- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

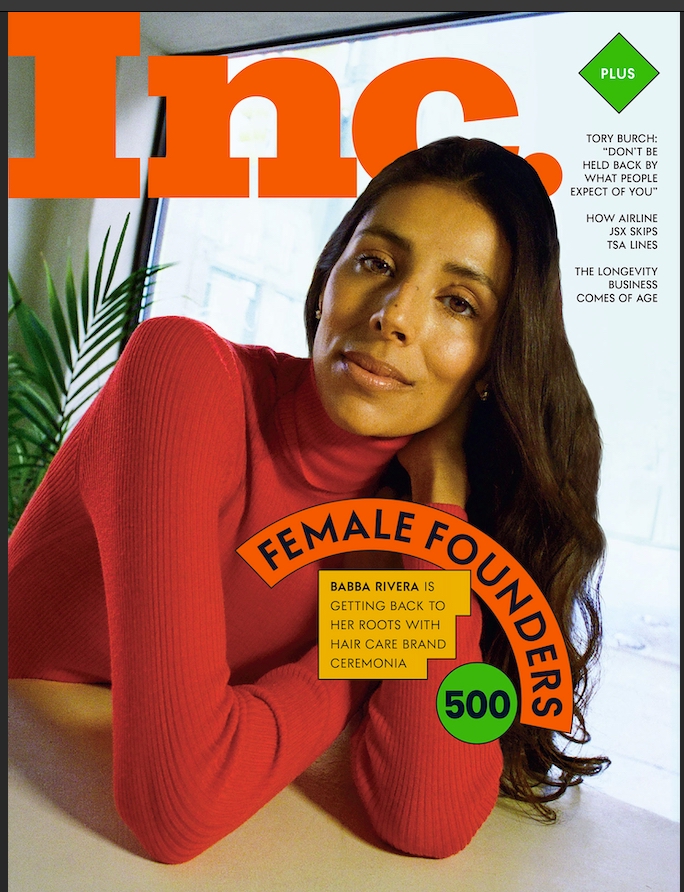

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

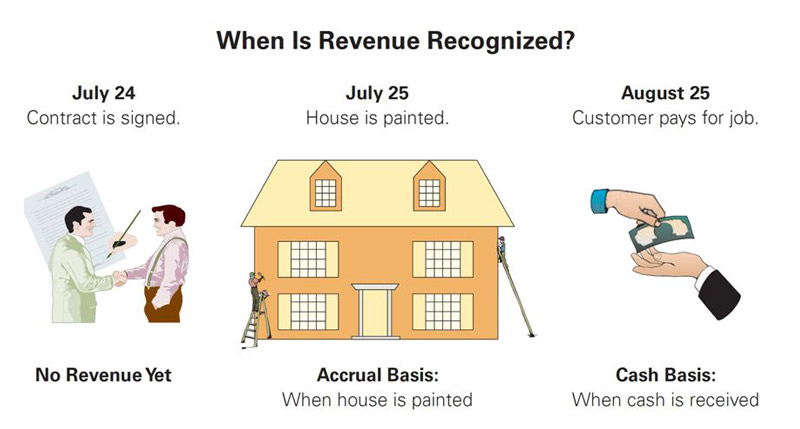

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

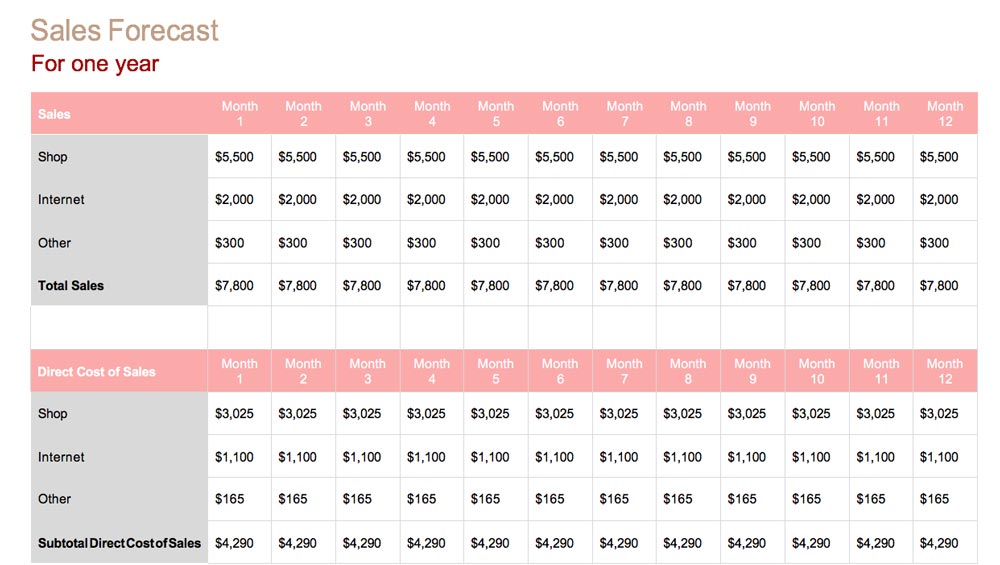

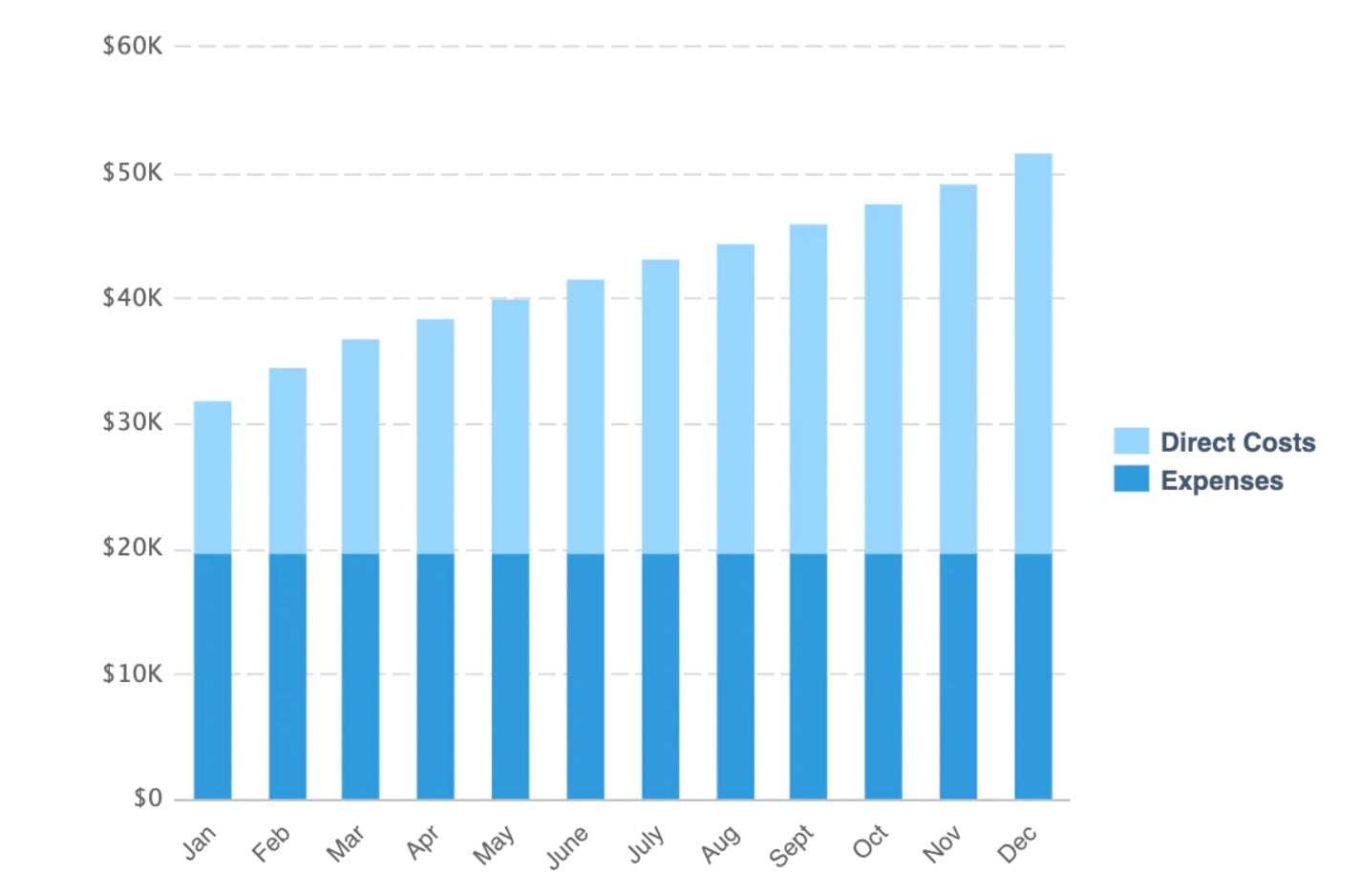

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

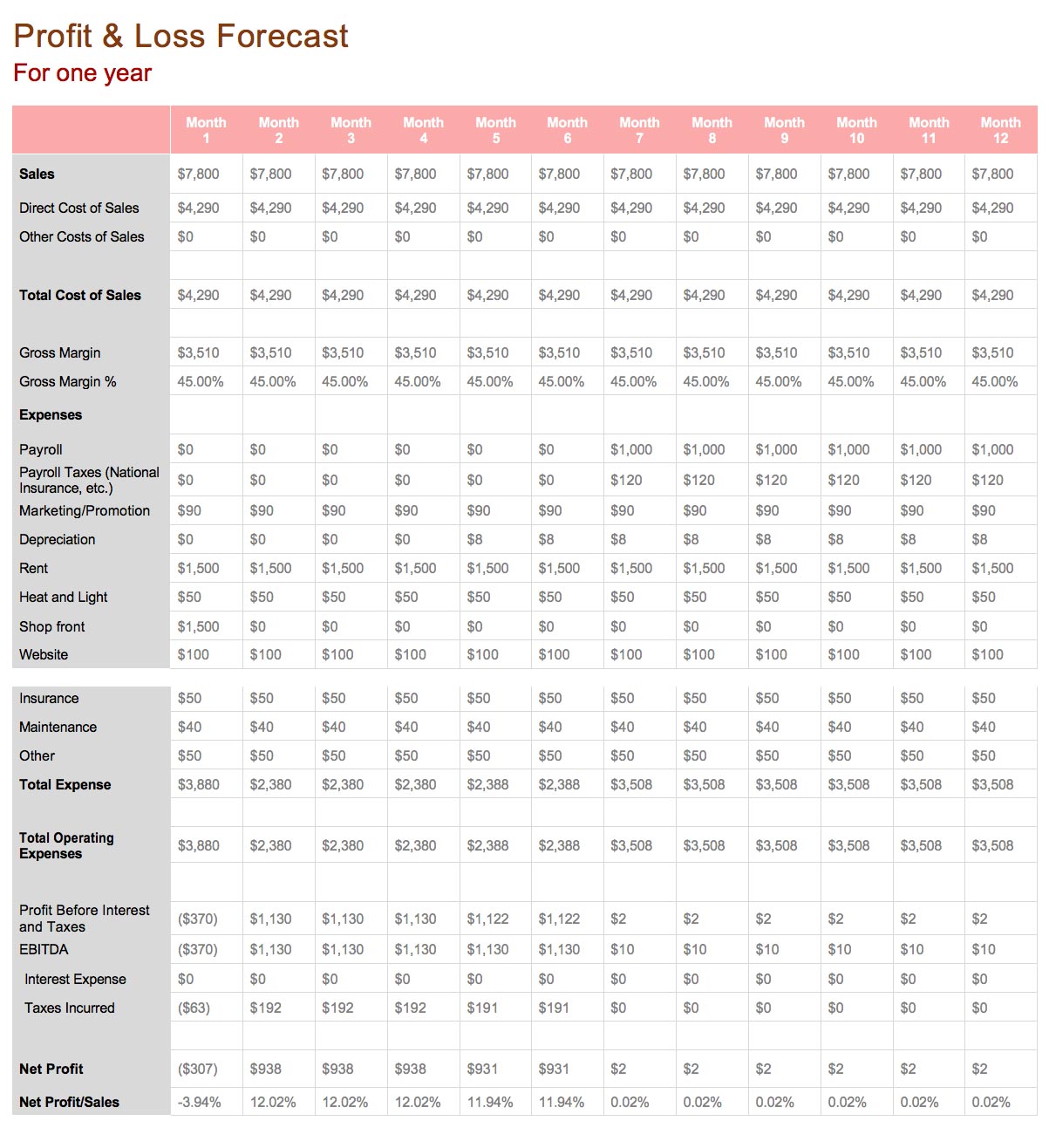

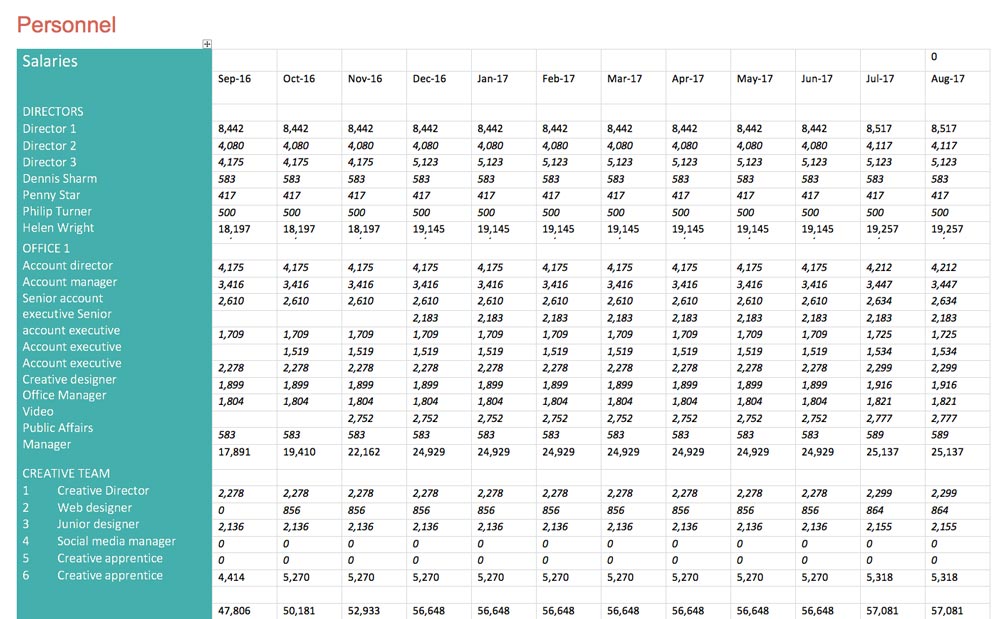

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

Quickbooks Sync and compare with your quickbooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth and investor readiness

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

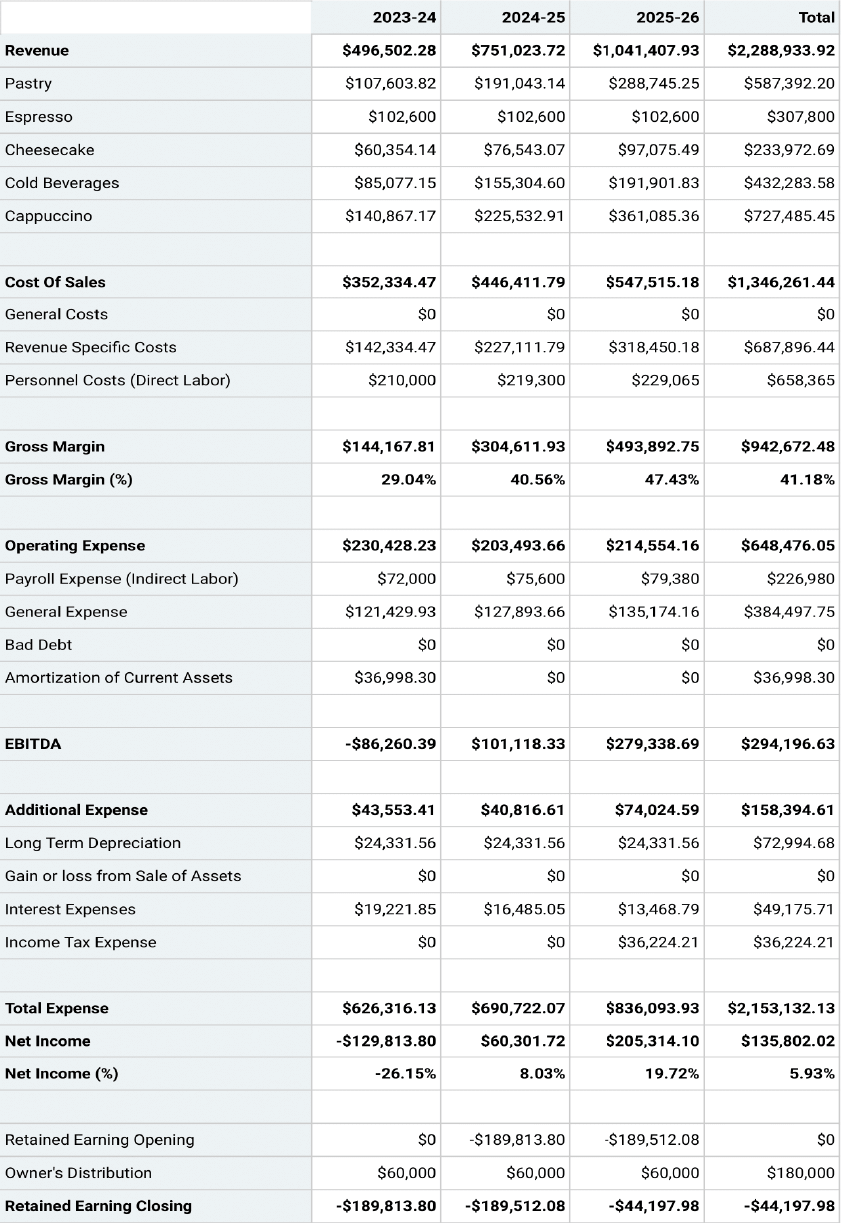

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

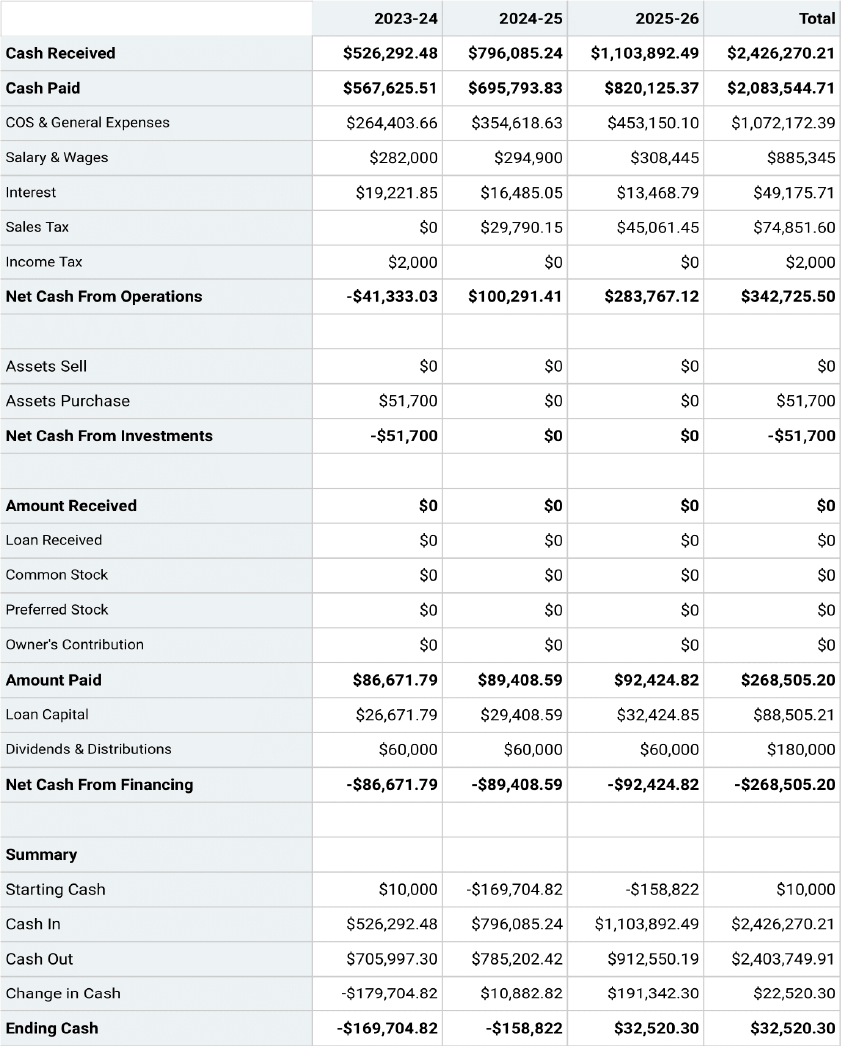

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

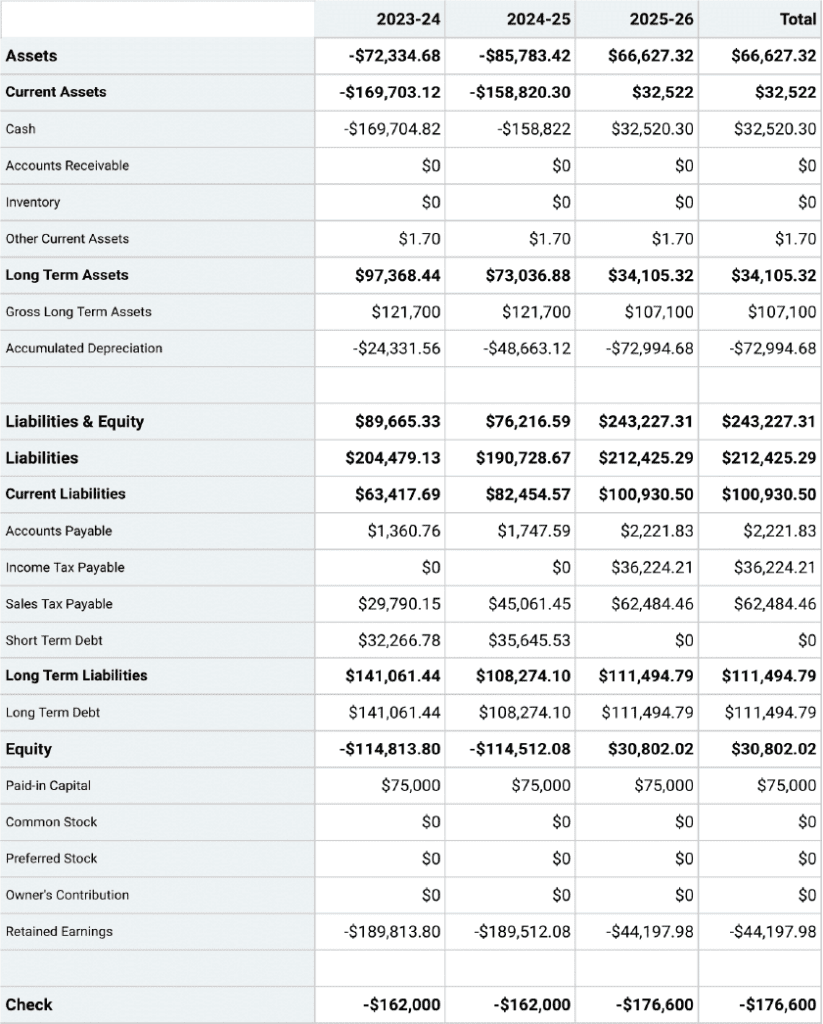

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

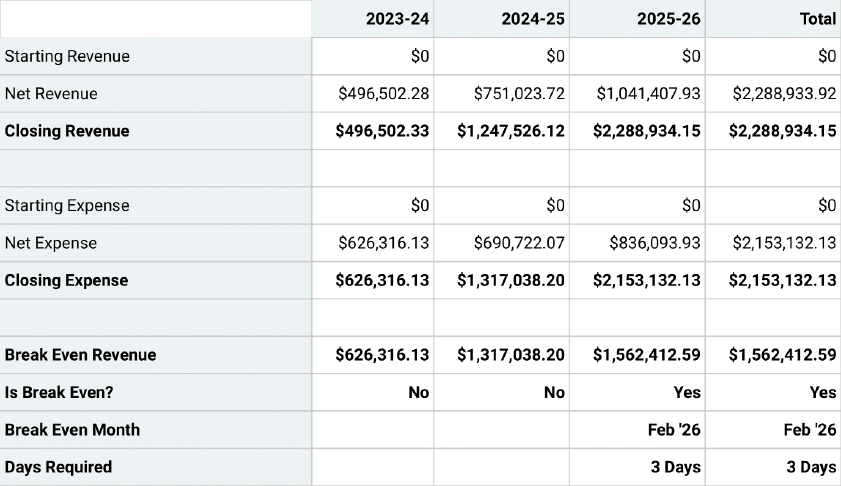

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

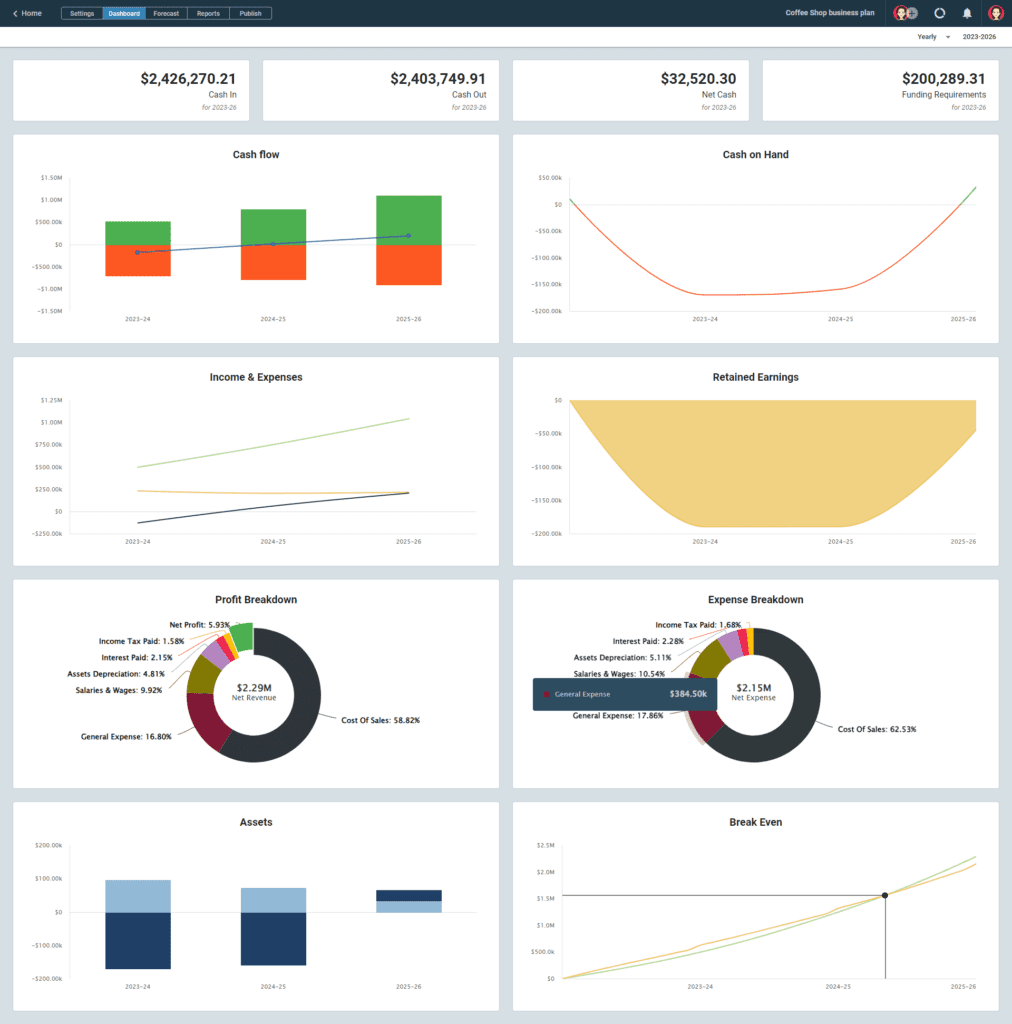

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business How to Write a Business Plan Outline [Examples + Templates]

How to Write a Business Plan Outline [Examples + Templates]

Written by: Letícia Fonseca Aug 11, 2023

When venturing into crafting a business plan, the initial hurdle often lies in taking that first step.

So, how can you evade those prolonged hours of staring at a blank page? Initiate your journey with the aid of a business plan outline.

As with any endeavor, an outline serves as the beacon of clarity, illuminating the path to confront even the most formidable tasks. This holds particularly true when composing pivotal documents vital to your triumph, much like a business plan.

Nonetheless, I understand the enormity of a business plan’s scope, which might make the task of outlining it seem daunting. This is precisely why I’ve compiled all the requisite information to facilitate the creation of a business plan outline. No need to break a sweat!

And if you’re seeking further assistance, a business plan maker and readily available business plan templates can offer valuable support in shaping your comprehensive plan.

Read on for answers to all your business plan outline questions or jump ahead for some handy templates.

Click to jump ahead:

What is a business plan outline (and why do you need one), what format should you choose for your business plan outline, what are the key components of a business plan outline.

- Business plan template examples

- Writing tips to ace your outline

A business plan outline is the backbone of your business plan. It contains all the most important information you’ll want to expand on in your full-length plan.

Think of it this way: your outline is a frame for your plan. It provides a high-level idea of what the final plan should look like, what it will include and how all the information will be organized.

Why would you do this extra step? Beyond saving you from blank page syndrome, an outline ensures you don’t leave any essential information out of your plan — you can see all the most important points at a glance and quickly identify any content gaps.

It also serves as a writing guide. Once you know all the sections you want in your plan, you just need to expand on them. Suddenly, you’re “filling in the blanks” as opposed to writing a plan from scratch!

Incidentally, using a business plan template like this one gives you a running head start, too:

Perhaps most importantly, a business plan outline keeps you focused on the essential parts of your document. (Not to mention what matters most to stakeholders and investors.) With an outline, you’ll spend less time worrying about structure or organization and more time perfecting the actual content of your document.

If you’re looking for more general advice, you can read about how to create a business plan here . But if you’re working on outlining your plan, stick with me.

Return to Table of Contents

Most business plans fit into one of two formats.

The format you choose largely depends on three factors: (1) the stage of your business, (2) if you’re presenting the plan to investors and (3) what you want to achieve with your business plan.

Let’s have a closer look at these two formats and why you might choose one over the other.

Traditional format

Traditional business plans are typically long, detailed documents. In many cases, they take up to 50-60 pages, but it’s not uncommon to see plans spanning 100+ pages.

Traditional plans are long because they cover every aspect of your business. They leave nothing out. You’ll find a traditional business plan template with sections like executive summary, company description, target market, market analysis, marketing plan, financial plan, and more. Basically: the more information the merrier.

This business plan template isn’t of a traditional format, but you could expand it into one by duplicating pages:

Due to their high level of detail, traditional formats are the best way to sell your business. They show you’re reliable and have a clear vision for your business’s future.

If you’re planning on presenting your plan to investors and stakeholders, you’ll want to go with a traditional plan format. The more information you include, the fewer doubts and questions you’ll get when you present your plan, so don’t hold back.

Traditional business plans require more detailed outlines before drafting since there’s a lot of information to cover. You’ll want to list all the sections and include bullet points describing what each section should cover.

It’s also a good idea to include all external resources and visuals in your outline, so you don’t have to gather them later.

Lean format

Lean business plan formats are high level and quick to write. They’re often only one or two pages. Similar to a business plan infographic , they’re scannable and quick to digest, like this template:

This format is often referred to as a “startup” format due to (you guessed it!) many startups using it.

Lean business plans require less detailed outlines. You can include high-level sections and a few lines in each section covering the basics. Since the final plan will only be a page or two, you don’t need to over prepare. Nor will you need a ton of external resources.

Lean plans don’t answer all the questions investors and stakeholders may ask, so if you go this route, make sure it’s the right choice for your business . Companies not yet ready to present to investors will typically use a lean/startup business plan format to get their rough plan on paper and share it internally with their management team.

Here’s another example of a lean business plan format in the form of a financial plan:

Your business plan outline should include all the following sections. The level of detail you choose to go into will depend on your intentions for your plan (sharing with stakeholders vs. internal use), but you’ll want every section to be clear and to the point.

1. Executive summary

The executive summary gives a high-level description of your company, product or service. This section should include a mission statement, your company description, your business’s primary goal, and the problem it aims to solve. You’ll want to state how your business can solve the problem and briefly explain what makes you stand out (your competitive advantage).

Having an executive summary is essential to selling your business to stakeholders , so it should be as clear and concise as possible. Summarize your business in a few sentences in a way that will hook the reader (or audience) and get them invested in what you have to say next. In other words, this is your elevator pitch.

2. Product and services description

This is where you should go into more detail about your product or service. Your product is the heart of your business, so it’s essential this section is easy to grasp. After all, if people don’t know what you’re selling, you’ll have a hard time keeping them engaged!

Expand on your description in the executive summary, going into detail about the problem your customers face and how your product/service will solve it. If you have various products or services, go through all of them in equal detail.

3. Target market and/or Market analysis

A market analysis is crucial for placing your business in a larger context and showing investors you know your industry. This section should include market research on your prospective customer demographic including location, age range, goals and motivations.

You can even include detailed customer personas as a visual aid — these are especially useful if you have several target demographics. You want to showcase your knowledge of your customer, who exactly you’re selling to and how you can fulfill their needs.

Be sure to include information on the overall target market for your product, including direct and indirect competitors and how your industry is performing. If your competitors have strengths you want to mimic or weaknesses you want to exploit, this is the place to record that information.

4. Organization and management

You can think of this as a “meet the team” section — this is where you should go into depth on your business’s structure from management to legal and HR. If there are people bringing unique skills or experience to the table (I’m sure there are!), you should highlight them in this section.

The goal here is to showcase why your team is the best to run your business. Investors want to know you’re unified, organized and reliable. This is also a potential opportunity to bring more humanity to your business plan and showcase the faces behind the ideas and product.

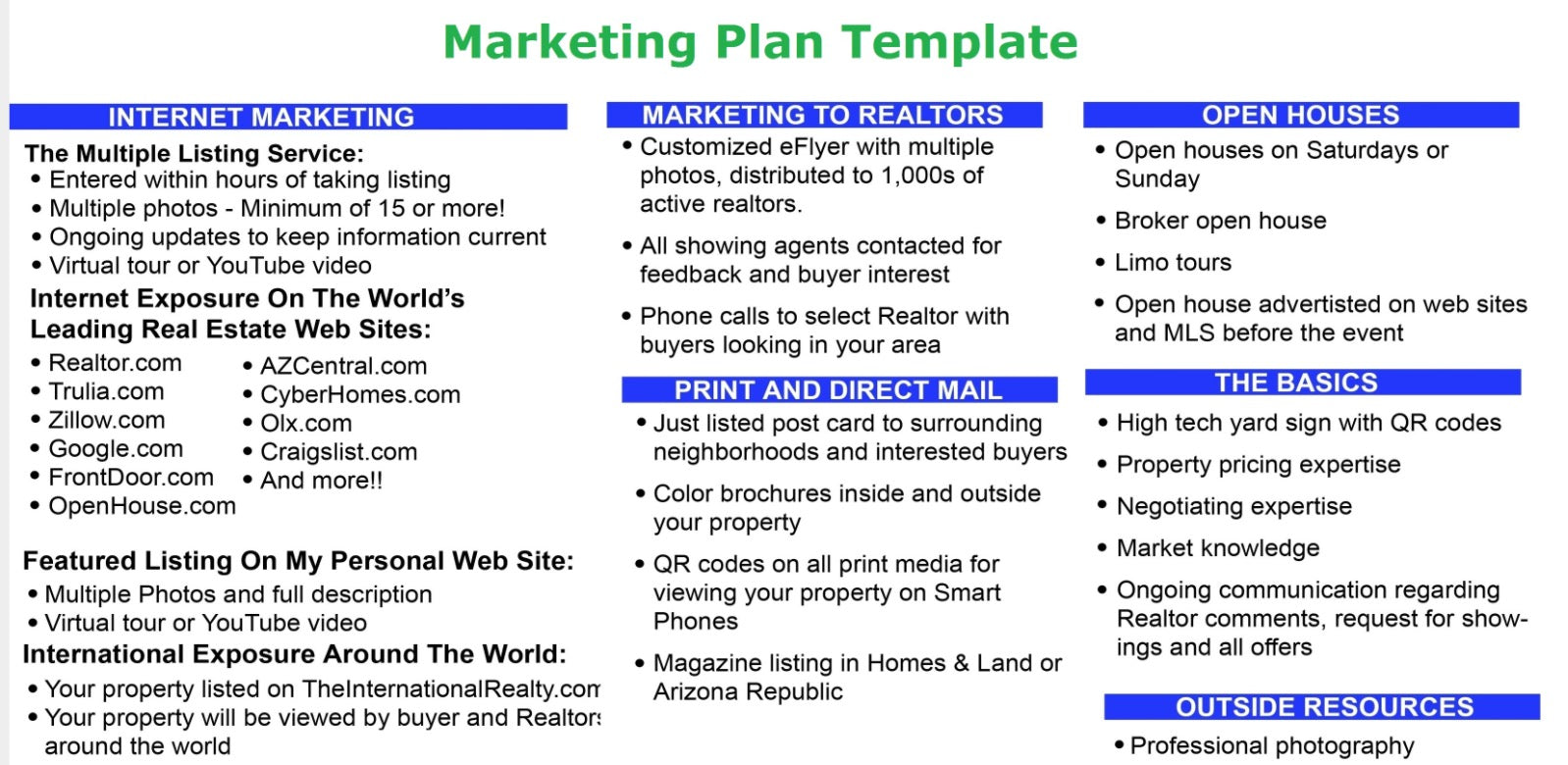

5. Marketing and sales

Now that you’ve introduced your product and team, you need to explain how you’re going to sell it. Give a detailed explanation of your sales and marketing strategy, including pricing, timelines for launching your product and advertising.

This is a major section of your plan and can even live as a separate document for your marketing and sales teams. Here are some marketing plan templates to help you get started .

Make sure you have research or analysis to back up your decisions — if you want to do paid ads on LinkedIn to advertise your product, include a brief explanation as to why that is the best channel for your business.

6. Financial projections and funding request

The end of your plan is where you’ll look to the future and how you think your business will perform financially. Your financial plan should include results from your income statement, balance sheet and cash flow projections.

State your funding requirements and what you need to realize the business. Be extremely clear about how you plan to use the funding and when you expect investors will see returns.

If you aren’t presenting to potential investors, you can skip this part, but it’s something to keep in mind should you seek funding in the future. Covering financial projections and the previous five components is essential at the stage of business formation to ensure everything goes smoothly moving forward.

7. Appendix

Any extra visual aids, receipts, paperwork or charts will live here. Anything that may be relevant to your plan should be included as reference e.g. your cash flow statement (or other financial statements). You can format your appendix in whatever way you think is best — as long as it’s easy for readers to find what they’re looking for, you’ve done your job!

Typically, the best way to start your outline is to list all these high-level sections. Then, you can add bullet points outlining what will go in each section and the resources you’ll need to write them. This should give you a solid starting point for your full-length plan.

Business plan outline templates

Looking for a shortcut? Our business plan templates are basically outlines in a box!

While your outline likely won’t go into as much detail, these templates are great examples of how to organize your sections.

Traditional format templates

A strong template can turn your long, dense business plan into an engaging, easy-to-read document. There are lots to choose from, but here are just a few ideas to inspire you…

You can duplicate pages and use these styles for a traditional outline, or start with a lean outline as you build your business plan out over time:

Lean format templates

For lean format outlines, a simpler ‘ mind map ’ style is a good bet. With this style, you can get ideas down fast and quickly turn them into one or two-page plans. Plus, because they’re shorter, they’re easy to share with your team.

Writing tips to ace your business plan outline

Business plans are complex documents, so if you’re still not sure how to write your outline, don’t worry! Here are some helpful tips to keep in mind when drafting your business plan outline:

- Ask yourself why you’re writing an outline. Having a clear goal for your outline can help keep you on track as you write. Everything you include in your plan should contribute to your goal. If it doesn’t, it probably doesn’t need to be in there.

- Keep it clear and concise. Whether you’re writing a traditional or lean format business plan, your outline should be easy to understand. Choose your words wisely and avoid unnecessary preambles or padding language. The faster you get to the point, the easier your plan will be to read.

- Add visual aids. No one likes reading huge walls of text! Make room in your outline for visuals, data and charts. This keeps your audience engaged and helps those who are more visual learners. Psst, infographics are great for this.

- Make it collaborative. Have someone (or several someones) look it over before finalizing your outline. If you have an established marketing / sales / finance team, have them look it over too. Getting feedback at the outline stage can help you avoid rewrites and wasted time down the line.

If this is your first time writing a business plan outline, don’t be too hard on yourself. You might not get it 100% right on the first try, but with these tips and the key components listed above, you’ll have a strong foundation. Remember, done is better than perfect.

Create a winning business plan by starting with a detailed, actionable outline

The best way to learn is by doing. So go ahead, get started on your business plan outline. As you develop your plan, you’ll no doubt learn more about your business and what’s important for success along the way.

A clean, compelling template is a great way to get a head start on your outline. After all, the sections are already separated and defined for you!

Explore Venngage’s business plan templates for one that suits your needs. Many are free to use and there are premium templates available for a small monthly fee. Happy outlining!

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

- Franchise Trends

- The Female Founder

- The Roadmap

- The Small Business Show

- U.S. Chamber of Commerce Small Business Update

- Company Culture

- Customer Experience

- Entrepreneurship

- Growth Strategy

- Recruitment

- Small Business Grants

- Social Media

- Contribute Content Request

- Show Appearance Request

Crafting Success: Jaime Schmidt’s journey from kitchen creations to corporate acquisition.

Revolutionizing child nutrition: the mission mightyme journey – jj jaxon, small business update: how smbs are adapting to inflation amid economic…, latrice smith esquire shares key legal considerations for business growth and….

- business plan

- small busienss

- balance sheet

How to Complete the Financial Section of Business Plan

A plan intends to explain the business, introduce critical contributors, products and, services and defines the goals for the future. It paints a picture of the founder’s expectations and helps others see their vision. The financial section of the plan provides the proof behind the story. It is the section that investors and lenders are most interested in, and often the first section they read, despite it being near the end of the plan. It also acts as a roadmap and a guide for the direction the company will take into the future.

Financial Section Elements

While it may sound complicated, the financial section of a business plan only contains three documents and a brief explanation of each. It is necessary to prepare an income statement, cash flow projection and a balance sheet either using spreadsheets, or software that does all of the calculations automatically. Before beginning this statement, it’s necessary to gather the following information:

Business Start-Up Expenses

This list of all of the costs associated with getting the business up and running comprises what primarily are one-time fees such as registering the company. Following is only a partial list of possible start-up costs, every business is unique, and the list may, or may not, contain these items and more.

- Business registration fees

- Licensing and permits

- Product inventory

- Deposit on rental property

- Down payment to purchase property

- Down payment on machines and equipment

- Set-up fees for utilities

Business Operating Costs

As the name implies, operating costs are the ongoing expenses that need to be paid to keep the business running. These expenses are usually monthly bills, and for a start-up, estimate six months worth of these costs. A company’s list of operating expenses might include:

- Monthly mortgage payment or rent

- Logistics and distribution

- Marketing and promotion

- Loan paymentsRaw materials

- Office supplies

- Building/vehicle maintenance

The Income Statement

This financial statement details the company’s revenues, expenses, and profit for a set period. Established businesses generated these annually, or semi-annually, based on actual performance. Start-ups with no previous years to look at have to use statistical data within the industry to make reasonable projections. A start-up will also produce monthly versions of this statement to show the forecast of growth. This section will include the data such as:

- Gross revenue (sales, interest income and sales of assets)

- General and administrative expenses (start-up and operating costs)

- Corporate tax rate (expected tax liabilities)

The math is simple here: subtract the expenditures from the revenue, and the remaining number is profit. When put into the proper format, an income statement gives a clear view of the financial viability of a company.

Cash-Flow Projection

This statement shows how you expect cash to flow in to, and out of, your business. It’s an essential internal cash management tool and a source of data that shows what your business’s capital needs will be in the near future. For investors and bank loan officers, it helps determine your creditworthiness and amount you can borrow. The cash-flow projection contains three parts:

- Cash revenues — This part details the incoming cash from sales for specific periods of time, usually monthly. It is an estimate, based upon past performance and future projections for current businesses, and industry averages for start-ups.

- Cash disbursements — Every monthly bill or other expense that is paid out in cash gets listed in this section. As with revenue, these are estimates, either based upon historical data, current data, or industry data.

- Cash flow projection — This merely is a reconciliation of the cash revenues to cash disbursements. Adding the current month’s revenues to the carried-over balance, then subtracting the month’s disbursements creates estimated cash flow.

The Balance Sheet

The final financial statement required for the business plan’s financial section is a balance sheet. This statement is a snapshot of the company’s net worth at a given point in time. Established businesses produce a balance sheet annually. Information from the income statement and cash flow projection are used to complete this statement. It summarizes the business’s financial data into three main categories:

- Assets — This is the total of all of the tangible items that the company owns that hold monetary value. That includes equipment, property, and cash-on-hand, for example.

- Liabilities — This is the total amount of debt that the company owes its creditors. You’ll include every debt, whether recurring, one-time, fixed, or variable.

- Equity — This is merely the difference between the company’s assets, including retained earnings and current earnings, and its liabilities.

Side-Notes and Details

In some cases, it may be necessary to explain details within the financial statements. Denote these instances within the statement and include a brief explanation sheet as an attachment. It may also be useful to add information on the process used to estimate revenues and expenses, which will show interested parties the intent and help them better understand the data.

Don’t Sweat the Process

It’s important to note that the order in which these financial statements is created may vary from the way they are presented here. This is to be expected. In fact, most business plan creators end up going back and forth with these statements as the numbers reveal the business’s financial reality. It paints a crystal clear picture of its economic viability, which can present to a lender, investor, or shareholder with confidence.

All of these financial documents can be created by using accounting and business software readily available online. Even so, some people aren’t entirely comfortable creating financial statements for their business plan, and outsource this critical task to a professional. Even the largest corporations struggle with financial planning and reporting, and they often hire the job out to someone more qualified. It’s merely a matter of making sure that the data is accurate, easy to track, and based on sound accounting practices.

Related Articles

Safeguarding your business: navigating third-party app risks.

- Terms of Use

- Privacy Policy

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today .

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Apply for the CO—100!

The CO—100 is an exclusive list of the 100 best and brightest small and mid-sized businesses in America. Enter today to share your story and get recognized.

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

A small business guide to setting up an e-commerce business, how to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers