- For Ophthalmologists

- For Practice Management

- For Clinical Teams

- For Public & Patients

Museum of the Eye

- Meeting Information

- Past and Future Meetings

- Contact Information

- Meeting Guide

- Policies and Disclaimers

- Annual Meetings News

- Health & Safety

- Program Highlights

- Subspecialty Day

- Virtual Meeting

- Program Committees

- CME Information

- Meeting Archives

- Registration

- Hotel Reservation Information

- International Attendees

- Hotel Meeting Space

- Presenter Central

- Abstract Selection Process

- Submission Policies

- Subject Classification/Topics

- Instruction Courses and Skills Transfer Labs

- Papers and Posters

- Grand Rounds Symposium

- Program Participant and Faculty Guidelines

- Faculty Development Program

- Exhibitor Central

- New Exhibiting Companies

- Exhibitor Resources

- International Exhibitors

- Promotional Opportunities

- Exhibitor Hotel Reservations

- Presenter Central /

- Program Participant and Faculty Guidelines /

- Presenter Financial Disclosure

Financial Disclosure and First-slide Policy

Transparency through disclosure of relationships with companies is one step in the Academy’s process of ensuring that all its educational activities are fair, balanced, and not commercially biased. The Academy's Board of Trustees supports the position that having a financial relationship should not restrict expert scientific, clinical, or non-clinical presentation or publication or participation in Academy leadership or governance, provided that appropriate disclosure of such relationship is made, and mitigation occurs. As an ACCME accredited provider of accredited Continuing Education (CE) activities, the Academy has established policies and processes to ensure balance, independence, objectivity, and scientific rigor in all individual and jointly provided CME activities.

Who Should Disclose?

All Academy presenters, authors and other contributors to educational and leadership activities. If your role in an educational activity includes planning, directing, writing, editing, commenting or otherwise controlling the content that is presented to learners, you should disclose.

What Relationships do You Need to Disclose?

All financial relationships with Companies that you have had within the previous 24 months . A Company, or ACCME-defined “ineligible company” is a company whose primary business is producing, marketing, selling, re-selling, or distributing healthcare products used by or on patients.

Types of Financial Relationships

| C | Consultant/Advisor Consultant fee, paid advisory boards, or fees for attending a meeting. |

| E | Employee Hired to work for compensation or received a W2 from a company. |

| L | Lecture Fees/Speakers Bureau Lecture fees or honoraria, travel fees or reimbursements when speaking at the invitation of a commercial company. |

| P | Patents/Royalty Beneficiary of patents and/or royalties for intellectual property. |

| S | Grant Support Grant support or other financial support from all sources, including research support from government agencies (e.g., NIH), foundations, device manufacturers, and\or pharmaceutical companies. Research funding should be disclosed by the principal or named investigator even if your institution receives the grant and manages the funds. |

| EE | Employee, Executive Role Hired to work in an executive role for compensation or received a W2 from a company. |

| EO | Owner of Company Ownership or controlling interest in a company, other than stock. |

| SO | Stock Options Stock options in a private or public company. |

| PS | Equity/Stock Holder - Private Corp (not listed on the stock exchange) Equity ownership or stock in privately owned firms, excluding mutual funds. |

| US | Equity/Stock Holder - Public Corp (listed on the stock exchange) Equity ownership or stock in publicly traded firms, excluding mutual funds. |

| I | Independent Contractor Contracted work, including contracted research |

If you have a type of financial or non-financial relationship with a company or organization that does not fall into any of the categories above, email [email protected] for assistance.

When and How to Disclose

Financial disclosures must involve both the following steps:

- Each presenter must have a first slide pertaining to financial interests. This first slide must either:

- Disclose all financial interests , or

- If there is nothing to disclose, the slide must state, “I have no financial interests or relationships to disclose.”

- Presenters are required to verbally state at the start of the talk any financial interests that specifically pertain to their presentation. If there is nothing to disclose or your financial disclosures are not relevant to the content of the CME activity, verbally state that you do not have any financial interests or relationships to disclose.

Even with these acknowledgements, the Academy’s Annual Meeting Program Committee expects that all presenters will give a fair and unbiased scientific talk.

A PowerPoint disclosure slide is made available to download for your presentation in Presenter Central .

Financial disclosure is something the Academy takes very seriously. During and after the meeting, Academy staff will be conducting spot checks of presentations to ensure the first-slide policy is followed. Any presenter who does not follow this policy will receive an official warning letter after the meeting and may result in exclusion from future meeting programs.

All content on the Academy’s website is protected by copyright law and the Terms of Service . This content may not be reproduced, copied, or put into any artificial intelligence program, including large language and generative AI models, without permission from the Academy.

- About the Academy

- Jobs at the Academy

- Financial Relationships with Industry

- Medical Disclaimer

- Privacy Policy

- Terms of Service

- Statement on Artificial Intelligence

- For Advertisers

- Ophthalmology Job Center

FOLLOW THE ACADEMY

Medical Professionals

Public & Patients

Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10 .

- Payment Plans

- Product List

- Partnerships

- Try Free Trial

- Study Packages

- Levels I, II & III Lifetime Package

- Video Lessons

- Study Notes

- Practice Questions

- Levels II & III Lifetime Package

- About the Exam

- About your Instructor

- Part I Study Packages

- Part I & Part II Lifetime Package

- Part II Study Packages

- Exams P & FM Lifetime Package

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

- About your Instructors

- EA Practice Questions

- Data Sufficiency Questions

- Integrated Reasoning Questions

Presentation and Disclosures Relating to Inventories

Disclosures are very useful to users of financial statements, especially when analyzing a company’s performance. Coincidentally, the disclosure and presentation requirements are very similar under IFRS and US GAAP.

Under IFRS, the following financial statement disclosures concerning inventories are required:

- the accounting policies that were adopted in measuring inventories, including the cost formula used;

- the total carrying amount of inventories and the carrying amount in classifications that are appropriate to the entity;

- the carrying amount of inventories that are carried at fair value less the costs to sell;

- the amount of inventories that are recognized as an expense during the reporting period;

- the amount of any write-down of inventories that are recognized as an expense in the reporting period;

- the amount of any reversal of any write-down that is recognized as a reduction in the cost of sales during the reporting period;

- the circumstances or events which have led to the reversal of a write-down of inventories; and

- the carrying amount of inventories that are pledged as security for liabilities.

The inventory-related disclosures under US GAAP are quite similar to those under IFRS. However, the second and third requirements from the bottom of the above list are irrelevant since US GAAP prohibits the reversal of prior-year inventory write-downs. In addition, US GAAP requires disclosure of significant estimates applicable to inventories and any material amount of income that results from the liquidation of LIFO inventory.

Question 1 Under US GAAP, which of the following is least likely a relevant disclosure relating to inventories? The accounting policies adopted in measuring inventories. The amount of inventories recognized as an expense during the period. The circumstances which led to the reversal of a write-down of inventories. Solution The correct answer is C . Under US GAAP, the circumstance which led to the reversal of a write-down of inventories is not a relevant requirement because US GAAP does not permit the reversal of prior-year inventory write-downs. Options A and B give relevant disclosure requirements. Question 2 The financial disclosure information required by the IFRS, but not US GAAP is: Information related to inventory write-downs. Information related to inventory write-down reversals. Information related to the carrying amount of each inventory section. Solution The correct answer is B . US GAAP does not require the disclosure of write-down reversals because it does not allow for the reversal of write-downs.

Offered by AnalystPrep

Inter-market Analysis

Time value of money explained with relevant examples, financial statements.

The statement of financial position, statement of comprehensive income, statement of changes in... Read More

Basic and Diluted EPS

Both IFRS and US GAAP mandate the presentation of earnings per share (EPS)... Read More

Mechanisms That Discipline Financial R ...

Given the negative implications that low financial reporting quality can have, disciplinary mechanisms... Read More

Evaluate Past Financial Performance

The evaluation of a company’s past financial performance can serve many purposes. Among... Read More

- COI Updates

- COI Best Practices Requirement

- Point Person Email Templates

- Liaison Email Templates

- Clinical Trial Procedure

Disclosure in Publications, Presentations, etc.

- Organizations following PHS Regulations

- Exempt Non-governmental Sponsors

UCI's standard practice requires researchers reviewed by the COIOC to disclose their financial interests in the publications and presentations related to that study to promote transparency. The Disclosing Individual is required to embed a financial interest disclosure in the text of the publication, either in the footnotes or in the acknowledgement section, whether or not such disclosure is or is not also required by the journal. Similarly, the COIOC will also require researchers to include a slide concerning the disclosure in all presentations of their research.

The following are examples of how a financial interest with an outside entity should be disclosed in publications of research results:

Example #1:

These studies were supported by a grant from NIH (Award #________________). Joe Doe has an equity interest in XYZ, Inc., a company that may potentially benefit from the research results, and also serves on the company's Scientific Advisory Board. John Doe's relationship with XYZ, Inc. has been reviewed and approved by the University of California, Irvine in accordance with its conflict of interest policies.

Example #2:

Dr. John Doe receives research funding from XYZ, Inc., which is developing products related to the research described in this paper. In addition, the author serves as a consultant to XYZ, Inc., and receives compensation for these services. John Doe's relationship with XYZ, Inc. has been reviewed and approved by the University of California, Irvine in accordance with its conflict of interest policies.

Example #3:

The University of California, Irvine has a financial [ownership] interest in X Biotech, the company sponsoring this research. Jane Doe and the University of California, Irvine may potentially benefit from this research. Jane Doe has received honoraria from X Biotech. Jane Doe's relationship with X Biotech has been reviewed and approved by the University of California, Irvine in accordance with its conflict of interest policies.

Example #4:

These studies were supported by a grant from the NSF (Grant #________________). Principal Investigator _______________ has an equity interest in XYZ, Inc. ____'s relationship with XYZ, Inc. has been reviewed and approved by the University of California, Irvine in accordance with its conflict of interest policies.

Please Note: In addition to the guidelines stated above, journals have different standards about publishing financial relationships. For additional examples on how to incorporate such language, access guidance from the International Committee of Medical Journals Editors and the American Chemical Society Publications .

For full functionality of this site it is necessary to enable JavaScript. Here are the instructions how to enable JavaScript in your web browser .

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Skip to content

- Skip to navigation

- Global site

- Asia Pacific

- Middle East

- Going beyond business as usual

- Meet our International Business Centre Directors

- Why Grant Thornton Whether you’re growing in one market or many, looking to operate more effectively, managing risk and regulation, or realising stakeholder value, our firms can help.

- Culture and experience Grant Thornton’s culture is one of our most valuable assets and has steered us in the right direction for more than 100 years.

- Global scale and capability Beyond global scale, we embrace what makes each market unique, local understanding on a global scale.

- Join our network In a world that wants more options for high quality services, we differentiate in the market to grow sustainably in today’s rapidly changing environment.

- Leadership governance and quality Grant Thornton International Ltd acts as the coordinating entity for member firms in the network with a focus on areas such as strategy, risk, quality monitoring and brand.

- Global locations

- Africa 24 member firms supporting your business.

- Americas 31 member firms, covering 44 markets and over 20,000 people.

- Asia-Pacific 19 member firms with nearly 25,000 people to support you.

- Europe 53 member firms supporting your business.

- Middle East 8 member firms supporting your business.

- Business consulting services Our business consulting services can help you improve your operational performance and productivity, adding value throughout your growth life cycle.

- Business process solutions We can help you identify, understand and manage potential risks to safeguard your business and comply with regulatory requirements.

- Business risk services The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

- Cybersecurity As organisations become increasingly dependent on digital technology, the opportunities for cyber criminals continue to grow.

- Forensic and investigation services At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

- Mergers and acquisitions We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

- Recovery and reorganisation Workable solutions to maximise your value and deliver sustainable recovery.

- Transactional advisory services We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

- Valuations We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

- IFRS At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting from IFRS 1 to IFRS 17 and IAS 1 to IAS 41.

- Audit quality monitoring Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

- Global audit technology Our global assurance technology platform provides the ability to conduct client acceptance, consultations and all assurance and other attestation engagements.

- Corporate and business tax Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

- Direct international tax Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

- Global mobility services Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

- Indirect international tax Using our finely tuned local knowledge, teams from our global organisation of member firms help you understand and comply with often complex and time-consuming regulations.

- Transfer pricing The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

- Asset management

- Business services

- Energy and natural resources

- Life sciences

- Not for profit

- Private equity

- Public sector

- Real estate and construction

- Telecommunications

- Travel, tourism and leisure

- Latest insights

- Diversity, equity and inclusion

- Environmental, social and governance (ESG)

- Growing internationally

- International Financial Reporting Standards (IFRS)

- Women in Business 2024 2024 marks the 20th year of monitoring and measuring the proportion of women occupying senior management roles around the world.

- COP28: Mid-market firms should seize the opportunity from adaption and innovation COP28 was the first time there has been a global stocktake on progress against the Paris Agreement.

- Scanning the horizon: Mid-market sets sights on global trade growth The latest International Business Report (IBR) data shows that mid-market businesses have high expectations for global trade.

- Mid-market businesses less optimistic, despite record numbers expecting increased profitability A closer examination of the data offers some explanation of this apparent contradiction.

- Women in business across the globe Without a greater focus on the issue, women’s parity in senior management won’t be reached until 2053 at the current rate.

- Women in business: Regional picture We saw an increase in the percentage of senior management roles held by women, on a global level, but there are some significant regional and country variations.

- Pathways to Parity: Leading the way To push towards parity of senior management roles held by women, who leads within an organisation is vital.

- Generating real change with a long-term focus The most successful strategy to achieve parity of women in senior management is one which stands alone, independent of an ESG strategy.

- People at the heart of great business Businesses have started to put guidelines and incentives in place, focused on driving employees back to the office.

- Building a culture that champions diversity Grant Thornton UAE has grown to have a team comprising more than 50 nationalities and this diverse staff has been key in building the inclusive culture of the firm.

- Focusing and developing a solid strategy around diversity, equity and inclusion Grant Thornton Greece is pioneering a growing set of diversity, equity and inclusion (DE&I) initiatives that centre around three strategic pillars.

- Ten considerations for preparing TCFD climate-related financial disclosures Insights for organisations preparing to implement the International Sustainability Standards Board (ISSB)’s Standards.

- Transition Plan Taskforce publishes its final disclosure framework As organisations in the private sector make commitments and plans to reach net zero, there's a growing need for stakeholders to be able to assess the credibility of their transition plans.

- Promoting ESG excellence through tax ESG considerations have never been more important for an organisation’s long-term success, but how can tax be used to add value to an ESG agenda?

- International business: Mid-market growth and expansion The mid-market looks to international business opportunities for growth.

- Top five constraints to international business in the mid-market Top five major constraints that are testing the mid-market’s ability to grow their businesses internationally.

- Brand and international marketing – breaking global barriers Brand has been identified as a key driver of mid-market success when looking to grow and develop international business.

- The key to international business: Investing in people How can recruitment and retention help grow international business?

- Building resilience in international business Evolving supply chains and trade patterns amid ongoing global uncertainty.

- IFRS Alerts IFRS Alerts covering the latest changes published by the International Accounting Standards Board (IASB).

- Example Financial Statements General guidance for preparers of financial statements that supports the commitment to high quality, consistent application of IFRS.

- Insights into IFRS 2 Insights into IFRS 2 summarises the key areas of the Standard, highlighting aspects that are more difficult to interpret and revisiting the most relevant features that could impact your business.

- IFRS 3 Mergers and acquisitions are becoming more common as entities aim to achieve their growth objectives. IFRS 3 ‘Business Combinations’ contains the requirements for these transactions.

- IFRS 8 Our ‘Insights into IFRS 8’ series considers some key implementation issues and includes interpretational guidance in certain problematic areas.

- IFRS 16 Are you ready for IFRS 16? This series of insights will help you prepare.

- IAS 36 Insights into IAS 36 provides assistance for preparers of financial statements and help where confusion has been seen in practice.

- IFRS 17 Explaining the key features of the Standard and providing insights into its application and impact.

- Pillar 2 Key updates and support for the global implementation of Pillar 2.

- Global expatriate tax guide Growing businesses that send their greatest assets – their people – overseas to work can face certain tax burdens, our global guide highlights the common tax rates and issues.

- International indirect tax guide Navigating the global VAT, GST and sales tax landscape.

- Global transfer pricing guide Helping you easily find everything you need to know about the rules and regulations regarding transfer pricing and Country by Country reporting for every country you do business with.

- Find your local member firm

- Profile page My bookmarks

Presentation and disclosure

IFRS 16 requires lessees and lessors to provide information about leasing activities within their financial statements. The Standard explains how this information should be presented on the face of the statements and what disclosures are required. In this article we identify the requirements and provide a series of examples illustrating one possible way the note disclosures might be presented.

Download IFRS 16 - Presentation and disclosure [pdf]

When it comes to the notes, the Standard tends to focus on the details of the information to be provided, leaving it to preparers to decide on the most meaningful way to present it. As a result, your specific disclosures may not look exactly the same as the ones we’ve chosen.

Download this article

Presentation

For a lessee, a lease that is accounted for under IFRS 16 results in the recognition of:

- a right-of-use asset and lease liability

- interest expense (on the lease liability)

- depreciation expense (on the right-of-use asset).

The right-of-use asset and lease liability must be presented or disclosed separately from other, non-lease assets and liabilities (except for investment property right-of-use assets which are presented as investment property). Where a lessee chooses not to present its right-of-use assets separately on the face of the balance sheet, they must be presented in the same line item that would be used if the underlying asset were owned. In many, but not all, cases this will be property, plant and equipment.

In the statement of cash flows, lease payments are classified:

- as a financing activity for amounts relating to the repayment of the principal portion of the lease liability

- in the same classification as interest paid on other forms of financing (ie, as either a financing or operating activity) for amounts relating to interest charged on the lease liability

- as operating activities for amounts relating to short-term and low-value asset leases that are accounted for off-balance sheet and for variable payments not included in the lease liability.

For a lessor, the requirements are largely the same as IAS 17’s:

- for finance leases the net investment is presented on the balance sheet as a receivable, and

- assets subject to operating leases continue to be presented according to the nature of the underlying asset.

Disclosures

IFRS 16 requires different and more extensive disclosures about leasing activities than IAS 17. The objective of the disclosures is to provide users of financial statements with a basis to assess the effect of leasing activities on the entity’s financial position, performance and cash flows. To achieve that objective, lessees and lessors disclose both qualitative and quantitative information. For lessees, this information is required to be presented in a single note or as a separate section of the financial statements. Information already included in other notes need not be repeated as long as it is appropriately cross-referenced.

For more detail on the disclosure requirements and for illustrative disclosures download the full IFRS 16 - Presentation and disclosure article.

We hope you find the information in this article helpful in giving you some detail into aspects of IFRS 16. If you would like to discuss any of the points raised, please speak to your usual Grant Thornton contact or your local member firm .

Are you ready?

Definition of a lease.

Instructions for Filling Out Disclosure Slide/Form for All Presentations at ISPE Meetings

A disclosure statement must accompany each presentation. For oral presentations, potential conflicts must be listed on a disclosure slide immediately following the title slide. For poster presentations, potential conflicts must be listed on the poster after the title and in a type size consistent with the rest of the poster

The first part of the disclosure slide should list all funding sources for the current project. For a project carried out purely within a university or governmental institution with no external funding, the university or governmental institution should be named as the funding source.

On the second section of the disclaimer slide, list all other potentially conflicting relationships that existed at any time during the conduct of the study, or the 1-year period before the meeting- whichever is longer. Nonfinancial conflicts (e.g., a close relationship with, or a strong antipathy to, a person or organization whose interests may be affected) should also be disclosed, for example under "other".

List the relationships using the following categories during the conduct of the project:

- Employment by commercial entity

- Consultancies or advisory Board memberships

- Lecture fees paid by a commercial entity (honoraria)

- Expert witness for a commercial entity

- Industry-sponsored grants (received or pending) including contracted research

- Patents received or pending

- Royalties from a commercial entity

- Stock ownership or options

Only include categories for which you have a disclosure to report. Continue on a second slide, if needed.

If you have no disclosures to make, type “No relationships to disclose”.

My ISPE Conference

For Conference Registrants Only

Member Login

Disclaimers for Presentations

Legal Research Team at TermsFeed

Presentations can benefit from disclaimers because they protect both the presenter and the event host from legal liabilities arising from the content of the presentation while informing the prestentation viewers of important information.

We've put together a list of potential disclaimers to use in your presentations based on the content and the venue. Some of these are generally useful , particularly if the presentation will be published online, and others are targeted towards specific scenarios where a disclaimer may be required by law.

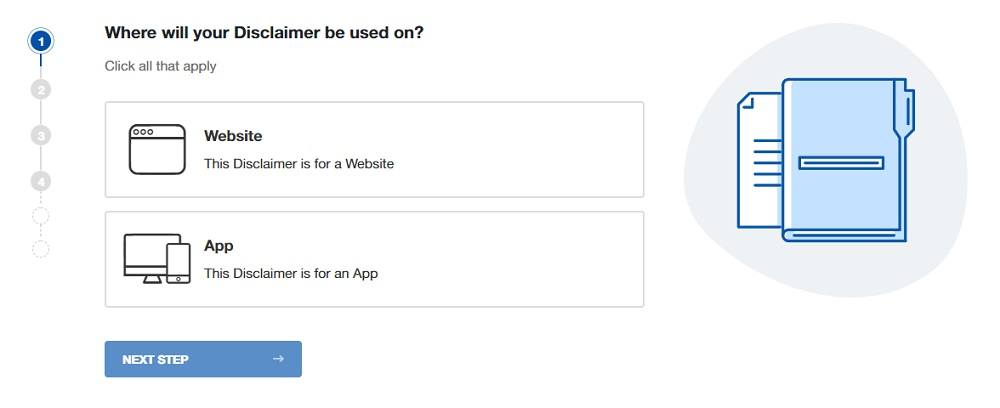

Our Disclaimer Generator can generate a legal disclaimer for your business, website or mobile app. Just follow these steps:

At Step 1, select where your Disclaimer will be used.

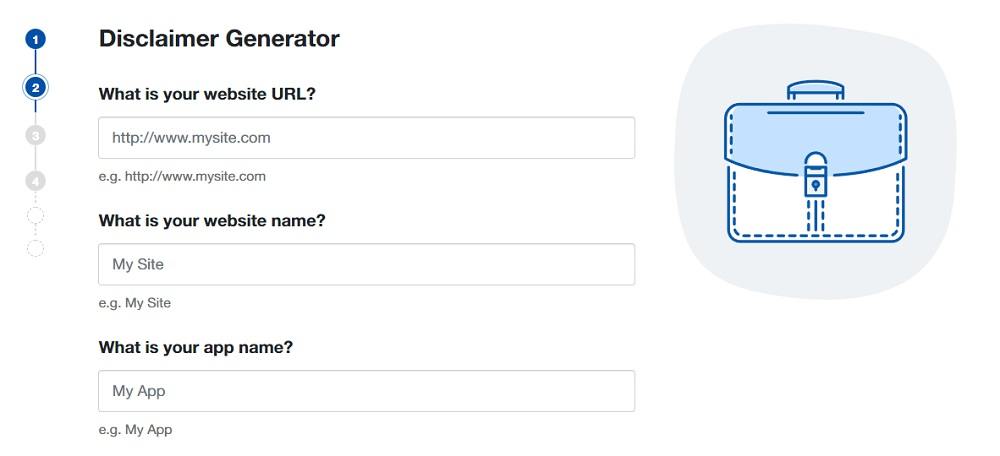

At Step 2, add in information about your website/app and business.

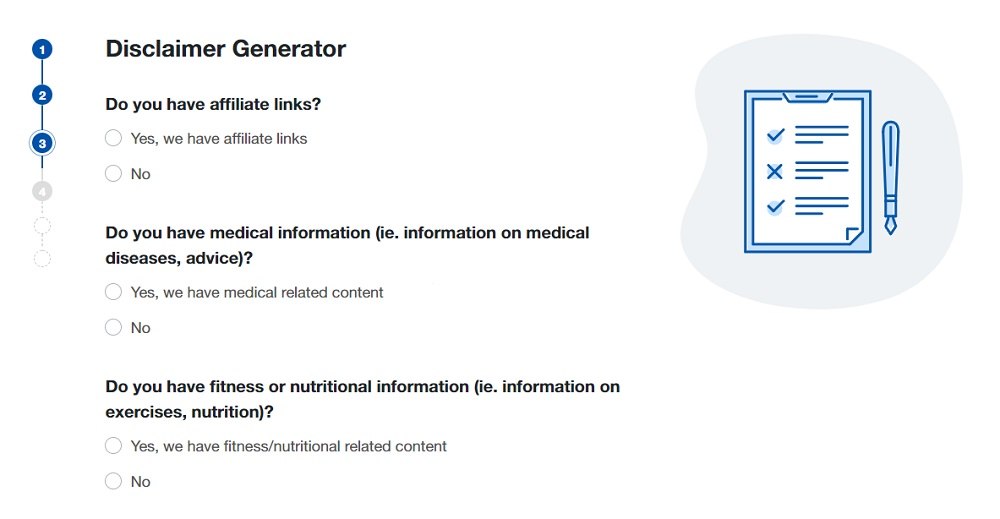

Answer some questions about your business practices.

Enter an email address where you'd like to receive your Disclaimer and click "Generate."

Done! You'll be able to instantly access and download your new Disclaimer.

- 1. Fair Use Disclaimers for Presentations

- 2. Copyright Disclaimers for Presentations

- 3. Risk Disclaimers for Presentations

- 4. Errors and Omissions Disclaimers for Presentations

- 5. Confidentiality Disclaimers for Presentations

- 6. Views Expressed Disclaimers for Presentations

- 7. Presentation Disclaimer

- 8. Protecting Your Presentations with Disclaimers

Fair Use Disclaimers for Presentations

A fair use disclaimer announces that you're using copyrighted material for limited purposes under the Fair Use Act. According to the Fair Use Act, it's ok to use copyrighted work without license or permission when you're using it for teaching, research, criticism or commentary.

If you're borrowing another author's work or intellectual property for use in your presentation, don't forget to add this type of disclaimer to protect yourself from allegations of theft.

In addition to citing your sources for any borrowed text or graphics, the fair use disclaimer show that you acknowledge the law in your borrowed sources. While these disclaimers aren't necessary for live presentations (especially with cited sources), adding one is always a good idea if you intend to upload your slides to the internet.

The disclaimer won't protect you if the inclusion of the copyrighted material falls outside of fair use, but it does provide some cover in the event your presentation begins showing up in Google searches.

A fair use disclaimer doesn't need to be complex. The Smithee Awards added this basic disclaimer to its website:

It simply states that the site may contain copyrighted material without asking permission from the owner but that the use falls within the standards of "fair use." It doesn't hurt to add a citation of the law (Title 17, Chapter 1, Section 107 US Copyright Law) to your disclaimer.

Add the disclaimer to a page before the title of your page or to the bibliography at the end of your presentation.

Copyright Disclaimers for Presentations

Copyright disclaimers are a simple way to declare that your presentation's contents belong to you and cannot be used without your permission unless noted.

If you are you using materials or ideas that are your own intellectual property, don't forget to add a copyright disclaimer (also referred to as a copyright notice ) to your presentation.

These disclaimers can be added to the footer of your presentation or at the very end in a resources page . We recommend using them whenever you're sharing personal intellectual property or that of your company.

A copyright disclaimer is simple. Just add:

- Your name/company name

- Year or years the content was created in

- Copyright symbol

- Rights reserved statement (optional)

Here's an example from SodaStream's website:

While it's not in a presentation, the format is standard and will be the same wherever you use this disclaimer.

Risk Disclaimers for Presentations

A risk disclaimer states that you cannot be held liable if someone uses the advice or information you're providing and then experiences damages of some kind. It's basically a "use at your own risk" statement.

Here's a good example from Market Traders Institute :

Here, the legal page talks about the risks inherent in investing for everyone. It says anyone should carefully consider whether they can afford to lose the money they choose to invest.

Here's another example from Macquarie's disclaimer that addresses risks along with other issues:

If you're creating a finance-related presentation, this kind of disclaimer should be placed at the beginning or end of your presentation. If the advice you're giving isn't financial but still comes with risks, the same format of a disclaimer can be used, but tailored for your particular industry.

For example, if instead of giving financial advice you give exercise and fitness advice, your disclaimer should make it clear that you aren't a health professional and that risks come with new exercise routines. As another example, say your presentation is for how to build a piece of furniture and requires the use of power tools and other dangerous tools. You should include a disclaimer that states there may be a risk to using the tools and completing the steps in the presentation.

Errors and Omissions Disclaimers for Presentations

This type of disclaimer states that your presentation may not include all relevant facts or the most up-to-date research, and you're not liable in the event that omissions or errors occur.

There's no time to include every important fact or caveat within the time or slide limit of a presentation. What's more, some presentations don't age well because the subject is constantly evolving.

Rather than worrying about the eventualities of presentations, protect yourself by adding an errors and omission disclaimer.

Maloney and Novotny offers this disclaimer that addresses errors, omissions, and the accuracy and completeness of information:

Adding a disclaimer like this to the beginning of your presentation is a smart idea.

Confidentiality Disclaimers for Presentations

This type of disclaimer states that the information provided isn't to be shared . Essentially, it tells your audience that what is said in the room should stay in the room.

Presentations given at private events, like board meetings or ticketed conferences, may include information that shouldn't leave the room.

If your presentation falls within this category, add a confidentiality disclaimer.

You can do this with a short, to-the-point statement early on in the presentation, such as on the title slide or as the first slide after the title slide and before any actual content is presented.

Here's how the Ankeny Board of Education displays its confidentiality disclaimer at the beginning of its presentation, giving it an entire slide:

Alternatively, or in conjunction with this approach, you can include a short statement about the confidentiality of the presentation at the bottom of every slide. Here's an example of such a statement:

Other companies include longer disclaimer pages at the beginning of presentations that include confidentiality disclaimers and any other disclaimers that they wish to display.

Moovly dedicates the first two slides after its title slide to disclose a number of disclaimers, including a confidentiality disclaimer

This is an effective way to present all of your relevant disclaimers at once and before any information is shared with the people viewing your presentation.

Views Expressed Disclaimers for Presentations

If you are sharing personal opinons that shouldn't be associated with the company you work for or the organization hosting the presentation, this disclaimer can create separation between your presentation and other parties. It will state that the views expressed in your presentation don't necessarily reflect the views of anyone else.

Some presentations are developed in line or conjunction with another body, but the information or opinions don't legally represent them. In these cases, it's important to add a views expressed disclaimer to provide distance between the presenter and any associated organizations.

Here's an example:

You work for a media organization, and you've been invited to speak at a university about your experiences in new media. You've been invited with the knowledge of your affiliation, but you're not invited to represent your organization.

In the event that you were formally representing your employer, your presentation would likely follow a set of company guidelines. But since you're not, you have significantly more freedom to express yourself. Adding a 'views expressed' disclaimer informs your audience that the views expressed are your own and don't reflect your employer.

The disclaimer clears up any ambiguity about the information you provide and could even protect your job in the event you say something that doesn't jive with your organization's media messaging.

Novartis added this disclaimer to a presentation uploaded to its website:

If you have users sign up for an account with you or provide an email address before you share your presentation with them, you can share your disclaimer at sign-up, as seen here:

These disclaimers tend to be very short and with boilerplate, standard language as seen in the example above.

Presentation Disclaimer

A general presentation disclaimer will address a number of topics in one disclaimer, such as errors and omissions, confidentialilty issues, and copyright notices.

If you're posting your presentations online, consider using a broad presentation disclaimer to cover yourself across anything uploaded.

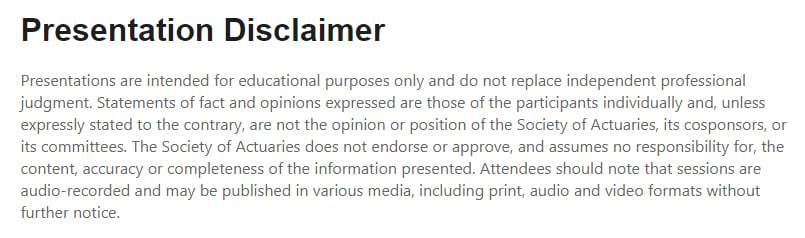

The Society of Actuaries has a presentation disclaimer on its main website. The text states that the presentations are provided for educational use only and do not replace the judgement of independent professionals. It also limits liability because it notes that the Society of Actuaries is in no way responsible for the accuracy or message of the content.

Ultimately, this disclaimer addresses many of the topics found in previous disclaimers:

This disclaimer is both general and sweeping and thus could easily be adapted and modified for any website, app, or guidebook where your presentations may be made available.

Protecting Your Presentations with Disclaimers

Disclaimers help protect you from legal liability when used appropriately in your presentations.

As more presentations transition from PowerPoints in boardrooms to the online sphere, it's important to add the same protections to your presentations that you might to other online content, particularly when you're working with your or someone else's intellectual property.

The disclaimers listed above won't apply to ever presentation, but there's a good chance you'll need to use at least one on future work.

Already have a database full of past presentations? You can post a "presentation disclaimer" on your main website to retroactively protect your work and limit your liability.

Comprehensive compliance starts with a Privacy Policy.

Comply with the law with our agreements, policies, and consent banners. Everything is included.

Generate Privacy Policy

This article is not a substitute for professional legal advice. This article does not create an attorney-client relationship, nor is it a solicitation to offer legal advice.

Last updated on

12 May 2024

- Disclaimer Agreements

Related articles

Federal Trade Commission (FTC) Disclosures

The Federal Trade Commission (FTC) is a government organization that works to regulate the marketplace and ensure that consumers are safe from fraudulent or deceptive business practices. The FTC requires companies that use certain business practices to maintain specific disclosures on their websites, blogs, social media posts, videos, and apps. These...

Medical Disclaimer Template

If you are a medical, healthcare, or fitness-based business, including a medical disclaimer on your website is crucial. Doing so can help you reduce legal liability by clearly communicating the limitations and scope of your information or services. It can also offer important information to your users to help keep...

Advertising Disclaimers

Advertising disclaimers is a statement that lets people know that you're being compensated in some way for your public post about a product or service, so that it is in effect an advertisement post. This article will explain when and why you need an advertising disclaimer and help you create and...

- Submit Disclosure

- InQbation Lab

- Lakeside Discovery

- Innovation & Entrepreneurship

INVO INNOVATION AND NEW VENTURES

- Invention Management

- Understanding Disclosures

- What is Disclosure?

Overview of Public Disclosure

Patent law places a fairly low threshold on what is considered a public disclosure. Although you can disclose some information about an invention (y ou can describe an invention without giving details), almost any disclosure without limitation or obligation of secrecy may constitute a public disclosure.

The disclosures that will ultimately act as a bar to patentability must be "enabling"--that is, it must give enough information to someone "of ordinary skill in the art" to actually duplicate the invention. An invention is considered to be publically disclosed when it falls into one of these four broad categories:

1. It is described in a printed publication

Printed publications include commonly associated items such as book chapters, journal articles, and theses. But printed publications also include:

- Email correspondence : Providing information to individuals outside Northwestern University by email, letters or other correspondence without indicating that the information being provided is confidential could also constitute disclosure.

- Grant proposals : Grant proposals to federal agencies are deemed publications as they are accessible under Freedom of Information Laws, but you can take active steps to ensure that information you provide under grant proposals is maintained in confidence when necessary. The first page of the proposal should carry the following notice: “Confidential Information--Pages __ to __ of THIS PROPOSAL contain potentially patentable information” List the pages containing the confidential information and conspicuously write “CONFIDENTIAL” on each page that contains the confidential information.

- Posters, Abstracts and Proceedings

- Oral disclosures : Oral presentations are a gray area in terms of whether they constitute disclosure or not. If at a formal talk, you distribute a copy of your presentation in which your invention is disclosed, it is clearly a disclosure. However, even if handouts are not provided but someone in the audience takes detailed notes that describe the invention, it would also constitute disclosure. For these reasons you need to carefully plan your oral presentations so that you do not inadvertently disclose your invention. Thus conference presentations, departmental seminars , or thesis defense all present opportunities for public disclosure.

2. It is in public use

Distribution of research materials and prototypes that embody the invention, may constitute disclosure under certain conditions. If the materials are provided without any restriction on use or further distribution it may be considered to be made available to the public. If they are clearly provided only for testing and/or evaluation or for research purposes under written agreements clearly specifying the same, it would not be considered disclosure.

3. It is on sale

A sale or an offer to sell a research material or prototype also constitutes disclosure and could establish a bar date for patent purposes.

4. It is otherwise available to the public

This is a new provision implemented under the American Invents Act on March 16, 2013. As this is a new statutory provision, it is unclear exactly how it will be implemented in practice. This provision may therefore expand the list of public disclosures in yet unforeseen ways.

Unfortunately we don't fully support your browser. If you have the option to, please upgrade to a newer version or use Mozilla Firefox , Microsoft Edge , Google Chrome , or Safari 14 or newer. If you are unable to, and need support, please send us your feedback .

We'd appreciate your feedback. Tell us what you think! opens in new tab/window

CRediT author statement

CRediT (Contributor Roles Taxonomy) was introduced with the intention of recognizing individual author contributions, reducing authorship disputes and facilitating collaboration. The idea came about following a 2012 collaborative workshop led by Harvard University and the Wellcome Trust, with input from researchers, the International Committee of Medical Journal Editors (ICMJE) and publishers, including Elsevier, represented by Cell Press.

CRediT offers authors the opportunity to share an accurate and detailed description of their diverse contributions to the published work.

The corresponding author is responsible for ensuring that the descriptions are accurate and agreed by all authors

The role(s) of all authors should be listed, using the relevant above categories

Authors may have contributed in multiple roles

CRediT in no way changes the journal’s criteria to qualify for authorship

CRediT statements should be provided during the submission process and will appear above the acknowledgment section of the published paper as shown further below.

Term | Definition |

|---|---|

Conceptualization | Ideas; formulation or evolution of overarching research goals and aims |

Methodology | Development or design of methodology; creation of models |

Software | Programming, software development; designing computer programs; implementation of the computer code and supporting algorithms; testing of existing code components |

Validation | Verification, whether as a part of the activity or separate, of the overall replication/ reproducibility of results/experiments and other research outputs |

Formal analysis | Application of statistical, mathematical, computational, or other formal techniques to analyze or synthesize study data |

Investigation | Conducting a research and investigation process, specifically performing the experiments, or data/evidence collection |

Resources | Provision of study materials, reagents, materials, patients, laboratory samples, animals, instrumentation, computing resources, or other analysis tools |

Data Curation | Management activities to annotate (produce metadata), scrub data and maintain research data (including software code, where it is necessary for interpreting the data itself) for initial use and later reuse |

Writing - Original Draft | Preparation, creation and/or presentation of the published work, specifically writing the initial draft (including substantive translation) |

Writing - Review & Editing | Preparation, creation and/or presentation of the published work by those from the original research group, specifically critical review, commentary or revision – including pre-or postpublication stages |

Visualization | Preparation, creation and/or presentation of the published work, specifically visualization/ data presentation |

Supervision | Oversight and leadership responsibility for the research activity planning and execution, including mentorship external to the core team |

Project administration | Management and coordination responsibility for the research activity planning and execution |

Funding acquisition | Acquisition of the financial support for the project leading to this publication |

*Reproduced from Brand et al. (2015), Learned Publishing 28(2), with permission of the authors.

Sample CRediT author statement

Zhang San: Conceptualization, Methodology, Software Priya Singh. : Data curation, Writing- Original draft preparation. Wang Wu : Visualization, Investigation. Jan Jansen : Supervision. : Ajay Kumar : Software, Validation.: Sun Qi: Writing- Reviewing and Editing,

Read more about CRediT here opens in new tab/window or check out this article from Authors' Updat e: CRediT where credit's due .

- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search., q2 2024 new ifrs® accounting standards and amendments: are you ready.

Our semi-annual outlook helps preparers in the US keep track of changes in IFRS Accounting Standards and assess their relevance. New in this edition, IFRS 18 and IFRS 19 have been issued, changing the presentation and disclosure landscape in 2027.

From the IFRS Institute – June 7, 2024

As anticipated, the International Accounting Standard Board (IASB®) has issued two new standards – IFRS 18 Presentation and Disclosure in Financial Statements , and IFRS 19 Subsidiaries without Public Accountability: Disclosures – which will be effective in 2027. Narrow-scope amendments to IFRS 9 and IFRS 7 have also been issued, effective in 2026. In addition, IFRS Accounting Standards preparers need to be ready to implement amendments related to income taxes, debt with covenants, sale-and-leaseback transactions, and supplier finance arrangements, all of which are effective in 2024, as well as the amendment to IAS 21, effective in 2025.

Our semi-annual outlook is a quick aid to help preparers in the US keep track of coming changes to IFRS Accounting Standards and assess the relevance to their financial statements.

The following summaries highlight new authoritative guidance issued by the IASB, provide a high-level comparison to US GAAP, and identify resources for further reading. The content is organized by effective dates 1 :

|

|

As a reminder, to be in compliance with IFRS Accounting Standards, companies also need to timely implement all IFRS Interpretations Committee Agenda Decisions. Read the KPMG IFRS Perspectives article for a summary of 2024 Agenda Decisions .

Lastly, in On the radar , we highlight the upcoming amendments to IAS 37 around commitments and how they should be applied to greenhouse gas emissions. See also the IFRS Foundation work plan for other IASB projects that are currently in progress.

Effective January 1, 2024 1

| |

requires a seller-lessee to account for variable lease payments that arise in a sale-and-leaseback transaction as follows. Seller-lessees are required to reassess and potentially restate sale-and-leaseback transactions entered into since the implementation of IFRS 16 in 2019. | Unlike IFRS Accounting Standards, US GAAP does not include variable lease payments in the measurement of a lease liability arising from a sale-and-leaseback transaction. Accounting for sale-and-leaseback transactions under US GAAP overall differs significantly from IFRS Accounting Standards; therefore, dual reporters may need to separately track the accounting for these transactions. |

, published in 2020 and 2022 respectively, clarify that the classification of liabilities as current or noncurrent is based solely on an entity’s right to defer settlement for at least 12 months after the reporting date. The right needs to exist at the reporting date and must have substance. Only covenants with which an entity must comply on or before the reporting date affect this right. Covenants to be complied with after the reporting date do not affect the classification of a liability as current or noncurrent at the reporting date. However, disclosure about covenants is now required to help users understand the risk that those liabilities could become repayable within 12 months after the reporting date. The amendments also clarify that the transfer of an entity’s own equity instruments is regarded as settlement of a liability, in certain circumstances. If a liability has any equity conversion options, they generally affect its classification as current or noncurrent (e.g. if the conversion option is bifurcated as an embedded derivative from the host debt), unless these conversion options are recognized as equity under IAS 32 . | The current and noncurrent classification of liabilities was not converged between IFRS Accounting Standards and US GAAP before the amendments to IAS 1. We expect differences will still exist because, unlike IAS 1, US GAAP factors in other elements in the classification assessment – e.g. the intent and ability of the debtor to refinance the obligation on a long-term basis, and certain subsequent events such as covenant breaches and related waivers. Further, under US GAAP, the classification as current or noncurrent is not based on whether the conversion option is separated as an embedded derivative from the host debt. Refer to KPMG Article, for further discussion on the differences that exist. |

requires an entity (the buyer) to disclose qualitative and quantitative information about its supplier finance arrangements , such as terms and conditions – including, for example, extended payment terms and security or guarantees provided. Amongst other characteristics, IAS 7 explains that a supplier finance arrangement provides the entity with extended payment terms, or the entity’s suppliers with early payment terms, compared to the related invoice payment due date. | Like IFRS Accounting Standards, US GAAP requires an entity (the buyer) to disclose qualitative and quantitative information about its supplier finance programs. However, the characteristics required to qualify as a supplier finance program under US GAAP are different from those under IAS 7. For example, they do not include the entity obtaining extended payment terms under the arrangement. In addition, unlike IFRS Accounting Standards, US GAAP does not require disclosure of: |

| |

Back to top

Effective January 1, 2025 1

| applies when one currency cannot be exchanged into another. This may occur, for example, because of government-imposed controls on capital imports and exports, or a limitation on the volume of foreign currency transactions that can be undertaken at an official exchange rate. The amendments clarify when a currency is considered exchangeable into another currency, and how an entity estimates a spot rate for currencies that lack exchangeability. The amendments introduce new disclosures to help financial statement users assess the impact of using an estimated exchange rate. | Where the lack of exchangeability is not temporary, Topic 830 (foreign currency matters) explicitly requires an entity to consider the propriety of consolidation, combination, or equity method of accounting for foreign operations with significant non-exchangeable currencies, unlike IFRS Accounting Standards. Also, there is no concept of estimating exchange rates under US GAAP, however, the lack of exchangeability must be disclosed. |

| |

Effective January 1, 2026 1

|

|

clarify financial assets and financial liabilities are recognized and derecognized at settlement date except for regular way purchases or sales of financial assets and financial liabilities meeting conditions for new exception. The new exception permits companies to elect to derecognize certain financial liabilities settled via electronic payment systems earlier than the settlement date. They also provide guidelines to assess contractual cash flow characteristics of financial assets, which apply to all contingent cash flows, including those arising from environmental, social, and governance (ESG)-linked features. Additionally, these amendments introduce new disclosure requirements and update others. | Under Topic 405, financial liabilities are considered extinguished once the debtor has settled the debt or is legally released from being the primary obligor. There are no specific considerations to assess the timing of debt extinguishment when payments are made via electronic payment systems. Further, US GAAP does not address the timing of the recognition of financial asset settlements. Further, the classification of financial assets under US GAAP is primarily based on management’s intent for holding the assets. Any contingent cash flows, including those arising from ESG-linked features are evaluated for potential bifurcation as embedded derivatives. |

| |

Effective January 1, 2027 1

|

|

IFRS 18 replaces IAS 1, which sets out presentation and base disclosure requirements for financial statements. The changes, which mostly affect the income statement, include the requirement to classify income and expenses into three new categories – operating, investing and financing – and present subtotals for operating profit or loss and profit or loss before financing and income taxes. Further, operating expenses are presented directly on the face of the income statement – classified either by nature (e.g. employee compensation), by function (e.g. cost of sales) or using a mixed presentation. Expenses presented by function require more detailed disclosures about their nature. IFRS 18 also provides enhanced guidance for aggregation and disaggregation of information in the financial statements, introduces new disclosure requirements for management-defined performance measures (MPMs)* and eliminates classification options for interest and dividends in the statement of cash flows. *Non-GAAP measures that meet the definition of MPMs will be subject to the disclosure requirements. | US GAAP generally has no requirements to classify income and expenses by specific category, or present subtotals for profit or loss. SEC regulations prescribe expense classification requirements for certain specialized industries. Non-GAAP measures are generally prohibited from inclusion in the financial statements. Therefore, presentation and disclosure differences are expected to continue to arise in practice when IFRS 18 comes into effect. The FASB has issued a proposal that would require income statement expenses to be disaggregated into certain natural expense categories in the notes. As proposed, the new US GAAP disclosures would be similar in spirit to certain IFRS 18 disaggregation requirements, but may be more cumbersome and would apply only to public business entities. |

| |

IFRS 19 is a voluntary standard that applies to entities without public accountability, but whose parents prepare consolidated financial statements under IFRS Accounting Standards. For in-scope companies, IFRS 19 simplifies disclosures on various topics, including leases, exchange rates, income taxes, statement of cash flows, etc. If elected, IFRS 19 is expected to reduce the cost of preparing in-scope financial statements while maintaining the usefulness of those financial statements for stakeholders. | Under US GAAP, private companies can elect to apply Private Company Alternatives, aimed at reducing complexity and costs in financial reporting for in-scope companies. This includes the option to amortize goodwill over a set period, the ability to combine similar intangible assets, a simplified approach to evaluating variable interest entities, a simpler approach to lease accounting, and alternative methods for estimating fair value in certain cases. There is no specific alternative focused solely on reducing disclosures; however, certain US GAAP disclosure requirements only apply to public entities. The entities eligible to elect Private Company Alternatives under US GAAP compared to IFRS 19, as well as the results of applying each, may differ. |

KPMG resources: | |

On the radar

IAS 37 standard-setting developments

Effective since 1999, IAS 37, the one-stop standard for accounting for provisions under IFRS Accounting Standards is being put to the test with a recent uptick in climate-related accounting matters. Some of them – such as those relating to emission schemes and climate-related commitments – are being addressed by the IFRS Interpretations Committee. In 2022, an Agenda Decision 3 explored whether measures to encourage reductions in vehicle carbon emissions give rise to an obligation requiring a liability under IAS 37. In 2024, another Agenda Decision 4 sets out a two-step approach to first assess if the commitments a company makes to reduce or offset its future greenhouse gas emissions create a constructive obligation, and second if that constructive obligation results in a liability under IAS 37. It highlights that setting or announcing a commitment, on its own, does not trigger recognition of a liability, even if a public announcement has created a valid expectation and resulted in a constructive obligation, unless an expenditure has been incurred.

Meanwhile, the IASB is considering targeted improvements to IAS 37 5 itself, and has begun to develop proposals to clarify the requirements related to the recognition of liabilities, non-performance risk in discount rates, and costs to include in measuring a provision.

Given the widespread use of IAS 37, preparers and users of financial statements prepared under IFRS Accounting Standards should monitor upcoming developments in this area.

- Effective dates are for annual periods beginning on or after the stated date. Early adoption is permitted unless otherwise stated.

- These arrangements may also be referred to as ‘reverse factoring’ or ‘supply chain financing’ arrangements.

- Refer to June 2022 Agenda Decision on negative low emission vehicle credits .

- Refer to March 2024 Agenda Decision on climate-related commitments .

- Refer to IASB Provisions – Targeted Improvements project page.

Explore more

2024 IFRS® Interpretations Committee Agenda Decisions

A summary of 2024 IFRIC activity and comparison to US GAAP.

IFRS Accounting Standards first-time adoption for US subsidiaries

When a subsidiary converts to IFRS Accounting Standards later than its parent, optional exemptions apply under IFRS 1.

IFRS Institute

Delivering KPMG guidance, publications and insights on the application of IFRS® Accounting Standards in the United States.

Meet our team

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

Self-regulation and self-presentation in sustainability reporting: Evidence from firms' voluntary water disclosure

65 Pages Posted: 6 Jun 2024

Tianjin University of Science & Technology

Hans van der Heijden

University of Sussex Business School

Date Written: May 30, 2024

This study examines factors that influence sustainability disclosure decisions using two alternative theoretical framings of sustainability reporting: self-regulation theory and self-presentation theory. This study focuses on water disclosure, a key dimension of sustainability reporting, which, despite the importance of water, has received relatively little theoretical and empirical attention. Using a large dataset from an established global water survey spanning from 2010 to 2020, we document supportive evidence for the positive relations between voluntary water disclosure and several self-regulation mechanisms such as policies and actions on water efficiency and emission reductions. In addition, we use ‘water-to-value-add’ measures as supplementary proxies for corporate water efficiency. We find that firms with high water efficiency are more likely to disclose water information in the global water survey to proactively showcase their good water performance to key stakeholders; whereas firms with low water efficiency are less likely to respond to the survey to maintain an existing corporate image. Our theoretical contribution to the accounting literature is the novel integration of self-regulation and self-presentation theory, and its application to water disclosure: our findings suggest that firms disclose water performance data strategically to present a favourable image of corporate water stewardship, providing support for assertive self-presentation behaviour.

Keywords: water disclosure, self-regulation, self-presentation, water efficiency, CSR

Suggested Citation: Suggested Citation

Siwen Liu (Contact Author)

Tianjin university of science & technology ( email ).

No1038 Da Gu Nan Lu, Tianjin, 300222 China

Hans Van der Heijden

University of sussex business school ( email ).

Jubilee Building Falmer Brighton, BN1 9SN United Kingdom

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, financial accounting ejournal.

Subscribe to this fee journal for more curated articles on this topic

Corporate Governance & Economics eJournal

Corporate governance: disclosure, internal control, & risk-management ejournal, corporate social responsibility (csr) ejournal, csr & management practice ejournal, water sustainability ejournal, accounting - disclosure ejournal.

Subscribe to this free journal for more curated articles on this topic

Environmental, Social & Governance (ESG) Research Hub eJournal

COMMENTS

Sample Disclosures. These examples provide sample formats and language for speakers to use on their slides or posters when announcing their course title, financial and nonfinancial disclosures, and learning outcomes at the beginning of courses registered for ASHA CEUs. Please refer to the examples below prior to your presentation in order to ...

their presentations. Such disclosure is intended to provide participants with sufficient information to evaluate whether any given presentation has been influenced by the presenters' relationship(s) or financial interest(s) with said companies. This procedure does not replace paper or electronic signed Disclosure Statements.

disclosure. • Speaker's Bureau: List all companies or emit for no disclosure. • Consultant: List all companies or emit for no disclosure. • Major Shareholder: List all companies or emit for no disclosure. • Other: List all companies or emit for no disclosure.

In compliance of the Conflict of Interest policies, the scientific direction requires speakers to disclose any relevant financial relationship they may have had within the last 12 months. Each presenter must have a first slide pertaining to financial interests and make a statement at the beginning of their presentation. This first slide must ...

A PowerPoint disclosure slide is made available to download for your presentation in Presenter Central. Financial disclosure is something the Academy takes very seriously. During and after the meeting, Academy staff will be conducting spot checks of presentations to ensure the first-slide policy is followed.

Presentation and Disclosures Relating to Inventories. Under IFRS, the following financial statement disclosures concerning inventories are required: the accounting policies that were adopted in measuring inventories, including the cost formula used; the total carrying amount of inventories and the carrying amount in classifications that are ...

The presentation and disclosure requirements discussed in this guide presume that the related accounting topics are considered to be material and applicable to the reporting entity. That assumption applies throughout the guide and will not be restated in every instance. Accounting topics or transactions that are not material or not applicable ...

Disclosure in Publications, Presentations, etc. Open publication and presentation of financial disclosures for readers, reviewers and colleagues to evaluate best serves the scientific community and the public. In addition, many scientific journals and funding agencies require authors disclose related financial interests to improve the integrity of the science and manage financial conflicts of ...

Presentation and disclosure Presentation and disclosure. The IASB discussed presentation and disclosure issues. The existing Conceptual Framework does not have a section on presentation and disclosure, resulting, in the views of some, in disclosure requirements that are not always focused on the right/relevant disclosures and are too voluminous.

Purpose of the paper. This paper discusses the scope and content of presentation and disclosure guidance to be included in the Conceptual Framework Exposure Draft. In June 2014, the IASB discussed materiality and communication aspects of presentation and disclosure guidance. The IASB's tentative decisions from that meeting are set out in ...

Presentation and disclosure. 31 Jul 2019. IFRS 16 requires lessees and lessors to provide information about leasing activities within their financial statements. The Standard explains how this information should be presented on the face of the statements and what disclosures are required. In this article we identify the requirements and provide ...

A disclosure statement must accompany each presentation. For oral presentations, potential conflicts must be listed on a disclosure slide immediately following the title slide. For poster presentations, potential conflicts must be listed on the poster after the title and in a type size consistent with the rest of the poster. The first part of ...

The objective of IFRS 18 is to set out requirements for the presentation and disclosure of information in general purpose financial statements (financial statements) to help ensure they provide relevant information that faithfully represents an entity's assets, liabilities, equity, income and expenses.

salaried full professor in Communication Science and Disorders at the University of Pittsburgh. research funded by the National Institute on Deafness and Other Communication Disorders. co‐author of and receives royalties for a text: Vocology. receives royalties from Plural Publishing, Inc., based on sales of manuals for Lessac‐Madsen ...

Self-disclosure and self-presentation are two related yet distinct communication processes that both reflect and influence how people associate with others. Self-disclosure is the intentional sharing of personal information about oneself with one or more people and is a key factor in the development and management of interpersonal relationships.

Presentations can benefit from disclaimers because they protect both the presenter and the event host from legal liabilities arising from the content of the presentation while informing the prestentation viewers of important information.. We've put together a list of potential disclaimers to use in your presentations based on the content and the venue.

Oral disclosures: Oral presentations are a gray area in terms of whether they constitute disclosure or not. If at a formal talk, you distribute a copy of your presentation in which your invention is disclosed, it is clearly a disclosure. ... A sale or an offer to sell a research material or prototype also constitutes disclosure and could ...

8. Additional guidance on the presentation and disclosure of specific types of financial instruments can be found in international and/or national accounting standards. For example, IPSAS 13, "Leases" contains specific disclosure requirements relating to finance leases. Definitions 9.

Preparation, creation and/or presentation of the published work by those from the original research group, specifically critical review, commentary or revision - including pre-or postpublication stages. Visualization. Preparation, creation and/or presentation of the published work, specifically visualization/ data presentation. Supervision

From the IFRS Institute - June 7, 2024. As anticipated, the International Accounting Standard Board (IASB®) has issued two new standards - IFRS 18 Presentation and Disclosure in Financial Statements, and IFRS 19 Subsidiaries without Public Accountability: Disclosures - which will be effective in 2027. Narrow-scope amendments to IFRS 9 and IFRS 7 have also been issued, effective in 2026.

Our theoretical contribution to the accounting literature is the novel integration of self-regulation and self-presentation theory, and its application to water disclosure: our findings suggest that firms disclose water performance data strategically to present a favourable image of corporate water stewardship, providing support for assertive ...