Free 1-year Financial Projection Template

Complete the form to get your copy of this free resource!

Free excel template to create financial projections for any business startup and first year. Forecast revenue, expenses, employee costs and generate an income statement, balance sheet, and cash flow pro forma automatically

Join 15,000+ founders and consultants who have used our free resources and tools

Free 1 Year Pro Forma Template

Download our 12 months financial projection template for free. This tool will allow you to:

- Forecast startup costs

- Project your first 12 months of product or service revenue

- Forecast your operating expenses

- Add Salary Forecasts for your employees

Once you have input all of your own assumptions, you will be able to generate:

- 12 month pro forma income statement

- 12 month cash flow forecast

- 12 month balance sheet projection

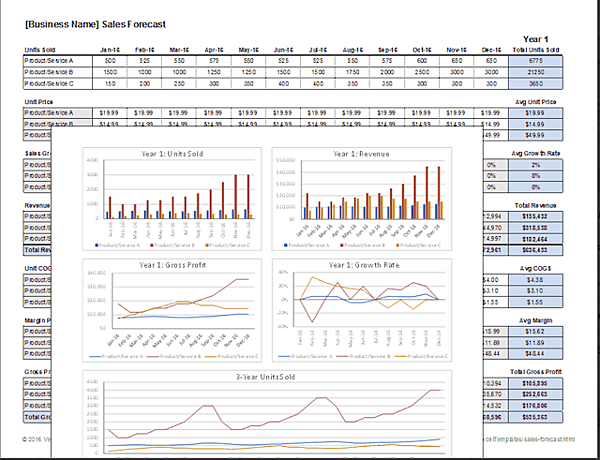

- Basic graphs and charts

This free financial model is industry agnostic. If you need an industry specific financial model you can check out ProjectionHub’s premium pro forma templates .

Below you will be able to see some examples of the input and outputs of the projection spreadsheet.

Financial Model Input Examples

Below you will be able to see examples of the input tabs for startup costs, fixed assets, revenue, operating expenses and salaries.

Example of Startup Cost Forecast

The financial model input assumptions tab will include general assumptions and startup costs like your fixed assets like buildings, equipment, leasehold improvements and vehicles. On the input assumptions tab you will also be able to include startup cost assumptions like initial inventory.

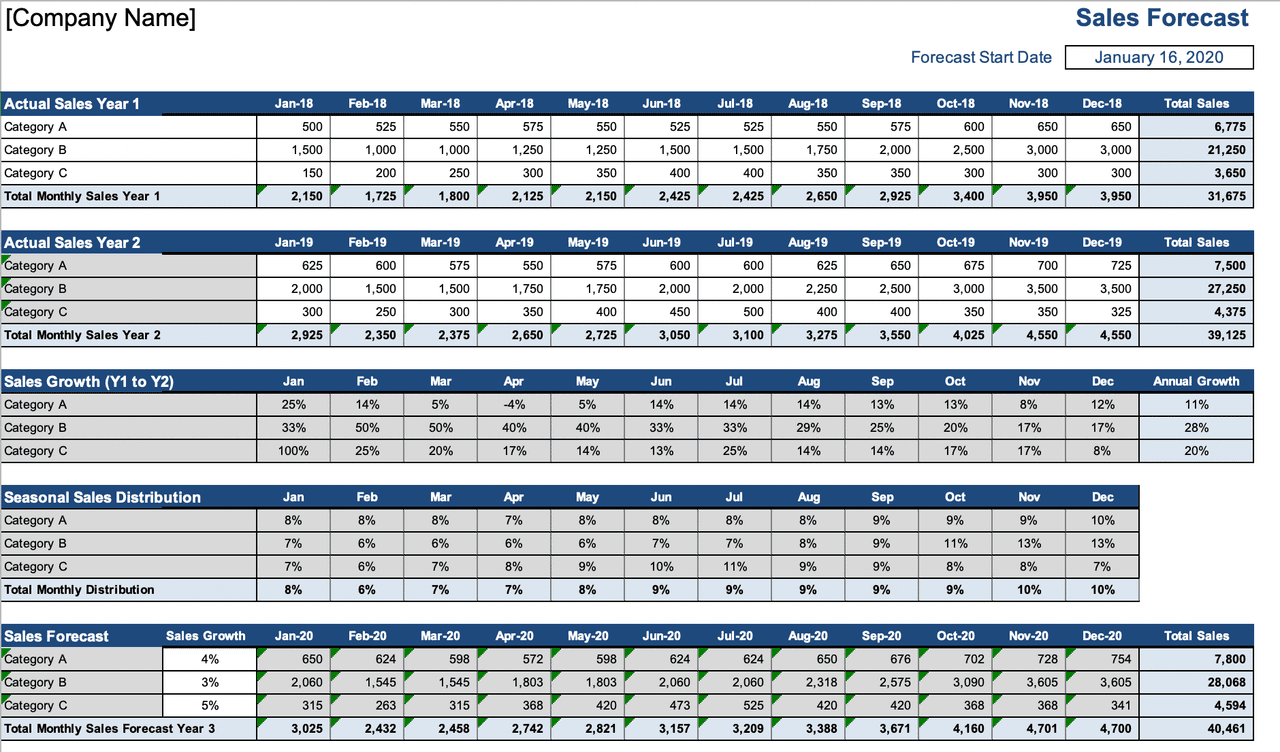

12 Month Revenue Forecast Example

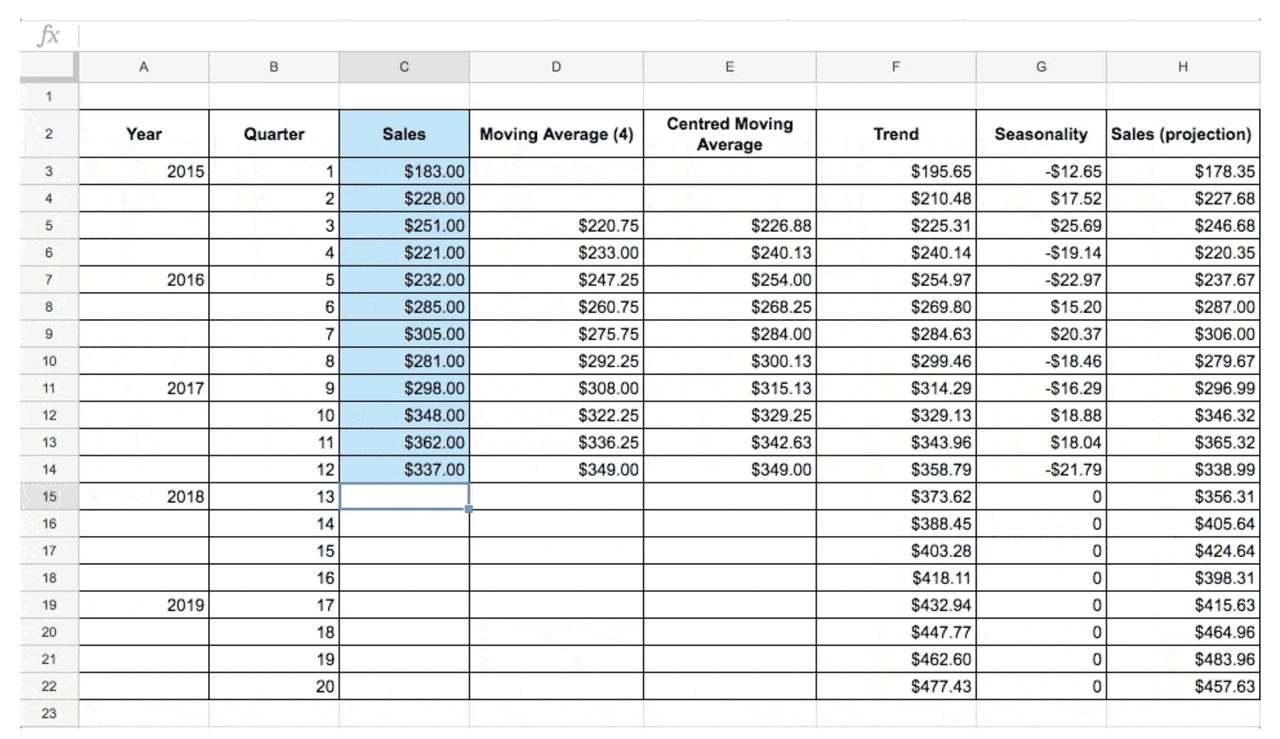

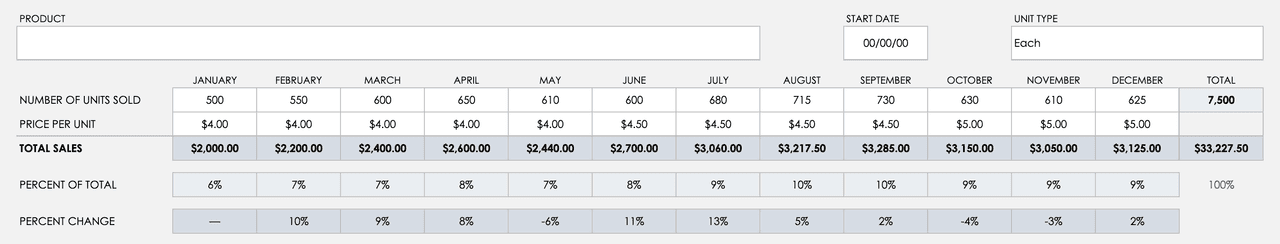

Our revenue assumptions tab will allow you to forecast your number of customers, the products or services they purchase, the purchase price and the percentage of total units sold represented by each product. You can see a quick example of our revenue model below:

Startup Operating Expense Projections Example

You can enter in your operating expense projections for your startup in the table below. It will allow you to add expenses as a fixed monthly expense or a percentage of revenue.

Startup Salary Forecasting Example

The last input tab is our salary forecast assumptions. You can set a salary, employer taxes, benefits, the month the employee starts and ends, and the number of the particular employee.

Projection Template Output Examples

Our free financial model spreadsheet will produce 12 months of income statement, cash flow and balance sheet projections. You can see examples of each of these outputs below along with some of the basic charts and graphs that will be included.

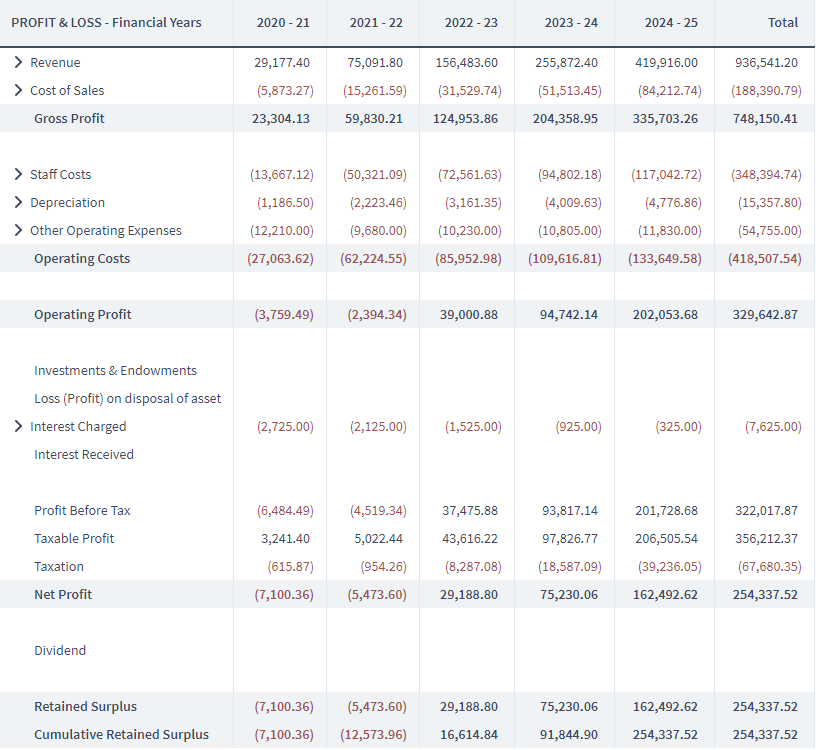

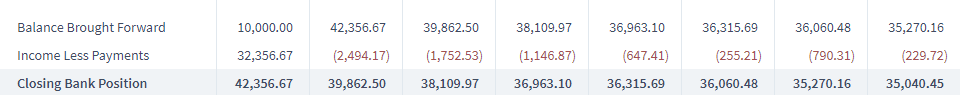

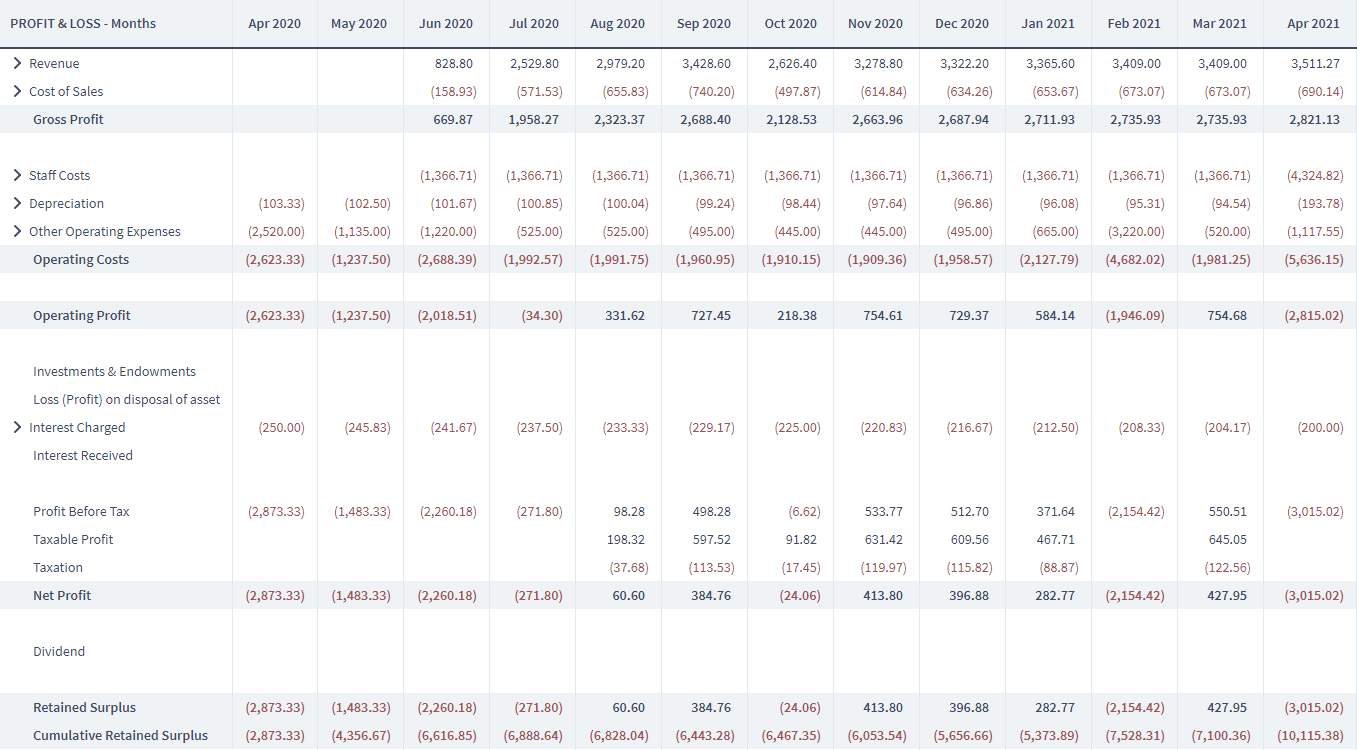

Example of a 12 Month Pro Forma P&L

Below you will see an example of our income statement pro forma output.

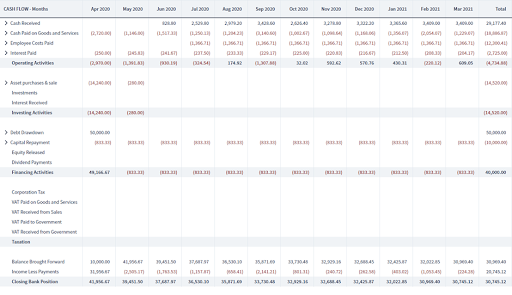

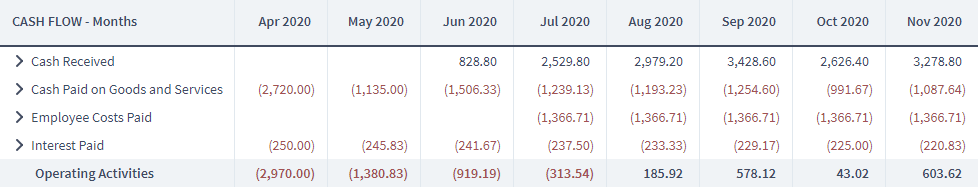

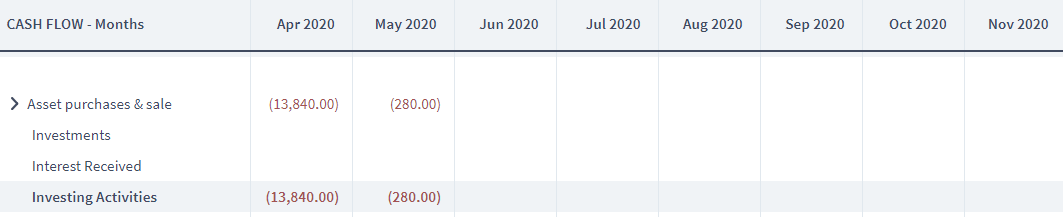

Cash Flow Forecast 12 Month Example

Next you will see an example of our cash flow forecast output with cash from operating activities, financing and investing activities.

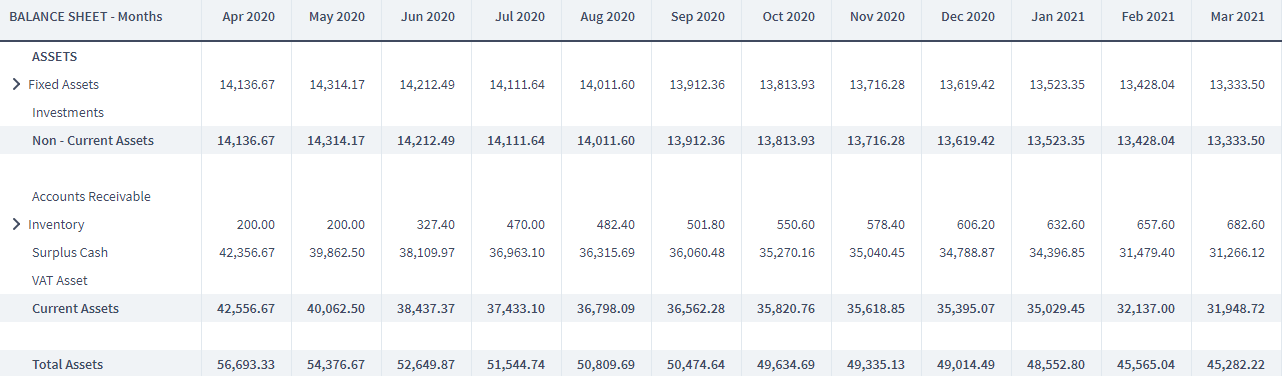

Balance Sheet Forecast Example for 12 Months

The balance sheet forecast output will include 12 months of forecasted assets and liabilities as seen below:

Pro Forma Graphs

Finally, our free template includes a profit and loss at a glance, a monthly sales forecast and graph to display monthly sales, gross profit and net income.

If you are needing a more tailored template to your industry as well as 5 years of projections, we have 100+ different industry templates to choose from as well:

Examples: Restaurant, Trucking, SaaS, Airbnb, Brewery, Dentist, etc.

Check out our Highly Rated Financial Projection Templates

12-Month Cash Flow Projection Template

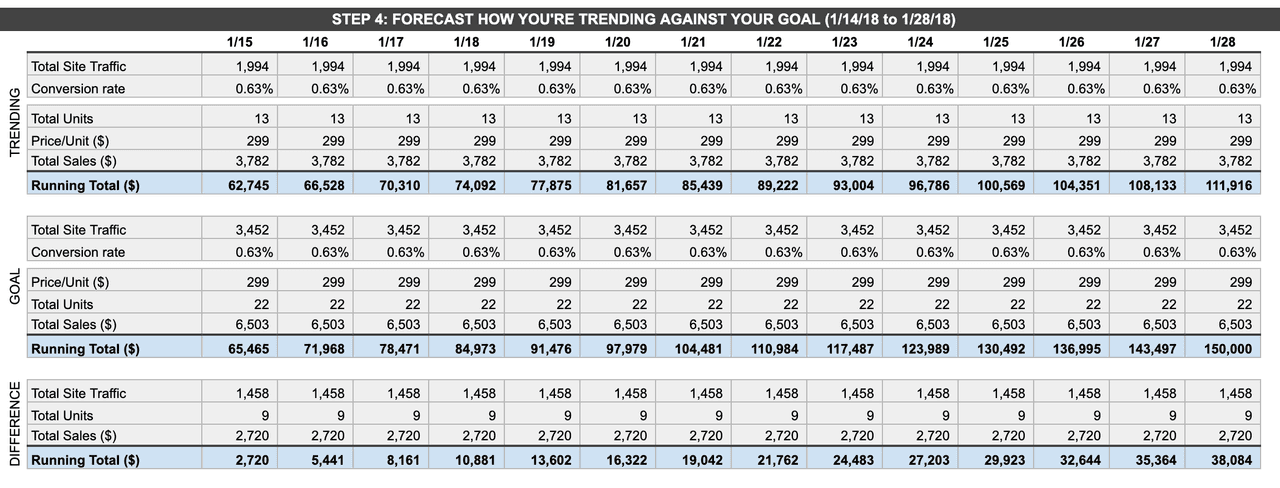

Identify monthly fixed costs, estimate variable costs, calculate total monthly costs, project monthly sales revenue, subtract total costs from sales revenue to get net income, estimate any cash inflows other than sales revenue, estimate any cash outflows other than expenses, sum projected cash at beginning with net income and other cash flows, document assumptions used in the forecast, review initial 12-month cash flow projection.

- 1 Income projections

- 2 Expense projections

- 3 Cash flow calculations

- 4 Financial performance analysis

- 1 Inaccurate revenue projections

- 2 High expense estimates

- 3 Cash flow deficit

- 4 Improper financial performance

Approval: Financial Analyst

- Review initial 12-month cash flow projection Will be submitted

Adjust projections based on feedback

Final review of the adjusted projection.

- 1 Adjusted income projections

- 2 Adjusted expense projections

- 3 Updated cash flow calculations

- 4 Revised financial performance analysis

- 1 Inaccurate adjusted revenue projections

- 2 Unaccounted expenses

- 3 Cash flow imbalance

- 4 Unsatisfactory financial performance

Approval: Finance Manager

- Final review of the adjusted projection Will be submitted

Prepare a summary of the projection

Present the 12-month cash flow projection to the executive team, approval: executive team.

- Present the 12-month cash flow projection to the executive team Will be submitted

Implement the 12-month cash flow projection into monthly reporting

Take control of your workflows today., more templates like this.

Our work is reader-supported, meaning that we may earn a commission from the products and services mentioned.

How to Create Financial Projections for your Business Plan

- Last Updated: March 27, 2023

- By: Greg Bouhl

Advertising Disclosure

Starting a business is an exciting time, but one that can come with some uncertainty. Writing out your business plan helps to increase your success significantly in addition to reducing some of the worries by getting all the ideas out of your head and organized on paper.

Financial projections are an essential component of the business plan to provide a realistic view as to whether or not your business is financially viable for success.

By creating financial plans, you are also able to test some of your assumptions to see the financial impact and analyze whether your business idea is feasible.

What are financial projections?

Financial projections (sometimes referred to as pro forma) are an essential part of a business plan. They are used to forecast a business’s expected sales and expenses and analyze the financial feasibility of the company. These forecasts evaluate past trends, current market conditions, and future expectations. They will also take into account regional sales potential and growth strategies and examine external and internal costs, such as the cost of customer acquisition and the amount of money you can afford to pay team members and yourself.

While it may be tempting to skip this step, not completing it could be costly.

Why are financial projections important?

Financial projections are one of the most critical steps in starting a small business. These figures help show you whether or not your business has a reasonable chance of being profitable. If your company does not reflect a profit based on your projections, you may have to make some adjustments. Financial projections can also help determine realistic price points and sales goals. They can also show you whether or not a profitable market even exists for the product or service you wish to provide.

The sales forecast is also useful in analyzing cash flows from accounts receivable and accounts payable to ensure the company has enough cash to operate.

Another reason financial projections are important is when requesting funding. The bank will review whether you have realistic financial projections before making a business loan.

How to create financial projections?

It is important to understand that financial projections are simply the best estimates you can determine based on the information available.

These figures are next to impossible to predict accurately. While this financial forecast can’t predict how the business will perform in the future, it will provide the analysis to make informed decisions and plans for the business.

Financial projections are typically shown as a 12-month projection in the first year and by quarter in the second year and third year.

To begin with, your business plan financial projections, start by focusing on your revenue potential and likely expenses.

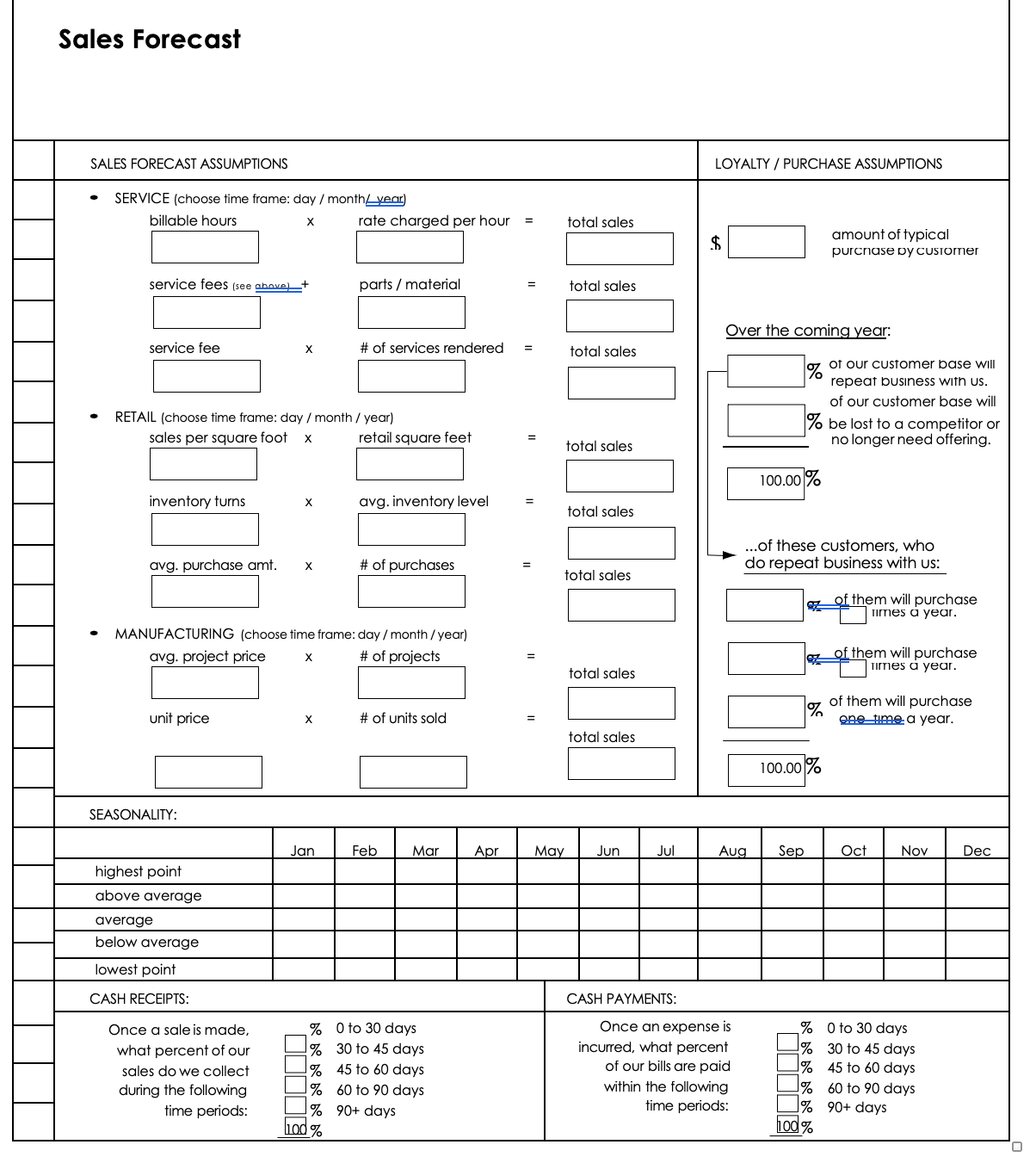

1. Create sales projections

Projecting sales projections (also known as revenue projections) for a new business is difficult, especially if you are new to the type of business you are starting. They are a few approaches you can consider when preparing the sales forecast. Some companies will have multiple sources of revenue. To make these easier to follow, each revenue stream is often put on a separate line in the projections.

Average household spending – The Consumer Expenditure Survey program from the U.S. Bureau of Labor Statistics (scroll down to the Annual Calendar Year Tables) provides data on the expenditures of U.S. consumers. Using the average household spending multiplied by the population in your target area, you can come up with the total potential sales. Try not to get too carried away with your target area as it will have a significant impact on potential sales.

Using the BLS data, you can look up how much people spend on food and beverages (such as food at home, food away at home, bakery products, alcoholic beverages, etc.), appliances, apparel, education, reading – and the list goes on. This information can be assessed against demographic information such as age, income, education level, occupation, race, religion, and more.

Not only can you use this data to provide useful because you can use it to gauge the feasibility of your business. For instance, if there are three competitors in your market, and you need 10% of the market to make an adequate profit, this may be a good indication your business would be successful. If you needed 80% of the market, it would likely be much more challenging.

Trade associations – Depending on the industry you are starting your business in, it’s likely there is an industry association. Do a Google search for “[type of business] industry association” or even find a Facebook group to join and ask questions. Many industry associations have statistics and formulas you can use to estimate sales. Make sure to reference your work, so the bank or prospective investors know you didn’t come up with these numbers out of thin air. Be sure to do your own due diligence as these numbers may be overly optimistic.

Menu of services – Another way to project sales is to create a list of services to assess how many jobs you can do in a day and the pricing of each job.

For instance, if you own a car detailing business and it takes 4 hours per vehicle to detail, you may be able to do up to two vehicles per day, ten vehicles a week, or 40 vehicles a month (you could squeeze in a few more in a month, but let’s keep the math easy for now).

Each vehicle brings in an average of $100 for a total monthly sales revenue of $4,000. Let’s say that after subtracting rent, utilities, supplies, advertising, etc, you are left with $2,000. Now you find that best case, you have a profit of $2,000, and by working 8 hours a day, you would make $12.50 per hour. Now you have to ask yourself that in this best-case scenario where you have clients lined up each and every day and you are making $12.50 per hour, is this business worth your time?

Regardless of how you project sales, be sure to explain the key assumptions in the business plan so the reader can follow the math!

2. Project operating expenses

Next, project the monthly operating expenses of the business. Some expenses are going to be easy to estimate, such as fixed costs like rent, insurance, and utilities. Other expenses need to be carefully examined as they can make a large difference in the projected profit.

The biggest expense for most businesses is the cost of goods sold, sometimes called COGS, cost of sales, or cost of inventory. This is the cost to produce the item being sold, such as the raw materials to produce it. A typical example is a wedding band sold at a jewelry store. The sales price to the customer may have been $1,000, but the jewelry store purchased it for $700. The cost of goods sold in this instance is $700. Many times COGS is represented as a percentage, which in this example would have been 70% ($700 /$1,000).

You can often find the average cost of goods for most businesses by searching for industry publications.

Another major expense for most businesses is employees. This number can be found for many industries as a percentage of sales; however, we would recommend you create a list of the positions needed, the number of employees for each position, the number of hours worked, and wages. By comparing the industry average with your own list, you can have some confidence your numbers are in the ballpark.

Make a list of the monthly expenses and the cost for those expenses to use later in the financial statements.

3. Seasonality

After getting the sales projections completed, you will also want to look at seasonality. Seasonality refers to the fluctuations in monthly sales. Some businesses will be affected more by seasonality than others, but it is important to analyze because it may show your business will run out of cash. Lenders and potential investors will expect some seasonality, but if you have a business that has steady sales, be sure to explain why your sales are consistent.

In most areas, landscapers are a common business that has fluctuating sales. The spring and fall are really busy, while in the winter, there is little to no work.

4. Financial projections

With the sales projections, expenses, and seasonality now out of the way, creating the pro forma financial statements are actually pretty straightforward.

Business plan financial forecasting is typically set up to show a three-year outlook. Depending on the project, especially if it is one that has a significant amount of research and development time before revenues start to come in, some banks and lenders will occasionally want to see a five-year outlook.

There will be three financial statements to create:

- Cash flow statement – Similar to a detailed view of a checkbook, the projected cash flow statement looks at cash coming in and cash going out of the business. Cash flow projections usually look at the first year broken out into 12 months, and the following two years by quarter.

- Profit and loss statement – Also referred to as an income statement, this statement is an annual estimate of the taxable profits (or losses) of the business. The numbers in the P&L statement are similar to the cash flow statement; however, depreciation and amortization are also included.

- Balance sheet – Not every bank will request a proforma balance sheet for a start-up business. The balance sheet is similar to a personal financial statement that looks at assets and liabilities to determine the net worth.

The balance sheet is projected at the end of each year.

5. Sources and uses of funds

The sources and uses of funds section provide an overview of the financing activities, use of working capital, loan repayments, and how the money is spent.

The sources section is a list of where the money is coming from to fund the project. This will commonly have a line for the amount of the bank loan and another line for the amount the owner is investing in the business. Keep in mind when preparing this for the bank that most banks will want to see the business owner invest 15%-25% of their own funds in a start-up business.

The uses section provides details of all the startup costs for the business. Items are usually put into categories such as:

- Real estate

- Renovations

The amount in the sources section should equal the amount in the uses section.

Financial Projection Templates

There are free financial projection templates from Smartsheet , Spreadsheet 123 , and others. LivePlan has a guided approach (like Turbo Tax) to creating financial projections that are pretty thorough and easy to use.

There are free financial projection templates from Smartsheet , Spreadsheet 123 , and others. LivePlan has a guided approach (like Turbo Tax) to creating financial projections that are pretty thorough and easy to use.

With over two decades as an entrepreneur, educator, and business advisor, Greg Bouhl has worked with over 2,000 entrepreneurs to help them start and grow their businesses. Fed up with clients finding and acting on inaccurate and outdated information online, Greg launched StartUp101.com to be a trusted resource for people starting a business.

Other Resources You Might Be Interested In

- How to Write a Business Plan

- Home Business Taxes

- Setting up Bookkeeping for Your First Business

- Can You Run A Business Out Of Your Home?

- Can I Sell Canva Designs on Etsy? A Guide to Making…

- How to Design a Business Card on Canva

- The Business Model Canvas Explained

- What Is A Sole Proprietorship And How Do I Register?

- How To Get Funds For Starting A Business

I am thinking about selling items i make at craft shows. What do i need to do with the state of Iowa to begin doing that?

Choosing a Business Location

Laundromat Business Loan Help

How Should a Husband and Wife LLC File?

Do I need a DBA for my website address?

How to Fill Out & File IRS Form 2553 | S-Corp Election Instructions

LLC vs. Corporation | What’s Right for You?

What is General Liability Insurance?

What Is A Multi-Member LLC?

Popular Questions

See more start-up questions

Popular Business Ideas

See more business ideas

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Form An LLC

Business ideas, common start-up questions, get in touch.

Contact Form

Mailing Address: PO Box 2571 Carbondale, IL 62901

Rules and regulations for starting a business change frequently. While we do our best to keep this information fully up-to-date, its very difficult to stay on top of the changes for every state. Also, this site is for informational purposes only and does not provide legal or tax advice.

Additionally, Startup101 may earn a small commission from products or services mentioned on this site.

Disclaimer | Privacy

© 2017 – 2024 StartUp101 LLC – All Rights Reserved.

Some (but not all) of the links on StartUp101.com are affiliate links. This means that a special tracking code is used and that we may make a small commission on the sale of an item if you purchase through one of these links. The price of the item is the same for you whether it is an affiliate link or not, and using affiliate links helps us to maintain this website.

StartUp101.com is also a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com .

Our mission is to help businesses start and promoting inferior products and services doesn’t serve that mission. We keep the opinions fair and balanced and not let the commissions influence our opinions.

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

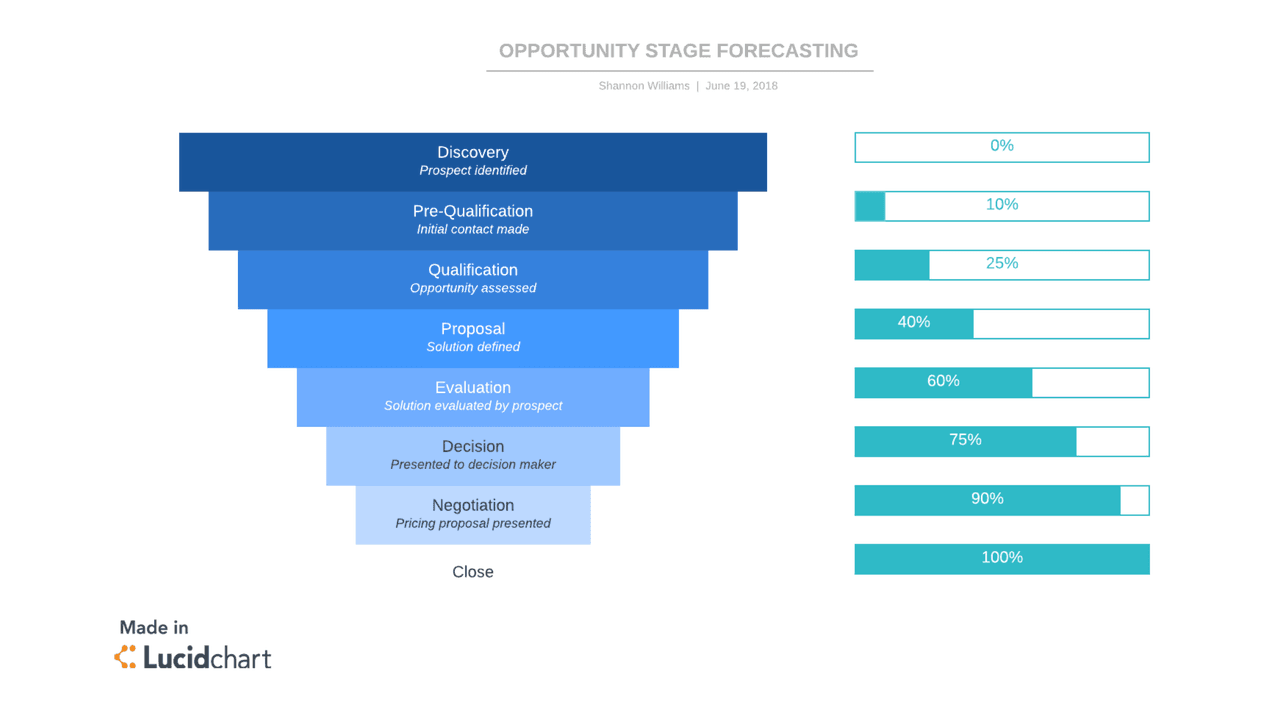

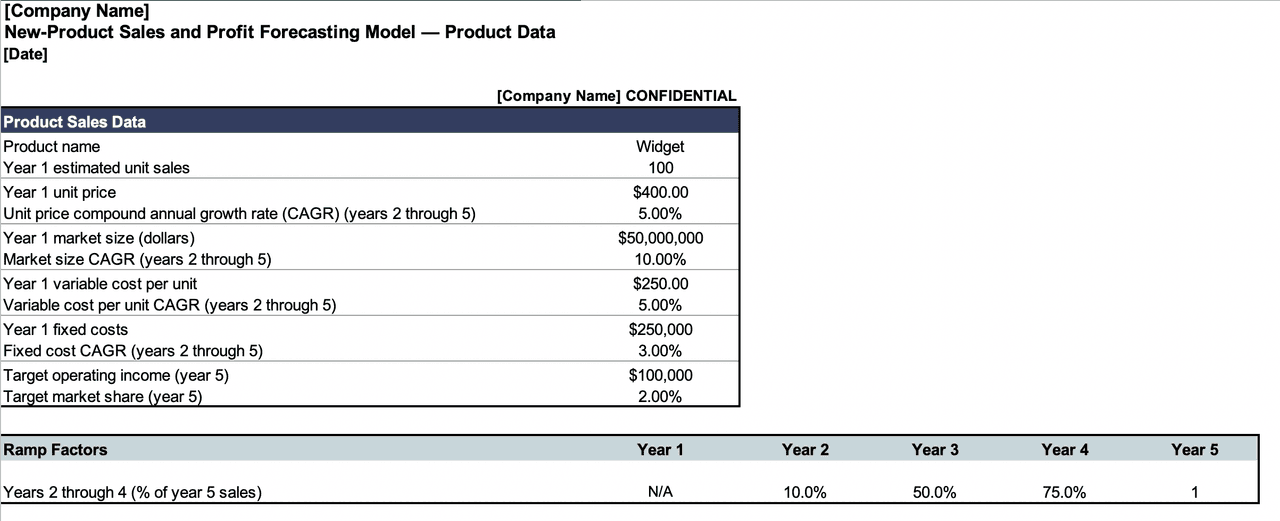

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

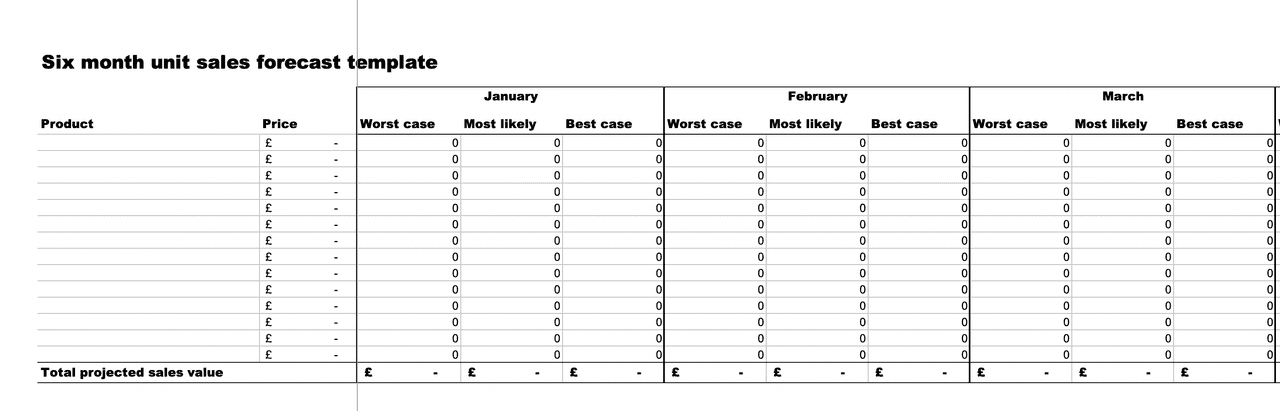

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

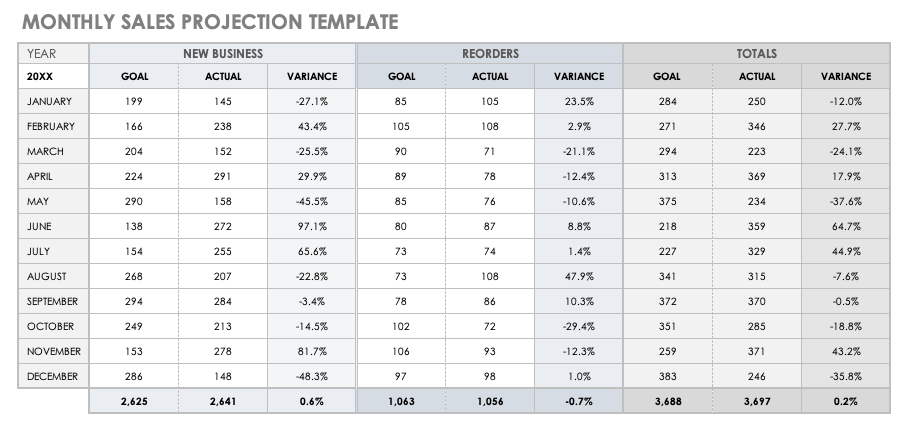

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

Sales | Templates

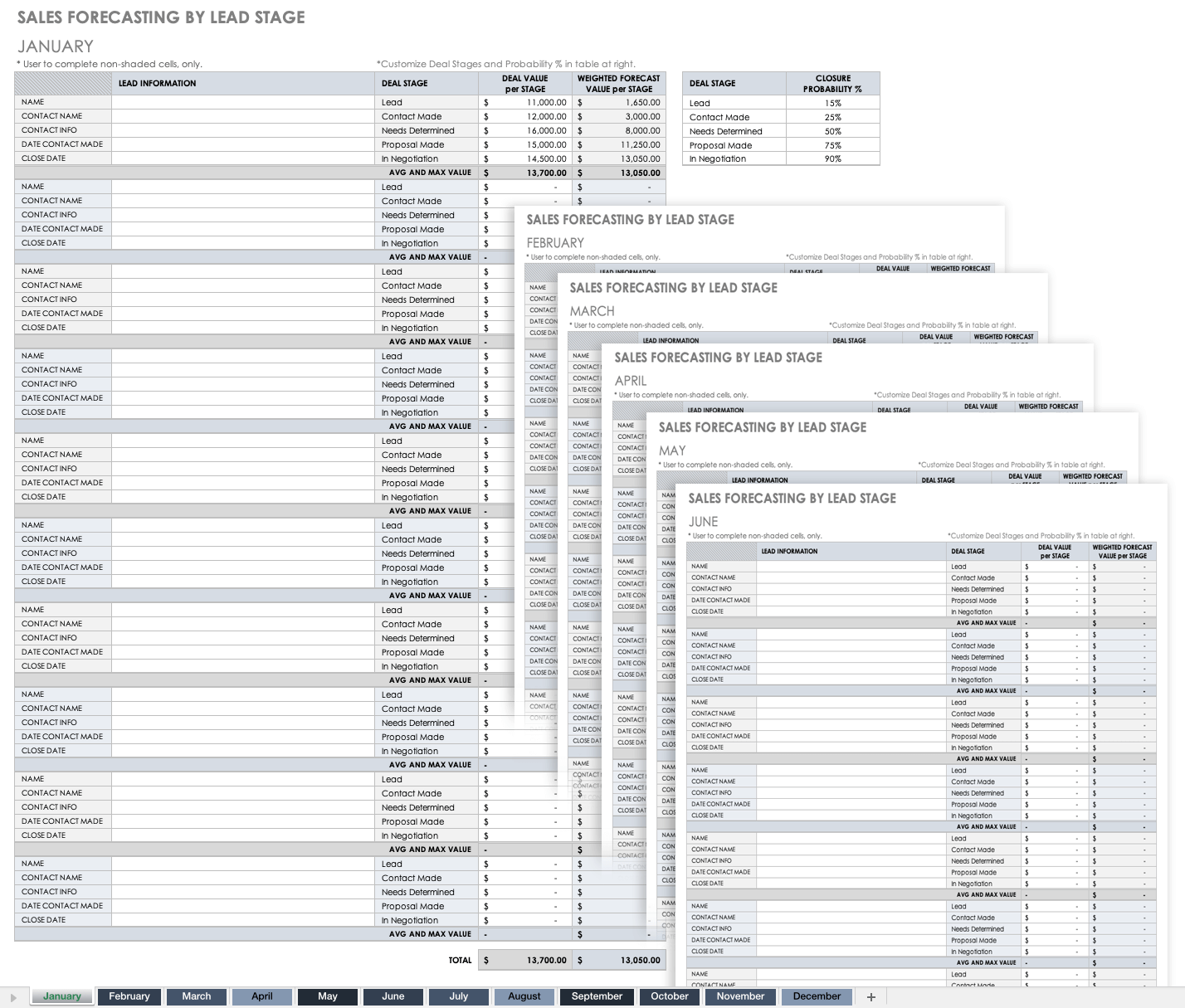

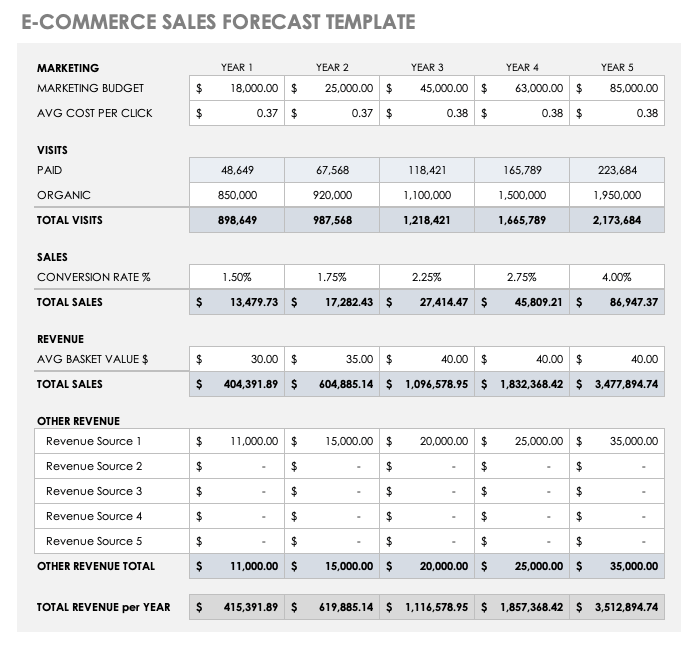

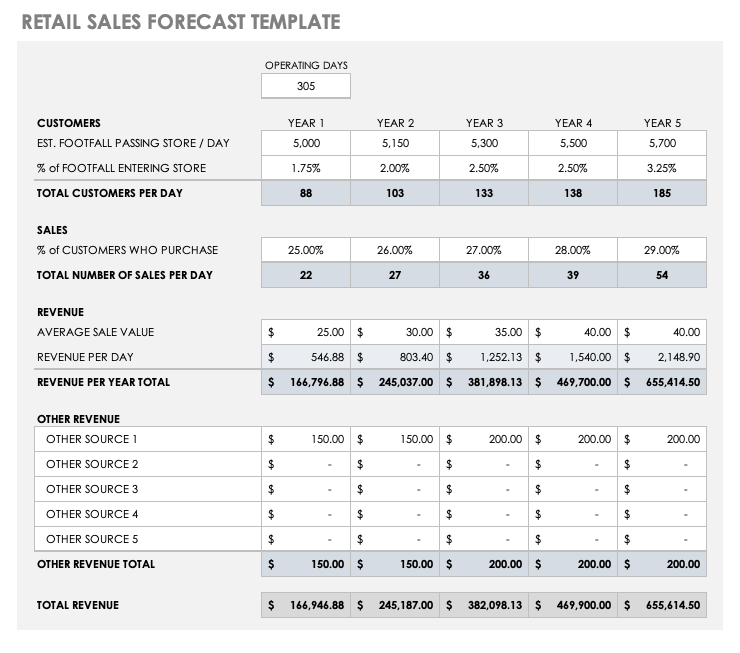

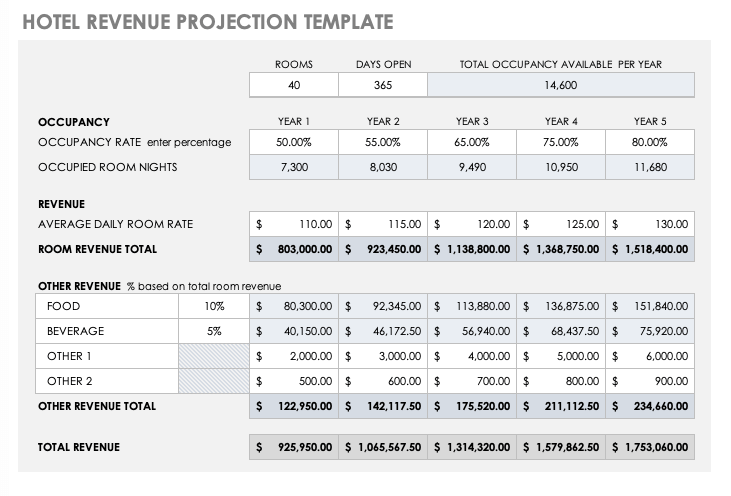

9 Free Sales Forecast Template Options for Small Business

Published March 7, 2023

Published Mar 7, 2023

REVIEWED BY: Jess Pingrey

WRITTEN BY: Jillian Ilao

This article is part of a larger series on Sales Management .

- 1 Simple Sales Forecast Template

- 2 Long-term Sales Forecast Template

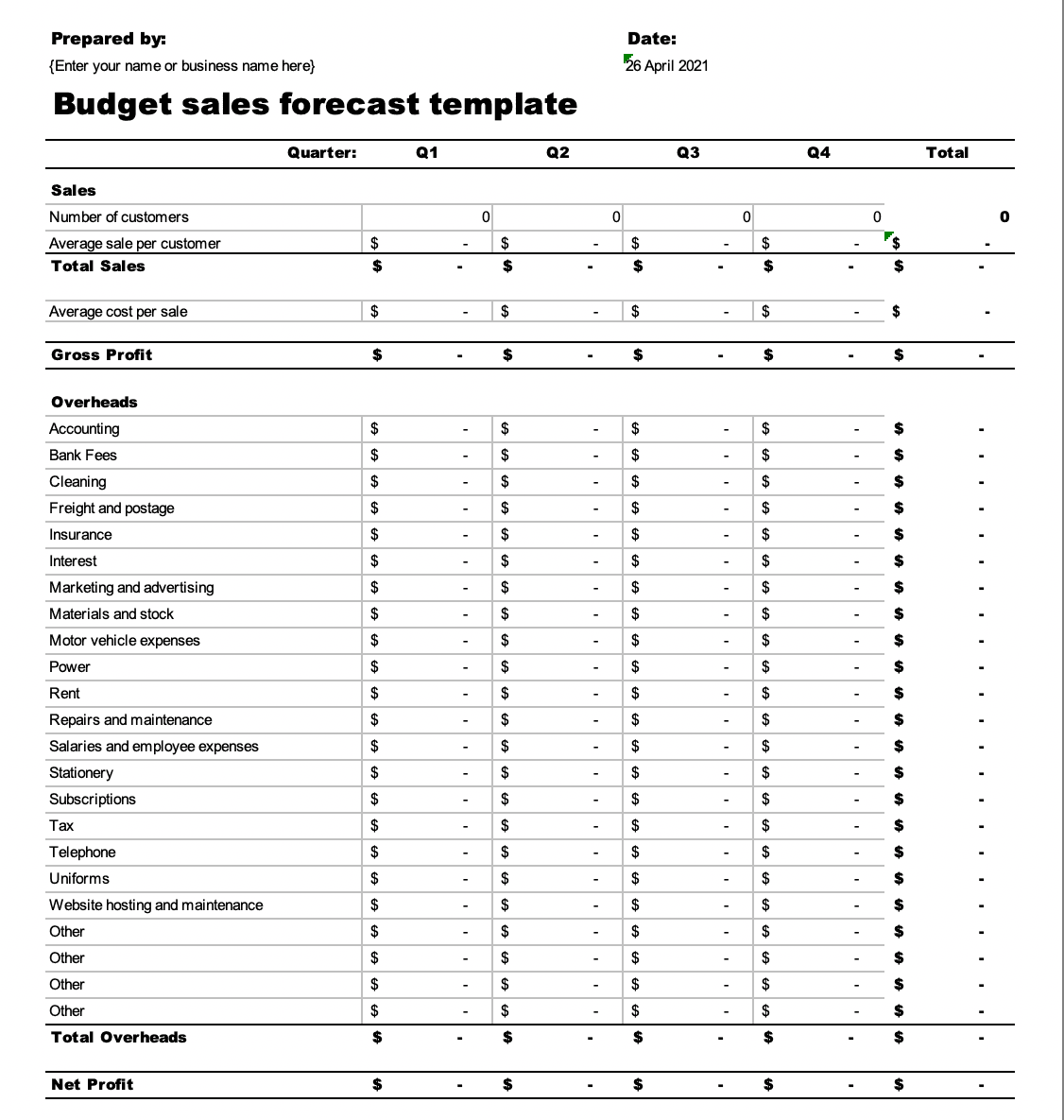

- 3 Budget Sales Forecast Template

- 4 Month-to-month Sales Forecast Template

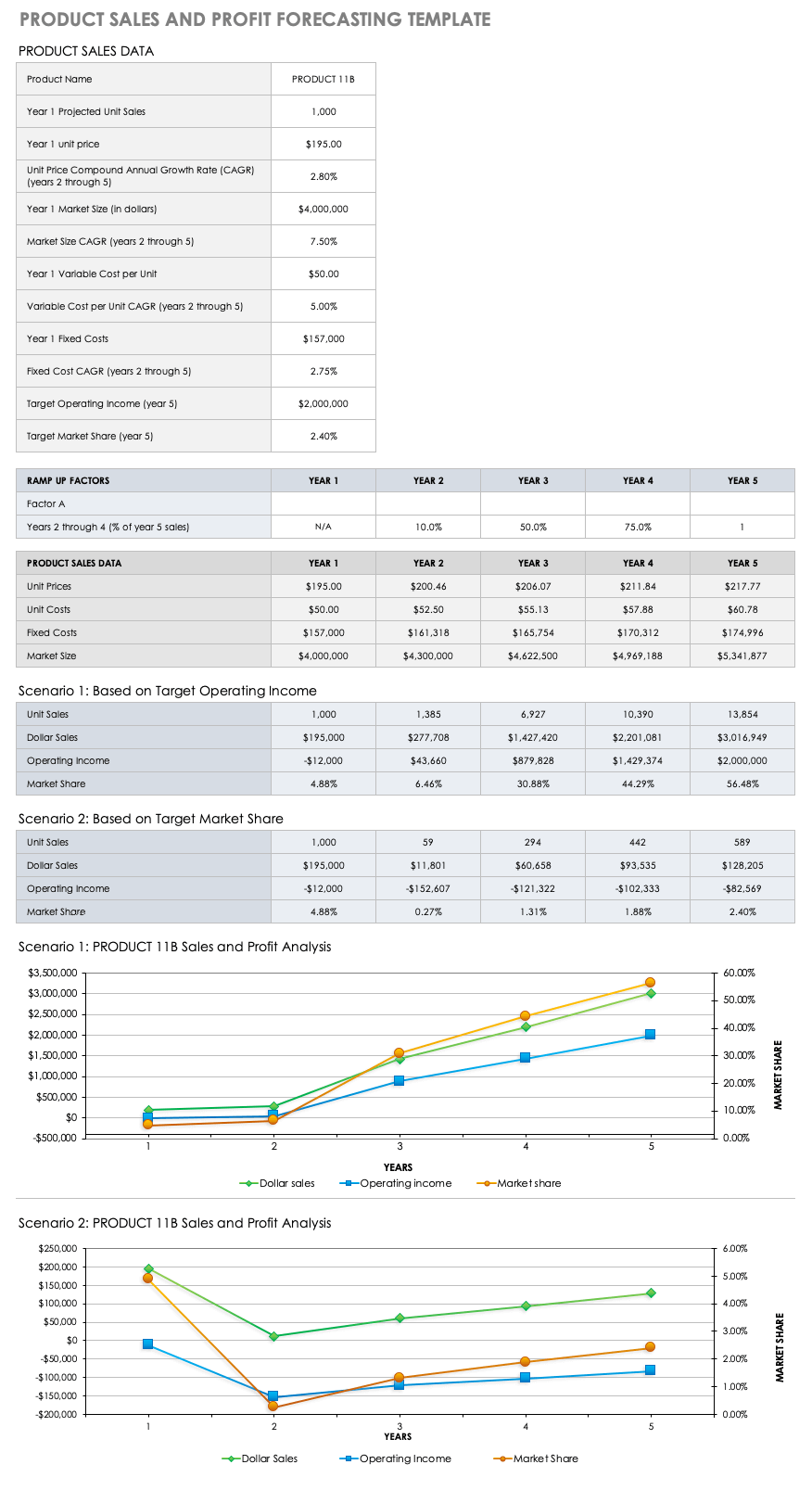

- 5 Individual Product Sales Forecast Template

- 6 Multi-product Sales Forecast Template

- 7 Retail Sales Forecast Template

- 8 Subscription-based Sales Forecast Template

- 9 B2B Lead Sales Forecast Template

- 10 CRMs with Built-in Sales Forecasting

- 11 Frequently Asked Questions (FAQ)

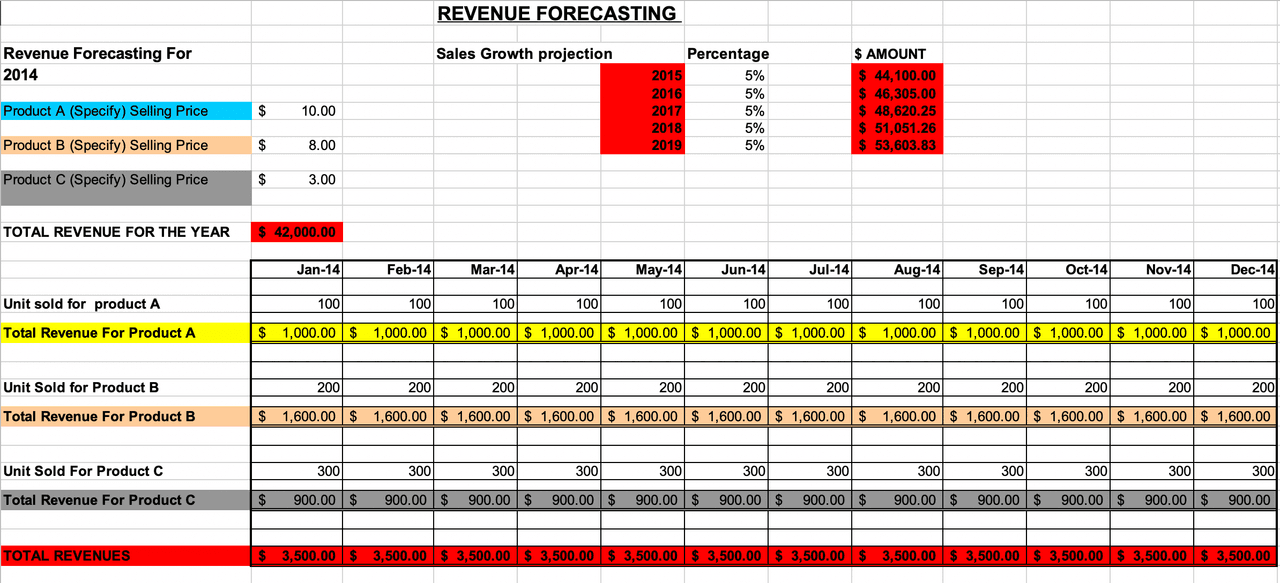

- 12 Bottom Line

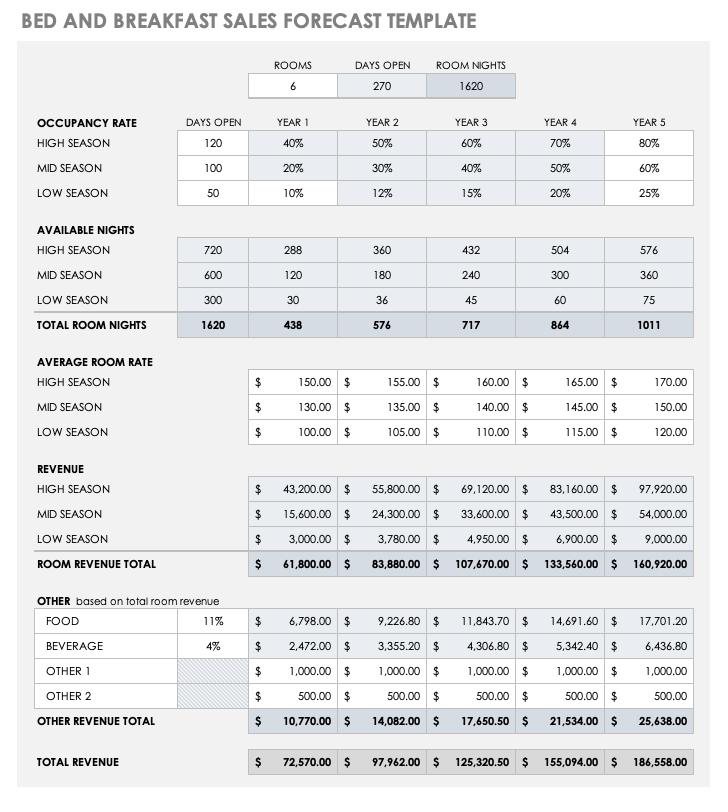

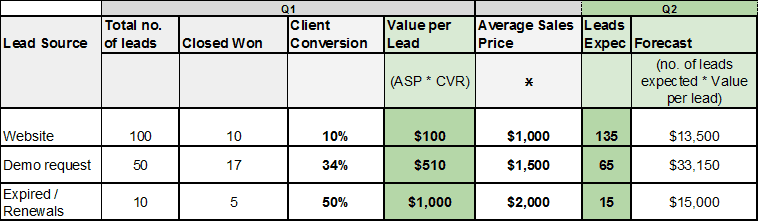

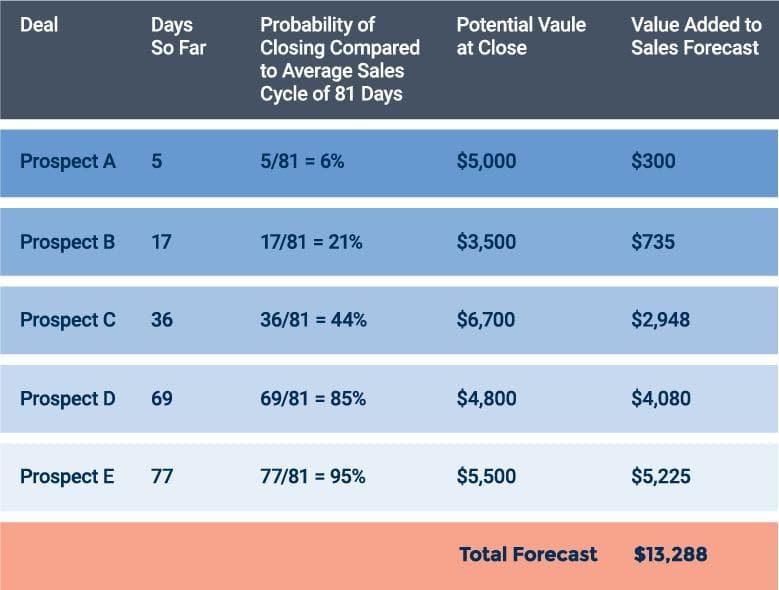

Using a sales forecast, business owners can create realistic projections about incoming revenue and business performance based on their current data and how they have performed in the past. Sales forecasts may cover weekly, monthly, annual, and multi-annual projections, and can be done using Google Sheets or Excel templates, as well as through customer relationship management (CRM) software.

We’ve compiled nine free sales projection templates you can download. Each downloadable file contains an example forecast you can use as a reference. We also included a blank template you can copy and fill in with your own sales data.

Did you know? Sales forecasts create projections you can use for things like goal setting, performance measurement, budgeting, projecting growth, obtaining financing, and attracting investors. This is why it is important to use software tools or a CRM system that gives you realistic, data-driven forecasts.

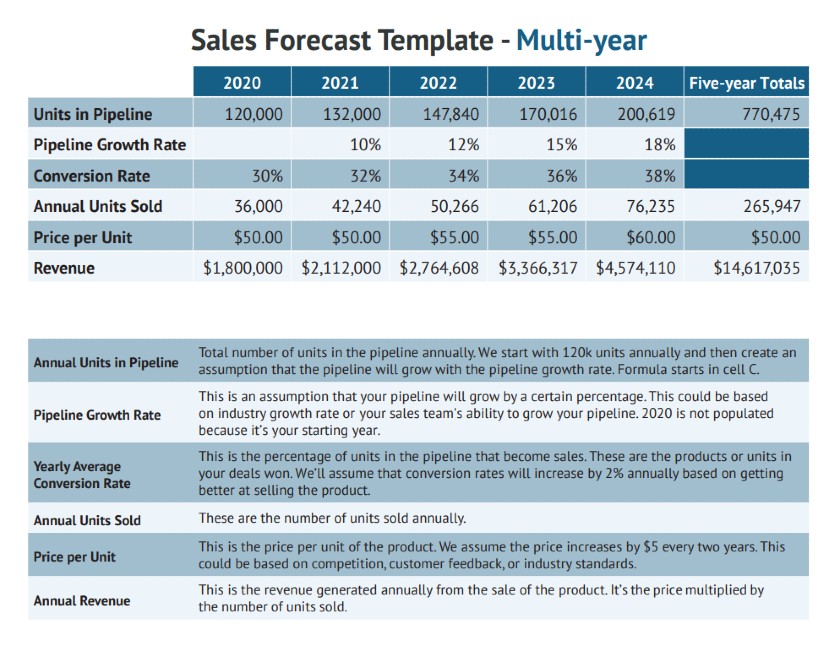

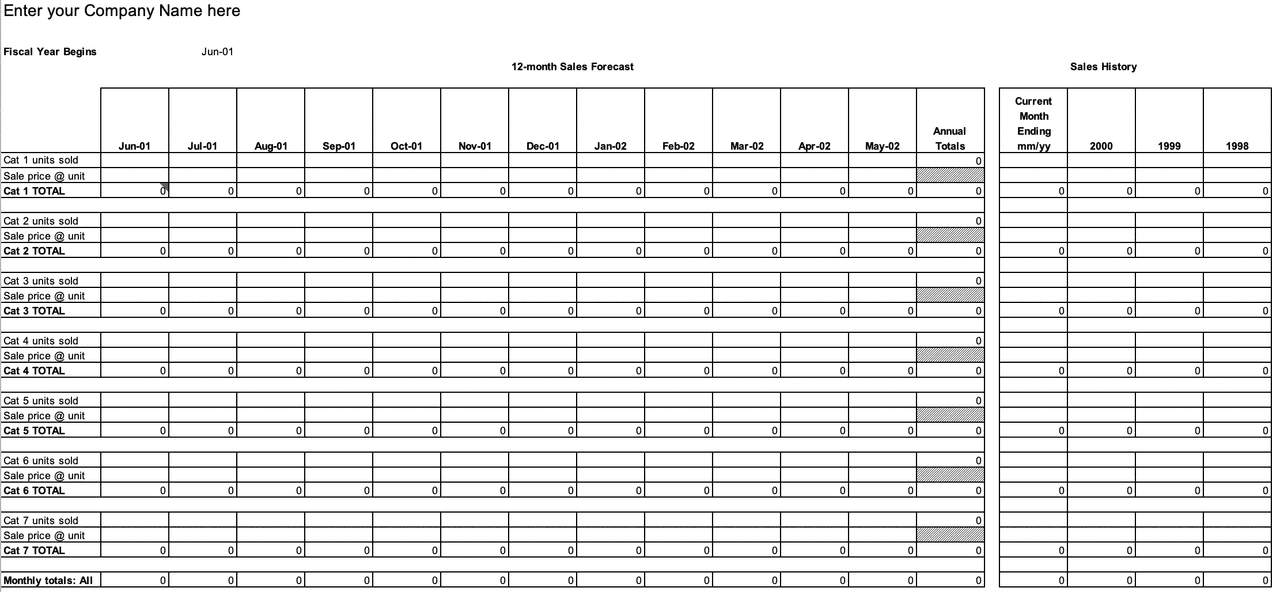

1. Simple Sales Forecast Template

Our free simple sales forecast template will help you get started with sales estimates to plan and grow your business. You can modify this multi-year projection sheet in either Google Sheets or Excel. It can also generate future revenue estimates based on units sold, pipeline growth percentages, lead conversion rates, and your product pricing. This gives you an idea of how much your business can grow sales-wise in the next few years.

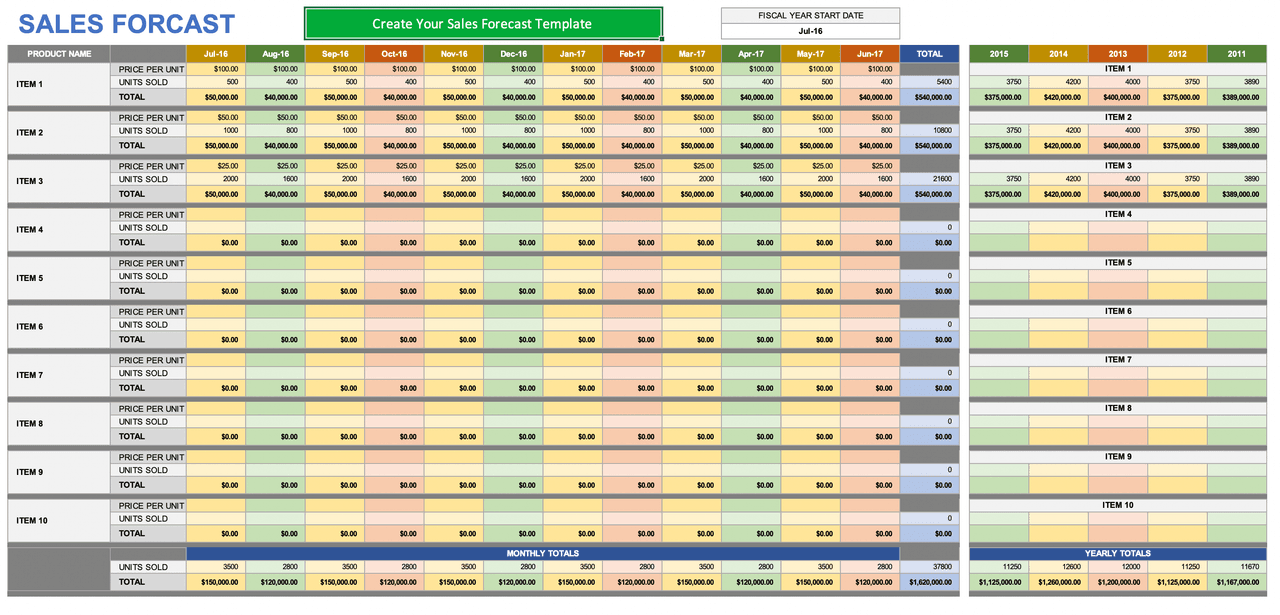

Sales projection template for multiple years

FILE TO DOWNLOAD OR INTEGRATE

FREE Sales Forecasting Template - One-Year

Thank you for downloading!

FREE Sales Forecasting Template - Multi-Year

2. Long-term Sales Projection Forecast

Part of creating a sales plan is forecasting long-term revenue goals and sales projections, then laying out the strategies and tactics you’ll use to hit your performance goals. Long-term sales projection templates usually provide three- to five-year projections. These templates are accessible in both Excel and Google Sheets.

Long-term sales prediction templates are best for businesses looking to scale and want insights about how much working capital they can expect to be able to tap into for growth initiatives. This type of sales projection template is also often required when applying for commercial loans or through other channels such as outside investors or crowdfunding.

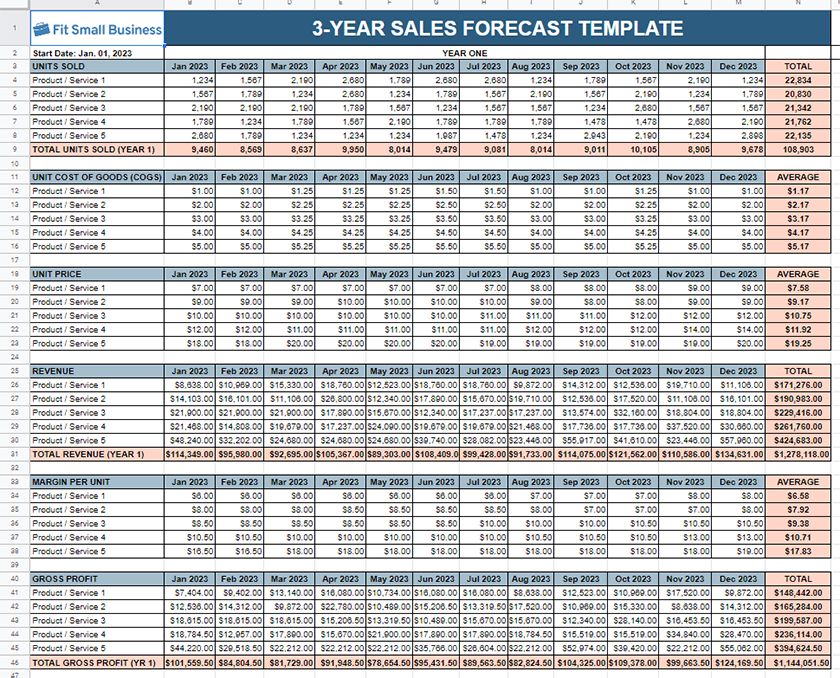

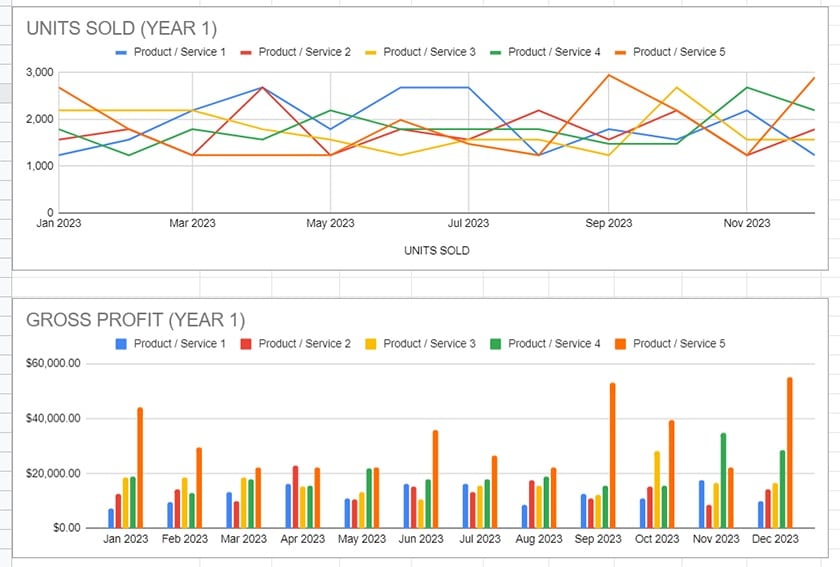

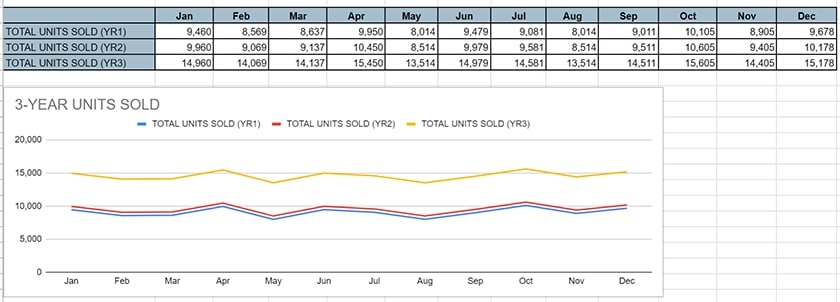

Three-year forecast template

Projection of units sold and gross profit from a three-year forecast template

Three-year projection of units sold

FREE 3-Year Forecast Template

FREE 5-Year Forecast Template

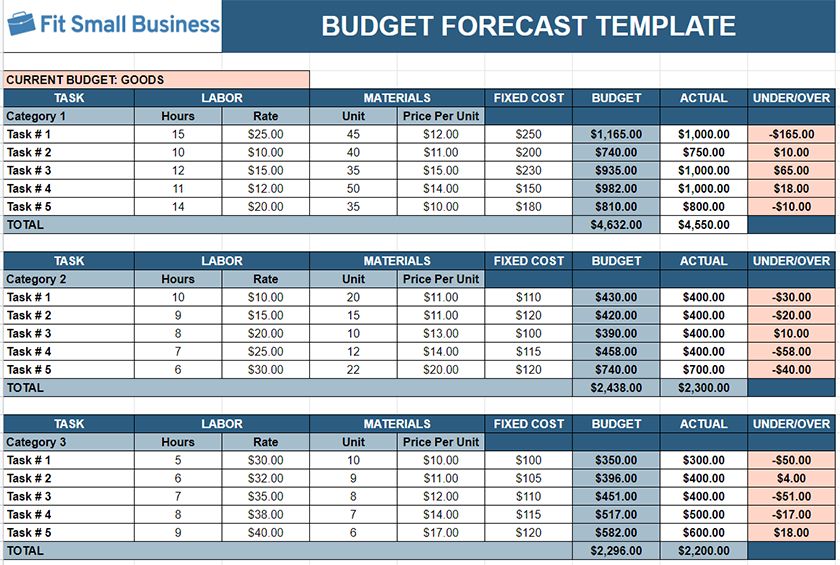

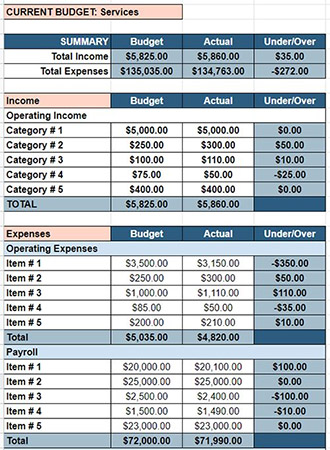

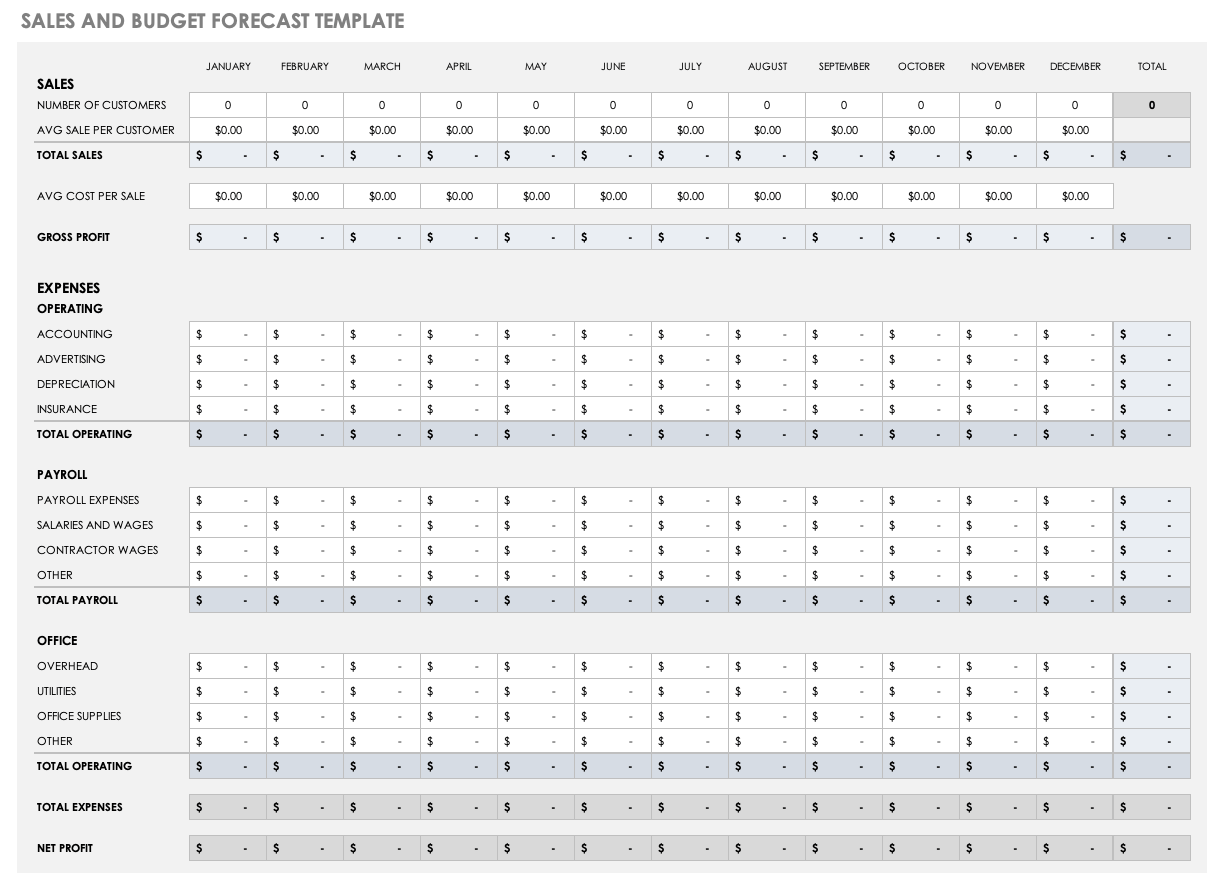

3. Budget Sales Projection Template

A budget sales forecast template shows expense estimates in relation to revenue, allowing you to calculate how much you can spend during a specified period. Budget templates will enable you to enter income projections and available cash to indicate your spending capabilities for that time frame.

This type of template is best for new and growing businesses trying to figure out their future available expenditures. Additionally, businesses interested in making a large asset purchase, such as a company vehicle, piece of equipment, or commercial real estate, can use this template to see how much of the asset can be self-financed.

Budget forecast template example

Budget forecast template for services example

FREE Budget Sales Forecast Template

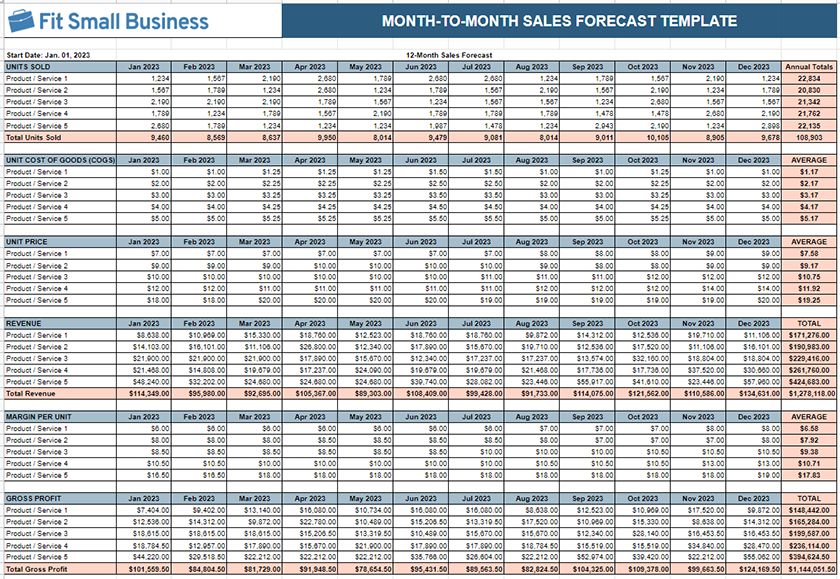

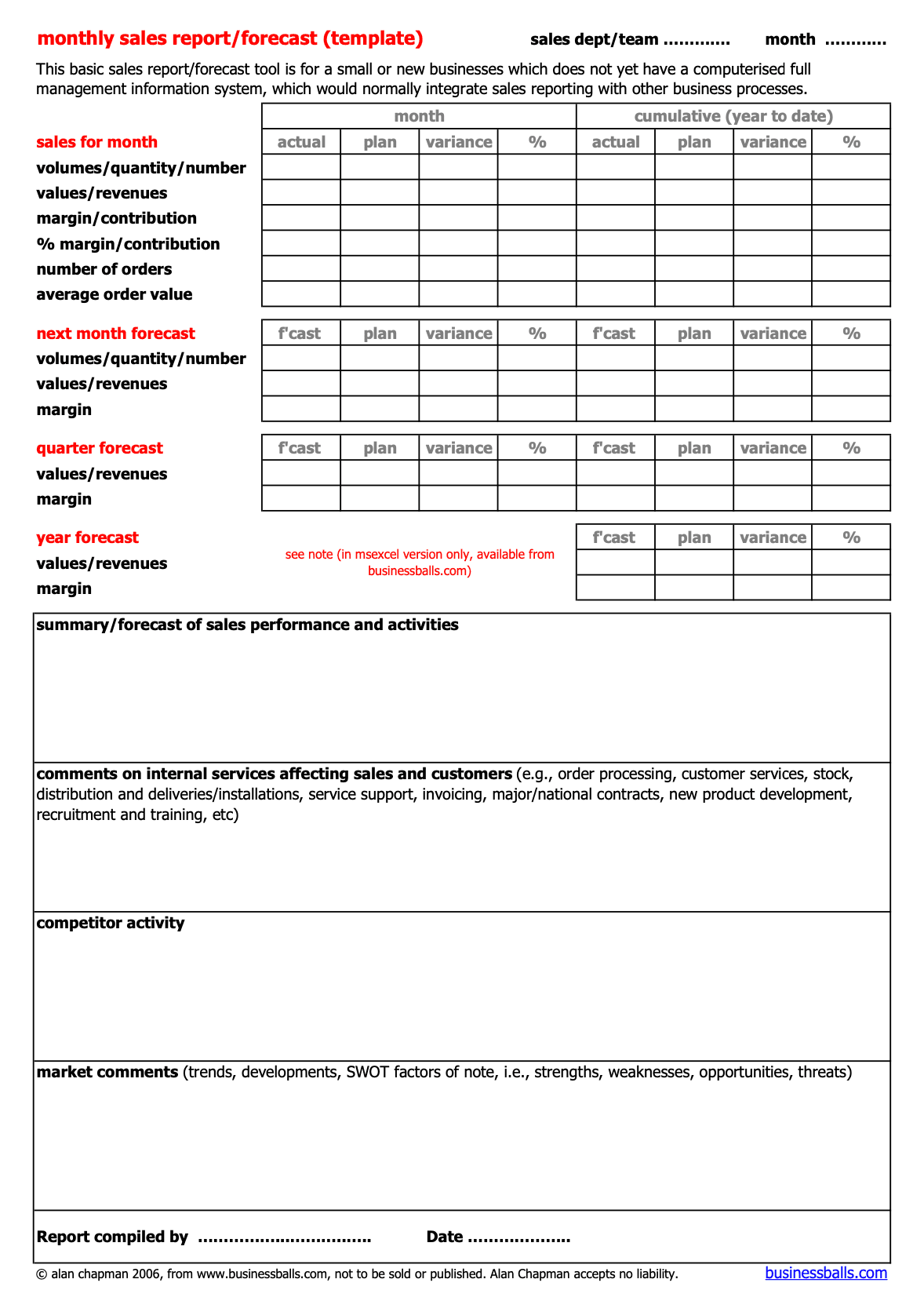

4. Month-to-Month Sales Forecast Template

The month-to-month (or monthly) sales projection template shows sales projections for a year divided into monthly increments. This type of revenue forecast template makes it easier to estimate your incoming revenue. This is because you can break down your pricing model, such as the average number of units sold, on a monthly rather than an annual basis.

This monthly sales projection example is best for seasonal businesses that experience significant revenue fluctuations in some months compared to others. It’s also appropriate for businesses that want to view rolling 12-month projections as a key performance indicator (KPI). You can also use it to project one-year sales estimates before implementing major campaigns or initiatives, such as a growth strategy.

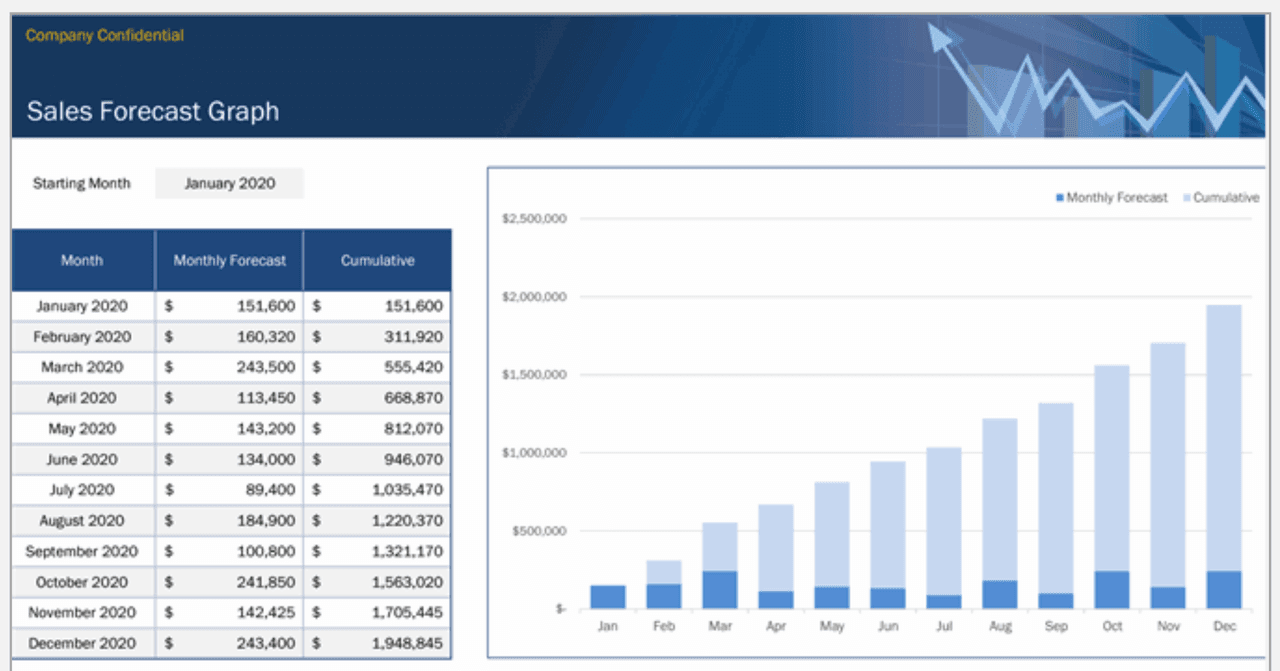

Month-to-month forecast template example

FREE Month-to-Month Forecast Template

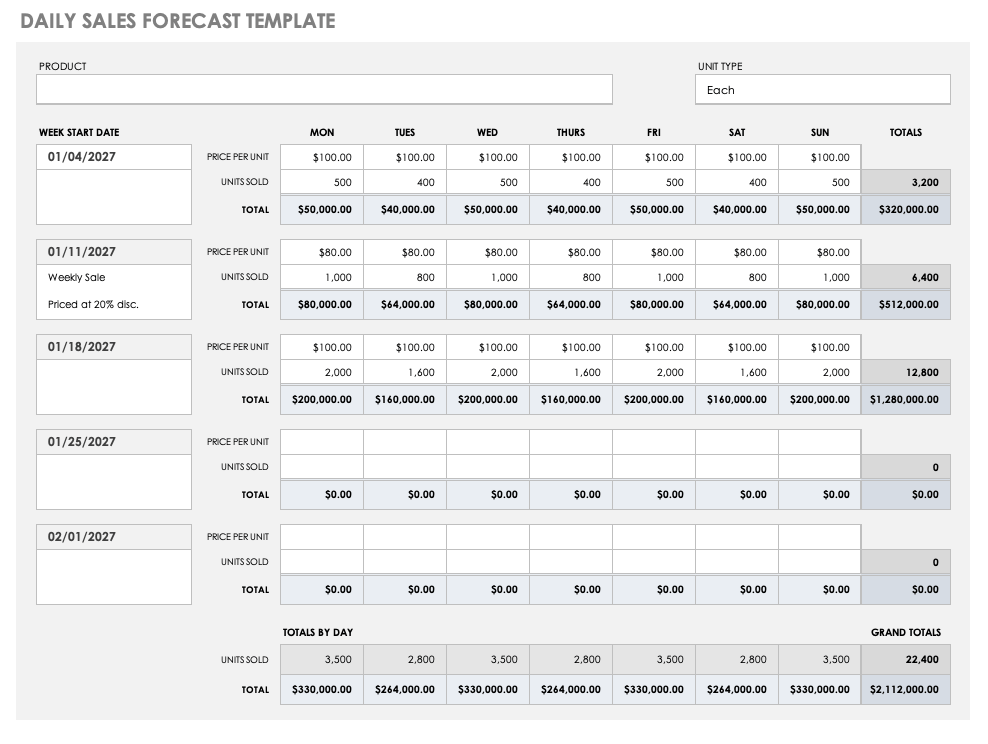

5. Individual Product Sales Forecast Template

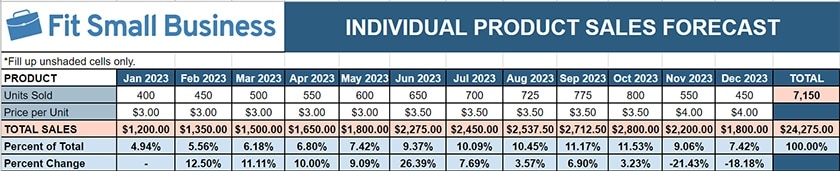

An individual product sales projection template can be used by businesses that sell one product or service or for projecting sales of a new (or any single) product or service. This forecast indicates how you expect the product to perform based on units sold and the price per unit monthly.

An individual product forecast template benefits businesses that sell products through a storefront or ecommerce medium. It helps businesses that are adding a new product to their arsenal in estimating sales exclusively for that product. It is also recommended for companies that need to track individual performance for the most popular or profitable products.

Individual product forecast template example

FREE Individual Product Forecast Template

6. Multi-product Sales Forecast Template

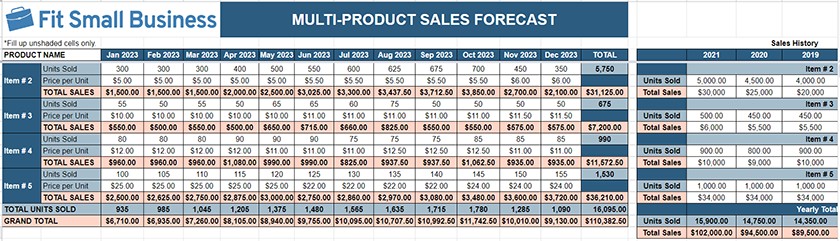

Use this revenue projection template to generate sales projections if your business sells multiple products. Through this type of template, you can compare the estimated performance of specific products by tracking the units sold and the price per unit. In turn, this will yield a total sales revenue estimate.

The multi-product forecasting template is best for retail or wholesale businesses selling various products. You can also use it to project the revenue of multiple product categories. Here, each “item” represents a category rather than an individual product, and the price per unit is calculated in aggregate.

Multi-product sales forecast template example

FREE Multi-product Forecast Template

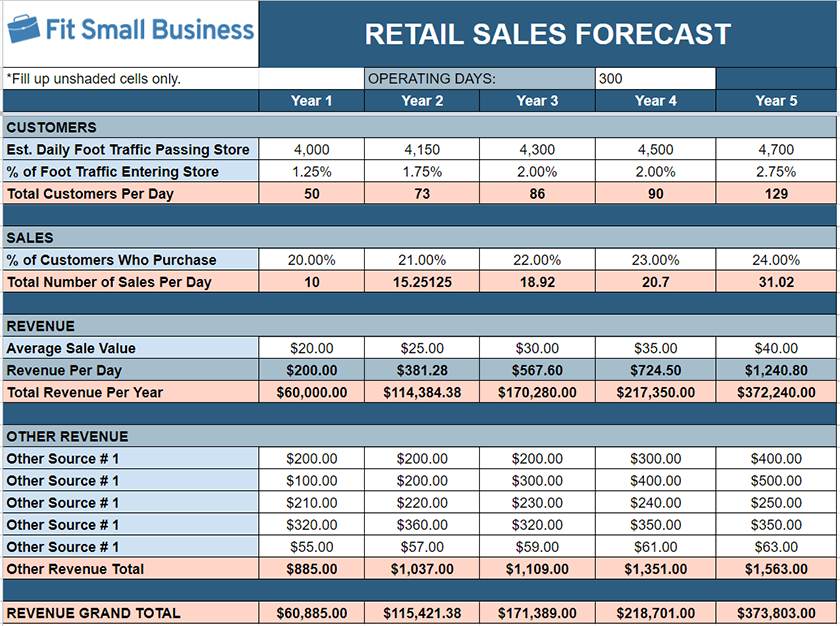

7. Retail Sales Forecast Template

A retail sales projection template forecasts revenue for brick-and-mortar stores since it includes data related to foot traffic. The retail sales template calculates projected revenue by year based on foot traffic, the percentage of foot traffic that enters the store, and the scale of conversions or those who make a purchase. Since it has a field for “other revenue,” it can be used by retail stores selling online.

This business forecast template is mostly designed for brick-and-mortar retail businesses. However, a combination of ecommerce and brick-and-mortar businesses, as well as ecommerce operations, can also use this forecast template. The estimated customers passing store data fields can be replaced with website traffic to convert this sales forecast Excel sheet into an ecommerce sales forecasting template.

Retail forecast template example

FREE Retail Forecast Template

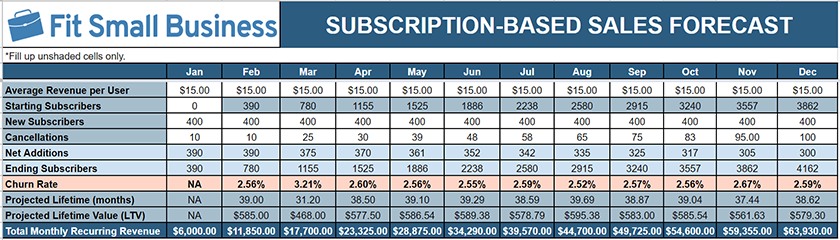

8. Subscription-based Sales Forecasting Template

Businesses relying on recurring revenue from sign-ups or contract renewals should use the subscription-based sales prediction spreadsheet. Enter data into the visitor and sign-up fields to show the visitor-to-sign-up conversion rate. Then, enter the number of new customers to show the percentage of sign-ups that convert to paying customers.

This business projection template also helps you track customer churn. It calculates your churn and retention rate based on the number of paying customers at the end of the period compared to the number at the beginning, plus the number of new customers added. Knowing your churn rate is essential since a high or increasing rate of customer turnover could indicate problems with your organization or its products or services.

How to Calculate Churn Rate:

To manually calculate churn rate, divide the number of lost customers by the total customers at the start of the time period, then multiply the result by 100. For example, if your business had 200 customers at the beginning of January and lost 12 customers by the end, you would divide 12 by 200. The answer is 0.06. Then, multiply that by 100, giving you a 6% monthly churn rate.

Churn Rate Calculator

Manual calculation of monthly customer churn rate

The fields of this template can be altered for use by contract renewal businesses like insurance agencies, information technology (IT) companies, and payroll processors. For example, subscribers can be replaced with “leads,” and new subscribers can be replaced with “presentations,” “free trials,” or “demos.” Then, change the churn rate to “non-renewed contracts” to estimate new and recurring business revenue year-to-year.

Subscription-based forecast template example

FREE Subscription-based Forecast Template

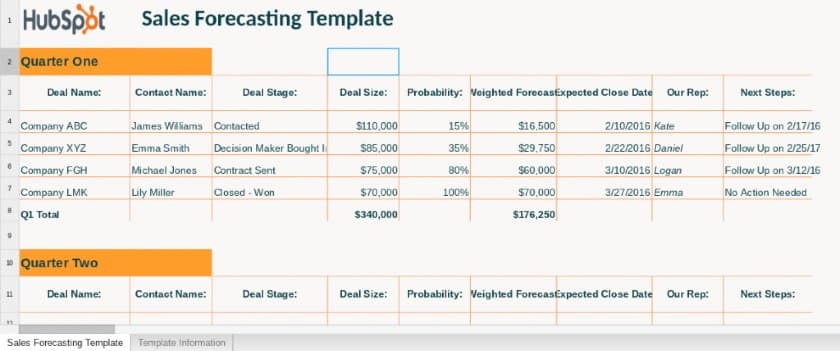

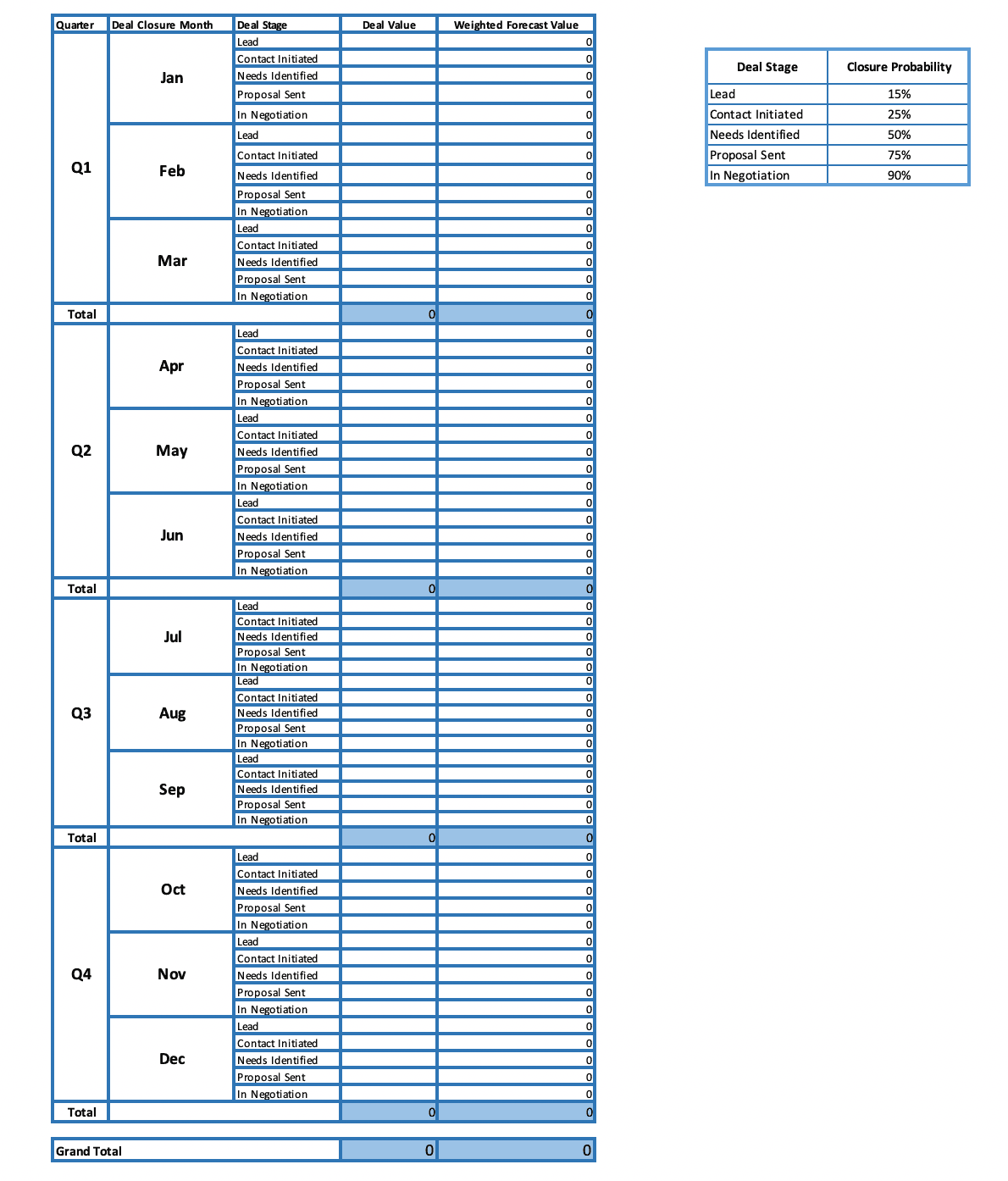

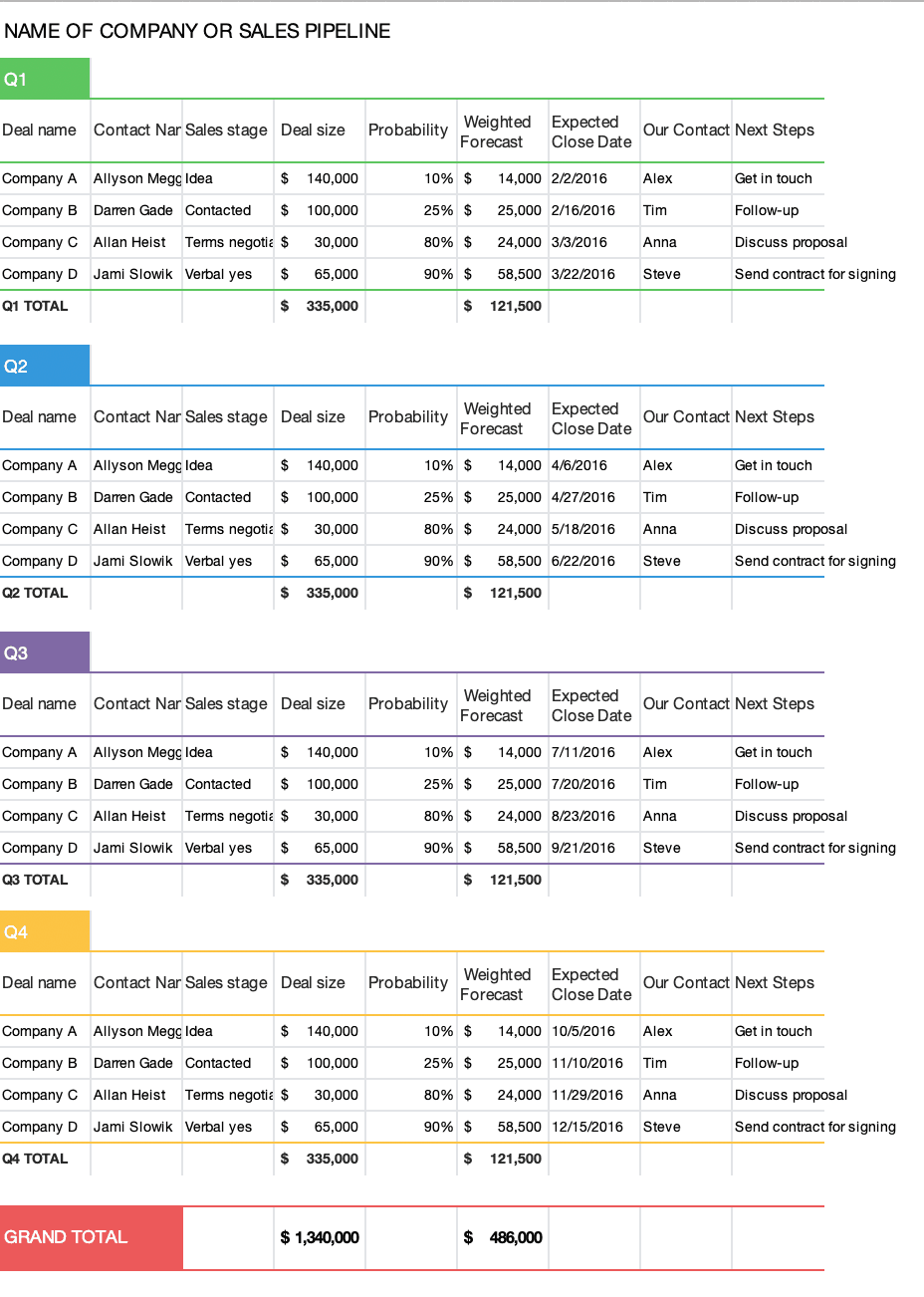

9. B2B Lead Sales Forecast Template

A business-to-business (B2B) lead forecast template estimates sales revenue from current deal opportunities in the sales pipeline through business leads. Businesses can use estimated deal values and the percent chance of closing those deals to obtain a sales projection.

This revenue projection template is best for B2B organizations, aka businesses selling to other businesses or organizations, rather than business-to-consumer (B2C) organizations. It can also be used for direct sales prospecting activities and for businesses that submit business proposals in response to solicitation requests.

FREE B2B Lead Forecast Template

CRMs With Built-in Sales Forecasting Features

Sales forecast sample templates are easy to modify. However, customer relationship management (CRM) systems generally offer more robust tools for managing revenue opportunities that can be converted into sales forecasts. They are valuable tools for providing sales predictions on premade charts through the data collected in the system. Below are examples of CRM platforms that could double as great sales forecasting software :

- HubSpot CRM

HubSpot CRM can instantly create revenue projections or automatically produce these reports for you monthly or quarterly at no additional cost, saving you time and helping your business stay on track.

Users can easily generate sales prediction reports on HubSpot with their historical data. (Source: HubSpot )

Starting price: Free for unlimited users or $45 per month (annual billing) for two users

Visit HubSpot

Pipedrive can take information such as potential deal value and probability of closing for a lead or opportunity to provide sales estimates in highly customizable templates.

Pipedrive weighted deal forecasting (Source: Pipedrive )

Starting price: $14.90 per user, per month (annual billing)

Visit Pipedrive

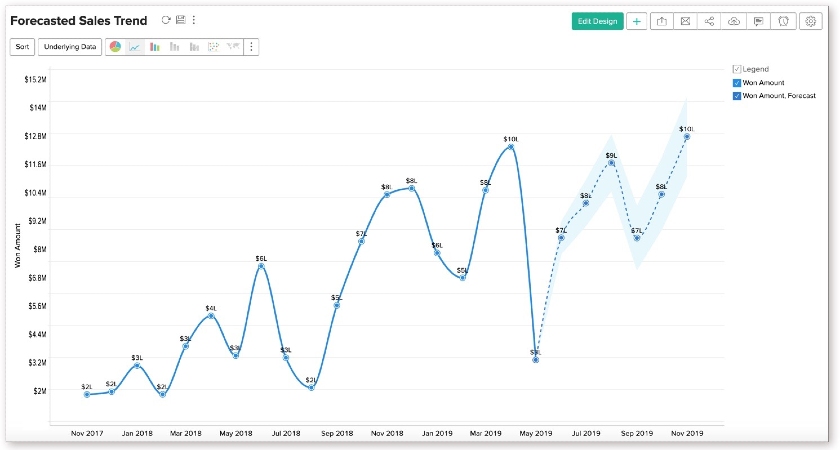

Zoho CRM provides sales forecasting through its native integration with Zoho Analytics, which analyzes and visualizes the data. Users can customize their forecasts by viewing them on different visual channels, including line, bar, and scatter charts.

Zoho Analytics sales prediction (Source: Zoho )

Starting price: Free for three users or $14 per user, per month (annual billing)

Providing the right tools for your sales team to organize leads, communicate with prospects, and analyze sales data is crucial for streamlining a sales operation, one of many responsibilities of a sales manager. Other insights for managing your sales team can be found in our ultimate guide to sales management .

Visit Zoho CRM

Frequently Asked Questions (FAQ)

Why is sales forecasting essential.

Sales forecasting provides a clear picture of your anticipated sales performance based on the number of opportunities in your pipeline and the industry that your business operates in. Having visibility will help you plan your business correctly—especially when the forecast is downward, and you need to scout for new opportunities to meet your sales targets.

What is a sales forecast template?

A sales forecast template is a predesigned spreadsheet that allows businesses to project their future sales revenue for a specific period. It is typically based on historical sales data figures and market trends. It also includes various factors that may potentially affect future sales performance, such as new product launches, seasonality, economic conditions, and changes in consumer behavior.

Bottom Line

Business forecast spreadsheets are available in both Excel and Google Sheets templates as well as other premade templates you can download, customize, and use. You may also take advantage of CRM features that organize, estimate, and visualize your company’s sales information, including sales predictions.

A CRM can save sales reps time in making projections as well as optimize your sales pipeline to generate leads and close more deals. We highly recommend CRMs such as HubSpot CRM , Pipedrive , and Zoho CRM , which all provide excellent sales forecasting features on top of robust sales management and lead nurturing tools.

About the Author

Jillian Ilao

Jill is a sales and customer service expert at Fit Small Business. Prior to joining the company, she has worked and produced marketing content for various small businesses and entrepreneurs from different markets, including Australia, the United Kingdom, the United States, and Singapore. She has extensive writing experience and has covered topics on business, lifestyle, finance, education, and technology.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Cash Flow Projection – The Comple...

Cash Flow Projection – The Complete Guide

Table of Content

Key takeaways.

- Cash flow projection is a vital tool for financial decision-making, providing a clear view of future cash movements.

- Cash flow is crucial for business survival and includes managing cash effectively and providing a financial planning roadmap.

- Automation in cash flow management is a game-changer. It enhances accuracy, efficiency, and scalability in projecting cash flows, helping businesses avoid common pitfalls.

Introduction

Cash flow is the lifeblood of any business. Yet, many companies constantly face the looming threat of cash shortages, often leading to their downfall. Despite its paramount importance, cash flow management can be overwhelming, leaving businesses uncertain about their financial stability.

But fear not, there’s a straightforward solution to this common problem – cash flow projection. By mastering the art of cash flow projection, you can gain better control over your finances and steer your business away from potential financial crises. Cash flow projections offer a proactive approach to managing cash flow, enabling you to anticipate challenges and make informed decisions to safeguard the future of your business.

If you’re unsure how to accurately perform cash flow projections or if you’re new to the concept altogether, this article will explain everything you need to know about cash flow projections – to help you confidently navigate the financial landscape of your business.

What Is Cash Flow?

To grasp the concept of cash flow projections, we must first understand the essence of cash flow itself. Cash flow is all about the movement of money flowing in and out of business. It reflects the company’s financial health and liquidity, capturing the inflows and outflows of cash over a specific timeframe.

To truly grasp your business’s financial landscape, you must understand the stages of cash flow: operating, investing, and financing activities, and how to analyze and make sense of it.

Read more to uncover a step-by-step guide on how to perform a cash flow analysis (template + examples) and methods to assess key items in cash flow statements.

What Is Cash Flow Projection?

Cash flow projection is the process of estimating and predicting future cash inflows and outflows within a defined period—usually monthly, quarterly, or annually.

Think of cash flow projection (also referred to as a cash flow forecast) as a financial crystal ball that allows you to peek into the future of your business’s cash movements. It involves mapping out the expected cash inflows (receivables) from sales, investments, and financing activities and the anticipated cash outflows (payables) for expenses, investments, and debt repayments.

It provides invaluable foresight into your business’s anticipated cash position, helping you plan for potential shortfalls, identify surplus funds, and make informed financial decisions.

Why Are Cash Flow Projections Important for Your Business?

Managing cash flow is a critical aspect of running a successful business. It can be the determining factor between flourishing and filing for Chapter 11 (aka bankruptcy ).

In fact, studies reveal that 30% of business failures stem from running out of money. To avoid such a fate, by understanding and predicting the inflow and outflow of cash, businesses can make informed decisions, plan effectively, and steer clear of potential financial disasters.

Cash Flow Projection vs. Cash Flow Forecast

Having control over your cash flow is the key to a successful business. By understanding the differences between cash flow statements and projections, small business owners can use these tools more effectively to manage their finances and plan for the future.

Discover the power of HighRadius cash flow forecasting software ,designed to precisely capture and analyze diverse scenarios , seamlessly integrating them into your cash forecasts. By visualizing the impact of these scenarios on your cash flows in real time, you gain a comprehensive understanding of potential outcomes and can proactively respond to changing circumstances.

Here’s how AI takes variance analysis to the next level and helps you generate accurate cash flow forecasts with low variance. It automates the collection of data on past cash flows, including bank statements, accounts receivable, accounts payable, and other financial transactions, and integrates with most financial systems. This data is analyzed to detect patterns and trends that can be used to anticipate future cash flows. Based on this historical analysis and regression analysis of complex cash flow categories such as A/R and A/P, AI selects an algorithm that can provide an accurate cash forecast.

Step-by-Step Guide to Creating a Cash Flow Projection

Step 1: choose the type of projection model.

- Determine the appropriate projection model based on your business needs and planning horizon.

- Consider the following factors when choosing a projection model:

- Short-term Projections: Covering a period of 3-12 months, these projections are suitable for immediate planning and monitoring.

- Long-term Projections: Extending beyond 12 months, these projections provide insights for strategic decision-making and future planning.

- Combination Approach: Use a combination of short-term and long-term projections to address both immediate and long-range goals.

Step 2: Gather historical data and sales information

- Want to determine where you’re going? Take a look at where you’ve already been. Collect relevant historical financial data, including cash inflows and outflows from previous periods.

- Analyze sales information, considering seasonality, customer payment patterns, and market trends.

Pro Tip: Finance teams often utilize accounting software to ingest a range of historical and transactional data. Read on to discover the business use cases of implementing a treasury management solution for optimal cash flow management .

Step 3: Project cash inflows

- Estimate cash inflows based on sales forecasts, considering factors such as payment terms and collection periods.

- Utilize historical data and market insights to refine your projections.

Step 4: Estimate cash outflows

- Identify and categorize various cash outflows components, such as operating expenses, loan repayments, supplier payments, and taxes.

- Use historical data and expense forecasts to estimate the timing and amount of cash outflows.

Pro Tip: By referencing the cash flow statement, you can identify the sources of cash inflows and outflows. Learn more about analyzing projected cash flow statement .

Step 5: Calculate opening and closing balances

- Calculate the opening balance for each period, which represents the cash available at the beginning of the period.

- Opening Balance = Previous Closing Balance

- Calculate the closing balance by considering the opening balance, cash inflows, and cash outflows for the period.

- Closing Balance = Opening Balance + Cash Inflows – Cash Outflows

Step 6: Account for timing and payment terms

- Consider the timing of cash inflows and outflows to create a realistic cash flow timeline.

- Account for payment terms with customers and suppliers to align projections with cash movements.

Step 7: Calculate net cash flow

- Calculate the net cash flow for each period, which represents the difference between cash inflows and cash outflows.

- Net Cash Flow = Cash Inflows – Cash Outflows

Pro Tip: Calculating the net cash flow for each period is vital for your business as it gives you a clear picture of your future cash position. Think of it as your future cash flow calculation.

Step 8: Build contingency plans

- Incorporate contingency plans to mitigate unexpected events impacting cash flow, such as economic downturns or late payments.

- Create buffers in your projections to handle unforeseen circumstances.

Step 9: Implement rolling forecasts

- Embrace a rolling forecast approach, where you regularly update and refine your cash flow projections based on actual performance and changing circumstances.

- Rolling forecasts provide a dynamic view of your cash flow, allowing for adjustments and increased accuracy.

Cash Flow Projection Example

Let’s take a sneak peek into the cash flow projection of Pizza Planet, a hypothetical firm. In March, they begin with an opening balance of $50,000. This snapshot will show us how their finances evolved during the next 4 months.

Here are 5 key takeaways from the above cash flow projection analysis for Pizza Planet:

Upsurge in Cash Flow from Receivables Collection (April):

- Successful efforts in collecting outstanding customer payments result in a significant increase in cash flow.

- Indicates effective accounts receivable management and timely collection processes.

Buffer Cash Addition (May and June):

- The company proactively adds buffer cash to prepare for potential financial disruptions.

- Demonstrates a prudent approach to financial planning and readiness for unexpected challenges.

Spike in Cash Outflow from Loan Payment (May):

- A noticeable cash outflow increase is attributed to the repayment of borrowed funds.

- Suggests a commitment to honoring loan obligations and maintaining a healthy financial standing.

Manageable Negative Net Cash Flow (May and June):

- A negative net cash flow during these months is offset by positive net cash flow in other months.

- Indicates the ability to handle short-term cash fluctuations and maintain overall financial stability.

Consistent Closing Balance Growth:

- The closing balance exhibits a consistent and upward trend over the projection period.

- Reflects effective cash flow management, where inflows cover outflows and support the growth of the closing cash position.

How to Calculate Projected Cash Flow?

To calculate projected cash flow, start by estimating incoming cash from sources like sales, investments, and financing. Then, deduct anticipated cash outflows such as operating expenses, loan payments, taxes, and capital expenditures. The resulting net cash flow clearly shows how much cash the business expects to generate or use within the forecasted period.

Calculating projected cash flow is a crucial process for businesses to anticipate their future financial health and make informed decisions. This process involves forecasting expected cash inflows and outflows over a specific period using historical data, sales forecasts, expense projections, and other relevant information. Regularly updating and reviewing projected cash flow helps businesses identify potential cash shortages or surpluses, allowing for proactive cash management strategies and financial planning.

Benjamin Franklin once said, ‘Beware of little expenses; a small leak will sink a great ship.’ This underscores the importance of managing and understanding cash flow in business.

Download this cash flow calculator to effortlessly track your company’s operating cash flow, net cash flow (in/out), projected cash flow, and closing balance.

6 Common Pitfalls to Avoid When Creating Cash Flow Projections

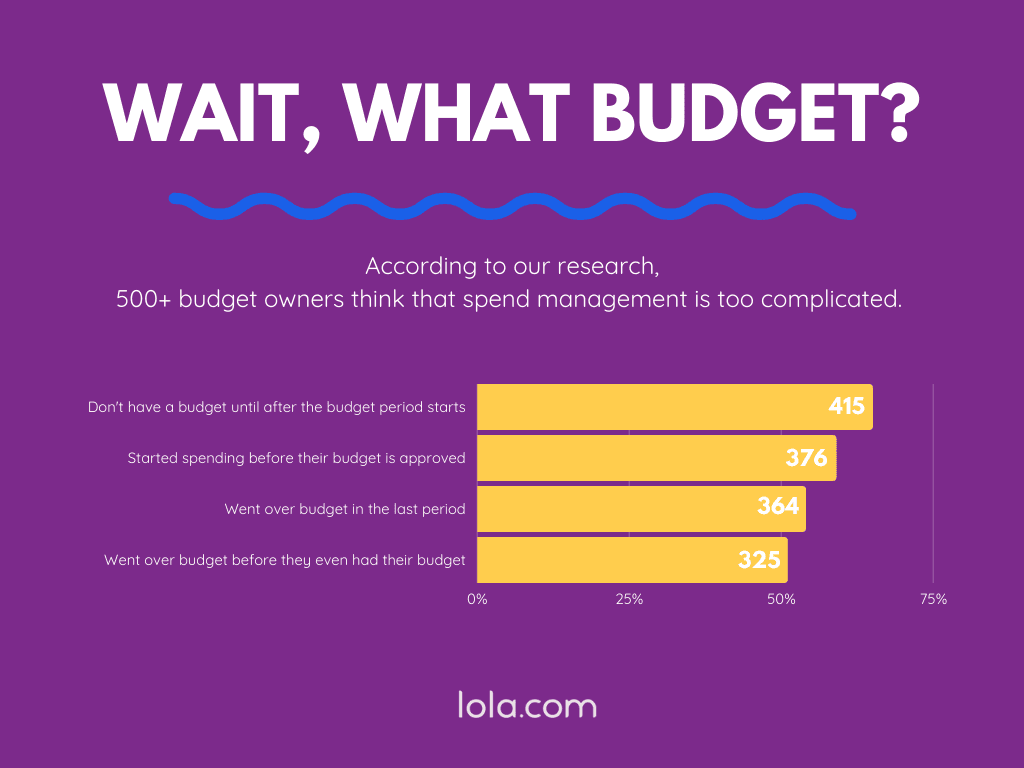

At HighRadius, we recently turned our research engine toward cash flow forecasting to shed light on the sources of projection failures. One of our significant findings was that most companies opt for unrealistic projections models that don’t mirror the actual workings of your finance force.

Cash flow projections are only as strong as the numbers behind them. No one can be completely certain months in advance if literal or figurative storm clouds are waiting for them on the horizon. Defining a realistic cash flow projection for your company is crucial to achieving more accurate results. Don’t let optimism cloud your key assumptions. Stick to the most likely numbers for your projections.

A 5% variance is acceptable, but exceeding this threshold warrants a closer look at your key assumptions. Identify any logical flaws that may compromise accuracy. Take note of these pitfall insights we’ve gathered from finance executives who have shared their experiences:

- Avoid overly generous sales forecasts that can undermine projection accuracy.

- Maintain a realistic approach to sales projections to ensure reliable cash flow projections.

- Reflect the payment behavior of your customers accurately in projections, especially if they tend to pay on the last possible day despite a 30-day payment schedule.

- Adjust the projection cycle to align with the actual payment patterns.

- Factor in annual and quarterly bills on the payables side of your projections.

- Consider potential changes in tax rates if your business is expected to reach a new tax level.

- Account for seasonal fluctuations and cyclical trends specific to your industry.

- Analyze historical data to identify patterns and adjust projections accordingly to reflect these variations.

- Incorporate contingencies in your projections to prepare for unforeseen circumstances such as economic downturns, natural disasters, or changes in market conditions.

- Build buffers to mitigate the impact of unexpected events on your cash flow.

- Failing to create multiple scenarios can leave you unprepared for different business outcomes.

- Develop projections for best-case, worst-case, and moderate scenarios to assess the impact of various circumstances on cash flow.

By addressing these pitfalls and adopting best practices shared by finance executives, you can create more reliable and effective cash flow projections for your business. Stay proactive and keep your projections aligned with the realities of your industry and market conditions.

How Automation Helps in Projecting Cash Flow?

Building a cash flow projection chart is just the first step; the real power lies in the insights it can provide. Cash flow projection is crucial, but let’s face it – the traditional process is resource-consuming and hampers productivity. Finance teams have no choice but to abandon it and let it gather dust for the remainder of a month.

However, there’s a solution: a cash flow projection automation tool.

Professionals in Controlling or Treasury understand this need for automation, but it requires an investment of time and money. Building a compelling business case is straightforward, especially for companies prioritizing cash reporting, forecasting, and leveraging the output for day-to-day cash management and investment planning.

Consider the following 3 business use cases shared by finance executives, highlighting the benefits that outweigh the initial investment:

Scalability and adaptability:

Forecasting cash flow in spreadsheets is manageable in the early stages, but as your business grows, it becomes challenging and resource-intensive. Manual cash flow management struggles to keep up with the increasing transactions and customer portfolios.

Many businesses rely on one-off solutions that only temporarily patch up cash flow processes without considering the implications for the future. Your business needs an automation tool that can effortlessly scale with your business, accommodating evolving needs.

Moreover, such dependable partners often offer customization options, allowing you to tailor the cash flow projections to your specific business requirements and adapt to changing market dynamics.

Time savings:

Consider a simple example of the time and effort involved in compiling a 13-week cash flow projection for stakeholders every week. The process typically includes

- Capture cash flow data from banking and accounting platforms and classify transactions.

- Create short-term forecasts using payables and receivables data.

- Model budget and other business plans for medium-term forecasts.

- Collect data from various business units, subsidiaries, and inventory levels.

- Consolidate the data into a single cash flow projection.

- Perform variance and sensitivity analysis.

- Compile reporting with commentary.

This process alone can consume many hours each week. Let’s assume it takes six hours for a single resource and another six hours for other contributors, totaling 12 hours per week or 624 hours per year. Whether you are an enterprise or an SMB, learn how a 13-week cash flow projection template can help you keep your business on track and achieve your financial goals.

Imagine the added time spent on data conversations, information requests, and follow-ups. Cash reporting can quickly become an ongoing, never-ending process.

By implementing a cash flow projection automation tool, you can say goodbye to tedious manual tasks such as logging in, downloading data, manipulating spreadsheets, and compiling reports. Automating these processes saves your team countless hours, allowing them to focus on strategic initiatives and high-value activities.

Accuracy and efficiency:

When it comes to cash flow monitoring and projection, accuracy is paramount for effective risk management. However, manual data handling introduces the risk of human error, which can have significant financial implications for businesses. These challenges may include:

- Inaccurate financial decision-making

- Cash flow uncertainty

- Increased financial risks

- Impaired stakeholder confidence

- Wasted resources and time

- Compliance and reporting challenges

- Inconsistent data processing

Automating cash flow projections mitigates these risks by ensuring accurate and reliable results. An automation tool’s consistent data processing, real-time integration, error detection, and data validation capabilities instill greater accuracy, reliability, and confidence in the projected cash flow figures.

For example, Harris, a leading national mechanical contractor, transformed their cash flow management by adopting an automation tool. They achieved up to 85% accuracy across forecasts for 900+ projects and gained multiple 360-view projection horizons, from 1-Day to 6-Months, updated daily. This improvement in accuracy allowed the team to focus on higher-value tasks, driving better outcomes.

Cash Flow Projections with HighRadius

Managing cash flow projections today requires a host of tools to track data, usage, and historic revenue trends as seen above. Teams rely on spreadsheets, data warehouses, business intelligence tools, and analysts to compile and report the data.

HighRadius has consistently provided its customers with powerful AI and forecasting tools to support real-time visibility, historical tracking, and predictive insights so your teams can reap the benefits of automated cash flow management.

When your forecast is off, you can miss opportunities to invest in growth or undermine your credibility and investor confidence. An accurate forecast means predictable growth and increased shareholder confidence.

Cash Flow Projection FAQs

1) how do you prepare a projected cash flow statement.

Steps to prepare a projected cash flow statement :

- Analyze historical cash flows.

- Estimate future sales and collections from customers.

- Forecast expected payments to suppliers and vendors.

- Consider changes in operating, investing, and financing activities.

- Compile all these estimates into a projected cash flow statement for the desired period.

2) What is projected cash flow budget?

A projected cash flow budget is a financial statement that estimates the amount of cash your business is expected to receive and pay out over a specific time period. This information can be helpful in determining whether your business has enough cash flow to maintain its regular operations during the given period. It can also provide valuable insight into how to allocate your budget effectively.

3) What is a 3-year projected cash flow statement?

A 3-year projected cash flow statement forecasts cash inflows and outflows for the next three years. It helps businesses assess their expected cash position and plan for future financial needs and opportunities.

4) What is projected cash flow and fund flow statement?

Projected cash flow statement forecasts cash inflows and outflows over a period, aiding in budgeting and planning. Fund flow statement tracks the movement of funds between sources and uses, analyzing financial position. Both provide insights into a company’s liquidity and financial health.

5) What are the 4 key uses for a cash flow forecast?

- Evaluate cash availability for operational expenses and investments.

- Identify potential cash flow gaps or surpluses.

- Support financial planning, budgeting, and decision-making.

- Assist in securing financing or negotiating favorable terms with stakeholders.

6) What is the cash flow projection ratio?

The term cash flow projection ratio is not a commonly used financial ratio. However, various ratios like operating cash flow ratio, cash flow margin, and cash flow coverage ratio are used to assess a company’s cash flow generation and management capabilities.

7) What is the formula for projected cash flow?

The projected cash flow formula is Projected Cash Flow = Projected Cash Inflows – Projected Cash Outflows . It calculates the anticipated net cash flow by subtracting projected expenses from projected revenues, considering all sources of inflows and outflows.

8) What are the advantages of cash flow projection?

Cash flow projection helps businesses:

- Anticipate future financial needs

- Manage cash shortages effectively

- Make informed decisions

- Ensure stability and growth

- Provide a roadmap for financial planning

- Stay proactive in managing finances

Related Resources

A Complete Guide on Fluctuation (Flux) Analysis in Accounting

Understanding Cash Flow Forecasting Methods: Short Term Vs. Long Term

Why Cash Flow Is King: Importance & How to Improve It

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

The HighRadius™ Treasury Management Applications consist of AI-powered Cash Forecasting Cloud and Cash Management Cloud designed to support treasury teams from companies of all sizes and industries. Delivered as SaaS, our solutions seamlessly integrate with multiple systems including ERPs, TMS, accounting systems, and banks using sFTP or API. They help treasuries around the world achieve end-to-end automation in their forecasting and cash management processes to deliver accurate and insightful results with lesser manual effort.

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Collections Management

- Cash Application Management

- Deductions Management

- Credit Management

- Electronic Invoicing

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

- Business Planning

- Cash Flow Forecasting

- Scenario Planning

- Financial Reporting

- Financial Planning & Analysis

- For Enterprises

- For Franchises

- Case Studies

- Partnerships

- Software Integrations

- Templates & Downloads

Financial Forecasting Template for Startups

To begin effective and accurate financial planning for startups , you will need three key reports: a Balance Sheet, a Cash Flow Statement, and a Profit and Loss Statement (sometimes called an Income Statement). From these, you will be able to put together the five main components of your financial projection and use them effectively within your business plan.

They are one of the most important elements of any business plan, so it’s important to get them right. Whether you plan to use them to help you win over investors, obtain bank loans, or produce a long-term growth strategy for your business, financial forecasts can help your business in a number of ways.

Creating financial projections for startups

This post continues on with our topic of creating an effective business plan. Here, we focus on the fact that financial projections are not only essential to a new startup’s business plan. We emphasise that they are also essential to you as a business owner. Financial projections are able to help you gain a solid grasp of your company’s financial health.

As a rule of thumb, your financial projection should be 5 years long, with monthly figures shown for at least the first 12 months. In some cases, you may only be asked for a 12-month projection or a 3-year plan. But you can beat both of these expectations – and there are good reasons to do so.

When looking at the above image of a Profit and Loss Statement, it showcases that 5 years is long enough to plan what the business will look like when it has matured, something most startups don’t think about.

Why a 5-year projection?

“But,” I hear you ask, “how can I plan anything accurately over 5 years? I haven’t even started my business yet!”

The answer is – you don’t need to plan accurately that far ahead. Planning accurately more than a few months into the future is impossible. But plans do not need to be 100% accurate – they need to be well informed and grounded in reasonable expectations and research. Any long term plan you make will turn out differently in reality. But right now, making that plan is the only way you can gain insight into what might happen in the future.

A 5-year financial projection gives the business enough time to demonstrate what it will be like after its startup period – when it is fully established and running optimally. 5 years also gives you the potential to look to the future of the business – how it will expand its horizons after getting up and running.

The organisational principles we’ll cover are applicable whether you’re planning in Brixx or creating your own projection from scratch. While Brixx simplifies things for you by completing all of the calculations for your reports and makes it easy to restructure and test your plan, it is entirely your choice whether to use specialised software or spreadsheet for your startup’s financial projections.

What is the aim of using a financial forecast template?

What are we going to get out of it and actually present in our startup business plan? Here’s a quick list.

Three detailed financial reports:

- Cash Flow Forecast

- Profit & Loss Forecast

- Balance Sheet Forecast

And some quick takeaway information:

- General Assumptions

- Sales Forecasting

- Startup Costs

- Running Costs

- Salaries & Contracts

- Funding Requirements

The three financial reports form the backbone of your financial projection, while the quick takeaway information is an easily digestible way of displaying this information.

Now, the three reports I mentioned above may sound intimidating – and the truth is they use language and concepts which can take a little while to pick up! While they seem a bit alien at first, what’s important to understand is that each report is just a different way of viewing what’s going on financially in your business. Each report is made of the data you have gathered, just arranged in a standardised way. With these reports, you can create a comprehensive financial projection that will elevate your business plan or even an investor pitch.

Keep in mind

It is also worth noting that you should be able to test your financial projections. Why? Well, for a start, that’s what a lot of investors will be asking you for! What happens if sales are lower, or a project doesn’t reach completion on time? What happens if a vehicle breaks down and needs repairs or replacement? Can the business handle this – and what are the knock-on effects? All of these questions and more are easy to answer if every element of your financial plan is a modular component that you can add, change or remove without affecting the validity of the projection’s calculations.

It is crucial to keep record of your projections, documents, etc. Depending on your business plan’s audience, you may need to include items that support your statements and/or figures in the plan. These might include important staff member CVs and detailed market/competitor research data, etc. Some information will go in the appendix section, allowing you to expand on the information you’ve supplied throughout.

Understanding cash flow in your startup’s financial projection reports

The cash that comes into the business, and the cash that goes out of the business. The Cash Flow shows when cash (digital or physical) actually changes hands in these transactions. To me, cash flow is the simplest report to understand, as it shows what is the case at any given time.

Before we move into the next section, you’re going to need a spreadsheet or a piece of software like Brixx to build your Cash Flow Forecast. If you don’t fancy trying Brixx then we also have a free cash flow template which you can build it in too.

The Cash Flow Report in your financial projections

The Cash Flow Report takes into account when cash actually changes hands. The Profit & Loss Statement accounts for when the transaction agreement takes place. Let’s say you deliver a product/service immediately to your customer and they then pay you a month later. An electrician, for example, might complete some work, and then send an invoice for payment. The electrician’s charge for their work appears on their business’ Profit and Loss Report when they send the invoice, but the cash payment only appears on their business’ Cash Flow Report when they actually get paid by their customers.

This delay between the sale happening and the cash being received is part of what makes the Cash Flow Report so useful. Many businesses, even large and established ones, can suffer from a lack of ready cash. If this business can’t pay its bills this will ultimately lead to the failure of the business. Making a cash flow forecast is a means of looking ahead and trying to foresee and mitigate these problems before they happen. This can be done by identifying the periods and time and areas of the business that are a cause for concern, cash-wise.

Key questions the cash flow can answer:

- How much cash in hand the business has every month

- The consequences of projects, payments or purchases happening at unexpected times

- The toll each type of cash flow has on net cash

- Will the business stay afloat!?

Key cash flow information:

The cash flow is made up of several ‘cash flows’ – each representing different kinds of business activity, as well as ‘bottom line’ totals of these cash flows.

Understanding your Cash Flow Report

Cash flows from operating activities.

The day-to-day operations of the business: income from sales, minus the cost of sales, minus overheads like rent, electricity, paying interest and salaries.

Cash Flows from Investing Activities

The purchase and sale of assets, investments and income gained from interest on savings are recorded here. These are activities that in many cases are outside of the day-to-day running of the business. Initial asset purchases may be necessary to get the business up and running in the first place or replace existing assets that are crucial to the business but they aren’t a regular part of the business’s revenue stream or monthly bills.

Cash Flows from Financing Activities

Financing activities show where the business gets its funding from. Additionally, financing is cash received from sources external to the business, like loans or external investment. These financing cash flows also include dividends the business pays to shareholders and loan repayments to lenders.

Cash Flows from Taxation

The tax you pay and any tax refunds are included here.

Income Less Payments

This line shows the net cash movement in any given month, that is, the total of all the cash flows mentioned above. This is great for helping you identify problem periods of the year.