- Order Status

- Testimonials

- What Makes Us Different

FERRARI: THE 2015 IPO Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> FERRARI: THE 2015 IPO

Ferrari: the 2015 IPO Case Study Help

Enterprise Value and Share Price in Dollars:

The cost of capital we have taken was 5 percent. After assuming the cost of capital of 5 percent, we have considered the perpetuity growth model in which we have assumed that the cash flow will be growing with the constant growth rate of around 2 percent. However, it might be difficult to use this model, but it is crucial to determine the growth rate by which the cash flows will grow or is expected to grow.

The enterprise value of the Ferrari Company is 9,113 million dollars. The enterprise value is an essential useful tool used to find and measure the value of the company. It seems to be the alternative which is comprehensive to the equity market capitalization. The share price of the Ferrari Company is 48.22 per share in Euros and 54.85 per share in dollars.

Pros and Cons of Using Market Multiple Business Valuation Approach:

The pros of determining the value of business by using market multiples, includes:

- The market multiple approach valuation techniques involves simple calculations and can be easily explained to the investors.

- The data used in the market multiple valuation technique is real i.e. based on actual figures.

- This valuation approach does not involve subjective forecasts or assumptions therefore, the results or value determined by the approach seems to be accurate as compared to other valuation methods that involve high degree of subjectivity.

- The data used in the market multiple valuation method is easy to find, as the data is available publically and can be accessed easily by anyone.

- The market multiple can also be used as a tool to assess the performance of the business, as higher market multiple indicates the higher enterprise value and suggeststhat the business does possess high growth potential and prospects.

The cons of determining the value of business using market multiples, include:

- The value determined using this method might not be compared with assets or business worth of other companies as the companies might have different accounting policies despite operating in the same industry.

- The multiples used in this approach might be misinterpreted or incomparable due to differences in accounting policies of different companies. Therefore, the multiples used will have a requirement to be adjusted according to the accounting policies, and tend to consume more time as compared to other companies.

- The valuation method does not take into account the growth in the business operation, while determining its value . Since the method fails to consider the growth aspect of the business; the value determined by this method might be unreliable.

- The value determined by using this method might not be reliable as this method uses the company’s financial data i.e. Earnings before interest tax depreciation and Amortization (EBITDA), which might be manipulated by the organization for showing a positive performance of its business.

Potential Benefits and Cost of Ferrari’s Spinoff and IPO:

The potential benefits of spinoff the public companies often end up resulting to a series several disadvantages that might make anyone think twice about going public. One of the most important changes is the need for added disclosure for investors. In addition, public companies are regulated by the Securities Exchange Act of 1934 in regards to the periodic financial reporting, which might be difficult for newer public companies to follow. They must also meet other rules and regulations that are monitored by the Securities and Exchange Commission (SEC).

....................................

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- Federal Reserves: Monetary Policy

- Black Caucus Groups at Xerox Corp. January 1991(Abridged) Video

- Four Star Industries Singapore

- Intel Corp.--1968-2003

- FreshDirect: Is it Really Fresh?

- Teaming at Disney Animation

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Previous Articles

- Lee Kum Kee: Female Succession In Family Business Case Solution

- Paytm: Building A Payments Network Case Solution

- RubiconMD Case Solution

- Kjell And Company: Motivating Salespeople Through The Sales Force Compensation Plan (A) Case Solution

- *gramLabs Case Solution

- GEF India Private Limited January 2011: Defining The Market Research Problem Case Solution

- Doc's Barbershop Case Solution

- How To Overcome Resistance And Get Commitment From Users Case Solution

- Coats (B): Cash Flows And Small Lot Dyeing Case Solution

- Coats (A): Responsive Production And Order Fulfillment Case Solution

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

- Business Case Studies

Finance & Accounting

Ferrari: The 2015 Initial Public Offering

Ferrari: The 2015 Initial Public Offering ^ UV7259

Want to buy more than 1 copy? Contact: [email protected]

Product Description

Publication Date: January 11, 2017

Source: Darden School of Business

This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding production despite the company's long standing tradition of severely limiting production strategy to maintain an exclusive brand image. The case is designed to showcase corporate valuation using discounted cash flow and peer-company market multiples for a company that exists in two sectors: automotive and luxury goods.

This Product Also Appears In

Buy together, related products.

Initial Public Offerings

Netscape's Initial Public Offering

Genset Initial Public Offering (A)

Copyright permissions.

If you'd like to share this PDF, you can purchase copyright permissions by increasing the quantity.

Order for your team and save!

Product details

- This case has been featured on our website, click to view the article .

FERRARI: THE 2015 IPO Case Solution & Answer

Home » Case Study Analysis Solutions » FERRARI: THE 2015 IPO

Ferrari: the 2015 IPO Case Study Help

Introduction:

Ferrari Company is a leading company, which is responsibly engages in the manufacturing of luxurious cars. It was founded in 1929 by Enzo Ferrari. It is one of the world’s powerful and largest brand. Following are some scenarios that are undertaken in order to find the valuation of share stock.Since we have calculated the average EBITDA multiple for both car industry and luxury industry, we got to know that the EBITDA multiple of the car industry is lower than EBITDA of luxury industry.

There are many car manufacturing companies that must be excluded while calculating EBITDA multiple. The calculation of this gives us strong means of comparing the capital structures of multiple companies.

In the very first part, we have calculated the EBITDA for the year 2014, the range of the share price falls between $48 and $52. After summing depreciation, amortization and operating profit; we have found the value of EBITDA, which is 678. After the IPO, the number of shares that were outstanding was 189 million. It really matters that the FCA hold 172 million shares.

Holding the large amount of shares is important because it tends to be included in the earning per share calculation for the company, which is not only important for earning per share, but is also important for calculating the market capitalization of the company. The company that holds shares is important, because the investors tend to calculate the earnings per share in order to make decision whether the investment should be made in share stock or not? Whether it will be able to generate revenue or not?

Benchmark Firm:

By using the debt to equity ratio for founding the benchmark firm, it has also been found that the Ferrari’s debt to equity ratio at the end of the year 2014 is 0.87, which is near to the General Motors (GM)’s debt to equity ratio of around 0.83 at the end of the year 2014. The earnings before interest, tax, depreciation and amortization (EBITDA) to total revenue percentage for Ferrari and General Motors (GM) are 25 percent and 6 percent respectively at the end of the year 2014. Along with which, the compound growth rate of Ferrari and General Motor (GM)’s are 7 percent and 4.5 percent respectively at the end of the year 2014.

By using the compound growth rate to find the benchmark firm, it has been found that the Ferrari’s compound growth rate is 7.1 percent at the end of the year 2014, which is near tothe compound growth rate of Honda Motors (HM) i.e. around 6.9 percent at the end of the year 2014. The debt to equity ratio of Ferrari at the end of the year 2014 is 0.87, while the debt to equity ratio ofHonda Motors (HM) is around 1.03 at the end of the year 2014. The earnings before interest, tax, depreciation and amortization (EBITDA) to total revenue percentage for Ferrari and Honda Motors (HM) are 25 percent and 13 percent respectively at the end of the year 2014………………………

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

Related Case Solutions:

LOOK FOR A FREE CASE STUDY SOLUTION

You have no items in your shopping cart.

- Accounting & Control

- Business & Government

- Case Method

- Decision Analysis

- Entrepreneurship & Innovation

- Leadership & Organizational Behavior

- Management Communications

- Operations Management

- Darden Course Pack

- Forio Simulation

- Multimedia Case

- Technical Note

- Video Playlist

Share This Product

Ferrari: the 2015 initial public offering, product overview.

This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne’s interest in expanding production despite the company’s long standing tradition of severely limiting production strategy to maintain an exclusive brand image. The case is designed to showcase corporate valuation using discounted cash flow and peer-company market multiples for a company that exists in two sectors: automotive and luxury goods.

Learning Objectives

Review the institutional aspects of the equity issuance transaction; hone corporate valuation skills, particularly using market multiples; develop an appreciation for the considerations associated with identifying an appropriate comparable set; and explore the costs and benefits associated with public share offerings.

- Add to Cart

- Save to Library

Related Products

- Financial Markets & Institutions_Spring 2024 Ning, Zi "Nancy" Darden Course Pack

- UAB MBA621 F2F Fu, Richard Darden Course Pack

- UAB MBA621 Fin Fu, Richard Darden Course Pack

- MBA 641 Investments & Portfolio Management _Summer... Ning, Zi "Nancy" Darden Course Pack

- UTSA FIN 4893 Burns Spring 2024 Burns, Natasha Darden Course Pack

Customers Also Bought

- DuPont Corporation: Sale of Performance Coatings Chaplinsky, Susan; Marston, Felicia C.; Merker, Brett Case

- Methods of Valuation for Mergers and Acquisitions Chaplinsky, Susan; Schill, Michael J.; Doherty, Paul Technical Note

- An Introduction to Debt Policy and Value Bruner, Robert F. Exercise

Case Analysis Ferrari IPO

- A Arturo Enrich Solar

- 5 minutos de lectura

In the present Case Analysis, the main topic that is going to be addressed is the evolution of the company Ferrari N.V.’s stock price since its Initial Public Offering, in which it is included the kind of business and Fundamental Analysis. Ferrari NV, known as Ferrari, is an Italy-based designer, manufacturer and retailer of sports cars that is incorporated in the Netherlands. It operates under the Ferrari brand. Its sports cars portfolio includes, among others, F12berlinetta, FF, Ferrari 488 GTB, 488 Spider, 458 Speciale, Ferrari California T, F12tdf and LA Ferrari. The Company also offers financing services through Ferrari Financial Services. It also produces limited series and one-off cars. The Company divides its regional markets in EMEA (Europe, the Middle East, India and Africa), Americas, Greater China and Rest of APAC (Asia-Pacific region, excluding Greater China) and is active in over 60 markets worldwide through a network of authorized dealers (Nasdaq, 2019).

Kind of Business Ferrari

Ferrari N.V. licenses the Ferrari brand to a select number of producers and retailers of luxury and lifestyle goods, the company sell Ferrari-branded merchandise through a network of 20 franchised and 12 owned Ferrari stores and on its website. As one of the world’s most recognized premium luxury brands, it believes the company is well positioned to selectively expand the presence of the Ferrari brand in attractive and growing lifestyle categories consistent with its image, including sportswear, watches, accessories, consumer electronics and theme parks which it believes enhance the brand experience of it loyal following of clients and Ferrari enthusiasts. (Nasdaq, 2019).

Initial Public Offering Analysis of Ferrari

The state in which Ferrari N.V. was incorporated was Amsterdam, its employees as of 12/31/2014 where 2858. On the other hand, the company was listed in the New York Stock Exchange priced on 10/21/2015 offering 17,175,000 stocks with a share price of $52 hence the offer amount was $893,100,000. Ferrari N.V. This is an initial public offering of common shares of Ferrari N.V. (“Ferrari”). Fiat Chrysler Automobiles N.V. (“FCA”) is selling 17,175,000 common shares of Ferrari, equal to approximately 9 percent of the Ferrari share capital (FCA, 2019). Ferrari N.V. was not selling common shares and it will not receive any of the proceeds from the sale of common shares by FCA. Prior to this offering, there has been no public market for its common shares (Ferrari, 2019). On the other hand, In the sports car segment Ferrari N.V.’s products, are the 488 GTB, 488 Spider, 458 Italia, 458 Spider, 458 Speciale, 458 Speciale Aperta and F12berlinetta and its principal competitors are Lamborghini (Huracán and Aventador), McLaren (650S), Porsche (911 Turbo and Turbo S), Mercedes (SL 63/65 AMG), Aston Martin (Vanquish and V12 Vantage/ S) and Audi (R8 V10). In the GT segment our products are the California T and FF models and our principal competitors are Rolls-Royce (Wraith), Bentley (Cont. GT/GTC, V12 and V8 (Speed and S version), GT3-R), Aston Martin (DB9) and Mercedes Benz (CL 63/65 AMG, S Coupé 63/65 AMG) (Nasdaq, 2019).

In terms of Ferrari N.V.’s employees, by 12/03/2019 the company had 3587 employees which represents an increase of 25.51% from October 2015 to 12/03/2019. On the other hand, the average monthly returns of the company from the last two years were lower than the average monthly returns of the S&500 Index: the average returns were 0.45% and 0.76% respectively, the standard deviation of the monthly returns of Ferrari N.V. from the last two years was lower than the S&500 Index (3.49% from Ferrari N.V. and 3.60% from the S&500 Index); this means that the monthly returns from the las two years of Ferrari N.V. were less deviated from its average. In order to measure the variations of the monthly returns from the last two years in relation to the mean, the coefficient of variation was calculated which was 773.04% for Ferrari N.V. and 474.83% for the S&500 Index; this means that there was more dispersion in the Ferrari N.V.’s monthly returns from the last two years than those of the S&500 Index hence the best relationship in terms of risk and return was for the S&500 Index (global). The share price of Ferrari N.V. by 12/03/2019 was $131.76, this means that from October 2015 to 12/03/2019 the company’s share price increased 153.38%, although the shares outstanding and the market capitalization from October 2015 to 12/03/2019 increased 1327.30% and 3516.56% respectively.

Fundamental Analysis

Ferrari n.v.’s share performance.

Ferrari Shares Performance

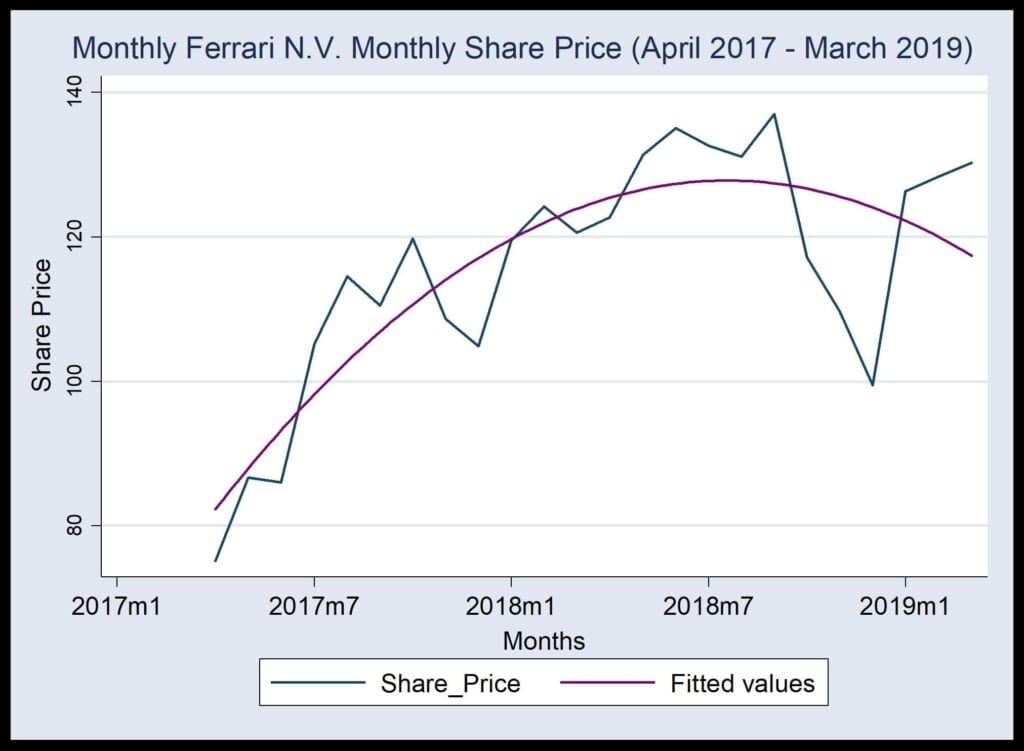

From the Stock Chart it can be seen that the behavior of the Ferrari N.V.’s monthly stock prices (April 2017-March 2019) is heteroscedastic, and it cannot be seen cyclical fluctuations, on the other hand; a possible increasing trend can be observed: it seems that the stock prices are moving upward in a coordinated way over time. On the other hand, it could be possible that the company’s stock prices could be changing its trend.

Earnings per share

Ferrari N.V.’s relationship between the current market price of the stock and its earnings per share in the third quarter of 2018 was 1.17, it means that Ferrari N.V.’s common stock is selling in the market place for 1.17 times its earnings; the expected earnings per share of analysts for the third quarter of 2018 was 1.15. Analysts could have expected a lower earnings per share than the real value because they estimated a higher value for the shares outstanding than the real one, another possibility is that they estimated a lower value for the net income than the real value.

Income Statement

Ferrari Income Statement

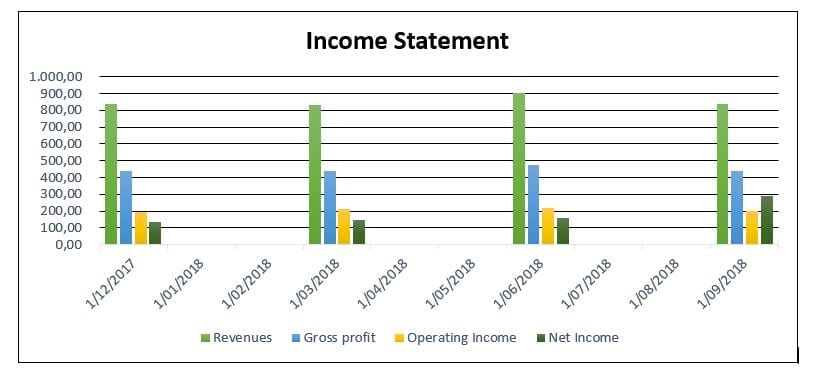

The percentage of total sales revenue that Ferrari N.V. retains after incurring the direct costs of associated with producing the goods and services it sells in the third quarter of 2018 is expressed as 52.16%, this means that after Ferrari N.V. pays off its inventory costs, it still has 52.16% of its sales revenue to cover its operating costs. The profit that Ferrari N.V. retains after removing operating expenses (such as cost of goods sold and wages) and depreciation is expressed as 24.23%, this means that there remain 0.2423 cents to cover all none-operating costs. The percentage of each sales dollar, on average, that represents income of Ferrari N.V. is 34.23%. After all expenses and taxes have been paid, the company was able to produce a profit margin of 34.23% of sales. The measure of how effectively a company can earn a return on its investment in assets is expressed as the percent rate of Return on Investment, in the case of Ferrari N.V. is 6.22%; it means that every dollar invested by Ferrari N.V. in assets, generates 6.22% of net income.

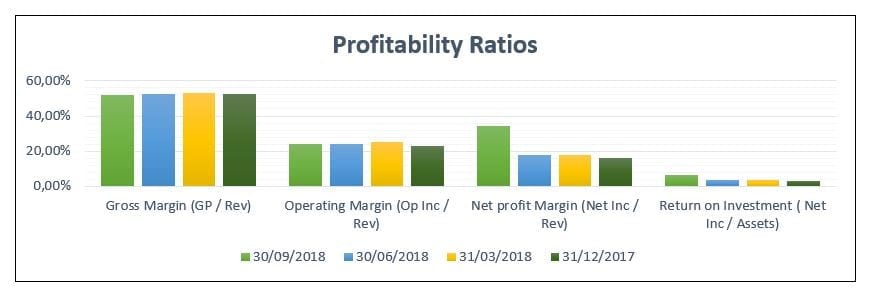

Ferrari Profitability Ratios

Balance Sheet

Ferrari Balance Sheet

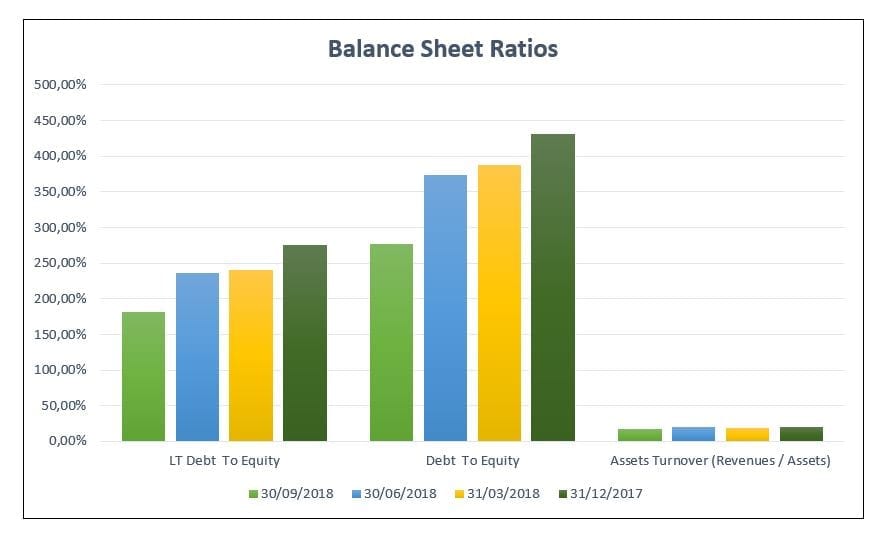

The measure of how much debt Ferrari N.V. is using to finance its assets relative to the value of shareholder’s equity is expressed as 180.89%, this means that there are 180.89% more liabilities than there is equity. The indicator of efficiency in which Ferrari N.V. is deploying its assets in generating revenue is expressed as 18.16, this means that Ferrari N.V.’s inventory turns 18.16 times a year. Ferrari N.V.’s ability to pay current debts as they become due is expressed as 2.0435, this means that for every two dollars of current liabilities, Ferrari N.V. has $0.0435 of current assets to pay those obligations.

Ferrari Balance Sheet Ratios

Bibliography

Ferrari Corporate. (2019). Retrieved from http://corporate.ferrari.com/en

Nasdaq. (2019). Retrieved from https://www.nasdaq.com/markets/ipos/company/ferrari-nv-971252-79019

¿Usas sitios de redes sociales para encontrar información académica o laboral? *

By Wordpress Survey plugin

¿Cuál es tu sexo? *

¿Cuál es tu rango de edad? *

¿Qué sitios de redes sociales utilizas para investigación académica o laboral *

Puedes seleccionar las opciones que quieras.

Que tipo de dispositivo usas al utilizar redes sociales *

¿Cuántas cuentas de redes sociales tienes? *

¿Cuántas horas a la semana le dedicas a las redes sociales? *

IPO Process – A Guide to the Steps in Initial Public Offerings (IPOs). (2019). Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/ipo-process/

Cita esta página

Escrito por:, artículos relacionados.

Case Analysis IPO: Ferrari N.V.

IMAGES

VIDEO

COMMENTS

Ferrari: the 2015 IPO Case Study Help. Enterprise Value and Share Price in Dollars: The cost of capital we have taken was 5 percent. After assuming the cost of capital of 5 percent, we have considered the perpetuity growth model in which we have assumed that the cash flow will be growing with the constant growth rate of around 2 percent.

This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding production despite the company's long standing tradition of severely limiting production strategy to maintain an exclusive ...

The following tips and bits should be kept in mind while preparing your finance case solution in a Ferrari The 2015 Initial Public Offering xls spreadsheet: Avoid using fixed numbers in formulae. Avoid hiding data. Useless and meaningful colours, such as highlighting negative numbers in red. Label column and rows.

"The Ferrari: The 2015 Initial Public Offering case prompts students to ask themselves about the coherence between valuation, company growth strategy and the glamour of luxury brands. The case requests students to use two valuation methods to provide the estimation of the value of Ferrari. Students' impulse is to give the attributes of the car to the stock.

Publication Date: January 11, 2017. Source: Darden School of Business. This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding ...

https://www.thecasesolutions.comThis Case Is About Ferrari: The 2015 Initial Public Offering Case Solution and AnalysisGet Your Ferrari: The 2015 Initial Pub...

It was October 20, 2015, the day before what was anticipated to be the first day of public trading for the stock of legendary Italian sports car company Ferrari NV (Ferrari). Sergio Marchionne, chairman of Ferrari and CEO of its parent company, Fiat Chrysler Automobiles NV (FCA), had announced a year previously that FCA would be spinning off ...

Email us directly at caseanalysisteam(at)gmail(dot)com if you want to solve the case. CaseAnalysisTeam(at)gmail(dot)com Please replace (at) by @ and (dot) by...

Abstract. This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding production despite the company's long standing tradition of ...

Ferrari: the 2015 IPO Case Study Help. Introduction: Ferrari Company is a leading company, which is responsibly engages in the manufacturing of luxurious cars. It was founded in 1929 by Enzo Ferrari. It is one of the world’s powerful and largest brand. Following are some scenarios that are undertaken in order to find the valuation of ...

This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding production despite the company's long standing tradition of severely limiting production strategy to maintain an ...

This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Question: Need knowledge of Ferrari: The 2015 IPO Case Study What was going on at Ferrari (i.e., executive summary)? What was the relationship between FCA and Ferrari?

Ferrari IPO case for advance finance fin 413 spring 2022 ferrari: the 2015 ipo your goal is to advise ferrari on their valuation around their ipo. given their. Skip to document. ... in this case, Ferrari doesn't get to keep any of the cash raised - this goes to the parent company FCA. But, you'll still want to use the post-money share ...

The case is designed to showcase corporate valuation using discounted cash flow and peer-company market multiples for a company that exists in two sectors: automotive and luxury goods. Excerpt . UVA-F-1775 . Rev. Apr. 14, 2017 . Ferrari: The 2015 Initial Public Offering

IPO completed on October 21, 2015. Traded under the ticker symbol RACE. Prices closed at $55 a share. At $55, Ferrari closed trading with a $10.4 billion market value, well above analysts official valuation of $5-7 billion. With IPO pricing of $52, and a closing price of $55, the company left nearly $52 million on the table.

CASE STUDY Ferrari: The 2015 Initial Public Offering Lara Grein, 12134930 Anna-Maria Stefanescu, 12136371 Company Intro Company Intro Ferrari is a successful luxury car brand which was built by Enzo Ferrari and owned by Fiat Chrysler Automobiles NV (FCA). At the time of Enzo. Get started for FREE Continue.

Description for case study is given below : This case examines the October 2015 initial public offering pricing decision for legendary Italian sports car company Ferrari by Fiat Chrysler management. Students are invited to model the value of Ferrari in light of Ferrari CEO Sergio Marchionne's interest in expanding production despite the ...

Initial Public Offering Analysis of Ferrari. The state in which Ferrari N.V. was incorporated was Amsterdam, its employees as of 12/31/2014 where 2858. On the other hand, the company was listed in the New York Stock Exchange priced on 10/21/2015 offering 17,175,000 stocks with a share price of $52 hence the offer amount was $893,100,000.

Ferrari Case Study ferrari case study fin305 executive summary ferrari is luxury automotive manufacturer that was founded enzo ferrari in 1947 and is owned ... and in return provide less cash for FCA. In 2015, Ferrari's balance sheet showed a very unfavorable debt-to-equity ratio, and management must be sure to not transfer too large an ...

Case Studies in Finance. Ferrari Case Study. Summary Ferrari, an Italy-based company, is famous all over the globe for its exclusive and luxurious sports cars. The company was initiated and built by Enzo Ferrari but only 10% of the firm is owned by the Ferrari family.

FERRARI 2015 IPO CASE STUDY 2 Ferrari 2015 IPO Case Study Introduction Ferrari is one of the leading global luxury car brands concentrated on designing, engineering, retailing, and producing some of the globe's most renowned luxury-performing sports vehicles. The brand affiliates itself with exceptionality, invention, high-tech sporting, engineering heritage, and Italian design.