Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

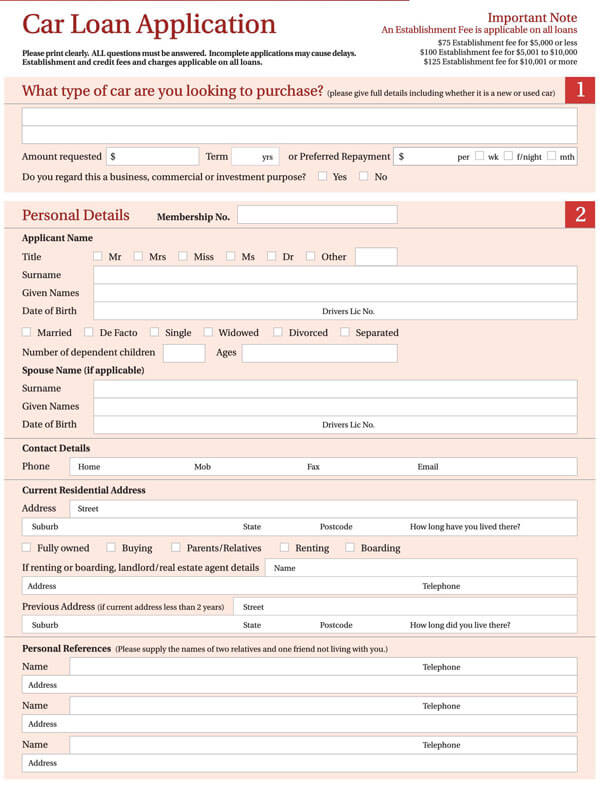

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

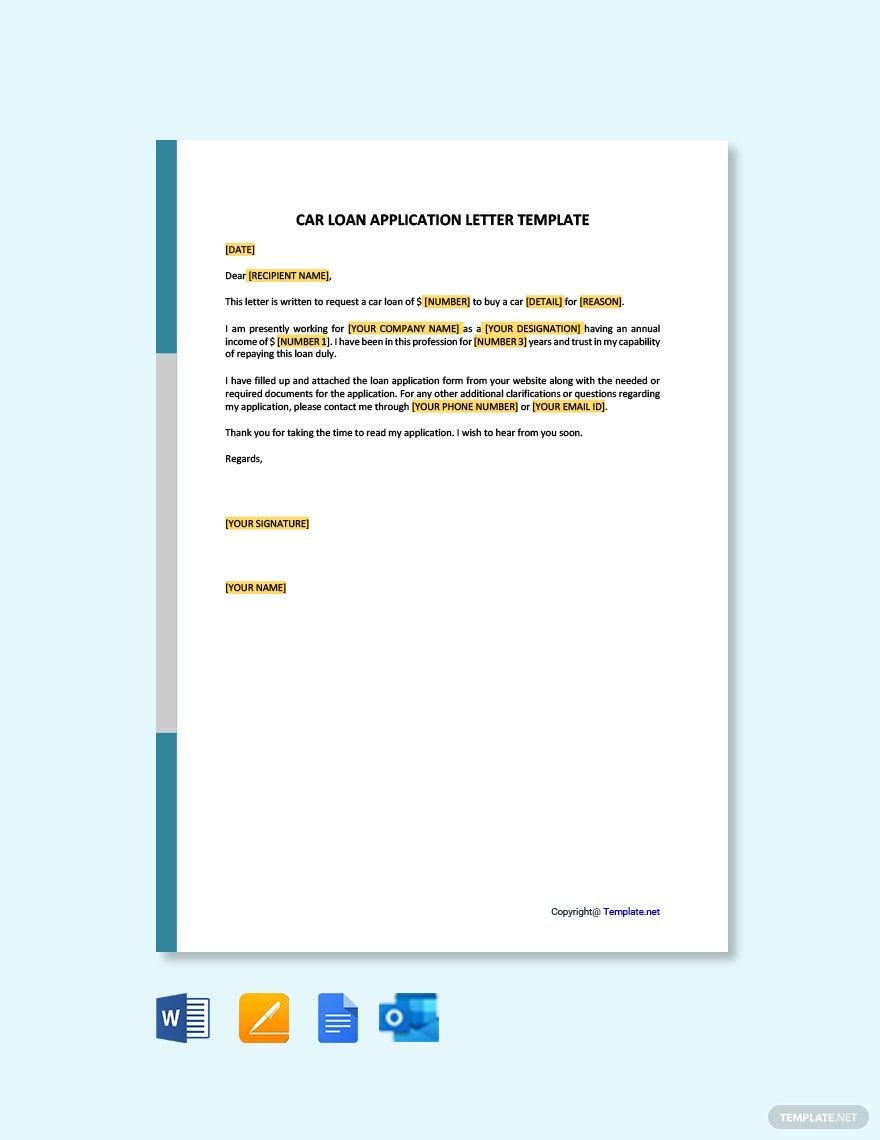

Car Loan Application Letter Template

Download this Car Loan Application Letter Template Design in Word, Google Docs, PDF, Apple Pages, Outlook Format. Easily Editable, Printable, Downloadable.

A letter template that can help you make an application for a car loan. Download this file for free and get to write a formal and effective letter by editing and customizing the template.

CAR LOAN APPLICATION LETTER TEMPLATE

Dear [RECIPIENT NAME],

This letter is written to request a car loan of $ [NUMBER] to buy a car [DETAIL] for [REASON].

I am presently working for [YOUR COMPANY NAME] as a [YOUR DESIGNATION] having an annual income of $ [NUMBER 1]. I have been in this profession for [NUMBER 3] years and trust in my capability of repaying this loan duly.

I have filled up and attached the loan application form from your website along with the needed or required documents for the application. For any other additional clarifications or questions regarding my application, please contact me through [YOUR PHONE NUMBER] or [YOUR EMAIL ID].

Thank you for taking the time to read my application. I wish to hear from you soon.

[YOUR SIGNATURE]

[YOUR NAME]

Already a premium member? Sign in

You may also like

How to Write an Email Requesting a Loan

An email requesting a loan is an official document written to a possible employer or firm, and it expresses your ambitions and the reason for why you are seeking a loan.

Your email requesting a loan must reflect your life as an individual, demonstrating your accomplishments and talents and therefore attracting the hiring manager’s attention or the person in charge of examining loan applications.

This email requesting a loan should be entertaining enough for the manager to read. It should stress the critical characteristics that distinguish you as a good candidate for the loan, causing them to consider inviting you in for an interview.

Important Considerations When Writing an Email Requesting a Loan

Essential considerations when writing an email requesting a loan include the following points:

1. Make Sure You’re Talking to The Appropriate Person

For example, your manager, human resources, or loan officer. Any correspondence must be addressed to the appropriate party in your email requesting a loan. It is essential since it serves as the starting point of a formal discussion, and you would want to ensure that the conversation gets off on the correct foot.

Therefore, when writing an email requesting a loan, always make an effort to determine to who the application should be sent and address it correctly.

2. Be Clear About the Way the Money Will Be Used

When writing an email requesting a loan, insisting on a certain quantity of money without specifying why will be seen as overly imprecise and will create a feeling of uneasiness.

The lender will want to know why you want the funds to determine if your requirement is fair and whether the funds will be put to good use.

The legality of the situation is also crucial since they do not want the money to be utilized for unlawful activities such as drugs or other criminal activities. As a result, any debtor would be interested in knowing if their money is being used legally.

How to Write a Bank Authorization Letter: Tips, and Sample Letter Formats

3. Be Precise About the Amount

When you have a genuine cause for an email requesting a loan, you must provide a specific amount, as this will assist the lender in determining whether or not you have the borrowing capacity.

Providing your earnings are adequate to meet the cost of repaying the money you borrowed in the first place. It also specifies if the amount of money borrowed is appropriate for lending it.

4. Demonstrate Favorable Characteristics About Yourself to Demonstrate that You Are Trustworthy

When writing an email requesting a loan, your excellent behavior and positive job history are the only things you can present as security to ensure that the money will be returned to you if the lender, like some others, requests it.

5. Explain How You Plan To Repay The Debt

When writing an email requesting a loan, this expresses your desire to return the money to the bank. This is critical because it provides a comprehensive view of the loan cycle. Provide accurate facts while being truthful.

Consequently, being truthful and honest about the issue is vital to maintaining a solid credit history with the lending institution you are working with.

The Format and Content of An Email Requesting for A Loan Application

When writing an email requesting a loan, you need no specific number of paragraphs. Just try to ensure that each critical issue is handled separately.

When an email requesting a loan, attach the loan amount asked, a description of your company, the purpose of the loan, the target market, and competitors, and the amount of money you have put into your business are all included in the application’s content.

Call the bank and ask for the name of the person who is in charge of business loans. Address the letter to that specific person in the bank.

Request for Bank Statement Email: Samples and Examples Included

Personal Loan Request Letter to Manager

Loan application letter to boss, loan request letter, email example requesting for a loan from a bank, email example requesting for a loan from your company sample, email requesting for a loan from a loan shark sample.

People write an email requesting a loan, for several reasons. In an email requesting a loan offer facts about your business’s success to pique interest in your loan request. Be honest, and hope for the best.

About The Author

Jim Blessed

Related posts.

9 Tips You Need to Write and Respond to Emails Professionally

12 Rules of Writing Emails Professionally and Effectively

How to Write Professional Emails: 7 Critical Ingredients

8 Simple Lessons for Writing Irresistible Business to Business Emails

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Search Search Please fill out this field.

How to Write a Loan Letter to Your Bank

How a Letter to the Bank Might Get Your Loan Approved

Why Write a Letter to Your Bank?

- Letter for a Mortgage Application

Parts of a Loan Letter to a Bank

Sample outline for a loan letter.

Maskot / Getty Images

Sometimes getting a loan is as easy as filling out an application. But as dollar amounts increase or the situation gets more complicated, lenders may want reassurance. They could even ask you to explain why your loan is a good idea.

If your bank wants more than the basic information that goes on an application, a letter to the bank could be in order. Some banks specifically request letters, while others might appreciate any extra steps you take to try and win the loan.

Learn how a loan letter can improve your application and what you should include in one.

When you write a loan letter to accompany your application, you have the chance to explain exactly why the lender should approve your request. It gives you an opportunity to:

- Add commentary on topics that do not appear in a standard application

- Explain your financial situation thoroughly

- Lay out your plan for using and repaying the loan

- Address any weak spots in your application or finances

Loan letters can be particularly beneficial for small businesses, which often need capital to grow but may not meet the strict requirements laid out by bank loan applications.

Like a cover letter for a job application, a loan letter is your chance to make your case on your terms.

Loan Letter for a Mortgage Application

If you are applying for a mortgage and your application has some weak spots or unexplained elements, writing a loan letter can increase your chances of approval or of receiving a lower interest rate.

You may need to write a letter to accompany your mortgage application if you have:

- Multiple names on your credit report

- Negative entries in your credit report

- Gaps in employment

- Atypical sources of incomes, such as a small business or freelance work

- A recent change in jobs

- Unusual activity in your bank account

- Former delinquencies or bankruptcies

A loan letter gives you a chance to explain these things and address any concerns they may create for the bank.

When writing a letter to accompany your loan application, you need to both keep things brief and provide sufficient detail to make a convincing argument.

Even while keeping things concise, however, there is still specific information you will want to include.

Who and What

Tell the bank a little bit about yourself. If you're applying for a business loan , be sure to include information about the whole team, including the number of employees and how long you've been in business.

Highlight any strengths, designations, or credentials you've earned, as well as successes in your past. Don't go overboard: just pick just a few of the most impressive and relevant things that come to mind.

Lay out the specific amount that you are requesting for your loan. But sure to include the timeframe, such as $100,000 to be repaid over five years.

Explain exactly how you will use the funds. Your lender needs to know that the money will be put to good use.

For example, if you have been turning away business because you didn't previously have capacity, let your lender know about this unmet demand and your ability to satisfy it.

Demonstrate that you have done some market research and know how the loan will impact your business or personal finances .

Your lender needs to know how you’ll fund the repayment. Will you repay a personal loan from your salary or a business loan from increased revenues?

Be specific about how and why your earnings will increase as a result of the loan.

Your lender will notice if you have bad credit or insufficient income to repay the loan. When you address those issues directly, you signal that you're a serious borrower who understands what's at stake.

Be polite and formal in your language, addressing your letter to the loan officer or specialist that you are working with and ending with "Sincerely" or "Regards." Be sure to include your full legal name, address, and contact information.

Like a cover letter for a resumé, aim to keep your loan letter no longer than one page.

Sample for a Small Business Loan Letter

- Overview : “ACME Enterprises specializes in… and has been in business since 2007...”

- Reason : “I’m writing to request a loan for $100,000…”

- Professional information : “ACME Enterprises was founded by Jane Doe, who has over 10 years of industry experience. The marketing team is led by John Jones, who previously helped grow XYZ Corporation…”

- How funds will be used : “Our goal is to increase the number of daily service visits by purchasing an additional vehicle and related equipment. The total cost of these investments is…”

- Benefit : “Currently we are unable to respond to 30% of requests for service, which results in customers calling our competitors or switching products. We will be able to profitably respond to all of those calls with the additional equipment…”

- Basic financial information : “ACME Enterprises currently operates at a profit. Revenue from the previous year was $X, and net income was $Y…”

- Concerns : Anything else that shows you’ve done your homework and deserve the loan.

- Closing : “Please see the enclosed business plan, and feel free to contact me with any questions you have at…”

You will also need to submit a business plan with your loan application. Think of your introductory letter as an abbreviated version of the business plan.

Sample for a Mortgage Loan Letter

- Personal information : “My spouse and I have recently submitted a mortgage application at XYZ Bank, our full names and contact information are...”

- Basic financial information : “You will see in our application that our joint income for the last ten years has ranged from $X to $Y..."

- Concerns : “I’m writing to explain my irregular income and why this will not impact my ability to repay the mortgage I have applied for…”

- Explanation : "Since 2011, I have been self-employed. My business is ABC Enterprises, which provides freelance ABC services for clients such as... My business has made an annual income of no less than $XX for the last ten years, out of which my personal salary has increased from $X to $Y. In the enclosed business plan, you will see that due to These Market Factors I expect demand to continue increasing as I expand my services..."

- Closing : “Thank you for your time and attention, and feel free to contact me with any questions you have at…”

The lending decision ultimately depends on the financials, such as your credit scores , income, collateral , and ability to repay the amount you borrow. But a loan letter can improve your chances by explaining your situation and the impact the loan will have on those factors.

Search This Blog

Search letters formats here, request letter to bank manager for car loan noc (sample).

submit your comments here

Post a comment.

Leave your comments and queries here. We will try to get back to you.

Closing Car Loan Application Procedure (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional closing car loan application procedure.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Car Loan Termination Application Process

First, find the sample template for closing car loan application procedure below.

To, The Branch Manager, [Bank’s Name], [Branch’s Address],

Subject: Request for Closure of Car Loan Account

Dear Sir/Madam,

I, [Your Full Name], the holder of the car loan account number [Loan Account Number], request for the closure of the said account since I have fully repaid my car loan as of [Date of last EMI payment].

I kindly request you to initiate the necessary procedures to close the car loan account and provide me with a No Objection Certificate (NOC) as well as a loan closure certificate. These documents are important as they serve as proof that I have fulfilled all my loan obligations.

Please inform me about any additional paperwork or procedures that need to be completed for this process. I am ready to visit the bank branch at your convenience for the same.

I am grateful for your assistance during the loan tenure and look forward to your prompt action in this matter.

Yours Sincerely,

[Your Full Name] [Your Contact Number] [Your Email ID] [Your Residential Address]

Date: [Current Date] Place: [Current Place]

Below I have listed 5 different sample applications for “closing car loan application procedure” that you will certainly find useful for specific scenarios:

Car Loan Closure Application Following Car Accident and Total Loss

To, The Branch Manager, [Bank Name], [Branch Address],

Subject: Car Loan Closure Application Following Car Accident and Total Loss

I, [Your Name], holding the account number [Account Number], had availed a car loan for my [Car Make and Model] bearing registration number [Car Registration Number] from your esteemed bank on [Loan Taken Date]. I regret to inform you that my car met with an accident on [Date of Accident] which resulted in a total loss of the vehicle.

As per the assessment of the insurance company, it has been declared a total loss, and I have received the insurance claim amount. I would like to use this amount to settle my outstanding car loan with your bank.

My loan account number is [Loan Account Number]. I request you to kindly provide me with the exact outstanding amount, including any prepayment charges if applicable, and the procedure to close the loan. I would like to complete the loan closure process at the earliest.

Kindly acknowledge the receipt of this application and guide me through the next steps. I would be grateful for your prompt attention to this matter.

Thanking you,

Yours faithfully, [Your Name] [Your Address] [Your Contact Number] [Email Address]

Application for Re-Evaluation of Financing Terms Before Car Loan Closure

To, The Branch Manager, [Bank Name], [Bank Branch], [City],

Subject: Application for Re-Evaluation of Financing Terms Before Car Loan Closure

Respected Sir/Madam,

I, [Your Name], am writing this application to request a re-evaluation of the financing terms attached to my car loan (Account No: [Your Account Number]) before its closure. I have been servicing this loan for the past [loan period, e.g., 3 years], and now I am approaching the end of the loan term.

Given the recent changes in the economy and the financial market, I believe it would be prudent for both parties to reassess the terms of the car loan prior to its closure. This would help ensure that the closure process is fair, transparent and in line with the current market conditions.

I kindly request you to initiate the re-evaluation process at the earliest, as it will allow me sufficient time to make any necessary arrangements before the loan closure. I am willing to provide any additional documents or information that may be required for the re-evaluation process.

Looking forward to your prompt attention and cooperation in this matter.

Yours sincerely,

[Your Name] [Your Address] [City] [Contact number] [Email ID]

Transferring the Car Loan Balance to Another Lender Application

To, The Branch Manager, [Current Lender’s Name], [Branch Address]

Subject: Application for Transferring the Car Loan Balance to Another Lender

I, [Your Full Name], holding a car loan account with your esteemed bank (Loan Account Number: [Your Loan Account Number]) availed for purchasing a [Car Make and Model]. I have been regular in my loan repayments and have maintained a good track record.

Due to recent changes in my personal financial situation, I have found a more suitable loan offer from [New Lender’s Name]. Therefore, I request you to kindly initiate the process of transferring the outstanding balance of my car loan to the said lender.

I have already obtained a loan sanction letter from the new lender and have enclosed a copy of the same with this application. Kindly provide the necessary clearance and documents required for the transfer at the earliest.

I understand that there may be charges related to this transfer and I am willing to bear them as per the applicable terms and conditions. Please let me know if there are any additional formalities or documents required from my end to facilitate the smooth completion of this transfer process.

I appreciate your prompt action and assistance in this regard. Kindly acknowledge the receipt of this application and keep me informed about the progress of the loan transfer process.

Thank you for your attention and cooperation.

[Your Full Name] [Your Contact Number] [Your Email Address] Date: [Date of Submission]

Application for Car Loan Closure Due to Vehicle Sale

To, The Branch Manager, [Bank Name], [Branch Name], [Branch Address],

Subject: Application for Car Loan Closure Due to Vehicle Sale

I, [Your Name], am writing this letter to inform you that I have sold my car, [Car Make and Model], bearing Registration Number [Car Registration Number] on [Date of Sale]. The said car was purchased with the help of a car loan from your esteemed bank under Loan Account Number [Loan Account Number].

As the car has now been sold, I would like to request you to kindly close the said car loan account. I am ready to clear any outstanding dues or charges, if applicable, and would appreciate if you could provide me with a statement mentioning the outstanding amount to be paid for the closure.

Kindly consider this application as a formal request for car loan closure and guide me on the necessary steps to be taken to complete the process at the earliest. Your prompt assistance in this matter would be highly appreciated.

Thanking you in advance.

Yours faithfully,

[Your Name] [Your Address] [Your Contact Number] [Your Email Address]

Date: [Current Date]

Early Repayment for Car Loan Closure Application

To, The Branch Manager, [Bank Name], [Bank Branch Address]

Subject: Early Repayment for Car Loan Closure Application

I, [Your Name], have availed a car loan (Loan Account number: [Loan Account Number]) from your esteemed bank on [Date of Loan Disbursal] for purchasing a [Car Make and Model]. The loan tenure was [Loan Tenure] months, with an EMI of INR [Amount] per month.

I am writing this letter to express my intent to close the loan by making an early repayment of the outstanding principal amount. I have maintained a good track record of timely EMI payments, and my current outstanding loan amount is INR [Amount].

I kindly request you to provide me with the necessary details, including foreclosure charges (if any), the exact amount to be paid, and the required procedure to close the loan.

Please find enclosed a copy of my loan account statement for your reference. I would appreciate your prompt assistance in this matter, as I want to close the loan at the earliest.

Thank you for your attention to my request. I look forward to a favorable response from your end.

[Your Name] [Your Address] [Your Contact Number] [Your Email Address] [Date]

How to Write Closing Car Loan Application Procedure

Some writing tips to help you craft a better application:

- Start with your contact information: Begin the application with your name, address, and contact details to identify yourself.

- Include the date: Mention the date of writing the application to keep a record of it.

- Address the recipient: Directly address the person in charge of closing the car loan, such as the loan officer or branch manager.

- Specify the subject line: Clearly state the purpose of the application in a brief and concise subject line.

- Mention your loan account number: Provide your car loan account number for easy reference and tracking.

- State your intention: Clearly state that you wish to close your car loan and mention the reasons for doing so.

- Provide car loan details: Briefly summarize the car loan details, such as the loan amount, interest rate, and tenure.

- Request for a settlement letter: Ask for a settlement or closing letter that outlines the final payment amount and due date.

- Ask for necessary documents: Request the bank to provide you with the list of required documents to close the car loan, such as the No Objection Certificate (NOC).

- Specify your preferred mode of payment: Indicate your preferred method to make the final payment, such as online transfer, cheque, or demand draft.

- Confirm the procedure: Request the bank to confirm the closing procedure and the exact steps to be followed.

- Thank the recipient: Express gratitude for their assistance and cooperation in closing the car loan.

- End with your signature: Conclude the application with your full name and signature to make it official.

Related Topics:

- BSNL Connection Closure Application Request

- Credit Card Closure Application Letter

- Recurring Deposit (RD) Account Closure Application

View all topics →

I am sure you will get some insights from here on how to write “closing car loan application procedure”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Hardship Letter For Car Payment Sample: Free & Effective

In my years of experience crafting numerous hardship letters for clients facing financial difficulties, I’ve learned that transparency, honesty, and a clear request are the pillars of a compelling hardship letter for car payments .

Key Takeaways

- Understanding the Purpose : Recognize that a hardship letter is your opportunity to explain your financial situation and request assistance.

- Essential Components : Include your personal information, account details, explanation of hardship, the assistance you’re seeking, and supporting documents.

- Proof of Hardship : Be ready to provide documents that support your claim of financial hardship.

- Free Template : Utilize the provided template to simplify the process.

- Follow-Up : Express your willingness to discuss the matter further and provide contact information.

These letters are a way to communicate with your lender about your financial situation and to seek specific relief. Drawing from my extensive background, I’ll guide you through the process of writing an effective hardship letter for car payments, including a template to get you started and personal insights to enhance your appeal.

Step-by-Step Guide to Writing Your Hardship Letter

Step 1: start with your personal information.

Begin your letter by writing your name, address, phone number, and email at the top. Below this, include the date and the lender’s information, such as the name of the representative (if known), company name, and address.

Step 2: Provide Loan Information

Clearly state your account or loan number early in the letter. This helps the lender quickly identify your case.

Step 3: Explain Your Hardship

This is the core of your letter. Describe the circumstances that have led to your financial hardship. Common reasons include job loss, illness, unexpected expenses, or reduced income. Be honest and concise, and avoid unnecessary details that don’t contribute to explaining your situation.

Step 4: Specify the Assistance You’re Seeking

Trending now: find out why.

Be clear about what you’re asking for. Do you need a temporary reduction in payments, a loan modification, or forbearance? Your request should be reasonable and reflect your actual financial situation.

Step 5: Demonstrate Your Commitment to Resolve the Situation

Show that you’re not looking for an easy way out. Mention any steps you’ve already taken to mitigate the situation, such as cutting expenses or seeking additional income sources.

Step 6: Attach Supporting Documents

Although not always part of the letter, mention that you are willing to provide documentation upon request. This may include bank statements, medical bills, job termination notices, etc.

Step 7: Close with a Respectful Request for a Response

End your letter by thanking the lender for considering your request and provide your contact information, expressing your willingness to discuss your situation further.

Personal Tips from Experience

- Be Personal but Professional : While it’s important to convey your struggles, maintaining a professional tone is crucial. This shows the lender that you are serious and respectful.

- Keep It to One Page : Lenders are busy. A concise, one-page letter is more likely to be read in full.

- Proofread : Typos or grammatical errors can detract from the seriousness of your request. Always proofread your letter or have someone else review it.

Real-Life Example

In one case, a client had been laid off unexpectedly and faced significant medical bills due to an illness in the family. We outlined these challenges clearly, demonstrating how these unexpected events drastically impacted their ability to meet car payments.

The lender responded positively to the well-documented and sincere appeal, agreeing to a temporary reduction in payments.

Template for Hardship Letter for Car Payment

[Your Name] [Your Address] [City, State, Zip] [Phone Number] [Email Address]

[Lender’s Name] [Company Name] [Company Address] [City, State, Zip]

Re: Request for Assistance with Car Loan Payments (Account #XXXXXX)

Dear [Lender’s Name],

I am writing to explain my current financial situation and to request assistance with my car loan payments. Due to [brief explanation of hardship, e.g., “a recent job loss”], I am finding it increasingly difficult to meet my monthly obligation of [$amount].

[Detailed explanation of hardship, including any relevant dates and how you’ve attempted to remedy the situation.]

Given these circumstances, I am requesting [specific request, e.g., “a temporary reduction in my monthly payments” or “a loan modification to lower the interest rate”]. I am committed to fulfilling my financial obligations and have taken steps to reduce unnecessary expenses and [any other measures you’ve taken].

I understand the importance of maintaining good standing with your company and am eager to find a solution that works for both parties. I am willing to provide any necessary documentation to support my request.

Thank you for considering my situation. I hope to hear from you soon to discuss this matter further. I can be reached at [phone number] or [email address].

[Your Name]

Writing a hardship letter for car payments is about striking the right balance between detailing your financial struggles and demonstrating a proactive approach to resolving the issue. The key is to be honest, specific, and respectful.

By following the steps outlined above, you’ll be able to write a letter that effectively communicates your situation and your willingness to work towards a solution.

I hope this guide helps you navigate through your difficult time with greater ease. If you have any questions or would like to share your own experiences, please leave a comment below. Your insights could be invaluable to someone in a similar situation.

Frequently Asked Questions (FAQs)

Q. what is a hardship letter for car payment.

Answer: A hardship letter for car payment is a letter that explains the financial difficulties that you are experiencing and requests the lender to consider a reduction or delay in your car payments.

It is usually used when a borrower is facing a temporary financial hardship that has affected their ability to make their car payments on time.

Q. Why do I need to write a hardship letter for car payment?

Answer: A hardship letter for car payment is used to provide the lender with an understanding of your current financial situation and request their help in addressing your difficulties.

It is an opportunity to explain why you are struggling to make your payments and request a solution that will allow you to catch up and continue making payments in the future.

Q. What should I include in my hardship letter for car payment?

Answer: Your hardship letter for car payment should include the following information:

- An introduction that explains the purpose of the letter

- A description of your current financial situation, including any changes that have affected your ability to make your car payments, such as a loss of income or unexpected expenses

- A request for a specific solution, such as a reduction in the monthly payment amount or a delay in payments

- An explanation of how you plan to address your financial difficulties in the future

- A statement of your willingness to work with the lender to find a solution

- Your contact information

Q. How do I submit my hardship letter for car payment?

Answer: You can submit your hardship letter for car payment by mail, email or fax. Be sure to include all necessary documentation and proof of your financial situation. It’s important to keep a copy of your letter and any documentation you provide for your own records.

Q. What is the process of applying for a hardship program for car payment?

Answer: The process of applying for a hardship program for car payments will vary depending on the lender. However, in general, the process may involve the following steps:

- Contact your lender to inquire about hardship programs or options

- Provide the lender with a hardship letter and any required documentation

- Wait for the lender to review your application and make a decision

- If your application is approved, work with the lender to implement the hardship program and make the necessary arrangements

- If your application is denied, consider other options such as refinancing or selling the car.

Q. What are some common reasons for needing a hardship letter for car payment?

Answer: Some common reasons for needing a hardship letter for car payment include loss of income, unexpected expenses, medical emergencies, and job loss.

Related Articles

Sample hardship letter for loan modification: free & effective, breaking a lease due to financial hardship sample: free & effective, medical hardship transfer letter sample: free & customizable, sample hardship letter for loss of income: free & effective, hardship letter for hoa fees sample: free & effective, free hardship letter for mortgage modification sample, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Home » Letters » Bank Letters » Request Letter to Bank for Closing Loan Account

Request Letter to Bank for Closing Loan Account

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, letter requesting for closure of loan account.

To, The Branch Manager, ____________ (Loan Department) ____________ (Name of the Bank) ____________ (Branch Address)

Date: __/__/____ (Date),

Subject- Closure of the loan account (Loan Account number)

Respected sir,

I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.). The reason for closure is due to ___________ (reason for account closure – loan tenure complete/EMI Complete/ Full Amount Paid/Any other reason).

Details of the account are mentioned below: Loan Account holder/s name: ____________ Account number: ____________

As per bank requirement, I am enclosing ___________ (Loan account closure form, KYC, other documents if applicable) with the application. I have already _________ (completed the tenure/All EMI Paid /Full Amount Paid). I am authorizing to debit charges from the account for the closure of the loan account (if any).

Thanking you,

Kind regards, ____________ (Name) ____________ (Address), ____________ (Contact Number)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- Documents such as a loan account closure form, KYC documents, and any other documents specified by the bank may be required for closing a loan account.

- You can review your loan account statement or contact your bank to verify if all payments, including EMIs or the full loan amount, have been made.

- While it's not mandatory, providing a reason for closing the loan account can help the bank understand your request better and expedite the closure process.

- Depending on the bank's policy, there may be certain charges associated with closing a loan account. These charges can vary and may include prepayment penalties or administrative fees.

- The time taken to close a loan account varies depending on the bank's procedures and the completeness of the submitted documents. It's advisable to inquire with the bank for an estimated timeline.

Incoming Search Terms:

- loan account close application format

- application for closing bank loan account letter format

- letter for closing bank loan account

By lettersdadmin

Related post, internship request letter – how to write an application for internship | sample letter, salary increment request letter – sample request letter for salary increment, loan application letter | sample application letter to bank manager for loan, leave a reply cancel reply.

You must be logged in to post a comment.

Request Email for Sick Leave – How to write an Sick Leave Email

Follow-up email for pending leave approval – how to write an email for leave submitted and pending approval | sample email, complaint email for bad service – how to write complaint email for poor service | sample email, request email to manager for 2 days leave – how to write 2 days leave email in office, privacy overview.

IMAGES

VIDEO

COMMENTS

Given below is a format, which can be of some help when writing a car loan application letter: Date. John Doe. Car Loan Officer. Name of Company. Address. City, State, Zip Code. Dear Mr. Doe, I have recently come across the loan plan on your company's official website and I would like to apply for a loan.

Begin your letter by introducing yourself and stating the purpose of your application. Keep it brief and to the point. Example: "Dear [Lender's Name], I am writing to apply for a car loan to purchase a [Car Make and Model]. As a [Your Profession], I believe this vehicle will significantly contribute to my daily commuting needs.".

It should include: Your name and contact information: Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached. The date: Include the month, day, and year of the letter.

Business telephone and cell phone numbers. Lender's contact details. Lender's or Loan Agent's Name and Title. A subject line stating the loan amount you are requesting for. Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Template 3: Application with a Co-signer. Subject: Car Loan Application with Co-signer. Dear [Lender's Name], I am writing to apply for a car loan for the acquisition of a [make and model of the car], with the intention to secure favorable financing through [Lender's Name]. To strengthen my application, I have a co-signer, [Co-signer's ...

Follow the steps to write a letter for loan approval: 1. Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. An effective header includes some lines, providing the basics of your business loan request.

First, the borrower is made to fill out a loan application form which is prepared by the lender. The aspects which are to be included in the loan application form are the following: The payment method, whether personal, through a check, online banking, etc. The number of times the payment is going to be made.

Your name. Company name. Company phone number. Company address. Loan agent or lender's name and title. Loan agent or lender's contact details. A subject line stating the desired loan amount. Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone. 2.

A letter template that can help you make an application for a car loan. Download this file for free and get to write a formal and effective letter by editing and customizing the template. CAR LOAN APPLICATION LETTER TEMPLATE [DATE] Dear [RECIPIENT NAME], This letter is written to request a car loan of $ [NUMBER] to buy a car [DETAIL] for [REASON].

When an email requesting a loan, attach the loan amount asked, a description of your company, the purpose of the loan, the target market, and competitors, and the amount of money you have put into your business are all included in the application's content. Call the bank and ask for the name of the person who is in charge of business loans.

Your loan request letter should include: Introduction: Briefly introduce yourself and your position in the company. Statement of Purpose: Clearly state that you are requesting a loan. Explanation of Need: Detail the reason for the loan request. Loan Amount and Repayment Plan: Specify the amount needed and propose a feasible repayment plan.

Letter for a Mortgage Application. Parts of a Loan Letter to a Bank. Sample Outline for a Loan Letter. Photo: Maskot / Getty Images. Writing a letter can improve your chances of loan approval. Learn why and see what should go in a loan letter.

New York, NY 65782. RE: Small business loan request for $20,000. Dear Mr. Burrows: The purpose of this letter is to request a small business loan in the amount of $20,000 for the purpose of enlarging our warehouse. Entirely Electronics began operation on June 1, 2020, with two employees.

Subject: Request for cancellation of car loan application number _____ (car loan application number) Dear Sir/Madam, My name is _____ (mention your name) and I am writing this letter in reference to the application number _____ (mention number) which I have submitted to your branch for availing a car loan. ...

You are hereby requested to issue an NOC or a loan clearance certificate in respect of the vehicle financed under a loan agreement. The same can be forwarded to my registered address. Kindly do the needful and oblige. Thanking you, Yours faithfully, (Signature) (Name of the Loan Account-holder) TEMPLATE #2.

How to write an application letter. Follow these steps to compose a compelling application letter: 1. Research the company and job opening. Thoroughly research the company you're applying to and the specifications of the open position. The more you know about the job, the better you can customize your application letter.

First, find the sample template for closing car loan application procedure below. Subject: Request for Closure of Car Loan Account. Dear Sir/Madam, I, [Your Full Name], the holder of the car loan account number [Loan Account Number], request for the closure of the said account since I have fully repaid my car loan as of [Date of last EMI payment].

Components of an Effective Settlement Letter. Personal Information: Include your full name, address, and loan account number. Loan Details: Reference the specifics of your loan, including the total amount and the date the loan was taken. Your Proposal: Clearly state your settlement offer, whether it's a lump-sum payment or a revised payment plan.

I am writing this letter to inform you that I am willing to make a payment of the pending amount of the loan and make a full and final settlement in order to close the loan. As per records, a sum amount of _______ (Amount) is pending. I am ready to pay the amount. Kindly consider informing me about the available benefits for the early payment ...

Step-by-Step Guide to Writing Your Hardship Letter Step 1: Start with Your Personal Information. Begin your letter by writing your name, address, phone number, and email at the top. Below this, include the date and the lender's information, such as the name of the representative (if known), company name, and address. Step 2: Provide Loan ...

I am authorizing to debit charges from the account for the closure of the loan account (if any). Thanking you, Kind regards, _____ (Name) _____ (Address), _____ (Contact Number) Incoming Search Terms: loan account close application format; application for closing bank loan account letter format; letter for closing bank loan account