Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

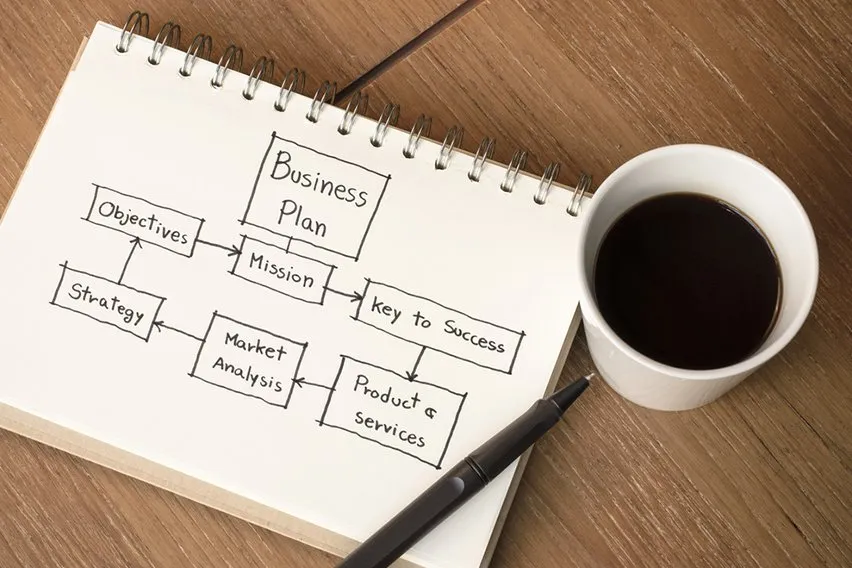

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

What is the purpose of a business plan?

A business plan is like a map for small business owners, showing them where to go and how to get there. Its main purposes are to help you avoid risks, keep everyone on the same page, plan finances, check if your business idea is good, make operations smoother, and adapt to changes. It's a way for small business owners to plan, communicate, and stay on track toward their goals.

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

Send invoices, estimates, and other docs:

- via links or PDFs

- automatically, via Wave

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada . See Wave’s Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Business plan FAQs

How does having a business plan help small business owners make better decisions.

Having a business plan supports small business owners in making smarter decisions by providing a structured framework to assess all parts of their businesses. It helps you foresee potential challenges, identify opportunities, and set clear objectives. Business plans help you make decisions across the board, including market strategies, financial management, resource allocation, and growth planning.

What industry-specific issues can business plans help tackle?

Business plans can address industry-specific challenges like regulatory compliance, technological advancements, market trends, and competitive landscape. For instance, in highly regulated industries like healthcare or finance, a comprehensive business plan can outline compliance measures and risk management strategies.

How can small business owners use their business plans to pitch investors or apply for loans?

In addition to attracting investors and securing financing, small business owners can leverage their business plans during pitches or loan applications by focusing on key elements that resonate with potential stakeholders. This includes highlighting market analysis, competitive advantages, revenue projections, and scalability plans. Presenting a well-researched and data-driven business plan demonstrates credibility and makes investors or lenders feel confident about your business’s potential health and growth.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

6 Reasons You Really Need to Write A Business Plan

Published: October 14, 2020

Starting a busine ss can be a daunting task, especially if you’re starting from square one.

It’s easy to feel stuck in the whirlwind of things you’ll need to do, like registering your company, building a team, advertising, the list goes on. Not to mention, a business idea with no foundation can make the process seem incredibly intimidating.

Thankfully, business plans are an antidote for the new business woes that many entrepreneurs feel. Some may shy away from the idea, as they are lengthy documents that require a significant amount of attention and care.

However, there’s a reason why those who take the time to write out a business plan are 16% more likely to be successful than those who don’t. In other words, business plans work.

What is a business plan, and why does it matter?

In brief, a business plan is a roadmap to success. It's a blueprint for entrepreneurs to follow that helps them outline, understand, and cohesively achieve their goals.

Writing a business plan involves defining critical aspects of your business, like brand messaging, conducting market research, and creating pricing strategies — all before starting the company.

A business plan can also increase your confidence. You’ll get a holistic view of your idea and understand whether it's worth pursuing.

So, why not take the time to create a blueprint that will make your job easier? Let’s take a look at six reasons why you should write a business plan before doing anything else.

Six Reasons You Really Need To Write a Business Plan

- Legitimize your business idea.

- Give your business a foundation for success.

- Obtain funding and investments.

- Hire the right people.

- Communicate your needs.

- It makes it easier to sell your business.

1. Legitimize your business idea.

Pursuing business ideas that stem from passions you’ve had for years can be exciting, but that doesn’t necessarily mean it’s a sound venture.

One of the first things a business plan requires you to do is research your target market. You’ll gain a nuanced understanding of industry trends and what your competitors have done, or not, to succeed. You may find that the idea you have when you start is not likely to be successful.

That may feel disheartening, but you can always modify your original idea to better fit market needs. The more you understand about the industry, your future competitors, and your prospective customers, the greater the likelihood of success. If you identify issues early on, you can develop strategies to deal with them rather than troubleshooting as they happen.

It’s better to know sooner rather than later if your business will be successful before investing time and money.

2. Give your business a foundation for success.

Let's say you’re looking to start a clean beauty company. There are thousands of directions you can go in, so just saying, “I’m starting a clean beauty company!” isn’t enough.

You need to know what specific products you want to make, and why you’re deciding to create them. The Pricing and Product Line style="color: #33475b;"> section of a business plan requires you to identify these elements, making it easier to plan for other components of your business strategy.

You’ll also use your initial market research to outline financial projections, goals, objectives, and operational needs. Identifying these factors ahead of time creates a strong foundation, as you’ll be making critical business decisions early on.

You can refer back to the goals you’ve set within your business plan to track your progress over time and prioritize areas that need extra attention.

All in all, every section of your business plan requires you to go in-depth into your future business strategy before even acting on any of those plans. Having a plan at the ready gives your business a solid foundation for growth.

When you start your company, and your product reaches the market, you’ll spend less time troubleshooting and more time focusing on your target audiences and generating revenue.

3. Obtain funding and investments.

Every new business needs capital to get off the ground. Although it would be nice, banks won’t finance loans just because you request one. They want to know what the money is for, where it’s going, and if you’ll eventually be able to pay it back.

If you want investors to be part of your financing plan, they’ll have questions about your business’ pricing strategies and revenue models. Investors can also back out if they feel like their money isn’t put to fair use. They’ll want something to refer back to track your progress over time and understand if you’re meeting the goals you told them you’d meet. They want to know if their investment was worthwhile.

The Financial Considerations section of a business plan will prompt you to estimate costs ahead of time and establish revenue objectives before applying for loans or speaking to investors.

You’ll secure and finalize your strategy in advance to avoid showing up unprepared for meetings with potential investors.

4. Hire the right people.

After you’ve completed your business plan and you have a clear view of your strategies, goals, and financial needs, there may be milestones you need to meet that require skills you don’t yet have. You may need to hire new people to fill in the gaps.

Having a strategic plan to share with prospective partners and employees can prove that they aren’t signing on to a sinking ship.

If your plans are summarized and feasible, they’ll understand why you want them on your team, and why they should agree to work with you.

5. Communicate your needs.

If you don’t understand how your business will run, it’ll be hard to communicate your business’s legitimacy to all involved parties.

Your plan will give you a well-rounded view of how your business will work, and make it easier for you to communicate this to others.

You may have already secured financing from banks and made deals with investors, but a business’ needs are always changing. While your business grows, you’ll likely need more financial support, more partners, or just expand your services and product offers. Using your business plan as a measure of how you’ve met your goals can make it easier to bring people onto your team at all stages of the process.

6. It makes it easier to sell your business.

A buyer won’t want to purchase a business that will run into the ground after signing the papers. They want a successful, established company.

A business plan that details milestones you can prove you’ve already met can be used to show prospective buyers how you’ve generated success within your market. You can use your accomplishments to negotiate higher price points aligned with your business’ value.

A Business Plan Is Essential

Ultimately, having a business plan can increase your confidence in your new venture. You’ll understand what your business needs to succeed, and outline the tactics you’ll use to achieve those goals.

Some people have a lifetime goal of turning their passions into successful business ventures, and a well-crafted business plan can make those dreams come true.

Don't forget to share this post!

Related articles.

![reasons for embarking on a business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

What is a Business Plan? Definition, Tips, and Templates

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

![reasons for embarking on a business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![reasons for embarking on a business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Limited Time Offer:

Save Up to 25% on LivePlan today

0 results have been found for “”

Return to blog home

15 Reasons Why You Need a Business Plan in 2024

Posted january 21, 2022 by noah parsons.

As a small business owner or aspiring entrepreneur, a business plan can seem more like a hurdle you have to overcome than a useful tool. It’s a barrier that’s keeping you from moving forward with your business. Maybe the bank won’t review your loan application without a business plan or a potential investor has asked to see your business plan before they will meet with you.

But, writing a business plan doesn’t have to feel like a homework assignment. Instead, think of writing a business plan as an investment in your business. It’s a tool to figure out a strong and financially viable strategy for growth. And, it’s even been scientifically proven that planning will increase your chances of success and help you grow faster.

Still not convinced? Read on for our definitive list of reasons why you should write a plan for your business.

What is the key purpose of a business plan?

Imagine you’re setting out on a journey. You know what your final destination is, but you haven’t figured out how to get there. While it might be fun to just start driving and figure things out as you go, your trip will most likely take longer than you anticipated and cost you more. If you instead take a look at a map and chart the best way to get to your destination, you’ll arrive on time and on budget. Planning for your business isn’t that much different.

The primary purpose of a business plan is to help you figure out where you want to go with your business and how you’re going to get there. It helps you set your direction and determine a winning strategy. A solid business plan will set your business up for success and help you build an unbeatable company.

If you start off without a plan, you may go down some interesting detours, but you’re unlikely to grow quickly or stick to your budget.

Why do you need to write a business plan?

Establishing a strategic roadmap for your business is the primary benefit of writing a business plan. But what does that really look like for you and your business? Here are our top 15 reasons why you should write a business plan.

1. Reduce your risk

Writing a business plan takes some of the risk out of starting a business. It ensures that you’re thinking through every facet of your business to determine if it can truly be viable.

Does your solution fit the market? Are your startup or operational costs manageable? Will your proposed business model actually generate sales? What sort of milestones would you need to hit to achieve profitability? These are all questions associated with business risk that you can answer with your plan.

For those already running a business, writing a plan can help you better manage ongoing risk. Should you bring on a new employee? What does cash flow look like for your next month, quarter, or even year? Are you on track to meet your milestones or do you need to change your focus? Keep your plan up to date, review it regularly and you can easily answer these questions and mitigate risk.

2. Uncover your business’s potential

Writing a business plan helps you think about the customers you are serving and what their needs are. Exploring those customer needs will help you uncover new opportunities for your business to serve them and potentially expose new products and services that you could offer. When you use your business plan to manage your business, you’ll be able to see the parts of your strategy that are working and those that aren’t. For example, you may have invested in new marketing efforts to sell one of your products, but that strategy just isn’t working out. With a business plan in hand, you’ll be able to see what’s going to plan and where you need to make adjustments to your strategy, pivoting to new opportunities that will drive profitability.

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Test a new business idea

When you have a new business idea, it really helps to spend a little time thinking through all the details. A business plan will help you think about your target market, your budget, how much money you’ll need to launch, and how your idea will actually work before you spend any real money. A business plan will also help you easily share your idea with other people to get input and feedback before you get started.

We recommend using a one-page business plan to test ideas quickly and easily.

4. Attract investors and get funding to start and grow your business

Sharing your business idea with investors requires a business plan. Now, you probably won’t share a long, detailed business plan to get investors interested, but you probably will share your executive summary — which is an overview of your business plan. Investors may never actually ask for your full business plan, but they will certainly ask you questions that you’ll only be able to answer if you’ve taken the time to write a plan.

At the very least, they’ll want to see your financial forecasts , so you should be prepared for this. If you end up pitching your business to investors, whether in-person or remotely , having a business plan written makes it much easier to translate the right information into a pitch deck. In short, you’ll have all of the right information ready and available to show why your business is worth investing in.

5. Plan for different scenarios

Even if you have a plan in place, things rarely actually go to plan. The world is always changing, customer tastes change, and new competitors arrive on the scene. Having a plan allows you to experiment with different scenarios to see how changes to your business will impact your forecasts, budgets, profitability, and cash flow.

6. Research shows that business plans definitely work

A Journal of Management Studies study found that businesses that take the time to plan grow 30% faster than those that don’t. Our own 2021 small business research study found that 58% of small business owners that have or are working on a plan feel confident in their business, even amidst a crisis. And a study in Small Business Economics found that entrepreneurs that write business plans for their ideas are 152% more likely to actually start their businesses. There’s plenty of additional research that links planning with success, so it’s a proven fact that you won’t be wasting your time when you write your plan.

7. Build a better budget and a financial forecast

A core component of any business plan is a financial forecast. When you take the time to plan, you’ll have to think through your expense budget, your sales goals, and the cash that it’s going to take to keep your doors open, purchase inventory, and more.

The beauty of incorporating forecasts into your business plan is that you don’t need to have the exact numbers to start. You can work with general assumptions and compare against competitive benchmarks to set a baseline for your business. As you operate and collect financial data you can then begin to update your forecasts to generate a more accurate view of how your business will operate.

8. Determine your financial needs

Without a business plan, it’s impossible to really know how much money it’s going to take to start and run your business. You don’t just need money for your initial purchases. You need to have enough cash in the bank to keep your business afloat while you get fully up and running. A plan will help you determine exactly how much money you’ll need and help you keep track of your cash flow and runway .

9. Attract employees

Especially if you’re a young startup company, attracting employees can be hard. Without a proven track record, why should someone take a risk to work for you? Having a business plan can help solve that problem. Your plan can help a prospective employee understand your business strategy and plans for growth so that they can feel confident joining your team. It’s also incredibly useful in determining when and if it’s feasible for you to bring on more employees .

10. Get your team all on the same page

A great strategy for your business can only be successful if your team understands it. By documenting your strategy with a business plan, you can easily get everyone on the same page, working towards the same goals. It’s even better if you regularly review your plan with members of your team. This ensures that everyone is consistently going back to the core strategy documentation, analyzing it, and exploring how it impacts individual and team goals .

11. Manage your business better

A business plan is all about setting goals for your company — both financial goals and milestones you hope to accomplish. When you use your plan to regularly check in on your business to see how you’re doing and what your progress is, you’re managing your business. Regular review , ideally monthly, will help you build a strong, resilient business.

12. Understand your market and build a marketing plan

No matter how good your idea is, you have to figure out who your ideal customers are and how you’re going to get the word out to them. That’s where a marketing plan comes in. It can be an indispensable tool for figuring out how you get your first customers as well as your thousandth customer.

13. It’s easier than you think

You may be procrastinating in writing a business plan because it sounds like a lot of work. The truth is that planning is much less complicated than you think. Start small with a one-page business plan that you complete in half an hour . From there, refine your plan until your idea is solid. At that point, you can invest a little more time in a more detailed business plan. Just start with the basics and expand from there.

14. You’ll sleep better at night

When you have a plan for your business, you have peace of mind. You know that you’ve invested the time to figure out a business model that actually works and you’ve considered different financial scenarios so you can handle the unexpected. And, you’ve got a management tool to run your business better than your competitors.

15. Effectively navigate a crisis

Having a business plan not only helps you create a roadmap for your business but also helps you navigate unforeseen events. Large-scale economic downturns, supply shortages, payment delays, cash flow problems, and any number of other issues are bound to pop up. But, you can be prepared to face each crisis head-on by leveraging your business plan.

A plan helps you assess your current situation, determine how the crisis will alter your plan, and begin to explore what it will take to recover. With a little planning, you can even prepare your business for future downturns with this same process. It’ll make crisis planning easier and ideally recession-proof your business by having the right plan and processes in place.

Don’t wait, start writing your business plan today

There are plenty of reasons to write a business plan, but the real reason is about finding success for you and your business. Taking the time to plan is an investment in yourself and your business that will pay dividends, whether you’re starting a new business or taking your existing business to the next level.

You can jump-start your business plan writing process with our article covering how to write a business plan in as little as 30-minutes .

If you’re looking for a tool to help you get more from your business plan, we recommend trying out LivePlan . Our business planning and management tool will guide you through the entire process, including all of your financial forecasts, without ever requiring that you open a spreadsheet.

Like this post? Share with a friend!

Noah Parsons

Posted in business plan writing, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Small Business Trends

How to create a business plan: examples & free template.

This guide has been designed to help you create a winning plan that stands out in the ever-evolving marketplace. U sing real-world examples and a free downloadable template, it will walk you through each step of the process.

Table of Contents

How to Write a Business Plan

Executive summary.

The Executive Summary serves as the gateway to your business plan, offering a snapshot of your venture’s core aspects. This section should captivate and inform, succinctly summarizing the essence of your plan.

Example: EcoTech is a technology company specializing in eco-friendly and sustainable products designed to reduce energy consumption and minimize waste. Our mission is to create innovative solutions that contribute to a cleaner, greener environment.

Overview and Business Objectives

This part of the plan demonstrates to investors and stakeholders your vision for growth and the practical steps you’ll take to get there.

Company Description

Include information about the company’s founders, their expertise, and why they are suited to lead the business to success. This section should paint a vivid picture of your business, its values, and its place in the industry.

Define Your Target Market

Example: Our target market comprises environmentally conscious consumers and businesses looking for innovative solutions to reduce their carbon footprint. Our ideal customers are those who prioritize sustainability and are willing to invest in eco-friendly products.

Market Analysis

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

Competitive analysis.

In this section, you’ll analyze your competitors in-depth, examining their products, services, market positioning, and pricing strategies. Understanding your competition allows you to identify gaps in the market and tailor your offerings to outperform them.

Organization and Management Team

Example: EcoTech’s organizational structure comprises the following key roles: CEO, CTO, CFO, Sales Director, Marketing Director, and R&D Manager. Our management team has extensive experience in technology, sustainability, and business development, ensuring that we are well-equipped to execute our business plan successfully.

Products and Services Offered

Marketing and sales strategy.

Describe the nature of your advertising campaigns and promotional activities, explaining how they will capture the attention of your target audience and convey the value of your products or services. Outline your sales strategy, including your sales process, team structure, and sales targets.

Logistics and Operations Plan

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

Financial Projections Plan

In the Financial Projections Plan, lay out a clear and realistic financial future for your business. This should include detailed projections for revenue, costs, and profitability over the next three to five years.

Income Statement

The income statement , also known as the profit and loss statement, provides a summary of your company’s revenues and expenses over a specified period. It helps you track your business’s financial performance and identify trends, ensuring you stay on track to achieve your financial goals.

Cash Flow Statement

| Section | Description | Example |

|---|---|---|

| Executive Summary | Brief overview of the business plan | Overview of EcoTech and its mission |

| Overview & Objectives | Outline of company's goals and strategies | Market leadership in sustainable technology |

| Company Description | Detailed explanation of the company and its unique selling proposition | EcoTech's history, mission, and vision |

| Target Market | Description of ideal customers and their needs | Environmentally conscious consumers and businesses |

| Market Analysis | Examination of industry trends, customer needs, and competitors | Trends in eco-friendly technology market |

| SWOT Analysis | Evaluation of Strengths, Weaknesses, Opportunities, and Threats | Strengths and weaknesses of EcoTech |

| Competitive Analysis | In-depth analysis of competitors and their strategies | Analysis of GreenTech and EarthSolutions |

| Organization & Management | Overview of the company's structure and management team | Key roles and team members at EcoTech |

| Products & Services | Description of offerings and their unique features | Energy-efficient lighting solutions, solar chargers |

| Marketing & Sales | Outline of marketing channels and sales strategies | Digital advertising, content marketing, influencer partnerships |

| Logistics & Operations | Details about daily operations, supply chain, inventory, and quality control | Partnerships with manufacturers, quality control |

| Financial Projections | Forecast of revenue, expenses, and profit for the next 3-5 years | Projected growth in revenue and net profit |

| Income Statement | Summary of company's revenues and expenses over a specified period | Revenue, Cost of Goods Sold, Gross Profit, Net Income |

| Cash Flow Statement | Overview of cash inflows and outflows within the business | Net Cash from Operating Activities, Investing Activities, Financing Activities |

Tips on Writing a Business Plan

3. Set realistic goals: Your business plan should outline achievable objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Setting realistic goals demonstrates your understanding of the market and increases the likelihood of success.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

What is a Business Plan?

Why you should write a business plan, what are the different types of business plans.

In today’s fast-paced business world, having a well-structured roadmap is more important than ever. A traditional business plan provides a comprehensive overview of your company’s goals and strategies, helping you make informed decisions and achieve long-term success. There are various types of business plans, each designed to suit different needs and purposes. Let’s explore the main types:

| Type of Business Plan | Purpose | Key Components | Target Audience |

|---|---|---|---|

| Startup Business Plan | Outlines the company's mission, objectives, target market, competition, marketing strategies, and financial projections. | Mission Statement, Company Description, Market Analysis, Competitive Analysis, Organizational Structure, Marketing and Sales Strategy, Financial Projections. | Entrepreneurs, Investors |

| Internal Business Plan | Serves as a management tool for guiding the company's growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. | Strategies, Milestones, Deadlines, Resource Allocation. | Internal Team Members |

| Strategic Business Plan | Outlines long-term goals and the steps to achieve them. | SWOT Analysis, Market Research, Competitive Analysis, Long-Term Goals. | Executives, Managers, Investors |

| Feasibility Business Plan | Assesses the viability of a business idea. | Market Demand, Competition, Financial Projections, Potential Obstacles. | Entrepreneurs, Investors |

| Growth Business Plan | Focuses on strategies for scaling up an existing business. | Market Analysis, New Product/Service Offerings, Financial Projections. | Business Owners, Investors |

| Operational Business Plan | Outlines the company's day-to-day operations. | Processes, Procedures, Organizational Structure. | Managers, Employees |

| Lean Business Plan | A simplified, agile version of a traditional plan, focusing on key elements. | Value Proposition, Customer Segments, Revenue Streams, Cost Structure. | Entrepreneurs, Startups |

| One-Page Business Plan | A concise summary of your company's key objectives, strategies, and milestones. | Key Objectives, Strategies, Milestones. | Entrepreneurs, Investors, Partners |

| Nonprofit Business Plan | Outlines the mission, goals, target audience, fundraising strategies, and budget allocation for nonprofit organizations. | Mission Statement, Goals, Target Audience, Fundraising Strategies, Budget. | Nonprofit Leaders, Board Members, Donors |

| Franchise Business Plan | Focuses on the franchisor's requirements, as well as the franchisee's goals, strategies, and financial projections. | Franchise Agreement, Brand Standards, Marketing Efforts, Operational Procedures, Financial Projections. | Franchisors, Franchisees, Investors |

Using Business Plan Software

Enloop is a robust business plan software that automatically generates a tailored plan based on your inputs. It provides industry-specific templates, financial forecasting, and a unique performance score that updates as you make changes to your plan. Enloop also offers a free version, making it accessible for businesses on a budget.

| Software | Key Features | User Interface | Additional Features |

|---|---|---|---|

| LivePlan | Over 500 sample plans, financial forecasting tools, progress tracking against KPIs | User-friendly, visually appealing | Allows creation of professional-looking business plans |

| Upmetrics | Customizable templates, financial forecasting tools, collaboration capabilities | Simple and intuitive | Provides a resource library for business planning |

| Bizplan | Drag-and-drop builder, modular sections, financial forecasting tools, progress tracking | Simple, visually engaging | Designed to simplify the business planning process |

| Enloop | Industry-specific templates, financial forecasting tools, automatic business plan generation, unique performance score | Robust, user-friendly | Offers a free version, making it accessible for businesses on a budget |

| Tarkenton GoSmallBiz | Guided business plan builder, customizable templates, financial projection tools | User-friendly | Offers CRM tools, legal document templates, and additional resources for small businesses |

Business Plan FAQs

What is a good business plan, what are the 3 main purposes of a business plan, can i write a business plan by myself.

We also have examples for specific industries, including a using food truck business plan , salon business plan , farm business plan , daycare business plan , and restaurant business plan .

Is it possible to create a one-page business plan?

How long should a business plan be, what is a business plan outline, what are the 5 most common business plan mistakes, what questions should be asked in a business plan.

A business plan should address questions such as: What problem does the business solve? Who is the specific target market ? What is the unique selling proposition? What are the company’s objectives? How will it achieve those objectives?

What’s the difference between a business plan and a strategic plan?

How is business planning for a nonprofit different.

Hot Summer Savings ☀️ 60% Off for 4 Months. BUY NOW & SAVE

60% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

The importance of business plan: 5 key reasons.

A key part of any business is its business plan. They can help define the goals of your business and help it reach success. A good business plan can also help you develop an adequate marketing strategy. There are a number of reasons all business owners need business plans, keep reading to learn more!

Here’s What We’ll Cover:

What Is a Business Plan?

5 reasons you need a well-written business plan, how do i make a business plan, key takeaways.

A business plan contains detailed information that can help determine its success. Some of this information can include the following:

- Market analysis

- Cash flow projection

- Competitive analysis

- Financial statements and financial projections

- An operating plan

A solid business plan is a good way to attract potential investors. It can also help you display to business partners that you have a successful business growing. In a competitive landscape, a formal business plan is your key to success.

Check out all of the biggest reasons you need a good business plan below.

1. To Secure Funding

Whether you’re seeking funding from a venture capitalist or a bank, you’ll need a business plan. Business plans are the foundation of a business. They tell the parties that you’re seeking funding from whether or not you’re worth investing in. If you need any sort of outside financing, you’ll need a good business plan to secure it.

2. Set and Communicate Goals

A business plan gives you a tangible way of reviewing your business goals. Business plans revolve around the present and the future. When you establish your goals and put them in writing, you’re more likely to reach them. A strong business plan includes these goals, and allows you to communicate them to investors and employees alike.

3. Prove Viability in the Market

While many businesses are born from passion, not many will last without an effective business plan. While a business concept may seem sound, things may change once the specifics are written down. Often, people who attempt to start a business without a plan will fail. This is because they don’t take into account all of the planning and funds needed to get a business off of the ground.

Market research is a large part of the business planning process. It lets you review your potential customers, as well as the competition, in your field. By understanding both you can set price points for products or services. Sometimes, it may not make sense to start a business based on the existing competition. Other times, market research can guide you to effective marketing strategies that others lack. To have a successful business, it has to be viable. A business plan will help you determine that.

4. They Help Owners Avoid Failure

Far too often, small businesses fail. Many times, this is due to the lack of a strong business plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. Some of them are listed below, which can be avoided by having a business plan:

- The market doesn’t need the business’s product or service

- The business didn’t take into account the amount of capital needed

- The market is oversaturated

- The prices set by the business are too high, pushing potential customers away

Any good business plan includes information to help business owners avoid these issues.

5. Business Plans Reduce Risk

Related to the last reason, business plans help reduce risk. A well-thought-out business plan helps reduce risky decisions. They help business owners make informed decisions based on the research they conduct. Any business owner can tell you that the most important part of their job is making critical decisions. A business plan that factors in all possible situations helps make those decisions.

Luckily, there are plenty of tools available to help you create a business plan. A simple search can lead you to helpful tools, like a business plan template . These are helpful, as they let you fill in the information as you go. Many of them provide basic instructions on how to create the business plan, as well.

If you plan on starting a business, you’ll need a business plan. They’re good for a vast number of things. Business plans help owners make informed decisions, as well as set goals and secure funding. Don’t put off putting together your business plan!

If you’re in the planning stages of your business, be sure to check out our resource hub . We have plenty of valuable resources and articles for you when you’re just getting started. Check it out today!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

6 Reasons Why You Need a Business Plan

A business plan is very important and for entrepreneurs to secure funding such as bank loans that’s why do you need a business plan. Get some Reasons! A good business plan helps you prove your business idea, grow faster, secure funding, reduce risk, build a team, and develop a rewarding marketing strategy.

Why should I write a business plan ? If you’re like many entrepreneurs excited to get your idea off the ground, then the idea of sitting down and writing a business plan may falsely look like a waste of time.

Why is a business plan important?

1. it helps you think through your business model., 2. it helps you secure funding., 3. it helps you attract and retain employees., 4. it helps you stay on track., 5. it helps you adapt to change., 6. it helps you identify and mitigate risks..

A business plan stands as a cornerstone for entrepreneurs, a strategic tool that charts the path to success. A well-crafted business plan not only directs entrepreneurs towards the vital steps needed for their business ideas to flourish but also paves the way for both short-term and long-term achievements.

Before embarking on the journey of crafting a business plan, it’s essential to ponder three critical questions:

- What do you wish to inspire in their response?

- How will this plan adapt to the ever-changing business environment?

- Who will be the reader of this plan?

Need Professional Business Plan Writer

Hire our experienced business plan writers to create a winning business plan to achieve your company’s goals.

Starting a business is a lot of work, and it can be tempting to just wing it. But if you want your business to be successful, you need a plan. A business plan is a written document that outlines your goals, strategies, and how you plan to achieve them.

Here are five reasons why you need a business plan, even if you’re a startup:

When you’re writing a business plan, you’re forced to think through all the key aspects of your business, such as your target market , products and services , pricing strategy , and marketing plan . This process can help you identify any potential problems or gaps in your business model before you launch.

If you’re planning to raise money from investors , you’ll need a business plan. Investors want to see that you have a clear plan for how you’re going to use their money to grow your business. A well-written business plan will show investors that you’re serious about your business and that you have a realistic chance of success.

Potential employees want to know that they’re joining a company with a bright future. A business plan can help you show potential employees that your company has a clear vision and a plan for growth . It can also help you attract and retain talented employees by offering them a sense of ownership in the company’s success.

As your business grows and changes, it’s important to have a roadmap to guide you. Your business plan can serve as this roadmap. By regularly reviewing and updating your business plan, you can make sure that your business is on track to achieve its goals.

The business world is constantly changing, and it’s important to be able to adapt to these changes. Your business plan can help you stay flexible and adaptable. By regularly reviewing your business plan, you can identify any potential threats or opportunities and make necessary adjustments to your strategies.

Every business faces risks, such as competition, economic downturns, and regulatory changes. A business plan can help you identify and assess these risks, and develop strategies to mitigate them.

For example, your business plan may include a section on risk management that identifies the following risks:

- Increased competition from new entrants to the market.

- A potential economic recession.

- New regulations that could impact your business.

Your business plan can then outline strategies for mitigating these risks, such as:

- Developing a strong brand identity to differentiate your business from the competition.

- Diversifying your product or service offerings to reduce your reliance on any one product or service.

- Building relationships with key stakeholders, such as government officials and industry leaders, to stay ahead of the curve on regulatory changes.

By having a business plan in place, you’ll be better prepared to deal with any challenges that come your way.

Free: Business Plan Examples

Do you need help creating a business plan? Check out these 14 free, proven business plan examples from different industries to help you write your own.

A business plan serves as a roadmap for your business. It outlines your goals, strategies, and the steps you need to take to achieve success. It provides a clear direction, helps you make informed decisions, attracts investors or lenders, and keeps you focused on your objectives.

There are several benefits to having a business plan. It helps you:

- Define your business goals and objectives.

- Identify your target market and understand customer needs.

- Develop strategies to differentiate your business from competitors.

- Determine your financial projections and funding requirements.

- Create a framework for measuring progress and evaluating success.

- Communicate your business concept effectively to stakeholders.

Every entrepreneur or business owner, regardless of the size or stage of their business, can benefit from having a business plan. Whether you’re starting a new venture, seeking funding, expanding an existing business, or reevaluating your strategies, a well-crafted business plan provides guidance and serves as a valuable tool.

A comprehensive business plan typically includes the following sections:

- Executive Summary: An overview of your business and its objectives.

- Company Description: Detailed information about your business, its structure, and mission.

- Market Analysis: Research on your target market, competition, and industry trends.

- Products or Services: Description of what you offer and how it meets customer needs.

- Marketing and Sales Strategy: Plans for promoting and selling your products or services.

- Organization and Management: Details about your team and organizational structure.

- Financial Projections: Forecasts of revenue, expenses, and profitability.

- Funding Request (if applicable): If seeking funding, details on the amount and purpose of the funding.

A business plan is not a static document. It should be seen as a dynamic tool that evolves with your business. Regularly reviewing and updating your business plan allows you to adapt to market changes, revise your strategies, and set new goals. This ensures that your business remains relevant, competitive, and aligned with your long-term vision.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

What Is the Importance & Purpose of a Business Plan?

- Small Business

- Business Planning & Strategy

- Importance of Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

What Is an Appendix in a Business Plan?

How to write a constitution for a nonprofit organization, how to make a paragraph in an email.

- How to Create a Positive Work Culture

- Components of Project Scope Statements

Small-business owners have been known to describe business plans in the most colorful terms. Since a business plan requires a huge time commitment, it's understandable why you may have heard it described as “detailed,” “expansive” and even “exhausting.” Business plans can be all of these things, but there probably isn't a small-business owner alive who wouldn't add another word to the list once the exercise is complete: “ Necessary.”

The main purpose of a business plan is to answer two key questions. What does this business hope to accomplish? How are we going to accomplish it?

Start from the Bottom Up

This is no lead-in to a pep talk, but if it serves as one, it would be OK with the U.S. Small Business Administration. It has long touted a business plan as the foundation of a business – and you know what would happen to a house if it were built on a shaky, unreliable foundation.

Small-business advocates like to say that a business plan is a must-have document for both potential business partners and investors. But after contemplating the purpose, importance and actual contents of a business plan, you might agree that it's most valuable to the small-business owner who writes it.

Grasp the Purpose of the Plan

Writers would say that they are guided by purpose; they have to know why they are writing and what they hope to achieve. Although it may ultimately consist of dozens of pages, a business plan must answer two fundamental questions:

- What do I hope to accomplish?* How am I going to accomplish it?

These questions serve as a backdrop as the business plan probes:

- The business model of a new venture

- The opportunities and risks it faces

- Current market trends, including customer demand, competition, business volume and prices

- The business' objectives

- Financial projections

All told, the business plan functions as a “road map for how to structure, run and grow” a business, the SBA says.

Grasp the Importance of the Plan

Anytime you assign your thoughts to paper, you hopefully achieve clarity of purpose; good writing demands it. For the small-business owner who is understandably a bit “fuzzy” on some of the details of launching a business and all that it involves, a business plan can crystallize concepts and ideas.

In this way, a business plan becomes a compass, supplying direction and focus as an entrepreneur's business vision takes shape.

Many small-business owners liken the launch of their business as a journey. It's an apt analogy – and one worth extending. If you wouldn't embark on a trip across town, much less across the country, without figuring out how you're going to get there, it defies logic how anybody could consider embarking on the journey of a lifetime without a business plan. It should take the front-row seat before the journey even begins.

The Plan Should be Written Without Delay

That distinction is important for two other reasons, besides navigational value:

- Many researchers, including those at Harvard Business Review, find that the most successful entrepreneurs don't procrastinate writing their business plan. They get to work on it between six and 12 months after deciding to start a business.

- Once you make the commitment to launch a business, you will have time for little else. It will become the focus of your time and energies.

Open the Table of Contents

Like that demanding college professor with high expectations, reviewing a template of a business plan has a way of dispelling any notion that a business plan can be written in one night, or even two. It takes time to do it right and complete the sections in a thoughtful manner. The sections include:

- The executive summary

- Company description

- Product or service offering

- Management and organization

- Market analysis

- Marketing and sales management

As you go about implementing the countless details involved in starting a business, you probably will refer to your business plan repeatedly. It may become your most valuable resource, so don't even think about filing it away – unless you file it under “N,” for “necessary.”

- U.S. Small Business Administration: Write your business plan

- SCORE: What is the purpose of a business plan?

- Business Case Analysis: Business Plan Purpose, Contents

- Harvard Business Review: When Should Entrepreneurs Write Their Business Plans?

Mary Wroblewski earned a master's degree with high honors in communications and has worked as a reporter and editor in two Chicago newsrooms. Then she launched her own small business, which specialized in assisting small business owners with “all things marketing” – from drafting a marketing plan and writing website copy to crafting media plans and developing email campaigns. Mary writes extensively about small business issues and especially “all things marketing.”

Related Articles

What are the functions of a business plan, how to write a preface for a business plan, definition of business objectives & goals, can an organization have a successful strategic plan without effective mission & vision statements, the disadvantages of business planning, marketing program examples in a business plan, why is an effective business plan introduction important, definition of a swot analysis, what does "abridged" mean on a business plan, most popular.

- 1 What Are the Functions of a Business Plan?

- 2 How to Write a Preface for a Business Plan

- 3 Definition of Business Objectives & Goals

- 4 Can an Organization Have a Successful Strategic Plan Without Effective Mission & Vision Statements?

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Nine reasons why you need a business plan

Building a great business plan helps you plan, strategize and succeed. Presented by Chase for Business .

Making the decision to create a new business is an exciting yet stressful experience. Starting a business involves many tasks and obstacles, so it’s important to focus before you take action. A solid business plan can provide direction, help you attract investors and ensure you maintain momentum.

No matter what industry you plan on going into, a business plan is the first step for any successful enterprise. Building your business plan helps you figure out where you want your business to go and identify the necessary steps to get you there. This is a key document for your company to both guide your actions and track your progress.

What is the purpose of a business plan?

Think of a business plan like a roadmap. It enables you to solve problems and make key business decisions, such as marketing and competitive analysis, customer and market analysis and logistics and operations plans.

It can also help you organize your thoughts and goals, as well as give you a better idea of how your company will work. Good planning is often the difference between success and failure.

Here are nine reasons your company needs a business plan.

1. Prove your idea is viable

Through the process of writing a business plan, you can assess whether your company will be successful. Understanding market dynamics, as well as competitors, will help determine if your idea is viable.

This is also the time to develop financial projections for your business plan, like estimated startup costs, a profit and loss forecast, a break-even analysis and a cash flow statement . By taking time to investigate the viability of your idea, you can build goals and strategies to support your path to success.

A proper business plan proves to all interested parties—including potential investors, customers, employees, partners and most importantly yourself — that you are serious about your business.

2. Set important goals

As a business owner, the bulk of your time will mostly likely be spent managing day-to-day tasks. As a result, it might be hard to find time after you launch your business to set goals and milestones. Writing a business plan allows you to lay out significant goals for yourself ahead of time for three or even five years down the road. Create both short- and long-term business goals.

3. Reduce potential risks

Prevent your business from falling victim to unexpected dangers by researching before you break ground. A business plan opens your eyes to potential risks that your business could face. Don’t be afraid to ask yourself the hard questions that may need research and analysis to answer. This is also good practice in how your business would actually manage issues when they arise. Incorporate a contingency plan that identifies risks and how you would respond to them effectively.

The most common reasons businesses fail include:

- Lack of capital

- Lack of market impact or need

- Unresearched pricing (too high or low)

- Explosive growth that drains all your capital

- Stiff competition

Lack of capital is the most prevalent reason why businesses fail. To best alleviate this problem, take time to determine how your business will generate revenue. Build a comprehensive model to help mitigate future risks and long-term pain points. This can be turned into a tool to manage growth and expansion.

4. Secure investments

Whether you’re planning to apply for an SBA loan , build a relationship with angel investors or seek venture capital funding, you need more than just an elevator pitch to get funding. All credible investors will want to review your business plan. Although investors will focus on the financial aspects of the plan, they will also want to see if you’ve spent time researching your industry, developed a viable product or service and created a strong marketing strategy.

While building your business plan, think about how much raised capital you need to get your idea off the ground. Determine exactly how much funding you’ll need and what you will use it for. This is essential for raising and employing capital.

5. Allot resources and plan purchases

You will have many investments to make at the launch of your business, such as product and services development, new technology, hiring, operations, sales and marketing. Resource planning is an important part of your business plan. It gives you an idea of how much you’ll need to spend on resources and it ensures your business will manage those resources effectively.

A business plan provides clarity about necessary assets and investment for each item. A good business plan can also determine when it is feasible to expand to a larger store or workspace.

In your plan, include research on new products and services, where you can buy reliable equipment and what technologies you may need. Allocate capital and plan how you’ll fund major purchases, such as with a Chase small business checking account or business credit card .

6. Build your team

From seasoned executives to skilled labor, a compelling business plan can help you attract top-tier talent, ideally inspiring management and employees long after hiring. Business plans include an overview of your executive team as well as the different roles you need filled immediately and further down the line.

Small businesses often employ specialized consultants, contractors and freelancers for individual tasks such as marketing, accounting and legal assistance. Sharing a business plan helps the larger team work collectively in the same direction.

This will also come into play when you begin working with any new partners. As a new business, a potential partner may ask to see your business plan. Building partnerships takes time and money, and with a solid business plan you have the opportunity to attract and work with the type of partners your new business needs.

7. Share your vision

When you start a business, it's easy to assume you'll be available to guide your team. A business plan helps your team and investors understand your vision for the company. Your plan will outline your goals and can help your team make decisions or take action on your behalf. Share your business plan with employees to align your full staff toward a collective goal or objective for the company. Consider employee and stakeholder ownership as a compelling and motivating force.

8. Develop a marketing strategy

A marketing strategy details how you will reach your customers and build brand awareness. The clearer your brand positioning is to investors, customers, partners and employees, the more successful your business will be.

Important questions to consider as you build your marketing strategy include:

- What industry segments are we pursuing?

- What is the value proposition of the products or services we plan to offer?

- Who are our customers?

- How will we retain our customers and keep them engaged with our products or services and marketing?

- What is our advertising budget?

- What price will we charge?

- What is the overall look and feel of our brand? What are our brand guidelines?

- Will we need to hire marketing experts to help us create our brand?

- Who are our competitors? What marketing strategies have worked (or not worked) for them?

With a thoughtful marketing strategy integrated into your business plan, your company goals are significantly more in reach.

9. Focus your energy

Your business plan determines which areas of your business to focus on while also avoiding possible distractions. It provides a roadmap for critical tradeoffs and resource allocation.

As a business owner, you will feel the urge to solve all of your internal and customers’ problems, but it is important to maintain focus. Keep your priorities at the top of your mind as you set off to build your company.

As a small business owner, writing a business plan should be one of your first priorities. Read our checklist for starting a business, and learn how to take your business from a plan to reality. When you’re ready to get started, talk with a Chase business banker to open a Chase business checking or savings account today.

For Informational/Educational Purposes Only: The views expressed in this article may differ from other employees and departments of JPMorgan Chase & Co. Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results.

JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender, ©2023 JPMorgan Chase & Co

What to read next

Manage your business how to help protect your business from check fraud.

Think writing checks is a safe way to pay vendors? Think again. Learn about five common scams and how to help prevent them.

START YOUR BUSINESS 10 tips before starting your new businesses

Thinking about starting a business? Check these 10 items off your list.

MANAGE YOUR BUSINESS Inventory management can help maintain cash flow

Inventory can eat up a lot of cash. Here are a few ways to manage inventory with cash flow in mind.