- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt , and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/concernedman-ba55c714fbc94fc28f7fd6b7c7723894.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

What is an Assignment of Debt?

By Vanessa Swain Senior Lawyer

Updated on February 22, 2023 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

Perfecting Assignment

- Enforcing an Assigned Debt

Recovery of an Assigned Debt

- Other Considerations

Key Takeaways

Frequently asked questions.

I t is common for creditors, such as banks and other financiers, to assign their debt to a third party. Usually, an assig nment of debt is done in an effort to minimise the costs of recovery where a debtor has been delinquent for some time. This article looks at:

- what it means to ‘assign a debt’;

- the legal requirements to perfecting an assignment; and

- common problems with enforcing an assigned debt.

Whether you’re a small business owner or the Chief Financial Officer of an ASX-listed company, one fact remains: your customers need to pay you.

This manual aims to help business owners, financial controllers and credit managers best manage and recover their debt.

An assignment of debt, in simple terms, is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once a debt is properly assigned, all rights and responsibilities of the original creditor (the assignor ) transfer to the new owner (the assignee ). Once an assignment of debt has been perfected, the assignee can collect the full amount of the debt owed . This includes interest recoverable under the original contract, as if they were the original creditor. A debtor is still responsible for paying the outstanding debt after an assignment. However, now, the debt or must pay the debt to the assignee rather than the original creditor.

Purchasing debt can be a lucrative business. Creditors will generally sell debt at a loss, for example, 20c for each dollar owed. Although, the amount paid will vary depending on factors such as the age of the debt and the likelihood of recovery. This can be a tax write off for the assignor, while the assignee can take steps to recover 100% of the debt owed.

In New South Wales, the requirements for a legally binding assignment of debt are set out in the Conveyancing Act :

- the assignment must be in writing. You do this in the form of a deed (deed of assignment) and both the assignor and assignee sign it; and

- the assignor must provide notice to the debtor. The requirement for notice must be express and must be in writing. The assignor must notify the debtor advising them of the debt’ s assign ment and to who it has been assigned. The assignee will send a separate notice to the debtor, putting them on notice that the debt is due and payable. They will also provide them with the necessary information to make payment.

The assignor must send the notices to the debtor’s last known address.

Debtor as a Joined Party

In some circumstances, a debtor will be joined as a party to the deed of assignment . There can be a great benefit in this approach . This is because the debtor can provide warranties that the debt is owed and has clear notice of the assignment. However, it is not always practical to do so for a few reasons:

- a debtor may not be on speaking terms with the assignor;

- a debtor may not be prepared to co-operate or provide appropriate warranties; and

- the assignor or the assignee may not want the debtor to be made aware of the sale price . This occurs particularly where the sale price is at a significant discount.

If the debtor is not a party to the deed of assignment, proper notice of the assignment must be provided.

An assignment of debt that has not been properly perfected will not constitute a legal debt owing to the assignee. Rather, the legal right to recover the debt will remain with the assignor. Only an equitable interest in the debt will transfer to the assignee.

Enforcing an Assigned Debt

After validly assigning a debt (in writing and notice has been provided to the debtor’s last known place of residence), the assignee is entitled to take any legal steps available to them to recover the outstanding debt. These recovery options include:

- commencing court proceedings;

- obtaining a judgment; and

- enforcement of that judgment.

Suppose court proceedings have been commenced or judgment already entered in favour of the assignor. In that case, the assignee must take steps to have the proceedings or judgment formally changed into the assignee’s name.

In our experience, recovery of an assigned debt can be problematic because:

- debtors often do not understand the concept of debt assignment and may not be aware that their credit contract contains an assignment of debt clause;

- disputes can arise as to whether a lawful assignment of debt has arisen. A debtor may claim that the assignor did not provide them with the requisite notice of the assignment, or in some cases, a contract will specifically exclude the creditor from legally assigning a debt;

- proper records of the notice of assignment provided to the debtor must be maintained. If proper records have not been kept, it may be difficult to prove that notice has been properly given, which may invalidate the legal assignment; and

- the debtor has the right to make an offsetting claim in defence to any recovery action taken by the assignee. A debtor may raise an offsetting claim which has arisen out of a previous arrangement with the assignor (which the assignee may not be aware of). For example, the debtor may have entered into an agreement with the assignor whereby the assignor agreed to accept a lesser amount of the debt owed by way of settlement. Because the assignee acquires the same rights and obligations of the assignor, the terms of that previous settlement agreement will bind the assignee. The court may find that there is no debt owing by the debtor. In this case, the assignee will have been assigned nothing of value.

Other Considerations

When assigning a debt, it is essential that the assignee, in particular, considers relevant statutory limitation periods for commencing proceedings or enforcing a judgment debt . In New South Wales, the time limit:

- to file legal proceedings to recover debts is six years from the date of last payment or when the debtor admitted in writing that they owed the debt; and

- for enforcing a judgment debt is 12 years from the date of judgment.

An assignment of a debt does not extend these limitation periods.

While there can be benefits to both the assignor and the assignee, an assignment of debt will be unenforceable if done incorrectly. Therefore, if you are considering assigning or being assigned a debt, it is important to seek legal advice. If you need help with drafting or reviewing a deed of assignment or wish to recover a debt that has been assigned to you, contact LegalVision’s debt recovery lawyers on 1300 544 755 or fill out the form on this page.

An assignment of debt is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once the assignee has validly assigned a debt, they are entitled to take any legal steps available to them to recover the outstanding debt. This includes commencing court proceedings, obtaining a judgment and enforcement of that judgment.

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Sponsoring overseas workers for your hospitality business, safeguarding vulnerable clients: mandatory ndis & in-home aged care reporting, tips for sponsoring overseas workers for ndis and aged care, engaging contractors: latest employment law changes, contact us now.

Fill out the form and we will contact you within one business day

Related articles

Dealing With Proceedings in the Small Claims Division of the NSW Local Court

What Are the Pros and Cons of a Writ for Levy of Property?

I’m a Judgment Debtor. What are the Next Steps?

How Can I Enforce a Judgment Debt in New South Wales?

We’re an award-winning law firm

2023 Fast Firms - Australasian Lawyer

2022 Law Firm of the Year - Australasian Law Awards

2021 Law Firm of the Year - Australasian Law Awards

2020 Excellence in Technology & Innovation Finalist - Australasian Law Awards

2020 Employer of Choice Winner - Australasian Lawyer

- France (FR)

- Germany (DE)

- Netherlands

United Kingdom

- United States

- Suing for book debts after assignment: who can bring proceedings?

Finance brief - January 2013

- A Guide to Yacht Finance

- A Guide to Recovering Money from a Russian Personal Guarantor

- Marketforce and IEA 10th "The Future of Private Banking" Conference, October 2012

- General liens and financial collateral

- All monies guarantees: do they do what it says on the tin?

- Potential lender liability when taking security over an asset

The subject of who can sue for book debts following their assignment was recently addressed by the Court of Appeal in the case of Bexhill (UK) Ltd v Razzaq [2012] EWCA Civ 1376 . Specifically, the Court of Appeal considered whether (i) a particular assignment of book debts was absolute or operated by way of charge only, (ii) who could sue for recovery of book debts following an assignment of such book debts in favour of a lender and (iii) whether the lender as assignee of the book debts could authorise the borrower to bring an action for recovery of the book debts in the borrower's sole name.

The borrower provided premium credit funding to insurance brokers, enabling insurance brokers to offer to their clients the facility to pay their annual insurance in instalments rather than in an annual lump sum. The borrower did not itself fund the sums it advanced to the insurance brokers but entered into a facility agreement with a lender to fund these premium funding arrangements. As security for the obligations owed by the borrower to the lender, the borrower entered into a debenture in favour of the lender pursuant to which it "assigns and agrees to assign absolutely in favour of [the lender] all of [the borrower's] rights, title, interest and benefit in "receivables" and it assigns and agrees to assign absolutely in favour of [the lender] all of [the borrower's] right, title, interest and benefit in each "relevant contract". The receivables comprised all present and future book and other debts, money claims and other amounts recoverable or receivable by the claimant. It also extended to the benefit of all rights and remedies relating to claims for damages and other remedies for non-payment.

Under the terms of the debenture entered into in favour of the lender, the borrower undertook that all payments received by it pursuant to the arrangements it entered into with the insurance brokers were to be paid directly into a collection account and all other receivables were to be collected by the borrower in the ordinary course of trading as agent for the lender and upon receipt paid into the collection account.

A customer of the borrower had given a legal charge over a commercial property as security to the borrower for amounts advanced under a premium credit funding arrangement. When the borrower's customer defaulted, the borrower sought possession of the property pursuant to the charge. The customer argued that the borrower had no right to sue for possession as whatever rights it had constituted receivables and such receivables had been assigned to the lender, which was not a party to the legal proceedings.

Key points in the decision

Whether a particular instrument creates an absolute assignment or an assignment by way of charge is a question of construction of the relevant instrument taken as a whole and the principle and the consequences of an assignment being absolute or by way of charge only were explained in Hughes v Pump House Hotel Co 1902 2KB 190 where it was stated that " if it is clear from the instrument as a whole that the intention was to pass all of the rights of the assignor in the debt or chose in action to the assignee the case will come within section 25 of the Judicature Act and the action must be brought in the name of the assignee." In this case the wording in the debenture entered into between the borrower and the lender assigns absolutely to the lender all of the existing receivables. Whether such an absolute assignment is a legal assignment will depend on whether notice in writing has been given to the debtor in each case (which had not been given in this case) and when future receivables come into being then they will be the subject of absolute assignments in equity. When there has been an absolute assignment that takes effect in equity, as was the case in this instance, the general rule is that it is the equitable assignee i.e. the lender that has the right to sue, and the borrower will not be allowed to maintain an action unless the lender is joined as a party to the claim.

The Court also held that having assigned its rights absolutely to the lender, the borrower could not bring an action in its own name as agent as such an action would need explicit wording granting the borrower authority to act as the lender's agent. Secondly, the notion of the borrower acting as agent of the lender seemed to be inconsistent with what had been assigned to the lender and would need "clear wording" to authorise the borrower to bring proceedings in the lender's name of the very thing that had been assigned by the borrower.

Takeaway points for a lender

Note that in many standard form debentures, it may well be that the that the reveivable or contract is charged in favour of the lender rather than assigned, in which case the issues discussed in this article will not arise.

However, in the event that the security is being granted by way of an assignment, care should be exercised by a lender in framing the nature of the assignment that it requires from a borrower. Absent clear wording to the contrary, a borrower who has assigned absolutely the benefit of a receivable or contract under a security document will be unable to take proceedings to recover those receivables or sue on that contract without joining the lender as a party to the proceedings. This has cost implications for a lender and needs to be considered carefully at the outset of any relevant transaction.

Assignment Of Debt

Jump to section, what is an assignment of debt.

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt. Debt assignment allows creditors to improve liquidity by reducing their financial risk. If a creditor has taken on a large amount of unsecured debt, an assignment of debt agreement is a quick way to transfer some of the unsecured loans to another party.

Common Sections in Assignments Of Debt

Below is a list of common sections included in Assignments Of Debt. These sections are linked to the below sample agreement for you to explore.

Assignment Of Debt Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 19 ex107.htm ASSIGNMENT OF DEBT AND SECURITY , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Debt?

Lawyers with backgrounds working on assignments of debt work with clients to help. Do you need help with an assignment of debt?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of debt. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Lawyers

I am a solo-practitioner with a practice mostly consisting of serving as a fractional general counsel to start ups and growth stage companies. With a practical business background, I aim to bring real-world, economically driven solutions to my client's legal problems and pride myself on efficient yet effective work.

Billy Joe M.

I graduated from the University of Illinois at Urbana-Champaign in 2006 with a degree in Political Science, Finance, and Economics. I stayed around Champaign for law school and graduated in 2009. I then worked at a big law firm in downtown Chicago. It was boring, so I quit in early 2011. I thought that I could not be happy practicing law - I was wrong. After I quit the traditional law firm life, I began representing my own clients. I realize now that I love helping normal people, small business owners, and non-profits address a variety of legal issues. I hope to hear from you.

G'day, my name is Michele! I work with startups, entrepreneurs and small/medium-sized businesses across the country in a wide array of industries. I help them with all of their ongoing, daily legal needs. This includes entity formation, M&A, contract drafting and review, employment, asset sale & acquisition, and business sales or shareholder exits. I'm half-Australian, half-Italian, and I've lived the last 20+ years of my life in America. I've lived all over the USA, completing high school in the deep south, graduating cum laude from Washington University in St. Louis, and then cum laude from Georgetown University Law Center. After law school I worked for the Los Angeles office of Latham & Watkins, LLP. After four intense and rewarding years there, I left to become General Counsel and VP of an incredible, industry-changing start-up called Urban Mining Company (UMC) that manufactures rare earth permanent magnets. I now work for Phocus Law where I help run our practice focused on entrepreneurs, startups, and SMEs. I love what I do, and I'd love to be of help! My focus is on providing stress-free, enjoyable, and high-quality legal service to all of my clients. Being a good lawyer isn't enough: the client experience should also be great. But work isn't everything, and I love my free time. I've been an avid traveler since my parents put me on a plane to Italy at 9-months old. I'm also a music nut, and am still looking for that perfect client that will engage me to explain why Dark Side Of The Moon is the greatest album of all time. Having grown up in a remote, and gorgeous corner of Australia, I feel a strong connection to nature, and love being in the elements.

Nicholas A.

I help small business owners build and protect their dreams. I always thought that I would just be a litigator. Then I joined an intellectual property clinic in law school. We were helping nonprofits and small businesses reach their goals. I fell in love with the work and decided to open my own firm so I could keep helping them. When I decided to start Victrix Legal, I decided that it would be a modern law firm designed to serve professionals. It would be different from every other law firm. In my experience, my law firms are designed to promote inefficiency and reactionary lawyering. Because in most firms, you make more money when you spend more time on a project. And you lose money if your client doesn't get sued. In my opinion, that's a built-in conflict of interest. My firm is different. I use flat fees for most basic projects to keep costs predictable for you and incentivize efficiency. I offer long-term advisory plans and legal audits to prevent issues from happening. I want my clients to see me as their business partner, not just the guy they call when they are in trouble. If any of that interests you, please reach out to me. I offer free consultations. Let's set aside some time and talk about what your legal needs are.

My clients know me as more than just an attorney. First and foremost, my background is much broader than that. Prior to attending the Valparaiso University School of Law, I earned a Master of Business Administration and ran a small business as a certified public accountant. Thanks to this experience, I possess unique insight which in turn allows me to better assist my clients with a wide range of business and tax matters today. In total, I have over 20 years of experience in financial management, tax law, and business consulting, and I’m proud to say that I’m utilizing the knowledge I’ve gained to assist the community of Round Rock in a variety of ways. In my current practice, I provide counsel to small to medium-sized businesses, nonprofit organizations, and everyday individuals. Though my primary areas of practice are estate planning, elder law, business consulting, and tax planning, I pride myself on assisting my clients in a comprehensive manner. Whenever I take on a new client, I make an effort to get to know them on a personal level. This, of course, begins with listening. It is important that I fully understand their vision so I can help them successfully translate it into a concrete plan of action that meets their goals and expectations. I appreciate the individual attributes of each client and know firsthand that thoughtful, creative, and customized planning can maximize both financial security and personal happiness. During my time as a certified public accountant, I cultivated an invaluable skill set. After all, while my legal education has given me a deep understanding of tax law, I would not be the tax attorney I am today without my background in accounting. Due to my far-reaching experience, I am competent in unraveling even the most complex tax mysteries and disputes. My CPA training benefits my estate planning practice, too. In the process of drafting comprehensive wills and trusts, I carefully account for every asset and plan for any tax burdens that may arise, often facilitating a much smoother inheritance for the heirs of my clients. Prior to becoming certified as a CPA, I made sure to establish a solid foundation in business both in and out of the classroom, and the acumen I’ve attained has served me well. Not only am I better able to run my own practice than I otherwise would be; I am able to help other small business owners fulfill their dreams, as well.

James David W.

I graduated from Harvard Law School and worked first for a federal judge and then a leading DC firm before starting a firm with a law school classmate. My practice focuses on company formations, early-stage investments, and mergers & acquisitions.

Anna is an experienced attorney, with over twenty years of experience. With no geographical boundaries confining her practice, Anna works on corporate, healthcare and real estate transactions. Anna brings extensive big firm experience, garnered as an associate in the Miami office of the world's largest law firm, Baker and McKenzie, and the Miami office of the international law firm Kilpatrick Townsend. Her areas of expertise include: mergers and acquisitions, initial public offerings, private placements, healthcare transactions, corporate finance, commercial real estate transaction and acting as a general corporate counsel. Anna is certified to practice law in Florida and was admitted to the Florida Bar in 1998. Anna is also a Certified Public Accountant. She passed May 1995 CPA Exam on the first sitting. She is fluent in Russian (native).

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt lawyers by city

- Austin Assignment Of Debt Lawyers

- Boston Assignment Of Debt Lawyers

- Chicago Assignment Of Debt Lawyers

- Dallas Assignment Of Debt Lawyers

- Denver Assignment Of Debt Lawyers

- Houston Assignment Of Debt Lawyers

- Los Angeles Assignment Of Debt Lawyers

- New York Assignment Of Debt Lawyers

- Phoenix Assignment Of Debt Lawyers

- San Diego Assignment Of Debt Lawyers

- Tampa Assignment Of Debt Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Practical Law

Assignment of book debts

Practical law uk legal update 9-100-2070 (approx. 3 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- General Contract and Boilerplate

- Security and Quasi Security

- United Kingdom

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

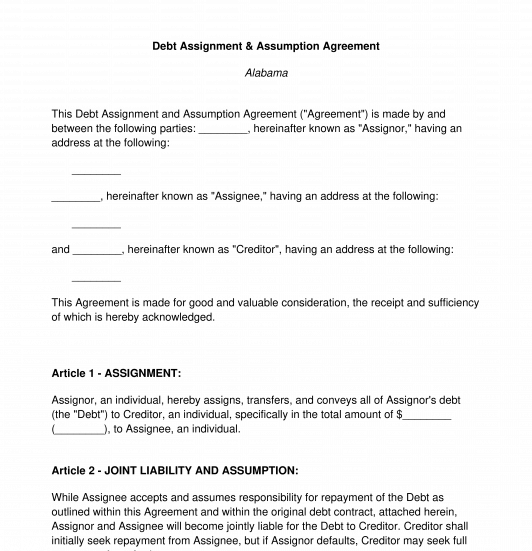

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

What Is an Assignment of Debt?

George Simons | December 02, 2022

Co-Founder of SoloSuit George Simons, JD/MBA

George Simons is the co-founder and CEO of SoloSuit. He has helped Americans protect over $1 billion from predatory debt lawsuits. George graduated from BYU Law school in 2020 with a JD-MBA. In his spare time, George likes to cook, because he likes to eat.

Edited by Hannah Locklear

Editor at SoloSuit Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: Have a debt collection agency coming after you for a past due account? Not convinced that they have the right to sue you? Learn about the assignment of debt and how you can beat a debt collector in court.

Assignment of debt means that the debt has been transferred, including all obligations and rights, from the creditor to another party. The debt assignment means there has been a legal transfer to another party, who now owns the debt. Usually, the debt assignment involves a debt collector who takes the responsibility to collect your debt.

How does a debt assignment work?

When the creditor lends you money, it does so thinking that what it lends you as well as interest will be paid back according to the legal agreement. The lender will wait to get the money back according to the contract.

When the debt is assigned to another party, you must be notified when it happens so you know who owns the debt and where to send your payments. If you send payments to the previous creditor, the payments probably will be rejected and you could default.

When the debtor gets this notice, it's wise for them to check that the creditor has the right balance and the payment that you should pay each month. Sometimes, you may be able to offer changes to the terms of the loan. If you decide to try this, the creditor must respond.

Respond to debt collection lawsuit in 15 minutes with SoloSuit.

Why creditors assign debts

Note that debt assignments and debt collectors must adhere to the Fair Debt Collection Practices Act . This is a law overseen by the FTC that restricts when the debtor can contact you and how. For example, they only can call you between 8 am and 9 pm and they cannot call you at work if you tell them not to do so.

If the FDCPA is broken by the debt collector, you can file a countersuit and may get them to pay damages and your attorney fees.

There are many reasons why the creditor may assign a debt. The most common reason is to boost their liquidity and reduce risk. The creditor could need capital, so they'll sell off some of their debts to debt collection companies.

Also, the creditor may have many higher-risk loans and they could be worried they could have a lot of defaults. In these situations, the creditor may be ok with selling debts for pennies on the dollar if it enhances their financial outlook and reassures investors.

Or, the creditor may think the debt is too old to worry about and may not assign it at all.

Different perspectives on debt assignment

Debt assignment is often criticized, especially in the past 30 years. Debt buyers often engage in shady practices. For example, some debt collectors may call consumers in the middle of the night and harass them to pay debts. Or, they may call friends and family looking for you. Some debt collectors even use foul language with consumers and threaten them.

Sometimes the debt is sold several times, so the consumer is chased for a debt she doesn't owe. Or, the debt amount could be different than what the debt collector claims.

Don't let debt collectors harass you. Respond with SoloSuit.

What to do if a debt collector comes after you

If you owe a debt and the debt has been assigned to a debt collector, you may be getting a lot of phone calls at all hours to get you to pay what you allegedly owe. This can continue for months or even years.

Sometimes, you can just ignore the phone calls and nothing happens. However, if enough money is involved, the debt collector could file a lawsuit against you. The worst thing you can do in this situation is to ignore the lawsuit.

What you should do is use the debt assignment game against them. What happens is this: The debt was probably sold a few times. You want to make the debt collector prove that the debt is yours and that you owe what they say you owe.

When the debt has been sold several times, it can be difficult for them to track down all that paperwork. You need to respond to the lawsuit by filing an answer with your clerk of court and then mail that answer to the debt collector by certified mail.

If you are being pursued for a debt that has been purchased by a third party debt buyer, there is a good chance you can get the issue resolved fairly easily. For example, in many instances, you may be able to negotiate a fairly low settlement on the debt, if you prefer to do so. This is because many companies who specialize in debt assignments actually purchased the debt for pennies on the dollar and are not actually looking to collect on the full amount owed.

Even if you cannot negotiate a settlement, make sure to log all of your interaction with the debt buyer since the collection agents they employ are notorious for routinely violating provisions contained within the FDCPA, which means you may have grounds to file a counterclaim and demand compensatory damages.

What is SoloSuit?

SoloSuit makes it easy to respond to a debt collection lawsuit.

How it works: SoloSuit is a step-by-step web-app that asks you all the necessary questions to complete your answer. Upon completion, you can either print the completed forms and mail in the hard copies to the courts or you can pay SoloSuit to file it for you and to have an attorney review the document.

Respond with SoloSuit

"First time getting sued by a debt collector and I was searching all over YouTube and ran across SoloSuit, so I decided to buy their services with their attorney reviewed documentation which cost extra but it was well worth it! SoloSuit sent the documentation to the parties and to the court which saved me time from having to go to court and in a few weeks the case got dismissed!" – James

>>Read the FastCompany article: Debt Lawsuits Are Complicated: This Website Makes Them Simpler To Navigate

>>Read the NPR story on SoloSuit: A Student Solution To Give Utah Debtors A Fighting Chance

How to answer a summons for debt collection in your state

Here's a list of guides for other states.

All 50 states .

Guides on how to beat every debt collector

Being sued by a different debt collector? We're making guides on how to beat each one.

- Waypoint Resource Group

Win against credit card companies

Is your credit card company suing you? Learn how you can beat each one.

- Wells Fargo

Going to Court for Credit Card Debt — Key Tips

How to Negotiate Credit Card Debts

How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

Get answers to these FAQs

Need more info on statutes of limitations? Read our 50-state guide.

Why do debt collectors block their phone numbers?

How long do debt collectors take to respond to debt validation letters?

What are the biggest debt collector companies in the US?

Is Zombie Debt Still a Problem in 2019?

SoloSuit FAQ

If a car is repossessed, do I still owe the debt?

Is Portfolio Recovery Associates Legit?

Is There a Judgment Against Me Without my Knowledge?

Should I File Bankruptcy Before or After a Judgment?

What is a default judgment?— What do I do?

Summoned to Court for Medical Bills — What Do I Do?

What Happens If Someone Sues You and You Have No Money?

What Happens If You Never Answer Debt Collectors?

What Happens When a Debt Is Sold to a Collection Agency

What is a Stipulated Judgment?

What is the Deadline for a Defendant's Answer to Avoid a Default Judgment?

Can a Judgement Creditor Take my Car?

Can I Settle a Debt After Being Served?

Can I Stop Wage Garnishment?

Can You Appeal a Default Judgement?

Do I Need a Debt Collection Defense Attorney?

Do I Need a Payday Loans Lawyer?

Do student loans go away after 7 years? — Student Loan Debt Guide

Am I Responsible for My Spouse's Medical Debt?

Should I Marry Someone With Debt?

Can a Debt Collector Leave a Voicemail?

How Does Debt Assignment Work?

What Happens If a Defendant Does Not Pay a Judgment?

Can You Serve Someone with a Collections Lawsuit at Their Work?

What Is a Warrant in Debt?

How Many Times Can a Judgment be Renewed in Oklahoma?

Can an Eviction Be Reversed?

Does Debt Consolidation Have Risks?

What Happens If You Avoid Getting Served Court Papers?

Does Student Debt Die With You?

Can Debt Collectors Call You at Work in Texas?

How Much Do You Have to Be in Debt to File for Chapter 7?

What Is the Statute of Limitations on Debt in Washington?

How Long Does a Judgment Last?

Can Private Disability Payments Be Garnished?

Can Debt Collectors Call From Local Numbers?

Does the Fair Credit Reporting Act Work in Florida?

The Truth: Should You Never Pay a Debt Collection Agency?

Should You Communicate with a Debt Collector in Writing or by Telephone?

Do I Need a Debt Negotiator?

What Happens After a Motion for Default Is Filed?

Can a Process Server Leave a Summons Taped to My Door?

Learn More With These Additional Resources:

Need help managing your finances? Check out these resources.

How to Make a Debt Validation Letter - The Ultimate Guide

How to Make a Motion to Compel Arbitration Without an Attorney

How to Stop Wage Garnishment — Everything You Need to Know

How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

Defending Yourself in Court Against a Debt Collector

Tips on you can to file an FDCPA lawsuit against a debt collection agency

Advice on how to answer a summons for debt collection.

Effective strategies for how to get back on track after a debt lawsuit

New Hampshire Statute of Limitations on Debt

Sample Cease and Desist Letter Against Debt Collectors

The Ultimate Guide to Responding to a Debt Collection Lawsuit in Utah

West Virginia Statute of Limitations on Debt

What debt collectors cannot do — FDCPA explained

Defending Yourself in Court Against Debt Collector

How to Liquidate Debt

Arkansas Statute of Limitations on Debt

You're Drowning in Debt — Here's How to Swim

Help! I'm Being Sued by My Debt Collector

How to Make a Motion to Vacate Judgment

How to Answer Summons for Debt Collection in Vermont

North Dakota Statute of Limitations on Debt

ClearPoint Debt Management Review

Indiana Statute of Limitations on Debt

Oregon Eviction Laws - What They Say

CuraDebt Debt Settlement Review

How to Write a Re-Aging Debt Letter

How to Appear in Court by Phone

How to Use the Doctrine of Unclean Hands

Debt Consolidation in Eugene, Oregon

Summoned to Court for Medical Bills? What to Do Next

How to Make a Debt Settlement Agreement

Received a 3-Day Eviction Notice? Here's What to Do

How to Answer a Lawsuit for Debt Collection

Tips for Leaving the Country With Unpaid Credit Card Debt

Kansas Statute of Limitations on Debt Collection

How to File in Small Claims Court in Iowa

How to File a Civil Answer in Kings County Supreme Court

Roseland Associates Debt Consolidation Review

How to Stop a Garnishment

Debt Eraser Review

It only takes 15 minutes. And 50% of our customers' cases have been dismissed in the past.

"Finding yourself on the wrong side of the law unexpectedly is kinda scary. I started researching on YouTube and found SoloSuit's channel. The videos were so helpful, easy to understand and encouraging. When I reached out to SoloSuit they were on it. Very professional, impeccably prompt. Thanks for the service!" – Heather

Not sued yet? Use our Debt Validation Letter.

Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it.

What is an Assignment of Debt?

By Sej Lamba

Updated on 26 February 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

When Could an Assignment of Debt Happen?

Key issues on assignment of debt, drafting the correct documentation, giving notice, key takeaways.

Debts are increasingly common in today’s financial climate, and unfortunately, many people struggle to repay what they owe. Debts owed can be sold to third parties and a lot of companies in the UK purchase debts. However, this can be complicated as specific legal formalities apply when assigning debts. This article will explain some of the critical issues around the assignment of debt.

Debt collection can be a complex process. There are various reasons as to why debt is assigned. For example, a company owed debt may want to avoid putting in time and effort to chase it or want to take legal action to recover it.

To picture a scenario, imagine this:

- Joe Bloggs gets a brand-new shiny credit card. Joe purchases lots of nice things for his family with the credit card. Usually, he can keep up with payments as he keeps track of them and earns enough to pay them back;

- suddenly, Joe has an injury and cannot work anymore. He has to give up his job and now can’t afford to pay the credit card company back;

- Joe ignores various letters chasing the debt and hopes the problem will disappear. Ultimately, after months, the credit card company gives up and sells Joe’s debt to a debt collection agency.

So, in summary – after the debt sale, Joe now owes money to a different company.

In practice, debt assignments can be complex, and the parties must follow the relevant legal rules and draft the correct documentation.

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee).

In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third-party debt collection business.

This process can be complex. There have been several legal cases in the courts where this process has given rise to disputes.

There are two different types of assignment of debt – a legal assignment of debt and an equitable assignment of debt.

In simple terms:

- a legal assignment of debt will transfer the right for enforcement of the debt; and

- an equitable assignment of debt will transfer only the benefit of the debt without the right to enforce it.

Let us explore each type below.

Legal Assignment of Debt

If the assignment complies with specific legal requirements under the Law of Property Act 1925, it will be a ‘legal assignment’. This means that the assignee will be the new owner of the debt.

A legal assignment requires various formalities to be effective. For example, it must:

- be in writing and signed by the assignor;

- the debtor must be given written notice of the assignment;

- be absolute with no conditions attached to it;

- relate to the whole of the debt and not just part of it; and

- not be a charge.

After the transfer of the debt, the assignor can sue the debtor in its own name.

Equitable Assignment of Debt

It is also possible to have an equitable debt transfer – the requirements for this are much less strict. For example, this can be done informally by the assignor informing the assignee that the rights are transferred to them.

Download this free Commercial Contracts Checklist to ensure your contracts will meet your business’ needs.

For an equitable assignment, giving notice is not essential, but still always highly advisable.

Where an equitable assignment is made, the assignee won’t have the right to pursue court action for the debt. In this case, the assignee will have to join forces with the assignor to sue for the debt to sue for the debt.

The debtor should receive notice of any debt transfer so they know to whom the money is owed. Following notice, the new debt owner can pursue the debt owed.

A legal assignment is the best option for an assignee of debt – this will give them full rights to enforce the debt.

Assignments of debts can be very complex. For a legal assignment of debt, you need to follow various formalities. Otherwise, it may be unenforceable and lead to disputes. If you need help executing a debt assignment correctly, you should seek legal advice from an experienced lawyer.

If you need help with an assignment of debt, LegalVision’s experienced business lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 0808 196 8584 or visit our membership page .

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Understanding your business’ new employment law obligations, a roadmap to business success: how to franchise in the uk, contact us now.

Fill out the form and we will contact you within one business day

Related articles

3 Key Considerations to Manage Contract Risks

3 Business Benefits of Working With a Specialist Commercial Contracts Lawyer

What Are the Risks of a Verbal Contract With Your Customers?

3 Points Your Business Should Consider to Minimise Risk Before Signing a New Contract

We’re an award-winning law firm

2023 Economic Innovator of the Year Finalist - The Spectator

2023 Law Company of the Year Finalist - The Lawyer Awards

2023 Future of Legal Services Innovation - Legal Innovation Awards

2021 Fastest Growing Law Firm in APAC - Financial Times

English law assignments of part of a debt: Practical considerations

United Kingdom | Publication | December 2019

Enforcing partially assigned debts against the debtor

The increase of supply chain finance has driven an increased interest in parties considering the sale and purchase of parts of debts (as opposed to purchasing debts in their entirety).

While under English law part of a debt can be assigned, there is a general requirement that the relevant assignee joins the assignor to any proceedings against the debtor, which potentially impedes the assignee’s ability to enforce against the debtor efficiently.

This note considers whether this requirement may be dispensed with in certain circumstances.

Can you assign part of a debt?

Under English law, the beneficial ownership of part of a debt can be assigned, although the legal ownership cannot. 1 This means that an assignment of part of a debt will take effect as an equitable assignment instead of a legal assignment.

Joining the assignor to proceedings against the debtor

While both equitable and legal assignments are capable of removing the assigned asset from the insolvency estate of the assignor, failure to obtain a legal assignment and relying solely on an equitable assignment may require the assignee to join the relevant assignor as a party to any enforcement action against the debtor.

An assignee of part of a debt will want to be able to sue a debtor in its own name and, if it is required to join the assignor to proceedings against the debtor, this could add additional costs and delays if the assignor was unwilling to cooperate. 2

Kapoor v National Westminster Bank plc

English courts have, in recent years, been pragmatic in allowing an assignee of part of a debt to sue the debtor in its own name without the cooperation of the assignor.

In Charnesh Kapoor v National Westminster Bank plc, Kian Seng Tan 3 the court held that an equitable assignee of part of a debt is entitled in its own right and name to bring proceedings for the assigned debt. The equitable assignee will usually be required to join the assignor to the proceedings in order to ensure that the debtor is not exposed to double recovery, but the requirement is a procedural one that can be dispensed with by the court.

The reason for the requirement that an equitable assignee joins the assignor to proceedings against the debtor is not that the assignee has no right which it can assert independently, but that the debtor ought to be protected from the possibility of any further claim by the assignor who should therefore be bound by the judgment.

Application of Kapoor

It is a common feature of supply chain finance transactions that the assigned debt (or part of the debt) is supported by an independent payment undertaking. Such independent payment undertaking makes it clear that the debtor cannot raise defences and that it is required to pay the relevant debt (or part of a debt) without set-off or counterclaim. In respect of an assignee of part of an independent payment undertaking which is not disputed and has itself been equitably assigned to the assignee, we believe that there are good grounds that an English court would accept that the assignee is allowed to pursue an action directly against the debtor without needing the assignor to be joined, as this is likely to be a matter of procedure only, not substance.

This analysis is limited to English law and does not consider the laws of any other jurisdiction.

Notwithstanding the helpful clarifications summarised in Kapoor, as many receivables financing transactions involve a number of cross-border elements, assignees should continue to consider the effect of the laws (and, potentially court procedures) of any other relevant jurisdictions on the assignment of part of a debt even where the sale of such partial debt is completed under English law.

Legal title cannot be assigned in respect of part of a debt. A partial assignment would not satisfy the requirements for a legal assignment of section 136 of the Law of Property Act 1925.

If an assignor does not consent to being joined as a plaintiff in proceedings against the debtor it would be necessary to join the assignor as a co-defendant. However, where an assignor has gone into administration or liquidation, there may be a statutory prohibition on joining such assignor as a co-defendant (without the leave of the court or in certain circumstances the consent of the administrator).

[2011] EWCA Civ 1083

- Financial institutions

Recent publications

Publication

UK Carbon Border Adjustment Mechanism: how will it work?

In February, we reported on the Department of Energy Security and Net Zero’s confirmation that a UK Carbon Border Adjustment Mechanism (CBAM) would be bought into force by 2027

Global | May 14, 2024

Regulatory gatekeepers in Energy M&A – ACCC and FIRB

Increasing activity in energy-focused M&A is expected. In the face of a changing regulatory gatekeeping landscape and shifting regulator priorities.

Australia | May 14, 2024

Tips on how an effective IP settlement can be a winning strategy

Litigating intellectual property disputes, including patent, trademark, copyright, industrial design and trade secret rights, can be complex and time-consuming.

Canada | May 13, 2024

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023

- Canada (English)

- Canada (Français)

- United States

- Deutschland (Deutsch)

- Germany (English)

- The Netherlands

- Türkiye

- United Kingdom

- South Africa

- Hong Kong SAR

- Marshall Islands

- Nordic region

- +8801712620018 Call Us For Free Consultation

Home » Law and Ethics » How do the courts classify charges over book debts?

How do the courts classify charges over book debts?

Executive Summary

This study is designed to get a clear understanding of charges over a company’s book debts and the courts role to develope it by judging the nature and volume of reported cases. Although, the charges over book debts frequently give rise to difficulties as the Company Act 1985 does not define ‘book debt’, it has been defined by judges in a series of cases.

This project further discusses the evolution of the floating charge and recent developments in the law which have considered the question whether a lender may create a fixed charge over the borrower’s assets which are of a type traditionally the subject of a floating charge, in particular book debt. The recent Privy Council decision in Agnew is at odds with the English position and this article considers whether the current uncertainty in the law should be resolved by legislative reform based upon the New Zealand model.

Finally, the project examines the nature of the security mechanisms of fixed and floating charges. In particular, charges over company book debts and their practical importance to corporate activity, are considered.

Relevant English, Australian and New Zealand case law is examined, with a detailed analysis of the judgment of the Privy Council in Agnew and Kevin James Bearsley v. The Commissioner of Inland Revenue and Official Assignee for the Estate in Bankruptcy of Bruce william Birtwhistle and Mark Leslie Birtwhistle(2001) UKPC 28; (2002) 20 ACLC 3,051

1.The creation of a charge on book debts:

Significant developments take place this century in law by the courts in relation to one particular type of charge frequently used by companies as security for repayment of a loan, namely, a charge over a company’s book debts. However, a charge over a book debt may be created in many ways and, for it to operate as an equitable assignment or charge, no particular form of words is required in the document 1 . In particular, an agreement between a debtor and a creditor that the debt owing shall be paid out of a specific fund coming to the debtor, or an order given by a debtor to his creditor upon a person owing money or holding funds belonging to the debtor, directing such person to pay the funds to the creditor, will create a valid equitable charge upon such fund, unless there is an absolute assignment. This will only be the case if the agreement, as well as providing that the fund shall be applied in a particular way, also imposes a positive obligation in favour of the creditor to apply the fund towards payment of the debt 2 .

Thus, an undertaking to pay a specified sum out of the first moneys to be received on a future sale of certain rights constituted a good equitable assignment of the entitlement to the moneys 3 . A letter from a company to its customer instructing the customer to pay to the company’s account at its bank all amounts payable by the customer and stating that the instructions were to be regarded as irrevocable without the bank’s consent, constituted a charge on the book debts of the company and also has been held to be within S 396 (1) (e) of the Company Act 1985 4 .

2.Book debts define in common law:

This category of charge frequently gives rise to difficulties because the Companies Act 1985 does not define ‘book debts’ . The question whether any item is a book debt is generally a question of fact. The term ‘book debts’ has been defined by Lord Esher MR as ‘debts arising in a business in which it is the proper and usual course to keep books, and which ought to be entered in such books’ 5 . Furthermore, a debt is a book debt if it arises in the course of a business and, as a matter of practice, such a debt would, in the ordinary course of a business, be entered in well-kept books relating to the business 6 . It is not necessary that it actually be entered, only that it be of the sort that accountancy practice would ordinarily require to be entered in the relevant books as a book debt (or, at least, as a debt) 7 . The fact that a company holds security or a guarantee for the debt does not alter its nature as a book debt. However, to be a book debt it must be enforceable by action directly against the debtor.

3.The nature of the charges:

The courts primarily determine whether a charge has been created over book debts and, if it has, the nature of the charge 8 . However, companies generally have two options available to them. First, a company can, like a natural person, provide a lender with a fixed or specific charge over the company’s property, for example a mortgage over its land. Secondly, unlike a natural person, a company can provide a floating charge. Thus, a fixed charge is one, which attaches to a specific item of property such as freehold and leasehold property, goodwill, shares in subsidiaries, intellectual property rights, fixed plant and machinery. The fixed charges also attaches to these categories of assets acquired in the future by the company. Importantly, the chargor is not permitted to dispose of the property without the chargee’s consent. A floating charge, on the other hand, covers a class of property, but does not attach to any specific items within the class until some specified future event occurs. Until that event transpires, the chargor can dispose of items in the class in the ordinary course of its business without reference to the chargee. In this way, a floating charge enables a company to provide security for a loan via assets, which will flow into and out of its ownership 9 .

It can be said that recently, the boundary between the fixed and floating charge was fairly settled, at least in England, judging by the nature and volume of reported cases. Lord Macnaghten’s description of fixed versus floating charges in Illingworth v. Houldsworth 10 is helpful:

A specific charge, I think, is one that without more fastens on ascertained and definite property or property capable of being ascertained and defined; a floating charge, on the other hand, is ambulatory and shifting in its nature, hovering over and so to speak floating with the property which it is intended to affect until some event occurs or some act is done which causes it to settle and fasten on the subject of the charge within its reach and grasp 11 .

However, the instrument creating the several charges will, in most cases, state whether each is intended to take effect as ‘fixed’ or ‘floating’ security. So, the characterisation in the instrument is unlikely to be determinative; a charge expressed to be ‘fixed’ may take effect as a floating charge. Indeed, it has been said that ‘the subjective intentions of the parties to the instrument are irrelevant and inadmissible’ for the purposes of determining the proper categorisation of the charge 12 .

4.The creditors prefer to take fixed charge over book debts:

The efficient operation of company business relies to a great extent on the ability of companies to procure debt capital. This in turn is dependent on the confidence of lenders in their ability to protect themselves against undue risk. A fixed charge gives a greater level of protection than a floating charge. One of the inherent risks of a floating charge, not shared by a fixed charge, is that certain unsecured creditors, including employees of the company, are given priority over a creditor who holds a floating charge (including a floating charge that has become fixed). For this reason, a lender taking security will prefer to obtain a fixed charge over those assets available for such a charge, that is, fixed assets which the company is not likely to want to dispose of whilst the charge exists. Furthermore, many small companies do not have large tangible assets such as property. Therefore, the practice was that the bank would like to take a fixed charge over future monies due to the company (e.g. book and trade debts, amounts due under insurance claims, refunds due from Crown Departments etc.). In reality, for many small companies, the book debt ledger was the barometer, which set the level of lending the bank, was prepared to extend.

However, there may be insufficient fixed assets available and this will then necessitate the creation of floating charges with their attendant risk. The types of assets, which are typically subject to floating charges, are book debts and trading stock.

5.The floating charge becomes attractive to the creditors:

The floating charge is used most often to take security over a company’s book debts, leaving the company the freedom to deal with the book debts by collecting them in the ordinary course of its business. However, the use of the floating charge took hold because, if a corporate debtor had been obliged to comply with the terms of a fixed charge, the effect on its circulating capital would be to paralyse its business. The reason for this was that under a fixed charge, unless the debtor company obtained the consent of the creditor, it would be unable to deal with its assets without breaking the terms of the fixed charge. This meant that it would be unable to give its customers ownership of the goods that it sold to them, or make use of the money that they paid it for goods sold. It could not use that money or the cash in its bank account to buy more goods or to meet other commitments 13 . In other words, a fixed charge deprived the company of its cash flow.

The floating charge, on the other hand, was intended to give creditor effective and comprehensive security over the debtor company’s whole business as well as its assets, while at the same time leaving the debtor company free to deal with its assets and pay its trade creditors in the ordinary course of its business. This form of security became especially attractive for banks that advanced loans to their corporate customers.

6.The vulnerability of the floating charges:

By the 1970s, however, banks had become disillusioned with the floating charge, because of the increasing range of claims of other creditors with floating charges, as well as the growth in other classes of preferential creditor with priority over the banks on the insolvency of corporate debtors. This led the banks to explore other ways of expanding their use of fixed charges 14 .

It was, however, generally considered that it was not possible to take a fixed charge over a fluctuating class of present and future book debts. The reasons for this were commercial: book debts were part of the circulating capital of a business, and were an important component of its cash flow, and a fixed charge would have the effect of strangling the debtor’s business.

7.The controversial academic debates on book debts:

In 1994, a decision of the English Court of Appeal (Civil Division) 15 , relating to charges over company book debts, gave rise to a flurry of academic debate. Professor Roy Goode started the debate, in which he pronounced the New Bullas decision to be “so disappointing” 16 . Conversely, Alan Berg, in a reply to Goode described New Bullas as “a correct and helpful decision ” 17 . The debate (into which a number of other academics also weighed) centred on the question of whether security in a book debt and its proceeds creates one security interest or two. According to Goode , if it creates a single interest which changes its character “from fixed to floating as it moves from assets to proceeds” 18 , then the interest in the proceeds ranks ahead of the claims of preferential creditors. If, on the other hand, upon collection of the proceeds of the book debt an entirely new floating security “springs into existence ” 19 , then the interest will be subordinate to the claims of preferential creditors.

Recently, the Privy Council in Agnew and Kevin James Bearsley v. The Commissioner of Inland Revenue and Official Assignee for the Estate in Bankruptcy of Bruce William Birtwhistle and Mark Leslie Birtwhistle 20 emphatically declared New Bullas to have been wrongly decided. The Privy Council’s decision is of significant interest to banks or others that hold a charge over the book debts of a borrowing company as security for a loan. Lenders may be wise to re-evaluate the level of security that such charges afford them, in light of the direction in which the Privy Council’s decision has taken the law.

The Agnew case, which emanated from New Zealand , concerned a company, Brumark Investments Limited that went into receivership. The receiver collected payment of various book debts of the company. The issue before the Privy Council was whether the amounts realised from the book debts should be applied towards payment of the company’s employees (and the Commissioner of Inland Revenue) as preferential creditors, or whether the amounts collected should be paid to Westpac Bank which held a charge over Brumark’s book debts. The answer turned on whether the charge was fixed or floating, for only a fixed charge would allow the bank to receive preferential payment under the relevant statutory provisions relating to receivership. The trial judge held the charge in question was a fixed charge, but this was reversed by the New Zealand Court of Appeal. The Privy Council dismissed the subsequent appeal by the bank and held the charge to be a floating charge, notwithstanding its description as a fixed charge in the debenture.