- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

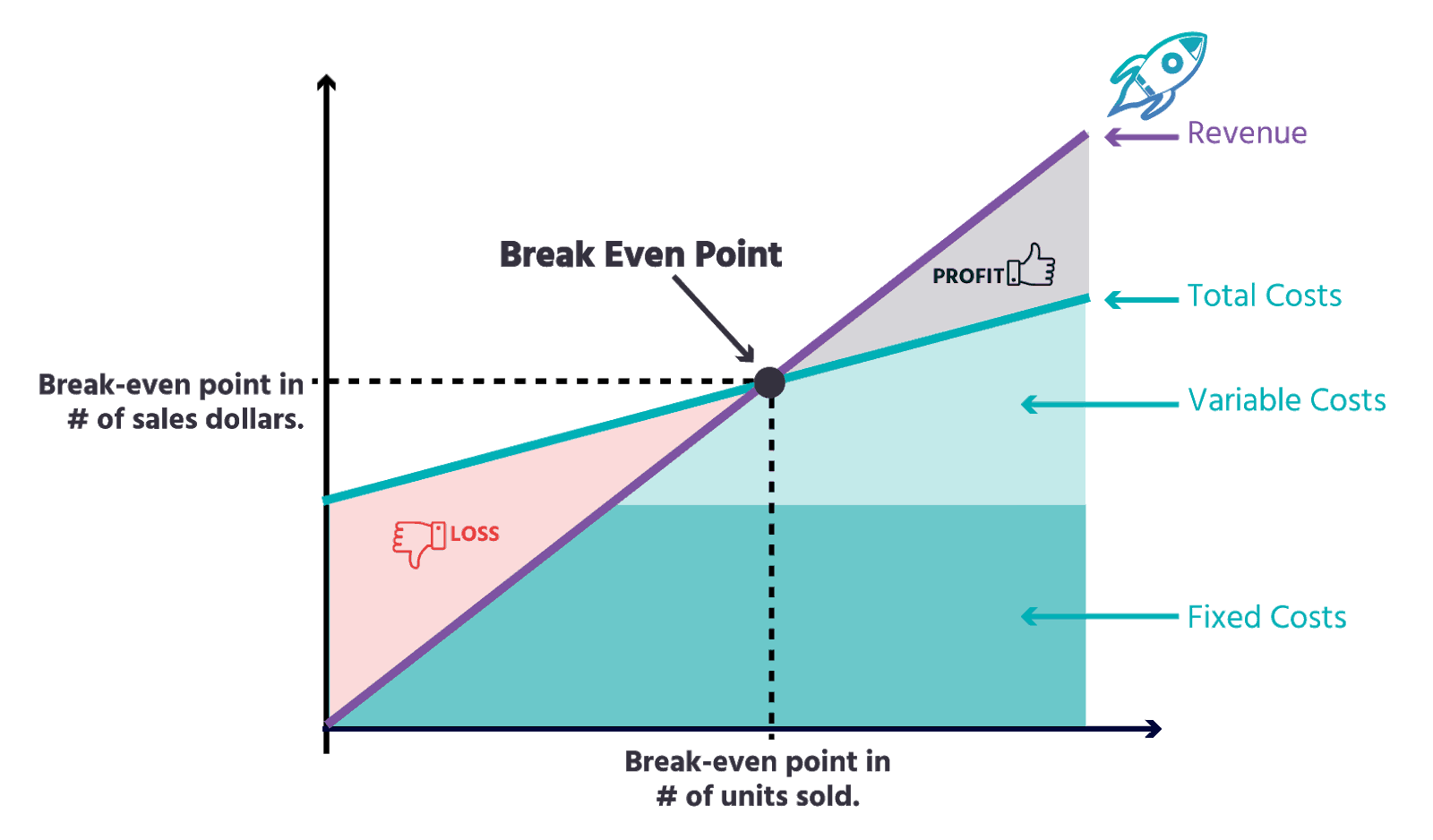

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

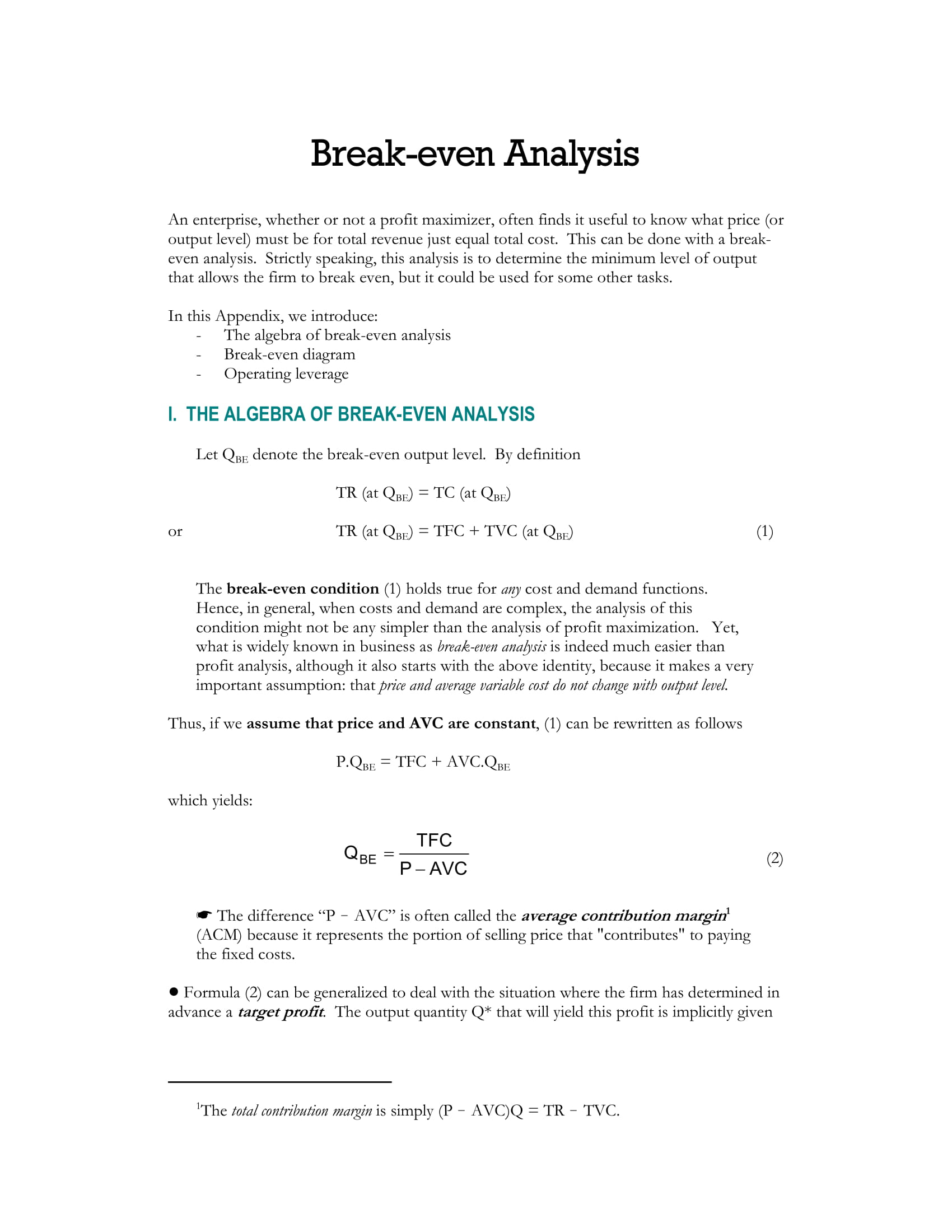

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

- Search Search Please fill out this field.

What Is Break-Even Analysis?

Break-even point formula.

- Calculating BEP and Contribution Margin

Who Calculates the BEP?

Why break-even analysis matters, the bottom line.

- Investing Basics

Break-Even Analysis: Formula and Calculation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

Break-even analysis compares income from sales to the fixed costs of doing business. Five components of break-even analysis include fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs to begin generating a profit. The break-even point formula can help find the BEP in units or sales dollars.

Key Takeaways:

- Using the break-even point formula, businesses can determine how many units or dollars of sales cover the fixed and variable production costs.

- The break-even point (BEP) is considered a measure of the margin of safety.

- Break-even analysis is used broadly, from stock and options trading to corporate budgeting for various projects.

Investopedia / Paige McLaughlin

Break-even analysis involves a calculation of the break-even point (BEP) . The break-even point formula divides the total fixed production costs by the price per individual unit, less the variable cost per unit.

BEP = Fixed Costs / (Price Per Unit - Variable Cost Per Unit)

Break-even analysis looks at the fixed costs relative to the profit earned by each additional unit produced and sold. A firm with lower fixed costs will have a lower break-even point of sale and $0 of fixed costs will automatically have broken even with the sale of the first product, assuming variable costs do not exceed sales revenue. Fixed costs remain the same regardless of how many units are sold. Examples of fixed and variable costs include:

Calculating the Break-Even Point and Contribution Margin

Break-even analysis and the BEP formula can provide firms with a product's contribution margin. The contribution margin is the difference between the selling price of the product and its variable costs. For example, if an item sells for $100, with fixed costs of $25 per unit, and variable costs of $60 per unit, the contribution margin is $40 ($100 - $60). This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

Contribution Margin = Item Price - Variable Cost Per Unit

To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Assume total fixed costs are $20,000. With a contribution margin of $40 above, the break-even point is 500 units ($20,000 divided by $40). Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0.

BEP (Units) = Total Fixed Costs / Contribution Margin

To calculate the break-even point in sales dollars, divide the total fixed costs by the contribution margin ratio. The contribution margin ratio is the contribution margin per unit divided by the sale price.

Contribution Margin Ratio = Contribution Margin Per Unit / Item Price

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

The contribution margin ratio is 40% ($40 contribution margin per item divided by $100 sale price per item). The break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%).

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

- Entrepreneurs

- Financial Analysts

- Stock and Option Traders

- Government Agencies

Although investors are not interested in an individual company's break-even analysis on their production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

- Pricing : Businesses get a comprehensible perspective on their cost structure with a break-even analysis, setting prices for their products that cover their fixed and variable costs and provide a reasonable profit margin.

- Decision-Making : When it comes to new products and services, operational expansion, or increased production, businesses can chart their profit to sales volume and use break-even analysis to help them make informed decisions surrounding those activities.

- Cost Reduction : Break-even analysis helps businesses find areas to reduce costs to increase profitability.

- Performance Metric: Break-even analysis is a financial performance tool that helps businesses ascertain where they are in achieving their goals.

What Are Some Limitations of Break-Even Analysis?

Break-even analysis assumes that the fixed and variable costs remain constant over time. Costs may change due to factors such as inflation, changes in technology, or changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

What Are the Components of Break-Even Analysis?

There are five components of break-even analysis including fixed costs, variable costs, revenue, contribution margin, and the break-even point (BEP).

Why Is the Contribution Margin Important in Break-Even Analysis?

The contribution margin represents the revenue required to cover a business' fixed costs and contribute to its profit. Through the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even to measure its repayment of debt or how long that repayment will take to complete.

Break-even analysis is a tool used by businesses and stock and option traders. Break-even analysis is essential in determining the minimum sales volume required to cover total costs and break even. It helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps find the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

U.S. Small Business Administration. " Break-Even Point ."

Professor Rosemary Nurre, College of San Mateo. " Accounting 131: Chapter 6, Cost-Volume-Profit Relationships ."

:max_bytes(150000):strip_icc():format(webp)/BreakevenPoint-b6ed6dc69b2742358a937e280a3fc103.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

5 Easy Steps to Creating a Break-Even Analysis

- What Break-Even is Used For

Gathering Information for Analysis

- Steps to Break-Even Analysis

Analyzing a Break-Even Chart

Break-even is one of those vital numbers that can mean success or failure to a small business. If you are breaking even your income is are equal to your costs. You have no profit or loss at this point. But, above the break-even point, every dollar of sales is pure profit.

How to Use a Break-Even Analysis in Financial Planning

A break-even analysis is important in several different situations:

- As your business plans new products, knowing the break-even point helps you price more efficiently.

- As you plan your overall business cash and profit strategy, break-even can be used to determine profit points for product lines.

- As your business plans for financing, knowing your overall company breakeven point can help make your case for a business loan.

A lender or investor will probably want to see this information in the financial report section of your business plan .

Before you begin your break-even analysis, you'll need some information. Let's say you're dong an analysis for a potential new product. Make a list of all your costs and expenses relating to that product, including facilities, the cost of materials and supplies, machines or equipment, and costs for paying employees to make the product and prepare it to ship.

You'll also need to know two other pieces of information:

- The range of prices you are considering, starting at $0.00

- The range of quantities you estimate being able to sell, starting at none (0)

You will need to separate out fixed costs and variable costs . Fixed costs are those you must pay even if you have no sales (like rent and utilities). Variable costs are those you spend to make and sell and ship products (like raw materials, supplies, and labor).

5 Steps to Creating a Break-Even Analysis

Here are the steps to take to determine break-even:

- Determine variable unit costs: Determine the variable costs of producing one unit of this product. Variable costs are those costs associated with making the product or buying it wholesale. If you are making a product, you will need to know the cost of all the components that go into that product. For example, if you are printing books, your variable unit costs are paper, binding, and glue for one book, and the cost to put one book together.

- Determine fixed costs: Fixed costs are costs to keep your business operating, even if you didn't produce any products. To determine fixed costs, add up the cost of running your factory for one month. These costs would include rent or mortgage, utilities, insurance, salaries of non-production employees, and all other costs. Don't forget the cost to design the product and packaging, make the prototype, and maybe patent your product.

- Determine unit selling price: Determine the unit selling price for your product. This price may change as you see where your break-even point is.

- Determine sales volume and unit price: The break-even point will change as the sales volume for this product and the unit price change.

- Create a spreadsheet: To do a break-even calculation, you will construct or use a spreadsheet then turn the spreadsheet into a graph. The spreadsheet will plot break-even for each level of sales and product price, and it will create a graph showing you break-even for each of these prices and sales volumes.

A simple formula for break-even is:

Break-even quantity = Fixed costs/(Sales price per unit –Variable cost per unit).

This formula is best expressed in a spreadsheet because variable cost changes. The spreadsheet shows you break-even for a range of costs and sales prices.

You can use Excel or another spreadsheet to create a break-even analysis chart. SCORE has an Excel template , or you can use this one form Microsoft . You'll need someone who's familiar with Excel to tweak the spreadsheet to your specific situation.

Now that you have break-even, what do you do with this information? You want to find the highest price you can sell the product at and still make a profit. See what happens when you change either fixed or variable costs to see what happens if you reduce them. Maybe you can increase the volume by finding new markets. What happens when output volume rises or falls. All of these can affect your business profits on this product.

Of course, a break-even analysis isn't created in a vacuum. If you're creating a new product that no one's ever seen before, you have no idea what the volume would be or how soon competitors might pop up. But at least it gives you a way to begin your search for the "best" price for your product.

SCORE.org. " Break-Even Analysis Template ." Accessed Sept. 10, 2020.

Corporate Finance Institute. " Break Even Analysis ." Accessed Sept. 10, 2020.

Harvard Business Review. " A Quick Guide to Breakeven Analysis ." Accessed Sept. 10, 2020.

What Is a Break-Even Analysis?

3 min. read

Updated October 27, 2023

The break-even analysis lets you determine what you need to sell, monthly or annually, to cover your costs of doing business—your break-even point.

- Understanding break-even analysis

The break-even analysis is not our favorite analysis because:

- It is frequently mistaken for the payback period, the time it takes to recover an investment. There are variations on break even that make some people think we have it wrong. The one we do use is the most common, the most universally accepted, but not the only one possible.

- It depends on the concept of fixed costs, a hard idea to swallow. Technically, a break-even analysis defines fixed costs as those costs that would continue even if you went broke. Instead, you may want to use your regular running fixed costs, including payroll and normal expenses. This will give you a better insight on financial realities. We call that “burn rate” these post-Internet days.

- It depends on averaging your per-unit variable cost and per-unit revenue over the whole business.

Over the past few years, the break-even analysis has fallen out of favor with financial analysts. It is okay when done right, can be useful, but not for all businesses and not for all situations. And, to add to the confusion, the term “break-even” is often used to refer to “payback” or “payback period.” And there are several ways to do the analysis. But what is shown here is the most common.

- Three assumptions of the break-even analysis

The break-even analysis depends on three key assumptions:

1. Average per-unit sales price (per-unit revenue):

This is the price that you receive per unit of sales. Take into account sales discounts and special offers. Get this number from your sales forecast.

For non-unit based businesses, make the per-unit revenue one dollar and enter your costs as a percent of a dollar. The most common questions about this input relate to averaging many different products into a single estimate.

The analysis requires a single number, and if you build your sales forecast first, then you will have this number. You are not alone in this, the vast majority of businesses sell more than one item, and have to average for their break-even analysis.

2. Average per-unit cost:

This is the incremental cost, or variable cost, of each unit of sales. If you buy goods for resale, this is what you paid, on average, for the goods you sell. If you sell a service, this is what it costs you, per dollar of revenue or unit of service delivered, to deliver that service.

If you are using a units-based sales forecast table (for manufacturing and mixed business types), you can project unit costs from the sales forecast table. If you are using the basic sales forecast table for retail, service and distribution businesses, use a percentage estimate, e.g., a retail store running a 50 percent margin would have a per-unit cost of .5, and a per-unit revenue of 1.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Monthly fixed costs:

Technically, a break-even analysis defines fixed costs as costs that would continue even if you went broke. Instead, we recommend that you use your regular running fixed costs, including payroll and normal expenses (total monthly operating expenses). This will give you a better insight on financial realities.

If averaging and estimating is difficult, use your profit and loss table to calculate a working fixed cost estimate—it will be a rough estimate, but it will provide a useful input for a conservative break-even analysis. As sales increase, the profit line passes through the zero or break-even line at the break-even point. This is a classic business chart that helps you consider your bottom-line financial realities. Can you sell enough to make your break-even volume?

The break-even analysis depends on assumptions made for average per-unit revenue, average per-unit cost, and fixed costs. These are rarely exact. We recommend that you do the break-even table twice; first, with educated guesses for assumptions, as part of the initial assessment, and later on, using your detailed sales forecast and profit and loss numbers. Both are valid uses.

Do you have any questions about running a break-even analysis?

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

8 Min. Read

How to Plan Your Exit Strategy

10 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

6 Min. Read

How to Forecast Sales for a Subscription Business

How to Create a Profit and Loss Forecast

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

In Pursuit of Profit: Applications and Uses of Break-Even Analysis

Table of Contents

The break-even analysis is one tool that every entrepreneur should use in their financial planning. It helps you understand your business’s revenue, expenses and cash flow – which is critical to keeping your doors open and your business profitable. Read on to learn more about what a break-even analysis is and how this essential form of financial planning helps business owners make informed decisions.

What is a break-even analysis?

A break-even analysis is a financial tool that helps you determine at which stage your company, service or product will be profitable. It is a financial calculation used to determine the number of products or services a company must sell to cover its expenses, especially the fixed costs.

Here’s an example of the elements that go into a break-even analysis:

- Fixed costs: These are the costs that stay the same no matter how much the business sells, also referred to as overhead costs. They include utilities, bills, salaries and wages, rent, and insurance.

- Variable costs: Variable costs are based on a business’s sales. They can include additional labor from independent contractors, materials and payment processing fees.

- Average price: This is the average amount you will charge for your products and services.

What is the break-even point formula?

Taken together, these elements create a formula known as the break-even point formula. It is a relatively simple calculation, but it is critical in planning for profitability.

Fixed Costs / (Average Price – Variable Cost) = Break-Even Point

The term “break-even” refers to a situation where you are neither making nor losing money, but all of your costs have been covered. With a break-even analysis, you can determine when your company will generate enough revenue to cover its expenses and earn a profit. The same holds true for a particular product or service. This data is often used for financial projections.

Examples of break-even analysis

Here are two examples of the break-even point formula.

The price of one of the products you sell is $100. Your total fixed costs are $10,000 per month, and the variable cost is $50 per product. The formula to calculate how many products you must sell to break even would look like this:

$10,000 / ($100 – $50) = 200

Based on the formula, you would need to sell 200 products to cover your costs, effectively breaking even. To be profitable, you would have to sell at least 201 products.

In this example from the Corporate Finance Institute , a water company has total fixed costs of $100,000. The variable costs of making one bottle of water is $2 per unit, and each bottle is sold for $12. Using the break-even analysis formula, you can see that the company must sell 10,000 bottles to recoup its costs and 10,001 bottles to begin earning a profit:

$100,000 / ($12 – $2) = 10,000

Editor’s note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs.

Why is a break-even analysis important?

A break-even analysis informs you of the bare minimum performance your business must meet to avoid losing money. It also helps you understand at which point you’ll generate profits so you can set production goals accordingly.

You can use this information when your business is in the planning stages to determine whether your idea is feasible or not. Then, once your business is established, you can use a break-even analysis to develop direct cost structures and to identify opportunities for promotions and discounts.

While there is a lot to know about conducting a break-even analysis, let’s focus on the three most common uses.

1. It helps you identify the point of profitability.

A business that doesn’t turn a profit could take a turn for the worse at any time. This is why every company needs to focus on its point of profitability. Ask yourself these questions:

- How much revenue do I need to generate to cover all my expenses?

- Which products or services generate a profit?

- Which products or services are sold at a loss?

A company’s goal is to become profitable as soon as possible. To ensure that you are on the right track, it is necessary to focus on your numbers upfront. If you don’t calculate the break-even points for your products or services, you risk not generating a profit (or not as much of a profit as you believed you would).

2. It ensures that you properly price a product or service.

When most people think about pricing, they primarily take into account how much their product costs to create and fail to consider overhead costs – underpricing their products as a result. Finding your break-even point will help you price your products correctly. You will know where you need to set your margins to generate the right amount of revenue to break even and begin turning a profit.

If you offer only a couple of products or services, determining your break-even point is simple. It becomes more challenging as your service offerings and production increase.

Image via Business Tool Pro

As you determine your break-even point for a product or service, ask yourself the following questions:

- What is the total cost?

- What are the fixed costs?

- What are the variable costs?

- What is the total variable cost?

- What is the cost of any raw materials?

- What is the cost of labor?

Last but not least, you should ask yourself, “What adjustments can I make to lower the cost of manufacturing or generate the end result I envision?” For instance, you may be able to source some products from a cheaper distributor, or perhaps make some changes to your hiring process to save on labor costs.

3. It gives you the information you need to implement the best strategy moving forward.

Using your break-even analysis, you can create a strategy for the future. If your business’s profitability is determined by the success of one or more products, the break-even point for each product provides a timeline for the company, which can help you implement a better overall financial strategy that fits the projected costs and profits.

This analysis can also help you determine ways to speed up your company’s break-even point, such as reducing your overall fixed costs, reducing the variable costs per unit, improving the sales mix by selling more of the products that have larger contribution margins, and increasing the prices (as long as it doesn’t cause the number of units sold to decline significantly).

When should I use a break-even analysis?

There are many situations in running a business where a break-even analysis comes in handy. According to Rick Vazza, a CFA and CFP and the president of Driven Wealth Management , you should use a break-even analysis to answer the following questions about your business:

- How much of my product or service do I need to sell per month?

- How much volume do I expect to sell?

- What price makes those figures match my break-even calculation?

- What price allows me to generate a reasonable profit?

Your goal is to get an accurate look at what your profit, net cash flow and finances will be.

“It’s much easier for people to decide whether they can beat that minimum than guessing how many sales they may make,” said Rob Stephens, founder of CFO Perspective .

Here are three times when you should consider performing a break-even analysis.

If you are expanding your business

Stephens suggests using a break-even analysis to get a reality check on how long it will take any planned investments or changes in your business to become profitable.

“These investments might be a new product or location,” Stephens said. “I’ve done break-even calculations many times for modeling the minimum sales needed to cover the costs of a new location.”

If you need to lower your pricing

This analysis is also helpful when you need to lower your prices to beat a competitor. “You can also use break-even analysis to determine how many more units you need to sell to offset a price decrease,” Stephens said. “The most common use of break-even analysis in my career has been modeling price changes.”

If you want to narrow down your options

When making changes to your business, you may be bombarded with various scenarios and possibilities, which can be overwhelming when you’re trying to make a decision. Stephens suggests using a break-even analysis to reduce your decisions to scenarios with straightforward yes-or-no questions like, “Can we do better than the minimum needed for success?”

More financial planning resources

Here are four additional resources to help you better understand how to conduct a break-even analysis and use the data accordingly:

- University of Baltimore’s break-even calculators

- SCORE’s break-even analysis template

- Colorado State University’s Break-Even Method of Investment Analysis

Julianna Lopez contributed to the reporting and writing in this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Quick Guide to Breakeven Analysis

It’s a simple calculation, but do you know how to use it?

In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You’ve probably heard of it. Maybe even used the term before, or said: “At what point do we break even?” But because you may not entirely understand the math — and because understanding the formula can only deepen your understanding of the concept — here’s a closer look at how the concept works in reality.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

🎉 Celebrate Small Business Month:

25% Off Annual Plans! SAVE NOW

0 results have been found for “”

Return to blog home

Break-Even Analysis Explained—How to Find the Break-Even Point

Posted november 2, 2022 by kiara taylor.

Conducting a break-even analysis is a crucial tool for small business owners. If you’re planning on launching a business, writing a business plan , or just exploring a new product, knowing your break-even point can tell you whether or not a product or service is a good idea.

In this guide, we’ll cover what a break-even point is, why it’s critical to calculate, how to calculate it, and additional factors you should consider.

What is the break-even point?

The break-even point is where an asset’s market price equals its original cost. Put another way; the break-even point is when the total revenues of a certain production level equal the total expenses of producing that product. For small business owners, it’s essentially the amount that you need to earn in order to cover your costs.

Why you should know your break-even point

So, why is knowing your break-even point so important? Here are a few important reasons to consider.

Minimize risk

Risk comes in various forms , but break-even points can help you understand the viability of certain products before they’re even launched.

For example, before even sending an order to a factory, you can already know how many units you need to sell and what expenses will go into making that product. Understanding this is key whether you’re launching a business for the first time or starting a new product line.

Identify unseen expenses

Running a break-even analysis forces you to outline all potential expenses associated with an initiative. Expenses that you’d otherwise miss without it. Usually, these expenses come from the fixed and variable costs of production. In this process, you can often identify unexpected expenses that you may not have considered before.

Appropriately price your products/services

Because your break-even point concerns the price relationship to your expenses, you can calculate different break-even points based on sold units or different pricing schemes. For example, you may find that your product is unprofitable at a certain price point except at extremely large scales.

If that’s the case, you can explore higher price points. However, it’s important that you do not do this in isolation. Instead, use this exercise to understand potential pricing options and begin testing them with your target customers .

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Prepare for funding

If you’re seeking funding for your business, this information is often expected or required by lenders and investors . It helps them gauge the viability of your idea and determine what level of funding is appropriate. For you as a business owner, it can help you determine how much funding you think you’ll need and even identify how you’ll use those funds.

How to calculate the break-even point

To calculate your break-even point, you’ll need to know the following:

- Fixed costs: Expenses that remain consistent no matter your sales volume.

- Variable costs: Expenses that change depending on your sales/production volume.

- Sales price: The price that you intend to sell the product/service for.

Break-even point formula

The break-even point is calculated using your fixed costs and your contribution margin. The contribution margin is the selling price of the product minus the total variable costs. Your selling price is usually the amount you place on any customer invoices.

The contribution margin formula is:

Contribution Margin = Selling Price – Total Variable Costs

Once you have the contribution margin, you then take the total fixed costs per unit and divide those costs by the contribution margin. This will give you the break-even number of units required to offset your costs.

The break-even point formula is:

Break-Even Point = Fixed Costs / Contribution Margin

Break-even point example

Now that you know the formula for calculating your break-even point let’s put it into practice.

Imagine you are the owner of a small paper company and considering adding a new line of paper to your available products. You expect to sell a ream of paper for $5.00.

The variable costs of the ream of the paper include:

- $1.00 for the paper itself

- $0.50 for the packaging of the ream

- $0.50 of costs to package each ream

According to this information, you have $2.00 in variable costs. Using the formula mentioned above, we can calculate the contribution margin for your paper ream:

$5.00 – $2.00 = $3.00

Next, we’ll incorporate fixed costs to determine how many units need to be sold. After holding an office meeting in the conference room, you determine that the following fixed costs are associated with producing reams of paper:

- $50.00 in salaries

- $50.00 in office rent

- $50.00 for monthly shipments from the paper factory

Your total fixed costs come to: $50.00 + $50.00 + $50.00 = $150.00.

Lastly, we’ll calculate the break-even point: $150.00 / $3.00 = 50 units. To break even, you would need to sell 50 reams of paper.

Maximizing your break-even point formulas

You can also utilize this calculation to figure out your break-even point in dollars. This is done by dividing the total fixed costs by the contribution margin ratio. You can figure out your contribution margin ratio by taking the contribution margin per unit and dividing it by the sales price.

Your contribution margin ratio using the data from the above example is:

$3.00 (your contribution margin) / $5.00 (price per one ream of paper) = 60%.

Finally, divide your total fixed costs ($150.00) by your contribution margin ratio (60%) to calculate the break-even point in dollars:

$150.00 / 60% = $250.00 in sales

You can confirm your findings by multiplying your break-even point in units (50) by the sales price ($5.00):

50 x $5.00 = $250.00

What is a standard break-even time period?

The standard break-even period is hard to predict and fully depends on your business. However, once you know your break-even point, you can gauge the time it will take to break even more accurately.

Your break-even period is the amount of time it takes you to sell enough units to break even. This means that the only thing holding back your ability to break even is how fast you sell your units.

The formula to calculate your break-even time period is:

Break-Even Time Period = Break-Even Units / Amount Sold per Period (Period)

If we return to the paper company example, we can estimate what the break-even period is. After reviewing your financials, you learn that the average number of reams you expect to sell daily is 5. Now, take your number of break-even units (50) and divide them by the amount sold in a given period (5):

50 / 5 = 10. Under this analysis, you would break even in approximately 10 days.

However, it’s important to remember that fixed costs, which are an important part of calculating your break-even point, may accumulate faster than you can sell your product. In that case, you’ll need to factor this into your analysis.

How to lower your break-even point

Everyone wants to lower their break-even point because it typically leads to greater profitability at a faster rate. But how do you lower your break-even point? The key thing to remember is that it’s a ratio of your fixed and variable costs. To reduce your break-even point, you’ll need to lower one or both.

One of the most efficient ways to reduce your break-even point is to start by reducing variable costs. Keep in mind that variable costs are associated with each unit. Other fixed costs, those that exist regardless, like the $20-$80 you pay for your employees’ no medical life insurance every month, can be more difficult to eliminate because they are essential.

What you can do with a break-even analysis

Conducting an initial break-even analysis is incredibly useful when starting a business. But, did you know that you can use it on an ongoing basis as part of your management process ? Here are a few key uses you can leverage.

Determine if your prices are correct

A break-even analysis can be used to continuously audit and fine-tune your pricing strategy. If you find sales are missing expectations, you can reference this calculation to easily understand what quantities must be sold if you decide to adjust the price.

Explore current fixed and variable costs

You can also explore how different costs impact your bottom line. At the end of the day, your business needs to know what costs are impacting its ability to generate revenue. A break-even analysis can help you understand whether some products may be costing you more money than their worth. For example, products with low contribution margins or ratios might be too expensive to keep in production.

Narrow down financial scenarios

Finally, you can use your break-even analyses as part of any forecast scenarios that you explore. By changing numbers in your formula, you can test different types of prices and quantities based on perceived consumer interest. This can help inform a larger analysis of your sales, cash, and expenses based on how reasonable your price and volume adjustments are.

Other metrics to consider

Now that you understand break-even points and break-even analysis, you’ll be able to put them to work for your business. Remember, this is just a piece of measuring business performance and there are other valuable metrics you should be tracking. You can do this manually with spreadsheets, leverage budgeting and accounting software, or better explore future performance with LivePlan’s performance tracking and forecasting features .

Whatever option you choose, the important thing is that you are aware of these metrics and actively using them. It will help you better understand the health of your business, make more strategic decisions, and ultimately grow your business.

Like this post? Share with a friend!

Kiara Taylor

Posted in growth & metrics, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Break-Even Analysis: What It Is and How to Calculate

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A break-even analysis helps business owners find the point at which their total costs and total revenue are equal, also known as the break-even point in accounting . This lets them know how much product they need to sell to cover the cost of doing business.

At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

advertisement

QuickBooks Online

What is the break-even analysis formula?

The break-even analysis formula requires three main pieces of information:

Fixed costs per month: Fixed costs are what your business has to pay no matter how many units you sell. This could include rent, business insurance , business loan payments, accounting and legal services and utilities.

Sales price per unit: This is the amount of money you will charge the customer for every single unit of product or service you sell. Make sure to include any discounts or special offers you give customers. If you sell multiple products or services, figure out the average selling price for everything combined.

Variable costs per unit: These are the costs you incur for each unit you sell. They may include labor, the price of raw materials or sales commissions, and they are subject to change as sales fluctuate. To calculate, multiply the number of units produced by the costs of producing just one unit.

From there, the break-even point can be calculated in units.

Break-even point in units = fixed costs / (sales price per unit – variable costs per unit)

This gives you the number of units you need to sell to cover your costs per month. Anything you sell above this number is profit. Anything below this number means your business is losing money.

Once you’re above the break-even point, every additional unit you sell increases profit by the amount of the unit contribution margin. This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula. To find it, subtract variable costs per unit from sales price per unit.

» MORE: Best apps for small businesses

Break-even analysis example

Let's say you're thinking about starting a furniture manufacturing business. The first unit you're going to sell is a table. How many tables would you need to sell in order to break even?

If it costs $50 to make a table and you have fixed costs of $1,000, the number of tables you must sell to break even varies depending on price. Here are two scenarios:

If you sell a table at $100: $1,000 / ($100 — $50) = 20 tables

If you sell a table at $200: $1,000 / ($200 — $50) = 6.7 tables

This is a great example of how selling a product for a higher price allows you to reach the break-even point significantly faster. However, you need to think about whether your customers would pay $200 for a table, given what your competitors are charging.

» MORE: NerdWallet’s picks for the best small-business accounting software

When to use break-even analysis

Break-even analysis formulas can help you compare different pricing strategies.

For example, if you raise the price of a product, you’d have to sell fewer items, but it might be harder to attract buyers. You can lower the price, but would then need to sell more of a product to break even. It can also hint at whether it’s worth using less expensive materials to keep the cost down, or taking out a longer-term business loan to decrease monthly fixed costs.

Here are a few specific situations where a break-even analysis is especially useful:

Starting a new business: When starting a business , break-even analysis can help you figure out the viability of your product or service. If you do this analysis along with writing a business plan, you can spot weak points in your company's financial strategy and develop a plan to address them.

Launching a new product or service: Whenever you launch a new product or service, you'll need to determine its sale price and how much it costs to produce it. Using a break-even analysis, you can see how both of these factors affect your profitability. Eventually, you can choose a price that's fair to customers and realistic for your company.

Adding a new sales channel: If your business model changes to incorporate a new sales channel, that's a good opportunity to do a break-even analysis. For example, if you have a brick-and-mortar store but want to start an e-commerce business, your costs and pricing might change. You should make sure you at least break even so that you don't put too much financial strain on your business.

This article originally appeared on Fundera, a subsidiary of NerdWallet.

On a similar note...

Original text

What is a break-even analysis? The break-even point is the point when your business’s total revenues equal its total expenses.

Your business is “breaking even”—not making a profit but not losing money, either.

After the break-even point, any additional sales will generate profits.

To use this break-even analysis template, gather information about your business’s fixed and variable costs, as well as your 12-month sales forecast .

When should you use a break-even analysis.

A break-even analysis is a critical part of the financial projections in the business plan for a new business. Financing sources will want to see when you expect to break even so they know when your business will become profitable.

But even if you’re not seeking outside financing, you should know when your business is going to break even. This will help you plan the amount of startup capital you’ll need and determine how long that capital will need to last.

In general, you should aim to break even in six to 18 months after launching your business. If your break-even analysis shows that it will take longer, you need to revisit your costs and pricing strategy so you can increase your margins and break even in a reasonable amount of time.

Existing businesses can benefit from a break-even analysis, too.

In this situation, a break-even analysis can help you calculate how different scenarios might play out financially. For instance, if you add another employee to the payroll, how many extra sales dollars will be needed to recoup that additional expense? If you borrow money, how much will be needed to cover the monthly principal and interest payments?

A break-even analysis can also be used as a motivational tool. For instance, you can calculate a monthly, weekly, or even daily break-even analysis to give your sales team a goal to aim for.

Do you need help completing your break-even analysis? Connect with a SCORE mentor online or in your community today.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Sales Forecast (12 months) The sales forecast is the key to the whole financial plan, so it is important to use realistic estimates. Download SCORE's Sales Forecast template.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

ZenBusinessPlans

Home » Business Plans

How to Do a Business Plan Break Even Analysis for Beginners

Are you currently writing a business plan and want to do break even analysis? If YES, here’s a beginner’s guide on how to calculate break even point for a business.

Every business is established with the aim of making profits. No entrepreneur wants to go through the stress of establishing and running a business that would not be able to pay its bills after a particular time frame. This is the major reason why it is very pertinent to run a break even analysis whenever one thinks of starting a business.

What is a Break Even Analysis?

Break even analysis is a calculation that will tell you how many units of products you need to sell or how many people you have to offer services to in order to break even in your business. In essence, your break-even point is the sales level that is required for your business to operate without incurring financial loss. To succeed in any business you are doing, it is pertinent to determine this point as the viability of your business is reliant on staying above this number.

For instance, as an entrepreneur selling umbrellas, you need to know how many umbrellas you need to sell to cover your overhead costs. You need to know that anything you sell above your break-even point will mean profit for your business.

A break-even analysis is a key part of any good business plan as it would help you know if your business idea is worth pursuing, and it can remain helpful in the long run as a way to figure out the best pricing structure for your products.

It is a fact that experienced entrepreneurs would not even think of starting a business until they are sure, from their break-even analysis, that their predicted revenue would be greater than their costs, and that they can break even at a certain point that is predictable. Once this point is established, the entrepreneurs can then continue creating their business plans. A break-even analysis is the best way to determine whether your business idea is a winner or a loser.

A company can be said to have achieved break even when its total sales or revenue equals its total expenses. No profit has been made at the break even point, and no losses have been incurred either. It should be noted that any revenue that is made above the breakeven point is pure profit for the business.

4 Times When It is Important to Carry Out Break Even Analysis

- When starting a new business

Like we have already established, whenever you want to start a new business, your first thoughts should go to conducting break even analysis. Not only will it help you decide if your business idea is viable, but it will force you to do research and be realistic about costs, as well as think through your .

- When you want to create or introduce a new product line

If you already have a running business, you are still required do a break-even analysis before adding a new product line, especially if that product is expected to add significant expenses to your business. Even if your fixed costs, like an office lease, stay the same, you will need to work out the variable costs related to your new product and set prices before you start selling.

- When adding a new sales channel

Any time you add a new sales channel, your costs will change—even if your prices don’t. For example, if you have been selling online and you are now thinking about opening a pop-up shop, you will have to make sure you at least break even so as not to add a strain to your business.

- When changing your

If you are thinking about changing your business model, for example, switching from a retail store to eCommerce, you are required to do a break-even analysis. Your costs could change significantly and this will help you figure out if your prices need to change too.

When conducting a break-even analysis, you need to take note of certain variables. The first step basically is to list all your costs of doing business. You need to put down everything, from the cost of your product, to rent, to bank fees and others. Think through everything you have to pay for and write it down.

The next step is to divide them into fixed costs and variable costs.

- Fixed Costs

Fixed costs are any costs that stay the same regardless of how much products you sell. This could include things like rent, software subscriptions, insurance, deposits or contingency funds and labour. You have to make a list of everything you have to pay for no matter what.

In most cases, you can list the expenses as monthly amounts unless you are considering an event with a shorter time frame. If you are starting your business from the scratch, you should never rely on guesswork to estimate your costs. You can check with trade associations for information on average costs in your particular industry.

- Variable Costs

Variable costs are costs that fluctuate based on the amount of products you sell. This could include things like materials, commissions, payment processing, labour, shipping costs of the product, and inventory etc.

Some costs could go in either category, depending on your business. If you have salaried staff, they will go under fixed costs. But if you pay part-time hourly employees who only work when it’s busy, then they will be considered as variable costs.

- Average price per unit

Finally, you need to decide on a price for your product. Don’t worry if you are not ready to fix a final price yet, you can change this later. Keep in mind that this is just the average price. If you offer some customers bulk discounts, it will lower the average price. To determine your price, consider these factors:

- What is your competition selling the same thing for?

- Do you want to be at the low, middle, or high end of the price range?

- What is your cost for the unit, and how much profit do you want to make above that?

You can also use informal focus groups to see what people might be willing to pay for your wares or services.

Importance of the Breakeven Point for Businesses

It is very possible for a business to be turning over a lot of money and still be running at a loss. By determine your breakeven point, you will be able to decide the appropriate price, sales budget to have and it also helps in preparing the business plan. The breakeven point analysis is a very useful parameter for determining the critical profit driver for your business including sales volume, average production costs and average sales price.

The other importance of a breakeven point is that it will help you to be able to:

- Determine the productivity of the current product or service you are into

- Know how far you can sustain declining sales in your business before you will start incurring loses.

- Know how many units of your products that you will need to sell before you will be able to make profits

- Know how reduction of sales volume or price will affect your business

- Know how much of an increase in price or volume of sales you will need to make up for an increase in fixed costs.

Calculating Your Break-Even Point

In order to determine your break even point, you will have to arrange the above figures into a break-even analysis formula. A breakeven analysis formula looks like this:

- Break-even point = fixed costs / (average price per unit – variable costs)

Using the formula above, and using the example of an entrepreneur that retails shoes. Let’s just say his fixed costs are $2,000 a month, and his average sales price is $100. It costs him $40 to buy each shoe, which leaves $60. Divide that into $2,000 (monthly fixed costs) and the entrepreneur must sell 33 shoes a month to break even. Any units he sells above that are profit.

Another example, if you have a business that is selling digital information products online at a rate of $100 (that is, the selling price is equal to $100), and the variable cost is $20 and the fixed cost for a particular period in question is $2,000. To get the breakeven point in number of units, you should divide the fixed cost by the contribution.

To get the contribution or gross profit, you will have to subtract the selling price ($100) by the variable cost ($20) which will give you $80. Therefore dividing the fixed cost ($2,000) by the contribution ($80) will give you a breakeven point of 25 units (2,000 ÷ 80 = 25). What this answer means is that 25 units of the information product must be sold in order to cover the costs of running the business.

What Will Happen to the Breakeven Point If Sales Change?

So, what would be the fate of your breakeven point in the event that sales change? Take for instance, if the economy of the country was in recession, the sales that the business has may drop. If this should happen, then you may stand the risk of not selling enough to meet your breakeven point.

Using the business that is selling digital information products above as an example, you might not sell up to the 25 units that are needed in order to breakeven. In this scenario, you will not be able to pay all your expenses, so what can you do to remedy this situation?

There are two possible solutions to this problem. You can either decide to raise the price of your product or you can find ways to cut your costs, both fixed and variable.

- Analyzing your Outcomes

A break even analysis is not just conducted for fun, the analysis if done well is meant to speak volumes about your intended business. In this wise, it’s important to understand what the result of your break even analysis is telling you. The above analysis has told us that the entrepreneur will break even in business when he sells 33 pairs of shoes in a month. This is great, but the next step is to decide whether this can be done at a particular point in time.

If you don’t think that you can sell 33 pairs of shoes within one month as dictated by your financial situation, patience, personal expectations, location and other variables, then this may not be the right business for you. This is because the business would not be able to produce the cash that would sustain it.

If your break-even point is higher than you expected but you still have hopes for the business, you may consider manipulating certain factors to yield a desirable break-even point. You can consider shopping around for less expensive shoes, reducing the number of, or eliminating employees altogether, working from home and raising your sales price.

If after changing some of these factors your break-even point is still too high, then your business idea may not be attainable. This realization is what makes break-even analyses so important. If you end up scratching your supposed business plan, then know that you have saved yourself a lot of time, effort and money.

Furthermore, you need to understand that a break even analysis cannot accurately predict demand. If you go to the market with the wrong product or the wrong price, it may be tough to ever hit your break-even point.

Drawbacks of Break-Even Analysis

Though conducting breakeven analysis for your business is quite necessary before even writing business plan , it is a fact that this analysis also has its drawbacks or limitations. Some of these drawbacks include;

- It doesn’t take note of future changes

One typically ignores the future when calculating breakeven analysis. Although your analysis would show you how many units of products you need to sell over the course of the month, but you won’t see how things would change if your sales fluctuate week to week.