- Explore Goldman Sachs’ most-viewed research over various timeframes—from intraday to up to a year

- Maintain awareness of critical industry news with our “In the Spotlight” research stream

- Incorporate exclusive Goldman Sachs events and webcasts into your schedule with Marquee’s embedded Research calendar

- Set your content preferences by region, focus, role, language, and more

- Receive notifications for updates to your favorite publications; new releases from your selected authors; and reports related to your selected companies

- Use the power of our search engine to create complex custom alerts based on keywords, tags, and combinations

- No services available for your region.

- GS Dynamic Municipal Income Fund

- GS Core Fixed Income Fund

- GS GQG Partners International Opportunities Fund

- See All Mutual Funds

- GS S&P 500 Core Premium Income ETF (GPIX)

- GS Access Ultra Short Bond ETF (GSST)

- GS Small Cap Core Equity ETF (GSC)

- See All ETFs

- Liquidity Solutions

- Separately Managed Accounts

- Variable Insurance Trust

- Interval Fund

- Investment Centers

- Alternatives

- Buy-Write Strategy

- Emerging Markets

- Exchange-Traded Funds

- Fixed Income

- Model Portfolios

- Municipal Bonds

- Retirement (DCIO)

- Workplace Retirement Solution

In The Spotlight

Alternatives - Private Credit

- Macro & Market Views

- Investment Strategy

- ESG/Sustainable Investing

- ETF Investing

- Quantitative Investing

- By Asset Class

- Perspectives

- GSAM Connect

- All Insights

- Goldman Sachs Global Investment Research

- Product Collateral

- Product Brochures

- Investment Solutions

- Fund Commentaries

- Advisor Resources

- Strategic Advisory Solutions

- Asset Allocation PRISM

- Practice Management

- Client Service Account Access

- Documents and Forms

- Tax Information

- Forms & Applications

- Regulatory Documents

- All Documents

- Municipal Solutions Tool

- Diversified Investment Allocation Tool

- Floating Nav Vs. Stable Nav

Our In-Depth Commentary Could Help You Gain a Competitive Edge

Stay on top of the latest market developments, key themes, and investment ideas affecting your portfolio and practices.

- News and Media

- Company Sites

- Goldman Sachs

- Private Wealth Management

- Personal Financial Management

- Internal View

Explore how we can help you

MARKET INSIGHTS

Market strategy.

Complex markets can be difficult to decipher. We provide investment professionals and their clients with a global perspective to help explain the issues and trends affecting their portfolios.

Chart of the Week

Sense and sensitivity.

A higher cost of capital may create challenges for firms that need to raise capital to continue operations. Against this backdrop, we find that unprofitable growth stocks are more sensitive to changes in interest rates rather than their profitable peers. We expect potential rate cuts in the second half of this year and into next year to provide some relief to unprofitable companies, though a higher terminal rate may keep investor scrutiny on company fundamentals elevated.

Source: GS GIR and GS Asset Management. As of April 30, 2024.

Market Know-How

Pressure relief.

In this edition of the Market Know-How, we consider how investors may relieve the pressures of excess cash and single stock concentration by using exchange funds for a diversified basket without triggering a capital gains tax, transitioning concentrated positions into liquid, diversified portfolios in a tax-efficient manner via tax-advantaged SMAs, and extending duration to take advantage of the low cost of being early with potential Fed cuts on the horizon.

2Q2024 Themes

A new kind of recession - rolling recession, learn about the goldman sachs absolute return tracker fund, the great stabilizer: how municipalities deploy property taxes.

Stay posted on the latest market developments and key themes for your portfolios and practices

More Market Strategy

Monthly Market Pulse: May

What began as a smooth uphill ride for US large-cap equities in 2024 has progressed into a less certain investment backdrop, characterized by high S&P 500 dispersion and increasing volatility. With potentially little further index upside, we believe it is an ideal time to reevaluate core equity exposures. Persistent tax-loss harvesting is an effective tool investors can use to maximize bottom-line returns and as demonstrated this year, opportunities to do so remain robust even in constructive return environments.

View more perspectives on the latest market developments and trends

Stay Informed and Be Ahead of the Curve

Market monitor.

Weekly views from senior Goldman Sachs economists and strategists

MARKET KNOW-HOW

Triannual insights on market conditions and timely investment ideas

MARKET PULSE

Monthly market commentary coupled with insights on portfolio construction

GSAM CONNECT

Posts on the latest market developments and key themes for your portfolios

Asset Class Views

Access the latest views from our product teams on macro strategies and browse insights by key topics, such as equities, fixed income, money markets and alternatives.

Global Fixed Income Weekly: Musings

GOLDMAN SACHS RESEARCH

Follow trends in the global economy, including policy issues and analysis of economic development from Goldman Sachs Global Investment Research.

FIXED INCOME MACRO VIEWS

Weekly update on key developments across macro and sector strategies

MACRO INSIGHTS

Monthly synthesis of key insights and macro views

Also Explore

Clear and explainable guidance on the construction of long-term strategic portfolios

Tailored business strategies designed to strengthen key aspects of your practice

Products & Investment Centers

- Mutual Funds

Market Insights

Tools & resources.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

One chart shows how the 'magnificent 7' have dominated the stock market in 2023.

The S&P 500 ( ^GSPC ) has never been this top-heavy.

The "Magnificent Seven" tech stocks — Apple ( AAPL ), Alphabet ( GOOGL , GOOG ), Microsoft ( MSFT ), Amazon ( AMZN ), Meta ( META ), Tesla ( TSLA ), and Nvidia ( NVDA ) — make up 29% of the S&P 500's market cap.

And a chart in Goldman Sachs' 2024 US Equity Outlook shows that's the largest portion of S&P 500 market cap ever dominated by just seven stocks.

That perspective helps explain a second chart from Goldman that shows the Magnificent Seven have gained 71% while the other 493 stocks have added just 6%. Given the benchmark's market cap distribution, which allows larger stocks to contribute more to the index's movements, the S&P 500 has added about 19% this year.

Goldman Sachs' equity research team led by chief US equity strategist David Kostin described the Magnificent Seven's outperformance as a "defining feature of the equity market in 2023." And perhaps rightfully so.

Two other charts included in Goldman's outlook show how the Magnificent Seven have outperformed the other 493 stocks in key metrics that typically drive stock performance.

From 2013 to 2019, the Magnificent Seven stocks grew at a compound annual growth rate of 15% compared to a 2% growth rate from the rest of the pack. That margin narrowed in the past two years to 18% and 15% respectively, but Goldman sees it widening again in the coming years. From 2023 to 2025, Goldman sees the Magnificent Seven growing at a compound annual growth rate of 11% compared to a 3% rate for the rest of the S&P 500.

The Magnificent Seven's net profit margin also outperforms, where its 19% margins are above the 9.8% for the rest of the companies. Not to mention, the long-term earnings per share growth expectations are 17% for the Seven while that number sits at 9% for the other companies in the index.

"From a fundamental perspective, in recent years the trajectory of earnings has explained the performance of the Magnificent 7 relative to the rest of the market," Kostin wrote. "The outperformance of the Magnificent 7 this year has coincided with a rebound in margins and earnings that has outpaced the weakness across the rest of the market."

He added: "Consensus expects the Magnificent 7 will continue to deliver faster growth than the rest of the index."

Goldman sees the path forward for the Magnificent Seven stocks to likely be higher, too, but that doesn't make it the ideal trade for 2024 given the group's rise over the last year.

"The 7 stocks have faster expected sales growth, higher margins, a greater re-investment ratio, and stronger balance sheets than the other 493 stocks and trade at a relative valuation in line with recent averages after accounting for expected growth," Kostin wrote. "However, the risk/reward profile of this trade is not especially attractive given elevated expectations."

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Wall Street Analysts Think Goldman (GS) Is a Good Investment: Is It?

I nvestors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Before we discuss the reliability of brokerage recommendations and how to use them to your advantage, let's see what these Wall Street heavyweights think about Goldman Sachs (GS).

Goldman currently has an average brokerage recommendation (ABR) of 1.48, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 23 brokerage firms. An ABR of 1.48 approximates between Strong Buy and Buy.

Of the 23 recommendations that derive the current ABR, 17 are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 73.9% and 4.4% of all recommendations.

Brokerage Recommendation Trends for GS

Check price target & stock forecast for Goldman here>>>

While the ABR calls for buying Goldman, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every "Strong Sell" recommendation, brokerage firms assign five "Strong Buy" recommendations.

In other words, their interests aren't always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock's price movement.

With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock's near -term price performance. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers -- 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers' vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company's changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Is GS Worth Investing In?

Looking at the earnings estimate revisions for Goldman, the Zacks Consensus Estimate for the current year has increased 3.3% over the past month to $36.57.

Analysts' growing optimism over the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #1 (Strong Buy) for Goldman. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Therefore, the Buy-equivalent ABR for Goldman may serve as a useful guide for investors.

To read this article on Zacks.com click here.

- My View My View

- Following Following

- Saved Saved

Goldman Sachs picks insiders to co-run German, Austrian investment banking

- Medium Text

Sign up here.

Reporting by Emma-Victoria Farr, writing by Andrey Sychev; Editing by Madeline Chambers

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

BHP shares dip after mining giant walks from $49 bln Anglo takeover deal

The Australian-listed shares of BHP Group fell 1.5% on Thursday after the mining giant walked away from its $49 billion plan to take over rival Anglo American , ending for now its six-week pursuit.

- MY CONTENT HOME

- YOUR PROFILE HOMEPAGE

- MACRO MARKETS

- PORTFOLIO STRATEGY

- COMMODITIES

- CREDIT STRATEGY

- EMERGING MARKETS

- MACRO FORECASTS

- PROPRIETARY INDICATORS

- STOCK SCREENER

- CONVICTION LISTS

- THEMES HOMEPAGE

- TOP OF MIND

- RECESSION RISK

- CHINA REOPENING

- INFLATION REDUCTION ACT

- ARTIFICIAL INTELLIGENCE

- MORE THEMES VIA THE THEMES TRACKER

- PUBLICATIONS

US Daily: Remote Work, Three Years Later

Remote work, three years later.

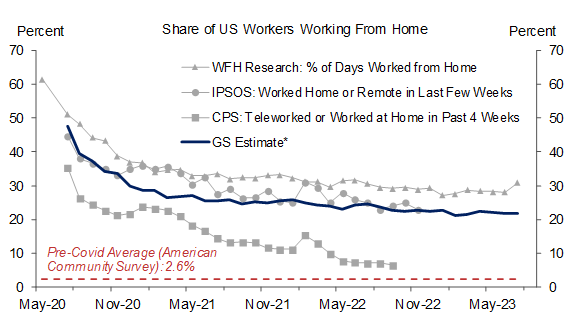

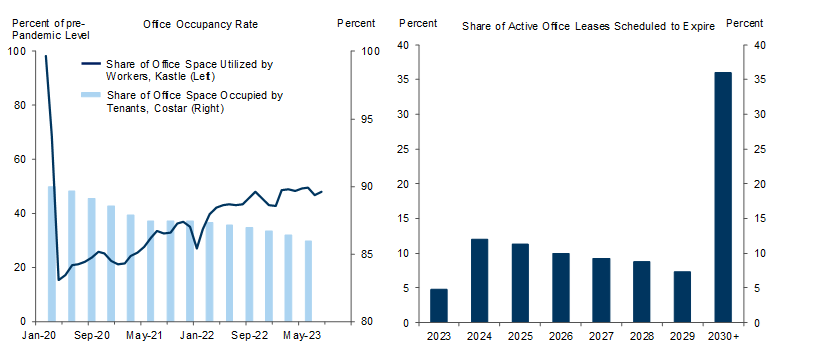

The share of US workers working from home (WFH) at least part of the week has stabilized at around 20-25%, below its peak of 47% at the height of the pandemic but well above the pre-pandemic average of 2.6%. In this US Daily , we discuss the implications of WFH for office demand, consumer spending, and productivity.

The persistence of WFH reflects both structural and cyclical factors. Structurally, the pandemic-related lockdowns spurred technological innovations that make teleworking easier, and surveys show that workers now place more value on being able to work from home. Cyclically, tight labor markets over the last two years have made employers more willing to allow employees to work remotely. Using state-level data, we find that a 1pp increase in the job-worker gap leads to a 0.3pp increase in the share of remote job postings. This implies that further labor market rebalancing should reduce the share of remote job postings from 11.5% to 10.8% in the next 3 years.

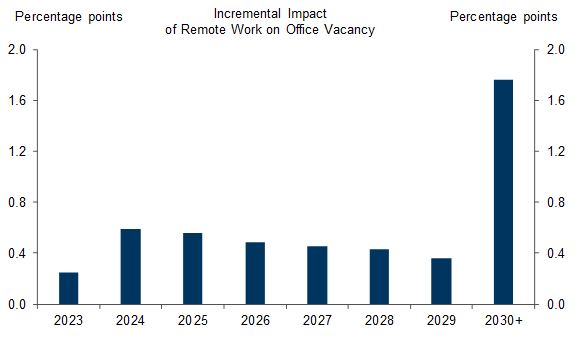

WFH has reduced office utilization rates but has not yet led to substantial declines in office occupancy rates because most firms are locked in long duration leases. Going forward, 17% of all office leases are scheduled to expire by the end of 2024, 47% between 2024-2029, and the rest after 2030. Our baseline estimates suggest that remote work will likely exert 0.8pp of upward pressure on the office vacancy rate by 2024, an additional 2.3pp over 2025-2029, and another 1.8pp in 2030 and beyond, though this is likely to be partially offset by a decline in new construction.

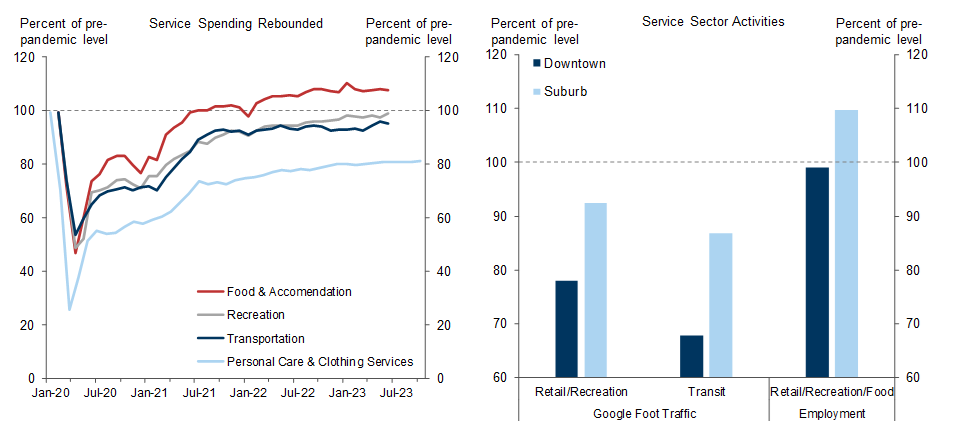

The shift to remote work has also changed the geographic distribution of retail spending and employment. While spending on services that require face-to-face contact has now fully recovered in the aggregate, the recovery has been skewed towards suburban areas and away from city centers where traditional office-related activities take place.

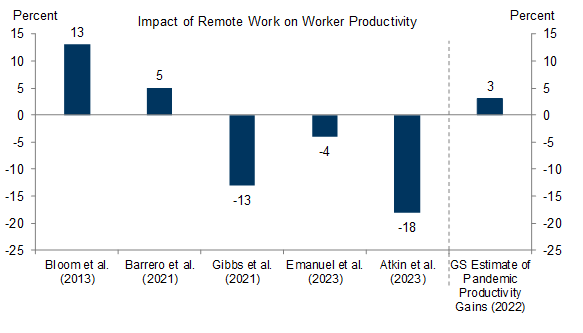

Economic studies disagree on the productivity effects of WFH, with estimates ranging from -19% to +13% and compared to our baseline of +3% for pandemic productivity gains more generally. The lack of consensus across these studies is likely driven by differences in how they measure productivity and the types of tasks and industries they study. More recent studies that measure productivity through complex performance metrics in industries involving high-cognitive tasks reveal more negative effects.

The share of US workers working from home (WFH) at least part of the week has declined from its peak and stabilized at an elevated level. Combining various data sources, we estimate that the share of US workers performing at least some work from home remains at 20-25% ( Exhibit 1 ), below its peak of 47% at the height of the pandemic but well above the pre-pandemic average of 2.6%.

Exhibit 1 : The Share of Workers Working at Least Partly Remotely Has Declined by Roughly Half From Its Peak to Around 20-25%

*May 2020-Sep 2022 is based on the average of WFH Research, IPSOS, CPS. We use the implied linear relationship between WFH Research and the average to extrapolate for months after Sep 2022.

Source: WFH Research, IPSOS, Current Population Survey, Goldman Sachs Global Investment Research

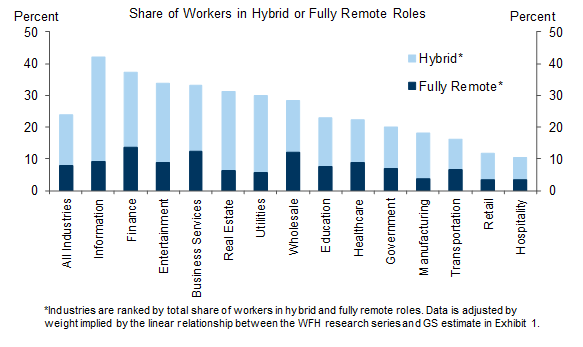

The WFH rate varies across industries ( Exhibit 2 ). The share of employees working remotely remains remarkably elevated in industries like information that require less face-to-face interaction, while it is much lower in contact-heavy sectors like retail and hospitality. As of July 2023, 16% of workers are in hybrid roles and 8% are in fully remote roles, suggesting that the hybrid work model remains the more prevalent option across industries relative to the fully remote model.

Exhibit 2 : The Work From Home Rate Varies Across Industries

Source: Goldman Sachs Investment Research, WFH Research

We suspect both structural and cyclical factors are driving the persistence of remote work.

The pandemic caused several structural changes that have made remote work appealing to both firms and workers. The pandemic lockdowns spurred a wave of technological innovations that made teleworking easier and more widespread. The onset of remote work allowed workers to relocate away from offices with little to no short-term consequences, but these workers now face higher costs of returning to offices due to longer or more costly commutes. [ 1 ] At the same time, survey data also shows that workers prefer the flexibility and work-life balance of remote work, signaling a lasting shift in work environment preferences. [ 2 ]

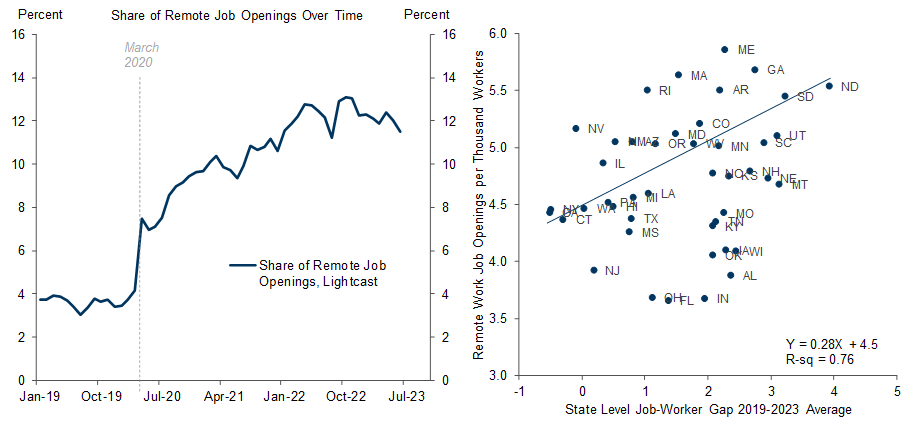

Cyclical labor market tightness has also contributed to the persistence of remote work. The share of remote job openings increased rapidly with the onset of the pandemic and is now above 10%, roughly 2.5 times its pre-pandemic level (left-hand side of Exhibit 3 ). Using state-level panel data, we estimate that a 1pp increase in our jobs-worker gap is associated with a 0.3pp increase in remote work postings as a share of the local labor force, similar to our global economics team’s estimate based on cross-country data . Going forward, we expect that further labor market rebalancing will modestly weaken firms’ incentive to provide the remote work benefit and lead to a decline in the remote share of job openings from 11.5% to 10.8% in the next 3 years.

Exhibit 3 : Firms Continue to Offer Remote Work Positions and Are More Likely to Do So in Tight Labor Markets

Source: Lightcast, WFH Research, Goldman Sachs Global Investment Research

The persistence of remote work has implications for office demand, consumption patterns, and productivity.

Remote work has depressed office utilization. Indeed, data from Kastle Systems tracking building access swipes across 10 major US cities shows that the average office utilization remains half of the pre-pandemic level (dark blue line on the left-hand side of Exhibit 4 ). But the depressed office utilization rates have not yet translated into significant declines in occupancy rates by commercial tenants, with the CoStar data showing a small drop from 90% to 86% in the past 3 years (light blue bars on the left-hand side of Exhibit 4 ).

The extent to which the high WFH rate translates into a higher office vacancy rate depends on (1) how frequently firms can renew their lease contracts, and (2) how much firms reduce their office demand at the time of renewal. First, the duration of lease terms in the office market is quite long, on average 4-7 years, according to a report by Compstak. For the inventory of office spaces as of August 2023, 17% is scheduled to expire by the end of 2024, 11% expires in 2025, and more than 35% expires after 2030. The lock-in effect of long lease duration limits firms’ ability to adjust office demand in the near term.

Exhibit 4 : Elevated WFH Results in Lower Utilization of Office Space, but Tenant Occupancy Rate Remains High Due to the Long Duration of Most Leases

Source: CoStar, Kastle, Compstak

The second factor is how sensitive firms’ office demand is given the current remote work rate. A recent study using lease-level data finds that a 10% increase in the remote work share leads to a 4-5% reduction in office demand at the time of lease renewal. Combing these two factors, we estimate the remote work induced office vacancies for the next 10 years ( Exhibit 5 ).

Our baseline analysis assuming further labor market rebalancing shows that remote work will likely exert 0.8pp of upward pressure on the office vacancy rate by 2024, an additional 2.3pp over 2025-2029, and another 1.8pp in 2030 and beyond. This is equivalent to an increase in vacant office space by 46 million sqft at the end of 2024, an additional 125 million sqft over 2025-2029, and another 96 million sqft in 2030 and beyond, a sizable impact compared to the 49 million sqft of new office construction completed in 2022. The increased vacant space from remote work is likely to crowd out new investment in office structures by $6.4 billion in 2024 and $6.0 billion in 2025. [ 3 ] We estimate the combined drag on annual GDP growth is likely to be small, with a decline of 0.03pp in 2024 and in 2025.

Exhibit 5 : Office Vacancy Rates Will Rise if WFH Rates Stay Elevated

The projection uses GS forecasted labor market rebalancing for 2023-2026. For horizons that extend beyond our forecasts, we assume the labor market tightness stays unchanged. The vacancy rate is imputed using 2023 office inventory data from the Cushman & Wakefield market report.

Source: Goldman Sachs Global Investment Research

Real spending on services that involve face-to-face contact has mostly recovered to its pre-pandemic level (left-hand side of Exhibit 6 ). Categories associated with “fun” activities such as food and accommodation, recreation, and transportation have rebounded strongly, while spending on less “fun” activities such as personal care, laundry and clothing services remains depressed.

While the aggregate spending in these service categories has rebounded, the prevalence of remote work has skewed the recovery away from downtown where traditional office activities take place. The right-hand side of Exhibit 6 shows that both foot traffic at retail and recreation sites—a good proxy for consumer spending—and employment in retail services are much higher in suburban areas than in city centers.

Exhibit 6 : Real Spending on Services Has Rebounded, but Recovery Is Skewed Away From Downtown Office Areas

Our sample includes Austin, Chicago, Washington DC, Dallas, Houston, Los Angeles, New York, Philadelphia, San Francisco, and San Jose, where the Kastle and Costar office occupancy data are available.

Source: Department of Commerce, Google Mobility Report, Department of Labor, Goldman Sachs Global Investment Research

In theory, WFH could either lower or raise productivity. On the one hand, remote work may lower productivity by reducing workers’ ability to learn from their peers, interfering with workers’ ability to focus on work-related tasks, and reducing creativity and innovation. [ 4 ] On the other hand, WFH may increase workers’ productivity by offering shorter commuting times, more flexible scheduling, and a quieter working environment. [ 5 ] Firms can also repurpose office-related expenses to other more productive uses. [ 6 ] The technological innovations spurred by the shift to remote work could generate positive spillover effects throughout the economy.

In previous research, we found that WFH adoption was positively correlated with post-pandemic productivity outcomes in the industry cross-section. This cautions against a “return to normal” explanation of last year’s productivity weakness. However, economic studies disagree on the productivity effects of remote work ( Exhibit 7 ). The lack of consensus is likely driven by differences in how the studies measure productivity and the types of tasks and industries they study. Earlier work that used survey data with a self-assessed measure of productivity or experimental evidence in an industry that involved routine tasks (e.g. call centers) tended to find positive impacts of remote work. More recent studies that measure productivity through complex performance metrics and draw evidence from industries involving high-cognitive tasks (e.g. IT services) reveal more negative effects. One limitation of the academic studies is that they have largely focused on how remote work can affect productivity through changing workers’ performance. But remote work can also have effects on economy-wide productivity through other channels, such as helping firms reduce office expenses and spurring technological innovations. In previous research, we estimated that remote work and other pandemic changes boosted private-sector productivity by roughly 3% once these channels are considered (see here and here ), though we continue to see considerable uncertainty around these estimates.

Exhibit 7 : Estimates of the Impact of Remote Work on Productivity From Economic Studies

We thank Elsie Peng and Jessica Rindels for their work on this report.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix , or go to www.gs.com/research/hedge.html .

Disclosure Appendix

We, Jan Hatzius, Alec Phillips, David Mericle, Spencer Hill, CFA, Ronnie Walker, Tim Krupa and Manuel Abecasis, hereby certify that all of the views expressed in this report accurately reflect our personal views, which have not been influenced by considerations of the firm's business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs' Global Investment Research division.

Disclosures

Regulatory disclosures, disclosures required by united states laws and regulations.

See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager or co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-managed public offerings in prior periods; directorships; for equity securities, market making and/or specialist role. Goldman Sachs trades or may trade as a principal in debt securities (or in related derivatives) of issuers discussed in this report.

The following are additional required disclosures: Ownership and material conflicts of interest: Goldman Sachs policy prohibits its analysts, professionals reporting to analysts and members of their households from owning securities of any company in the analyst's area of coverage. Analyst compensation: Analysts are paid in part based on the profitability of Goldman Sachs, which includes investment banking revenues. Analyst as officer or director: Goldman Sachs policy generally prohibits its analysts, persons reporting to analysts or members of their households from serving as an officer, director or advisor of any company in the analyst's area of coverage. Non-U.S. Analysts: Non-U.S. analysts may not be associated persons of Goldman Sachs & Co. LLC and therefore may not be subject to FINRA Rule 2241 or FINRA Rule 2242 restrictions on communications with subject company, public appearances and trading securities held by the analysts.

Additional disclosures required under the laws and regulations of jurisdictions other than the United States

The following disclosures are those required by the jurisdiction indicated, except to the extent already made above pursuant to United States laws and regulations. Australia: Goldman Sachs Australia Pty Ltd and its affiliates are not authorised deposit-taking institutions (as that term is defined in the Banking Act 1959 (Cth)) in Australia and do not provide banking services, nor carry on a banking business, in Australia. This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other entities which are the subject of its research reports. In some instances the costs of such site visits or meetings may be met in part or in whole by the issuers concerned if Goldman Sachs Australia considers it is appropriate and reasonable in the specific circumstances relating to the site visit or meeting. To the extent that the contents of this document contains any financial product advice, it is general advice only and has been prepared by Goldman Sachs without taking into account a client's objectives, financial situation or needs. A client should, before acting on any such advice, consider the appropriateness of the advice having regard to the client's own objectives, financial situation and needs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests and a copy of Goldman Sachs’ Australian Sell-Side Research Independence Policy Statement are available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html . Brazil: Disclosure information in relation to CVM Resolution n. 20 is available at https://www.gs.com/worldwide/brazil/area/gir/index.html . Where applicable, the Brazil-registered analyst primarily responsible for the content of this research report, as defined in Article 20 of CVM Resolution n. 20, is the first author named at the beginning of this report, unless indicated otherwise at the end of the text. Canada: This information is being provided to you for information purposes only and is not, and under no circumstances should be construed as, an advertisement, offering or solicitation by Goldman Sachs & Co. LLC for purchasers of securities in Canada to trade in any Canadian security. Goldman Sachs & Co. LLC is not registered as a dealer in any jurisdiction in Canada under applicable Canadian securities laws and generally is not permitted to trade in Canadian securities and may be prohibited from selling certain securities and products in certain jurisdictions in Canada. If you wish to trade in any Canadian securities or other products in Canada please contact Goldman Sachs Canada Inc., an affiliate of The Goldman Sachs Group Inc., or another registered Canadian dealer. Hong Kong: Further information on the securities of covered companies referred to in this research may be obtained on request from Goldman Sachs (Asia) L.L.C. India: Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (India) Securities Private Limited, Research Analyst - SEBI Registration Number INH000001493, 951-A, Rational House, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025, India, Corporate Identity Number U74140MH2006FTC160634, Phone +91 22 6616 9000, Fax +91 22 6616 9001. Goldman Sachs may beneficially own 1% or more of the securities (as such term is defined in clause 2 (h) the Indian Securities Contracts (Regulation) Act, 1956) of the subject company or companies referred to in this research report. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Goldman Sachs (India) Securities Private Limited Investor Grievance E-mail: [email protected]. Compliance Officer: Anil Rajput |Tel: + 91 22 6616 9000 | Email: [email protected]. Japan: See below. Korea: This research, and any access to it, is intended only for "professional investors" within the meaning of the Financial Services and Capital Markets Act, unless otherwise agreed by Goldman Sachs. Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs (Asia) L.L.C., Seoul Branch. New Zealand: Goldman Sachs New Zealand Limited and its affiliates are neither "registered banks" nor "deposit takers" (as defined in the Reserve Bank of New Zealand Act 1989) in New Zealand. This research, and any access to it, is intended for "wholesale clients" (as defined in the Financial Advisers Act 2008) unless otherwise agreed by Goldman Sachs. A copy of certain Goldman Sachs Australia and New Zealand disclosure of interests is available at: https://www.goldmansachs.com/disclosures/australia-new-zealand/index.html . Russia: Research reports distributed in the Russian Federation are not advertising as defined in the Russian legislation, but are information and analysis not having product promotion as their main purpose and do not provide appraisal within the meaning of the Russian legislation on appraisal activity. Research reports do not constitute a personalized investment recommendation as defined in Russian laws and regulations, are not addressed to a specific client, and are prepared without analyzing the financial circumstances, investment profiles or risk profiles of clients. Goldman Sachs assumes no responsibility for any investment decisions that may be taken by a client or any other person based on this research report. Singapore: Goldman Sachs (Singapore) Pte. (Company Number: 198602165W), which is regulated by the Monetary Authority of Singapore, accepts legal responsibility for this research, and should be contacted with respect to any matters arising from, or in connection with, this research. Taiwan: This material is for reference only and must not be reprinted without permission. Investors should carefully consider their own investment risk. Investment results are the responsibility of the individual investor. United Kingdom: Persons who would be categorized as retail clients in the United Kingdom, as such term is defined in the rules of the Financial Conduct Authority, should read this research in conjunction with prior Goldman Sachs research on the covered companies referred to herein and should refer to the risk warnings that have been sent to them by Goldman Sachs International. A copy of these risks warnings, and a glossary of certain financial terms used in this report, are available from Goldman Sachs International on request.

European Union and United Kingdom: Disclosure information in relation to Article 6 (2) of the European Commission Delegated Regulation (EU) (2016/958) supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council (including as that Delegated Regulation is implemented into United Kingdom domestic law and regulation following the United Kingdom’s departure from the European Union and the European Economic Area) with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest is available at https://www.gs.com/disclosures/europeanpolicy.html which states the European Policy for Managing Conflicts of Interest in Connection with Investment Research.

Japan: Goldman Sachs Japan Co., Ltd. is a Financial Instrument Dealer registered with the Kanto Financial Bureau under registration number Kinsho 69, and a member of Japan Securities Dealers Association, Financial Futures Association of Japan Type II Financial Instruments Firms Association, The Investment Trusts Association, Japan, and Japan Investment Advisers Association. Sales and purchase of equities are subject to commission pre-determined with clients plus consumption tax. See company-specific disclosures as to any applicable disclosures required by Japanese stock exchanges, the Japanese Securities Dealers Association or the Japanese Securities Finance Company.

Global product; distributing entities

Goldman Sachs Global Investment Research produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the world produce research on industries and companies, and research on macroeconomics, currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd (ABN 21 006 797 897); in Brazil by Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; Public Communication Channel Goldman Sachs Brazil: 0800 727 5764 and / or [email protected]. Available Weekdays (except holidays), from 9am to 6pm. Canal de Comunicação com o Público Goldman Sachs Brasil: 0800 727 5764 e/ou [email protected]. Horário de funcionamento: segunda-feira à sexta-feira (exceto feriados), das 9h às 18h; in Canada by Goldman Sachs & Co. LLC; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in India by Goldman Sachs (India) Securities Private Ltd.; in Japan by Goldman Sachs Japan Co., Ltd.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs New Zealand Limited; in Russia by OOO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in the United States of America by Goldman Sachs & Co. LLC. Goldman Sachs International has approved this research in connection with its distribution in the United Kingdom.

Goldman Sachs International (“GSI”), authorised by the Prudential Regulation Authority (“PRA”) and regulated by the Financial Conduct Authority (“FCA”) and the PRA, has approved this research in connection with its distribution in the United Kingdom.

European Economic Area: GSI, authorised by the PRA and regulated by the FCA and the PRA, disseminates research in the following jurisdictions within the European Economic Area: the Grand Duchy of Luxembourg, Italy, the Kingdom of Belgium, the Kingdom of Denmark, the Kingdom of Norway, the Republic of Finland and the Republic of Ireland; GSI - Succursale de Paris (Paris branch) which is authorised by the French Autorité de contrôle prudentiel et de resolution (“ACPR”) and regulated by the Autorité de contrôle prudentiel et de resolution and the Autorité des marches financiers (“AMF”) disseminates research in France; GSI - Sucursal en España (Madrid branch) authorized in Spain by the Comisión Nacional del Mercado de Valores disseminates research in the Kingdom of Spain; GSI - Sweden Bankfilial (Stockholm branch) is authorized by the SFSA as a “third country branch” in accordance with Chapter 4, Section 4 of the Swedish Securities and Market Act (Sw. lag (2007:528) om värdepappersmarknaden) disseminates research in the Kingdom of Sweden; Goldman Sachs Bank Europe SE (“GSBE”) is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) and Deutsche Bundesbank and disseminates research in the Federal Republic of Germany and those jurisdictions within the European Economic Area where GSI is not authorised to disseminate research and additionally, GSBE, Copenhagen Branch filial af GSBE, Tyskland, supervised by the Danish Financial Authority disseminates research in the Kingdom of Denmark; GSBE - Sucursal en España (Madrid branch) subject (to a limited extent) to local supervision by the Bank of Spain disseminates research in the Kingdom of Spain; GSBE - Succursale Italia (Milan branch) to the relevant applicable extent, subject to local supervision by the Bank of Italy (Banca d’Italia) and the Italian Companies and Exchange Commission (Commissione Nazionale per le Società e la Borsa “Consob”) disseminates research in Italy; GSBE - Succursale de Paris (Paris branch), supervised by the AMF and by the ACPR disseminates research in France; and GSBE - Sweden Bankfilial (Stockholm branch), to a limited extent, subject to local supervision by the Swedish Financial Supervisory Authority (Finansinpektionen) disseminates research in the Kingdom of Sweden.

General disclosures

This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large majority of reports are published at irregular intervals as appropriate in the analyst's judgment.

Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have investment banking and other business relationships with a substantial percentage of the companies covered by Global Investment Research. Goldman Sachs & Co. LLC, the United States broker dealer, is a member of SIPC ( https://www.sipc.org ).

Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

We and our affiliates, officers, directors, and employees will from time to time have long or short positions in, act as principal in, and buy or sell, the securities or derivatives, if any, referred to in this research, unless otherwise prohibited by regulation or Goldman Sachs policy.

The views attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do not necessarily reflect those of Global Investment Research and are not an official view of Goldman Sachs.

Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in the products mentioned that are inconsistent with the views expressed by analysts named in this report.

This research is focused on investment themes across markets, industries and sectors. It does not attempt to distinguish between the prospects or performance of, or provide analysis of, individual companies within any industry or sector we describe.

Any trading recommendation in this research relating to an equity or credit security or securities within an industry or sector is reflective of the investment theme being discussed and is not a recommendation of any such security in isolation.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of investments referred to in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Investors should review current options and futures disclosure documents which are available from Goldman Sachs sales representatives or at https://www.theocc.com/about/publications/character-risks.jsp and https://www.fiadocumentation.org/fia/regulatory-disclosures_1/fia-uniform-futures-and-options-on-futures-risk-disclosures-booklet-pdf-version-2018 . Transaction costs may be significant in option strategies calling for multiple purchase and sales of options such as spreads. Supporting documentation will be supplied upon request.

Differing Levels of Service provided by Global Investment Research: The level and types of services provided to you by Goldman Sachs Global Investment Research may vary as compared to that provided to internal and other external clients of GS, depending on various factors including your individual preferences as to the frequency and manner of receiving communication, your risk profile and investment focus and perspective (e.g., marketwide, sector specific, long term, short term), the size and scope of your overall client relationship with GS, and legal and regulatory constraints. As an example, certain clients may request to receive notifications when research on specific securities is published, and certain clients may request that specific data underlying analysts’ fundamental analysis available on our internal client websites be delivered to them electronically through data feeds or otherwise. No change to an analyst’s fundamental research views (e.g., ratings, price targets, or material changes to earnings estimates for equity securities), will be communicated to any client prior to inclusion of such information in a research report broadly disseminated through electronic publication to our internal client websites or through other means, as necessary, to all clients who are entitled to receive such reports.

All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client websites. Not all research content is redistributed to our clients or available to third-party aggregators, nor is Goldman Sachs responsible for the redistribution of our research by third party aggregators. For research, models or other data related to one or more securities, markets or asset classes (including related services) that may be available to you, please contact your GS representative or go to https://research.gs.com .

Disclosure information is also available at https://www.gs.com/research/hedge.html or from Research Compliance, 200 West Street, New York, NY 10282.

© 2023 Goldman Sachs.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of The Goldman Sachs Group, Inc.

- Jan Hatzius

- Economics Research

- Commercial real estate (CRE)

- Labor Markets

- United States

AI is showing ‘very positive’ signs of eventually boosting GDP and productivity

Goldman Sachs Research predicted last year that generative AI could boost GDP and raise labor productivity growth over the coming decade. Since publishing that outlook, investment in generative AI has boomed, but it will take time for the technology to filter into the overall economy.

“Until we've seen more significant uptake in the actual application of AI, in the regular work production process, I don't think that we're going to see as big of an impact on productivity,” says Joseph Briggs, who co-leads the Global Economics team in Goldman Sachs Research. Briggs wrote last year’s AI report with Goldman Sachs economist Devesh Kodnani.

“That being said, the early signals of future productivity gains look very, very positive,” he adds.

While adoption of generative AI is lagging investment in the technology , Goldman Sachs Research sees potential for AI to automate many work tasks. It’s expected to start having a measurable impact on US GDP in 2027 and begin affecting growth in other economies around the world in the years that follow.

We spoke with Briggs about how the team’s forecast has held up over the past year, which businesses are adopting generative AI, and the technology’s impact on the labor market.

Based on what you’re seeing from the data, how are we tracking against your productivity prediction?

We haven't seen much of an impact on productivity growth so far. But the reason being is, even though we still see a lot of potential for AI to automate a lot of the things that workers do on a day-to-day basis, thereby saving a lot of time and generating large productivity gains, the adoption rates are just fairly limited right now. The key step, of course, in automating tasks is that people have to start using it. And so until we've seen more significant uptake in the actual application of AI, in the regular work production process, I don't think that we're going to see as big of an impact on productivity.

That being said, the early signals of future productivity gains look very, very positive. Some of the academic literature and economic studies that have looked at the increase in productivity that we've seen following AI adoption, in a few specific cases, supports our view that large productivity gains are possible. The average increase in productivity is about 25%. Case studies of companies that have adopted AI imply similarly large efficiency gains. And so, you know, there's a lot of reasons to be optimistic. It will just take a little bit more time to see these productivity gains realized.

Did you change your forecast for the coming decade based on the actual data?

No, it really hasn't changed because our forecasts don’t assume any AI boost at all before 2027. And the very small increases in adoption that we've seen in the one year since we wrote our initial report, I think, are consistent with our view that over the next three years AI is probably not going to be a main driver of labor productivity and potential GDP growth. Even though we do still think that it's going to be a significant driver of productivity and GDP growth over a much longer horizon.

What explains the divergence between the strong investment in generative AI that you’re seeing compared with the slow rates of adoption?

For AI to be deployed on a widespread basis, there's a lot of things that need to happen. First you need to have models that are powerful enough and trained appropriately so they can actually be useful in everyday work product. Then you need to have the capability to facilitate and answer all the queries that people are going to be posing to AI models, when they do use them every day multiple times a day when they're engaged in regular work. Having both these things requires a big increase in investment in semiconductors which in turn requires a big increase in investment in network capacity.

And ultimately, that’s going to require an increase in electricity and collective power investment to support the increase in demand that facilitating queries will require.

We are seeing clear signs that investment is increasing. Revenues of semiconductor manufacturers are up about 50% since early 2023. If you look at forecast revisions for AI hardware providers, they imply about a $250 billion increase since a year ago. And so there's a lot of signs that the investment laying the groundwork for future use of AI is occurring.

The adoption and usage will occur when these pieces are in place, and companies actually start using AI on an everyday basis. For the most part that hasn't happened yet. We see about 5% of companies reporting that they do use generative AI today in regular production, but this is a fairly small share relative to the overall number of companies that we think will ultimately benefit.

How is that 5% putting generative AI to use?

There are a few specific use cases that are emerging if you look across the industries that are using generative AI. First and foremost, we see adoption rates higher in areas like information services, finance and insurance. The motion picture and sound recording industry, for instance, is another area where adoption is far above the economy wide average.

If we're talking about the things that people say that they're using it for, marketing, automation, chatbot, speech text, and data analysis are all areas that stand out as ways that companies are applying AI right now. This is kind of the low hanging fruit where AI is most applicable, at least in its current form. Ultimately, we think that a broader set of tasks are going to be automated by generative AI. But that probably requires a build out of an application layer to support the broader automation we see possible.

What about the other 95%? What’s holding them back?

There are a number of factors that are slowing down the pace of AI adoption. A lot of executives can see the economic potential of generative AI, but even those that see benefits report a lack of knowledge about AI, concerns about privacy and security, and concerns about overinvesting in an early version of the technology as barriers. I think that a lot these reasons broadly reflect that companies want to make sure that they get generative AI right, and companies are therefore taking deliberate approach to AI adoption.

These views generally align with what we've seen in some of the business surveys, where CEOs are asked about their intention to use generative AI. Very few say that they expect it's going to significantly impact their business over the next one to three years. Most say that they expect to see a significant impact over the three-to-10-year horizon.

What’s been the net impact on jobs? How do you expect that to change over time?

Given that we've seen very little adoption, it's not surprising that we haven't seen much of an impact on the labor market. If we look at things like the unemployment rate between occupations that are highly exposed to AI automation, and those that are less, they basically tracked each other one-for-one for the last year or two. There have been some layoff announcements attributed to generative AI, but for the most part it seems like a very, very small share – less than 20,000 of all layoffs generated in the economy, which comes down to less than 0.1% of total job separations. So AI hasn't resulted in any significant job loss yet.

In fact, if we look at the labor demand that is generated it’s probably driven a net increase in employment. There has been a notable pickup in job postings mentioning AI as a desirable skill. This is especially true in the information technology sector. And so, it's very well possible, and probably even likely, that the net impact on the labor market has been positive thus far. This is kind of in line with our expectations over the long run, where we do expect that generative AI won't lead to a large amount of job loss. We generally think that it's going to create opportunities either in AI adjacent sectors or occupations or in sectors where labor has a comparative advantage.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Explore More Insights

Sign up for briefings, a newsletter from goldman sachs about trends shaping markets, industries and the global economy..

Thank you for subscribing to BRIEFINGS: a newsletter from Goldman Sachs about trends shaping markets, industries and the global economy.

Some error occurred. Please refresh the page and try again.

Invalid input parameters. Please refresh the page and try again.

Connect With Us

COMMENTS

Learn how Goldman Sachs Research provides original insights and analysis for clients in various markets. Explore reports, podcasts, events and more on topics such as gene editing, music industry and black entrepreneurship.

Learn about the global team that provides fundamental research on companies, economies, industries, currencies and commodities. Explore our thought leadership, market-leading convening power and alumni network in the equity, fixed income, currency and commodities markets.

09 NOV 2023 Goldman Sachs Research Macro Outlook 2024: The Hard Part is Over. Goldman Sachs Research expects several tailwinds to global growth in 2024, including strong real household income growth, a smaller drag from monetary and fiscal tightening, a recovery in manufacturing activity, and an increased willingness of central banks to deliver insurance cuts if growth slows.

A vast library of research reports authored by Goldman Sachs' Global Investment Research analysts Search for and read research in your asset class, industry, region, and more Explore Goldman Sachs' most-viewed research over various timeframes—from intraday to up to a year

A report by Goldman Sachs Global Investment Research on the global economic outlook for 2022, with a focus on growth, inflation, and policy rates. The report expects strong global growth, a gradual normalization of monetary policy, and a persistent inflation surge in the near term.

A report by Goldman Sachs analysts projecting the future growth of global capital markets, focusing on equity market capitalisation, out to the year 2075. The report covers the long-term trends, drivers, and challenges for the global economy and the major economies, with a focus on emerging markets.

A report by Goldman Sachs Global Investment Research on the US and global economic outlook, inflation, monetary policy, and recession risks. The report cuts the US recession probability to 20%, expects the Fed to hike once more in July and then pause, and sees other G10 central banks nearing the end of their tightening cycles.

At Goldman Sachs, we commit our people, capital and ideas to help our clients, shareholders and the communities we serve to grow. Founded in 1869, we are a leading global investment banking, securities and investment management firm. Headquartered in New York, we maintain offices around the world.

Global Investment Research (GIR) provides investment recommendations by generating fundamental research and analysis of companies, industries, markets and economies. ... At Goldman Sachs, we commit our people, capital and ideas to help our clients, shareholders and the communities we serve to grow. Founded in 1869, we are a leading global ...

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by GSAM and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR).

Source: Goldman Sachs Global Investment Research 6 December 2022 . 5. Goldman Sachs. Global Economics Paper. RW-4704-982215856.pdf | RW-4704-982215856.pdf | Theme #3: A decade of US exceptionalism that is unlikely to be repeated. Uniquely. among large, developed economies, the US slightly outperformed our long-term real .

At Goldman Sachs, we commit our people, capital and ideas to help our clients, shareholders and the communities we serve to grow. Founded in 1869, we are a leading global investment banking, securities and investment management firm. Headquartered in New York, we maintain offices around the world. We believe who you are makes you better at what ...

Global Investment Research, Global Macro Research, Credit Strategy Research, Analyst Goldman Sachs New York, NY 1 week ago Over 200 applicants

The Global Investment Research Division of Goldman Sachs produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the world produce equity research on industries and companies, and research on macroeconomics, currencies, commodities and portfolio strategy.

Research from Goldman Sachs shows the S&P 500 has never been this top-heavy, which is leading to gains in seven stocks driving the major average higher. (Goldman Sachs Global Investment Research)

A redacted version of a report published in January 2022, featuring interviews with experts on the virus, vaccines, and treatments, and the macro and market implications of the Omicron variant. The report covers the US, Japan, Europe, and EM economies, and provides GS proprietary datapoints and forecasts.

Generative AI could raise global labor productivity and GDP by 7% by automating tasks and creating new jobs, according to a Goldman Sachs report. The report analyzes the capabilities, adoption, and effects of generative AI on the labor market and the economy.

Goldman Sachs' Global Investment Research division delivers value-added research to clients in the equity, fixed income, currency and commodities markets. Goldman Sachs develops global client-focused research in economics, portfolio strategy, derivatives and equity and credit securities. Our clients use these insights and investment ideas to ...

Towards a Better Balance. We recently laid out our Global Macro Outlook for 2024—The Hard Part is Over. We provide more detail on our Global Markets Outlook here, highlighting as usual. 10 core investment themes that drive many of our market views. More detailed outlooks for the individual asset classes are forthcoming.

Goldman currently has an average brokerage recommendation (ABR) of 1.48, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc ...

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other ...

BERLIN, May 23 (Reuters) - Goldman Sachs (GS.N) has chosen Jens Hofmann and Tibor Kossa, both working for the bank, as new co-heads of its Germany and Austria investment banking business, one of ...

Goldman Sachs Careers. Apply for your next opportunity with Goldman Sachs. DIVISIONAL OVERVIEW. Global Investment Research (GIR) provides investment recommendations by generating fundamental research and analysis of companies, industries, markets and economies. Our clients include asset managers, hedge funds, mutual funds, pension funds, and ...

Incorporating that information, along with our equity analysts' revenue growth projections for key AI-exposed businesses, Goldman Sachs Research estimates AI investment could approach $100 billion in the U.S. and $200 billion globally by 2025. "Despite this extremely fast growth, the near-term GDP impact is likely to be fairly modest given ...

Goldman Sachs Careers

This research, and any access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman Sachs. In producing research reports, members of Global Investment Research of Goldman Sachs Australia may attend site visits and other meetings hosted by the companies and other ...

Published on 13 MAY 2024. Topic: Artificial Intelligence. Goldman Sachs Research predicted last year that generative AI could boost GDP and raise labor productivity growth over the coming decade. Since publishing that outlook, investment in generative AI has boomed, but it will take time for the technology to filter into the overall economy.