Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

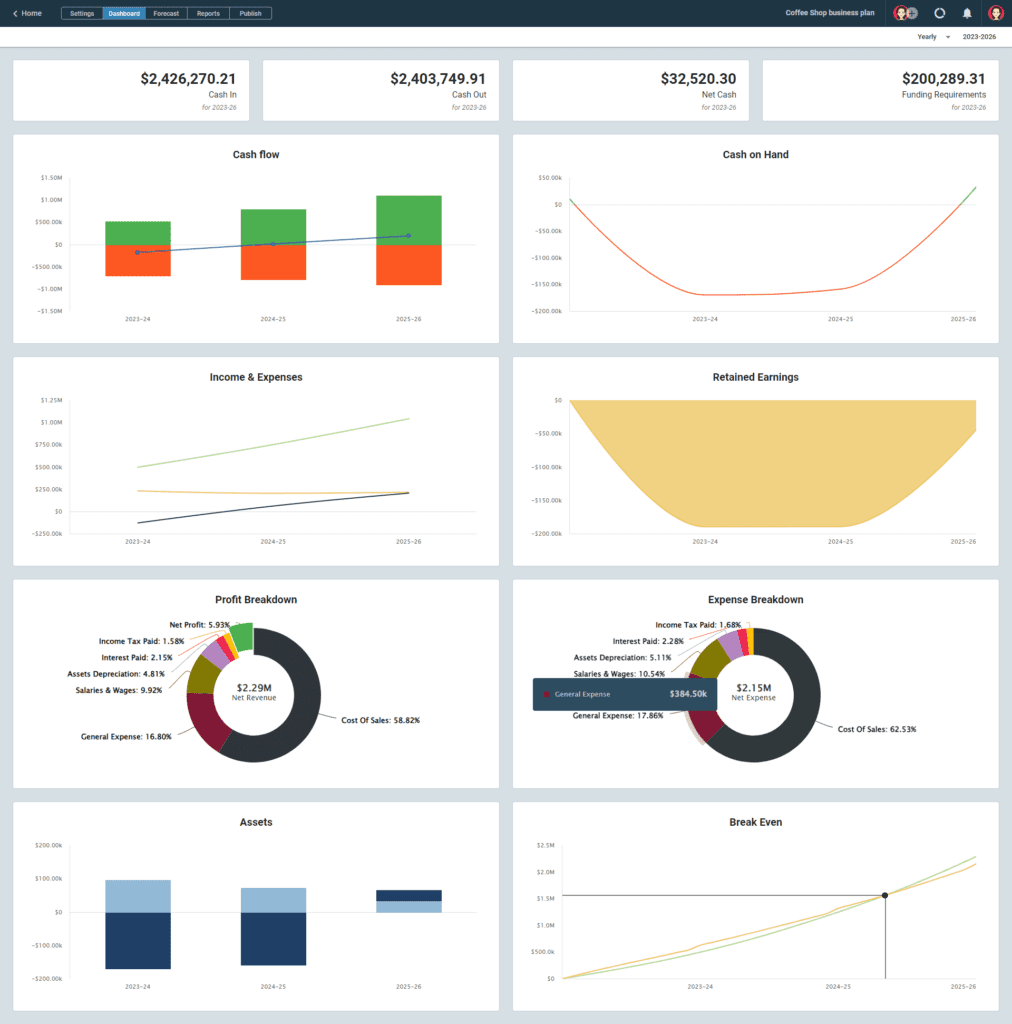

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

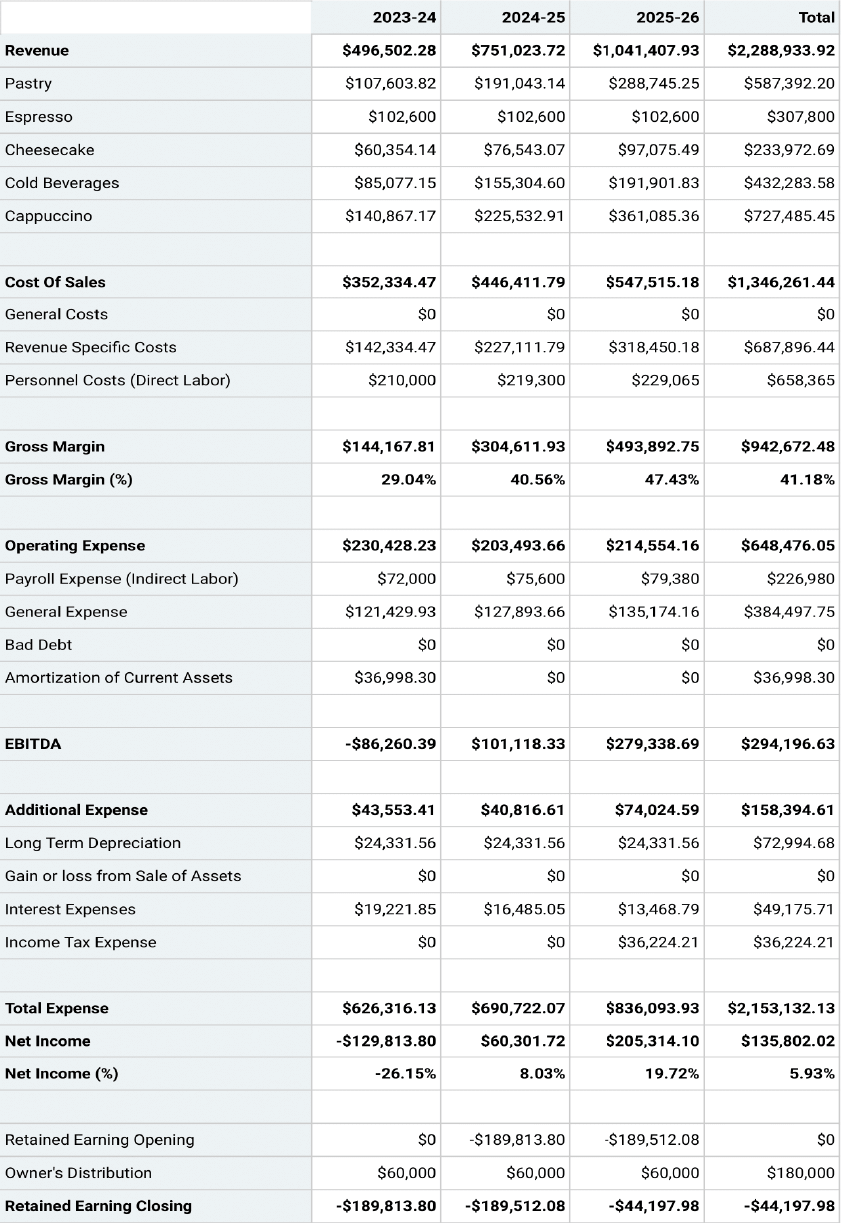

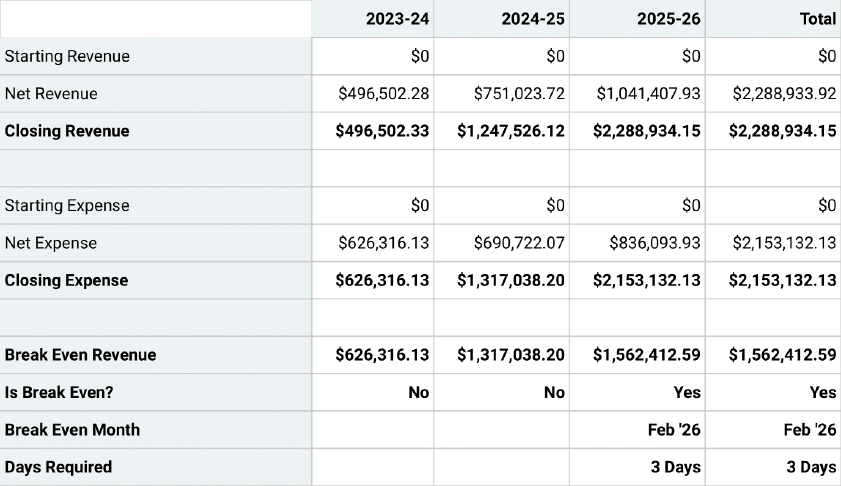

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

ZenBusinessPlans

Home » Business Plans

How to Write a Business Plan Financial Projection [Sample Template]

How do you prepare a business plan financial statement? Do you need help developing business plan financial projections? Do you need a business plan projections template? Then i advice you read on because this article is for you.

What is a Business Plan Financial Statement?

The financial statement is a distinct section of your business plan because it outlines your financial projections. A business lives and dies based on its financial feasibility and most importantly its profitability. Regardless of how hard you work or how much you have invested of your time and money, people, at the end of the day, only want to support something that can return their investments with profits.

Your executive summary may be brilliantly crafted, and your market or industry analysis may be the bomb. But your business plan isn’t just complete without a financial statement to justify it with good figures on the bottom line.

Your financial statement is what makes or mars your chances of obtaining a bank loan or attracting investors to your business. Even if you don’t need financing from a third party, compiling a financial statement will help you steer your business to success. So, before we dig further into how to prepare a financial statement, you need to understand what a financial statement is not.

What’s the Difference Between a Financial Projection Statement and Accounting Statement?

However, you need to keep in mind that the financial statement is not the same as an accounting statement. Granted, a financial statement includes financial projections such as profit and loss, balance sheets, and cash flow, all of which makes it look similar to an accounting statement.

But the major difference between them is that an accounting statement deals with the past, while the financial projections statement of your business plan outlines your future spending and earnings. Having made this point clear, let’s now look at the steps involved on preparing a financial statement for your business plan.

So what exactly do you have to include in this section? You will need to include three statements:

- Income Statement

- Balance Sheet

- Cash-Flow Statement

Now, let’s briefly discuss each.

Components of a Business Plan Financial Statement

Income statement.

This beautiful composition of numbers tells the reader what exactly your sources of revenue are and which expenses you spent your money on to arrive at the bottom line. Essentially, for a given time period, the income statement states the profit or loss ( revenue-expenses ) that you made.

Balance sheet

The key word here is “ balance, ” but you are probably wondering what exactly needs to be weighed, right? On one side you should list all your assets ( what you own ) and on the other side, all your liabilities ( what you owe ), thereby giving a snapshot of your net worth ( assets – liabilities = equity ).

Cash flow statement

This statement is similar to your income statement with one important difference; it takes into account just when revenues are actually collected and when expenses are paid. When the cash you have coming in ( collected revenue ) is greater than the cash you have going out ( disbursements ), your cash flow is said to be positive.

And when the opposite scenario is true, your cash flow is negative. Ideally, your cash flow statement will allow you to recognize where cash is low, when you might have a surplus, and how to be on top of your game when operating in an uncertain environment.

How to Prepare a Business Plan Financial Projections Statement

1. Start by preparing a revenue forecast and a forecast profit and loss statement

Also, prepare supporting schedules with detailed information about your projected personnel and marketing costs. If your business has few fixed assets or it’s just a cash business without significant receivables, you don’t need a forecast balance sheet.

2. Using your planned revenue model, prepare a spreadsheet

Set the key variables in such a way that they can be easily changed as your calculations chain through. To ensure that your projected revenues are realistic and attainable, run your draft through a number of iterations. For each year covered in your business plan, prepare a monthly forecast of revenues and spending.

3. If you plan to sell any goods, then include a forecast of goods sold

This applies the most to manufacturing businesses. Give a reasonable estimate for this cost. And be of the assumption that the efficiency of your products would increase with time and the cost of goods sold as a percentage of sales will decline.

4. Quantify your marketing plan

Look at each marketing strategy you outlined in the business plan and attach specific costs to each of them. That is, if you are looking at billboard advertising, TV advertising, and online marketing methods such as pay-per-click advertising and so on; then you should estimate the cost of each medium and have it documented.

5. Forecast the cost of running the business, including general and administrative costs

Also, forecast the cost of utilities, rents, and other recurring costs. Don’t leave out any category of expenses that is required to run your business. And don’t forget the cost of professional services such as accounting and legal services.

6. In the form of a spreadsheet, forecast the payroll

This outlines each individual that you plan to hire, the month they will start work, and their salary. Also include the percentage salary increases (due to increased cost of living and as reward for exemplary performance) that will come in the second and subsequent years of the forecast.

Additional tips for Writing a Business Plan Financial Statement

- Don’t stuff your pages with lots of information, and avoid large chunks of text. Also, use a font size that is large enough. Even if these would spread out your statement into more pages, don’t hesitate to spread it out. Legibility matters!

- After completing the spreadsheets in the financial statement, you should summarize the figures in the narrative section of your business plan.

- Put a table near the front of your financial statement that shows projected figures, pre-tax profit, and expenses. These are the figures you want the reader to remember. You can help the reader retain these figures in memory by including a bar chart of these figures, too.

As a final note, you should keep in mind that a financial statement is just an informed guess of what will likely happen in the future. In reality, the actual results you will achieve will vary. In fact, this difference may be very far from what you have forecast.

So, if your business is a start-up, prepare more capital than your projections show that you will need. Entrepreneurs have a natural tendency to project a faster revenue growth than what is realistic. So, don’t let this instinct fool you.

More on Business Plans

4 Steps to Creating a Financial Plan for Your Small Business

When it comes to long-term business success, preparation is the name of the game. And the key to that preparation is a solid financial plan that sets forth a business’s short- and long-term financial goals and how it intends to reach them. Used by company decision-makers and potential partners, investors and lenders, alike, a financial plan typically includes the company’s sales forecast, cash flow projection, expected expenses, key financial metrics and more. Here is what small businesses should understand to create a comprehensive financial plan of their own.

What Is a Financial Plan?

A financial plan is a document that businesses use to detail and manage their finances, ensure efficient allocation of resources and inform a plethora of decisions — everything from setting prices, to expanding the business, to optimizing operations, to name just a few. The financial plan provides a clear understanding of the company’s current financial standing; outlines its strategies, goals and projections; makes clear whether an idea is sustainable and worthy of investment; and monitors the business’s financial health as it grows and matures. Financial plans can be adjusted over time as forecasts become replaced with real-world results and market forces change.

A financial plan is an integral part of an overall business plan, ensuring financial objectives align with overall business goals. It typically contains a description of the business, financial statements, personnel plan, risk analysis and relevant key performance indicators (KPIs) and ratios. By providing a comprehensive view of the company’s finances and future goals, financial plans also assist in attracting investors and other sources of funding.

Key Takeaways

- A financial plan details a business’s current standing and helps business leaders make informed decisions about future endeavors and strategies.

- A financial plan includes three major financial statements: the income statement, balance sheet and cash flow statement.

- A financial plan answers essential questions and helps track progress toward goals.

- Financial management software gives decision-makers the tools they need to make strategic decisions.

Why Is a Financial Plan Important to Your Small Business?

A financial plan can provide small businesses with greater confidence in their short- and long-term endeavors by helping them determine ways to best allocate and invest their resources. The process of creating the plan forces businesses to think through how different decisions could impact revenue and which occasions call for dipping into reserve funds. It’s also a helpful tool for monitoring performance, managing cash flow and tracking financial metrics.

Simply put, a financial plan shows where the business stands; over time, its analysis will reveal whether its investments were worthwhile and worth repeating. In addition, when a business is courting potential partners, investors and lenders, the financial plan spotlights the business’s commitment to spending wisely and meeting its financial obligations.

Benefits of a Financial Plan

A financial plan is only as effective as the data foundation it’s built on and the business’s flexibility to revisit it amid changing market forces and demand shifts. Done correctly, a financial plan helps small businesses stay on track so they can reach their short-term and long-term goals. Among the benefits that effective financial planning delivers:

- A clear view of goals and objectives: As with any type of business plan, it’s imperative that everyone in a company is on the same financial page. With clear responsibilities and expected results mapped out, every team member from the top down sees what needs to be done, when to do it and why.

- More accurate budgets and projections: A comprehensive financial plan leads to realistic budgets that allocate resources appropriately and plan for future revenue and expenses. Financial projections also help small businesses lay out steps to maintain business continuity during periods of cash flow volatility or market uncertainty.

- External funding opportunities: With a detailed financial plan in hand, potential partners, lenders and investors can see exactly where their money will go and how it will be used. The inclusion of stellar financial records, including past and current liabilities, can also assure external funding sources that they will be repaid.

- Performance monitoring and course correction: Small businesses can continue to benefit from their financial plans long after the plan has been created. By continuously monitoring results and comparing them with initial projections, businesses have the opportunity to adjust their plans as needed.

Components of a Small Business Financial Plan

A sound financial plan is instrumental to the success and stability of a small business. Whether the business is starting from scratch or modifying its plan, the best financial plans include the following elements:

Income statement: The income statement reports the business’s net profit or loss over a specific period of time, such a month, quarter or year. Also known as a profit-and-loss statement (P&L) or pro forma income statement, the income statement includes the following elements:

- Cost of goods sold (COGS): The direct costs involved in producing goods or services.

- Operating expenses: Rent, utilities and other costs involved in running the business.

- Revenue streams: Usually in the form of sales and subscription services, among other sources.

- Total net profit or loss: Derived from the total amount of sales less expenses and taxes.

Balance sheet: The balance sheet reports the business’s current financial standing, focusing on what it owns, what it owes and shareholder equity:

- Assets: Available cash, goods and other owned resources.

- Liabilities: Amounts owed to suppliers, personnel, landlords, creditors, etc.

Shareholder equity: Measures the company’s net worth, calculated with this formula:

Shareholder Equity = Assets – Liability

The balance sheet lists assets, liabilities and equity in chart format, with assets in the left column and liabilities and equity on the right. When complete — and as the name implies —the two sides should balance out to zero, as shown on the sample balance sheet below. The balance sheet is used with other financial statements to calculate business financial ratios (discussed soon).

Balance Sheet

Cash flow projection: Cash flow projection is a part of the cash flow statement , which is perhaps one of the most critical aspects of a financial plan. After all, businesses run on cash. The cash flow statement documents how much cash came in and went out of the business during a specific time period. This reveals its liquidity, meaning how much cash it has on hand. The cash flow projection should display how much cash a business currently has, where it’s going, where future cash will come from and a schedule for each activity.

Personnel plan: A business needs the right people to meet its goals and maintain a healthy cash flow. A personnel plan looks at existing positions, helps determine when it’s time to bring on more team members and determines whether new hires should be full-time, part-time or work on a contractual basis. It also examines compensation levels, including benefits, and forecasts those costs against potential business growth to gauge whether the potential benefits of new hires justify the expense.

Business ratios: In addition to a big-picture view of the business, decision-makers will need to drill down to specific aspects of the business to understand how individual areas are performing. Business ratios , such as net profit margin, return on equity, accounts payable turnover, assets to sales, working capital and total debt to total assets, help evaluate the business’s financial health. Data used to calculate these ratios come from the P&L statement, balance sheet and cash flow statement. Business ratios contextualize financial data — for example, net profit margin shows the profitability of a company’s operations in relation to its revenue. They are often used to help request funding from a bank or investor, as well.

Sales forecast: How much will you sell in a specific period? A sales forecast needs to be an ongoing part of any planning process since it helps predict cash flow and the organization’s overall health. A forecast needs to be consistent with the sales number within your P&L statement. Organizing and segmenting your sales forecast will depend on how thoroughly you want to track sales and the business you have. For example, if you own a hotel and giftshop, you may want to track separately sales from guests staying the night and sales from the shop.

Cash flow projection: Perhaps one of the most critical aspects of your financial plan is your cash flow statement . Your business runs on cash. Understanding how much cash is coming in and when to expect it shows the difference between your profit and cash position. It should display how much cash you have now, where it’s going, where it will come from and a schedule for each activity.

Income projections: Businesses can use their sales forecasts to estimate how much money they are on track to make in a given period, usually a year. This income projection is calculated by subtracting anticipated expenses from revenue. In some cases, the income projection is rolled into the P&L statement.

Assets and liabilities: Assets and liabilities appear on the business’s balance sheet. Assets are what a company owns and are typically divided into current and long-term assets. Current assets can be converted into cash within a year and include stocks, inventory and accounts receivable. Long-term assets are tangible or fixed assets designed for long-term use, such as furniture, fixtures, buildings, machinery and vehicles.

Liabilities are business obligations that are also classified as current and long-term. Current liabilities are due to be paid within a year and include accrued payroll, taxes payable and short-term loans. Long-term liabilities include shareholder loans or bank debt that mature more than a year later.

Break-even analysis: The break-even point is how much a business must sell to exactly cover all of its fixed and variable expenses, including COGS, salaries and rent. When revenue exceeds expenses, the business makes a profit. The break-even point is used to guide sales revenue and volume goals; determination requires first calculating contribution margin , which is the amount of sales revenue a company has, less its variable costs, to put toward paying its fixed costs. Businesses can use break-even analyses to better evaluate their expenses and calculate how much to mark up its goods and services to be able to turn a profit.

Four Steps to Create a Financial Plan for Your Small Business

Financial plans require deliberate planning and careful implementation. The following four steps can help small businesses get started and ensure their plans can help them achieve their goals.

Create a strategic plan

Before looking at any numbers, a strategic plan focuses on what the company wants to accomplish and what it needs to achieve its goals. Will it need to buy more equipment or hire additional staff? How will its goals affect cash flow? What other resources are needed to meet its goals? A strategic financial plan answers these questions and determines how the plan will impact the company’s finances. Creating a list of existing expenses and assets is also helpful and will inform the remaining financial planning steps.

Create financial projections

Financial projections should be based on anticipated expenses and sales forecasts . These projections look at the business’s goals and estimate the costs needed to reach them in the face of a variety of potential scenarios, such as best-case, worst-case and most likely to happen. Accountants may be brought in to review the plan with stakeholders and suggest how to explain the plan to external audiences, such as investors and lenders.

Plan for contingencies

Financial plans should use data from the cash flow statement and balance sheet to inform worst-case scenario plans, such as when incoming cash dries up or the business takes an unexpected turn. Some common contingencies include keeping cash reserves or a substantial line of credit for quick access to funds during slow periods. Another option is to produce a plan to sell off assets to help break even.

Monitor and compare goals

Actual results in the cash flow statement, income projections and relevant business ratios should be analyzed throughout the year to see how closely real-life results adhered to projections. Regular check-ins also help businesses spot potential problems before they can get worse and inform course corrections.

Three Questions Your Financial Plan Should Answer

A small business financial plan should be tailored to the needs and expectations of its intended audience, whether it is potential investors, lenders, partners or internal stakeholders. Once the plan is created, all parties should, at minimum, understand:

How will the business make money?

What does the business need to achieve its goals?

What is the business’s operating budget ?

Financial plans that don’t answer these questions will need more work. Otherwise, a business risks starting a new venture without a clear path forward, and decision-makers will lack the necessary insights that a detailed financial plan would have provided.

Improve Your Financial Planning With Financial Management Software

Using spreadsheets for financial planning may get the job done when a business is first getting started, but this approach can quickly become overwhelming, especially when collaborating with others and as the business grows.

NetSuite’s cloud-based financial management platform simplifies the labor-intensive process through automation. NetSuite Planning and Budgeting automatically consolidates real-time data for analysis, reporting and forecasting, thereby improving efficiency. With intuitive dashboards and sophisticated forecasting tools, businesses can create accurate financial plans, track progress and modify strategies in order to achieve and maintain long-term success. The solution also allows for scenario planning and workforce planning, plus prebuilt data synchronization with NetSuite ERP means the entire business is working with the same up-to-date information.

Whether a business is first getting started, looking to expand, trying to secure outside funding or monitoring its growth, it will need to create a financial plan. This plan lays out the business’s short- and long-term objectives, details its current and projected finances, specifies how it will invest its resources and helps track its progress. Not only does a financial plan guide the business along its way, but it is typically required by outside sources of funding that don’t invest or lend their money to just any company. Creating a financial plan may take some time, but successful small businesses know it is well worth the effort.

#1 Cloud Accounting Software

Small Business Financial Plan FAQs

How do I write a small business financial plan?

Writing a small business financial plan is a four-step process. It begins with creating a strategic plan, which covers the company’s goals and what it needs to achieve them. The next step is to create financial projections, which are dependent on anticipating sales and expenses. Step three plans for contingencies: For example, what if the business were to lose a significant client? Finally, the business must monitor its goals, comparing actual results to projections and adjusting as needed.

What is the best financial statement for a small business?

The income statement, also known as the profit and loss (P&L) statement, is often considered the most important financial statement for small businesses, as it summarizes profits and losses and the business’s bottom line over a specific financial period. For financial plans, the cash flow statement and the balance sheet are also critical financial statements.

How often should businesses update their financial plans?

Financial plans can be updated whenever a business deems appropriate. Many businesses create three- and five-year plans and adjust them annually. If a market experiences a large shift, such as a spike in demand or an economic downturn, a financial plan may need to be updated to reflect the new market.

What are some common mistakes to avoid when creating a small business financial plan?

Some common mistakes to avoid when creating a small business financial plan include underestimating expenses, overestimating revenue, failing to plan for contingencies and adhering to plans too strictly when circumstances change. Plans should be regularly updated to reflect real-world results and current market trends.

How do I account for uncertainty and potential risks in my small business financial plan?

Small businesses can plan for uncertainty by maintaining cash reserves and opening lines of credit to cover periods of lower income or high expenses. Plans and projections should also take into account a variety of potential scenarios, from best case to worst case.

What is a typical business financial plan?

A typical business financial plan is a document that details a business’s goals, strategies and projections over a specific period of time. It is used as a roadmap for the organization’s financial activities and provides a framework for decision-making, resource allocation and performance evaluation.

What are the seven components of a financial plan?

Financial plans can vary to suit the business’s needs, but seven components to include are the income statement, operating income, net income, cash flow statement, balance sheet, financial projections and business ratios. Various financial key performance indicators and a break-even analysis are typically included as well.

What is an example of a financial plan?

A financial plan serves as a snapshot of the business’s current standing and how it plans to grow. For example, a restaurant looking to secure approval for a loan will be asked to provide a financial plan. This plan will include an executive summary of the business, a description and history of the company, market research into customer base and competition, sales and marketing strategies, key performance indicators and organizational structure. It will also include elements focusing on the future, such as financial projections, potential risks and funding requirements and strategies.

Financial Management

Small Business Financial Management: Tips, Importance and Challenges

It is remarkably difficult to start a small business. Only about half stay open for five years, and only a third make it to the 10-year mark. That’s why it’s vital to make every effort to succeed. And one of the most fundamental skills and tools for any small business owner is sound financial management.

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

6 Elements of a Successful Financial Plan for a Small Business

Table of Contents

Many small businesses lack a full financial plan, even though evidence shows that it is essential to the long-term success and growth of any business.

For example, a study in the New England Journal of Entrepreneurship found that entrepreneurs with a business plan are more successful than those without one. If you’re not sure how to get started, read on to learn the six key elements of a successful small business financial plan.

What is a business financial plan, and why is it important?

A business financial plan is an overview of a business’s financial situation and a forward-looking projection for growth. A business financial plan typically has six parts: sales forecasting, expense outlay, a statement of financial position, a cash flow projection, a break-even analysis and an operations plan.

A good financial plan helps you manage cash flow and accounts for months when revenue might be lower than expected. It also helps you budget for daily and monthly expenses and plan for taxes each year.

Importantly, a financial plan helps you focus on the long-term growth of your business. That way, you don’t get so caught up in the day-to-day activities that you lose sight of your goals. Focusing on the long-term vision helps you prioritize your financial resources.

The 6 components of a successful financial plan for business

1. sales forecasting.

You should have an estimate of your sales revenue for every month, quarter and year. Identifying any patterns in your sales cycles helps you better understand your business, and this knowledge is invaluable as you plan marketing initiatives and growth strategies .

For instance, a seasonal business can aim to improve sales in the off-season to eventually become a year-round venture. Another business might become better prepared by understanding how upticks and downturns in business relate to factors such as the weather or the economy.

Sales forecasting is also the foundation for setting company growth goals. For instance, you could aim to improve your sales by 10 percent over each previous period.

2. Expense outlay

A full expense plan includes regular expenses, expected future expenses and associated expenses. Regular expenses are the current ongoing costs of your business, including operational costs such as rent, utilities and payroll.

Regular expenses relate to standard business activities that occur each year, such as conference attendance, advertising and marketing, and the office holiday party. It’s a good idea to distinguish essential expenses from expenses that can be reduced or eliminated if needed.

Expected future expenses are known future costs, such as tax rate increases, minimum wage increases or maintenance needs. Generally, a part of the budget should also be allocated to unexpected future expenses, such as damage to your business caused by fire, flood or other unexpected disasters. Planning for future expenses ensures your business is financially prepared via budget reduction, increases in sales or financial assistance.

Associated expenses are the estimated costs of various initiatives, such as acquiring and training new hires, opening a new store or expanding delivery to a new territory. An accurate estimate of associated expenses helps you properly manage growth and prevents your business from exceeding your cost capabilities.

As with expected future expenses, understanding how much capital is required to accomplish various growth goals helps you make the right decision about financing options.

3. Statement of financial position (assets and liabilities)

Assets and liabilities are the foundation of your business’s balance sheet and the primary determinants of your business’s net worth. Tracking both allows you to maximize your business’s potential value.

Small businesses frequently undervalue their assets (such as machinery, property or inventory) and fail to properly account for outstanding bills. Your balance sheet offers a more complete view of your business’s health than a profit-and-loss statement or a cash flow report.

A profit-and-loss statement shows how the business performed over a specific time period, while a balance sheet shows the financial position of the business on any given day.

4. Cash flow projection

You should be able to predict your cash flow on a monthly, quarterly and annual basis. Projecting cash flow for the full year allows you to get ahead of any financial struggles or challenges.

It can also help you identify a cash flow problem before it hurts your business. You can set the most appropriate payment terms, such as how much you charge upfront or how many days after invoicing you expect payment .

A cash flow projection gives you a clear look at how much money is expected to be left at the end of each month so you can plan a possible expansion or other investments. It also helps you budget, such as by spending less one month for the anticipated cash needs of another month.

5. Break-even analysis

A break-even analysis evaluates fixed costs relative to the profit earned by each additional unit you produce and sell. This analysis is essential to understanding your business’s revenue and potential costs versus profits of expansion or growth of your output.

Having your expenses fully fleshed out, as described above, makes your break-even analysis more accurate and useful. A break-even analysis is also the best way to determine your pricing.

In addition, a break-even analysis can tell you how many units you need to sell at various prices to cover your costs. You should aim to set a price that gives you a comfortable margin over your expenses while allowing your business to remain competitive.

6. Operations plan

To run your business as efficiently as possible, craft a detailed overview of your operational needs. Understanding what roles are required for you to operate your business at various volumes of output, how much output or work each employee can handle, and the costs of each stage of your supply chain will aid you in making informed decisions for your business’s growth and efficiency.

It’s important to tightly control expenses, such as payroll or supply chain costs, relative to growth. An operations plan can also make it easier to determine if there is room to optimize your operations or supply chain via automation, new technology or superior supply chain vendors.

For this reason, it is imperative for a business owner to conduct due diligence and become knowledgeable about merchant services before acquiring an account. Once the owner signs a contract, it cannot be changed, unless the business owner breaks the contract and acquires a new account with a new merchant services provider.

Tips on writing a business financial plan

Business owners should create a financial plan annually to ensure they have a clear and accurate picture of their business’s finances and a realistic view for future growth or expansion. A financial plan helps the business’s leaders make informed decisions about purchases, debt, hiring, expense control and overall operations for the year ahead.

A business financial plan is essential if a business owner is looking to sell their business, attract investors or enter a partnership with another business. Here are some tips for writing a business financial plan.

Review the previous year’s plan.

It’s a good idea to compare the previous year’s plan against actual performance and finances to see how accurate the previous plan and forecast were. That way, you can address any discrepancies or overlooked elements in next year’s plan.

Collaborate with other departments.

A business owner or other individual charged with creating the business financial plan should collaborate with the finance department, human resources department, sales team , operations leader, and those in charge of machinery, vehicles or other significant business tools.

Each division should provide the necessary data about projections, value and expenses. All of these elements come together to create a comprehensive financial picture of the business.

Use available resources.

The Small Business Administration (SBA) and SCORE, the SBA’s nonprofit partner, are two excellent resources for learning about financial plans. Both can teach you the elements of a comprehensive plan and how best to work with the different departments in your business to collect the necessary information. Many websites, including business.com , and service providers, such as Intuit, offer advice on this matter.