WTO / Applications / 20 Best Loan Application Letter Samples (Guide and Format)

20 Best Loan Application Letter Samples (Guide and Format)

An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time.

The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the information provided or not. Writing it is important because it helps convince lending institutions to lend you a specific amount of money. It is their first impression of you, which is why it should be written with great care. In this article, we will guide you on how to write it, the type of information you should provide, and some pointers that will help you highlight your strengths in the letter.

Brief Overview- What to Include

There are no strict rules for writing an application for a loan. It depends on the borrower to decide what information to include, but the following items are typically included in it:

- Contact information

- Explanation of why money is needed

- Amount of money being requested

- Purpose of the money

- Details about employment history

- Personal references

- Company information

- A list of supporting documents

When to Write?

Two main situations warrant this letter. The first instance is when you are seeking a loan from a conventional bank lender. Conventional bank lenders are financial institutions that do not offer loans but make them available to the general public. Conventional banks usually require applicants to submit this application to prove their creditworthiness.

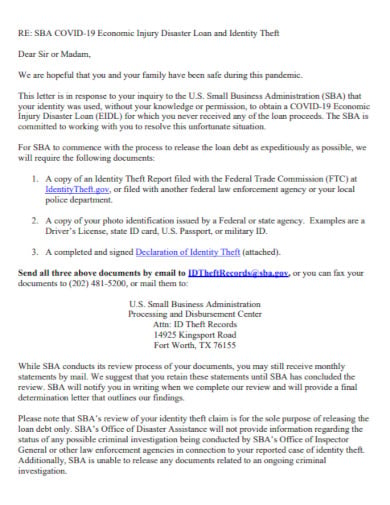

The second situation that warrants its use is when applying for an SBA-guaranteed loan. An SBA-guaranteed loan involves the federal government; applicants must undergo additional screening before they are approved for funding. Applicants can improve their chances of getting an SBA guarantee by submitting a personalized, formal loan application with supporting documentation.

There are situations when you do not necessarily need to write this letter, such as when you are borrowing from friends and family, from an alternative lender who may only require your bank statements or pay slips, when seeking equipment financing, and lastly when you are requesting a business line of credit.

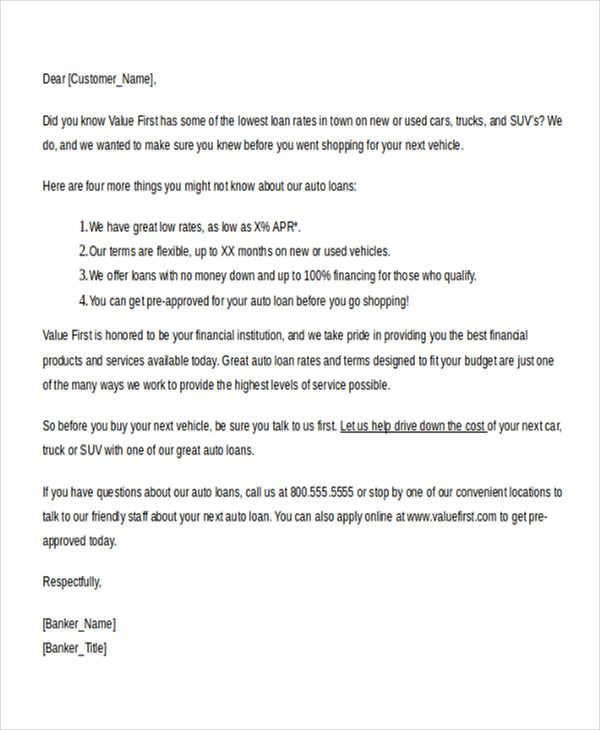

Free Templates

Pre-writing Considerations

Applying for a loan involves being prepared for anything, so it is important to have the things you need before writing. Do some research on your lender, and write down notes about why they are suitable for you and what you would like them to know about your project. Write those questions that may arise during the process of applying for your loan. Check your credit score and know your rights as a borrower when you apply for a loan.

After you have done all of the above, review everything and ensure that what you’ve written is easy to understand by someone who has not read your notes or audited your finances. When applying for a loan in a major financial institution or applying for an SBA loan, you will almost always be required to write an application letter for a loan. It is important to note that unless it is supported by a sound credit situation or proper financial planning, it may not be enough to help you secure the loan.

Fortunately, there are two things that you can do to increase your loan limit and increase your chances of getting a loan. You can first check your business and personal credit scores from accredited credit reporting bureaus such as TransUnion, Equifax, and Experian and take the necessary steps to improve them.

The second thing that you can do is to prepare your business financial statements, i.e., your profit and loss statement, cash-flow statement, balance statement, etc., for the past six months and attach them to your letter. These documents are essential when applying for a loan as they help the financial institution assess your creditworthiness and increase your chances of securing a loan.

How to Write a Loan Application?

Writing it can seem daunting, but it can be a simple process if you follow the proper format and include all the required information.

The following is a summary of the information you must provide in your letter:

The header is an integral part of the standard business letter format. It should include:

- Your name and contact information : Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached.

- The date : Include the month, day, and year of the letter. You must ensure that you write the date on which the letter was created.

- The name of the recipient : This will be a bank representative in many cases, but it can also be an SBA representative or another financial institution to whom the borrower is addressing the letter.

Subject line

When writing it, make sure to include a clear subject line that will help the recipient understand the purpose of the letter. Make sure to include whether the loan is for personal or professional use in the subject line.

“Loan Request Application Letter.”

Address your letter correctly. If you do not know who will be reading it, write “ To Whom It May Concern .” If you are trying to get a business loan, address it to the company’s representative issuing the loan. If you are applying for a personal loan, address it to the bank or whoever provides it.

Introduction

It should begin with a brief statement of the goal and amount you are requesting. It should also state your qualifications for the loan and any other pertinent information that can be used for your evaluation as a borrower such as your financial status, your work history, the length of time you have been in business, etc.

The body is the main part of the letter, and it should contain all the information the recipient will need to decide whether to grant the loan or deny the request.

Some of the information that must be covered in the body includes:

- Basic business information : If you are writing it, the first item to include in the body of the letter is details about your business. This information will help the lender understand who you are and will serve as the foundation for your loan application. Some of the information that you should cover in this section includes your business’s registered name, business type (i.e., partnership , sole proprietorship, LLC , etc.), nature of your business (i.e., what you do), main services and products, your business model, the number of employees that you have, and your annual generated revenue.

- The purpose of the loan : You must explain why you need the loan and the purpose for which it is being requested. This can be to purchase or expand a business, for a personal reason, or to pay some debt.

- Present yourself as being trustworthy : To get a loan, you need to establish trust with the lender. This can be achieved by explaining what you do for a living, providing some identity documents, and demonstrating why you deserve to be trusted.

- Explain how you intend to pay back : Explain briefly how you plan on repaying the loan. This should include a timeline for repayment and be supported by evidence such as a business plan, personal financial statement, or credit report .

- Proof of financial solvency : In some cases, you will be asked to provide evidence that the funds requested are not your only source of income. Documents like bank statements or tax returns can help you prove that you have other sources of funding, which will increase the likelihood that your request will be granted.

In the conclusion, you must thank the lender for considering your request. Briefly mention all the attached financial documents. Remember that each lender has their own set of loan application requirements and may request different information or documentation from borrowers, so make sure to double-check the specific instructions provided by the lender.

Once you have finished writing the letter, be sure to sign it at the bottom. You may include phrases such as:

“Respectfully yours” or “Sincerely yours”.

Place your name and contact information directly above the signature line.

SBA Loan Application Letter Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Loan Officer’s Name]

[Bank Name]

[Bank Address]

Dear [Loan Officer’s Name],

I am writing to apply for a Small Business Administration (SBA) loan to help fund my [business name]. I am excited to have the opportunity to present my business plan to you and explain why I believe my business is a great candidate for an SBA loan.

[Provide an introduction to your business, including its history, products or services offered, and unique selling proposition. Explain why you started the business and what sets it apart from competitors. This should be no more than two paragraphs.]

I am seeking an SBA loan in the amount of [$ amount], which will be used to [briefly explain how the funds will be used]. My business has experienced steady growth in recent years, but we need additional capital to take advantage of new opportunities and expand our reach.

[Provide a detailed explanation of how you plan to use the funds, including any expected return on investment. Be specific about the amount of money you need, how long you will need it for, and how it will be used.]

As part of my loan application, I have included the following documents for your review:

- Business plan

- Financial statements for the past three years

- Tax returns for the past three years

- Cash flow projections

- Articles of incorporation

- Personal financial statements for all owners

A list of collateral that will be used to secure the loan, if applicable

[Provide a comprehensive list of all the documents you have included with your application. Make sure you have included everything the bank has asked for, and any additional documents that may be relevant.]

I am confident in the future success of my business and believe that an SBA loan is the right choice for us. I understand that the loan application process can be lengthy, and I am committed to providing any additional information or documentation that may be required to support my application.

Thank you for considering my loan application. I look forward to hearing from you soon.

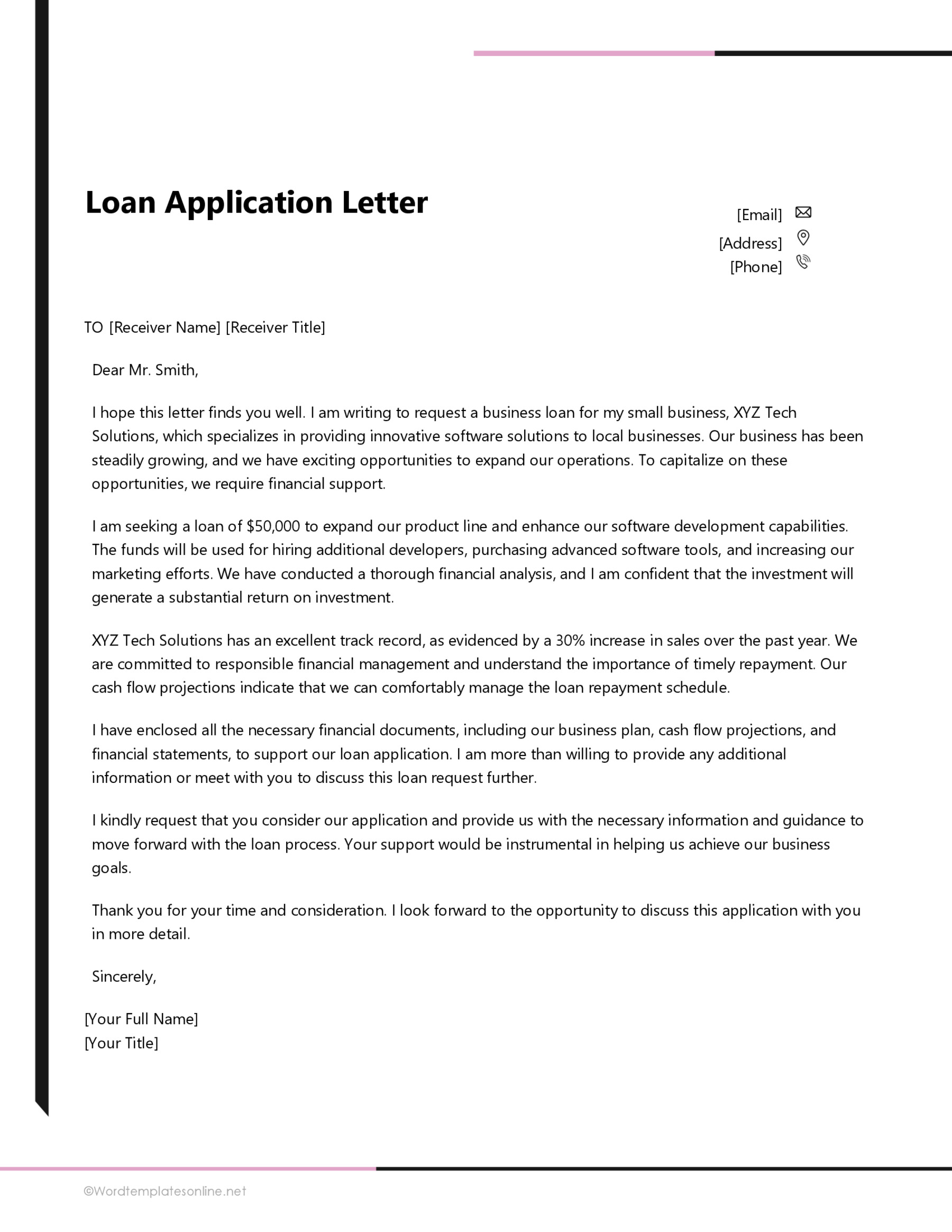

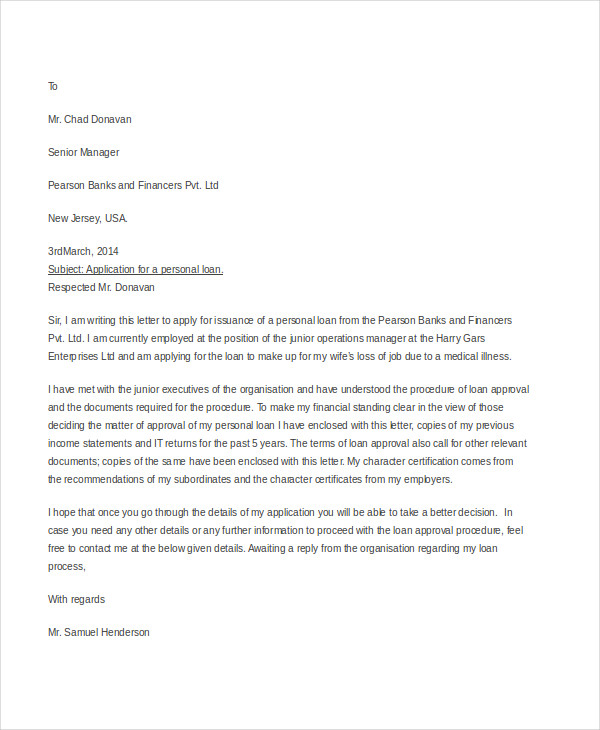

Loan Application Letter Sample

Make your small business loan application more polished with our simple sample letters. They’re crafted to help you convey your needs professionally and improve the impact of your request.

Sample letter 1

Dear Sir/Madam,

I am writing to apply for a Small Business Administration loan to support my growing business, GreenTech Innovations. Established in 2018, we specialize in eco-friendly technology solutions. Our recent market analysis indicates significant growth potential in sustainable energy products.

To capitalize on this opportunity, we require additional funding for research and development, marketing, and expanding our team. An SBA loan would enable us to invest in these critical areas, fostering innovation and job creation. Our business plan, attached to this application, outlines our strategy for a sustainable and profitable future.

GreenTech Innovations has a strong financial track record, with consistent revenue growth over the past three years. We have maintained a healthy cash flow and have a solid plan for loan repayment, as detailed in our financial projections. Our commitment to financial responsibility and strategic growth makes us an ideal candidate for an SBA loan.

Thank you for considering our application. We are committed to contributing positively to the economy and the environment. Your support would be instrumental in helping us achieve our goals.

Jordan Smith

Owner, GreenTech Innovations

Sample letter 2

Dear Business Loan Officer,

I am reaching out to request a business loan for my company, Bella’s Boutique, a unique clothing and accessories store located in downtown Springfield. Since our opening in 2019, we have become a beloved part of the local community, known for our exclusive designs and personalized customer service.

This loan is sought to enhance our inventory, upgrade our in-store technology, and expand our online presence. These improvements are essential for keeping pace with the evolving retail landscape and meeting the growing demands of our customers. Our detailed business plan is attached for your review.

Financially, Bella’s Boutique has demonstrated resilience and growth, even amid challenging economic times. Our sales figures have shown a steady increase, and we have a clear plan for managing the loan and ensuring its repayment. We believe these factors make us a strong candidate for a loan.

Your consideration of our loan application is greatly appreciated. This funding will not only help Bella’s Boutique thrive but will also support the local economy by providing more employment opportunities and enhanced retail experiences.

Thank you for your time and consideration.

Warm regards,

Isabella Martinez

Founder, Bella’s Boutique

The effectiveness of these sample letters as a guide for someone seeking to write a loan application lies in several key aspects. Firstly, they demonstrate the importance of a clear and concise introduction, where the purpose of the letter is immediately stated, ensuring the reader understands the intent from the outset. This is crucial in any formal business communication. Both samples skillfully describe the nature and background of the respective businesses, providing just enough detail to give the reader a sense of the company’s identity and market position without overwhelming them with unnecessary information. This balance is vital in maintaining the reader’s interest and establishing the context of the request.

Moreover, the letters excel in explicitly stating the purpose of the loan, which is a critical component of any loan application. They outline how the funds will be utilized to grow and improve the business, demonstrating not only a clear vision but also a strategic approach to business development. This helps in building a sense of trust and reliability with the lender. Furthermore, the inclusion of financial health indicators, such as past revenue growth, cash flow management, and a repayment plan, adds to this trust by showing financial responsibility and foresight.

The writers also incorporate attachments like business plans and financial projections, which provide additional depth and substantiation to their claims. This shows thorough preparation and professionalism, which are highly regarded in the business world. Finally, the tone of the letters is appropriately formal yet approachable, and they conclude with a note of gratitude, reflecting good business etiquette. This combination of clarity, conciseness, relevance, and professionalism makes these letters exemplary guides for anyone looking to draft an effective and persuasive business loan application.

Tips for Writing

Following are some tips for writing this letter:

Be specific

Be sure to include specific details in it to keep the reader’s attention. Ensure that you include information about the purpose of the loan, how much money you need, and the reason why you are a good candidate for a loan.

Brevity is essential when writing this letter. Stick to the essential points and avoid extraneous details. This will help to ensure that your letter is easy to read and that the reader is not distracted by irrelevant information.

Address the appropriate person

Ensure that you address your letter to the most relevant party for your particular situation.

Consider contacting the bank to find out to whom it should be addressed. This is how you can be sure that it will get to the right person.

Use a proper format and layout

As with all letters, you should use clear, concise paragraphs and avoid unnecessary jargon. Make sure to use the appropriate format for formal letter writing and use a professional, polished layout.

Include business financial statements

The financial statements for your company must be attached to your letter if you are a business owner. In this way, the reader will better understand your overall financial situation and help demonstrate that you are a good candidate for a loan.

The following are some of the purposes for which you may request a small business administration loan: to start a new business, to buy new equipment or inventory for your company, to upgrade or expand an existing business, to cover unanticipated expenditures, to pay off high-interest debt, to fund marketing campaigns, to move your office to a new location, to buy insurance for your business, to purchase stock, to buy out shareholders, and for any other lawful reason authorized by the lender.

Key Takeaways

Here are the key takeaways from this article:

- When writing an application for a loan, be sure to provide specific details about the purpose of the loan, how much money you need, and why you are a good candidate for a loan.

- Use the standard business letter format and use clear, concise paragraphs.

- Brevity is vital when writing such a document, so mention only the essential points and avoid extraneous details.

- Address your letter to the most relevant party for your situation, and be sure to include your company’s financial statements.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Applications , Forms

Application for texas title (form 130 u) – guide & overview.

40 Free Credit Application Forms and Samples

Applications , Forms , Guides

How to fill out a rental application form [expert guide].

Applications , Education

11 best college application essay examples (format guide), thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

Applications , Request Letters

Loan Request Letter (Format & Sample Applications)

A Loan Request Letter is a letter written by a loan applicant and addressed to a lending institution, generally sent as a part of the loan application process. A loan request letter introduces you to the bank or other lending institution, clearly describes your planned use for the loan funds, and describes how you will pay back the loan. It is the part cover letter and part resume because you demonstrate the qualities that make you a good candidate for a loan by outlining your qualifications.

Anyone who applies for personal or business loan should write a loan request letter and enclose it with their loan application. This letter is often the lending institution’s first impression of you as a borrower. Therefore, it should be professional, clear, and concise, easily fitting into one page.

Important: Write using a professional format and in a professional tone. Banks and other lending organizations are concerned about your ability to repay the loan. Pointing out your financial problems works against you – instead, point out your qualifications as a borrower. Remember, this letter is your first contact with the lender and uses it to showcase your company as a reliable borrower.

What a Lender Needs to Know

In order to consider your loan request, a lender needs some information about you or your company. Although this information is included in detail in your loan application, your letter should formally introduce your request. Here is what you should include in your loan request letter:

- Your name and/or your company name, including any DBA

- Your contact information

- Your business entity structure

- Brief description of your business

- Your number of employees

- How long you have been in operation

- Annual revenue and profits if your company is profitable

- Amount of loan requested

- How the funds will be spent

- Your financial security

- A list of enclosures

The bank or lending institution is primarily concerned with how the money they are lending will be spent and repaid. Be sure to include information on these two critical points in your letter.

In addition to the loan application, you should enclose applicable financial documents, such as tax returns. Send your business plan, cash flow statement, and profit and loss (P&L) statement.

Loan Request Letter (Format)

{your name}

{your company’s name}

{your address}

{lender name}

{lender title}

{lender institution name}

{lender address}

RE: {(Small business) or (Personal)} loan request for {amount}

Dear {lender name}:

The purpose of this letter is to request a {(small business) or (personal)} loan in the amount of {amount} for the purpose of {purpose}. {Use this space to discuss your small business. Include name, business structure, and industry.}

{Business name} began operation on {date}, with {number} employees. As a {business structure type}, {business name} has consistently grown and now employs {number} individuals. {Use this space to discuss your marketing presence.}

{Use this area to briefly discuss your most recent year’s revenue and profit, if profitable. Discuss revenue and profit consistently over time when possible.}

{Use this area to describe the reason for the loan request.} {Use this area to explain that the opportunity is immediately available, but you lack sufficient immediate funds.}

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of {number} combine to make us a safe credit risk for {lending institution name}.

I would greatly appreciate the opportunity to speak with you about a {(small business) or (personal)} loan. I can be reached at {phone number} or by email at {email address}.

Thank you for your time and your consideration of my request.

{your signature}

Sample Loan Application Letter

Matthew Dobney

Entirely Electronics

3048 West First Street

Spavinah, OK 89776

EntirelyElectronics.com

June 22, 2048

Mr. James Burrows

SBA Loan Administrator

Bank of American Businesses

New York, NY 65782

RE: Small business loan request for $20,000

Dear Mr. Burrows:

The purpose of this letter is to request a small business loan in the amount of $20,000 for the purpose of enlarging our warehouse.

Entirely Electronics began operation on June 1, 2020, with two employees. As a partnership, Entirely, Electronics has consistently grown and now has 20 full-time employees. Entirely Electronics has been quite successful in obtaining a proportionate share of the online electronic retail community. Our online presence has grown from our website alone to Facebook, Instagram, and Yelp. Our marketing techniques consistently drive new customers to Entirely Electronics, and we boast a high customer retention rate.

Last year, Entirely, Electronics saw a growth of 25% in revenue over the previous year. Our profit margin remained stable at 18% throughout the year.

Our growth has created a significant shortage of available warehouse space, and market research shows we will continue to grow. As we look to the future, we understand we must create more warehouse space to continue growing. Although our revenue is consistent, we do not have the immediate large amount needed to complete the necessary expansions to our warehouse.

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of 790 combine to make us a safe credit risk for Bank of American Businesses.

I would greatly appreciate the opportunity to speak with you about a small business loan. I can be reached at 983-744-6597 or by email at [email protected] .

Loan Request Letter Template

Writing a loan request letter takes a bit of time and research, but does not have to be difficult. Using the above format, you can easily request a loan for your small business or a personal need. The sample letter demonstrates how to make a great first impression on a lending institution.

How did our templates helped you today?

Opps what went wrong, related posts.

Boyfriend Application Forms

Rental Application Forms & Templates

Rental Application Denial Letter: Template and Example

Leave Application Cancellation Letter

Cancellation Letter for House Purchase – Sample & Template

Sample Application Cancellation Letter (Tips & Template)

How to Write a Maternity Leave Letter

Leave of Absence Letter for Personal Reasons

Thank you for your feedback.

All Formats

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

Formal Loan Purpose Application Letter to Senior Manager

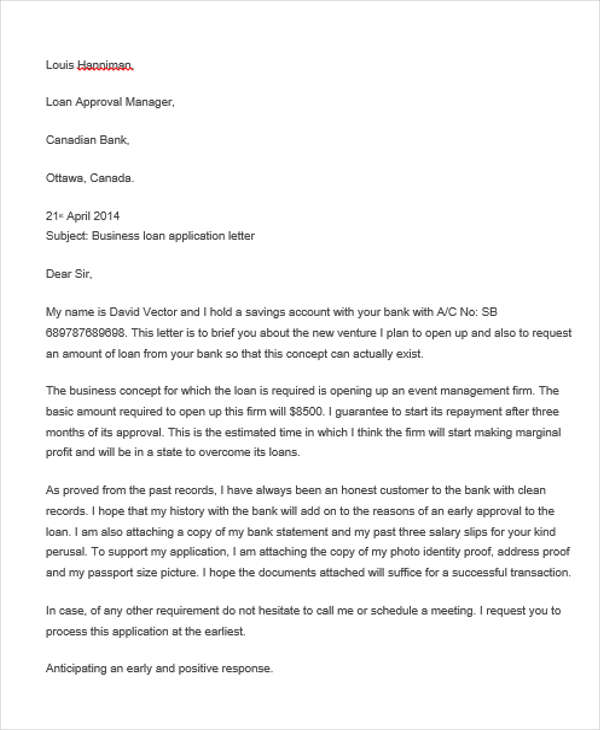

Formal Event Management Small Business Letter

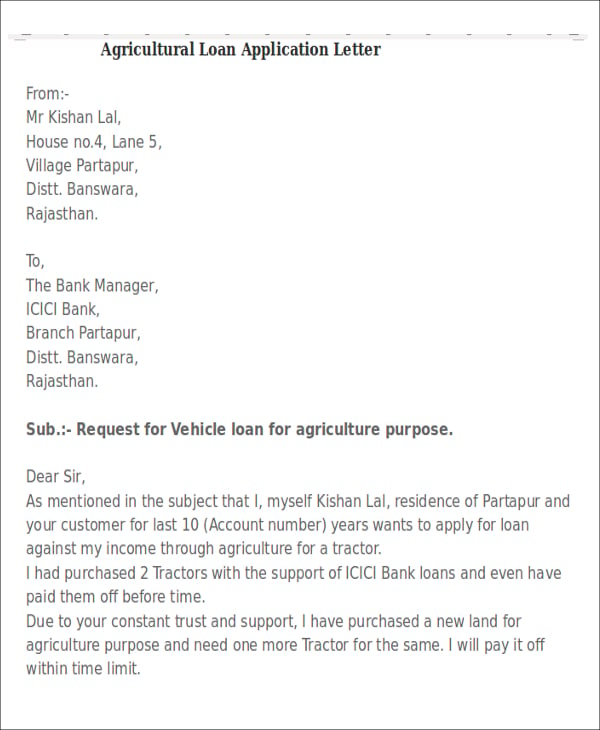

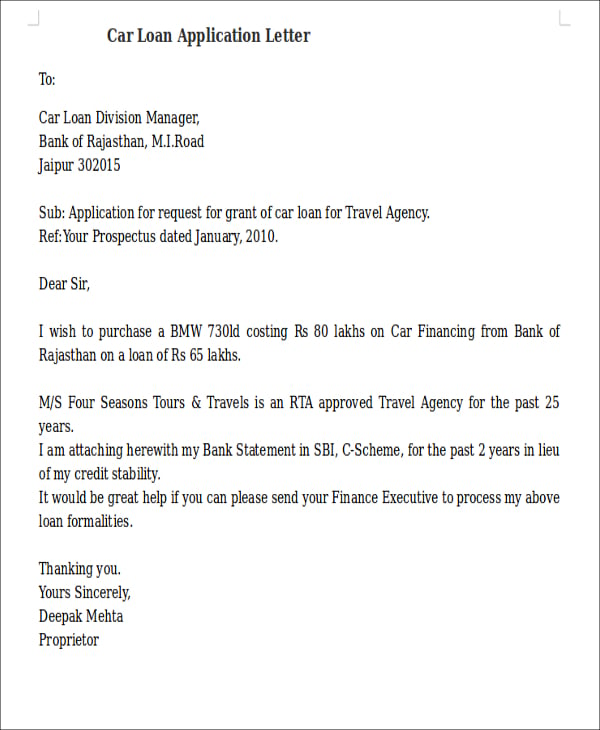

Sample Vehicle Application Letter Example

Agricultural Office Vehicle Application Letter Template

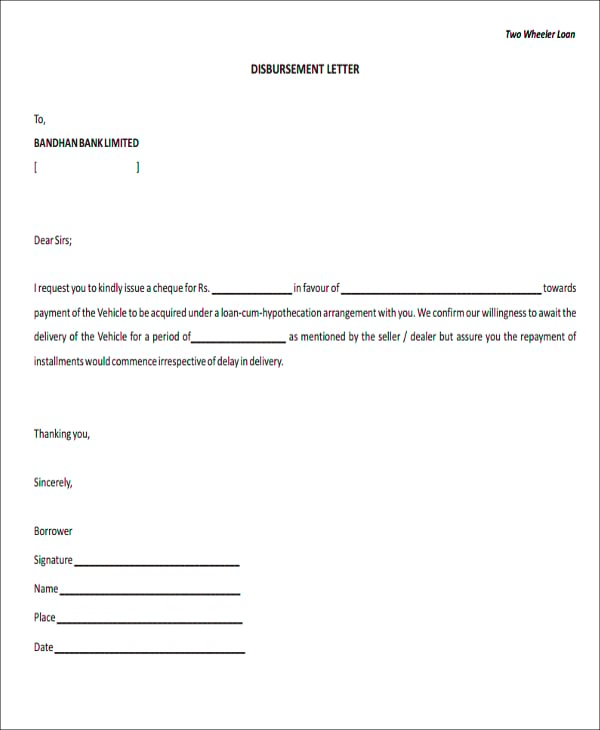

Sample Foreclosure Disbursement Application Form Letter

Example Work Travel Agency Letter

Application Letter to Canadian Bank for Loan

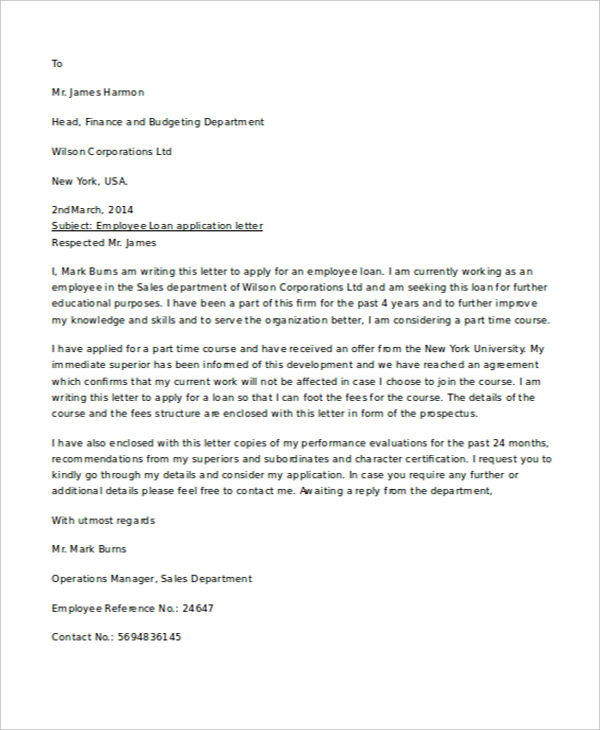

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

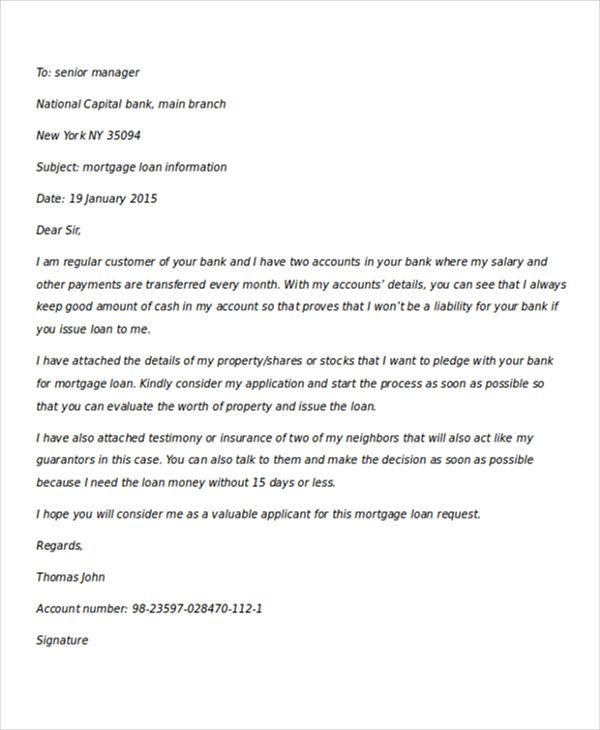

Mortgage Loan Application Letter with Boss Recommendation

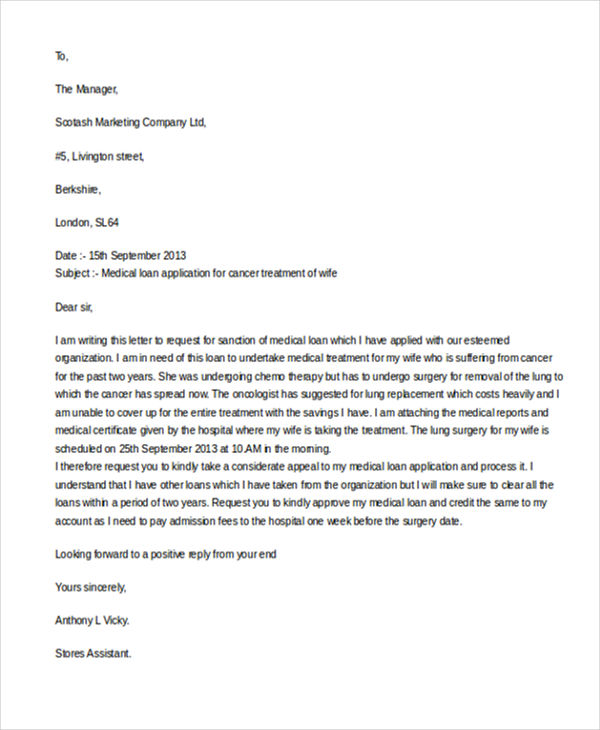

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

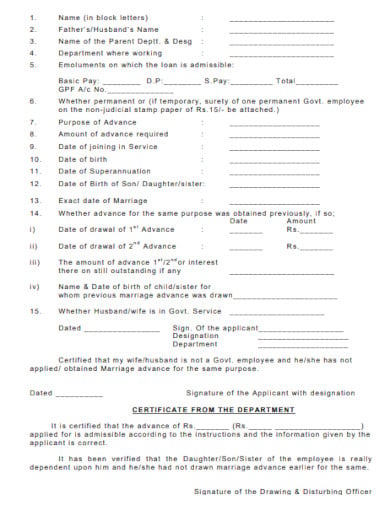

Loan Application Letter for Wedding/Marriage Template

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Sample Loan Application Letter Template

Simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template, loan application request letter to boss template, office loan application letter template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

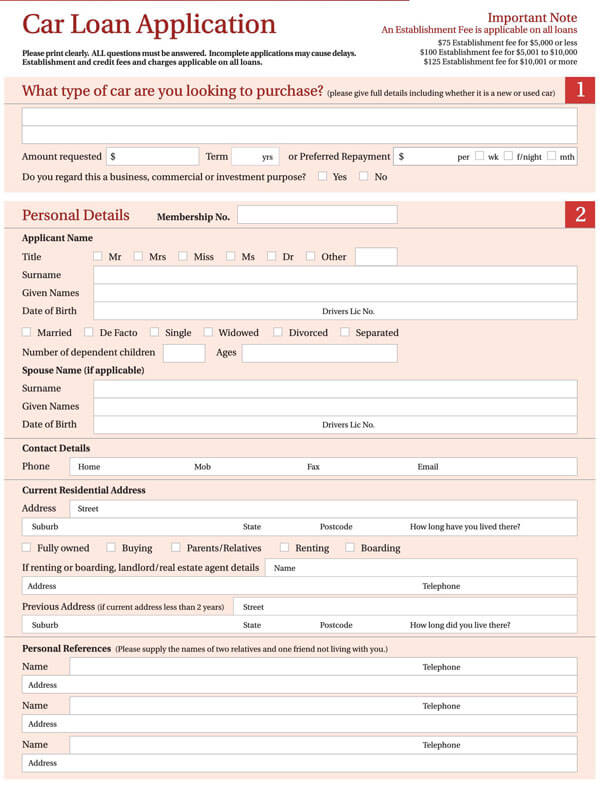

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

IMAGES

VIDEO

COMMENTS

When writing an application for a loan, be sure to provide specific details about the purpose of the loan, how much money you need, and why you are a good candidate for a loan. Use the standard business letter format and use clear, concise paragraphs.

Applying for a loan often requires not just meeting specific criteria but also writing a compelling loan application letter. This letter should provide a detailed account of how you plan to utilize the funds and why you’re a trustworthy candidate.

Writing a loan request letter takes a bit of time and research, but does not have to be difficult. Using the above format, you can easily request a loan for your small business or a personal need. The sample letter demonstrates how to make a great first impression on a lending institution.

Borrowing Money to save Your Business From Foreclosure is Now Easier When You Get Template.net's Free, Downloadable Loan Application Letter Templates In PDF, Word, and Google Docs with Sample Format.

Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need.

In this guide, I’ll share my personal tips, real-life examples, and three unique templates to help you write a loan application letter that works. Key Takeaways. Purpose of a Loan Application Letter: Explain why you need the loan and how you plan to use the funds.