Free Download: NEXIT Business Plan for Exited N-Power Beneficiaries

Last updated on May 23rd, 2023 at 08:19 pm

The Ministry of Humanitarian Affairs, Disaster Management, and Social Development revealed that exited N-Power beneficiaries would receive credit facilities from the Central Bank of Nigeria (CBN) after their NEXIT training.

The training which is scheduled to commence on Monday, March 14, 2022, nationwide will see the successful candidates at various NEXIT training centres

“Training of the first batch of 75,600 @npower_ng exited Beneficiaries from the 36 states and the FCT is proposed to be flagged off next week in Abuja for the five-day entrepreneurial training, which thereafter, qualifies them for loans,” Advertisements (adsbygoogle = window.adsbygoogle || []).push({}); Mrs Nneka Ikem Special Assistant, Media & Publicity, to the Minister Sadiya Farouq, says on Twitter.

Before downloading the business plan, you have to first check the training venue and date for the NEXIT programme.

NEXIT Business Plan

To obtain the NEXIT-CBN loan, candidates will be mandated to submit a business plan that contains the following details:

- Personal details

- Business information

- Equipment list

- Working capital

- Product and services

- Competition analysis

- Management plan

- Loan information

- SWOT analysis

You can download the NEXIT business plan here

Note : There are differences between a business plan and a business proposal , as such, you are advised to carefully study the prescribed NEXIT business plan to avoid any kind of issues.

How many NEXIT applicants will get the CBN loan?

The CBN loan will first be made available to 75,600 exited N-Power beneficiaries across 36 states of Nigeria. A new date will be made available for the second batch

My name is not on the first batch of NEXIT list, what can I do?

If you didn’t make the first batch, wait for the next batch which contains the names of 154,400 exited N-Power beneficiaries.

How many exited beneficiaries qualified for the CBN loan?

According to the ministry, only 230,000 exited N-Power beneficiaries qualify for the loan which is backed by Nigeria’s apex bank.

How much is NEXIT loan?

The ministry is yet to reveal the exact amount each of the successful candidates will receive from the CBN.

What’s the NEXIT-CBN training about?

The training will educate successful candidates on entrepreneurship including farming and innovative ideas. As such, the curriculum for shortlisted NEXIT applicants has been made available

Master the Art of Crafting a Two-Page Business Plan To Secure Your Loan (with a Proven Template)

Business Plan For an Agrochemical Company: Example and Proven Strategies for Success

Difference between business plan and business proposal.

Writing a Recharge Card Printing Business Plan: A Comprehensive Guide

AGSMEIS Loan Business Plan: 8 Key Sections You Must Prioritize

Procedure in Writing Massage Therapy Business Plan

6 Key Points To Include In Hairdressing Salon Business Plan

Problems faced by national cranberry cooperative and how they’ve got out of them, business plan for organic honey (plus free template download), 8 components of an executive summary (with a sample), leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Sign up for our newsletters

The best of Business news, in your inbox.

Last Updated on Mar 23rd, 2024

Elizabeth Ifeoluwa

Were you once a participant of the Npower scheme and you want to apply for its exit benefits? Then, you must have heard about the NEXIT loan. The Npower/CBN Empowerment scheme, also called NEXIT aims to empower Npower exited beneficiaries by giving them loans to start up a business. This guide will help you understand what the scheme is all about and how to register and qualify for the loan.

An Overview Of NEXIT Loan

NEXIT loan is a type of loan that the Federal Government Of Nigeria provides for exited participants of the N-Power programme. The government created the NEXIT registration portal solely for all N-power beneficiaries.

The Federal Ministry of Humanitarian Affairs along with the Central Bank of Nigeria collaborated with the Federal Government to create this platform. With this portal, all N-power beneficiaries can access a variety of CBN empowerment options.

Also, they can apply for the numerous entrepreneurship, economic, and empowerment programmes the Central Bank of Nigeria has to offer.

How Can I Register And Apply For A NEXIT Loan?

To register and apply for the NEXIT loan, just follow the procedures below:

1. First, visit the N-power NEXIT web portal via https://nexit-fmhds.cbn.gov.ng/auth/signup

2. Input the E-mail Address you registered with as an N-Power Beneficiary

3. Next, input your password and confirm it. Remember to always keep your password private.

4. Thereafter, enter your basic details like your first name, surname, and BVN.

Lastly, cross-check the details to ensure that they are correct then click on submit. Yep platform will redirect you to an E-mail activation page. When you get to this stage, do this:

1. Re-enter your email address then click on ‘Resend Activation Mail‘

2. Wait for a verification mail that the portal will send to you.

3. Next, activate your account by clicking on the link in the verification mail that you received.

Lastly, re-login into the NEXIT portal and enter all your necessary information. Once you do this, your registration is successful.

What Requirements Do I Need To Apply For NEXIT Loan?

Candidates who want to apply for this loan benefit must fulfil the following conditions:

1. You Must Be Nigerian by Birth

2. Not currently employed in any government establishment (either State or Federal Government)

3. You must be either N-Power Batch A and B beneficiary.

4. Your NIN Number is also compulsory.

5. Educational Qualification Credentials

6. Your NPVN number

7. Bank Verification Number (BVN)

8. Your deployment letter from your PPA (place of primary assignment)

9. You need a valid means of identification like a voter’s card, National Identity Card, Driver’s Licence, NIN Number, or International Passport.

How much is the loan for NEXIT?

Candidates whose applications are successful will get up to 5 Million Naira loan without needing any collateral. This makes the offer a very attractive one.

How Can I Qualify For A NEXIT Loan?

The NEXIT Loan Business Plan is divided into 10 Parts, namely:

1. Personal Details (Biodata)

2. Business Information

3. Loan Information

4. Equipment List

5. Working Capital List

6. Product And Services

7. Assets List

8. Competitive Analysis

9. Management Plan

10. Swot Analysis

However, the major points the programme uses to disqualify candidates depend on the information in Numbers 4,5,6, and 7. Also, the judges will screen your managerial Plan and Competitive Analysis.

If you want to qualify for this loan, you should have a professional perspective on how to effectively use the loan capital. This is especially important for the numbers the judges are most concerned about. You have to draft a professional but detailed summary of your proposed business plan.

Do I need a CAC Certificate To Access The NEXIT Loan?

Basically, if your business has a CAC (Corporate Affairs Commission) certificate, it can increase your chances of securing higher loan amounts. With this certificate, you may be able to secure a loan within the range of a N1million to N3million. However, if you do not have this certificate, this means that you may receive lower loan amounts for your business.

Bottom Line

NEXIT loan is a special type of loan the Federal Government of Nigeria offers to individuals who have completed the N-power programme successfully. Basically, this loan serves as a source of financial empowerment to enable these individuals to start a business. If you need a guide on how it works, follow the tips above.

Top Stories

Sme loans in nigeria – how to apply in 2024.

How to Delete PalmPay Account with 2 Simple Methods

How to Lock Money on Opay in 2024

List of FCCPC, CBN-Approved Loan Apps in Nigeria

Compare and get quick loans from different lenders.

Get access to up to N10,000,000 (Ten Million Naira) loan on the spot!

Related Posts

May 2nd, 2024, apr 29th, 2024, all the news straight to your inbox., signup for loanspot weekly news letter., disclaimer : loanspot is not a lender and we do not offer loans to customers. loanspot offers lending technology infrastructure to lenders empowering lenders to offer loans to their customers effectively, securely and at scale. we are ndpr certified and compliant..

Privacy Policy

205a Corporation Drive, Ikoyi, Lagos, Nigeria.

+234 809 237 8856

Nexit Business Plan Form For All States In Nigeria

NPower beneficiaries who were exited last year can now apply for the Central Bank of Nigeria CBN Nexit Business Loan . As a requirement to apply for the Nexit Business loan, exited NPOWER beneficiaries will have to submit a Business plan.

Below are the links to the websites where you can fill the Nexit Business Plan Form . The Nexit Business Plan Form is available For All States In Nigeria.

Note that the Federal Government (FG) has begun the training of 467,183 beneficiaries of exited N-Power batches on entrepreneurship.

After the training, beneficiaries of the scheme are to receive up to N3million loan to establish businesses of their own.

However, one of the requirements to get NEXIT CBN Entrepreneurial Loan is a business plan.

Eligibility for NEXIT CBN Entrepreneurial Loan

The N-Power batches eligible for NEXIT CBN loan are the beneficiaries who were exited last year after over two years to pave way for another set of beneficiaries of the National Social Investment Programme (NSIP) of the federal government.

Before we proceed to show you links (URL) to fill NEXIT loan business plan form, kindly note that the NEXIT business plan forms in the links below are being provided by training agency. Those who have not gotten the link to fill the Nexit business plan for m , should check below.

Link to fill Nexit business plan form for all States

Click on your state Nexit loan business plan form to start filling the form online.

FCT Abuja Nexit loan business plan form

Nassarawa Nexit loan business plan form

Sokoto Nexit loan business plan form

Zamfara Nexit loan business plan form

With these forms you can Create your Business Plan for the CBN Nexit Entrepreneurial Loan application.

Check back for Links for the remaining States on this page as we will continue to add them.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- How to Move to Canada 2024

- 7 EASIEST AND SAFE WAYS TO MOVE TO CANADA

- Study In Canada – Financial Aid, Scholarships, Visa and Admission Requirements

- Canada Nanny Jobs for Foreigners

- Truck Driver Jobs In Canada Including VISA Sponsorship

- Cali Sight Mobile Menu

- Cali Sight Modal Search Menu

- Cali Sight Posts List

- Cali Sight Reviews

- Checkout – cali_sight

- Login/Register – cali_sight

- My Account – cali_sight

- Privacy Policy

- School Senate

- Switching plans wizard

- Terms of Use

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

Job Vacancies

Npower: nexit business plan for exited n-power beneficiaries ( how to download).

Last week, the Ministry of Humanitarian Affairs, Disaster Management, and Social Development revealed that exited N-Power beneficiaries would receive credit facilities from the Central Bank of Nigeria (CBN) after their NEXIT training.

The training which is scheduled to commence on Monday, March 14, 2022, nationwide will see the successful candidates at various NEXIT training centres

sponsored by the Central Bank of Nigeria (CBN), which is scheduled for next week.

“Training of the first batch of 75,600 @npower_ng exited Beneficiaries from the 36 states and the FCT is proposed to be flagged off next week in Abuja for the five-day entrepreneurial training, which thereafter, qualifies them for loans,” Mrs Nneka Ikem Special Assistant, Media & Publicity, to the Minister Sadiya Farouq, says on Twitter.

Before downloading the business plan, you have to first check the training venue and date for the NEXIT programme.

NEXIT Business Plan

To obtain the NEXIT-CBN loan, candidates will be mandated to submit a business plan that contains the following details:

- Personal details

- Business information

- Equipment list

- Working capital

- Product and services

- Competition analysis

- Management plan

- Loan information

- SWOT analysis

You can download the NEXIT business plan here

For Nasarawa candidates, head straight to the G-Consulting website to access the online business plan form

You can check the FCT NEXT candidates if you haven’t done so

Note : There are differences between a business plan and a business proposal , as such, you are advised to carefully study the prescribed NEXIT business plan to avoid any kind of issues.

How many NEXIT applicants will get the CBN loan?

The CBN loan will first be made available to 75,600 exited N-Power beneficiaries across 36 states of Nigeria. A new date will be made available for the second batch

My name is not on the first batch of NEXIT list, what can I do?

If you didn’t make the first batch, wait for the next batch which contains the names of 154,400 exited N-Power beneficiaries.

How many exited beneficiaries qualified for the CBN loan?

According to the ministry, only 230,000 exited N-Power beneficiaries qualify for the loan which is backed by Nigeria’s apex bank.

How much is NEXIT loan?

The ministry is yet to reveal the exact amount each of the successful candidates will receive from the CBN.

What’s the NEXIT-CBN training about?

The training will educate successful candidates on entrepreneurship including farming and innovative ideas.

A multi-talented individual with a passion for diverse fields, Treasure Orokpo is a trained journalist, skilled cook, and AI enthusiast. When she's not uncovering the latest stories, you can find her whipping up culinary creations in the kitchen and entertainment.

You may like

Latest NPower News for today Saturday 24th February 2024

Latest update on NPower, Betta Edu, Humanitarian Ministry Scandal for Jan 22, 2024

Latest update on NPower, Betta Edu, Humanitarian Ministry Scandal for Jan 18, 2024

Latest update on NPower, Betta Edu, Humanitarian Ministry Scandal for Jan. 16, 2024

Latest update on NPower, Betta Edu, Humanitarian Ministry Scandal for Jan. 14, 2024

Latest update on NPower, Betta Edu, Humanitarian Ministry Scandal for Jan. 12, 2024

Two dead as herdsmen attack Agatu

BREAKING: Gunmen kill NSCDC Commander, Mike Ode in Benue

Tinubu returns to Nigeria

Central Bank releases list of licensed Deposit Money Banks in Nigeria

Fortune teller arrested for impregnating man’s wife in Gombe

Black market Dollar to Naira exchange rate today 8th May 2024

Gunmen kidnap Taj Bank manager in Zamfara

Controversy over fresh attempts to impeach Gov Fubara of Rivers

DSS arrests ex-Oyo PMS Chairman, Auxiliary

Presidency reveals date Tinubu will return to Nigeria

BREAKING: CBN suspends cash deposit charges till September

Bolt fires 22 workers in Nigeria

CHAT WITH US

- LATEST NEWS

- SPONSORED POSTS

- Cryptocurrency

- Job Past Questions

- PRICE WATCH

- Press Release

- Breaking News

- education news

- Personal Finance

NEXIT: Soft Loan Disbursement to Commence Soon as Business Plan submission ends

Petrol Marketers in Nigeria Demand End to NNPC’s Supply Monopoly Amid Subsidy Concerns

Canada’s Regulatory Authority Sets Clear Stablecoin Rules for Exchanges and Issuers

THORSwap Temporarily Halts Operations Amidst Concerns Over Illicit Transactions

Controversy Swirls in Oil Sector as NNPC Awards Pipeline Contracts to MRS, AA Rano Once Again

Federal Government to Revise Visa-On-Arrival Policy, Emphasizing Reciprocity

Naira Weakens at Official FX Market, Strengthens in Parallel Black Market

Nigeria’s Industrial Ambitions Stalled Amid Economic Headwinds

The Downfall of a Crypto Titan: Understanding the Sam Bankman-Fried Trial

Federal Government Eyes 50% Annual Increase in Tech Startup Revenue

Majority of Nigeria’s Used Cars Imported from the US, Reports ITA

Tuesday trading sees naira rising against dollar as fx market reopens.

Federal Government Urges NLC and TUC to Reconsider Nationwide Strike

- Privacy Policy

- Terms of Use

- CRYPTO WATCH

N-power Portal Login npvn.npower.gov.ng/login 2020/2021 – Update Your Account

NEXIT: Soft Loan Disbursement to Commence Soon as Business Plan submission ends – Npower Batch A and B volunteers especially exited Npower trainees in Lagos should visit blinkplan.biz the template for preparing the business plan, exited Npower Batch A and B volunteers will observe that the columns have been completed as promised by the NEXIT training officers.

Recall, few weeks ago at the last day of the NEXIT soft loan training, the NEXIT training officials promised to assist Npower Batch A and B volunteers having difficulties in completing some columns in the business plan such as the financial plan, and other details, all the columns as we speak has been completed.

All things being equal exited Npower Batch A and B volunteers should start receiving their NEXIT soft loans by May, as promised by the NEXIT training officers, loan amount will be maximum of ₦3,000,000 and will be provided by the Central Bank of Nigeria in conjunction with NIRSAL Micro Finance Bank.

Nigerian Naira to Dollar Exchange Rate Stable on Friday

Examining web3 development across africa.

Tosan Olajide

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

List of Stanbic IBTC bank Routing Number, sort codes and branches in Nigeria

Nigerian bank employee grades and levels

List of Zenith bank Routing Number, sort codes and branches in Nigeria

List of UBA bank Routing Number, sort codes and branches in Nigeria

UTME result: How to Check JAMB Result 2022 – Jamb Result Checker

Utme 2021: Check JAMB Results Using JAMB Registration Number

Jamb Portal 2021: How to check Jamb Results – jamb.org.ng/efacility

www.p-yes.gov.ng – Register For P-YES Progeamme Portal – Apply Now

JAMB Results 2021 Online Checking Steps | www.jamb.org.ng Result

Copyright © 2023 Financial Watch.

Navigate Site

Welcome back.

Login to your account below

Remember Me

Retrieve your password

Please enter your username or email address to reset your password.

#Advertisement

- Npower News

- Jobs In Nigeria

Npower Nexit Training - How To Know If You Are Selected

In today's latest Npower news - We will be discussing Npower Nexit Training as part of the question that you have been asking since the Minister of humanitarian affairs release a statement about the Nexit programme training of the Npower batches A and B exited beneficiaries. So read on.

What is Nexit Training?

Nexit Training is a sort of entrepreneurship training that Exited Npower Volunteers will undergo to equip them with skills needed to manage or run a successful business. This training could be online or physical.

The Nexit Scheme Applicants have passed through the first stage of Nexit which is indicating interest by registering on the Nexit portal to participate in the FG empowerment opportunities for the Exited Npower Volunteers. Read also Why You Should Start A Business Before Nexit Loan Disbursement

The second stage of the nexit scheme exercise is the training of applicants fellow by the disbursement of starter Packages to the beneficiaries which is the third stage.

According to the Minister, out of the 500,000 exited N Power beneficiaries, about 390,000 of them have successfully been accommodated into the NEXIT programme while about 109,000 are already on their way to entrepreneurship on their own even before we started the NEXIT.

How To Know If You Are Selected For Npower Nexit Training

To know if you have been selected for the Nexit training when due, the following will happen:

1. You must have been among the registered Exited Npower Volunteers on Nexit Programme.

2. You will be informed via your Nexit registered email of your selection to participate in the next training.

3. The Nexit portal which is currently closed might probably be reopened for selected applicants to accept their selection and to probably update some records like bank account details.

NEXIT is an exit package for all the Exited beneficiaries of the N-Power in partnership with the Central Bank of Nigeria (CBN) to enable them to benefit from the CBN empowerment options. FG is working with the CBN to support the beneficiaries with soft loans - Nexit loans. Read also Template To Help You Write Business Plan For NYIF Loan And Others

Posted by: Admin

You may like these posts, post a comment.

we love your comments! Use the post a comment box to Comment, you can also join our facebook discussion Click Here

Featured Post

Search this blog, popular posts.

Link To Apply For National MSME Awards 2024 May 03, 2024

Link To Check FGLoanGrant PCGS Beneficiaries Names April 29, 2024

Apply For Nigerian Army 87 Regular Recruits Intake 2024 May 03, 2024

- BBTitans 11

- Jobs in Nigeria 659

- npower news 1399

- Technology 75

- npower news

- Jobs in Nigeria

- Npower Discussion

- Scholarship

- Nasims Portal

Favorite Sites

- 3MTT Program

Follow By Email

Footer menu widget.

- Privacy Policy

Social Footer Widget

NPower Rolls Out NEXIT Package, 200,000 Beneficiaries To Be Engaged As Financial Service Operators

The Federal Government’s NPower scheme has rolled out the exit packages (NEXIT) for all beneficiaries of the programme.

With the NEXIT plan package, at least 200,000 exited Npower beneficiaries will be engaged as financial services operators under a Shared Agent Network Expansion Facility (SANEF) scheme controlled by the Central Bank of Nigeria.

Among other things, the NEXIT programme is expected to create a platform for Nigerian owned financial services companies to grow whilst empowering and creating job opportunities for Nigerian youths.

Investors King gathered that over 30,000 Npower volunteers have already been engaged as geospatial experts and enumerators in the Economic Sustainability Plan’s Mass Agric programme such as Federal Ministry of Agriculture and Rural Development/Agriculture for Food and Job Plan (FMARD AFJP) and the Project for Agricultural Co-ordination and Executive (PACE), while other Npower volunteers be given the alternative of benefiting from the GEEP micro-enterprise loans.

Also, about 200,000 exited Npower volunteers will be enrolled on a programme known as the Shared Agent Network Expansion Facility (SANEF) while at least 30,000 Npower volunteers will be deployed for the Mass Agric programme, a component of the Economic Sustainability Plan (ESP), and other NPower volunteers will be given the opportunity to develop their entrepreneurial skills and start new businesses under a micro-enterprise scheme.

The SANEF programme is a Federal Government initiative operated by the Central Bank of Nigeria, Commercial Deposit Money Banks, Nigeria Inter-Bank Settlement Systems (NIBSS), Chattered Institute of Bankers of Nigeria, Licensed Mobile Money Operators, and Shared Agents with the primary aim and goal of accelerating financial inclusion and financial growth and development in Nigeria.

The SANEF, in partnership with the National Social Investment Programme (NSIP) will have 200,000 Npower graduates as its agents under the approved ‘SANEF licensed Super Agents’.

Recall that Investors King had earlier reported that the Federal government had, through its Ministry of Humanitarian Affairs, Disaster Management and Social Development which is handling the scheme, launched a portal for the 500,000 exited beneficiaries to apply for their exit packages.

The minister, Hajiya Sadiya Umar Farouq had encouraged the beneficiaries to exercise more patience and await the result of her efforts.

Npower News: Latest Update On Npower Payment for October, November

NPower News: FG Commences Processing Of November Stipends To Batch C Beneficiaries

You may like

Tinubu Suspends National Social Investment Programme Amid Alleged Malfeasance Investigation

Npower: EFCC Set to Grill Former Minister Sadiya Umar-Farouk Over Alleged N37.1 Billion Fraud

N-Power Beneficiaries Secure Presidential Intervention, Receive Nine Months’ Stipends

Federal Government Commences Payment of N-Power Arrears to Beneficiaries

N-Power Beneficiaries to Embark on Nationwide Protest Planned for Overdue Stipends

N-Power Beneficiaries Decry Delay in Monthly Stipends, Seek Government Intervention

British Airways Owner IAG Prepares for Summer Surge Amid High Travel Demand

As the world gradually emerges from the grip of the pandemic, the travel industry is witnessing a resurgence in demand with British Airways owner IAG SA gearing up for a busy summer season.

Despite lingering challenges, the airline conglomerate remains optimistic about the outlook, citing strong demand for travel within Europe and across the Atlantic.

In a recent stock exchange filing, IAG disclosed an adjusted operating profit of €68 million ($73.3 million) for the three months ending March.

According to Chief Executive Officer Luis Gallego, the group’s core markets, including the North Atlantic, South Atlantic, and intra-Europe routes, have shown robust performance, positioning them well for the upcoming peak travel period.

With vaccination rates increasing and travel restrictions easing in many parts of the world, consumers are eager to resume travel plans, fueling the surge in demand.

However, the road ahead is not without its challenges. While travel within Europe and across the Atlantic remains strong, other regions present a more complex operating environment.

The ongoing conflict in the Middle East has dampened demand for certain destinations, while airspace restrictions resulting from geopolitical tensions, such as the Russian invasion of Ukraine, have disrupted flight routes to East Asia.

Despite these hurdles, IAG remains resilient, banking on the strength of its core markets and the performance of its brands to weather the storm.

The company’s strategic positioning and proactive measures to adapt to changing circumstances have positioned it to capitalize on the rebound in travel demand.

As the summer season approaches, IAG is focused on ensuring operational readiness to meet the surge in passenger numbers.

With travelers eager to reconnect with loved ones, explore new destinations, and embark on long-awaited vacations, the airline group stands ready to facilitate safe and seamless travel experiences.

As vaccination campaigns progress and travel sentiment rebounds, IAG’s proactive approach and strategic investments position it as a key player in the aviation industry’s recovery journey. With optimism on the horizon, the company remains committed to delivering exceptional service and fostering a seamless travel experience for passengers worldwide.

Israeli Troops Take Control of Rafah Border Crossing Amidst Ceasefire Talks

Israeli troops took control of the Rafah border-crossing area in Gaza on Tuesday morning, with Hamas saying all aid flows from Egypt had stopped.

The army has halted “the movement of people and aid completely,” the Hamas-run crossing authority said in a statement. Soldiers replaced Palestinian flags with Israeli ones.

It’s the first time Israel’s army has moved into the area since the war with Hamas began in October.

Israeli Military Tells About 100,000 People to Leave Eastern Rafah

Palestinians sheltering in Rafah were told Monday to move to an “expanded humanitarian area”.

The border is the main entry point for aid into Gaza, and the Palestinian territory’s only crossing aside from those with Israel. The US has been urging Israel for weeks to allow more food and other supplies into Gaza, parts of which the United Nations says are on the verge of famine.

The movement of troops came a day after Israel told residents in parts of eastern Rafah to leave immediately ahead of a possible attack on the city.

Most Arab and many European states have said Israel should not attack Rafah, fearing it would cause mass casualties. Prime Minister Benjamin Netanyahu says Rafah is the last bastion of Hamas, with about 5,000 to 8,000 of its fighters and senior leaders lodged in the city, as well as many Israeli hostages.

Cease-fire talks between the two sides continue to drag. Hamas said on Monday night it had accepted a proposal from mediators Egypt and Qatar. Israel rejected it, saying it contained demands the Jewish state cannot accept.

Israel Calls for Evacuation of Rafah Amid Threat of Assault

Israel called on civilians to evacuate parts of Rafah on Monday in what appeared to be preparation for a long-threatened assault on Hamas holdouts in the southern Gaza Strip city where more than a million war-displaced Palestinians have been sheltering.

Instructed by Arabic text messages, telephone calls, and flyers to move to what the Israeli military called an “expanded humanitarian zone” 20 km (7 miles) away, some Palestinian families lumbered out under chilly spring rain, witnesses said.

Israel’s military said it had begun encouraging residents of Rafah to evacuate in a “limited scope” operation. It gave no specific reasons, nor did it say if any offensive action might follow.

Seven months into its war against Hamas, Israel has been threatening to launch incursions in Rafah, which it says harbours thousands of Hamas fighters and potentially dozens of hostages. Victory is impossible without taking Rafah, it says.

The prospect of a high-casualty operation worries Western powers and neighbouring Egypt, which is trying to mediate a new round of truce talks between Israel and Hamas under which the Palestinian Islamist group might free some hostages.

The Rafah plan has opened an unusually public rift between Israel and Washington. Speaking to his U.S counterpart, Israeli Defence Minister Yoav Gallant linked Monday’s operation to the deadlock in indirect diplomacy, which he blamed on Hamas.

“During their discussion, Gallant discussed the efforts undertaken to achieve the release of hostages and indicated that at this stage, Hamas refuses the frameworks at hand,” the Israeli Defence Ministry said in a statement.

“Gallant emphasized that military action is required, including in the area of Rafah, at the lack of an alternative,” it added On Monday, the Israeli military called on Palestinians in eastern parts of Rafah to move to a nearby “humanitarian area”, saying it would “encourage … the gradual movement of civilians in the specified areas”.

Emefiele Trial: Witness Details Alleged Extortion by CBN Director Over $400,000

Ebenezer Olufowose Takes Helm at First Bank of Nigeria Limited as Chairman

IMF Warns of Challenges as Nigeria’s Economic Growth Barely Matches Population Expansion

Naira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

Dollar to Naira Black Market Today, April 17th, 2024

Dollar to Naira Black Market Today, April 18th, 2024

Naira Appreciates to N1,136/$ Officially, N1,050/$ Parallel Market

Dollar to Naira Black Market Today, April 24th, 2024

Citigroup Predicts $3,000 Value Amidst Investor Surge

Eni Aluko Breaks Barriers: First Black Female Football Club Owner in Italy

ARISE News Channel Goes Global: Launches in Nine Southern African Countries

Don't have an account? Sign up now

Lost Password?

Please leave this field empty

Password will be generated and sent to your email address.

Download Ogun TESCOM Past Questions

Download UBTH Past Questions...

Business Plan Writing in Nigeria for Government Loan / Bank Proposal

We will write your business plan or proposal from the scratch and enable you get banks / government loans like Npower Nexit Loan, small scale business loan etc. Need professionals online to write your business plan? We are professional human resource team with years of experience in staffing and business management, hence writing a professional business plan in Nigeria is a walk over for us.

Writing Business Plan in Nigeria – What You Need to Know:

Business plan is not just an ordinary two pages document. Among other reasons, the primary reason for business plan is to secure business funding / loan from the government or banks for business start up or expansion.

A good Nigeria business plan must be unique, comprehensive and written from the scratch. A business plan must be written with the purpose of the business plan in mind for proper targeting so as to meet the desire purpose at the end of the day.

We Can Write Any Type of Nigeria Business Plan and Proposal From The Scratch

Irrespective of the reason you need a business plan or proposal, we can write any type of business plan for you from the scratch to achieve the desire aim. With our professional business plan you can easily get Nigeria government empowerment loans like N-power Nexit Loan, Central Bank of Nigeria (CBN) NIRSAL COVID-19 Loan, NYSC CBN Loan, NYSC CBN Loan, Npower GEEP loan, NHF loan from Federal Mortgage Bank of Nigeria, Trader Moni Loan, Market Moni loan, NYIF Loan etc

For example, let’s take a quick look at Npower Nexit Loan and the kind of business plan you need for this kind of loan.

Business Plan For Npower Nexit Loan

This kind of loan is very juicy as it has a very favorable pay-back policy hence N-power Nexit loan is very competitive. The only mean of screening out and reducing the high number of people yearning for this loan is to make all the past Npower beneficiaries write a professional business plan, any business plan that is not unique, written from the scratch with purpose driven for this kind of loan will surely fail to yield the desire goal.

Process of Subscribing For Our Business Plan Writing and Delivery

The process is very simple, it take just 4 easy steps to subscribe for our business plan writing and deliver the fully written business plan from the scratch to you. See the steps below:

Step 1: We have different prices based on the time of delivery, choose a delivery plan that is best for you.

Step 2: Make payment either online or via mobile transfer into our bank account

Step 3: Fill our one page business assessment form to enable us know few basic thing about your existing business or intending business

Step 4: As soon as we receive your completed business assessment form, we will swoop into action and start writing your business plan from the scratch and deliver it to you via your email in PDF format based on the time of delivery you paid for.

Frequently Asked Questions About Our Business Plan Writing

What type of business plan do you write.

We write any type of professional business plan, just tell us the purpose of the business plan and we will get it professionally done for you

Do you also write business plan for Npower Nexit Loan?

Yes we write professional business plan that will enable you secure Npower Nexit Loan

What is the process of suscribing?

The process is quite simple; You make payment based on your delivery plan, fill our initial business assessment form, then upon confirmation of your payment and receipt of the completed business assessment form, we will start writing your business plan from the scratch and deliver based on the delivery time chosen

When exactly do you deliver?

We have different delivery plan, ranging from 24 hour to 7 days. You can chose the time that’s best for you

How will i get the final written business plan, do you have some kind of collection centre?

You don’t need to go to any location for collection, the document will be in PDF format and will be sent to your email address

I have little or no knowledge about the business, can i still subscribe?

Don’t worry, we will do the heavy-lifting for you and take care of all the technical business decision that will enable us coin your business plan to success. The only thing we need from you is just a general overview of the business you are into or trying to start

I am not comfortable with online payment, do you have account details i can do a direct transfer to?

You can simply do a direct mobile transfer to our bank account if you are not comfortable with paying online with your credit cards. Simply pay the required amount to the account details below and notify us after payment:

Bank Name: Guaranty Trust Bank (GTB or GTCO)

Account Name: JobsGivers HR Services

Account Name: 0628306323

Do you have some kind of reviews of other customers who have paid for any product or service before on your website?

JobsGivers.com is a large Human resource / business portal. Employers, job seekers and business owners patronize us on daily bases for different products and services, some customers reviews can be found here .

You will surely get what you paid for. “Sincerity and integrity are the qualities that keep us going! We can’t afford to loose them.”

My question is not in this list, how do i contact you for more questions and clarification?

Our dedicated support officers are waiting on our whatsapp support page ready to answers all your questions. Simply click here to begin chat on whatsapp via 08083053951

Use the pricing table below to choose the plan that is best for you and subscribe to a happy ending

Note: The business plan is not pre-written. It will be written from the scratch to suit your purpose!

7 days Delivery

5 days delivery, 3 days delivery, 1 day delivery.

You can do a direct transfer into our account details below if you are not comfortable using the above online payment method. After your transfer please notify us via WhatsApp

ACCOUNT DETAILS

BANK NAME: GUARANTY TRUST BANK (GTB)

ACCOUNT NUMBER: 0628306323

ACCOUNT NAME: JOBSGIVERS HR SERVICES

If you find anything difficult you can click here to contact us or for faster response, Click here to chat with us on Whatsapp via 08083053951

- 25248 Jobs Posted

- 19557 Companies Hiring

- 169399 Candidates Registered

- 12150 Past Questions in Stock

Please minister release the Npower Nexit loan

The Social Investment Programme was initiated by the Buhari administration in 2015 when it came to power. The programme included the Npower which engaged about…

The Social Investment Programme was initiated by the Buhari administration in 2015 when it came to power. The programme included the Npower which engaged about 500,000 youths who were each paid N30,000 monthly stipend for the period of two years.

After the expiration of their two years engagement, the beneficiaries were exited in the year 2020 with the promise that they would not be allowed to go back to the streets; that the federal government, through the Ministry Humanitarian and Disaster Management, which is the supervising ministry, promised that they would be placed on the Nexit programme. Under the new programme, each volunteer would be given a loan to start a business.

The volunteers were, therefore asked to fill an online application form in 2021 to show interest for the Nexit programme.

In February 2022, the same disengaged volunteers were again asked to dial a USSD code *45665#.

It took many of them an average of four attempts before they were able to access the USSD code successfully and each attempt costs N50. Imagine 500,000 making such attempts at least five times.

After all that, a text message was sent to some selected exited volunteers about the Nexit programme in March 2022 inviting them to a three-day training which will qualify them for a loan from the Central Bank of Nigeria to enable them to start a business of their choice. During the training they were asked to write a business plan for their chosen business, which will enable them to access the loan.

Unfortunately up to this moment, we have not heard from the minister and the ministry about the Nexit loan that was promised.

Even though the minister in interviews she granted various media houses admitted that the funds have been approved by the president for disbursement to the beneficiaries, none of them has received a kobo.

We are yet to know why the approved fund has not been disbursed or why it is taking too long to reach the beneficiaries.

It is in this regard that I am appealing to relevant authorities and the Ministry of Humanitarian and Disaster Management to please fast-track the process of disbursement to enable the Nexit volunteers to start something on their own in order to take care of themselves and their families in this harsh economic times.

Comrd Titus Chongkon wrote via [email protected]

LEARN AFFILIATE MARKETING: Learn How to Make Money with Expertnaire Affiliate Marketing Using the Simple 3-Step Method Explained to earn $500-$1000 Per Month. Click here to learn more.

AMAZON KDP PUBLISHING: Make $1000-$5000+ Monthly Selling Books On Amazon Even If You Are Not A Writer! Using Your Mobile Phone or Laptop. Click here to learn more.

GHOSTWRITING SERVICES: Learn How to Make Money As a Ghostwriter $1000 or more monthly: Insider Tips to Get Started. Click here to learn more. Click here to learn more.

SECRET OF EARNING IN CRYPTO: Discover the Secrets of Earning $100 - $2000 Every Week With Crypto & DeFi Jobs. Click here to learn more.

Free Business Plan Templates in Excel

By Joe Weller | September 27, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up an extensive list of free business plan templates and samples for organizations of all sizes. You can download all of the plans in Excel.

Included on this page, you’ll find business plan templates in Excel , business plan checklists in Excel , business plan financial templates in Excel , and more.

Business Plan Templates in Excel

These Excel business plan templates are designed to guide you through each step of a well-rounded strategy that supports your marketing, sales, financial, and operational goals.

Business Plan Template in Excel

This Excel business plan template has all the traditional components of a standard business plan, with each section divided into tabs. This template includes space to provide the executive summary, target audience characteristics, product or service offering details, marketing strategies, and more. The plan also offers built-in formulas to complete calculations for sales forecasting, financial statements, and key business ratios.

Download Business Plan Template

Excel | Smartsheet

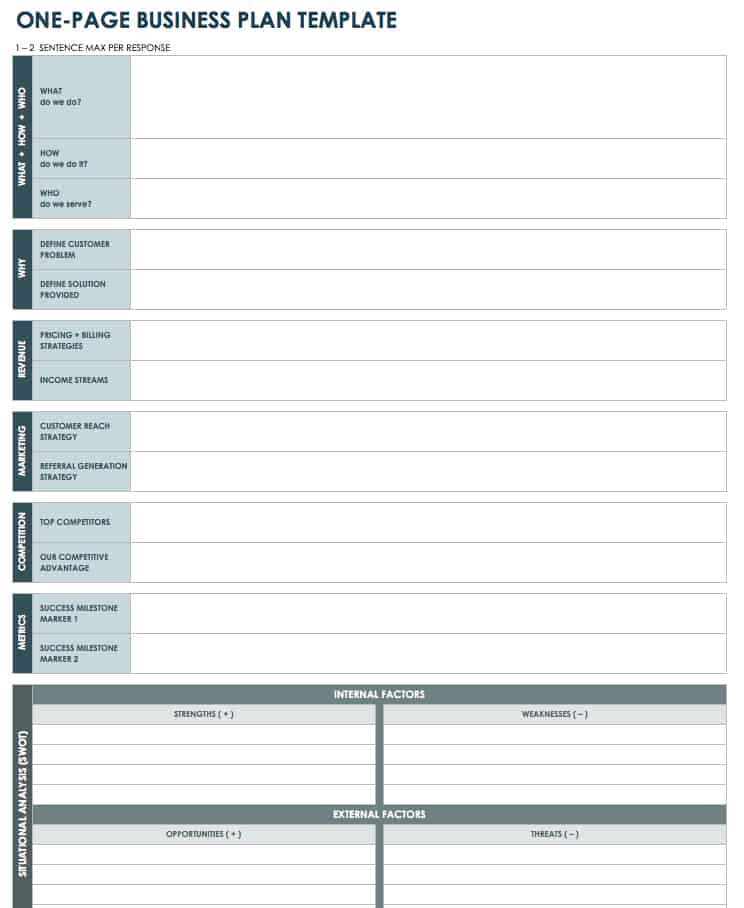

One-Page Business Plan in Excel

To check the feasibility of your business concept, use this single-page business plan template. The template allows you to jot down the core details related to your idea. This template also includes room for you to provide concise information about what you do, how you do it, why you do it, who your idea serves, your competitive advantage, your marketing strategies, and your success factors. At the bottom of this one-page plan, you’ll find a table to conduct a SWOT (strengths, weaknesses, opportunities, and threats) analysis. Find more downloadable single-page plans and examples at “ One-Page Business Plan Templates with a Quick How-To Guide .”

Download One-Page Business Plan

Excel | Word | PDF | Smartsheet

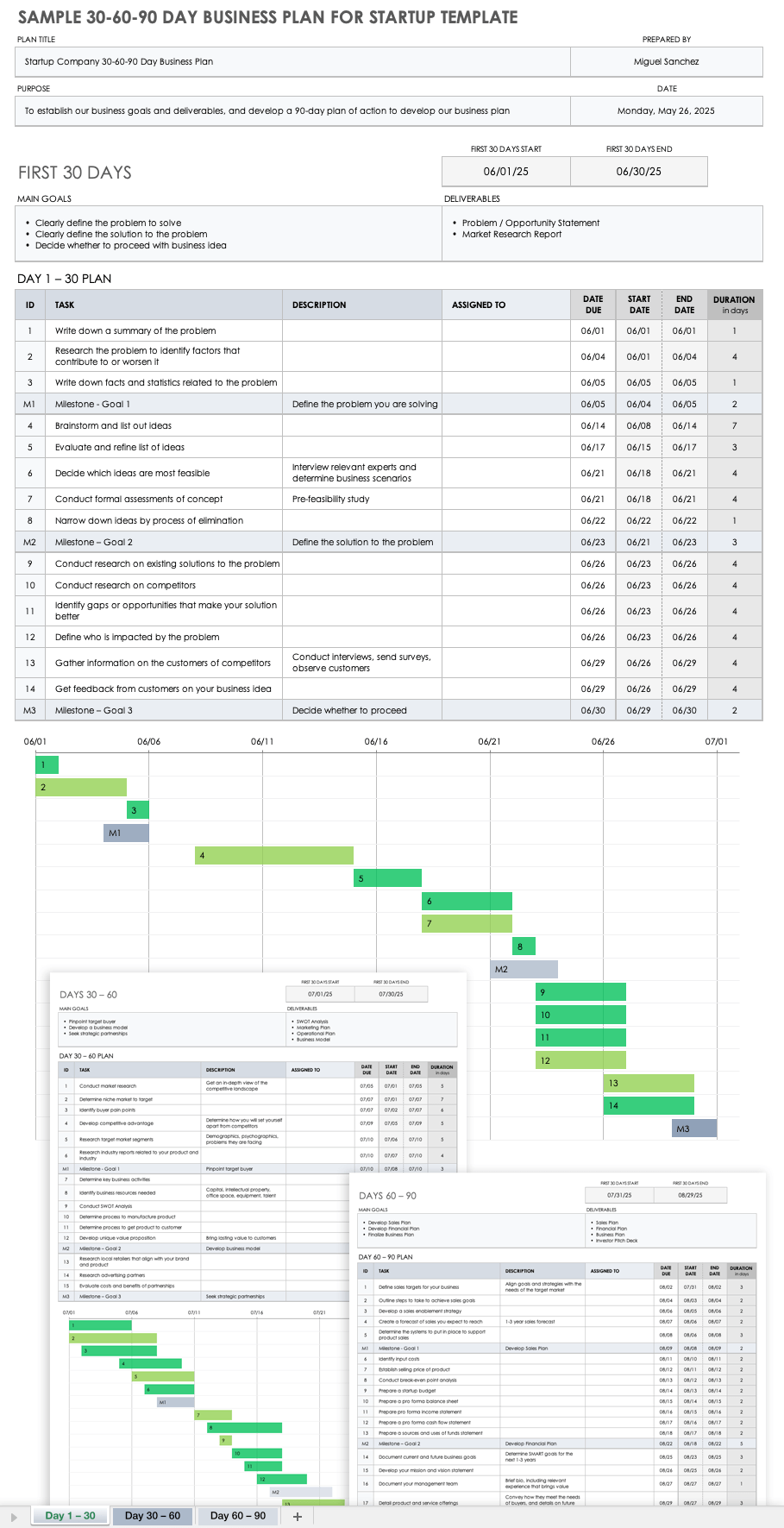

Sample 30-60-90-Day Business Plan for Startup in Excel

This 90-day business plan is designed for startup companies to develop a 90-day action plan. This template gives you room to outline the following: main goals and deliverables for each 30-day increment; key business activities; task ownership; and deadlines. This template also includes a built-in Gantt chart that adjusts as you enter dates. Visit “ 30-60-90-Day Business Plan Templates and Samples ” to download more free plans.

Download 30-60-90-Day Business Plan for Startup

For more free business plans in a wider variety of formats, visit “ Simple Business Plan Templates .”

Business Plan Checklists in Excel

These business plan checklists are useful for freelancers, entrepreneurs, and business owners who want to organize and track the progress of key business activities.

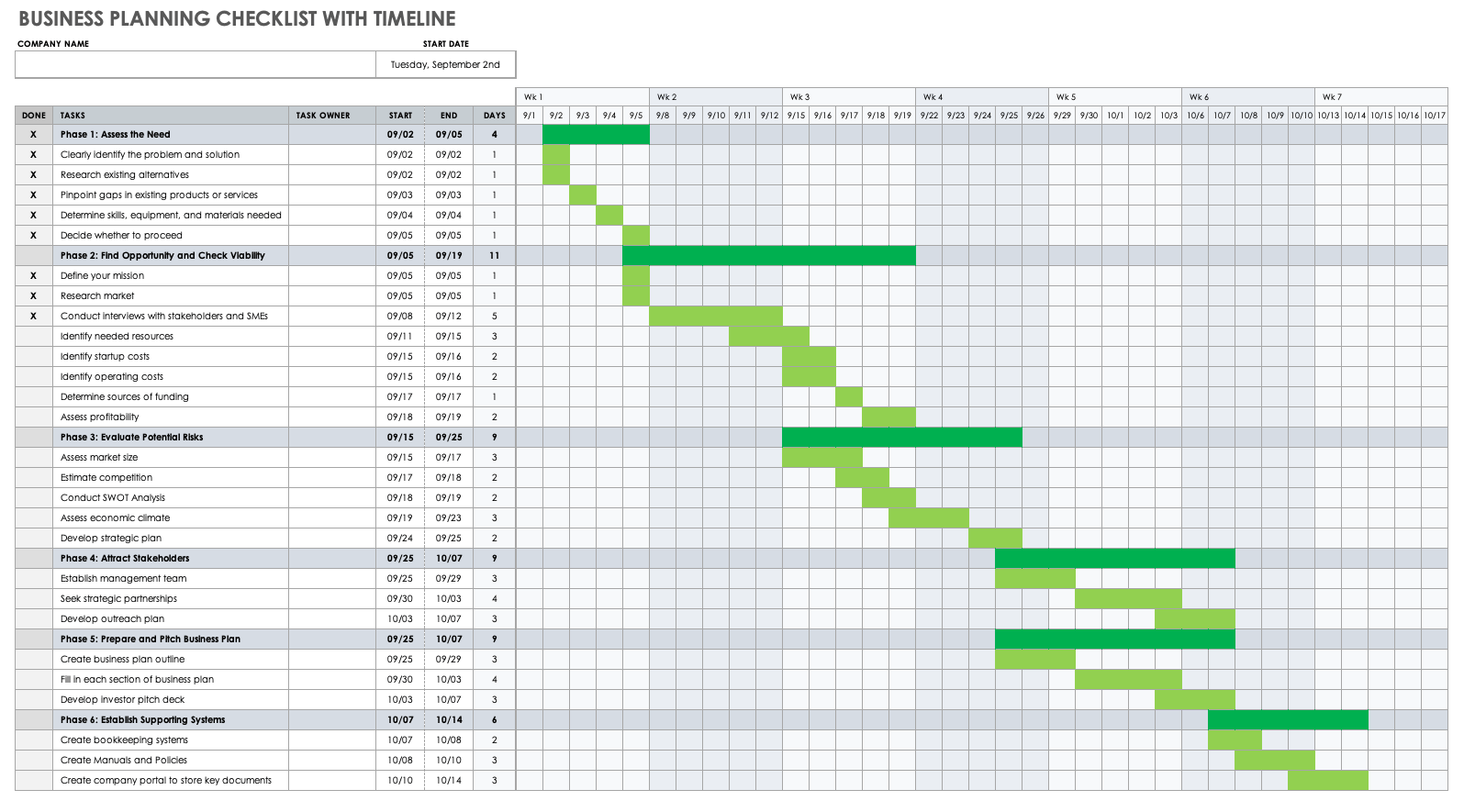

Business Planning Checklist with Timeline in Excel

Use this checklist to keep your business planning efforts on track. This template enables you to add tasks according to each phase of your plan, assign an owner to each task, and enter the respective start and end dates. The checklist also enables you to create and color-code a visual timeline when you highlight the start and end dates for each task.

Download Business Planning Checklist with Timeline Template

Business Plan Checklist with SWOT Analysis in Excel

Use this business plan checklist to develop and organize your strategic plan. Add the name of the business activity, along with its status, due date, and pertinent notes. This template also includes a separate tab with a SWOT analysis matrix, so you can evaluate and prioritize your company’s strengths, weaknesses, opportunities, and threats.

Download Business Plan Checklist with SWOT Analysis - Excel

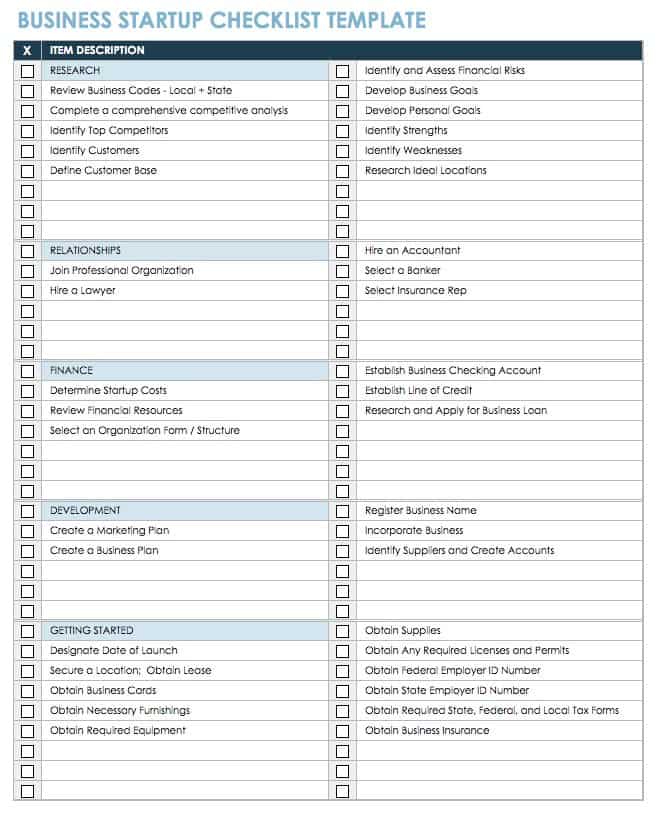

Business Startup Checklist in Excel

This checklist template is ideal for startup organizations. It allows you to list and categorize key tasks that you need to complete, including items related to research, strategic relationships, finance, development, and more. Check off each task upon completion to ensure you haven’t missed or overlooked any important business activities. Find additional resources by visiting “ Free Startup Plan, Budget & Cost Templates .”

Download Business Startup Checklist Template

Business Plan Financial Templates in Excel

Use these customizable templates to develop your organization’s financial plan.

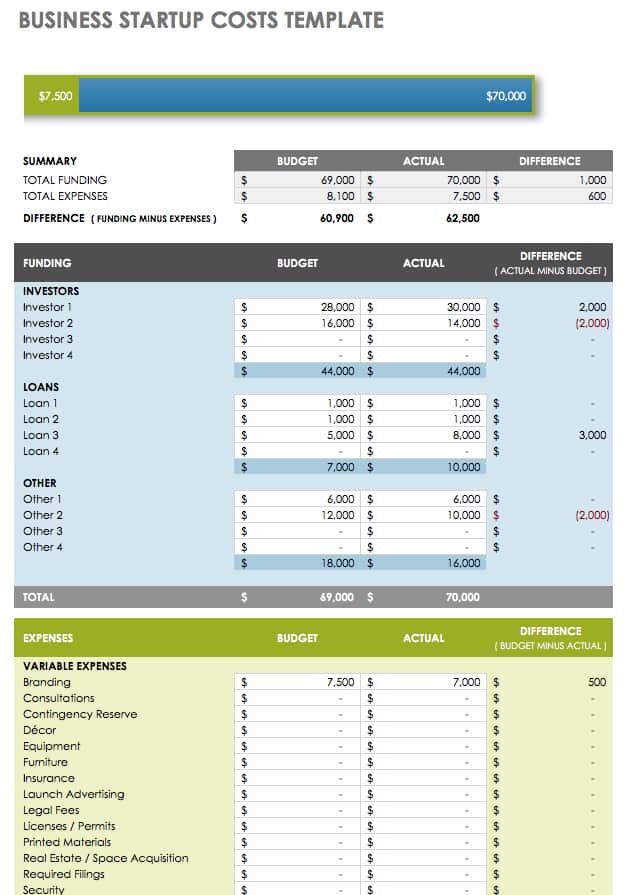

Business Startup Costs Template in Excel

Use this template to estimate and track your startup and operational costs. This template gives you room to list line items for both funding and expenses; you can automatically calculate totals using the built-in formulas. To avoid overspending, compare budgeted amounts against actual amounts to determine where you can cut costs or find additional funding.

Download Business Startup Costs Template

Small-Business Budget Template in Excel

This simple business budget template is designed with small businesses in mind. The template helps you track the income and expenses that you accrue on a monthly and yearly basis. To log your cash balances and transactions for a given time frame, use the tab for cash flow recording.

Download Small-Business Budget Template - Excel

Startup Financial Statement Projections Template

This financial statement projections template includes a detailed profit and loss statement (or income statement), a balance sheet with business ratios, and a cash flow statement to analyze your company’s current and future financial position. This template also comes with built-in formulas, so you can calculate totals as you enter values and customize your statement to fit the needs of your business.

Download Startup Financial Statement Projections Template

For additional templates to help you produce a sound financial plan, visit “ Free Financial Templates for a Business Plan .”

Business Plan Marketing and Sales Templates in Excel

Use these downloadable templates to support and reinforce the marketing and sales objectives in your business plan.

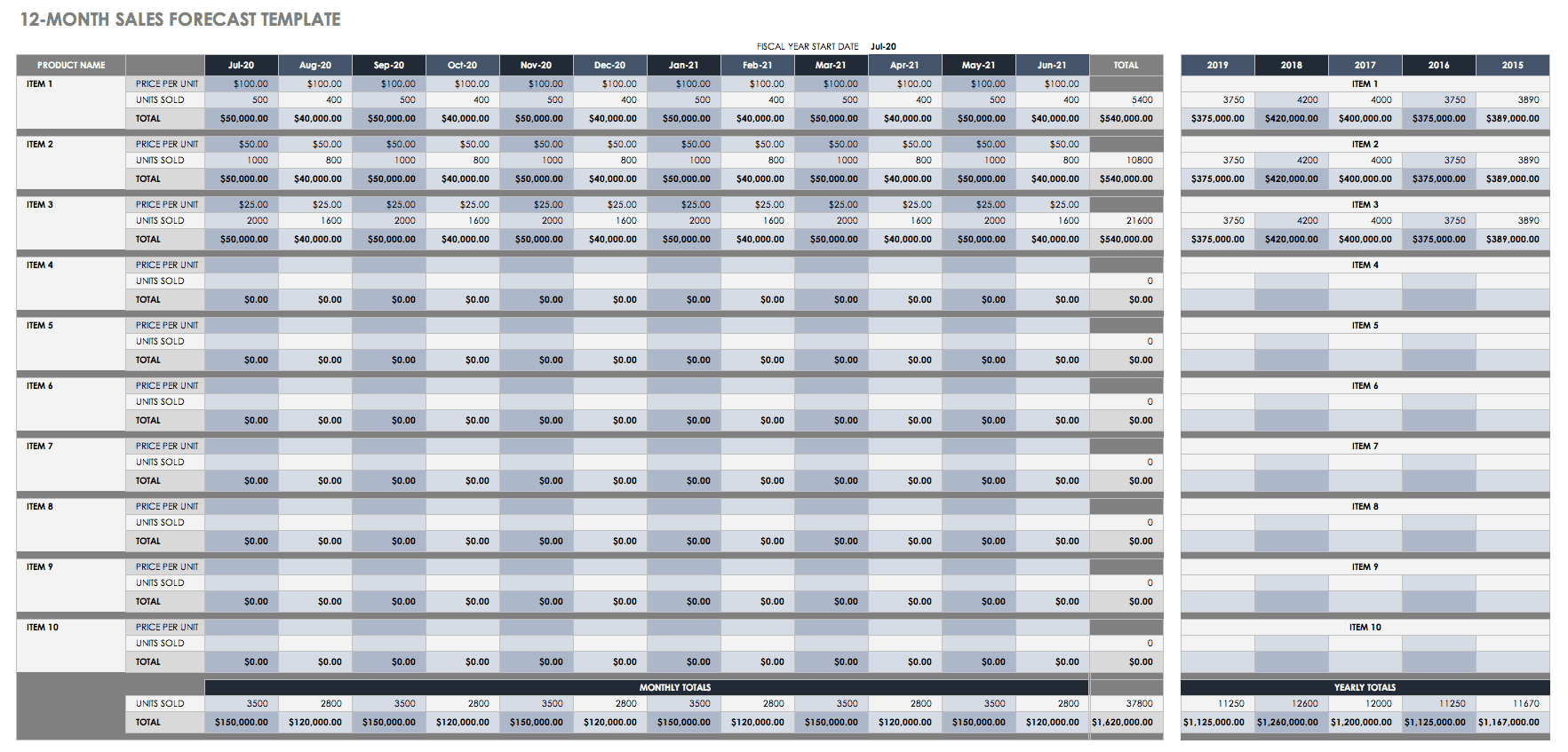

Sales Forecast Template in Excel

This sales forecast template allows you to view the projected sales of your products or services at both individual and combined levels over a 12-month period. You can organize this template by department, product group, customer type, and other helpful categories. The template has built-in formulas to calculate monthly and yearly sales totals. For additional resources to project sales, visit “ Free Sales Forecasting Templates .”

Download Sales Forecast Template

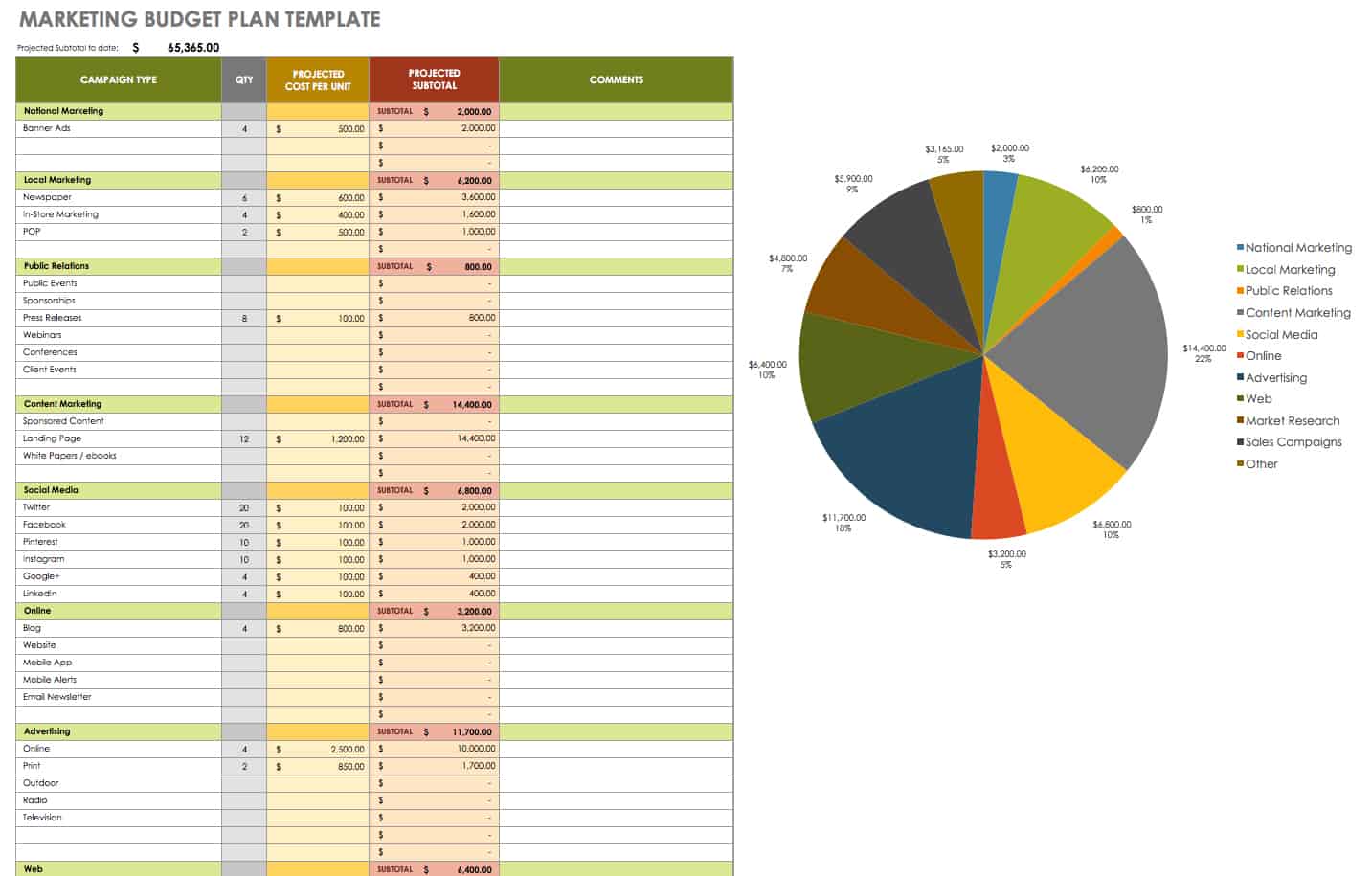

Marketing Budget Plan in Excel

This marketing budget plan template helps you organize and plan your campaign costs for key marketing activities, such as market research, advertising, content marketing , and public relations. Enter the projected quantity and cost under each campaign category; the built-in formulas enable you to calculate projected subtotals automatically. This template also includes a graph that auto-populates as you enter values, so you can see where your marketing dollars are going.

Download Marketing Budget Plan Template

Other Business Plans in Excel

Use these business plan templates to conduct analyses and develop a plan of action that aligns your strategy with your main business objectives.

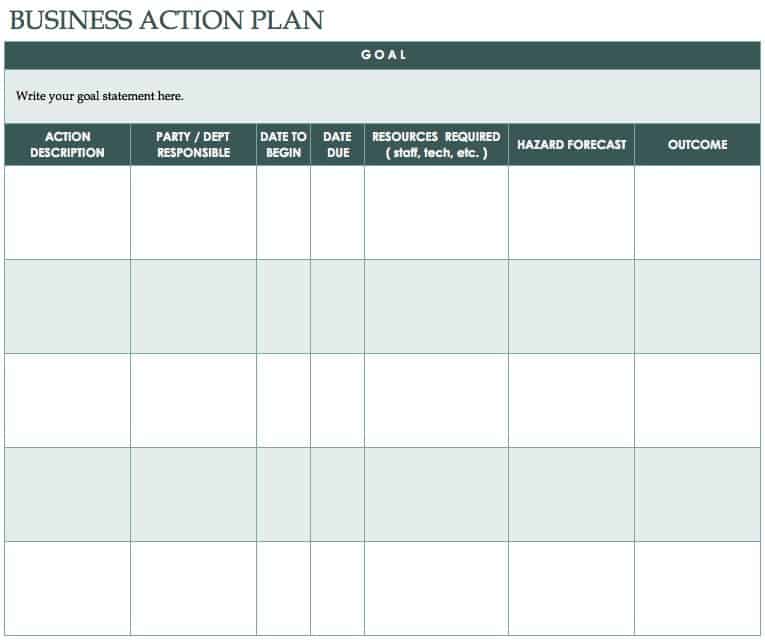

Business Action Plan Template in Excel

Use this basic action plan template to develop a roadmap for reaching your goals. Add a description of each action item, assign the responsible party, and list the required resources, potential hazards, key dates, and desired outcome. You can use this template to develop an action plan for marketing, sales, program development, and more.

Download Business Action Plan Template

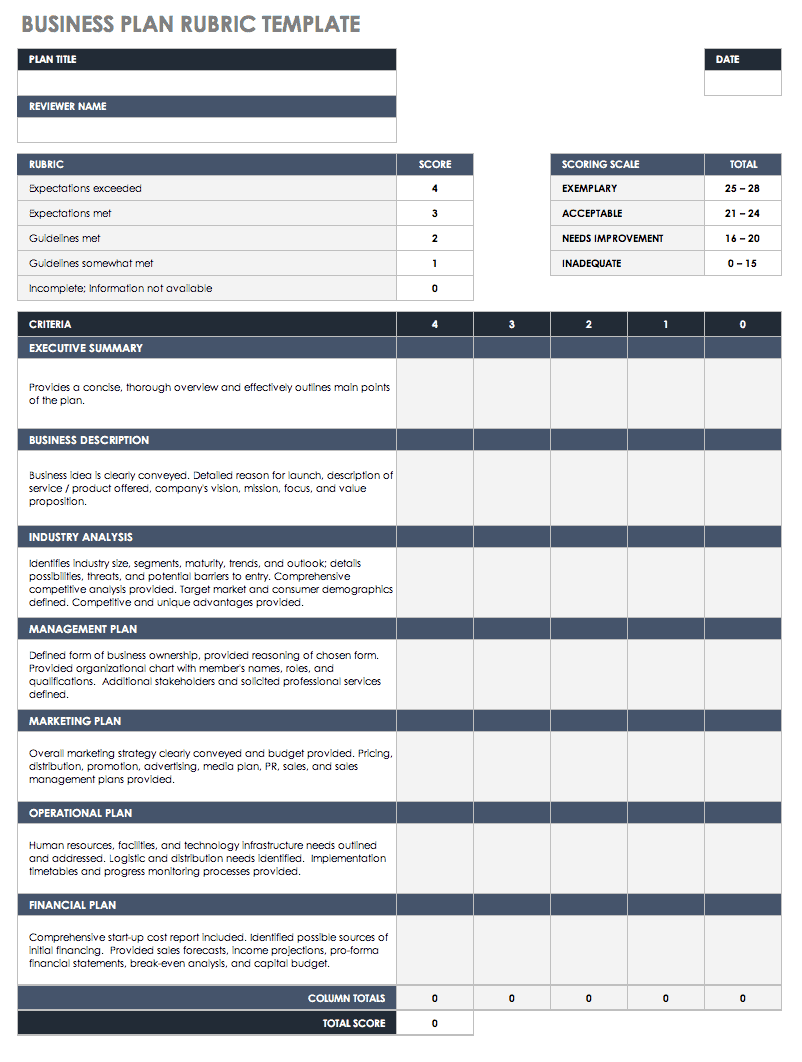

Business Plan Rubric in Excel

Once you complete your business plan, use this rubric template to score each section to ensure you include all the essential information. You can customize this rubric to fit the needs of your organization and provide insight into the areas of your plan where you want to delve more deeply or remove unnecessary details. By following these steps, you can make certain that your final business plan is clear, concise, and thorough.

Download Simple Business Plan Rubric

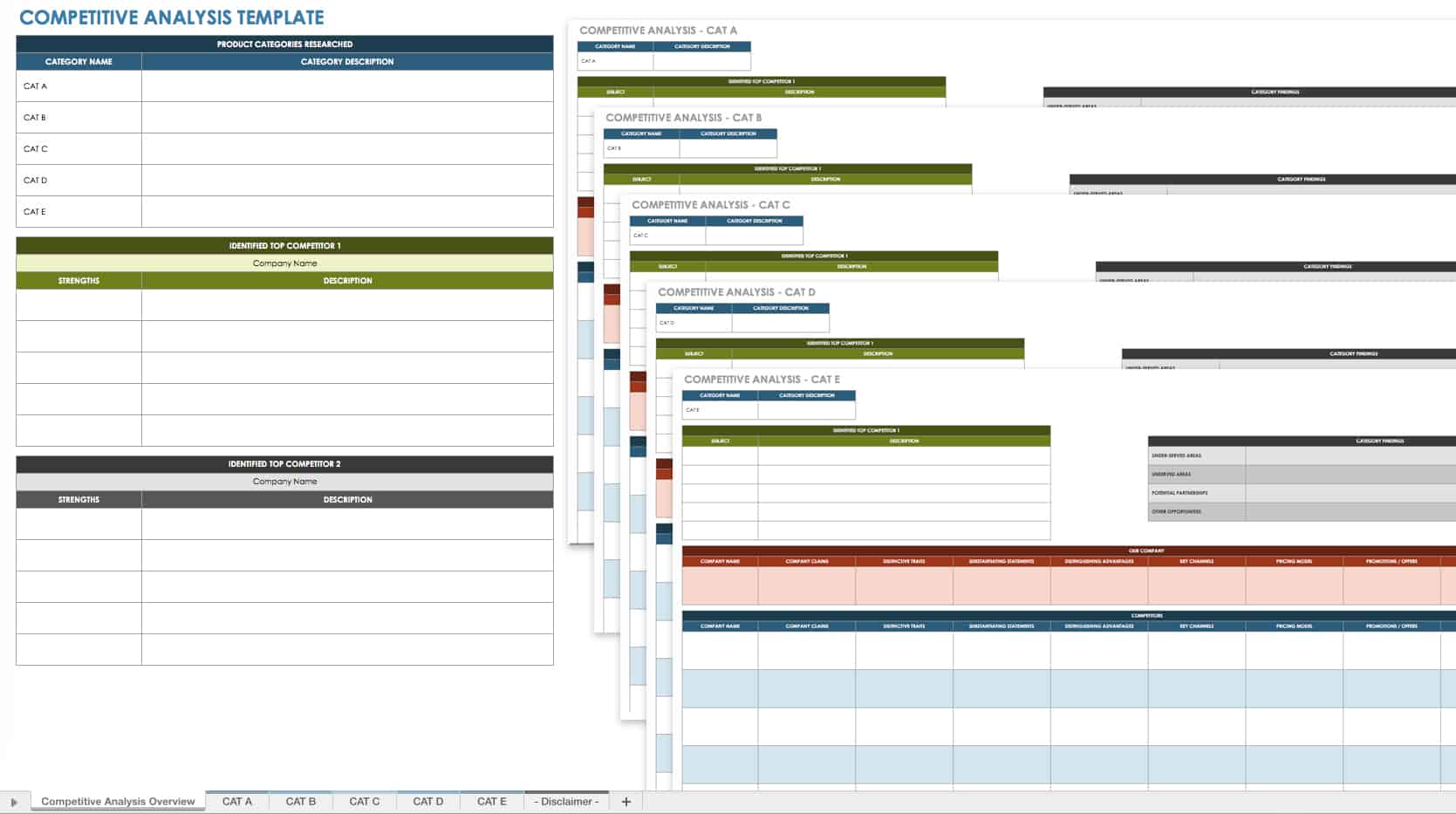

Competitive Analysis Template in Excel

This template enables you to analyze the competitive landscape and industry for your business. By providing details related to your company and competitors, you can assess and compare all key areas, including the target market, marketing strategies, product or service offerings, distribution channels, and more.

Download Competitive Analysis Template

Excel | Smartsheet

For additional free templates for all aspects of your business, visit “ Free Business Templates for Organizations of All Sizes .”

Turbo-Charge Your Business Plans with Templates from Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

48% of small businesses don’t make it past 5 years: Here’s how your business can beat the odds

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Small businesses are the backbone of America, making up the majority of all U.S. businesses. But despite Americans relying on small businesses to meet their everyday needs, almost half of all small businesses close after five years.

There are many reasons why small businesses fail, with financials and lack of planning being the leading causes.

To understand why more than half of small businesses fail within five years, we’ll look at small business statistics , failure reasons and what you can do to keep your business up and running.

Key insights: Small business statistics

- 435,629 businesses applied for business formation in March 2024 ( U.S. Census Bureau )

- Small businesses account for 99% of all U.S. businesses ( U.S Bureau of Labor Statistics )

- Between 2013 and 2023, small businesses employed an average of 46% of the workforce (U.S. Bureau of Labor Statistics)

- 79.4% of businesses survive past their first year ( U.S. Bureau of Labor Statistics , 2018-2023)

- 52% of businesses survive five years after opening (U.S. Bureau of Labor Statistics, 2018-2023)

- 34.7% of businesses survive 10 years after opening ( U.S. Bureau of Labor Statistics )

Why do small businesses fail?

While it can be difficult to pinpoint exactly why almost half of all small businesses fail within five years, there are areas that can make or break a business.

Small businesses may fail because they don’t have enough revenue or aren’t getting their products and services in front of the right customers. They may also fail due to poor business planning or lack of capital. Here are some reasons that small businesses don’t make it past the first few years:

They don’t have a clear business plan

A business plan is a good exercise in mapping out a business’s strategy. It helps business owners outline key aspects of growing their businesses, including stating the value of products and services and outlining the business structure, financial forecast and budget. It also allows the busines s to show potential revenue and any relevant goals or metrics.

Without a business plan, it can be difficult to scale a business and make thoughtful, strategic decisions.

They can’t get access to financing

Businesses may also not make it past their first five years because they may face financial challenges and need financing. Unfortunately, financing is hard to obtain for businesses under five years old.

According to the 2023 Small Business Credit Survey , 40 percent of businesses five years old and under were fully approved for a loan. By comparison, 53 percent of businesses between six and 20 years old were fully approved, and 66 percent of businesses over 20 years old were approved.

While there are lenders who offer some of the best startup business loans with more accessible eligibility criteria, brand-new businesses may still struggle to qualify. Additionally, as newer businesses are considered higher risk, lenders may charge higher interest rates and fees, making it difficult to fit loan payments into a new business’s budget. So, it’s no surprise that the 2023 Small Business Credit Survey found that 36 percent of businesses aged five years or younger used personal funds or a loan from family and friends to finance their business.

They manage cash flow poorly

Another common reason for closure is when a business can’t properly manage its cash flow. Good cash flow management starts with a business setting up and following a business budget, which will track your business’s fixed and variable costs and estimated revenue.

Some business owners think that a business budget is optional, and they don’t know their exact revenue and expenses. Without knowing where the business stands financially, it may fail at the first sign of a cash shortfall or emergency expense. The Q1 2024 Small Business Index found that while 71 percent of small businesses are adequately prepared for any future threats or disasters, 27 percent of businesses say they are only one disaster or threat away from closing.

They don’t have a target market

Many small businesses go to market without having a clear user or customer in mind or a defined product and niche. Small businesses may also enter a saturated market, making it difficult to stand out from all the other businesses offering the same products. Without market research and a customer in mind, businesses are not likely to succeed and make enough revenue to be profitable.

Small business failure rate by industry

Different industries have varying failure rates, which can relate to the profitability of some industries and businesses .

For example, hotel and accommodation services are one of the top industries for growth potential and have a fairly low failure rate. Similarly, agriculture makes up 5.6 percent of the U.S. gross domestic product and has one of the highest five-year survival rates at 65.2 percent.

Source: Survival of private sector establishments by opening year, 2018 to 2023. U.S. Bureau of Labor Statistics

How to maintain a successful small business

Achieving success with your small business means making a strategy for growth and planning ahead to overcome challenges that may crop up. Here are tips for running a successful small business:

Set goals and double down efforts

Use a business plan or other planning document to set business goals, including revenue, sales and marketing goals. Understand what measurements you’re going to use to determine if you’re successful. Then, put in the effort to make sales calls, go to trade shows or work on product development so that you can achieve your goals.

Develop a marketing plan

Consider the various platforms you will use to market your business, whether that’s direct mailers, social media , TV commercials or print advertising. Think through how you will reach your potential customers and track the success of your advertising campaigns to help you make future decisions.

Keep a close eye on finances

Set a business budget and keep track of all revenue and expenses down to the dollar. You want to know how your money is being used so that you can make the most of your income, cut down on waste and plan for unexpected expenses. If possible, also consider starting an emergency fund that you can use in case of an unexpected expense, slow month or actual emergency to avoid financial strain.

Hire talent

You may not have the time or skill to operate every part of your business alone. Think about hiring a talented employee with more skill in an area than you have. By doing so, you may increase sales while giving yourself time back to focus on the areas that you enjoy or excel at.

Apply for financing

You may not need the funds now, but you can apply for a business credit card or line of credit to use for future expenses, build business credit and establish a relationship with a lender, which can benefit your business in the long run.

Bottom line

Being a small business owner means joining the millions of small businesses that serve Americans the most, but it also comes with risks. U.S. Bureau of Labor Statistics data shows that from 2018 to 2023, only a little over half of all small businesses survived five years. But knowing the risks of your industry and managing finances and business loans well will give your business the best shot of surviving and becoming successful over many years.

Frequently asked questions

What is the #1 reason small businesses fail, what should you do when your small business is failing, what is the biggest key to success for a small business.

Article sources

We use primary sources to support our work. Bankrate’s authors, reporters and editors are subject-matter experts who thoroughly fact-check editorial content to ensure the information you’re reading is accurate, timely and relevant.

Business Formation Statistics . U.S. Census Bureau. Accessed on April 24, 2024.

2023 Small Business Profile . U.S. Small Business Administration. Accessed on April 24, 2024.

Survival of private sector establishments by opening year . U.S. Bureau of Labor Statistics. Accessed on April 24, 2024.

2024 Report on Employer Firms: Findings from the 2023 Small Business Credit Survey . Federal Reserve Banks. Accessed on April 24, 2024.

Business Employment Dynamics . U.S. Bureau of Labor Statistics. Accessed on April 24, 2024.

Related Articles

How to qualify for competitive rates on low-interest personal loans

What is an unsecured loan?

What is the APR on a personal loan?

What is a low-interest personal loan?

Exit Strategies - All You Need to Know about Business Exit Planning