Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

What is the purpose of a business plan?

A business plan is like a map for small business owners, showing them where to go and how to get there. Its main purposes are to help you avoid risks, keep everyone on the same page, plan finances, check if your business idea is good, make operations smoother, and adapt to changes. It's a way for small business owners to plan, communicate, and stay on track toward their goals.

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

Send invoices, estimates, and other docs:

- via links or PDFs

- automatically, via Wave

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada . See Wave’s Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Business plan FAQs

How does having a business plan help small business owners make better decisions.

Having a business plan supports small business owners in making smarter decisions by providing a structured framework to assess all parts of their businesses. It helps you foresee potential challenges, identify opportunities, and set clear objectives. Business plans help you make decisions across the board, including market strategies, financial management, resource allocation, and growth planning.

What industry-specific issues can business plans help tackle?

Business plans can address industry-specific challenges like regulatory compliance, technological advancements, market trends, and competitive landscape. For instance, in highly regulated industries like healthcare or finance, a comprehensive business plan can outline compliance measures and risk management strategies.

How can small business owners use their business plans to pitch investors or apply for loans?

In addition to attracting investors and securing financing, small business owners can leverage their business plans during pitches or loan applications by focusing on key elements that resonate with potential stakeholders. This includes highlighting market analysis, competitive advantages, revenue projections, and scalability plans. Presenting a well-researched and data-driven business plan demonstrates credibility and makes investors or lenders feel confident about your business’s potential health and growth.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

14 Reasons Why You Need a Business Plan

10 min. read

Updated May 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

7 Min. Read

8 Business Plan Templates You Can Get for Free

5 Consequences of Skipping a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- The Importance of a Business Plan: A Roadmap to Success

- Jean R Gunter

- 3.2k Comments

Introduction

Starting and running a successful business requires careful planning and strategic thinking. A well-defined business plan plays a pivotal role in providing entrepreneurs with a clear vision and direction for their venture. It serves as a comprehensive document that outlines the goals, strategies, and financial projections of a business, guiding entrepreneurs in navigating the complexities of the business landscape. Let's explore the various aspects of a business plan and understand its importance in achieving entrepreneurial success.

Defining a Business Plan

A business plan is a formal document that outlines the goals, strategies, and financial projections of a business. It acts as a roadmap, guiding entrepreneurs in making informed decisions and managing their operations effectively. A well-written business plan typically includes an executive summary, company description, market analysis, organizational structure, product or service offerings, marketing and sales strategies, operational plans, and financial projections.

Clarifying Business Goals and Objectives

A crucial aspect of a business plan is clarifying the goals and objectives of the business. By defining clear and measurable goals, entrepreneurs can establish a sense of direction and purpose for their venture. These goals may include revenue targets, market share objectives, customer acquisition goals, or product development milestones. A well-defined business plan helps entrepreneurs align their actions with their long-term objectives, increasing the chances of success.

Identifying Target Market and Competition

A comprehensive market analysis is an integral part of a business plan. It involves identifying the target market and understanding customer needs, preferences, and purchasing behaviors. By conducting thorough market research, entrepreneurs gain valuable insights into the competitive landscape, customer demographics, market trends, and industry dynamics. This information helps them position their products or services effectively and develop strategies to gain a competitive advantage.

Developing Effective Strategies and Tactics

A well-defined business plan enables entrepreneurs to develop effective strategies and tactics to achieve their business goals. Based on the market analysis, entrepreneurs can identify the most viable target segments and tailor their marketing and sales efforts accordingly. The business plan outlines the marketing channels, pricing strategies, promotional activities, and customer acquisition tactics that will be employed to reach the target audience. It also helps entrepreneurs develop operational plans, including supply chain management, production processes, and resource allocation strategies.

Creating a Financial Roadmap

Financial projections are a vital component of a business plan. They provide a detailed outlook on the financial performance of the business, including revenue forecasts, expense projections, profit margins, and cash flow analysis. Financial projections help entrepreneurs assess the feasibility and profitability of their business idea, identify potential funding requirements, and set realistic financial targets. By creating a financial roadmap, entrepreneurs can plan their financial strategies, monitor their progress, and make necessary adjustments to achieve their financial goals.

Guiding Decision-Making and Resource Allocation

A well-defined business plan serves as a guide for decision-making and resource allocation. It provides entrepreneurs with a framework to assess the viability of various opportunities and make informed choices. When faced with critical decisions, entrepreneurs can refer to their business plan to evaluate the alignment of the opportunity with their overall goals and strategies. Additionally, a business plan helps entrepreneurs allocate resources effectively by identifying the key areas that require investment and prioritizing initiatives based on their potential impact on the business's success.

Attracting Investors and Securing Funding

Investors and lenders often require a comprehensive business plan before considering funding a business. A well-crafted business plan demonstrates the entrepreneur's commitment, expertise, and vision, making the venture more attractive to potential investors. It provides detailed financial projections, market analysis, competitive positioning, and growth strategies that instill confidence in investors. By presenting a compelling business plan, entrepreneurs increase their chances of securing funding, whether through loans, venture capital, or angel investments.

Adapting to Changing Business Environment

The business landscape is dynamic, and entrepreneurs need to adapt to changes in the market, industry trends, and customer preferences. A well-defined business plan acts as a flexible tool that can be revised and updated to reflect the evolving business environment. It enables entrepreneurs to monitor their progress, evaluate the effectiveness of their strategies, and make necessary adjustments to stay competitive. Regularly reviewing and updating the business plan ensures that entrepreneurs stay aligned with their goals and seize emerging opportunities.

A well-defined business plan serves as a roadmap to success for entrepreneurs and business owners. It provides clarity, direction, and a comprehensive understanding of the business's objectives, strategies, and financial projections. With a solid business plan in place, entrepreneurs can make informed decisions, allocate resources effectively, attract investors, and adapt to the ever-changing business landscape. By understanding the importance of a business plan and investing time and effort into its development, entrepreneurs can increase their chances of achieving their goals and building successful ventures.

1. What should be included in a business plan? A comprehensive business plan typically includes an executive summary, company description, market analysis, organizational structure, product or service offerings, marketing and sales strategies, operational plans, and financial projections.

2. How can a business plan help in securing funding? A well-crafted business plan provides potential investors or lenders with a detailed understanding of the business's viability, market potential, growth strategies, and financial projections. It instills confidence in investors and increases the chances of securing funding.

3. How often should a business plan be reviewed and updated? A business plan should be regularly reviewed and updated to reflect changes in the market, industry trends, and business performance. It is advisable to review the business plan annually or whenever significant changes or new opportunities arise.

4. Can a business plan help in decision-making? Yes, a business plan serves as a guide for decision-making by providing entrepreneurs with a framework to evaluate opportunities, assess their alignment with business goals, and allocate resources effectively.

5. How does a business plan assist in adapting to the changing business environment? By regularly reviewing and updating the business plan, entrepreneurs can monitor their progress, evaluate the effectiveness of their strategies, and make necessary adjustments to stay competitive and capitalize on emerging opportunities.

Power of choice is untrammelled and when nothing prevents our being able to do what we like best, every pleasure is to be welcomed and every pain avoided. But in certain circumstances and owing to the claims of duty or the obligations of business it will frequently occur that pleasures have to be repudiated and annoyances accepted. The wise man therefore always holds in these matters to this principle of selection.

- Application

Comments (20)

Jesse Sinkler

There are many variations of passages the majority have suffered in some injected humour or randomised words which don't look even slightly believable.

Daniel Wellman

Kenneth Evans

Leave a comment.

The Importance of A Business Plan for Startups - Explained

A business plan is a crucial blueprint for a business idea, outlining its goals, strategies, and potential challenges. It serves as a roadmap, guiding startups towards success while attracting investors. Proper business planning ensures clarity, focus, and a solid foundation for both short-term actions and long-term vision.

What is A Business Plan?

A business plan actively charts a company's future, setting clear objectives and mapping out strategies to achieve them.

Think of it as the strategic playbook for a business, covering vital areas like marketing, operations, finance, and leadership.

At its essence, a business plan isn't just a document; it's a hands-on tool that helps small businesses and their business owner navigate the journey, by securing funding and reassuring stakeholders.

Whether you're kickstarting a new venture or steering an existing one, a robust business planning process remains a cornerstone of sustainable success.

The Importance of Business Plan for Your Startup?

1. Roadmap for Success

Think of launching a startup as embarking on a journey. You wouldn't set out without a map, right? That's what a business plan is for startups - a clear, detailed map. It lays out every step, sets checkpoints, and even warns about potential roadblocks. By dividing the journey into manageable tasks, startups find it easier to focus and act.

You need a business plan because it's not just about dodging pitfalls; this roadmap ensures every move you make drives the business closer to its goals.

2. Attracting Investors

In the cut-throat world of business, winning an investor's trust is a big deal. They're not just looking for a spark of an idea but solid evidence that it'll catch fire. Enter the business plan.

It showcases your grasp of the market, the challenges ahead, and your strategies to overcome them. By laying out the potential ROI with data to back it, you're essentially telling investors, "Your money's safe with us, and here's the proof."

3. Resource Allocation

Every startup feels the pinch - be it funds, time, or talent. So, how do you ensure you're putting your resources in the right place?

The business plan comes to the rescue again. It's like a compass, pointing out where to invest resources for the best outcomes.

It highlights what needs your immediate attention and what can simmer on the back burner. By channeling resources smartly, startups can strike a balance between today's needs and tomorrow's goals, ensuring both efficiency and growth.

4. Setting Clear Objectives

Imagine you're leading a team into a vast forest. Without a map or direction, chances are, you'll get lost. That's where writing a business plan really steps in.

It lets you carve out tangible goals, making sure everyone on your team knows where they're going and what they're aiming for. It's not just about setting targets; it's about keeping everyone on the same page, driven, and laser-focused.

5. Risk Management

Let's face it; the business world is unpredictable. But instead of being caught off-guard, having a business plan means you see those curveballs coming.

It's your playbook, helping you map out potential challenges, whip up a Plan B on the fly, and tackle surprises head-on. This isn't just a good strategy; it's showing stakeholders you're prepared for anything.

6. Growth Strategy

Think of your startup as a plant. You want it to grow, right? A good business plan is your growth formula with extremely specific business milestones. It spells out whether you're branching out to new territories, unveiling fresh products, or amplifying your operations.

With this strategy in hand, you're not just shooting in the dark; you're charting a course to scale smartly and sustainably.

7. Securing Loans

Let's get real. Walk into a bank without a solid business plan, and chances are, you'll walk out empty-handed. Banks need to know they're making a smart bet.

Presenting a detailed business plan tells them you've got skin in the game. It screams stability and showcases your vision, making them more likely to back you up.

8. Performance Measurement

Steering a startup without benchmarks is like sailing without stars to guide you. A business plan helps set those stars for you. It gives you clear markers to gauge how well you're doing.

If things seem off, you check your plan, adjust your course, and keep pushing forward.

9. Clarity and Focus

Ever had a whirlwind of ideas that seemed too scattered? Jotting them down in a business plan is like tidying up a messy room.

It forces you to sift through the clutter, zoom in on what matters, and sharpen your marketing strategy. The result? A crystal-clear path forward.

10. Stakeholder Communication

Think of your business plan as your startup's spokesperson. It tells your story to partners, employees, and potential investors. But it's more than just words on paper.

It aligns everyone, ensuring you're all singing from the same hymn sheet, driving home your business idea's vision and direction.

The Critical Components of an Ideal Business Plan

1. Executive Summary

Think of this as your handshake. In a few sentences, introduce your new business name, share your mission, and give a sneak peek of your game plan.

2. Business Description

Get down to brass tacks. Spell out what your small business really does, the problems you tackle, and the needs you meet in the market.

3. Market Analysis

With a marketing plan, show that you've rolled up your sleeves. Break down your industry insights, pinpoint your target audience, and size up the competition. Highlight where the market's heading and how you fit in. Creating the business plan forces you to analyze the competition.

4. Organization and Management

Who's in your corner? Sketch out your business structure, spotlight your team, and detail their roles. Share who calls the shots, who manages the show, and who advises from the boardroom.

5. Service or Product Line

What's on the shelf? A well-written business plan dives into what you're offering. Talk about its benefits, how it stands out, and the brains and brawn behind its development.

6. Marketing and Sales Strategy

How do you make the cash register ring? Share your marketing plan for getting the word out and closing the deal.

7. Funding Request

Need some financial muscle? If you're reaching out for funds, lay out how much you need now, what you'll need down the road, and the terms that would work for you.

8. Financial Projections

Got a crystal ball? Maybe not, but you can predict your financial future. Share your numbers game for the next five years, from profits to cash flow.

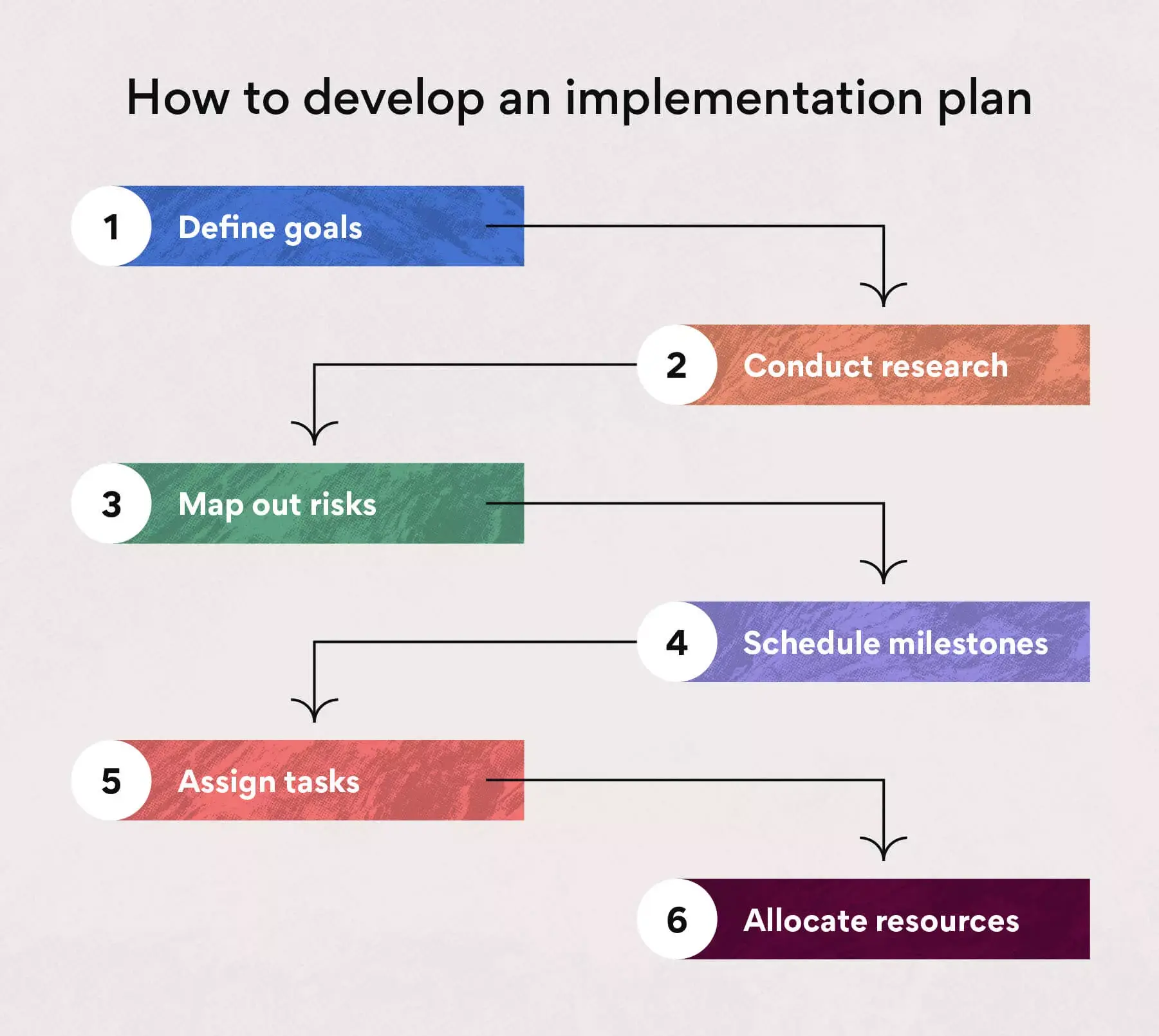

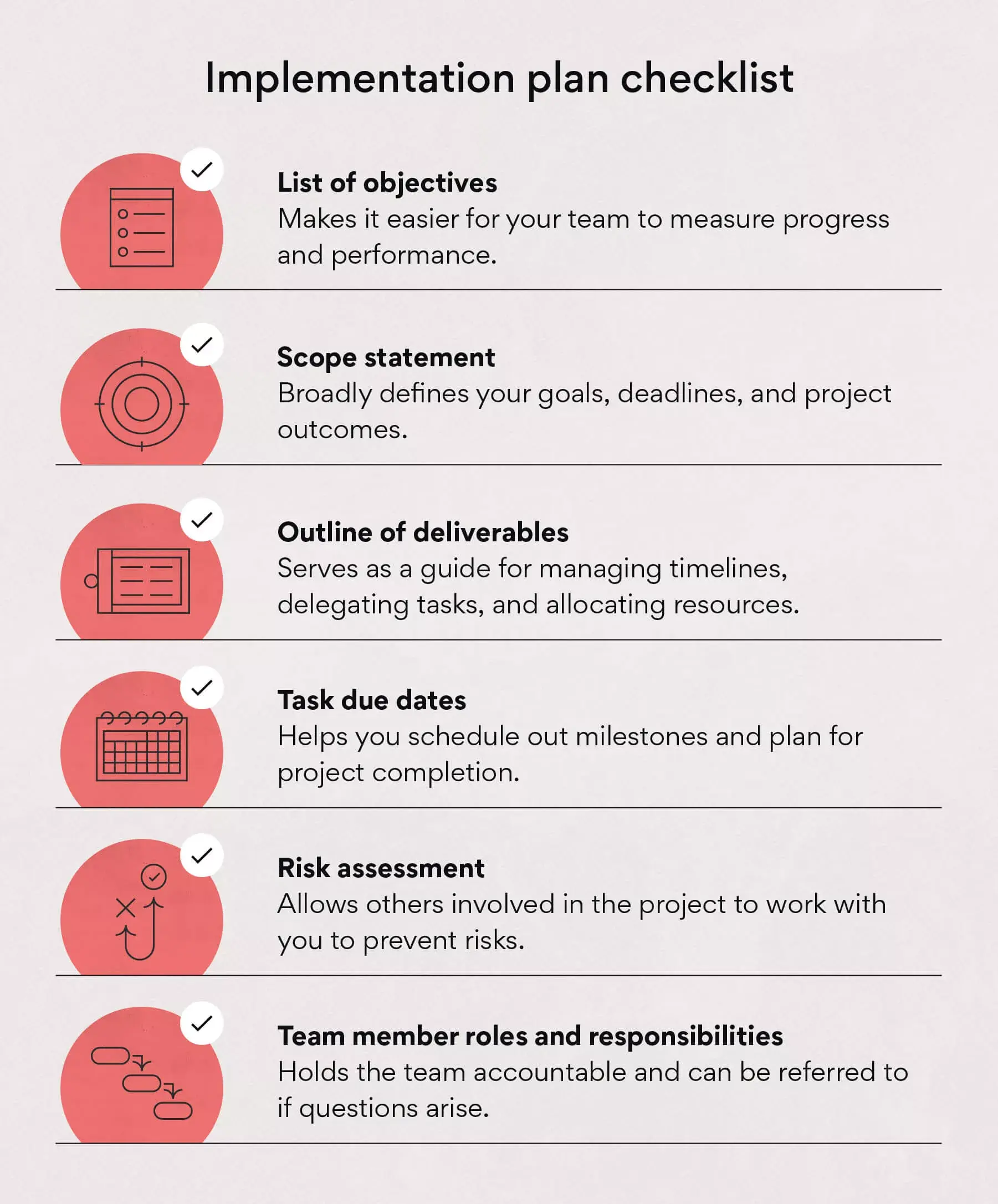

9. Implementation Plan

How do you roll? Detail the steps you'll take, the time you'll need, and the resources you'll tap into to kick things off and keep them running.

10. Appendix

Got some extras? Tuck them here. Whether it's research, permits, or any other paperwork, if it backs up your plan, it goes in.

A Template for Your Startup's Business Plan

Here's a template for a startup business plan:

Startup Business Plan Template

1. cover page.

- Business Name: [Your Startup's Name]

- Logo: [Your Startup's Logo]

- Contact Information: Address, Phone Number, Email, Website

2. Executive Summary

- Mission Statement : What's your core purpose?

- Objective : What do you aim to achieve in the short and long term?

- Brief Overview: A snapshot of your business concept and plan.

3. Business Description

- Nature of Business: What exactly does your startup do?

- Vision: Where do you see your business in the future?

- Value Proposition: Why should customers choose you?

4. Market Analysis

- Industry Overview: Current trends and future growth.

- Target Market: Who are your customers? Demographics, behaviors, needs.

- Competitor Analysis: Who are your main competitors? Strengths, weaknesses, opportunities.

5. Product/Service Line

- Description: What are you offering?

- Benefits to Customers: Why it's valuable.

- Development Stage: Is it an idea, prototype, or in production?

6. Marketing & Sales Strategy

- Positioning : How will you place your product in the market?

- Promotion: Advertising, PR, content marketing plans.

- Sales Tactics : Online sales, direct sales, retailers.

7. Organization & Management

- Business Structure: Sole proprietorship, partnership, LLC, corporation?

- Key Personnel: Brief profiles of your team members and their roles.

- Advisory Board: If you have one, who's on it?

- Startup Costs: Initial expenses before you start selling.

- Break-Even Analysis: When will you start making a profit?

- Projected Profit and Loss: Forecast for the next 3-5 years.

- Cash Flow Statement: Monthly cash flow projections for at least one year.

9. Funding Request

- Amount Requested: How much money do you need?

- Use of Funds : How will you use the invested money?

10. Implementation Plan

- Milestones : Key actions and dates from launch to operations.

- Risks: Potential challenges and your strategies to mitigate them.

11. Appendix

- Supporting Documents : Resumes, patents, licenses, contracts, and other relevant documents.

Final Thoughts

A successful business plan is the backbone of any startup, providing direction, attracting support, and mitigating risks. Beyond mere documentation, it embodies the vision and strategy of an entrepreneur .

In the ever-evolving business landscape, having a structured plan ensures resilience, adaptability, and a clear path to success.

FAQs: Importance of A Business Plan

What is a business plan in your own words.

A business plan is a strategic blueprint that outlines a company's goals, the strategies to achieve them, and the resources required. It serves as both a roadmap and a communication tool for stakeholders.

What are the 3 main purposes of a business plan?

The three main purposes are:

a) To provide a strategic guide for the business's direction and growth.

b) To attract potential investors and secure funding.

c) To identify challenges ahead and devise solutions in advance.

What are 5 reasons for a business plan?

The five reasons are:

a) To set clear objectives and milestones.

b) To secure funding from existing businesses, investors or loans.

c) To understand the market and competition better.

d) To allocate resources effectively.

e) To onboard stakeholders and align the team's efforts with business plans.

What is the most important thing in a business plan?

The most important thing is the clarity of vision and feasibility of the plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. It should be realistic, backed by the market research, and adaptable to changing circumstances.

Is it really necessary to have a business plan?

Yes, it's necessary. A formal business plan provides direction, helps in securing funding, and ensures that all stakeholders are aligned towards the same goals.

What are the benefits of having a business plan?

The benefits of having a viable business plan includes, a clear direction and marketing strategies for growth, increased chances of securing funding, better understanding of the market and competition, effective resource allocation, and risk mitigation.

What are the 3 major components of a business plan?

The three major components are:

a) Executive Summary: An overview of the business, its mission, and objectives.

b) Market Analysis: A deep dive into the industry, target audience, and competitors.

c) Financial Projections: Predictions about revenue, costs, and profitability over a specified period.

Website Builder & CMS

Community Forum

Unified Inbox

Live Chat & Helpdesk

Marketing Campaigns

Project & Task Management

Form Builder

AI Assistant

Affiliate Management

Capital & Fundraising

Newsletters

Coaching / Consulting

Digital products

Memberships sites

Content business

Local businesses

Comparisons

Squarespace

Help Center

Startup Academy

Startup Blog

Startup Community

Startup Events

Startup Stories

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

6 Tips for Transitioning from Strategy Formulation to Implementation

- 17 Nov 2022

Strategy formulation is key to a successful business, but it's only effective when implemented correctly. Some professionals are experienced in developing comprehensive business plans, while others are well-versed in execution —more commonly known as "thinkers" versus "doers."

A balanced combination of both is an invaluable asset to any business. If you're struggling to bring your business strategy across the finish line, here are tips for transitioning from strategy formulation to implementation and a deeper understanding of why it's essential to your company's long-term success.

Access your free e-book today.

Formulating a Successful Strategy

Developing an effective strategy requires in-depth knowledge, critical thinking, and careful planning. While several frameworks can help set the foundation, Harvard Business School Online's Business Strategy course uses the value stick.

The value stick is a visual representation of value-based strategy and can help you formulate a business model that factors in pricing, product positioning, and vendor management. Value-based strategy relies on customers' perceived value of the products or services being sold and determines the organization's prices, costs, and supplier strategy.

Some key terms for formulating a value-based strategy include:

- Willingness to pay (WTP): The price customers are willing to pay for a product or service. The margin between a customer's WTP and the actual price is deemed "customer delight," or customers' perceived received value.

- Price: The price the product is sold for. The margin between the price and cost is the firm margin, or the money the business makes.

- Cost: The cost of manufacturing the product.

- Willingness to sell (WTS): The lowest price a supplier is willing to accept for its services. The margin between WTS and cost is called "supplier surplus" or "supplier delight"—the value suppliers believe they're receiving.

This is just one framework for formulating a successful strategy. You can use similar tools, but the best option will always depend on your company's strategic planning needs . To ensure you're on the right path to an effective business strategy, here are six tips for formulating and implementing successfully.

6 Tips For Transitioning from Formulation to Implementation

After formulating a well-developed business strategy, it's time to execute, which is easier said than done. Strategy execution often poses several challenges that can be hard to overcome.

According to the HBS Online course Business Strategy , there are three characteristics of strategy implementation that make the process difficult for many companies:

- Boring: Strategy tends to be exciting; implementation, by comparison, can be rather mundane

- Time-consuming: The best strategies typically require years to implement effectively

- Detail-oriented: Good strategy implementation requires an attention to detail many managers don't have

To prevent these obstacles and ensure a smooth transition from formulation to successful implementation, here's an overview of what you can do to set your business strategy up for success .

1. Set Clear Goals

A simple and effective way to transition from formulation to execution is to set clear strategic goals . Strategic goals are measurable, actionable objectives that align with an organization's purpose and long-term vision. These goals ensure that individuals implementing the strategy have clear guidelines on how to define successful execution.

“When we set goals, we like to imagine a bright future with our business succeeding,” says HBS Professor Robert Simons in Strategy Execution . “But to identify your critical performance variables, you need to engage in an uncomfortable exercise and consider what can cause your strategy to fail.”

Planning in advance and identifying possible weaknesses in your strategy can help you achieve these business goals and objectives without additional roadblocks.

2. Create a Value Map

A value map is a visual tool that helps organizations determine the needs, pain points, or desires its products or services can solve or fulfill for potential customers. It's a tool that illustrates a business's potential value drivers, the factors that influence customers' willingness to pay for a product or service. Identifying and mapping value drivers can be used to formulate an organization's value proposition and key differentiators.

According to HBS Online's Business Strategy course, there are five steps to creating an effective value map:

- Identify value drivers: Determine 10 purchasing criteria customers use when choosing between your product and competing products.

- Rank value drivers: Rank those 10 criteria from most to least important.

- Rate your company's performance: For each value driver, rate how your company is performing from a score of one (poor) to five (excellent).

- Rate your competitors' performance: Repeat this process for two or three of your main competitors.

- Review your value map: Ask yourself if your findings accurately reflect the market's competitive situation, your company's strengths and weaknesses, and if there are actionable next steps to mend any competitive gaps.

By creating a value map, you can review your business's performance and discover new opportunities to improve your position in the market. A value map can also rank how well your company is attracting and maintaining talent compared to competitors.

3. Strengthen Important Value Drivers

Once you've identified your key value drivers, the next step of execution is to strengthen them. Yet, it's important to focus on strengthening the most important ones rather than all of them.

"If you strive to be exceptional everywhere and spread resources evenly across all your value drivers, you end up being mediocre throughout," says Harvard Business School Professor Felix Oberholzer-Gee, who teaches Business Strategy .

Once you've identified the most important value drivers, strengthening them requires generating creative ideas . Since enhancing value drivers can be a relatively vague task, creativity provides ideas and direction. Don't be afraid to think outside the box, take risks, or even fail. Through experimentation and testing, new ideas can strengthen your value drivers and propel your business forward.

4. Create a Plan For Evolving Your Value Proposition

A value proposition is a short statement explaining the value your company provides and how your product or services differ from competitors. As the business landscape and market shift, so must your value proposition.

Competitors often become imitators or substitutes, which can cannibalize your revenue. To stay on top, your strategy—including your value drivers and value proposition—will have to evolve continually.

5. Delegate Work Effectively

Successful strategy implementation can be an overwhelming, multi-step process. It's important for managers to delegate effectively . By assigning tasks to other team members, leadership can spend more time focusing on bigger picture elements and:

- Engage other team members

- Share core business values

- Encourage strategy buy-in

- Win together and boost team morale

6. Continue to Review Performance

While these tools can be helpful for any strategy implementation, they don’t guarantee success without constant review and oversight. A successful strategic plan that drives value for a business and its customers requires continuous performance reviews and improvements.

One factor of strategy implementation to review is your employees. According to Strategy Execution , it can be beneficial in some cases to use ranking systems when reviewing employee performance to ensure your strategic initiatives receive the support needed to succeed long term.

“Ranking systems have really good features that managers can use to stimulate performance,” says HBS Professor Susanna Gallani in Strategy Execution . For example, employees who are highly motivated by personal achievement often thrive as a result of ranking systems.

It’s also important to continuously review your strategy, even after implementation. To ensure you get the most out of this review process, consider setting up a standardized operating procedure (SOP) for a designated task owner to run regularly to analyze and determine if an update is necessary. This can help you avoid common pitfalls of business strategy failures.

Why Business Strategy Formulation and Execution Are Important

Business strategy is an essential component of long-term growth and success. It offers value to customers, encouragement to key stakeholders, purpose for your company initiatives, and direction to your team. Yet, formulation only gets you so far.

Don't lose momentum during the implementation phase—ensure all your hard work pays off. With the right framework, you can create value for your customers and implement a frictionless strategy to achieve outstanding financial results.

Are you interested in learning about strategy implementation? Explore Business Strategy and Strategy Execution , two of our online strategy courses , to develop your strategic planning and implementation skills. To determine which strategy course is right for you, download our free flowchart .

This post was updated on November 3, 2023. It was originally published on November 17, 2022.

About the Author

Importance of Business Plan to an Entrepreneur – A business plan is an essential road map that entrepreneurs use to navigate the difficult process of starting and expanding a profitable firm. It performs as a strategic instrument for outlining the goals. Also, serve as a financial prediction of a company.

Whether you’re just starting or an experienced entrepreneur looking to sharpen your strategies, this guide will provide you with the knowledge and instructions you need to harness the power of a well-structured business plan.

Importance of a Business Plan to an Entrepreneurs

A strong business plan’s importance cannot be overstated since it provides entrepreneurs with a comprehensive framework for making decisions, attracting investors , securing funding, and navigating the dynamic business world. This article will cover the significance of a business plan. Also, offer practical guidance on how entrepreneurs can utilize it to advance their ventures. Let’s discuss what are the importance of a business plan to an entrepreneur.

A Business Plan Provides a Roadmap for a Business

A business plan may be compared to a road map that directs businesses toward commercial success. It acts as a strategy document that explains the objectives, strategies, and activities necessary to establish and expand a successful company. A business plan offers entrepreneurs a clear path to follow to accomplish their business goals. It is just like a roadmap that aids travelers in navigating new roads and arriving at their destination.

Picture you are going on a road trip to a dream destination. Before setting off, you would carefully plan your route, mark critical milestones, estimate travel time, and consider alternative paths in case of detours. Similarly, a business plan helps entrepreneurs chart their course by defining their vision, identifying target markets, assessing competition, setting financial goals, and mapping out strategies to overcome challenges.

Read – Can Anyone Be an Entrepreneur

Helps Entrepreneurs to Define Their Objectives

A business plan is a valuable tool that helps entrepreneurs in defining their objectives clearly. It offers business owners a well-organized framework for expressing their vision and establishing clear objectives. Entrepreneurs that go through the process of writing a business plan find clarity and concentration in their goals.

Imagine that an entrepreneur wishes to launch a sustainable clothing line. They would specify their goals through the business planning process, such as advancing ethical fashion, minimizing environmental effects, and making a good social impact. The business plan would outline these objectives and establish strategies and action steps to align the business activities with these goals.

Defined objectives in a business plan help entrepreneurs think critically, establish purpose, and guide decision-making. By setting SMART objectives, entrepreneurs can track performance, evaluate strategies, and make necessary adjustments to achieve desired outcomes. For example, an e-commerce business can increase online sales by 50% within a year, allowing regular monitoring, analysis, and adjustments to achieve its target.

Importance of Entrepreneurs to Identifying Their Target Market

When determining the target market for their goods or services, businesses place a lot of weight on their business plans. A business plan aids entrepreneurs in comprehending their potential clients, their demands, and their preferences by doing in-depth market research and analysis. This knowledge is essential for creating efficient marketing plans and modifying the company’s product offerings to satisfy the needs of the target market.

Let’s use the example of an entrepreneur who wants to launch a line of fitness clothes to demonstrate the significance of this. They would do market research as part of the process of writing a business plan to pinpoint their target consumers, such as fitness fanatics, gym visitors, or athletes. The business plan would include insightful information on the target market’s demographics, hobbies, and purchase patterns. With this knowledge, the business owner may carefully coordinate their product offering, price, and marketing messaging to appeal to the determined target demographic.

Entrepreneurs may focus on the appropriate audience, avoid one-size-fits-all techniques, and customize their products, services, and marketing strategies to their consumers’ needs by determining their target market. This aids in comprehending the competitive landscape, spotting gaps, and creating distinctive value propositions that appeal to the target market.

Read – Qualities of a Good Businessman

Helps Entrepreneurs to Assesses Competition

A business plan is a valuable tool that helps entrepreneurs assess their competition and gain a deeper understanding of the market landscape in which they operate. By following a structured approach, a business plan guides entrepreneurs on how to effectively analyze and evaluate their competitors.

A business plan helps entrepreneurs identify their key competitors by conducting research and gathering information about their products or services, pricing strategies, target market, marketing tactics, distribution channels, and customer reviews. This helps entrepreneurs understand their unique selling points and position themselves in the market. Entrepreneurs can compare their strengths and weaknesses to those of their competitors, identifying areas for differentiation. They also analyze market demand and customer preferences to identify gaps or underserved segments, tailoring their products or services to cater to these needs. A business plan guides entrepreneurs in positioning themselves against their competition, developing a unique value proposition that resonates with the target market. This roadmap helps entrepreneurs stay agile and adapt their strategies accordingly.

Importance to Evaluate Feasibility

When assessing the viability of their business idea, entrepreneurs must give the highest priority to their business plans. It acts as a helpful road map for business owners as they determine whether their idea is workable and has the potential to succeed.

Entrepreneurs should undertake in-depth market research and analysis, create financial predictions, perform a SWOT analysis, examine operational factors, and seek professional guidance to determine whether a company strategy is feasible. These steps help determine the feasibility of the business idea, identify potential blind spots, and develop contingency plans. By addressing factors such as resource availability, skills, expertise, infrastructure requirements, and operational processes, entrepreneurs can develop contingency plans and strategies to mitigate risks and ensure the venture’s success.

Read – Benefits of Being an Entrepreneur

Importance of Entrepreneurs to Attract Investors

A business plan holds immense importance for entrepreneurs when it comes to attracting investors to support their venture. A well-crafted business plan serves as a persuasive tool that demonstrates the potential of the business and convinces investors to provide financial backing.

To attract investors, entrepreneurs should create a compelling executive summary, detailed business description, market analysis, competitive advantage, financial projections, marketing and sales strategy, management team, risk assessment and mitigation, and clear exit strategy. These elements help investors understand the business’s growth potential, market potential, and competitive advantage.

Helps Entrepreneurs to Secures Their Funding

A business plan is essential for assisting entrepreneurs in obtaining finance for their projects. It acts as a roadmap that details the company’s potential, financial estimates, and growth plans. Entrepreneurs should write a succinct executive summary, thorough business description, market and competitive analysis, financial projections, funding requirements, marketing and sales strategy, management team, risk assessment, and mitigation, and supporting documents to obtain funding through a business plan.

These elements help investors and lenders understand the business’s unique value proposition, target market, revenue potential, and funding requirements. By presenting realistic financial projections, well-supported financial projections, and a well-thought-out marketing and sales strategy, entrepreneurs can secure funding and attract investors and lenders.

Read – Common Myths about Entrepreneurs

Business Plan Guides Entrepreneurs to Resource Allocation

A business plan serves as a valuable tool that guides entrepreneurs in allocating their resources effectively. It provides a clear roadmap for resource allocation by outlining the key areas of the business that require attention and investment.

To effectively allocate resources in a business plan, entrepreneurs should identify resource needs, set priorities, allocate financial resources based on projections and budget, allocate human resources based on skills and expertise, optimize time management, monitor and adjust resource allocation, seek efficiency and optimization, and regularly review and update the plan to reflect changes in resource needs. By doing so, entrepreneurs can optimize their resources and maximize the value derived from available resources. Regularly reviewing and updating the business plan ensures that resources are allocated effectively and efficiently.

Importance to Facilitate Decision-Making

A business plan holds great importance for entrepreneurs in facilitating effective decision-making throughout their entrepreneurial journey. It provides a framework that helps entrepreneurs make informed decisions by considering various factors and evaluating potential outcomes.

To effectively use a business plan for decision-making, entrepreneurs should define goals and objectives, gather relevant information, evaluate alternatives, consider financial implications, analyze risks and mitigation strategies, seek input from experts, regularly review and update the plan, and trust intuition and vision. This balances analytical thinking with an entrepreneurial instinct, ensuring long-term sustainability and informed decisions.

Read – Entrepreneur Mindset Books

Identifies Risks and Mitigation Strategies

A business plan plays a vital role in helping entrepreneurs identify risks and develop effective mitigation strategies. By carefully considering potential challenges and uncertainties, entrepreneurs can proactively address them and minimize their impact on the business.

To identify risks and develop mitigation strategies in a business plan, conduct a comprehensive risk assessment, analyze the impact and likelihood of risks, and develop specific strategies. Allocate resources, including financial, personnel, and time, to support the implementation of these strategies. Regularly monitor and update the business plan, seeking external expertise or consulting with industry professionals to gain insights. Communicate the identified risks and mitigation strategies clearly to stakeholders, including investors, lenders, and partners, to demonstrate professionalism and confidence in the business.

Importance of Entrepreneurs to Assists in Team Building

A business plan holds great importance for entrepreneurs in assisting them with team building, as it provides a clear framework for recruiting, developing, and managing their team effectively.

Entrepreneurs can use a business plan to aid in team building by defining roles and responsibilities, establishing recruitment criteria, developing a training and development plan, fostering a collaborative culture, setting performance goals and metrics, regularly evaluating and providing feedback, and fostering leadership and empowerment. These steps help attract and select the right individuals, align with the business plan’s objectives, and promote a supportive environment for innovation and creativity.

Read – Entrepreneurship Books for Students

Business Plan Supports Marketing and Sales Efforts

A business plan holds significant importance in supporting marketing and sales efforts for entrepreneurs. It provides a strategic roadmap for effectively promoting products or services and attracting customers. A business plan helps understand the target market, define the unique selling proposition (USP), develop marketing strategies, allocate budgets, monitor and measure results, and adapt and evolve.

By conducting thorough market research, defining the USP, and focusing on channels and tactics, entrepreneurs can effectively reach and engage their target audience. Regularly updating the business plan to reflect market trends and competitors can help entrepreneurs stay competitive and adapt their strategies accordingly.

Guides Product or Service Development

A business plan is essential for directing entrepreneurs as they create their goods or services. It offers a methodical way to determine consumer demands, specify product characteristics, and create a schedule for product development.

A business plan can guide product or service development by identifying customer needs, defining product or service features, setting development milestones, determining resource requirements, conducting testing and iteration, and integrating marketing and launch strategies. This helps entrepreneurs stay focused, track progress, and ensure the timely completion of activities. The plan should also outline the necessary funding, collaborations, and resources needed for the development process. By incorporating continuous improvement and iterative development, entrepreneurs can create a high-quality offering that meets or exceeds customer expectations.

Read – Green Innovation

Importance of Entrepreneurs to Manage Finances Effectively

A business plan holds great importance for entrepreneurs when it comes to managing finances effectively. It offers a thorough foundation for comprehending the financial facets of the firm and aids business owners in making defensible choices to maximize financial resources.

Entrepreneurs should construct a financial overview, define financial goals and objectives, develop a budget, track financial performance, plan for managing cash flow, and seek expert financial assistance to manage their money efficiently. This helps entrepreneurs forecast future financial needs, allocate resources effectively, and identify potential issues early on. By implementing these strategies, entrepreneurs can ensure the sustainability of their businesses and make informed decisions about their financial future.

Business Plan Measures Progress and Success

A business plan holds significant importance for entrepreneurs in measuring their progress and success. They may compare their accomplishments to it as a standard to see if they are progressing in the correct path.

Establish Key Performance Indicators (KPIs) that are in line with the goals of the business’s plan to successfully measure the growth and success of entrepreneurs. Regularly track and monitor KPIs to assess progress and make informed decisions. Conduct periodic reviews to evaluate progress against the plan, identify areas for adjustments or course corrections, and celebrate milestones and successes. Continuously update and evolve the business plan to reflect evolving goals, strategies, and market conditions.

Read – Difference Between Entrepreneur and Intrapreneur

Business Plan Importance to Enhance Credibility

A business plan plays a crucial role in enhancing the credibility of entrepreneurs and their ventures. It demonstrates to stakeholders, including potential investors, lenders, partners, and even customers, that entrepreneurs have a well-thought-out and strategic approach to their business.

To enhance entrepreneurs’ credibility, a well-presented business plan should present a professional image, conduct thorough market research, highlight the unique selling proposition, provide detailed financial projections, incorporate risk analysis and mitigation strategies, seek third-party validation, and regularly update and refine the plan. This shows credibility and commitment to continuous improvement, demonstrating the business’s ability to adapt and thrive in the ever-changing landscape.

Business Plan Provides a Basis for Partnerships

When forming partnerships, entrepreneurs place a lot of weight on their business plans. It offers a strong platform for prospective partners to comprehend the company. Also, its objectives, and the value it brings.

To successfully attract and establish partnerships, entrepreneurs should clearly define their business, highlight their target customers, market opportunities, and competitive advantages, outline partnership opportunities, develop partnership plans, and use the business plan as a communication tool. This aids potential partners in comprehending the goals and potential of the company as well as the growth potential of the market. Entrepreneurs may successfully convey their vision, ambitions, and potential to potential partners by emphasizing the advantages of collaboration, promoting development and success for both parties.

Read – Imitative Entrepreneurship

Importance of Entrepreneurs to Do Business Expansion

A business plan plays a crucial role for entrepreneurs when it comes to business expansion. It provides a strategic framework and guidance for expanding operations, entering new markets, or launching new products or services.

Entrepreneurs can use a business plan to facilitate expansion by evaluating current performance, defining expansion goals and objectives, conducting market research, developing a strategic expansion plan, assessing financial requirements, monitoring and adjusting the plan as needed, and continuously monitoring and adjusting the plan to ensure success. This approach helps businesses navigate market dynamics, identify strengths and weaknesses, and adapt to unforeseen challenges or opportunities.

Guides Entrepreneurs to Succession Planning

A business plan is of significant importance when it comes to guiding entrepreneurs in succession planning, which involves preparing for the future transition of leadership and ownership within a business.

To effectively use a business plan for succession planning, assess current leadership and ownership, identify potential successors, define succession goals and timeline, develop a succession plan, communicate with stakeholders, and regularly review and update the plan. This process ensures alignment with the long-term vision and aspirations of the business and its stakeholders. Regularly assess the progress of potential successors and provide development opportunities to enhance their skills and knowledge.

Importance to Increases Self-Awareness

A business plan is crucial for entrepreneurs because it may help them become more self-aware and better grasp their advantages, disadvantages, and possibilities for growth.