- How It Works

- Sample NDA Template

- Non-disclosure (NDA)

10 Key Clauses to Have in Non-Disclosure Agreements

Non-disclosure agreements (NDAs) have become so commonplace in business transactions that they almost seem generic and clichéd, causing many business professionals to neglect their true significance.

To make matters worse, of those who want to use one, few understand how to do so correctly so the drafted agreement often ends up being weak and ineffective , if not worthless and outright void .

Despite its bad reputation, however, an NDA is a crucial legal document, essential to the protection of any legitimate company or business owner. In fact, neglecting to implement this kind of well-written legal agreement can cause your business considerable harm.

In an effort to bring some love back to this overlooked and habitually misused agreement, we’ve taken the liberty of highlighting its importance here and revealing the 10 key clauses needed to make your non-disclosure agreement worth more than just the paper it’s written on.

The importance of signing non-disclosure agreements

First, to address the growing notion that NDAs are irrelevant, I say to you this: ideas are the foundation of all trade, are they not?

Without an idea , you have no industry. Without an industry, you have no business. In fact, for most companies, their net worth is entirely wrapped up in their patents, trademarks, designs, systems, processes, trade secrets and clientele base. Money follows unique ideas and their results.

Second, I address the sad fact that NDAs, when used, are far too often done so incorrectly .

Remember, an NDA is simply an agreement wherein two or more parties agree to keep certain privileged information confidential or secret. This kind of legal agreement can be a mutual or one-way agreement, but always the main goal is to protect information or trade secrets that are critical to a company’s success.

In order for this kind of legal agreement to effectively protect your confidential information, however, it has to be a well-written, legitimate and compelling agreement. In other words, if it won’t stand up in court, then what’s the point?

On that note, let’s go over the 10 key clauses you should have in every non-disclosure agreement.

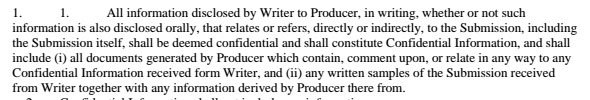

Clause #1: Definition of Confidential Information

Without a doubt, the most critical component of a non-disclosure is the definition of the confidential information.

This clause clearly spells out what information is not to be disclosed. This is the whole point of the agreement right here.

Here’s an example of this kind of clause from Sonnyboo Non-Disclosure Agreement where it basically states that all information disclosed by the writer to the producer is confidential:

And as simple as it sounds, far too many agreements have ambiguous definitions which don’t hold up so well in court.

Included in this type of clause should be specifications about what constitutes “ privileged ” information, as well as an explanation of which formats are covered.

In other words, cover all your bases and specify that information shared through documents, emails, oral conversations, hand-written notes, letters, etc. is all included.

If you’re the Disclosing Party in the agreement, you want to cast a wide net, but not leave any holes.

Clause #2: The Parties

Besides the obvious need to define the Disclosing and the Recipient parties, a non-disclosure should also contain a clause that specifies who else the Recipient Party may disclose the confidential information to during the course of due diligence and business discussions.

For example, the Recipient Party may have their own accountants and attorneys who may need to review the information.

Or, they may contract a third-party to perform some work, such as a graphic designer, editor, developer, etc. These third-party recipients of your confidential information are critical to the performance of this legal contract and should be included in the non-disclosure.

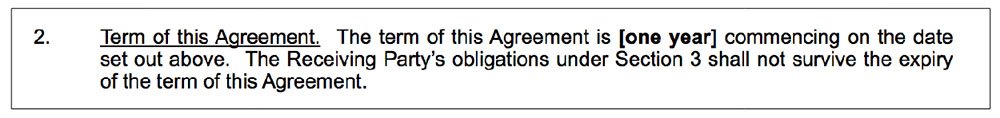

Clause #3: The Terms and Duration

Every non-disclosure agreement should have a clearly defined timeframe .

When does the agreement end and for how long does the confidential information need to stay confidential?

There’s no standard time-limit for these agreements, as each situation is unique. Some trade secrets may be just as crucial 10 years from now as they are today, so specify that in the agreement.

Other details, however, may be irrelevant in 18 months and the agreement should reflect that as well.

Under this type of clause, it’s important to keep in mind that most jurisdictions won’t enforce unrealistic time limits on any legal agreement, including non-disclosures.

While you want to protect your business and the information you’re about to disclose, you also have to be practical and fair to the receiving party.

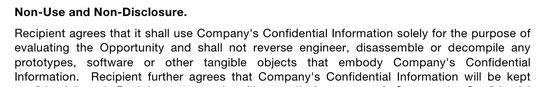

Clause #4: The Permitted Use of the Information

This clause is where you need to clearly define the intended use of the shared, confidential information.

In other words, why are you sharing this information with the Recipient Party in the first place? Be specific. Sometimes this clause is also used to define third parties, but we prefer to keep those separate for clarity’s sake.

For example, a standard non-disclosure agreement often includes this type of clause like this:

Clause #5: The Legal Obligation to Disclose

Even the most careful and reliable of Recipients to confidential information may, at some point, be legally compelled to disclose the information they agreed to keep confidential under this type of agreement.

This may come from a government agency, administrative entity or via the courts.

To protect both parties – the Disclosing and the Recipient – in these kind of instances, your non-disclosure should include a clause acknowledging that a legal obligation to disclose is not a violation of the agreement.

However, as the Disclosing Party (the party that discloses the information to another party), you also want to include verbiage stating that the Recipient Party (the party that receives the information), if compelled to disclose, will only disclose the information that’s absolutely necessary and that they’ll notify you if such a demand occurs.

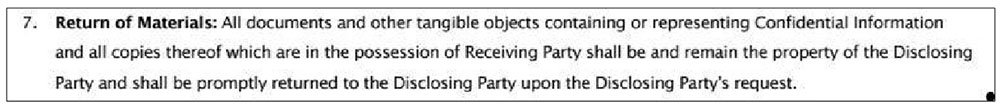

Clause #6: The Return of the Information

At the end of the agreement, the confidential information typically needs to be returned or destroyed by the Recipient Party.

Your non-disclosure should contain a clause stipulating exactly how and when this should occur. This can largely depends on the circumstances of your relationship.

Due to the advent of hard drives, drop boxes, thumb drives, email storage, etc. it’s nearly impossible to completely destroy or return every bit of information that’s shared electronically.

But this type of clause would inform the Recipient Party that all received information must be returned or deleted. If the information is difficult to erase, the clause can include verbiage to prevent the Recipient Party from using the information in the normal course of business or sharing it in the future.

Clause #7: The Jurisdiction

Even the most diligent and thorough of contracts can’t prevent every possible conflict between business parties. Breaches occur and misunderstandings happen.

You want to be prepared for this unfortunate event by including a clause in your non-disclosure that specifies which court has jurisdiction over any resulting legal action.

Believe it or not, arguments about jurisdiction can become just as big as whatever disagreement started the legal action in the first place. Avoid this non-sense by affirming jurisdiction in the agreement.

Clause #8: The Remedies

Along the same lines as the Jurisdiction clause explained above, your agreement should also include a clause that specifies the acceptable remedies in the case of a breach from the Recipient Party’s part.

The costs of a breach can be hard to calculate or prove, so a mutual agreement up front as to what constitutes a fair remedy will help you avoid a lengthy legal battle later on.

This clause should include the possible consequences of a breach and explicitly preserve your right as the Disclosing Party to seek equitable remedies.

Remember that this clause should be a mutually agreeable one so be careful to avoid being too specific, excessive in your remedy requirements or one-sided when it comes to possible resolutions. If it’s too biased, the Recipient Party may be hesitant to sign the agreement as well.

Clause #9: Responsibility over Legal Fees

Many in the legal world frown upon clauses that specifically award attorney’s fees or punitive damages to the Disclosing Party, should they prevail in case of a breach of contract.

The argument is that such a clause renders this kind of legal agreement partial to the Disclosing Party and gives them too much incentive to file suit, even for the most trivial of matters.

With that in mind, it’s best to have a mutually agreeable clause that clearly defines who will be responsible for legal fees should a suit be filed. Even if that means clarifying that each party will be responsible for their own fees , regardless of the outcome. The point is to have that discussion up front and make sure everybody is on the same page.

Clause #10: The No Binding

Last, but certainly not least, no non-disclosure should be complete without a non-binding clause .

Because these agreements are often initiated prior to negotiations for a merger, partnership, temporary project, or other similar collaboration, it’s important to include a non-binding clause which allows both parties to terminate the relationship at any point.

In other words, the signing of a non-disclosure agreement generally doesn’t signify a permanent relationship and you should preserve your right to withdraw from the relationship at any point you see fit, provided you abide by any relevant laws or contractual stipulations (the terms in your agreement) when doing so.

Here’s what a standard “ No Obligation ” clause will look like:

At the end of the day, when non-disclosure agreements are used properly, they protect confidential information, keep trade secrets, and preserve the unique aspects that make your business work.

A well-written NDA will cast a broad net for the Disclosing Party and close any potential loopholes while still retaining a respectable level of fairness and value for the Recipient Party.

Credits: Icon Bulleted List by Travis Avery from the Noun Project.

Nov 16, 2017 | Non-disclosure Agreements

This article is not a substitute for professional legal advice. This article does not create an attorney-client relationship, nor is it a solicitation to offer legal advice.

Search our blog

More legal articles from EveryNDA

What’s a Non-Use Agreement

Beware: Residuals Clauses in your NDA

NNN Agreements – Beware the traps for the unwary

Separate agreement or just a clause

How many pages long should my NDA be?

The Right Time to Use NDAs

EveryNDA © 2024

Disclaimer: Legal information is not legal advice, read the disclaimer .

Privacy Policy — Terms of Use

- Platform Overview All-in-one legal research and workflow software

- Legal Research Unmetered access to primary and secondary sources

- Workflow Tools AI-powered tools for smarter workflows

- News & Analysis Paywall-free premium Bloomberg news and coverage

- Practical Guidance Ready-to-use guidance for any legal task

- Contract Solutions New: Streamlined contract workflow platform

- Introducing Contract Solutions Experience contract simplicity

- Watch product demo

- Law Firms Find everything you need to serve your clients

- In-House Counsel Expand expertise, reduce cost, and save time

- Government Get unlimited access to state and federal coverage

- Law Schools Succeed in school and prepare for practice

- Customer Cost Savings and Benefits See why GCs and CLOs choose Bloomberg Law

- Getting Started Experience one platform, one price, and continuous innovation

- Our Initiatives Empower the next generation of lawyers

- Careers Explore alternative law careers and join our team

- Press Releases See our latest news and product updates

- DEI Framework Raising the bar for law firms

- Request Pricing

Confidentiality and Nondisclosure Agreements Explained

August 9, 2023

In a confidentiality or non-disclosure agreement, parties agree to keep private nonpublic information received during a business relationship, including in the early stages of exploring a potential business relationship. The need for confidentiality and non-disclosure agreements arises in a wide variety of contexts, including mergers and acquisitions, joint ventures, sales and services, employment, and intellectual property licensing.

Once parties have established an ongoing business relationship, non-disclosure provisions are often negotiated and incorporated into the relevant transaction documents, which may replace stand-alone agreement, and are incorporated into the larger contract management workflow for the remainder of the contract lifecycle.

This article outlines essential information regarding confidentiality and non-disclosure agreements, including a succinct definition, the differences and scope of these agreements, and a downloadable confidentiality agreement template .

What is a confidentiality agreement?

Confidentiality agreements protect parties entering into business relationships or transactions that require the exchange of sensitive, private information otherwise inaccessible to third parties. Confidential information is the heart of any confidentiality agreement. For the agreement to adequately protect against unwanted disclosure, the parties must clearly describe the information or types of information they wish to protect and the scope of each party’s non-disclosure obligation.

The provider of confidential information typically wants to define its confidential information as broadly as possible to include all material shared with the recipient. The recipient, on the other hand, must be careful to carve out any information from the definition that the recipient may later be legally required to disclose; otherwise, the recipient risks choosing between breaking the law and breaking its confidentiality obligation.

Parties may also wish to expressly carve out personal data from the definition of confidential information and negotiate separate terms that govern the use and protection of such data, as applicable privacy and data security laws tend to be much stricter than general confidentiality requirements.

Is a non-disclosure agreement the same as a confidentiality agreement?

Non-disclosure agreements (NDAs) and confidentiality agreements are both legal contracts between two or more parties that specify the criteria for maintaining the confidentiality of certain information. Whereas NDAs are often used in business and legal settings to protect trade secrets, client lists, and financial data, confidentiality agreements are typically devised in employment or personal situations to protect sensitive information.

Confidentiality and non-disclosure agreements typically:

- Describe the context for the parties’ agreement, referencing any related transactional documents.

- Define the specific information to remain confidential.

- Outline the parameters for the parties’ use of confidential information.

Do confidentiality agreements expire?

Most confidentiality and non-disclosure agreements provide a specific term of non-disclosure (e.g., one to three years). Some confidentiality and non-disclosure agreements, on the other hand, are open-ended in duration, although they will not be legally enforceable to the extent the confidential information becomes public. Because a confidentiality or non-disclosure covenant will not be enforceable if the confidential information enters the public domain, parties often qualify that the confidentiality obligation applies only while the information remains nonpublic.

Having a reasonable duration is particularly important in employment-related agreements. Employers must balance their legitimate business need for confidentiality against employees’ rights to engage in protected concerted activity, such as discussing the terms and conditions of their jobs. For example, the duration of employees’ confidentiality obligations related to an internal investigation may be deemed as overly restrictive if it exceeds the duration of the investigation. In addition, various states have laws that limit the ability of employers to require their employees to sign non-compete agreements , which are generally used to prevent the use of information or know-how by former employees in a way that may unfairly benefit a competitor.

What are the limits of confidential information?

Confidentiality and non-disclosure agreements may include a unilateral covenant governing one party’s access to and use of confidential information, or they may contain mutual obligations of the parties to keep each other’s confidential information private. The typical confidentiality obligation imposes a duty to use confidential information only for its intended purpose. The agreement may allow limited disclosure of confidential information to designated agents or advisers if these third parties are made aware of the duty of confidentiality and acknowledge their duty to observe it. The duty of confidentiality generally requires the non-disclosing party to keep the information secure, exercising the same level of care as that used for its own confidential information. A confidentiality or non-disclosure agreement may prohibit confidential information from being copied and may require confidential material to be returned or destroyed when no longer needed or the agreement is terminated.

A standstill provision prevents the party receiving confidential information of a company from engaging in a hostile acquisition transaction or taking steps towards a hostile acquisition transaction for a period (often one to three years) or, if applicable, for so long as the recipient party holds at least a certain percentage of that company’s shares (typically 5%).

As an example, standstill provisions are common in private investments in public equity (PIPE) transactions when PIPE investors receive material confidential information, or in acquisition transactions when acquirers receive confidential information, in each case prior to the parties entering into definitive transaction documents. The recipient party may argue that a standstill provision isn’t necessary due to the restrictions placed on its use of confidential information. However, the party providing confidential information may argue that it is easier to prove that a standstill provision has been breached than it is to prove that its confidential information was wrongfully used in formulating the terms of a hostile transaction.

Equitable relief

Confidentiality and non-disclosure agreements frequently provide that money damages alone are an inadequate remedy for breach of the agreement, so equitable relief (including injunctions) is deemed the more appropriate enforcement mechanism.

How do you write a confidentiality agreement?

[Download this sample mutual non-disclosure and confidentiality agreement that can be adapted for your individual needs.]

Confidentiality agreement template

A reciprocal, or “mutual,” non-disclosure and confidentiality agreement (also commonly titled simply a “non-disclosure agreement” or a “confidentiality agreement”) provides protection to individuals and companies from the misappropriation or unauthorized disclosure of information revealed in confidence or for a limited purpose. It is used in situations where both parties to an agreement contemplate disclosing company-private information in connection with a commercial opportunity, collaboration, or proposed transaction. Download the full confidentiality agreement sample here.

WHEREAS , the Parties desire to explore further potential opportunities or transactions involving [Describe Opportunity or Transaction Generally] (the “ Purpose ”);

WHEREAS , in connection with such [Purpose] [proposed commercial relationship], each of the Parties wishes to receive a disclosure of valuable proprietary or confidential information of the other, and is willing to ensure that such information will be treated as confidential and used only as permitted by the terms of this Agreement.

NOW THEREFORE , in consideration of the mutual covenants, promises, representations, and warranties contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Definitions

For purposes of this Agreement, the following terms shall have the meanings set forth below:

1.1 “ Affiliate ” means with respect to any entity, any other entity that controls, is controlled by or is under common control with such first entity.

1.2 “ Confidential Information” means information furnished by the disclosing party, whether orally, in writing, electronically, in other tangible form or format, or through or by observation, and identified as confidential or proprietary or otherwise disclosed in a manner such that a reasonable person would understand its confidential nature.

(a) Confidential Information includes, without limitation,

(i) information that is related to products, product plans, services, service plans, market studies, reports, documentation, drawings, computer programs, software code (object or source codes), inventions (whether patentable or not), concepts, designs, flow charts, diagrams, product specifications, formulas, data, schematics, customer and supplier lists, price lists, designs, creations, models, business materials, work-in-progress, methods of manufacture, technical information, know-how, improvements, and Trade Secrets (as defined in Section 1.4 below);

(ii) all information relating to the disclosing party or the business, business plans, markets, condition (financial or other), operations, assets, liabilities, results of operations, forecasts, strategies, cash flows or prospects of the disclosing party (whether prepared by the disclosing party, its advisors or otherwise), historical or projected financial statements, budgets, sales, capital spending budgets, plans, or identities of key personnel; and

(iii) any information about or concerning any third party (which information was provided to the disclosing party subject to an applicable confidentiality obligation to such third party) in each case disclosed or furnished by or on behalf of the disclosing party before, on or after the date hereof, whether or not marked or designated as confidential or proprietary.

(b) Notwithstanding the foregoing, information shall not be considered Confidential Information for purposes of this Agreement, which can conclusively be demonstrated by independent written files or records if:

(i) the receiving party or its Affiliates already possess the information without an obligation of confidentiality at the time of disclosure;

(ii) the information is or becomes generally available to the public other than as a result of an unauthorized disclosure of such information or a violation of this Agreement by the receiving party or its Affiliates;

(iii) the information has been or is made available to the receiving party or its Affiliates by a third party that, to the receiving party’s or its Affiliates’ knowledge, is not under an obligation of confidentiality to the disclosing party or its Affiliates; or

(iv) the information is independently developed by the receiving party or its Affiliates without violating any obligations in this Agreement.

1.3 “ Records ” or “ records ” means and includes writings, spreadsheets, presentations, web pages, emails, voicemails, drawings, graphs, charts, photographs, sound recordings, optical or magnetic disks, and data compilations in whatever form recorded or stored from, which information can be obtained and/or translated, if necessary, into reasonably usable form, and any reproductions thereof.

1.4 “ Trade Secret(s) ” means any information (a) that is actually secret; (b) where the disclosing party has taken reasonable measures to maintain its secrecy; and (c) where independent economic value is derived from that secrecy.

2. Mutual obligations of confidentiality and non-disclosure

For a period of [Number (#)] years following the disclosure of Confidential Information, and for an indefinite period of time following the disclosure of Trade Secrets, the receiving party shall:

2.1 receive and hold the Confidential Information in strict confidence;

2.2 take such steps as may be reasonably necessary to prevent the disclosure of Confidential Information using not less than the same degree of care that the receiving party uses to prevent the unauthorized use, dissemination, or publication of its own most valuable confidential and proprietary information (but with at least the same degree of care used by a reasonably prudent business person);

2.3 not disclose such Confidential Information to any third party for any purpose whatsoever without (a) the prior written approval from the disclosing party; and (b) the agreement on the part of such third party to be bound by the restrictions on use and non-disclosure set forth in this Agreement; provided, however, that the receiving party may disclose Confidential Information to the receiving party’s Representatives (as defined herein), who are bound by the confidentiality and use provisions of this Agreement;

2.4 not permit access to the Confidential Information to anyone other than employees, officers, directors, advisors, and consultants of the Parties or their Affiliates (collectively, the “ Representatives ”) and then, only to the extent those individuals (a) need to know the Confidential Information to carry out the Purpose; (b) are informed by the receiving party of the confidential nature of the Confidential Information; and (c) are bound by the terms of their employment or engagement to treat the Confidential Information in a manner consistent with the terms of this Agreement;

2.5 not disclose, or permit any of its Representatives to disclose, without the prior written consent of the disclosing party, to any other person the fact that the Confidential Information has been made available, that discussions or evaluations are taking place concerning the Purpose, or any of the terms, conditions, or other facts with respect thereto;

2.6 acknowledge that the Confidential Information is, and will at all times remain, the exclusive property of the disclosing party; and

2.7 use the disclosing party’s Confidential Information only for the strictly limited Purpose and for no other purpose whatsoever. Notwithstanding the foregoing provisions of this Section 2, the receiving party is specifically prohibited from (a) using, directly or indirectly, any of the Confidential Information furnished to it hereunder for its own benefit or for the benefit of others, except for the Purpose as set forth above; or (b) creating any improvements, modifications, or derivative or related works or materials which incorporate or utilize, directly or indirectly, any Confidential Information (such improvements, modifications, derivative or related works, if any, receiving party acknowledges and agrees shall be deemed Confidential Information of the disclosing party).

3. Compelled disclosure

Notwithstanding the foregoing, if the receiving party is requested or required (by oral questions, interrogatories, requests for information or documents, subpoena, civil investigative demand, or other process) to disclose any Confidential Information, it will provide the disclosing party with prompt notice of such request so that the disclosing party may seek an appropriate protective order and/or waive compliance herewith. If, in the absence of such protective order or waiver, the receiving party is compelled to disclose Confidential Information to any tribunal or other authority, the receiving party shall (a) disclose only that part of the Confidential Information that, in the opinion of its legal counsel, is required to be disclosed; (b) deliver to the disclosing party written notice of the Confidential Information to be disclosed as far in advance of its disclosure as is practicable; and (c) use commercially reasonable efforts to obtain an order or other reliable assurance that confidential treatment will be accorded to such portion of the Confidential Information required to be disclosed.

4. Return of materials

Upon request of the disclosing party, in the disclosing party’s sole discretion, the receiving party shall either return to the disclosing party or destroy all documents and other writings supplied by the disclosing party, together with all copies of any such documents or other writings, and shall certify to the return or destruction of all tangible Confidential Information and references thereto and the destruction of any references thereto on magnetic or other intangible media. In addition, that portion of the Confidential Information which consists of analyses, compilations, data, studies, or other documents prepared by the receiving party or its Representatives will be immediately destroyed at the written request of the disclosing party and such destruction will be confirmed to the disclosing party in writing. The return to the disclosing party or destruction of such Confidential Information shall not relieve the receiving party of any obligation of confidentiality contained herein.

5. Injunctive relief

The Parties acknowledge that money damages will be both incalculable and an insufficient remedy for a breach of this Agreement by either Party. Accordingly, the Parties agree that, in the event of any breach of this Agreement, the non-breaching Party shall be entitled to equitable relief, including, without limitation, injunctive relief or specific performance. If either Party elects to seek injunctive relief for breach of this Agreement, such election shall not preclude the non-breaching Party from pursuing other legal remedies at law. Notwithstanding Section 10.5, below, regarding choice of forum, the Parties agree that equitable relief may be sought in any court of competent jurisdiction for the sake of expediency.

6. No representation or warranty

The Parties understand, acknowledge, and agree that neither the disclosing party nor its Representatives is making any representation or warranty as to the accuracy, reliability, or completeness of any Confidential Information and that neither the disclosing party nor its Representatives shall have any responsibility or liability (including, without limitation, in contract, tort, or otherwise) to the receiving party or any of its Representatives arising from use or reliance on the Confidential Information. THE DISCLOSING PARTY PROVIDES THE INFORMATION SOLELY ON AN “AS IS” BASIS.

The term of this Agreement shall be [Number (#)] years from the Effective Date unless extended or terminated earlier in accordance with the provisions of this Agreement. Either Party may terminate this Agreement by providing thirty (30) days written notice to the other. Neither the termination nor expiration of this Agreement shall affect the obligations of the Parties set forth in Section 2, Mutual Obligations of Confidentiality and Non-Disclosure.

Except as may be otherwise provided herein, all notices, requests, waivers, and other communications made pursuant to this Agreement must be in writing and are conclusively deemed to have been duly given (a) when hand delivered to the other Party; (b) when received if sent by facsimile or electronic mail to the number or the email address set forth below, provided that the sending Party receives a confirmation of delivery; (c) three (3) business days after deposit in the U.S. mail, with first class or certified mail, receipt requested, postage prepaid, and addressed to the other Party; or (d) forty-eight (48) hours after deposit with an internationally recognized overnight delivery service, postage prepaid, addressed to the other Party as set forth below with next business-day delivery guaranteed, provided that the sending Party receives a confirmation of delivery from the delivery service provider. A Party may change or supplement the addresses, facsimile numbers, and email addresses provided in its signature block below, or designate additional addresses, facsimile numbers, or email addresses, for purposes of this Section by giving the other Party written notice of the new address, facsimile numbers, or email addresses in the manner set forth above.

If to Party A: [Address and electronic coordinates]

If to Party B: [Address and electronic coordinates]

9. No binding agreement for transaction

Unless and until a definitive agreement is entered into, neither Party will be under any legal obligation of any kind whatsoever to proceed with respect to a potential business transaction or venture in whole or in part or to continue discussions relating thereto by virtue of (a) this Agreement; or (b) any written or oral expression with respect to a potential transaction by either Party or any of their respective Representatives. The Parties further understand and agree that they shall not have any claims whatsoever against the other Party or the other Party’s Representatives arising out of or relating to the possible business relationship or any potential or actual transaction unless otherwise provided in a definitive agreement.

10. Miscellaneous

10.1 This Agreement shall be binding upon the successors and assigns of the Parties hereto.

10.2 No patent, copyright, trademark, or other proprietary right is licensed, granted, or otherwise transferred directly, or by implication, estoppel, or otherwise, by this Agreement or any disclosure hereunder, except for the right to use such information in accordance with this Agreement.

10.3 It is understood and agreed that no failure or delay by either Party in exercising any right, power, or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any right, power, or privilege thereunder.

10.4 The laws of the [State/Commonwealth] of [State], without giving effect to its conflicts of law principles, govern all matters arising out of or relating to this Agreement, without limitation, its validity, interpretation, construction, performance, and enforcement.

10.5 Each Party hereto unconditionally consents to the personal jurisdiction of the state or federal courts located within the [Jurisdiction] for any actions, suits, or proceedings arising out of or relating to this Agreement and, subject to and except as provided in Section 5 hereof regarding equitable actions, each Party agrees not to commence any action, suit, or proceeding relating thereto except in such courts. Each Party unconditionally waives and agrees not to plead in any such court that any such action, suit, or proceeding brought in any such court has been brought in an inconvenient forum.

10.6 The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of the other provisions of this Agreement, which shall remain in full force and effect. If any of the covenants or provisions of this Agreement shall be deemed to be unenforceable by reason of its extent, duration, scope, or otherwise, then the Parties contemplate that the court making such determination shall reduce such extent, duration, scope, or other provision, and shall enforce them in their reduced form for all purposes contemplated by this Agreement.

10.7 This Agreement embodies the entire understanding and agreement between the Parties with respect to the subject matter hereof and supersedes any prior written or oral understandings and agreements relating thereto.

10.8 This Agreement may not be amended or modified except in writing executed by both Parties. This Agreement and any such written amendment or modification may be executed in counterparts.

10.9 Neither Party shall assign this Agreement or any rights provided under this Agreement without the prior written consent of the other Party. Any such attempted assignment shall be null and void. Neither Party shall delegate or subcontract any obligation or performance under this Agreement without the prior written consent of the other Party, and any such attempted delegation or subcontract shall be void.

10.10 No agency or partnership relationship is created between the Parties by this Agreement.

IN WITNESS WHEREOF , each the Parties hereto has caused this Agreement to be executed by a duly authorized representative as of the Effective Date.

Draft contracts faster with Bloomberg Law

Save valuable time when you trust Bloomberg Law’s practical guidance, templates, and sample language to tackle complex contract management tasks with ease. Download this sample confidentiality agreement for market-standard language and expert commentary to help you draft contracts more efficiently and mitigate risk. Then, head to our Guide to Contract Management to access additional resources and best practices from legal experts.

Related Articles

Noncompete Clauses in Employment and Commercial Contracts

Sample Indemnification Clause

Sample Notification Letter of a Force Majeure Event

Sample: 10-Step Checklist for an Effective Contract Management Process

Recommended for you

See bloomberg law in action.

From live events to in-depth reports, discover singular thought leadership from Bloomberg Law. Our network of expert analysts is always on the case – so you can make yours. Request a demo to see it for yourself.

Business development

- Billing management software

- Court management software

- Legal calendaring solutions

Practice management & growth

- Project & knowledge management

- Workflow automation software

Corporate & business organization

- Business practice & procedure

Legal forms

- Legal form-building software

Legal data & document management

- Data management

- Data-driven insights

- Document management

- Document storage & retrieval

Drafting software, service & guidance

- Contract services

- Drafting software

- Electronic evidence

Financial management

- Outside counsel spend

Law firm marketing

- Attracting & retaining clients

- Custom legal marketing services

Legal research & guidance

- Anywhere access to reference books

- Due diligence

- Legal research technology

Trial readiness, process & case guidance

- Case management software

- Matter management

Recommended Products

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

Fast track case onboarding and practice with confidence. Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

A business management tool for legal professionals that automates workflow. Simplify project management, increase profits, and improve client satisfaction.

- All products

Tax & Accounting

Audit & accounting.

- Accounting & financial management

- Audit workflow

- Engagement compilation & review

- Guidance & standards

- Internal audit & controls

- Quality control

Data & document management

- Certificate management

- Data management & mining

- Document storage & organization

Estate planning

- Estate planning & taxation

- Wealth management

Financial planning & analysis

- Financial reporting

Payroll, compensation, pension & benefits

- Payroll & workforce management services

- Healthcare plans

- Billing management

- Client management

- Cost management

- Practice management

- Workflow management

Professional development & education

- Product training & education

- Professional development

Tax planning & preparation

- Financial close

- Income tax compliance

- Tax automation

- Tax compliance

- Tax planning

- Tax preparation

- Sales & use tax

- Transfer pricing

- Fixed asset depreciation

Tax research & guidance

- Federal tax

- State & local tax

- International tax

- Tax laws & regulations

- Partnership taxation

- Research powered by AI

- Specialized industry taxation

- Credits & incentives

- Uncertain tax positions

A powerful tax and accounting research tool. Get more accurate and efficient results with the power of AI, cognitive computing, and machine learning.

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

Automate workpaper preparation and eliminate data entry

Trade & Supply

Customs & duties management.

- Customs law compliance & administration

Global trade compliance & management

- Global export compliance & management

- Global trade analysis

- Denied party screening

Product & service classification

- Harmonized Tariff System classification

Supply chain & procurement technology

- Foreign-trade zone (FTZ) management

- Supply chain compliance

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Risk & compliance management.

- Regulatory compliance management

Fraud prevention, detection & investigations

- Fraud prevention technology

Risk management & investigations

- Investigation technology

- Document retrieval & due diligence services

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Who we serve.

- Broadcasters

- Governments

- Marketers & Advertisers

- Professionals

- Sports Media

- Corporate Communications

- Health & Pharma

- Machine Learning & AI

Content Types

- All Content Types

- Human Interest

- Business & Finance

- Entertainment & Lifestyle

- Reuters Community

- Reuters Plus - Content Studio

- Advertising Solutions

- Sponsorship

- Verification Services

- Action Images

- Reuters Connect

- World News Express

- Reuters Pictures Platform

- API & Feeds

- Reuters.com Platform

Media Solutions

- User Generated Content

- Reuters Ready

- Ready-to-Publish

- Case studies

- Reuters Partners

- Standards & values

- Leadership team

- Reuters Best

- Webinars & online events

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

- Reuters Media Center

- Jurisdiction

- Practice area

- View all legal

- Organization

- View all tax

Featured Products

- Blacks Law Dictionary

- Thomson Reuters ProView

- Recently updated products

- New products

Shop our latest titles

ProView Quickfinder favorite libraries

- Visit legal store

- Visit tax store

APIs by industry

- Risk & Fraud APIs

- Tax & Accounting APIs

- Trade & Supply APIs

Use case library

- Legal API use cases

- Risk & Fraud API use cases

- Tax & Accounting API use cases

- Trade & Supply API use cases

Related sites

United states support.

- Account help & support

- Communities

- Product help & support

- Product training

International support

- Legal UK, Ireland & Europe support

New releases

- Westlaw Precision

- 1040 Quickfinder Handbook

Join a TR community

- ONESOURCE community login

- Checkpoint community login

- CS community login

- TR Community

Free trials & demos

- Westlaw Edge

- Practical Law

- Checkpoint Edge

- Onvio Firm Management

- Proview eReader

NDAs and confidentiality agreements: What you need to know Protection of confidential information within an organization is usually a vital business priority. Learn what you need to know when structuring confidentiality agreements.

Nearly all businesses have valuable confidential information, and for many, confidential information is a dominant asset. Companies also share, receive, and exchange confidential information with and from customers, suppliers and other parties in the ordinary course of business and in a wide variety of commercial transactions and relationships.

Contractual confidentiality obligations are fundamental and necessary to help protect the parties that disclose information in these situations. Depending on the circumstances, these obligations can be documented in either:

- A free-standing confidentiality agreement (also known as a nondisclosure agreement or NDA)

- Clauses within an agreement that covers a larger transaction

When is a confidentiality agreement needed?

A range of commercial transactions and relationships involve either the disclosure of confidential information by one party to the other or a reciprocal exchange of information. In both cases, the parties should have a confidentiality agreement in place.

For example, confidentiality agreements may be used when evaluating or engaging a business or marketing consultant or agency, where the hiring company will necessarily disclose confidential information to enable the consultant to perform the assignment. They can also be used when soliciting proposals from vendors, software developers, or other service providers, which usually involves the exchange of pricing, strategies, personnel records, business methods, technical specifications, and other confidential information of both parties.

Finally, your company may need a confidentiality agreement when entering a co-marketing relationship, as an e-commerce business, with the operator of a complementary website or a similar type of strategic alliance.

Why is it necessary to have written confidentiality agreements?

- There are numerous reasons to enter into written confidentiality agreements, such as:

- Avoiding confusion over what the parties consider to be confidential.

- Allowing more flexibility in defining what is confidential.

- Delineating expectations regarding treatment of confidential information between the parties, whether disclosing or receiving confidential information.

- Enforcing written contracts is easier than oral agreements.

- Memorializing confidentiality agreements is often required under upstream agreements with third parties (for example, a service provider's customer agreement may require written confidentiality agreements with subcontractors).

- Maximizing protection of trade secrets, because under state law this protection can be weakened or lost (deemed waived) if disclosed without a written agreement.

- Covering issues that are indirectly related to confidentiality, such as non-solicitation.

- Maintaining standards that are expected of most commercial transactions and relationships.

The forms of confidentiality agreements

Depending on the type of transaction or relationship, only one party may share its confidential information with the other, or the parties may engage in a mutual or reciprocal exchange of information.

In unilateral confidentiality agreements, the nondisclosure obligations and access and use restrictions will apply only to the party that is the recipient of confidential information, but the operative provisions can be drafted to favor either party.

In mutual confidentiality agreements, each party is treated as both a discloser of its—and a recipient of the other party's—confidential information (such as when two companies form a strategic marketing alliance). In these situations, both parties are subject to identical nondisclosure obligations and access and use restrictions for information disclosed by the other party.

In some circumstances, the parties may share certain confidential information with each other but not on a mutual basis. Instead of entering into a fully mutual confidentiality agreement, the parties enter into a reciprocal confidentiality agreement, in which the scope and nature of the confidential information that each party will disclose is separately defined and their respective nondisclosure obligations and access and use restrictions may differ accordingly.

Limitations and risks of confidentiality agreements

Confidentiality agreements are very useful to prevent unauthorized disclosures of information, but they have inherent limitations and risks, particularly when recipients have little intention of complying with them. These limitations include the following:

- Once information is wrongfully disclosed and becomes part of the public domain, it cannot later be "undisclosed."

- Proving a breach of a confidentiality agreement can be very difficult.

- Damages for breach of contract (or an accounting of profits, where the recipient has made commercial use of the information) may be the only legal remedy available once the information is disclosed. However, damages may not be adequate or may be difficult to ascertain, especially when the confidential information has potential future value as opposed to present value.

- Even where a recipient complies with all the confidentiality agreement's requirements, it may indirectly use the disclosed confidential information to its commercial advantage.

Nondisclosure obligations

In general, recipients of confidential information are subject to an affirmative duty to keep the information confidential, and not to disclose it to third parties except as expressly permitted by the agreement. The recipient's duty is often tied to a specified standard of care. For example, the agreement may require the recipient to maintain the confidentiality of the information using the same degree of care used to protect its own confidential information, but not less than a reasonable degree of care.

Recipients should ensure there are appropriate exceptions to the general nondisclosure obligations, including for disclosures:

- To its representatives. Most confidentiality agreements permit disclosure to specified representatives for the purpose of evaluating the information and participating in negotiations of the principal agreement.

- Required by law. Confidentiality agreements usually allow the recipient to disclose confidential information if required to do so by court order or other legal process. The recipient usually must notify the disclosing party of any such order (if legally permitted to do so) and cooperate with the disclosing party to obtain a protective order.

Disclosing parties commonly try to ensure that recipients are required to have downstream confidentiality agreements in place with any third parties to which subsequent disclosure of confidential information is permitted. In these cases, either the recipient or the discloser may prefer to have these third parties enter into separate confidentiality agreements directly with the discloser.

Term of agreement and survival of nondisclosure obligations

Confidentiality agreements can run indefinitely, covering the parties' disclosures of confidential information at any time, or can terminate on a certain date or event.

Whether or not the overall agreement has a definite term, the parties' nondisclosure obligations can be stated to survive for a set period. Survival periods of one to five years are typical. The term often depends on the type of information involved and how quickly the information changes.

The information in this article was excerpted from Confidentiality and Nondisclosure Agreements. The full practice note, one of more than 65,000 resources, is available at the Thomson Reuters Practical Law website.

The information in this article was excerpted from Confidentiality and Nondisclosure Agreements . The full practice note, one of more than 65,000 resources, is available at the Thomson Reuters Practical Law website.

Related content

Title: Is your legal function prepared for global expansion?

Risk considerations for third-party relationships

The modern law department: designed to provide superior value

Check out Practical Law for sample NDA documents

- Non-Disclosure Agreement (NDA)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on January 29, 2024

Get Any Financial Question Answered

Table of contents, what is a non-disclosure agreement (nda) or confidentiality agreement.

"Non-Disclosure Agreements" or "Confidentiality Agreements" are legal contracts where one individual assures not to reveal private information that is shared with them.

This type of agreement could also be called a "Confidential Disclosure Agreement", "Proprietary Information Agreement". or simply a "Secrecy Agreement".

The name differs based on the industry or company. This guide will use the term "NDA" to refer to all of these agreements. Contracts like these are traditionally called "agreements" because the word sounds less imposing than the term contract.

Even so, NDAs are legally binding contracts.

The party who possesses the information or technology to be revealed is typically called the "Discloser" or "Disclosing Party". Contrarily, the party receiving this confidential information is referred to as the "Recipient" or "Receiving Party".

The level of protection offered by an NDA can differ. Some NDAs only require the Recipient to keep the information confidential, while others also forbid them from using any of the disclosed information or bar them from improving upon or reverse engineering any technology that was revealed.

There are even some NDAs with assignment clauses that make the Recipient assign anything they invent or develop as a result of learning about the Disclosing Party's information to said party.

Non-disclosure agreements (NDAs) are often signed when two businesses, people, or other legal entities want to start working together and need information about the processes used in one of the other's businesses.

Before NDAs can be put into place, both parties must agree on what confidential material will be restricted and how long the period of restriction lasts.

Additionally, employers may require their employees to sign NDA contracts containing provisions that restrictions apply to both sides or just a single party.

Types of NDAs

Unilateral or bilateral.

From a legal perspective, there are two general types of NDAs:

(1) a "unilateral" or "one way" NDA - where only one party (the Recipient) agrees to keep the information disclosed confidentially.

This agreement does not legally bind the other party.

(2) a "bilateral", "two way", or "mutual" NDA - where both parties agree to keep the information disclosed confidentially and are legally bound by this agreement when they receive such information from the other party.

For example, let us say you have a new product idea and want to discuss it with a possible manufacturer.

Ideally, you want the manufacturer to sign your unilateral or one way NDA because you are disclosing information about your product or technology.

However, the manufacturer could require that you sign a bilateral or two way NDA instead.

In some cases, there might be good legal reasons why the manufacturing company insists that both parties should be required to keep secret any shared information.

For example, if the manufacturer discloses private methods of production or other trade secrets to you, they will likely want you to agree to keep the information secret as well.

Business people often feel better when there is an equal exchange in the agreement.

So, in many situations, two way NDAs are used even though a one way NDA would be preferable from a legal perspective.

Even if the other party has the information you want, remember that if you agree to confidentiality in a mutual NDA, then you cannot use the confidential information from the other party for any other purpose or with any other person.

This might limit what you can do in the future and with other people, so always weigh the pros and cons of an NDA before signing one.

Strong or Weak?

As mentioned earlier, the degree of protection an NDA affords varies. NDAs can therefore be broadly classified according to how much protection they offer.

There are typically (1) "recipient friendly" NDAs, and (2) "disclosing party" or "discloser" friendly NDAs.

Many companies have two versions of their NDA forms: one for when they expect to receive the majority of information (recipient-friendly version) and another where they will provide most details (discloser friendly version).

Consequently, many knowledgeable companies keep these four varieties on hand at all times:

(1) A mutual recipient friendly NDA;

(2) A mutual discloser friendly NDA;

(3) A one-way recipient friendly NDA; and

(4) A one-way disclosed friendly NDA.

They will never tell an outsider which NDA agreement they sent you nor how many versions they have. Usually, only lawyers know the difference between forms.

There tend to be minor variances between a recipient friendly NDA and a discloser friendly one, so watch out when signing any contract of this sort.

If you want to share your technology or inventions with a large company, chances are high that they will send you a "Recipient Friendly" NDA.

Recipient Friendly NDAs

Recipient Friendly NDAs, as the name suggests, shift some of the load regarding obligations and damages off of the recipient and onto the disclosing party.

There are provisions that can make an NDA exponentially more difficult for a disclosing party if they are not careful. Some examples are:

(1) Definition of "Confidential Information" - If an NDA narrowly defines Confidential Information, the agreement would not cover much of what is typically included.

(2) Exceptions to Confidential Information – Most NDAs will have a list of exceptions to what is considered confidential information.

An example of this would be information that is already public knowledge. However, in a Recipient Friendly NDA, there are other exceptions included which nullify much of the disclosed information.

(3) Limitations on Damages - In some NDAs that are friendly to the recipient, the damages are limited to "direct damages." However, in an NDA situation, there probably will not be direct damages.

Furthermore, if there are any direct damages, such damage would be more complicated than usual to prove. Thus, an NDA with a clause limiting direct damages may nullify any real liability of the Recipient.

Discloser Friendly NDAs

Discloser Friendly NDAs are broader in meaning than Recipient Friendly NDAs, and the exceptions or exclusions included are fewer.

In a discloser friendly NDA, there would typically be no limits to damages that could be claimed, and indemnity clauses may also be present.

Moreover, NDAs that are friendly to those who must disclose information often have additional specific provisions to safeguard the disclosing party.

These may include: not being able to use the information for any purpose other than what is specified, no reverse engineering of the confidential info, and if the recipient creates intellectual property based on said information, then automatic assignment of intellectual property rights.

Short or Long?

People often get nervous when they see a long contract, believing they are about to be scammed with legal trickery.

So, we have many clients who prefer shorter NDAs. A short sample NDA is included in the last part of this guide for reference purposes only.

Some clients prefer NDAs that are one page or shorter. In response, some law firms manipulate the physical appearance of the document by reducing the font size and using dual columns.

Hence, it appears to be one cohesive page, even though it is difficult to read without a magnifying glass.

NDAs that are well-written and comprehensive can protect both parties involved because they address most potential problems that could arise.

This minimizes ambiguity in the contract and reduces the likelihood of facing unknown risks.

Conversely, short agreements do not cover as many eventualities, leading to more ambiguity and greater chances of encountering unforeseen issues.

Some law firms prefer contracts that are well-organized and address a variety of potentialities. They usually prefer lengthy yet concise and easy-to-read contracts.

If shorter agreements are used, they must be "custom" orders, which may be more expensive than longer forms since the lawyer will have to understand the intricacies of the business deal and both sides involved before knowing how to modify the NDA properly.

As Mark Twain once said, "I did not have time to write a short letter, so I wrote a long one instead".

In many ways, the same applies to legal contracts and forms.

For example, if the client is pushing for a shorter NDA, It might be inclined to leave out the venue clause (the section that specifies where any disputes will be settled).

Suppose the client is working with another nearby business.

In that case, it is likely perfectly okay to omit the venue clause because any disagreements by default would go through the local court system.

The client could be forced to spend extra money in proceedings if the contract does not address or indicate where uncertainties might lie.

To avoid this, always recommend a long form that is more comprehensive and lessens the likelihood of problems later on.

I f the client requests a shorter document, gather additional information about them and their business deal to determine what can be safely left out without compromising fundamental protection interests.

Companies often find themselves in hot water because they use the same NDA form for every situation rather than customizing it to fit each specific circumstance.

What has worked in a past agreement may not be useful or binding in another case involving different parties. It is alarming how many companies carelessly use a recipient friendly form when they are the Disclosing Party.

Strategies for Dealing with More Established Companies

The distinction between a "one way" or "two way" NDA, as well as a Recipient friendly or Discloser friendly NDA, largely boils down to the comparative bargaining power of the people involved.

For example, suppose you are working for a small company or pitching an idea to a large manufacturer as an individual inventor. In that case, likely, you will not have much-negotiating power.

In this case, the large manufacturer may require you to use their standard "two way" recipient-friendly NDA.

Initially, when you begin working with a large company, you will likely come into contact with contact the organization's lawyers and paralegals.

These individuals usually request that their own forms be used. While it is possible to ask for changes to be made to these (particularly if you can explain why), more often than not, the legal team states that policy does not allow for such modifications.

In other words: "If you want our business, agree to use our form as is--even though we are fully aware that it puts you at a disadvantage".

It is a shame that this is the perspective of various businesses. However, just because a situation is complicated does not imply you should give up on a possible business deal. Instead, take an empathetic and non-legalistic approach instead.

When you are not in the ideal position to use an NDA, protect your information as much as possible, and be discerning about what details you share with them.

This will require self-control since many clients act like they can tell anything once an NDA is signed. Your strategy should focus on interesting the company's businessmen and engineers in your product or technology.

If they express interest, they can put pressure on their lawyers to negotiate a second, more favorable agreement with you.

When dealing with a big company who is unwilling to use balanced forms, take a two-step approach. Only share the information required to get their business or technical personnel interested at first.

Once they are showing genuine interest, you have more leverage to insist on a stronger NDA before revealing any more details about your technology.

Uses of NDAs

As stated before, non-disclosure agreements are frequently signed when two companies or people are thinking about conducting business and need to be privy to the processes used in business for assessment purposes.

Many employers make their employees sign an NDA or a similar agreement as a requirement of employment.

Companies should also oblige that their vendors and contractors sign NDAs if they will have access to internal company procedures or information.

If someone you have a non-disclosure agreement (NDA) with divulges your trade secrets without permission, in theory, you can go to court and get an injunction to make them stop.

You might also be able to sue them for the damages caused by their breach of confidentiality.

However, NDAs can often be hard to enforce. They should not be relied on too heavily--think of them more as insurance that is hopefully never used.

Generally speaking, you should only disclose confidential information if the other party really needs to know. You do not want to give away more than necessary for the business deal to go through.

This especially applies to engineers and those with a sales background--you need to be aware of your natural inclination towards disclosure and teaching.

Remember that the best way to protect yourself is not to disclose anything!

Your second best form of protection is a non-disclosure agreement that limits disclosure and is fully enforceable. Although it can be difficult to enforce NDAs, they offer other benefits such as patent and trade secret protection.

Patent Protection

Disclosing the details of your inventions to anyone without an NDA often starts patent filing deadlines and may destroy your ability to obtain patents, especially overseas.

In other words, disclosing a patentable invention or technology to someone without an NDA could lose the opportunity for international patents. You will probably damage your chances at U.S. protection.

Let us say you are a doctor with an idea for a new surgical instrument. Approaching a medical device company without an NDA in place will make it more difficult to obtain patents, both domestically and abroad.

This also puts potential investors at risk, as they are unlikely to invest in a company or technology that cannot be protected.

Therefore, even if you do not have immediate plans to file for patents, it is important not to damage your chances of doing so down the line.

If you think your technology might be patentable, always use an NDA when disclosing it to other parties.

Trade Secret Protection

The primary purpose of NDAs is to protect trade secrets. Unlike patents, which must eventually be made public, trade secrets- by definition- are meant to be "secret".

Most states and countries offer special legal protection for those who own trade secrets.

However, remember that this only applies if reasonable steps are being taken to keep the information hidden from others.

NDAs are contractual agreements that prevent the sharing of private information. They often protect trade secrets from being exposed, and companies will have their employees sign NDAs.

A well-known example is Coca-Cola's secret formula for "Coke". If it were to get into the public domain, anyone could make it, and Coke would lose its value. So, both present and future employers sign NDAs with contracts stating they will not reveal the recipe.

It would have made the ingredients publicly available if it had filed patent protection for its product formula over 100 years ago.

Instead, Coke chose to keep it as a trade secret, maintaining its allure throughout the decades.

However, NDAs that are used to protect trade secrets must be carefully drafted by a lawyer who understands this area of law in your particular state.

If you are going to disclose trade secrets, speak with such a professional beforehand.

The "trade secret" problem is complicated. Although it may be confusing, the following explanation will give you a better grasp of the issue.

Do not fret if this explanation leaves you feeling unclear about the subject matter.

The issue at hand is that many states have conflicting laws when it comes to "trade secrets laws" and "contracts laws." To summarize, these conflicts are as follows:

- Waiver of Trade Secrets - for NDAs limiting the use of trade secrets, the disclosing party should request a perpetual obligation from the recipient to maintain information confidentially. Otherwise, there is a possibility that the disclosing party accidentally waives their right to keep the disclosed material secret after a specific amount of time has passed (three to five years being common.) So, under trade secret law, keeping secrecy requirements placed on an NDA last forever is best.

- Contracts Law - As stated before, NDAs are contracts and therefore follow state contract law. Generally speaking, contract law is not a fan of ambiguous or open-ended terms. Perpetual obligations in contracts are unenforceable in many states. The reasoning is that while companies may want an agreement to last forever initially, circumstances often change and lead to the termination of a business relationship. An agreement that does not have a set end date or has an obligation that never ends is usually terminable at any time by either party, which goes against the point of having an NDA in the first place.

The term of an NDA under trade secret law cannot be definite (for example, five years) without putting your trade secrets at risk. However, contract law requires the use of a definite term; otherwise, the contract may not be legally binding in most cases.

Be cautious of revealing trade secrets, as many problems could arise from such a disclosure. It is best to avoid disclosing them if possible or, at the very least, minimize the information given.

Typical NDA Provisions

This section will provide an overview of the typical provisions found in many NDAs to discuss the primary issues for the reader.

The following section will include a comprehensive examination of various provisions in an NDA. Most NDAs have six main areas or provisions, which are:

- The definition of "confidential information" and how it will be protected under this NDA;

- Exclusions to what is considered confidential information;

- The obligations and duties of the party receiving said confidential information;

- The amount of time for which this NDA will be valid and can be enforced in a court setting;

- Additional provisions to help with enforcing the terms of this NDA (usually called ex-parte injunctive relief); and

- Miscellaneous other provisions.

The Definition of Confidential Information

An NDA, or non-disclosure agreement, exists to protect a business's confidential information.

This term usually encompasses a broad range of items like unpublished patent applications, technical know-how, etc.

By defining what is included in the NDA agreement, both parties understand and agree upon what can and cannot be shared outside the meeting or conversation.

As stated before, not every NDA is the same. In fact, some NDAs have such a specific definition of Confidential Information that it makes the entire agreement pointless.

Therefore, comprehending the term "Confidential Information" in an NDA Agreement is key.

"Recipient friendly" forms have a narrowly defined term for "Confidential Information", while slipping in a large exception later on in the agreement.

In contrast, "provider friendly" forms usually have broadly defined terms for Confidential Information and do not contain many exceptions.

You can find examples of broad and narrow definitions in Section 3 of the second part of this guide.

For example, some "recipient friendly" forms confine the definition of Confidential Information to solely that information which has been conspicuously marked "Confidential".

Other forms use a broad definition of Confidential Information but restrict the secrecy requirements on behalf of the receiver to information that had been plainly labeled as "Confidential".

In our experience, this is not a reasonable prerequisite because most clients would not mark their correspondence with one another as "Confidential".

Many clients claim early presentations are "confidential"; however, they rarely document conversations or appropriately label follow-up emails.

As a result, chats, follow-up emails, and presentations often are not covered under the NDA requirements because the person revealing the information forgets to document conversations or mark all messages as "Confidential".

Frequently people do not realize this when they sign an NDA with such provisions.

Conversely, "disclosure friendly" measures typically classify any information revealed as "confidential information", whether it is labeled or not, regardless of how it was divulged.

For instance, this would include informal chats, emails, and text messages.

In fact, some NDAs consider anything written down by the recipient based on the disclosing party's info as confidential information.

If you are supplying most of the information to the other person, make sure to use a definition that favors disclosure instead of one that protects recipients (for example, by requiring information to be clearly labeled).

Exclusions from Confidential Information

Non-disclosure agreements typically have a few exceptions to their definition of confidential information. A couple of common and valid examples are:

(1) if the Confidential Information becomes public domain by no mistake of the Recipient,

(2) when the Confidential Information is already known to the Recipient, or

(3) with Disclosing Party's written agreement that some of said Confidential Information could be treated as non-confidential.

Some forms also have other exclusions, so it is crucial to understand the limits of any exclusion.

For example, many "Recipient friendly" forms might include an exception for information that the Recipient develops independently from Confidential Information.

However, this can create issues when trying to prove that new independent information was actually developed without using disclosed Confidential Information.

An exclusion similar to this is "information that was created or discovered by the recipient before any involvement with the disclosing party".

This is a justifiable exclusion ONLY IF the disclosing party can prove, through conventional business documentation, that it possessed said information before disclosure occurred.

Thus, when listing this type of exception, be sure to state what standard of proof will be needed.

If, for example, you hire a contractor who creates something that uses your trade secrets before disclosing any information to that contractor, then the law still permits the contractor to use their invention in public.

This is especially true if the contractor can demonstrate through standard business documentation–such as an inventor's notebook or provisional patent application–that they invented the technology independently.

Obligations and Duties of the Recipient

Non-disclosure agreements typically outline the expectations and responsibilities of the party receiving confidential information.

These often include requirements to keep the information private. However, in "Discloser Friendly" versions of these contracts, there may be additional language obligating parties to:

- The Confidential Information must not be used,

- The Confidential Information must not be reverse-engineered,

- No intellectual property can be developed from the Confidential Information,

- Competing products cannot be created from Confidential Information,

- Employees or vendors of the Disclosing Party cannot be solicited, and

- Any intellectual property resulting from the Confidential Information will be assigned.

Including certain restrictions and obligations in an NDA typically boils down to the relative bargaining power between the parties.