- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 13,917+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

- Find a Lawyer

- Legal Topics

- Real Estate Law

Mortgage Assignment Laws and Definition

(This may not be the same place you live)

What is a Mortgage Assignment?

A mortgage is a legal agreement. Under this agreement, a bank or other lending institution provides a loan to an individual seeking to finance a home purchase. The lender is referred to as a creditor. The person who finances the home owes money to the bank, and is referred to as the debtor.

To make money, the bank charges interest on the loan. To ensure the debtor pays the loan, the bank takes a security interest in what the loan is financing — the home itself. If the buyer fails to pay the loan, the bank can take the property through a foreclosure proceeding.

There are two main documents involved in a mortgage agreement. The document setting the financial terms and conditions of repayment is known as the mortgage note. The bank is the owner of the note. The note is secured by the mortgage. This means if the debtor does not make payment on the note, the bank may foreclose on the home.

The document describing the mortgaged property is called the mortgage agreement. In the mortgage agreement, the debtor agrees to make payments under the note, and agrees that if payment is not made, the bank may institute foreclosure proceedings and take the home as collateral .

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party. That party is referred to as the assignee, and receives the right to enforce the agreement’s terms against the assignor, or debtor (also called the “mortgagor”).

What are the Requirements for Executing a Mortgage Assignment?

What are some of the benefits and drawbacks of mortgage assignments, are there any defenses to mortgage assignments, do i need to hire an attorney for help with a mortgage assignment.

For a mortgage to be validly assigned, the assignment document (the document formally assigning ownership from one person to another) must contain:

- The current assignor name.

- The name of the assignee.

- The current borrower or borrowers’ names.

- A description of the mortgage, including date of execution of the mortgage agreement, the amount of the loan that remains, and a reference to where the mortgage was initially recorded. A mortgage is recorded in the office of a county clerk, in an index, typically bearing a volume or page number. The reference to where the mortgage was recorded should include the date of recording, volume, page number, and county of recording.

- A description of the property. The description must be a legal description that unambiguously and completely describes the boundaries of the property.

There are several types of assignments of mortgage. These include a corrective assignment of mortgage, a corporate assignment of mortgage, and a mers assignment of mortgage. A corrective assignment corrects or amends a defect or mistake in the original assignment. A corporate assignment is an assignment of the mortgage from one corporation to another.

A mers assignment involves the Mortgage Electronic Registration System (MERS). Mortgages often designate MERS as a nominee (agent for) the lender. When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

An advantage of a mortgage assignment is that the assignment permits buyers interested in purchasing a home, to do so without having to obtain a loan from a financial institution. The buyer, through an assignment from the current homeowner, assumes the rights and responsibilities under the mortgage.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Failure to observe mortgage assignment procedure can be used as a defense by a homeowner in a foreclosure proceeding. Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note.

If the bank fails to “produce the note,” that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note. Therefore, it lacks legal standing to commence a foreclosure proceeding.

If you need help with preparing an assignment of mortgage, you should contact a mortgage lawyer . An experienced mortgage lawyer near you can assist you with preparing and recording the document.

Save Time and Money - Speak With a Lawyer Right Away

- Buy one 30-minute consultation call or subscribe for unlimited calls

- Subscription includes access to unlimited consultation calls at a reduced price

- Receive quick expert feedback or review your DIY legal documents

- Have peace of mind without a long wait or industry standard retainer

- Get the right guidance - Schedule a call with a lawyer today!

Need a Mortgage Lawyer in your Area?

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Daniel Lebovic

LegalMatch Legal Writer

Original Author

Prior to joining LegalMatch, Daniel worked as a legal editor for a large HR Compliance firm, focusing on employer compliance in numerous areas of the law including workplace safety law, health care law, wage and hour law, and cybersecurity. Prior to that, Daniel served as a litigator for several small law firms, handling a diverse caseload that included cases in Real Estate Law (property ownership rights, residential landlord/tenant disputes, foreclosures), Employment Law (minimum wage and overtime claims, discrimination, workers’ compensation, labor-management relations), Construction Law, and Commercial Law (consumer protection law and contracts). Daniel holds a J.D. from the Emory University School of Law and a B.S. in Biological Sciences from Cornell University. He is admitted to practice law in the State of New York and before the State Bar of Georgia. Daniel is also admitted to practice before the United States Courts of Appeals for both the 2nd and 11th Circuits. You can learn more about Daniel by checking out his Linkedin profile and his personal page. Read More

Jose Rivera

Managing Editor

Preparing for Your Case

- What to Do to Have a Strong Mortgage Law Case

- Top 5 Types of Documents/Evidence to Gather for Your Mortgages Case

Related Articles

- Assumable Mortgages

- Loan Modification Laws

- Behind on Mortgage Payments Lawyers

- Home Improvement Loan Disputes

- Reverse Mortgages for Senior Citizens

- Mortgage Settlement Scams

- Short Sale Fraud Schemes

- Deed of Trust or a Mortgage, What's the Difference?

- Owner Carryback Mortgages

- Contract for Deed Lawyers Near Me

- Mortgage Subrogation

- Property Lien Waivers and Releases

- Different Types of Promissory Notes

- Repayment Schedules for Promissory Notes

- Ft. Lauderdale Condos and Special Approval Loans

- Special Approval Loans for Miami Condos

- Removing a Lien on Property

- Mortgage Loan Fraud

- Subprime Mortgage Lawsuits

- Property Flipping and Mortgage Loan Fraud

- Avoid Being a Victim of Mortgage Fraud

- Second Mortgage Lawyers

- Settlement Statement Lawyers

- Loan Approval / Commitment Lawyers

- Broker Agreement Lawyers

- Truth in Lending Disclosure Statement (TILA)

- Housing and Urban Development (HUD) Info Lawyers

- Good Faith Estimate Lawyers

- Mortgage Loan Documents

Discover the Trustworthy LegalMatch Advantage

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

How does LegalMatch work?

Law Library Disclaimer

16 people have successfully posted their cases

What Is Assignment of Mortgage: What You Need to Know

We will explore the idea of mortgage assignment in this thorough guide, going over its definition, steps involved, potential consequences, and more. So read on to learn more about this important facet of the real estate market, whether you’re a homeowner, a prospective buyer, or just inquisitive about mortgages.

What is Assignment of Mortgage?

The assignment of mortgage, often simply referred to as mortgage assignment , is a legal process that involves the transfer of a mortgage loan from one party to another. This transfer typically occurs between mortgage lenders or financial institutions and is a common practice within the mortgage industry.

The Key Parties Involved

- Assignor: The person transferring the mortgage is known as the assignor. The initial lender or financial organization that gave the borrower the mortgage loan is often the assignor.

- Assignee: The assignee is the party receiving the mortgage assignment. This could be another lender or financial institution that is buying the mortgage, often as part of a financial transaction.

- Borrower: The borrower is the individual or entity that initially took out the mortgage loan to finance the purchase of a property.

Why is Assignment of Mortgage Necessary?

Assignment of mortgage occurs for various reasons, and it serves specific purposes for all parties involved.

1. Loan Portfolio Management

Mortgage assignment is a common practice used by lenders to better manage their loan portfolios. Lenders might raise funds to offer more loans or issue new mortgages by selling or transferring mortgage loans to other financial organizations. This procedure aids in keeping their portfolios risk-balanced and liquid.

2. Risk Mitigation

Lenders may also assign mortgages to mitigate risk. When they transfer a mortgage to another entity, they are essentially transferring the associated risk as well. This can be a strategic move to reduce their exposure to potential defaults or financial instability.

3. Secondary Mortgage Market

The secondary mortgage market plays a significant role in the assignment of mortgages. Many mortgages are bundled together into mortgage-backed securities (MBS) and sold to investors. Assignment of mortgages allows lenders to participate in this market, which provides additional funding for new mortgage loans.

The Assignment of Mortgage Process

The process of assigning a mortgage, or deciding to sell your mortgage , involves several steps and legal requirements. Here’s a breakdown of the typical process:

1. Agreement between Parties

The assignor (original lender) and assignee (new lender or investor) must enter into a formal agreement outlining the terms and conditions of the new mortgage assignment. This agreement includes details such as the transfer price, terms of the loan, and any specific warranties or representations.

2. Notice to the Borrower

Once the agreement is in place, the borrower is typically notified of the assignment. This notice informs them that the servicing of their mortgage, including collecting monthly mortgage payments, will now be handled by the assignee. The borrower is advised to send future payments to the assignee.

3. Recordation

In many jurisdictions, mortgage assignments must be recorded with the appropriate government office, such as the county recorder’s office. This recordation provides public notice of the transfer and ensures that the assignee has a legal claim on the property.

4. Continuation of Monthly Mortgage Payments

For the borrower, the most noticeable change is the address where monthly payments are sent. Instead of sending payment to the original lender, the borrower will send them to the assignee. It is crucial for borrowers to keep records of these changes to avoid any confusion or missed payments.

Implications of Mortgage Assignment for Borrowers

While the assignment of mortgage primarily involves lenders and investors, it can have implications for borrowers as well. Here are some important considerations for borrowers:

1. No Change in Loan Terms

Borrowers should be aware that the assignment of mortgage does not change the terms of their loan. The interest rate, monthly payments, and other loan terms remain the same. The only change is the entity to which payments are made.

2. Proper Record-Keeping

Borrowers must maintain accurate records of their mortgage payments and correspondence related to the assignment. This helps ensure that payments are correctly credited and can be vital in case of any disputes or issues.

3. Communication with the New Lender

If borrowers have questions or concerns about their mortgage after the assignment, they should reach out to the new lender or servicer. Open and clear communication can help address any issues that may arise during the transition.

4. Property Taxes and Insurance

Borrowers are still responsible for property taxes and homeowner’s insurance, even after the assignment of mortgage. These payments are typically not affected by the transfer of the loan.

The Role of Mortgage Servicers

Mortgage servicers play a crucial role in the assignment of mortgage process. This section will explore the responsibilities of mortgage servicers, their relationship with borrowers, and how they manage mortgage loans on behalf of investors or lenders.

Legal Requirements and Regulations

Assignment is subject to various legal mortgage requirements and regulations that vary by jurisdiction. Discussing these legal aspects will help readers understand the legal framework governing the assignment of mortgages in their region and how it impacts the process.

Impact on Credit and Credit Reporting

The assignment of mortgage can have implications for borrowers’ credit reports and scores. Explore how mortgage assignment can affect credit histories, reporting by credit bureaus, and what borrowers can do to protect their credit during and after the assignment.

Assignment of Mortgage vs. Assumption of Mortgage

Differentiating between assignment of mortgage and assumption of mortgage is important. This section will explain the key differences, where one party takes over the mortgage and liability, while the other party merely transfers the loan to a new lender.

Impact on Property Taxes and Insurance

Taxes and insurance are essential components of homeownership. Explain how the assignment of mortgage may affect property tax payments and the homeowner’s insurance policy, as these are often escrowed into the monthly mortgage payment.

Potential Challenges and Disputes

Discuss common challenges or disputes that can arise during or after the assignment of mortgage, such as miscommunication, incorrect payment processing, or disputes over ownership rights. Offer advice on how to handle and resolve these issues.

Foreclosure and Default Scenarios

In the unfortunate event of mortgage default, understanding how the assignment of mortgage affects foreclosure proceedings is crucial. Explain how the assignee handles foreclosures and what options are available to borrowers facing financial difficulties.

Future Trends and Innovations

Explore emerging trends and innovations in the mortgage industry related to the assignment of mortgages. This could include the use of blockchain technology, digital mortgages, or other advancements that may impact the process.

In the complex world of real estate and mortgage financing , the assignment of mortgage plays a pivotal role in the movement of funds and management of risk. It allows lenders to efficiently manage their portfolios, mitigate risk, and participate in the secondary mortgage market. For borrowers, understanding the process and implications of mortgage assignment is essential to ensure the smooth continuation of their monthly mortgage payments.

As you navigate the world of homeownership or consider entering it, remember that the assignment of mortgage is a routine occurrence designed to benefit all parties involved. By staying informed and maintaining open communication with your lender or servicer, you can ensure that your mortgage loan remains a manageable and secure financial commitment.

In summary, purchase of mortgage is a vital mechanism within the mortgage industry that facilitates the transfer of mortgage loans from one party to another. This process helps lenders manage their portfolios, mitigate risk, and participate in the secondary mortgage market.

For borrowers, it means a change in the entity collecting their monthly mortgage payments but typically does not alter the terms of the original loan. Keeping accurate records and staying informed about the transition are crucial steps to ensure a smooth experience for homeowners. So, whether you’re a homeowner, lender, or investor, understanding assignment of mortgage is key to navigating the real estate landscape effectively.

This article is for informational purposes only and does not constitute legal, tax, or accounting advice.

Written by Alan Noblitt

Leave a comment.

Your email address will not be published. Required fields are marked *

Have a question?

Click the button below, and we will get back to you quickly

- Assignment of Mortgage

Get free proposals from vetted lawyers in our marketplace.

Real Estate Terms Glossary

- Annual Percentage Rate

- Application Fee

- Appreciation

- Assessed Value

- Assumable Mortgage

- Assumption Fee

- Automated Underwriting

- Balance Sheet

- Balloon Mortgage

- Balloon Payment

- Before-tax Income

- Biweekly Payment Mortgage

- Bridge Loan

- Building Code

What is an Assignment of Mortgage?

In real estate, an assignment of mortgage is the transfer of a mortgage, or mortgage note , to another party which typically happens on the servicing side or lender side. This is commonly seen one when lender sells or transfers your mortgage to another lender. Lenders typically have the right to to sell mortgages and assign them to new parties, but don’t typically allow borrowers to do the same. When a borrower transfers their mortgage obligation to a new party, this is called an assumed mortgage.

Assignment of Mortgage Examples

Examples where you will find assignment of mortgages include:

- Example 1. A lender selling your mortgage to another lender for servicing.

Here’s Property Shark’s definition of assignment of mortgage .

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Real Estate Lawyers

I am a multifaceted lawyer, experienced in corporate law, nonprofits, private equity, real estate, financial services, taxation, trust and estate planning, and philanthropy. I am a strategic thinker and cross-functional collaborator who understands the importance of balancing revenue needs with business-minded legal counsel. I am skilled and experienced in preparing and reviewing SaaS agreements, service and vendor agreements, confidentiality, NDAs, data privacy, IP, licensing, real estate transactions, and partnership agreements.

Experienced business attorney in the field of real estate, construction, and design.

Family Law attorney with focus on Divorce Mediation

I am an experienced New York Real Estate Attorney and Florida Licensed Title Agent with extensive knowledge in the Real Estate industry. With more than 20 + years and over 2500 closed transactions, I have become an expert at accurately assessing realtors', lenders' & investors' needs and proposing/implementing viable solutions that bring value to them. I focus on real estate settlement services, education, and training of real estate professionals. I am also skilled working with high-end clients, managing large and complex projects, building solid relationships, effectively and creatively solving complex issues, producing results under stress all with impeccable customer service.

Having more than ten (10) years of experience in commercial law, I have garnered both relevant in-house and law firm experience. With more than a combined seven (7) years in-house experience, I have gained valuable insight in balancing the business needs with the legal risks and applying the legal skills I have acquired to various fields. I have specific experience with SaaS, vendor contracts, customer contracts, and general marketing agreements. Moreover, my law firm background has taught me to be detail-oriented and to be an effective negotiator in all types of commercial dealings.

I have been practicing law since 2005 and am licensed in the state of Pennsylvania. I started in Pittsburgh, PA and then moved to Williamsport in 2007 where I have practiced family law almost exclusively since. I am the managing partner /owner of Protasio & Jasper, P.C. I have had multiple Pennsylvania Supreme Court family law cases that have changed the law in Pennsylvania. I pride myself on being able to arm clients with information so that they can make informed decisions about their case.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Real Estate lawyers by city

- Atlanta Real Estate Lawyers

- Austin Real Estate Lawyers

- Boston Real Estate Lawyers

- Chicago Real Estate Lawyers

- Dallas Real Estate Lawyers

- Denver Real Estate Lawyers

- Fort Lauderdale Real Estate Lawyers

- Houston Real Estate Lawyers

- Las Vegas Real Estate Lawyers

- Los Angeles Real Estate Lawyers

- Memphis Real Estate Lawyers

- Miami Real Estate Lawyers

- New York Real Estate Lawyers

- Oklahoma City Real Estate Lawyers

- Orlando Real Estate Lawyers

- Philadelphia Real Estate Lawyers

- Phoenix Real Estate Lawyers

- Richmond Real Estate Lawyers

- Salt Lake City Real Estate Lawyers

- San Antonio Real Estate Lawyers

- San Diego Real Estate Lawyers

- San Francisco Real Estate Lawyers

- Seattle Real Estate Lawyers

- Tampa Real Estate Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

Assigning Loan Documents: Practical Reminders

The recent Supreme Court of Delaware case J.M. Shrewsbury v. The Bank of New York Mellon , CA No. N15L-03-108 (Del. 2017), provides a reminder of the importance of clearly documenting the assignment of loan documents. The Court’s holding requires that prior to the assignee of a mortgage loan filing suit on the note or mortgage, the assignee must have received both an allonge/assignment of the note and an assignment of the mortgage. The case is a reminder of the importance of maintaining a precise chain of title when assigning loan documents. The facts of the case as described below demonstrate the need to make sure that you “don’t leave the note behind.”

In 2007, J.M. Shrewsbury and Kathy Shrewsbury signed a promissory note in favor of Countrywide Home Loans, Inc. Concurrently, the Shrewburys were granted a mortgage to secure their obligations under the note, which mortgage encumbered real property in Delaware. In 2011, the mortgage was assigned to The Bank of New York Mellon (Bank). In 2013, the Shrewsburys requested and received a copy of the original note, which contained no indication that the note had been assigned. Neither party disputed the fact that the Shrewsburys stopped making mortgage payments in 2010.

The Bank commenced a mortgage foreclosure action in 2015 in the Superior Court of the State of Delaware, Bank of N.Y. Mellon v. Shrewsbury , C.A. No. N15L-03-108 CLS (Del. Super. Ct. Feb. 17, 2016). In holding in favor of the Bank, the Superior Court found that the Bank need only show that it had a valid assignment of the mortgage to enforce its rights. The Shrewsburys appealed the decision to the Court.

In reversing and remanding the decision of the Superior Court, the Court followed its reasoning in Iowa-Wisconsin Bridge Co. v. Phoenix Finance Corporation, Iowa-Wisconsin Bridge Co. v. Phoenix Finance Corporation , 25 A.2d 383, 389 (Del. 1942), stating that a debt is an essential requisite to a mortgage. While persuaded by wide-ranging case law and other respected authorities, the Court’s decision relied most heavily on the United States Supreme Court case Carpenter v. Longan, 83 U.S. 271 (1872), holding that the “note and mortgage are inseparable; the former as essential, the latter as an incident. An assignment of the note carries the mortgage with it, while an assignment of the latter alone is a nullity.”

Practical Reminders

While this case involved a residential transaction, important considerations can be applied in commercial mortgage transactions whether in connection with construction, bridge or permanent mortgage financing, a loan sale, a transfer of a loan to an affiliate of the original lender, or other assignment of the loan.

Practical reminders include:

- Make sure that the chain of title is precise when assigning the mortgage, the note and other collateral documents such as assignments of leases and rents, guarantees and UCC’s. Don’t leave the note “behind.”

- Assign and endorse the note by allonge so that the chain of title is complete. Firmly affix the allonge(s) to the underlying note.

- Keep good records of all documentation, including recorded ( i.e. the mortgage an assignment of mortgage) and unrecorded documents. Retain originals in a safe place (such as under the control of a custodian or servicer or in a vault) and copies of all loan documents including assignment documents.

- When the loan is assigned, always deliver the original note along with the original allonge.

Members of our Real Estate and Finance Groups regularly handle commercial real estate financing and sales transactions throughout the country. If you have questions or would like further information, please contact Tim Davis ( davist@whiteandwilliams.com ; 215.864.6829) or Pat Haggerty ( haggertyp@whiteandwilliams.com ; 215.864.6811).

PRACTICE AREAS

- Real Estate

KEY ATTORNEYS

- Cherry Hill

- Center Valley

- Philadelphia

By using this site, you agree to our updated Privacy Policy and our Terms of Use .

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Understanding how assignments of mortgage work.

The bank or other mortgage lender that provides a borrower with the funds to purchase a home often later transfers or assigns its interest in the mortgage to another firm. When this happens, the borrower will start sending monthly mortgage payments to the new owner of the mortgage instead of the original lender. Some other things, such as the available modes of payment, many also change. However, the general terms of the mortgage, such as the interest rate and payment amounts, will stay the same.

If you need help with a mortgage, consider finding a financial advisor to work with .

Mortgage Assignment Basics

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender’s interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest. However, by assigning the loan the mortgage company will free up capital. This allows the original lender to make more loans and generate additional origination and other fees.

At closing, borrowers sign a document granting the original lender the right to assign the mortgage elsewhere. This means the original lender doesn’t have to ask for permission to assign the mortgage but can do so whenever it wants to. Often this occurs within a few months after the closing, but it can happen at any time during the term of a mortgage. Once a loan has been assigned, it can be assigned again.

The assignment of mortgage document uses several pieces of information to accurately identify the specific mortgage that is being transferred. These generally include:

The name of the borrower

The date of the mortgage

The jurisdiction where it was recorded

The amount of money that was originally loaned

A legal description of the home or other property used as collateral to secure the loan.

Although a lender doesn’t need to request the borrower’s permission before assigning a mortgage, the lender does have to notify the borrower after the mortgage has been assigned. This notice will generally provide the new lender’s name, contact information and mailing address or other information need to make payments.

Effects of Mortgage Assignment

When a mortgage is assigned, the original terms of the mortgage remain unchanged. The monthly principal and interest, interest rate and total number of payments required to pay the loan off will be the same as on the mortgage when it was signed at closing.

A company assigned a mortgage may have different methods of accepting monthly payments, such as online payments, paper checks or money orders. A borrower who wants more payment methods may be able to get a new mortgage holder to provide them upon request.

Some things may change, however. For instance, the new owner of the mortgage may have a different method of handling escrow payments that are used to pay property taxes and the premiums for hazard insurance. The law requires mortgage companies to charge no more than one-twelfth the annual cost of property taxes and insurance each month. However, they can also require borrowers to maintain a cushion of up to one-sixth the annual total required to pay taxes and insurance. If a new mortgage company has a different policy on this cushion, it could change the total monthly payment.

Don't miss out on news that could impact your finances. Get news and tips to make smarter financial decisions with SmartAsset's semi-weekly email. It's 100% free and you can unsubscribe at any time. Sign up today .

The borrower also does not need to notify the local taxing authorities or the hazard insurance provider about the assignment. The new holder of the mortgage is required to handle these notifications.

Borrowers should check the information about where payments are supposed to go. This need to be accurate so payments will be directed correctly to the holder of the mortgage and the borrower will receive credit for them.

Another important matter that may change when a loan is assigned is the procedure the mortgage company will follow in the event of default. Borrowers should make themselves familiar with the notification methods used by the new mortgage to let them know if payments are not being received and foreclosure is in the offing.

The Bottom Line

Home mortgages are often assigned by their original lenders to other companies. Assignment usually doesn’t change much for the borrower, except that the payments will go to a different address. The original loan amount, interest payment, term and monthly principal and interest part of the payment will stay the same. Assigning mortgages frees up money for the lenders to make more loans. Borrowers don’t have to be told a mortgage will be assigned, since they agree to this at closing. However, they must be notified after an assignment and told how to contact the new mortgage holder.

Mortgage Tips

A financial advisor can help you evaluate home buying and other important financial moves. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now .

Borrowers can find out whether and where their mortgage has been assigned through the Mortgage Electronic Registration Systems (MERS). This is an organization created by mortgage companies to track mortgage assignments. Borrowers can use a free online service provided by MERS to find out who owns their mortgage.

Mortgage rates are more volatile than they have been in a long time. Check out SmartAsset’s mortgage rates table to get a better idea of what the market looks like right now.

Photo credit: ©iStock.com/ArLawKa AungTun, ©iStock.com/ridvan_celik, ©iStock.com/damircudic

The post Understanding How Assignments of Mortgage Work appeared first on SmartAsset Blog .

- (888) 634-7684

- mintrak® 2 ™

Assignment of Mortgage (AOM) Service

Protect your investment with the right partner.

When loans are bought and sold, it’s good practice for buyers to take control of the process and partner with an experienced third party to ensure that assignments are done correctly. When a buyer is in control of the assignment, careful follow-up will ensure that everything is signed, returned and sent for electronic recording.

If the buyer is not on the county record as the loan owner, it can put the investment at risk. This is especially important for non-performing loans, which are commonly sold. It’s critical that paperwork is done timely and correctly on these loans. For this type, portfolio modifications or foreclosure is the resolution. The new owner of the asset must be on record with a proper chain of title to follow this path. An investor who is not listed in the real property records as the owner will not be notified of adverse incidents or situations. This can be critical information to managing your assets properly.

The rejection of a lien release by the county is another potential risk when the loan on record is not in the investor’s name. A borrower who pays off a loan may suffer as a result of difficulty in releasing the lien , resulting in poor service to the customer.

How Our Assignment Service Works

Our assignment solution is built around good communication with our clients, allowing us to work quickly and efficiently. We rely on our proprietary system, Eclipse TM , and a team dedicated to your success. Here’s how the process works:

- You provide the legal names of the assignor and assignee and we load the information into Eclipse, eliminating the need to re-enter every assignment and providing you with easy-to-access, real-time insight into file statuses

- Once the appropriate source document is provided (recorded mortgage/DOT/title policy), MetaSource generates an assignment document using county specific rules to eliminate obstacles that can lead to rejection

- The assignment is recorded electronically, where possible, and sent by mail using our in-house sending and tracking system where e-recording is not an option

- When the recorded assignment is received from the county, your assignment is imaged for further routing and the original is returned to you or your designee

We manage the assignment process every step of the way until the recording process is complete.

Tracking Missing Assignments

Missing intervening assignments is another potential challenge that may arise. Tracking down missing assignments is time consuming, but becomes even harder if those assignments belong to companies that have gone out of business. In that case, an experienced document services provider can provide valuable help.

MetaSource leverages its database of contact information for companies and their authorized employees to get problems resolved quickly. Even servicers and investors with staff to handle this problem can leverage our extensive database to determine how quickly problems might be solved.

Contact us to learn more about our assignment of mortgage service

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- The Legally Invalid Assignment Defense to Foreclosure

People who are facing the possibility of a foreclosure on their home may want to investigate the history of their mortgage. If the assignment to the foreclosing party is not valid, this may be a viable defense to a foreclosure. In some states, you can demand that the foreclosing party produce a written assignment of the mortgage. If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

Courts in other states are more lenient in their review of assignments. Since the mortgage is closely associated with the promissory note, the foreclosing party may be allowed to enforce the promissory note even if it cannot produce a valid assignment of the mortgage. You should seek legal guidance in your state to determine whether this defense may be viable.

Homeowners who believe that they may have a defense based on an invalid assignment may wish to consult with a knowledgeable foreclosure lawyer, since this defense can become complicated. Justia offers a lawyer directory to simplify researching, comparing, and contacting attorneys who fit your legal needs.

The Relationship Between Mortgages and Promissory Notes

The mortgage and the promissory note are the two key documents attached to a loan for buying a home. Some purchases involve a deed of trust rather than a mortgage, but they are functionally equivalent in this context. While the promissory note is your guarantee to repay the loan, the mortgage gives the lender the right to foreclose if you do not repay the loan as arranged. The mortgage also identifies the property that will serve as security for the loan. Thus, the two documents work together in establishing the lender’s rights.

The Role of Mortgage Assignments in Loan Transfers

A bank or other lender often will sell a mortgage to another party, which will collect payments and pursue the homeowner if they fail to keep up with the mortgage. To transfer the loan, the original lender will endorse the promissory note to the new owner of the mortgage. This is because collection efforts hinge on owning the promissory note. If the foreclosing party cannot produce the promissory note, the homeowner will have a defense to the foreclosure.

Meanwhile, the new owner will record the assignment of the mortgage. This includes transferring the right to foreclose, as provided by the mortgage, to the new owner. The assignment will provide the amount of the mortgage and the names of the homeowner, the original lender, and the new owner of the mortgage. It also will contain a description of the property attached to the mortgage and the date when the mortgage took effect.

An invalid assignment defense may only be a temporary solution until the new owner records an assignment in their name.

The mortgage industry uses a tool known as the Mortgage Electronic Registration System (MERS) to keep track of assignments. MERS may be a nominee for the lender, or it may receive the mortgage as an assignment. If MERS is the current assignee, it cannot pursue a foreclosure because it does not have an interest in the promissory note. MERS simply serves as an agent for the current owner of the mortgage and assists in creating a record for transfers of the mortgage. This allows banks to more easily transfer loans among them without creating a new assignment each time. You may have a defense against a foreclosure action if MERS is listed as the owner of the mortgage. However, this likely will be only a temporary solution until the new owner records an assignment in their name.

Last reviewed October 2023

Foreclosure Law Center Contents

- Foreclosure Law Center

- Errors and Abuses by Mortgage Servicers & Your Legal Rights

- Foreclosure Trustees & Their Legal Obligations

- Strict Foreclosure Laws

- Expedited Foreclosure Laws & Procedures

- Tax Debt Leading to Foreclosure & Legal Concerns

- Homeowners' Association Liens Leading to Foreclosure & Other Legal Concerns

- Timeshare Foreclosures & the Legal Process

- Investment Property Foreclosures & Your Legal Options

- Manufactured Home Foreclosures & Relevant Legal Concerns

- The Right of Redemption Before and After a Foreclosure Sale Under the Law

- Reinstatement and Payoff to Prevent Foreclosure & Your Legal Rights

- Fannie Mae and Freddie Mac Foreclosure Prevention Strategies

- Divorce and Foreclosure Prevention — Legal & Practical Considerations

- Natural Disasters and Legal Options for Foreclosure Prevention

- Federal Mortgage Servicing Laws Protecting Homeowners

- Fighting a Foreclosure — Legal Options and Issues

- Homeowners' Legal Rights Before, During, and After Foreclosure

- How Liens and Second Mortgages May Legally Affect Foreclosure

- Foreclosure Scams — Legal Concerns & Consumer Protections

- Judicial vs. Non-Judicial Foreclosure Under the Law

- Fighting a Foreclosure in Court & Legal Strategies

- Delaying a Foreclosure

- The Statute of Limitations Defense Under Foreclosure Law

- Using the Legally Defective Affidavit or Declaration Defense to Foreclosure

- Setting Aside a Foreclosure Sale

- Challenging Fees in Foreclosure

- Mortgage Servicing Rules, the FDCPA, and Your Legal Rights

- Working With a Foreclosure Lawyer

- Alternatives to Foreclosure — Legal & Financial Considerations

- Foreclosure Laws and Procedures: 50-State Survey

- Foreclosure Law FAQs for Consumers

- Find a Foreclosure Defense Lawyer

Related Areas

- Home Ownership Legal Center

- Bankruptcy Law Center

- Debt Relief & Management Legal Center

- Consumer Protection Law Center

- Landlord - Tenant Law Center

- Related Areas

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Real Estate Law Blog

The Deed of Reconveyance – What Happens if You Pay Off Your Loan and The Trustee Does Not Clear Title?!

A brief refresher of how the Deed of Trust works. Despite common parlance, California is not a “mortgage” state. For example, if Betty Borrower purchases a house in San Jose and puts down $100k and borrows $400k from Wells Fargo Bank, that $400k is memorialized with a Promissory Note (debt instrument) and then the house becomes collateral under the Deed of Trust (security instrument).

The Deed of Trust has 3 parties:

1) The Trustor (borrower who puts up the house)

2) The Beneficiary (lender who lent the purchase money)

3) The Trustee (the person the Beneficiary designates to sell the collateral if the loan is not repaid.)

When Betty Borrower finishes paying off her loan, Wells Fargo Bank must notify the Trustee that the loan is paid off, and complete the “Request for Reconveyance”, which is typically the lower portion of the Deed of Trust (usually not recorded).

California Civil Code section 2941 (b)(1) requires the beneficiary, upon payoff, to “execute and deliver to the trustee the original note, deed of trust, request for a full reconveyance….” The trustee then executes and records the full reconveyance within 21 days of receipt of the documents from the beneficiary, delivers a copy of the reconveyance to the beneficiary and, upon request, delivers the original note and deed of trust to the trustor. (Civ.Code § 2941, subd. (b)(1)(A)-(C).)

What happens if the Trustee or the Benficiary does NOT do this? The statute provides two backup methods to help the owner clear title to their property. First, upon request by the trustor, the beneficiary must substitute itself in as trustee and execute a full reconveyance. (Civ.Code § 2941, subd. (b)(2).) Second, if neither the trustee nor the beneficiary has executed the full reconveyance within 75 calendar days after the loan payoff, “a title insurance company may prepare and record a release of the obligation” after giving notice of its intent to do so to the trustor, trustee, and beneficiary. “The release issued pursuant to this subdivision shall be entitled to recordation and, when recorded, shall be deemed to be the equivalent of a reconveyance of a deed of trust.” (Civ.Code § 2941, subd. (b)(3)(B).)

Are there any teeth to this provision? Not really.

Section 2941(d) states “The violation of this section shall make the violator liable to the person affected by the violation for all damages which that person may sustain by reason of the violation, and shall require that the violator forfeit to that person the sum of three hundred dollars ($300).”

Obviously $300 is not a big penalty for the violation. Establishing the damages from the delayed recording then becomes the more crucial factor. In today’s market of falling interest rates, there is probably a stronger likelihood that Betty Borrower can show some damages due to the inability to refinance at a lower interest rate or take out money of the property—but those types of damages can be difficult to prove beyond speculation.

More crucially, this statute only has 1 year statute of limitations, which means that Betty Borrower has very limited time to file suit against the Trustee and/or Beneficiary. [ Prudential Home Mortgage Co. v. Superior Court (1998) 66 Cal.App.4th 1236.]

Ultimately, we have found that clients with this issue have more success after an attorney has worked his or her way up the food chain at a title company to prepare and record the release. Title companies earn revenue by selling insurance and performing a function like this, while part of their duties, does not necessarily earn them any income so working with them can be time consuming. This time delay is further exacerbated by the fact that over the years, many title companies have merged, gone bankrupt or simply changed names thereby making it difficult to track them down. Betty Borrower will be best served if she finds legal assistance early as opposed to waiting until she is trying to sell the property and close escrow in a rush.

Latest Posts

Out of Contract? Not So Fast…

In the highly-competitive real estate market in California, agents are being more aggressive in enforcing contract terms. So before you tell your client that you are “out of contract”, you might want to be sure the contract is actually cancelled! [Read More]

What a Three-Day Notice to Pay Rent or Quit Really Means

It is after Labor Day weekend and that means school supplies, summer vacation credit card bills, and preparing for the holidays. With all these added costs, the tenant may not have enough money to pay rent and the landlord serves [Read More]

Can A Buyer Back Out of a Non-Contingent Offer?

In my last article, we discussed liquidated damages in the context of a residential real estate purchase contract. This article will examine whether a buyer may have a right to back out of a contract and receive their full deposit [Read More]

Peter N. Brewer, Esq.

Subscribe to our newsletter.

Keep up with the pulse of real estate law by subscribing to our monthly e-mail newsletter.

- Stay Connected

- LEGAL GLOSSARY

More results...

- Browse By Topic – Start Here

- Self-Help Videos

- Documents & Publications

- Find A Form

- Download E-Books

- Community Organizations

- Continuing Legal Education (MCLE)

- SH@LL Self-Help

- Free Legal Consultation (Lawyers In The Library)

- Ask a Lawyer

- Onsite Research

- Interlibrary Loan

- Document Delivery

- Borrower’s Account

- Book Catalog Search

- Passport Services

- Contact & Hours

- Library News

- Our Board of Trustees

- My E-Commerce Account

SacLaw Library

Www.saclaw.org, documentary transfer tax, identifying grantors and grantees.

- Free Sources

- Community Resources

Adding or Changing Names on Property (Completing and Recording Deeds)

Templates and forms.

Warning about adding names

- If you are adding someone as part of a credit repair or loan deal, it may be a scam .

- If you add a name or sign a quitclaim deed, the grantee becomes an owner . You can’t change your mind without their signature.

- If you are adding an heir, you could use a living trust or Transfer on Death Deed instead of making them a joint tenant. This can avoid probate without giving up ownership while you are alive.

Any time owners make a change to the title of real estate, they must record a deed with the County Recorder. This Step-by-Step guide outlines the requirements and provides samples with instructions.

Related Guides

PCOR Tips: All recorded forms must be accompanied by a PCOR (Preliminary Change of Ownership Report). This guide has links to the form and tips on filling it out.

Affidavits of Death: If you are transferring Joint Tenancy property, Community Property with Rights of Survivorship, or Transfer on Death Deed property because someone has died, use the Affidavits of Death guide instead of this one.

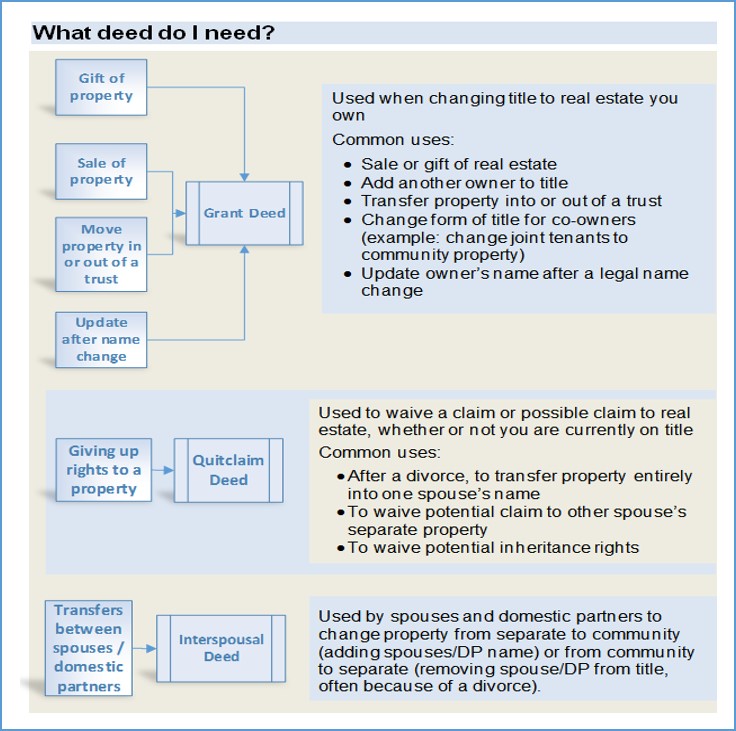

Types of Deeds in California

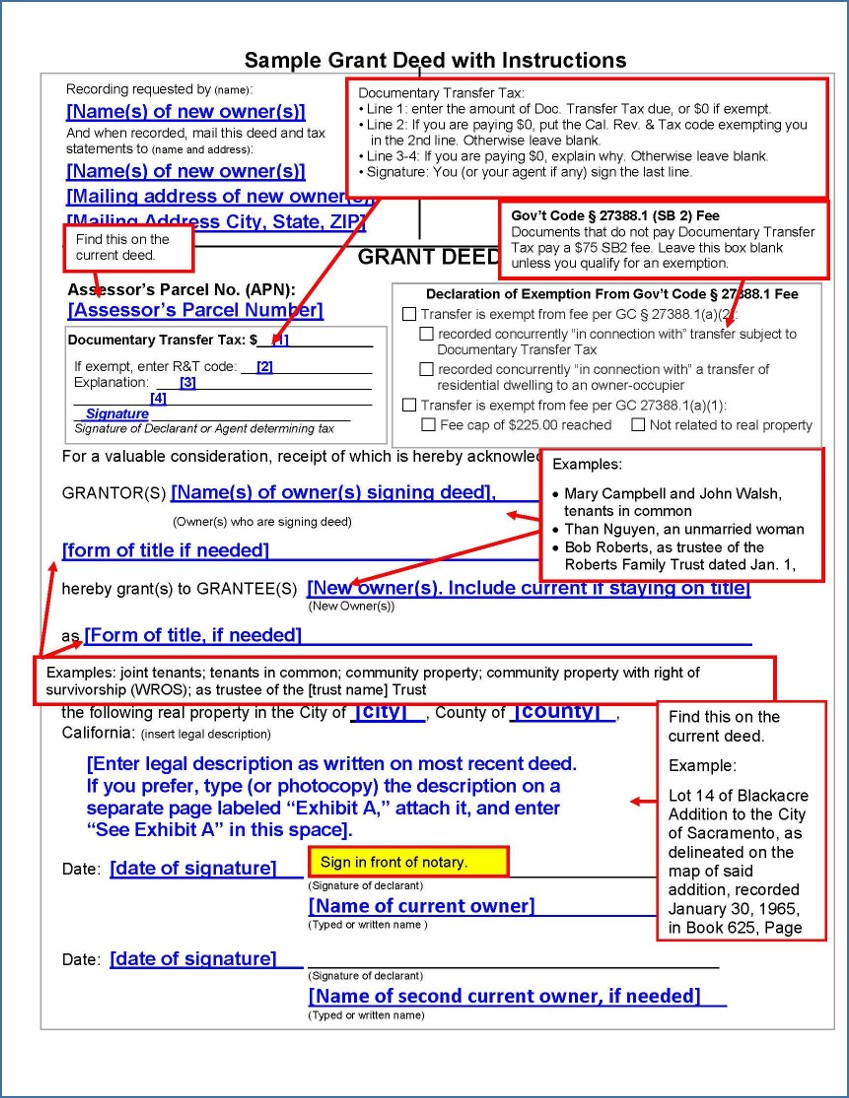

California mainly uses two types of deeds: the “grant deed” and the “quitclaim deed.” Most other deeds you will see, such as the common “interspousal transfer deed,” are versions of grant or quitclaim deeds customized for specific circumstances. Since the interspousal deed is so commonly requested, we are including a sample in this guide.

A grant deed is used when a person who is on the current deed transfers ownership or adds a name to a deed. The grantor(s) promise that they currently own the property and that there are no hidden liens or mortgages.

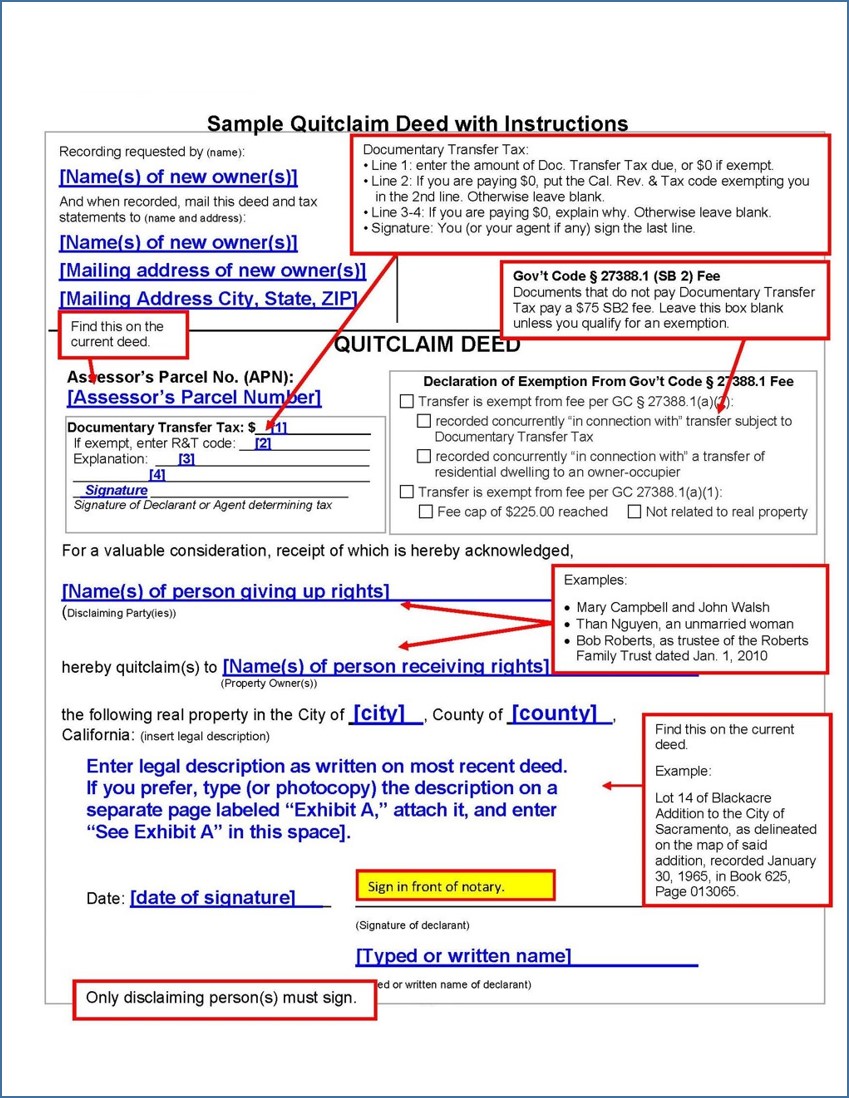

Quitclaim deed

A quitclaim deed (sometimes misspelled “quick claim”) is used when someone gives up (waives or disclaims) ownership rights in favor of another person. The grantor may or may not be on the current deed. A quitclaim deed is often used in divorces or inheritance situations, when a spouse or heir gives up any potential rights to real estate. The grantor is giving up their own rights, if any, but not promising anything else.

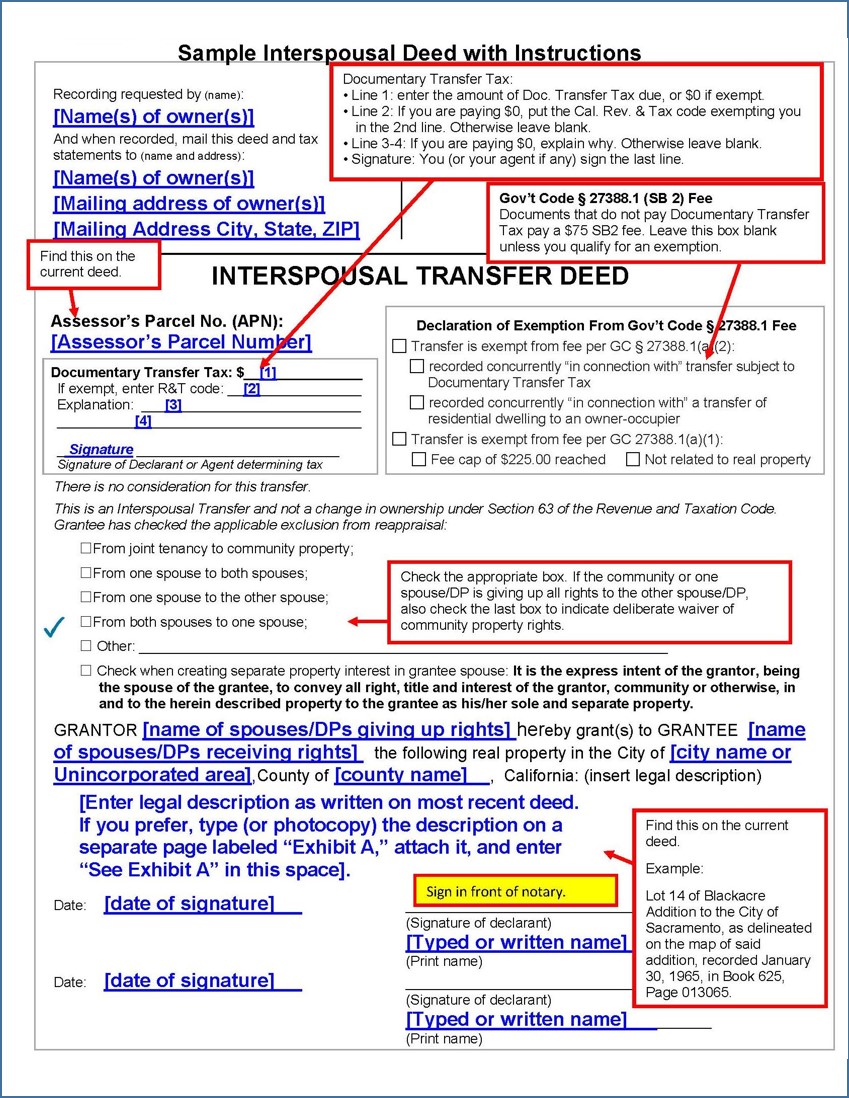

Interspousal deed

An interspousal deed is used between spouses or registered domestic partners (“DP”) to change real estate to or from community property. Spouses/DPs can use grant or quitclaim deeds to do the same things, but the interspousal deed makes it clear that the transaction is intended to affect community property rights.

The deed I need is not on your list!

There are many other types of deeds, such as warranty deed, joint tenancy deed, easement deed, trust deed, etc. In some states, these may be considered separate deed types, but in California, these are usually just customized grant deeds.

In a warranty deed, the grantor promises to pay for any lawsuits or damages due to undisclosed ownership disputes. In California, title insurance usually covers such disputes.

Other types of deeds, such as joint tenancy deeds, corporation deeds, easement deeds, or mineral rights deeds, can be created by customizing our grant deed format by downloading the RTF (word) version from our website. Consult an attorney or come to the Law Library to research appropriate wording.

Step by Step Instructions

Locate the current deed for the property.

You will need information from the current deed. If you need a copy of the current deed, contact the Recorder’s Office where the property is located. In Sacramento, call (916) 874-6334.

Determine What Type of Deed to Fill Out for Your Situation

To transfer ownership, disclaim ownership, or add someone to title, you will choose between a “grant deed” and a “quitclaim deed.” Spouses/domestic partners transferring property between each other may choose an “interspousal deed.”

Here is a flow chart to help you choose:

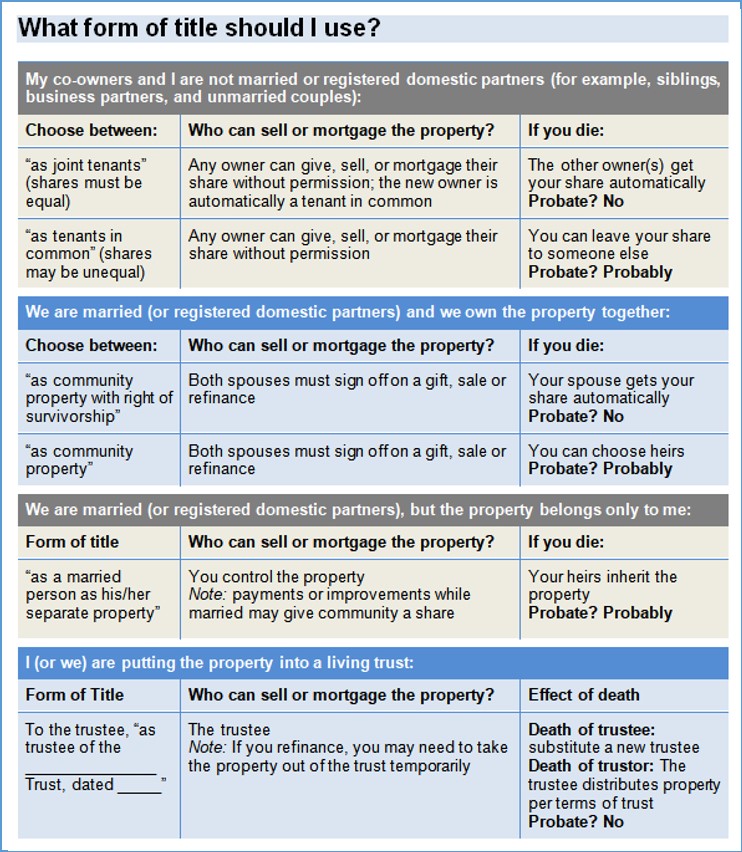

Determine How New Owners Will Take Title

If there is more than one new owner, you are moving the real estate into or out of a trust , or the new owner is married, the form of title can have important effects.

One, unmarried owner: leave blank

If there is only one new owner, and that person is unmarried, title can usually be left blank, although it doesn’t hurt to state something like “a single person” or “a widow” or the like.

More than one owner, owners not married: “Tenants in common” or “joint tenants”

- “Tenants in common” (When one dies, their heirs get their share; probate may be needed. Shares do not need to be equal. Any owner can sell or mortgage their portion.)

- “Joint tenants” (When one owner dies, the other(s) gets their share automatically. Shares must be equal. Any owner can sell or mortgage their portion, but it turns the title into tenants in common.)

If you leave this blank, the default is “tenants in common.”

Examples: siblings who inherit property together, business partners, couples who are not married or registered domestic partners (DP).

Owners are married couple: “Community property,” “community property WROS,” or “joint tenants”

- “Community property” (Both must agree to sell or mortgage the property. At death, a share goes to the surviving spouse/DP and another share to heirs. This will probably require at least a summary probate.)

- “Community property with rights of survivorship (WROS)” (Both must agree to sell or mortgage the property. At death, 100% goes to surviving spouse/DP, with no requirement of probate.)

- “Joint tenants” (When one dies, the other(s) gets 100%. Shares must be equal. Either spouse/DP can sell their portion. May receive less favorable tax treatment when first spouse/DP dies.)

If you leave the title line blank, or fill in something like “as husband and wife” or “as domestic partners,” it will be treated as “community property” and a share will go to any heirs instead of all to the surviving spouse/DP.

Owner is married, but property not shared: “as sole and separate property”

If only one spouse/DP owns the property (because that person already owned it when they got married, or it was a gift or inheritance), they can make that clear by using the phrase “a married man/woman/person as his/her/their sole and separate property.” Note : if any money earned during the marriage is spent to purchase, make mortgage payments, maintain, or improve the house, the community owns a share regardless of what it says on the deed.

Property is being transferred into or out of a trust

Many couples use trusts to hold their property. The contents of a trust are technically owned by the trustees. Therefore, when transferring property into a trust, the grantees are the “[name of trustees], as trustees of the [name of trust] dated [date trust was signed].”

When transferring property out of a trust, the grantors are the trustees, identified the same way.

See “ Forms of Title for Multiple Owners ,” below, for examples of how these are entered onto the deed.

Your choice of title can have many effects later, such as when you sell or refinance, if one owner falls into debt, if one owner dies, or if a couple divorces. Some examples of potential effects are:

- reassessment of property raising annual property taxes (since 2022, parent-child transfers are no longer always immune);

- higher capital gains taxes when an owner sells;

- how the property is divided in a divorce;

- whether the property can be liened or foreclosed on for one of the owners’ debts;

- ineligibility for benefits such as Medi-Cal;

- difficulty refinancing if one owner has bad credit;

- lack of eligibility for a reverse mortgage.

If you have questions about which form of title to use, talk to a family or estate lawyer or research your options at the law library.

Fill Out the New Deed (Do Not Sign)

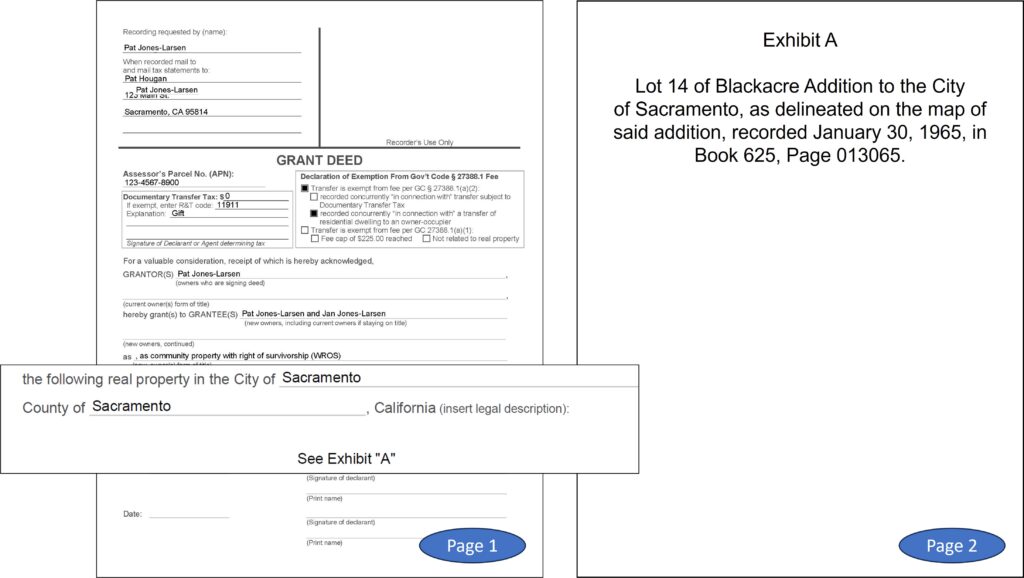

You will find filled-out samples of each type of deed at the end of this guide.

The deed can be filled out online, typed, or neatly written in dark blue or black ink. You will need the following information:

- Assessor’s Parcel Number. (Find this on the current deed.)

- Document Transfer Tax amount or exemption code. (Calculate 1.1% of current market value, or enter applicable exemption.)

- Names of “grantors” (the current owner(s) signing the deed) or of the disclaiming party(ies). (Enter the name(s) as spelled on the current deed.)

- Names of “grantees.” (Enter all the intended owners, including any current owners who will still own the property). Important: If you add a name, that person legally becomes an owner. You cannot change your mind without their signature.

- Form of title the grantee(s) will use. (If no form of title is entered, this will be “tenants in common” for unmarried owners or “community property” for married couples.)

- The legal description of the property. (Find this on the current deed.)

Grantor(s) Sign in Front of a Notary

The notary will charge a fee for this service. You can find notaries at many banks, mailing services, and title companies.

The new owners do not need to sign.

Fill Out the Preliminary Change of Ownership Report (PCOR)

The PCOR is required when property changes hands, to update the tax records. Turn it in at the Recorder’s Office along with the deed. You can download a Sacramento version of the PCOR from Cal Assessor e-Forms. Each county has its own version; contact the assessor’s office in the county where the property is located to obtain the proper form.

Record the Deed and File the PCOR at the Recorder’s Office

The Recorder’s Office charges a recording fee (currently $20/first page plus $3 for additional pages). Current Sacramento fees are available at the County Clerk/Recorder’s website . You may also need to pay the Documentary Transfer Tax or a $75 “Building Homes and Jobs Act” fee.

File Reassessment Exclusion Claim, if any, at the Assessor’s Office

When property changes hands, it is reassessed for tax purposes, often causing a sizeable increase in property tax for the new owner.

Certain transfers are excluded from reassessment, including:

- Parent to child or child to parent (“Prop 58 Exclusion” for deaths before 2/15/2022, “Prop 19 Exclusion” for deaths after 2/15/2022)

- Grandparent to grandchild (but not vice versa) (“Prop 58 Exclusion” for deaths before 2/15/2022, “Prop 19 Exclusion” for deaths after 2/15/2022)

- Transfers between spouses or registered domestic partners during marriage or as part of a property settlement or divorce

- Changes in method of holding title that do not change ownership interests (for instance, changing joint tenants into tenants in common)

If your transfer is excluded from reassessment, you may need to file a claim with the County Assessor. For more information in Sacramento, call the Assessor’s office (916‑875-0750) or visit the Sacramento Assessor’s office website .

Common questions when filling out deeds

Some parts of deeds often need more explanation.

When property changes hands, the county charges a one-time tax of $.55 per $500 of the value of the real estate (1.1%). Some kinds of transfers are exempt. If yours is exempt, enter the Revenue and Taxation code that provides the exemption, and an explanation, then sign. If yours is not exempt, calculate the dollar amount and write it in.

Common exemption codes and explanations:

- Gift (transferring property, or adding name to property, without compensation) : Code: “R&T 11911” Explanation:“Gift.”

- Living Trust (transfer into or out of revocable living trust): Code: “R&T 11930” Explanation: “Transfer into or out of a trust”

- Name Change (confirming name change after marriage or court-ordered name change): Code: “R&T 11925” Explanation: “Confirming change of name, the grantor and grantee are the same party.”

- Conveyances in dissolution of marriage: Code: “R&T 11927” Explanation: “Dissolution of marriage.”

Other exemptions may be available. See the list of “Transfer Tax Exemptions” on the Sacramento Recorder’s website.

Building Homes and Jobs Act Fee (SB 2)

There is an additional $75 fee on mortgage refinances and other real estate transactions that are exempt from Documentary Transfer Tax. Some exceptions apply. Contact your county recorder’s office to determine the total amount you will need to pay.

Grantor(s): The current owner or person transferring the property rights or part of the property rights. This is the person or people who will sign this deed.

Grantee(s) : List all people who are receiving property rights from the grantor(s). If the grantor is staying on title, be sure to list the grantor’s name as one of the grantees also.

It’s often helpful to include the grantors’ and grantees’ marital status.

Forms of Title for Multiple Owners

When there is more than one grantee, you will need to specify the form of title. It can also be helpful to do that if a grantee is a married person or domestic partner.

Here are examples of common title phrases:

- One owner, not married: generally no form of title is needed.

- John Doe, A 50% interest, Jeffrey Doe, a 25% interest, and Paula Smith, a 25% interest, as tenants in common

- John Doe, Jeffrey Doe, and Paula Smith, as joint tenants

- Pat Jones-Larsen and Jan Jones-Larsen, as community property

- Pat Jones-Larsen and Jan Jones-Larsen, as community property with right of survivorship (WROS)

- Pat Jones-Larsen, a married person, as their sole and separate property

- Janet and Lewis Campbell, as trustees of the Campbell Family Living Trust, dated January 3, 2017

- Elm Street Books, a partnership

- Janet Smith and Mark Baker, a partnership

- Acme, Inc., a Delaware corporation

- Initech, LLC, a California Limited Liability Company

Here is a quick reference chart comparing common forms of title.

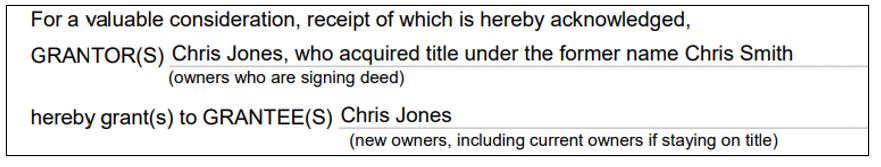

Name Changes: Updating Title after Changing Your Name

If you change your name (by court-ordered name change, marriage, or divorce), deeds made out to your old name should be updated. Make out a new grant deed from yourself ([new name], who acquired title under the former name [old name]) as Grantor to yourself ([new name]) as Grantee. For example:

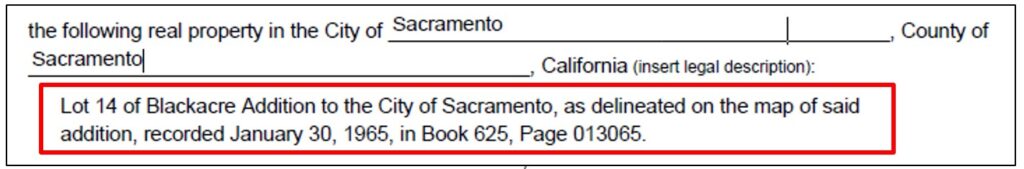

Legal Description

This is the full description of the property, not just the address. It may be brief or very long and full of legalese. It must match the current deed exactly .

You may want to photocopy the legal description and attach it to the new deed as an exhibit, especially if it is too long to fit on the page.

For More Information

Sacramento County Clerk-Recorder’s Office Sacramento County Assessor’s Office :

- Change in Ownership Reassessment Exclusions

- Proposition 19 (Changes to Parent/Child and Grandparent/Grandchild Exclusions)