- Career Blog

35 Bank Manager Job Description & Duties for 2024

A bank manager is an individual responsible for overseeing the operations of a financial institution. They are responsible for supervising employees, managing daily operations, and ensuring compliance with governing regulations. Bank managers also develop strategies to attract and retain customers, manage budgets, and evaluate financial data.

The role of a bank manager is vital to the success of any financial institution. They are responsible for creating a culture of exceptional customer service, developing and implementing policies and procedures, and managing the overall financial health of the bank. Bank managers also lead their teams in delivering efficient and effective financial services to customers. Without a skilled bank manager, a bank may struggle to stay competitive in the marketplace and meet the needs of its customers.

Key Skills and Qualifications of a Bank Manager

Bank Managers play a crucial role in the success of a financial institution. They are responsible for overseeing the daily operations of a bank and ensuring that all operations run smoothly to satisfy the needs of customers. The following are the key qualifications, skills, and experience needed to succeed in this role.

A. Qualifications Required

Bank Managers are required to have a Bachelor’s Degree in finance, accounting, economics, or any other related fields. In some cases, a Master’s Degree in business administration or finance may be preferred. This level of education proves that the manager has the necessary skills and knowledge to handle the complex and demanding financial responsibilities of the job. Additionally, bank managers are required to pass exams to get a license as per their state’s financial regulatory authorities.

B. Skillset Required

A successful bank manager must have an array of skills to execute their daily duties with precision. They should have strong communication and leadership skills to manage a team of bank employees effectively. Bank managers need to have strong analytical capabilities, problem-solving skills, and critical thinking to recognize any loopholes in the bank’s operations, evaluate risks, and proactively take appropriate action before they create problems. They must be familiar with financial analysis, accounting, budgeting, and banking regulations. In addition, a bank manager must be proficient in using various computer programs such as MS Excel, PowerPoint, and Outlook.

C. Experience Required

The ideal candidate for a bank manager role should have at least five years of experience in banking, finance, or accounting. They should have a proven record of success in handling wide-ranging banking operations and financial management duties. Experienced bank managers have a strong sense of how to improve customer experience, retain customer loyalty, and create sustaining relationships with clients. They should be conversant with banking procedures and regulations, understand the challenges that arise in banking operations, and show the ability to adapt and strategize.

Bank Manager positions are in high demand, and achieving the required qualifications, skills, and experience takes time and dedication. Candidates who possess excellent leadership skills, strong analytical skills, and financial know-how always stand a better chance of securing a bank manager role.

Roles and Responsibilities of a Bank Manager

As a bank manager, you are responsible for overseeing the day-to-day operations of the bank, as well as the long-term direction and growth of the institution. Here are some of the most important duties and responsibilities associated with this role:

A. Planning and Coordinating Activities

One of your primary responsibilities as a bank manager is to plan and coordinate the various activities that take place within the bank. This includes everything from setting goals and benchmarks, to developing strategies for growth and expansion, to ensuring that all employees are working together efficiently and effectively.

To achieve this, you will need to work closely with each department within the bank to identify areas of improvement and to develop plans to address those areas. You will also need to be able to communicate effectively with both employees and customers, in order to ensure that everyone is on the same page and working towards the same goals.

B. Meeting Sales Targets

Meeting sales targets is another important responsibility of a bank manager. This involves setting targets for the bank’s various products and services, and then working with your team to ensure that those targets are met.

To accomplish this, you will need to develop a strong understanding of the various products and services offered by your bank, as well as the needs and preferences of your customer base. You will also need to be able to motivate and inspire your team to work towards those targets, through effective coaching and performance management.

C. Managing Customer Service Operations

Another important responsibility of a bank manager is to manage the customer service operations of the bank. This involves ensuring that all customers are treated with respect and courtesy, and that their needs and concerns are addressed in a timely and effective manner.

To achieve this, you will need to work closely with your customer service team to develop training programs and procedures, as well as to monitor and evaluate customer satisfaction levels. You will also need to be able to establish and maintain positive relationships with customers, in order to build long-term loyalty and trust.

D. Ensuring Compliance with Laws and Regulations

As a bank manager, you will be responsible for ensuring that your bank is in compliance with all relevant laws and regulations. This involves staying up-to-date with the latest regulatory changes, and developing policies and procedures to ensure that the bank is operating in accordance with those regulations.

To achieve this, you will need to work closely with your legal and compliance teams, as well as with third-party auditors and regulators. You will also need to be able to communicate effectively with all employees, in order to ensure that they understand and are following all relevant laws and regulations.

E. Managing Funds and Budgets

Finally, as a bank manager, you will be responsible for managing the funds and budgets of the bank. This involves ensuring that the bank’s assets are being used effectively and efficiently, and that the bank is operating within its budgetary constraints.

Key Competencies of a Bank Manager

As a bank manager, there are several key competencies that you need to have in order to be successful in the role. Here are five of the most important competencies:

A. Leadership

Leadership is a crucial competency for a bank manager. You need to be able to inspire and motivate your team to achieve their goals, while also setting a good example by demonstrating integrity and accountability. A good leader is someone who is able to communicate effectively, delegate tasks appropriately, and create a positive work environment for their team.

B. Decision-making

Bank managers are often faced with difficult decisions that can have significant consequences. Being able to make good decisions quickly and confidently is therefore a crucial competency for the role. This involves being able to gather and analyze relevant information, weighing up the pros and cons of different courses of action, and making a decision based on sound judgment.

C. Communication Skills

Effective communication is an essential skill for any bank manager. You need to be able to convey complex information clearly and concisely, both verbally and in writing. This includes communicating with staff, customers, and other stakeholders, and being able to adapt your communication style to suit different audiences.

D. Business Acumen

Bank managers need to have a good understanding of the banking industry, as well as broader business and economic trends. This involves keeping up to date with changes in regulations, technology, and consumer behavior, and being able to use this knowledge to make informed decisions and identify opportunities for growth.

E. Analytical Thinking

Finally, bank managers need to be able to think analytically and strategically. This involves being able to analyze data, identify patterns and trends, and make informed decisions based on this information. It also involves being able to anticipate potential problems and proactively develop strategies to mitigate any risks.

The five key competencies for a bank manager are leadership, decision-making, communication skills, business acumen, and analytical thinking. By developing and honing these competencies, you will be well-equipped to succeed in this challenging and rewarding role.

Job Duties of a Bank Manager

A bank manager holds a critical position in a financial institution. He or she must be able to manage a sales team, ensure that business goals are met, develop and implement policies and procedures, monitor employee performance, and ensure customer satisfaction. In this section, we will explore each of these job duties in more detail.

A. Managing a Sales Team

One of the most important job duties of a bank manager is managing a sales team. Bank managers must be able to provide leadership and support to their sales team, motivating them to achieve their sales quotas and goals. Managers should identify areas for improvement through tracking sales figures, providing sales training to their team, and setting realistic targets.

B. Meeting Business Goals

Bank managers are responsible for ensuring that their branch meets business goals. These goals could include increasing loan volume or deposits, attracting new customers, and providing outstanding customer service. To achieve these goals, managers must have a deep understanding of the banking industry, trends, and challenges. Managers must review reports to evaluate bank performance and modify strategies to improve outcomes.

C. Developing and Implementing Policies

Developing and implementing policies is another vital job duty of a bank manager. Managers must ensure branch compliance with all applicable regulations and policies. For example, they might implement liquidity ratios, anti-fraud policies, and loan-to-deposit ratios. Managers have to work with multiple stakeholders, such as compliance and legal teams, to develop these policies.

D. Monitoring Employee Performance

Bank managers monitor employee performance within a branch. This job duty includes performing regular employee evaluations to ensure that the branch is meeting its goals, providing targeted training and development, and addressing any employee issues as they arise. Managers play a critical role in supporting employee growth and performance.

E. Ensuring Customer Satisfaction

Lastly, the bank manager must ensure that customers at their branch are satisfied. They must understand and adopt a customer-centric approach and maintain regular interaction with customers. The manager must ensure a high level of customer service, implement feedback programs, and maintain accountability for customer engagement metrics.

A bank manager’s job duties encompass a wide range of activities. They need to have strong problem-solving skills, leadership qualities, business acumen, and excellent communication skills. By effectively managing a sales team, meeting business goals, developing and implementing policies, monitoring employee performance, and ensuring customer satisfaction, the bank manager can help ensure the long-term success of the financial institution.

Types of Bank Managers

There are several types of bank managers, each with their own specific responsibilities and duties. In this section, we will discuss the four main types of bank managers: retail bank managers, investment bank managers, commercial bank managers, and private bank managers.

A. Retail Bank Manager

A retail bank manager oversees the daily operations of a bank’s branch or branches that serve individual customers. They are responsible for managing the bank’s personnel, budget, and sales goals. Retail bank managers are also charged with ensuring that customers are provided with quality service and products, managing the bank’s finances, and meeting regulatory requirements.

Depending on the size of the bank, the retail bank manager may have to perform additional duties such as handling customer complaints or assisting with loan applications. They may also be responsible for maintaining the bank’s records and ensuring that all financial transactions are accurately recorded.

B. Investment Bank Manager

An investment bank manager is responsible for overseeing the investment banking division of a bank. They manage a team of investment bankers who work with corporate clients to raise capital and provide financial advice. Investment bank managers are also responsible for managing the division’s finances and ensuring that the team meets its sales and revenue goals.

Investment bank managers must have a deep understanding of financial markets and economic trends, as well as the ability to build and maintain relationships with clients. They must also have strong leadership and management skills in order to effectively manage their team.

C. Commercial Bank Manager

A commercial bank manager oversees the daily operations of a bank’s commercial banking division. They manage a team of commercial bankers who work with business clients to provide loans, lines of credit, and other financial products and services. Commercial bank managers are also responsible for managing the division’s finances and ensuring that the team meets its sales and revenue goals.

Commercial bank managers must have strong financial and analytical skills, as well as the ability to build and maintain relationships with clients. They must also have strong leadership and management skills in order to effectively manage their team.

D. Private Bank Manager

A private bank manager is responsible for managing the bank’s portfolio of high net worth individuals and families. They work with clients to develop customized investment strategies and provide financial advice on estate planning, tax planning, and wealth management. Private bank managers also oversee a team of private bankers who work with clients to provide personalized financial solutions.

Private bank managers must have a deep understanding of financial markets and investment strategies, as well as the ability to build and maintain relationships with clients. They must also have strong leadership and management skills in order to effectively manage their team.

Bank managers play a crucial role in the success of a bank. Whether they are managing a retail, investment, commercial, or private banking division, bank managers must have strong financial and analytical skills, as well as the ability to build and maintain relationships with clients. They must also possess strong leadership and management skills to effectively manage their teams and meet their division’s goals.

Qualities of an Effective Bank Manager

A successful bank manager is not only responsible for overseeing the daily operations of a branch and ensuring customer satisfaction but also needs to possess certain qualities that will enable them to lead, motivate, and guide their team towards achieving the overall objectives of the bank. Here are some essential qualities that an effective bank manager must have:

A. Strategic Planning Skills

Strategic planning is crucial for the success and growth of any organization, and a bank is no exception. An effective bank manager should have the ability to analyze market trends, identify growth opportunities and threats, and develop a strategic plan that aligns with the bank’s vision and goals. This includes setting targets, creating action plans, and making informed decisions that will drive the bank’s growth and profitability.

B. Adaptability to Change

The banking industry is constantly evolving, and an effective bank manager should be able to adapt quickly to changes in the market, technology, and regulations. They must be able to pivot their strategies and work collaboratively with their team to adjust to new situations and stay ahead of the competition.

C. Strong Work Ethics

An effective bank manager should lead by example and have a strong work ethic that inspires their team to perform at their best. They need to be punctual, dependable, and accountable, and they should take ownership of their responsibilities. They should also promote a culture of integrity, honesty, and respect within their team and across the bank.

Compassion and understanding are vital qualities of an effective bank manager. They need to relate well to their team and customers, listen actively to their concerns, and ensure that their needs are met. This includes showing empathy towards customers who may be going through difficult financial situations and supporting their team members who may be facing challenges.

E. Transparency

Transparency is critical to building trust and confidence between the bank, its customers, and staff members. An effective bank manager should communicate openly and honestly with their team, customers, and stakeholders. This includes providing clear and comprehensive information about the bank’s operations, fees, and policies that affect customers. It also means being transparent about the bank’s financial performance and reporting it accurately and timely.

Being an effective bank manager requires a combination of skills, qualities, and experience. Strategic planning skills, adaptability to change, strong work ethics, empathy, and transparency are some of the essential qualities that an effective bank manager should have. By possessing these qualities, a bank manager can lead their team towards achieving the bank’s goals, retaining customers, and ensuring profitability.

Career Opportunities for Bank Managers

Banking is a dynamic sector, and there are a lot of opportunities for growth for ambitious and dedicated bank managers. In this section, we’ll take a closer look at some of the job roles available to bank managers, salary projections, and the various promotion and growth opportunities that exist within this field.

A. Job Roles

Bank managers are responsible for overseeing the daily operations of a bank branch, dealing with customer inquiries and complaints, and managing a team of employees. However, there are a few different job roles within this profession that you may be interested in pursuing.

Some of the different job roles that bank managers may hold include:

- Branch Manager – responsible for the overall management of a bank branch and its employees

- Assistant Branch Manager – supports the branch manager in day-to-day operations

- Operations Manager – oversees the operational side of the bank, ensuring that it runs smoothly and efficiently

- Relationship Manager – manages customer relationships and helps to grow the bank’s customer base

Depending on your strengths and interests, you may be better suited to one of these roles than another. It’s worth considering what you enjoy doing most and what skills you bring to the table when looking at potential job roles.

B. Salary Projections

Bank managers are highly skilled professionals who play an instrumental role in ensuring the success of a bank. As such, salaries for this role tend to be quite competitive. According to data from the research, the median annual salary for a bank manager in the United States is around $87,000, though this can range from around $68,000 to over $110,000 depending on your experience level and the size of the bank you’re working for.

In addition to a competitive salary, bank managers may also be eligible for bonuses and other benefits. These can include things like health insurance, retirement benefits, and paid time off.

C. Promotions and Growth Opportunities

One of the great things about a career in banking is that there are many opportunities for growth and advancement. As a bank manager, there are a few different ways that you can progress in your career:

- Moving into a more senior position within your current branch (e.g. from assistant branch manager to branch manager)

- Taking on a leadership role within the broader organization (e.g. regional manager)

- Pursuing a more specialized role within the bank (e.g. credit analyst or investment banker)

One of the most important things you can do to increase your chances of getting promoted and advancing in your career is to continually invest in your own professional development. This might involve attending training programs, pursuing additional qualifications or certifications, or simply seeking out opportunities to take on new challenges and responsibilities.

Ultimately, the career opportunities available to bank managers are vast and varied. Whether you’re interested in moving up the ranks within your current branch or exploring new opportunities within the broader financial sector, there are plenty of options available to you.

Educational Requirements for Bank Managers

Bank Managers are responsible for overseeing the daily operations and finances of a bank. In order to become a bank manager, you must meet certain educational requirements. These requirements include a degree in a related field, additional certifications, and continuous education.

A. Degree Requirements

Most banks require a bachelor’s degree in finance, accounting, economics, or a related field to become a bank manager. Some banks may accept degrees in business administration or management as well. Additionally, a master’s degree in business administration (MBA) or finance is strongly preferred and may be a requirement for higher-level bank management positions.

B. Additional Certifications

In addition to a degree, bank managers must also possess certain certifications. The most common certification is the Certified Bank Manager (CBM) or Certified Community Bank Manager (CCBM) from the Institute of Certified Bankers. This certification program demonstrates high levels of expertise in banking, and requires in-depth knowledge of banking laws and regulations, customer service, and bank management.

C. Continuing Education

Bank managers must constantly keep up with the ever-changing financial industry. This is achieved by continuous education and training. Bank managers must attend regular training sessions and seminars on topics such as financial regulations, customer service, and risk management.

Becoming a bank manager requires a combination of education, certification, and continuous education. A bachelor’s degree in a related field, such as finance or accounting, is typically required. Additionally, bank managers must obtain certifications such as the CBM or CCBM, as well as attend regular training and seminars to stay up-to-date on industry changes.

Hiring Bank Managers

A. job posting and advertising.

When it comes to hiring bank managers, the first step is to create a compelling and detailed job posting that will attract the right candidates. This should include a clear job title, a summary of the position’s responsibilities, and a list of qualifications and required experiences. It’s also important to provide an overview of the bank’s culture and mission, as this can help potential candidates determine if they align with the organization’s values.

In addition to posting the job on the bank’s website and social media channels, it’s also a good idea to advertise the position on job boards and industry-specific websites. Networking in the banking community can also help spread the word about the job opening.

B. Interview Process

Once a pool of candidates has been identified, the interview process can begin. Typically, this will involve several rounds of interviews, with each round building on the previous one. For example, a first-round interview may be a phone screen to gauge basic qualifications, while a second-round interview could focus more specifically on the candidate’s skills and experience related to the job.

It’s important to ask open-ended questions that require candidates to give detailed answers, rather than simple yes or no responses. Questions that focus on real-world scenarios and how the candidate would handle them can also provide valuable insight into their problem-solving abilities.

C. Background Checks

One of the final steps in hiring a bank manager is to complete comprehensive background checks. This can include verifying employment history, conducting credit checks, and checking for any criminal records or legal issues that may impact the candidate’s ability to perform the job.

It’s important to follow all relevant laws and regulations related to background checks, as well as to inform the candidate that this step will be taken. If any issues arise from the background check, it’s important to consider them in light of the candidate’s overall qualifications and experience before making a final hiring decision.

Hiring bank managers is a multi-step process that requires careful consideration and attention to detail. By creating a detailed job posting, conducting thorough interviews, and performing comprehensive background checks, banks can ensure that they are bringing on the right candidate for the job.

Training and Development of Bank Managers

The success of any banking institution largely depends on the effectiveness and capability of its managers. As such, it is essential that these managers receive adequate training and development opportunities to hone their skills and stay abreast of emerging trends.

There are various ways in which banks can provide training and development opportunities for their managers, including on-the-job training, mentoring and coaching, and professional development programs.

A. On-the-Job Training

On-the-job training involves providing bank managers with hands-on learning experiences that are relevant to their roles. This may include job shadowing, job rotation, or projects that allow managers to acquire new skills and knowledge while carrying out their current responsibilities.

The beauty of on-the-job training is that it allows managers to learn in a practical environment, where they can immediately apply the concepts they learn. With the guidance of experienced professionals in the organization, managers can safely test new ideas and approaches to problem-solving and decision-making.

B. Mentoring and Coaching

Mentoring and coaching programs offer a more personalized approach to training and development. In these programs, experienced managers or external coaches are assigned to guide and support the development of their mentees.

Mentors and coaches work closely with the bank managers, providing feedback, advice, and support as they tackle new challenges. These programs encourage open communication and give managers a safe space to discuss their strengths and weaknesses, with the aim of building strengths and reducing gaps.

C. Professional Development Programs

Professional development programs aim to provide managers with comprehensive training that covers a range of skills and competencies. These programs are usually organized by the bank and may include workshops, seminars, and conferences.

Professional development programs offer a structured approach to learning, covering a wide range of topics such as leadership, strategic planning, risk management, and customer service. They provide opportunities for networking and learning from industry experts and peers.

The training and development of bank managers are critical to the success of any banking institution. Providing on-the-job training, mentoring and coaching, and professional development programs can help managers acquire the skills and knowledge they need to perform their roles effectively and stay ahead of the curve.

Related Articles

- Find Your Perfect Career Counselor: A Complete Guide

- Production Planner Resume: 30+ Winning Examples for 2023

- Dishwasher Job Description & Career Opportunities in 2023

- Including an MBA on Your Resume: Examples and Tips

- Business Unit Manager: Role, Responsibilities, and Career

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

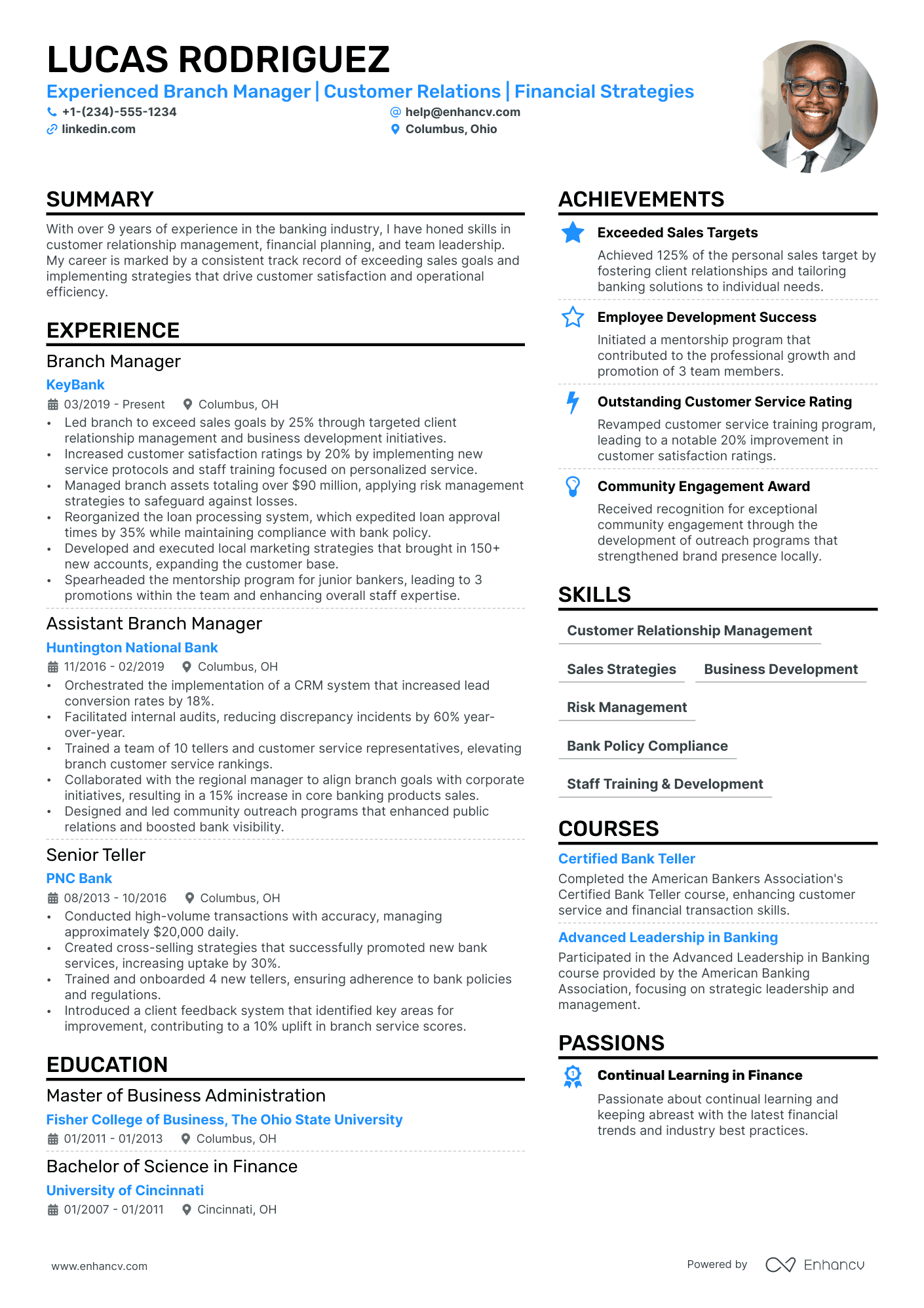

- • Led branch to exceed sales goals by 25% through targeted client relationship management and business development initiatives.

- • Increased customer satisfaction ratings by 20% by implementing new service protocols and staff training focused on personalized service.

- • Managed branch assets totaling over $90 million, applying risk management strategies to safeguard against losses.

- • Reorganized the loan processing system, which expedited loan approval times by 35% while maintaining compliance with bank policy.

- • Developed and executed local marketing strategies that brought in 150+ new accounts, expanding the customer base.

- • Spearheaded the mentorship program for junior bankers, leading to 3 promotions within the team and enhancing overall staff expertise.

- • Orchestrated the implementation of a CRM system that increased lead conversion rates by 18%.

- • Facilitated internal audits, reducing discrepancy incidents by 60% year-over-year.

- • Trained a team of 10 tellers and customer service representatives, elevating branch customer service rankings.

- • Collaborated with the regional manager to align branch goals with corporate initiatives, resulting in a 15% increase in core banking products sales.

- • Designed and led community outreach programs that enhanced public relations and boosted bank visibility.

- • Conducted high-volume transactions with accuracy, managing approximately $20,000 daily.

- • Created cross-selling strategies that successfully promoted new bank services, increasing uptake by 30%.

- • Trained and onboarded 4 new tellers, ensuring adherence to bank policies and regulations.

- • Introduced a client feedback system that identified key areas for improvement, contributing to a 10% uplift in branch service scores.

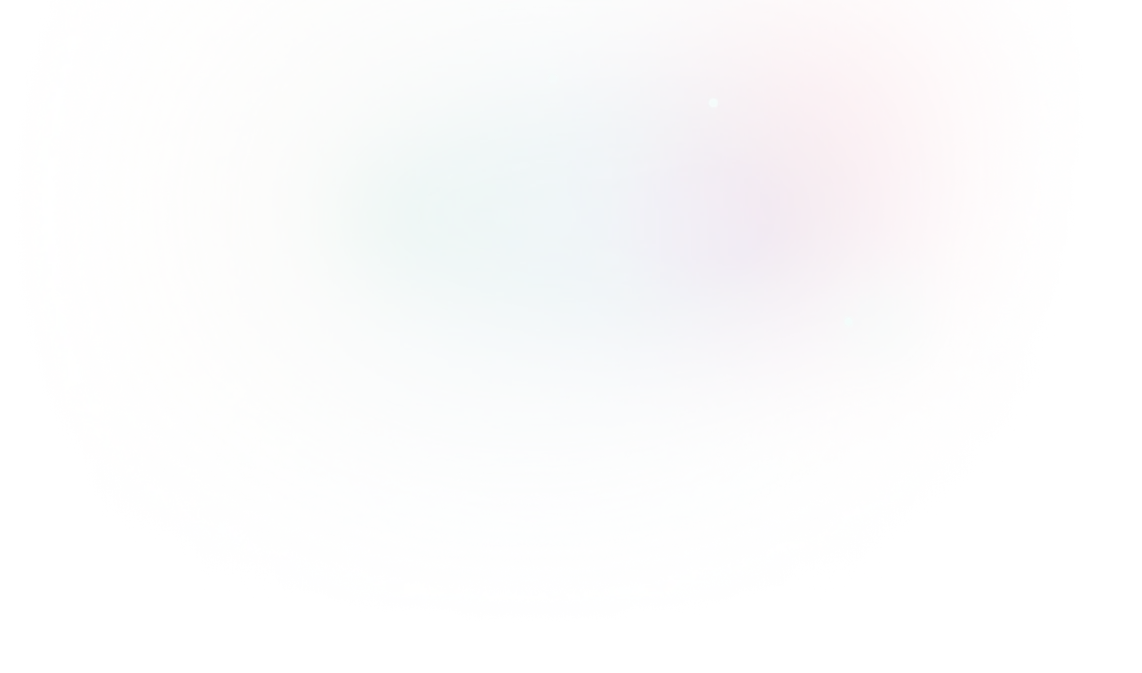

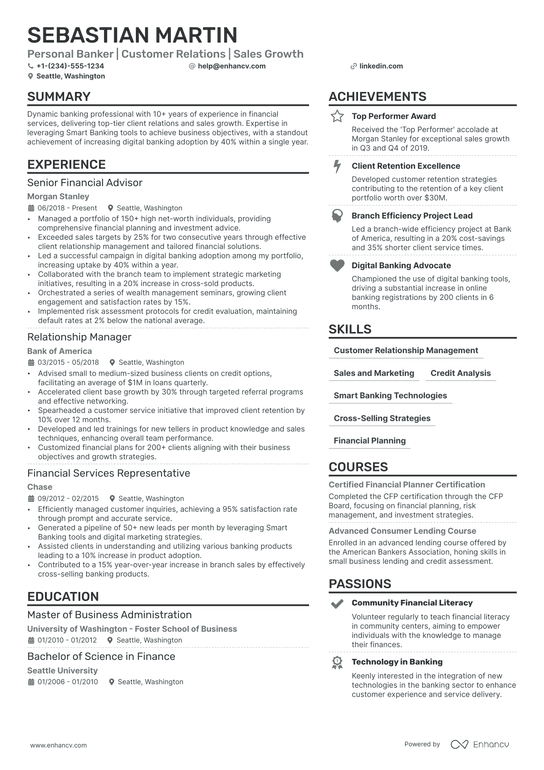

3 Bank Manager Resume Examples & Guide for 2024

As a bank manager, your resume must showcase a robust background in financial management. Highlight your experience with budget planning and risk assessment to illustrate your competence. Demonstrate your leadership skills by detailing previous roles where you successfully managed teams. Your resume should reflect your ability to drive staff performance and achieve bank objectives.

Resume Guide

Resume Format Tips

Resume Experience

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

Bank Branch Manager

Personal banker.

Crafting a resume that succinctly encapsulates your multifaceted experience as a bank manager can be daunting, as you need to balance technical skills with leadership prowess. Our guide provides tailored tips and examples to help you highlight your strategic planning and team management accomplishments, ensuring you present a compelling narrative to potential employers.

- Get inspired from our bank manager resume samples with industry-leading skills, certifications, and more.

- Show how you can impact the organization with your resume summary and experience.

- Introducing your unique bank manager expertise with a focus on tangible results and achievements.

If the bank manager resume isn't the right one for you, take a look at other related guides we have:

- Financial Management Analyst Resume Example

- Hotel Night Auditor Resume Example

- Loan Processor Resume Example

- Accounts Payable Resume Example

- Business Analyst Accounting Resume Example

- Tax Accountant Resume Example

- Forensic Accounting Resume Example

- Financial Controller Resume Example

- Finance Associate Resume Example

- Credit Manager Resume Example

Professional bank manager resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The six in-demand sections for your bank manager resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Proven experience in managing branch operations, including financial analysis, loan and deposit growth strategies, and risk management.

- Demonstrated ability to lead, develop, and motivate a team, showing a track record of high employee engagement and performance coaching.

- Expertise in regulatory compliance, with a strong understanding of banking laws and regulations, including anti-money laundering (AML) and Know Your Customer (KYC) procedures.

- Strong financial acumen with a history of successfully implementing business plans to achieve sales targets and profitability.

- Exceptional customer service skills and experience with relationship building, maintaining a high customer retention rate, and managing a diverse client portfolio.

Adding your relevant experience to your bank manager resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your bank manager resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the bank manager advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample bank manager resumes on how to best create your resume experience section.

- Spearheaded branch-wide digital transformation by implementing new online banking platforms, enhancing customer experience and increasing digital transactions by 30%.

- Developed and executed innovative marketing strategies that targeted local businesses, growing the commercial loan portfolio by 25% within two years.

- Streamlined branch operations by introducing new risk assessment tools, reducing non-performing assets by 15% and bolstering overall financial stability.

- Successfully led a team of 20+ employees, fostering a collaborative environment that improved customer satisfaction scores by over 20%.

- Oversaw an increase in small business lending by 40%, by personally conducting community outreach and financial literacy workshops.

- Negotiated with third-party vendors to reduce operational costs by 10%, reallocating savings to customer retention programs.

- Masterminded the launch of a pilot financial advisory service within the branch, boosting cross-selling of investment products by 35%.

- Championed a high-performing sales culture that surpassed the region's sales goals by 50% for two consecutive years.

- Mentored and developed four assistant managers who went on to become successful branch managers at other locations.

- Directed branch operations, achieving top-tier performance in loan origination, with over $50 million in loans originated during my tenure.

- Implemented comprehensive compliance training, resulting in zero compliance violations during annual audits.

- Increased branch profitability by 18% through strategic cost reduction while maintaining high levels of customer service.

- Pioneered a customer relationship management program aimed at high-net-worth individuals, growing the number of premium accounts by 200.

- Leveraged advanced data analytics to redefine sales strategies, leading to an unprecedented 22% growth in deposit volume.

- Cultivated a culture of compliance and ethical behavior, reducing the risk of financial fraud and increasing customer trust.

- Orchestrated a branch turnaround strategy that enhanced overall performance, moving from the lowest to the highest quartile in the regional ranking within 18 months.

- Launched a successful customer retention initiative that reduced churn rate by 12% and improved overall customer satisfaction.

- Managed critical banking relationships that led to securing over 15 corporate accounts with deposits totaling over $30 million.

- Drove a culture change initiative, emphasizing ethical banking practices, which augmented the branch's reputation in the community.

- Expanded the branch's mortgage lending services, resulting in a 50% increase in home loan approvals and significantly contributing to revenue growth.

- Collaborated with the IT department to enhance the bank's cybersecurity measures, thus ensuring the safety of customer data and reducing potential financial liabilities.

- Led the development and implementation of a fintech partnership program, which attracted innovative startups and expanded the bank's technology offering.

- Managed the restructuring of the retail banking division, increasing operational efficiency by 15% without compromising service quality.

- Directed the investment and savings department achieving an increase in investment portfolio size by 30% through personalized investment planning services.

Quantifying impact on your resume

- List the dollar amount of deposits and loans managed to highlight your capability to handle significant financial assets.

- Indicate the percentage growth in customer accounts to showcase your success in business development.

- Specify the number of branch locations supervised to demonstrate managerial reach and scalability.

- Mention the exact number of employees you've led, emphasizing your leadership and team management skills.

- Quantify cost reductions achieved through operational improvements to show fiscal responsibility.

- Present the annual budget you have managed, underlining your financial oversight capabilities.

- Discuss the number of regulatory audits passed to reflect compliance and attention to detail.

- Detail the percentage increase in cross-sell and up-sell of financial products to exhibit sales and marketing acumen.

Action verbs for your bank manager resume

No experience, no problem: writing your bank manager resume

You're quite set on the bank manager role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

- Should I Put In An Incomplete Degree On A Resume?

- When You Should (And Not) Add Dean's List On Your Resume

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Featuring your hard skills and soft skills on your bank manager resume

The skills section of your bank manager resume needs to your various capabilities that align with the job requirements. List hard skills (or technical skills) to showcase to potential employers that you're perfectly apt at dealing with technological innovations and niche software. Meanwhile, your soft skills need to detail how you'd thrive within your new, potential environment with personal skills (e.g. resilience, negotiation, organization, etc.) Your bank manager resume skills section needs to include both types of skills to promote how you're both technical and cultural fit. Here's how to create your bespoke bank manager skills section to help you stand out:

- Focus on skill requirements that are listed toward the top of the job advert.

- Include niche skills that you've worked hard to obtain.

- Select specific soft skills that match the company (or the department) culture.

- Cover some of the basic job requirements by including important skills for the bank manager role - ones you haven't been able to list through the rest of your resume.

Get inspired with our bank manager sample skill list to list some of the most prominent hard and soft skills across the field.

Top skills for your bank manager resume:

Financial Management

Risk Management

Regulatory Compliance

Loan and Credit Analysis

Strategic Planning

Budgeting and Forecasting

Business Development

Financial Reporting

Customer Relationship Management (CRM)

Banking Software Proficiency

Communication

Problem-Solving

Decision-Making

Customer Service

Time Management

Analytical Thinking

Negotiation

Attention to Detail

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Education section and most popular bank manager certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value bank manager candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your bank manager resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular bank manager certificates - to help you update your resume quicker:

The top 5 certifications for your bank manager resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Bank Auditor (CBA) - Bank Administration Institute

- Certified Financial Services Auditor (CFSA) - The Institute of Internal Auditors

- Certified Banking & Credit Analyst (CBCA) - Corporate Finance Institute

- Professional Banker Certificate (PBC) - The American Bankers Association

- How to List a Major & Minor on Your Resume (with Examples)

How To Include Your Relevant Coursework On A Resume

Deciding between a resume summary or objective for your bank manager role.

Understanding the distinction between a resume summary and an objective is crucial for your bank manager resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career . This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a bank manager job

- With a robust 12-year tenure at a leading financial institution, I have directed operations with an emphasis on risk management, strategic planning, and optimizing client satisfaction. My track record features a 150% growth in loan portfolio and a 20% increase in overall customer retention through tailored financial solutions.

- Senior financial analyst for 10 years, transitioning into the banking sector, leveraging profound expertise in financial modeling, regulatory compliance, and market analysis. Recognized for spearheading a $50M company-wide cost-saving initiative leading to a 30% increase in EBITDA.

- Eager to apply 15 years of experience managing high-performance teams in the retail industry to a dynamic banking environment. Highly skilled in CRM systems, sales strategy, and fostering client loyalty, instrumental in achieving a 40% market share increase within a saturated market.

- Bilingual corporate lawyer with a decade-long track record in multinational contract negotiation, intellectual property rights, and corporate governance, seeking to leverage legal expertise and meticulous attention to detail to ensure stringent compliance and robust client relations in the banking industry.

- Seeking to bring fresh perspectives and an energetic drive to a career in banking. My passion for finance, coupled with a strong foundation in mathematics and a recent Bachelor’s degree in Business Administration, have equipped me with the analytical tools necessary to excel in fostering client financial success.

- Determined to embark on a banking career path where my adaptability and quick learning abilities will be assets. With a comprehensive understanding of economics and international finance from my academic pursuits, I am prepared to contribute positively to client service and financial management tasks.

Recruiters' favorite additional bank manager resume sections

When writing your bank manager resume, you may be thinking to yourself, " Is there anything more I can add on to stand out? ".

Include any of the below four sections you deem relevant, to ensure your bank manager resume further builds up your professional and personal profile:

- Books - your favorite books can showcase that you have an excellent level of reading comprehension, creativity, and outside the box thinking;

- Languages - make sure you've included your proficiency level alongside a relevant certificate or a form of self-assessment;

- Website link - ensure you've curated your most relevant and recent projects in your professional portfolio (and that the link is a part of your resume header) to support your application;

- Passions - showing recruiters how you spend your time outside of work and what activities or causes you're invested in.

Key takeaways

We've reached the end of our bank manager resume guide and hope this information has been useful. As a summary of our key points:

- Always assess the job advert for relevant requirements and integrate those buzzwords across various sections of your bank manager resume by presenting tangible metrics of success;

- Quantify your hard skills in your certificates and skills section, while your soft skills in your resume achievements section;

- Ensure you've added additional relevant experience items, such as extracurricular activities and projects you've participated in or led;

- Use both your resume experience and summary to focus on what matters the most to the role: including your technical, character, and cultural fit for the company.

Bank Manager resume examples

Explore additional bank manager resume samples and guides and see what works for your level of experience or role.

Bank Branch Manager positions have strong roots in financial planning and customer service, which is why trends in these domains influence bank management trends globally.

When applying for Bank Branch Manager jobs in the banking industry, keep these points at the forefront:

- Competency in branch operations management is crucial. Delivery channel management, security & compliance, audit & budgeting are some practices you could have dealt with.

- Ensure to include relevant experience in these operations and your skills in the management area, or your application might get overlooked.

- Highlight financial planning expertise affecting the branch's success. Many successful Bank Branch Managers have well-rounded financial backgrounds. Feature your economic skills and how they have impacted the branch's financial health on your resume.

- Don’t simply list your finance skills. Illustrate how they contributed to the growth of the branch and its operations, e.g., 'improved bank's profitability by....', 'increased customer deposits after....' and so on. Stick to the 'skill-action-results' formula.

Looking to build your own Bank Manager resume?

- Resume Examples

What Are You Passionate About: Best Interview Answers

What should you name your cover letter file, how to use numbers on your resume, email to send resume: how to build yours [+ template], how to use a qr code on your resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

3 Bank Manager Resume Examples Proven to Work in 2024

Bank Manager Resume

Formal bank manager resume, elegant bank manager resume.

- Bank Manager Resume Writing 101

Banks have a detailed structure, with compliance and efficiency being crucial to success. That’s why managers like you are needed to train staff members, develop sales goals, and create an outstanding customer experience.

Are you done writing a cover letter and preparing your resume to show you have the leadership abilities banks need?

Since banking leaders need such a well-versed skill set, it can feel overwhelming trying to narrow down what to include on your resume . Take a look at these bank manager resume examples that are research-driven and proven to land jobs in today’s job market.

or download as PDF

Related resume examples

- Personal banker

- Real estate investment banking

- Investment banking

- Bank teller

What Matters Most: Your Bank Manager Skills & Work Experience

Bank managers oversee everything from sales initiatives to ensuring financial compliance. So, how do you choose the best 6 to 10 skills to put on your resume?

Start by analyzing the job description to see what managerial skills each bank you apply to is seeking. Do they need help improving loan approval processes? Then, your skills in loan processing and credit score analysis may be essential.

Here are some of the best bank manager skills for resumes.

9 best bank manager skills

- Risk management

- Staff development

- Customer service

- Strategic planning

- Sales initiatives

Sample bank manager work experience bullet points

Results are crucial for bank managers while trying to improve the bottom line and retain customers with friendly and efficient operations.

When optimizing your resume , it’s important to include more than just work responsibilities, such as “in charge of risk analysis.”

Instead, you want to write actionable bullet points about previous work achievements. For example, you could write about how you analyzed data in Salesforce to identify 11 ways to improve customer relations efforts, boosting customer retention by 54%.

Here are a few samples:

- Created Tableau dashboards with performance data to increase data accessibility throughout operations by 48%.

- Conceptualized new repayment strategies for over 100 mortgage loans at risk of default, leading to a 68% boost in loan repayment.

- Facilitated a new employee onboarding program focused on regulatory compliance, boosting adherence to ABA standards by 79%.

- Led a new sales initiative promoting discounts when current customers signed up for a savings account, increasing conversions by 57%.

Top 5 Tips for Your Bank Manager Resume

- You should always measure your impact in examples with metrics that are most important to banks. For instance, you could write about how you accelerated loan approval processes or increased quarterly sales.

- Banking managers always need to take action when account errors happen, or policies need to be adjusted. You can emphasize how you perform in those crucial moments by using action words like “improved” or “advised” in your examples.

- Banking managers must be well-versed. Therefore, you should include both interpersonal skills like staff development and technical abilities in risk management or strategic planning to show why you’re the best fit for the job.

- Many layers are involved in aspects like financial compliance. However, including too many details will make your resume too long and lose a hiring manager’s attention. Instead, limit examples to short one-sentence descriptions, such as how you revamped record-keeping systems with Sage Intacct to improve compliance rates by 70%.

- Bank managers must be able to analyze data accurately to make the correct decisions in account reconciliation and performance optimization. Submitting an accurate and grammatically correct resume will help those abilities stand out immediately, so always proofread before submitting it.

One page is the appropriate length for a bank management resume. You want to keep your resume template brief for easy review, ensuring your top skills in ACH payment processing and financial compliance stand out.

Reverse chronological formatting will work best for bank managers. As you’ve worked up the ladder from positions like a teller, personal banker, or assistant manager, your loan processing and strategic planning skills have likely grown a lot. Therefore, listing your most recent experiences first will help you emphasize relevant abilities.

Even if you haven’t worked as a bank manager, you can still show you want the job and have the right skills in many ways. You could include banking experiences that showcase high technical abilities, such as how you boosted client investment returns as a personal banker. In addition, including alternative leadership experiences, such as leading a 12-person team in a fraud reduction initiative, will work well.

- Bank Manager Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Bank Manager Resumes:

- Overseeing daily banking operations : This involves managing the day-to-day operations of the bank, ensuring that all processes are running smoothly and efficiently.

- Setting and achieving sales targets : The bank manager is responsible for setting sales targets for the bank's products and services and ensuring that these targets are met.

- Managing bank staff : This includes hiring, training, and supervising bank staff to ensure that they are performing their duties effectively and providing excellent customer service.

- Developing and implementing business strategies : The bank manager is responsible for developing strategies to grow the bank's customer base and increase profitability.

- Ensuring compliance with banking laws and regulations : This involves staying up-to-date with the latest banking laws and regulations and ensuring that the bank is in compliance with these rules.

- Managing customer relationships : This includes handling customer complaints, resolving disputes, and ensuring that customers are satisfied with the bank's services.

- Monitoring financial performance : The bank manager is responsible for monitoring the bank's financial performance and making necessary adjustments to improve profitability.

- Implementing risk management processes : This involves identifying potential risks and implementing strategies to mitigate these risks.

- Conducting regular audits : The bank manager is responsible for conducting regular audits to ensure that the bank's financial records are accurate and up-to-date.

- Developing and maintaining relationships with the community : This includes participating in community events and activities to promote the bank and its services.

- Providing financial advice to customers :

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Bank Manager Resume Example:

- Successfully implemented a sales strategy that resulted in a 25% increase in new customer acquisition and a 15% growth in revenue within the first year.

- Streamlined operational processes, reducing customer wait times by 20% and improving overall customer satisfaction scores by 10%.

- Led a team of 20 bank staff members, providing training and guidance that resulted in a 30% improvement in employee productivity and a decrease in customer complaints by 15%.

- Developed and executed a comprehensive risk management plan, resulting in a 20% reduction in fraudulent activities and a 10% decrease in financial losses.

- Implemented customer relationship management strategies, leading to a 15% increase in customer retention and a 10% growth in customer referrals.

- Collaborated with senior management to develop and implement cost-saving initiatives, resulting in a 10% reduction in operational expenses and an improvement in profitability by 5%.

- Successfully led a team in achieving and exceeding sales targets, resulting in a 20% increase in loan portfolio and a 15% growth in deposits.

- Implemented a customer-centric approach, resulting in a 10% improvement in customer satisfaction scores and a 5% increase in customer loyalty.

- Developed and maintained relationships with key stakeholders in the community, leading to a 10% increase in community partnerships and a positive brand reputation.

- Strategic planning and execution

- Sales strategy development

- Operational efficiency improvement

- Team leadership and training

- Customer relationship management

- Risk management and fraud prevention

- Cost-saving initiative development

- Financial management and profitability improvement

- Achievement of sales targets

- Customer-centric service approach

- Stakeholder relationship management

- Community outreach and partnership development

- Brand reputation management

- Revenue growth strategies

- Employee productivity enhancement

- Customer satisfaction and loyalty improvement

- New customer acquisition strategies

- Customer retention strategies

- Process streamlining and optimization

- Conflict resolution and complaint management.

Top Skills & Keywords for Bank Manager Resumes:

Hard skills.

- Financial Analysis and Reporting

Risk Management

- Budgeting and Forecasting

- Regulatory Compliance

- Loan and Credit Management

- Sales and Business Development

- Team Leadership and Management

- Customer Relationship Management (CRM)

- Strategic Planning and Execution

- Performance Evaluation and Metrics

- Financial Product Knowledge

- Project Management

Soft Skills

- Leadership and Team Management

- Communication and Presentation Skills

- Collaboration and Cross-Functional Coordination

- Problem Solving and Critical Thinking

- Adaptability and Flexibility

- Time Management and Prioritization

- Empathy and Customer-Centric Mindset

- Decision Making and Strategic Planning

- Conflict Resolution and Negotiation

- Financial Analysis and Risk Management

- Relationship Building and Networking

Resume Action Verbs for Bank Managers:

- Implemented

- Strategized

- Collaborated

- Coordinated

Generate Your Resume Summary

Resume FAQs for Bank Managers:

How long should i make my bank manager resume, what is the best way to format a bank manager resume, which keywords are important to highlight in a bank manager resume, how should i write my resume if i have no experience as a bank manager, compare your bank manager resume to a job description:.

- Identify opportunities to further tailor your resume to the Bank Manager job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Bank Managers:

Bank teller, loan officer, finance manager, investment banker, loan processor, finance director, investment banking analyst.

Bank Manager resume examples for 2024

Bank managers are responsible for overseeing the day-to-day operations of a bank branch, from staff management to customer service and sales. They must be able to foster positive relationships with clients and the local community, and have a strong understanding of financial products and services. Bank managers are also responsible for ensuring that the branch is compliant with all relevant regulations, such as the Bank Secrecy Act and anti-money laundering. They must also be able to analyze financial data to make informed decisions about business development and risk management.

Bank Manager resume example

How to format your bank manager resume:.

- Use the same job title on your resume as the one in the job application for the bank manager role

- Highlight accomplishments rather than responsibilities in your work experience section, such as 'Promoted growth and profitability by focusing on safety, customer service, and effective branch management.'

- Bank managers are advised to fit their resume on one page, focusing on relevant achievements and skills

Choose from 10+ customizable bank manager resume templates

Choose from a variety of easy-to-use bank manager resume templates and get expert advice from Zippia’s AI resume writer along the way. Using pre-approved templates, you can rest assured that the structure and format of your bank manager resume is top notch. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

Bank Manager resume format and sections

1. add contact information to your bank manager resume.

Bank Manager Resume Contact Information Example # 1

Hank Rutherford Hill

St. Arlen, Texas | 333-111-2222 | [email protected]

2. Add relevant education to your bank manager resume

Your resume's education section should include:

- The name of your school

- The date you graduated ( Month, Year or Year are both appropriate)

- The name of your degree

If you graduated more than 15 years ago, you should consider dropping your graduation date to avoid age discrimination.

Optional subsections for your education section include:

- Academic awards (Dean's List, Latin honors, etc. )

- GPA (if you're a recent graduate and your GPA was 3.5+)

- Extra certifications

- Academic projects (thesis, dissertation, etc. )

Other tips to consider when writing your education section include:

- If you're a recent graduate, you might opt to place your education section above your experience section

- The more work experience you get, the shorter your education section should be

- List your education in reverse chronological order, with your most recent and high-ranking degrees first

- If you haven't graduated yet, you can include "Expected graduation date" to the entry for that school

Check More About Bank Manager Education

Bank Manager Resume Relevant Education Example # 1

Bachelor's Degree In Business 2011 - 2014

Strayer University Washington, DC

Bank Manager Resume Relevant Education Example # 2

Bachelor's Degree In Accounting 1998 - 2001

Pennsylvania State University Main, PA

3. Next, create a bank manager skills section on your resume

Your resume's skills section should include the most important keywords from the job description, as long as you actually have those skills. If you haven't started your job search yet, you can look over resumes to get an idea of what skills are the most important.

Here are some tips to keep in mind when writing your resume's skills section:

- Include 6-12 skills, in bullet point form

- List mostly hard skills ; soft skills are hard to test

- Emphasize the skills that are most important for the job

Hard skills are generally more important to hiring managers because they relate to on-the-job knowledge and specific experience with a certain technology or process.

Soft skills are also valuable, as they're highly transferable and make you a great person to work alongside, but they're impossible to prove on a resume.

Example of skills to include on an bank manager resume

Those products which a bank offers to its customers are called bank products. There a variety of services that a bank offers to attract customers. Some of the banking products/ services are: giving loans, overdrafts, check payments, exchange of foreign currency, consultancy services credit, debit and ATM cards, home and online banking.

Financial services are economic services that are offered by the finance sector, which includes banks, financial institutes credit-card agencies, insurance companies, accountancy firms, and others that handles assets. Organizations in the financial services sector are concerned with money and risk management.

Business development is the ideas or initiatives that work to make business work better. Selling, advertising, product development, supply chain management, and vendor management are only a few of the divisions involved with it. There is still a lot of networking, negotiating, forming alliances, and trying to save money. The goals set for business development guide and coordinate with all of these various operations and sectors.

Secrecy is the method of hiding data from individuals or groups while disclosing it with other individuals especially if they do not qualify the "need to know".

Anti-Money Laundering or, as it is often shortened to, AML is the name of a set of laws, regulations, and similar rules and rulings which are crafted and applied with the goal of preventing people from engaging in and successfully doing money laundering.

Real estate is land that has buildings on it. This kind of property consists of permanent improvements either natural or man-made, which include, houses, fences, bridges, water trees, and minerals. There are 4 types of real estate namely; residential real estate, commercial real estate, industrial real estate, and vacant land.

The operational procedure means the prescriptive documents that describe processes involving several partners. The involved techniques get utilized in defining the related work.

Top Skills for a Bank Manager

- Bank Products , 6.8%

- Financial Services , 6.7%

- Business Development , 6.5%

- Secrecy , 5.7%

- Other Skills , 74.3%

4. List your bank manager experience

The most important part of any resume for a bank manager is the experience section. Recruiters and hiring managers expect to see your experience listed in reverse chronological order, meaning that you should begin with your most recent experience and then work backwards.

Don't just list your job duties below each job entry. Instead, make sure most of your bullet points discuss impressive achievements from your past positions. Whenever you can, use numbers to contextualize your accomplishments for the hiring manager reading your resume.

It's okay if you can't include exact percentages or dollar figures. There's a big difference even between saying "Managed a team of bank managers" and "Managed a team of 6 bank managers over a 9-month project. "

Most importantly, make sure that the experience you include is relevant to the job you're applying for. Use the job description to ensure that each bullet point on your resume is appropriate and helpful.

- Revised and disseminated all Policies and Procedures related to Retail Marketing Promotions and E-Coupon.

- Coached and strengthened Teller knowledge of consumer and business products to help increase referral effectiveness.

- Provided ongoing coaching to tellers to effectively identify referral opportunities & lead branch district in teller referrals.

- Generated sales lead utilizing community outreach and development of key business partners while fostering strong client and business relations.

- Managed a portfolio of clients: grew portfolio by prospecting for new clients and deepening relationships with existing clientele.

- Processed night drop bags, serviced ATM, and performed as vault teller.

- Expressed effective communication and leadership within a team environment.

- Ensured daily settlement of cash drawer and transaction proof and performed daily settlement of ATM and vault.

- Handled restocking and balancing of ATM'S, TCD'S, and managed breaks and lunches for teller staff.

- Bonded Processed ATM transactions for major corporations and business, along with individual accounts Processed Daily Balance Sheets

- Provided oversight and guidance to caseworkers and handled the more complex cases.

- Recruited to perform internal audit of operational and financial systems.

- Trained 60 Peace Corps volunteers and host country counterparts in financial literacy, business planning and animal husbandry.

- Facilitated management oversight of all Red Cross programs, staff, budget and program executions.

- Prepared monthly schedules for 15 lifeguards and 20 facility staff.

- Audited the branch's vault, balanced ATM, provided entry to safety deposit boxes and operated drive-through teller window.

- Submitted daily cash recap for the branch, as well as balancing branch cash vault and ATM.

- Balanced a teller cash drawer, vault, ATM, CDM, ordered branch cash, shipped and received branch cash.

- Promoted to ATM custodian where I was responsible for counting, processing and managing $50,000 without error.

- Pulled monthly reports ensuring that the branch is in compliance with SunTrust rules and regulations.

5. Highlight bank manager certifications on your resume

Specific bank manager certifications can be a powerful tool to show employers you've developed the appropriate skills.

If you have any of these certifications, make sure to put them on your bank manager resume:

- Certified Manager Certification (CM)

- Certified Sales Professional (CSP)

- Certified Bank Auditor (CBA)

- Sales Management

- Certified Management Accountant (CMA)

6. Finally, add an bank manager resume summary or objective statement

A resume summary statement consists of 1-3 sentences at the top of your bank manager resume that quickly summarizes who you are and what you have to offer. The summary statement should include your job title, years of experience (if it's 3+), and an impressive accomplishment, if you have space for it.

Remember to emphasize skills and experiences that feature in the job description.

Common bank manager resume skills

- Bank Products

- Financial Services

- Business Development

- Bank Secrecy Act

- Community Involvement

- Anti-Money Laundering

- Client Relationships

- Local Community

- Real Estate

- Operational Procedures

- Business Relationships

- Risk Management

- Cash Management

- Bank Operations

- Regulatory Compliance

- Loan Applications

- Financial Solutions

- Wealth Management

- Bank Policies

- Credit Card

- Consumer Loans

- Corporate Banking

- Customer Satisfaction

- Commercial Banking

- Customer Complaints

- Internal Controls

- Direct Reports

- Strong Analytical

- Cross-Selling

- Financial Institutions

- Loan Portfolio

- Origination

- Performance Reviews

- Customer Relations

- Business Plan

- Financial Statements

- Performance Evaluations

- Financial Products

- Customer Issues

- Commercial Loans

- Branch Management

Bank Manager Jobs

Links to help optimize your bank manager resume.

- How To Write A Resume

- List Of Skills For Your Resume

- How To Write A Resume Summary Statement

- Action Words For Your Resume

- How To List References On Your Resume

Updated April 25, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Bank Manager Related Resumes

- Asset Manager Resume

- Assistant Branch Manager Resume

- Banking Center Manager Resume

- Branch Manager Resume

- Cash Manager Resume

- Collections Manager Resume

- Credit Manager Resume

- Finance Center Manager Resume

- Finance Manager Resume

- Finance Planning Manager Resume

- Management Accounts Manager Resume

- Portfolio Manager Resume

- Relationship Manager Resume

- Risk Manager Resume

- Senior Finance Manager Resume

Bank Manager Related Careers

- Asset Manager

- Assistant Branch Manager

- Banking Center Manager

- Branch Manager

- Business Manager-Finance Manager

- Business Relationship Manager

- Cash Manager

- Collections Manager

- Credit Manager

- Finance And Insurance Manager

- Finance Center Manager

- Finance Manager

- Finance Planning Manager

- Management Accounts Manager

- Manager Finance Planning And Analysis

Bank Manager Related Jobs

What similar roles do.

- What Does an Asset Manager Do

- What Does an Assistant Branch Manager Do

- What Does a Branch Manager Do

- What Does a Business Manager-Finance Manager Do

- What Does a Business Relationship Manager Do

- What Does a Cash Manager Do