English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- AMD (ADVANCED MICRO DEVICES)

- NVIDIA CORPORATION

- NIPPON ACTIVE VALUE FUND PLC

- GAMESTOP CORP.

- META PLATFORMS, INC.

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Growth stocks at reasonable prices

- Trend-Following Stocks

- Momentum stocks

- Quality stocks at a reasonable price

- Solar energy

- The genomic revolution

- Pricing Power

- Europe's family businesses

- Financial Data

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- The Golden Age of Video Games

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

National Grid plc

Gb00bdr05c01, multiline utilities.

| Market Closed - London S.E. 11:35:27 2024-06-07 am EDT | 5-day change | 1st Jan Change | ||

| 869.2 | +0.60% | -1.50% | -17.84% | |

| Jun. 06 | ||

| Jun. 06 | RE |

- National Grid : WPD RIIO-ED2 final business plan - Dec 2021

Western Power

Distribution

RIIO-ED2 final business plan

Investor Relations | December 2021

"Our commitment to customers for RIIO-ED2:

A transformed energy network to drive net zero by as early as 2028 across our region. This is what WPD's highly ambitious Business Plan for 2023-2028(RIIO-ED2) will deliver. It has been co- created with more than 25,000 stakeholders and future customers and has received significant levels of acceptability from wider consumers"

Highlights from our business plan

Investment of £6.7bn during 2023-2028 with embedded efficiency savings of £723m

- A 27% increase on annual average expenditure in RIIO-ED1

- Capex of £6.1bn across the regulatory period

- The average customers' bill to remain broadly flat in real terms

- 96% of customers found the plan fully acceptable

Large expenditure in network resiliency, customer service support and new infrastructure

- The business and its regions to be net zero by as early as 2028, the fastest commitment in the UK

- To be ready for 1.5m EV's and 600,000 heat pumps, by providing timely, affordable low carbon technology connections, a 279% increase in our EV commitment compared to RIIO-ED1

- 1.2m vulnerable customers to be offered a smart energy advice plan every two years

- The average customer power cut will only last 22 minutes by end of RIIO-ED2, every two years

- A target of 93% for customer satisfaction

Our commitment to 'net zero' is underpinned by our four core pillars | Sustainability Connectability |

- Sustainability - leading the drive to net zero as early as possible

- Connectability - enabling customers to connect when they want to

- Vulnerability - first class customer support where everyone benefits

• Affordability - maintaining excellent customer service, safety and network performance and transforming the energy grid, while keeping bills broadly flat

RIIO-ED2 Timeline

Vulnerability Affordability

FY21/22 | FY22/23 | FY23/24 | ||||||||

Formal business plan | Draft | Statutory | RIIO-ED2 | |||||||

submission to Ofgem | determination | licence | starts | |||||||

consultation | ||||||||||

Independent stakeholder | ||||||||||

Open hearings | Final | |||||||||

user group reports to Ofgem | ||||||||||

determination | ||||||||||

Independent challenge | ||||||||||

group reports to Ofgem |

National Grid - Western Power Distribution | How WPD is delivering in RIIO-ED1 |

- Responsible for distributing electricity to 8m customers

- Operating a network of assets across the Midlands, South West and Wales, serving homes and businesses

- The top performing DNO for overall customer satisfaction since 2015, with an average score of 90%

- Helped 92,000 fuel poor customers save more than £37m on their energy bills since 2015

- Delivered a 38% reduction in power cuts and a 48% reduction in power cut duration since 2015

- Reduced our business carbon footprint by 36% since 2015

- Over and above our plan, we spearhead the UK's largest rollout of flexibility services and are increasing available network capacity for demand growth by 709MW

Further highlights of WPD's final

RIIO-ED2 business plan

- Targeting additional savings of £95m through innovation and digitalisation

- Maximising efficiency of the existing network, will save money for customers by avoiding £94m in conventional reinforcement

- A new same day connections response for low carbon technologies to enable a significant increase in renewable generation

- Increase the resilience of the network to environmental factors and to cyber and physical attacks

- £1m 'Community Matters' Support Fund plus £540k to install solar PV at 45 schools per year funded by shareholders

WPD's RIIO-ED2 baseline totex

Vehicles, | Other | |||||||

Property & | ||||||||

Engineering | ||||||||

Equipment | 7% | 42% | Non Load Network | |||||

Investment and | ||||||||

IT & | ||||||||

Reinforcement | ||||||||

Telecoms | 13% | Baseline totex | ||||||

42% | ||||||||

17% | £1.3bn p.a. |

Engineering Management

Changes to our draft business plan

- Our plan is now based on expenditure to achieve WPD's Best View, which represents the most realistic uptake of low carbon technologies and demand growth

- Clearer quantification of efficiencies

- Six final Consumer Value Propositions

- An updated expenditure total and financing parameters including cost of equity: 4.96%

Important notice

Our proposed financial package

Cost of | Cost of | Cost of | Gearing |

equity | debt | Capital | |

4.96% | 2.22% | 3..31% | 60.0% |

Note: CPIH real, RIIO-2 average

- Assumed dividend yield: 5%

- Totex capitalisation rate: 75%

- 45-year straight line depreciation for new assets

This document contains certain statements that are neither reported financial results nor other historical information. These statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include information with respect to National Grid's financial condition, its results of operations and businesses, strategy, plans and objectives. Words such as 'aims', 'anticipates', 'expects', 'should', 'intends', 'plans', 'believes', 'outlook', 'seeks', 'estimates', 'targets', 'may', 'will', 'continue', 'project' and similar expressions, as well as statements in the future tense, identify forward-looking statements. Furthermore, this document, which is provided for information only, does not constitute summary financial statements and does not contain sufficient information to allow for as full an understanding of the results and state of affairs of National Grid, including the principal risks and uncertainties facing National Grid, as would be provided by the full Annual Report and Accounts, including in particular the Strategic Report section and the 'Internal control and risk factors' section on pages 236 to 239 of National Grid's most recent Annual Report and Accounts for the year ended 31 March 2021, as updated by National Grid's unaudited half-year financial information for the six months ended 30 September 2021, published on 18 November 2021. Copies of the most recent Annual Report and Accounts are available online at www.nationalgrid.com or from Equiniti Limited. Except as may be required by law or regulation, National Grid undertakes no obligation to update any of its forward-looking statements, which speak only as of the date of this document. The content of any website references herein do not form part of this document.

Further information

Nicholas Ashworth

Director of Investor Relations

- +44 (0) 7814 355590 [email protected]

James Flanagan

Investor Relations Manager (US)

- +44 (0) 7970 778952 [email protected]

National Grid plc 1-3 Strand London WC2N 5EH United Kingdom

Angela Broad

Senior Investor Relations Manager

- +44 (0) 7825 351918 [email protected]

Caroline Dawson

Investor Relations Manager

- +44 (0) 7789 273241 [email protected]

Peter Kennedy

- +44 (0) 7966 200094 [email protected]

Investor Relations Officer

- +44 (0) 7899 928247 [email protected]

@Grid_Media

nationalgrid.com/investors

Attachments

- Original Link

- Original Document

National Grid plc published this content on 02 December 2021 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 02 December 2021 11:40:07 UTC .

Latest news about National Grid plc

| RE | RE | CI | CI | CI | CI | CI | MT | MT | MT | RE | AN | ZD | MT | ZD | AN | MT | AN | ZD | MT | RE | RE |

Chart National Grid plc

Company Profile

Income statement evolution, analysis / opinion.

National Grid plc : High voltage

May 27, 2024 at 11:33 am EDT

NATIONAL GRID : Model update after a £7bn rights issue

Ratings for National Grid plc

Analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector other multiline utilities.

| 1st Jan change | Capi. | |

|---|---|---|

| -17.84% | 41.16B | |

| -24.57% | 80.8B | |

| +51.12% | 74.65B | |

| -.--% | 51.55B | |

| -5.77% | 39.26B | |

| +19.18% | 36.3B | |

| +1.48% | 34.81B | |

| -17.00% | 27.48B | |

| +8.33% | 23.94B | |

| -9.97% | 22.96B |

- Stock Market

- News National Grid plc

The latest Investing Matters Podcast episode with London Stock Exchange Group's Chris Mayo has just been released. Listen here .

- Share Prices

- AQSE Share Prices

- Stock Screeners

- News & RNS

- Trading Brokers

- Finance Tools

Latest Share Chat

- GGP. If it ever gets resolved...

- THG. Further dissent by other lar...

- CASP. He's worth it haaaaaaaaaaaaa...

- HBR. All the bots paid from the n...

- CEY. Our Sukari team in Egypt joi...

- THG. Https://www.thetimes.co.uk/a...

- KOD. Lmao, you lot have too much ...

- CCL. You can even get frat fruit ...

- GGP. WEDNESDAY 7 AUGUST 2:00 pm ...

- GKP. Following the Dubai model an...

- Finance News

National Grid's Western Power finalises RIIO-ED2 business plan

Wed, 01st Dec 2021 10:07

(Alliance News) - National Grid PLC on Wednesday said its UK electricity distribution business, Western Power Distribution will submit its final business plan to energy regulator Ofgem for the RIIO-ED2 price control period, which runs over five years from 2023 to 2028.

Shares in the FTSE 100 gas and electric utility were down 1.0% at 996.70 pence on Wednesday in London.

Western Power's plan has a baseline capital expenditure and operational expenditure spend of GBP6.7 billion over the period, reflecting a 30% rise from the levels seen in the ED1 period.

This investment is expected to fund Western Power's commitments to provide a further 1.5 million electric vehicles and 600,000 heat pumps.

The price controls of Ofgem set the revenue monopoly electricity network owners can earn from charges on consumers' energy bills.

"The plans include a financial framework that takes account of recent regulatory precedent as well as the uncertainty around the pace of the energy transition and the impact it will have on electricity distribution investment. Given this, it is critical for all stakeholders that we have the right incentives, and an appropriate level of return, to attract the investment required to enable net zero goals," National Grid stated.

By Dayo Laniyan; [email protected]

Copyright 2021 Alliance News Limited. All Rights Reserved.

Related Shares

London stocks close higher on miners boost; ECB cuts rates

FTSE 100 up 0.5%, FTSE 250 adds 0.2% *

LONDON BROKER RATINGS: Berenberg raises Ricardo; Goldman cuts LandSec

(Alliance News) - The following London-listed shares received analyst recommendations Monday morning and on Friday:

Citi upgrades National Grid, cites attractive risk/reward

(Sharecast News) - Citi upgraded National Grid on Monday to 'buy' from 'neutral' and lifted the price target to 985p from 920p as it cited an attracti...

London stocks end higher for third month

FTSE 100 up 0.5%, FTSE 250 gains 0.3% *

LONDON MARKET CLOSE: FTSE 100 rounds off decent May with gain

(Alliance News) - Equities in Europe ended higher on Friday, though stocks in New York were weaker, despite a key US inflation gauge landing in line w...

Login to your account

- Login failed

Quickpicks are a member only feature

National Grid: Rights Issue Highlights Lack Of Compounding

- A couple of years after the step down of baseline compensation for the transmission network, the distribution concession is now also seeing lower baseline comp.

- Transmission is growing because RAB gets indexed to inflation, but a lot of the growth was non-recurring and otherwise has to be financed by large basically obligatory CAPEX.

- The compensation at fair values by Ofgem means that there's no outstanding compounding engine here. It's why they needed to do a rights issue equity raise.

- The absolute forward P/E at around 14x barely competes with risk free rates, which might be fair, but it's not compelling.

- At least it's a better profile and valuation than Redeia.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

National Grid Plc ( NYSE: NGG )( OTCPK:NGGTF ) is past the RIIO-ED1 compensation regime as of March 2023 and is now in ED2, and it's been working on the RIIO-T2 regime since 2021 for the transmission networks. ED2 was appealed and contested by operators, as always, over the fact that its compensation may not be sufficient for the operators of the transmission and distribution concessions. Not just now but also in 2021 , lowered regulated cost of equity brings down compensation rates to the point where National Grid has actually done a rights issue in order to expand its coffers, possibly to deal with grid improvements in order to handle the electrification trend, already having maximised their comfortable debt capacity. We addressed this as the primary issue in our last coverage . Still, their major RAB growth and capital investments are allowing for growth on a constant currency (C.C.) basis. While it's not a business we're interested in due to a moderate absolute valuation and relatively poor economics, we do note that it's valued better than other regulated utilities that might be considered in a business-unfriendly environment.

Earnings Breakdown

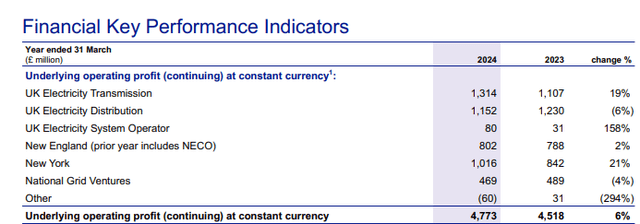

The C.C. figures pan out as follows for the full year :

FY IS Highlights (FY PR)

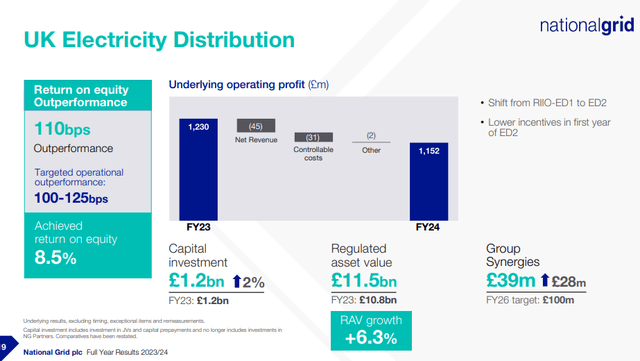

Distribution fell on account of lower baseline compensation from the RIIO-ED2 regime which was not offset by investments and higher RAB. Additionally, there was cost inflation in operating the distribution network for electricity. This is the ED2 regime. It is still benefiting from a RAB that is indexed to inflation, but the lower baseline is the issue, even after revisions up from the first draft, which was rough.

Distribution Concession (FY Pres)

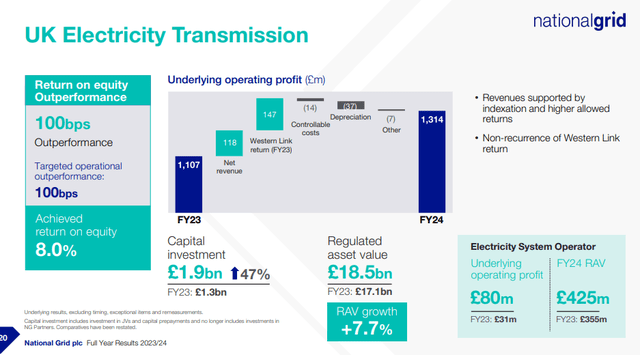

The RIIO-T2 regime was also complained about by the operators , but at least it has indexation in it which has allowed for higher costs of capital, indexed to the prevailing rate environment, to up the compensation accordingly over the last couple of years since the regime came into effect in 2021. Half the growth in the segment was due to liquidated damages from Western Link, which is a major project among UK regulated utilities to allow for export of clean energy from Scotland to the English and Welsh grids. This is a non-recurring positive effect and related to investigations around the timely delivery of the project.

UK Transmission Concession (FY Pres)

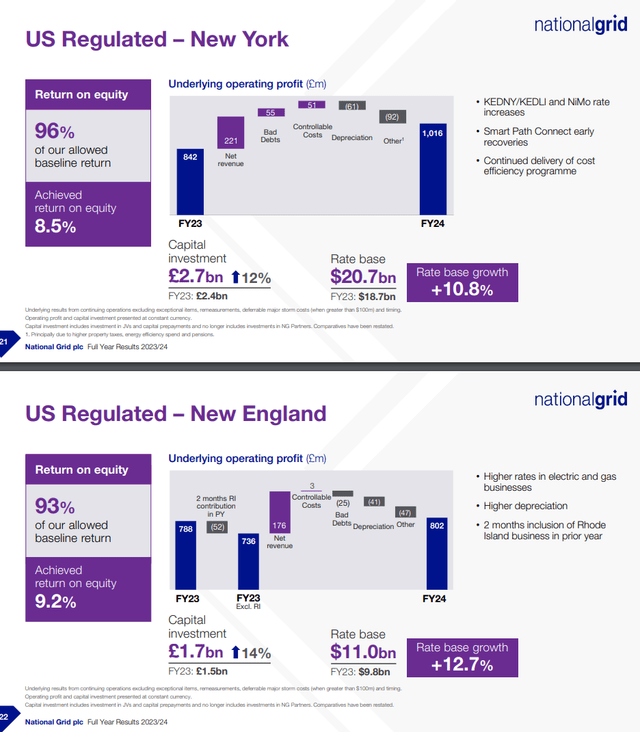

In terms of regulatory pressure, the later adoption of electrification in the US means that it's less intense, and NG has been able to negotiate rate increases with the public utility authorities, getting pretty substantial raises to its rates in New England and in New York . In general, these US concessions, which are around 40% of operating profit, are attractive from a regulatory point of view.

US Concessions (FY Pres)

Bottom Line

Ofgem lowering cost of equity to levels that are notionally in line with a lower-beta equity return, around a 5.23% total at low assumed interest rates , has been a blow to the distribution business. The RIIO-T1 used to be unusually attractive for the transmission concessions before, but the change to T2 had brought things back to Earth in 2021. Together, the last few years have been a period of greater regulatory pressure and virtually no excess returns on the infrastructural investments. Of course, NG receives in exchange a less volatile cash flow, but things aren't that great in the UK concessions, particularly in a rather inflationary environment where one will be concerned whether broad indexation fully does the job of compensating the operators who have to take the risk of operating the network at inflating costs. The US concessions don't have that issue and are close to 50% of the business on a normalised basis.

It is still technically a growth business, as there is a lot to do in terms of growing RAB and meeting demand from the grid from consumers, but when that incremental investment is done at more or less fair value, there is no scope for outstanding value creation in the economic set up of the UK concessions. Again, the US concessions offer more latitude.

Highlighting the issues is the rights issue, which is increasing share counts by about 30%. This is of course dilutive, and also reflects perhaps a peaking debt capacity, with net debt at around 10x underlying operating profits and cash flows. The need for this outside financing at peak debt capacity reflects the lack of a compounding engine, so some negative market reaction was unsurprising. The return will be lower than the cost on those funds incrementally, but NGG is basically obligated to make improvements. This is all on top of the high pace of asset growth they are currently sustaining, skewed almost entirely to the UK and not the US concession.

CAPEX Mounting (FY 2023 Pres)

These are all negative considerations, and it's why we aren't really interested in it at a 13x multiple due to the relatively weak absolute earnings yield, even in the face of guided 6-8% EPS growth even after the rights issue. However, we note that on average, it's in a much better place than a peer like Redeia ( OTCPK:RDEIY ). The CNMC in Spain is perennially more difficult than the UK regulators around compensation, and NGG has its US concessions. Yet, Redeia trades at around a 17x PE on a forward basis.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab . We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4% . We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration.

This article was written by

The Valkyrie Trading Society is a team of analysts sharing high conviction and obscure developed market ideas that are downside limited and likely to generate non-correlated and outsized returns in the context of the current economic environment and forces. They are long-only investors.

They lead the investing group The Value Lab where they offer members a portfolio with real time updates, chat to answer questions 24/7, regular global market news reports, feedback on member stock ideas, new trades monthly, quarterly earnings write-ups, and daily macro opinions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About ngg stock.

| Symbol | Last Price | % Chg |

|---|

More on NGG

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| NGG | - | - |

| NGGTF | - | - |

Trending Analysis

Trending news.

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Altitude, Area, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

| Country | |

|---|---|

| Oblast |

Elektrostal Demography

Information on the people and the population of Elektrostal.

| Elektrostal Population | 157,409 inhabitants |

|---|---|

| Elektrostal Population Density | 3,179.3 /km² (8,234.4 /sq mi) |

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

| Elektrostal Geographical coordinates | Latitude: , Longitude: 55° 48′ 0″ North, 38° 27′ 0″ East |

|---|---|

| Elektrostal Area | 4,951 hectares 49.51 km² (19.12 sq mi) |

| Elektrostal Altitude | 164 m (538 ft) |

| Elektrostal Climate | Humid continental climate (Köppen climate classification: Dfb) |

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal Weather

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

| Day | Sunrise and sunset | Twilight | Nautical twilight | Astronomical twilight |

|---|---|---|---|---|

| 8 June | 02:43 - 11:25 - 20:07 | 01:43 - 21:07 | 01:00 - 01:00 | 01:00 - 01:00 |

| 9 June | 02:42 - 11:25 - 20:08 | 01:42 - 21:08 | 01:00 - 01:00 | 01:00 - 01:00 |

| 10 June | 02:42 - 11:25 - 20:09 | 01:41 - 21:09 | 01:00 - 01:00 | 01:00 - 01:00 |

| 11 June | 02:41 - 11:25 - 20:10 | 01:41 - 21:10 | 01:00 - 01:00 | 01:00 - 01:00 |

| 12 June | 02:41 - 11:26 - 20:11 | 01:40 - 21:11 | 01:00 - 01:00 | 01:00 - 01:00 |

| 13 June | 02:40 - 11:26 - 20:11 | 01:40 - 21:12 | 01:00 - 01:00 | 01:00 - 01:00 |

| 14 June | 02:40 - 11:26 - 20:12 | 01:39 - 21:13 | 01:00 - 01:00 | 01:00 - 01:00 |

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

| Located next to Noginskoye Highway in Electrostal, Apelsin Hotel offers comfortable rooms with free Wi-Fi. Free parking is available. The elegant rooms are air conditioned and feature a flat-screen satellite TV and fridge... | from | |

| Located in the green area Yamskiye Woods, 5 km from Elektrostal city centre, this hotel features a sauna and a restaurant. It offers rooms with a kitchen... | from | |

| Ekotel Bogorodsk Hotel is located in a picturesque park near Chernogolovsky Pond. It features an indoor swimming pool and a wellness centre. Free Wi-Fi and private parking are provided... | from | |

| Surrounded by 420,000 m² of parkland and overlooking Kovershi Lake, this hotel outside Moscow offers spa and fitness facilities, and a private beach area with volleyball court and loungers... | from | |

| Surrounded by green parklands, this hotel in the Moscow region features 2 restaurants, a bowling alley with bar, and several spa and fitness facilities. Moscow Ring Road is 17 km away... | from | |

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

| Direct link | |

|---|---|

| DB-City.com | Elektrostal /5 (2021-10-07 13:22:50) |

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

Post comment

or continue as guest

Current time by city

For example, New York

Current time by country

For example, Japan

Time difference

For example, London

For example, Dubai

Coordinates

For example, Hong Kong

For example, Delhi

For example, Sydney

Geographic coordinates of Elektrostal, Moscow Oblast, Russia

City coordinates

Coordinates of Elektrostal in decimal degrees

Coordinates of elektrostal in degrees and decimal minutes, utm coordinates of elektrostal, geographic coordinate systems.

WGS 84 coordinate reference system is the latest revision of the World Geodetic System, which is used in mapping and navigation, including GPS satellite navigation system (the Global Positioning System).

Geographic coordinates (latitude and longitude) define a position on the Earth’s surface. Coordinates are angular units. The canonical form of latitude and longitude representation uses degrees (°), minutes (′), and seconds (″). GPS systems widely use coordinates in degrees and decimal minutes, or in decimal degrees.

Latitude varies from −90° to 90°. The latitude of the Equator is 0°; the latitude of the South Pole is −90°; the latitude of the North Pole is 90°. Positive latitude values correspond to the geographic locations north of the Equator (abbrev. N). Negative latitude values correspond to the geographic locations south of the Equator (abbrev. S).

Longitude is counted from the prime meridian ( IERS Reference Meridian for WGS 84) and varies from −180° to 180°. Positive longitude values correspond to the geographic locations east of the prime meridian (abbrev. E). Negative longitude values correspond to the geographic locations west of the prime meridian (abbrev. W).

UTM or Universal Transverse Mercator coordinate system divides the Earth’s surface into 60 longitudinal zones. The coordinates of a location within each zone are defined as a planar coordinate pair related to the intersection of the equator and the zone’s central meridian, and measured in meters.

Elevation above sea level is a measure of a geographic location’s height. We are using the global digital elevation model GTOPO30 .

Elektrostal , Moscow Oblast, Russia

IMAGES

VIDEO

COMMENTS

A transformed energy network to drive net zero by as early as 2028 across our region. This is what NGED's highly ambitious Business Plan for 2023-2028 (RIIO-ED2) will deliver. It has been co-created with more than 25,000 stakeholders and future customers and has received significant levels of acceptability from wider consumers.

Western Power Distribution. RIIO-ED2 final business plan. Investment of £6.7bn during 2023- 2028 with embedded efficiency savings of £723m • A 27% increase on annual average expenditure in RIIO-ED1 • Capex of £6.1bn across the regulatory period • The average customers' bill to remain broadly flat in real terms

Western Power Distribution (WPD) is required to submit a 200 page Business Plan document, supplementary annexes, detailed cost tables, financial information and a range of other documents which form our submission under RIIO-ED2 to Ofgem, which will be used to determine allowed revenues for the price control period.

priorities for Western Power Distribution (WPD) in relation to driving innovation and new services. We have now ... by Ofgem as RIIO-ED2. Our Business Plan consultation document sets out how much we plan to spend from 2023-2028 and our specific commitments. For each of our commitments we have set out four levels of ambition and what the impact ...

Western Power Distribution RIIO-ED2 final business plan Investor Relations | December 2021 "Our commitment to customers for RIIO-ED2: A transformed energy network to drive net zero by as early as 2028 across our region. This is what WPD's highly ambitious Business Plan for 2023-2028(RIIO-ED2) will deliver.

• "RIIO-ED2" will cover the 5 years 2023-2028 • We are developing our Business Plan for that period - setting out, in detail, our commitments to stakeholders, performance targets and planned investment and expenditure "RIIO-ED2": Revenue = Incentives + Innovation + Outputs (Electricity Distribution 2)

Western Power Distribution, Business Plan 2023-2028 ... Subtransmission document series and in RIIO-ED2 will be replaced by our forthcoming Network Development Plan. We take this information on future growth and compare the costs and benefits of potential different solutions through our

Wed, 01st Dec 2021 10:07. (Alliance News) - National Grid PLC on Wednesday said its UK electricity distribution business, Western Power Distribution will submit its final business plan to energy ...

From Western Power Distribution's Customer Engagement Group. 13th December 2021. WPD has now submitted its RIIO-ED2 business plan for 2023 to 2028 to the industry regulator, Ofgem. This plan has evolved over the past 24 months, derived from WPD's extensive knowledge of the network it operates in combination with significant and extensive ...

Looking to the future RIIO-ED2, covering the period April 2023 to March 2028, is the second price control to be set under the RIIO model. The first draft of our RIIO-ED2 business plan was submitted to Ofgem's challenge group on 1 July 2021 and the final submission was made on 1 December 2021.

This document is a Supplementary Annex to the Western Power Distribution (WPD) RIIO-ED1 Business Plan for the five year period from 1st April 2023 to 31st March 2028. It provides an overview of our robust investment appraisal approach to our RIIO-ED2 Business Plan and an outline of our investment appraisal toolbox.

Introduction & our RIIO ED2 engagement plan. Your opinion is so important to us, we are trying to capture everyone's opinions on what we should be doing for our next Business Plan - RIIO ED2. The below presentation is an introduction to WPD and a short explanation on the engagement plans we have with you, our stakeholders, for our upcoming ...

Our Draft Determinations on DNO allowances under the RIIO-ED2 price control, due to be published in summer 2022 for consultation, will be informed by all relevant considerations including this Call for Evidence. This Call for Evidence sets out the background to RIIO-ED2 price control and the enhanced stakeholder engagement process.

The investment represents an annual average step up of nearly 30% compared to ED1 levels, which will fund the business plan commitments to provide the system capability to cater for a further 1.5 ...

RIIO-ED1 is the current Business Plan framework, this represents Revenue = Incentives + Innovation + Outputs. In the ED1 framework there are currently 6 categories under which our 76 commitments are structured, within the new ED2 structure Ofgem would like to consolidate this into 3 categories to make it as simple as possible.

Distribution fell on account of lower baseline compensation from the RIIO-ED2 regime which was not offset by investments and higher RAB. Additionally, there was cost inflation in operating the ...

Elektrostal Geography. Geographic Information regarding City of Elektrostal. Elektrostal Geographical coordinates. Latitude: 55.8, Longitude: 38.45. 55° 48′ 0″ North, 38° 27′ 0″ East. Elektrostal Area. 4,951 hectares. 49.51 km² (19.12 sq mi) Elektrostal Altitude.

A residential and industrial region in the south-east of Mocsow. It was founded on the spot of two villages: Chagino (what is now the Moscow Oil Refinery) and Ryazantsevo (demolished in 1979). in 1960 the town was incorporated into the City of Moscow as a district. Population - 45,000 people (2002). The district is one of the most polluted residential areas in Moscow, due to the Moscow Oil ...

Geographic coordinates of Elektrostal, Moscow Oblast, Russia in WGS 84 coordinate system which is a standard in cartography, geodesy, and navigation, including Global Positioning System (GPS). Latitude of Elektrostal, longitude of Elektrostal, elevation above sea level of Elektrostal.

Western Power Distribution Business Plan 2 Consultation Report April 2021 Which WPD region is relevant to you? • The majority of stakeholders felt positively about the overall picture of WPD's Business Plan for RIIO-ED2, with the increased ambition and stretched targets on business carbon footprint, Net Zero and capacity for low

Cities near Elektrostal. Places of interest. Pavlovskiy Posad Noginsk. Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right.