What is a Competitive Analysis — and How Do You Conduct One?

Published: April 24, 2024

Every time I work with a new brand, my first order of business is to conduct a competitive analysis.

A competitive analysis report helps me understand the brand’s position in the market, map competitors’ strengths/weaknesses, and discover growth opportunities.

![how to do competitive research Download Now: 10 Competitive Analysis Templates [Free Templates]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)

In this article, I’ll break down the exact steps I follow to conduct competitor analysis and identify ways to one-up top brands in the market.

We’ll cover:

What is competitive analysis?

What is competitive market research, competitive analysis in marketing.

- How To Conduct Competitive Analysis in 5 Steps

How to Do a Competitive Analysis (the Extended Cut)

Competitive product analysis, competitive analysis example, competitive analysis templates.

- Competitive Analysis FAQs

Competitive analysis is the process of comparing your competitors against your brand to understand their core differentiators, strengths, and weaknesses. It’s an in-depth breakdown of each competitor’s market position, sales & marketing tactics, growth strategy, and other business-critical aspects to see what they’re doing right and find opportunities for your business.

Competitive analysis gives you a clearer picture of the market landscape to make informed decisions for your growth.

That said, you have to remember that competitive analysis is an opportunity to learn from others. It isn’t:

- Copying successful competitors to the T.

- Trying to undercut others’ pricing.

- A one-and-done exercise.

Let’s look at how this exercise can help your business before breaking down my 5-step competitive analysis framework.

4 Reasons to Perform Competitive Analysis

If you’re on the fence about investing time and effort in analyzing your competitors, know that it gives you a complete picture of the market and where you stand in it.

Here are four main reasons why I perform a competitive analysis exercise whenever working with a brand for the first time:

- Identify your differentiators. Think of competitor analysis as a chance to reflect on your own business and discover what sets you apart from the crowd. And if you’re only starting out, it helps you brainstorm the best opportunities to differentiate your business.

- Find competitors’ strengths. What are your competitors doing right to drive their growth? Analyzing the ins and outs of an industry leader will tell you what they did well to reach the top position in the market.

- Set benchmarks for success. A competitor analysis gives you a realistic idea of mapping your progress with success metrics. While every business has its own path to success, you can always look at a competitor’s trajectory to assess whether you’re on the right track.

- Get closer to your target audience. A good competitor analysis framework zooms in on your audience. It gives you a pulse of your customers by evaluating what they like, dislike, prefer, and complain about when reviewing competing brands.

The bottom line: Whether you’re starting a new business or revamping an existing one, a competitive analysis eliminates guesswork and gives you concrete information to build your business strategy.

.webp)

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

You're all set!

Click this link to access this resource at any time.

Competitive market research is a vital exercise that goes beyond merely comparing products or services. It involves an in-depth analysis of the market metrics that distinguish your offerings from those of your competitors.

A thorough market research doesn't just highlight these differences but leverages them, laying a solid foundation for a sales and marketing strategy that truly differentiates your business in a bustling market.

In the next section, we’ll explore the nuts and bolts of conducting a detailed competitive analysis tailored to your brand.

10 Competitive Analysis Templates

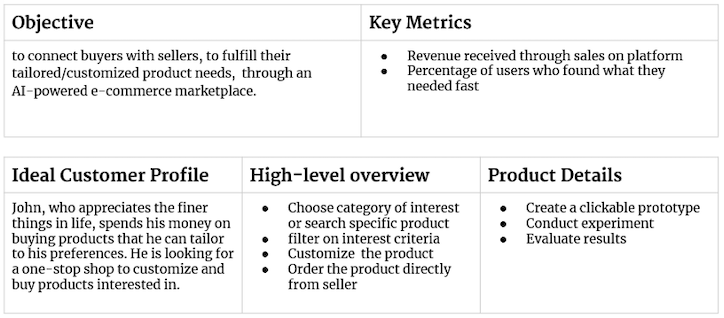

Fill out the form to access the templates., essential aspects to cover in competitive analysis research .

Before we walk through our step-by-step process for conducting competitor analysis, let’s look at the main aspects to include for every competitor:

- Overview. A summary of the company — where it’s located, target market, and target audience.

- Primary offering. A breakdown of what they sell and how they compare against your brand.

- Pricing strategy. A comparison of their pricing for different products with your pricing.

- Positioning. An analysis of their core messaging to see how they position themselves. Customer feedback: A curation of what customers have to say about the brand.

Now, it’s time to learn how to conduct a competitive analysis with an example to contextualize each step.

Every brand can benefit from regular competitor analysis. By performing a competitor analysis, you'll be able to:

- Identify gaps in the market.

- Develop new products and services.

- Uncover market trends.

- Market and sell more effectively.

As you can see, learning any of these four components will lead your brand down the path of achievement.

Next, let's dive into some steps you can take to conduct a comprehensive competitive analysis.

How to Conduct Competitive Analysis in 5 Quick Steps

As a content marketer, I’ve performed a competitive analysis for several brands to improve their messaging, plan their marketing strategy, and explore new channels. Here are the five steps I follow to analyze competitors.

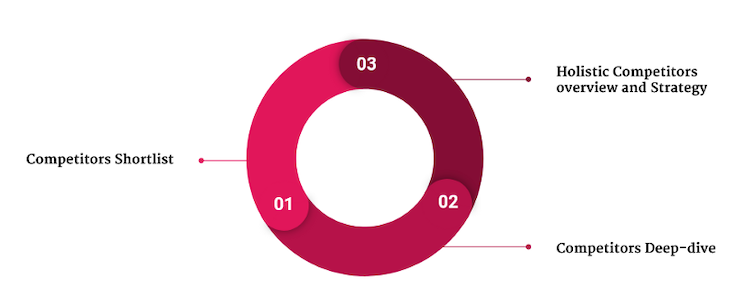

1. Identify and categorize all competitors.

The first step is a simple yet strategic one. You have to identify all possible competitors in your industry, even the lesser-known ones. The goal here is to be aware of all the players in the market instead of arbitrarily choosing to ignore a few.

As you find more and more competitors, categorize them into these buckets:

- Direct competitors. These brands offer the same product/service as you to the same target audience. People will often compare you to these brands when making a buying decision. For example, Arcade and Storylane are direct competitors in the demo automation category.

- Indirect competitors. These businesses solve the same problem but with a different solution. They present opportunities for you to expand your offering. For example, Scribe and Whatfix solve the problem of documentation + internal training, but in different ways.

- Legacy competitors. These are established companies operating in your industry for several years. They have a solid reputation in the market and are a trusted name among customers. For example, Ahrefs is a legacy competitor in the SEO industry.

- Emerging competitors. These are new players in the market with an innovative business model and unique value propositions that pose a threat to existing brands. For example, ChatGPT came in as a disruptor in the conversational AI space and outperformed several brands.

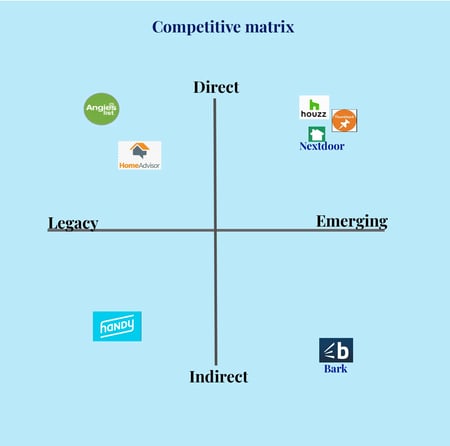

Here’s a competitive matrix classifying brands in the community and housing space:

Testing It Out

To help you understand each step clearly, we’ll use the example of Trello and create a competitor analysis report using these steps.

Here’s a table of the main competitors for Trello:

able of the main competitors for Trello:

2. Determine each competitor’s market position.

Once you know all your competitors, start analyzing their position in the market. This step will help you understand where you currently stand in terms of market share and customer satisfaction. It’ll also reveal the big guns in your industry — the leading competitors to prioritize in your analysis report.

Plus, visualizing the market landscape will tell you what’s missing in the current state. You can find gaps and opportunities for your brand to thrive even in a saturated market.

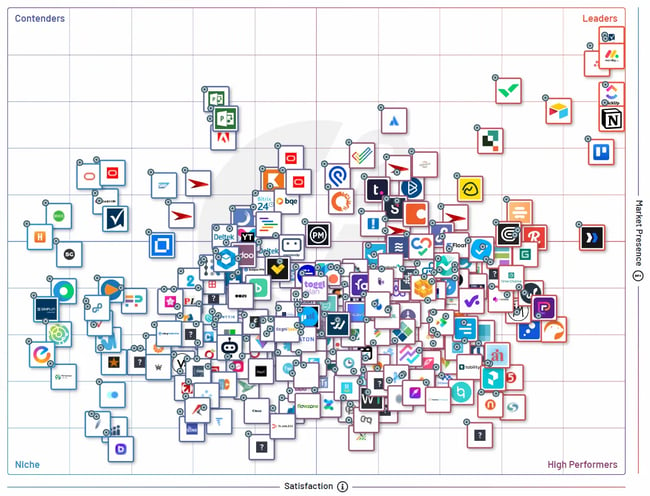

To map competitors’ market positions, create a graph with two factors: market presence (Y-axis) and customer satisfaction (X-axis). Then, place competitors in each of these quadrants:

- Niche. These are brands with a low market share but rank high on customer satisfaction. They’re likely targeting a specific segment of the audience and doing it well.

- Contenders. These brands rank low on customer satisfaction but have a good market presence. They might be new entrants with a strong sales and marketing strategy.

- Leaders. These brands own a big market share and have highly satisfied customers. They’re the dominant players with a solid reputation among your audience.

- High performers. These are another category of new entrants scoring high on customer satisfaction but with a low market share. They’re a good alternative for people not looking to buy from big brands.

This visualization will tell you exactly how crowded the market is. But it’ll also highlight ways to gain momentum and compete with existing brands.

Here’s a market landscape grid by G2 documenting all of Trello’s competitors in the project management space. For a leading brand like Trello, the goal would be to look at top brands in two quadrants: “Leaders” and “High Performers.”

Image Source

3. Extensively benchmark key competitors.

Step 2 will narrow down your focus from dozens of competitors to the few most important ones to target. Now, it’s time to examine each competitor thoroughly and prepare a benchmarking report.

Remember that this exercise isn’t meant to find shortcomings in every competitor. You have to objectively determine both the good and bad aspects of each brand.

Here are the core factors to consider when benchmarking competitors:

- Quality. Assess the quality of products/services for each competitor. You can compare product features to see what’s giving them an edge over you. You can also evaluate customer reviews to understand what users have to say about the quality of their offering.

- Price. Document the price points for every competitor to understand their pricing tactics. You can also interview their customers to find the value for money from users’ perspectives.

- Customer service. Check how they deliver support — through chat, phone, email, knowledge base, and more. You can also find customer ratings on different third-party platforms.

- Brand reputation. You should also compare each competitor’s reputation in the market to understand how people perceive the brand. Look out for anything critical people say about specific competitors.

- Financial health. If possible, look for performance indicators to assess a brand's financial progress. You can find data on metrics like revenue growth and profit margins.

This benchmarking exercise will involve a combination of primary and secondary research. Invest enough time in this step to ensure that your competitive analysis is completely airtight.

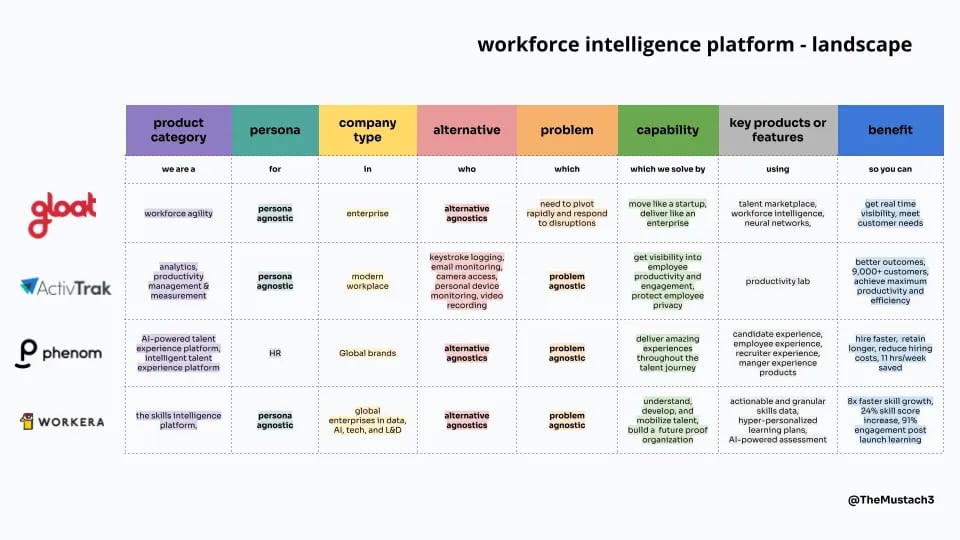

Check out this example of a competitor benchmarking report for workforce intelligence tools:

Here’s how I benchmarked Asana based on these criteria using the information I could find:

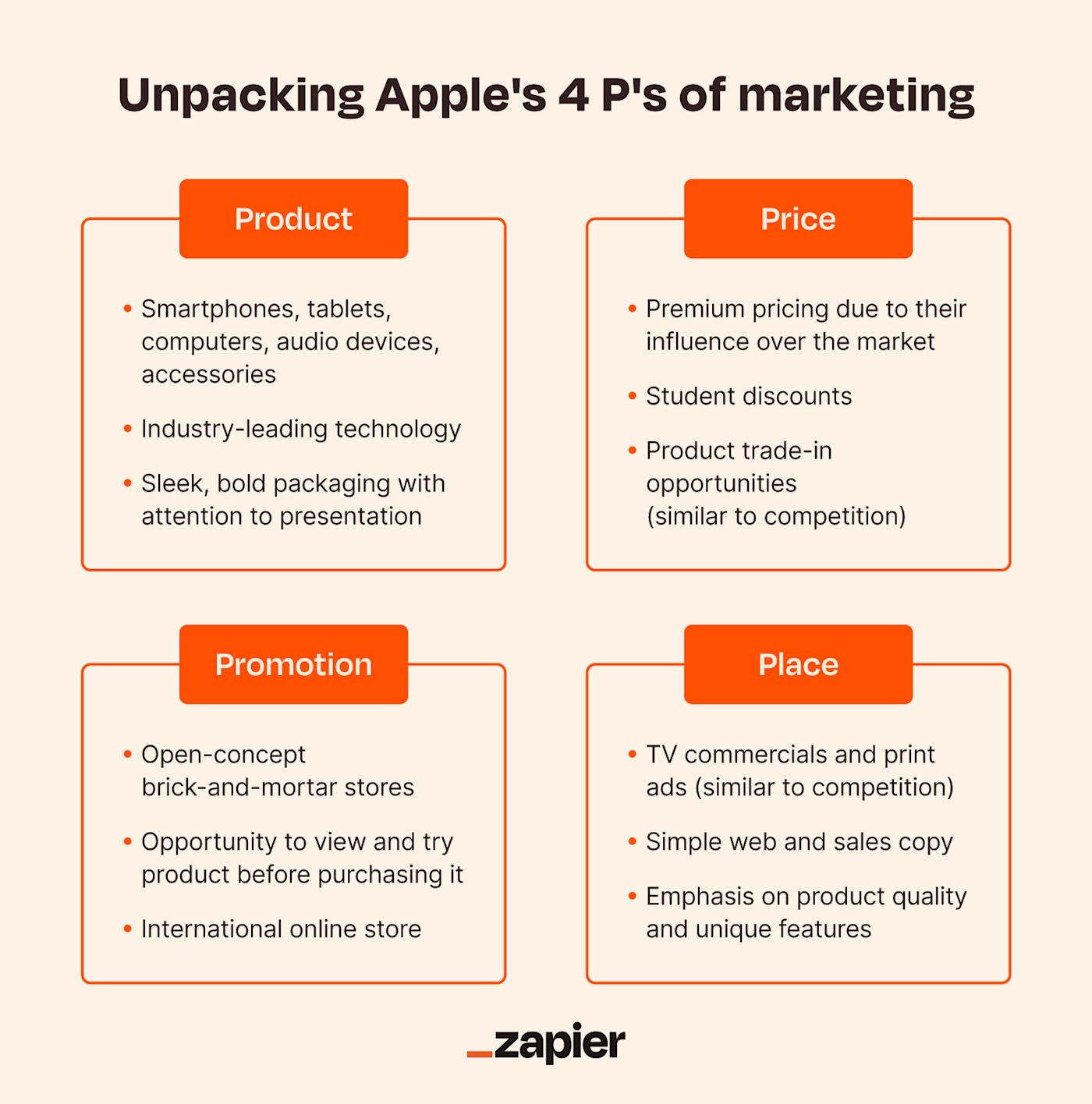

4. Deep dive into their marketing strategy.

While the first few steps will tell you what you can improve in your core product or service, you also need to find how competitors market their products.

You need to deep-dive into their marketing strategies to learn how they approach buyers. I analyze every marketing channel, then note my observations on how they speak to their audience and highlight their brand personality.

Here are a few key marketing channels to explore:

- Website. Analyze the website structure and copy to understand their positioning and brand voice.

- Email. Subscribe to emails to learn their cadence, copywriting style, content covered, and other aspects.

- Paid ads. Use tools like Ahrefs and Semrush to find if any competitor is running paid ads on search engines.

- Thought leadership. Follow a brand’s thought leadership efforts with content assets like podcasts, webinars, courses, and more.

- Digital PR. Explore whether a brand is investing in digital PR to build buzz around its business and analyze its strategy.

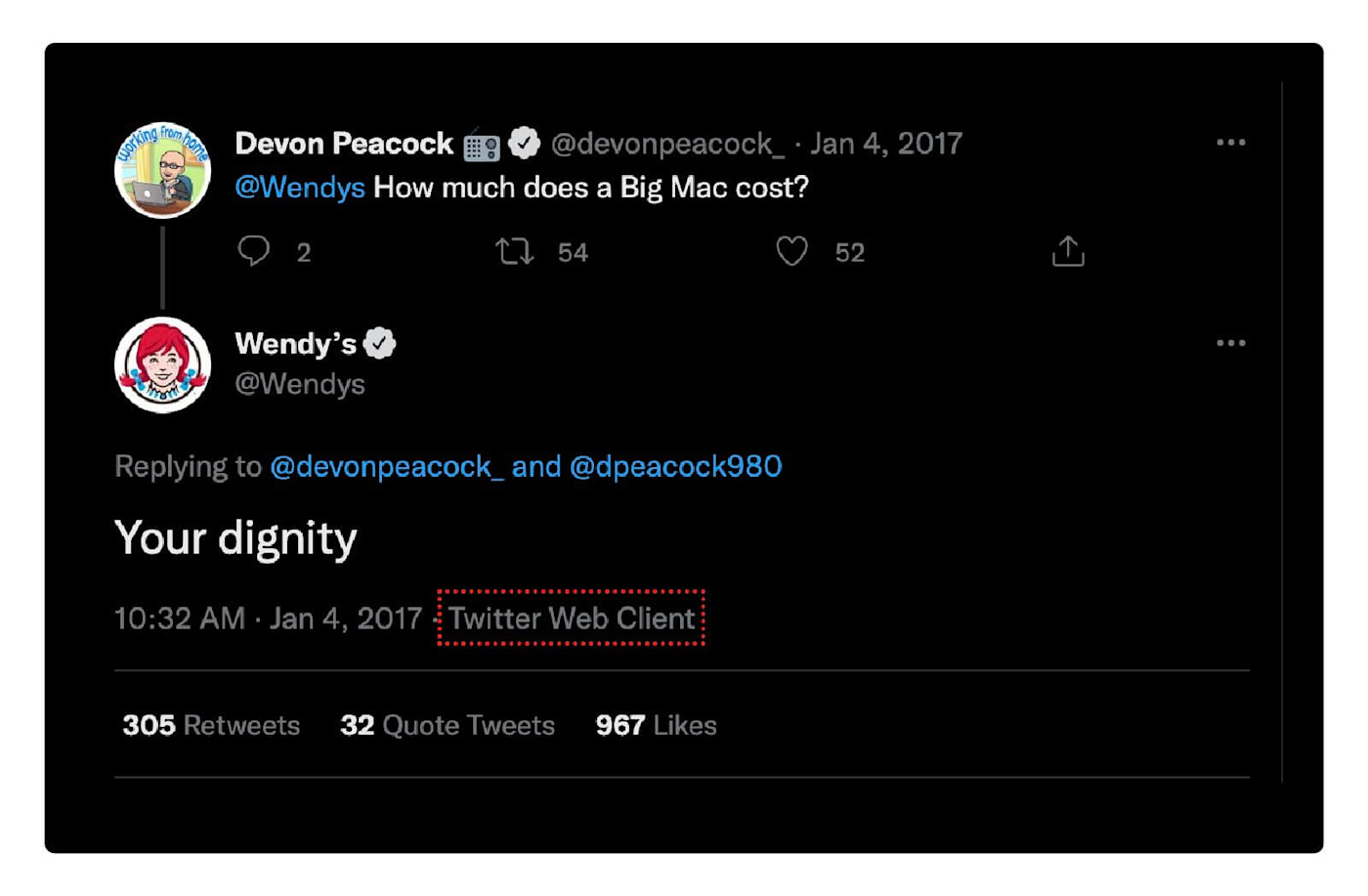

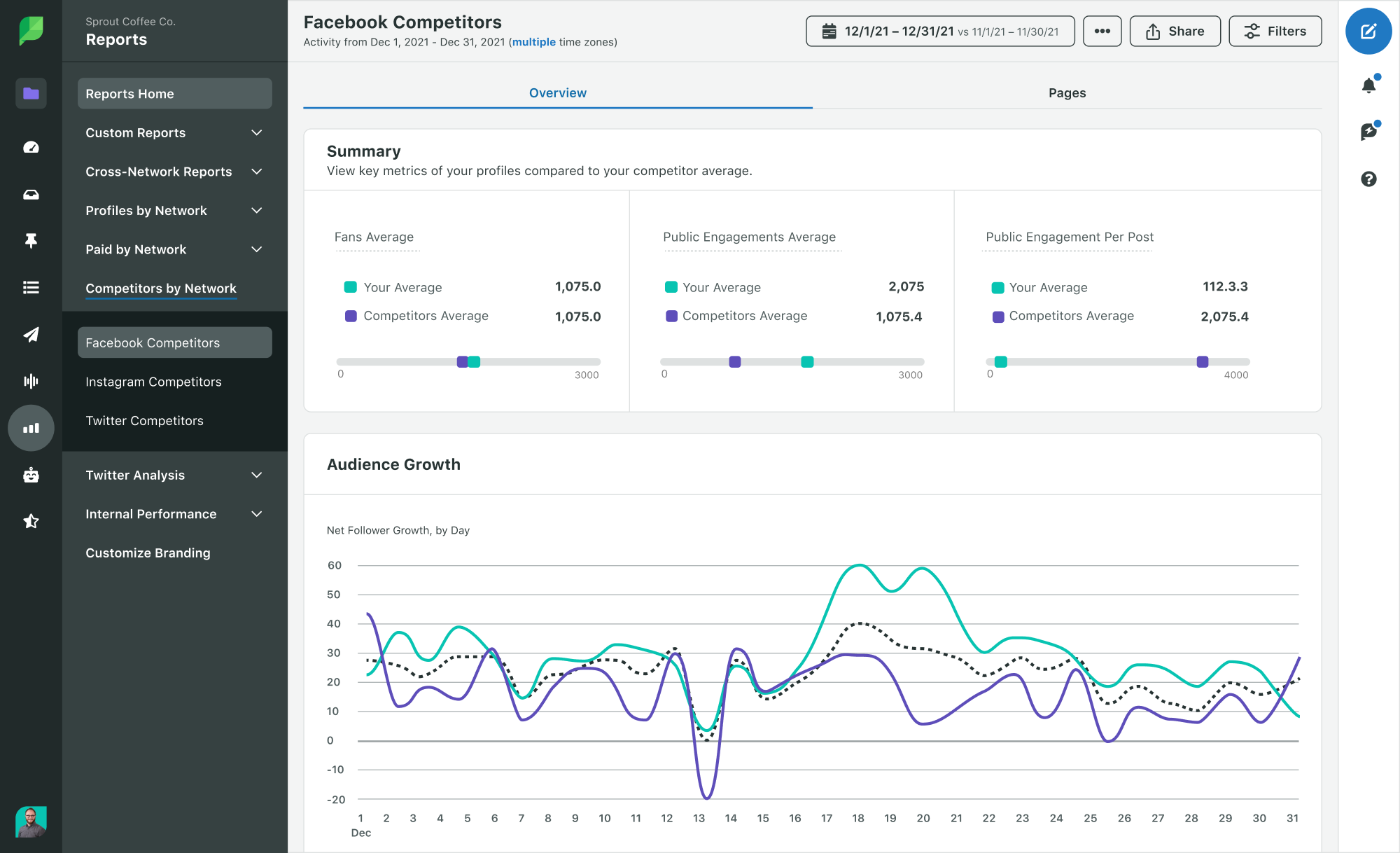

- Social media. See how actively brands use different social channels and what kind of content is working best for them.

- Partnerships. Analyze high-value partnerships to see if brands work closely with any companies and mutually benefit each other.

You can create a detailed document capturing every detail of a competitor’s marketing strategy. This will give you the right direction to plan your marketing efforts.

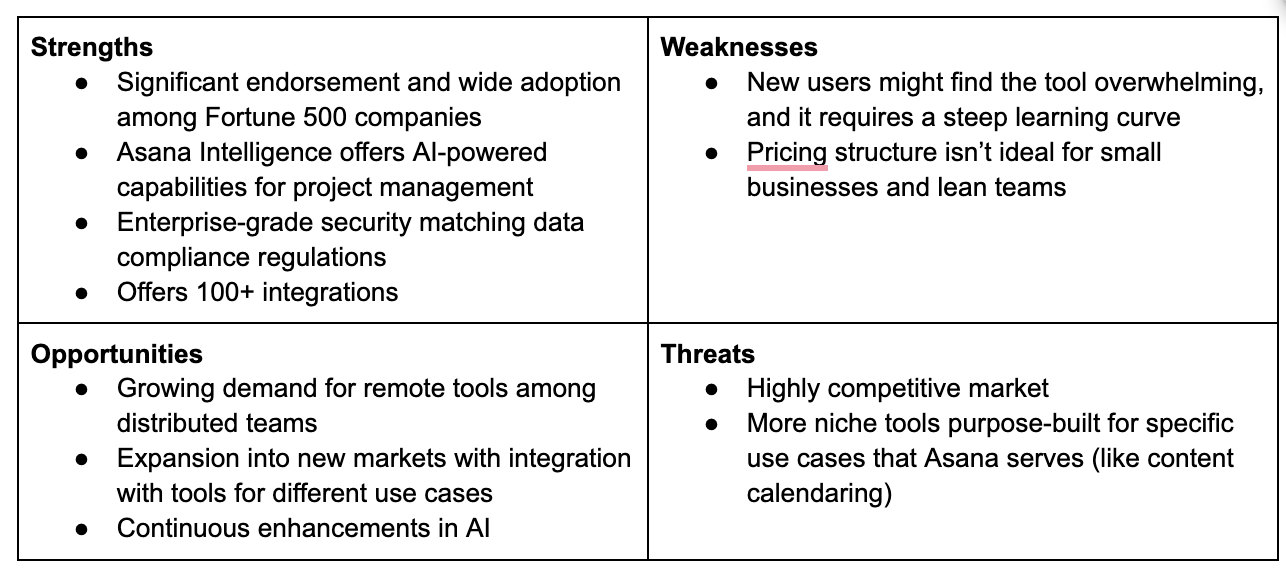

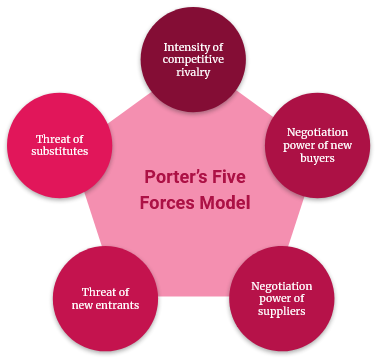

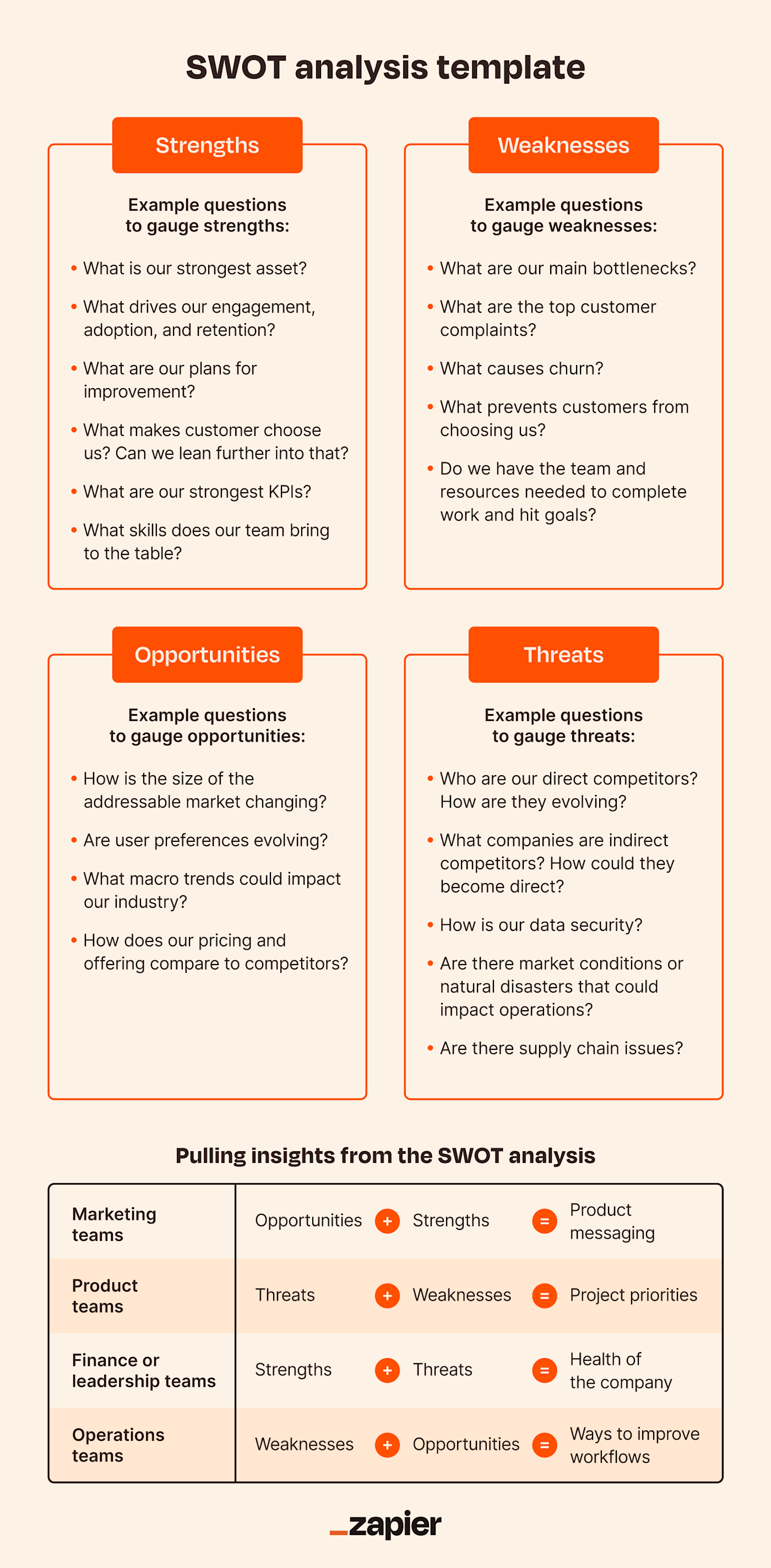

5. Perform a SWOT analysis.

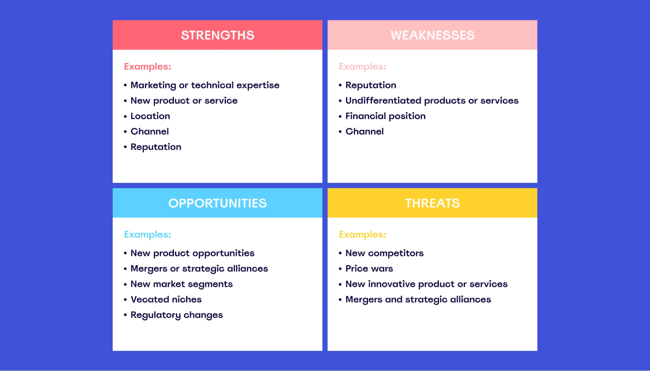

The final step in a competitive analysis exercise is creating a SWOT analysis matrix for each company. This means you‘ll take note of your competitor’s strengths, weaknesses, opportunities, and threats. Think of it as the final step to consolidate all your research and answer these questions:

- What is your competitor doing well?

- Where do they have an advantage over your brand?

- What is the weakest area for your competitor?

- Where does your brand have the advantage over your competitor?

- In what areas would you consider this competitor a threat?

- Are there opportunities in the market that your competitor has identified?

You can use tools like Miro to visualize this data. Once you visually present this data, you’ll get a clearer idea of where you can outgrow each competitor.

Here’s a SWOT analysis matrix I created for Asana as a competitor of Trello:

- Determine who your competitors are.

- Determine what products your competitors offer.

- Research your competitors' sales tactics and results.

- Take a look at your competitors' pricing, as well as any perks they offer.

- Ensure you're meeting competitive shipping costs.

- Analyze how your competitors market their products.

- Take note of your competition's content strategy.

- Learn what technology stack your competitors use.

- Analyze the level of engagement on your competitors' content.

- Observe how they promote marketing content.

- Look at their social media presence, strategies, and go-to platforms.

- Perform a SWOT Analysis to learn their strengths, weaknesses, opportunities, and threats.

To run a complete and effective competitive analysis, use these ten templates, which range in purpose from sales to marketing to product strategy.

Featured Resource: 10 Competitive Analysis Templates

1. Assess your current product pricing.

The first step in any product analysis is to assess current pricing.

Nintendo offers three models of its Switch console: The smaller lite version is priced at $199, the standard version is $299, and the new OLED version is $349.

Sony, meanwhile, offers two versions of its PlayStation 5 console: The standard edition costs $499, and the digital version, which doesn’t include a disc drive, is $399.

2. Compare key features.

Next is a comparison of key features. In the case of our console example, this means comparing features like processing power, memory, and hard drive space.

3. Pinpoint differentiators.

With basic features compared, it’s time to dive deeper with differentiators. While a glance at the chart above seems to indicate that the PS5 is outperforming its competition, this data only tells part of the story.

Here’s why: The big selling point of the standard and OLED Switch models is that they can be played as either handheld consoles or docked with a base station connected to a TV. What’s more, this “switching” happens seamlessly, allowing players to play whenever, wherever.

The Playstation offering, meanwhile, has leaned into market-exclusive games that are only available on its system to help differentiate them from their competitors.

4. Identify market gaps.

The last step in a competitive product analysis is looking for gaps in the market that could help your company get ahead.

When it comes to the console market, one potential opportunity gaining traction is the delivery of games via cloud-based services rather than physical hardware.

Companies like Nvidia and Google have already made inroads in this space, and if they can overcome issues with bandwidth and latency, it could change the market at scale.

How do you stack up against the competition? Where are you similar, and what sets you apart? This is the goal of competitive analysis.

By understanding where your brand and competitors overlap and diverge, you’re better positioned to make strategic decisions that can help grow your brand.

Of course, it’s one thing to understand the benefits of competitive analysis, and it’s another to actually carry out an analysis that yields actionable results. Don’t worry — we’ve got you covered with a quick example.

Sony vs. Nintendo: Not all fun and games.

Let’s take a look at popular gaming system companies Sony and Nintendo.

Sony’s newest offering — the Playstation 5 — recently hit the market but has been plagued by supply shortages.

Nintendo’s Switch console, meanwhile, has been around for several years but remains a consistent seller, especially among teens and children.

This scenario is familiar for many companies on both sides of the coin; some have introduced new products designed to compete with established market leaders, while others are looking to ensure that reliable sales don’t fall.

Using some of the steps listed above, here’s a quick competitive analysis example.

In our example, it’s Sony vs Nintendo, but it’s also worth considering Microsoft’s Xbox, which occupies the same general market vertical.

This is critical for effective analysis; even if you’re focused on specific competitors and how they compare, it’s worth considering other similar market offerings.

PlayStation offers two PS5 versions, digital and standard, at different price points, while Nintendo offers three versions of its console.

Both companies also sell peripherals — for example, Sony sells virtual reality (VR) add-ons, while Nintendo sells gaming peripherals such as steering wheels, tennis rackets, and differing controller configurations.

When it comes to sales tactics and marketing, Sony and Nintendo have very different approaches.

In part thanks to the recent semiconductor shortage, Sony has driven up demand via scarcity — very low volumes of PS5 consoles remain available. Nintendo, meanwhile, has adopted a broader approach by targeting families as its primary customer base.

This effort is bolstered by the Switch Lite product line, which is smaller and less expensive, making it a popular choice for children.

The numbers tell the tale : Through September 2021, Nintendo sold 14.3 million consoles, while Sony sold 7.8 million.

Sony has the higher price point: Their standard PS5 sells for $499, while Nintendo’s most expensive offering comes in at $349. Both offer robust digital marketplaces and the ability to easily download new games or services.

Here, the key differentiators are flexibility and fidelity. The Switch is flexible — users can dock it with their television and play it like a standard console or pick it up and take it anywhere as a handheld gaming system.

The PS5, meanwhile, has superior graphics hardware and processing power for gamers who want the highest-fidelity experience.

5. Analyze how your competitors market their products.

If you compare the marketing efforts of Nintendo and Sony, the difference is immediately apparent: Sony’s ads feature realistic in-game footage and speak to the exclusive nature of their game titles.

The company has managed to secure deals with several high-profile game developers for exclusive access to new and existing IPs.

Nintendo, meanwhile, uses brightly lit ads showing happy families playing together or children using their smaller Switches while traveling.

6. Analyze the level of engagement on your competitor's content.

Engagement helps drive sales and encourage repeat purchases.

While there are several ways to measure engagement, social media is one of the most straightforward: In general, more followers equates to more engagement and greater market impact.

When it comes to our example, Sony enjoys a significant lead over Nintendo: While the official Playstation Facebook page has 38 million followers, Nintendo has just 5 million.

Competitive analysis is complex, especially when you’re assessing multiple companies and products simultaneously.

To help streamline the process, we’ve created 10 free templates that make it possible to see how you stack up against the competition — and what you can do to increase market share.

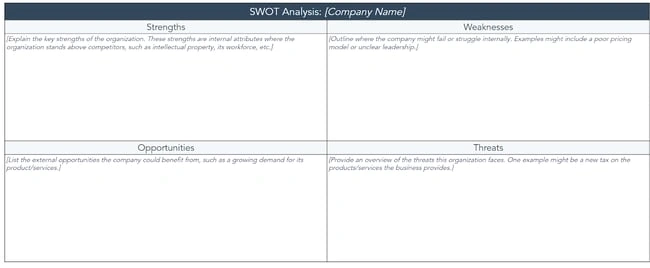

Let’s break down our SWOT analysis template. Here’s what it looks like:

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

Market Research: A How-To Guide and Template

![how to do competitive research SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![how to do competitive research How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![how to do competitive research 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![how to do competitive research 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

10 free templates to help you understand and beat the competition.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, sizing up the competition: how to conduct competitive research.

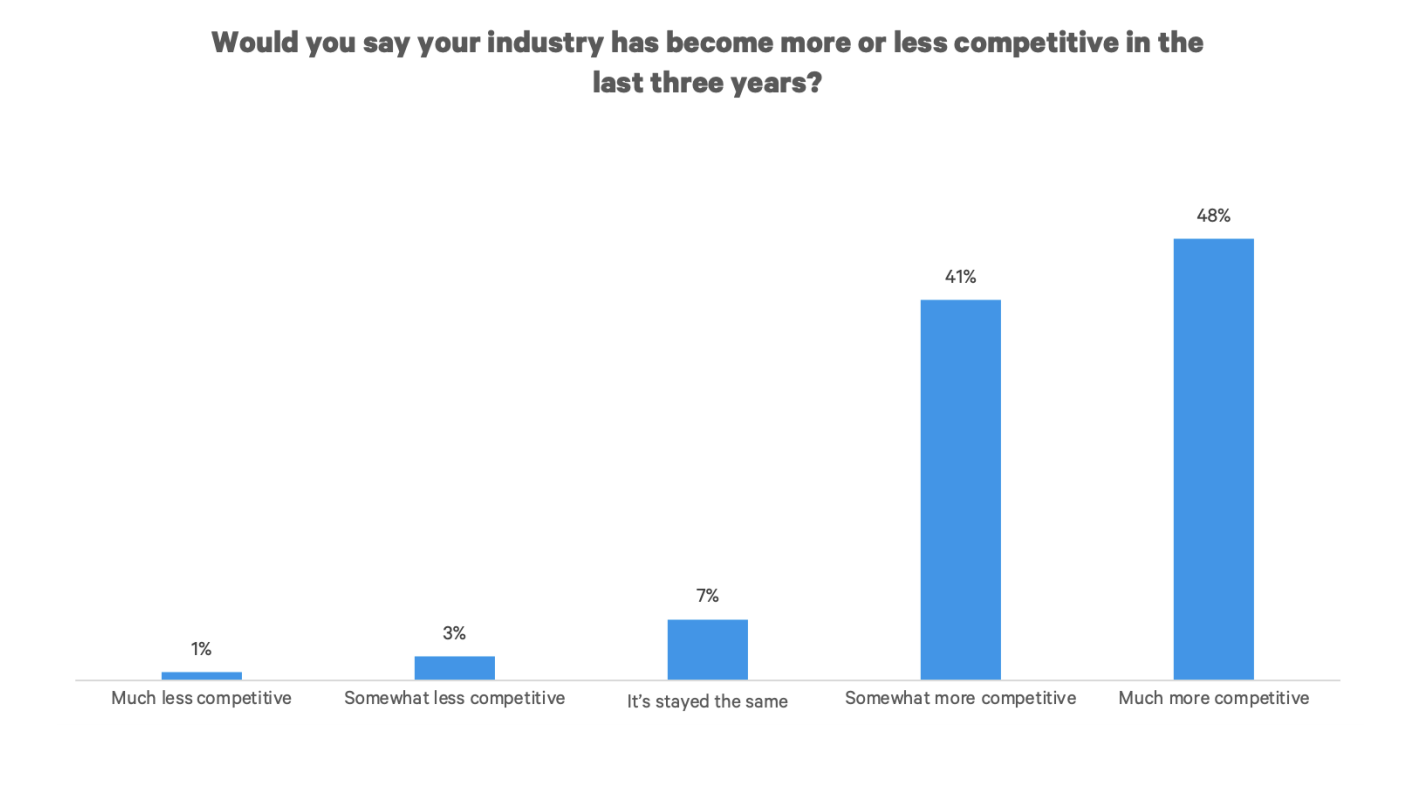

Competitive research can reveal trends in the marketplace and gaps in your own business plan.

Competitive research is a crucial part of any good marketing plan. This term may elicit some negative images but competitive research has nothing to do with spying. It has everything to do with paying attention to your competition and what they are doing.

Many people will lose out on business to competitors they have never even heard of simply because they’ve never taken the time to do competitive research. Understanding what your competition is doing will help you position yourself, and your product or service, within the market.

What is competitive research?

Competitive research involves identifying your competitors, evaluating their strengths and weaknesses and evaluating the strengths and weaknesses of their products and services. By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing.

Four benefits to doing competitive research are:

- Understanding your market . Competitive research can reveal trends in the marketplace that might have otherwise been missed. The ability to identify and predict trends is a huge asset for any business, helping to improve value proposition for customers. This is an important component of competitive research that you should constantly be doing.

- Improving your marketing . Your customers care about how your product or service is going to make their lives better. If they are leaving to go to one of your competitors, it’s probably because that company does a better job of explaining the benefits to the customer base, or does in fact provide a better product or service. Competitive research helps you understand why customers choose to buy from you or your competitors and how your competition is marketing their products. Over time, this can help you improve your own marketing programs.

- Identifying market gaps . When you do competitive research, you’re analyzing the strengths and weaknesses of your competitors. You’ll often find that, by looking at the data, there is a segment of the population that is being underserved. This could put your business in a unique position to reach those customers.

- Planning for the future . The most important byproduct of competitive research is that it will help you create a strategic plan for your business. This includes things like improving your product or service, using more strategic pricing strategies, and improving the promotion of your products.

Good competitive research could put your business in a unique position to reach customers who are being underserved.

6 steps to competitive research

It may sound obvious, but the first step is to simply identify who your top competitors are . There are two different types of competitors to identify: direct and indirect.

Direct competitors are targeting the same customer base you’re targeting. They are solving the same problem that you are trying to solve and sell a similar product or service.

Indirect competitors may sell something similar to your product or service but target a different audience, or they may target your same customer base but have a slightly different product or service.

It’s important to understand this segment of your market for two reasons: (1) it could provide you with growth opportunities for your own business, and (2) it could also highlight a threat to your business of which you would otherwise be unaware.

Here are six steps to getting started on competitive research:

Identify main competitors.

The most obvious way to do this is simply by searching your product or service category on the web and seeing what comes up. You can also check websites like Crunchbase or Product Hunt . You may find competitors that you might not have noticed before.

The goal is to cast a wide net and get an idea of who your main competitors are. Another good way to identify direct and indirect competitors is to ask your potential customers what services they are already using.

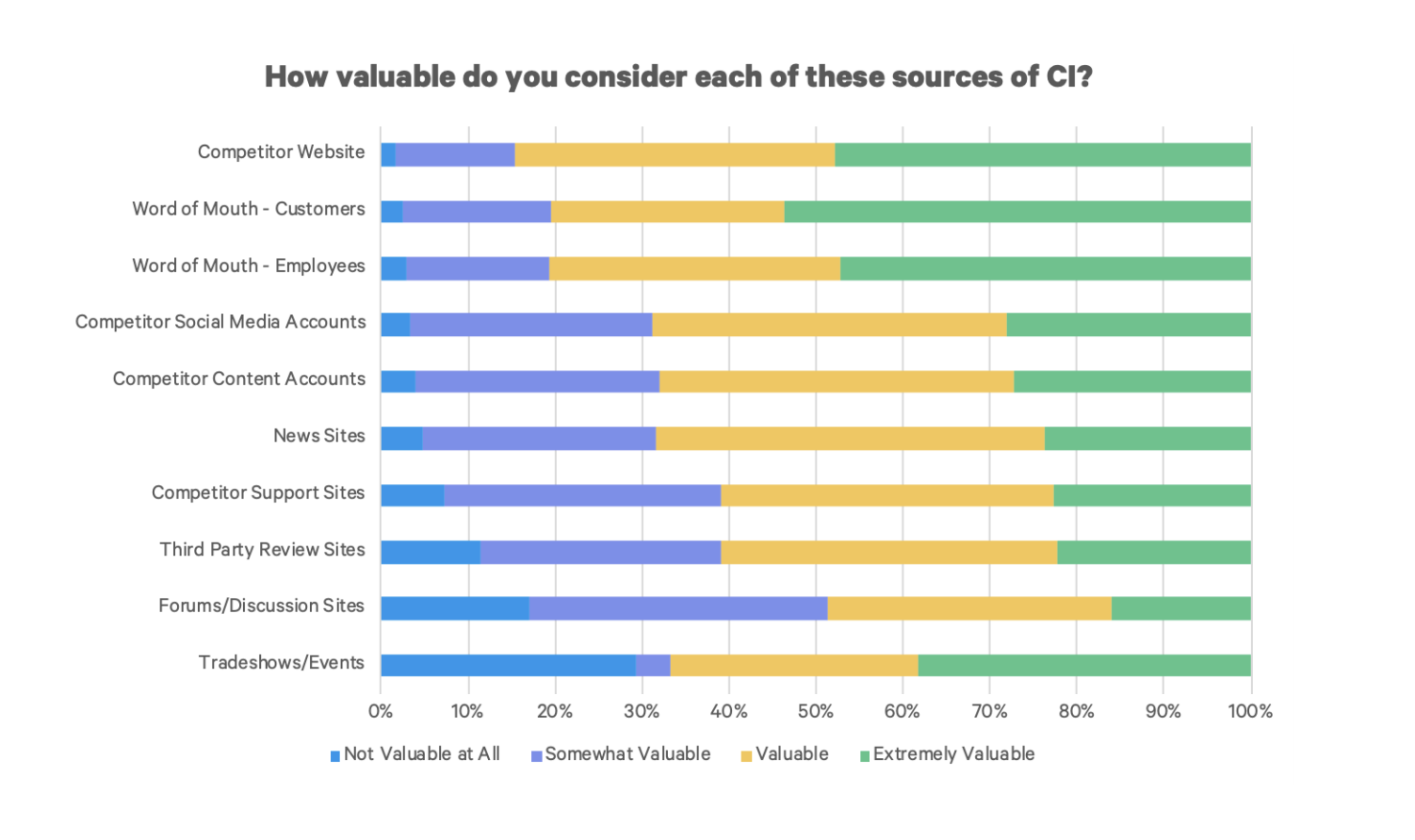

Analyze competitors' online presence

Once you’ve identified your main competitors, you want to look at their website, the type of content they are publishing, and their social media presence. Then, look for any blogs, white papers, and social media content being provided about their products and how to use them. Ask yourself these questions:

- What is the user experience like on their website?

- Is it easy to navigate?

- Do you clearly understand the products or services they offer?

- Is their website mobile-optimized?

- How often do they blog and most importantly, is the quality of their content good?

- What topics do they blog about most frequently?

- What social platforms are they actively using to talk about their products and services?

- Is this content engaging their target audience?

The answers to these questions show you opportunities where you can outperform your competitors. You will want to pay close attention to anything they are doing well that you aren’t doing. This will help give you a better understanding of where you should be focusing your attention and resources.

Gather information

The best way to gather information about your competitors is by acting like one of their customers. Sign up for their email list so you can get an idea of how they communicate.

Also, follow their blog and social media accounts and watch how they interact with their customers online. What kind of experience do customers have with your competitors?

You should consider shopping from them so you can see what their product looks like and what the experience is like from a customer perspective.

Track your findings

Make sure you track your competitors' findings on a spreadsheet; it will help with ongoing monitoring. This isn’t a complicated process, you just need to keep track of what they are doing over time so that you can see how they change everything from pricing to marketing and promotional activities.

You’ll start by dividing your competitors into direct and indirect customer columns. You’ll then track the following information:

- Company name

- Social media sites

- Unique features

- Pros and cons

- Screenshots and additional links

Check online reviews

Try to find as many reviews of your competitors as possible. Read their social media reviews, comments on their blogs, and case studies on their website. If they offer and present Google reviews, read them as well. It’s a good idea to understand not only the good things that your competitors may be doing, but the bad things as well. Include mentions with the Better Business Bureau about them in your research.

How customer-focused are they? This could be an opportunity for you to stand out. And, if they sell a product similar to yours, this will be a good way to find out if a lot of people are interested in it.

Any negative feedback will help you identify areas where you can improve your own product or service.

Identify areas for improvement

Now that you’ve taken note of some of the biggest differences between you and your competitors, it’s time to think about how you can use this information to improve your own business results.

Your competitive research should reveal at least one area your business can stand to improve in. This will help you learn how to engage better with your customers and online followers.

Keep in mind that competitive research is never a "one-and-done" event. Ongoing monitoring, such as observing how competitors evolve, is necessary to ensure that you are staying competitive in the marketplace.

Tools for competitive research

Software and technology now make it easier than ever to conduct competitive research. However, there are hundreds of competitive research tools on the market and narrowing down the right software can feel overwhelming.

This is why we’ve done the legwork and narrowed it down for you. Here are four tools you should consider using to conduct your competitive research:

SEMrush : This is one of the best competitive research tools on the market. It contains over 30 tools that can track things like SEO, PPC, keyword research, competitive research, and more. SEMrush will help you discover new competitors, find their best-used keywords, and analyze their ad copy. They have flexible pricing plans depending on your business needs.

SpyFu : This search analytics tool reveals the keywords websites buy on Google. So, once you’ve identified your biggest competitors, you can track every keyword they’ve bought. Plus, you can track every keyword they are ranking for and find the content and backlinks that helped them rank in the first place.

BuzzSumo : BuzzSumo lets you see how your content is matching up to your competitors’ content. You can see which content is shared more frequently on social media compared to others, and you can even schedule alerts on your competitors’ content which will make it easier to continue tracking them.

Owletter : Owletter tracks and analyzes emails sent from a website. This allows you to track your competitors’ email marketing and see what is and isn’t working for them. To get started, you’ll need to sign up to join your competitors’ email list. Then, every time you receive an email, Owletter will take a screenshot, analyze it, and alert you to any useful information.

Competitive research can seem daunting at first but it’s an essential part of running a successful business. When you incorporate the right tools into your research, you may find that it’s not as difficult as you imagined.

On some level, understanding your competitors is just as important as understanding your customers. Your competitors have valuable lessons to teach you and it’s important to regularly monitor their online activity. Doing so will strengthen your business and improve your own value for your customers.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Find Keyword Ideas in Seconds

Boost SEO results with powerful keyword research

Competitor Analysis: Core Principles and How to Conduct One

Written by Leigh McKenzie In collaboration with Semrush

In the fast-paced realm of digital marketing, understanding and outperforming your competitors is not just an advantage, it’s a necessity.

Competitor analysis, a critical skill for any marketer, provides insights that can be the difference between leading the market or lagging behind.

This guide, rooted in Backlinko’s expert approach to digital marketing strategies, delves into the nuts and bolts of effective competitor analysis.

From leveraging SEO tactics to understanding audience needs, we unpack the methods that will not only help you understand your rivals but also enable you to outmaneuver them strategically.

Get ready to transform your approach to competition, armed with tools and insights that put you ahead in the digital marketing game.

Let’s dive in.

Key Takeaways

- A competitor analysis involves collecting data about your competitors to identify their strengths and weaknesses and improve your marketing strategy.

- Any type of business can benefit from conducting a competitor analysis.

- Before you begin a competitor analysis, you need to be sure of who your target customer is.

- The next step of a competitor analysis involves identifying your organic and paid search competitors. You also need to determine if they’re classed as direct, indirect, or replacement competitors.

- Once you’ve identified your competitors, you need to analyze their content strategies , backlink profiles, technical SEO , and paid media strategies.

The Importance of Competitor Analysis in Marketing

Before we discuss how to carry out your competitor analysis, let’s take a look at exactly what it is and why it’s so beneficial.

What is Competitor Analysis?

A competitor analysis, commonly referred to as competitive analysis, is a strategic and systematic approach to identifying competitors within your industry and analyzing their strengths and weaknesses.

It involves assessing your competitors’ product offerings, pricing strategies, distribution channels, customer service, innovation, marketing strategies, and overall market positioning.

This in-depth analysis serves as a valuable benchmark. It helps you grasp not just the strategies and tactics your competitors employ but also allows you to pinpoint your own strengths and weaknesses relative to each competitor.

Armed with this well-rounded view, you can strategically position your business for success in the competitive arena.

A competitive analysis can be broad or specific. You can delve into every aspect of your competitors’ business or focus on just one area. For example, you might choose to concentrate solely on analyzing their marketing strategy.

However you decide to go about it, you need to ensure your approach is customized to align with the needs and goals of your business.

Who Can Benefit from an Analysis?

Simply put, anyone who wants to gain a better understanding of a market and the competitive landscape will benefit from a competitor analysis.

Business Owners and Executives

Competitive research helps business owners and executives:

- Identify opportunities and threats posed by competitors

- Make informed decisions

- Optimize resource allocation

- Stay ahead of industry trends

- Proactively respond to competitive challenges

As a result, these actions contribute to business growth and sustained success.

Product Marketing Teams

Conducting market research can greatly benefit product marketing teams by helping them:

- Identify unique features and benefits of their products

- Understand how competitors position and present their products

- Tailor their marketing messages to highlight distinct advantages of their products

- Recognize market gaps for potential product innovation

- Understand customer preferences

- Adapt strategies to differentiate products effectively in the market

Brand Marketing Teams

Gathering market competitor insights will help brand marketing teams:

- Understand how competitors position and present their brands

- Develop strategies to create a distinct and compelling brand image

- Identify unique selling points to differentiate the brand

- Adapt messaging to address customer perceptions and preferences

Content Marketing Teams

Content marketing teams will be able to use the insights gained from conducting competitor research to:

- Tailor content to address customer needs based on competitor insights

- Identify content gaps and opportunities in the market

- Adapt their messaging to differentiate content from competitors

- Learn from competitors’ successful content strategies

- Improve overall content effectiveness and relevance in the market

SEO Professionals

SEOs can use these competitive benchmarks to help them:

- Identify keywords competitors are ranking for

- Uncover link-building opportunities

- Discover content gaps to provide valuable and unique information

- Improving website structure and user experience based on their competitors’ successes

Pay-Per-Click (PPC) Specialists

A competitive analysis can help PPC specialists:

- Identify effective strategies used by competitors in their ads

- Adjust bidding strategies based on competitors’ performance

- Improve ad creatives and messaging to stand out in the market

Social Media Teams

The insights gained from an analysis allows Social media teams to:

- Identify successful strategies used by competitors on social platforms. This includes analyzing content themes and engagement tactics that resonate with the target audience.

- Uncover the various social media platforms their competitors leverage

- Discover opportunities for unique and engaging social content

- Adapt posting schedules and frequency based on their competitors’ performance

Sales Teams

Competitor analysis data will help Sales teams:

- Determine their competitors’ strengths and weaknesses

- Identify their competitors’ unique selling points

- Anticipate customer objections, and stay informed about market trends

This helps them tailor their pitches, address customer concerns effectively, and position their products or services competitively. As a result, it can enhance sales outcomes.

Identifying Your Target Customer

Before delving into a competitor analysis, it’s crucial to clearly understand your target audience. Without this insight, you’re essentially navigating in the dark. To help clear things up, let’s dive into why it’s so important. Plus, we’ll cover the best ways to identify your target audience, but first, let’s discuss the difference between a target market and a target customer.

Target Market vs. Target Customer

A target market is a fairly broad group of customers you hope to sell your products or services to. For example, if you sell gym wear, your target market could be fitness enthusiasts.

A target customer is a more specific segment of your target market. So, your target customer within your target market could be a fitness enthusiast aged 25 to 35, who lives in Los Angeles.

The process begins by identifying your target market and then pinpointing more specific target customers within that market.

To pinpoint your target market, you must assess the key features and benefits of your products or services. Delve into understanding the problems they solve and the value they offer. Next, identify the broad groups of customers who are likely to find these qualities appealing.

By identifying your target customers, you can efficiently allocate resources to analyzing the competitors that engage with your specific audience.

How to Identify Your Target Customer

So, now you know why it’s important to identify your target customer before carrying out a competitor analysis, but how do you do it?

1. Start With Your Existing Customers

If you’re already selling products or services, you should have insights into your existing customer base, which can significantly inform your understanding of your target customer. Analyzing your current customer data, including demographics, preferences, and purchase behavior, provides a foundation for identifying and refining your target customer profile.

Additionally, gathering feedback directly from your current customers proves invaluable in gaining deeper insights.

A highly effective method to achieve this is by initiating surveys with your customer base. You can do this via email, text, or call to ask customers who have purchased to complete a survey. You can also add survey buttons and links to certain pages on your site or read customer reviews.

Furthermore, you should leverage social media platforms as an additional channel to connect with your current customers. You should create posts or direct messages inviting them to participate in surveys or share their thoughts and experiences.

2. Gather Demographics Data With Google Analytics 4 (GA4)

To collect demographic data on your target audience, you can utilize GA4 . This tool offers comprehensive insights, allowing you to get a deeper understanding of your audience.

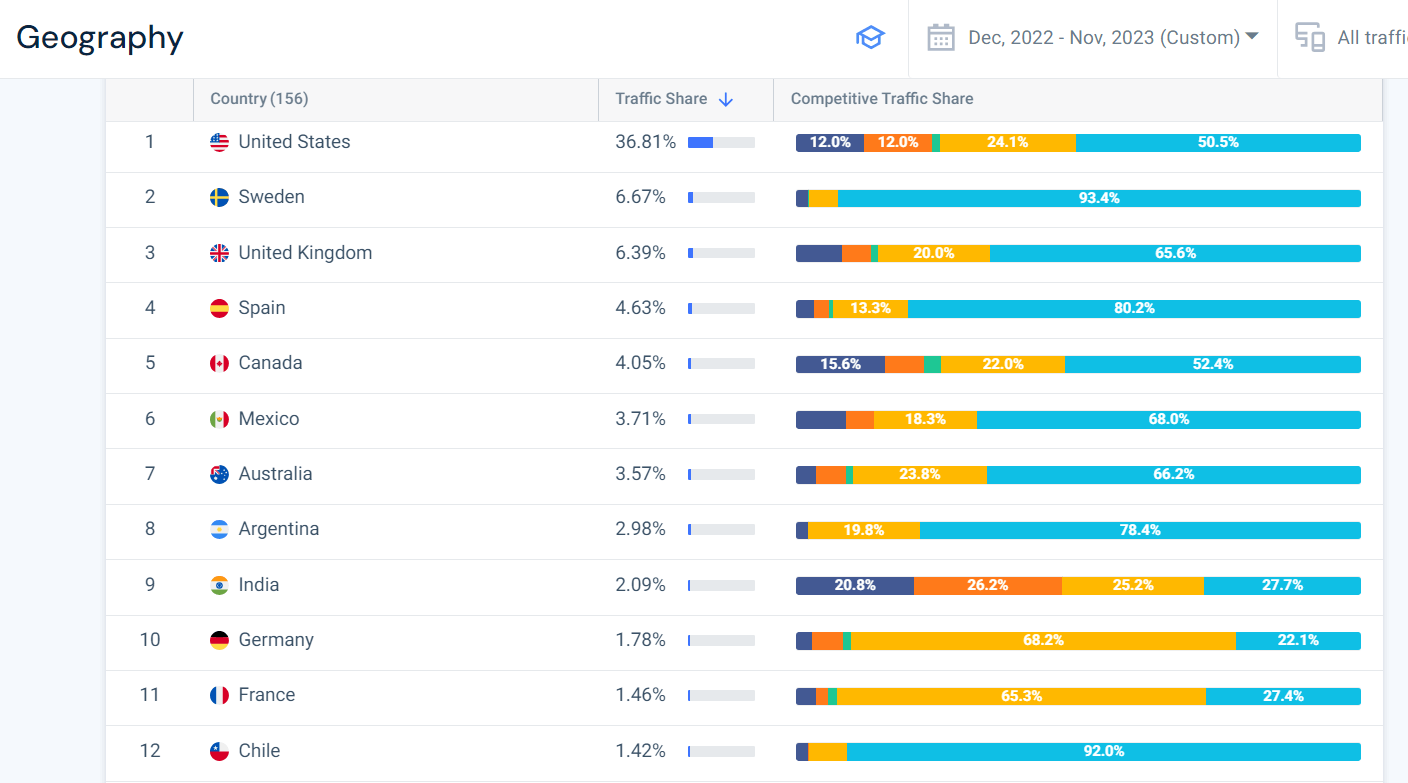

After you log in, click “Reports”, “User attributes”, and then “Demographic details”. You’ll now see a graph representing the number of users who visited your site from different countries.

Scroll down, and you’ll see the total number of “Users” for each country, as well as the number of “New Users” (users who interacted with your site for the first time).

To view different types of demographic data, click the “Country” button in the table and you’ll get a dropdown.

For example, we chose “Interests”, and this is what the tool gave us.

In this case, the data provided above clearly indicates that a significant portion of our audience is located in the US and Canada, with a keen interest in technology, media, and entertainment.

By applying different filters, we can also see data about the audience’s:

3. Dig Into Your Social Media Analytics

Another way to identify your target customer is to explore your social media analytics. This helps you gain insights into the behaviors, preferences, and demographics of your audience.

Semrush’s Social Tracker tool allows you to analyze your followers, mentions, and engagement levels on multiple social media platforms.

This helps you identify the type of customer who interacts with your site via social media and also reveals the social media channels that generate the highest engagement and traffic for your site. You can then focus on these channels when analyzing your competitor’s social media strategy .

4. Create a Target Audience Profile

Once you’ve collected the data, it’s time to put it to use by creating a profile of your ideal target customer.

This should include information like:

- Level of education

- Platform usage

It’s essential to recognize that you may have various types of target customers. For example, an e-commerce store could have a distinct target customer for each product or service they offer.

The more data you can collect about your different types of target customers before you start a competitor analysis, the better.

How to Conduct a Competitor Market Analysis

After you identify who your target customer is, it’s time to begin your competitive research.

Before we begin, here’s a bit of advice.

- A competitor analysis can easily become overwhelming if you try to do everything at once.

- It’s always best to start fairly small and break it down into manageable chunks. Instead of analyzing 50 competitors, start with a small number (even one will do) and gradually increase the scope of your analysis over time.

- Identify what your goals are before you start your analysis. Ideally, your main objective should be conducting sufficient research to take actions that positively impact your business.

- Store your competitor insight data in a spreadsheet, which should be a living document that you return to periodically and update with new information.

OK, let’s get into how to conduct a competitor analysis.

1. Identifying Your Main Competitors

First things first, it’s time to figure out who your main competitors are.

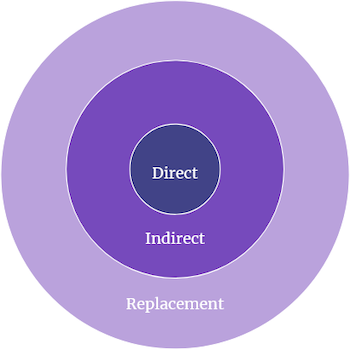

When identifying your competitors, you need to break them down into three categories:

Direct Competitors

Direct competitors are businesses in your industry or local area that sell products or services very similar to the ones you offer. They also have the same target audience as you and are of a similar size and scope to your business.

McDonald’s and Burger King are direct competitors in the fast-food market. Both chains offer a range of fast-food items such as burgers, fries, and beverages. They target a similar customer base and compete for market share in the quick-service restaurant industry.

Indirect Competitors

Indirect competitors are businesses that offer different solutions to the same customer needs or cater to the same target audience. Unlike direct competitors, indirect competitors do not provide similar products or services but fulfill a similar customer need or serve the same overall market.

You and your competitor both run travel websites. However, you focus on offering luxurious beach vacations while they specialize in adventure vacations – like hiking trips. Even though you’re both trying to attract people looking for vacations, the key difference is that you provide different kinds of trips.

Replacement Competitors

Replacement competitors offer alternative or substitute products or services to what your business offers.

- Your business: Specializes in selling traditional incandescent lightbulbs.

- Replacement competitor: Specializes in selling energy-efficient LED bulbs.

The replacement competitor is considered as such because, although they offer a different type of product, their offerings serve as a substitute or replacement for the traditional incandescent lightbulbs sold by your business.

Customers looking for a solution to their lighting needs have the option to choose between your traditional bulbs and the energy-efficient LED bulbs offered by the replacement competitor.

The competition arises because both businesses are aiming to satisfy the same fundamental customer need, illumination, albeit through different types of products.

How to Identify Your Competitors

Whenever we need to identify our competitors, we primarily use Semrush, but there are other ways you can get an idea of who your industry competitors are. These include:

- Customer Feedback: Reach out to your existing customers and inquire about the other businesses they considered before choosing yours. Make sure to ask for their opinions on which other businesses they perceive as providing a similar service or product.

- Market research: Consult your sales department to understand the businesses they frequently encounter during research within your target market. Their on-the-ground insights can contribute valuable information.

- Google Search: Conduct a Google Search using your target keyword (e.g., “running shoes”) to identify competitors. Analyze the first page of the search results to pinpoint key players in your industry.

You’ll also want to gain a comprehensive understanding of your organic, paid, and local competitors.

Several features within the Semrush tool can help you.

Identify Your Organic Search Competitors

These are sites that compete with you in the SERPs for non-paid traffic. They use SEO strategies to rank as highly in the SERPs as possible.

The easiest way to identify your organic competitors is to use Semrush’s Organic Research tool .

Type in your domain, hit “Search”, then click “Competitors”.

You’ll see a chart representing your site and your main competitors who rank for the same organic keywords as you. The X-axis shows you how many keywords your competitors are ranking for, and the Y-axis shows you how much monthly traffic they receive.

Scroll down, and you’ll see a long list of competitors with several bits of data like competition level (how closely a site is competing with you for the same keywords) and common keywords (the number of keywords both you and your competitor are ranking for).

Now, just because these sites are competing with you for the same organic keywords doesn’t necessarily mean they’re direct competitors, they could be targeting a different audience to you.

Here’s an example to give you a better grasp:

Imagine there’s a website that writes a blog about advertising. They want to attract people interested in “online marketing strategies.”

Now, let’s say you have a blog about SEO, and you also want to attract people searching for “online marketing strategies.” Even though you’re both targeting the same keyword, you’re not necessarily in direct competition.

Here’s why: The first website is focused on advertising, so their audience is interested in learning about advertising. On the other hand, your blog is about SEO, and your audience is more interested in SEO topics.

So, even though you target the same keyword, the sites serve different interests and are not considered direct competitors.

The best way to determine whether the sites in your list are direct, indirect, or replacement competitors is to visit each site and analyze their offerings. Here, we clicked on “neilpatel.com”.

A brief review of the blog content indicates that it shares similarities with ours and is geared toward the same audience. This categorizes it as a direct competitor.

Find Your Paid Search Competitors

Paid search advertising, or Pay-Per-Click (PPC) advertising, involves businesses bidding on keywords. Ads from the highest bidders are then displayed in the SERPs when users search for these keywords.

To identify your paid search competitors, you can use Semrush’s Advertising Research tool . You’ll see the same graph you get in the Organic Research tool but with paid traffic and keywords instead.

Below, you’ll get a table of your paid competitors.

As with the Organic Traffic table, you can see the number of keywords you have in common with your competitors. This is a good indication of how closely you’ll be competing with them.

Remember, to split your competitors into different types, you’ll need to examine the site content, and their products or services to see what they offer. This may sound like a lot of work, but as we said earlier, you only need to start small.

Identifying Local Competitors

Your local competitors are the businesses in your area that offer a similar product or service. You may already have several local businesses in mind that you consider to be your competition. However, your local competitors might not be exactly what you expected when it comes to SEO.

Local SEO competitors are businesses that rank prominently in the SERPs for keywords related to your products or services within a specific geographical area. These businesses are your direct competition for visibility in local search results and aim to attract local customers searching for relevant products or services.

The most effective method to pinpoint these competitors is through Google. For example, if you operate a law office in Seattle, users searching for such services in your area will likely use long-tail keywords (three or more words) with location modifiers specific to the region, such as “lawyer in Seattle.”

Type this into Google and see which businesses appear in the local search results. One of the most important things to pay attention to is the Map Pack. This is a group of top-ranking local businesses that are displayed prominently in the SERPs.

2. Analyzing Your Competitor’s Content Strategy

Once you’ve identified your competitors, it’s time to analyze their content strategy .

The goal is to identify the components of their strategy that are performing well and those that are not. By doing so, you can replicate the successful elements and take advantage of the opportunities created by the shortcomings in the weaker aspects of their strategy.

The key things to analyze are:

Content Types and Formats

Identify the various kinds of content competitors create, like blog posts , videos , infographics , or podcasts .

Additionally, analyze the formats they employ to present information within these content types. For example, blog post formats may include how-to guides, listicles , or thought leadership articles.

This analysis will help you understand the diversity of their approach and allow you to tailor your content strategy to meet similar or unique audience preferences.

Content Quality and Relevance

Assess the overall quality of their content. Look at factors such as relevance, depth, and level of expertise. Evaluate how well their content meets the users’ search intent and addresses the needs and interests of their target audience.

The insights you gain will allow you to learn from your competitors’ successes or capitalize on their failures. By identifying what works well in their content, you can incorporate similar strategies into your own. Similarly, understanding where their content falls short provides an opportunity to avoid similar pitfalls and tailor your approach for better results.

Content Frequency

Analyze how often they publish new content and the consistency of their posting schedule. This can provide insights into their content production capabilities and audience engagement strategy.

By evaluating your competitors’ content frequency, you can learn from their success in maintaining a consistent posting schedule, potentially improving your own content planning . On the flip side, identifying gaps or irregularities in their posting schedule presents an opportunity to capitalize on potential shortcomings and enhance your own content consistency for better audience engagement.

Content Distribution Channels

This involves recognizing the platforms or mediums competitors use to promote and share their content , which may include social media, email newsletters , or external platforms.

This analysis will help you to learn from their success in reaching audiences through specific platforms. It also provides insights into potential gaps or missed opportunities. This offers you a chance to capitalize on alternative channels for broader content reach and engagement.

Analyzing the keywords your competitors prioritize provides insights into what their audience is actively searching for, allowing you to align your content with similar user intent . Identifying the keywords they are targeting will help you spot industry trends and topics that resonate with your shared audience.

If you create a Semrush project, Copilot AI will automatically check what keywords your competitor ranks for. It will also check where they’re gaining visibility compared to you.

You’ll also be able to identify content gaps that will help you tailor your strategy to address topics that may be underserved in your niche. Additionally, analyzing how your competitors utilize keywords in their meta titles, page headings, and main content can offer valuable insights. This analysis will guide you in optimizing your content effectively or seizing opportunities where your competitors may fall short.

Backlink Profile

By analyzing the quality and quantity of backlinks pointing to their content, you will get insights into the authority and credibility of their content in the eyes of search engines.

3. Assessing Your Competitor’s Backlink Profile

A backlink is a hyperlink from a page on one site to a page on another site. Acquiring backlinks from high-authority sites that align with your niche is a great way of increasing the authority of your site.

When analyzing your competitor’s backlink profile, you need to assess the quality of their links rather than focusing solely on the quantity.

Analyzing your competitors’ backlink profiles is important because sites with robust and diverse link profiles are likely to rank highly in the SERPs. By analyzing their strategies, you can identify backlink opportunities for your site, and boost your rankings and traffic.

If you’d like to learn more about building links, check out our comprehensive guide on link-building strategies .

Here’s how to check up on your competitors’ backlinks.

You can use Semrush’s Backlink Analytics tool .

On the “Overview” page, you will see:

Referring Domains: This is the total number of referring domains pointing to your competitor’s domain.

Backlinks: This is the total number of backlinks your competitor has earned.

As mentioned earlier, the quality of the backlinks is more important than the quantity. You’ll need to assess the quality of referring domains that are linking to your competitor’s pages. To do this, click on “Referring Domains”.

On the “Referring Domains” page, select:

- Set the AS score to 40-100

- Click on “Add filter” and select “Follow”

As you can see in the image above, there are over 3.5k high-authority referring domains linking to this competitor’s domain.

Now, if you want to check the actual backlinks pointing to your competitor’s pages, click on “Backlinks”.

Here you can see the source pages, their AScore, and the pages they are linking to on your competitor’s site.

4. Evaluating Your Competitor’s Technical SEO

Analyzing the technical aspects of your competitor’s site is crucial to understanding how well their site performs. You then compare this data to your site and identify areas where you’re outperforming them and where you need to improve.

Here’s why conducting a technical analysis of your competitors’ sites is essential:

- Identify Strengths and Weaknesses: Analyzing the technical aspects of your competitors’ sites can reveal their strengths and weaknesses in terms of website structure, page speed, mobile optimization, and other technical elements. Understanding these aspects helps you identify areas where you can surpass them.

- User Experience (UX): Technical SEO influences the user experience. By analyzing your competitors’ technical elements, you can gain insights into how user-friendly their websites are. This understanding can guide improvements to your site’s UX.

- Crawling and Indexing: Examining how well your competitors’ websites are crawled and indexed by search engines provides insights into their overall search engine visibility. This can reveal potential issues or opportunities for improvement on your site.

You can use the info you gather to avoid common mistakes, prioritize tasks, and replicate successful strategies. Ultimately, this can lead to better UX, increased traffic, and improved rankings.

5. Exploring Your Competitor’s Paid Media Strategy

Simply put, analyzing your competitor’s paid media strategy helps you:

- Learn what works in your industry

- Stay updated on market trends

- Benchmark your performance

- Discover new advertising channels

- Improve your creativity and messaging

- Adapt to changes

- Enhance your targeting strategies

All of this ensures your advertising efforts remain effective and competitive.

Here’s how to go about analyzing your competitors’ paid media strategies.

Keyword Research

You need to identify the keywords your competitors are bidding on. This will help you uncover gaps in your PPC keyword strategy.

Analyze Historical Performance

You should analyze your competitors’ click-through rates, ad spends, and conversion rates. This will help you determine if their tactics are worth replicating to improve your site’s PPC results.

Ad Placement Analysis

You need to identify where your competitors are placing their ads. Do they tend to favor specific sites, the SERPs, or social media platforms like Facebook? This provides valuable insights into the effectiveness of the different channels they use, their overall market presence, and their strategic focus. Armed with this knowledge you can optimize your advertising approach based on successful practices and focus on platforms that yield better results.

Ad Copy Analysis

A key part of any PPC competitor analysis involves assessing your competitors’ ad copy. You need to analyze the ways they position their product or service and how they promote their unique selling points (USPs).

When analyzing ad copy, it’s useful to ask questions like:

- What types of CTA do they use?

- How do they incorporate keywords into their ad copy?

- Do the color schemes in their ads align with those of their brand?

- Do they use graphics or videos to drive clicks?

Landing Page Analysis

Optimized landing pages are one of the most important elements of a successful PPC campaign. If they contain effective CTAs, enticing content, and are well laid out, they can greatly increase your conversion rates.

So, it’s important to dig into your competitors’ landing pages to identify their strengths and weaknesses. Key things to analyze include:

- Relevance: Does the landing page align with the ad copy that led users to it? To maintain user trust and increase conversions, there must be consistency between the content of a landing page and the ad that leads to it.

- Visuals: How do your competitors use images, graphics, and videos on their landing pages? Are they high-quality and relevant? Do they support the overall message of the page?

- Headline: Pay attention to how clear and compelling the headline on the landing page is, and if it quickly communicates the value proposition of the product or service to the user. The value proposition tells the user the benefits and value of a product or service. For example, “Save time and money with our user-friendly project management software designed for small businesses.”

- Social proof and trust indicators: Keep an eye out for social proof signals like reviews and user ratings, and trust signals like security badges, as these can enhance credibility and user trust.

Track Performance and Return On Investment (ROI)

Keeping tabs on your competitors’ performance and ROI helps you to set goals and KPIs for your site.

Semrush’s Advertising Research tool enables you to effortlessly monitor key performance and ROI metrics, such as CPC and average positions.

Paid Social Media Analysis

Analyzing your competitors’ paid social media strategies will help you identify the ad copy and promotions they use to attract customers within your target audience. The insights you gather will offer ideas that you can integrate into your own paid social media campaigns.

One way of doing this is to use the tools that are built into social media platforms, like Meta Ads Library. This allows you to see all of your competitor’s ads that are currently active on Facebook or Instagram. All you need to do is choose a location and the type of ads you want to see and then type in a keyword or a competitor’s domain.

Then, you’ll be taken to a page with the ads your competitor is running. For each ad, it tells you when it was launched and which Meta platforms it’s running on and you can view the ad itself.

However, this doesn’t provide insight into the success of competitor’s ads. To gauge their effectiveness, we need to uncover metrics such as ad spend, impressions, and share of voice. You can use Semrush’s AdClarity tool to gain these insights. The tool allows you to track your competitors’ ad performance metrics on social media platforms including Facebook, Instagram, TikTok, and X (formerly Twitter).

Real-World Competitor Analysis Example

OK, you now know what information you need to uncover during your competitor analysis and how to conduct one. To make it even clearer, we’re going to walk you through a real-world example where we’ll carry out our own competitor analysis.

For this example, we’re going to identify a single competitor for “Backlinko.com”, and focus on them for the analysis.

As we already went into detail about how to identify your target customer, we’ll be skipping this step. We’ve already used the steps laid out above to determine that our target customer lives in the US, is aged between 18 to 34, and is interested in SEO but isn’t necessarily an SEO professional.

Step 1: Identify Your Competitor

Using Semrush’s Organic Research tool, we can pull up a list of the main competitors (we’ll be focusing on organic competitors in this example).

In the list above, you can see that Backlinko has 7.3K keywords in common with “wordstream.com” and 13% “Competition Level”. By quickly scanning the site, we can also see that we create similar types of content and target the same audience.

This makes “wordstream.com” a great choice for our competitor analysis.

Step 2: Content Analysis

During the next phase of competitor analysis, we’re going to dig into WordStream’s content strategy.

First, identify the types of content they publish. The easiest way to do this is to simply have a look at the WordStream site and make a note of all the different content formats.

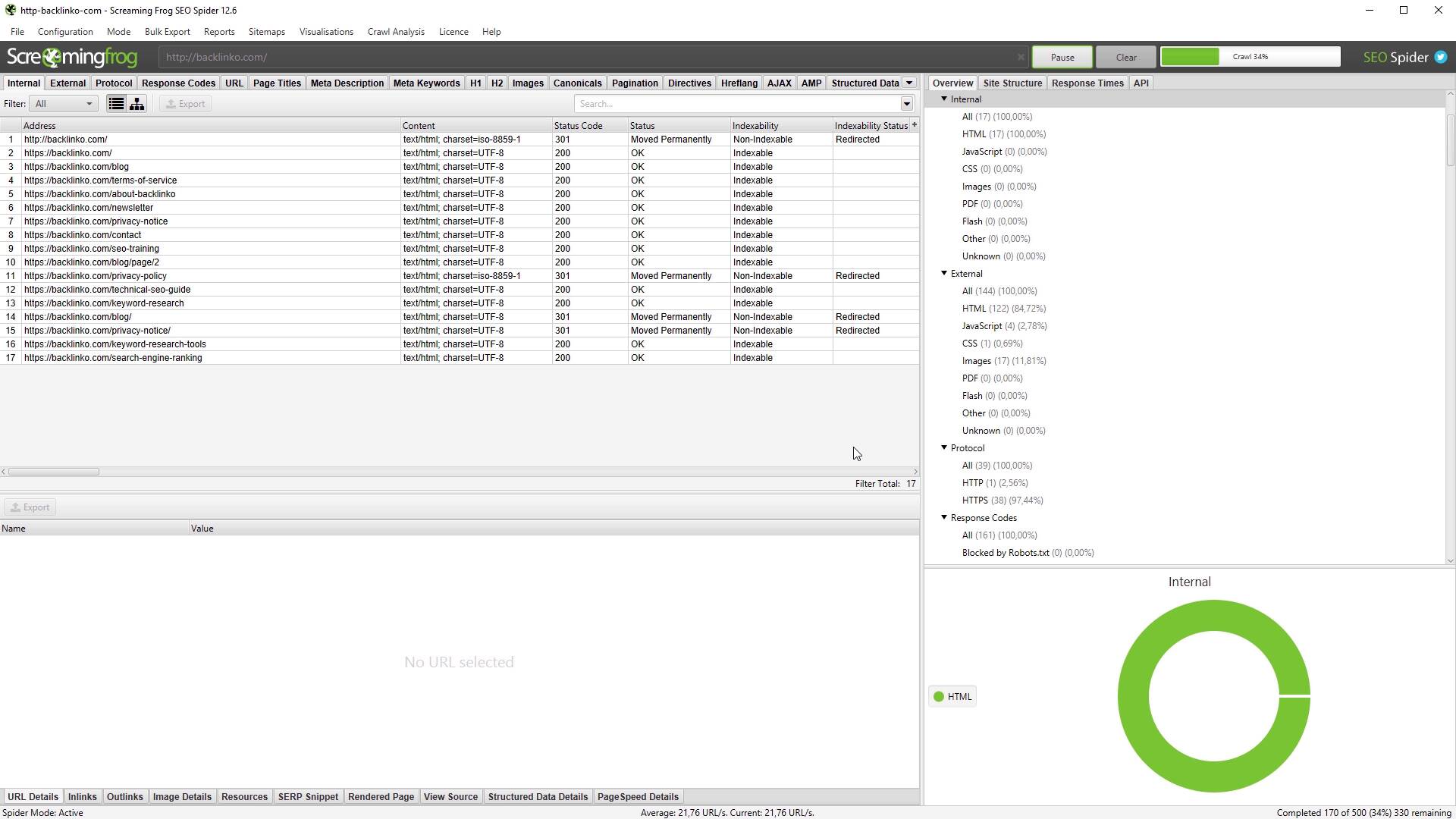

You can also analyze WordStream’s meta titles to get an understanding of the content they create. For this, we’re going to use Screaming Frog SEO Spider.

This is a tool that crawls domains and gives you valuable info about them. The free version allows you to crawl up to 500 URLs, which is perfect for smaller websites.

By analyzing these meta titles, you can start to build a picture of the types of content WordStream is creating. We can see titles include phrases like “How to” and “25 ways”, which indicates WordStream is creating how-to guides and listicles.

When analyzing your competitor’s content strategy, you should identify how frequently they publish content. To do this, type site:your competitor’s domain into Google, click “Tools”, and click “Anytime”.

Next, choose a date range from the dropdown menu. We went with “Past month”.

This will give you an idea of the amount of content your competitor publishes a month.

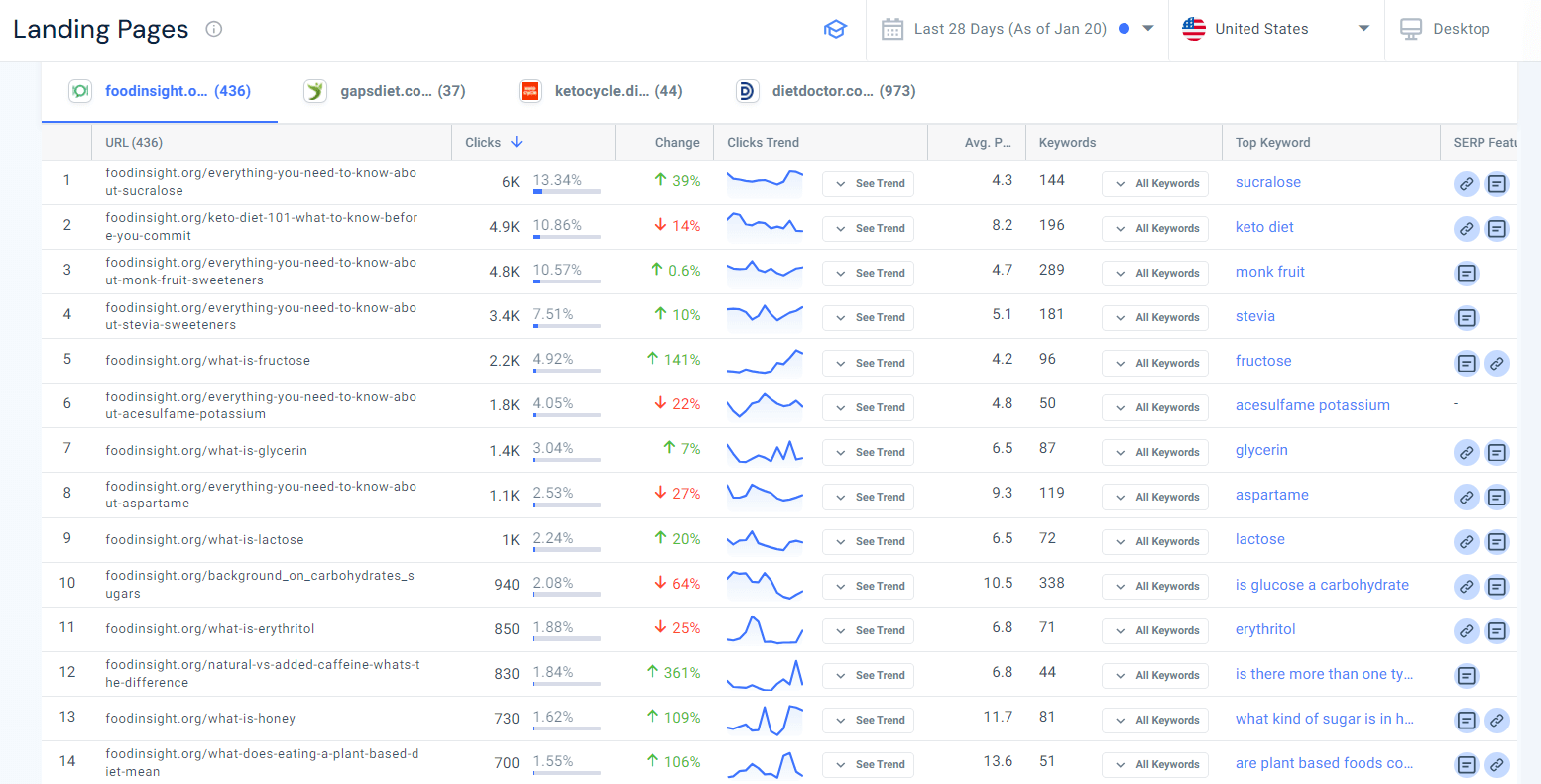

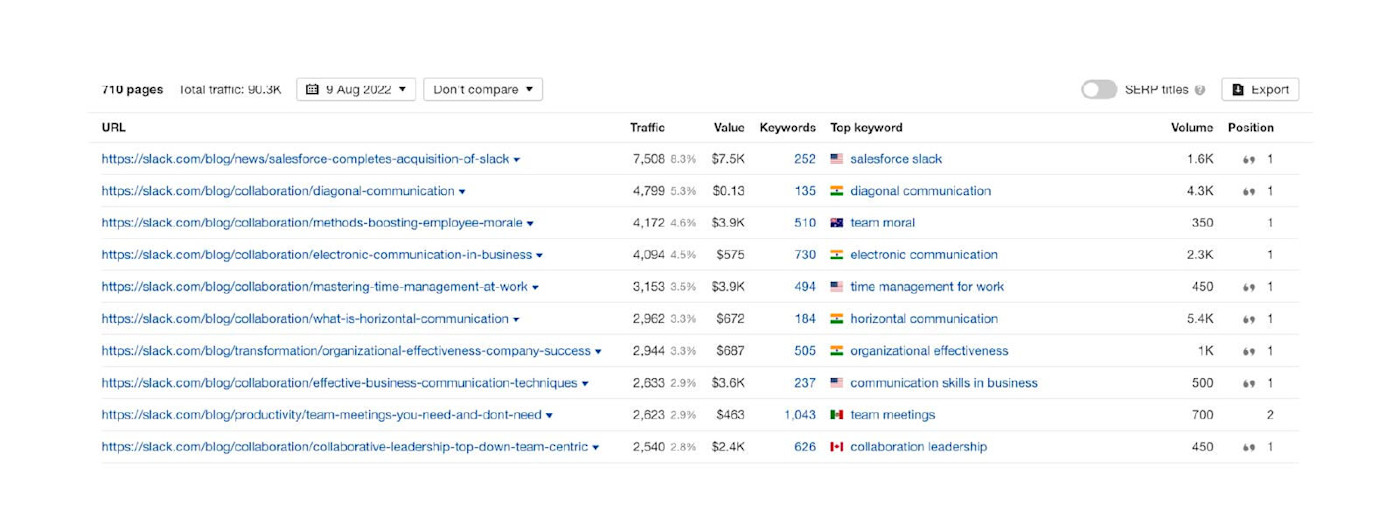

Next, you should take a look at the pages driving the most traffic to your competitor’s site. To do this, you can use the “Organic Pages” report in Semrush’s Organic Research tool.

There are two things you can learn from this report.

- These insights will provide content ideas. Identify the topics most relevant to your site and start creating content for them.

- If you already have content covering these topics but the pages aren’t getting a lot of traffic, you need to optimize them to start drawing in higher levels of traffic.

Next, you need to assess the quality of the content your competitor is producing. You need to look at the depth of the content and its relevance. Is the information well researched and does the content match search intent?

Next, evaluate the levels of E-E-A-T (Experience, Expertise, Authority, and Trustworthiness) your competitor demonstrates within their content.

For example, do they demonstrate experience by including hands-on videos within their how-to guides?

Or do they communicate their expertise by including info about the authors of their articles?

Here’s a look at an article on Wordstream.

Step 3: Backlink Analysis

Next, we’re going to analyze WordStream’s backlink profile. There are many different elements of this we could analyze, but we’re going to focus on four main things during this competitor analysis:

- Number of backlinks: The total number of backlinks pointing to WordStream’s site.

- Quality of backlinks: The number of high-authority referring domains linking to WordStream.

- Top-linked pages: The number of pages that have the most backlinks pointing to them. This indicates the quality and popularity of their content.

Using Semrush’s Backlink Analytics tool, we can see that WordStream has a total of 10.6M backlinks and 87K referring domains.

Now, let’s check out how many of those links are coming from high authority referring domains.

To do this, click on the number under “Referring Domains”.

You’ll only want to pay attention to the domains with the highest Authority Score (AS), so click “AS” at the top-left of the table to view the list in descending order. You can also view the number of backlinks your competitor receives from each domain.

Underneath the domain name, Semrush tells us what category the site falls into. By looking at this table, we can determine the diversity of sources for WordStream’s backlink profile, too.

Next, we want to analyze the pages receiving the most backlinks. Just click on the “Indexed Pages” to get the report:

If your site has pages covering the same topics as your competitors, you should compare the backlinks you’ve received with those of your competitor’s pages. This comparison provides insights into whether you’re outperforming them or falling short in terms of backlink performance.

If your site lacks pages covering these topics, prioritize the most relevant topics and create superior content.

Then, identify the referring domains linking to your competitor’s pages, and proactively reach out to the webmasters of these domains and ask for a link.

Step 4: Technical SEO Analysis

There are a huge number of technical SEO elements you can analyze during a competitor analysis. we’re going to focus on site performance, and analyze Wordstream’s Core Web Vitals, page load speeds, and check if their site is mobile-friendly.

Core Web Vitals

Core Web Vitals are a set of metrics that measure a site’s performance in terms of providing a positive UX. The Core Web Vitals metrics are:

- Cumulative Layout Shift (CLS): Measures how visually stable a page is by analyzing how much the content of the page shifts around as it loads.

- First Input Delay (FID): Measures the time it takes between a user first interacting with a page and the browser starting to process this interaction. FID will be replaced by a new metric called Interaction to Next Paint (INP) in March 2024.

- Largest Contentful Paint (LCP): Measures how long it takes for the largest content element on a page to become visible to the user.

All of these metrics are important for providing a good UX, and they’re also included in Google’s ranking factors , which is why it’s worth analyzing them.

The quickest way to do this is by using Google’s Page Speed Insights .

First, you’ll see your competitor’s Core Web Vitals for the mobile version of their page.

Click on the “Desktop” tab to see the metrics for the desktop version.

Analyzing your competitor’s Core Web Vitals is useful as it can serve as a benchmark for the performance of your site.

When you analyze several of your competitors, you can build a picture of the average performance levels for sites within your niche, and ensure that your site performs to this level or above it. This will result in a better UX and could improve your rankings.

Page Load Speeds

Next, we’re going to use Page Speed Insights again to check up on WordStream’s page load speeds. The metric to pay close attention to is the “Speed Index”. This shows how long it takes for the visual elements on the page to be fully rendered.

Ideally, you want this to be 2-3 seconds or lower. So, this page is pretty slow.

The key takeaway here is that by analyzing your competitor’s page speed, you can compare it to yours. This indicates whether you’re outperforming them or if improvements are needed.

It’s important to note that the “Speed Index” metric is not representative of the entire site, it only pertains to the specific URL you paste in for analysis.

Mobile-Friendliness

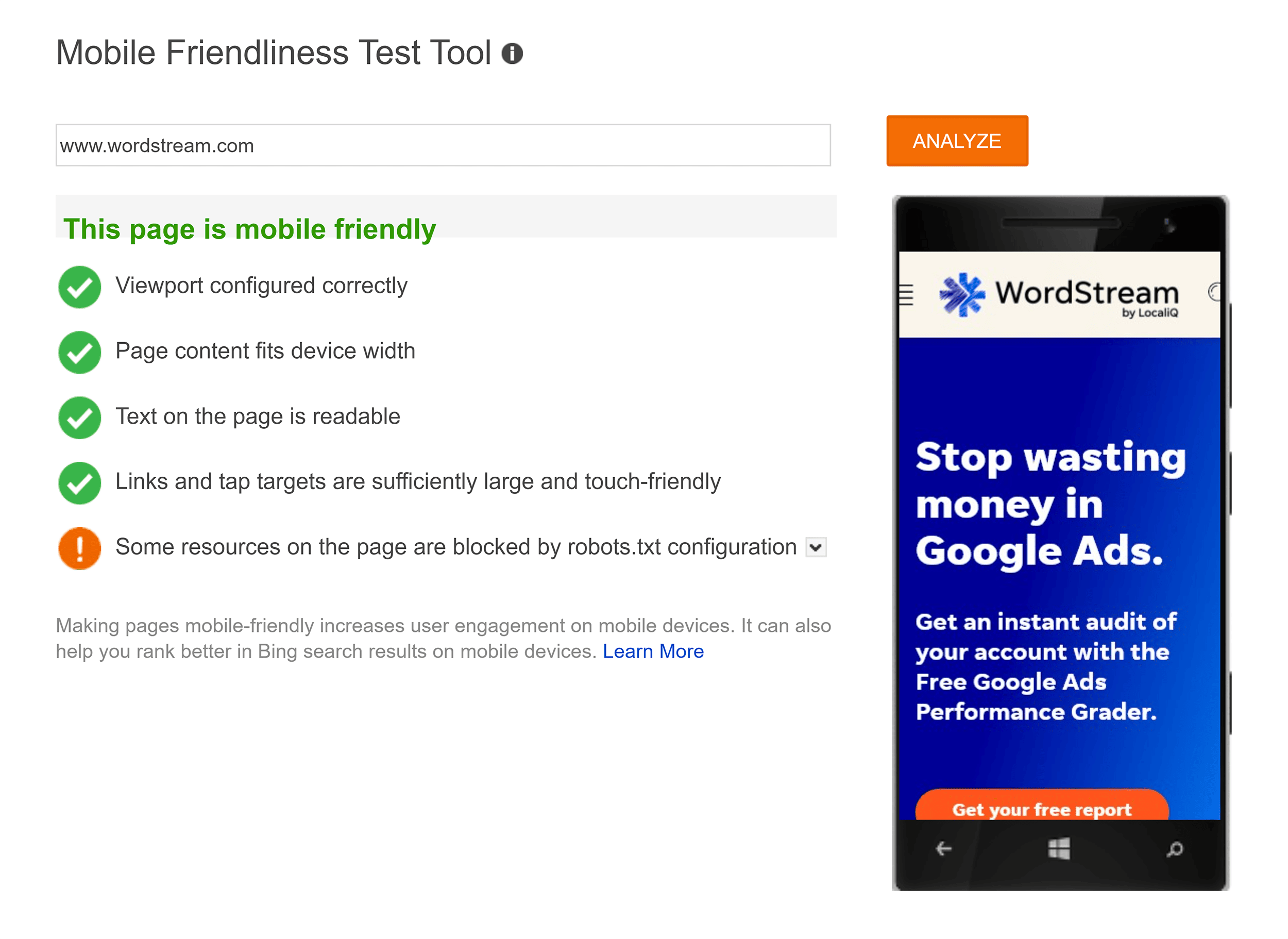

Now, we need to check whether WordStream’s site is mobile-friendly or not. As Google has retired its Mobile-Friendly Test, we’re going to use Bing’s Mobile Friendliness Test Tool instead.

You can see that Wordstream’s page is mobile-friendly.

The primary reason for conducting this analysis is to benchmark your site against your competitors. For instance, if the pages on your site aren’t mobile-friendly, it signifies that you are lagging behind competitors. In the realm of online marketing, sometimes a single factor can determine whether you have an advantage over your competitors or vice versa.

Step 5: Paid Media Analysis

In the final stage of this competitive analysis, we’re going to take a look at WordStream’s paid media strategy.

PPC Keyword Research

The first thing we want to do is gain some insights into WordStream’s PPC keywords using Semrush’s Advertising Research tool . The tool allows you to view metrics such as:

- Position changes

- Search volume

This analysis will reveal the keywords your competitor is excelling in and those where they are struggling. Take note of their success with certain keywords and the areas where they are not performing well.

If you and your competitor are targeting the same keywords, compare your ad performance to theirs. This will enable you to identify areas where you are outperforming them or falling short.

By analyzing the keywords in which your competitor is finding success, you can attempt to replicate it by analyzing their ad copy. On the other hand, by analyzing the keywords they are not performing well for, you can optimize your ad copy and outperform them.

Another effective way to improve your PPC strategy is to identify the paid keywords your competitor is targeting but you aren’t.

To do this, we’re going to use Semrush’s Keyword Gap tool .

Here, we get a list of paid keywords that WordStream is targeting but our site isn’t.

This analysis will give you insights into their PPC strategy and their target audience.

Additionally, analyzing the CPC for the keywords they are targeting provides valuable insights into their ad budget. This understanding will help you determine the budget required to compete effectively with them.

Competitive Analysis Templates and Tools to Guide Your Research Journey

As you can see from this real-world example, Semrush has many features that can aid you in conducting an in-depth competitor analysis, but you need somewhere to store all of the info you gather.

Don’t worry, we’ve got you covered. This free spreadsheet template , courtesy of Semrush, allows you to store your competitor analysis data in one easily accessible place.

Analyzing your competitors is vital for gaining insights into their digital marketing strategies, so you can learn from their success and enhance your own.

It also highlights areas where your competitors are not performing well, presenting opportunities for you to capitalize on their shortcomings and outperform them.

But remember, the key is to start small. Don’t overwhelm yourself by analyzing a ton of competitors at once.

The objective should be to gain insights that you can act on immediately to improve your marketing efforts and stay ahead of the competition.

If you found this guide useful, then check out our in-depth guide on SEO Competitor Analysis.

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management