometimes a firm will intentionally build clients in one area. Others realize they have, say, many construction clients and then move to the particular niche.

If moving toward a niche practice, consider:

- What’s your timeline? When should you plan to transition to a specialized practice? When is the right time to stop chasing general clients?

- Partnering with more generalist firms can help take on other needs from clients while you take only the niche side of their business.

- Gaining professional affiliations is important. They can help distinguish you in a competitive market and further signal your niche work.

What’s the most popular accounting niche?

Niches, like many things, are often dependent on location, interest, and understanding where there is a need across different businesses. However, some of the most successful niches are the ones serving fellow professionals such as doctors, dentists, attorneys.

Services based niches as opposed to manufacturing-based are also on the rise. For example, real estate professionals, landscapers, and farming clients are becoming a more prosperous and unique way to do business.

However, it’s important to remember that you have to target businesses where you have the right location and the right skills. Again, farming has particular needs and goals. If you can fill them, then you have a specialization that is highly valuable to that market.

What do prospective clients consider when deciding how to choose an accountant? What do they look for in a CPA?

What are the things that are most likely to influence a client’s perception of you in the little amount of information they’re able to get from a flyer, website, or social media? While the idea that “first impressions matter” may seem a little cliché, they still matter to your clients. As a result, making sure your communication is direct, pleasing, and engaging is critical to your success.

Some important deciding factors include:

- Aesthetics. What’s the aesthetic of your website? Is it mobile compliant? Does it seem modern? Do your documents use color and seem to be professionally designed? Take care to control the new prospective client’s perception of you and what they think they see in you.

- Have a professional place to meet. Whether you operate a brick-and-mortar business or a virtual one, having a professional place to meet with clients is essential.

- Clients want comfort and assurance . Clients want the assurance that, if the IRS or another regulatory authority comes after them, that you be my defender and stand between them and the organization? Extending that sense of comfort is going to help influence them.

- Know your target market . Know what your market is looking for and make it very clear that’s what you can provide them.

Thanks to our subject matter experts Jordan Kleinsmith and Mo Arbas for their input into this article.

Bring more value to your clients.

Accounting Business Plan Template

Written by Dave Lavinsky

Accounting Business Plan

You’ve come to the right place to create your Accounting business plan.

We have helped over 5,000 entrepreneurs and business owners create business accounting plans and many have used them to start or grow their accounting firms.

Below is a template to help you create each section of your Accounting business plan.

Executive Summary

Business overview.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana. We provide a full suite of accounting services to local businesses, including bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. His expertise, reputation, and loyal clientbase will ensure that our firm is successful.

Product Offering

DeSanta & Co will offer its clients a full suite of accounting services. These services include bookkeeping, accounting, tax services, and auditing. The company will employ a large and diverse staff of professional accountants to ensure we can offer as many services as possible.

Customer Focus

DeSanta & Co will serve small and medium-sized businesses located in the Indianapolis, Indiana area. Most of these businesses will have less than 1000 employees and earn a revenue less than $10 million per year. We will also offer limited services to individuals, such as tax prep and help.

Management Team

DeSanta & Co’s most valuable asset is the expertise and experience of its founder, Michael DeSanta. Michael has been a certified public accountant (CPA) for the past 20 years. Throughout his career, he has developed a loyal client base, and many clients have stated that they will switch to DeSanta & Co once the company is established and running. Michael’s combination of skills, accounting knowledge, and loyal following will ensure that DeSanta & Co is a successful firm.

Success Factors

DeSanta & Co will be able to achieve success by offering the following competitive advantages:

- Michael DeSanta will initially help the clientbase that he has built carefully over the past twenty years.

- The company will emphasize providing client-focused service so that our clients feel valued.

- The company will provide our accounting services at an affordable rate.

Financial Highlights

DeSanta & Co is currently seeking $400,000 to launch. The funding will be dedicated to the office build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Office design/build: $100,000

- Office equipment, supplies, and materials: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $50,000

- Working capital: $50,000

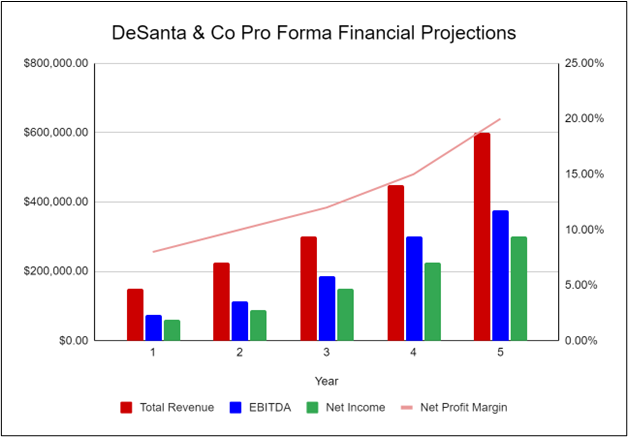

The following graph below outlines the pro forma financial projections for DeSanta & Co.

Company Overview

Who is desanta & co.

DeSanta & Co is a new accounting firm located in Indianapolis, Indiana that provides local businesses with a full suite of accounting services. We are a small firm but have considerable experience, so we can offer better quality of services than our competition. We expect that our most popular services will include bookkeeping, accounting, and tax services. Our combined decades of expertise and client-focused service ensures that we will become the #1 accounting firm in the next five years.

DeSanta & Co is run by Michael DeSanta. Michael has decades of accounting experience and has gained a loyal clientbase from providing his services through competing firms. After working for several accounting firms around town, he surveyed his clientbase to see if they would be willing to switch to his new company once launched. Most of his clients responded positively, which motivated Michael to finally launch his business.

DeSanta & Co History

Upon surveying his clientbase and finding a potential office, Michael DeSanta incorporated DeSanta & Co as an S-Corporation in April 2023.

The business is currently being run out of Michael’s home office, but once the lease on DeSanta & Co’s office location is finalized, all operations will be run from there.

Since incorporation, DeSanta & Co has achieved the following milestones:

- Found an office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

- Began recruiting key employees

DeSanta & Co Services

DeSanta & Co will provide the following services to its clients:

- Bookkeeping

- Tax services

- Advisory services

- Investment services

- Management consulting

- Valuation and planning

Industry Analysis

The accounting industry is essential to the success of other businesses and industries. Accountants record and track financial transactions, which helps businesses ensure they are making a profit. As such, accounting services are always in demand and the industry often sees great growth.

There are several essential services that accounting firms can provide to businesses and individuals. The most popular services include bookkeeping, tax services, advisory services, and valuation and planning. Though most businesses employ their own accountants, many businesses are switching to hiring accounting firms to save on costs.

The accounting industry is expected to grow over the next several years. According to The Business Research Company, the accounting industry is expected to grow at a CAGR of 4.2% from now until 2027. This growth is due to the increasing demand for accountants worldwide. This increase in demand and industry growth ensures that DeSanta & Co will achieve success.

Customer Analysis

Demographic profile of target market, customer segmentation.

DeSanta & Co will primarily target the following customer profiles:

- Local small businesses

- Medium-sized businesses

- Individuals

Competitive Analysis

Direct and indirect competitors.

DeSanta & Co will face competition from other companies with similar business profiles. A description of each competitor company is below.

Perkins & Smith

Perkins & Smith is a small accounting firm that has intentionally remained small so that they can have stronger relationships with their clients. Since they opened in 1960, Perkins & Smith has been one of the leading accounting firms in the Four State Region. They offer a wide range of services including accounting, bookkeeping, payroll services, tax prep and planning, and advisory services. They have built up a loyal clientele and maintained a strong, positive reputation since their opening decades ago.

Premiere Accounting

Premiere Accounting is a large accounting firm that specializes in helping large businesses with accounting, taxes, and similar services. Since opening in 1995, they have acquired a loyal client base, including several multi-billion dollar companies. They employ over a hundred professionals who all have diverse backgrounds. This helps serve their diverse clientele and ensures they are meeting the specific needs of every business that works with them.

Jackson Brothers Accounting

Jackson Brothers Accounting is a privately held accountant practice that has been popular in the area since 1985. They offer a wide variety of services including, tax planning and preparation, payroll processing, financial planning, and small business accounting. Though they are open to helping nearly all businesses and sectors, they primarily focus on local small businesses and startups.

Competitive Advantage

DeSanta & Co will be able to offer the following advantages over the competition:

- Client-oriented service : DeSanta & Co will put a focus on customer service and maintaining long-term relationships. We aim to be the best accounting firm in the area by catering to our customer’s needs and developing a strong connection with them.

- Management : Michael has been extremely successful working in the accounting sector and will be able to use his previous experience to help his clients better than the competition.

- Relationships : Having lived in the community for 25 years, Michael DeSanta knows many of the local leaders, newspapers and other influences.

Marketing Plan

Brand & value proposition.

DeSanta & Co will offer a unique value proposition to its clientele:

- Client-focused financial services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for DeSanta & Co is as follows:

Targeted Cold Calls

DeSanta & Co will initially invest significant time and energy into contacting potential clients via telephone. In order to improve the effectiveness of this phase of the marketing strategy, a highly-focused call list will be used, targeting individuals in areas and occupations that are most likely to need accounting services. As this is a very time-consuming process, it will primarily be used during the startup phase to build an initial client base.

DeSanta & Co understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

DeSanta & Co will invest heavily in a social media advertising campaign. The company will create social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Website/SEO

DeSanta & Co will invest heavily in developing a professional website that displays all of the company’s services. It will also invest heavily in SEO so that the firm’s website will appear at the top of search engine results.

The fees and hourly pricing of DeSanta & Co will be moderate and competitive so clients feel they are receiving great value when utilizing our accounting services.

Operations Plan

The following will be the operations plan for DeSanta & Co. Operation Functions:

- Michael DeSanta will be the Owner of DeSanta & Co. In addition to providing accounting services, he will also manage the general operations of the business.

- Michael DeSanta is joined by a full-time administrative assistant, Jessica Baker, who will take charge of the administrative tasks for the company. She will also be available to answer client questions and will be the primary employee in charge of client communications.

- As the company builds its client base, Michael will hire more accounting professionals to provide the company’s services, attract more clients, and grow our business further.

Milestones:

DeSanta & Co will have the following milestones completed in the next six months.

- 6/2023 Finalize lease agreement

- 7/2023 Design and build out DeSanta & Co

- 8/2023 Hire and train initial staff

- 9/2023 Kickoff of promotional campaign

- 10/2023 Launch DeSanta & Co

- 11/2023 Reach break-even

Though he has never run his own business, Michael DeSanta has worked as an accountant long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. He also already has a starting client base that he served while working for other accounting firms. He will hire several other employees who can help him run the aspects of the business that he is unfamiliar with.

Financial Plan

Key revenue & costs.

DeSanta & Co’s revenues will primarily come from charging clients for the accounting services we provide. We will charge our clients an hourly rate that will vary depending on the services they need.

The notable cost drivers for the company will include labor expenses, overhead, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of clients:

- Year 4: 100

- Year 5: 125

- Annual Rent: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, accounting business plan faqs, what is an accounting business plan.

An accounting business plan is a plan to start and/or grow your accounting business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Accounting business plan using our Accounting Business Plan Template here .

What are the Main Types of Accounting Businesses?

There are a number of different kinds of accounting businesses , some examples include: Full Service Accounting Firm, Bookkeeping Firm, Tax Firm, and Audit Firm.

How Do You Get Funding for Your Accounting Business Plan?

Accounting businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Accounting Business?

Starting an accounting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Accounting Business Plan - The first step in starting a business is to create a detailed accounting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your accounting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your accounting business is in compliance with local laws.

3. Register Your Accounting Business - Once you have chosen a legal structure, the next step is to register your accounting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your accounting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Accounting Equipment & Supplies - In order to start your accounting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your accounting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful accounting business:

- How to Start an Accounting Business

How to Create an Accounting Business Plan

Blog > how to create an accounting business plan, table of content, introduction, executive summary, market analysis, services and pricing, marketing and sales strategies, operational plan, human resources and team building, financial projections, client acquisition and retention, risk management and compliance, technology and innovation, expansion and growth strategies, exit strategy, our other categories.

- Company Valuation

- Pitch Deck Essentials

- Raising Capital

- Startup Guide

- Uncategorized

Reading Time : 50 Min

Business plan 101.

In the world of accounting, a well-crafted business plan is the foundation for a successful venture. Whether you’re a seasoned accounting professional starting your own firm or an entrepreneur entering the accounting industry, creating a comprehensive business plan is essential to steer your business towards growth and profitability.

As a startup consultant service provider, Stellar Business Plans is committed to guiding you on this exciting journey. In this blog post, we’ll walk you through a step-by-step guide on how to create an accounting business plan that aligns your vision with market trends and customer needs. By following our expert advice and leveraging our expertise, your accounting firm is poised to make a lasting impact in the financial world.

The Executive Summary is a critical part of your accounting business plan as it provides an overview of your entire document. It is often the first section that potential investors, partners, or lenders read. This summary should be concise, yet compelling enough to entice readers to explore the entire plan.

Overview of Your Accounting Business: Introduce your accounting firm, including its name, location, and the services it offers. Provide a brief history of the firm, highlighting any significant achievements or milestones.

Example: “XYZ Accounting Firm is a full-service accounting firm located in [City]. With a team of highly skilled professionals, we offer a wide range of accounting services, including bookkeeping, tax planning, financial consulting, and auditing. Established in [Year], our firm has been recognized for its excellence in client service and innovative solutions.”

Vision, Mission, and Core Values: Clearly articulate your firm’s long-term vision and mission. Describe the purpose of your accounting firm and how it aims to add value to clients. Additionally, mention the core values that underpin your business philosophy and guide decision-making.

Example: “Our vision is to be the preferred accounting partner for businesses of all sizes, providing reliable financial expertise and fostering their growth. Our mission is to deliver exceptional accounting services that empower clients to make informed financial decisions. We are driven by integrity, professionalism, and a commitment to excellence.”

Key Objectives and Goals: State specific short-term and long-term objectives for your accounting firm. Include measurable goals such as revenue targets, client acquisition numbers, and geographic expansion plans. Ensure that the objectives align with your firm’s vision and mission.

Example: “Over the next three years, our primary objectives are to achieve a 25% increase in revenue, expand our client base by 30%, and establish a strong presence in neighboring cities. We also aim to enhance client satisfaction, maintaining a client retention rate of at least 90%.”

In this section, delve deep into the accounting industry to gain a comprehensive understanding of its current state, trends, and potential opportunities. Conduct thorough research and gather relevant data to support your analysis.

Analyzing the Accounting Industry Landscape: Provide an overview of the accounting industry, its size, growth rate, and major players. Highlight any recent trends or disruptions in the industry, such as advancements in cloud accounting, changes in tax regulations, or the growing demand for virtual accounting services.

Example: “The accounting industry is witnessing significant growth, driven by the increasing complexity of financial regulations and the rising demand for professional financial advice. According to [source], the global accounting services market is projected to reach $X billion by [year], with a CAGR of X%. Technological advancements, such as cloud-based accounting software and artificial intelligence, are reshaping traditional accounting practices.”

Identifying Target Clients and Niche Markets: Define your ideal client profile and target markets. Determine the industries or sectors your accounting firm aims to serve. Explain how your firm’s expertise aligns with the needs of these specific clients.

Example: “Our target clients include small and medium-sized businesses (SMBs), startups, entrepreneurs, and individual professionals. We specialize in providing accounting solutions to industries such as technology, healthcare, real estate, and professional services. By focusing on niche markets, we can better address our clients’ unique financial challenges and offer tailored services.”

Competitor Analysis and Market Share: Identify key competitors in the accounting industry and analyze their strengths, weaknesses, and market share. Highlight what sets your firm apart from competitors, such as specialized services, industry expertise, or innovative technology adoption.

Example: “The accounting landscape in [City] is competitive, with several established accounting firms and individual practitioners. Competitor A has a strong reputation for tax advisory services, while Competitor B excels in providing financial consulting for startups. While our competitors have unique strengths, our firm’s competitive advantage lies in our comprehensive suite of services, personalized client approach, and cutting-edge technology integration. Our emphasis on building long-term client relationships also sets us apart from other players in the market.”

The Services and Pricing section outlines the range of accounting services your firm offers and explains your pricing strategies to attract and retain clients.

Detailing Your Accounting Services Offered: List the various accounting services your firm provides, such as bookkeeping, tax preparation, financial analysis, payroll management, and auditing. Provide a brief description of each service and explain how it benefits clients.

- Bookkeeping: Our bookkeeping services help clients maintain accurate and up-to-date financial records, ensuring compliance with tax regulations and providing valuable insights into business performance.

- Tax Planning and Preparation: We offer comprehensive tax planning and preparation services to minimize tax liabilities and maximize tax savings for individuals and businesses alike.

- Financial Consulting: Our financial consulting services assist clients in making strategic financial decisions, analyzing financial data, and developing actionable financial plans to achieve their goals.

- Payroll Management: Our payroll management services streamline payroll processing, ensuring timely and accurate salary payments while complying with payroll tax obligations.

- Auditing and Assurance: We conduct rigorous financial audits to provide independent assurance on the accuracy and reliability of financial statements, fostering trust among stakeholders.

Pricing Strategies and Packages: Describe your pricing model, whether it’s based on hourly rates, fixed fees, or value-based pricing. Offer different service packages tailored to the needs of different client segments. Mention any discounts or promotions you may offer to attract new clients.

Example: “At XYZ Accounting Firm, we understand that each client’s financial needs are unique. As such, we offer flexible pricing options to accommodate various business sizes and budgets. Our pricing is based on the complexity of the accounting services required, the volume of transactions, and the level of financial analysis needed. We also provide discounted packages for clients opting for multiple services, such as combining bookkeeping and tax preparation services. Our transparent pricing policy ensures that clients know what to expect, without any hidden costs.”

Highlighting Your Unique Value Proposition: Explain your firm’s unique value proposition (UVP) that differentiates you from competitors. Emphasize your strengths, such as specialized industry knowledge, exceptional customer service, or a personalized approach to client needs.

Example: “At XYZ Accounting Firm, we take pride in our client-centric approach, where each client receives personalized attention from our dedicated team of professionals. Our industry expertise in sectors such as technology and healthcare allows us to offer tailored solutions that address our clients’ specific financial challenges. Moreover, our adoption of cutting-edge technologies, such as cloud-based accounting software and data analytics tools, streamlines accounting processes, leading to greater accuracy and efficiency. With our commitment to providing actionable insights and excellent customer service, we forge lasting partnerships with our clients, empowering them to achieve financial success.”

In this section, outline your marketing and sales strategies to promote your accounting services and acquire new clients. Leverage both traditional and digital marketing channels to reach your target audience effectively.

Developing a Strong Brand Identity for Your Accounting Firm: Detail your branding strategy, including your firm’s logo, colors, and overall brand message. Explain how you will communicate your brand identity through marketing materials and online presence.

Example: “As part of our branding strategy, we have designed a distinctive logo that reflects our firm’s commitment to professionalism, integrity, and precision. The color scheme of our marketing materials and website aligns with our brand message of reliability and trustworthiness. Our website serves as an informative platform, showcasing our services, success stories, and thought leadership articles. By maintaining a consistent brand identity across all communication channels, we aim to build brand recognition and instill confidence in our target audience.”

Crafting an Effective Marketing Strategy: Describe your overall marketing approach, including online and offline marketing tactics. This may include content marketing, email marketing, direct mail, networking events, and participation in industry conferences.

Example: “Our marketing strategy is built on the principles of inbound marketing, where we provide valuable content and resources to our target audience, positioning us as thought leaders in the accounting industry. Our website hosts a blog that covers accounting tips, tax updates, and financial planning insights. We leverage social media platforms, such as LinkedIn and Twitter, to share our blog posts and engage with potential clients. Additionally, we participate in industry events and conferences to network with key stakeholders and establish credibility. By focusing on educational content and active engagement, we attract prospects who recognize the value of our expertise.”

Leveraging Digital Marketing Channels: Explain how you will leverage digital marketing to reach your target audience. This could include search engine optimization (SEO) to improve website visibility, pay-per-click (PPC) advertising, and social media marketing to engage with potential clients.

Example: “Our digital marketing efforts involve optimizing our website for search engines to rank higher in organic search results. Through SEO, we aim to attract prospects actively searching for accounting services in [City]. Additionally, we employ PPC advertising on platforms such as Google Ads to display targeted ads to users searching for specific accounting keywords. Our social media marketing strategy focuses on building an active presence on platforms relevant to our target audience. By sharing valuable content, responding to queries, and participating in industry discussions, we enhance our brand visibility and nurture relationships with potential clients.”

Utilizing Referral Marketing and Networking: Describe your approach to generating referrals from existing clients and strategic partners. Outline your networking strategy to build relationships with other professionals, such as lawyers, business consultants, and financial advisors, who may refer clients to your accounting firm.

Example: “Word-of-mouth referrals are a significant source of new business for us. To encourage referrals, we maintain open communication channels with our existing clients, ensuring their satisfaction with our services. We request testimonials and online reviews from satisfied clients, showcasing their positive experiences on our website and social media platforms. Furthermore, we actively engage in networking events and industry associations, collaborating with professionals in related fields. Our collaborative approach fosters mutual referrals, expanding our network of potential clients and partners.”

The Operational Plan section outlines the day-to-day operations of your accounting firm and how it will function efficiently.

Setting Up Your Accounting Firm’s Office: Provide details about your office location, layout, and equipment needed to run the firm smoothly. Discuss any specific software or tools required for accounting tasks.

Example: “Our office is strategically located in [City], easily accessible to clients and professionals from diverse industries. The layout of our office promotes a collaborative environment, with designated spaces for team meetings and client consultations. To enhance productivity, we invest in state-of-the-art accounting software that enables real-time data access, secure document sharing, and seamless communication with clients. Additionally, our firm follows strict data security protocols to safeguard sensitive financial information.”

Selecting Accounting Software and Tools: Evaluate various accounting software options available in the market and select the ones that best suit your firm’s needs. Highlight features such as financial reporting, client management, and secure data storage.

Example: “The choice of accounting software is critical to our firm’s efficiency and service quality. After thorough research, we have selected an industry-leading cloud-based accounting software that offers robust financial reporting, data analytics, and customizable dashboards. This software allows us to streamline accounting processes, automate repetitive tasks, and generate accurate financial reports for our clients. Additionally, we use secure file-sharing tools to exchange confidential documents with clients, ensuring data protection and compliance with privacy regulations.”

Designing an Efficient Workflow and Process: Explain the workflow for client onboarding, data collection, financial analysis, and reporting. Describe how your firm will streamline processes to optimize efficiency and deliver accurate results to clients.

Example: “Our workflow starts with an initial consultation with prospective clients, where we understand their financial needs and determine the scope of services required. Upon engagement, we collaborate with clients to gather financial data and documents securely through our client portal. Our team of accountants and analysts diligently review the data, perform in-depth financial analysis, and generate comprehensive reports. We maintain clear communication channels with clients throughout the process, updating them on the progress and addressing any queries promptly. Our aim is to provide accurate, timely, and actionable financial insights that empower our clients to make informed decisions.”

The Human Resources and Team Building section focuses on building a skilled and cohesive team to support your accounting firm’s growth.

Identifying Key Roles and Responsibilities: List the key roles in your accounting firm, such as accountants, bookkeepers, tax specialists, and administrative staff. Describe the responsibilities and qualifications required for each position.

- Chief Accountant: The Chief Accountant oversees all accounting operations, financial reporting, and tax compliance. This role requires a certified public accountant (CPA) designation, extensive experience in accounting, and leadership skills to guide the team effectively.

- Tax Specialist: The Tax Specialist is responsible for providing expert tax advice, preparing tax returns, and staying updated on tax regulations. This position requires a strong understanding of tax laws and excellent analytical skills.

- Bookkeeper: The Bookkeeper manages day-to-day financial transactions, reconciles accounts, and maintains accurate financial records. Proficiency in accounting software and attention to detail are crucial for this role.

- Financial Analyst: The Financial Analyst conducts in-depth financial analysis, prepares financial statements, and offers strategic financial insights to clients. Strong analytical and communication skills are essential.

Recruitment and Hiring Strategies: Detail your recruitment process, including sourcing candidates, conducting interviews, and evaluating potential team members. Explain how you will attract top talent to your accounting firm.

Example: “To build a high-performing team, we adopt a multi-channel approach to recruitment. We leverage online job portals, social media platforms, and industry-specific networks to attract qualified candidates. Our rigorous interview process assesses candidates’ technical skills, cultural fit, and alignment with our firm’s values. We focus on hiring individuals who possess a passion for accounting, a client-centric mindset, and a commitment to continuous learning. By offering competitive compensation packages, professional development opportunities, and a supportive work environment, we aim to retain top talent and foster long-term employee loyalty.”

Nurturing a Collaborative Work Culture: Explain how you will foster a collaborative work environment that encourages teamwork, knowledge sharing, and professional growth.

Example: “Our firm values collaboration, where every team member’s contribution is recognized and appreciated. We encourage open communication and knowledge sharing, providing opportunities for cross-functional training and skill development. Our team participates in regular brainstorming sessions to foster creativity and innovation, contributing to process improvements and client service enhancements. Additionally, we promote work-life balance, recognizing that a healthy and engaged team leads to better client outcomes.”

Continuous Training and Skill Development: Outline your firm’s commitment to ongoing training and skill development for your team. Explain how you will invest in their professional growth to ensure they stay updated on industry trends and best practices.

Example: “We recognize that staying ahead in the ever-evolving accounting industry requires continuous learning and development. To equip our team with the latest knowledge and skills, we invest in ongoing training programs, workshops, and webinars. Our team members have access to industry publications, research papers, and certification courses, enabling them to stay informed about emerging trends and regulatory changes. By nurturing a learning culture, we empower our team to deliver cutting-edge solutions to our clients.”

The Financial Projections section presents detailed financial forecasts for your accounting firm, demonstrating its financial viability and growth potential. Ensure that your projections are realistic and supported by market research and historical data.

Revenue Projections: Provide a breakdown of projected revenues for each service offered by your accounting firm. Base your revenue projections on factors such as client acquisition rate, pricing strategy, and anticipated market demand.