Business Plan Review

Jump to Section

A business plan review is an in-depth examination of your business plan and its viability. It can be conducted by a single expert, a panel of experts, or you and your colleagues.

What Is a Business Plan?

A business plan is essential for any company wishing to start or expand its operations. It provides a framework for decision-making and helps to make sure that all sections of the organization are working together towards common goals. A good business plan can also help attract investors or obtain loans from banks or other lending institutions.

The main purpose of a business plan is to provide investors with information about the opportunities and challenges facing your company so they can make informed decisions about whether or not they want to invest in it. If they decide to invest, they'll know how much money they are likely to make and what risks might arise during their investment term (usually between five years and ten years).

Of course, not all startups need a full-blown business plan — but if you seek outside funding or investment, it's best to start developing yours as early as possible. And even if you don't seek outside funding, it's still smart to develop a comprehensive plan for your business to clearly define what success looks like and how you'll get there.

What Is a Business Plan Review?

A business plan review should be conducted before you begin your venture, at least once during its life cycle (preferably after you have experienced some success), and when it comes time for you to close up shop. The objective is to identify strengths and weaknesses in your plan so that you can take steps toward improving those areas.

The purpose of a business plan review is not to evaluate the likelihood of success for a given project or company but rather to determine whether the project has been adequately researched and whether the information presented is accurate and comprehensive enough for investors or other stakeholders to make an informed decision about investing in it.

Why Should You Have Your Business Plan Reviewed?

Your business plan is a living document. Over time, it will change as you grow and learn more about your business, market and competition.

But even when the plan isn't changing, it's important to review it regularly to ensure that you're still on track. Here are seven reasons why:

A good review will give you an unbiased look at your plan, highlighting areas where more information is required or gaps in your thinking. This can help ensure that your plan contains everything it needs to, which makes it easier to manage and gives investors confidence in your business.

A business plan is a blueprint for reaching your long-term goals. But a good review will help you see how well your current strategy aligns with those goals and whether there are any holes in the plan. If there are gaps, the reviewer can help you identify what needs to be changed and where resources must be allocated to achieve those goals.

Having someone look over your plan from an objective point of view can help you see potential problems before they become major issues. You might find that something is missing from your strategy or that too many steps are involved in achieving your goals. It could also reveal other important information that will help improve the overall quality of your plan.

Business plans don't just cover what's happened so far — they also forecast what's going to happen next year, six months from now and beyond. So if things change along the way, they may not be reflected in the plan written today. A review can help keep your focus on where you want to go in the future by reviewing your progress each month and adjusting accordingly if needed.

A good consultant will give you constructive feedback about areas where your business plan falls short. This is invaluable when it comes time to revise your plan to more accurately reflect the reality of what's happening in your company, whether due to external factors or internal mistakes. A comprehensive review will also show you where there are holes in your strategy and suggest how they can be filled to strengthen your company's position in its marketplace.

Looking at how your business has performed over time, you can identify areas of concern before they become serious problems.

For example, if sales are declining or profits are shrinking, these trends might be due to temporary factors that can be corrected with better marketing or product development. If sales continue to fall despite these efforts, however, there could be deeper-rooted problems that need addressing.

A good business plan will give you an idea of what your company can accomplish in the short term and over time.

A good business plan also helps potential investors understand what your business is about and why it has the potential for success. This means that if they invest in your company, they can be more confident that they're making a smart choice that will make them money.

- Business Strategy: Planning a company's strategic direction and goals. The business strategy consists of setting a business's vision and mission, identifying its strengths and weaknesses, and evaluating growth opportunities.

- Business Forecast: A business forecast predicts how well the company's revenue and expenses will fare for the next few years. It typically includes financial statements for the current year, estimates for the following year, and projections for two or three subsequent years.

- Bank-Ready Business Plan: A business plan that has been carefully prepared to meet all criteria set by banks when applying for a loan. The bank will want financial projections showing how your business can repay the loan and reasonable evidence that you have identified all costs associated with starting and operating your new business.

Hire the best lawyers for a business plan review through Contracts Counsel where you can find many qualified and vetted lawyers to help you go over your business plan.

Meet some of our Lawyers

Skilled in the details of complex corporate transactions, I have 15 years experience working with entrepreneurs and businesses to plan and grow for the future. Clients trust me because of the practical guided advice I provide. No deal is too small or complex for me to handle.

Steven Stark has more than 35 years of experience in business and commercial law representing start-ups as well as large and small companies spanning a wide variety of industries. Steven has provided winning strategies, valuable advice, and highly effective counsel on legal issues in the areas of Business Entity Formation and Organization, Drafting Key Business Contracts, Trademark and Copyright Registration, Independent Contractor Relationships, and Website Compliance, including Terms and Privacy Policies. Steven has also served as General Counsel for companies providing software development, financial services, digital marketing, and eCommerce platforms. Steven’s tactical business and client focused approach to drafting contracts, polices and corporate documents results in favorable outcomes at a fraction of the typical legal cost to his clients. Steven received his Juris Doctor degree at New York Law School and his Bachelor of Business Administration degree at Hofstra University.

Advised startups and established corporations on a wide range of commercial and corporate matters, including VC funding, technology law, and M&A. Commercial and Corporate Matters • Advised companies on commercial and corporate matters and drafted corporate documents and commercial agreements—including but not limited to —Convertible Note, SAFE, Promissory Note, Terms and Conditions, SaaS Agreement, Employment Agreement, Contractor Agreement, Joint Venture Agreement, Stock Purchase Agreement, Asset Purchase Agreement, Shareholders Agreement, Partnership Agreement, Franchise Agreement, License Agreement, and Financing Agreement. • Drafted and revised internal regulations of joint venture companies (board of directors, employment, office organization, discretional duty, internal control, accounting, fund management, etc.) • Advised JVs on corporate structuring and other legal matters • Advised startups on VC funding Employment Matters • Drafted a wide range of employment agreements, including dental associate agreements, physician employment agreements, startup employment agreements, and executive employment agreements. • Advised clients on complex employment law matters and drafted employment agreements, dispute settlement agreements, and severance agreements. General Counsel • As outside general counsel, I advised startups on ICOs, securities law, business licenses, regulatory compliance, and other commercial and corporate matters. • Drafted or analyzed coin or token sale agreements for global ICOs. • Assisted clients with corporate formations, including filing incorporation documents and foreign corporation registrations, drafting operating and partnership agreements, and creating articles of incorporation and bylaws. Dispute Resolution • Conducted legal research, and document review, and drafted pleadings, motions, and other trial documents. • Advised the client on strategic approaches to discovery proceedings and settlement negotiation. • Advised clients on employment dispute settlements.

The Castro Law Firm, located in Royal Palm Beach, Florida, provides a range of legal services to clients that focus on probate, estate plannnig and business matters. Our staff is fluent in Spanish. We offer free consultations and virtual appointments.

Artem (Art) V.

Art is an attorney licensed to practice in New York, specializing in business and corporate law. His expertise encompasses a wide range of services, including corporate governance, finance transactions, contractual issues, non-disclosure agreements, intellectual property, and privacy matters. Art's professional experience also includes advising institutional lenders in the commercial real estate sector on financing, restructuring, and workout projects. Passionate about supporting the growth and development of start-ups, as well as small and mid-sized corporations, Art offers customized legal solutions for a broad spectrum of concerns related to corporate matters, contracts, and general business affairs. His approach is tailored to meet the unique needs of each client, ensuring comprehensive support in navigating the complexities of the legal landscape.

Tayane M. Oliveira is a founding partner at Vannucci Oliveira. With a concentration in family law, Tayane is renowned for her commitment to providing compassionate yet powerful representation to her clients. Her experience as an associate attorney at Brodzki Jacobs & Brook, coupled with her unwavering dedication to her clients' welfare, prepared her for her current role at Vannucci Oliveira. Tayane's academic achievements are a testament to her rigorous intellectual curiosity and dedication to her profession. She graduated with a Bachelor of Arts degree in Criminal Justice, supplemented by a minor in Psychology, from Florida Atlantic University in 2013. The culmination of her academic pursuit came in 2017, when she earned her Juris Doctor degree, cum laude, from the esteemed Nova Southeastern University's Shepard Broad College of Law. Before co-founding Vannucci Oliveira, Tayane honed her skills in the heat of the courtroom, representing clients in an array of general civil litigation matters. This diversified exposure instilled in her an ability to tackle complex legal challenges, a skill she employs to benefit her clients in family law. Originally from Brazil, Tayane brings an international perspective to her practice. When not delving into legal briefs or advocating for her clients, she indulges in travelling, reading, spoiling her puppies, and exercising, activities that not only rejuvenate her but also provide her with a broader perspective on the world and her practice. *Supreme Court Certified Portuguese Speaking Mediator

P. McCoy Smith is the Founding Attorney at Lex Pan Law LLC, a full-service technology and intellectual property law firm based in Portland, Oregon, U.S.A and Opsequio LLC, an open source compliance consultancy. Prior to his current position, he spent 20 years in the legal department of a Fortune 50 multinational technology company as a business unit intellectual property specialist; among his duties was setting up the free & open source legal function and policies for that company. He preceded his in-house experience with 8 years in private practice in a large New York City-based boutique intellectual property law firm, working simultaneously as a U.S. patent litigator and U.S. patent prosecutor. He was also a patent examiner at the U.S. Patent & Trademark Office prior to attending law school. He is licensed to practice law in Oregon, California & New York and to prosecute patent applications in the U.S. Patent & Trademark Office; he is also a registered Trademark and Patent Agent with the Canadian Intellectual Property Office. He has degrees from Colorado State University (Bachelor of Science, Mechanical Engineering, with honors), Johns Hopkins University (Masters of Liberal Arts) and the University of Virginia (Juris Doctor). While in private practice, and continuing into his in-house career, he taught portions of the U.S. patent bar exam for a long-standing and well-known patent bar exam preparation course, and from 2014-2020 was on the editorial board of the Journal of Open Law, Technology & Society (JOLTS), and starting in 2023 will be on the editorial board of the American Intellectual Property Law Quarterly Journal (AIPLAQJ). He is the author or co-author of chapters on open source and copyright and patents in “Open Source Law, Policy & Practice” (2022, Oxford University Press). He lectures frequently around the world on free and open source issues as well as other intellectual property topics.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Need help with a Business Plan?

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

CONTRACT LAWYERS BY TOP CITIES

- Austin Business Lawyers

- Boston Business Lawyers

- Chicago Business Lawyers

- Dallas Business Lawyers

- Denver Business Lawyers

- Houston Business Lawyers

- Los Angeles Business Lawyers

- New York Business Lawyers

- Phoenix Business Lawyers

- San Diego Business Lawyers

- Tampa Business Lawyers

BUSINESS PLAN REVIEW LAWYERS BY CITY

- Austin Business Plan Review Lawyers

- Boston Business Plan Review Lawyers

- Chicago Business Plan Review Lawyers

- Dallas Business Plan Review Lawyers

- Denver Business Plan Review Lawyers

- Houston Business Plan Review Lawyers

- Los Angeles Business Plan Review Lawyers

- New York Business Plan Review Lawyers

- Phoenix Business Plan Review Lawyers

- San Diego Business Plan Review Lawyers

- Tampa Business Plan Review Lawyers

Legal Plans

ContractsCounsel made it very easy to find a lawyer to help our company with its legal needs.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Small Business BC

Resources for entrepreneurs to start and grow successful businesses.

Accédez la page d'accueil dédiée aux ressources en française de SBBC

Utilisez notre outil de traduction pour le site entier

5 Reasons Why You Should Get a Business Plan Review

As an entrepreneur, you understand the value of a well-crafted business plan. It’s the essential roadmap for launching your business and something you’ll use to impress banks and investors. Writing your plan yourself is the perfect opportunity to think critically about every aspect of your business. But it’s easy to get caught up in the process. Here are five reasons you should get a business plan review from a professional.

1. Get Validation

A business plan review is the perfect opportunity to discuss your strategies, plans, and goals with an experienced professional. They’ll give you objective feedback on your idea, flag any potential challenges, ensure you include key information, and present ideas you may have yet to consider.

2. Test Your Pitch

The ability to pitch your business is a necessary skill for any aspiring entrepreneur. At its core, a business plan is essentially an in-depth pitch. Knowing your plan inside and out will foster confidence among all investors you meet. So, having it undergo a review is like a “stress test” for your business.

3. Know Your Business Model is Viable

No matter how fantastic your business is, you’ll need money to sustain it. Can you demonstrate how your business will generate cash over the next six to 12 months? A business plan reviewer will ensure this is covered. They’ll be able to identify gaps in your numbers, how to adjust, and any minor details you may have missed.

4. Discover What to Tackle First

Getting a second set of eyes on your document will help you identify issues you must tackle before sharing it with investors. An experienced reviewer can clearly identify what to fix first so you can make it presentable as quickly as possible.

5. Gain Clarity in Your Decisions

Entrepreneurship can feel like a lot of pressure. Reviewing your business plan lets you share and discuss your plans and options with an expert. They can help you weigh the pros and cons of your choices and evaluate your decisions objectively. Once you’ve considered their recommendations, you can make an informed decision.

Where to Get A Business Plan Review

There are many more benefits to conducting a business plan review, and Small Business BC’s consulting and review service can help at every step of the way. Work with our expert business plan advisors and get the professional advice you need to turn your business ideas into reality. Download SBBC’s Business Plan Template and Cash Flow Forecasting Tool to get started on your business plan.

Small Business BC is Here to Help

SBBC is a non-profit resource centre for BC-based small businesses. Whatever your idea of success is, we’re here to provide holistic support and resources at every step of the journey. Check out our range of business webinars , on-demand E-Learning Education , our Talk to an Expert Advisories , or browse our business articles .

Share this Story

Related articles:.

- How to Start a Business as an Immigrant

- No, Business Plans Aren’t Dead – So Write a Good One

- How To Estimate Start-Up Costs for Your New Company

About Small Business BC

When you find yourself asking "How do I...?" Give us a call. We'd be happy to help.

- Sign up for eNews to get the latest SBBC updates:

- Your Name * First Last

Note: you can withdraw your consent at any time - for more information see our Privacy Policy or Contact Us for more details.

- Email This field is for validation purposes and should be left unchanged.

We respectfully acknowledge our place of work is within the ancestral, traditional and unceded territories of the Xʷməθkʷəy̓əm (Musqueam), Sḵwx̱wú7mesh (Squamish) and səl̓ilwətaʔɬ/sel̓ílwitulh (Tsleil-Waututh) and that we serve the Peoples of the many Nations throughout British Columbia.

- Class Notes

Digital Exclusives

- Blog Network

- School News

- Alumni Spotlight

Show Your Logic

Avoid conflict and build trust by establishing the “why” behind decisions and sharing it with colleagues.

Asking Questions, Unlocking Solutions

How reframing a problem creates value for customers

The Future of Fast Food

Alumni dish on the industry's digital transformation.

On a meteoric rise through the fiercely competitive luxury retail market, high-end handbag brand Anima Iris has been picked up by Nordstrom, Saks Fifth Avenue, and even Beyoncé. With geometric and bold designs, founder Wilglory Tanjong G22 WG22 expresses her ancestry in a fashionable and sustainable way. The bags are made in Senegal by expert craftspeople who have honed their techniques over decades and draw inspiration from centuries of heritage. The leather and other materials are sourced through local African business merchants. Anima Iris is environmentally friendly and employs a zero-waste model that ensures all materials are used and that no two products are the same.

Bilt Rewards

Bilt Rewards launched in 2021 and achieved immediate success in its first year. The startup credit-card rewards program by founder and CEO Ankur Jain W11 makes redeeming points from purchases easy with a unique twist — the card can be used toward rent payments. Jain explains that renters today are living with inflation and rising rent costs, resulting in many who now must pay close to 50 percent of their earned income on rent. Bilt helps this generation build credit while earning rewards that open up affordability in other areas of their lives, such as travel experiences and eventual home ownership.

An organic coconut butter with its early roots in Venture Lab’s Food Innovation Lab can now be found in 1,300 stores, including national chains Sprouts and Wegmans. Couple-turned-business-partners Breanna Golestani WG23 and Jared Golestani WG23 founded Kokada in 2020 to provide a healthier alternative to sugar-laden snacks and spreads typically found at the grocery store. Kokada offers a range of coconut butters that are all peanut-free and sugar-free and designed to be enjoyed as a dip, with a treat, or as part of a meal. The company gives back two percent of all sales to SERVE, a certified NGO based in Sri Lanka, where its ingredients are sourced.

Flagler Health

Developed by Albert Katz WG23 and Will Hu GED19, Flagler Health combines patient data and the power of AI to help physicians recommend treatments to their patients. (“It’s like giving a calculator to a mathematician,” says Katz.) Backed by $6 million in funding, Flagler Health now serves more than 1.5 million patients and recently launched a new product that provides remote patients with exercises to keep joints moving pre- and post-op. The startup made the Poets & Quants “Most Disruptive MBA Startups of 2023” list and was a finalist in Penn’s 2023 Venture Lab Startup Challenge.

Catching Eyes in the Attention Economy

New research shows how to use language to capture audience attention, from word choice to building suspense.

Juggling multiple vendors can be daunting for a small-business owner. Certa, led by CEO Jagmeet Lamba WG07 and CFO Dudley Brundige WG07, streamlines relationships with third-party vendors, making onboarding up to three times faster. The platform itself can reduce IT labor needs, allowing users to create personalized workflows. The company also has its own AI technology — CertaAssist — that can fill out supplier questionnaires, consolidate intake requests, and create data visualizations. Certa’s clients include Uber, Instacart, and Box, whose executives have reported reduced cycle times and operating costs after using the procurement software.

United for a Brighter Future

Dean Erika James reflects on opportunities for the Wharton community to come together and lead.

On the Scene

From Hong Kong to New York, Wharton alumni unite for Impact Tour gatherings, GOLD events, good music, and more.

Sigo Seguros

Spanish remains the most widely used language in the U.S. behind English, with an estimated 41 million current speakers. But Hispanic immigrants still face cultural barriers when they arrive in the States. Nestor Hugo Solari G19 WG19 and Júlio Erdos C10 ENG10 G19 WG19 created Sigo Seguros, a bilingual Texas-based car insurance technology company, to better serve this population. “Our differentiated product starts with a deep understanding of our community and its needs,” says Solari. The Spanish-language mobile and web portals, coupled with quick payback periods, are particularly appealing to working-class drivers. The “insurtech” company raised $5.1 million in additional pre-seed funding in 2023.

Supercharge Your Startup

Resources to help you jump-start your venture’s growth

Cancer can bring your life to a screeching halt. Along with the burden of navigating through new medical terminology and uncertainty, a positive diagnosis can generate feelings of loneliness and isolation. CancerIQ was founded by Feyi Olopade Ayodele W05 WG12 to offer a supportive and more strategic solution for health-care providers working with patients in early cancer detection and prevention. As a software platform, CancerIQ offers hyper-personalized care plans and assesses risks in patients by avoiding the one-size-fits-all approach. The tool focuses on early detection with more precise screening. CancerIQ has been implemented in more than 200 clinic locations across the U.S.

Every day seems to bring a new way to send, receive, or manage money. Managing cash flow on numerous platforms has become quite onerous, non? Au contraire . Piere, an AI-powered app founded by Yuval Shmul Shuminer W19, analyzes past transactions to create a customized budget in two taps. It’s a peer-to-peer facilitator (for such tasks as getting reimbursed for a group meal) and a spending tracker in one. Since Intuit shut down its popular Mint budgeting app, Piere is reported to be the ideal successor: News outlets have featured the app as part of the “loud budgeting” social media trend, and financial publications highlight it as a valuable tool for monitoring spending.

Heidi Block WG95 and her family first got hooked on pickleball during the COVID-19 lockdowns, when they played the sport together at home in New Jersey to pass the time and stay active. But when Block couldn’t find apparel specifically designed for pickleball, she decided to make her own. Along with her eldest son, Max, she founded Play-PKL, an online retailer selling premium pickleball equipment and stylish outfits for recreational players. The site also offers tips and lessons for beginning pickleballers.

Mid-Year Business Review: A Company’s Path to Success

Deciding whether or not to administer a mid-year business review can make or break the path of your company. Even if you’re busy, tired, or have other things to do, carving out a chunk of time to hold a review can significantly improve your chance of achieving financial goals.

A quality, comprehensive business review serves as a business status update and plan for the remainder of the year. The frequency of business reviews typically varies by company size as larger businesses tend to conduct them more frequently than smaller firms. While business advisors often, and perhaps accurately, recommend a quarterly business review, my observations among the most successful companies show only a mid-year review is necessary. The purpose of the mid-year business review is to monitor business performance, create solutions to make more money, and provide guidance for leadership via communication with, and for, your team.

Since management encompasses planning, organizing, leading, and controlling, a quality business plan review integrates each of those disciplines together. Let’s explore if a mid-year business review will benefit your company.

The purpose of a mid-year review

- Evaluate performance.

- Reallocate resources to better achieve goals.

- Make more money than you would have otherwise.

- Take stronger corrective actions than you would have without a mid-year review.

- Provide leadership for your team—too much silence taxes milestone goals.

- Offer focus for your team.

Reasons a mid-year review might be unnecessary

- Clearly meeting financial goals.

- Your team has knowledge of their duties and expectations of them for the rest of the year.

- Regular and sufficient monitoring of business performances.

- A full sales/marketing pipeline.

- Presence of all of the above.

There’s nothing quite like an abundance of cash in the checking account and a full sales and marketing pipeline to make a business owner comfortable and, consequently, ignore the need for business reviews. The goal of quality planning, however, is to prepare for the inevitable downturn while enjoying plentiful resources.

Types of business reviews and when to conduct them

While there are many different types of business reviews, these three fundamental types persist because they’re simple and effective. The following chart provides key elements for each fundamental business review, allowing you to determine which is right for your company:

Knowing how often to conduct the reviews stems from the successes your company has experienced.

- Never: Unfortunately, most small firms never conduct a review of their business, even if they need it.

- Annually: Conduct a review each year especially when successes remain high.

- Semi-annual: The best-in-class business planning processes occur in private industry when comprehensive reviews take place mid-year.

- Quarterly: Suggested as ideal in empirical business literature and by publicly traded companies due to quarterly SEC filing requirements, but often not practiced in smaller firms unless required by law.

- Monthly: Perform a monthly review when it seems that problems prevent goal attainment.

- Bi-Monthly: These reviews should be applied in the case of emergency situations.

- Weekly: The execution of a weekly review exists when facing bankruptcy, workouts, or the demands of obsessive-compulsive micro-managers.

Tips for a quality mid-year business review

Completing a mid-year business review makes updating your business plan easier. A review brings energy and action to the business planning process. To ensure a quality and comprehensive plan, employ the following tips:

- Planning and preparation by you must precede the meeting.

- Create and show your written agenda to your team.

- Allow sufficient time to complete the review.

- State the type of meeting, protocol, and expectations of the review.

- Discuss money matters last, or at least late, within the meeting(s).

- Meet your team where they are, as opposed to where you want them to be.

- Discuss first the successes and accomplishments to fertilize minds on necessary areas of improvement.

- Complete quality control check for communications with key players and organizations.

Taking time out of one’s busy schedule to hold a review is an essential part of business management. The first step is to write down an outline agenda highlighting what you want to accomplish with your team for the remainder of the current year. Try it. The exercises of integration, resource allocation, leadership, and communications strengthen the collective body of your company. Afterward, you will feel great knowing that you have created a more successful journey for you and your team.

Four Ways Managers Can Maximize Team Engagement

Executive coach Alissa Finerman WG98 offers strategies for improving both team and individual performance.

Battle Business Interruption, Keep Goals

To handle one of these six business interruptions, It’s OK for business leaders to shift attention from long-term goals, writes Wharton alumnus John J. McAdam.

Management Advice from a Startup All-Star

In her latest “Perfect Pitch” column, Katlyn Grasso W15 discusses leadership and increasing gender diversity on the cap table with Beth Ferreira, managing partner of WME Ventures.

Partnering with Millennials

It's estimated that one out of three employees in the U.S. workforce are millennials. Alissa Finerman explains why you can't ignore them and how managers can develop and partner with this important group.

Business Plan Evaluation

What’s a rich text element, static and dynamic content editing.

para link here

What is Business Plan Evaluation?

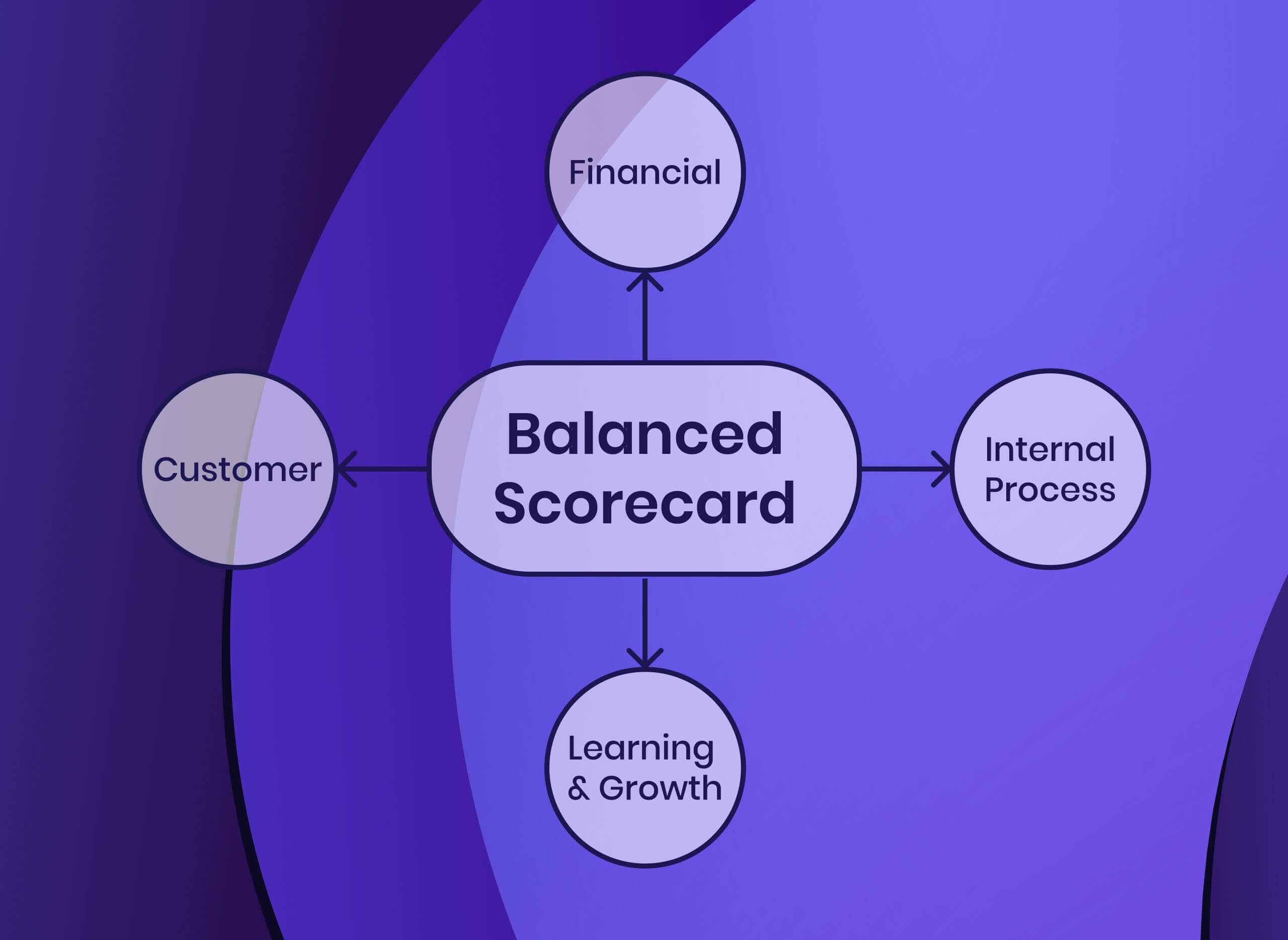

A business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business. The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team.

The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives. The evaluation process also helps identify areas where improvements can be made to enhance the chances of success. This process is particularly important for solopreneurs who are solely responsible for the success or failure of their business.

Importance of Business Plan Evaluation

The evaluation of a business plan is an essential step in the business planning process. It provides an opportunity for the entrepreneur to critically examine their business idea and identify potential challenges and opportunities . The evaluation process also provides valuable insights that can help improve the business plan and increase the chances of success.

For investors, a business plan evaluation is a crucial tool for risk assessment. It allows them to assess the viability of the business idea, the competence of the management team, and the potential for return on investment. This information is vital in making investment decisions.

For Solopreneurs

For solopreneurs, the evaluation of a business plan is particularly important. As they are solely responsible for the success or failure of their business, it is crucial that they thoroughly evaluate their business plan to ensure that it is feasible, viable, and has the potential to be profitable.

The evaluation process can help solopreneurs identify potential challenges and opportunities, assess the feasibility of their business idea, and determine the likelihood of achieving their business objectives. This information can be invaluable in helping them make informed decisions about their business.

For Investors

Investors use the evaluation process to determine whether or not to invest in a business. They look at various aspects of the business plan, including the business model, market analysis, financial projections, and management team, to assess the potential for success. If the evaluation reveals that the business plan is solid and has a high potential for success, the investor may decide to invest in the business.

Components of a Business Plan Evaluation

A business plan evaluation involves the analysis of various components of the business plan. These components include the executive summary, business description, market analysis, organization and management, product line or service, marketing and sales, and financial projections.

Each of these components plays a crucial role in the overall success of the business, and therefore, they must be thoroughly evaluated to ensure that they are realistic, achievable, and aligned with the business objectives.

Executive Summary

The executive summary is the first section of a business plan and provides a brief overview of the business. It includes information about the business concept, the business model, the target market, the competitive advantage, and the financial projections. The executive summary is often the first thing that investors read, and therefore, it must be compelling and persuasive.

In the evaluation process, the executive summary is assessed to determine whether it clearly and concisely presents the business idea and the plan for achieving the business objectives. The evaluator also assesses whether the executive summary is compelling and persuasive enough to attract the attention of investors.

Business Description

The business description provides detailed information about the business. It includes information about the nature of the business, the industry, the business model, the products or services, and the target market. The business description also provides information about the business's competitive advantage and how it plans to achieve its objectives.

In the evaluation process, the business description is assessed to determine whether it provides a clear and comprehensive description of the business. The evaluator also assesses whether the business description clearly outlines the business's competitive advantage and how it plans to achieve its objectives.

Methods of Business Plan Evaluation

There are several methods that can be used to evaluate a business plan. These methods include the SWOT analysis, the feasibility analysis, the competitive analysis, and the financial analysis. Each of these methods provides a different perspective on the business plan and can provide valuable insights into the potential for success.

It's important to note that no single method can provide a complete evaluation of a business plan. Therefore, it's recommended to use a combination of these methods to get a comprehensive understanding of the business plan.

SWOT Analysis

SWOT analysis is a strategic planning tool that is used to identify the strengths, weaknesses, opportunities, and threats related to a business. This method involves examining the internal and external factors that can affect the success of the business.

In the evaluation process, a SWOT analysis can provide valuable insights into the potential for success of the business. It can help identify the strengths and weaknesses of the business plan, as well as the opportunities and threats in the market.

Feasibility Analysis

A feasibility analysis is a process that is used to determine whether a business idea is viable. This method involves assessing the practicality of the business idea and whether it can be successfully implemented.

In the evaluation process, a feasibility analysis can provide valuable insights into the feasibility of the business plan. It can help determine whether the business idea is practical and whether it can be successfully implemented.

In conclusion, a business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business.

The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team. The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives.

Whenever you're ready, there are 4 ways I can help you:

1. The Creator MBA : Join 4,000+ entrepreneurs in my flagship course. The Creator MBA teaches you exactly how to build a lean, focused, and profitable Internet business. Come inside and get 5 years of online business expertise, proven methods, and actionable strategies across 111 in-depth lessons.

2. The LinkedIn Operating System : Join 22,500 students and 50 LinkedIn Top Voices inside of The LinkedIn Operating System. This comprehensive course will teach you the system I used to grow from 2K to 550K+ followers, be named a Top Voice and earn $7.5M+ in income.

3. The Content Operating System : Join 10,000 students in my multi-step content creation system. Learn to create a high-quality newsletter and 6-12 pieces of high-performance social media content each week.

4. Promote yourself to 215,000+ subscribers by sponsoring my newsletter.

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated April 17, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

10 Min. Read

14 Reasons Why You Need a Business Plan

11 Min. Read

How to Create a Sales Forecast

3 Min. Read

11 Key Components of a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The business plan review

Business Development Articles , Business Development Resources

If you have written a business plan for your business, how often do you look at it?

A business plan’s first purpose is to act as a road map for your business .

It acts as a framework through which you can express your thoughts on what should be achieved in your business and how you intend to achieve it. However, as your business grows and changes significantly, it is important to adjust your plan accordingly. It should be used as a checklist for all your objectives and goals, both short term and long term, and regularly reviewed as a way of noting your progress—particularly with regards to what strategies are working and which are not.

The review is a good practice for the beginning of each financial year in order to get your priorities straight and your head in the right mindset, and especially to reiterate your mission, vision and your goals for the year ahead.

You can look at what has changed within your business. Perhaps your business model changed, or you have new products and services (or have removed some). Maybe your costing models need to be altered, or you have an entirely new target market and need an updated customer profile. You might be looking to implement an offbeat marketing campaign or a different set of strategies. There could be a new competitor in your segment of the marketplace, or it could be as simple as a decline in figures. Basically, after any major changes, you need to dig up your business plan and reassess so your business can move forward and continue to grow. This article is based on an extract from the MentorNet mentoring program session on Business Planning, which was presented by Wendy Fogarty. For more information about the HerBusiness’s mentoring services, see the Mentoring section of this website. For details of the next Business Plans Made Easy, visit the Upcoming Events section of this website. This article was co-authored by Elizabeth Rowe. Elizabeth graduated with a Bachelor of Arts (English Literature) at the ANU and a Masters of Media Practice at the University of Sydney. She is currently completing an internship with the HerBusiness.

About the Author

HerBusiness (formerly Australian Businesswomen’s Network) is a membership community that provides education, training, resources, mentoring and support for women business owners.

view profile

author social links:

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business