- SUPRIYA LIFESCIENCE LTD.

- SECTOR : PHARMACEUTICALS & BIOTECHNOLOGY

- INDUSTRY : PHARMACEUTICALS

Supriya Lifescience Ltd.

NSE: SUPRIYA | BSE: 543434

Mid-range Performer

366.20 -1.50 ( -0.41 %)

56.97% Gain from 52W Low

238.4K NSE+BSE Volume

NSE 24 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

1 active buys

Broker 1Year sells

0 active sells

Broker 1Year neutral

1 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

Supriya Lifescience Ltd. share price target

Supriya lifescience ltd. has an average target of 355. the consensus estimate represents a downside of -3.06% from the last price of 366.20. view 4 reports from 2 analysts offering long-term price targets for supriya lifescience ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

- Option Chain

- Daily Reports

- Press Releases

24-May-2024 15:30

29-May-2024 | 83.1300

24-May-2024 17:00

Lac Crs 416.04 | Tn $ 5.01

24-May-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Series : ( )

Announcements.

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %).

Click here for Block Deals

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, announcement xbrl details, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

- Super Investors

- Account

- Share Holding

- Balance Sheet

- Corp. Action

Supriya Lifescience share price

NSE: SUPRIYA BSE: 543434 SECTOR: Pharmaceuticals & Drugs 214k 468 90

Price Summary

₹ 378.5

₹ 364.25

₹ 424

₹ 233.3

Ownership Stable

Valuation expensive, efficiency excellent, financials average, company essentials.

₹ 2947.28 Cr.

₹ 2806.32 Cr.

₹ 97.28

₹ 157.58 Cr.

₹ 16.63 Cr.

₹ 14.96

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 6 Indices.

NIFTYMICRO250

NIFTYTOTALMCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- Company has been maintaining healthy ROE of 35.7225592236554 % over the past 3 years.

- Company has been maintaining healthy ROCE of 40.7273632378566 % over the past 3 years.

- Company is virtually debt free.

- Company has a healthy Interest coverage ratio of 40.4275223499361 .

- The Company has been maintaining an effective average operating margins of 29.7643355080448 % in the last 5 years.

- The company has an efficient Cash Conversion Cycle of 29.8904097656824 days.

- Company has a healthy liquidity position with current ratio of 4.85367661644794 .

- The company has a high promoter holding of 68.3 %.

Limitations

- The company has shown a poor profit growth of 6.97427906775647 % for the Past 3 years.

- The company has shown a poor revenue growth of 13.935924621295 % for the Past 3 years.

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports, ratings & research reports.

- Research HDFC Securities 26 Dec 2023

Company Presentations

- Concall Q4FY23 5 Jun 2023

- Concall Q4FY22 7 Jun 2022

- Concall Q3FY24 15 Feb 2024

- Concall Q3FY23 1 Mar 2023

- Concall Q3FY22 22 Feb 2022

- Concall Q3FY22 1 Feb 2022

- Presentation Q4FY23 31 May 2023

- Presentation Q3FY24 10 Feb 2024

- Presentation Q3FY22 27 Jan 2022

- Presentation Q2FY23 11 Nov 2022

Company News

Supriya lifescience stock price analysis and quick research report. is supriya lifescience an attractive stock to invest in.

The Indian healthcare sector is expected to reach US$ 372 billion by 2022, driven by rising incomes, greater health awareness, lifestyle diseases and increasing access to insurance. Healthcare has become one of India’s largest sectors - both in terms of revenue and employment.

Healthcare comprises hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance, and medical equipment. The structure of the healthcare delivery system in India consists of three broad segments: Primary care, Secondary care, and Tertiary care.

- Primary care is the first point of contact between the population and the healthcare service providers. For example, Sub-center (SC), Primary Health Centre (PHC) and Community Health Centre (CHC) which is more relevant to rural areas (PHC’s).

- Secondary care providers inpatient as well as outpatient medical services and includes simple surgical procedures. For example, District level & Mid-sized hospitals.

- Tertiary care is the third level of the healthcare delivery system in the country. These hospitals are specialized consultative healthcare infrastructure. For example, Single specialty and Multi-specialty hospitals.

While healthcare services are offered by the public as well as private sectors, in urban as well as rural areas, generally people prefer private hospitals over public hospitals for treatment of diseases, illness, and sickness. So, let’s look into Supriya Lifescience and its performance over the period of time. Supriya Lifescience stock price today is Rs 366.2 .

- Operating cash flow ratio: It measures the adequacy of a company’s cash generated from operating activities to pay off short-term financial obligations. Supriya Lifescience cash from the operating activity was Rs 66.187 Cr.

- Financial Strength: Health care organizations usually have high debt loads and low equity capital in their balance sheet. So, Debt to Equity ratio is important to analyze the company’s sustainability. Supriya Lifescience has a Debt to Equity ratio of 0.0238 , which is a strong indication for the company.

- EPS growth: Investors should ensure the EPS figure is growing faster than revenue numbers because it indicates company management is increasing the efficiency with which it runs the company. In Supriya Lifescience , the EPS growth was - 40.8097805629337 % which is bad for the company.

- Operating profit margin : It determines a company's potential earnings. It assesses how well-managed a company with respect to its basic overhead costs and other operating expenses, Supriya Lifescience has OPM of 27.8655697729413 % which is a good sign for profitability.

- ROE : Supriya Lifescience have a average ROE of 13.6649363151039 %. ROE is an important financial parameter for hospitals & health care companies because they expand and grow rapidly. Therefore, ROE measures how efficiently a shareholder's fund is used for generating profits.

- Share Price : - The current share price of Supriya Lifescience is Rs 366.2 . One can use valuation calculators of ticker to know if Supriya Lifescience share price is undervalued or overvalued.

Brief about Supriya Lifescience

Supriya lifescience ltd. financials: check share price, balance sheet, annual report, quarterly results, shareholding, company profile and news for company analysis.

Supriya Lifescience Ltd. is a leading pharmaceutical company specializing in the development, manufacturing, and marketing of high-quality generic drugs. With a strong presence in both domestic and international markets, the company has established itself as a trusted provider of affordable healthcare solutions. Supriya Lifescience offers a wide range of products across various therapeutic categories, including cardiovascular, gastrointestinal, respiratory, and women's health. With a commitment to innovation and customer satisfaction, the company has earned a reputation for delivering superior healthcare products.

Supriya Lifescience Ltd. - Share Price

Supriya Lifescience Ltd.'s share price is an important indicator for investors interested in the company. The share price reflects the market's perception of the company's value and future prospects. It is influenced by various factors, including financial performance, industry trends, and market sentiment. Investors can track the share price through our website's stock analysis page. We provide real-time and historical share price data, along with charts and tools to help investors analyze the stock's performance.

Supriya Lifescience Ltd. - Balance Sheet

The balance sheet of Supriya Lifescience Ltd. provides a snapshot of the company's financial position at a given point in time. It reveals the company's assets, liabilities, and shareholders' equity. The balance sheet helps investors assess the company's liquidity, solvency, and ability to generate returns. Using our pre-built screening tools, investors can analyze Supriya Lifescience's balance sheet and identify key financial ratios and indicators. Additionally, our premium features allow for fair value calculations using tools like DCF Analysis, BVPS Analysis, Earnings multiple approach, and DuPont analysis.

Supriya Lifescience Ltd. - Annual Report

The annual report of Supriya Lifescience Ltd. provides a comprehensive overview of the company's performance, strategy, and future prospects. It contains important information such as financial statements, management's discussion and analysis, corporate governance practices, and sustainability initiatives. As part of our commitment to transparency, we make Supriya Lifescience's annual reports available for download on our website. Investors can access these reports to gain deeper insights into the company's operations and make informed investment decisions.

Supriya Lifescience Ltd. - Dividend

Dividends are an important consideration for long-term stock investors. They represent a portion of a company's earnings that is distributed to its shareholders. Supriya Lifescience Ltd. has a track record of consistently sharing its profits with shareholders through dividends. Investors can stay updated on the company's dividend payouts through our stock analysis page. Additionally, our website provides access to research reports and credit ratings that evaluate Supriya Lifescience's dividend payout history and financial stability.

Supriya Lifescience Ltd. - Quarterly Result

Supriya Lifescience Ltd.'s quarterly results provide investors with insights into the company's financial performance and operational efficiency. By monitoring the quarterly results, investors can track the company's progress, identify trends, and assess its ability to generate sustainable earnings. Our website offers downloadable materials such as con-call transcripts and investor presentations that provide in-depth analysis and commentary on Supriya Lifescience's quarterly results.

Supriya Lifescience Ltd. - Stock Price

Supriya Lifescience Ltd.'s stock price reflects the market's valuation of the company at any given time. It is influenced by various factors such as financial performance, industry trends, market sentiment, and economic conditions. Our stock analysis page provides investors with real-time and historical stock price data, along with interactive price charts. Investors can utilize our pre-built screening tools to analyze Supriya Lifescience's stock price and identify potential investment opportunities.

Supriya Lifescience Ltd. - Price Chart

Analyzing price charts is an essential tool for technical analysis and understanding Supriya Lifescience Ltd.'s stock price movements. Our website offers interactive price charts that allow investors to track historical price data, identify patterns, and determine potential entry or exit points. By using our pre-built screening tools in combination with price charts, investors can gain valuable insights into Supriya Lifescience's stock price behavior.

Supriya Lifescience Ltd. - News

Staying informed about the latest news and developments in Supriya Lifescience Ltd. is crucial for investors. Our stock analysis page provides a dedicated news section that covers relevant industry news, company announcements, regulatory updates, and market insights. Investors can access our website for the most up-to-date news that can impact Supriya Lifescience's stock performance.

Supriya Lifescience Ltd. - Concall Transcripts

Concall transcripts provide a detailed account of Supriya Lifescience Ltd.'s conference call discussions with analysts and investors. These transcripts offer insights into the company's strategy, financial performance, future outlook, and responses to pertinent questions. As part of our commitment to providing comprehensive information, we make these transcripts available for download on our website. Investors can access them to gain a deeper understanding of Supriya Lifescience's operations and investment prospects.

Supriya Lifescience Ltd. - Investor Presentations

Investor presentations are a valuable resource for understanding Supriya Lifescience Ltd.'s business model, growth strategy, and competitive advantages. These presentations often include financial data, operational highlights, and upcoming initiatives. At our website, we provide downloadable investor presentations to provide investors with a comprehensive overview of Supriya Lifescience's investment potential.

Supriya Lifescience Ltd. - Promoters

Promoters play a critical role in shaping the direction and performance of Supriya Lifescience Ltd. Promoters are individuals or entities that have founded or established the company and hold a significant stake in its equity. Understanding the promoters' background, experience, and ownership is crucial for investors evaluating Supriya Lifescience's long-term prospects. Our stock analysis page provides detailed information about Supriya Lifescience's promoters to help investors make informed decisions.

Supriya Lifescience Ltd. - Shareholders

Shareholders are the owners of Supriya Lifescience Ltd. and have a vested interest in the company's growth and profitability. Identifying the major shareholders and their stake in the company provides insights into the ownership structure and potential influence on decision-making. Our website offers information about Supriya Lifescience's major shareholders, allowing investors to gauge the level of institutional and retail investor participation in the company.

Please note that this content is focused on providing stock analysis information and does not include any financial data or numbers about the stock.

Ratio Delete Confirmation

- Company Info

- Competitors

- P&L A/C

- Balancesheet

- Half yearly

- Nine Monthly

- Capital Structure

- Shareholding Pattern

Supriya Lifescience Quarterly results

BSE: 543434 | NSE: SUPRIYAEQ | IND: Pharma - Indian | ISIN code: INE07RO01027 | SECT: Pharmaceuticals

Prv. Close:

The Quarterly Results page of Supriya Lifescience Ltd. presents the key result items, its comparison with the sector peers and its previous 5 Quarterly Results.

TOTAL INCOME

Rs 143.14Cr.

Rs 40.59Cr.

Rs 29.79Cr.

Quick Links

Supriya lifescience ltd. quick links, markets quick links, more from markets.

View Complete Site Map »

Date Sources: Live BSE and NSE Quotes Service: TickerPlant | Corporate Data, F&O Data & Historical price volume data: Dion Global Solutions Ltd. BSE Quotes and Sensex are real-time and licensed from the Bombay Stock Exchange. NSE Quotes and Nifty are also real time and licenced from National Stock Exchange. All times stamps are reflecting IST (Indian Standard Time). By using this site, you agree to the Terms of Service and Privacy Policy.

- Trending Stocks

- Suzlon Energy INE040H01021, SUZLON, 532667

- Vodafone Idea INE669E01016, IDEA, 532822

- IRFC INE053F01010, IRFC, 543257

- Cochin Shipyard INE704P01025, COCHINSHIP, 540678

- Bharat Dynamics INE171Z01026, BDL, 541143

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Pitchcraft REA

- Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Pharmaceuticals & Drugs

Samco Stock Rating

Supriya Lifescience Ltd.

As on 24 May, 2024 | 03:59

* BSE Market Depth (24 May 2024)

As on 24 May, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Stock with medium financial performance with average price momentum and val

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 13.63% away from 52 week high

- Market Cap - Above industry Median

- Promoters holding remains unchanged at 68.30% in Mar 2024 qtr

BIG SHARK INVESTORS

- Birla Group 3.5%

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- FDA Warnings

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing Debt to Equity

Companies decreasing their debt to equity ratio, decreasing roe, companies that are decreasing efficiency in utilisation of shareholders funds, companies in which fiis have increased holding qoq.

- D/E< D/E 1 yr Back

- Market Capitalization >250

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- FIIHolding>FIIHolding1QtrBack AND

- MarketCap>500

Rising Book Value

Book value of these companies rising over last 3 years, price to book value above industry, companies with price to book value above industry, premium to peers, companies trading at premium pe valuation as compared to their industry peers.

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

- Price to book value >Industry PBV AND

- Market Capitalization >500

- Price to Earning >Industry PE AND

DII Selling, FII Buying

List of companies in which diis have reduced and fiis increased holding qoq, companies with low leverage, list of companies with low debt to equity ratio.

- DIIHolding<DIIHolding1QtrBack AND

- MarketCap>250

- D/E<0.1 AND

Double Trouble

Companies reporting falling profits and profit margins yoy.

- NetProfit<NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

Price and Volume

Supriya lifesci standalone september 2023 net sales at rs 140.10 crore, up 24.89% y-o-y.

Supriya Lifesci Standalone June 2023 Net Sales at Rs 132.02 crore, up 30.26% Y-o-Y Aug 04 2023 11:18 AM

Buy Supriya Lifesciences; target of Rs 292: KR Choksey Jun 01 2023 12:16 PM

Supriya Lifesci Standalone March 2023 Net Sales at Rs 142.27 crore, down 21.51% Y-o-Y May 26 2023 06:56 PM

Buy Supriya Lifescience; target of Rs 278: KR Choksey Feb 22 2023 12:14 PM

Community Sentiments

Data not available.

What's your call on today?

Read 0 investor views

Thank you for your vote

You are already voted!

450 480 500 today can possible will big player run behind this stock ??? View more

Posted by : RRR0909

Repost this message

450 480 500 today can possible will big player run behind this stock ???

move up to 10% easily View more

Posted by : ffffff

move up to 10% easily

can today stock move 10 to 20 percent for the day ??? View more

can today stock move 10 to 20 percent for the day ???

- Broker Research

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

GRAVITON RESEARCH CAPITAL LLP

Dovetail india fund class 6 shares.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Shivani satish wagh, saloni satish wagh, satish waman wagh.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Shivani Satish Wagh Acquisition

Shivani satish wagh & pacs disposal, shivani satish wagh & pacs acquisition, dr saloni satish wagh disposal.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Supriya Lifescience - Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

Supriya lifescience - board meeting intimation for regulation 29(1) of sebi (listing obligations anddisclosure requirements) regulations, 2015.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds have increased holdings from 0.04% to 0.05% in Mar 2024 qtr.

- Number of MF schemes remains unchanged at 2 in Mar 2024 qtr

- FII/FPI have increased holdings from 4.56% to 5.37% in Mar 2024 qtr.

About the Company

Company overview, registered office.

207/208, Udyog Bhavan, ,Sonawala Road,, Goregaon - East,

Maharashtra

022-40332727

http://www.supriyalifescience.com

C 101, 247 Park, L.B.S. Marg, Vikhroli (West),,

Mumbai 400083

022-49186270, 49186200

022-49186060

http://www.linkintime.co.in

Designation

Chairman & Managing Director

Whole Time Director

Included In

INE07RO01027

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

Access your Detailed Credit Report - absolutely free

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NVIDIA CORPORATION

- AMD (ADVANCED MICRO DEVICES)

- MICROSOFT CORPORATION

- SINGAPORE AIRLINES LIMITED

- NIPPON ACTIVE VALUE FUND PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Quality stocks

- Dividend Aristocrats

- Growth stocks

- Undervalued stocks

- The Cannabis Industry

- The Internet of Things

- Biotechnology

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Cannibal companies

- The genomic revolution

- Europe's family businesses

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Supriya Lifescience Limited

Ine07ro01027, pharmaceuticals.

- Supriya Lifescience Limited Reports Earnings Results for the Third Quarter and Nine Months Ended December 31, 2023

Latest news about Supriya Lifescience Limited

Chart supriya lifescience limited.

Company Profile

Income statement evolution, ratings for supriya lifescience limited, eps revisions, quarterly revenue - rate of surprise, sector other pharmaceuticals.

- Stock Market

- SUPRIYA Stock

- News Supriya Lifescience Limited

Suggestions or feedback?

MIT News | Massachusetts Institute of Technology

- Machine learning

- Social justice

- Black holes

- Classes and programs

Departments

- Aeronautics and Astronautics

- Brain and Cognitive Sciences

- Architecture

- Political Science

- Mechanical Engineering

Centers, Labs, & Programs

- Abdul Latif Jameel Poverty Action Lab (J-PAL)

- Picower Institute for Learning and Memory

- Lincoln Laboratory

- School of Architecture + Planning

- School of Engineering

- School of Humanities, Arts, and Social Sciences

- Sloan School of Management

- School of Science

- MIT Schwarzman College of Computing

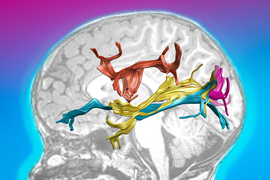

Study explains why the brain can robustly recognize images, even without color

Press contact :, media download.

*Terms of Use:

Images for download on the MIT News office website are made available to non-commercial entities, press and the general public under a Creative Commons Attribution Non-Commercial No Derivatives license . You may not alter the images provided, other than to crop them to size. A credit line must be used when reproducing images; if one is not provided below, credit the images to "MIT."

Previous image Next image

Even though the human visual system has sophisticated machinery for processing color, the brain has no problem recognizing objects in black-and-white images. A new study from MIT offers a possible explanation for how the brain comes to be so adept at identifying both color and color-degraded images.

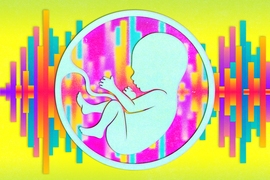

Using experimental data and computational modeling, the researchers found evidence suggesting the roots of this ability may lie in development. Early in life, when newborns receive strongly limited color information, the brain is forced to learn to distinguish objects based on their luminance, or intensity of light they emit, rather than their color. Later in life, when the retina and cortex are better equipped to process colors, the brain incorporates color information as well but also maintains its previously acquired ability to recognize images without critical reliance on color cues.

The findings are consistent with previous work showing that initially degraded visual and auditory input can actually be beneficial to the early development of perceptual systems.

“This general idea, that there is something important about the initial limitations that we have in our perceptual system, transcends color vision and visual acuity. Some of the work that our lab has done in the context of audition also suggests that there’s something important about placing limits on the richness of information that the neonatal system is initially exposed to,” says Pawan Sinha, a professor of brain and cognitive sciences at MIT and the senior author of the study.

The findings also help to explain why children who are born blind but have their vision restored later in life, through the removal of congenital cataracts, have much more difficulty identifying objects presented in black and white. Those children, who receive rich color input as soon as their sight is restored, may develop an overreliance on color that makes them much less resilient to changes or removal of color information.

MIT postdocs Marin Vogelsang and Lukas Vogelsang, and Project Prakash research scientist Priti Gupta, are the lead authors of the study, which appears today in Science . Sidney Diamond, a retired neurologist who is now an MIT research affiliate, and additional members of the Project Prakash team are also authors of the paper.

Seeing in black and white

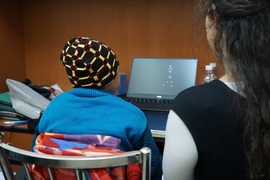

The researchers’ exploration of how early experience with color affects later object recognition grew out of a simple observation from a study of children who had their sight restored after being born with congenital cataracts. In 2005, Sinha launched Project Prakash (the Sanskrit word for “light”), an effort in India to identify and treat children with reversible forms of vision loss.

Many of those children suffer from blindness due to dense bilateral cataracts. This condition often goes untreated in India, which has the world’s largest population of blind children, estimated between 200,000 and 700,000.

Children who receive treatment through Project Prakash may also participate in studies of their visual development, many of which have helped scientists learn more about how the brain's organization changes following restoration of sight, how the brain estimates brightness, and other phenomena related to vision.

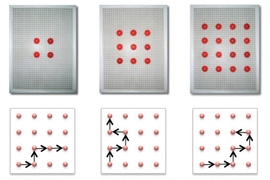

In this study, Sinha and his colleagues gave children a simple test of object recognition, presenting both color and black-and-white images. For children born with normal sight, converting color images to grayscale had no effect at all on their ability to recognize the depicted object. However, when children who underwent cataract removal were presented with black-and-white images, their performance dropped significantly.

This led the researchers to hypothesize that the nature of visual inputs children are exposed to early in life may play a crucial role in shaping resilience to color changes and the ability to identify objects presented in black-and-white images. In normally sighted newborns, retinal cone cells are not well-developed at birth, resulting in babies having poor visual acuity and poor color vision. Over the first years of life, their vision improves markedly as the cone system develops.

Because the immature visual system receives significantly reduced color information, the researchers hypothesized that during this time, the baby brain is forced to gain proficiency at recognizing images with reduced color cues. Additionally, they proposed, children who are born with cataracts and have them removed later may learn to rely too much on color cues when identifying objects, because, as they experimentally demonstrated in the paper, with mature retinas, they commence their post-operative journeys with good color vision.

To rigorously test that hypothesis, the researchers used a standard convolutional neural network, AlexNet, as a computational model of vision. They trained the network to recognize objects, giving it different types of input during training. As part of one training regimen, they initially showed the model grayscale images only, then introduced color images later on. This roughly mimics the developmental progression of chromatic enrichment as babies’ eyesight matures over the first years of life.

Another training regimen comprised only color images. This approximates the experience of the Project Prakash children, because they can process full color information as soon as their cataracts are removed.

The researchers found that the developmentally inspired model could accurately recognize objects in either type of image and was also resilient to other color manipulations. However, the Prakash-proxy model trained only on color images did not show good generalization to grayscale or hue-manipulated images.

“What happens is that this Prakash-like model is very good with colored images, but it’s very poor with anything else. When not starting out with initially color-degraded training, these models just don’t generalize, perhaps because of their over-reliance on specific color cues,” Lukas Vogelsang says.

The robust generalization of the developmentally inspired model is not merely a consequence of it having been trained on both color and grayscale images; the temporal ordering of these images makes a big difference. Another object-recognition model that was trained on color images first, followed by grayscale images, did not do as well at identifying black-and-white objects.

“It’s not just the steps of the developmental choreography that are important, but also the order in which they are played out,” Sinha says.

The advantages of limited sensory input

By analyzing the internal organization of the models, the researchers found that those that begin with grayscale inputs learn to rely on luminance to identify objects. Once they begin receiving color input, they don’t change their approach very much, since they’ve already learned a strategy that works well. Models that began with color images did shift their approach once grayscale images were introduced, but could not shift enough to make them as accurate as the models that were given grayscale images first.

A similar phenomenon may occur in the human brain, which has more plasticity early in life, and can easily learn to identify objects based on their luminance alone. Early in life, the paucity of color information may in fact be beneficial to the developing brain, as it learns to identify objects based on sparse information.

“As a newborn, the normally sighted child is deprived, in a certain sense, of color vision. And that turns out to be an advantage,” Diamond says.

Researchers in Sinha’s lab have observed that limitations in early sensory input can also benefit other aspects of vision, as well as the auditory system. In 2022, they used computational models to show that early exposure to only low-frequency sounds, similar to those that babies hear in the womb, improves performance on auditory tasks that require analyzing sounds over a longer period of time, such as recognizing emotions. They now plan to explore whether this phenomenon extends to other aspects of development, such as language acquisition.

The research was funded by the National Eye Institute of NIH and the Intelligence Advanced Research Projects Activity.

Share this news article on:

Related links.

- Project Prakash

- Department of Brain and Cognitive Sciences

Related Topics

- Brain and cognitive sciences

Related Articles

Scientists discover anatomical changes in the brains of the newly sighted

After a lifetime of blindness, newly sighted can immediately identify human locomotion

Early sound exposure in the womb shapes the auditory system

Vision is key to spatial skills

Previous item Next item

More MIT News

Understanding why autism symptoms sometimes improve amid fever

Read full story →

School of Engineering welcomes new faculty

Turning up the heat on next-generation semiconductors

Sarah Millholland receives 2024 Vera Rubin Early Career Award

A community collaboration for progress

MIT scholars will take commercial break with entrepreneurial scholarship

- More news on MIT News homepage →

Massachusetts Institute of Technology 77 Massachusetts Avenue, Cambridge, MA, USA

- Map (opens in new window)

- Events (opens in new window)

- People (opens in new window)

- Careers (opens in new window)

- Accessibility

- Social Media Hub

- MIT on Facebook

- MIT on YouTube

- MIT on Instagram

IMAGES

VIDEO

COMMENTS

See 4 recent research reports for SUPRIYA, BSE:543434 Supriya Lifescience Ltd. from 2 source(s) with an average share price target of 355. ... Supriya Life Science reported a quarterly revenue growth of INR 1422.7 mn in Q4FY23, compared to INR 1051.0 mn in Q3FY23. The growth was primarily supported by strong traction in the US, Europe, and ...

Supriya Lifescience Limited headquartered in Mumbai, India is a public listed generic pharmaceutical company established in 1987 dedicated to developing, commercializing APIs & FDFs to treat patients with various diseases and infections. ... Supriya Life Science के Q3 Results, नए प्रोडक्ट लॉन्च और ...

Managing DirectorSatish Waman Wagh. Listing NSE: SUPRIYA, BSE: 543434. CountryIndia. Headquarters Mumbai, Maharashtra. Website www.supriyalifescience.com. Business. Supriya Lifescience Limited engages in the research and development, manufacture, and sale of bulk drugs and pharmaceutical chemicals worldwide.

32 Our Stakeholder Value-Creation Report, 2021-22 40 The drivers of our business excellence 50 Employee testimonials 52 Corporate Social Responsibility 53 Environment Health Safety 58 Our leadership team 62 Management discussion and analysis 70 How we manage risks at Supriya Lifescience 73 Corporate Information Statutory section 74 Notice

Supriya Lifescience is engaged in the manufacturing of Active pharmaceutical ingredients (APIs). As of March 31, 2021, the company produces 38 APIs focused on diverse therapeutic segments such as antihistamine, analgesic, anaesthetic, vitamin, anti-asthmatic and anti-allergic. The company has been the largest exporter of

Supriya Lifescience Limited (SLL) is one of the key Indian manufacturers and suppliers of Active Pharmaceuticals Ingredients (APIs), with a focus on research and development (R&D). As of October 31, 2021, the company had niche product offerings of 38 APIs - focused on diverse therapeutic segments such as antihistamine, analgesic, anaesthetic ...

Annual Report; Draft Annual Return; Annual Report; Draft Annual Return; Quick links. About Company; APIs; Investors Relation; Awards; Regulatory Affairs; CONTACT US. Corporate Office 207/208 Udyog Bhavan,Sonawala Road Goregaon [E],Mumbai - 400 063. India +91-022 40332727; [email protected]; Manufacturing Unit A-5/2, MIDC Lote ...

Supriya Lifescience Limited is an India-based manufacturer of active pharmaceutical ingredients (APIs). The Company is primarily engaged in manufacturing of bulk drugs and pharmaceutical chemicals. The Company exports its products in the antihistamine, anesthetics and anti-asthma therapy categories to approximately 86 countries.

Get the latest Supriya Lifescience Ltd (SUPRIYA) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Supriya Lifescience Limited was incorporated in March 2008 by Satish Waman Wagh. Company is one of the key Indian manufacturers and suppliers of active pharmaceutical ingredients (APIs). Supriya Lifescience Limited focus on research and development along with this company focus is on diverse therapeutic areas and niche products. Company has niche product offerings of 38 …

Get Supriya Lifescience latest Quarterly Results, Financial Statements and Supriya Lifescience detailed profit and loss accounts. ... RESEARCH Advice Broker Research ... Download Annual Report in ...

Supriya Lifescience Limited Share Price Today, Live NSE Stock Price: Get the latest Supriya Lifescience Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account, research, results and more details at NSE India.

Yes. Post-IPO, the company's stock will trade at a P/B of around 4.1, which is less than its peers' average P/B of 4.8. Also read about Supriya Lifesciences IPO: Information analysis to learn about the key IPO details and important information about the company. Disclaimer: The authors may be an applicant in this Initial Public Offering.

42 Supriya's EHS priority 46 Profile of Board of Directors 50 Management discussion and analysis 56 Risk management at Supriya Lifescience Statutory section 59 Corporate Information 60 Notice 68 Board of Director's Report 106 Report on Corporate Governance Financial section 127 Financial Statements

Supriya Lifescience Ltd. - Annual Report. The annual report of Supriya Lifescience Ltd. provides a comprehensive overview of the company's performance, strategy, and future prospects. It contains important information such as financial statements, management's discussion and analysis, corporate governance practices, and sustainability initiatives.

During Q3FY23, Supriya lifesciences Ltd. reported a revenue of INR 1051mn, which dropped by 13.5% YoY and 6.1% QoQ as a result of headwinds facedby the firm in the China markets but marginally offsetby the demandfrom other Asian countries. On the operational front, EBITDA decreased to INR 140.4mn, a decrease of by 67.9% YoY (-72.8% QoQ).

Supriya Lifescience Limited reported earnings results for the third quarter and nine months ended December 31, 2023. For the third quarter, the company reported sales was INR 1,400.74 million compared to INR 1,051.4 million a year ago.

Supriya Lifescience Quarterly Results: Get the key information of Supriya Lifescience Q1, Q2, Q3 and Q4 results, previous Quarterly Results, Quarterly Earnings and comparison on Economic Times. ... Research and Development Expenses.00.00.00.00.00: Expenses Capitalised.00.00.00.00.00: Other Expenses: 26.40: 29.20: ... RPG Life Sci Share Price ...

Supriya Lifesci Share Price: Find the latest news on Supriya Lifesci Stock Price. Get all the information on Supriya Lifesci with historic price charts for NSE / BSE. Experts & Broker view also ...

Supriya Lifescience Limited reported earnings results for the third quarter and nine months ended December 31, 2023. For the third quarter, the company reported sales was INR 1,400.74 million compared...

New MIT research offers a possible explanation for how the brain learns to identify both color and black-and-white images. The researchers found evidence that early in life, when the retina is unable to process color information, the brain learns to distinguish objects based on luminance, rather than color.

Annual Report and Return. Disclosure. Quick links. About Company; APIs; Investors Relation; Awards; Regulatory Affairs; CONTACT US. Corporate Office 207/208 Udyog Bhavan,Sonawala Road Goregaon [E],Mumbai - 400 063. India +91-022 40332727; [email protected]; Manufacturing Unit A-5/2, MIDC Lote, Khed, District Ratnagiri - 415722 ...